AgWest Farm Credit

Banner Bank

Bouten Construction Company

Canopy Credit Union

Central Pre-Mix Concrete Co. a CRH Co.

Chase Bank

DAA Northwest

Delta Air Lines

DH

Eastern Washington University

Gesa Credit Union

Gonzaga University

Inland Power

Kaiser Aluminum

Lydig Construction

McKinstry Company

NAC Architecture

Providence Health Plan

Robert Half Talent Solutions

Rosauers Supermarkets

Spokane Colleges

University of Washington

Wagstaff

Washington State University Health Sciences

Spokane

Westcoast Entertainment

Whitworth University

Paul Read Publisher, JournalofBusiness

Steve Scranton, CFA ChiefEconomist WashingtonTrustBank

Steve Scranton, CFA Chief Economist Washington Trust Bank

• Economic growth is bifurcated between upper and lower income earners.

• Fiscal stimulus, corporate spending and tax refunds will support economic growth.

• Short-term interest rates will follow the Federal Reserve’s actions.

• Long-term interest rates will follow inflation and the economy.

2.3% vs Spending: 2.7%

• Short-term rates

• Expect the Federal Reserve to lower its overnight borrowing rate by another 0.25% by year-end.

• If the economy or labor market deteriorates more than expected, then additional rate cuts are possible.

• Long-term rates

• Expect 10-year Treasury to be volatile between 3.50% to 5.00%

• Dependent on three factors

• Progress on inflation

• Economic growth

• Buyers of long-term debt

• Expect 30-year mortgage rate to be between 6%-7.5%

Tariffs are a tax paid by businesses or consumers

US Imports = $3.3 Trillion

18.7% Tariff = $617 billion 12-month revenue to the US, tax to businesses and consumers

Burden on small businesses-reporting and compliance

20 out of 27 are above 2%, 11 out of 27 are above 4%

Deportation

• Any reduction in working undocumented immigrants will impact the labor pool.

• Agriculture, Construction, Healthcare, Leisure & Hospitality, and Manufacturing at risk.

Legislative Policy

• Tax policy risks out-migration.

“Boycott USA”

• Leisure & Hospitality and Agriculture at risk.

Aerospace and Deep Space

• Private enterprise driven-new businesses

• Small modular nuclear Energy

• Physical AI Technology

Focus on your business and ignore the noise of the media and politics. Focus

Reassure

Be the voice of reason for your employees, families, friends and customers.

Have active conversations with your business partners to develop contingency plans. Communicate

Prepare for the threats; look for the opportunities. Plan

Dr. Vange Ocasio Hochheimer ProfessorofEconomics&Finance

WhitworthUniversity

Note:

Vange Hochheimer, Ph.D. Professor of Economics and Finance CEO & Chief Economist, Grand Fir Analytics

