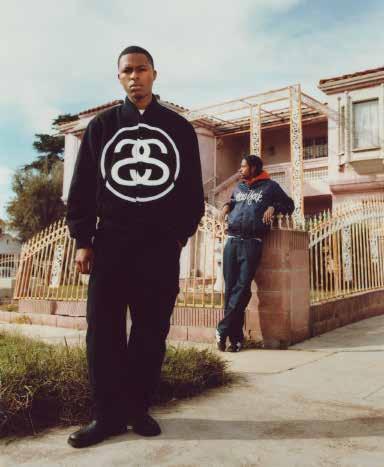

Fig 1: Chad

Skateboarding (1990). San Diego California .

Muska

4156

2 3 CONTENTS THE BRAND THE OPPORTUNITY THE COMPETITORS THE RANGE Fig 2: Shawn Stussy sitting down (2016). California 04: INTRODUCTION 06: BRAND IDENTITY 08: MARKETING POSITION 12: 4 P’S 19: SUSTAINABILITY 20: CONSUMER PROFILE 24: STRATEGY ALLIGNMENT 26: OPPORTUNITY 28: NIKE INIATIVES 30: RISK ANALYSIS 31:COMPEITORS 36:CASE STUDY 38: MOOD BOARD 40: RANGE LAYOUT 44: RANGE ANALYSIS 47: CONCLUSION 48: LIST OF FIGS 49: REFERENCES 50: BIBLIOGRAPHY 52: APPENDIX

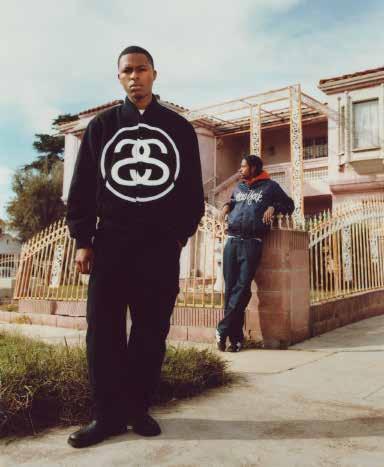

Stussy is the international unisex Streetwear brand, built on the foundations of Los Angeles Skate and Surf culture. Founder Shawn Stussy’s journey went from shaping Surfboards to Shaping the streetwear industry, with influential figures such as Kim Jones acknowledging him as a trailblazer who, “started it all” (Kim Jones,2020).

Stussy’s impact extends beyond transforming a Californian surf shop into a $50.9 million fashion powerhouse (ECDB,2022). It has cultivated a global community of like-minded creatives who share a genuine connection with the brand and its products Stussy’s Success lies through organically building relationships between their consumers and the brand identity..

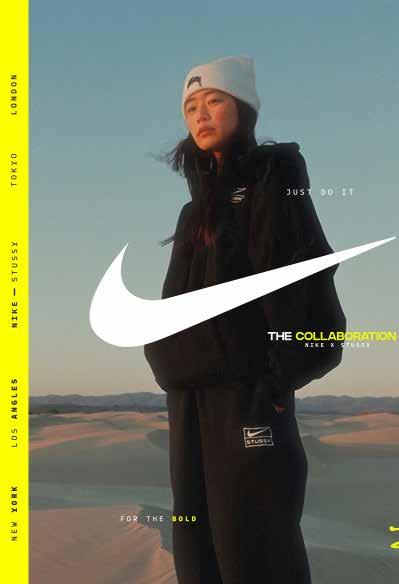

The brand strategically markets products through high-profile collaborations with industry giants including Nike, Our Legacy and Supreme. This approach involves a strong emphasis on delivering quality, classic silhouettes in Jersey and outwear featuring a unique twist (GQ,2021) strengthening consumer satisfaction. What sets Stussy apart is its holistic approach to consumer experience.

Rather than relying on wholesale channels, the brand has chosen to create intimate connections through its own physical stores; inviting consumers to directly engage with the brand. Stussy’s influence is not just about fashion; it’s about fostering a community and creating a genuine, lasting connection between the brand and its diverse global audience.

INTRODUCTION

This report aims to delve into Stussy’s current business strategy and product range; Analysing competitors and other external factors, identifying a relevant opportunity for product development.

“We wanted people who cared enough about what they wore to go out and discover us, and feel like they had found something unique, not available everywhere, that said something about who they were and how much they cared for what they wore. We weren’t advertising from the top down, we were about being discovered from the bottom up”

(Frank Sinatra Jr, 2022)

5

Fig 3:London Chapter of the International Stussy Tribe (1990). london

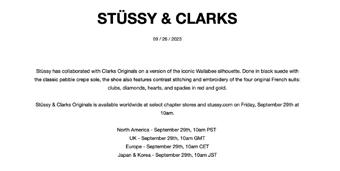

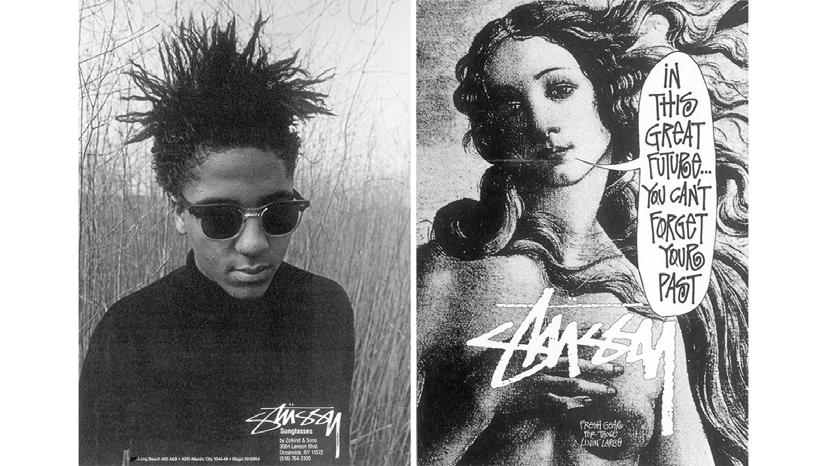

Fig 4: Leighton (1986) Stussy AD campaign New York. Fig 5: Stussy S. (1987) In this great future you can’t forget your past Newyork

BRAND IDENTITY

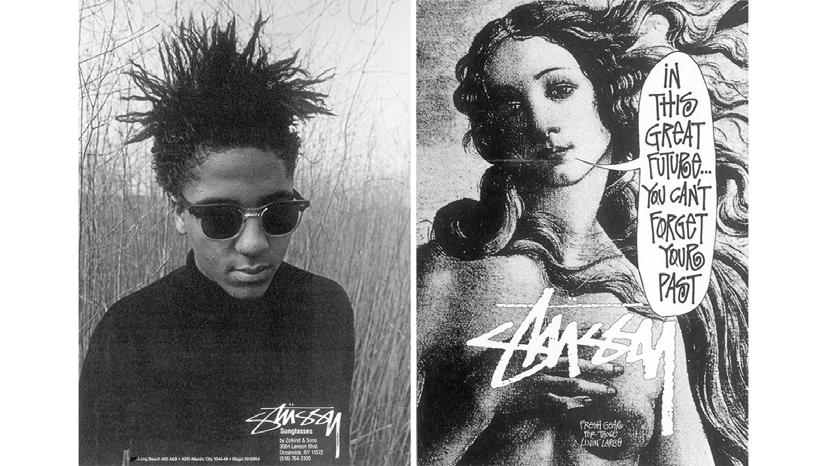

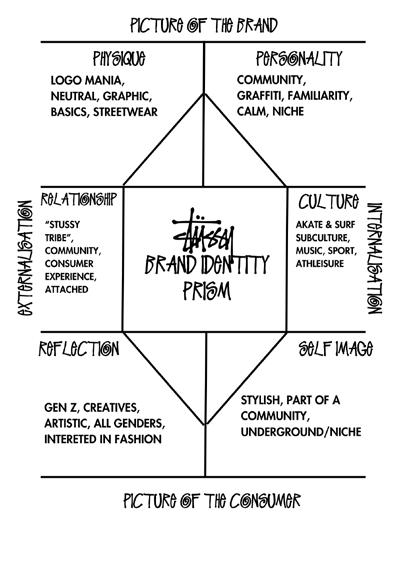

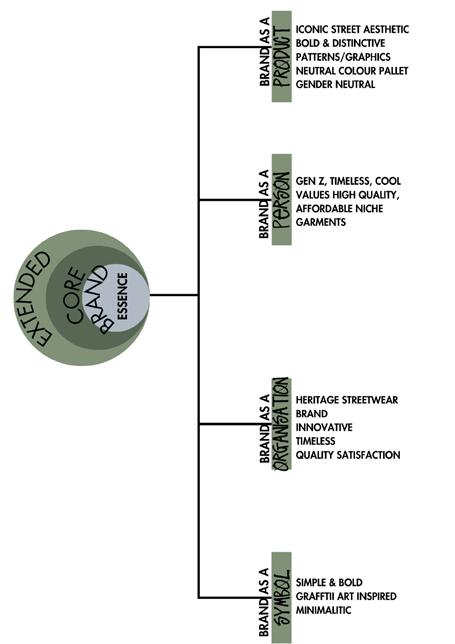

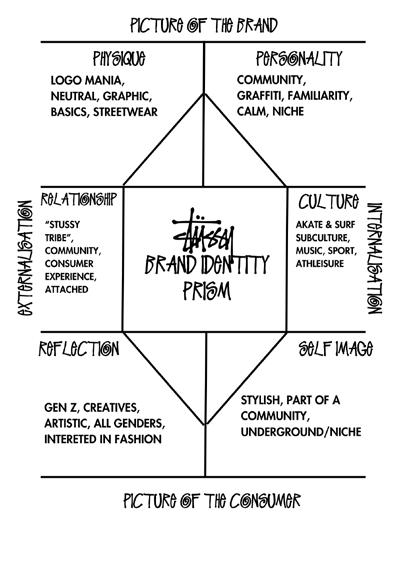

The development and management of a strong brand identity is crucial to effectively differentiate a brand in today’s highly saturated and competitive retail market (Aaker,2012). Aaker (1996) defined a “Brand identity model”; which Outlines the four critical dimensions of a brand identity (see Fig.6); The model encapsulates a holistic approach of combining a brand as a Product, organization, person and symbol (Aaker1996). Serving as a potent tool for enriching and differentiating a brands identity in a crowded marketplace. Kapferer (1996) builds on this through the “Brand identity theory” (See Fig:7) expanding into 6 different elements of Physique, Personality, culture, relationship, self-image and reflection; The prism works to identify how each components relates to one another to help solidify a strong brand image (Lombard, 2021).

In its application to (D. Aaker,1996) Brand identity model, Stussy is a prime example of a brand that has maintained a clear and compelling brand identity, through their commitment to consistency across quality, timeless and diverse product range while seamlessly harmonizing the overarching aesthetics and values which define the Stussy consumer. The brand identity is notably reflected within the consistency of its products, through exploring apparel, accessories and collaborative ventures, whilst staying true to their Surf and Skate cultures which built the brand to what it is now.The brand identity prism (see fig 8) (Kapferer 1996) clearly identifies a strategic coalition between Stussy from a brand perspective, towards a consumer experience and how the align together. There is a constant theme from specifically the Culture, Personality and relationship section of the prism (see Fig 8) of the underlying ethos of, “Community” and this idea of being a part of almost a club only strengthen the identity of Stussy goes much deeper than just a fashion house.

7

Fig 8: Stussy Madrid store (2010). Madrid

Fig 6: Stussy Brand structure (2024) adapted from Aakar (1996

Fig 9: Tribe , S. (1987) the NYC crew, Messrs Jules Gayton, Mittleman, Ross, Kevin Williams and Jeremy Henderson. New York

Fig 10: Tribe , stussy (1989) he London crew, Messrs Kopelman, Armitage, Turnbull, Lebon and Jones. London .

Fig 8: Stussy brand identity (2024) adapted from Kapferer (1996)

MARKET POSITION

Stussy positions itself within the premium tier of the Fashion Pyramid (See Fig:11), offering high-quality apparel at a price point that places it prominently within the premium high-street category. The Justification for their pricing strategy is rooted in limited high-quality garments and consumer desire for releases.

Stussy remains as a trail blazer in the realm of streetwear drop culture, strategically generating anticipation by creating hype around limited stock releases (Mbacke.M,2023).

This approach not only fuels demand but cultivates a devoted community of supporters eagerly awaiting each new release contributing to Stussy’s sustained brand hype. In contrast to competitors, Stussy possesses a distinct advantage derived from its 40-yearold history (Shawn Stussy, 1984). The extensive history is embedded in the brands ethos, rooted in the embrace of surf and skate subcultures. Stussy transcends the conventional role of an apparel company by prioritising the sale of a lifestyle over mere products.

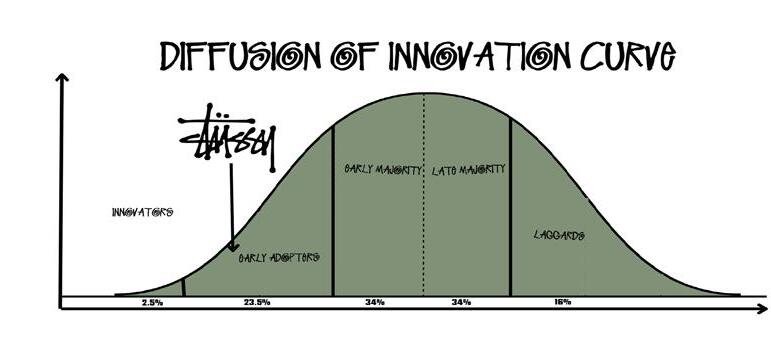

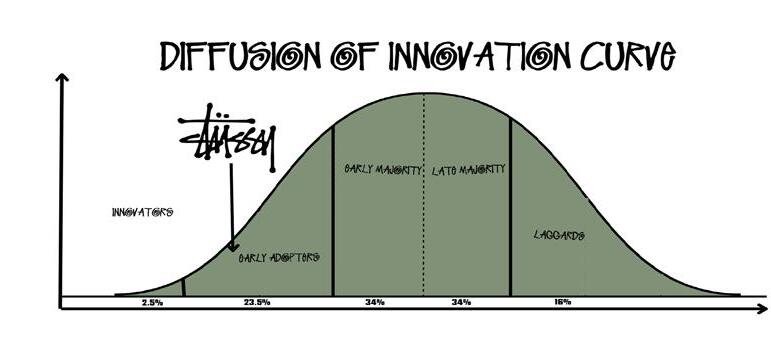

When identifying a Stussy consumer in comparison to the Rodgers diffusion of Innovation model (Rodgers,1962) (see Fig:12) they situate amongst the early adopters. The segment is identified for heightened brand sensitivity, with adopters being catalysts in the diffusion of exposure to new trends and brands (Beaudoin.P,2003).

