Nature-related financial disclosures

Nature related financial disclosures are evolving fast. Approaches and terminology are rapidly changing, as are the aspirations and expectations of accountants and governance professionals applying their experience to nature-related issues.

These frequently asked questions (FAQs) respond to questions members and stakeholders have asked Chartered Accountants Australia and New Zealand (CA ANZ) and Governance Institute of Australia in relation to the evolving area of nature related financial disclosures including thematic areas such as biodiversity and natural capital. We appreciate the assistance of members from the CA ANZ Sustainability Management Advisory Committee and the Governance Institute’s Sustainability Committee in providing their insight and feedback on the publication.

In these FAQs we cover the definition of nature and thematic areas such as biodiversity, the importance of nature to business, greenwashing, the Taskforce on Nature-related Financial Disclosures (TNFD) and other fundamental areas relating to nature.

Currency of information

Many of these FAQs relate to emerging and evolving issues. The responses are based on information available at the time of publication to assist members of CA ANZ and the Governance Institute of Australia to obtain an understanding of the landscape, and therefore be better placed to engage with nature-related risks and opportunities and supporting financial disclosures.

First published June 2024

Last update June 2024

Glossary

Term or Acronym Definition or Meaning

TNFD The Taskforce on Nature-Related Financial Disclosures

ISSB International Sustainability Standards Board

TCFD Task Force on Climate-Related Financial Disclosures

GRI Standards Global Reporting Initiative

NCP Natural Capital Protocol

IPCC Intergovernmental Panel on Climate Change

COP Conference Of the Parties

GVA Gross Value Added

GBF Global Biodiversity Framework

LEAP Locate, Evaluate, Assess and Prepare

EFRAG European Financial Reporting Advisory Group

SASB Sustainability Accounting Standards Board

CDSB Climate Disclosure Standards Board

CSRD Corporate Sustainability Reporting Directive

ASIC Australian Securities & Investments Commission

ACCC Australian Competition & Consumer Commission

WBCSD World Business Council for Sustainable Development

WEF World Economic Forum

IPBES Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) is an independent intergovernmental body established by States to strengthen the science-policy interface for biodiversity and ecosystem services for the conservation and sustainable use of biodiversity, long-term human well-being and sustainable development

Ecosystems A biological system composed of all the organisms found in a particular physical environment, interacting with it and with each other1

Ecosystem services Ecosystem services are defined as the direct and indirect contributions of ecosystems to human well-being, and have an impact on our survival and quality of life. There are four types of ecosystem services: provisioning, regulating, cultural and supporting services.2

1 Ecosystem (Oxford English Dictionary)

2 Explainer: What are Ecosystem Services? (Earth.org)

Frequently asked questions

Question Response

1. What is the difference between nature and biodiversity?

Nature is the foundation of life on earth

Biodiversity encompasses the variety of life on Earth at all levels: ecosystems, species, and genes.

According to the Convention on Biological Diversity, biodiversity refers to “the variability among living organisms from all sources including, inter alia, terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species and of ecosystems.” About 8 million kinds of organisms, including animals, plants, fungi, and bacteria, as well as the habitats that support them, such as oceans, forests, mountainous regions, and coral reefs form the concept of ‘biological diversity’ or ‘biodiversity’. Each species contributes significantly to the health of ecosystems and the preservation of the natural order, making biodiversity an important aspect of our daily existence.3 Biodiversity has a significant role to play in maintaining our natural environments. For example, biodiversity of our marine ecosystems is essential to managing acidity in the ocean, biodiversity of rainforests is essential to carbon capture and storage.

Nature, on the other hand, encompasses all systems that are currently in existence. It is defined by the TNFD as: “The natural world, with an emphasis on the diversity of living organisms (including people) and their interactions among themselves and with their environment.” It refers to all the existing systems created at the same time as the Earth, all the features, forces and processes, such as the weather, the sea and mountains. In other words, nature is all life on Earth (i.e., biodiversity), together with the geology, water, climate and all other inanimate components that comprise our planet.3

Links:

• The business case for nature

3 The meaning of nature and biodiversity for banks (Chartered Banker)

2. What are naturerelated dependencies?

3. What are naturerelated impacts?

Nature related dependencies are aspects of ecosystem services that an organisation or other actor (participant in an action or process) relies on to function. Dependencies include ecosystems’ ability to regulate water flow, water quality, and hazards like fires and floods; provide a suitable habitat for pollinators (who in turn provide a service directly to economies) and sequester carbon (in terrestrial, freshwater and marine realms)4

Ecosystem services include the food we eat, the water we drink and the plant materials we use for fuel, building materials and medicines.

For example, a local sandwhich shop will be reliant on ecosystem services such as food and drink, however would also be reliant on healthy soils, pollination, water purification and flood management to produce quality produce (lettuce, tomato, cucumber etc) for use in their operations. By understanding nature-related dependencies, nature-related physical risks can be better understood by a business.

Links:

• Nature Risk Profile: A Methodology for Profiling Nature Related Dependencies and Impacts

Nature-related impacts are caused, or contributed to, by an organisation’s exploitation, use or dependency on natural resources. Metrics embedded into the TNFD approach measure both negative and positive impacts on nature.

For example, a local sandwhich shop’s acitvities may have an impact on nature (which may or may not be material) from the produce used in its operations. For example, land use change and the production of agricultural inputs such as fertilisers and pesticides.

