WINNING FORMULA

Ourplatformenablesyou tospend80%ofyour timebeingaRainmaker, soyoucandowhatyou dobest…SELL.

THE CEO MINDSET PRODUCTS

The key is to get out of the weeds and focus on $500-an-hour activities that grow your business.

AND PRICING

PRODUCTS & PRICING

Ourgoalis foryoutofund every loan that comesyourway.

PRODUCTS AND PRICING

Wedowhateverittakesto providethebestproducts withcompetitiverates.

AGENCY / GOVERNMENT

AccessexclusiveFannie andFreddieprogramsand guidelinesco-developed justforRate.

Direct seller to Fannie, Freddie, FHA, VA and USDA

• We offer every product and program

• No overlays, manual underwriting available

• Best pricing in the industry with additional investors and retail-only platform

Affordability Products have never been better

FirstHome+1 Nationwide CRA Pricing Program

100% AMI conforming/120% AMI High Bal Markets, additional CRA pricing specials for ≤85% AMI

Special Purpose Credit Programs

DPAs in select markets, no LLPAs means better rates (.25–1 bps)

• BorrowSmart Access2 ($3k DPA) 140% AMI

• HomeReady First3 ($8k DPA), no AMI requirement

OneDown4

$3k–$5.5k assistance nationwide, ≤85% AMI, limited access.

4 National DPA programs

100% LTV, no AMI options, 3–5% DPAs, FHA, USDA and Conforming (one of select few w/conforming)

50 State HFA/Bond Program Coverage

380+ standalone DPAs

NON-AGENCY

#1Non-bankJumbolenderinthecountry.

30+ National/Regional Prime Non-Agency Outlets

Proprietary jumbo product backed by 150+ investors and in-house securitization

Details

• Fixed & ARM, with Interest Only options

• 15 – 30 Year Terms

• $100,000 – $9.5M Loan Amount

• 95% Max LTV

• 50% Max DTI options

• 660 Min FICO

• 1 – 4 Units, PUDs, Warrantable & Non-Warrantable

Condos, Co-ops and Condotels

• Unlimited Cash-Out5 options

• 2 months minimum reserves

• 4-year seasoning for Chapter 7 or 11 BK AND 2 year for Chapter 13

• TX 50a6, TX50a4, CEMA purchase / refinance

• RSU, Clean Energy & Doctor Programs

• Crypto Currency, 3-2-1 Temporary Buydowns

NON-QM PRODUCTS

Growyourbusiness withnon-QM.

• Proprietary Edge Product backed by 15+ investors and in-house securitization

• Program Types: Bank Statements, DSCR, 1 Year Full Doc, 1099, P&L and Asset Depletion

• Fully delegated, specialized non-QM underwriters

• Non-QM Deal Desk to help with complex scenarios

• Best pricing in the industry

• Fixed & ARM, with Interest Only options

• 15-40 Year Terms

• $50k - $3.5M Loan Amount

• 90% Max LTV

• 55% Max DTI

• 660 Min FICO

• Unlimited financed properties, titled to LLCs

• 1-4 Units, PUDs, Warrantable, Non-Warrantable Condos & Condotels

• Unlimited Cash-Out, C/O as reserves

• Min 3 Months Reserves

• 2 Years Derogatory Credit Event Seasoning

• 3% min borrower contribution

• 3-2-1 Buydowns6

• No income/employment programs Non-QM Highlights

Weareaone-stopshopwith uniqueproductofferingsthat willenableyoutoclosemoreloansthanyourcompetitors.

Reverse Mortgages8

Dedicated Reverse Team & Referral Program offering HECM, Purchase HECM, Jumbo up to $4M and Standalone Second

Buydowns6

Listing Agent options, Permanent and Temporary buydown programs for Fannie, Freddie, FHA, VA, USDA, Jumbo and nonQM. 3-2-1, 2-1-0, 1-1-1, 1-0-0, 1.5/.5-0

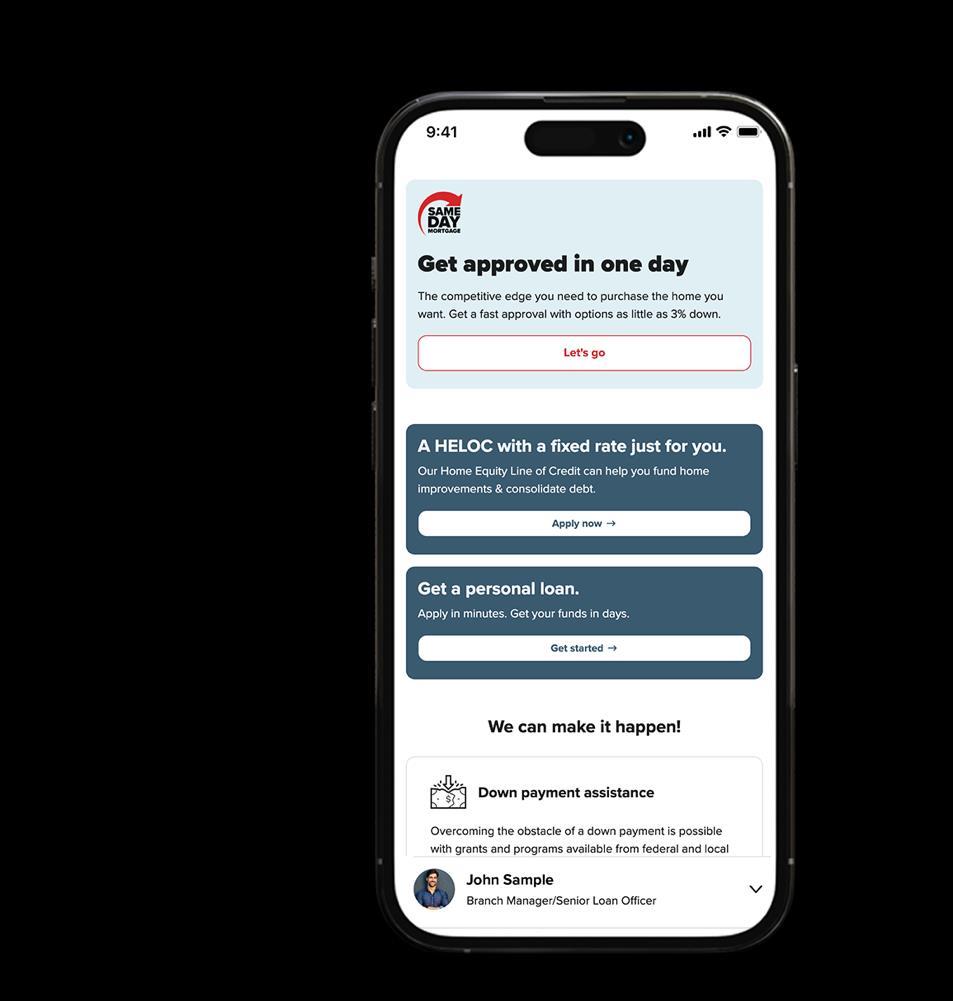

HELOCs9 / Seconds

Digital HELOC, no appraisal, fixed rate, funds in 510 days, 620 FICO, 85% LTV. 10/20 HELOCs, Closed End Seconds25 and NonQM seconds options

Builder, New Construction

Extended rate lock programs - 1 year w/floatdown option. Lock ‘n’Sell11 and Forward Commitments. Dream Bigger,12 non-warrantable condo preflight

Personal Loans13

Earn commissions on loans that take clients 10 minutes. Funds deposited in 1-2 business days. 1–5-year terms

Bridge Financing14

$500k bridge financing, 0% interest, 6-month balloon payment up to 30% of down payment options. 5+ additional $300k-$1M, jumbo to conforming, and IO options

Residential

Commercial Lending

A mortgage for the purchase of investment property with 5 or more units; available in 45 states with multiple loan options up to 5M for borrowers .

You’llhaveflexibility sothatyoucanprice tobeascompetitive asyouwanttobe.

• Expansive investor rate renegotiation

• Weekend locking and overnight rate protection

• Industry-leading buydowns & EPO protection programs

• Preferred Builder Program

• Flexible lock policies with short and extended lock term options

NEW CONSTRUCTION

Landnewbuilders withourprovenplatform andvalueprop.

• Premier Builder Program designed to capture key relationships

• Targeted products (Forward Commitments, Extended locks up to 1-year, Temp Buydowns,6 Lock n’ Sell,11 Dream Bigger12)

• Events to drive traffic to sales centers and model homes

• Specific comp plans for key Premier Builder accounts

• Digital Mortgage kiosks in builder sales centers

• Condo approval services and non-warrantable options

• Specialized builder POD flow

• The opportunity in reverse is huge: $13 trillion in home equity held by homeowners 62+

• Our Concierge Team supports you, from start to finish:

1. Structures the loan

2. Co-presents options to your senior borrowers

3. Processes, underwrites, and funds

• 1-hr training to become a certified Reverse Mortgage VP

For You

• Online process delivers offers in 5 minutes with no appraisal required10

• Soft credit pull; no harm to your customer’s score16

For Customers

• Lower monthly payments for debt consolidation

• Receive Funds Fast: 13 days on average and as fast as 5, vs. 30 – 60 days for a traditional HELOC

• Can be use many ways: Home renovation, education, vacation & investment properties

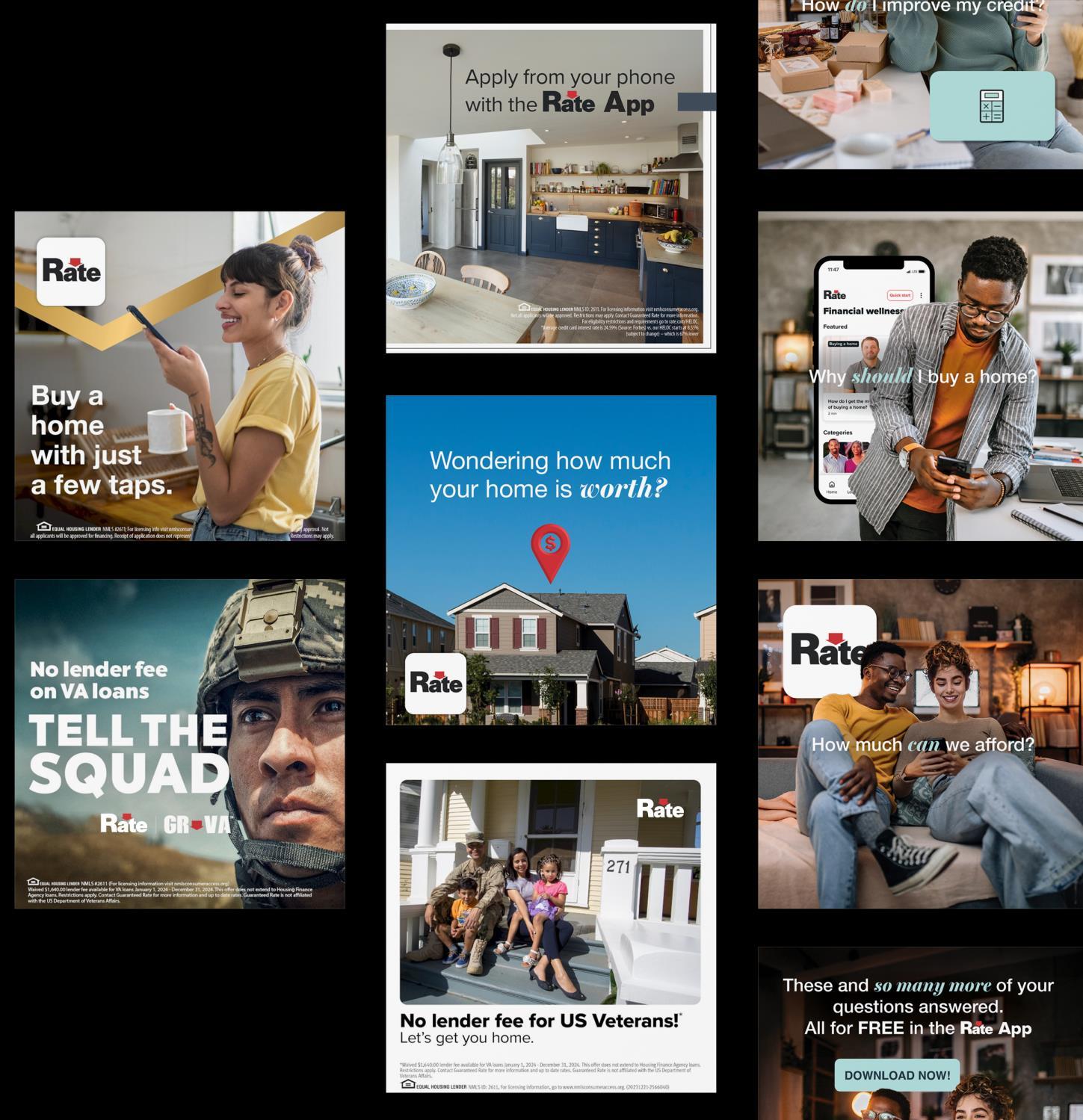

VA LOANS

Growyour VAbusinessand supportveteransinyour market.

• No lender fee at close on VA loans17

• No lender overlays on VA

• Loans up to $2M – $3M. Up to $3,000,000, 550 FICO, IRRRL, C/O 100% LTV, Energy Efficient Mortgage (EEM)

• No down payment or no down payment required

• Relaxed credit policies

• Manual underwriting: our VA underwriters are product experts only underwriting VA

• No one can move as fast as we can

Guaranteed Rate is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the Nevada Department of Veterans Services, the US Department of Agriculture,or any other government agency. No compensation can be received for advising or assistinganother person with a matter relating to veterans’ benefits except asauthorized under Title 38 of the United States Code.

Helpcustomersturnany homeintoadreamhome, allinonemortgage.

• Dedicated renovation team

• Referral program

• Homestyle Renovation, HomeCHOICE, 203k Standard, 203k Limited and VA Renovation

• Fast, online applications in as little as 10 minutes

• Funds deposited to your client’s accounts in 1 – 2 business days

• Repayment options from 1 – 5 years . Earncommissionswith personalloans thattake notimeatall.

RESIDENTIAL COMMERCIAL LENDING

Idealforscalingyour investorclient'sportfolios

• Loan options:

•Fix and flips

•Bridge loan

•Blanket loan

•DSCR (Debt-Service Coverage Ratio)

•New Construction

•Portfolio/Cross-collateralized loan

• Borrow up to $5M

• Purchase, refi and mixed-use

• Close with LLC under title

• Eligible in 45 states

OurAITechPlatformallowsyou tospend 80%of yourtimebeing arainmaker instead of80%of yourtimein the loan file.

OUR AI TECH PLATFORM

Bearainmaker.

Focuson$500/houractivities

Most loan officers spend 80% of their time in the loan file. At Rate, we flip the hourglass so that you spend your time doing what you do best: building your business.

