Human Capital Management

2024 Annual Report

2024 Annual Report

M&A activity in the HCM space rebounded in 2024, with an additional 82 deals over the 2023 total Staffing led the recovery with a 50% increase in deals year over year Over 440 acquisitions were announced, a 23% uptick from 2023. Notably, private equity-backed strategics saw their share of total deal activity decline from 37% to 31% year over year (Page 9)

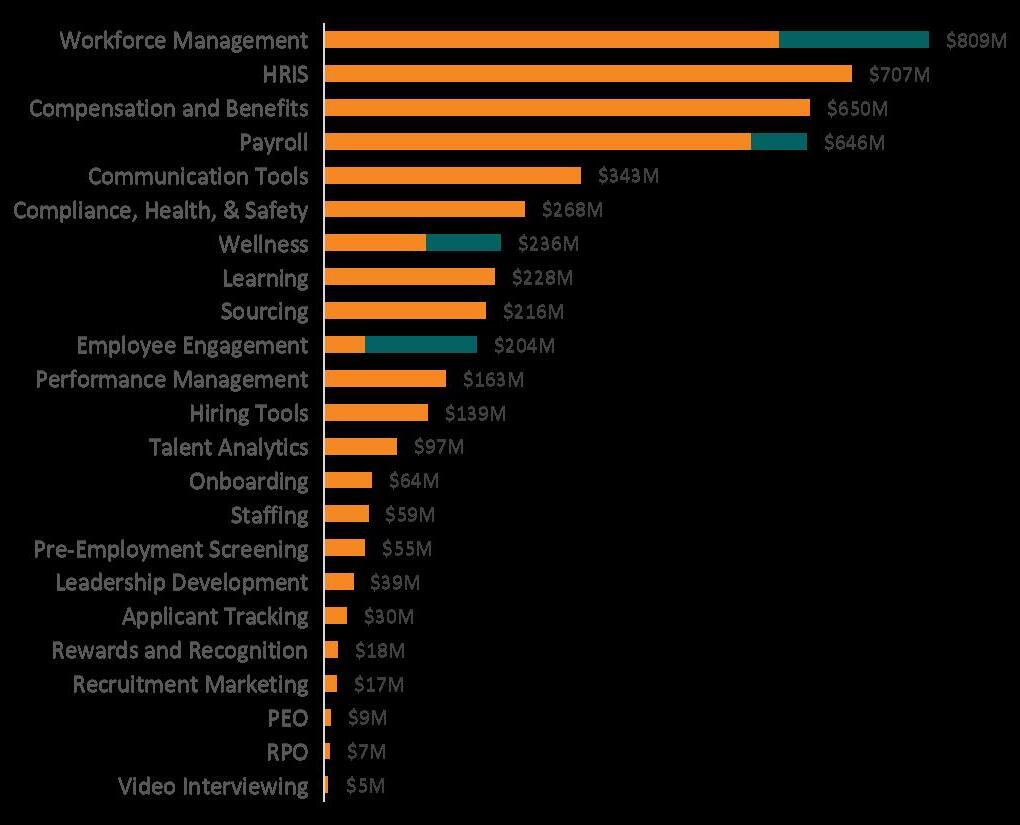

2024 venture activity remained muted, with deal volume declining 5% from 2023 totals Much like 2023, the bulk of HCM venture capital investments went towards firms in the Core HR space, garnering 62% of the $5B. Check sizes increased marginally from $6M (Early-Stage) / $25M (Later-Stage) to $7M / $27M (Page 16)

2024 was another year of self-reflection for Staffing and Recruiting amidst sustained challenges in the labor market and muted hiring activity Selectivity, re-positioning, and reconfiguration were the dominant themes across the transactions completed this year –most active buyers only deployed acquisition capital where there was a clear strategic advantage to be gained

• Technology: As many firms looked inward in 2024, digital transformation continued to be top of mind, reflected in SIA’s first-ever Technology Summit – see HVA’s commentary on the event here For many companies, technology has become not only a matter of competitive advantage – but also long-term survival.

• Digital Services + Access to Talent: Enterprise technology cycles are quickening and exacerbating the longstanding IT talent shortage. Some digital firms are opting to just acquire access to talent: Randstad Digital acquired Torc (an AIenhanced talent marketplace, Oxford Global Resources acquired Linksap Europe (an SAP consulting specialist), and Cognizant (NAS: CTSH) acquired Belcan (an engineering staffing provider).