vocasio@whitworth.edu

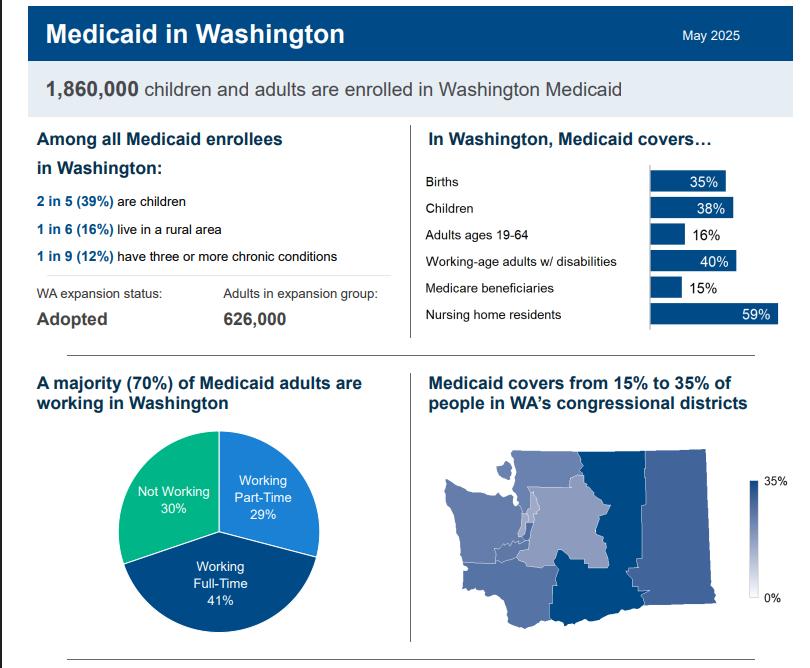

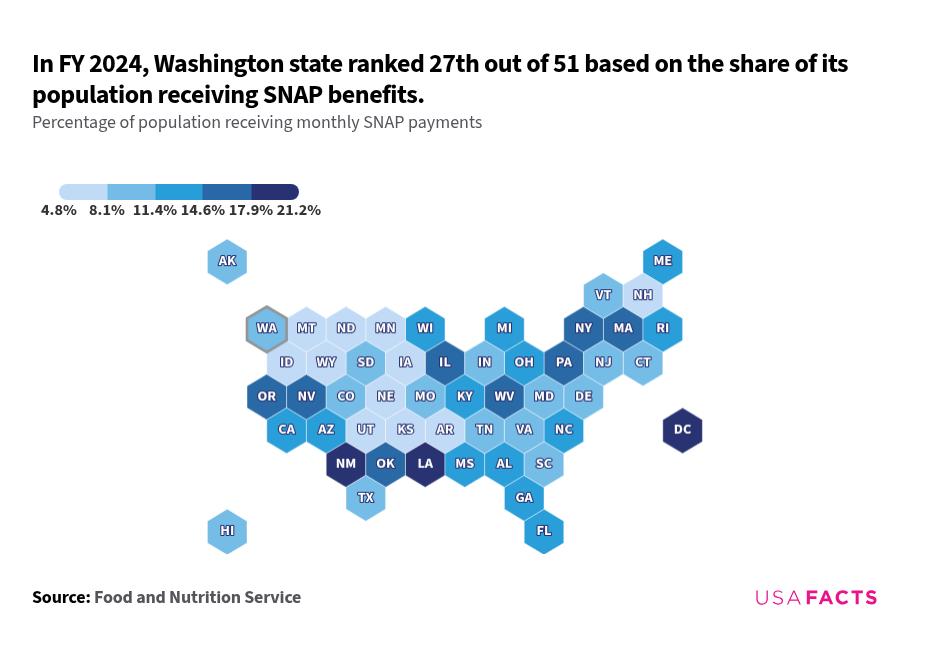

