A beginner’s guide to purpose driven ESG

ESG (Environmental, Social and Governance) is an internal and external framework used by investors and stakeholders to assess a company's risks and performance considering three key areas: environmental, social, and governance practices1

ESG addresses the risks and identifies the opportunities to create positive long-term value.

An ESG framework helps identify, organise, analyse, prioritise and accordingly guide decisions on various business risks. These risks, if left unaddressed can prove costly to the functioning and long term viability of businesses2

Environment Evaluates a company's impact on the environment, including climate change, resource depletion, pollution, and waste management practice

Social Focuses on a company's relationships with its people and society, including labour practices, diversity and inclusion, community engagement, human rights, and product safety.

Governance Encompasses the system by which an organisation is controlled and operates, and the mechanisms by which it, and its people, are held to account. Ethics, risk management, compliance and administration are all elements of governance. It assesses the effectiveness of a company's leadership, board structure, risk management practices, ethical conduct, and transparency.

Identifying the significance of ESG on the business, investor and stakeholder environment

ESG has become an increasingly necessary practice for business requiring them to be transparent with stakeholders. Investors are looking beyond the financial bottom line and want to understand how companies are managing their impacts on the environment, their employees and society. Companies are no longer considered standalone entities driven by a profit incentive, but rather as an integral part of society and economies that have far-reaching impacts on people and natural environments1

Investors are looking beyond the financial bottom line and want to understand how companies are managing their impacts on the environment, their employees and society.

What is driving the growth of ESG?

A major part of ESG growth has been driven by environmental concerns and responses to climate change. However, ways for companies to address social issues have also gained prominence2. Companies with a multi-dimensional environmental and social governance mindset are able to effectively address risks in a variety of ways:

Increased investor pressure: research indicates that companies with strong ESG performance often yield better long-term financial returns. More investors are integrating ESG criteria into their decisionmaking processes.

Regulatory change: local and international governments are enforcing regulations to protect natural environments, labour practices and increase the transparency of corporate decision-making. Noncompliance with these regulations poses legal risks and may negatively affect a company’s reputation and undermine stakeholder trust and their social licence to operate3

1 Effective ESG: Purpose, stewardship and employee buy in

2 Does ESG really matter and why

3 ASIC Annual Report 2022-23

4 Harvard Business Review, 2022

Stakeholder influence: customers, employees and social groups are exerting greater pressure on companies to uphold higher ESG standards. Employees are seeking to work for organisations aligned with their values, whilst customers are increasingly basing their purchasing decisions on a company’s ethical and environmental practices4

Climate change: there is a growing recognition of climate-related risks and an urgent need to address climate change. The international community is recognising the crucial role of company practices and culture in driving this change.

Enhanced risk management: ESG initiatives can mitigate potential risks associated with environmental issues, social issues and poor governance practices.

Developing awareness and effectively communicating the key benefits of ESG to business leaders

An ESG framework can enhance risk management, improve strategic decision-making, attract investors and talent, and build trust with stakeholders.

Benefit Description

ESG can improve a company’s reputation.

ESG helps companies identify and manage risks.

ESG can open new opportunities.

A focus on ESG helps nurture a positive company culture.

Stronger ESG performance can bring several benefits including:

Improved strategic decisionmaking

Enhanced risk management and regulatory compliance

Effective communication and alignment of corporate strategy

Strengthening investor confidence and access to capital

Building legitimacy and a social licence to operate

Long-term strategy for success

Avoid greenwashing and greenhushing

1 Reputations at state - William Harvery.

Businesses gain a “licence to operate” more easily1. This means they face fewer hurdles in achieving their goals and can navigate crises with stakeholders more effectively

From environmental regulations to employee relations, a proactive ESG approach can mitigate potential problems before they arise. By anticipating and addressing these risks, organisations can avoid costly fines, reputational damage and legal consequences.

As markets and society change, companies that address ESG issues can discover new markets, develop innovative products, and forge valuable partnerships.

Employees who feel their employer is purpose-driven and cares about sustainability are more likely to be engaged and productive2. Attracting and retaining top talent is essential for companies to maintain a competitive edge in today’s dynamic business landscape. Millennials and Gen Z employees prioritise working for companies that demonstrate strong social and environmental values3

ESG has moved from the periphery to become central to strategic planning. A holistic approach to corporate decision making considers not only financial returns but also the environmental and social impact of business operations.

robust ESG frameworks fosters a proactive approach to identifying and mitigating potential environmental, social and ethical risks. This has the benefit of improving risk management of issues like climate change, labour disputes and cyber breaches.

clear ESG goals and performance metrics established by the Board and communicated effectively create a framework for decision-making and hold management accountable for achieving ESG objectives.

organisations with strong ESG track records benefit from lower borrowing costs and access to new sources of capital, particularly from the growing pool of ESG-focused investors.

Robust ESG frameworks have a significant impact on building trust and legitimacy with various stakeholders, including local communities, NGOs and the general public. Trust is referred to a social licence to operate (SLO) which is essential for companies’ the long-term success and sustainability.

ESG is not just a compliance issue. It is about delivering better value to customers, the environment and society as a whole.

with rising concerns about greenwashing (misleading sustainability claims) and greenhushing (deliberately reducing transparency), accurate and comprehensive reporting is essential for maintaining credibility and avoiding legal or reputational risks.

2 Reputation management in the era of ESG.

3 2017 Cone Communications CSR Study

4.1 Start with mandatory regulatory disclosure and reporting obligations

Australia has introduced mandatory reporting obligations for modern slavery and more recently on climate-related financial risks.

Modern Slavery reporting framework

Modern Slavery definition.

Modern slavery is used to describe situations where coercion, threats or deception are used to exploit victims and undermine or deprive them of their freedom and is only used to describe serious exploitation.

Freedom from slavery is a fundamental human right found under the UN Guiding Principles on Business and Human Rights and entities have a responsibility to respect human rights in their operations and supply chains. This responsibility includes taking action to prevent, mitigate and where appropriate, remedy modern slavery in an entity’s operations and supply chains.

Does my entity need to comply with the Modern Slavery Act?

The Commonwealth Modern Slavery Act 2018 (the Act) established Australia’s national Modern Slavery Reporting Requirement and was the first national legislation in the world to define modern slavery.

Under the reporting requirement, certain entities must publish annual Modern Slavery Statements (statements) describing their actions to assess and address modern slavery risks. The reporting requirement applies to commercial and not for profit entities with annual consolidated revenue of at least AU$100 million.

