5 minute read

The Gleaner Cooperative Mutual Fire Insurance Company

died in a hospital in England. A total of 104 Gleaner servicemen were known to have died during World War I.

Forty years after the war the last Gleaner medal was returned to the Society. In April 1958, medal number 206 was picked up at half tide on the beach at Etretat, a small French village on the English Channel. It was given to Michel Leleu, a correspondent for the French Press News Agency. He in turn sent it to the American Battlefi eld Monument Commission.

Advertisement

The Monument Commission wrote to George Ransford, then president of Gleaner Life, asking for information. In a letter dated Aug. 15, 1958, Ransford replied:

“The Society was one of the rst to issue such identi cation medals, but so far as is known, all Gleaner members were accounted for at the end of World War I. Consequently, the register containing identi cation of the numbers on medals was destroyed many years ago.”

Because the register was destroyed we will never know who soldier number 206 was, but the little medal remains a part of Gleaner history.

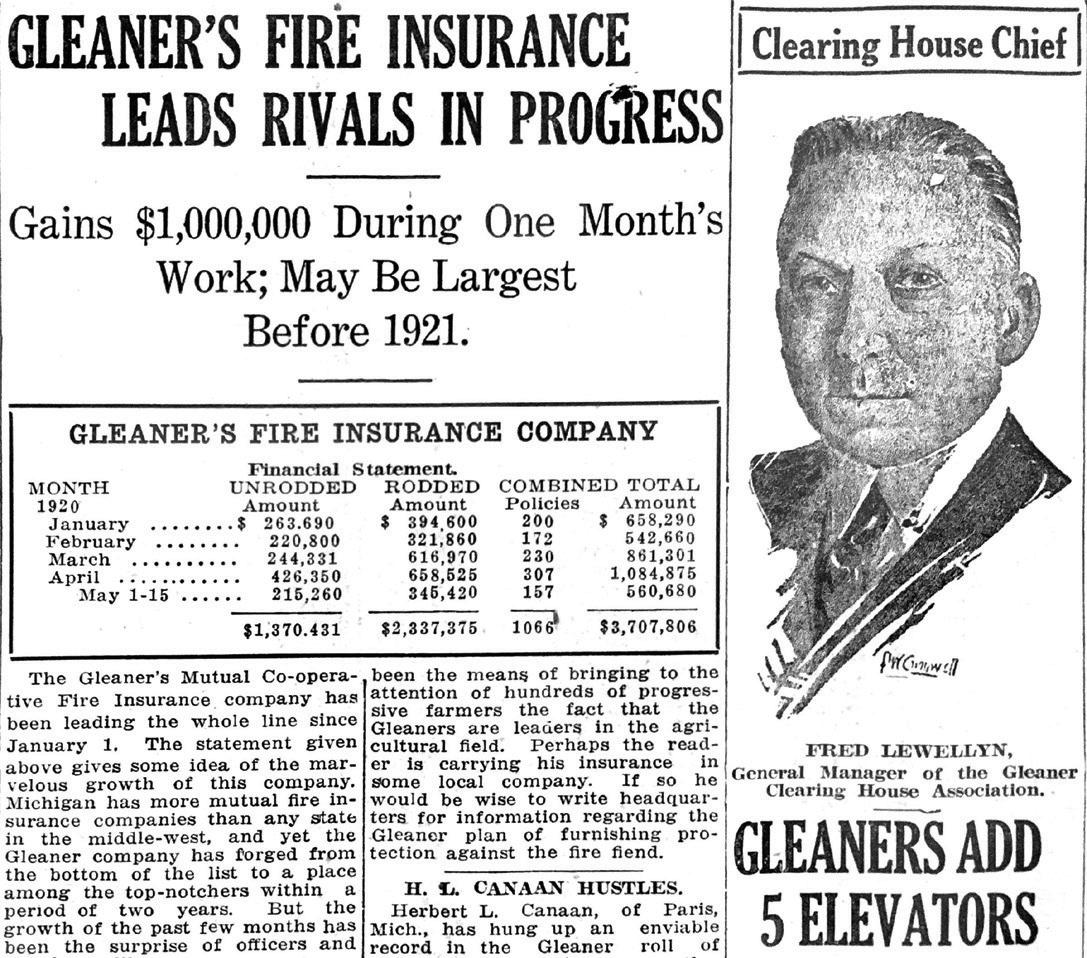

Of all the calamities that happened on farms, fi re was the one most feared. Barns housed cows and horses and were fi lled with hay and straw. It was a volatile mixture that often led to disaster. Barn fi res were common, often caused by lightning or just plain carelessness. After tractors, cars and small engines became common, the presence of gasoline made the situation even worse. Not many could aff ord fi re insurance. The problem is illustrated by a Gleaner report listing 60 buildings destroyed by fi re.