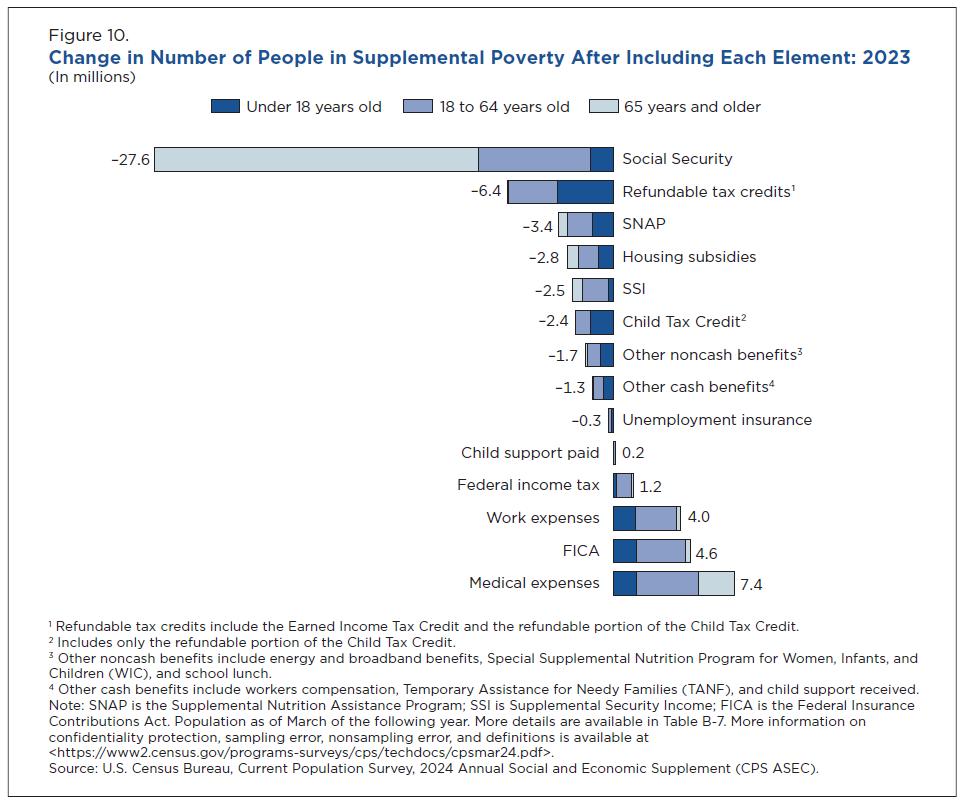

• Washington faces significant fiscal headwinds from federal spending cuts.