The Act applies to over 3,000 entities in the Australian market, including commercial and not-for-profit entities. An entity will need to comply with the Act if the entity has annual

consolidated revenue of at least AU$100m and is either an Australian entity or a foreign entity carrying on business in Australia. Entities that do not meet these requirements can choose to voluntarily comply with the Act.

Further guidance on Modern Slavery reporting can be accessed here

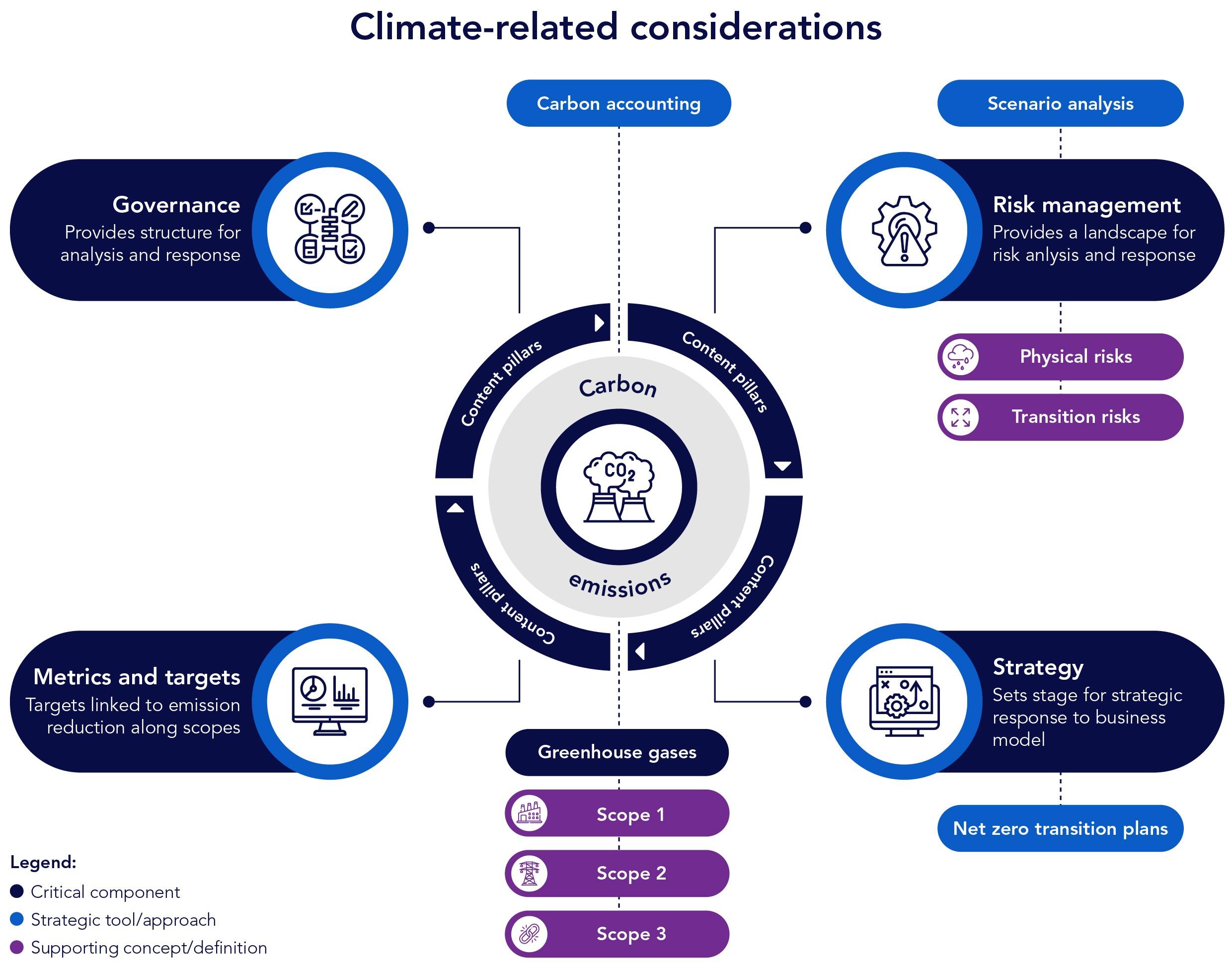

Climate-related reporting

Australia has introduced mandatory climate-related financial reporting. The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill (Cth) introduced a framework for Australia’s first climate-related financial disclosure regime.

The Australian Accounting Standards Board (AASB) has introduced Australian Sustainability Reporting Standards. AASB S1 General Requirements for Disclosure of Sustainability-related Financial Information will now be a voluntary standard whereas AASB S2 Climate-related Disclosures will be mandatory.

Reporting will commence on 1 January 2025 for Group 1 entities, with subsequent phases for Group 2 and Group 3 entities in the following years1. Qualifying business entities will need to disclose comprehensive climate-related financial information, including scenario analysis for Paris-aligned climate targets of 1.5°C warming scenario and a scenario where warming “well exceeds” 2°C. The disclosures are required to cover Scope 1,2 and 3 emissions to provide a complete picture of the company’s climate impact and resilience. ASIC has established a dedicated sustainability reporting page to provide information about the new regime and how ASIC will administer it.

As part of these obligations, directors are now expected to make a Qualified Directors' Declaration for the first three years, affirming that "reasonable steps" were taken to comply with the Corporations Act 2001 and associated AASB S2.

The Auditing and Assurance Standards Board (AUASB) will release related assurance standards that will complete Australia’s mandatory climate disclosure framework. 1

Publicly listed companies are guided by the ASX Corporate Governance Principles and Recommendations that encourage good corporate governance practices, including disclosing whether it has any “material exposure to environmental or social risks” and, if it does, how it manages or intends to manage those risks. If a board of a listed entity considers that Council recommendations are not appropriate for their circumstances, they must explain why they have not adopted the recommendation – if not, why not.

Focus on recommendations that consider:

• Integrity of corporate reporting released to the market. Where a corporate report, including a sustainability reports, is not subject to reasonable assurance or limited assurance by an external auditor, it is important that investors understand the process by which the entity has satisfied itself that the report is materially accurate, balanced and provides investors with appropriate information to make informed investment decisions.

• Risk management frameworks and risk appetites as they relate to sustainability and climate change The board or a committee of the board should review the entity’s risk management framework at least annually to satisfy itself that it continues to be sound and that the entity is operating with due regard to the risk appetite set by the board and disclose, in relation to each reporting period, whether such a review has taken place.