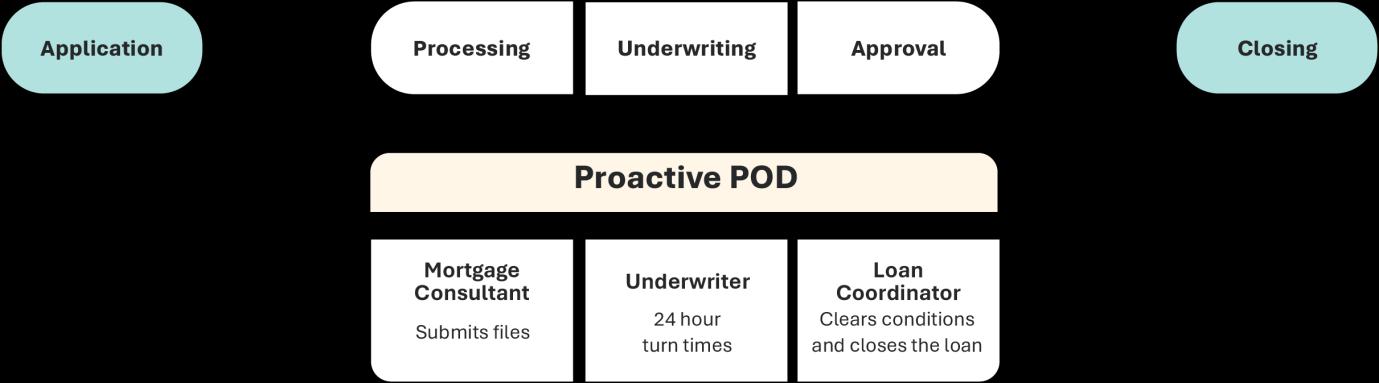

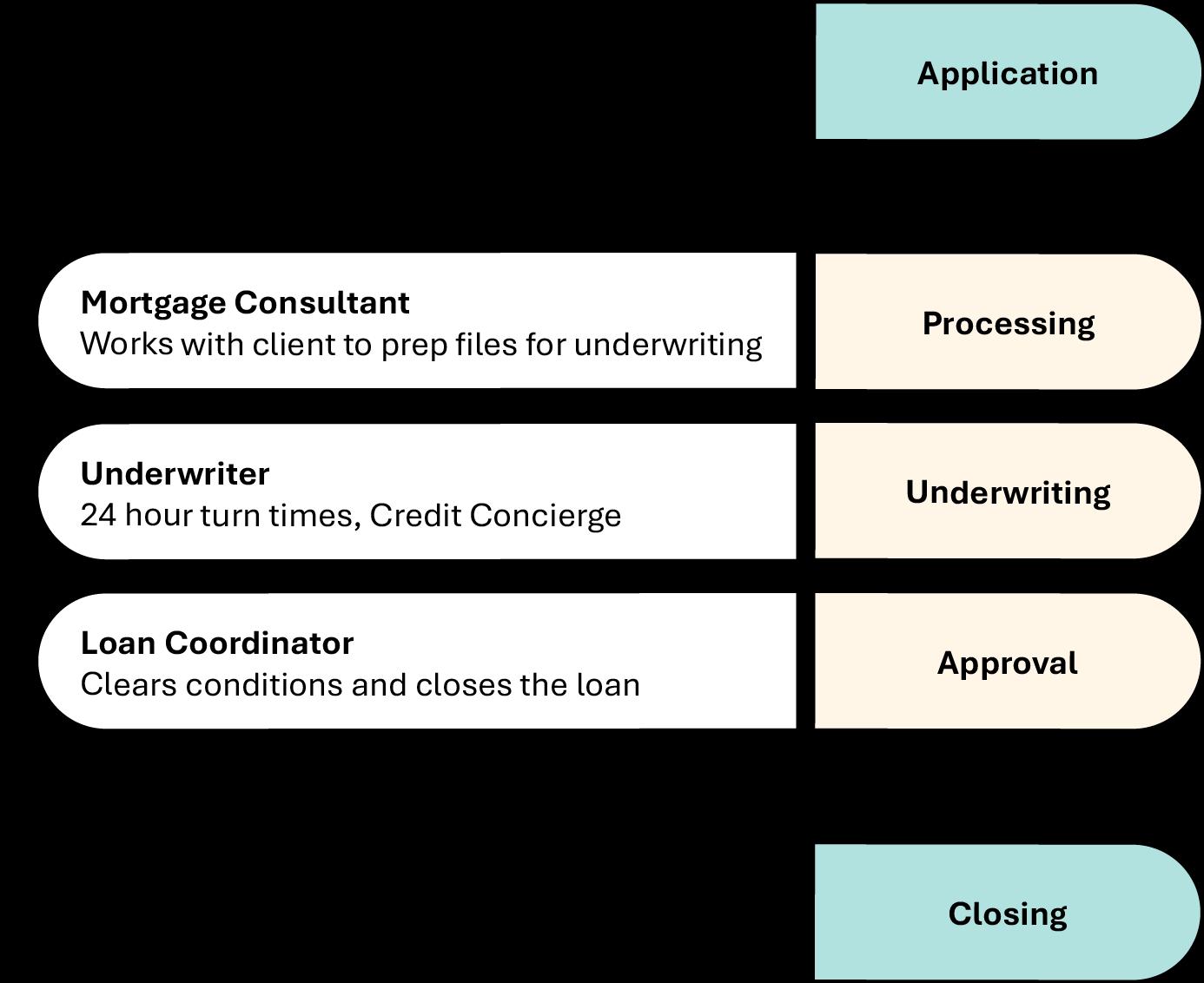

We put the LO in control of two Proactive POD Processing Teams that support you:

Standard Loans

Two processors keep files flying

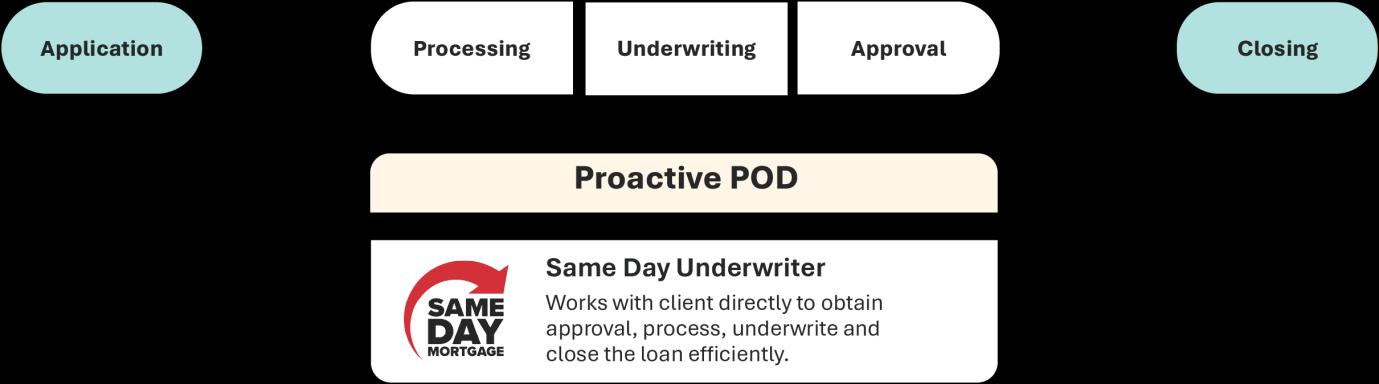

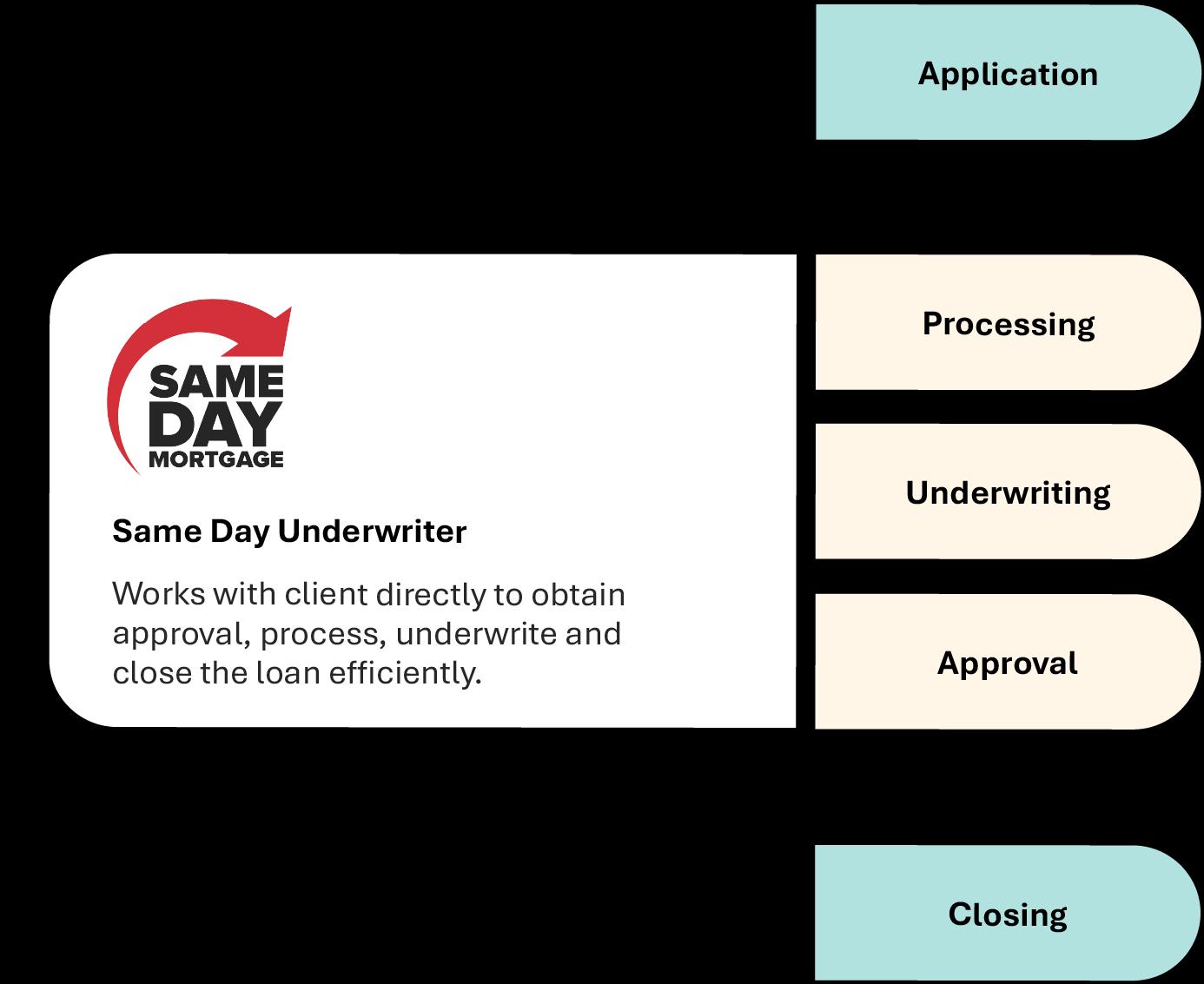

Same Day Mortgage

Lightning-fast path to CTC in as little as 8 hours

VPofMortgage Lending

Delegates & Audits Using GR Technology

STANDARD LOANS

Theeasiest,mostefficient processtocloseloansisour ProactivePODmodel.

Focus on $500/hour rainmaking activities

• The workflow is all about efficiency: it cuts days out of the process and gets you out of the weeds

• Two processors on a file means loans keep moving and removes the peaks and valleys each month

• Your dedicated team is compensated for both quality and speed

• Focus your time on exactly what you should be doing in this market: growing your business

• Expedited path to get a CTC in as little as one day

• A fast CTC increases confidence with your agents and reassures both buyers and sellers

• Great communication: the decision maker is the person communicating with clients

• Unbelievable consumer experience: speed, ease and certainty relieve stress (replace it with speed)

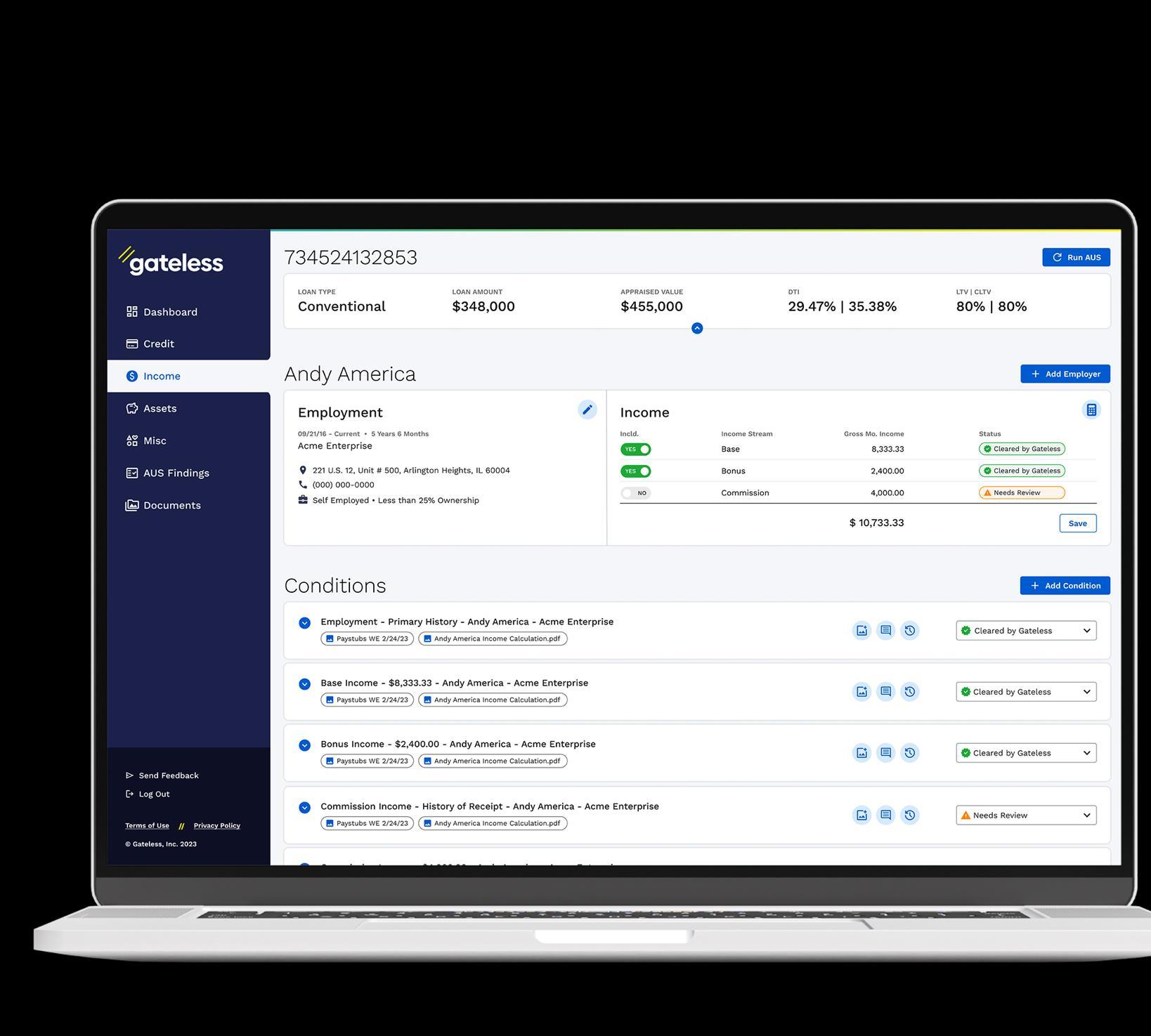

AI-POWERED UNDERWITING

We’vechangedthegame tomakeyourlifeeasier.