8 9

Fig 12: Stussy’s position on the diffusion of innovation curve (2023) adapted from Rodgers, 1962

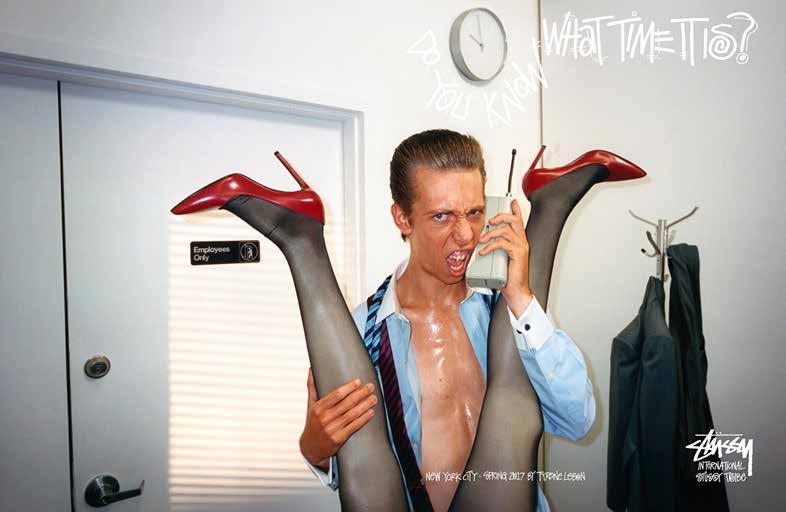

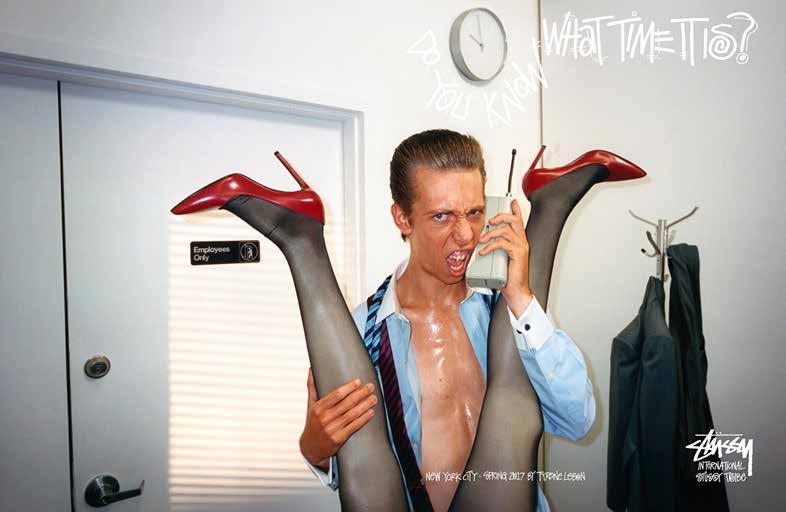

Fig 13: Lebon, T. (2017) Do you Know what time it is? New York .

Fig 11: Fashion market triangle (Authors own, 2023) adapted from Fashion market triangle (Sorgar, 2006)

MARKET POSITION

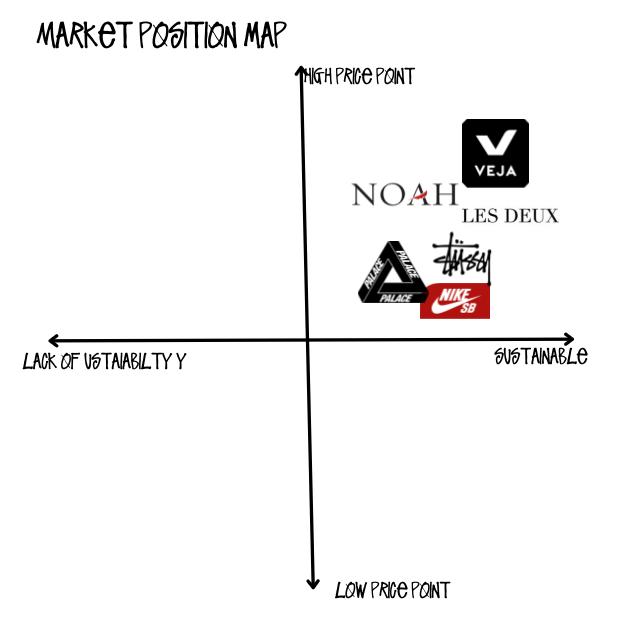

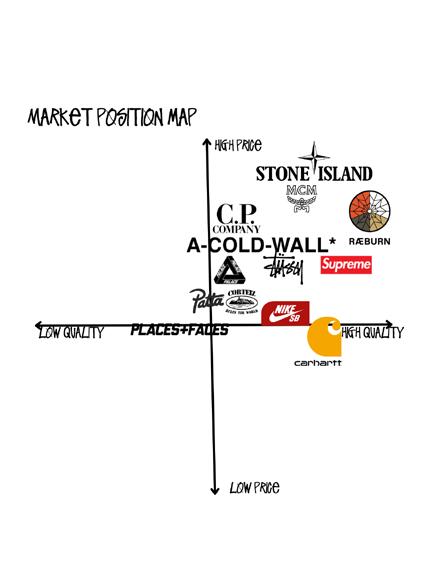

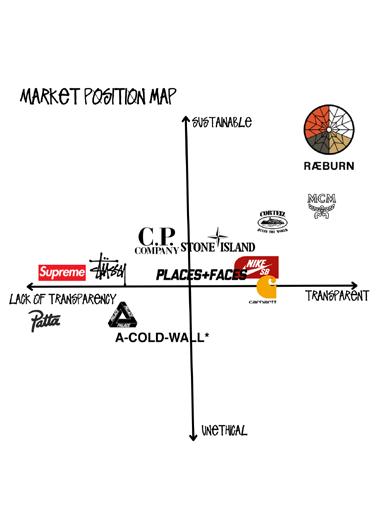

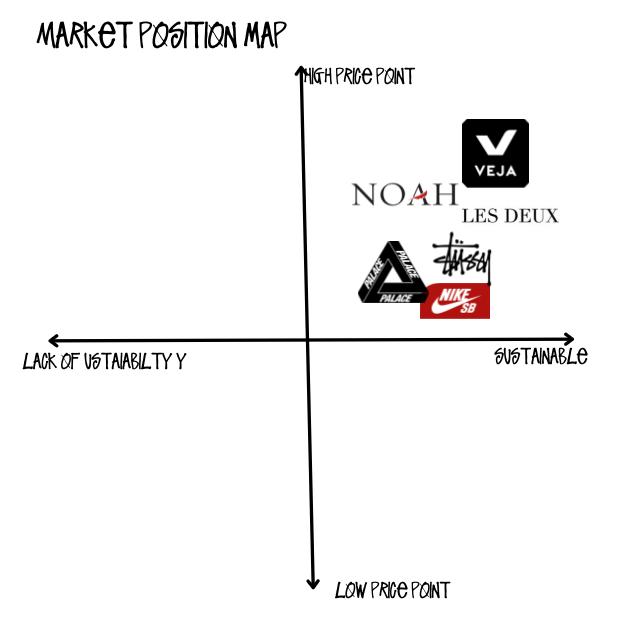

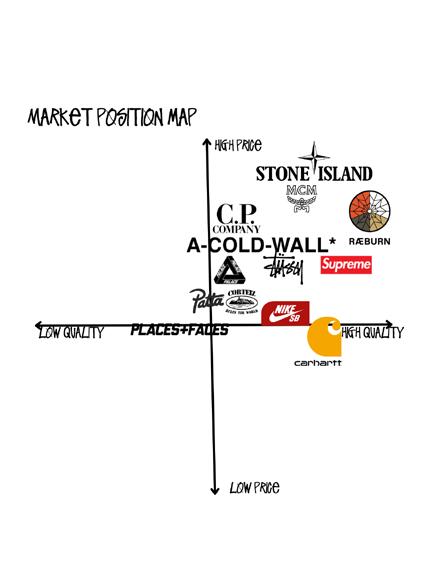

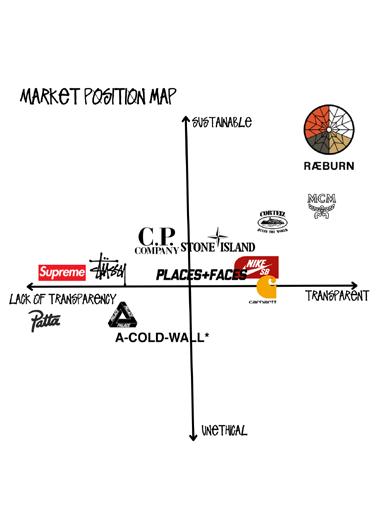

Examining Fig:14; it becomes apparent that the majority of Stussy’s direct competitors also occupy a similar positioning, Underscoring a prevailing consumer preference for high quality products, at more affordable price points. The map suggests a market segment that actively seeks superior product quality but remains sensitive to pricing considerations. In the second part of the Marketing Positioning Map (See Fig:15), its serves as a tool to gauge where Stussy stands concerning its transparency regarding sustainability practices in comparison to their competitors. As identified on Fig:15 Stussy situates themselves on the lower part of the Map, indicating a lack of transparency in communicating their sustainability initiatives. As illuminated by Fig:15, it becomes evident that Stussy’s positioning is not isolated, but rather a shared challenge within the industry.

As we delve further into understanding the market positioning of Stussy, a highly effective tool for analysis the Marketing positioning map. The method provides a comprehensive exploration on how Stussy performs in terms of price, quality and sustainability, allowing for easy comparison to industry peers. Referencing Fig:14, it becomes evident that Stussy situates itself towards the higher quality on the spectrum grid, aligning closely with esteemed brands such as Nike SB, Supreme and A-Cold-wall. Stussy’s positioning on the map is substantiated by the diverse range of products on offer, primarily focusing on Jersey and outwear, with an emphasis on the use of 100% cotton in their products (Stussy,2024).

With majority of Stussy’s direct competitors align with the brand on the map, highlighting that issue is pervasive across the streetwear sector.The findings prompt further investigation throughout the progression of the report, delving into the industry-wide dynamics and the steps taken by Stussy and its competitors to enhance transparency and adopt ethical practices in their operations.

10 11

Fig 13: Lebon, T. (2017) Do you Know what time it is? New York

Fig 14: Market positioning map Stussy (Authors own, 2024) Sustainable Market positioning map Stussy (Authors own, 2024)

PRODUCT

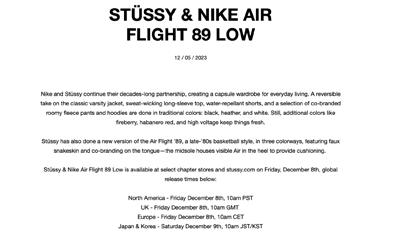

Stussy’s product strategy, extends beyond traditional avenues, incorporating innovative approaches to engage and excite consumers. Stussy adopts a dynamic approach to product releases through weekly drop system. Every Friday a new introduction of products is released, fostering anticipation and driving consumer engagement. The strategy effectively reinstates hype and encourages repeat purchases. Over the course of 2023 alone, we witnessed an impressive 11 collaborations with brands. Partnerships included, Converse, Nike and Our Legacy resulting in highly coveted releases such as the” Nike Vandal high” and the “Our Legacy Converse” (Stussy,2024). These collaborations not only elevated Stussy’s desire amongst consumers but introduced unique products to their and partners loyal fan base.

Stussy embarked on a strategic expansion into new markets, diversifying, its product offerings beyond traditional apparel and accessories and into tech through headphone collaboration with Beats by Dre. Inspired b 90’s skateboard and electronic culture, the headphone quickly gained traction and sold out within minutes of release (Hype beast, 2023). The success of the collaboration demonstrates the brands versatility in adapting its aesthetic and ethos to new product categories whilst maintain its authenticity and appeal.