The Society’s standing Committee on Cooperation met in January 1916. The problem of adequate fi re insurance was discussed and the committee recommended a company be formed to off er protection at reasonable rates. The idea was approved at a second meeting in September. In January 1917, the state issued a charter to The Gleaner Cooperative Mutual Fire Insurance Company Limited, with offi ces in the Gleaner Temple.

The idea of mutual or shared risk insurance was not a new one. Joseph England was a director of the Lapeer (County) Farm Mutual, and Grant Slocum was a director of the Tuscola County Mutual Fire Insurance Company. As a matter of fact, their lifelong friendship began because of an interest in low-cost fi re insurance.

The mutuals were usually formed within a county since travel and communication problems made it diffi cult to organize a larger area. In addition, the success of a mutual company depended on neighborly trust, and insuring strangers was not viewed with favor. Those who joined were protected against fi re and all members were assessed for the losses at the end of the year. The plan worked well when everyone paid their assessment, but problems arose when losses were high and some of the members did not pay.

Grant Slocum was elected president of the new company, Richard Pearson of Sandusky, Michigan, vice president, and George Carr of Detroit, secretary. John Livingston was named treasurer, and L.A. Siple, John O’Dell, Charles Barber and Edwin Stewart the fi rst directors.

The company struggled for survival from the very beginning. Not enough income was generated to pay the losses on time, and funds had to be borrowed to balance the books. Less than two years after the charter was

The Gleaner Fire Insurance Company was one of the most successful of the Society’s early ventures. The idea lives on today through the company’s evolution in 1924 into an independent insurance company that is separate from the Society.

James Slocum, one of Grant Slocum’s older brothers, guided the fire insurance company to become a successful and separate entity.

granted, James Slocum was engaged to investigate the possibility of liquidation. He reported that closing down the business would cause large assessments against the members, and for that reason he recommended trying to save the company. He was named secretary (the chief administrator), a post he held until his death in 1936. Under James Slocum’s leadership the company became fi nancially sound and by 1923 there were more than 7,000 members.

Gleaner members in other states saw the success of the fi re insurance company and asked to have coverage extended to them. An investigation revealed the laws in each state were diff erent enough to make it impossible. At the same time, the company could only sell to Michigan Gleaner members, a fact that limited growth. The issue was resolved in 1924 when the company was divorced from the Ancient Order of Gleaners and renamed The Pioneer Reserve Mutual Fire Insurance Company. The Detroit offi ces were moved about one mile from the Gleaner Temple to the Lexington Building, 2970 W. Grand Boulevard. Most of the offi cers were Gleaner members and a close relationship was maintained with the Society.

After the reorganization, Pioneer Reserve Mutual took a radical step, at least radical for that day. It required that premiums be paid in advance. James Slocum explained the reasons:

“The farmers of Michigan have become wise to the fact that any company operated on the mutual basis, insuring farm risks, and collecting assessments at the end of the year, must su er heavily from the failure of the unprincipled members to pay their just share of the losses and expenses, which in such event, that which the “Sneaker” fails to pay must be cared for by the other members. There is no other way out of it. The losses and expenses must be paid and if part of their members fail to pay for the bene ts that they have received it naturally falls upon the rest of the membership to make up the shortage.”

For 18 months following July 1923, the members could pay quarterly if necessary, but pay in advance they must. After that date assessments were billed for the entire year although six-month and three-month payments were accepted in hardship cases. Charging premiums in advance was considered a dangerous step because of a fear that members would move to other companies. Gleaner leaders expected a loss of $6 million in insurance but only lost a third of that amount. Financial stability soon followed even though the rates were less than half those charged by old-line companies. Encouraged by the Gleaner example, the Michigan Department of Insurance soon required all mutuals to collect premiums in advance.

In January 1933, company offi ces were moved from Detroit to 226 East Grand River Ave. in Lansing. In July 1952, the company was reorganized as a non-assessable general mutual insurance company. The name was changed once more to The Pioneer Mutual Insurance Company and began to insure city and suburban property as well as farm buildings.

More than one mutual fi re company was founded in Caro and Tuscola County. In 1908, eight years before the Gleaner Society entered the business, George Whiteacre, Travis Leach, John C. Robinson and Floyd Turner formed a