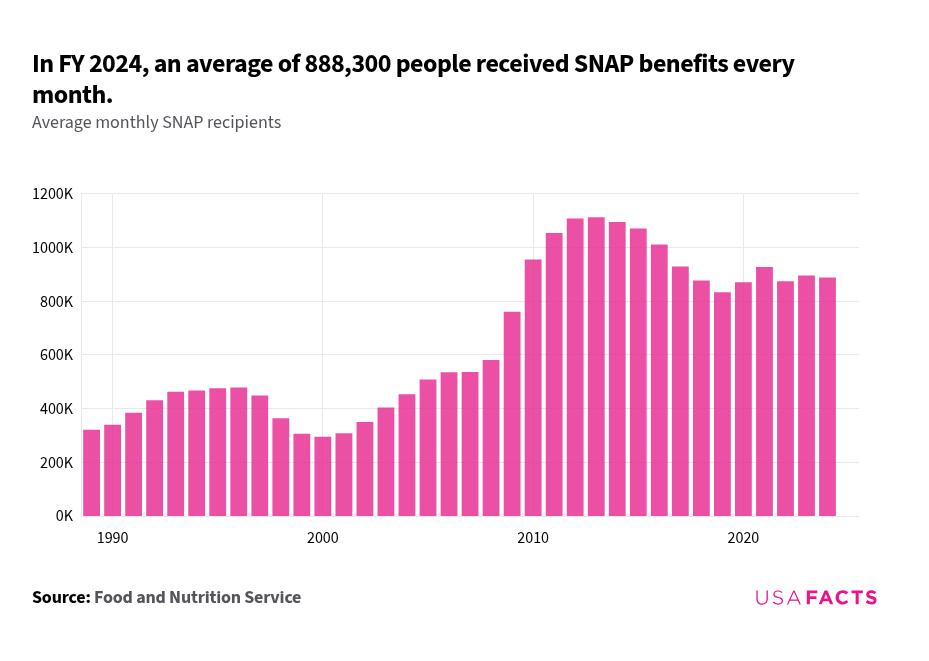

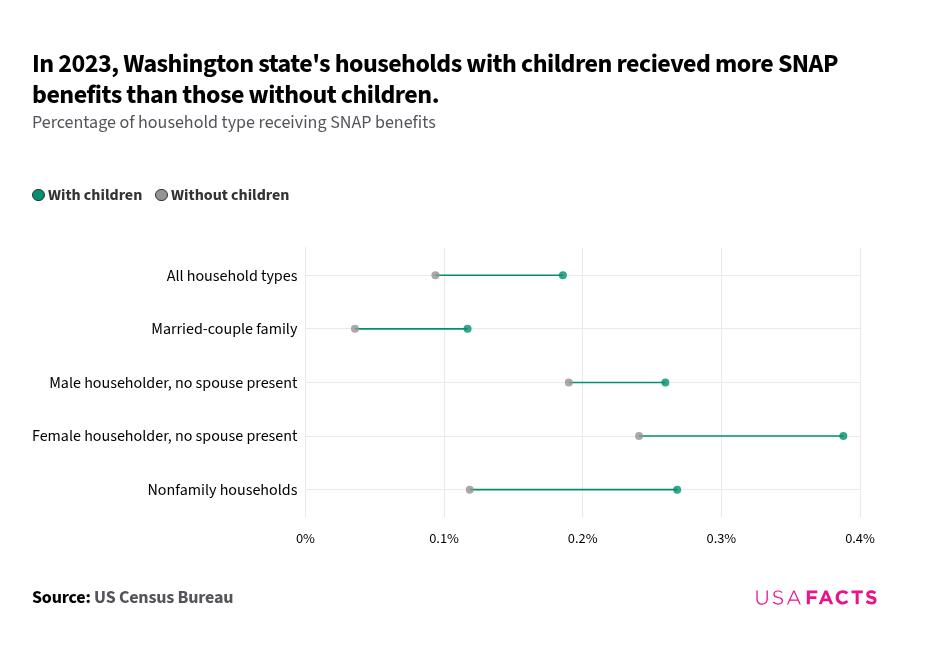

• Vulnerable populations, especially children, seniors, and lowincome workers, are most affected.