• Material exposure to environmental and social risks and sustainability reports Entities that report in accordance with a recognised standards, may meet this recommendation simply by crossreferencing to that report.

The 5th edition of the Corporate Governance Principles and Recommendations is currently in preparation and is likely to be released in 2025. To keep up-to-date with regulatory changes to the ASX Corporate Governance Principles and Recommendations click here.

The ISSB is an independent body that develops and approves the IFRS Sustainability Disclosure Standards. ISSB Standards enhance investor-company dialogue. They are designed to be decision-useful as they are globally comparable sustainabilityrelated disclosures that are assurable to meet the information needs of investors. They are also designed to enable companies to communicate to investors globally comparable, comprehensive information about sustainability-related risks and opportunities.

The International Financial Reporting Standards (IFRS) S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related disclosures were developed following the Taskforce of Climate-related Financial Disclosures (TCFD) recommendations that provide a roadmap to understand, manage and disclose climate risks across four key areas for climate-related financial disclosures.

To effectively oversee climate risk, boards can take several steps including:

• Education about climate change risks and their impacts on the organisation

• Regular reviews of the company’s climate risk management strategies and progress towards sustainability goals

• Engagement with management in developing and implementing a comprehensive climate action plan

What is IFRS S1?1

IFRS S1 asks for disclosures of material information about sustainability-related risks and opportunities with the financial statements, to meet investor information needs. It applies the TCFD architecture whenever providing information about sustainability and requires industry-specific disclosures and can be used in conjunction with any accounting requirements (GAPP)2 [1] The objective of S1 is to require information about all sustainability-related risks and opportunities that could reasonably be expected to affect the company’s prospects including its cash flows, access for finance or cost of capital over the short, medium or long term.

IFRS S1 requires an entity to disclose information about its sustainability-related risks and opportunities that is useful to users of general-purpose financial reports in making decisions relating to providing resources to the entity.

1 CPA Australia: Sustainability Reporting - IFRS S1 and S2

2 IFRS - ISSB: Frequently Asked Questions

Considerations for the entities include.

• How companies identify material sustainability information. Information is material if omitting, misstating or obscuring it could reasonably be expected to influence investor decisions.

• Information that enables understanding of the connections between sustainability-related risks and opportunities, disclosures on core content and sustainability-related financial disclosures and financial statements.

• Applies four pillars over core content areas including governance processes, controls and procedures a company uses to monitor, manage and oversee sustainability related risks and opportunities, a company’s strategy for managing sustainability-related risks and opportunities, the process a company uses to identify, assess, prioritise and monitor sustainability-related risks and opportunities and a company’s performance in relation to sustainability-related risks and opportunities using metrics and targets

• To identify relevant risks and opportunities, a company can use the ISSB Standards and consider the SASB Standards and may also consider Climate Disclosure Standards Board Framework Application Guidance, industry practice and materials of investor-focused standard setters, Global Reporting Initiative (GRI) standards and European Sustainability Reporting Standards (ESRS)

What is IFRS S2?

IFRS S2 requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long-term, that could reasonably be expected to affect the entity’s prospects.

It has been developed to capture climate-specific requirements which include strategy disclosures that distinguish between physical and transitional risks Disclosure of plans to respond to climate-related risks and opportunities, including how climate-related targets are set and any targets it is required to meet by law or regulation

Companies should perform scenario analysis to explain how various climate-related events may impact the business in the future. Climate-related metrics and target disclosures should include cross-industry metrics that are relevant to all companies such as GHG emissions, industry-based metrics relevant to companies within the related industries and company specific metrics considered by the board or management when measuring progress towards set targets

An increasing focus on biodiversity preservation and restoration.

The Taskforce on Nature-related Financial Disclosures (TNFD) provides a framework for companies to assess and disclosure nature-related risks and opportunities. Similar to the TCFD, it helps companies understand and manage nature related risks but with a specific focus on nature and biodiversity. It is a global initiative that has developed a framework for assessing and disclosing the financial impacts of nature-related risks and opportunities.

It is aimed at assisting companies to report and act on evolving nature-related issues and supporting a shift in global financial flows towards nature-positive outcomes. The TNFD was established to encourage and facilitate companies and financial institutions through enterprise and portfolio risk management and mainstream corporate reporting to recognise nature-risk and dependencies. The resulting set of recommendations and additional guidance aims to help organisations with the identification, assessment, management and disclosure of their material nature-related issues.

The four core areas for nature-related financial disclosures

• Governance: disclose the company’s governance of nature-related dependencies, impacts, risks and opportunities.

• Strategy: disclose the effects of nature-related dependencies, impacts, risks and opportunities on the organisation’s business model, strategy and financial planning where such information is material.

• Risk Management: describe the processes used by the company to identify, assess, prioritise and monitor nature-related dependencies, impacts, risks and opportunities.

• Metrics and Targets: disclose the metrics and targets used to assess and manage material nature-related dependencies, impacts, risks and opportunities.

The recommendations have been designed to be consistent with the language, structure and approach of both the TCFD and the ISSB Standards. The TNFD is also aligned with global policy goals and targets and the Global Biodiversity Framework (GBF), including Target 15 on corporate reporting of nature-related risks, dependencies and impacts. It also leverages the best available science, including assessments of IPBES and the climate science from the IPCC.

Nature-related impacts are caused, or contributed to, by an company’s exploitation, use or dependency on natural resources. Metrics embedded into the TNFD approach measure both negative and positive impacts on nature. Every

business, in every sector around the world, whatever its size is dependent to some extent on nature and its services.

The GRI helps organisations be transparent and take responsibility for their impacts on people and the environment. The GRI Standards are a modular system of interconnected standards. They allow organisations to publicly report the impacts of their activities in a structured way that is transparent to stakeholders and other interested parties. Standards can be used to report on an organisation’s impacts in a credible way that is comparable over time and in relation to other organisations and helps stakeholders and other information users understand what is expected from an organisation to report on and use the information published by organisations in various ways.