Links:

• Why nature matters – The fundamentals of nature and why it matters to the global economy

4. What are planetary boundaries?

Planetary boundaries are a framework to describe the limits to the impacts of human activities on the Earth system. The planetary boundaries concept presents a set of nine planetary boundaries within which humanity can continue to

4 The TNFD Nature-related Risk & Opportunity Management and Disclosure Framework (TNFD)

develop and thrive for generations to come. Understanding the interplay of planetary boundaries, especially climate and loss of diversity, is key in science and practice.5

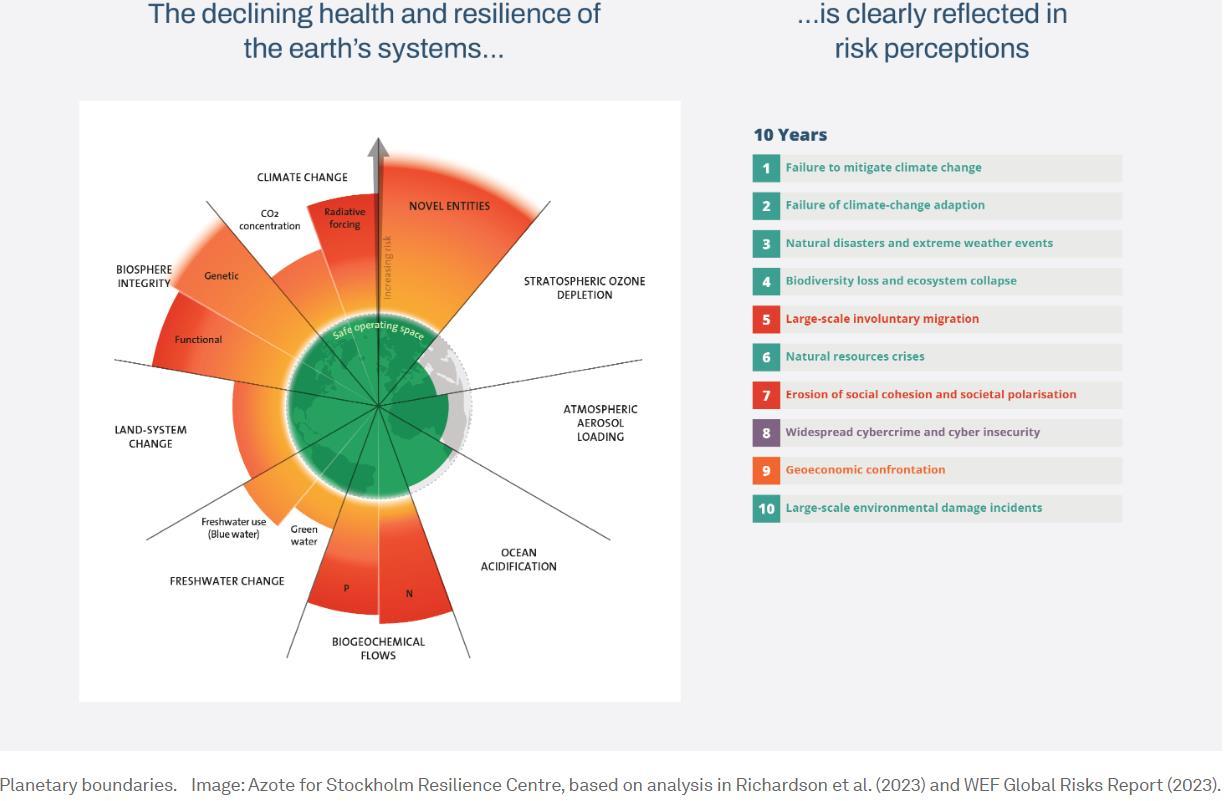

The declining health and resilience of the earth’s system (left of image below) is reflective of the top 10 risk perceptions in the next 10 years (right of image below) as illustrated in the World Economic Forum’s (WEF’s) 2023, 18th edition of the global risks report.

5 Planetary boundaries (Stockholm research Centre)

5. How does nature relate to climate?

Climate change and nature are interlinked.

The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES), identified five direct drivers of biodiversity loss as:

1. Land use change

2. Climate change

3. Pollution

4. Natural resource use and exploitation

5. Invasive species 6

In Australia, in the past decade, climate change in the form of more severe drought, extreme weather events, fire and habitat modification is becoming a new driver for habitat change and species loss.7 In New Zealand, It is almost certain that climate change will put increasing pressures on the ecosystems and biodiversity that underpin the functioning of our natural infrastructure (high confidence).8

Nature helps both mitigate against and adapt to the worst effects of the climate crisis. According to the Intergovernmental Panel on Climate Change (IPCC), managed and natural terrestrial ecosystems absorbed around onethird of anthropogenic CO2 emissions from 2010 to 2019.9