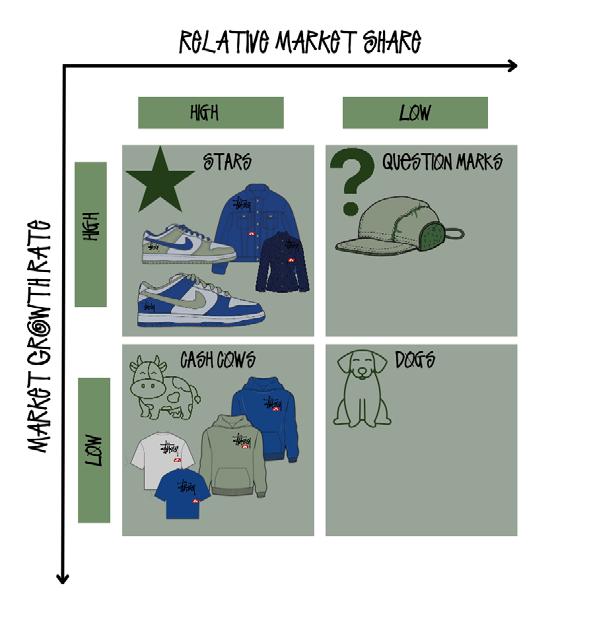

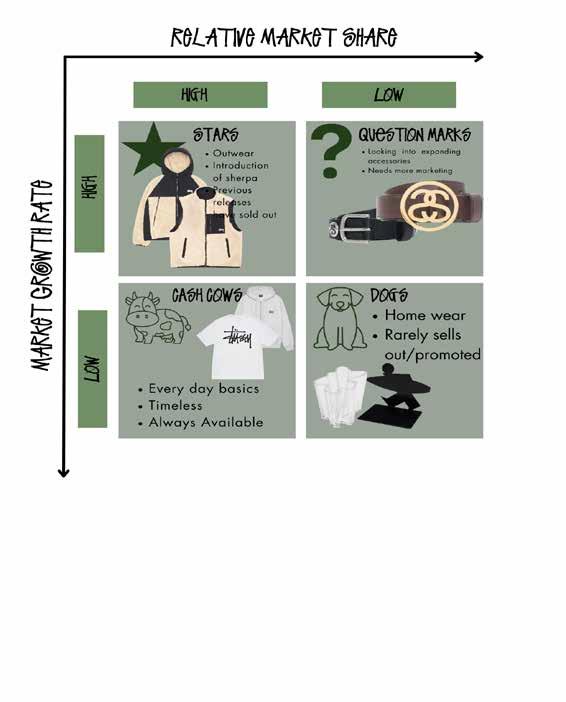

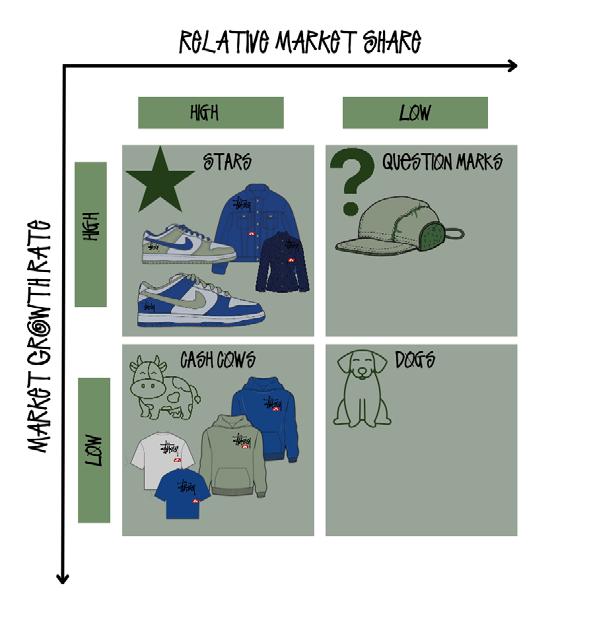

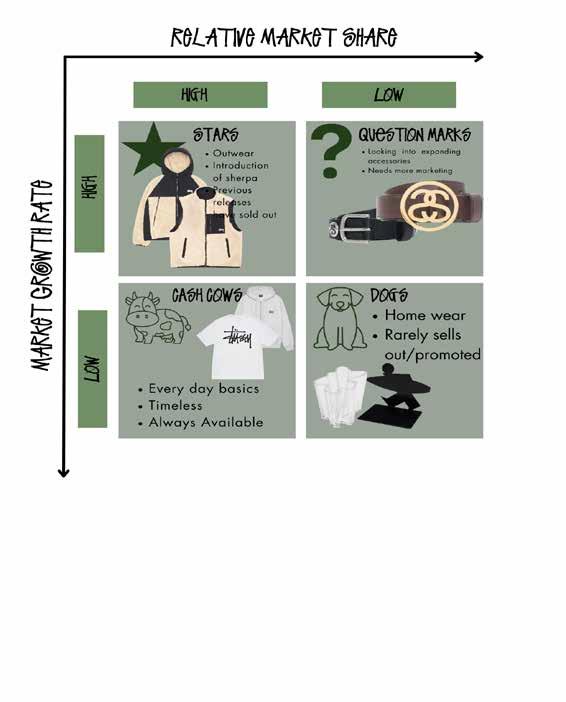

The Boston Matrix is an excellent planning tool to simply visualise and examine the financial performance of a product that a brand has to offer (Chen, 2015), Through demonstrating the rate of the market share. Stussy’s best sellers are their basics, (Hoodies, T-shirts etc) made up of neutral colourways of black, navy grey and white, featuring the signature Graffiti logo. These products are considered “cash cows” (see Fig: 16) which are always made available to the consumer rarely changing. Whilst we look at the “Star products” which hold a much larger market share and growth rate, being their sherpa jackets. Fig:16 Demonstrates the areas of focus when looking for an new opportunity for Stussy to launch into.

13

Fig 16: Stussy Boston Matrix (authors own, 2024) adapted from BCG Matrix.

Fig 17: Dodgson, C. (2022) Stussy car image . Los Angeles .

Fig 18: Dodgson, C. (2022) Stussy Dinosouar Jeep car image Los Angeles

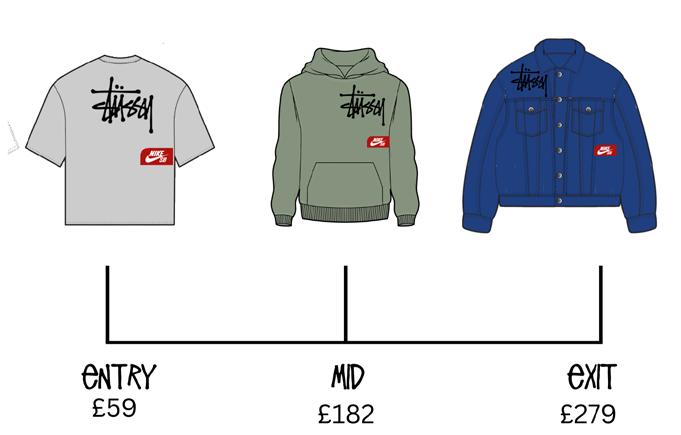

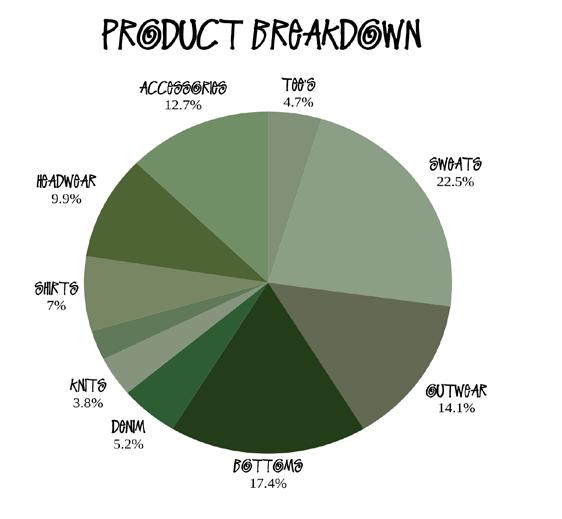

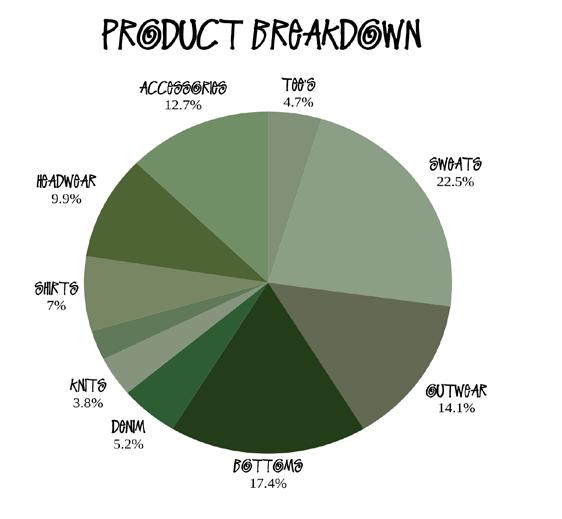

When examining Stussy’s product range the majority of items fall within the price range of £13-£200, with a median price point of £140 (Refer to fig 19).

Within this range, sweats and knits constitute a significant portion of the product offering, comprising 22.5% and 3.8% (Refer to fig 18) respectively, as highlighted in Fig:16. These products are identifying as the brands, “Cash cows” (Refer to Fig 16) indicating their consistent sales and contribution to overall revenue. Despite the predominance of mid-range priced items, Stussy’s exit priced products, particularly in the outwear category. Outwear constitutes 14.1% of the product range, with items like the work wear shearling bomber retailing at £650 (Refer to Fig 20).

However, the median price is very low compared to their exit priced products of outwear making up 14.1% of the product range (See Fig:19), being sold at a staggering £650 for a reversable Shearling Bomber (see Fig 20). A comparison between the Beach Shell Jacket and the two workwear jackets reveals differences in the quality of materials used in production, such as quilted leather versus textured weave. Additionally, higher- priced items often feature add-ons like welt pockets, YKK metal zippers, and structured linings, enhancing both functionality and aesthetic appeal.

14 15

PRICE

Fig 18: Stussy Product breakdown (Authors own, 2024)

strategy

Fig 19: Stussy, “Entry, median, Exit” price

(Authors own, 2024)

Fig 20: Stussy, “Good, better, best” (Authors own,2024)

£230 £650

Fig 21: Sion, T. (2018) Stussy Fall 18 credit card . London

Fall

soap image London.

Fig 22: Sion, T.

(2018) Stussy

18

PLACE

Globally the Covid-19 pandemic has created a new reality for consumers with having to adapt to digital technologies overnight (Erjavec, 2022). Consumers have become more inclined to change their behavioural patterns through shifting to online shopping (Dey et al, 2020). In 2021

Online shopping accounted for 19% of retail purchases and said to increase to 53% within the next ten years (Mordue,2021). This trend underpins the diminishing prominence of brick-and-mortar retail outlets as well as the divide between a consumer and brands relationship.

However, Stussy has steered away from online and wholesale expansion. Instead, the brand has concentrated on bolstering its physical store presence for a way for consumers to go experience the brand first hand (Klevu, 2023). By prioritizing physical store, Stussy seeks to cultivate a deeper connection with consumers, offering them a tangible and immersive experience that transcends the digital realm. The emphasis on storytelling serves as a powerful tool for driving sales and nurturing consumer loyalty, reinforcing Stussy’s position as a leading force in the streetwear industry.

Despite Stussy’s emphasis on creating a physical brand presence, the brand recognises the importance of promotional strategies to amplify its reach and engage with consumers effectively (Klevu,2023). Stussy leverages various promotional avenues, including aesthetic short films, imagery and blog features on its website, to spotlight collaborations and show case it’s products (Stussy,2024). These promotional efforts help to generate excitement around its partnerships and collections. Among Stussy’s marketing channels, its expansion of physical stores and its robust presence on Instagram, equating to over 5.2 million followers on Instagram. The brand strategically showcases its collaborations and product offerings through visually appealing content dived into Spring/Summer and Fall/Winter collections (Stussy, 2024). These promotional strategies not only broaden Stussy’s reach but helps to ensure continued relevance amongst keeping up to date with what their consumers need.

17

PROMOTION

Fig 23: Hypebeast (2023) Stussy London store. London

Fig 24: Stussy’s social media presence (Authors own, 2024)

SUSTAINABILITY

The analysis of Stussy’s sustainability practices reveals a notable gap in transparency and commitment to eco-friendly initiatives, a trend also mirrored by many of its direct competitors within the streetwear industry (Refer to Fig 14). This lack of transparency raises concerns about the ethical implications of the streetwear community, particularly considering its substantial contribution to the global apparel and footwear market, generating $185 billion in sales annually and comprising 10% of the total market (Strategy,2019).

However, questions arise regarding the implementation of sustainable practices within Stussy’s core seasonal collections, as these initiatives appear largely confined to collaborative endeavours. Furthermore, concerns are raised regarding the sustainability of Stussy partaking in weekly drop culture, which, while driving profitability and brand hype, may contribute to 10% of global carbon emissions and the $500 billion loss associated with clothing waste annually (Kasanen, 2023)

As the report progresses, an opportunity to penetrate the sustainable market will be explored, addressing the need for greater transparency and commitment to ethical practices within Stussy’s operations. By embracing sustainability as a core value and integrating it into all aspects of the business model, Stussy can not only enhance its brand reputation but also contribute positively to environmental and conservation efforts.

Despite these challenges, Stussy has taken notable steps towards sustainability, through collaborations with brands including Our Legacy, known for their exclusive upcycled and one of design products (GQ,2021). The capsule collection produced in partnership utilized 90’s Stussy dead stock fabrics, whilst being produced in Portugal showcasing a commitment to sustainable sourcing and production methods. The success of this collaboration has spurred further partnerships, with Stussy and Our Legacy collaborating most recently for Fall/ Winter 23, highlighting the importance and popularity of sustainable initiatives within the streetwear community.

18 19

Fig 25: Koqos, “Nike & Stussy Plant dyed air force 1 collaboration”(2023)

Fig 26: Our Legacy, Our legacy X Stussy campaign (2020)

Fig 27: Our Legacy, Our legacy X Stussy campaign (2020)

