PRO Dealer

PRO DRIVEN

BUT FORWARD WE’RE NOT GOING ANYWHERE...

BUTFORWARD GOINGANYWHERE...

Find out why thousands of retailers trust Orgill as their partner of choice b isiting Orgill. a/opportunity.

Orgillhasbeenservingtheindustryformore than175yearsbutwhat’smoreimportant thanhowlongthecompanyhasbeenaround iswhereitisgoing.Forthepastthree decades,Orgillhasbeenthefastest-growing distributorintheindustryandtoday,the companycontinuestoinvestinenhancingits products,programsandservicestocontinue Findoutwhythousandsofretailerstrust hoicebyvisiting

Orgill has been ser ing the industr for more than 175 years but what’s more important than ho long the compan has been around is where it is going. For the past three decades, Orgill has been the fastest-gro ing distributor in the industry and today, the company continues to invest in enhancing its products, programs and services to continue this legacy of growth.

PRODealer

EDITORIAL

EDITOR-IN-CHIEF

Steve Payne steve@hardlines.ca

FEATURES EDITOR

Geoff McLarney geoff @hardlines.ca

CONTRIBUTING EDITORS

Rebecca Dumais rebecca@hardlines.ca

Sarah McGoldrick sarah@hardlines.ca

CONTRIBUTOR

John Caulfield

ART DIRECTOR

Shawn Samson shawn@twocreative.ca

PRESIDENT

Michael McLarney mike@hardlines.ca

THIRD QUARTER/2025 // VOLUME 2, NO. 3

2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2 • 905-330-3061 @Hardlinesnews • www.hardlines.ca

ADVERTISING/ADMINISTRATION

VICE-PRESIDENT & PUBLISHER

David Chestnut david@hardlines.ca

ACCOUNT MANAGER

Shannon MacLeod shannon@hardlines.ca

SENIOR MARKETING & EVENTS MANAGER

Michelle Porter michelle@hardlines.ca

CLIENT SERVICES MANAGER Jillian MacLeod jillian@hardlines.ca

ACCOUNTING accounting@hardlines.ca

SUBSCRIBER SERVICES

★ FREE TO HOME IMPROVEMENT DEALERS ★ To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 866-764-0227; hhiq@mysubscription.ca.

EDITORIAL ADVISORY BOARD

Michelle Chouinard-Kenney GIBSON BUILDING SUPPLIES Aurora, Ont.

Brian Lavigne

EDDY GROUP TIMBER MART Bathurst, N.B.

Luc Léger

ELMWOOD GROUP HOME HARDWARE Moncton, N.B.

Brent Perry ALF CURTIS HOME IMPROVEMENTS Peterborough, Ont.

Gary Sangha CROWN BUILDING SUPPLIES

Surrey, B.C.

Hardlines PRO Dealer is published four times a year by Hardlines Inc., 2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Canadian Publications Mail Agreement #42175020. POSTMASTER: Send address changes to Hardlines PRO Dealer, 8799 Highway 89, Alliston, ON L9R 1V1.

All editorial contents ©2025 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

Hardlines PRO Dealer is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact:

Shannon MacLeod, Account Manager 905-691-2492 • shannon@hardlines.ca

“

I think wearing the red shirt means something to people across this country.

100% Canadian.

100% Dealer-owned and operated.

When you join the Home Hardware family, you become part of a tight-knit community that’s free from the pressures of external shareholders. Gain access to a trusted brand with personalized resources dedicated to helping your unique business thrive, plus a coastto-coast Dealer network ready to back you every step of the way.

”

Scan to learn more

Chris Locke Store Owner Orillia, ON

Home Depot agrees to buy GMS Inc.

RONA supports trades with ads

BMR Pierre Naud acquires five stores

Imperial Manufacturing acquires Dundas Jafine

Pro drive-throughs the

An interview with Cynthia Prazeres-Mare, the president of Senso Building Supplies, Toronto

A PRODUCT GOES WRON

Pro dealers talk about how they try to back their contractor customers when a product failure occurs

Pro dealers talk about how they’ve grown their rentals businesses and their margins

INFLUENCERS

A chat with three contractor infl uencers: Danielle Browne, Sasha Kassis, and Shannon Tymosko

Same high quality. Lower carbon emissions.*

CarbonLow™

Easi-Lite® | Type X | M2Tech® | GlasRoc®

Coming in 2025 from North America’s First Zero Carbon** Drywall Production Facility in Montreal

*Up to 60% less embodied carbon as per LCA action plan. **Scopes 1 & 2

BIG BOXES AND PROS

Home Depot is about to become a contractor giant

BY STEVE PAYNE Editor-in-Chief

DEALER

steve@hardlines.ca

Everybody thinks they know all about pros and big boxes.

“Contractors hate them.”

“Pros don’t have the time to shop them.”

“Trades can get better service elsewhere.”

Etcetera.

But Home Depot has succeeded in the pro market in spite of the conventional wisdom. The world’s largest home improvement store sells half of its goods annually to contractors—an estimated US$80 billion worth. And it has made moves recently that have cemented its leadership in selling to builders.

First, Home Depot unveiled the first of its Flatbed Distribution Centers (FDCs) in Dallas in 2020. These behemoths are intended to ship pro jobsites the same day or the next day, especially bulk building materials. Toronto’s first FDC opened last year. Home Depot says it will build a staggering 150 FDCs over time.

Second, Home Depot bought SRS Distribution last year for $18.25 billion.

The acquisition of the McKinney, Texas-based pro wholesaler will propel Home Depot into the ranks of the pro shipping experts—though not in Canada, where SRS does not have any DCs.

Third, Home Depot, through its SRS subsidiary, announced its intent to buy GMS Inc., one of North America’s largest GSDs, in June of this year. GMS will raise the bar for Home Depot contractor supply in Canada, because GMS Canada is one of the country’s largest pro dealers. It has almost a billion dollars of revenues north of the border and more than 40 points of sale.

Read all about Home Depot’s planned acquisition of GMS on page 12 of this issue. And read about both RONA and Home Depot targeting the contractor market in other ways on page 60.

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

—Attributed to Mark Twain

PRO Dealer

NEWS NEWS NEWS

WHAT’S HAPPENING IN THE PRO INDUSTRY

Sign-up for Breaking News at Hardlines.ca

HOME DEPOT AGREES TO BUY GMS INC.

The Home Depot, through its SRS Distribution subsidiary, has agreed to buy GMS Inc., of Tucker, Ga., one of the largest GSD distributors in North America. In this country, GMS is a big player with a Canadian division headquartered in Vaughan, Ont.—and stores across the country. It specializes in pros, with a signifi cant business in wallboard and complementary building products.

Under the terms of what Home Depot calls a “merger” agreement, announced on June 30, a subsidiary of SRS will commence a cash tender off er to purchase all outstanding shares of GMS common stock. The established price is US$110 per share,

refl ecting a total equity value of approximately $4.3 billion and implying a total enterprise value (including net debt) of approximately $5.5 billion. The deal is expected to be completed by the end of Home Depot’s 2025 fi scal year (end of January 2026), subject to regulatory requirements.

GMS Canada includes some of the biggest GSD names in the country. The company has on its roster, for example, Calgary’s Shoemaker Drywall Supplies; Watson Building Supplies in Vaughan, Ont.; and Yvon Building Supplies based in Burlington, Ont. YBS was acquired by GMS last July for C$195.5 million. It also has a number of more traditional building centres in its Canadian portfolio, including Slegg Building Materials on Vancouver Island.

On June 18, GMS Inc. reported its revenues for the fi scal year ended April 30. They were US$5.51 billion, an increase of 0.2 percent compared with the previous year. Net income for the year was $115.5 million, a decrease of 58.2 percent.

Immediately after GMS’s tepid profi tability numbers were announced, Brad Jacobs’s QXO, a roofing-products distributor, made an unsolicited bid for GMS. Home Depot made a competing off er shortly thereafter. QXO seemingly had no taste for

Blair Building Materials, based in Maple, Ont., is one of GMS Canada’s 40-plus points of sale.

a bidding war for GMS with the world’s largest home improvement retailer. QXO let its off er for GMS expire June 24.

This is not the first major acquisition by Home Depot in the pro market. Last June, the Atlantabased firm announced that it had closed the acquisition of SRS Distribution in McKinney, Texas, for a staggering US$18.25 billion. The Home Depot announced that SRS was bringing with it a “total addressable market of $50 billion” consisting of pro roofers, landscapers, and pool contractors. But the purchase of SRS, having no Canadian distribution centres, is unlikely to change the pro game very much in Canada.