The GRI Standards contain disclosures, which provide a structured means for an organisation to report information about itself and its impacts. The GRI Universal Standards apply to all organisations and consist of the following:

• GRI 1: Foundation 2021 – outlines the purpose of the GRI Standards, clarifies critical concepts and explains how to use the Standards. It lists the requirements that an company must comply with to report in accordance with the GRI Standards. It also specifies the principles – such as accuracy, balance and verifiability

• GR2: General Disclosures 2021 – contains disclosures relating to details about a company’s structure and reporting practices; activities and workers; governance; strategy; policies; practices; and stakeholder engagement. These give insight into the company’s profile and scale, and help in providing a context for understanding a company’s impacts.

• GR3: Material Topics 2021 – explains the steps by which a company can determine the topics most relevant to its impacts, its material topics, and describes how the Sector Standards are used in the process. It also contains disclosures for reporting its list of material topics; the process by which the company has determined its material topics; and how it manages each topic.

The GRI Sector Standards intend to increase the quality, completeness, and consistency of reporting by companies. Each Sector Standard consists of an initial section that gives an overview of the sector’s characteristics, including the activities and business relationships that can underpin its impacts. The main section of the Standard then lists the likely material topics for the sector. Topic by topic, the most significant impacts associated with the sector are described in this section.

The GRI Topic Standards contain disclosures for providing information on topics. Examples include Standards on waste, occupational health and safety and tax. Each Standard incorporates an overview of the topic and disclosures specific to the topic and how an organisation manages its associated impacts. An organisation selects those Topic Standards that correspond to the material topics it has determined and uses them for reporting.

How does GRI align with Australian regulations, particularly in relation to non-financial disclosures? The AASB has indicated that the AASB S1 and S2 will allow companies to use the GRI standards to report on broader sustainability impacts, ensuring that companies meet stakeholder expectations for transparency on issues such as human rights, labour practices, and environmental impact (Australian Accounting Standards Board, 2024).

A critical alignment between GRI and AASB S2 is the focus on Scope 3 emissions. GRI places significant emphasis on Scope 3 disclosures, which cover emissions across the value chain, including those from suppliers, product use, and downstream activities. The Australian regulatory framework, through the ASRS, also mandates the disclosure of Scope 1, 2, and 3 emissions, ensuring that companies provide a full account of their carbon footprint (PwC, 2024). This alignment not only supports global consistency but also ensures that Australian companies remain accountable for their entire environmental impact, from production to product disposal.

While the GRI Framework is integrated into Australia’s regulatory requirements, the ASRS takes a more prescriptive approach to the disclosure of material sustainability impacts. The GRI provides flexibility, allowing companies to choose which sustainability issues to disclose based on materiality, whereas the ASRS sets stricter guidelines, ensuring that certain ESG risks, such as climate change and human rights, are always addressed in sustainability reports.

Source: Homepage | UN Global Compact

How does this relate to business?

Responsible business and investment is essential to achieving transformational change through the SDGs. Further information on how companies can advance each of the SDGs is available here.

The 'Ten Principles' of the UN Global Compact are built on a value system for corporate sustainability that guides businesses to operate in ways that meet fundamental responsibilities in the areas of human rights, labour, environment and anti-corruption.

The Ten Principles of the United Nations Global Compact are derived from the Universal Declaration of Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development, and the United Nations Convention Against Corruption

Human Rights

• Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights

• Principle 2: Business should make sure that they are not complicit in human rights abuses.

Labour

• Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining

• Principle 4: Businesses should uphold the elimination of all forms of forced and compulsory labour

• Principle 5: Business should uphold the effective abolition of child labour

• Principle 6: Businesses should uphold the elimination of discrimination in respect of employment and occupation.

Environment

• Principle 7: Businesses should support a precautionary approach to environmental challenges

• Principle 8: Business should undertake initiatives to promote greater environmental responsibility

• Principle 9: Businesses should encourage the development and diffusion of environmentally friendly technologies.

Anti-Corruption

• Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery.

Sustainability Accounting Standards Board

SASB is a US-based independent standard setting board that has developed globally applicable standards for 77 different industries across the three pillars of ESG. These standards provide guidance on how organisations can align their reporting with investor needs and how companies gather standardised data.

SASB Standards enable organisations to provide industrybased disclosures about sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, access to finance or cost of capital over the short, medium or long term. SASB Standards aim to identify the sustainability-related issues most relevant to investor decision-making in 77 industries and were developed using a rigorous and transparent standard-setting process that included evidence-based research, broad and balanced participation from companies, investors and subject-matter experts, and oversight and approval from the independent SASB Standards Board

As of August 2022, the International Sustainability Standards Board (ISSB) of the IFRS Foundation assumed responsibility for the SASB Standards. The ISSB has committed to maintain, enhance and evolve the SASB Standards and encourages preparers and investors to continue to use the SASB Standards.

The Value Reporting Foundation (VRF), which resulted from the merger of the Sustainability Accounting Standards Board (SASB) and the International Integrated Reporting Council (IIRC), focuses on linking sustainability disclosures to enterprise value. The VRF’s approach is centred around integrated reporting, which combines financial and nonfinancial disclosures into a single, cohesive report. The objective is to show how sustainability risks and opportunities affect a company’s ability to create long-term value (VRF, 2023).

How has VRF influenced Australian standards?

The VRF encourages companies to assess which sustainability issues are most relevant to their business model and stakeholders, ensuring that disclosures focus on material risks and opportunities. This approach aligns with the ASRS’s requirement for companies to disclose how they identify, assess, and manage climate-related risks, ensuring that sustainability is integrated into risk management and governance processes (Dentons, 2024). While the VRF’s integrated reporting model provides a useful framework for linking sustainability to enterprise value, the ASRS takes a more granular approach by specifying the types of sustainability risks that must be disclosed. This ensures that companies do not overlook critical risks, such as climate change, even if those risks do not have an immediate financial impact.

Other disclosure regimes to be aware of EU Corporate Sustainability Reporting Directive (CSRD) EU law requires all large companies and all listed companies (except listed micro enterprises) to disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.

On 5 January 2023, the Corporate Sustainability Reporting Directive (CSRD) came into force. It modernises and strengthens EU rules concerning the social and environmental information that companies must report. Some nonEU companies will also have to report if they generate over EUR 150 million on the EU market. The first companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025. Companies subject to the CSRD will have to report according to the European Sustainability Reporting Standards (ESRS).

As required by the Accounting Directive, as amended by the CSRD, the ESRS take a “double materiality” approach – that is to say, they oblige companies to report both on their impacts on people and the environment, and on how social and environmental issues create financial risks and opportunities for the company. There are 12 ESRS, covering the full range of sustainability issues, including in such areas as climate, pollution, biodiversity and ecosystems, resource use and circular economy, workers in the value chain, affected communities, consumers and end users.