• Executive Search Consolidation: ZRG completed 5 acquisitions in 2024 across different sectors and geographies. True acquired the technology-focused provider Paradigm, and Alvarez & Marsal launched its own executive search practice, A&M Star, with the acquisition of London-based Wilkinson Partners.

• Regional Divestitures: A few larger players reassessed their territorial coverage – ManpowerGroup (NYSE: MAN) sold off its Korean business, and Adecco (SIX: ADEN) sold off its operations in Uruguay and Ecuador Additionally, Staffing 360 sold its UK business early in the year before selling entirely to Atlantic International Corp. in November.

• PE Platforms: Private equity platform activity was modest and opportunistic – The Vistria Group invested in Soliant (healthcare and education staffing), MidOcean Partners invested in The ReSourcing Group (F&A, legal, and IT), and Knox Lane invested in All Star Healthcare Staffing (locum tenens).

With 75 deals in 2024, the talent acquisition sector had a significant uptick from the 53 observed last year. This constitutes a 46% increase from 2023 transaction levels and reflects Talent Acquisition’s resurgence over the past year. Sourcing accounted for the largest share of talent acquisition transactions, with 20 deals over the past 12 months Similarly to 2023, Pre-Employment screening also made up a large chunk of M&A activity for the year, tallying 15 deals on the year.

• Background Screening: 2024 began with three publicly traded background screening players and ended with one We saw record deal size in the background screening sector with two deals eclipsing the billion-dollar mark. First Advantage (NAS: FA) completed its acquisition of Sterling Check Corporation for $2.2B in October while HireRight’s sale to investment funds affiliated with General Atlantic and Stone Point Capital closed at approximately $1 7B

• Freelance Talent Marketplaces: Platforms catering to freelance workers were a point of interest for larger strategics this year. The acquisitions of FlexJobs by BOLD and Workhoppers by freelance.ca aimed to add new markets in a broad range of industries while the acquisition of Growth Collective by Toptal focused more vertically on marketing

Core HR had a reversion to the mean following a record year in 2023. The sector posted 92 transactions in 2024, falling in line with prior years. The Core HR index in the public markets had a solid year, with a 12% increase in the prior 12 months While it failed to outpace the S&P 500, it was the highest performing sector within HCM Trends driving M&A activity included continued consolidation of compensation and benefit providers in the insurance industry, acquisitions of international payroll firms by established players looking to reach new markets, and workforce management solutions aimed at remote workforces

• Consolidation of PEOs: Vensure Employer Solutions made a continued push in the PEO space acquiring Tandem HR, Emplicity, Marathon HR, and Certipay to bring total acquisitions to over 75

• Compensation Transparency and Total Rewards: Retaining talent was a point of emphasis in 2024 with a specific focus on transparency and employee wellness. Acquisitions like Vivup and Benify, by Great Hill Partners and Zellis Group, respectively, signal interest in providers who can simplify and centralize the employee benefit experience, increasing transparency and access to resources for workers.

• Payroll Consolidation: Much like in the PEO industry, the payroll space saw consolidation from some of the larger players Execupay led the field with three acquisitions (Payrolls Unlimited, Charleston Payroll, and Professional Payroll) while IRIS Software Group and SD Worx Group each completed two deals. Also of note was the sale of Alight to H.I.G. Capital with upfront proceeds of $1B and up to $200M additional in seller notes.

M&A transaction volume grew slightly in 2024 with 94 deals this year compared to 87 in 2023 Deal flow in the employee learning space remained strong, while employee wellness emerged as the fastest growing subcategory, reflecting an increased desire to train, retain, and maintain positive relationships with existing employees. Of the wellness focused firms acquired, mental health, fitness, and financial coaching were among the most common offerings

• Upskilling: SkyHive was acquired by Cornerstone to bolster its reskilling and labor market intelligence offerings, and Skillcrush was acquired by PowerToFly to expand its professional skill development services, particularly for underrepresented professionals.

• Strategics added leadership development solutions: SelectHR (now Access) acquired Fly, and The Center for Sales Strategy acquired Robertson Lowstuter to add new leadership development capabilities to existing HR offerings.