The acquisition of GMS is diff erent. It has more than 40 points of sale in Canada. And it is a major player in this country, doing about C$948 million in revenue (Hardlines estimate).

The firm’s 2024 annual report said that Canada represented 12.2 percent of its revenues.

Home Depot is the largest home improvement retailer in Canada, at a revenue fi gure of $11.18 billion (Hardlines estimate). Adding GMS’s Canadian sales of $948 million to The Home Depot pie in this country will give it 21.2 percent market share—based on Hardlines’ estimated industry size of $57.32 billion. The number-two player, Home Hardware Stores Ltd., has an estimated 15.1 percent market share.

With this new acquisition, which expands considerably its pro footprint in Canada, Home Depot has opened up a signifi cant lead over its competitors in the contractor market.

RONA SUPPORTS PROS WITH ADS IN ONTARIO

At a time when economic conditions are putting pressure on Canadian companies, RONA inc. launched an initiative to support local businesses that are part of the home improvement industry. In June and July, the retailer gave away 85 percent of its ad space to nine local trades businesses in Ontario.

The company rolled out the initiative with some nationalistic fanfare, running full-page ads in various newspapers, including The Toronto Star. The ad read, in part: “Dear Canada, for over 85 years, we’ve stood with Canada’s tradespeople. Now it is our turn to give back.” The message then detailed the donation of 85 percent of its media to local trades, “instead of talking about ourselves,” it continued.

“It’s only natural for us to give back when they are facing hardships,” said Catherine Laporte, senior vice-president, marketing and customer experience, at RONA inc. “Earlier this year, we renewed our partnership with Well Made Here to help better showcase Canadian-made products. Now, we are turning our attention to local entrepreneurs, who are instrumental in building thriving communities and a strong Canadian economy.”

This story uses data from the 2025 Hardlines Retail Report. This incredible piece of research was published on July 25. To obtain your own copy, email Michelle Porter (michelle@hardlines.ca).

The promotion ran in Ontario only, “since it’s been hit the hardest by the recent tariff s due to its standing in international trade with the United States, especially in the automotive and metal sectors,” said Laporte. The selected businesses were in the Greater Toronto Area, Southwestern Ontario, and the Durham region, and saw an ad featuring their name and logo.

“This is just another way for us to stand with the communities that are building this country—one job, one project, one day at a time,” Laporte added.

BMR PIERRE NAUD BUYS FIVE STORES

Pierre Naud inc., a pro-oriented BMR dealer with six stores already, has expanded its footprint in the Mauricie/ Centre-du-Québec region with a deal that adds fi ve more locations.

Situated between Montreal and Quebec City, the newly acquired stores are in Saint-Grégoire and Gentilly, two communities in Bécancour, as well as Daveluyville, Sainte-Croix, and Trois-Rivières.

Groupe L’Acadien Bricoleur, a group of family-owned stores active since 1985, is transferring all its stores to Pierre Naud. They will all operate under the BMR banner. Founded 135 years ago, Pierre Naud inc. has more than 275 employees. It also owns two door and window manufacturing plants, as well as a wood-processing mill.

to remaining a local business, ongoing customer service, fast and reliable delivery, and a product selection tailored to all types of projects.

“We are very pleased with this strategic acquisition, which marks an important step in the growth of our organization,” said Marc-André Lebel, president of Pierre Naud inc. “By expanding our reach in this way, we are confi dent that we will open doors to new business opportunities with key players in the sectors we serve.”

The BMR dealer is obviously experiencing sustained growth, as the team reaffirms its commitment

IMPERIAL MANUFACTURING BUYS DUNDAS JAFINE, SELLS DIVISION TO CGC

Imperial Manufacturing Group (IMG), based in Richibucto, N.B., has announced the acquisition of Dundas Jafine, another Canadian manufacturer of air distribution products.

Dundas Jafine has locations in Brampton, Ont., and in Alden, N.Y. Established in 1934 by the Jafine family as a feed and seed retail store, Dundas Jafine entered the air distribution market in the early 1960s. Since then, it has expanded its HVAC product off ering.

“We are excited to have Dundas Jafine join the IMG group of companies,” said Normand Caissie, IMG founder and CEO. “We share similar values and have built strong partnerships with our customers.”

At the corporate level, BMR regards the latest addition to its rank as a signifi cant expansion of the BMR name in the Mauricie/Centre-duQuébec region. The group, a subsidiary of Sollio Cooperative Group, already has some 275 points of sale within its organization, located in Quebec, Ontario, and the Maritimes.

“This partnership represents a signifi cant milestone in our 90-year history,” said David Jafine, president of Dundas Jafine. “We’re excited to join this world-class company that shares our core values and strategic direction as we look towards growing our air distribution off ering.” He will remain with the company over the next six to twelve months to ensure a smooth transition to the new ownership. The current Dundas Jafine management team will continue managing and operating the business in collaboration with IMG.

Meanwhile, gypsum manufacturer CGC Inc. has entered into a definitive agreement for the acquisition of Imperial Building Products Ltd. (IBP), a manufacturer of steel framing components, drywall trims, accessories and proprietary structural solutions. IBP was created as a division of IMG in 1990.

PRO DRIVE-THROUGHS, THE EUROPEAN WAY

How hard can it be to develop an eff ective LBM drive-through for a store’s back end? It’s a common enough aspect of many dealers’ off erings. But what if other retailers are doing it better?

Hardlines recently toured some stores in Lisbon, Portugal, as part of the Global DIY-Summit in June. Delegates learned about better racking and endcaps and the wisdom of separating contractor business from DIY customers. And they learned about new tactics for drive-throughs.

The store tours event attracted fi ve busloads of the planet’s most infl uential vendors and retailers. The delegates included representatives from European retailers Brico Depot, Leroy Merlin, and a relative newcomer, Obramat.

Leroy Merlin stores were the second stop—and the third. The retailer is part of Adeo Group, a giant home improvement retail group which owns a number of retail home improvement banners. The first store we visited is very DIY-oriented, with clean lines and a bright layout that refl ected the best of Home Depot, RONA+, and IKEA. But another Leroy

Merlin is located directly across the highway from this store. This store is a pro store—and a huge one.

The pro location in Lisbon generated 21 million euros (C$33 million) in sales in 2024 and expects to reach 25 million euros ($39.3 million) this year. It has 52 full-time staff and more than half of them are women. The store works closely with its counterpart across the street to fulfil orders using cross-docking and cross-selling to provide customers with whatever they need in one stop.

But the drive-through was the area that had delegates snapping pictures and taking notes. The winding track allows a car to wind its way through the LBM area, pull over and load materials as needed from the various bays. These include plywood and lumber, drywall, and concrete blocks. When the products are loaded, the customer’s licence plate number is fed into the store’s system. When the customer reaches the exit, the system uploads the order and they can use a self-checkout to pay and exit. It’s a fast and eff ective system that keeps labour costs—and customer confusion—to a minimum.

The winding track allows a car to wind its way through the LBM area, pull over, and load materials as needed from the various bays.

Interview by Steve Payne

HOW TO GET THE WORD OUT ABOUT YOUR PRO BUSINESS

A three-minute interview with PAUL BERTO, who spent 17 years at Home Depot Canada, most recently as director of corporate communications and external aff airs

Some people think that public relations is not necessary for a pro dealer. What would you say to that?

I’d challenge that assumption. Public relations is not about chasing headlines, it’s about trust, visibility, and credibility. Your customer, the contractor, interacts with local news, follows trade publications, follows infl uencers, and increasingly interacts with brands online. When your brand is seen supporting the community, training apprentices, or off ering money-saving or time-saving products and services, it reinforces your value as a partner, not just as a supplier. A good PR strategy for a dealer makes sure your story is being told in a way that drives business and retention.

and why should your customers care? It’s about local relevance—how do you serve and impact the community? The key is consistent messaging across all your touchpoints, both physical and digital. I had a mentor of mine say you need to say it more than 20 times before the message sticks. Don’t forget about your employees—they are your best spokespeople and can make or break your brand. The home improvement category is rich with stories and is a backbone of the Canadian landscape; we have a great opportunity to tell those stories.

What are the fundamentals that you would look at when arriving at a company that wanted to ramp up its PR in this industry?

The PR fundamentals that I look for when ramping up your storytelling starts with a clear narrative— what makes your company diff erent

I had a mentor of mine say you need to say it more than 20 times before the message sticks.” “

What is the role of artificial intelligence in public relations and communications? How will AI change the game over the next 5, 10, and 25 years?