6 Models of drivers of biodiversity and ecosystem change (IPBES)

7 Biodiversity (Australia state of the environment)

8 New report highlights importance of natural assets and infrastructure to people and the economy (Stats NZ)

9 Why nature holds the key to meeting climate goals (UN Environment Programme)

6. Is nature important for business?

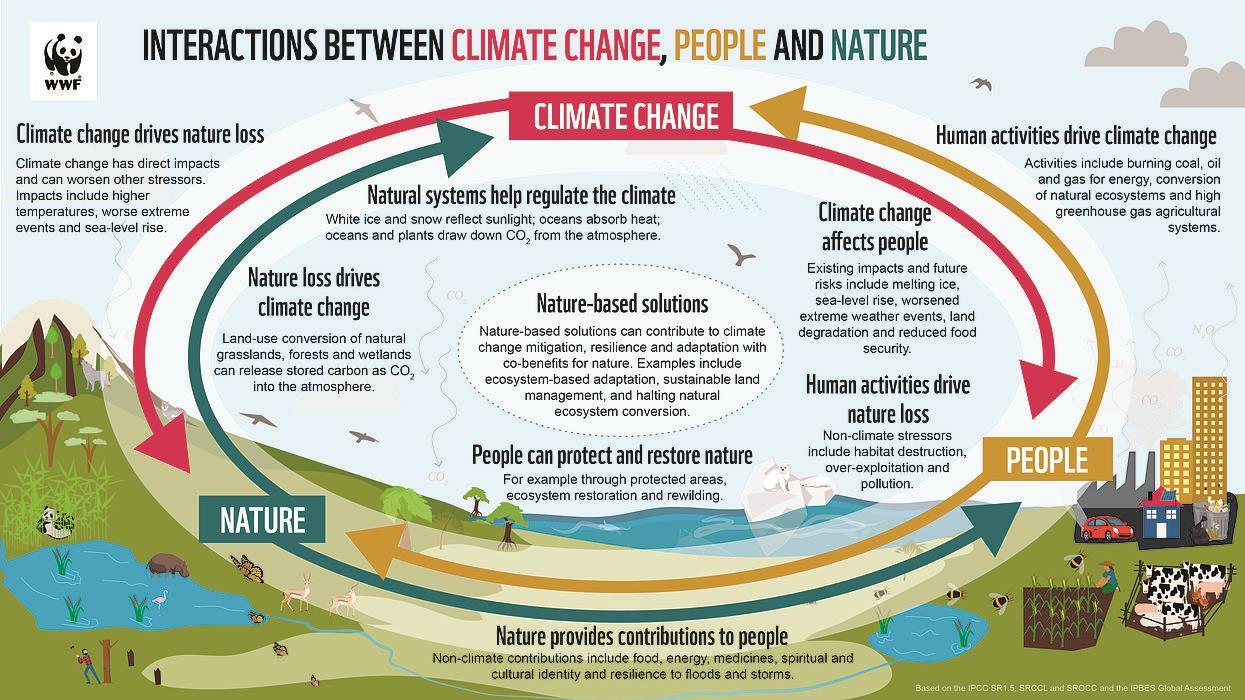

The World Wide Fund for Nature (WWF) diagram below illustrates the interactions between climate change, nature and people.

Every business, in every sector around the world, whatever its size is dependent to some extent on nature and its services.

Over half of the world’s total GDP, approx. $44 trillion, is moderately or highly dependent on nature and its services.

Source: Climate, Nature and our 1.5°C Future A synthesis of IPCC and IPBES reports

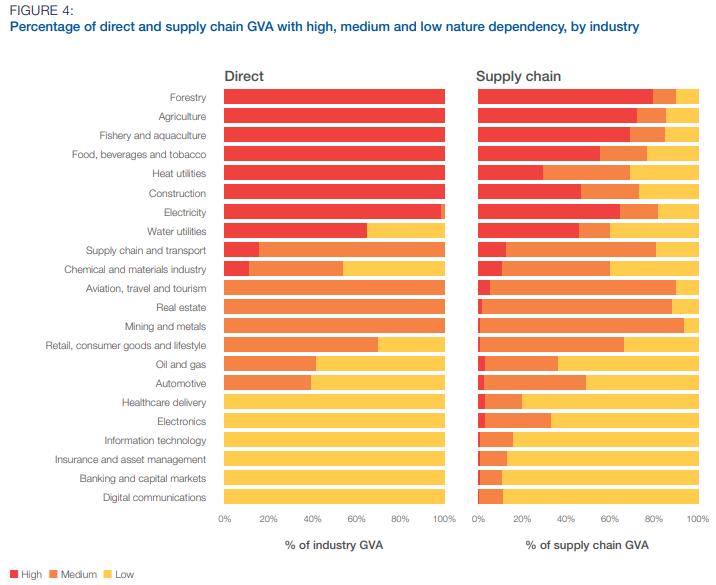

A World Economic Forum report found that many industries have significant “hidden dependencies” on nature in their supply chain and may be more at risk of disruption than expected. For instance, there are six industries which have less than 15% of their direct gross value added (GVA) highly dependent on nature, yet over 50% of the GVA of their supply chains is highly or moderately dependent on nature. These industries are chemicals and materials; aviation, travel and tourism; real estate; mining and metals; supply chain and transport; and retail, consumer goods and lifestyle.

Figure 4, from the World Economic Forum’s Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy publication highlights the percentage of GVA exposed to nature loss in 22 global industries.

Source: Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy (World Economic Forum)

The Green Finance Institute’s report on Assessing the Materiality of Nature-Related Financial Risks for the UK, presented the first quantitative evidence of the economic risk posed by nature degradation and the erosion of ecosystem services, both domestically and internationally to the UK economy. The report modelled that damage to the natural environment is slowing the UK economy and could lead to an estimated 12% reduction to GDP in the years ahead – larger than the hit to GDP from the global financial crisis or Covid-19. 10

The WWF’s Our Planet: Our Business film shows the immense value of nature to our economy, the scale of the challenges that we are facing, and the critical role that business can play in creating solutions at scale.

Links:

• Financing for nature (World Economic Forum)

• Half of World’s GDP Moderately or Highly Dependent on Nature, Says New Report

• Convention on Biological Diversity - the Biodiversity Plan (target 15)

• The business case for nature (Business for nature)

• Assessing the Materiality of Nature-Related Financial Risks for the UK (greenfinanceinstitute.com)

7. What are naturerelated financial disclosures? Disclosures that outline and describe nature-related dependencies, impacts, risks and opportunities that have been identified by an entity over the short, medium and long term which affect financial value and performance. Disclosures illustrate the effect on an organisation’s business model, value chain and strategy.