• Our AI Technology reads & extracts information from borrower documentation

• Using borrower docs, the tech digitally verifies and extracts data, and calculates income so you don’t have to

• Automatically identifies required loan conditions, analyzes data and clears conditions delivering real-time approvals

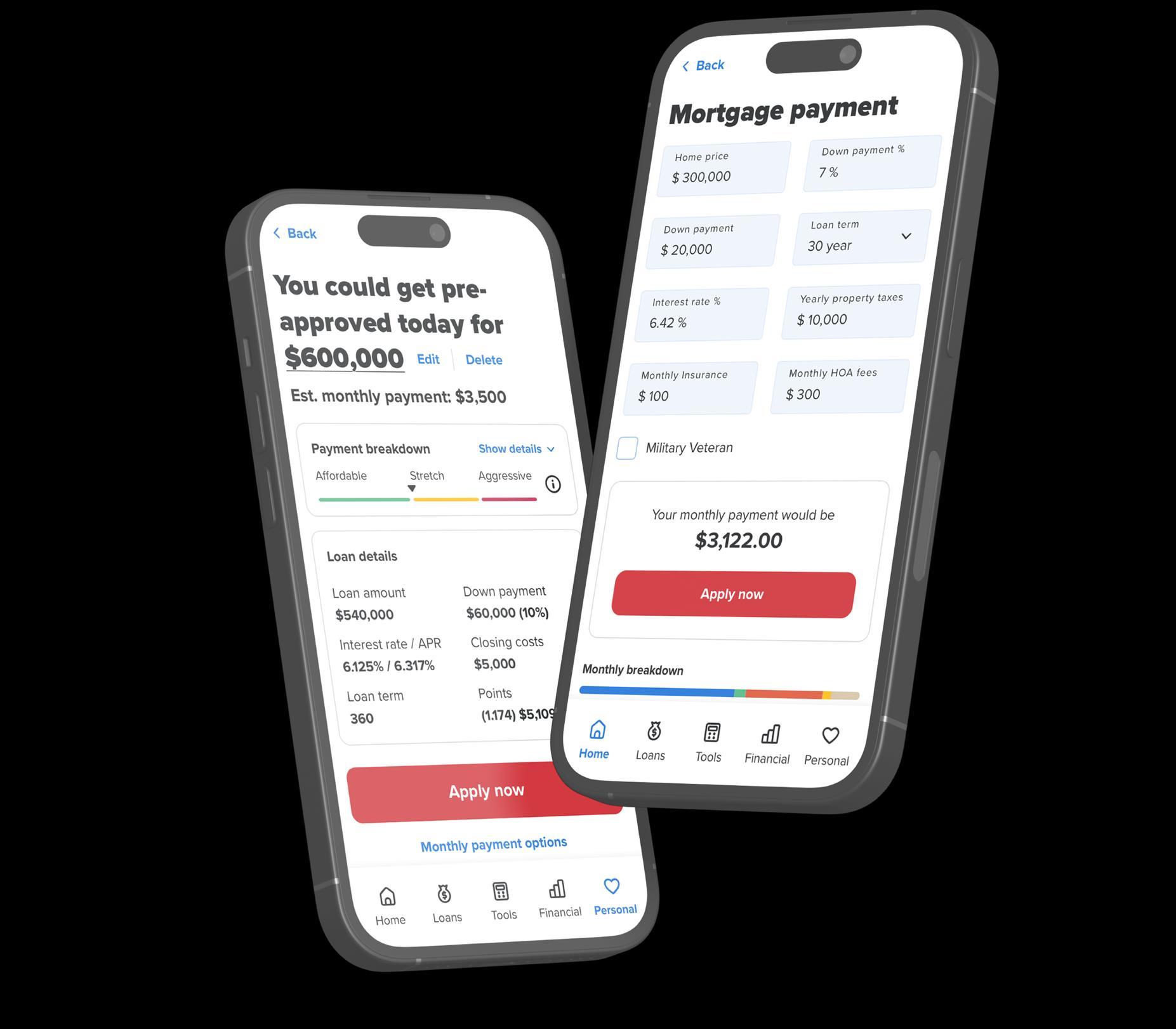

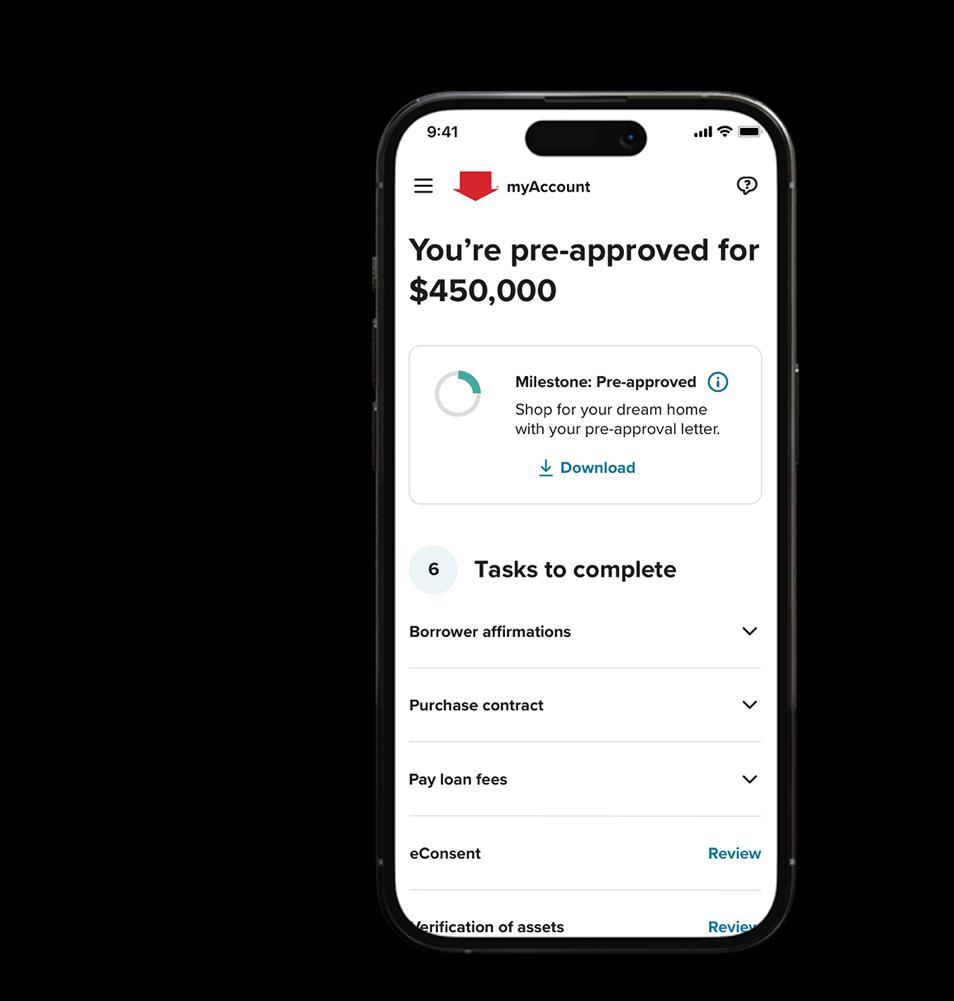

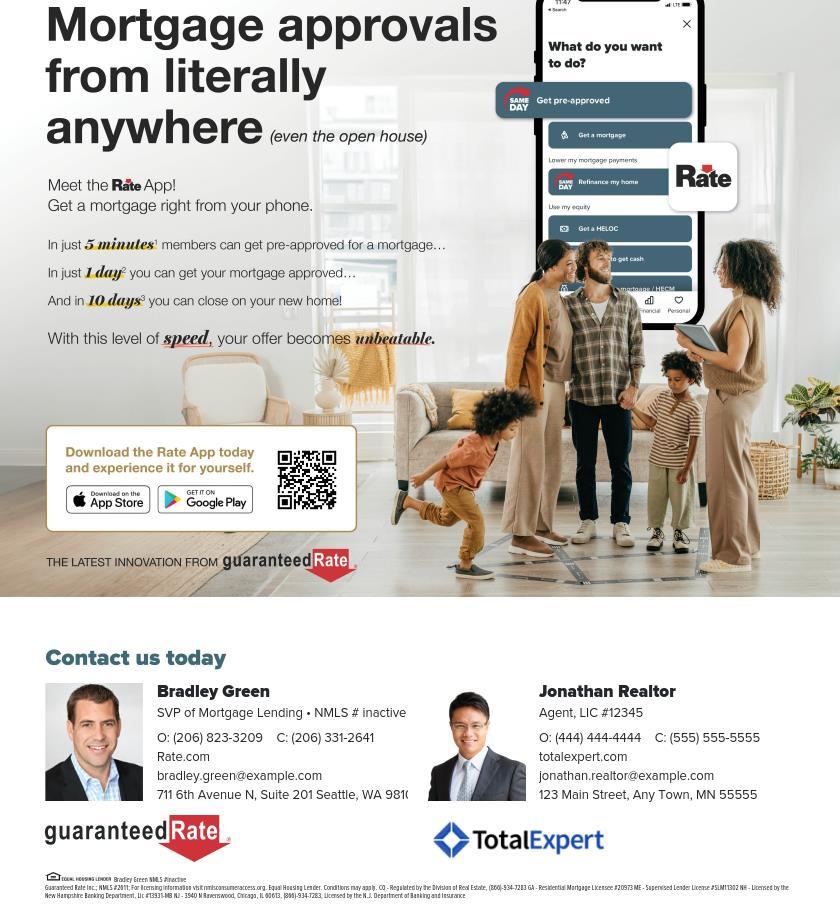

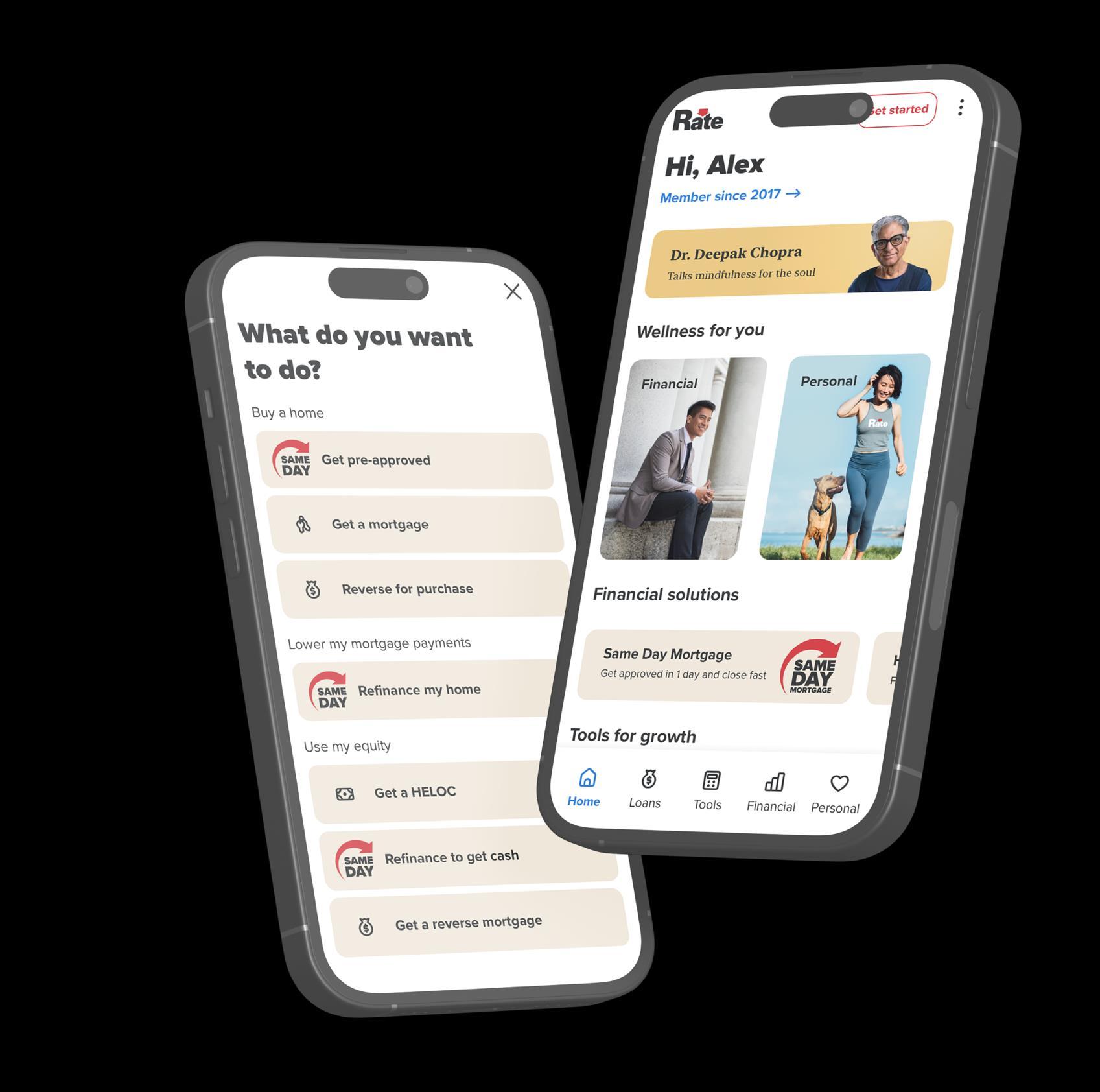

Ourgame-changingRateApp makesyour lifeeasier.

Our Rate App speeds up the entire process

• Approvals 26% faster through the Rate App

• Clear to Close 11% faster through the Rate App Empower your Agents and Customers

View loan details, e-sign documents, check tasks, upload documents and link accounts, pay fees, access closing package and obtain appraisal

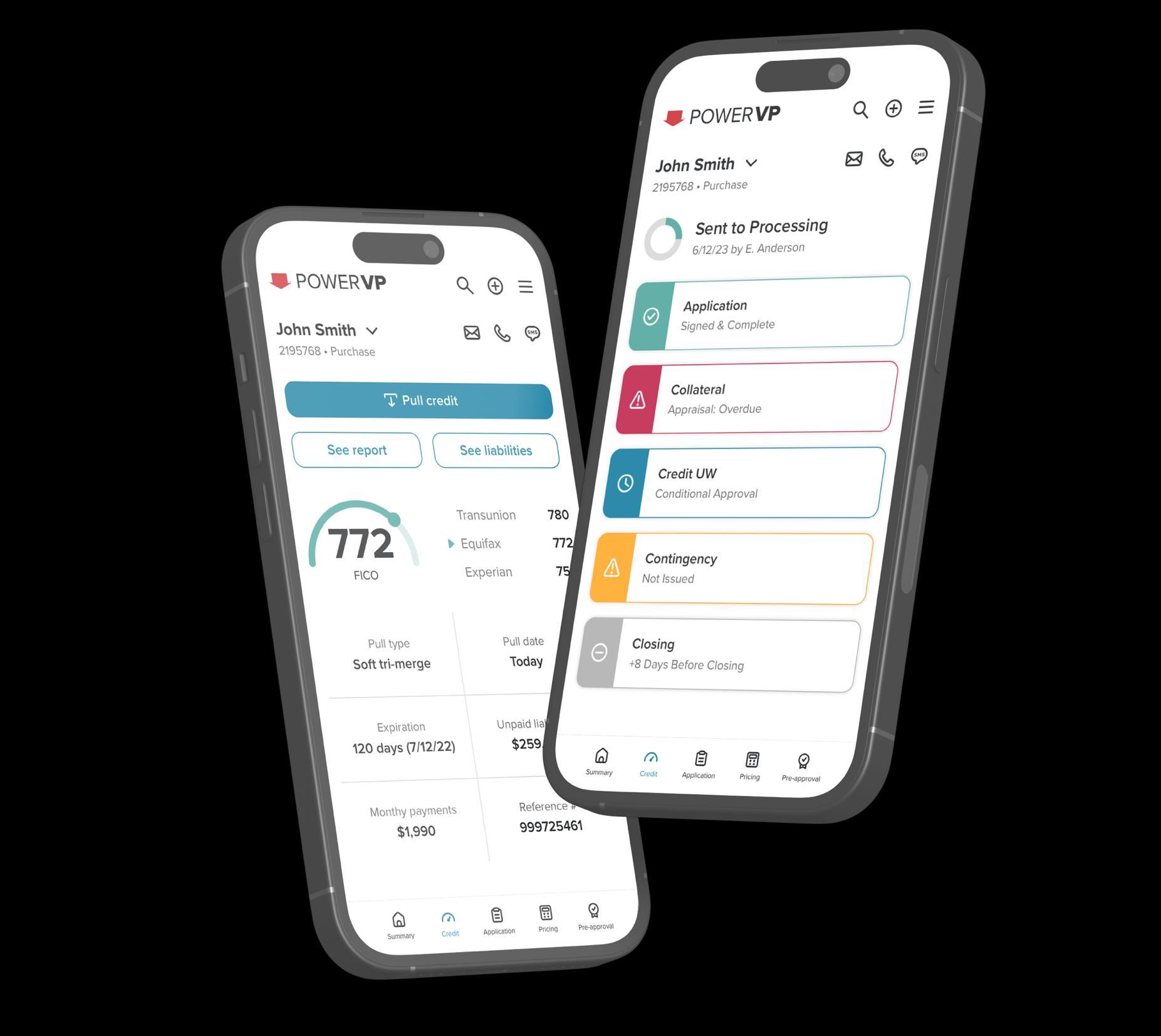

POWER VP

Ditchthe laptopand run yourbusinessfrom anywhere,anytime.