AI is already reshaping the landscape. Organizations are using AI to generate content in an instant, whether press releases or social posts or website content. AI is monitoring sentiment for your brand in real-time across multiple platforms. And, in some cases, it can predict potential PR crises before they happen. AI is being used as a strategic advisor for communication tone, timing, channel deployment, and even creative direction. But there’s a rub: AI shouldn’t replace the human element. Dealers who build emotional intelligence, strategic thinking, and real relationships into their communications will break through in a crowded market. Remember, AI is the tool and not the story.

PAUL BERTO

“We have had seven major expansions since joining Sexton Group in 2010. We couldn’t have done that without the tight-knit team of professionals at Sexton Group pointing us in the right direction. I’m often asked at conferences and meetings if I feel the pricing is competitive. I say “YES.” You don’t expand seven times in 10 years without competitive pricing programs. That’s why I am a Sexton member.”

Albert Pike, Pike’s Building Centre

PRODUCTS FORPROS

SAINT-GOBAIN

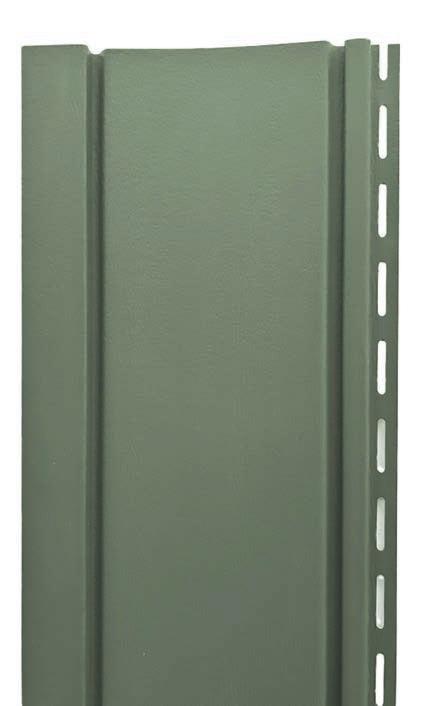

Davinci Vinyl Siding Panels

Davinci Intense Board and Batten vertical vinyl siding panels are designed for exceptional durability and curb appeal. Heavy gauge premium thickness provides outstanding impact resistance. A full 1/2-inch profile adds a deeper dimension while a low gloss wood grain finish creates a simple and elegant look. Duratron vinyl technology ensures durability and long-lasting performance. saint-gobain.com

GILLFOR

EWP PRO Advantage

Gillfor’s EWP PRO Advantage program supports builders from the ground up. The program off ers resources including special pricing, design support, or technical training built to meet real jobsite needs with real-time support. Program benefi ts include special bid and programs pricing, CSD iStruct Software integration, marketing and product support, and fast handling of repairs and warranty issues.

gillfor.com

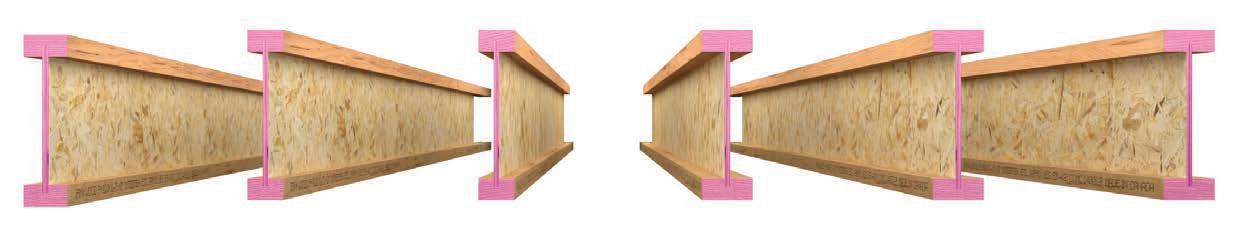

PINKWOOD PKjoists

With a focus on effi ciency and precision, PinkWood off ers top-tier, competitively priced I-joists that meet the demands of modern building projects. PKjoists are built with proprietary-grade fl anges and are available in a range of depths for residential and commercial applications. To protect against moisture-related end-checking and absorption, all PinkWood Ltd. I-joists are shipped with a pink moisture sealer. pinkwood.ca

VICWEST

Bellara Plank Siding

Vicwest’s Bellara Plank series, crafted to emulate natural wood, is engineered from steel, and designed to last a lifetime. Colourmatched trim system creates a seamless aesthetic. Available in two gauges, a wide range of woodgrains, and multiple widths that can be installed together, Bellara Plank blends seamlessly to look beautiful for generations. vicwest.com

TANDO COMPOSITES

Beach House Shake Shingles

Beach House Shake offers the authentic look of natural cedar shingles without the typical drawbacks like discolouration, mildew, cracking, or cupping. Made with a proprietary highperformance composite, it’s available in four natural styles including Sandcastle, Pacifica, Hatteras, and Atlantica, to suit a wide range of architectural styles and mixed material designs. Lightweight and easy to install with no special tools required. tandocomposites.com

JELD-WEN JWC8500 Vinyl Windows

As climate change reshapes the way we live, Canadian homeowners are facing new challenges. These products are energy efficient, lowering reliance on heating and cooling systems, leading to lower energy costs and a reduced environmental impact. Maximizing durability and style, these windows not only enhance the comfort of Canadian homes but also promote environmental responsibility. jeld-wen.ca

Smart Looks, Smarter Build.

Elevate your exterior with LP® SmartSide® Lap in brushed smooth texture. 16’ lengths mean faster, more efficient installs, while 16 colour options maintain your style. Helps protect against impacts from hail and resist termites and fungal decay— combining strength and beauty in one smart solution.

LP SmartSide products are available through Taiga Building Products, giving customers certainty with every product, every time.

Browse our full selection at

WESTMAN STEEL

Snap Lok Roofing Panels

Snap Lok is a concealed fastener steel roofing system designed for both beauty and performance. With clean, crisp lines and no visible screws, it delivers a modern, highend look while providing the strength and durability of steel. The panels “snap” together with a locking seam that hides fasteners, enhancing curb appeal.

westmansteel.ca

WESTMAN STEEL

EDCO Board & Batten Steel Panels

This product replicates the timeless charm of traditional wood siding and roofing, but with the unmatched longevity of steel. Designed to mimic the bold vertical lines of classic board and batten, this panel system combines old-world style with modern innovation. It’s engineered to resist fading, cracking, and warping, making it a smart choice for homeowners and contractors alike.

westmansteel.ca

By Geoff McLarney

G WHEN A PRODUCT GOES WRON

When a contractor tells you that a product has failed, it can create uncomfortable triangulations between contractor, retailer, and vendor. We talked to three pro dealers about how they balance customer loyalty and vendor relations

Every contractor wants their products to work, but sometimes something goes wrong— that’s where warranties can come in. But navigating their complexities and the requirements of manufacturers isn’t always straightforward, and the support of a dealer can be crucial for the pro customer seeking redress.

Jeff Anderson manages sales at Doidge Building Centres, which has 13 stores in Ontario, 12 of them under the RONA banner. “We’ve always had a good relationship with contractors right from the start,”

he explains, going back to the company’s origins as a single store.

From there, the group has expanded dramatically, welcoming six new locations in 2017 and two more, in Ottawa, last year. Along the way, Doidge has added locations with “a very high percentage” of pro customers. Anderson’s own background is at one of those contractor-oriented locations.

In Ontario, all new homes are covered by a mandatory Ontario New Home Warranty. For those builds, Tarion, the provincial agency that administers the

program, can do some of the legwork for the consumer. British Columbia, Alberta, and Quebec have similar mandatory programs, while in other provinces optional warranties are available through members of the Canadian Home Builders’ Association.

If a builder doesn’t meet “the criteria of what the end user is wanting,” Anderson explains, Tarion “would then go to bat for the homeowner to [ask] the contractor to either rectify a situation or provide documentation that this is part of the norm.”

In those cases, Anderson says his role is to liaise

“You’ve got to go with your gut on some of the calls that you make. But if it’s with a contractor that’s been with us for a long time, we usually just help them out no matter what.”

Kevin Gillman, manager, Grande Prairie Home Hardware Building Centre

with the manufacturer and “get their warranty information as to what would constitute a warranty claim for them. We would help the builders get the manufacturer out to the site to view the offending products. And then, if it is determined that it is a warrantable issue, we would then have the manufacturer provide us with the materials at the store level.”