8. What is TNFD?

The Taskforce on Nature-related Financial Disclosures (TNFD) is a global initiative that has developed a framework for assessing and disclosing the financial impacts of nature-related risks and opportunities. It is aimed at assisting organisations to report and act on evolving nature-related issues and supporting a shift in global financial flows towards nature-positive outcomes.

10 Assessing the Materiality of Nature-Related Financial Risks for the UK (greenfinanceinstitute.com)

9. What are the TNFD recommended disclosures?

The TNFD was established to encourage and facilitate companies and financial institutions through enterprise and portfolio risk management and mainstream corporate reporting to recognise nature-risk and dependencies. The TNFD developed a set of recommendations and additional guidance to help organisations with the identification, assessment, management, and disclosure of their material nature-related issues.

The International Sustainability Standards Board (ISSB) announced in 2024, that its two-year work plan will include the commencement of projects to research disclosure about risks and opportunities associated with biodiversity, ecosystems and ecosystem services and will build from relevant pre-existing initiatives, such as relevant aspects of work of the TNFD.11

The TNFD recommendations provide companies and financial institutions of all sizes with a risk management and disclosure framework to identify, assess, manage and, where appropriate, disclose nature-related issues.

TNFD recommendations are consistent with global policy goals and international sustainability reporting standards, designed to allow organisations across jurisdictions to initiate and build their disclosure ambition over time. The TNFD recommended disclosures are structured around four pillars:

1. Governance

2. Strategy

3. Risk & impact management

4. Metrics and Targets.

The recommendations have been designed to:

• Be consistent with the language, structure and approach of both the Task Force on Climate-related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB).

• Accommodate the different approaches to materiality now being applied in jurisdictions around the world, through two materiality lenses – meeting the material information needs of capital providers, consistent with the ISSB’s IFRS Standards and TCFD recommendations, and meeting the material information needs of stakeholders focused on impacts, aligned with a broader materiality approach, consistent with the GRI Standards.

11 ISSB to commence research projects about risks and opportunities related to nature and human capital (IFRS Foundation)

• Be aligned with the global policy goals and targets in the GBF, including Target 15 on corporate reporting of nature-related risks, dependencies and impacts; and

• Leverage the best available science, including assessments of the IPBES and the climate science from the IPCC.

For further information visit the TNFD recommendations.

TNFD Recommended Disclosures

Source: Figure 1: TNFD recommended disclosures, Recommendations of the Taskforce on Nature-related Financial Disclosures