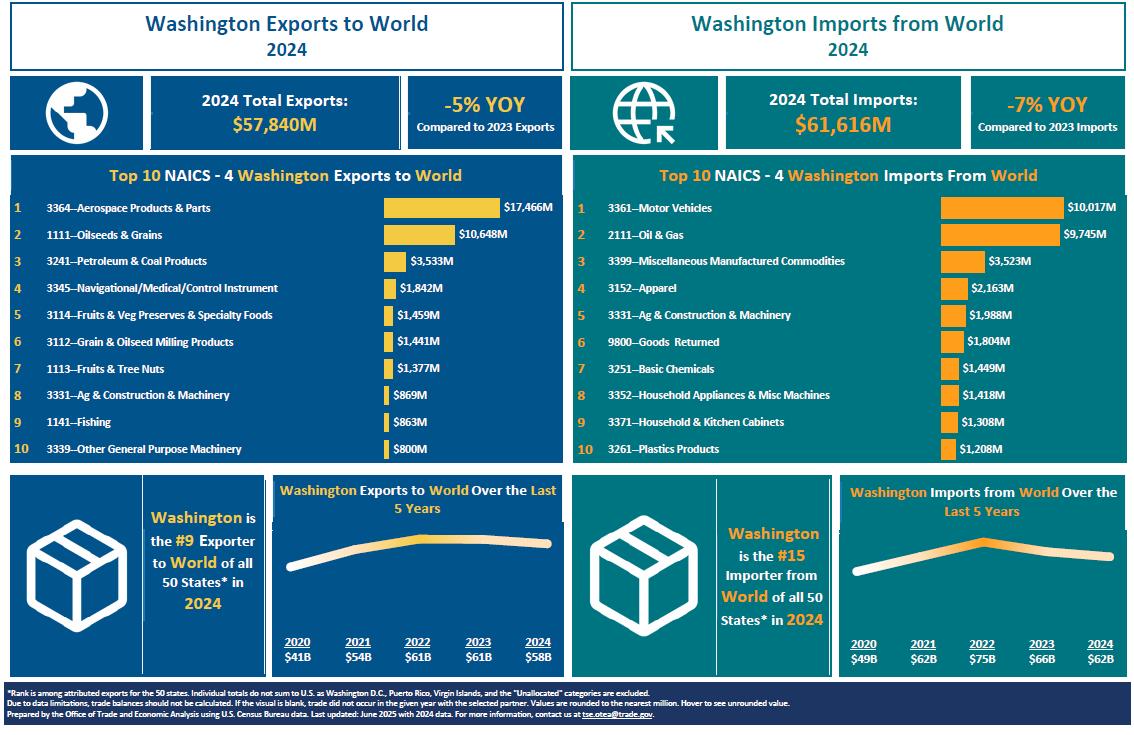

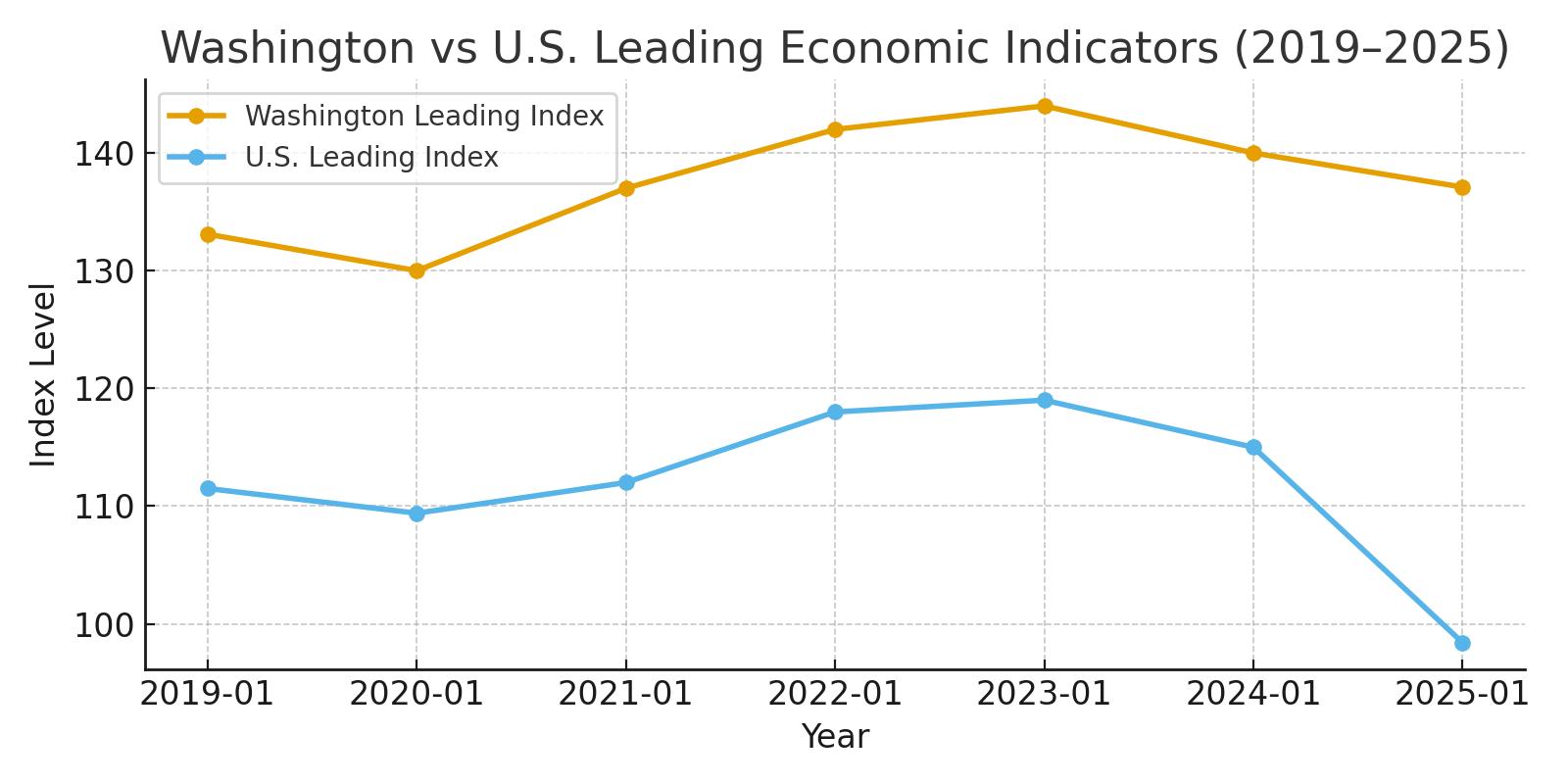

• Trade shocks and tariffs dampen growth in key industries like aerospace and agriculture.

• Yet positives include Washington’s diverse economy, clean energy leadership, and innovation ecosystem.

• Public-private collaboration and strong local governance remain key to resilience.