HOW IT WORKS IN QUEBEC

Marianne Moisan is co-owner, along with her cousin Mathieu Moisan, of BMR Paulin Moisan, a thirdgeneration pro dealer in Saint-Raymond, Que. The pair were named Young Retailers of the Year at the 2022 Outstanding Retailer Awards. She describes a similarly hands-on approach, including site visits.

“For materials such as shingles, sheet metal, and exterior cladding, we visit the customer’s site. We take photos of the defective product and send them to the supplier. We follow up on everything until the customer receives a credit.

“For tools, customers bring the defective tools to our store,” Moisan explains. The next steps depend on “the supplier and the value of the tool.” For example, the business has an agreement with King Canada that allows it to accept exchanges in-store for products valued under $200.

“

I don’t like to see a homeowner or a customer of mine stuck in a situation where a product has failed.”

—Jeff

Anderson, RONA Doidge Building Centres, 13 locations in Ontario

“Otherwise, we take the tools ourselves to a repair centre in Quebec City. We go there once a week, on Thursdays, to drop off tools for repair and/ or pick up repaired tools.”

Another wrinkle is the variety in warranty terms, including what’s covered. Some cover only materials, while others include labour. “If it’s just parts, we order the parts and we have someone in-house who is able to modify parts for most products,” says Moisan.

Yet another variable is how the dealer gets involved—and at whose behest. “The odd time you get the homeowner reaching out when it comes to a warranty claim; other times it’s the contractor,” says Kevin Gillman, general manager of Grande Prairie Home Hardware Building Centre, in the Alberta city of the same name. It received the Outstanding

Retailer Award for Best Building Supply or Home Centre over 15,000 square feet in 2022.

According to Gillman, the most challenging warranties are those for power tools. “It’s so vague. The vendors don’t really want to take it back once it’s been used. We run into the same problems with snowblowers, with lawnmowers. Once they’ve been used, especially if they’ve got any type of gas in them, we’re not supposed to take them back.”

Anderson agrees that sometimes “the manufacturer’s warranty isn’t clear, isn’t concise.” In those cases, the approach is to “work out a solution with the contractor to fi x the problem, either with a new product or helping them pay their labour or disposal of the bad product,” he says.

For Anderson, those eff orts are part of a broader concern for customer service. “I don’t like to see a

Doidge Building Centres has 13 locations in Ontario, 12 of them under the RONA banner. Right: Jeff Anderson.

We take photos of the defective product and send them to the supplier. We follow up on everything until the customer receives a credit.”

Marianne Moisan, co-owner, BMR Paulin Moisan, St-Raymond, Que.

homeowner or a customer of mine stuck in a situation where a product has failed.”

TAKING A LOSS

In some cases, the retailers agree, maintaining a customer relationship over the long run can mean taking a loss in the short term. “We prefer [taking a loss] to having an unsatisfied customer because of suppliers being less flexible,” says Moisan.

“If it’s a power tool, whether it’s a Milwaukee, a DeWalt, or a Makita, they could have it for less than a week,” Gillman explains. “And if it breaks down, what the manufacturer wants us to do is to send it to the vendor to get it repaired. That really doesn’t work for the builder that needs his circular saw or his drill.”

On the jobsite, of course, time is money. “If we’re going to send it away on his behalf, or even if he

sends it away, then he could be waiting for one, two, three weeks possibly, depending on how far away you’ve got to send it,” says Gillman.

“We’ve had circumstances where they’re pretty upset by that warranty, so we’ll take care of it ourselves. And sometimes we take a loss on it. We’ll give them a new product, we’ll take their damaged product, we’ll send it away. When we get it back, we have to sell it as used. So we do take a loss on it, but in the long run it’s worth it because it’s building relationships with our builders.”

None of this means you have to be a pushover. “If we figure that we’re being abused and somebody’s trying to take advantage of us because they’ve used the snowblower for a week during a heavy snowfall and then they want to bring it back—that doesn’t always work.

Cousins Marianne and Mathieu Moisan (right) are third-generation owners of BMR Paulin Moisan.

“You’ve got to pick and choose, and you’ve got to go with your gut on some of the calls that you make. But if it’s with a contractor that’s been with us for a long time, we usually just help them out no matter what.”

For his part, Anderson stresses that it’s important for his business not only to meet contractual obligations but also to do what’s “morally right.”

“In a situation where a company’s warranty is fi ve years on, cut and dried, on a certain aspect of the product line—if [the return is after] fi ve years and two months, we will sometimes go out of pocket in order to make sure we do the right thing.”

DOING RIGHT BY YOUR PROS

Ultimately, dealers are trying to do right by their pro customers just as the pros want to serve their own clients. “A lot of the time the contractor is trying to sell the job to their customer. Warranty is definitely a selling point for them, and you want to make sure that your supplier can fulfill any warranty obligations,” says Anderson.

“The homeowner may have one warranty claim in their lifetime for a particular product. The contractor may have two warranty claims in their

lifetime for another product. We as a supplier of that product may have 10 or 20 over the course of the lifetime with that product.

“So we’re a lot more familiar with the warranty process, and it helps us make the warranty claim process seamless when it comes to the contractor, for sure. And even more seamless when it comes to the homeowner.”

Likewise, Gillman says making an eff ort with warranties “goes a long way,” and a big part of that is transparency with the customer. “We will tell them what the warranty is and what we’re going to do, and they really do appreciate it. It works for us and it works for them.”

Anderson echoes the sentiment. “It’s customer service on our end. We would like to see both the contractor and the homeowner or the home builder come back to our stores, which is why we would tend to err on the side of helping facilitate and make sure that things are run smoothly when it is a warranty issue.”

In the end, Anderson says his goal is to help the customer “in any way we possibly can, because you’re only as good as the last interaction you had with that customer.”

Kevin Gillman is GM at Grande Prairie Home Hardware Building Centre in Alberta.

by Steve Payne

CUSTOMERDRIVEN

When Joaquim (Jack) Prazeres founded SENSO BUILDING SUPPLIES 15 years ago, he thought he was starting a small side business. It hasn’t worked out that way. During an interview with Senso Group president Cynthia Prazeres-Mare, we learn that listening to what contractors wanted has propelled Senso Group into a thriving, three division business

SENSO GROUP

SENSO BUILDING SUPPLIES

YEAR FOUNDED: 2010

LOCATIONS: ▶ 6 Hyde Avenue, Toronto ▶ 150 Rockcliff e Court, Toronto

NUMBER OF EMPLOYEES: 70

BUYING GROUP: AD

Interview

Photography: Ema Suvajac

Senso has three businesses in one: a building supply business, a rental equipment business, and a waste disposal business.

Left to right: David Mare, Jason Prazeres, Cynthia Prazeres-Mare, Otilia Prazeres, Jack Prazeres.

Let’s start with your father, Joaquim, who is known as Jack. He was born in a rural village northwest of Lisbon, Portugal, in 1962. His was a family of small farmers who grew wine grapes. He came with his family to Toronto in 1974. When he graduated high school, he co-founded a masonry company, Trican Masonry, with three partners. How did he come to create Senso?

Around 2010, the one partner wanted to take over. He bought my dad out. My dad had a non-compete for fi ve years, so he couldn’t go back into the bricklaying business. That’s how he decided to start Senso Building Supplies. He thought it would be a small side business—he had no expectations of it becoming what it is today. Our first yard was at 6 Hyde Avenue, Toronto, and it was quite small, and we outgrew it in about three years. So now we have

a bigger yard, at 150 Rockcliff e Court, which is just over four acres. We’ve kept both locations.

Your father’s been very successful both in business and in the Portuguese community, and in charities. He’s obviously a larger-thanlife guy. What is his role with Senso right now? He still oversees a lot of the operations. My brother, Jason, who is our CFO, and I run the day-to-day aspect of the business. But my father is here for all of our major decisions. And my husband, David Mare, came in to start up our waste management division in 2017. And my mother, Otilia, is involved with the accounting.

Senso Group president Cynthia Prazeres-Mare

Our diversity is due to our customer demands—just adding services based on the needs of our customers and trying to be a one-stop shop for everything they need.”

You’re 35 now and you are an alumnus of Carleton University, Ottawa, where you graduated in 2011 with a degree in zoology and animal biology. Have you been able to apply your university education to your work at Senso?

I think regardless of what you study, being able to get a university degree, it really opens up your thought processes. And it’s not so much about what it is that you’re taking, but about how you tackle situations and questions and problems. And learning how to manage a lot at once, being able to focus on what needs to be done to accomplish the goal.

