August 2025

Celebrating our 17th year, we combine the strategic thinking of a consulting firm with the execution experience of an investment bank to get things done. Through experience as entrepreneurs, management consultants, investment bankers and corporate development at leading firms, we bring a unique approach when advising our clients.

Nate Shepherd is a Partner at Harbor View Advisors leading the firm’s Industrials Practice

Civil Engineering & Construction Experience:

• Civil (B.S.) & Mechanical (minor) engineering

• Regional design, engineering, surveying, and construction services

• Licensed general contractor

Suzi Felix

SENIOR ASSOCIATE

Investment Banking Experience:

• Manages execution of sell-side and buy-side engagements

• Licenses: Series 79 & 63

• Sector focus: Industrial Technology, Industrial Services, Traditional Industrials

• Harbor View Advisors tenure began with internship experience, followed by Analyst and Associate roles

Investment Banking & Private Equity Experience:

• 29 years experience

• 44 companies served

• 92 transactions closed

• Services provided include sell-side, buy-side, growth capital, strategic advisory, board director & officer

• Transaction types include M&A, IPO, secondary, PIPE, go private, divestiture, minority recap, debt & equity financing

• Clients served include founder-owned, family-owned, closely held, private equity backed

• Sector focus: Industrial Technology, Industrial Services, Traditional Industrials

• Licenses: Series 79 & 63

Investment Banking Experience:

• Experience working on sell-side and buy-side engagements

• Sector focus: Industrial Technology, Industrial Services, Traditional Industrials

• Internship experience with Bank of America Merrill Lynch as a Financial Advisor Analyst Zuri Goodman

Investment Banking Experience:

• Experience working on sell-side and buy-side engagements

• Sector focus: Industrial Technology, Industrial Services, Traditional Industrials

• Internship experience with Harbor View Advisors working within the Industrials vertical

As we reflect on the first half of 2025, it’s clear why M&A in the Industrial Services sector has remained so active. The combination of essential, often non-discretionary service offerings, large and growing addressable markets, and a landscape that remains fragmented across many subsectors continues to drive robust investor interest.

• We see this playing out in virtually every corner of the space. Numerous subsectors, including environmental services, design & engineering, and utility & telecom, are benefitting from longterm demand trends and a steady flow of capital. At the same time, skilled labor challenges and increasing technical requirements are reinforcing the value of platforms with deep teams, strong safety cultures, and embedded customer relationships.

• Private equity and strategic buyers alike remain highly focused in the industrial services landscape. We continue to track both established consolidators and new entrants, many of whom are pursuing roll-up strategies across HVAC, plumbing, flow control, electrical services, perimeter solutions, and beyond. The subsector dynamics are compelling — many markets are large but fragmented, creating opportunities to build scale, cross-sell services, and introduce technology or sustainability solutions that can drive margin expansion.

• Notably, we’ve seen significant capital deployed across the sector in recent years, including nearly $140 billion in TICC, $64 billion in utilities & telecom, and $38 billion in flow control transactions since 2020.

Today, we’re actively supporting multiple clients across many of these subsectors whether it’s helping family and founder-owned businesses explore strategic options, running competitive processes to unlock value, or advising private equity groups as they look to expand their platforms.

All of this reinforces why we continue to allocate so much of our effort to industrial services. We appreciate the opportunity to share our perspectives throughout this deck and look forward to helping more clients navigate this dynamic market.