Our native mobile app gets out of Encompass and keeps you rainmaking:

Run Pricing

Run rates, create multiple scenarios, edit fees and lock loans

Issue Pre-Approvals

Edit pre-approval terms, run automated underwriting and customize with conditions

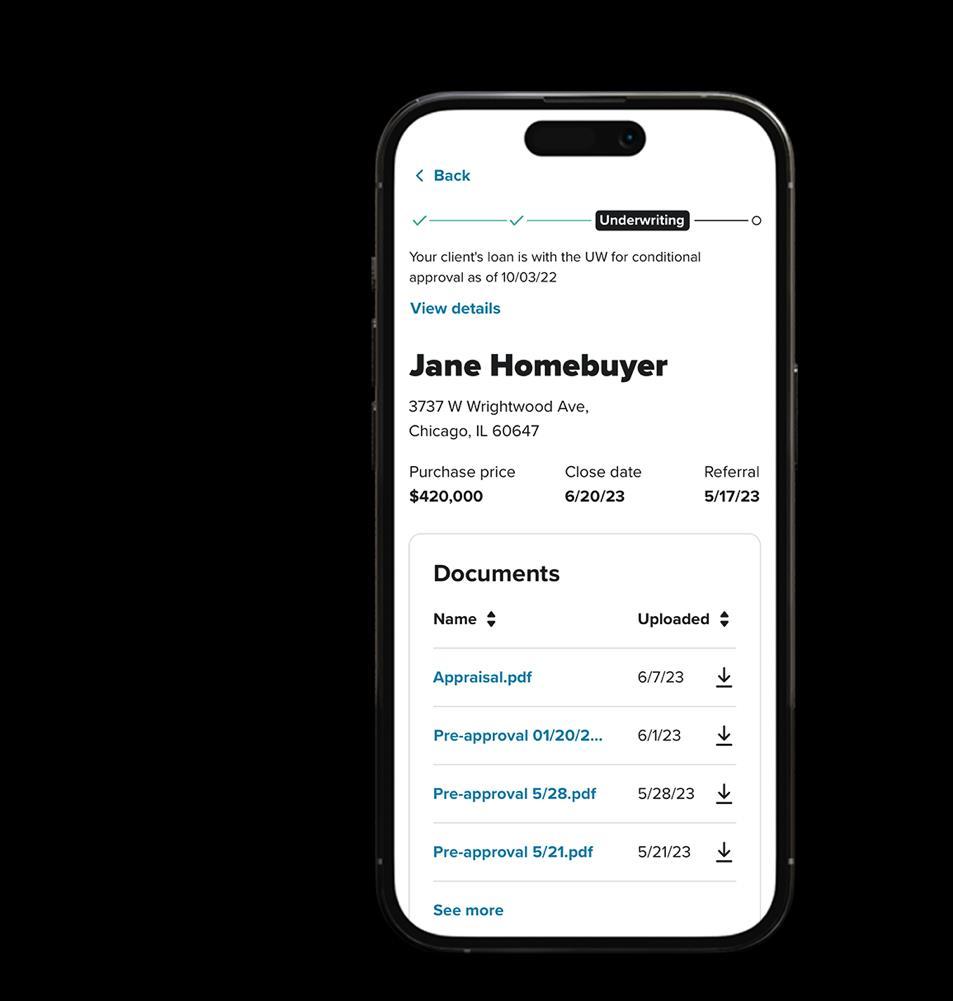

Check Status

Find loan status

Pull Credit

From 3 bureaus

Live Agent Status Updates

Easy access to everyone’s contact information

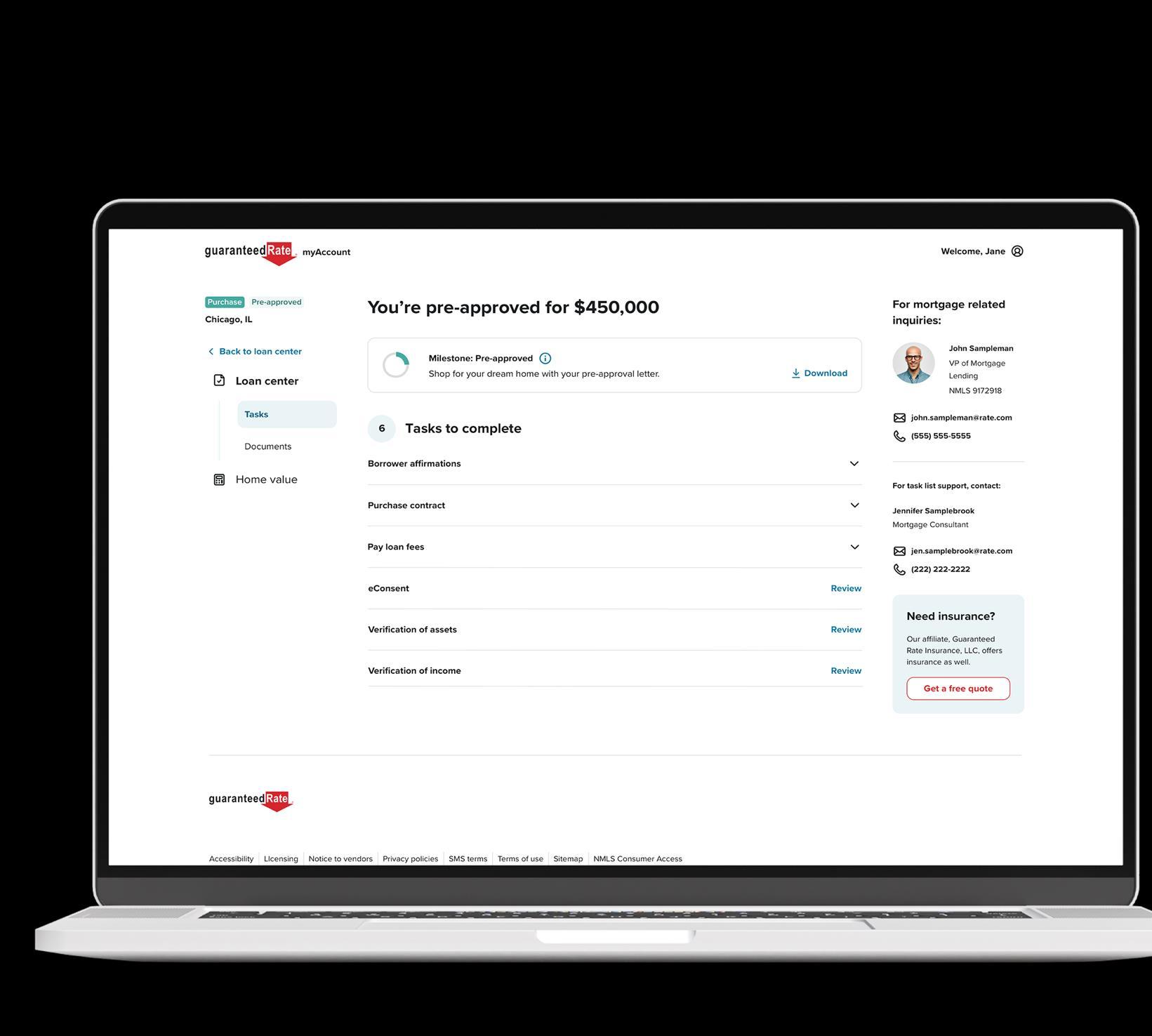

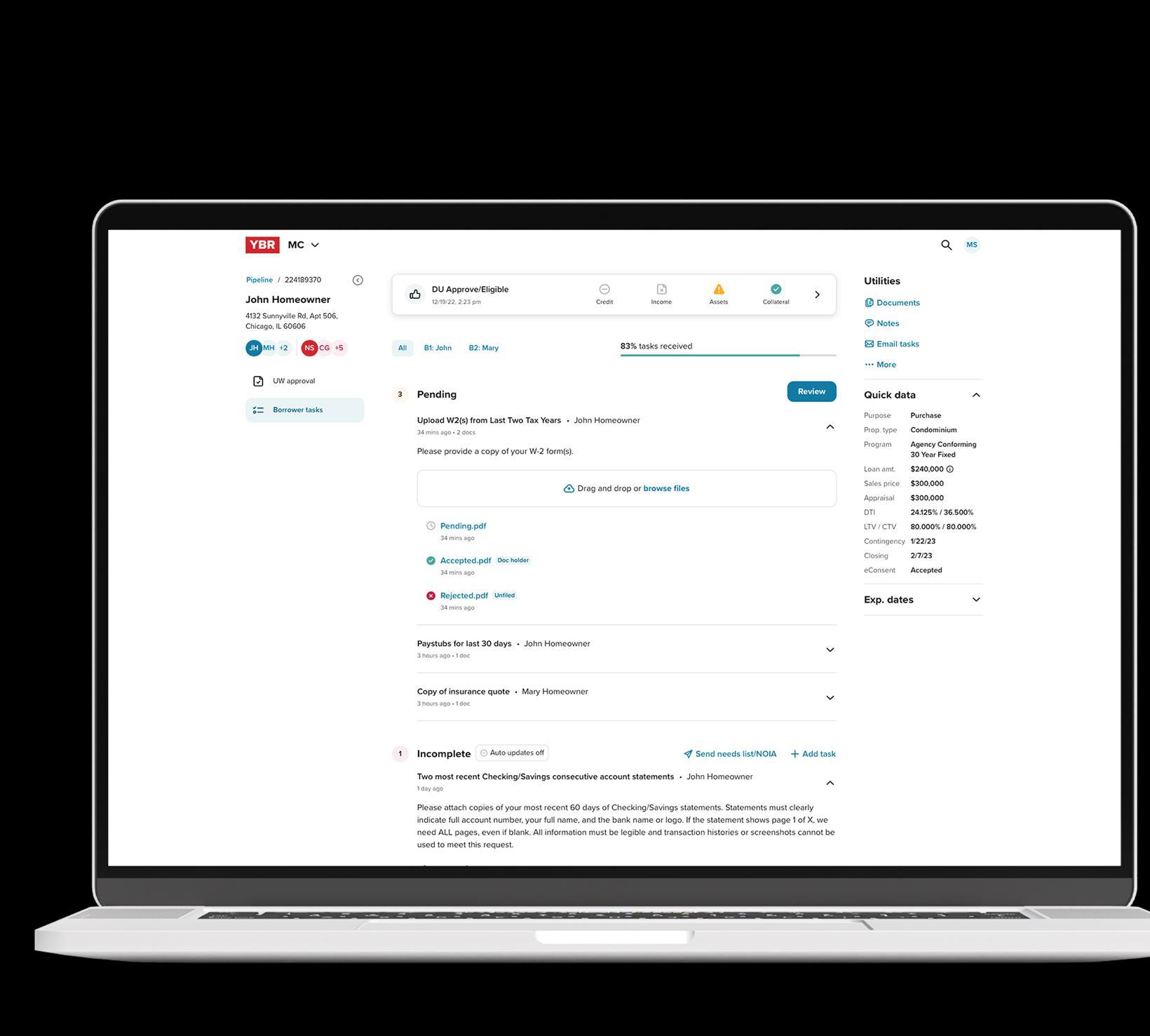

DIGITAL MORTGAGE EXPERIENCE

Ourfullyintegratedtech ecosystemiswaymorethan justanonlineapplication.

Customized task list for each

individual borrower

Digital Mortgage

• Credit pulls from three bureaus

• Runs Fannie and Freddie at point of application

• Integrated with your pricing

My Account authenticated customer portal

• Automation tools: Auto disclosures, income analysis, pay stubs, W-2s and bank statements

• Intelligent new task notifications

• Drag-and-drop uploads and 2-way doc sharing

• Native e-Sign disclosures

• Milestone tracking

Instantly syncs across all your devices

YOUR LOAN COMMAND CENTER

Ourautomatedpipeline managementapplication putsyouinfullcontrol.

• The front-end web-based application reads and writes seamlessly with Encompass—so you don’t have to work in Encompass, always waiting for screens to update

• Color-coded Loan Profiles let you see all the key milestones on one screen with intuitive status boxes

• Role-specific Work Queues organize and prioritize loans for immediate action based on prioritization

• Smart Task Lists including underwriting conditions, allow for full transparency of tasks completed

UNIQUE OPERATIONS DEPARTMENTS

In-housespecialtyteams saveyoutime,answer questions, andtakecare ofyour customers.

Credit Concierge

Provides early visibility on "viable" deals

Closing Table Remedy

Resolves any issues post-CTC prior to closing

Proactive Closing Model

Closers access loans & full pipeline early in process

Specialized Processing Teams

Fully Digital HELOC, Specialized broker, Reverse, Personal

Loan, LAP Processors, dedicated condo underwriting team

FLASHCLOSE

Closeinminutes, nothours.

Our two closing options using e-signed documents are faster, have fewer errors and deliver higher NPS and customer satisfaction scores.