While the public market multiples have fluctuated since 2023, private M&A transaction valuations have largely stabilized Public revenue multiples decreased slightly, while EBITDA multiples observed an uptick in 2024 Macroeconomic uncertainty was initially reduced following the U S election, and credit conditions have improved, allowing M&A transactions to happen more seamlessly. In 2025, we expect elevated transaction activity as strategics view M&A as a core component of their growth strategy, and private equity funds have record dry powder to deploy. Within HCM, we expect continued consolidation within compliance and Core HR solutions like PEOs and benefit administrators. We predict M&A interest in professional development and upskilling, especially targeted towards industries facing talent shortages. Finally, we expect AI advancements to drive innovation and digital transformation to accelerate across the HCM landscape

The talent acquisition sector has been evolving rapidly, and in 2024 we saw a noticeable shift towards serving frontline and dispersed workforces. Recent transactions in the hiring, applicant tracking systems (ATS), and onboarding niches have underscored several themes in this transformation.

While 80% of the global workforce consists of frontline workers, only 1% of software spend is targeted at the frontline. This incongruence creates an opportunity for companies to create end-to-end solutions focused on this underserved population. One prominent example is Fountain, a company focused on the hiring process for hourly workers that has raised over $200M to date.

The frontline industry captures over 100 million employees in the United States. This scale allows solution providers to offer specialized solutions to the unique needs of certain niches, while still serving a meaningful addressable market. For example, JobGet acquired Wirkn, a retail-focused hiring platform, to expand the company to offer specialized frontline hiring SaaS solutions, addressing the unique challenges of the retail economy.

The frontline workforce is unique in that many employees do not have a desk, computer, or even an email address. This creates unique challenges in recruiting and onboarding frontline workers. Companies like UKG have made significant investments to build out SMS announcement and communication tools for their clients’ frontline teams. Similarly, Adzuna’s November 2024 acquisition of Seiza, a recruitment platform that leverages social media, has granted new capabilities that allow recruiters to target previously unreachable candidates for hourly positions.

Employee experience transaction activity remained steady in 2024 as employers focused on AI-driven tools to enhance engagement, retention, and feedback. Investments were centered on platforms that streamline onboarding, support hybrid work, and foster inclusivity, with a continued emphasis on real-time, personalized solutions for diverse workforce needs.

One of the most prominent trends in recent years has been the focus on amplifying the "voice of the employee." This shift reflects a broader recognition that continuous feedback is essential for maintaining engagement and improving organizational culture. PerformYard’s $95M VC raise in January signaled the continued interest in employee appraisals and 360 reviews for organizations across the country.

A key trend in 2024 was the continued integration of feedback tools with performance management systems. In 2024, Culture Amp acquired Orgnostic, a people analytics company, to enhance its ability to analyze employee feedback and engagement. Additionally, Perceptyx’s 2023 acquisition of Humu, a platform that leverages behavioral science to nudge employees toward positive change based on insights from Perceptyx’s employee surveys, underscores the demand for solutions that drive actionable employee engagement and performance improvements.

The growth in organizations with varied workforces, including office-based, frontline, and remote workers presented unique challenges with respect to engagement and communication. With traditional offerings struggling to bridge the gap, the need for robust employer communication tools that work across mediums surged. In April 2023, Zoom acquired Workvivo, an employee experience platform aimed at uniting both frontline and desk-based employees for companies like Delta and Verizon.

Time and attendance is a core tenant of workforce management with solutions evolving from legacy punch card time clocks to biometric and mobile solutions today. Transaction activity in the time and attendance market has been increasingly shaped by several key trends in recent years.

Integration of Time Tracking with Payroll & Accounting Solutions:

Payroll and accounting companies are well-positioned to provide time and attendance solutions, as accurate time tracking forms the foundation for compensation and expense management. In 2023, ADP (NAS: ADP) acquired SecurTime to expand its time tracking and access management capabilities within the APAC region. In 2024, we saw this trend continue with IRIS’ acquisition of SwipeClock's workforce management solution. Additionally, construction industry specialist Foundation Software acquired AboutTime’s time tracking software and integrated the platform into its accounting suite.

Several acquisitions have been focused on certain frontline industries, such as hospitality, healthcare and manufacturing. These industries have unique time tracking and compliance needs that require innovative and flexible solutions. For example, Humi, a comprehensive HR company focused on the SMB market, acquired Ameego in 2022 for its scheduling and time tracking capabilities focused on the hospitality end-market. In 2024, Fingercheck received a $115m growth investment from Edison Partners to continue growing its workforce management solution focused healthcare, manufacturing, and other deskless industries.

Another emerging trend is the convergence of workforce management tools with security solutions. Notable examples include the 2022 acquisition of ControlID by Assa Abloy and the 2024 acquisition of SoftClean by SelectLine Software. These transactions exemplify how time and attendance solutions are increasingly incorporating access control and biometric security features. This reflects a growing demand for integrated security and time management systems, especially in industries with high compliance and security concerns.