Sincerely,

The HVA Industrials Team

Plumbing

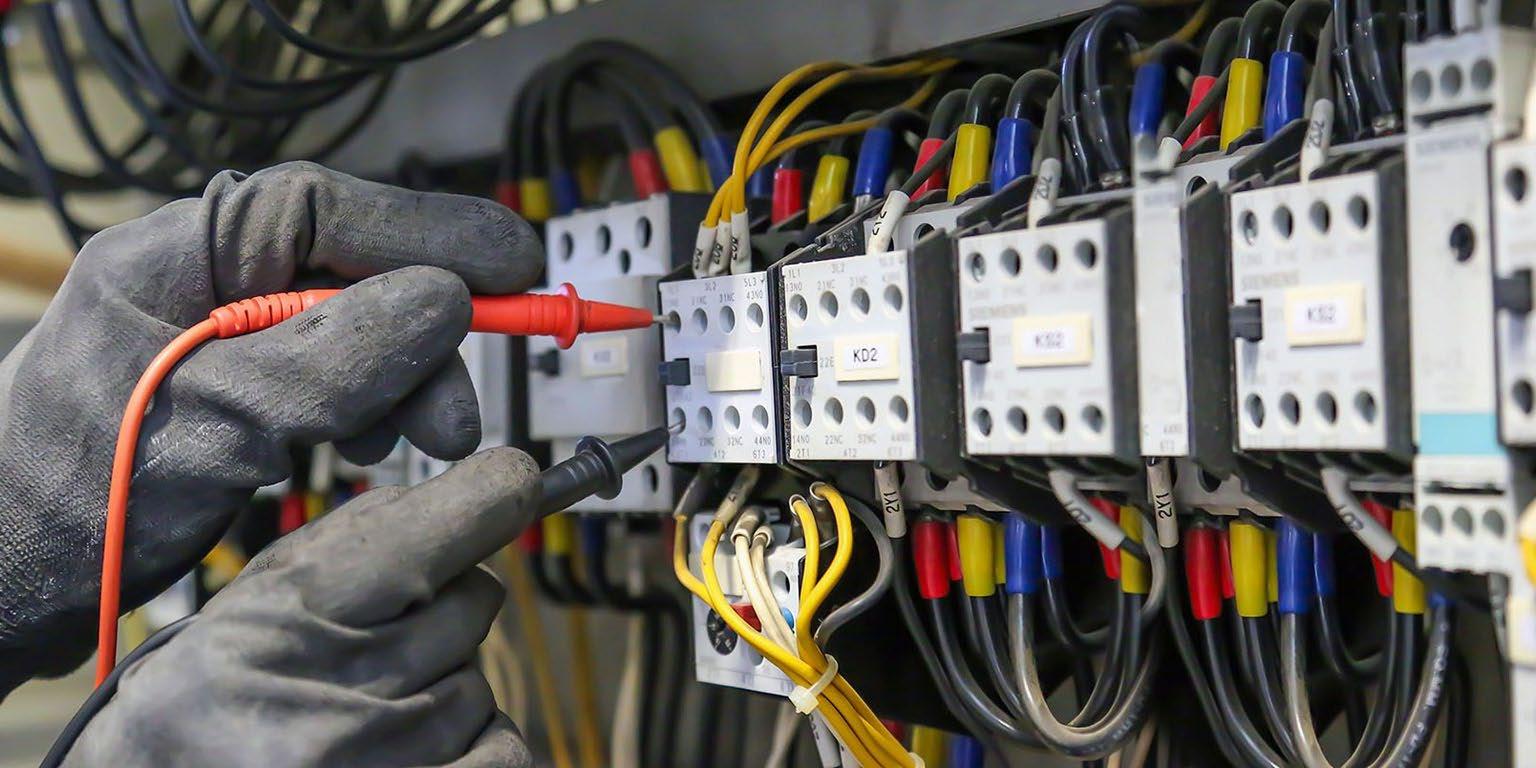

Electrical Services

Flow Control Services

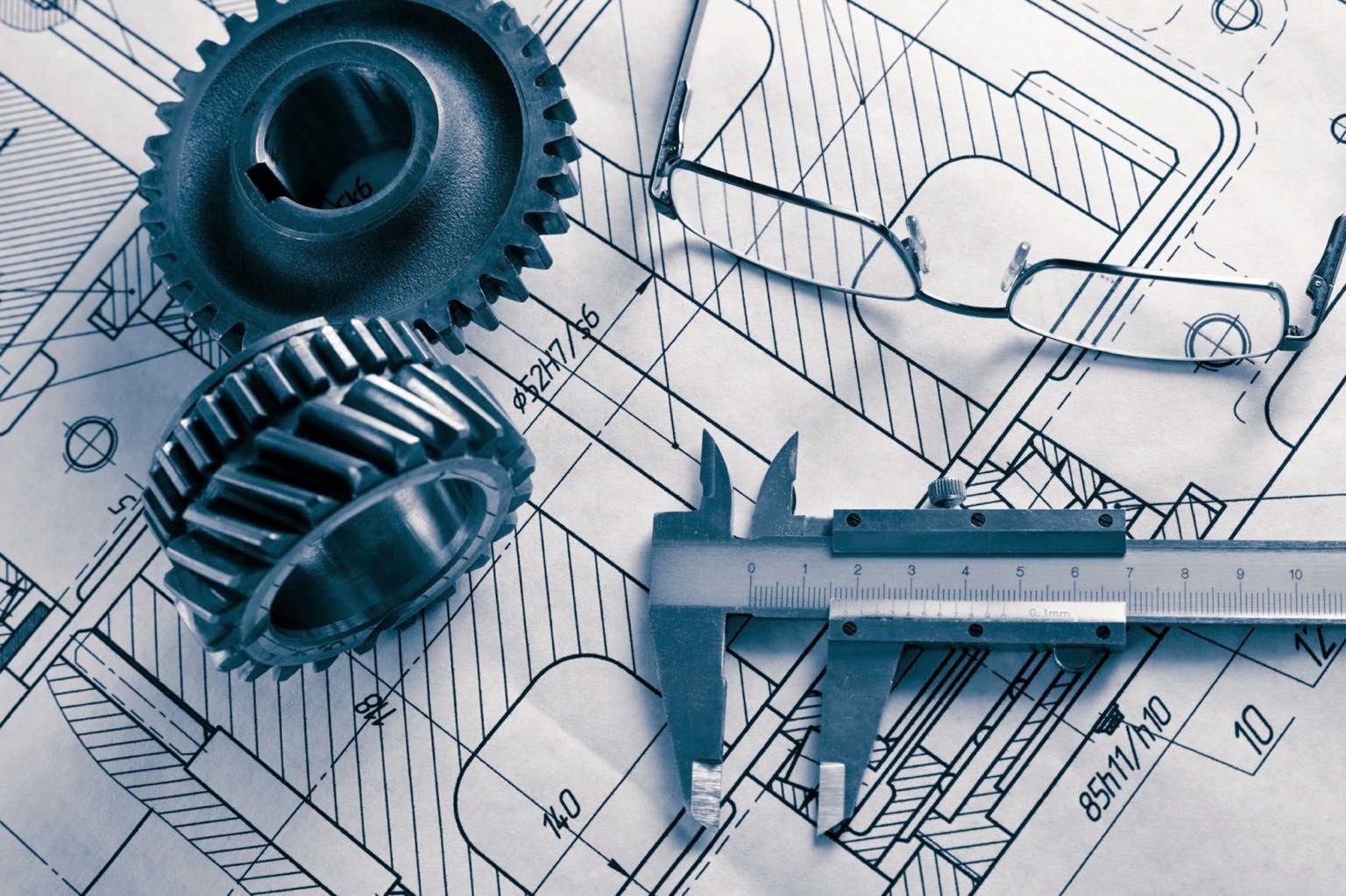

Design & Engineering

Utility & Telecom

HVAC providers are investing in intelligent building systems, energy monitoring, and automation to meet rising demand for efficiency and compliance with energy standards. Smart thermostats, integrated controls, and predictive maintenance platforms are transforming HVAC service offerings and increasing recurring revenue opportunities.