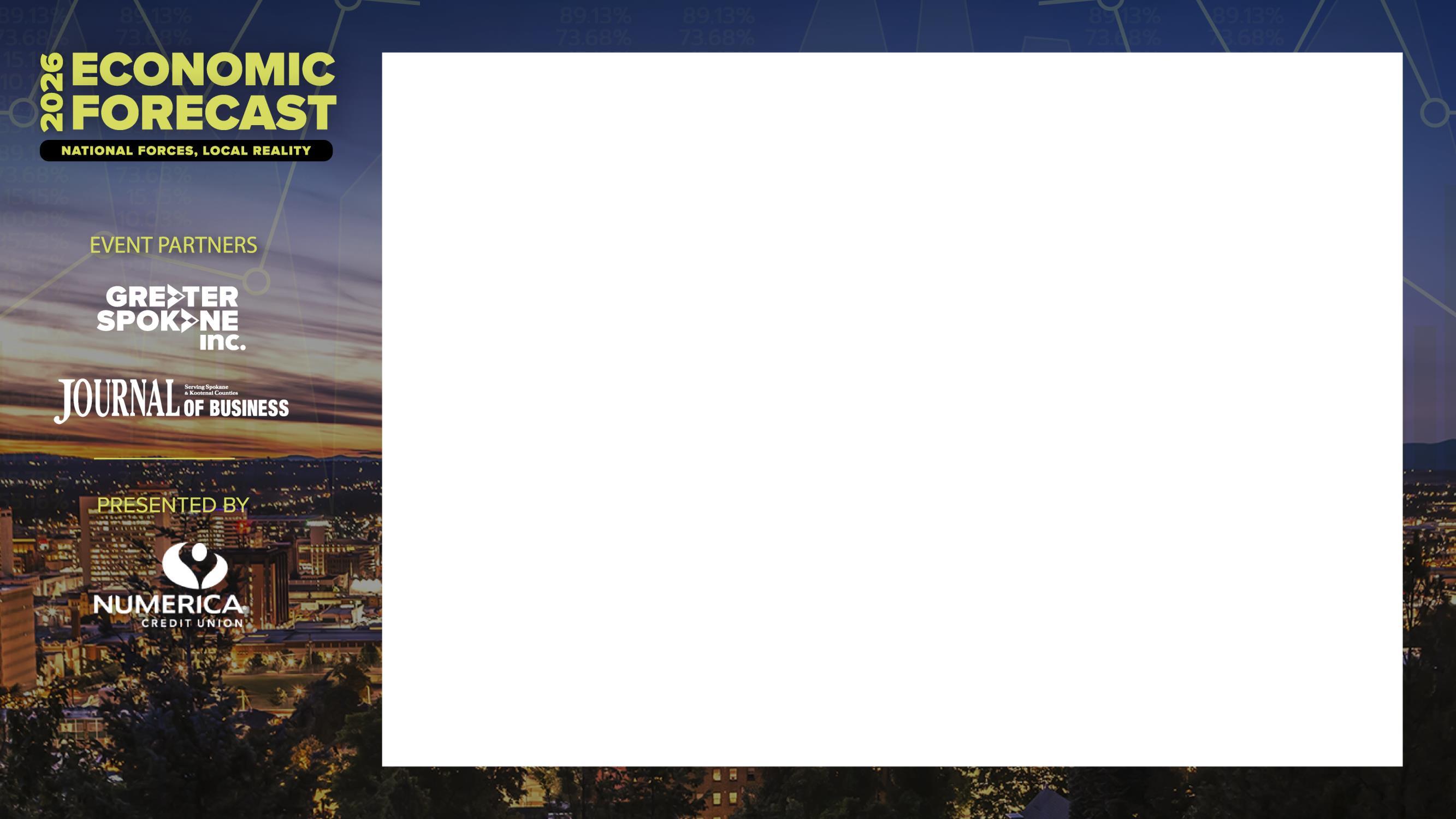

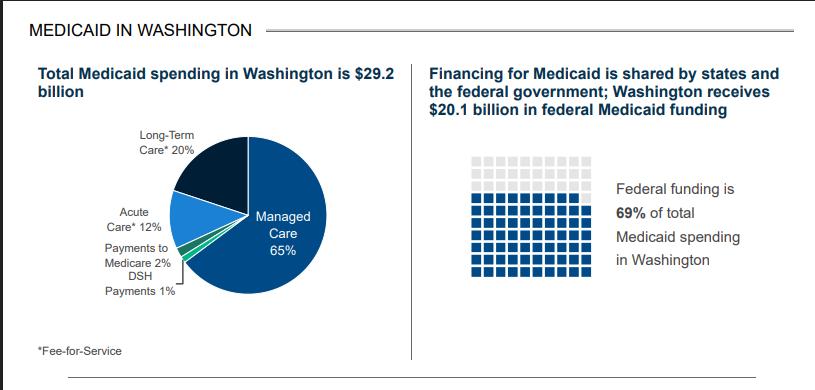

Source: kff.org

Source: kff.org

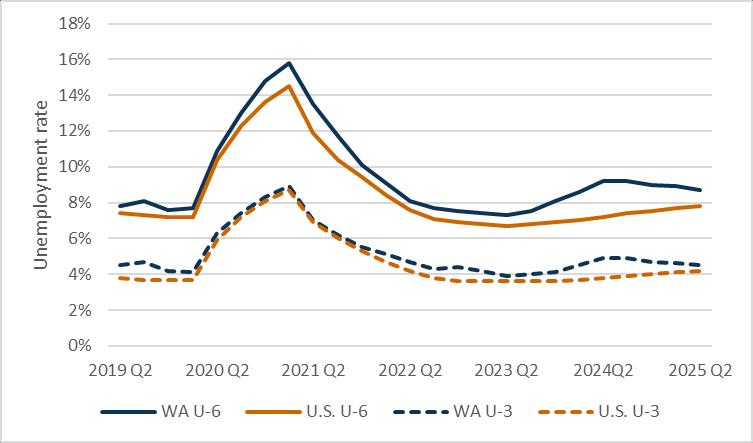

U3 – Official Unemployment Rate, WA, U.S. U6 – Broader Measure of Labor Underutilization, WA, U.S.

Source: Adapted from Employment Security Department/Labor Market Information and Research; U.S. Bureau of Labor Statistics, Local Area Unemployment Statistics