Aotearoa New Zealand Climate Standards (NZ CS)

• NZ CS1 Climate-related disclosures: The objective of this Standard is to enable primary users to assess the merits of how entities are considering climate-related risks and opportunities, and then make decisions based on those assessments.

• NZ CS2 Adoption of Aotearoa New Zealand Climate Standards: This Standard provides a limited number of adoption provisions recognising that developing the capability to produce high-quality climate-related disclosures, and that some disclosure requirements, by their nature, may require an exemption.

• NZ CS3 General requirements for climate-related disclosures: The objective of this Standard is to establish principles and general requirements to enable the provision of high-quality climate-related disclosures.

On 12 April 2024, the Shanghai Stock Exchange (SSE), the Shenzhen Stock Exchange (SZSE) and the Beijing Stock Exchange (BSE) respectively announced the issue of Self-Regulatory Guidelines - Sustainability Report (Trial) (“Guidelines”), which became effective on 1 May 2024. The Guidelines require companies to disclose sustainabilityrelated information in reports covering various topics, including climate change, pollution control and ecosystem protection, circular economy practices, and rural revitalisation

and contribution to China’s national development strategy, among others1

The disclosure requirements vary depending on the stock exchange. Currently, mandatory ESG disclosure is required for the following companies:

• SSE: SSE 180 Index companies, Kechuang 50 Index companies, and companies dual-listed in Shanghai and overseas.

• SZSE: Shenzhen 100 Index companies, ChiNext Index companies, and companies dual-listed in Shanghai and overseas.

For companies which are required to carry out mandatory disclosure, the first disclosure must be made no later than 30 April 2026 (for the year 2025). For BSE listed companies, all companies are encouraged to make voluntary disclosure.

Under the current framework, listed companies in Hong Kong are subject to the ESG Reporting Guide, which comprises two levels of disclosure obligations:

Mandatory disclosure requirements

This comprises a statement from the board which contains the following elements:

• a disclosure of the board’s oversight of ESG issues,

• the board’s ESG management approach and strategy, including the process used to evaluate, prioritise, and manage material ESG-related issues (including risks to the issuer’s businesses); and

• how the board reviews progress made against ESG-related goals and targets with an explanation of how they relate to the issuer’s businesses.

“Comply or explain” provisions

These provisions extend to (but are not limited to) an issuer’s emissions, use of resources, the environment and natural resources, climate change, employment, health and safety, labour standards, supply chain management, etc. If an issuer does not report on any of these aspects, it must provide considered reasons for the omission in its ESG report1

On 19 April 2024, HKEX published its consultation conclusions for introducing new climate-related disclosure requirements for listed companies in Hong Kong (HKEX New Requirements). These new disclosure requirements are largely in line with the IFRS S2 climate-related disclosures and are expected to serve as a significant milestone for requiring listed companies in Hong Kong to comply with renowned international reporting standards.

These new disclosure requirements include four distinct elements:

• Governance: Issuers will need to disclose the management’s role in the governance process, and specific individual(s) or body(ies) that are responsible for the oversight of climate-related risks and opportunities.

• Strategy: Issuers will need to identify and disclose material climate-related risks and opportunities, analysing their short, medium, and long-term impact on its core business.

• Risk Management: Issuers will need to disclose their internal risk management processes applicable to identifying, assessing, monitoring, and managing climate related risks and opportunities.

• Metrics and Target: Issuers will need to disclose key climate metrics and KPIs, including direct emissions (scope 1), emissions associated with purchased electricity (scope 2), and for some, emissions from a company’s value chain (scope 3)1

The Securities and Exchange Board in India (SEBI) developed the Business Responsibility and Sustainability Reporting (BRSR) to mandate Indian companies to provide quantifiable metrics on sustainability-related factors, such as respect for human rights or environmental protection2

The foundation for India’s ESG regulatory framework was laid with the introduction of Business Responsibility Reporting (BRR) guidelines in 2009. The new BRSR, in effect since 2023, is more closely aligned with globally accepted reporting frameworks like the GRI and TCFD. It requires the top 1,000 listed companies in India to respond to 140 questions, divided into 98 essential indicators (mandatory) and 42 leadership indicators (voluntary)2,3

The disclosure requirements are grouped into nine core categories, based on the principles of the National Guidelines for Responsible Business Conduct introduced by SEBI:

1. Environmental protection: Key performance indicators cover electricity consumption, water usage and air emissions.

2. Human rights: Focus on human rights violations and minimum and fair wages.

3. Integrity: Performance indicators include anti-corruption, anti-bribery and conflicts of interest policies.

4. Employee well-being: Metrics focused on parental benefits, employee accessibility and the percentage of unionized workers.

5. Inclusive growth: Policies favouring vulnerable and marginalized groups.

6. Sustainable goods and services: Information on investments in social and environmental impacts.

7. Responsible consumer engagement: KPIs encompass handling consumer complaints and feedback, product recall procedures and cybersecurity and data privacy policies. 1

8. Stakeholder responsiveness: Describing engagement with vulnerable and marginalized groups.

9. Responsible public policy engagement: Listing trade and industry affiliations and detailing issues relating to anticompetitive conduct1

On March 6, 2024, the SEC issued a final rule that requires registrants to provide climate-related disclosures in their annual reports and registration statements, including those for IPOs, beginning with annual reports for the year ending December 31, 2025, for calendar-year-end large accelerated filers. Registrants must provide information about:

1. Specified financial statement effects of severe weather events and other natural conditions

2. Certain carbon offsets and renewable energy certificates (RECs) AND,

3. Material impacts on financial estimates and assumptions as a result of severe weather events and other natural conditions or disclosed climate-related targets or transitions plans. Note that these disclosures will be subject to existing audit requirements for financial statements.

The Final rule can be accessed here

5.1 Developing a purpose-driven ESG framework that is verifiable and draws on quality data.

1. Conduct a materiality assessment

A materiality assessment is a critical step in designing an effective sustainability report. It ensures that the report focuses on the issues that matter most to both the company and its stakeholders. Materiality assessments help companies prioritise their ESG efforts, identifying the issues that have the greatest potential to impact business performance and stakeholder decision-making.