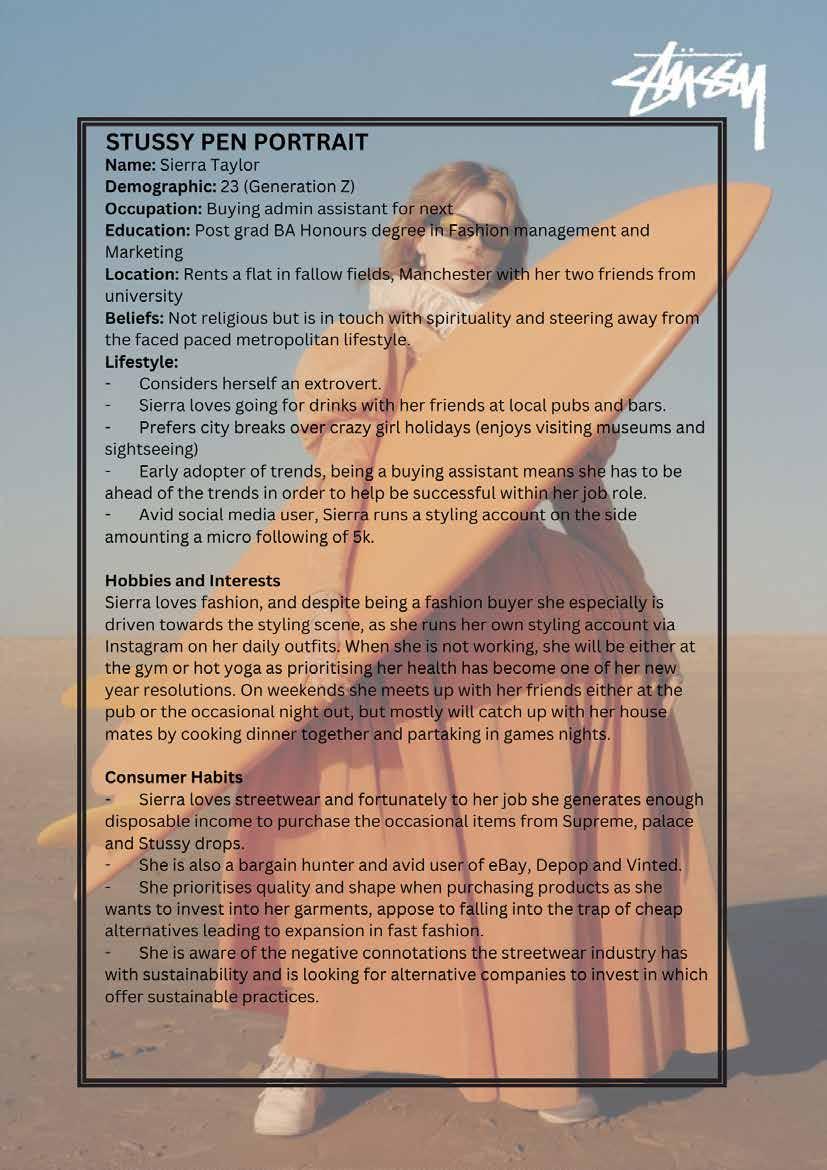

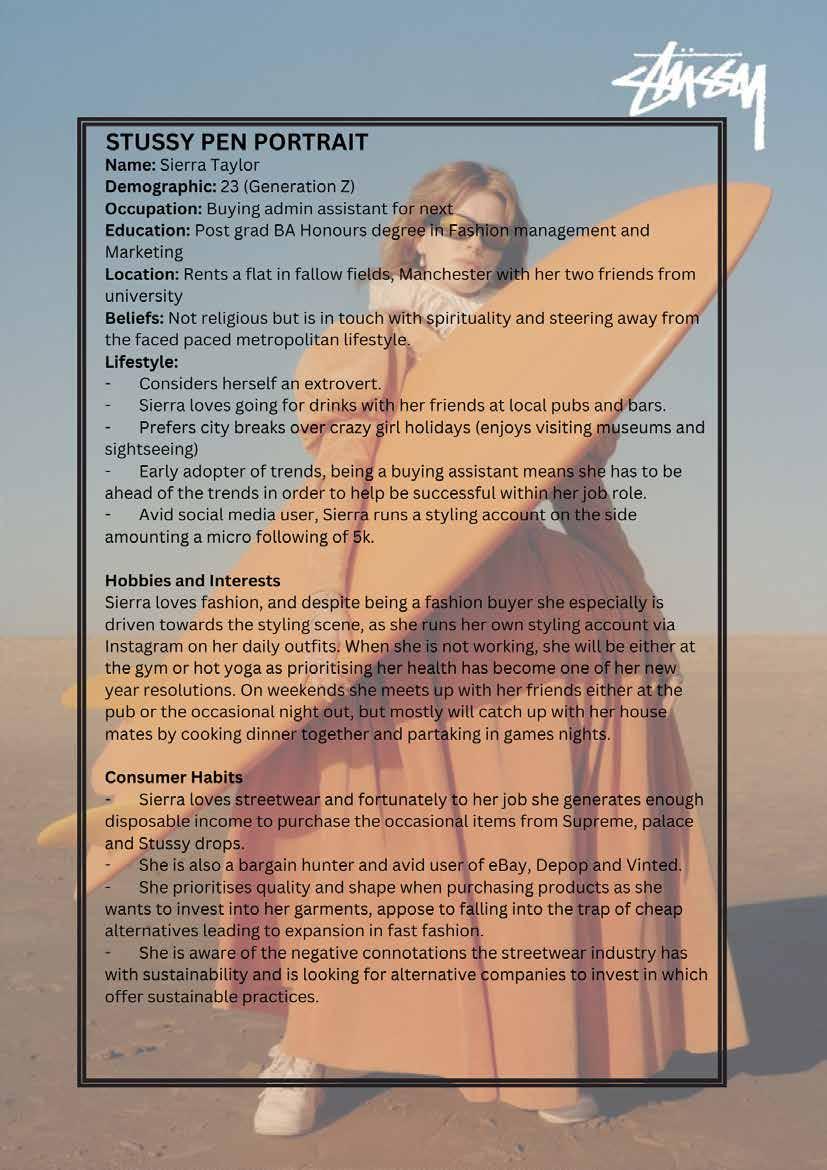

CONSUMER PROFILE

Stussy is an advocate for, “Consumer brand equity” as the brands marketing success relies heavily on the success of consumer experience (YouthfulParaphernalia,2013) towards Generation Z. The brand has been able to establish a lifestyle appose to just being a fashion brand, leading to a cult following of eager fashion enthusiasts. Fig: demonstrates a pen portrait of Stussy’s ideal consumer making up of their key characteristics to fit their consumer (Espirian, 2023).

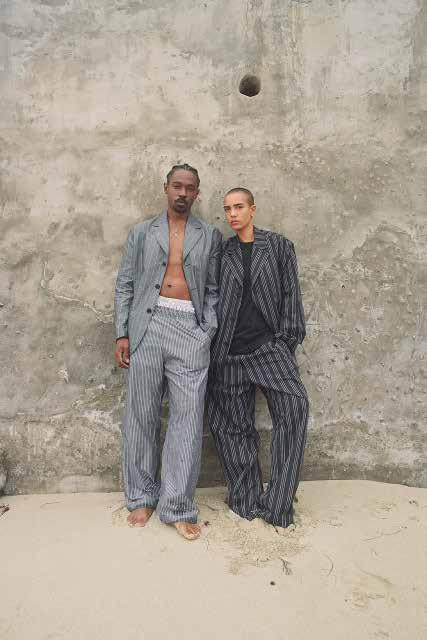

Fig 28: Boakye, P.N. (2022) Up-and-coming Ghanaian streetwear label and Off-White collaborator Free The Youth hosted a pop-up during Paris Fashion Week in October. Paris

Fig 29: Stussy (2021) Images from Stüssy’s second collaboration with Our Legacy.

Fig 29: Stussy pen portait (Authord own, 2024)Dodgson, C. (2022) S/S 2022 Stussy surfboard campaign . California

Fig 28: Boakye, P.N. (2022) Up-and-coming Ghanaian streetwear label and Off-White collaborator Free The Youth hosted a pop-up during Paris Fashion Week in October. Paris

Fig 29: Stussy (2021) Images from Stüssy’s second collaboration with Our Legacy.

Fig 29: Stussy pen portait (Authord own, 2024)Dodgson, C. (2022) S/S 2022 Stussy surfboard campaign . California

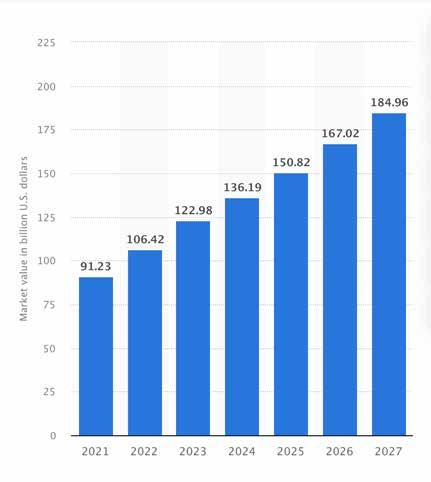

SUSTAINABLE MARKET RESEARCH

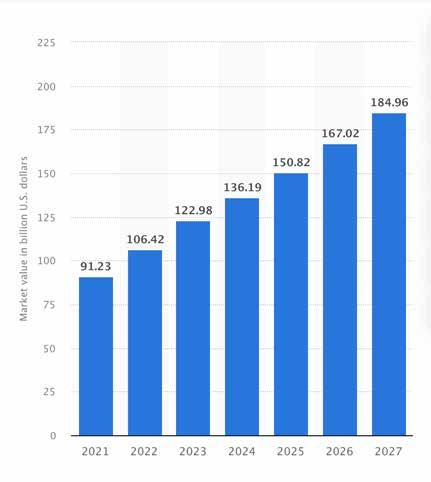

Fast fashion is increasingly becoming strenuous on the functioning of the fashion industry (See Fig 30), with the global fast fashion market projected to exceed 106 billion US dollars and forecasted to reach 185 billion US dollars by 2027 (Statista, 2024). This alarming trend underscores the urgent need for sustainability within the fashion industry to mitigate its detrimental environmental impact and address the fragmented nature of its practices.

A shift towards sustainable production processes presents a compelling opportunity for brands like Stussy, as the use of a proper marketing strategy can promote sustainable behaviour and nudge consumer towards sustainable purchase behaviours (Lee.E.J,2020)

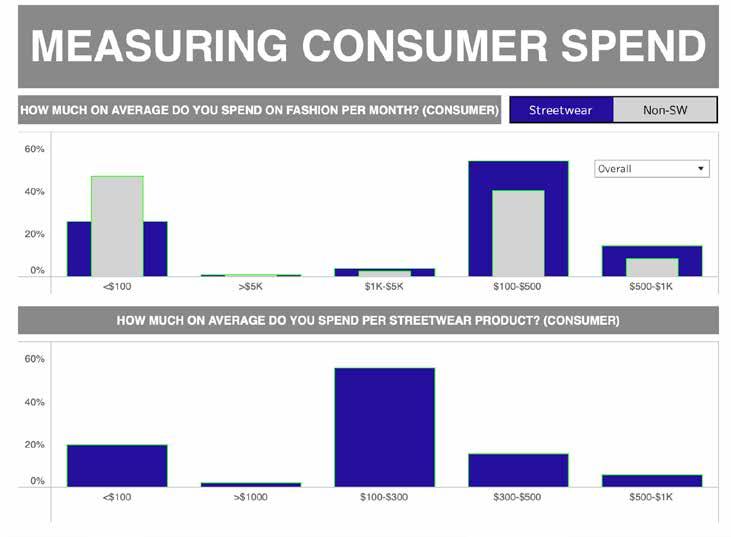

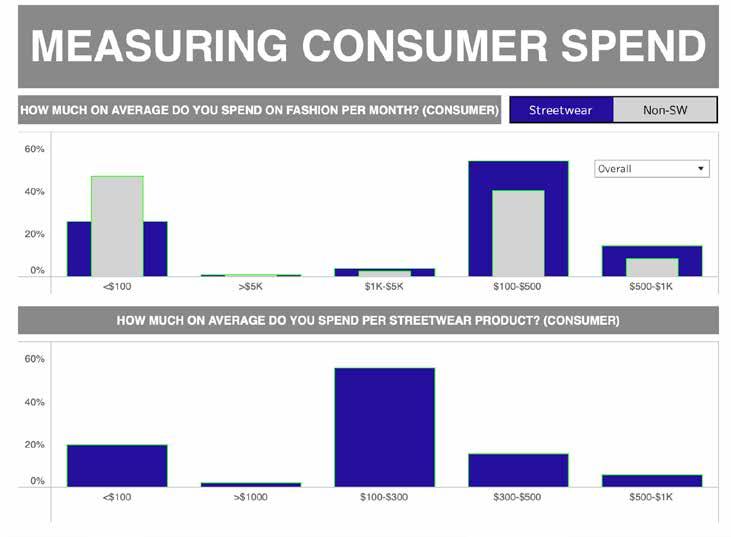

The demographic landscape further reinforces the potential for sustainable practices to resonate with consumers. Gen Z, comprising a significant portion of Stussy’s target market, demonstrate a willingness to invest in streetwear, with 56% reportedly spending an average of $100-$300 on a single item of streetwear (Hype beast, 2019)(Refer to Fig 31). Gen Z’s spending habits, coupled with their growing concern for environmental issues, suggest a receptiveness to sustainable fashion offerings and an opportunity to further penetrate a new market.

When looking into the possibilities of Stussy expanding into a new market of a sustainable capsule collection, Fig 32 demonstrates that consumers are 61.6% more likely to purchase footwear over any other streetwear item, partnered with the fact that key industry players find that Hoodies, t-shirts and footwear make up 67% of their best-selling products (Hypebeast,2019). When constructing Stussy’s new market opportunity, a focus will be put into the production of sustainably made Hoodies, T-shirts & Footwear.

22 23

Fig 30: Fast Fashion Market value (Staista,2023)

Fig 31: Measuring consumer spending (Hypebeast,2019)

Fig 32: Measuring top products (Hypebeast,2019)

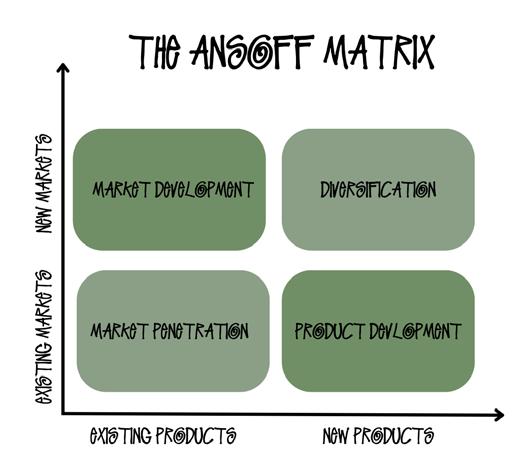

STRATEGY ALIGNMENT

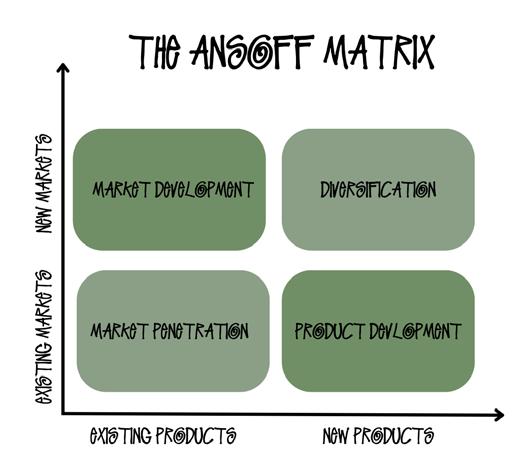

The Ansoff matrix (see fig 34) is an existing business model used to analyse growth strategies (Ansoff.H, 1957). It provides a framework for diversifying into new products or markets, enabling businesses to visualise and identify potential risks associated with each strategy (Dawes, 2018) Stussy minimises the risk associated with the partnerships, as they utilises a “Second mover advantage” strategy, which involves the benefit a company gains from following others into a market or mimicking an existing product (Fishbein, M. 2018).

Previous collaborations between Stussy and Nike SB, such as the 2005 partnership and more recent ventures in 2023, have underscored the success of the collaboration (Stussy, 2024). The resale value of products from these collaborations, such as the Stussy Dunk Low Pro valued at £2499.99, demonstrates the profitability and demand generated by the partnership 19 years after release (Kick game, 2024).

The success of Collaborating with Nike previously helps to bring security to the collaboration for the consumer response.