FlashClose Hybrid26

Allows borrowers to review and sign most closing documents in advance, shortening the settlement

eClose26

Skip the closing table completely! Borrowers can complete the closing online, when and where they want

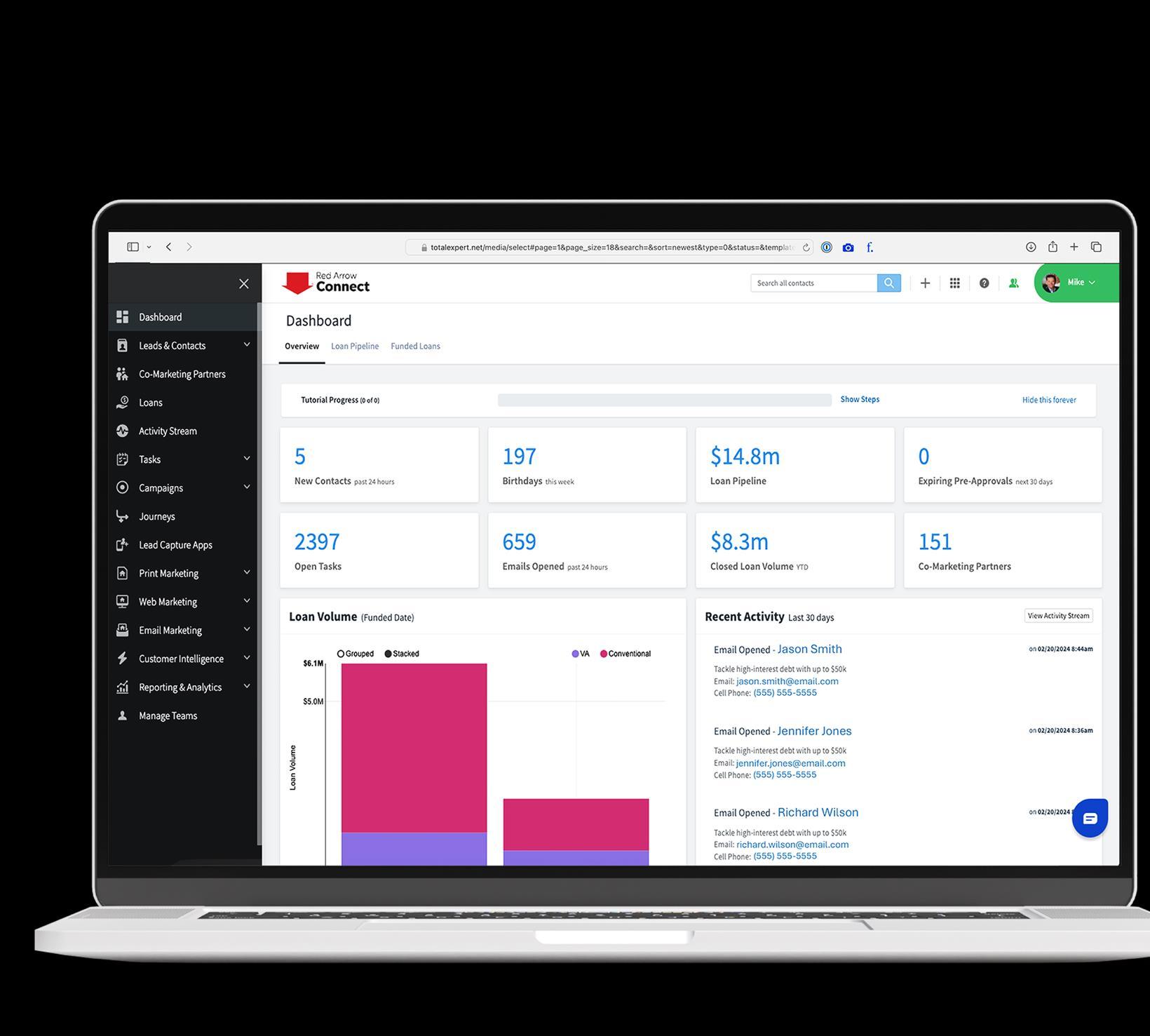

OurMarketingPlanis designed tobuild your personalbrand and doubleyourbusiness.

Ensureyourcustomers andreferralpartners thinkofyoufirst.

Our integrated Customer Relationship Management platform makes it really easy:

• Integrations across entire mortgage platform

• Instant marketing begins after automatic loading of new contacts

• Immediate alerts for MLS, equity, rate and customer life events

• Access to thousands of emails, video, social and direct mail templates

MORE CUSTOMER CONTACT WITH EMAIL

Automaticdripcampaigns arealwaysworkingforyou.

• Automated email marketing to your database multiple times per month

• Auto campaigns target your Prospects, In-Process Customers, Past Clients and Referral Partners

• Easily customizable templates allow you to quickly build your own emails

OPTIMIZE YOUR SOCIAL PRESENCE

Highqualitysocialposts in15secondsorless.

Automated social posts 12 – 15 times per month.

Customize your own posts 3x per week using thousands of pre-made templates:

• Posting flexibility allows you to schedule in advance or post in the moment

• Simple, integrated video creation via BombBomb

• Real-time integration of your social accounts and 5-start reviews

INCREASE YOUR WEBSITE CONVERSION

Capture andre-target visitorstoyourwebsite.

• Highly personalized (bio, rates and messaging) mobile-friendly website

• Capture leads and help your customers

• Instant loan application and lead nurturing

• Website visitor display ad re-targeting 20 times per month

HYPER TARGETED DIGITAL

BRANDING

Beeverywhere allthetime.

• Automated digital campaigns targeting agents within your geography

• Easily run your own customized campaigns to your entire database across Google, Facebook and Instagram

• Leads generated from digital advertising are automatically added to your database

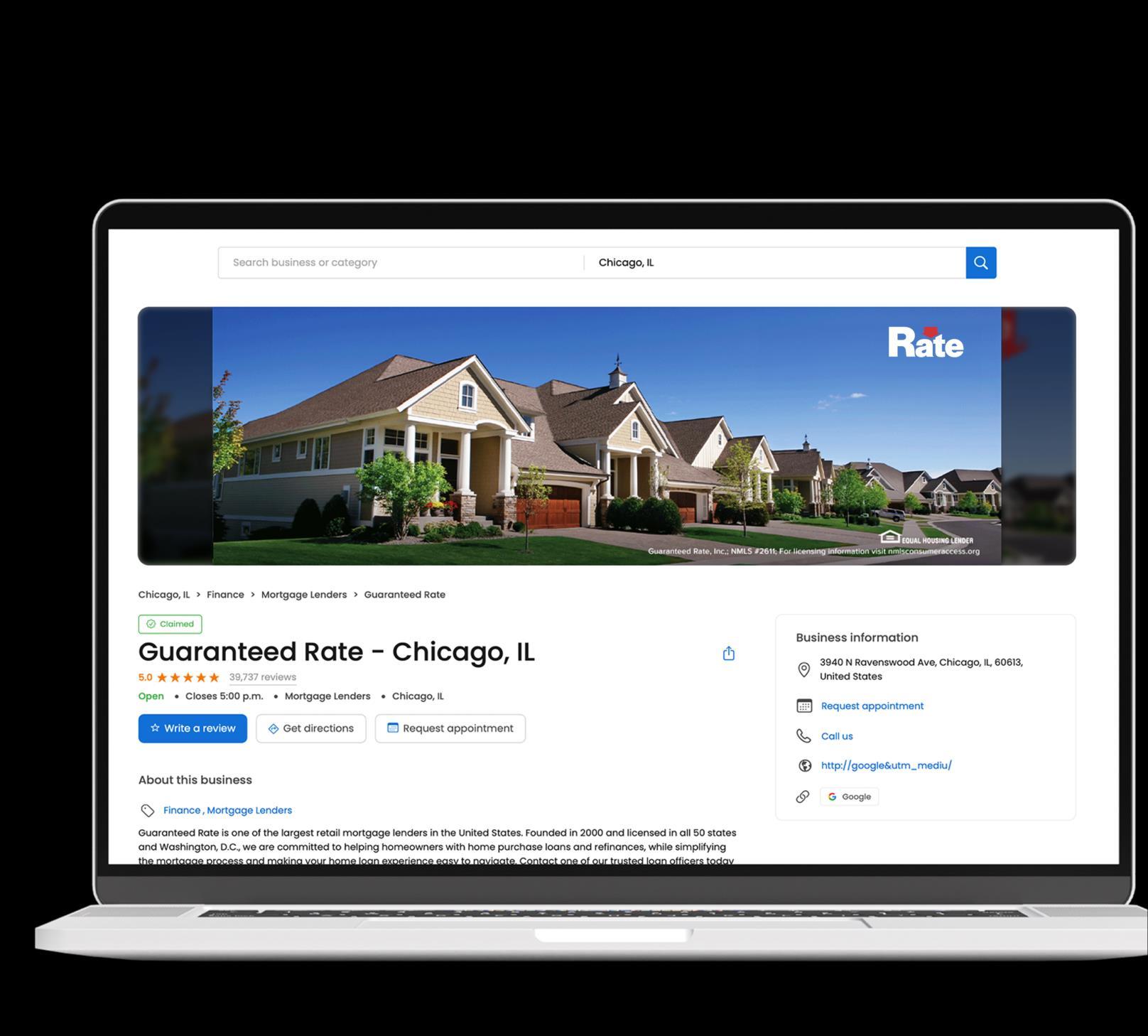

IMPROVE YOUR ONLINE REVIEWS

Showcaseyourexceptional serviceandbecomeeasier tofind

online.

• 98% of customers read online reviews before buying a product or selecting a service provider

• Our reputation management platform makes review management easy across Google, Facebook, Zillow

• Automatically solicit reviews and post responses with the help of AI to write copy

• Respond to customer feedback, automatically, during the loan process and after closing

• Connect your social accounts to automatically share your 5-star reviews to social media

ALWAYS STAY TOP OF MIND

Putyourselfin frontofyour contactsregularlysothey alwaysrememberyo

Consistency is critical — send 24 mailers a year to your contacts:

• 2 postcards or direct mail to customers every month

• 2 postcards or direct mail to referral partners every month

• Launch custom campaigns to your targeted geographic areas

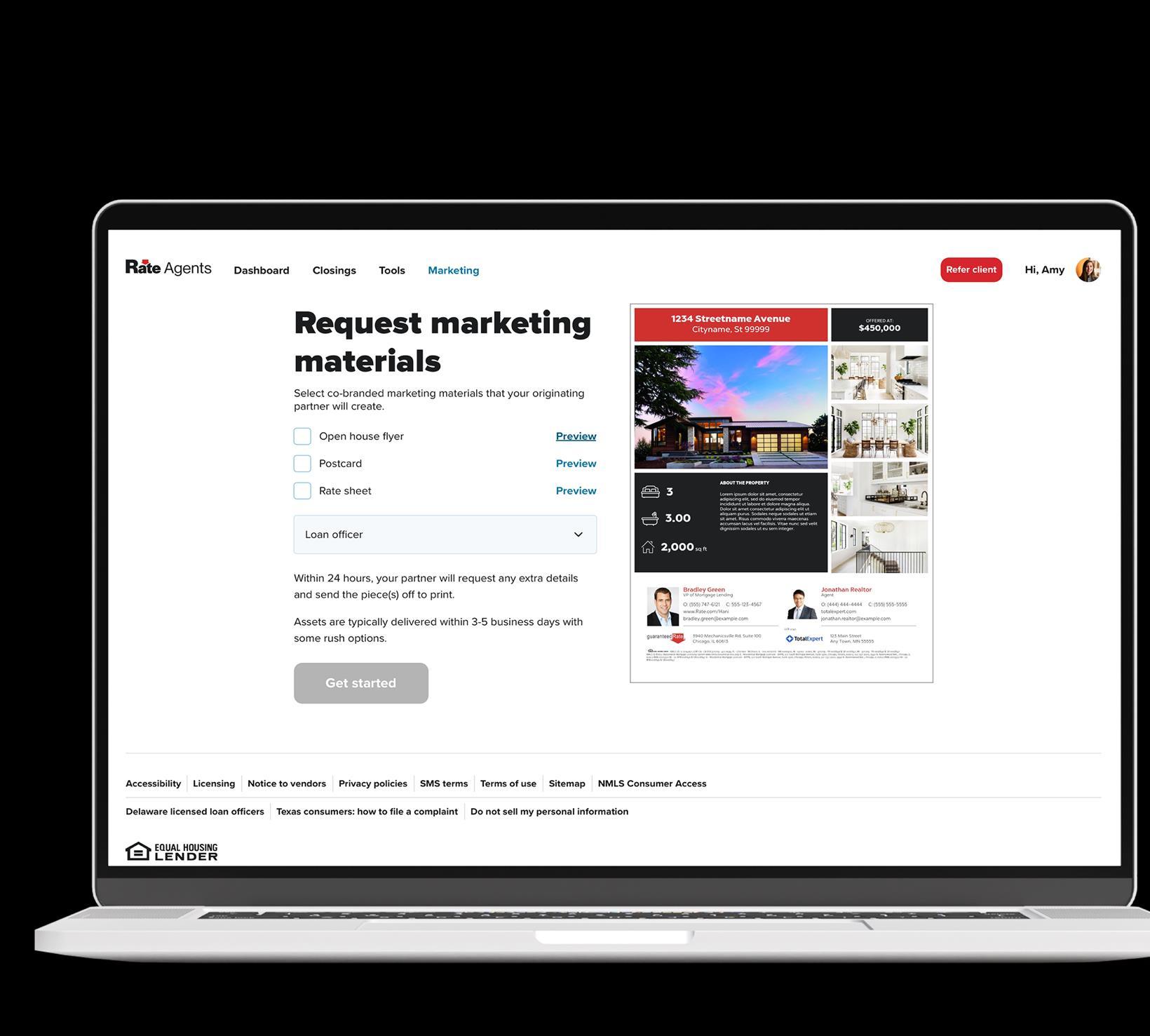

EASY CO-BRANDED MARKETING FINANCINGSOLUTIONS

Don’tjustbringsandwiches toopenhouses, actually helpyouragentssell.

Partner with agents to push their properties:

• Pricing engine (Optimal Blue) integration enables co-branded property statements, in less than a minute

• Automatically generate property flyers with your pricing

• Automatically promote the properties with single property websites just listed/just sold postcards

• Expansive library of print assets with templates for single-branded and co-branded options

$699,000 LISTED

442SQuncyStree HnsdaeIL60521 Wecome o442SQuncy hs u yupdated3bedroom 2 u bahgem

Contactmetodaytolearnmore!

DanGeldum

BanchManager/SVPo Mo gageLendng NMLS#686529 O (773)4

Raecom dan@ate 14WHns

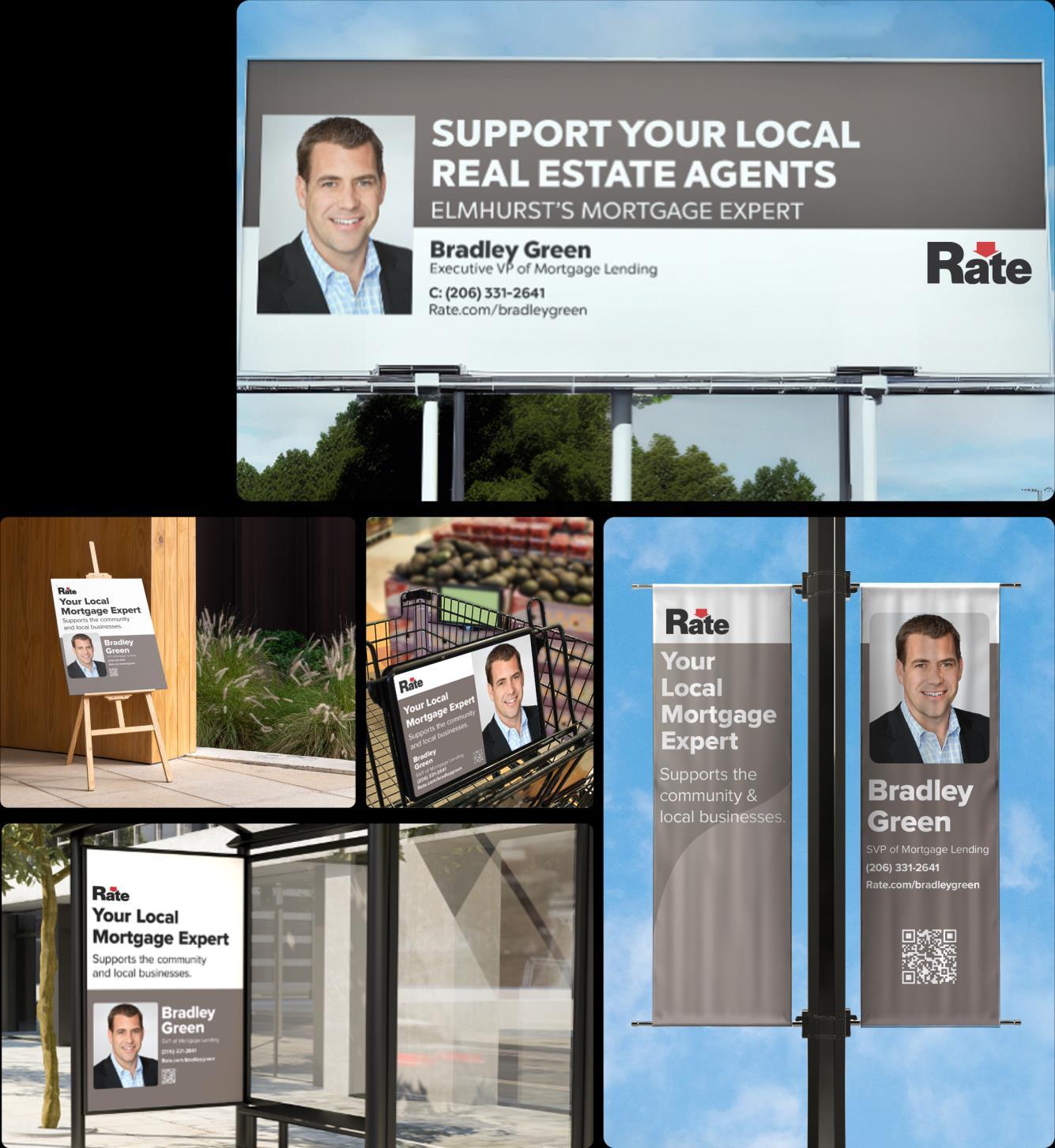

OWN YOUR MARKET

Expandyour presence and riseabove thepack.