ESG materiality assessments involve considerations of the possible financial impact of ESG factors on an company and how its operations affect different groups of stakeholders, not only investors, but also employees, customers, supply chain partners and their workers, community members and others1 Materiality of ESG risks will vary greatly between companies. Companies are expected to report on indicators which are material to their business and strategy. The materiality assessment can act as a blueprint guide for ESG strategies.

Steps to conducting a materiality assessment.

Identify Key ESG Issues: Companies begin by identifying a broad range of ESG issues that could affect their business. These issues may include climate change, biodiversity loss, water management, supply chain sustainability, labour practices, and human rights.

Engage Stakeholders: Companies then engage with a diverse group of stakeholders, including investors, customers, employees, and regulators, to understand their perspectives on which issues are most material. Stakeholder engagement can take the form of surveys, interviews, or workshops, and it provides valuable insights into the sustainability concerns that stakeholders prioritise (GRI, 2024).

Assess Financial and Operational Impact: Once key issues are identified, companies assess the potential financial and operational impacts of each issue. This step involves evaluating how ESG risks could affect revenue, costs, and business continuity, as well as how ESG opportunities could create value. Companies often use scenario analysis, particularly for climaterelated risks, to understand how different futures could impact their business.

Prioritise Material Issues: Finally, companies prioritise the most material issues based on their potential impact on the business and stakeholder concerns. These material issues form the basis of the company’s sustainability reporting and guide its strategic focus.

2. Identify, develop and harness quality qualitative and quantitative data

Data is essential to driving quality reporting, monitoring and assessment of material risks to the organisation. Data is necessary in providing a comprehensive and meaningful picture of the entity’s overall performance and allows stakeholders to track and compare progress over time. Effective data collection and management are at the core of sustainability reporting, particularly for climaterelated disclosures.

Quantitative data typically includes metrics such as GHG emissions, energy consumption, waste generation, water use, and diversity statistics. These data points should be consistent with recognised standards to ensure comparability across companies and industries. Quantitative data should be presented in a clear and accessible manner, using tables, graphs, and charts to help stakeholders visualise performance over time.

Qualitative data provides the narrative that explains why the quantitative data matters. It includes discussions of the company’s sustainability strategy, the rationale behind certain targets, the challenges faced in achieving sustainability goals, and the opportunities that have emerged. This contextual information is crucial for stakeholders to understand the significance of the quantitative data and how it fits into the company’s broader sustainability efforts.

Given the importance of sustainability reporting in decisionmaking and regulatory compliance, ensuring the accuracy of climate-related data is critical. Companies should implement robust data verification and management systems to avoid the risk of greenwashing and maintain stakeholder trust.

Considerations for data verification and management systems.

• External Assurance. External assurance plays a key role in enhancing the trust and confidence that stakeholders (including investors, regulators, and consumers on sustainabilitv information). Independent external auditors examine a company's sustainability data and provide an assurance report to ensure compliance with standards and accuracy in reporting. This practice not only enhances transparency but also ensures compliance with global standards.

• Data Management Systems. Companies should consider investment in robust data management systems that integrate all aspects of emissions tracking, from Scope 1 to Scope 3. These systems allow for real-time data collection, reduce human error, and provide a centralised platform for storing and reporting sustainability data. Large Carbon accounting software is widely used by large companies to automate the collection and analysis of emissions data, ensuring consistency and accuracy.

• Internal Controls and Training. Effective data management requires strong internal controls and staff training. Companies should establish clear protocols for collecting, verifying, and reporting data. Employees responsible for sustainability reporting must be trained in best practices for data collection and management, ensuring that they understand the importance of accuracy and are equipped to handle the complexities of Scope 3 emissions tracking.

3. Engage employees and the Board through committees and corporate governance structures1

Engaging with the operational branches of a company, relevant committees and the board is critical to informing and capturing the entity’s ESG framework. Audit, risk and sustainability committees can help drive relevant information through to decision-makers and the Board.

The role of committees.

• Sustainability Committees: These committees are responsible for providing oversight on all sustainability-related matters, including climate risks, human rights, and community engagement. In some cases, boards assign sustainability oversight to existing committees, such as the Risk Committee, to ensure that sustainability risks are managed alongside financial risks. These committees play a crucial role in ensuring that sustainability is embedded in decisionmaking processes and that the company remains accountable to stakeholders (KPMG, 2024).

• Audit Committees: Traditionally responsible for ensuring the accuracy of financial reporting, many audit committees are now also responsible for ensuring that sustainability data is credible and verifiable. This includes overseeing the disclosure of greenhouse gas (GHG) emissions (Scope 1, 2, and 3), ensuring that sustainability reports align with global frameworks and working with external auditors to provide assurance on sustainability disclosures (PwC, 2024).

• Risk Committees: These committees focus on identifying, assessing, and mitigating risks that could impact the company's long-term performance, including climate-related risks. Physical risks from climate change (e.g., extreme weather events) and transition risks (e.g., regulatory changes, carbon pricing) are increasingly important considerations for risk committees. These committees are also responsible for integrating scenario analysis into the company’s risk management framework, ensuring that the company is prepared for a range of climate futures.

Boards that are actively engaged in sustainability governance are better positioned to drive long-term value creation. This includes ensuring that sustainability goals are integrated into the company’s overall strategy, overseeing the implementation of sustainability initiatives, and holding management accountable for achieving sustainability targets.

4. Consider the organisation’s existing reporting obligations (if any) and synchronise reporting where possible through an integrated reporting framework approach

Synchronising and seeking alignment with risk and organisational mission statements is a useful guidepost of integrating reporting requirements. Integrated reporting can be a key component of effective sustainability governance. This approach combines financial and non-financial information into a single report, providing stakeholders with a holistic view of the company’s performance. Governance

frameworks that support integrated reporting ensure that sustainability risks and opportunities are fully embedded into the company’s overall strategy. Integrated Reporting Framework (IRF), developed by the IIRC, provides a framework for companies to disclose both financial and nonfinancial performance. By using this framework, companies can demonstrate how sustainability is linked to value creation over the short, medium, and long term (IIRC, 2024).

5. Consider a holistic longer-term net zero commitments and transition pathways

A net zero transition pathway articulates a company’s strategic plan and resource allocation in order to reach net zero in the future. Usually, a transition pathway is preceded by a net zero commitment, through which the company commits to reaching net zero at a determined point in the future.

Companies may be required to report their transition plans as part of a jurisdictions regulatory requirements. Transition pathways solidify net zero commitments into a credible plan that will evidence a company’s strategic response to climaterelated risks to its stakeholders. Transition pathways provide a vehicle to consider appropriate resource allocation, thereby aligning ambition with capital.