And while you were in Ottawa, you went to work in the office of a famous politician, Mario Silva. I learned about the ins and outs of the political system. And in the summers when I was home in

Toronto, I would work in his constituency office. There I was dealing with a lot of people, different personalities, different cultures, and figuring out what people’s priorities are.

The Toronto Portuguese community was obviously important to you, growing up?

Yes. My dad at one point was the president of our community (Portuguese) cultural centre in Mississauga. There were a lot of different aspects that we were able to connect with there. And coming into the construction industry, there are a lot of Portuguese and Italians. Our initial success was due in large part to the Portuguese community in the Greater Toronto Area. And because of that, we do our best to give back to various community groups.

Senso Building Supplies’ main location at 150 Rockliffe Court, Toronto, is ideally situated to serve the entire city.

Senso has three businesses in one: a building supply business, a rental equipment business, and a waste disposal business. That business model is not replicated in other places in Canada. It’s unique to Senso.

I sometimes get asked, who is your biggest competitor? And my answer is always: ‘In what field?’ I can’t find a direct competitor that does, even within the building supplies, everything that we do, let alone adding in the equipment and the waste management. And I don’t think that was ever really the plan for Senso. We started up as mostly a masonry supply store. But the real focus has always been on customer service.

Because of that, we’ve let our customers drive our growth and our expansion. They will tell you: ‘It would be really helpful if you had this product,’ or ‘It would be

great if you were able to do that for me.’ Or they’ll say: ‘I’m not happy with this supplier. Is there something that you can do?’ And we’ve let that drive our growth as opposed to saying, ‘You know what, today we think we’re going to get into the lumber game.’ Rather than trying to push that on our customers, we’ve let our customers guide our growth and direction.

You have a unique product mix, perfect for your industrial and commercial customers.

Compared to a regular lumberyard, yes. We have a lot of concrete products in our yard as well as bricks and interlock. Our sales are close to 60-70 percent industrial and ICI stuff right now. We had a big boom in residential construction when we were doing all sorts of subdivisions—but that sector is pretty slow at the moment. But it’ll rise.

We’ve been very adaptable as a company. And I guess we’re very lucky in the sense that we can change and manipulate what we sell. We’re not solely focused on one thing.”

What’s your prediction for 2025? What kind of a year are you going to have?

We’ve been very adaptable as a company. And I guess we’re very lucky in the sense that we can change and manipulate what we sell. We’re not solely focused on one thing. For example, last year, our masonry was down, but our lumber and drywall were up signifi cantly. Because we don’t fi t into one box, we can change what we focus on and how we attack the market based on where we find the demand that year. Predicting this year is a little bit tricky. Towards Q3 we think we’ll start seeing an uptick as the industry gets back on track.

Let’s talk about the evolution of your rental business. Who is the typical customer, or is that diffi cult to say?

Yes, it would be difficult. I would say on the rental side, it’s small to medium-sized contractors. And then, especially on the weekends, we get a lot of

homeowners still. We do sales, we also do service, which is a big one for us. We fi x everyone’s machines, and the rental machines as well. Again, our diversity is due to our customer demands. We’ve just added services based on the needs of our customers, trying to be a one-stop shop for everything they need.

Are you able to sell somebody or rent somebody a Kubota, like a mini backhoe-loader? Yeah, we do mini excavators, steers, and all of that other material handling equipment. And conveyor belts. Because we’re right in the city, and every-

thing’s so tight, we rent and sell a lot of smaller material handling machines. For example, we have a skid steer that’s five feet wide, but we also have a little ride-on one that’s three feet wide that can get between Toronto houses. We are really just trying to cater to our specific market.

Do you provide trusses?

Yes. That is a sector that we started developing in the last two years. We met with the right suppliers so we can provide our customers with this option. Within the last year, we’ve been successful at getting the whole lumber package for our customers. From floors to trusses, to all the framing lumber.

Can you talk about the disposal business?

How did Senso get into that?

We started with a product that was really unique. It was a bin with a multi-mixer on the side of it. We deliver that product a lot of times in the city. We put

Senso rents a unique product that is a combination disposal bin and concrete mixer.

Other than work hard, the phrase that my father uses all the time is: ‘If you don’t service your customer, someone else will.’ ” “

three yards of sand in there with a couple bags of masonry cement. And contractors will put it on the front lawn of the house, do their project, and then call us two or three days later to pick it up. It is an allin-one. It is a popular product. That was the starting point for us to get into different types of bins. And now we are really a full-service waste company.

What’s your father’s essential business philosophy?

Other than work hard, the phrase that he uses all the time is: ‘If you don’t service your customer, someone else will.’ It’s really putting a focus on the customer service. But overall, he’s a bit of a risk taker, I would say. He’s not scared to try something new. And one of the things I say to my staff is that if we’re not changing, then we’re going to fall behind. I love change. I embrace it. Being able to change is essential to our success!

Is it tough working with your immediate family members?

I think we actually work pretty well. We generally try not to step on each other’s toes. We definitely don’t always agree on everything. But we’ve got a good relationship where we can put work aside and talk about it over dinner if we need to, and move on.

And you have to mix parenting into it, as well. How old are your kids?

Eight and nine. I’ve got my mom and my motherin-law that both help with the kids. It makes it a lot easier for work when I need to stay late, or when I need to go to an event after work. They’re with their

grandmothers, so if they have to sleep over, they sleep over. No big deal. I’m very lucky that way.

How much Portuguese do you speak?

I’m fluent. My grandmother only speaks Portuguese. I generally try and get away to Portugal in the summer.

Every other year maybe. I still have some cousins there, so it’s nice for my daughters to get to know their family. It’s really a special bond.

And then you work on the community side?

Yes, I’m one of the vice chairs of Mississauga’s festival of cultures, Carrassauga. Senso is also a big supporter of Luso Canadian Charitable Society, which support adults with disabilities. We’ve been honoured to be a two-time recipient of AD’s Giving Back Award for the work we do with Luso CCS.

By John Caulfield

EQUIPMENT RENTALS FOR THE PRO DEALER

Even a small program can generate ancillary sales

Windsor Plywood’s building supply outlet

in Qualicum Beach, B.C., is this pro dealer’s only branch that specializes in equipment and tools, a program that Windsor Plywood inherited when it acquired the store in 1989.

Windsor Rentals, as the program is known by, is incorporated into the store, shares a service counter, and takes up about 25 lineal feet of display space.

Aside from an on-staff mechanic who handles maintenance and repair, Windsor Rentals has no exclusive

employees. A planned renovation and expansion of the store later this year will give more display space to Windsor Rentals and separate its equipment from the store’s for-sale products, says Sean Machan, the store’s manager.

Windsor Plywood seems typical of how pro dealers in general off er rental equipment and tools more as a customer service than as a profi t centre. As such, dealers might be missing some opportunities for growth and better investment returns. Achieving

Orgill’s Ken Duck says gross rental profits for the dealers in its program can run anywhere between 76 percent and 84 percent before factoring in overhead.”

those goals, though, would require a greater commitment to staff and inventory that the pro dealers we spoke with aren’t yet in any hurry to make.

NO DEDICATED STAFF REQUIRED

Let’s start with staffi ng. The dealers we contacted for this article say they are doing just fine without having any employees assigned primarily to rental. At least one—Niagara Building & Design Centre in Welland, Ont.—plans to add a dedicated associate once its rental program, which Niagara has off ered since the store opened its doors in 2022, is generating suffi cient revenue to support that person. (The program is currently averaging $4,000 in rental revenue per month, says co-owner Kevin Bolibruck, who expects his Castle store to reach the higher revenue threshold by 2027.)

will have to be someone whose job it is to take care of the department, even though it may not be their only job in the store.”

Pro dealers must also remember that their rental programs are competing against larger companies with outlets that specialize in renting equipment and tools to pros and consumers alike. One such competitor is the acquisition-minded Cooper Equipment Rentals. The compact equipment specialist (with 81 branches in six provinces) likes to staff its stores with “local people” who understand local customer needs.

Orgill, the hardlines distributor, has off ered dealers a rental equipment program for 20 years. That program—which according to the company has attracted a great deal of interest from Canadian dealers—includes comprehensive training where dealers are instructed on best practices.

“We have found that a successful rental equipment business typically requires dedicated staff to run the department,” observes Ken Duck, Orgill’s programs sales manager. While he concedes that dealers just launching a rental program can get away with using existing staff for a period of time, eventually “there

“We want to maintain personal contact, with both the customer and employee speaking the same language,” explains Cooper’s regional manager, Mike Wijayasundar. He adds that Cooper’s competitive formula for success hinges on serviceability and fl exibility, so “listening to customers” is essential to any rental transaction.

