6 minute read

Going Through Trials Together

from April 2020

32 // April 2020 by Erin Clay

Erin Clay is from Rome, Georgia. She is a wife and mom and works with special needs adults. Together with her husband, she created the blog www.wheninromega.com. About The Author I t was just a few minutes after midnight. My husband and I had just rung in the New Year and were preparing for bed when we got the call that shook our whole world. One of our adult kids had gotten into trouble.

Advertisement

Over the next few weeks, our emotions were raw and on edge. Our whole lives had been suddenly turned upside down. It was a time when we had to be patient with each other as well as the circumstance. It seemed that all of our time was consumed by our child and the hurricane created by his choices. We spent a lot of time with each of the other kids, trying to answer their questions and keep our home a calm and safe place.

After weeks of our new normal, I had to go to a store in the neighboring town. It was going to take us an hour and a half, tops, and we were going to pick up something to eat while we were out. This had become our new normal. While searching for grab-and-go restaurants, I found a new restaurant, and I insisted on going there. The new restaurant was packed and the service was a little slow. While sitting there, the couple next to us started talking to us. We talked about our businesses, our town, and the restaurant. We talked about a lot of things except for the hard time we were going through.

When we left the restaurant almost two hours later, my husband and I agreed that we needed that. God sent that couple, unknowingly, into our path to give us a muchneeded respite from our trials. It was also a reminder that God cares about our marriage. It is during times of trials and tribulation in our lives that we choose to cling to our spouse or pull away. So many times, when hard times come, the devil uses the opportunity to destroy marriages. In Matthew 12:25, Jesus says, “Every kingdom divided against itself is headed for destruction, and no city or house divided against itself will stand.”

A long time ago, we decided that God would be the center of our marriage. You have to actively guard your marriage and pray for each other. Tough times are not pretty. There are tears shed and voices raised, but at the end of the day, I have my husband and he has me. Marriage is hard—very hard at times. Some days I know that I am not lovable at all. I could not imagine going through the trials of life without my husband and without God’s guidance.

My husband wrote an article in January’s GoodNews about each day being a new day and starting from there to make each day count (not knowing when he wrote it in October that we would be putting it into practice as it was published). We are actively building better tomorrows in our daily lives. Some days are harder than others, but we are holding tightly to each other and our faith in God. We will pass through this storm stronger because of how we approach the trials we are facing today.

Human touch. Robotic precision.

Announcing advanced surgical technology with a personalized surgical plan, all in the palm of your surgeon’s hand.

Redmond is proud to offer the latest in robotic-assisted technology for partial and total knee replacement surgery. This new surgical technology is designed to enhance accuracy in placing implants and get you back to life as quickly as possible – all under the guidance of your surgeon. If you’ve been putting off orthopedic surgery, ask about the new robotic-assisted surgical technology at Redmond.

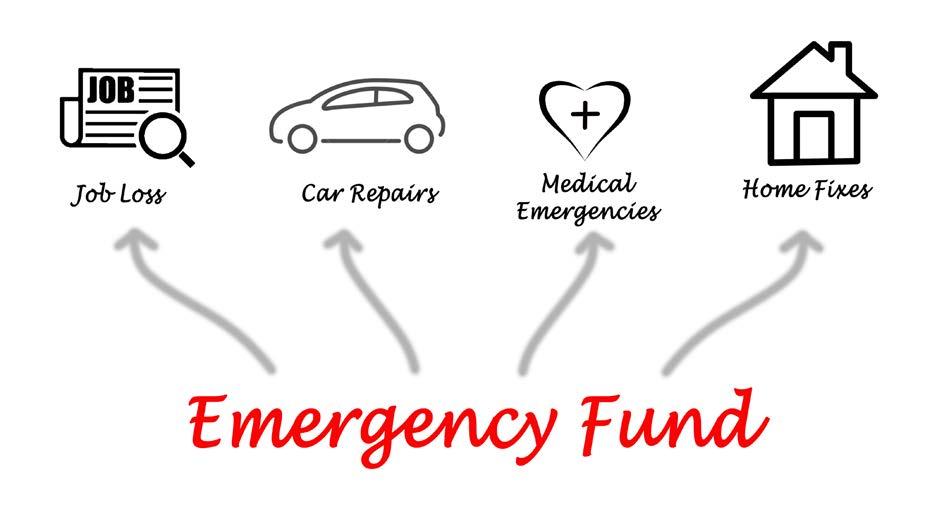

Sleep Better—Build An Emergency Fund by Charles Howell

Once you have a budget in place and know where your money is going, you need to build an emergency fund. Just knowing you have some money set aside is the perfect antidote for not sleeping well at night. It is also the first thing, financially, that represents real traction in getting your financial life in order. Making the slightest progress early will feed future efforts.

When you have this money set aside, “magically,” you seem to have fewer emergencies. That may not be entirely true, but it will feel like it because some things that used to be emergencies are no longer that. Take, for example, new tires for your car or Christmas. In both cases, these two events will occur: one every few years and the other every December 25. Anything you can anticipate can be budgeted for as you improve your budgeting skills and “find” money you can redirect to better service. If your budget is very tight because your income is low, start with finding things around the house you can sell. It may be minor things you can get $5 or $10 for, but these all add up. You can find a part-time job for extra cash. Do this until you can save $1000 for a basic emergency fund.

If you get the $1000 in the bank and have debt, this is a good time to work on debt. Getting rid of debt will free up your income to build a larger emergency

fund. Once you are past debt, start to build a larger emergency fund, one that will buffer you from most real emergencies. Next, you can slowly build sinking funds for more targeted savings. A sinking fund is just a savings account designated for a specific purpose. It would be wise to have a sinking fund for your car. You know you will need to maintain your car. Those expenses occur throughout the life of the car and at both predictable and unpredictable times. Do the same for other targeted savings as you can (house, vacation, etc.).

As you build up a basic emergency fund, then a full emergency fund, then targeted sinking funds, the thought of emergencies will seem like child’s play. You will easily tackle that car repair that used to be an emergency, and you will be ready for Christmas.

Celebrating next Christmas debt-free will be a true blessing!

About The Author

Charles Howell was trained under the Dave Ramsey Master Coach program. He has been a money nerd all his life. After retiring from a career in Information Technology in 2017, he is pursuing his dream career. Charles lives in Silver Creek, Georgia, and serves clients anywhere in the country.

CATCH THE THIEF IN YOUR INBOX

Your pastor just sent an email asking you to send money. The request seems out of the ordinary, but the email looks authentic. What would you do?

Schemes like this are becoming common—and more sophisticated. It can be difficult to discern between legitimate requests and scams. Access a free webinar on how to protect your ministry’s money and data from digital threats.

cyberwebinar.brotherhoodmutual.com

HALLMARK INSURANCE & Risk Management Solutions Brandon Hall 423.894.9497 HallmarkInsure.com Serving TN and North GA

an authorized agency of