The Transition Pathway Taskforce was announced at COP26 in Glasgow and launched in April 2022 to establish the gold standard for transition plans. The TPT has engaged globally with financial institutions, real economy corporates, policymakers, regulators and civil society to develop its materials. On 24th June 2024, the IFRS Foundation announced that it will assume responsibility for the disclosurespecific materials developed by the TPT. This decision marks an important milestone in the creation of global norms for transition plan disclosure. The TPT aligns its recommendations for net zero transition plans along three principles: 1) Ambition, 2) Action and 3) Accountability. The recommendations provide a holistic, structured and comprehensive approach to assembling and reporting an organisation's transition pathway.

The TPT Principles.

6. Develop and communicate an ESG Strategy for Board endorsement Boards and executive leadership play a pivotal role in sustainability governance. Effective board oversight ensures that sustainability is treated as a strategic priority rather than a peripheral issue. This oversight includes establishing sustainability goals, monitoring ESG performance, and ensuring compliance with regulatory requirements.

Executive leadership is responsible for operationalising the sustainability strategies approved by the board. This includes ensuring that sustainability objectives are reflected in day-today business operations, reporting processes, and employee engagement. Strong leadership is essential in embedding sustainability into the corporate culture and ensuring that all employees understand their role in advancing ESG goals.

The board’s role extends to creating accountability structures, setting risk management protocols, and ensuring that sustainability initiatives are well integrated into the company’s broader strategic framework. The 2024 climate reporting requirements also expect boards to understand scenario analysis and to incorporate these insights into strategic planning.

The board must be actively engaged in overseeing the company’s climate strategy and sustainability reporting. This involves regularly reviewing climate risks, evaluating the company’s progress toward its sustainability goals, and ensuring that climate-related risks are fully integrated into the company’s overall risk management framework. Board members may need training on emerging climate disclosure standards, such as those set by the ISSB or the GRI, to effectively oversee the company’s compliance efforts.

6. Are existing governance structures fit for purpose? Consider oversight, delegation structures, assigning ownership and action plans. Setting up an ESG Committee to review existing ESG matters can assist with weaving ESG and board oversight of ESG matters into the existing governance structures. An ESG Task Force can leverage individuals already part of committee structures to make best use of resources, understand the issues and identify solutions and opportunities. An external ESG Advisor can also support a lack of expertise on the part of the board and executive management to drive ESG development.

Questions to ask

• Does the company have a dedicated sustainability committee or a team responsible for overseeing sustainability and climate-related risks and disclosures?

• How engaged and knowledgeable is the board in reviewing, understanding and agreeing on sustainability and climate-related risks and opportunities?

• Is there a clear governance structure that integrates sustainability and climate risk into overall risk management?

• Are senior management and executives trained in understanding sustainability and climate risks and reporting obligations?

• Is sustainability-related performance linked to executive compensation or incentives?

• How frequently does the board discuss sustainability and climate related issues?

• What methods will be adopted to identify, monitor and disclose on the relevant ESG issues.

• Are Sustainability targets required and how will they be measured and communicated?

• How does this ESG issue relate to the organisation’s mission, strategy, key pillars, objectives and key risks?

• How do stakeholders, including the individuals and communities served and investors, view the importance of the organisation’s ESG framework? How does it affect them?

7. Measure progress and include positive-feedback loops from internal and external stakeholders to inform and track progress

Alignment with the organisations overall vision and purpose statement

A clear and meaningful purpose statement is one of the most powerful tools in bringing an ESG vision to life. Studies have shown that employees who work towards a clear organisational purpose that align with their personal values are more likely to be satisfied and engaged with their roles1. This drives employee retention, performance and productivity but also has the benefit of retaining consumer loyalty as well as attracting new customers and investors.

The communication of sustainability goals can assist in demonstrating that the organisation is prioritising environmental and social responsibility through a long-term vision and commitment to stakeholders, as well as an ability to manage risks. It may also be used to manage different expectations of stakeholders and assist in capturing the materiality of some of the environmental and social issues the organisation is dealing with.

Measuring progress leveraging rating agency criteria

International rating agencies provide useful guidance on how to measure against ESG goals. Below is a list of global ESG ratings agencies.

Commonly reported ESG Risk Rating agencies.

• Sustainalytics - provides a multi-dimensional assessment of a company's exposure to industryspecific material ESG risks and its management of those risks. Its methodology categorises risks into five severity levels, offering an absolute measure of risk.

• MSCI - ESG Metrics is designed to deliver a broad set of standardized ESG data and simple metrics that are comparable across a broad universe of 8,500 companies (the MSCI ACWI Investable Market Index (IMI)). Developed initially as inputs into the MSCI ESG Ratings model, these datasets can be used by institutional investors as inputs for in-house analytical models or to develop proprietary investment strategies.

• S&P Global - ESG Score measures a company’s performance on and management of material ESG risks, opportunities, and impacts informed by a combination of company disclosures, media and stakeholder analysis, modelling approaches, and in-depth company engagement via the S&P Global Corporate Sustainability Assessment (CSA). The S&P Global ESG Score uses a double materiality approach whereby a sustainability issue is considered to be material if it presents a significant impact on society or the environment and a significant impact on a company’s value drivers, competitive position, and long-term shareholder value creation.

External assurance play a crucial role in providing an independent evaluation of a company's sustainability reports, significantly boosting the credibility of the information presented. By demonstrating a commitment to transparency and accountability through external assurance, organisations can foster better communication with stakeholders. Stakeholders, including investors, regulators, and the public, are increasingly relying on sustainability reports to make informed decisions, and therefore, these reports must be subject to rigorous review. External assurance and internal audits are two primary mechanisms used to validate the integrity of sustainability data.

Australia has proposed a phased introduction of assurance requirements, beginning with limited assurance for governance, Strategy – risks and opportunities and Scope 1 and 2 emissions in the first year of reporting. Limited 1

assurance involves less extensive testing and review, often resulting in a conclusion that nothing has come to the auditor’s attention to indicate material misstatements. Limited assurance is less rigorous and does not provide the same level of scrutiny as a full audit at reasonable assurance.

Reasonable assurance of climate-related disclosures, including Scope 3 emissions, will become mandatory by July 2030. Reasonable assurance entails more comprehensive audit procedures, including detailed testing and evidencegathering, where external auditors provide a positive assurance opinion on the compliance of the company’s disclosures with the Corporations Act and applicable AASB standards. This shift reflects the growing importance of accurate, verifiable climate data in corporate reporting and the need for greater transparency in sustainability disclosures.