Nike is also implementing sustainable fabrics (See Case study: Page) including the use of recycled nylon from fish nets, using 100% Sustainable cotton since 2020 and recycled polyester (Nike, 2024). Through product development we will be able to see Stussy purse a more ethical approach and how their consumers will react towards their new sustainable products.

24

Fig 33: ‘Nike x stussy campaign” (2022) Los Angles

OPPORTUNITY

One of the key threats to Stussy, is that lack of transparency and use of sustainable practices and ethical procedures within the production of their collections. Although they have implemented the introduction of sustainability through using upcycled left over from, ‘Our legacy” collaborations (refer to appendix. These collaborations Showcase the potential for more sustainable textile production, yet we are unable to see this translate into capsule collections and future collaborations. Stussy need to expand on their sustainability initiatives to re-connect with Gen Z and their community, while producing a collaboration which can be expanded into a capsule collection.

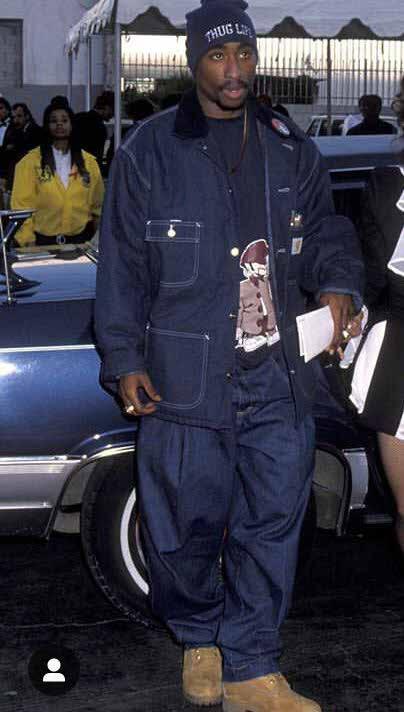

Nike Sb is a suitable brand for a collaboration, due to the successfulness of their previous partnership in 2005. Whilst also holding a strong heritage with Skateboarding, aligning with Stussy’s roots of being harboured by the Los Angeles Skate and Surf culture in their early expansion. Nike Sb are also in the process of becoming more sustainable through the introduction of their, ‘Dunk low Pro E’ manufactured from waste rubber whilst maintaining style and skate-ability (Nike Sb, 2020). These processes can be implemented into a new collaboration driving sustainable textile alternatives, not only educating the consumer but demonstrating the benefits of incorporating sustainability into the manufacturing process,Collaborations provide hype around a product, allowing to build on consumer experience and brand loyalty.

26

NIKE INIATIVES

Nike SB is a suitable partnership for a sustainable streetwear and sneaker collaboration with Stussy. Reasons being with the fact the company has a well-established sneaker reputation, so consumers know what to expect from quality & style.

Nike Sb is a certified skateboarding brand, which aligns with the heritage that Stussy was built on through the LA Surf and Skate culture, reinforcing a strong brand identity for consumers to relate to and advocates for the skater community.

Nike is also taking onboard many new sustainable initiatives through implanting recycled polyester, sustainable cotton and recycled nylon into the manufacturing of products, moving towards a more circular solution within the fashion industry (Nike,2024). Aside from implanting alternative textiles, and introduction of recycling and refurbishing schemes have been set up to help reduce waste within athletic shoes and apparel (Nike, 2024)

28

Fig 37: ‘Nike sustainable initiatives’ (2024) https://www.nike.com/dk/en/sustainability (Accessed: 30 January 2024). Fig 38: ‘Nike move to zero campaign’ (2024) https://www.nike.com/dk/en/sustainability (Accessed: 30 January 2024).

Fig 36: ’Nike move to zero” (2024)https://www.nike.com/dk/en/ sustainability(Accessed: 30 January 2024).

Consumer alienation: Consumers discouraged from purchasing the collaboration over misalignment of their values and purchasing mitigations.

Increased costs: Producing with raw materials will increase production cost for Stussy, as they are used to producing garments as 100% cotton.

RISK MANAGEMENT

Sourcing: Incorporating new materials into Stussy’s supply chain may

mean Stussy will have to change supply base.

61 % of `Gen Z are looking to invest into sustainable alternatives when purchasing apparel (Mckinzey, 2022)

Try to mange expections with costs, but by remaining with Nike Sb’ Supplier will allow for costs increase to be minimised.

Staying with Nike Sb’s suppliers, appose to finding new manufactoring companies to keep the price lower as Nike suppiers are used to handling new raw materials.

30

Fig: 35 Lebon, T. (2016) Stüssy SS16 Jamaica campaign

RISK ANALYSIS

COMPETITORS

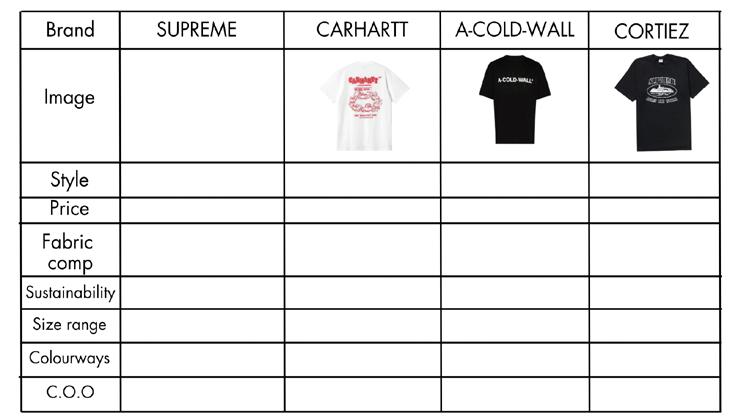

In Fig 39 the marketing position map represents Stussy’s new sneaker competitors when the collaboration has launched. These competitors have differed to Stussy’s initial competitors seen within the market position section of the report, as these brands already are producing Sustainable Sneaker alternatives. We can see a shift in competitors as these are companies what have already taken steps the Stussy and Nike SB intend to do. (Refer to Fig 40 ) for an overview of the new competitors identified.

32

Fig 39: Sustainable Market positioning map Stussy (Authors own, 2024)

Fig 40: Sneaker comp shop (Authors own, 2024)

COMP-SHOP

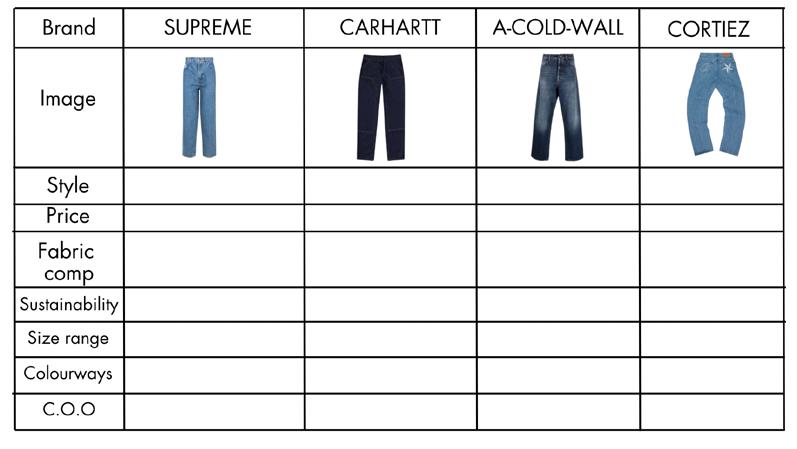

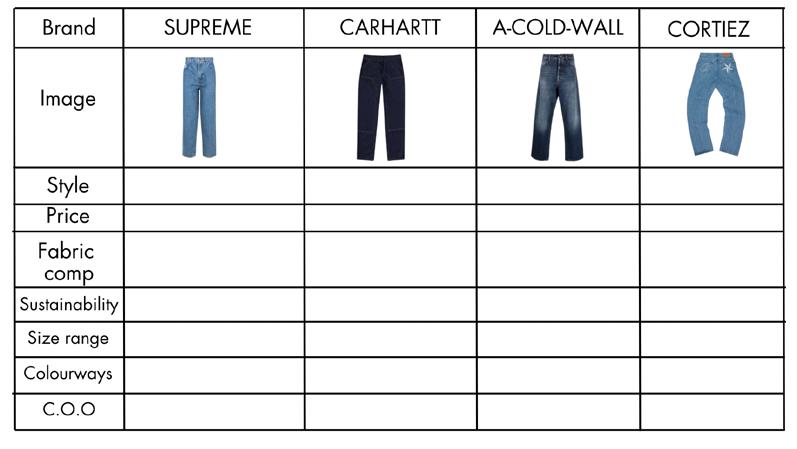

SUPREME X COOGI BAGGY EMBROIDERED LOOSE-FIT JEANS

£471

100% COTTON

N/A

S/M/L/XL/XXL

BLUE AUSTRALIA

CARHARTT WIP DENIM DOUBLE KNEE PANT

£109

100% COTTON

N/A

(28 X 32, 30 X 32, 32 X 32, 32 X 34, 34 X 34, 36 X 32)

BLUE RINSED MEXICO

VINTAGE WASH WIDE LEG JEANS]

£456

100% COTTON

N/A

XS/S/M/L/XL

VINTAGE WASH ITALY

CORTIEZ C-STAR DENIM JEANS

£140

TENCEL/HEMP

N/A

XS/S/M/L/XL/XXL

BLUE, GREY, BLACK, DARK BLUE USA

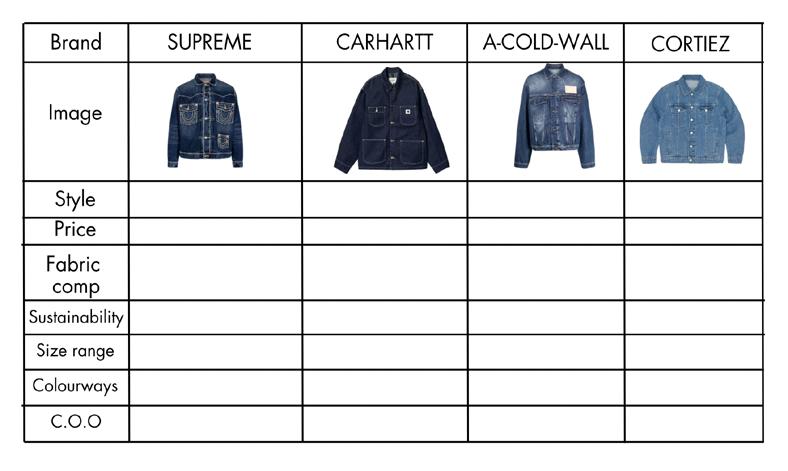

SUPREME STRAWBERRIES CANVAS

CAR IN HEART CAP

CAMP CAP

£114

100% COTTON

N/A

L/M

MULTICOLOR CANADA

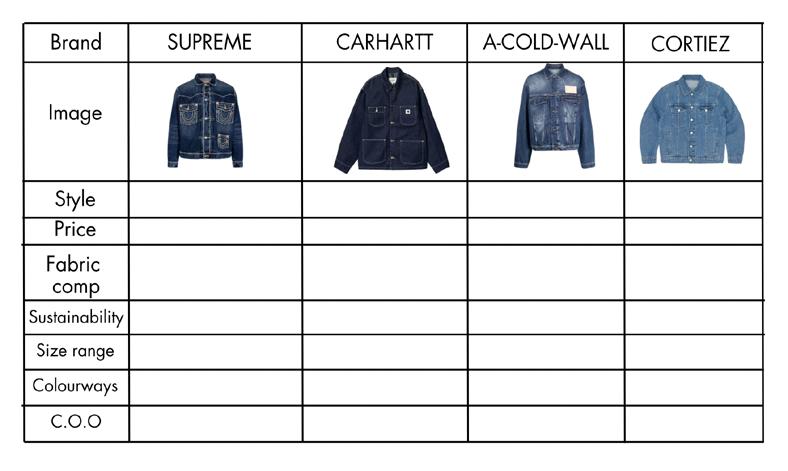

SUPREME X TRUE RELIGION

£529

100% COTTON

N/A S/M/L/XL

DARK WASH CANADA

W’ OG MICHIGAN COAT

£130

100% cotton ‘Norco’ denim 11.25 oz

N/A

XS/S/M/L

B/N/LB/AW/DW USA

VINTAGE WAS LOGO- PRINT DENIM JACKET

£476

100% COTTON

N/A S/M/L/XL

VINTAGE WASH ITALY

CORTIEZ C-STAR TRUCKER JACKET

£150

100% COTTON

N/A S/M/L/XL BLUE USA

£60

100% COTTON

N/A ONESIZE BLUE MEXICO

ACW SIGNATURE CAP

£140

100% COTTON

N/A ONESIZE BLACK ITALY

CORTIEZ 5 STARZ ALCATRAZ TRUCKER HAT

£35

100% COTTON

N/A ONESIZE

BLACK, BLUE, GREY, GREEN USA

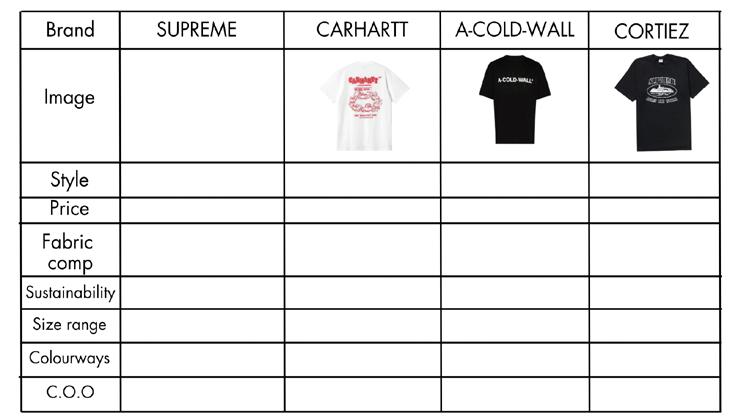

SUPREME SLAP SHOT TSHIRT

£114

100% COTTON

N/A S/M/L

BLACK CANADA

CARHARTT

£50

100% ORGANIC COTTON

N/A S/M/L/XL

WHITE MEXICO

A-COLD-WALL BLACK TSHIRT

£251

100% COTTON

N/A S/M/L/XL

BLACK ITALY

CORTIEZ RULES THE WORLD BLACK TEE

£40

75% TENCELL

N/A XS/S/M/L/XL

GREY, BLACK, WHITE USA

34 35

Fig 40: Sneaker comp shop (Authors own, 2024)

Fig 42: Denim Jacket comp shop (Authors own, 2024)

Fig 43: Baseball cap comp shop (Authors own, 2024)

Fig 44: Sneaker comp shop (Authors own, 2024)

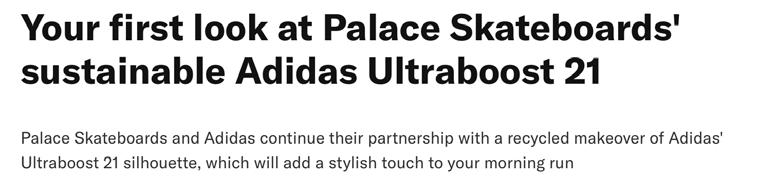

CASE STUDY

PALACE SKATEBOARDS X ADIDAS ULTRABOOST

When researching further into previous sustainable sneaker collaborations the 2021 collaboration between Palace skateboards and adidas ultra-boost would prove to be an excellent example for justification of my Collab. The collaboration consisted of sneakers being made of 81% recycled yarn with 50% of their plastic sourced from remote islands and beaches(maoui,2021). Not only have they adapted it into their trainers they have expanded the sustainability scheme to their clothing items such as socks which have 97% recycled materials used to produce them. This is a positive collaboration for Adidas and Palace as it paves a way for an broader opportunity to penetrate the sustainable market.