Amplify your visibility with proven outdoor media advertising strategies:

• Billboards

• Bus stops

• Shopping carts

• Charging stations

• Truck and car wraps

• Local event sponsorships

• Arena and stadium advertising

BECOME A BEST-IN-CLASS MARKETER

Position yourselfas theexpertinyour market.

We provide off-the-shelf tools and regular coaching on the latest marketing strategies to capture share.

Events-in-a-Box

Ready-made sales presentations on key topics and loan programs

On-demand training videos

Interactive training portal with self-serve videos

Marketing coaching

Weekly training classes and office hours

Discounted pricing on marketing subscriptions

Total Expert, Homebot, Mortgage Coach, MonitorBase, Birdeye, Yelp, AdWerx and MBS Highway

Wecustomize ourunique ReferralPartnerGrowth Planso youcan dominate your market and increaseyourreferral partnersby morethan300%.

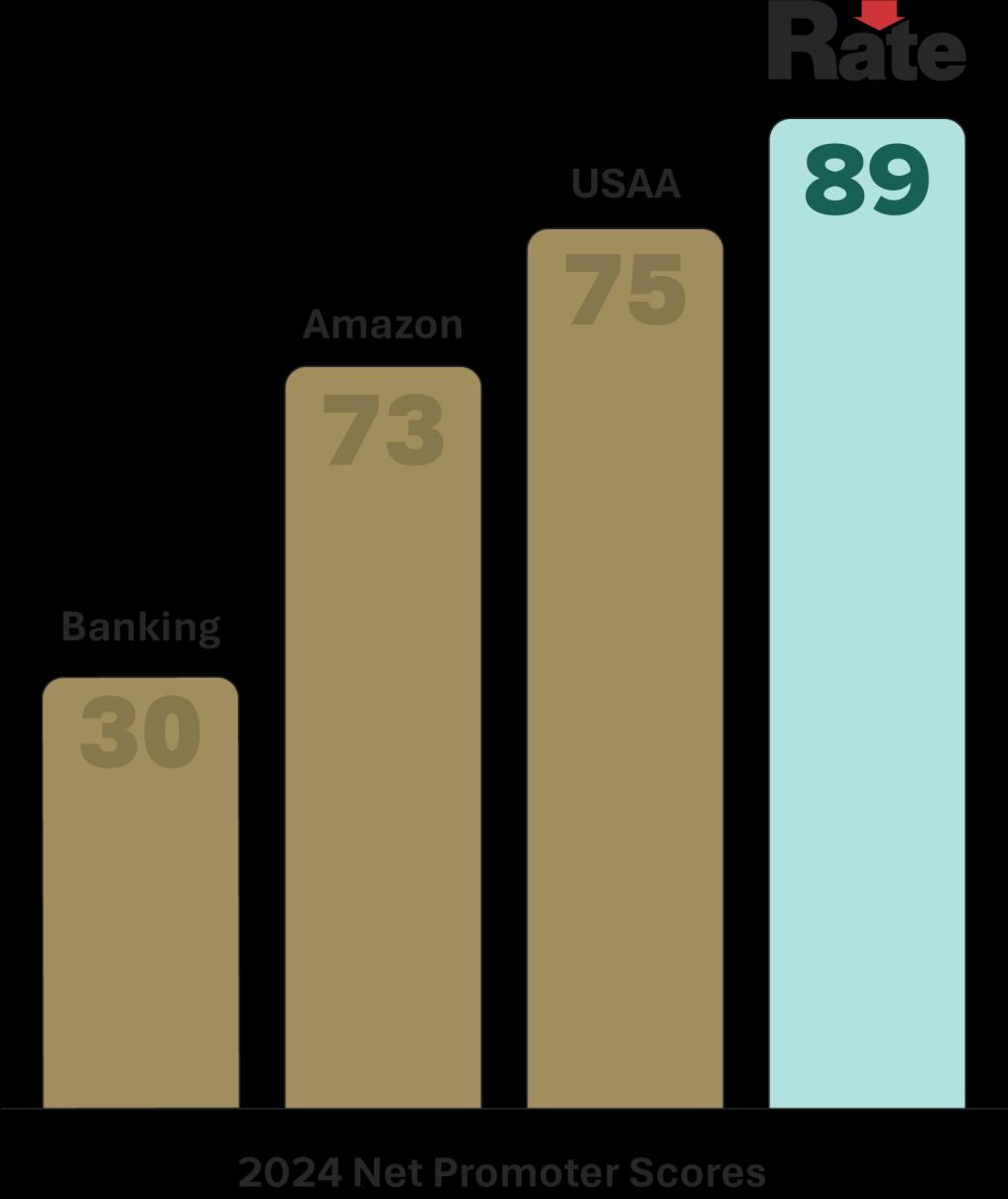

#1MostTrustedLenderinthecountrybyRealEstateAgents

Closest Competitor

91% of respondents ranked GR as trustworthy. Our closest competitor was just 47%.*

Rate is a trusted company with a strong national brand, so you’ll be able to add more referral partners and grow your business.

*According to 2024 Cint Agent Survey

TRUSTED LENDER

DEFINE YOUR MARKET FOCUS

Identifyandtargetthetop20% ofagentsinyourmarket.

• Our proprietary technology enables you to categorize and sort agents by product mix, production and geography.

• Target other referral partners in your market— financial planners, attorneys, CPAs, everyone who does real estate

• Focus on the people who are winning

• Click on a button and the name goes into your CRM and is automatically marketed to

ADD MORE REFERRAL PARTNERS

Meetnewreferral partnerswithoutmaking thecoldcallsyourself.

Our Biz Dev Team calls agents, builders, attorneys, financial planners, CPAs to set up 1:1 meetings for you

We’ll collaborate on your customized plan and get 8 – 12 meetings with new referral partners each month

Leverage our follow-up strategies that are proven to successfully convert new relationships into long-term business partners

BUILD STRONGER RELATIONSHIPS

White-gloveservicefromour EventsTeammakesmeeting with agentseasyandefficient.

Our Events Team handles all the details so that you can meet with referral partners 10 – 20 times every month.

1:1 Meetings

Coffee, lunch, dinner

Small Get-Togethers

Happy hours, lunch-n-learns, open houses & broker opens

Medium Gatherings

We can help you get spears for 100 – 300 referral partners

Large Events & GR Paloozas

Think big: fill a room with 300 – 1000+ potential partners

LEARN PROVEN STRATEGIES

Ourbest-of-thebestphilosophy isgroundedinsharingbest practiceswitheachother.

• Pulse Calls: On Victor Ciardelli’s bi-weekly calls, the executive team shares growth strategies and tools

• Sharing Success: Recurring coaching calls where the top VPs in the country share their best practices

• Success Coaching Solutions: Bi-weekly coaching calls that provide absolute accountability, a performance tracking dashboard and senior leadership insight

• Secondary Training: “In-house calls” with all the details of the new loan programs and pricing

• Marketing Training: On-demand training, live coaching sessions weekly, and an interactive training portal with self-serve video tutorials

BE RELEVANT 24-7-365

OurRateAppoffersongoing engagementwith clients.

• Easily share your personalized link with clients via text, email, or QR code, permanently connecting you together

• Your referral partners can introduce you to their clients with a tap of a button

• On-demand library of financial education videos

• Hundreds of free fitness classes: yoga, meditation and nutrition

• Expanded revenue opportunities when clients apply for HELOCs, Personal Loans, Rate Insurance and more

• Loan Status updates in the app automatically let Agents know the status of loans without calling you or your team

Featured partnership with world-renowned wellness expert.

Wide array of products to suit a customer’s unique financial needs.

180+ financial and 130+ personal wellness videos.

HELP AGENTS WIN MORE DEALS

Buyers

cangetfull underwritingcredit approvalbeforethey startlooking.

• Our PowerBid20 Approvals are reviewed by an LO and Underwriter in less than a day

• Clients can position themselves to compete with cash buyers.

• Your clients can be more competitive with the offer terms and increase the likelihood of the seller accepting

SHORTER PROCESS FASTER CHECK

SameDayMortgage increasesthechancesof gettingoffersaccepted.

Same Day Mortgage21

• 1-day approvals and close in as little as 10 days22

• 72% of Conventional loans are eligible

• NPS score of 9.7 out of 10 Agents can win more deals

Pre-underwritten approvals make for more competitive offers and increase the likelihood of the seller’s acceptance. Which means Agents get paid faster.

RELATIONSHIP MANAGEMENT PLATFORM

Offeragentsacomplete CRMplatformforfree.

Our proprietary agent portal enables agents to:

• Receive loan status updates

• Instantly generate property flyers in seconds with auto-populated MLS info, photo, contact info and pricing

• An expansive library of co-branded flyers, emails, postcards and social content

You can highlight each of your agent’s listings and sales through property flyers, single property websites, and just sold/just listed postcards for all their properties.

HELP AGENTS GET MORE BUSINESS

Agentscancapture moreleads throughouropenhouse app andco-brandedlistingsites.

Lead Capture Automation

Automate Open House follow up with automated lead capture apps, automated lead sharing and our Open House Follow Up email campaign.

Single Property Websites

• Customizable co-branded sites with full MLS and IDX integration are extremely easy to create

• Listings can be published onto Agents’ social media

• Visitor information is captured for auto campaigns

Single Property Websites

Open House Lead Capture App

EXPAND YOUR CUSTOMER

BASE

Growyour business byservingtheSpanishspeakingcommunity.

Co-market, solicit and advertise in Spanish in all 50 states without restrictions. Even if you don’t speak Spanish!

10k+ have used the Spanish Digital Mortgage experience

Guaranteed Rate offers the only 100% end-to-end Spanish language mortgage process.

Digital Mortgage en español

National certified bilingual Processing Team

Loan Disclosures in Spanish

Comprehensive Financial Education in Spanish

“We want LOs to grow and we want the best for our Hispanic community: the best experience, the best technology and the best service.” “

– Camilo Escalante, Executive Director Diverse Segments

Underwriters who understand our Hispanic buyer

Financial Products for the needs of Hispanic members

Marketing Materials to market, solicit & advertise in Spanish

BREADTH OF PRODUCT

Withaccesstovirtuallyall loanprograms, Agents neverhavetosaynoagain.

Lock‘n’Roll23

Allows borrowers to lock in a rate for 60, 75 or 90 days while shopping for a property before signing a purchase contract

Rate Reduce6 A temporary buydown, via a seller’s or builder’s concession

FirstHome+1

100% AMI conforming/120% AMI High Bal Markets

Special Purpose Credit Programs

BorrowSmart Access3 ($3k DPA) 140% AMI HomeReady First24 ($8k DPA), no AMI requirement

PROVEN RESULTS

12straightyearsof themostTopOriginators.

Loan originators are the backbone of our company, and the industry continues to recognize them because at Rate, they grow their business!

The most Scotsman Top Originators for 12 years

OurdedicatedTransitionTeam makes itsimple,smoothand easy —movingloansthrough yourpipelinesothat younever missabeat.

SMOOTH TRANSITION

Werollouttheredcarpet for newVPs.

A dedicated Transition Team keeps your loans moving, while you learn the GR system:

Consultant Vice President (CVP)

Expert Loan Officers in all markets are 100% dedicated to supporting you

Experienced processors

Focus on helping you and your team

Onboarding Concierge

Your point of contact from day one

Licensing Team Support

Facilitates your license transition

“The very first deal I brought to GR, on my first day, resulted in my CVP negotiating the rate with my client, showing me how to navigate it through Encompass, and have it approved for SDM.”

– Sean Kosmann, Producing Area Sales Manager

SUCCESS COACHING SOLUTIONS

Putyour careeron thefast trackwithRate’sSuccess CoachingSolutions.

Our Winning Formula helps you unlock your earnings potential and gives you the tools and strategies you need to succeed.

• Improve your sales techniques

• Master your negotiation strategies

• Build better client relationships

• Get guidance on complex sales solutions

• Become an expert on all loan products

• Step up your strategic decision-making

• Improve goal setting and accountability

What you’ll get:

Streamlined Solutions

A curated program tailored to your experience and ambition, including support for goal setting and relationship building

Biweekly Coaching Sessions

Scheduled training with expert coaches and accountability partners, along with our performance tracking dashboard and invaluable senior leader insights

Increased Productivity

Apply expert feedback and learn to master sales strategies, negotiations, partnerships and strategic decision-making

Business Boosters

Timesaving techniques and solutions to accelerate your business and potentially triple your production

2X GROWTH PLAN

Wehaveaplan todoubleyour businessinoneyear.

We start by making a big splash about YOU in the first 60 days and help you immediately market to your database.

First 60 Days

We tell everyone that you are here, repeatedly marketing to your entire database across all channels, both on and offline

Ongoing Marketing Support

Our proven marketing strategy, unique business development plan and ongoing training opportunities will help you accelerate your momentum and reach your full volume potential

Ongoing Coaching

Sharing Success Calls, Pulse Calls, Secondary Coaching Calls

NOW IS THE TIME

LET’S GET STARTED

1

– At least one borrower must be a first time homebuyer with total qualifying income 100% or lessof the MSA (Metropolitan Statistical Area) where the property is located and 120% or less if the property is located in an area where loan limits exceed standard conforming limits. Must meet income threshold based on the MSA. Amount by which loan cost may be reduced, if at all, is based on a variety of factorsincluding FICO score. Talk to your loan officer to find out if you qualify for the loan cost reduction. Restrictions apply.

2 – Available to borrowersresiding in specific censustracts in the listed MSAs. Borrowers may not own any other real estate at time of closing and will be required to obtain first time homebuyer counseling from a HUD approved agency. At least one borrower must be a first time home buyer.Eligible for purchases of one to four unit homes.Minimum borrower contribution and FICO score requirements apply. Applicant subject to credit and underwriting approval. Additional restrictions apply.

3 – Eligible for homebuyers purchasing a primary, 1-2 unit, owner occupied residence located within one of 10 metropolitan statistical areas. Borrower must obtain either a Freddie Mac Home One mortgage or a standard conventional mortgage. Not eligible for combination with other Freddie Mac assistance programs; however third party down payment assistance options which meet program requirements may be permissible. Borrowersmay utilize funds from other eligible sources and assistance may be used to fund up to 100% of required cash to close. Borrower will need pre purchase counseling from a HUD approved agency. Contact Proper Rate for a complete list of eligible statistical areasand additional information. Applicant subject to credit and underwriting approval. Restrictions apply.