As companies transition towards reasonable assurance, it is critical to implement strong data management systems and internal verification processes to ensure compliance. These systems should be designed to track emissions data consistently across all scopes and to streamline the assurance process by enabling accurate, real-time reporting.

External assurance involves engaging an independent, external entity to review and verify a company’s sustainability data. The goal is to ensure that the data is accurate, complete, and compliant with reporting standards. Assurance provides credibility to the report, builds trust with stakeholders, and helps companies manage risks associated with greenwashing or data misrepresentation.

Assurance standards

• International Standard on Sustainability Assurance ISSA 5000: is a newly established global standard developed by the International Auditing and Assurance Standards Board (IAASB). The IAASB is set to issue the ISSA 5000 in December 2024 with implementation support materials available in January 2025. ISSA 5000 will be replacing the ISAE 3000 as a dedicated framework for sustainability assurance. Australia is set to adopt ISSA 5000 as a foundational framework for sustainability assurance engagements in Australia going forward.

• International Standard on Assurance Engagements (ISAE) 3000: This standard, was issued by the International Auditing and Assurance Standards Board (IAASB) over a decade ago, is widely used for non-financial assurance engagements, including sustainability reporting. It provides a framework for auditors to evaluate the reliability of non-financial information, such as greenhouse gas (GHG) emissions or water usage data. Although ISSA 5000 will provide a dedicated framework for sustainability assurance, ISAE 3000 remains applicable for other types of assurance engagements that do not fall under the specific categories addressed by newer standards such as ISSA 5000.

• AccountAbility’s AA1000AS: This is another widely used assurance standard that focuses on the principles of inclusivity, materiality, and responsiveness in sustainability reporting. It is designed to help ensure that the report addresses the concerns of all stakeholders and that material issues are appropriately disclosed. In Australia, AccountAbility’s AA1000 may still hold value as a complementary standard focused on stakeholder engagement and broader sustainability principles. However, it will depend on how organizations choose to navigate their reporting and assurance strategies amidst evolving regulatory landscapes and stakeholder expectations.

Internal audits provide several benefits to companies engaged in sustainability reporting:

• Continuous Improvement: Internal audits help companies identify areas where their sustainability reporting processes can be improved, ensuring continuous improvement in data accuracy and reliability.

• Risk Management: By regularly auditing sustainability data, companies can identify and mitigate risks related to misreporting or non-compliance with regulations, reducing the likelihood of financial penalties or legal action.

• Prepares for External Assurance: Internal audits help companies prepare for external assurance by identifying potential gaps or weaknesses in their reporting framework. This proactive approach ensures that the company is wellprepared for external verification and can address any issues before they are identified by an external auditor.

9. Maintain awareness of the regulatory, legal and judicial approach to sustainability disclosure and reporting

Awareness of several legal and regulatory compliance requirements is necessary to inform the necessary quality of, and maintenance of data. ASIC has flagged ‘greenwashing’ as part of its ongoing priorities for its compliance and enforcement activities. Some questions to consider include whether:

1. The company has sought third-party verification for its sustainability data, including emissions reporting.

2. Whether the company has an internal audit process for verifying sustainability data before external publication.

3. Whether there is a timeline in place for meeting mandatory climate-related disclosure requirements.

The Corporations Act.

Advice on directors’ duties to nature-related risks and greenwashing is available from legal firms. Governance Institute’s Greenwashing Guide a Governance Perspective provides further insights into how to identify and prevent greenwashing. ASIC and the ACCC have also provided guidance on how to avoid greenwashing. The Hutley opinion on directors duties and climate risk is a supplementary legal opinion on climate change and directors’ duties.

5.2 ESG under the microscope: understanding relevant case law.

Landmark cases:

• Overstated claim to not invest in tobacco Vanguard Investments Australia Ltd

• “Two mode software” used to cheat emissions standards tests Volkswagen Aktiengesellschaft v ACCC (2021) ATPR 42-724; [2021] FCAFC 49

• Fuel consumption label complied with legal standard but was still misleading Mitsubishi Motors Australia Ltd v Begovic (2022) ATPR 42-792; [2022] VSCA 155

• “Biodegradable and compostable” disposable dishes and cutlery ACCC v Woolworths Group Ltd (2020) ATPR 42-693; [2020] FCAFC 162

• Claims: Carbon-neutral, Low emissions, Equal focus on clean energy, Environmental approval and solar capability Tlou Energy Ltd

• “Net-zero carbon emissions”, but no progress on specific works, no funding, no detailed plan or modelling Black Mountain Energy Limited

• Overstated claims to exclude polluting or harmful investments Diversa Trustees Limited

This Guide has been prepared for use by members of Certified Practising Accountant Australia (CPA) and members of Governance Institute of Australia (Governance Institute). It is not intended for use by any person who is not a CPA or Governance Institute member and/or does not have appropriate expertise in the Guide's subject matter. This Guide is intended to provide general information and is not intended to provide or substitute legal or professional advice on a specific matter. This publication has been prepared so that it is current as at the date of writing. You should be aware that such information can rapidly become out of date and that laws, practices and regulations may have changed since publication of this Guide. You should make your own inquiries as to the currency of relevant laws, practices and regulations. No warranty is given as to the correctness of the information contained in this Guide, or of its suitability for use by you. To the fullest extent permitted by law, CPA and Governance Institute are not liable for any statement or opinion, or for any error or omission contained in this Guide and disclaim all warranties with regard to the information contained in it, including, without limitation, all implied warranties of merchantability and fitness for a particular purpose. CPA and Governance Institute are not liable for any direct, indirect, special or consequential losses or damages of any kind, or loss of profit, loss or corruption of data, business interruption or indirect costs, arising out of or in connection with the use of this publication or the information contained in it, whether such loss or damage arises in contract, negligence, tort, under statute, or otherwise. © 2024 Certified Practising Accountant Australia ABN 64 008 392 452 and Governance Institute of Australia Ltd ABN 49 008 615 950. This document is protected by copyright. Other than for the purposes of and in accordance with the Copyright Act 1968 (Cth) this document may only be reproduced for internal business purposes and may not otherwise be reproduced, adapted, published, stored in a retrieval system or communicated in whole or in part by any means without express prior written permission.