36

MOODBOARD

38 39

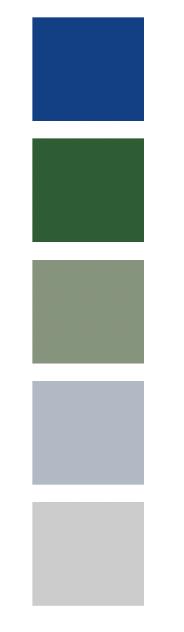

COLOUR PALLET

TENCELL FABRIC SWATCHES

Fig 45: Stussy X Nike moodboard (Authors own, 2024)W

STREET AND SURF CULTURE

RANGE LAYOUT

40 41

RANGE PLAN

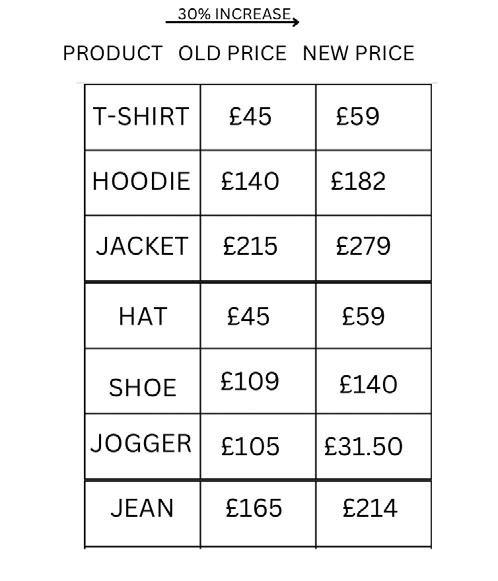

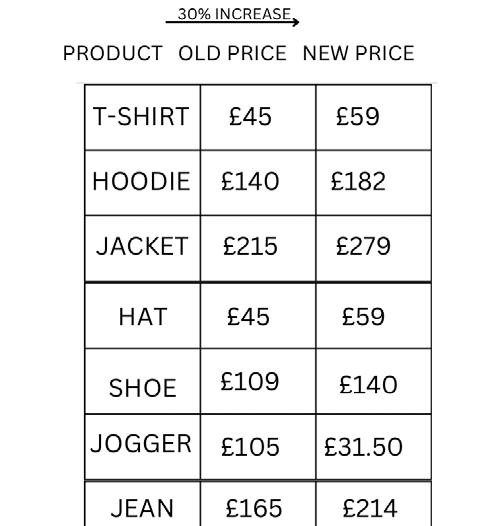

£140

3.5-13

Sole: 25% recyled rubber

75% Vegan leather alternative

£279

XS-XXL 100% recycled cotton

£214

XS-XXL 100% recycled cotton

£59

one size

100% recyled cotton

£225

XS-XXL 100% recyled cotton

£59

XS-XXL 100% recyled cotton

£135

XS-XXL 100% recyled cotton

£182

XS-XXL 100% recyled cotton

Embossed Stussy logo on left side

Embroidered Nike

SB logo on Front

Embossed Stussy x Nike

SB logo

Darted denim

Embossed

Stussy x Nike

SB logo

Balloon fit leg

Embossed Stussy x Nike

SB logo

Fleece lined

Toggle adjustment

Embossed Stussy x Nike

SB logo

Tailored fit

Longline

Embossed Stussy x Nike

SB logo

Boxy fit

Drop shoulder

Embossed Stussy x Nike

SB logo

Ribbed cuffs

Drawcord waist

Embossed Stussy x Nike

SB logo

Ribbed cuffs

Kangaroo pocket

42 43

“SURF TURF DUNK” “BOXY DENIM FIT” “90’S DENIM OG JEAN” “TRAPPER HAT” “FITTED DENIM FIT” “THE OG TEE” “THE OG JOGGER” “THE OG HOODIE”

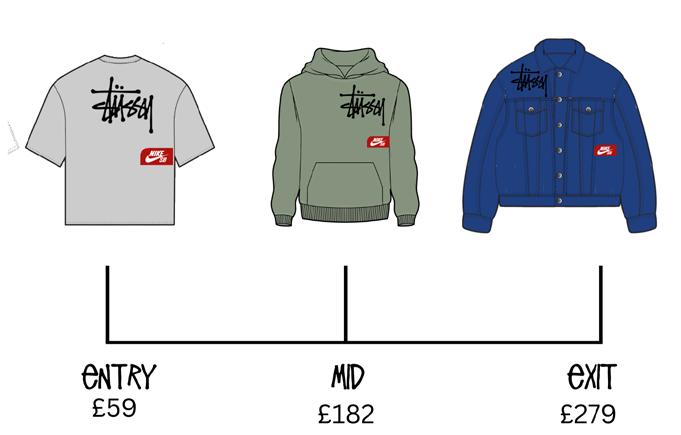

RANGE ANALYSIS

PRICING STRUCTURE

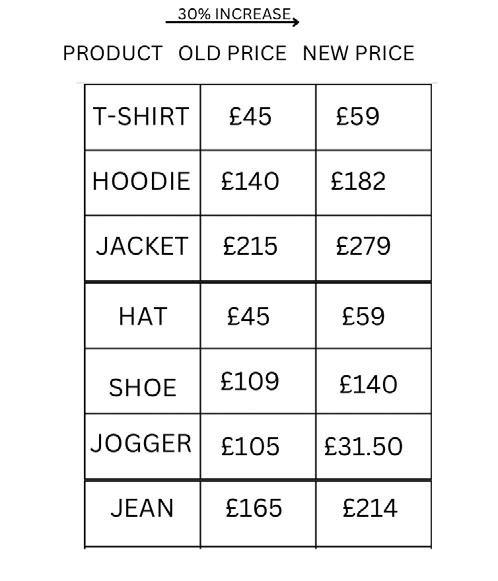

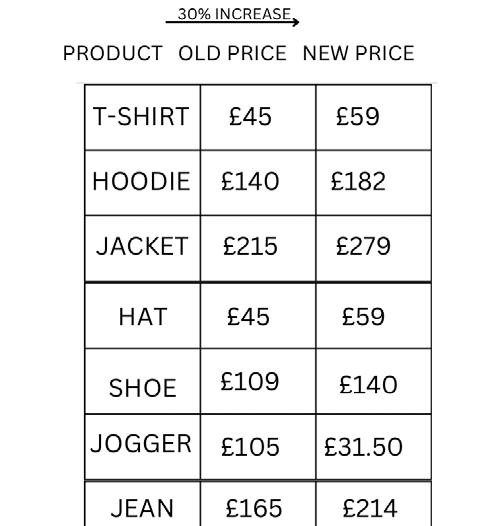

A marginally higher Exit, Mid and exit points for t he proposed range through comparison of Stussy’s previous collaborations (See appendix 5) as well as consideration for additional costs which will be implemented within the manufacturing process of raw materials. The price increase would be a value of 30% increase to the production of each product.

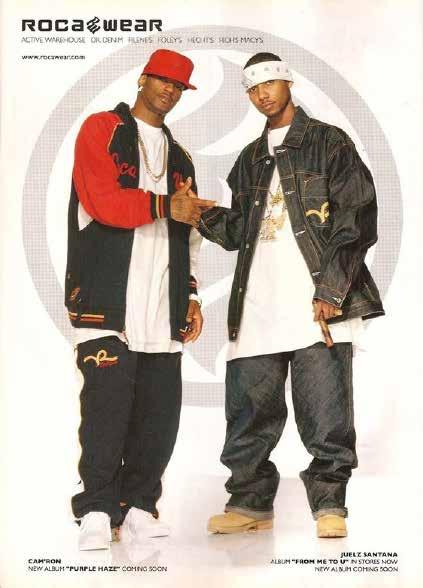

COLOUR PALLET

The colour pallet for the proposed colaboration is to reflect the heritage of both Stussy & Nike Sb. The cooler tones of Blue/grey representing the sea and sky of Los Angles, paying homage to Stussy’s roots of Surfing, whilst the greens representing reconnecting with the outdoors and nature. The Tones are muted and more directed towards a winter colour pallet, however although the collaboration is directed at A/W 24/25, the colours are light enough to be worn all year round.

PRODUCT DEVLOPMENT

Fig 48 demonstrates potential risk factors over the launch of the collaboration between Stussy and Nike SB. Opting for a larger quantity of core basics provides security for the brand that profit will be made, whereas an initial lower purchase level of the trend and trial garments would be beneficial to avoid risk factors. Fig 48 is useful to see how different levels respond to different consumers wants and needs when producing product development.

44 45

‘STUSSY SURF SHOP’ ‘BE TRUE TO YOU’ ‘THE OG’ ‘THE LA SKATE’ ‘THE OLLY’

Fig 46: Stussy X nike Entry, exit mid (Authors own, 2024)

Fig 47: Stussy X NIKE SB Boston Matrix (authors own, 2024) adapted from BCG Matrix

Fig 48: Stussy X nike fashion Triangle (Authors own, 2024)

CONCLUSION

The proposed collaboration with Nike SB presents an exciting opportunity for Stussy to further its commitment to sustainability while leveraging the strengths of both brands to create innovative and desirable products. By incorporating sustainable textiles and production methods into the collaboration, Stussy can not only appeal to environmentally-conscious consumers but also differentiate itself in the competitive streetwear market.

However, the collaboration also poses risks, including potential consumer alienation, sourcing challenges, and increased costs. These risks must be carefully managed through strategic planning and effective communication to ensure the success of the partnership.

Overall, Stussy’s journey from its origins in the Los Angeles skate and surf culture to its position as a global streetwear powerhouse is a testament to its enduring appeal and adaptability. By continuing to innovate, engage with its community, and embrace sustainability, Stussy is well-positioned to thrive in an ever-evolving fashion landscape while staying true to its roots and values.

47

FIG LIST

Fig 1: Chad Muska Skateboarding (1990). San Diego California .

Fig 2: Shawn Stussy sitting down (2016). California. https://www.highsnobiety.com/p/shawn-stussy-biography/

Fig 3: London Chapter of the International Stussy Tribe (1990). london https://testpressing.wordpress.com/2010/03/11/just-because-010-london-chapter-ofthe-international-stussy-tribe-1990/

Fig 4: Leighton (1986) Stussy AD campaign . New York. https://www.mrporter.com/en-us/journal/fashion/stssy-783216

Fig 5 :Stussy , S. (1987) In this great future you can’t forget your past . Newyork . https://www.mrporter.com/en-us/journal/fashion/stssy-783216

Fig 6: Stussy Brand structure (2024) adapted from Aakar (1996) Authors own

Fig 7: Stussy brand identity (2024) adapted from Kapferer (1996)

Fig 8: Stussy Madrid store (2010). Madrid https://hypebeast.com/2010/4/stussy-madrid-store-closer

Fig 9: Tribe , S. (1987) the NYC crew, Messrs Jules Gayton, Mittleman, Ross, Kevin Williams and Jeremy Henderson. New York . https://www.mrporter.com/en-us/ journal/fashion/stssy-783216

Fig 10: Tribe , stussy (1989) he London crew, Messrs Kopelman, Armitage, Turnbull, Lebon and Jones. London https://www.mrporter.com/en-us/journal/fashion/stssy-783216

Fig 11: Fashion market triangle (Authors own, 2023) adapted from Fashion market triangle (Sorgar, 2006) https://www.researchgate.net/figure/Fashion-industry-pyramid_fig1_254305548

Fig 12: Stussy’s position on the diffusion of innovation curve (2023) adapted from Rodgers, 1962 https://theboldbusinessexpert.com/2020/11/02/diffusion-of-innovation-getting-past-the-first-wave-of-innovators-and-early-adopters-to-reach-the-tipping-point/

Fig 13: Lebon, T. (2017) Do you Know what time it is? New York . https://www.dazeddigital.com/fashion/gallery/23355/0/stussy-ss17-campaign

Fig 14: Market positioning map Stussy (Authors own, 2024)

Fig 15: Sustainable Market positioning map Stussy (Authors own, 2024)

Fig 16: Stussy Boston Matrix (authors own, 2024) adapted from BCG Matrix. https://www.smartinsights.com/marketing-planning/marketing-models/use-bcg-matrix/

Fig 17: Dodgson, C. (2022) Stussy car image Los Angeles . https://uk.stussy.com/blogs/features/stussy-fall-19

Fig 18: Stussy Product breakdown (Authors own, 2024)

Fig 19: Stussy, “Entry, median, Exit” price strategy (Authors own, 2024)

Fig 20: Stussy, “Good, better, best” (Authors own,2024)

Fig 21: Sion, T. (2018) Stussy Fall 18 credit card . London. https://hypebeast.com/2018/8/stussy-fall-2018-campaign

Fig 22: Sion, T. (2018) Stussy Fall 18 soap image . London. https://hypebeast.com/2018/8/stussy-fall-2018-campaign

Fig 23: Hypebeast (2023) Stussy London store. London. https://hypebeast.com/2018/8/stussy-london-soho-store-inside-look

Fig 24: Stussy’s social media presence (Authors own, 2024)

Fig 25: Koqos, “Nike & Stussy Plant dyed air force 1 collaboration”(2023)

Fig 26: Our Legacy, Our legacy X Stussy campaign (2020) https://hypebae.com/2020/8/stussy-our-legacy-work-shop-collaboration-sustainable-eco-friendly-upcycling-release-info

Fig 27:Our Legacy, Our legacy X Stussy campaign (2020) https://hypebae.com/2020/8/stussy-our-legacy-work-shop-collaboration-sustainable-eco-friendly-upcycling-release-info

Fig 28: Boakye, P.N. (2022) Up-and-coming Ghanaian streetwear label and Off-White collaborator Free The Youth hosted a pop-up during Paris Fashion Week in October. Paris . https://www.businessoffashion.com/articles/retail/streetwear-virgil-abloh-supreme-balenciaga/

Fig: 29 Dodgson, C. (2022) S/S 2022 Stussy surfboard campaign . California . https://models.com/work/various-lookbookscatalogs-stussy-campaign

Fig 30: Smith, P. (2023) Fast fashion market forecast worldwide 2021-2027, Statista. Available at: https://www.statista.com/statistics/1008241/fast-fashion-market-value-forecast-worldwide/ (Accessed: 29 January 2024).