MAINTAINING WHAT YOU RENT

Cooper’s branches handle the maintenance and repair of the equipment and tools they rent. The way pro dealers maintain what they rent varies. For example, Barr’s BMR in Bobcaygeon, Ont., which generates about $10,000 per month in rental revenue during winter months and considerably more during hotter seasons, uses an off -site mechanic and, in a pinch, a couple of Barr’s employees who are mechanically adept, says Mitch Barr, the store’s manager.

One of Niagara Building Centre’s drivers doubles as its rental equipment repair guy, says Bolibruck. And Devon Chamberlain, an accounts receivables specialist, oversees maintenance and repair of rental equipment at Chamberlain TIMBER MART in Gravenhurst, Ont. Chamberlain’s rental program generates between $15,000 and $20,000 in annual revenue. And while it depends on the item, the store hopes to get four or fi ve good years out of its rental equipment and tools before they need to be replaced.

Windsor Plywood’s location in Qualicum Beach, B.C., specializes in rental equipment and tools.

Kevin Bolibruck

Orgill suggests that what’s missing from many dealers’ rental programs is a market study, which Ken Duck asserts is a “foundational block for building your offering.”

Cooper owns all the equipment it rents and relies on its vendors for parts. Most of the pro dealers interviewed own what they rent, too. The exception is Niagara Building Centre, which typically leases equipment from vendors like Hilti (which has its own Tools on Demand rental program) for three years, and then purchases the product for eventual resale.

Orgill’s Duck says gross rental profi ts for the dealers in its program can run anywhere between 76 percent and 84 percent before factoring in overhead. And while ROI on rentals is based on initial cost and rent frequency, Duck says that most dealers should reasonably expect a three- to fi ve-time return on smaller, more general items. Similar returns on larger equipment with higher upfront investment costs often take longer to realize, he says.

A MIX OF VENDORS

Dealer-member buying groups generally don’t get involved in supplying for-rent tools or equipment. Consequently, dealers with rental programs find themselves needing to purchase products they

rent from a combination of branded vendors, like Bostitch, Hilti, John Deere, Bobcat, and Makita; and specialized suppliers such as Pro Quip, Rent-EQuip, and G.C. Duke.

Orgill’s mix includes names that are familiar (Bluebird, Milwaukee Tool, Toro, Ditch Witch, Bosch) and specialists like Electric Eel and Mi-T-M. Wijayasundar says that each of Cooper’s branches deals with more than 150 vendors, sometimes several for the same product. But, he adds, “over the years we’ve found that we’re not pioneers. It’s more important to provide the best customer service.”

Cooper’s rental stores, which in Toronto can exceed 7,500 square feet, have the space needed for a robust rental assortment. But Wijayasundar is also quick to note that no dealer’s rental program is boundless. “You can’t be everything to everyone,” he says.

Pro dealers’ rental assortments are more modest, confined by available space and determined by customer demand. The equipment Chamberlain TIMBER MART rents includes AttiCat insulation blowers, air nailers, gas-powered soil compactors, ceramic tile saws, drywall board cutters, guillotine fl oor cutters, generators, PAM Fasteners screw guns, scaff olding, cement power saws, and rotary hammer drills. It keeps its rental equipment inside two 10x12-foot sheds in its yard. Its most popular rentals are cement mixers and fl oor nailers. Chamberlain says its rental mix has “evolved” based on changing customer requests.

Rental equipment takes up about 400 square feet of outside space at Niagara Building Centre, which

Cooper Rentals is one of the market leaders that pro dealers compete with. It has 81 stores in six provinces— some of which exceed 7,500 square feet.

Barr’s BMR in Bobcaygeon, Ont., generates about $10,000 per month in rental revenue during winter months and considerably more during hotter seasons.

also displays some rental stuff inside its store. Niagara focuses on small-engine equipment like power washers, dehumidifiers, and so forth. Jackhammers, fl oor sanders, and one-person augers are particularly popular, says Bolibruck. He notes that the program takes vendors’ advice about what to rent, and there’s a whiteboard in the store where customer requests are written and, often, met.

Machan says that his computer tracks the rental frequency of his equipment, and that pros are most likely to rent stuff like aerators and log splitters. He notes that Windsor Rentals has been moving more toward battery-powered equipment and away from gas-driven products.

Barr’s BMR devotes one-third of its 4,000 square foot store plus outdoor space to displaying rental products. Its mix includes articulated lifts (a popular rental, says Barr), backhoes, mini excavators, power washers and augers, shovels, leaf blowers and generators. Lately, it’s been staying away from wood chippers because of potential jamming problems. Other dealers say they avoid rental products that are expensive to fi x.

A MARKET STUDY NEEDED

Cooper’s Wijayasundar says his company sees growth potential in what he calls “specialty rentals,” which would include “pump and power” and trench

safety related products. Pro dealers, on the other hand, seem to be content letting customer demand guide their programs’ expansion. “What we have right now is pretty good,” says Bolibruck, who echoes how other dealers assess their rental mix.

Orgill’s Duck, however, suggests that what’s missing from many dealers’ rental programs is a market study, which he asserts is a “foundational block for building your off ering.” A rental market study (which Orgill will perform for dealers in its network) rates a specific area and positions the dealer accordingly to either capture market share or pick up margin dollars where opportunity exists. The study’s primary purpose, Duck says, “is to identify those opportunities and present the retailer with a blueprint for how to take advantage.”

One expectation that pro dealers say they have for their rental programs is that it leads to more sales eventually. In its description of its rental services on its website, Barr’s BMR Pro states “we can also off er a variety of supplies that you might need such as aggregate topsoil, cement, and lumber to make sure your project is fully supplied.”

Bolibruck confirms that his store’s rental program “absolutely” brings in business the store otherwise wouldn’t get. That occasionally includes the purchase of a tool or equipment that a pro customer had previously used as a rental and liked it.

CONFIRMED SPEAKERS

Summit to Success

Two days of presentations in scenic Ban , Alberta, featuring some of the world’s leading retailers. Plus networking with dealers and industry leaders from across Canada. Ideas. Insight.

Get them all at the 29th Annual Hardlines Conference, October 21 & 22, 2025, at the beautiful Fairmont Ban Springs.

Sherri Amos HOME HARDWARE STORES LIMITED

Stephen Bailey JOHN FLUEVOG SHOES

Steve Buckle SEXTON FAMILY OF COMPANIES

Ken Clark HARDWARE & BUILDING SUPPLY DEALER MAGAZINE

Amanda Fancy GOW’S HOME HARDWARE & FURNITURE

Nicole Gallucci IN GOOD COMPANY

David Ian Gray DIG360 CONSULTING LTD.

Mark Kennedy STAR BUILDING MATERIALS

Bob MacMillan RONA+ KINGSTON

Sophie Marai ENVIRONICS ANALYTICS

Russ Permann TAIGA BUILDING PRODUCTS

Joel Seibert MOUNTAIN VIEW BUILDING MATERIALS

Dan Tratensek NORTH AMERICAN HARDWARE AND PAINT ASSOCIATION Visit hardlinesconference.ca for further announcements.

Interview by Geoff McLarney & Steve Payne

TARIFFS, THE ECONOMY, AND BUILDING MATERIALS

This interview with RUSS PERMANN, president and CEO of Taiga Building Products, was conducted on June 19, 2025. Permann analyzes the market as of that date and looks at the prospects for the rest of the year and longer term.

Tariffs are all anyone can talk about right now. We know that commenting on tariffs for a print magazine is problematic, because the situation seems to change daily. Based on the situation in mid-June, at which point the market for building materials has slowed down, do you think that tariffs will become a bigger issue in the second half of the year? Especially as lumberyards start to get their reorders in?

I don’t think it’s a question of the timing of the ordering, it’s really a question of confidence. As you noted, the market has slowed down. Market prices have declined and to some extent that has offset some of the impacts of potential tariffs on goods. I should note that Canada and the U.S. are presently under the protection of the Canada-U.S.-Mexico Agreement [CUSMA, the 2020 replacement for NAFTA, the former North American Free Trade Agreement that was in place since 1994] so trade is less impacted. Although we still have some goods that are impacted by tariffs on both sides of the border.

The reason prices have declined is not tariffs, necessarily. They’ve declined because of weak demand. And weak demand is a function of the consumer’s lack of confidence and thus retail lack of confidence. There’s not as many people coming to the market to trade in commodities as we might see in a more buoyant market. And that has probably

created a little bit of an offset to the impact of tariffs.