4

– Proper Rate's OneDown loan program is for purchase transactionsof primary residences. Property type restrictions apply. Eligible occupant borrowersincome must be less than 80% of area median income and borrowers must contribute a minimum of 1% down payment from borrower's own funds.Any additional down payment or fundsrequired to close must be from an eligible source. At least one borrower must complete Homebuyer Education when all occupying borrowers are first time homebuyers. Applicant subject to credit and underwritingapproval.Restrictions apply.

5

– Using funds from a Cash-out Refinance to consolidate debt may result in the debt taking longer to pay off as it will be combined with borrower’smortgage principle amount and will be paid off over the full loan term. Contact Proper Rate for more information

6 – Both temporary and permanent RateReduce options are available fromparticipating builders and sellers on select properties. The 1.5/.5temporary buydown option is not available for VA loans.

7

– Proper Rate is an equal opportunity employer that welcomes and encourages all applicants to apply regardless of age, race, sex, religion, color, national origin, disability, veteran status, sexual orientation, gender identity and/or expression, marital or parental status, ancestry, citizenship status, pregnancy or other reason prohibited by law.

8

– This is not a commitment to lend. The borrower must meet all loan obligations, including living in the property asthe principal residence and paying property charges, including property taxes, fees, and hazard insurance. The borrower must maintain the home. If the borrower doesnot meet these loan obligations, then the loan will need to be repaid. Otherwise, the loan must be repaid when the last borrower passesaway or sells the home.Prices, guidelines and minimum requirements are subject to change without notice. Some products may not be available in all states. Subject to review of credit and/or collateral; not all applicants will qualify for financing.It isimportant to make an informed decision when selecting and using a loan product; make sure to compare loan types when makinga financingdecision. This material has not been reviewed, approved or issued by HUD, FHA or any government agency. Proper Rate is not affiliated with or acting on behalf of or at the direction of HUD,FHA or any other government agency. To find a Reverse Mortgage counselor near you,search the HECM Counselor Roster at https://entp.hud.gov/idapp/html/hecm_agency_look.cfm or call (800) 569-4287

Sample rates are national averages provided for illustrative purposesonly and are not advertised rates.The 1.5/.5 temporary buydown option is not available for VA loans. Contact Proper Rate for more information and up to date rates.

9 – The Proper Rate home equity line of credit (HELOC) is an open-end product where the full loan amount (minusthe origination fee) will be 100% drawn at the time of origination.The initial amount funded at origination will be based on a fixed rate; however, this product contains an additional draw feature.As the borrower repays the balance on the line, the borrower may make additional draws during the draw period. If the borrower elects to make an additional draw, the interest rate for that draw will be setas of the date of the draw and will be based on an Index,which is the Prime Rate published in the Wall Street Journal for the calendarmonth precedingthe date of the additional draw,plus a fixed margin.Accordingly, the fixed rate for any additional draw may be higher than the fixed rate for the initial draw.Thisproduct is currently only available in Illinois. The HELOC requires you to pledgeyour home as collateral, and you could lose your home if you fail to repay. Borrowersmust meet minimum lender requirements in order to be eligible for financing. Available for primary,second homesand investment properties only. Dependent on minimum credit score and debt-to-income requirements. Occupancy status, lien position and credit score are all factorsto determine your rate and max available loan amount. Not all applicants will be approved. Applicants subject to credit and underwriting approval. Contact Proper Rate for more information and to discussyour individual circumstances. Restrictions Apply.

10 - Applications may be completed in five minutes but may fluctuate.Five businessday fundingtimeline assumes closingthe loan with our remote online notary.Fundingtimelines may be longer for loans secured by properties located in countiesthat do not permit recording of e-signaturesor that otherwise require an in-person closing. In addition, funding timelines may be longer if we cannot readily verify that your property isin at least average condition with no adverse external factors with a property condition report and may need to order a desktop appraisal to confirm the value of your property

11 – The LockN' Sell builder paid price adjustment varies by lock period, up to 120 days, with a minimum cost of .25% and a maximum cost of .50%. Eligible for 30 year, fixed rate loan options. Borrower must be under contract and have submitted their application to Proper Rate no later than 15 days prior to lock expiration date. If the loan doesnot close during the initial lock period, or if the lock period expires, the borrower may incur additional fees. Restrictions apply.

12 – New build/new construction only. Third-party contractor ispaid 50% of material costsat close and three disbursements after closing. Everything held in escrow for third-party contractor. Project must be completed within 90 days of close, subject to exception depending on scope of project.

13 – Representative example of repayment terms for an unsecured personal loan: For $20,000 borrowed over 36 monthsat 10.74% (including 0.25% autopay discount), the monthly payment is $654.68 with a total loan cost of $23,568.47. This example is an estimate only and assumesall payments are made on time. Savingsare not guaranteed and depend on various factors including, but not limited to, interest rate and term length.Loan proceeds cannot be used for post-secondary education expenses or to purchase cryptocurrency or securities.

Termsand Conditions: You must be 18 yearsof age or older (19 years of age or older in Alabama). To qualify, a borrower mustbe a US citizen, a permanent resident, or a non-permanent resident in the US on a valid, long-term visa. All loan applicationsare subject to credit review and approval as well as income and employment verification. You must meet our minimum requirements established for this offer including, but not limited to, credit history, debt-to-income ratio, and application information.Your actual rate depends on your requested loan amount,loan term, creditworthiness, and a variety of other factors. Repayment optionsrange from 1 - 5 years. Loan amountsrange from $4,000 - $50,000. Standard fixed ratesfrom 10.99% to 21.99% APR. With a 0.25% autopay discount established at loan origination with an automated monthly debit from a qualifying deposit account for repayment, fixed rates range from 10.74% to 21.74% APR. Ratesand loan amountsmay differ due to state-specific requirementsand may impact your ability to qualify for a loan.Limitations: FL, ME, NC, TX,VT, PA, CT, LA,KS, SC,WY, RI, MA, MN, CO, AR and IA(rate); IL, MA, CA, RI, NM and SC (amount); OH (duration). The lowest rate advertised isreserved for the most creditworthy borrowers. Advertised rates and termsare current as of 10/26/2024 and are subject to change without notice.

Personal loans are only available in AL,AR, AZ,CA, CO, CT, DC, DE, FL, GA,IL, IN, IA, KS, LA,ME,MA, MI, MD, MN, MO, ND,NC, NH, NJ, NM,OH, OK, PA, RI,SC, TN, TX, UT, VT, WA, and WY as of 10/26/2024. Loan applications outside of these states will not be accepted at this time.

16

– The soft credit pull pre-approval option is available on conventional, government, and jumbo loans for purchase or refinance. No co-mortgagors are permitted at this time. This pre approval is an early assessment of borrowers’ qualifying information. A hard credit pull is required prior to a loan being submitted to underwriting and will impact borrower's credit score. Borrowers already under contract will default to a hard credit pull when they apply for loan approval. Applicants are subject to credit and underwriting approval. Not all borrowers will be approved. Restrictions apply.

17 – Waived $1,640.00lender fee available for VA loans that have a triggered RESPA app date as of January 1, 2024 through December 31, 2024 at 11:59pm EST. This offer does not extend to Housing Finance Agency loans. ‘Triggered RESPA’ in accordance with Regulation X, is defined as lender receiptof all six pieces of information received in a secure format; applicant name, property address, home value, loan amount, income and SSN. Not all borrowers will be approved. Borrower’s interestrate will depend upon the specific characteristics of borrower’s loan transaction, credit profile and other criteria. Offer not available from any d/b/a or operations that do not operate under the Guaranteed Rate

18 – Credit score and down payment requirements higher for 2-4 unit, investmentproperties and renovation products.

19 – Noteligible for all loan types, HFA loans, or investors. Eligible for conforming and jumbo loans as well as primary, 2nd home and investment properties. Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Contact Proper Rate for currentrates and for more information

20 – PowerBid Approval (the “Approval”) is contingent upon receipt of executed sales contract, an acceptable appraisal supporting value, valid hazard insurance policy, and a re-review of your financial condition. Proper Rate. reserves the right to revoke this Approvalatany time if there is a change in your financial condition or credit history which would impair your ability to repay this obligation and/or if any information contained your application is untrue, incomplete or inaccurate. Receipt of an application does notrepresent an approval for financing or interest rate guarantee. Not all applicants will be approved for financing. Restrictions may apply, contactProper Rate for currentrates and for more information.

21 – Proper Rate’s Same Day Mortgage promotion offers qualified customers who provide certain required financial information/documentation to Proper Rate within 24 hours of locking a rate on a mortgage loan the opportunity to receive a loan approval within 1 business day of timely submission of documentation and does not suggest that the borrower will receive funding on the same day as their application submission. For purposes of this offer, documents provided after 1pm local time or on a weekend or company holiday will be deemed submitted the next business day.Proper Rate cannot guarantee that a loan will be approved or that a closing willoccur within a specific timeframe. Proper Rate reserves the rightto revoke this approval at any time if there is a change in your financial condition or credit history which would impair your ability to repay this obligation. Read and understand your Loan Commitment before waiving any mortgage contingencies. Borrower documentation and Intent to Proceed must be signed within 24 business hours of receipt. Noteligible for all loan types or residence types. Minimum down payment requirements apply. Self-employed borrowers are not eligible. Not allborrowers will be approved. Borrower's interest rate will depend upon the specific characteristics of borrower's loan transaction, credit profile and other criteria. Not available in all states. Restrictions apply. Visit rate.com/same-day-mortgage for terms and conditions.

22 – Eligible borrowers must qualify for a "Clear to Close Loan Commitment" ("CTC”). Proper Rate cannot guarantee that a loan willbe approved or that a closing will occur within a specific timeframe. CTC is subject to certain underwriting conditions, including clear title and no loss of appraisal waiver, amongst others. Noteligible for all loan types or residence types. Minimum down payment requirements apply. Property must be eligible for an Appraisal Waiver and borrower mustopt in to AccountChekfor automated income and asset verification. Self-employed borrowers and Co-borrowers are not eligible. Not all borrowers will be approved. Restrictions apply.

23 – The Lock 'n' Roll program is eligible for conventional and government, fixed rate loans. Loan term requirements vary and apply based on loan type. Lock period must be a minimum of 60 days. Lock 'n' Roll locks cannot be extended, relocked, or renegotiated until after lender receives a fully executed sales contract and are only eligible for up to 30days of extension. If the purchase contract is terminated, Lock 'n' Roll locks cannot be transferred. Applicantsubject to credit and underwriting approval. Not all applicants willbe approved for financing. Restrictions apply

24 – The HomeReady Mortgage is available to borrowers with 80% or less of area median income for purchase or limited cash-out refinance transactions on one to four unit properties. Additional property restrictions and minimum borrower contribution requirements apply and vary based on number of units of subject property. Occupant borrowers may own one other financed residential property in addition to subject property atthe time of closing. Minimum FICO score requirements apply. Up to six months of reserves may be required based on the factors of borrowers' eligibility including but not limited to credit score, debt to income, and loan type. If all co-borrowers are first time homebuyers or when using non-traditional creditto qualify then at least one borrower will be subject to additional requirements regarding homeownership education or counseling from an approved source. Applicants subject to credit and underwriting approval. Not all borrowers will be approved. Restrictions apply. Contact your loan officer for more information and to determine your eligibility.

Proper Rate is an equal opportunity employer that welcomes and encourages all applicants to apply regardless of age, race, sex, religion, color, national origin, disability, veteran status, sexual orientation, gender identity and/or expression, maritalor parental status, ancestry, citizenship status, pregnancy or other reason prohibited by law.

25 - Available as closed end, fixed rate, second lien. Eligibility for second home and investment properties allows for only 10 total financed properties. The total of firstand second liens cannot exceed $3M. No more than two mortgage liens are permitted on a single property. Financing subordinate to the new second lien is not permitted. First lien mortgages must be fully amortizing, fixed rate or adjustable rate mortgage loans only. Minimum down payment and FICO score requirements apply and impact total loan amount available from $50,000to $500,000. Maximum debt to income cannot exceed 50%. Additional restrictions apply. Not all applicants will be approved. Applicant subject to credit and underwriting approval. Not a commitment to lend. Contact Proper Rate for more information.

26 - Noteligible for all loan types, or investors. Conventional loans only. Eligible for primary, 2nd home and investment properties. Title company restrictions may apply, not eligible for HFA programs. Knowledge-Base Authentication (KBA) required in order to enter the digital signing session. Applicant subject to credit and underwriting approval. FulleClose is not currently eligible in California, Connecticut, Delaware, Georgia, Maine, Massachusetts, Mississippi, New York, NorthCarolina, Rhode Island, South Carolina, Vermont, and West Virginia.

THE BEST OF THE BEST

PROFILES IN GROWTH

ShantBanosian

President Waltham, MA

Joined Guaranteed Rate in February 2012

NMLS# 7206

$1,000,162,647 IN 2024 PRODUCTION

$54 million

VOLUME PRIOR TO JOINING GUARANTEED RATE

BenCohen

Senior Vice President

Chicago, IL

Joined Guaranteed Rate in July 2010

NMLS# 217528

$554 million IN 2024 PRODUCTION

$40 million

VOLUME PRIOR TO JOINING GUARANTEED RATE

AZ

$30 million IN 2024 PRODUCTION

$15 million IN 2020 PRODUCTION

SamWarda

JenniferBeeston

$265 million IN 2024 PRODUCTION

$70

Todd Pianin

Branch Manager / SVP of Mortgage Lending Encinitas, CA

$43 million IN 2024 PRODUCTION

$28 million IN 2019 PRODUCTION

Julee Felsman

$121 million IN 2019 PRODUCTION SVP

in May 2017

$157 million IN 2024 PRODUCTION

JacquelineFrank

EricPetransky

LloydDaw

SebastianBolivar

$7 million IN 2023 at previous employer VP

$20 million IN 2024 PRODUCTION

Parsippany, NJ NMLS# 1588602

$15 million IN 2023 at previous employer VP of Mortgage Lending

$24 million IN 2024 PRODUCTION

JessSilva

BIO PAGES

DIVISIONAL MANAGERS

EAST

Jeff Nelson

"Rate has a winning culture and an atmosphere of success! Mortgage professionals who join us will see their business grow significantly, year over year," Jeff says. "One thing I absolutely love is the platform at Rate. No one else offers what we do for originators from A to Z. Our producers can double or even triple their business and still enjoy a life outside of work, and our technology is above all others. If a company wants to thrive and survive in the future, they should be investing in technology today. While many companies are not investing in the future, we are. I love seeing how much more advanced our tech stack is compared to all other competitors.”

In all his years leading mortgage professionals in the east and the west, Jeff has hired teams of successful originators and opened hundreds of offices across the country. The originators are the best in the mortgage industry, leading year in and year out.

"We have been able to hire great people here at Rate over the years. I am so proud of the success of so many wonderful people who work here, even in this tough lending environment. They continue to thrive and lead, no matter the conditions. They go to battle each day and win. I love that we can help these wonderful mortgage professionals lead by equipping them with the best tools in the business. Whether in tenured offices or new locations, they are all showing success, no matter what the market throws at them. They always take advantage of their hard-fought efforts to gain more market share. I believe that all the great people at Rate will continue to live and work their best lives and continue to thrive."

Based out of the Charlotte metro area, Jeff continues to build in the East and analyze the right strategy for each market regularly traveling throughout the country to manage Rate’s partnerships and relationships.

As he helps the company expand its presence, Jeff says he relates to the Core Value "Grow for Good," and building culture around great people. "We have more than tripled our sales during my time at Rate," Jeff says. "If you increase market share the right way and build around the right people, you win with your customers, clients, and communities. In addition, we truly believe in growing within. We refer to it as ‘GR Grown.’ We are very proud of the individuals who have joined us to grow their businesses for good," Jeff says.