Fig 31: Measuring consumer spending (Hypebeast,2019)

Fig 32: Measuring top products (Hypebeast,2019)

Fig 33: ‘Nike x stussy campaign” (2022) Los Angles Nwo, A. and Sandwich (no date Nike X Stüssy, Behance. Available at: https://www.behance.net/gallery/144533721/Nike-x-Stussy (Accessed: 30 January 2024).

Fig 34: Stussy Ansof matrix (2024) adapted from (H.Ansoff,1957)(Accessed: 30 January 2024).

Fig: 35 Lebon, T. (2016) Stüssy SS16 Jamaica campaign (Accessed: 30 January 2024).

Fig 36: ’Nike move to zero” (2024)https://www.nike.com/dk/en/sustainability(Accessed: 30 January 2024).

Fig 37: ‘Nike sustainable initiatives’ (2024) https://www.nike.com/dk/en/sustainability (Accessed: 30 January 2024).

Fig 38: ‘Nike move to zero campaign’ (2024) https://www.nike.com/dk/en/sustainability (Accessed: 30 January 2024).

Fig 37: ‘Nike sustainable initiatives’ (2024) https://www.nike.com/dk/en/sustainability (Accessed: 30 January 2024)

Fig 36: ’Nike move to zero” (2024)https://www.nike.com/dk/en/(Accessed: 30 January 2024)sustainability(Accessed: 30 January 2024).

Fig 39: Sustainable Market positioning map Stussy (Authors own, 2024)(Accessed: 30 January 2024)

Fig 40: Sneaker comp shop (Authors own, 2024)(Accessed: 30 January 2024)

Fig 40: Sneaker comp shop (Authors own, 2024)

Fig 42: Denim Jacket comp shop (Authors own, 2024)

Fig 43: Baseball cap comp shop (Authors own, 2024)

Fig 44: Sneaker comp shop (Authors own, 2024)

Fig 45: Stussy X Nike moodboard (Authors own, 2024)

Fig 46: Stussy X nike Entry, exit mid (Authors own, 2024)

Fig 47: Stussy X NIKE SB Boston Matrix (authors own, 2024) adapted from BCG Matrix

Fig 48: The fashion triangle

REFERENCES

1. Jackson, O. (2022) History of stüssy: How Stüssy became the Godfathers of Streetwear, HIP Blog. Available at: https://blog.thehipstore.co.uk/how-stussy-became-the-godfathers-of-streetwear/ (Accessed: 18 January 2024).

2. Stussy.com revenue: ECDB.com (2022) stussy.com revenue | ECDB.com. Available at: https://ecommercedb.com/store/stussy.com (Accessed: 23 January 2024).

3. Tashjian, R. (2021) How Stüssy became the Chanel of streetwear, GQ. Available at: https://www.gq.com/story/stussy-revival-2021 (Accessed: 23 January 2024).

4. Jackson, O. (2022) History of stüssy: How Stüssy became the Godfathers of Streetwear, HIP Blog. Available at: https://blog.thehipstore.co.uk/how-stussy-became-the-godfathers-of-streetwear/ (Accessed: 18 January 2024).

5. Aaker, D.A., 2012. Building strong brands. Simon and Schuster.(Accessed: 18 January 2024).

6. Kapferer, J.N. (1986), “Beyond positioning, retailer’s identity”, Esomar Seminar Proceedings, Brussels, Vol. 4/6, pp. 167-176. [Online]. Available at: https://www.emerald. com/insight/content/doi/10.1108/JPBM-01-2014-0478/full/html (Accessed: 23 January 2024)

7. Lombard, C. (2021) The brand identity prism and how it works, How Brands Are Built. Available at: https://howbrandsarebuilt.com/the-brand-identity-prism-and-how-itworks/ (Accessed: 24 January 2024).

8. Mbacke, M. (2023) Stussy: A case study in pioneering streetwear, Gabe Clothing. Available at: https://gabeclothing.ca/blogs/building-a-clothing-brand/stussy-case-study (Accessed: 24 January 2024).

9. Highsnobiety editor (2024) Stüssy: What you need to know about the clothing brand, Highsnobiety. Available at: https://www.highsnobiety.com/tag/stussy/ (Accessed: 18 January 2024).

10. Rogers, E.M. (1962). Diffusion of innovations, New York: The Free Press. Available at: https://www.proquest.com/docview/197971687?pq-origsite=gscholar&fromopenview=true&sourcetype=Scholarly%20Journals (Accessed: 23 January 2024)

11. Beaudoin, P., Lachance, M.J. and Robitaille, J. (2003), “Fashion innovativeness, fashion diffusion and brand sensitivity among adolescents”, Journal of Fashion Marketing and Management, Vol. 7 No. 1, pp. 23-30. https://doi.org/10.1108/13612020310464340(Accessed: 23 January 2024)

12. Stüssy & Our Legacy Work Shop (2024) Stüssy UK. Available at: https://uk.stussy.com/blogs/features/stussy-our-legacy-work-shop-3 (Accessed: 28 January 2024).

13. Saunders, B. (2023) Stüssy and beats link up for studio pro headphones, Hypebeast. Available at: https://hypebeast.com/2023/12/stussy-beats-studio-pro-headphones-collaboration-release-info (Accessed: 28 January 2024).

14. Chen Yuanping. (2015),”Design and Implementation of a Scientific Research Funds Analysis Model Based on Boston Matrix, Procedia Computer Science” Vol 55, pp. 953959. Available at: https://doi.org/10.1016/j.procs.2015.07.108.(Accessed: 23 January 2024)

15. Erjavec,Jure. (2022), “Online shopping adoption during COVID-19 and social isolation: Extending the UTAUT model with herd behavior” Vol 65 ,Available at: https:// www.sciencedirect.com/science/article/pii/S0969698921004331?casa_token=Fh7XCfcFRoAAAAAA:Yb_VkgFtBdHgGiVaicrzhwmUVciqe0KIY1wGqFU4sYo1VCzjGRfGTQubyKdCimHO8k7HuEE6 (Accessed: 23 January 2024)

16. B.L. Dey, W. Al-Karaghouli, S.S. Muhammad (2020) “adaptation, use and impact of information systems during pandemic time and beyond: research and managerial implications”. Vol 37 pp. 298-302, (Accessed: 23 January 2024)

17. Mordue, L. (2023) How the growth of e-commerce has affected the high street, JDR Group: Marketing Agency in Derby. Available at: https://www.jdrgroup.co.uk/blog/ how-is-ecommerce-affecting-the-high-street (Accessed: 28 January 2024).

18. Klevu Team (2023) Discovering new markets: How Stüssy and Creed do globalisation strategy, Klevu AI. Available at: https://www.klevu.com/discovered/tv/discovering-new-markets-panel-stussy-creed-bigcommerce/ (Accessed: 28 January 2024).

19. Strategy& (no date) Streetwear: The new exclusivity, Strategy&. Available at: https://www.strategyand.pwc.com/de/en/industries/consumer-markets/streetwear.html#:~:text=We%20estimate%20the%20size%20of,global%20apparel%20and%20footwear%20market. (Accessed: 28 January 2024).

20. Maoui, Z. (2021) Stüssy’s gone all sustainable (with our legacy’s help), British GQ. Available at: https://www.gq-magazine.co.uk/fashion/article/stussy-our-legacyspring-2021 (Accessed: 28 January 2024).

21. Maoui, Z. (2021a) Stüssy and Nike have set the benchmark for Sustainable Streetwear, British GQ. Available at: https://www.gq-magazine.co.uk/fashion/article/nike-stussy-2021-recycled (Accessed: 28 January 2024).

22. Kasanen, K. (2023) Streetwear begins to look like fast fashion, yet no one talks about its issue with sustainability: Magazine: Hypend: Curating streetwear culture, HYPEND. Available at: https://www.hypend.com/blog/streetwear-begins-to-look-like-fast-fashion-yet-no-one-talks-about-its-issue-with-sustainability (Accessed: 28 January 2024).

23. YouthfulParaphernalia and YouthfulParaphernalia (2013) Stussy, Advert Anatomy. Available at: https://advertanatomy.wordpress.com/2013/01/28/stussy/ (Accessed: 29 January 2024).

24. Espirian, J. (2016) Pen portraits: Understanding your ideal audience, Medium. Available at: https://medium.com/%40espirian/pen-portraits-understanding-your-ideal-audience-a807cac56411#:~:text=A%20pen%20portrait%20—%20sometimes%20called,in%20a%20lot%20more%20detail. (Accessed: 29 January 2024).

25. Steele, V. (2022) Definition of Fashion. LoveToKnow. Available online: https://fashion-history.lovetoknow.com/alphabetical-index-fashion-clothing-history/definitionn-fashion (accessed on 20 December 2023).

26. Ray, S. and Nayak, L. (2023) Marketing sustainable fashion: Trends and future directions, MDPI. Available at: https://www.mdpi.com/2071-1050/15/7/6202#B22-sustainability-15-06202 (Accessed: 29 January 2024).

27. Lee, E.-J.; Choi, H.; Han, J.; Kim, D.H.; Ko, E.; Kim, K.H. (20200 How to “Nudge” your consumers toward sustainable fashion consumption: An fMRI investigation. J. Bus. Res. , 117, 642–651.(Accessed: 29 January 2024).

28. Ruiz, A. (2023) 17 most worrying textile waste statistics & facts - the roundup, 17 Most Worrying Textile Waste Statistics & Facts. Available at: https://theroundup.org/ textile-waste-statistics/ (Accessed: 29 January 2024).

29. Ansoff, H. (1957.) ‘Strategies for Diversification,’ Harvard Business Review, Volume 35, Issue 5, October 1957.

30. Dawes, John, The Ansoff Matrix: A Legendary Tool, But with Two Logical Problems (February 27, 2018). Available at SSRN: https://ssrn.com/abstract=3130530 or http:// dx.doi.org/10.2139/ssrn.3130530

31. Fishbein, M. (2018) 4 second mover advantages: Why competitive markets can make for great companies, Mike Fishbein. Available at: https://mfishbein.com/4-second-mover-advantages-why-competitive-markets-can/ (Accessed: 30 January 2024).

32. Stussy team (no date) Stüssy, Nike Skateboarding. Available at: https://www.nikesb.com/the-vault/pink-box/stussy (Accessed: 23 January 2024).

33. kick game (no date) Stüssy x nike dunk low pro SB ‘cherry’, Kick Game. Available at: https://www.kickgame.co.uk/products/stussy-x-nike-dunk-low-pro-sb-cherry-304292-671 (Accessed: 23 January 2024).

34. Marinier, I. (2023) Gen Z as the Sustainability Generation, Painted Brain. Available at: https://paintedbrain.org/blog/mental-health/gen-z-as-the-sustainability-generation#:~:text=Gen%20Z%20is%20emerging%20as,than%20brand%20names%20when%20shopping. (Accessed: 30 January 2024).

35. Dunk low pro E (2020) Nike Skateboarding. Available at: https://www.nikesb.com/the-vault/striped-box-era/nike-sb-dunk-low-pro-e (Accessed: 30 January 2024).

36. Maoui, Z. (2021) Your first look at Palace Skateboards’ sustainable adidas ultraboost 21, British GQ. Available at: https://www.gq-magazine.co.uk/fashion/article/palace-skateboards-adidas-ultraboost-21 (Accessed: 31 January 2024).

37. Fig 37: ‘Nike sustainable initiatives’ (2024) https://www.nike.com/dk/en/sustainability (Accessed: 30 January 2024)

38. Fig 36: ’Nike move to zero” (2024)https://www.nike.com/dk/en/sustainability(Accessed: 30 January 2024).

39. Fig 39: Sustainable Market positioning map Stussy (Authors own, 2024)

40. Fig 40: Sneaker comp shop (Authors own, 2024)

48 49

BIBLIOGRAPHY

Bibliography

Amed, I. and Berg, A. (2023) The state of fashion 2024: Riding out the storm, The Business of Fashion. Available at: https://www.businessoffashion.com/reports/news-analysis/thestate-of-fashion-2024-report-bof-mckinsey/ (Accessed: 18 January 2024).

Assoune, A. (2023) Stone Island, Panaprium. Available at: https://www.panaprium.com/blogs/i/stone-island (Accessed: 25 January 2024). Caruso, C. (2021) Does streetwear really care about sustainability?, nss magazine. Available at: https://www.nssmag.com/en/fashion/26049/streetwear-sostenibilita-supreme-palace (Accessed: 25 January 2024).

Corteizclothing (2023) Fashion redefined by Corteiz with style and Sustainability, Medium. Available at: https://medium.com/@corteizclothing435/fashion-redefined-by-corteiz-with-style-andsustainability-584945f642a8#:~:text=Cortez%20is%20a%20company%20that,to%20lowering%20their%20carbon%20footprint. (Accessed: 25 January 2024).

Duong, A. (2023) Minimally designed collaborative streetwear, TrendHunter.com. Available at: https://www.trendhunter.com/trends/stssy-and-our-legacy#:~:text=Collaborative%20 Sustainable%20Fashion%20%2D%20The%20collaboration,through%20upcycling%20leftover%20fabric%20materials. (Accessed: 30 January 2024).

Espirian, J. (2016) Pen portraits: Understanding your ideal audience, Medium. Available at: https://medium.com/%40espirian/pen-portraits-understanding-your-ideal-audience-a807cac56411#:~:text=A%20pen%20portrait%20—%20sometimes%20called,in%20a%20lot%20more%20detail. (Accessed: 29 January 2024).