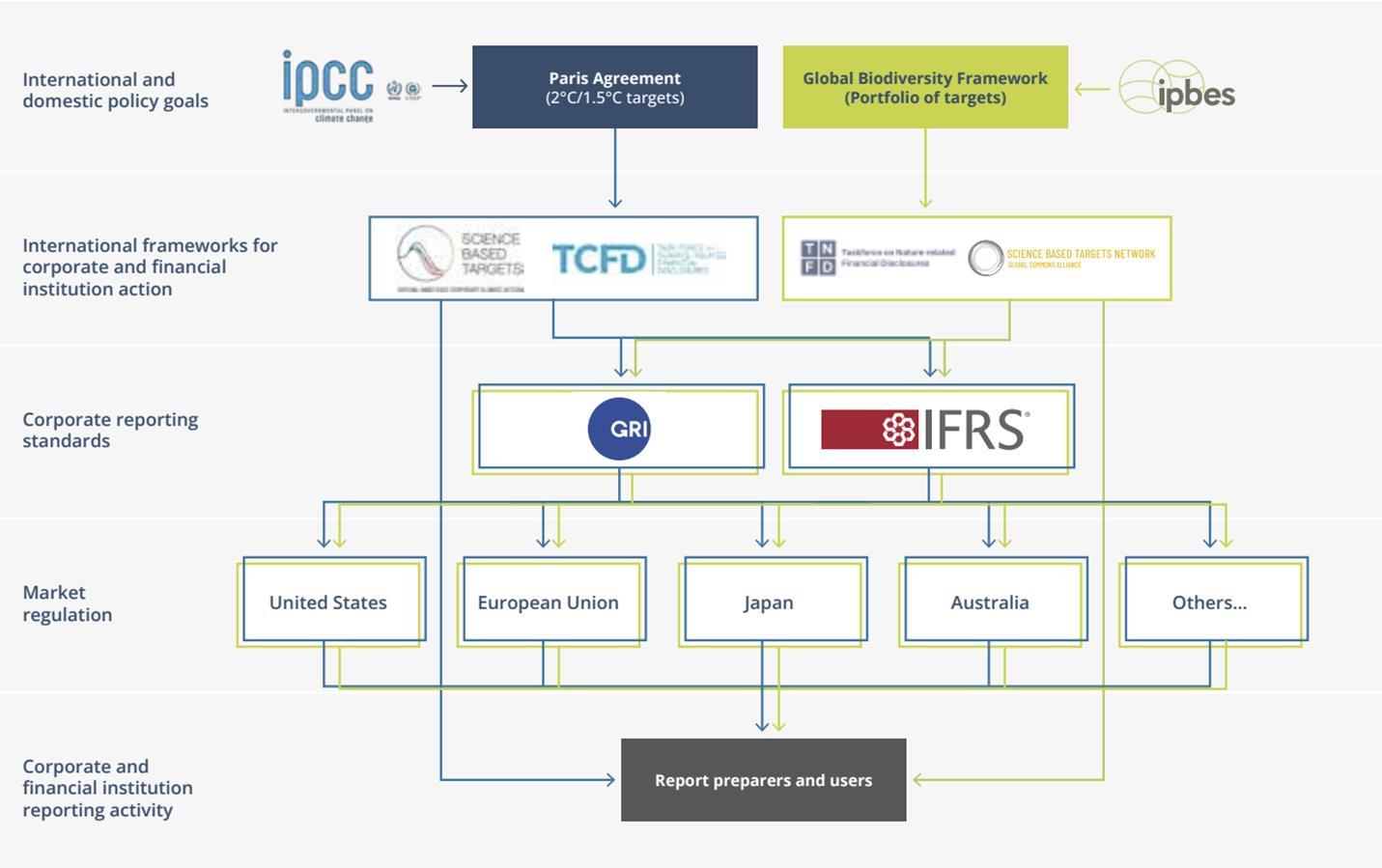

10. How does TNFD fit into the global sustainability reporting landscape?

The TNFD’s intention is to harmonise with existing climate and sustainability reporting frameworks to enable wider adoption in voluntary and mandatory sustainability disclosure. Below illustrates the current global sustainability reporting landscape.

Source: The Taskforce on Nature-related Financial Disclosures (TNFD): a briefing to address nature in the boardroom (Climate Governance initiative)

11. What is the difference between TNFD and TCFD?

The TNFD and the TCFD focus on the same four key pillars, governance, strategy, risk (and impact) management and metrics and targets. The TNFD framework also incorporates the LEAP (Locate, Evaluate, Assess and Prepare) method which is not considered in the TCFD.

Highlighted below are the key differences between the TCFD and TNFD disclosures (TNFD differences in coloured text).

Source: TNFD publishes final framework as TCFD disbands (King & Wood Mallesons)

12. Are TNFD recommendations aligned with other standards? Yes, the TNFD recommendations are aligned, or highly aligned with a number of other standards. For example:

• ISSB has noted high degree of consistency with the TNFD and will draw on this as a part of its continued work. In April 2024, the ISSB outlined their agenda priorities for the next two years with biodiversity, ecosystems and ecosystem services and human capital being the next two areas of focus. The ISSB will also consider existing work of the TNFD, SASB and CDSB.

• EFRAG also worked with TNFD, draft joint mapping document released.

• LEAP approach links to CSRD to assist report preparers.

• The GRI’s biodiversity 101 impact statement is highly aligned to the TNFD.

• There are synergies and interconnections between the Natural Capital Protocol and the TNFD’s LEAP approach.

Links:

Accountability for Nature: Comparison of Nature-related Assessment and Disclosure Frameworks and Standards

13. What is the LEAP approach?

The LEAP (Locate, Evaluate, Assess and Prepare) approach is an integrated approach developed by the TNFD to identify and assess nature-related dependencies, impacts, risks and opportunities.

The TNFD encourages users to scope their LEAP assessment before commencing to understand their potential cost, time and data availability constraints. It is encouraged when undertaking a LEAP assessment that relevant stakeholders are engaged and to draw on third-party expert advice as and when needed.

LEAP is designed as an iterative process across business locations, business lines for corporates and across investment portfolios and asset classes for financial institutions. LEAP is intended to be flexible in its application. For further information visit here.

14. Does the TNFD have any metrics for reporting?

Yes, the TNFD has published The TNFD Nature-related Risk and Opportunity Management and Disclosure Framework which outlines metrics for disclosure, these being:

• Metrics Annex 1: Dependency and impact disclosure metrics

• Metrics Annex 2: Risk and opportunity disclosure metrics

15. Where has the demand for naturerelated financial disclosures come from?

• Metrics Annex 3: Response disclosure metrics

• Metrics Annex 4: Disclosure metrics for the agriculture and food sector

• Metrics Annex 5: Disclosure metrics for the tropical forest biome

In December 2022 at the United Nations Biodiversity Conference (COP15) in Montreal, the Kunming-Montreal Global Biodiversity Framework (GBF) was adopted by 196 countries, Australia and New Zealand among them. The GBF consists of four overarching global goals to protect nature and 23 targets for achievement by 2030.

Target 15 (also known as the mandatory disclosure of nature-related risks) of the GBF relates to legal, administrative or policy measures to encourage and enable business, and in particular to ensure that large and transnational companies and financial institutions:

a) Regularly monitor, assess, and transparently disclose their risks, dependencies and impacts on biodiversity including requirements for all large as well as transnational companies and financial institutions to consider their operations, supply and value chains and portfolios;

b) Provide information needed to consumers to promote sustainable consumption patterns;

c) Report on compliance with access and benefit-sharing regulations and measures, as applicable;

in order to progressively reduce negative impacts on biodiversity, increase positive impacts, reduce biodiversity-related risks to business and financial institutions, and promote actions to ensure sustainable patterns of production.

GBF target 15 increases momentum for voluntary global industry bodies such as the TNFD (Taskfroce on Naturerelated Financial Disclosures), which was formally established in June 2021, to be adopted.

Links:

Convention on Biological Diversity - the Biodiversity Plan (target 15)

16. Are nature related financial disclosures mandatory?

Not yet. However, in Australia under RG 247 the operating and financial review and ASX CG P&R 4th edition, listed entities are required to disclose their material risks, which would include nature-related risks if they are material. In New Zealand, the NZX ESG Guidance note published by the New Zealand Stock Exchange (NZX) has outlined that issuers

17. When will organisations be required to make additional disclosures relating to nature/biodiversity?

may wish to explain the material ESG risks faced by their business including how the business intends to manage this risk in their reporting.

However, many jurisdictions have started to specifically consider nature-related financial disclosures. In New Zealand, there are many initiatives underway to pilot, input into the development of, and understand the impact of TNFD from an Aotearoa New Zealand perspective. The Australian Government contributed to the funding of the TNFD and the Department of Climate Change, Energy, the Environment and Water (DCCEEW), engaged EY to conduct pilots and published an Australian case study report on the Taskforce on nature-related financial disclosures.