Under the One Big Beautiful Bill Act (signed July 4, 2025), federal IRA tax credits for highefficiency HVAC (Sec. 25C) and residential clean energy (Sec. 25D) now expire after December 31, 2025. Homeowners and commercial property owners must complete projects this year to claim the tax credits. Similarly, federal EV credits expire in late-2025.

The HVAC industry continues to face acute skilled labor shortages, prompting acquirers to target firms with strong training programs, loyal technician bases, and institutional service contracts. Buyers view labor stability as a key differentiator and are willing to pay premiums for workforce continuity.

The HVAC industry remains highly fragmented, with thousands of regional service providers. Private equity groups are aggressively consolidating to build multi-regional platforms with cross-selling opportunities in MEP (mechanical/electrical/plumbing) services.

Post-COVID awareness has made indoor air quality and ventilation a long-term priority. Facility managers and school districts are increasingly investing in HVAC upgrades with enhanced filtration, UV technology, and air purification systems.

Degree of Recurring Service

TICC services often require highly credentialed personnel and specialized certifications. This creates strong barriers to entry and increases the value of firms with accredited staff and established client trust. Buyers are prioritizing targets with embedded technical expertise and recurring contract revenue.

Firms that embed software into their testing workflows - such as digital reporting portals, automated compliance alerts, and remote sensing capabilities - are commanding higher valuations. These capabilities reduce client churn and create embedded service loops, driving stickier revenue.

Despite a decline in M&A volume in 2024, the 5 largest publicly traded TICC companies remained active. Over the past year, SGS, Bureau Veritas, Intertek, Eurofins, and UL Solutions have collectively spent billions on acquisitions that are part of broader strategies to enhance their service portfolios and enter emerging markets.

For many TICC companies, the services offered are non-discretionary. Buyers are attracted to recession-resistant revenue and will often pay a premium for companies that offer “need to have” services.

As ESG regulations and investor scrutiny increases, companies are turning to TICC providers for carbon footprint verification, supply chain audits, and sustainability reporting. These evolving service lines are opening new, high-margin verticals for TICC firms.

Represents

Degree of Recurring Service

Source: PitchBook

*Note: All data through 6/30/2025 and representative of North American activity

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is revolutionizing waste management. Smart sensors and AI-driven analytics are optimizing collection routes, reducing operational costs, and enhancing recycling efficiency. Companies such as Veolia and Republic Services are driving adoption.

States are rapidly advancing EPR laws, requiring manufacturers and service providers to manage the full lifecycle of products like electronics, batteries, textiles, mattresses, etc. Compliance will demand facility upgrades and improved data systems, creating opportunities for innovation and alignment between sustainability and profitability.

As legislators continue to increase compliance regulations for manufacturers, water treatment service providers, waste operators, and many other industries, testing and remediation of PFAS will become increasingly necessary. Companies have the option to contract 3rd party providers or purchase required equipment for in-house PFAS testing.

Investors and corporations are prioritizing sustainability initiatives, driving demand for decarbonization, closed-loop recycling, and circular economy solutions. This is prompting new investments in waste-to-energy, organics recycling, and innovative reuse models to meet corporate ESG targets.

Rapid urban expansion is fueling demand for advanced environmental infrastructure, from smart waste collection systems to stormwater management. Municipalities are investing in IoT-enabled waste solutions, creating opportunities for technology-focused environmental service providers.

Degree of Recurring Service

Ongoing investments in warehousing, logistics hubs, data centers, and utility infrastructure are increasing the need for outsourced facility support - particularly for site prep, concrete, fencing, erosion control, and utility locating. These trades are critical early-stage enablers of capital projects.

Facility services firms with long-term contracts for landscaping, janitorial, waste removal, and snow/ice management offer stable recurring cash flows. Buyers are seeking platforms with predictable service schedules and multi-year client relationships, especially in industrial and municipal end markets.