Fishbein, M. (2018) 4 second mover advantages: Why competitive markets can make for great companies, Mike Fishbein. Available at: https://mfishbein.com/4-second-mover-advantages-why-competitive-markets-can/ (Accessed: 30 January 2024).

Highsnobiety editor (2024) Stüssy: What you need to know about the clothing brand, Highsnobiety. Available at: https://www.highsnobiety.com/tag/stussy/ (Accessed: 18 January 2024).

Hypebeast author (2019) measuring streetwear Streetwear market statistics & global trends. Available at: https://strategyand.hypebeast.com/streetwear-report-market-statistics-global-trends (Accessed: 18 January 2024).

Jackson, O. (2022) History of stüssy: How Stüssy became the Godfathers of Streetwear, HIP Blog. Available at: https://blog.thehipstore.co.uk/how-stussy-became-the-godfathers-ofstreetwear/ (Accessed: 18 January 2024).

Kasanen, K. (2023) Streetwear begins to look like fast fashion, yet no one talks about its issue with sustainability: Magazine: Hypend: Curating streetwear culture, HYPEND. Available at: https://www.hypend.com/blog/streetwear-begins-to-look-like-fast-fashion-yet-no-one-talks-about-its-issue-with-sustainability (Accessed: 28 January 2024).

Klevu Team (2023) Discovering new markets: How Stüssy and Creed do globalisation strategy, Klevu AI. Available at: https://www.klevu.com/discovered/tv/discovering-new-markets-panel-stussy-creed-bigcommerce/ (Accessed: 28 January 2024).

Lombard, C. (2021) The brand identity prism and how it works, How Brands Are Built. Available at: https://howbrandsarebuilt.com/the-brand-identity-prism-and-how-it-works/ (Accessed: 24 January 2024).

Maoui, Z. (2021) Stüssy’s gone all sustainable (with our legacy’s help), British GQ. Available at: https://www.gq-magazine.co.uk/fashion/article/stussy-our-legacy-spring-2021 (Accessed: 28 January 2024).

Marinier, I. (2023) Gen Z as the Sustainability Generation, Painted Brain. Available at: https://paintedbrain.org/blog/mental-health/gen-z-as-the-sustainability-generation#:~:text=Gen%20Z%20is%20emerging%20as,than%20brand%20names%20when%20shopping. (Accessed: 30 January 2024).

1. Marketing position map

Mbacke, M. (2023) Stussy: A case study in pioneering streetwear, Gabe Clothing. Available at: https://gabeclothing.ca/blogs/building-a-clothing-brand/stussy-case-study (Accessed: 24 January 2024).

Nike SB logo PNG Vector (EPS) free download (no date) Seeklogo. Available at: https://seeklogo.com/vector-logo/99507/nike-sb (Accessed: 23 January 2024).

1. Nike SB team (no date) Sustainability, Nike Skateboarding. Available at: https://www.nikesb.com/sustainability (Accessed: 25 January 2024).

2. Nike Sustainability. move to Zero (no date) Nike.com. Available at: https://www.nike.com/dk/en/sustainability (Accessed: 31 January 2024).

3. Planning our future, with the planet: MCM Sustainability (no date) MCM. Available at: https://uk.mcmworldwide.com/en_GB/mcm-sustainability/a-new-decade-of-change-and-action (Accessed: 25 January 2024).

Reference: Hypebeast author (2019) measuring streetwear , Streetwear market statistics & global trends. Available at: https://strategyand.hypebeast.com/streetwear-report-market-statistics-global-trends (Accessed: 18 January 2024).

Ruiz, A. (2023) 17 most worrying textile waste statistics & facts - the roundup, 17 Most Worrying Textile Waste Statistics & Facts. Available at: https://theroundup.org/textile-waste-statistics/ (Accessed: 29 January 2024).

Saunders, B. (2023) Stüssy and beats link up for studio pro headphones, Hypebeast. Available at: https://hypebeast.com/2023/12/stussy-beats-studio-pro-headphones-collaboration-release-info (Accessed: 28 January 2024).

Simmel, G. (1957), Fashion. Am. J. Sociol. (1957), 62, 541–558. [Google Scholar] [CrossRef] Smith, P. (2023) Fast fashion market forecast worldwide 2021-2027, Statista. Available at: https://www.statista.com/statistics/1008241/fast-fashion-market-value-forecast-worldwide/ (Accessed: 29 January 2024).

Stüssy & Our Legacy Work Shop (2024) Stüssy UK. Available at: https://uk.stussy.com/blogs/features/stussy-our-legacy-work-shop-3 (Accessed: 28 January 2024).

Stussy team (no date) Stüssy, Nike Skateboarding. Available at: https://www.nikesb.com/the-vault/pink-box/stussy (Accessed: 23 January 2024).

Stussy.com revenue: ECDB.com (2022) stussy.com revenue | ECDB.com. Available at: https://ecommercedb.com/store/stussy.com (Accessed: 23 January 2024).

Tashjian, R. (2021) How Stüssy became the Chanel of streetwear, GQ. Available at: https://www.gq.com/story/stussy-revival-2021 (Accessed: 23 January 2024).

Website Websites Wright, G. (2022) Brand identity - what does it mean? [models + examples], Smart Insights. Available at: https://www.smartinsights.com/online-brand-strategy/brand-positioning/ brand-identity/ (Accessed: 24 January 2024).

YouthfulParaphernalia and YouthfulParaphernalia (2013) Stussy, Advert Anatomy. Available at: https://advertanatomy.wordpress.com/2013/01/28/stussy/ (Accessed: 29 January 2024).

Academic journals

2. Aaker, D.A., 2012. Building strong brands. Simon and Schuster [Online}. Available at: https://www.sciencedirect.com/science/article/pii/ S0148296311002566#bb0005 (Accessed: 23 January 2024)

3. Ansoff, H. (1957.) ‘Strategies for Diversification,’ Harvard Business Review, Volume 35, Issue 5, October 1957.

4. B.L. Dey, W. Al-Karaghouli, S.S. Muhammad (2020) “adaptation, use and impact of information systems during pandemic time and beyond: research and managerial implications”. Vol 37 pp. 298-302, (Accessed: 23 January 2024)

5. Beaudoin, P., Lachance, M.J. and Robitaille, J. (2003), “Fashion innovativeness, fashion diffusion and brand sensitivity among adolescents”, Journal of Fashion Marketing and Management, Vol. 7 No. 1, pp. 23-30. https://doi.org/10.1108/13612020310464340(Accessed: 23 January 2024)

6. Chen Yuanping. (2015),”Design and Implementation of a Scientific Research Funds Analysis Model Based on Boston Matrix, Procedia Computer Science” Vol 55, pp. 953-959. Available at: https://doi.org/10.1016/j.procs.2015.07.108.(Accessed: 23 January 2024)

7. Dawes, John, The Ansoff Matrix: A Legendary Tool, But with Two Logical Problems (February 27, 2018). Available at SSRN: https://ssrn.com/ abstract=3130530 or http://dx.doi.org/10.2139/ssrn.3130530

8. Erjavec,Jure. (2022), “Online shopping adoption during COVID-19 and social isolation: Extending the UTAUT model with herd behavior” Vol 65 ,Available at: https://www.sciencedirect.com/science/article/pii/S0969698921004331?casa_token=Fh7XCfcFRoAAAAAA:Yb_VkgFtBdHgGiVaicrzhwmUVciqe0KIY1wGqFU4sYo1VCzjGRfGTQubyKdCimHO8k7HuEE6 (Accessed: 23 January 2024)

9. Kapferer, J.N. (1986), “Beyond positioning, retailer’s identity”, Esomar Seminar Proceedings, Brussels, Vol. 4/6, pp. 167-176. [Online]. Available at: https://www.emerald.com/insight/content/doi/10.1108/JPBM-01-2014-0478/full/html (Accessed: 23 January 2024)

10. Lee, E.-J.; Choi, H.; Han, J.; Kim, D.H.; Ko, E.; Kim, K.H. (20200 How to “Nudge” your consumers toward sustainable fashion consumption: An fMRI investigation. J. Bus. Res. 117, 642–651.(Accessed: 29 January 2024).

11. LUNDBLAD, J.P., 2003. A Review and Critique of Rogers’ Diffusion of Innovation Theory as it Applies to Organizations. Organization Development Journal, 21(4), pp. 50-64. Available at: https://www.proquest.com/docview/197971687?pq-origsite=gscholar&fromopenview=true&sourcetype=Scholarly%20Journals

12. Maoui, Z. (2021a) Stüssy and Nike have set the benchmark for Sustainable Streetwear, British GQ. Available at: https://www.gq-magazine.co.uk/ fashion/article/nike-stussy-2021-recycled (Accessed: 28 January 2024).

13. Mordue, L. (2023) How the growth of e-commerce has affected the high street, JDR Group: Marketing Agency in Derby. Available at: https:// www.jdrgroup.co.uk/blog/how-is-ecommerce-affecting-the-high-street (Accessed: 28 January 2024).

14. Ray, S. and Nayak, L. (2023) Marketing sustainable fashion: Trends and future directions, MDPI. Available at: https://www.mdpi. com/2071-1050/15/7/6202#B22-sustainability-15-06202 (Accessed: 29 January 2024).

15. Steele, V. (2022) Definition of Fashion. LoveToKnow. Available online: https://fashion-history.lovetoknow.com/alphabetical-index-fashion-clothing-history/definitionn-fashion (accessed on 20 December 2023).

Pictures

16. Chad Muska Skateboarding (1990). San Diego California

17. Lebon, T. (2017) Do you Know what time it is? New York . https://www.dazeddigital.com/fashion/gallery/23355/0/stussy-ss17-campaign

18. Leighton (1986) Stussy AD campaign New York.

19. London Chapter of the International Stussy Tribe (1990). london

20. Stussy S. (1987) In this great future you can’t forget your past Newyork

21. Stussy Madrid store (2010). Madrid https://hypebeast.com/2010/4/stussy-madrid-store-closer

22. wikipedia author (no date) File:Nike SB logo.png - wikimedia commons, Nike SB. PNG. Available at: https://commons.wikimedia.org/wiki/File:Nike_sb_logo. png (Accessed: 23 January 2024).

Books

Aaker, D.A. (1996) Building Strong Brands. Jossey-Bass Inc., U.S [Online] Available at: https://books.google.co.uk/books?hl=en&lr=&id=OLa_9LePJlYC&oi=fnd&pg=PT11&dq=building+strong+brand+aaker&ots=sEJcQ-cHb2&sig=pKv7rW7AcVmZRWDtf0DkwKGUMsQ&redir_esc=y#v=onepage&q=building%20strong%20 brand%20aaker&f=false (Accessed: 23 January 2024)

Van Assen, M., Den, V., Pietersma, P. and Ten Have, S. (2009). Key Management Models : the 60+ Models Every Manager Needs to Know. 2nd ed. Harlow, England New York: Financial Times/Prentice Hall.

Van Assen, M., Den, V., Pietersma, P. and Ten Have, S. (2009). Key Management Models : the 60+ Models Every Manager Needs to Know. 2nd ed. Harlow, England New York: Financial Times/Prentice Hall.

Varley, R, 2019. ‘Fashion Marketing’, in Varley, R., Roncha, A., Radclyffe-Thomas, N., & Gee, L. (eds), Fashion Management: A Strategic Approach. New York, NY: Red Globe Press, pp. 43– 57.

50 51

APPENDICIES

STRENGTHS

- Brand Synergy: Nike SB and Stüssy both have strong brand identities rooted in streetwear and skate culture. Teir collaboration capitalizes on their shared aesthetic and values, enhancing brand appeal and consumer engagement.

- Sustainable Textiles: The collaboration utilizes sustainable textiles, such as organic cotton, recycled polyester, and eco-friendly dyes. This commitment to sustainable materials enhances the brand’s environmental credentials and resonates with eco-conscious consumers.

- Innovation: By incorporating sustainable textiles into their collaboration, Nike SB and Stüssy demonstrate innovation and leadership in sustainable fashion. This positions them as industry pioneers and sets a precedent for future collaborations within the streetwear market.

- Market Differentiation: The use of sustainable textiles sets the collaboration apart from competitors, attracting environmentally conscious consumers who prioritize sustainability in their purchasing decisions. This market differentiation enhances brand reputation and increases market share.

WEAKNESSES

- Cost: The use of sustainable textiles may increase production costs, potentially leading to higher retail prices for collaboration products. - This could deter price-sensitive consumers and limit accessibility to a broader audience.

Supply Chain Challenges: Sourcing sustainable textiles may present challenges in the supply chain, such as limited availability or higher lead times. This could impact production timelines and potentially disrupt product launches.

OPPOURTUNITY

- Consumer Education: The collaboration presents an opportunity to educate consumers about the importance of sustainable textiles and their impact on the environment. By raising awareness, Nike SB and Stüssy can foster a deeper connection with environmentally conscious consumers and drive demand for sustainable products.

- Market Expansion: The collaboration opens doors to new market segments, particularly among environmentally conscious consumers who may not have previously engaged with either brand. This expands the collaboration’s reach and increases market penetration.

THREATS

- Competitive Pressure: Competitors may seek to replicate the collaboration’s success by introducing their own sustainable initiatives, increasing competitive pressure within the market. Nike SB and Stüssy must continuously innovate and differentiate to maintain their competitive advantage.

- Consumer Skepticism: Some consumers may question the authenticity of the collaboration’s sustainability claims or perceive them as greenwashing. Transparent communication and credible certifications can help mitigate consumer skepticism and build trust.

52 53

54 55 1.

Fig 28: Boakye, P.N. (2022) Up-and-coming Ghanaian streetwear label and Off-White collaborator Free The Youth hosted a pop-up during Paris Fashion Week in October. Paris

Fig 29: Stussy (2021) Images from Stüssy’s second collaboration with Our Legacy.

Fig 29: Stussy pen portait (Authord own, 2024)Dodgson, C. (2022) S/S 2022 Stussy surfboard campaign . California

Fig 28: Boakye, P.N. (2022) Up-and-coming Ghanaian streetwear label and Off-White collaborator Free The Youth hosted a pop-up during Paris Fashion Week in October. Paris

Fig 29: Stussy (2021) Images from Stüssy’s second collaboration with Our Legacy.

Fig 29: Stussy pen portait (Authord own, 2024)Dodgson, C. (2022) S/S 2022 Stussy surfboard campaign . California