Source: PitchBook, Data as of December 2024

12/31/2023 12/31/2024

The S&P 500 outperformed all four HCM indexes during this period. The Core HR index emerged as the topperforming HCM index thanks to the >50% returns from multiple components (ADP, ORCL, SAP)

Source: Yahoo Finance

$1.2B MAR 2024

$1.2B OCT 2024

$2B AUG 2024

$8.4B SEP 2024

$188M JUN 2024

ACQUIRED BY

UNDISCLOSED

FEB 2024

ACQUIRED BY

$425M

JUN 2024

ACQUIRED BY

UNDISCLOSED

MAR 2024

ACQUIRED BY

$615M DEC 2024

ACQUIRED BY

• H.I.G. Capital acquired Alight’s Payroll & HCM Outsourcing businesses within the Employer Solutions segment.

• The Payroll and Professional Services Business is a global provider of technologyenabled payroll, human capital management, and professional services.

• ADP’s (NAS: ADP) acquisition of WorkForce Software expands its global offering of workforce management solutions and enables future innovation in the space.

• ADP (NAS: ADP) raised its 2025 revenue growth forecast to 6%-7% from its previous target of 5%-6%, citing expected benefits from the acquisition.

• QGenda provides healthcare workforce management solutions to over 4,500 organizations, QGenda advances workforce scheduling, optimizes capacity and improves access to care.

• QGenda became part of Hearst Health, comprised of FDB, Homecare Homebase, MCG, MHK and Zynx Health

• Smartsheet, an enterprise work management platform, has been acquired by Blackstone and Vista Equity Partners for $8.4 billion

• With additional capital, Smartsheet aims to enhance product offerings and expand its global reach.

• Cobee is a Spanish employee benefits firm that serves more than 1,500 clients and 100,000 employees across Spain, Portugal, and Mexico.

• Pluxee reinforced Cobee’s leadership position in Spain, an underpenetrated and growing employee benefits market, and boosted its tech capabilities globally.

• A&M Capital Partners-backed INSPYR Solutions acquired Advantis Global in a transaction that merges two of the larger IT Staffing Firms (INSPYR is no. 30 and Advantis is no. 62 on SIA’s Largest IT Staffing Firms list).

• The combined company will have a significantly-expanded market reach and a broad range of enhanced technology and talent solutions for clients.

• Kelly Services (NAS: KELYA), a leading global specialty talent solutions provider, acquired Motion Recruitment Partners, a premier tech recruiting agency, from Littlejohn & Co.

• By leveraging Kelly's scale, this acquisition significantly enhances the combined company's global technology staffing capabilities.

• Elwood Staffing, the 10th largest industrial staffing firm in the U.S., acquired BelFlex Staffing Network, a provider of commercial staffing solutions.

• This acquisition expands Elwood's portfolio in the commercial staffing sector, enabling the company to venture into new markets beyond its traditional industrial focus.

• Cross Country Healthcare, a publicly traded healthcare staffing provider, was acquired by Aya Healthcare for $18.61 per share and with plans to be no longer be traded on the NASDAQ.

• The acquisition allows Aya Healthcare to diversify its services and technology by including Cross Country’s vast clinical experience in non-clinical settings.

1,005 acquisitions since June 30, 2022 19% of buyers made more than 1 acquisition in the last 30 months

Q4

Workforce Management

$200M APR 2024

RECEIVED INVESTMENT FROM

RECEIVED INVESTMENT FROM Employee Engagement

$150M JAN 2024

Source: PitchBook

$175M JAN 2024

RECEIVED INVESTMENT FROM Payroll

$100M JUL 2024

RECEIVED INVESTMENT FROM Wellness

Operating at the intersection of investment banking and management consulting, we partner with inspiring companies and private equity firms to help them design and execute their strategies for growth or exit. With decades of successful client outcomes, we help growing teams improve their opportunities for success. We provide Sell-side advisory, Buy-side advisory and Strategic Consulting to innovative companies and financial sponsors.

The material in this report is for information purposes only and is not intended to be relied upon as financial, accounting, tax, legal or other professional advice. This report does not constitute and should not be construed as soliciting or offering any investment or other transaction, identifying securities for you to purchase or offer to purchase, or recommending the acquisition or disposition of any investment. Harbor View Advisors does not guarantee the accuracy or reliability of any data provided from third party resources. Although we endeavor to provide accurate information from third party sources, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.