I don’t think people are necessarily seeing a rising cost of building materials in their inventories because the commodity market is doing its natural thing and stepping in. And providing a certain amount of relief because of the weak demand that’s a function of uncertainty. Saying what will happen going forward is that we don’t know. And I’ve been saying this since the pandemic! We don’t have a playbook or a framework to guide us through these markets. Sometimes injecting uncertainty is, in fact, a strategy. And I think that’s part of the issue now.

It’s hard to tell people where things are going to go when uncertainty is the strategy. I think from our perspective, we don’t presently see a lot of inflation. It’s very targeted on very specific items. But what I do see is volatility coming—and that will be a function of the uncertainty.

I don’t think we’re getting a clear direction on the market yet for the fall of 2025. But I think that you know there is an equal chance that we will see some inflation again on the material side. But that’s going to be a function of getting some kind of trade deal done between the two countries.

Do you think a recession is going to happen?

I’ve read analyses lately that suggests we’re already technically in a recession. It’s tough to say. Going

Sometimes injecting uncertainty is, in fact, a strategy. And I think that’s part of the issue now.”

back to the point I made on the previous question, it’s tough to say what trajectory the market will take. Because there are so many regional diff erences to account for. There are clearly slower parts of the country that are probably in some form of recession now, certainly on the building products and on the housing side of the market. When you look at Ontario and B.C., they are quite possibly in some form of technical recession.

But there are other parts of the market that are relatively buoyant. You know you’ve got places like Alberta and the Prairies where business is still very robust and sound. The risk is obviously there for the country to enter into a full-blown recession. But I remain optimistic.

And I’m bullish on housing long term. I think underlying demand for housing is there. And I think, based on the election results, the government willingness to support housing is there. I think we just need to get past this short-term uncertainty for housing to hit its stride. I think the back half of 2025 could be weaker than we had all hoped for going in. But I can see strength beyond that.

The last time you were with us [May 2023], you talked about the gap between the possibilities and the reality around technology in the LBM industry. Can you tell us what Taiga has done to narrow that gap?

Technology continues to be where our core investments are made in our business. We’re still investing in two key areas. We obviously invest in

the people-enabling side of our business that makes it easier for our staff to do their work—and supporting our customers. We definitely put the customer at the centre of all of our decisions around technology. The other area that we invest in is direct customer enablement technology. That is there to maximize the transparency our customers have in doing business with us—and other partners for that matter. We want people doing business here to have maximum control over the experience that they’re having.

So we’ve got our online store launched and operating. It’s a B2B platform for all of our customers. They can look at our inventories and check their prices. It’s individualized to each store. And it continues to be enhanced. So that’s probably a change since last we talked. And you know there’s so much room to grow on that side of the business and we continue to invest there.

But we’re also starting to work now on some AI-powered solutions that are focused on making our customers’ lives better in operating their businesses. We’re in some early pilot stages, so I won’t reveal too much about the activities there.

A longer audio version of this interview is published on the Hardlines website, hardlines.ca. Just follow the links to the What’s In Store podcast. Subscribe to Hardlines podcasts so you won’t miss frequent new podcasts that we do with industry leaders. There is no charge.

RUSS PERMANN

By Steve Payne

PRO INFLUENCERS

Three of the biggest social media influencers in the Canadian contractor market are women: Danielle Browne, Sasha Kassis, and Shannon Tymosko. “I think it’s just a different take on the world that tends to draw people’s attention,” Browne says

“I love what the university brings: service and maintenance. It’s such an old campus and I’m always busy working on something cool.”

—Danielle Browne

“As an owner, it’s my responsibility to not set unrealistic deadlines on time and stuff. Employees need to change. Bosses need to change.”

—Sasha Kassis

“If you have the courage to reach out for help, I promise to meet you with compassion, empathy, and support. I believe that seeking help takes immense bravery.”

—Shannon Tymosko

INFLUENCERS

Danielle Browne

Danielle Browne was the first female plumber in Newfoundland. She says there might be “about ten” nowadays. She is striving hard to see that number climb.

Danielle has worked as a Red Seal plumber for Memorial University in St. John’s, N.L., for the last 14 years.

“When I joined Memorial I’d had my fi ve years of commercial construction and it’s not what my ADHD brain likes,” she says. “I love what the university brings: service and maintenance. It’s such an old campus and I’m always busy working on something cool.”

AGE: 36

HOMETOWN: Portugal Cove-St. Philip’s, N.L.

OCCUPATION: Red Seal Plumber

EMPLOYER: Memorial University

MAIN PLATFORM: | @ thelittlestplumber

Danielle got her training at the College of the North Atlantic in Bonavista, N.L., three hours north of St. John’s. “I did my nine-month block there, taking two advanced plumbing courses.”

thelittlestplumber ...

thelittlestplumber Over half my life has been spent in the trades and I have seen the industry come so far, but more work is needed. Accelerating action means breaking barriers, building opportunities, and creating real change for women in the trades. Let’s invest, support, and upliftbecause when women thrive, industries and communities do too.

...

rocksolid_gg Hilarious & high energy video went live last night. Check the video out on the YouTubes. Look up @thelittlestplumber for amazing content. Seriously. the_ladyplumbero newfoundlanddonutco The interview we didn’t know we needed andtheyearwas1985 Loves it bys keep em comin!

“I’ve had an obsession with tools my entire life. There’s photos of me at eight years old, tools in my hands. But I never had that academic know-how. It never dragged me in. After high school, I didn’t know what I wanted to do. I ended up giving my resume to a garage.

“They hired me. I was stocking the shelves. And the boss said, ‘You know what? I think you’re a mechanic.’ I was thrilled. I had never worked on a car in my life.

“I worked there for seven years. I loved it but I didn’t want to do it for the rest of my life. One day, I ran into my friend, Chris. And he told me that he’d just applied to plumbing school. And I thought, that sounds fun. I applied the next week and that was it.”

Danielle is a well-known infl uencer and advocate for women in the trades. She works alongside carpenters, millwrights, electricians, and engineers at the university. They even have glass blowers and welders on staff.

She goes by the Instagram handle @thelittlestplumber.

“When I get to these trade shows in the U.S., they usually say to me: ‘You’re not so little!’ I’m 5 foot six inches tall.”

“Then I tell them it’s based on a famous Canadian TV show, The Littlest Hobo.”

For her numerous Instagram posts, Danielle makes all her own videos. She uses a variety of diff erent apps. “There are so many content creators in the trades that are willing to show you their tricks. It’s quite a community.”

thelittlestplumber

Exclusive X3™ Scale Prevention Technology

Extends product life up to 3x* and eliminates regular descaling service.

*compared to other tankless models without X3™ technology.

Sasha Kassis

Sasha Kassis first set foot on a construction site about 10 years ago in Edmonton. “I got into construction once I had fi gured out that working indoors would be the cause of my misery.

“It wasn’t necessarily a passion at first,” says the owner of Wildside Construction on the west coast of Vancouver Island.

“I went through so many moments where I just wanted to quit. I was sick of the toxic lifestyle, I was sick of the bosses I was getting. For the first couple of years, the pay wasn’t good—asking for a raise was almost impossible. And then I just decided to quit— and start finding some more bosses.

“And then I realized, okay, some people do pay fairly. Some people will treat you right.

sasha_the_carpenter ...

sash_the_carpenter It’s been a minute since I took the time to properly introduce myself to those who are new around here and gured that since I hit 50k FOLLOWERS - it would be a good time to do so. You probably already pieced in together that my name is Sasha and that I am a carpenter. I joined the industry 9 years ago after quitting my o ce job ...

sasha_the_carpenter ...

sash_the_carpenter Sometimes I post videos of myself working and think, What’s the point? Another nail. Another board. Another day. But then I get a message from women who say it gave them the courage to get in the tools. From moms who show their daughters and say, “See? You can do anything.” And I remember: Visibility matters. Representation matters.

AGE: 29

HOMETOWN: Fort-Coulogne, Quebec

RESIDENCE: Ucluelet, B.C.

OCCUPATION: Owner, Wildside Construction

MAIN PLATFORM: | @ sasha_the_carpenter

“When I went to work for Wiener Construction, it made me believe there’s actual potential in the construction industry. They treated people great, there was great crew morale, barbecues every Friday. We even had Funky Fridays. It was just day and night compared to all the companies I had been working with. And that’s when I was like, okay, I want this!”