Australia and New Zealand are signatories of the Kunming-Montreal Global Biodiversity Framework and targets are expected to be implemented by 2030, which means that mandatory requirements for businesses to assess, disclose and reduce biodiversity-related risks and negative impacts, specifically target 15, are likely to be implemented by countries by 2030, however jurisdictions may decide to implement earlier.

Links:

• Regenerating Nature in Aotearoa New Zealand: The Transformative Role of Business

• Taskforce on Nature-related Financial Disclosures – Pilots Australian case study report

Directors are required to disclose nature-related dependencies and impacts that pose a material risk of harm to the company in the directors’ report and corporate governance statement (see question 19).

As mentioned in response to question 15, the GBF is to be implemented by 2030 and target 15 includes mandatory nature-related disclosures.

Organisations may choose to voluntarily make nature/biodiversity related disclosures at any time and may choose to disclose in line with the recommendations as outlined by the TNFD.

18. Is materiality applied to nature related financial disclosures?

19. What are director obligations for nature

Yes, materiality is applied to nature related financial disclosures.

There are different types of materiality which is often referred to in sustainability reporting:

• Single materiality, considered the ‘outside in’ materiality perspective, is a consideration of what will affect the financial prospects of a company. Single materiality is often compared to financial materiality, however it is only a one sided approach.

• Impact materiality is considered the ‘inside out’ approach – the company’s impact to its external operating environment.

• Double materiality – which incorporates both single and impact materiality.

• Dynamic materiality – materiality of issues will change over time.

The GRI notes that ‘even if not financially material at the time of reporting, most, if not all, of the impacts of an organization’s activities and business relationships on the economy, environment, and people will eventually become financially material issues.’

The TNFD recommendations can be interpreted through two materiality lenses:

• Meeting the material information needs of capital providers consistent with the ISSB’s IFRS Standards’ and the TCFD recommendations, with a focus on risk management and how dependencies and impacts on nature create risks and opportunities for an organisation’s financial position and prospects; and

• Meeting the material information needs of stakeholders focused on impacts, aligned with a broader materiality approach, reporting against both the ISSB and the GRI standards.12

Consistent with the Natural Capital Protocol, the TNFD recommends that dependencies and impacts are identified and measured using dependency and impact pathways that consider:

1. Impact drivers and external factors;

2. Changes to the state of nature; and

3. Changes to the availability of ecosystem services.12

In 2023, Chapman Tripp, engaged by The Aotearoa Circle, outlined their opinion in relation to New Zealand director duties to manage nature-related risk and impact on natural capital.

12 Recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD)

related financial disclosures?

“Where appropriate, directors of New Zealand companies will be required to take foreseeable and financially material nature-related risks into account when making business decisions. Whether nature-related risks are foreseeable and material for a particular company will be impacted by anticipated domestic and international regulatory change that prioritises protection of nature, the degree of understanding of the risk and stakeholder expectations. The requirement stems principally from the directors’ duty to act with reasonable care under s 137 of the CA” (Companies Act 1993)”.

A legal opinion, released in October 2023, commissioned by Pollination Law and the Commonwealth Climate and Law Initiative (CCLI) and given by Sebastian Hartford-Davis and Zoe Bush (HDB Opinion), outlines the interaction of a director’s duty of care and diligence under section 180 of the Corporations Act 2001 (Cth) (Corporations Act) with nature-related risks arising from dependencies and impacts on nature (Opinion) concludes that:

• directors should be identifying a company’s nature-related dependencies and impacts, and considering the potential risks this may pose to the company;

• companies are required to disclose nature-related dependencies and impacts that pose a material risk of harm to the company in the directors’ report and corporate governance statement; and

• directors who fail to consider nature-related risks could be found liable for breaching their duty of care and diligence.

Links:

• New Zealand director duties to manage nature-related risk and impact on natural capital - legal opinion 2023

• Australian company directors and nature-related risk: A new legal opinion

20. What is greenwashing?

21. How does greenwashing arise?

Greenwashing is where companies make misleading or unsubstantiated claims about products or activities in order to appear more environmentally friendly than they really are. Financial think-tank Planet Tracker has identified six types of greenwashing: Greencrowding, Greenlighting, Greenshifting, Greenlabelling, Greenrinsing and Greenhushing.13

Over recent years, the prevalence of greenwashing has increased, and so too has awareness of it amongst regulators, investors and the public. A 2022 review by the Australian Competition and Consumer Commission (ACCC) found that 57 per cent of businesses made concerning claims about their environmental credentials. The European Commission review of corporate websites found that 42 per cent of environment-related claims were exaggerated, false or

13 What is greenwashing (Chartered Accountants Worldwide)

22. How can businesses make environmental claims appropriately?

deceptive. The potential for greenwashing arises with consumer and investor facing communications but is not limited to marketing material or product disclosure statements, it also arises with any publicly facing communications.

Greenwashing occurs in two key areas, disclosures, and marketing.

Disclosure – this relates to sustainability reporting, investor communications and other types of reports, and applies to climate, environmental or other sustainability related disclosures, such as those produced by listed companies or by organisations in the financial services and asset management sectors.

Marketing – this relates to product advertising, public relations and brand image, such as how fashion, transport or consumer goods are advertised.

While greenwashing may be deliberate, it can also be inadvertent, for example, because of a lack of understanding on the part of management about the rigour required to produce high-quality disclosure. This misrepresentation, whether deliberate or not, is potentially misleading for investors and consumers. The distinction between what constitutes genuine reporting of an organisation’s legitimate attempts to address environmental and climate-related issues, or its aspirations to do so, and what constitutes greenwashing, is somewhat nuanced.