Buyers are valuing firms that can mobilize quickly for storm cleanup, utility restoration, or disaster site stabilization. Those with equipment readiness, DOT prequalification, and standby contracts are positioned for high-margin, event-driven revenue.

Companies with owned fleets - such as hydro-excavators, mowers, or directional drills - are attracting premium valuations due to cost control, scheduling flexibility, and reduced reliance on third-party rentals. Asset-backed operators are better equipped to scale and serve high-volume contracts.

With high workforce intensity and physical jobsite risks, companies that demonstrate strong safety records and low employee turnover are outperforming peers and garnering interest from both private equity and strategic buyers.

Source: PitchBook *Note:

Represents acquirer

Represents relevant add-ons since 2020

Note: Logos are representative of a portion of ~38 total transactions since 2020

Degree of Recurring Service Buyer Activity to Date

Valuations

Buyers are prioritizing fence providers that offer integrated solutions - such as gates, surveillance systems, and access control hardware. These capabilities enable higher-margin projects and stickier maintenance revenue.

Rising concerns around theft, trespassing, and facility protection are pushing end-users to prioritize robust fencing solutions. Institutional buyers are seeking durable and secure perimeter solutions tailored to specific risk profiles across various sectors.

Growth in commercial, industrial, and public-sector construction - including the rapid buildout of data centers - is driving steady demand for perimeter fencing. Sub-contractors with strong general contractor relationships and experience on mission-critical sites are seeing increased bid volume and more durable backlog pipelines.

Fencing systems are evolving beyond physical barriers. Operators offering integrated surveillance, smart access control, and advanced detection capabilities, such as sensors and alarm systems, are becoming more attractive to both customers and investors.

Supply chain disruptions have transformed material availability and cost management into a competitive edge. Companies with fabrication capabilities or direct mill relationships can preserve margins and improve bid reliability.

Source: PitchBook

*Note: All data through 6/30/2025 and representative of North American activity

Growth in healthcare, multifamily, industrial, and data center construction is driving sustained plumbing demand. Contractors with bonding capacity, digital processes, and field labor scale are winning complex work across new builds and tenant improvement projects.

Plumbing upgrades are becoming more common as commercial buildings adapt to evolving efficiency and water conservation codes. Firms with experience in retrofit and tenant improvement work are seeing steady service call volume.

Plumbing remains a labor & license-intensive trade, making workforce depth a critical value driver. Buyers are gravitating toward firms with strong journeyman pipelines, in-house apprenticeship programs, and low turnover in foreman and superintendent roles.

While project-based plumbing tied to new builds can be high-dollar, it often comes with cyclicality and margin pressure. Buyers are favoring firms with recurring service revenue such as maintenance contracts, repair work, and on-call support which offers more yearround cash flow.

Municipal codes and owner preferences are pushing upgrades toward low-flow fixtures, leak detection systems, and greywater reuse. Firms with design-assist capabilities and familiarity with LEED or WELL standards are increasingly preferred by GCs and developers.

Electrical contractors with experience in data centers, healthcare, and government facilities are booking multi-phase projects with longer lead times. These end markets reward technical competency and consistent labor availability.

Public infrastructure projects tied to the Department of Transportation continue to generate consistent electrical services opportunities, including signalization, lighting, and traffic control systems. These projects are less sensitive to economic swings, offering contractors a reliable backlog even when private construction slows.

Emergency repairs, switchgear testing, and preventative maintenance are becoming reliable margin contributors. Buyers see value in firms that can generate revenue outside of ground-up construction cycles.

Firms that offer in-house design, building information modeling (BIM), and value engineering are winning work earlier in the development cycle. Owners and general contractors increasingly prefer electrical subs who can contribute before ground is broken.

Source: PitchBook

*Note: All data through 6/30/2025 and representative of North American activity

Large general contractors and institutional owners are increasingly screening subcontractors based on safety metrics and quality assurance procedures. Electrical firms with documented training programs, EMR transparency, and internal quality assurance protocols are standing out in procurement processes.