Sasha was born in the town of Fort-Coulogne, Quebec, 90 minutes northwest of Ottawa. The bilingual woman is now plying her trade—and building her company—thousands of miles away on the Pacifi c Ocean.

She founded Wildside Construction a few years ago. She tries to be an enlightened boss.

“As an owner, it’s my responsibility to not set unrealistic deadlines on time and stuff. Employees need to change. Bosses need to change.”

Sasha doesn’t have a specifi c trade and describes herself as an entrepreneur. “For that, you just need to know what you’re doing.

“Eventually we want to practise the four tens— meaning working four days a week, ten hours a day. This is about the nicest location in Canada. It’s basically a vacation paradise all year round.”

Sasha, like the other infl uencers in these pages, is a fervent advocate of getting more women into construction.

“We don’t have the same needs on a jobsite. For example, I can say I want equality, but you can tell that to someone and they’re going to give me the same harness as a guy that weighs 200 pounds and he’s six feet tall. So that’s not equality.”

“We fi ght for equity. So that’s basically accommodating everybody on the site. That’s the goal.”

INSULATI ON MATTERS FOR EVE RY R OOM

Make your home quiet and comfortable year-round with top notch insulation from Johns Manville.

Our high performing insulation options provide thermal and acoustical support for every room in the house. Request Johns Manville from your local contractor.

Shannon Tymosko

The week before our interview with Shannon, she found out that she had been laid off from her job at the Hamilton Airport.

“I’ll have to go back to the union and look for work,” she said. “I’m going to take a little break. The first layoff sucks when you’ve never been laid off before. But really, it’s nothing to be upset about.”

Shannon is a member of the International Brotherhood of Electrical Workers, Local 105.

She is an ambassador and advocate for apprentices and the skilled trades, known online as @lady.voltz.

Originally, she went to school for a semester of accounting. “It wasn’t for me.” She then completed

lady.voltz Tools are getting dirty, hands are getting rough, but the sense of pride is priceless! First week back on the job, and I’m thrilled to be contributing to Hamilton Airport’s transformation. I have to admit, I missed the daily grind - the learning, the challenges, and the sweat that comes with it.

lady.voltz What an incredible day with @BuildaDream at Janet Metcalf Public School! We built carpenter’s toolboxes with these talented girls and witnessed something truly special. From “I can’t do this” to “I CAN!”, we transformed doubts into con dence in just 1 hour! Watching these girls grow and shine makes my day (every time)! #BuildADream

AGE: 36

HOMETOWN: Keswick, Ontario

OCCUPATION: Fourth-year Electrical Apprentice

UNION: IBEW Local 105

MAIN PLATFORM: | @lady.voltz

a Children and Youth Worker diploma, fi nding a job in a shelter for homeless youth.

“I worked at a payday loan company while going to school. This evolved into an almost ten-year career.”

But Shannon was in her late twenties when she discovered what she really wanted to do.

“My best friend, Matt, bought a house. With the help of YouTube, we renovated his basement and did his bathroom. I enjoyed this. I found out that it didn’t matter what job I was on. It was seeing it come to life!”

Through her local YWCA, Shannon enrolled in a couple of pre-apprenticeship programs. The first was in machining, where her co-op partner was Dofasco (a legendary Hamilton steel company).

“Then they put a freeze on the Dofasco jobs. And another pre-apprenticeship opportunity came up in electrical. I completed that at the YWCA, too, handin-hand with Mohawk College. I was 29 or 30 when I finished it.”

She faciliates electrical workshops for the school board, promoting apprenticeships.

“I have a true passion for this educational piece. Starting out as a child and youth worker, I want to be an advocate. Apprenticeship is a potential career path that young people need to know about.”

Shannon believes that youth needs a hand up. She writes on Instagram: “If you have the courage to reach out for help, I promise to meet you with compassion, empathy, and support. I believe that seeking help takes immense bravery. And I’m committed to providing you with all the time and resources I can to help you achieve your goals.”

lady.voltz ...

lady.voltz ...

By Rebecca Dumais

HOW THE BIG BOXES ARE WOOING PROS

Every Canadian big box

home improvement chain is out to win over professional contractors— and the competition between stores like Home Depot and RONA has never been more fierce. The prize is a highly valuable, loyal customer base that consistently spends more than average homeowners. Here’s how both are working the room.

HOME DEPOT CANADA

Home Depot has a rich ecosystem tailored for professionals. Its Pro Business Account offers extended services like volume pricing, bulk pricing, commercial credit lines, and jobsite delivery.

The retailer’s Pro Xtra Rewards loyalty program earns rewards on all purchases—and pros can earn quarterly discounts on paint, for example, based on volume of the spend in a given quarter.

Beyond savings, pros get leads through Local Pro, a referral tool that can bring jobs directly to contractors via the Home Depot platform. They also benefit from targeted tools and vehicle rentals, temporary fencing, and streamlined jobsite order tracking, including delivery scheduling.

The Home Depot installer program adds another layer: certified professionals can become ‘authorized installers,’ tying into Home Depot’s consumer network. These pros receive marketing support, fast payments (up to three times per week), and access to big-ticket projects like kitchens and flooring.

Last year, Home Depot ramped up its deliveries to pros in the Greater Toronto Area with a 600,000 -square-foot Flatbed Distribution Centre (FDC) which ships direct to contractor jobsites. It was one of four FDCs that the Atlanta-based retailer opened last year. The chain says it will build 150 FDCs. Previously, the stores had to close down aisles to pick bulk orders like lumber, insulation, and roofing. More FDCs in Canada are on the way.

Home Depot ramped up its service to pros in the Toronto area with the opening of its Flatbed Distribution Centre close to Pearson Airport last year.

Get a new perspective from industry leaders

A free podcast series from Hardlines that features interviews with industry leaders from all parts of the home improvement industry. Listen while you are in the car, or from the comfort of your o ce. You will be entertained, educated and that much more connected to the industry!

David Ian Gray

Russ Permann

Russ Permann is president and CEO of Taiga Building Products Inc., Burnaby, B.C. In this newly-published podcast he talks to Hardlines editors about the e ect of tari s on the building materials business, the likelihood of a recession, and the prospects for the rest of the year. He also talks about his company’s investments in technology, AI, and what guides his company’s investment decisions: customer experience.

David Ian Gray of Vancouver-based DIG360 is a retail strategist and expert. In this podcast, Gray talks with Hardlines editor Rebecca Dumais about the changing retail landscape including the impact of tari s on Canadian businesses, the fall of iconic brands Hudson’s Bay Company and Peavey Mart and charting a path in uncertain economic times.

Peter Turkstra

In this episode, Peter Turkstra, third-generation owner of 11-store Hamilton, Ont.-based Turkstra Lumber, is interviewed by Pro Dealer editor Steve Payne. Peter talks about the headwinds that all dealers face in 2025, starting with the tari issue, which he describes as a “gong show.” Peter also talks about how municipal development charges have climbed steeply.

Plus many more podcasts to choose from!

The Hardlines Podcast Series has been made possible through the support of:

All in all, Home Depot is doubling down on pros, touting that 48 percent of its sales are from contractors. The FDCs allow pros to reserve materials, enjoy jobsite delivery, and pay on delivery—improving efficiency and reducing store congestion.

In March 2025, Home Depot Canada named Michael Rowe EVP of Pro for North America, highlighting the strategic importance of professionals in its business plan. Rowe was previously running the Canadian division for the world’s largest home improvement retailer. His appointment signals a coordinated push to deepen the pro ecosystem and optimize services—backed by digital tools, credit solutions, and delivery networks.

RONA

RONA has been ramping up its appeal to contractors via its VIPpro loyalty platform, launched in September 2020. The program offers bulk-buying options, discounts, exclusive events, and workshops—along with an app-based interface.

RONA is intensifying its focus on pros with enhanced services and a strengthened “RONA Pro ecosystem.” Key initiatives include:

•Appointment of Jamal Hamad, formerly of Home Depot Canada, spearheading pro services.

•Opening of a second Direct Delivery Centre in Hamilton, Ont., bolstering capabilities for bulk order and site delivery in Southern Ontario.

•Rolling out pro signage across 92 RONA+ big box stores, offering clear branding and a professional experience in-store.

In essence, RONA is making itself a one-stop shop for the pro contractor—offering deeper integration between digital, physical, and logistical support.

RONA has beefed up its physical footprint for pros. The new Direct Delivery Centres are critical: they mirror Home Depot’s flatbed model, enabling RONA to process and deliver large orders directly to job sites in major markets. Complemented by pro-specific signage, RONA is reshaping its stores to signal commitment to professional buyers.