A full report on greenwashing: A Governance perspective can be accessed here.

Businesses have obligations under the Australian Consumer Law – schedule 2 of the Competition and Consumer Act 2010 (Cth) not to make false or misleading representation or engage in misleading or deceptive conduct. These obligations should be considered whenever making environmental claims. The Australian Consumer and Competition Commission (ACCC) has produced eight principles for trustworthy environmental claims.

• Principle 1 – Make accurate and truthful claims

• Principle 2 – Have evidence to back up your claims

• Principle 3 – Do not hide or omit important information

• Principle 4 – Explain any conditions or qualifications on your claims

• Principle 5 – Avoid broad and unqualified claims

• Principle 6 – Use clear and easy-to-understand language

• Principle 7 – Visual elements should not give the wrong impression

23. How can businesses avoid greenwashing?

• Principle 8 – Be direct and open about your sustainability transition

More information on the ACCC Guide to making environmental claims, including further details on each principle, can be accessed here.

ASIC provides information about misrepresenting the extent to which a financial product or investment strategy is environmentally friendly, sustainable or ethical for responsible entities of managed funds, corporate directors of corporate collective investment vehicles (CCIVs), and trustees of registrable superannuation entitles (issuers).

Prohibitions against misleading and deceptive statements and conduct are found in sections 1041E, 1041G and 1041H of the Corporations Act 2001 (Corporations Act) and sections 12DA and 12DB of the Australian Securities and Investments Commission Act 2001 (ASIC Act).

When preparing a Product Disclosure Statement (PDS) for a sustainability-related product, you must comply with the disclosure obligations that apply to financial products, including sustainability related products. These obligations include:

- Section 1013D(1)(l) of the Corporations Act 2001 (Cth), which states that where a financial product has an investment component, its issuer must include in the PDS the extent to which labour standards for environmental, social or ethical considerations are taken into account in selecting, retaining or realising an investment.

- The guidelines in Regulatory Guide 65 Section 1013DA disclosure guidelines RG 65.

More information on ASIC guidance on avoiding greenwashing when offering or promoting sustainability-related products can be accessed here.

24. What are biodiversity credits?

Biodiversity credits are a verifiable, quantifiable and tradeable financial instrument that rewards positive nature and biodiversity outcomes (e.g. species, ecosystems and natural habitats) through the creation and sale of either land or ocean-based biodiversity units over a fixed period.14

14 Biodiversity Credits Initiative (World Economic Forum)

25. What sectors are most impacted by nature?

Biodiversity credits can create positive value for business by reducing exposure to physical nature risks, keeping pace with regulatory changes, supporting positive nature outcomes aligned with consumer preferences, and securing access to competitive finance. 14

Links:

• World Economic Forum - Biodiversity Credits Initiative

All businesses and sectors, in some shape or form are impacted by nature, however the material impacts and opportunities will vary. Conversely, all businesses and sectors have either a direct or indirect impact on nature and biodiversity. For example, companies with large water consumption, pollution, plastics, emissions also have very material corporate biodiversity footprints. These activities can drive global surface temperatures and unravel fragile ecological systems leading to coral reef destruction and declining footprints of rainforests. Extended periods of drought and intensification of the hydrological cycle in coastal areas resulting in increased flooding. These activities may be driven by businesses with no direct land and sea custodianship.

Business for Nature, the World Business Council for Sustainable Development (WBCSD) and the World Economic Forum (WEF) have identified and produced sector specific guidance outlining actions companies can take to transform their operations and value chains. The 12 sectors comprise agri-food, built environment, chemicals, construction materials – cement and concrete, energy, fashion and apparel, financial services, forest products, household and personal care products, travel and tourism, waste management, and water utilities and services.15

Read sector specific guidance from Business for Nature, WBCDS and the WEF

26. Are there sector specific metrics?

The TNFD has drafted proposed core sector disclosure metrics. Organisations in these sectors would be expected to disclose these metrics on a comply or explain basis once they are finished in 2024 and incorporated into TNFD additional guidance. The TNFD metrics approach includes different categories of metrics including a small set of core metrics or ‘core global metrics’ that apply to all sectors and ‘core sector metrics’ for each sector to be disclosed on a comply or explain basis and a larger set of additional metrics, which are recommended for disclosure, where relevant, best represent an organisation’s material nature-related issues, based on their specific circumstances.

15 Every sector must play their part in contributing towards a nature-positive future. Here’s how (World business Council for Sustainable Development)

27. What is nature positive?

Sector-specific metrics form an important part of this approach. This reflects the diversity of business models across value chains and their interface with nature across and within sectors. Sector-specific metrics help financial institutions to compare organisations within the same sector, which often face similar nature-related issues.

Find out more about the TNFD’s draft sector guidance.

Nature positive is a term used to describe circumstances where nature – species and ecosystems – is being repaired and is regenerating rather than being in decline.

16

Nature Positive is a global societal goal defined as ‘Halt and Reverse Nature Loss by 2030 on a 2020 baseline and achieve full recovery by 2050’. To put this more simply, it means ensuring more nature in the world in 2030 than in 2020 and continued recovery after that.

16 Nature Positive Plan: better for the environment, better for business (DCCEEW)

Businesses that aim to assess, commit, transform and disclose their impacts and dependencies on nature and disclose these activities are highlighting their contribution towards a nature positive future. Businesses should not be claiming that they are a ‘nature positive’ organisation as it is not an action that can be achieved by one organisation.