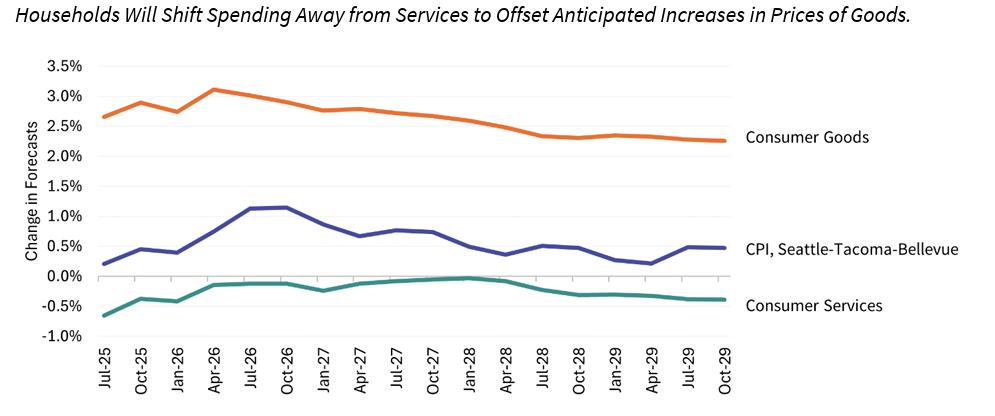

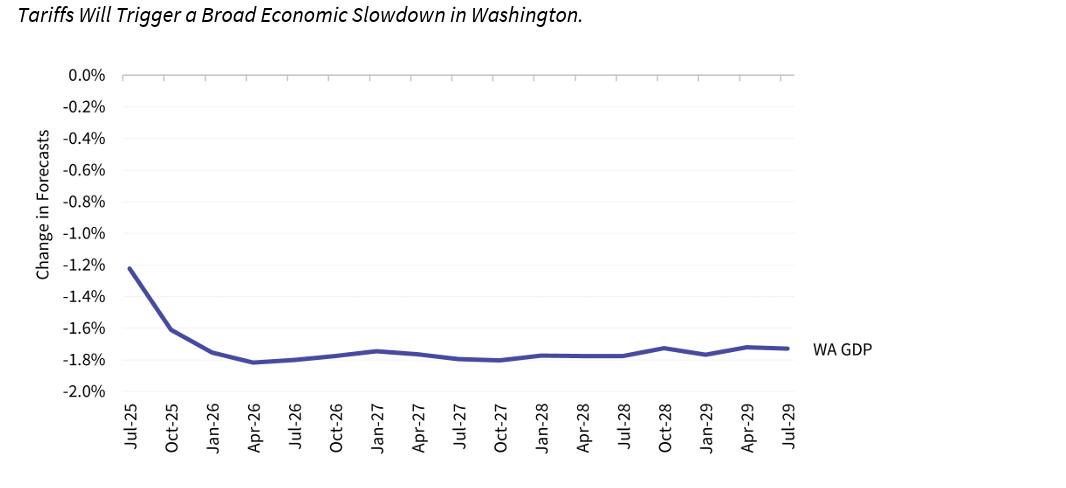

Expected Impact of Tariffs on Washington’s Prices of Goods and Services (May 2025 vs November 2024 S&P Forecast):

Source: Washington State Office of Financial Management

(May 2025 vs November 2024 S&P Forecast):

Source: Washington State Office of Financial Management

Source: The Conference Board, ERFC

• Risks from federal policy and global trade shifts are real but manageable.

• Strategic investment in workforce, innovation, and infrastructure will sustain growth.

• Washington is resilient, with strengths in energy, ports, and research institutions.

• The outlook is cautiously optimistic — challenges ahead, but clear opportunities to adapt and lead.

Dr. Grant Forsyth ChiefEconomist AvistaCorp.

• Metro area employment growth slowed significantly this year—with the WA side showing the most weakness.

• With the slowdown in employment growth, regional population growth has also slowed.

• Home price and rent growth remains low, but the price level remains high and affordability remains elusive.

• Residential units permitted are in-line with 2024, but with a shift towards singlefamily units.

December 10, 2025

THE DATE Olympia Fly-In

January 28-30, 2026

DC Fly-In

April 20-24, 2026

PRESENTED BY

EXECUTIVE SPONSORS

MAJOR SPONSORS

A4Ventures

SUPPORTING SPONSORS

VENUE PARTNER

Alaska Air

Lukins & Annis PS

Global Credit Union

Spokane Public Facilities District