Buyers are prioritizing firms with deep experience in valve automation, custom skid fabrication, or pump rebuilds. Shops with in-house machining, certified technicians, and testing capabilities stand out in an otherwise commoditized landscape.

Flow control providers serving the agriculture market must respond quickly during peak planting and harvest seasons, when equipment failures can halt operations. This urgency allows for premium pricing on repairs, making in-season break/fix work essential to the customer and a high-margin revenue stream for the provider.

Many flow control providers are expanding their rental offerings to meet short-term and emergency needs across industrial and municipal markets. Mobile pump fleets, temporary valve setups, and bypass systems are generating attractive margins without the need for long-term capital projects.

Private equity groups are backing regional distributors and service providers with authorized repair status from OEMs. These firms offer strong margins, exclusive territories, and durable manufacturer relationships that are difficult to replicate.

New rules around fugitive emissions and water discharge are prompting upgrades across valves, meters, and control systems. Service providers that understand compliance standards are gaining relevance with plant engineers and municipal buyers.

Source: PitchBook

*Note: All data through 6/30/2025 and representative of North American activity

Firms leveraging Geographic Information Systems (GIS), Computer-Aided Design (CAD), and digital twin modeling are streamlining design workflows and improving margins. Buyers are favoring groups that invest in software and can deliver accurate work product on tighter deadlines.

Owners and developers are favoring design-build delivery models, pulling engineers into earlier phases of project planning. Firms that can collaborate closely with contractors and provide constructability insight are winning more integrated scopes.

Federal and state funding for roads, bridges, and utilities is fueling steady demand for civil and structural design work. Engineering firms with DOT prequalification and municipal relationships are seeing consistent project flow amid macro volatility.

Licensed engineers, especially those with professional engineer (PE) or specialty certifications, remain in short supply. Acquirers are paying up for firms with strong bench depth and internal mentorship pipelines to ensure long-term staffing stability.

Private equity activity continues to center around regional design firms with sticky client bases and niche expertise. Buyers are looking for tuck-ins that offer new geography, end market diversity, or technical specialization without disrupting firm culture.

Source: PitchBook

*Note: All data through 6/30/2025 and representative of North American activity

& Telecom Transaction Count

The Utilities sector stabilized to pre-pandemic levels and has signs of momentum ahead, driven by investments in data centers and grid modernization. In contrast, the Telecom sector is witnessing a slowdown due to market saturation and evolving consumer demands. Consolidation remains strong as companies focus on scaling operations for growth.

Essential services like broadband internet, electricity grid management, and renewable energy storage are "must-haves" in today’s economy. Buyers are willing to pay premium multiples for companies that provide critical infrastructure due to their predictable cash flow and resilience in economic downturns.

Telecom giants like Verizon, AT&T, and Comcast, alongside energy companies like NextEra Energy and Duke Energy, remained active acquirers in 2024. Recent notable transactions include Verizon’s acquisition announcement of Frontier Communications and Duke Energy's acquisition of energy storage assets to expand its renewables footprint.

ESG considerations are increasingly influencing transaction strategies, with acquirers targeting companies that advance their renewable energy, energy efficiency, and sustainability goals. Federal tax credits for clean energy and broadband expansion are driving interest in companies with strong ESG alignment.

Increased antitrust scrutiny from the Federal Communications Commission (FCC) and Department of Justice (DOJ) has made it challenging for large players to pursue megatransactions. Instead, companies are focusing on smaller, strategic acquisitions to expand their capabilities and geographic reach without triggering regulatory intervention.

Nate Shepherd, Partner nshepherd@hvadvisors.com

Suzi Felix, Senior Associate sfelix@hvadvisors.com

Zuri Goodman, Associate zgoodman@hvadvisors.com

Carson Lubin, Analyst clubin@hvadvisors.com