Links:

• What is nature positive? (Nature positive initiative)

28. What is natural capital

29. What is natural capital accounting

Natural capital can be defined as the world’s stocks of natural assets which include geology, soil, air, water and all living things. It is from this natural capital that humans derive a wide range of services, often called ecosystem services, which make human life possible.17

Ultimately, nature is priceless. However, it is not valueless, and there have been many studies that have calculated natural capital’s value in financial terms. For example, street trees in California provide $1 billion per year in ecosystem services, through atmospheric regulation and flood prevention, and Mexico’s mangrove forests provide an annual $70 billion to the economy through storm protection, fisheries support, and ecotourism.17

Natural capital accounting identifies and records consistent and comparable information on natural capital assets and the services provided to the reporting entity and other users (e.g. society). It includes information on the state (quantity and quality, or extent and condition) of natural capital assets, the flows of natural resources (e.g. minerals or water) and ecosystem services (e.g. biomass provisioning or flood mitigation services) that these assets provide, and associated monetary values (if desired, and where it is feasible to identify such values). For organisations, natural capital accounting can be seen as a logical extension of management and financial accounts, bringing the structure and rigour to natural capital that is already applied to manufactured and financial capital.18

Unlike financial accounting frameworks which are well established and often mandatory natural capital accounting is currently a voluntary and flexible process for organisations. An international standard, the System of EnvironmentalEconomic Accounting (SEEA), exists for natural capital accounting at a national government level (United Nations, 2021, United Nations et al., 2012), but its application at local or organisational scale is still at an early stage (Barker 2019).

Links:

• The Natural Capital Handbook – A practical guide to corporate natural capital accounting, assessment, risk assessment and reporting 2023 (CSIRO)

17 What is natural capital (World Forum on Natural Capital)

18 The Natural Capital Handbook (CSIRO)

30. How can I start understanding and talking about nature?

The TNFD, in the Getting started with adoption of the TNFD recommendations publication outlined key steps to consider when getting started with nature-related assessment and disclosure include:

- Deepening an understanding of the fundamentals of nature;

- Making the business case for nature and buy-in from the board and management;

- Starting with what you have and leveraging other work;

- Planning for progression over time and communicating plans and approach;

- Encouraging collective progress through engagement;

- Monitoring and evaluating your own adoption progress

Business for Nature has outlined high-level business actions which businesses can take to assess, commit, transform and disclose nature related activities and information.

1. Assess – measure, value and prioritise your impacts and dependencies on nature to ensure you are acting on the most material ones.

2. Commit – set transparent, time bound, specific, science-based targets to put your company on the right track towards operating within the Earth’s limits.

3. Transform - Contribute to systems transformation by avoiding and reducing negative impacts, restoring, and regenerating, collaboration across land, seascapes and river basins, shifting business strategy and models, advocating for policy ambition and embedding your strategy within your corporate governance.

4. Disclose - Publicly report material nature-related information throughout your journey.

Source: Business for nature, high level business actions on nature

For more information:

• Business for nature, high level business actions on nature

• Getting started with adoption of the TNFD recommendations

31. Resources

• Business Statement for mandatory assessment and disclosure FAQ (businessfornature.org)

• Global risks table turning green and recent updates from the Taskforce on Nature-related Financial Disclosures (TNFD) (CA ANZ)

• Taskforce on Nature-related Financial Disclosures Pilots - Australian Case Study Report (DCCEEW)

• Protocol Training Resources – The Capitals Coalition (capitalscoalition.org)

• Unboxing nature-related risks (UN Environment Programme (finance Initiative))

• Nature (Accounting for Sustainability)

• WBCSD’s TNFD pilot - World Business Council for Sustainable Development (WBCSD)

• Assessing nature-related risks and opportunities: case studies from Global Canopy’s 2023 TNFD piloting programme (TNFD)

• When the bee stings: counting the cost of nature-related risks (TNFD)

• Forico illustrative example of integrated TNFD and TCFD disclosures (TNFD)

This Guide has been prepared for use by members of Chartered Accountants Australia and New Zealand (CA ANZ) in Australia and New Zealand and members of Governance Institute of Australia (Governance Institute). It is not intended for use by any person who is not a CA ANZ or Governance Institute member and/or does not have appropriate expertise in the Guide's subject matter.

This Guide is intended to provide general information and is not intended to provide or substitute legal or professional advice on a specific matter. This publication has been prepared so that it is current as at the date of writing. You should be aware that such information can rapidly become out of date and thatlaws, practices and regulations may have changed since publication of this Guide. You should make your own inquiries as to the currency of relevant laws, practices and regulations.

No warranty is given as to the correctness of the information contained in this Guide, or of its suitability for use by you. To the fullest extent permitted by law, CA ANZ and Governance Institute are not liable for any statement or opinion, or for any error or omission contained in this Guide and disclaim all warranties with regard to the information contained in it, including, without limitation, all implied warranties of merchantability and fitness for a particular purpose. CA ANZ and Governance Institute are not liable for any direct, indirect, special or consequential losses or damages of any kind, or loss of profit, loss or corruption of data, business interruption or indirect costs, arising out of or in connection with the use of this publication or the information contained in it, whether such loss or damage arises in contract, negligence, tort, under statute, or otherwise.

© 2024 Chartered Accountants Australia and New Zealand ABN 50 084 642 571 and Governance Institute of Australia Ltd ABN 49 008 615 950.

This document is protected by copyright. Other than for the purposes of and in accordance with the Copyright Act 1968 (Cth) this document may only be reproduced for internal business purposes and may not otherwise be reproduced, adapted, published, stored in a retrieval system or communicated in whole or in part by any means without express prior written permission.