"I love that GR is a home for the best originators in the business. This home was built by originators," he continues. "Leaders across the company—from VPs to the CEO—have origination experience, making Rate unique from other mortgage companies. We get it. We understand what it is like to be an originator and what the originator needs to be successful. Give the originator great tools, competitive rates, good compensation, and technology, and let the originator win in the market. Our culture is all about how we can best deliver to our employees and customers."

John Stewart WEST

Chief Production Officer, West (123) 123-4567

js@rate.com

John Stewart oversees Rate’s Western Divisions, bringing over 30 years of mortgage and finance industry experience to the company.

John leads an effort to capture additional market share primarily through recruiting the best of the best and developing leaders in both sales and operations. He regularly travels the Division to manage Rate’s partnerships and relationships throughout the markets.

John, who is based out of Beverly Hills, California, began his career as a loan originator and worked his way up the sales management ranks and has held leadership positions with some of the largest lenders in the country.

“When the opportunity to work at Rate presented itself, I couldn’t pass

up the chance to join the team,”John said. “Rate has a great value proposition for consumers and loan officers, which allows us to better serve homebuyers and deliver a hassle-free mortgage process.”

Todd Heaton

States: Arizona, New Mexico, Colorado, Texas, Oklahoma, Arkansas & Louisiana.

todd.heaton@rate.com

(480) 214-8869

Todd is a dynamic Senior Level Mortgage Banking Executive with over 25 years of experience leading highly productive sales teams. Todd’s servant-leadership style has allowed him to recruit, attract and retain the best mortgage talent in the markets he serves while delivering significant contributions to the company. Highly motivated, inspirational and a respected leader of teams, Todd’s passion for the mortgage business is apparent as he loves coaching and mentoring sales professionals to achieve at their highest potential.

Todd attended the University of Central Missouri where he met his future wife of 30 years. They have resided in Phoenix since 1993 and

have teenage boy/girl twins. Todd's twins will be attending Arizona State in the fall of 2023. Todd is the founding president of the Ahwatukee (Phoenix) Boys Team Charity. The BTC is a volunteer service organization with active participation of parents and sons in philanthropic projects within the community.

Todd leads the Central & Mountain Division of Arizona, New Mexico, Colorado, Texas, Oklahoma, Arkansas & Louisiana for Guaranteed

Rate and is always interested in speaking with high quality/professional branch managers, loan originators and support staff interested in learning more about Guaranteed Rate.

Lisa Mesler

States: West Virginia, Southern Virginia, North Carolina, South Carolina, Georgia, Tennessee, Florida, Mississippi and Alabama

lisa.mesler@rate.com

Lisa Mesler leads teams across the Southeast Division. With over 20 years of experience in mortgage banking, Lisa is a Senior-Level Executive who excels at building connected, high-performing teams through authentic leadership and a passion for empowering others.

Lisa’s leadership approach is guided by her core values of authenticity, inclusion, and connection. It enables her to recruit, attract, and retain top mortgage talent while fostering a collaborative environment where team members thrive. As Divisional Sales Manager at Guaranteed Rate, Lisa is committed to expanding market presence, driving customer satisfaction, and inspiring team growth. She is passionate about equipping her teams with the tools and resources needed to thrive in today’s competitive mortgage landscape.

In addition to her leadership role, Lisa is the Co-Chair of GROW (Guaranteed Rate Organization for Women), which provides women a platform to learn, exchange ideas, and build strength and confidence. Through GROW, Lisa is dedicated to creating opportunities for women to improve themselves and support one another.

Originally from Buffalo, NY, Lisa attended Canisius College, where she studied Industrial and Organizational Psychology—a foundation that complements her focus on leadership development. She and her husband of more than 20 years have called North Carolina home since 2002, raising two sons. Outside of work, Lisa enjoys hiking (including sections of the Appalachian Trail), running, and cheering for her favorite sports teams: the Buffalo Bills, New York Yankees and Buffalo Sabres.

Ryan Ogata

States: Northern California, Western Nevada, Oregon, Washington, Alaska and Wyoming

Ryan Ogata is the Divisional Manager of Rate’s Northwest Market. Based in the San Francisco Bay Area, Ryan originally joined the organization in 2017. He has served in the capacity of Regional and Divisional Sales Leader, as well as Executive Vice President of Reverse Mortgage Lending across all Rate Companies.

Ryan personally identifies with Rate’s Core Value #4 ,“We Think Big,” which embodies the core philosophy of the organization. “Being from the Bay Area, my focus has traditionally been on the Jumbo Markets. I never thought in a million years that I would be taking an interest in Reverse. There is a unique convergence of population age demographics, personal balance sheet composition and economic headwinds that will make Reverse a much larger part of the overall

mortgage business than it has been historically. I am excited to be working with a market leader like Rate to develop our value proposition in the Reverse mortgage space.”

Ryan earned his Bachelor of Arts from Cornell University. He maintains an active lifestyle, enjoying masters swimming and skiing.

Jim Eboli

States: Minnesota, Wisconsin, Illinois, Iowa, Missouri, Indiana, Michigan, Ohio, Kentucky, Western Pennsylvania, North Dakota, South Dakota, Kansas & Nebraska.

jim.eboli@rate.com

(773) 739-5147

I’ve been working in the mortgage industry for 24 years, spending the first 12 as a top-producing originator before stepping into a leadership role at Guaranteed Rate to scale its divisional talent across the Midwest. In addition to recruiting and supporting my current leadership team along with the company’s Midwest loan officers, I dedicate my time to developing strategic relationships with real estate agencies and homebuilders—a key component to our recruiting and origination success.

Behind the Core Values of ‘Decisive Action’ and ‘Hold Ourselves and Others Accountable,’ Guaranteed Rate has created a unique culture that empowers its people with the right tools, resources, and support necessary to succeed and best serve clients. As someone who has

always held themselves accountable before others, I am proud to work at Guaranteed Rate with people who share those same qualities.

A native Chicagoan, I was raised in the northwest ‘burbs, where I currently live with my wife and four children. Outside of work, you’ll find me with my family, cheering on my favorite Chicago sports teams, watching documentaries and enjoying those intense morning Peloton rides.

Dean Moran

States: Maine, Vermont, New Hampshire, Massachusetts, Connecticut, Rhode Island, New Jersey, New York, Eastern Pennsylvania, Northern Virginia, Delaware, Maryland & Washington D.C.

dean.moran@rate.com

(201) 645-6418

As a Guaranteed Rate Divisional Manager, I’m responsible for all strategic planning and growth in the Northeast market as I continue the company’s national expansion. Based in Parsippany, N.J., I have more than 25 years of experience in the financial and mortgage industries, having worked at several large national banks in the mortgage division where I established a proven track record of building sales teams to deliver profitability, heightened accountability and increased market share. I’m a highly experienced executive who formulates and executes strategic solutions to improve financial performance, loan quality and member service.

Working with the Guaranteed Rate team to help increase sales performance and loan volume in the Northeast is something I am

passionate about. I am proud to work at an organization that aims to be the #1 retail mortgage lender in the country and is powered by its best-in-class technology, people and products. I have no doubt we will reach our goals while maintaining focus on the member experience in our growing region.

Outside of work, I’m an avid classic car collector and history buff who also enjoys spending as much free time as I can with my kids and grandkids.

Tim Sorenson

States: Southern California, Nevada, Utah & Hawaii (949) 359-7114

tim.sorenson@rate.com

I oversee Guaranteed Rate’s Southwest Division, which includes Hawaii, Utah, Nevada and Southern California. A financial and mortgage industry veteran of 21 years, I started as an originator before working up to executive management level positions. The credit for my early success? Dynamic mentors who helped drive and shape my own leadership style.

A native of Orange County, Calif., I joined Guaranteed Rate in 2017 and rapidly built one of the most successful regions in the country. I’m most passionate about working with Guaranteed Rate to help my employees scale their businesses, reach their fullest potential and accomplish goals they never thought possible. I strive to help create industry leaders who will continue propelling the company to even greater heights.

I’m married to my high-school sweetheart, Stephanie, and have two daughters, Keira and Kaitlyn. I’m a total die-hard sports fan, love playing golf, and enjoy fine dining and travel as a family. Stephanie and I are dedicated to supporting local charities focused on providing services to underprivileged families and children in need.

I’ve never been happier in my career and am fortunate to work for a company whose core values are so closely aligned to my own. I love that Guaranteed Rate meaningfully executes on the belief to give back to the communities it serves.

CHIEF RETAIL GROWTH OFFICER

Ron Bergum

Ron.Bergum@rate.com

We demand excellence at Guaranteed Rate.

Our daily focus is to have a better value proposition than any other bank or mortgage company in the country for our customers, referral partners and Guaranteed Rate family. We have the highest standards. When we do our jobs with excellence, this business is easy—our referral partners are well served, and our customers keep coming back. Good enough, never is.

Company

Customerslove theexperience

The Rate platform enables our loan officers to provide the highest level of customer service to borrowers and referral partners.

CORE VALUES

Together,we willaccomplish amazingthings.

• We grow for good

• We put our members first

• We work with the best of the best

• We think big

• We have grit

• We have an owner’s mentality

• We embrace change

• We demand excellence

• We hold ourselves and others accountable

• We give a sh!t

Partnership Branch Opportunity

Webuiltabest-in-class modeltogrowyourbusiness andexpandyour branch.

Our unique Partnership Branch model offers an entrepreneurial structure with low corporate costs, industry-leading technology and sales leadership committed to branch recruiting efforts.

There is no better way to supercharge your career.

More Flexibility. More Ownership. More Reward.

Be the CEO of Your Branch

You are in control

Easy-to-Follow, one-page Profit & Loss statements

No Hidden Costs or Surprises

Realistic Financial Projections

We are looking for industry leaders who possess a CEO-mindset and want to take an active role in branch management.

Through skilled optimization of pricing and branch expenses, our model will enhance your earnings, provide extraordinary growth opportunities, and ensure a gratifying experience.

– Michael Barycki, Vice President, Secondary Marketing

Designated Support Team

We will Help you Recruit and Grow

GROW FOR GOOD

Themorewegrow,the moregoodwedo.

We measure the positive impact we have on our communities, and every year we

• Conduct companywide fundraisers such as ALS, Vetrans support, food drives, Toys for Tots and more

• Give each employee one paid day to improve our communities

• Support the Rate Foundation

Makingadirectimpactinpeople’s lives,whentheyneeditmost.

• Since 2012, over $7.7 million has helped more than 2,500 individuals who are overcoming difficult times.

• Every year, we help over 50 individuals and their families

• The average recipient receives over $10,000 directly (for expenses such as rent, car payments, groceries, and more)

• 100% of Foundation costs are covered by Rate Companies, so that every penny donated helps those who need it most.

SUCCESS COACHING SOLUTIONS

Growyourbusinessrapidly

Success Coaching Solutions provides bi-weekly coaching, absolute accountability, a performance tracking dashboard and senior leader insights.

Plan

Create your plan with a proven outline of effective actions that will get you to reach your goal

Analyze

What actions you are taking now, what do you want to accomplish and what are you willing to do to achieve it?

Execute

Bi-weekly accountability sessions to continuously improve your skill set on actions taken, sales methods and getting in front of the right business partners

The WinningFormula: We have a plan to double your business in one year. Flip the hourglass, get out loan files, spend 80% of your time selling. Grow your business, make more money, & have a better quality of life.

Rates & Programs

Whatever it takes to offer the best products with competitive rates

Agency / Government

Exclusive Fannie & Freddie programs

Direct seller to Fannie, Freddie, FHA, VA & USDA. No overlays, manual UW

Affordability products

FirstHome+ National CRA Pricing

Special Purpose Credit Programs, BorrowSmart Access, HomeReady First

OneDown

$3k-$5.5k assistance nationwide, ≤85% AMI, limited access

4 National DPA programs

100% LTV, no AMI options, 3-5% DPAs, FHA, USDA and Conforming

50 State HFA/Bond Program380+ standalone DPAs

#1 non-bank Jumbo lender

30+ Prime Non-Agency Outlets

Proprietary jumbo product, 150+ investors, in-house securitization

non-QM products

Proprietary Edge, 15+ investors

Full doc, Bank Statement, DSCR, 1099, 1-yr, P&L & Asset Depletion

Flexible Pricing

Expansive investor rate renegotiation, Weekend locking and overnight rate protection

One stop shop

Reverse, Buydowns, HELOCs, Builder, Personal loans, Bridge

AI Tech platform

The future of mortgage lending. Be a rainmaker. Focus on $500/hr

The LO is in Control

Two Proactive POD Teams

Standard loans

Two processors, dedicated team

Same Day Mortgage

72% of loans are eligible, with 24-hr approvals, avg CTC <10 days

AI-Powered Underwriting

Reads docs, extracts data, automatically identifies required loan conditions, clears conditions

Rate App speeds up the process

Approvals: 26% faster, CTC 11%

Power VP ditch the laptop

Run pricing, edit preapprovals, Check loan status

YBR Your Loan command center

Auto pipeline management app

DM Experience

More than an online application.

My Account Automation tools

Flashclose Close in minutes

In-house specialty Teams

Credit Concierge, Closing Table Remedy, Fully digital HELOC. Reverse, Specialized broker, Personal Loan, and LAP

Marketing Plan

Designed to build your brand and double your business

Maximize Your Database

CRM with integrations across full ecosystem driven by Encompass

12k+ branded assets

Instant alerts for 5D’s

Plug and Play Email

Journeys triggered at milestones

Postcards

Stay top of mind 24x a year

Social Media

High quality posts in 15 seconds or less.

Utilize GR Social team.

Add Value At Open Houses

Optimal Blue integration for co-branded property statements in < 1 min.

Hyper Targeted Digital Branding

Be everywhere, all the time without doing all the work. Leads sync directly to your CRM

Improve Online Reviews

98% of customers read online reviews before buying

Increase Your Website Conversion

Lead capture app on site and re-target visitors with display ads

Supercharge Your Brand

Online promo store with branded items at deep discounts, Automated Closing, creative support

Become a Best-In-Class Marketer

Events-in-a-Box presentations prepared for you 2x a month.

Business Development

Referral partner growth plan to dominate your market

#1 most trusted lender

GR: 91%. 2nd place: 47%

Target the top 20% agents

Proprietary technology enables you to categorize every agent

Biz Dev Team

Makes cold calls for you, sets up 1:1 8-12 meetings a month

National Events Team

Dedicated Events Team handles all the details for your events

Agent Advantage

Free CRM for agents, lead capture apps, single property Sites, Loan Status updates, coaching videos

Breadth of Products

Lock‘n’Roll, Rate Reduce, Affordability, Preferred Builder, Lock‘n’List, Forward Commitments

Rate App

Stay relevant 24-7-365

PowerBid Approvals

Full UW credit approval before buyers start looking

Same Day Mortgage

Agents can win more deals more competitive offers and better chance of seller’s acceptance

Language Access Program

Provides the only 100% end-to-end Spanish mortgage process.

Smooth Transition

Our dedicated Transition Team makes it simple, smooth and easy

Consultant Vice President (CVP) Expert Loan Officers in all markets are 100% dedicated to helping you

Experienced processors

Focus on helping you & your team

Onboarding Concierge

Your point of contact from day one

Licensing Team Support Facilitates your license transition

Hit the ground running

In the first 60 days, repeatedly marketing to your entire database across all channels

Ongoing Coaching

Our best-of-the best philosophy is grounded in sharing best practices with each other.

Pulse Calls

On Victor Ciardelli’s bi-weekly calls, the executive team shares growth strategies and tools

Sharing Success

Recurring coaching calls where the top VPs in the country share their best practices

Secondary Training

“In-house calls” with all the details of the new loan programs and pricing

Marketing Coaching

On-demand training, live coaching sessions weekly, interactive training portal with self-serve video tutorials