9 minute read

Nine — Into the 21st Century

Chapter Nine Into the 21st Century

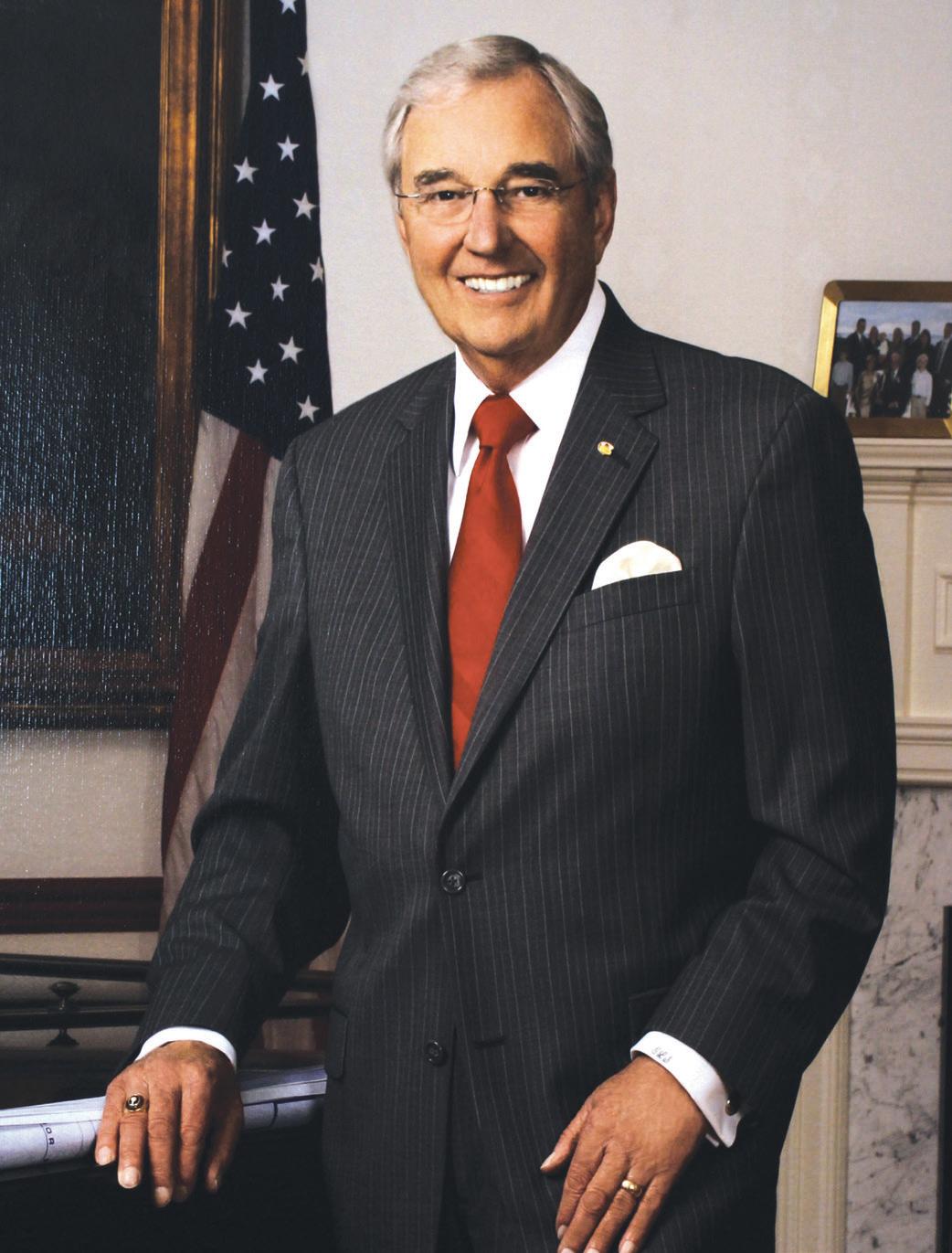

Michael J. Wade

Advertisement

President and CEO July 1, 2000, to Dec. 31, 2007

Gleaner reached another milestone in the 2000s when a third century dawned upon the Society. Founded in the 19th century before members had automobiles or telephones, it had entered the personal computing age of the 21st century. Not many organizations lasted that long or served as well.

One of the fi rst changes involved a transition in leadership. President and CEO Frank Dick had presided over more than 20 years of unprecedented Society growth. He was scheduled for his retirement in July of 2000. The Board of Directors appointed Michael J. Wade as the new President and CEO. Wade had already served Gleaner as an executive offi cer for 18 years, having previously been employed as vice president and treasurer at Mid-American Life Assurance Company in Saginaw, Michigan. He was hired Aug. 30, 1982, to help fi ll a vacancy created after Society Treasurer Carl Moore resigned. The Board of Directors appointed Wade as Treasurer and, three years later, added the offi ce of Secretary to his responsibilities. In 1990, they promoted him to Senior Vice President. In 1996, he relinquished his duties as Secretary and Treasurer when he was named Chief Operating Offi cer. At that time, the Board promoted Jeff rey S. Patterson, who had worked alongside Wade as the head of the Finance Department since 1985, to the offi ces of Secretary and Treasurer.

Wade was already a member of the Board of Directors when he became the Society’s seventh president. His election to the Board occurred at the 49th Biennial Convention in Springfi eld, Illinois. These changes were carefully orchestrated to accomplish an uninterrupted fl ow of leadership before the 50th Biennial Convention in the fall of 2001. One of the items on Wade’s agenda as the new president was to ensure the Society’s 50th convention did nothing short of celebrating Frank Dick’s 22 years of leadership, and the successes that resulted. Working with Fraternal Vice President Bill Warner, who was also set to retire at the conclusion of the 50th convention, they made sure the event was a grand gala.

On June 18, 2000, Gleaner supported the fi rst national day of service for fraternal benefi t societies, Join Hands Day. Created by the National Fraternal Congress of America, in conjunction with the Points of Light Foundation and the Volunteer Center National Network, Join Hands Day is designed to bridge the generation gap between youth and adults. The Society performed a project with participation from numerous arbors, Home Offi ce staff , Big Brothers Big Sisters, 4-H groups, and the Young Marines. Held at the Gleaner Home Offi ce, the groups worked together to assemble Fraternal Care Kits with various personal hygiene products for domestic violence shelters, nursing homes and other agencies in need; made placemats for a local nursing home; and held a softball game for the youth. Gleaner was recognized

Youth in the Big Brothers Big Sisters program joined Adrian Arbor for a 2005 Join Hands Day project. It included replacing mulch in the Mickey Phelps Memorial ower garden at Adrian College. President Wade and Vice President, Secretary and Treasurer Je rey Patterson prepare to announce $1 billion in assets at the 51st Biennial Convention.

with a National Join Hands Day Award. The $1,000 prize was donated to the Gleaner Life Insurance Society Scholarship Foundation.

The Society’s growth continued following its 100th anniversary. Bill Warner was elected in 2001 to the Board. On the fi nancial side, the Society’s assets grew from $469 million as of Dec. 31, 1993, to $814 million at the end of 2001 — nearing the $1 billion milestone. President Wade was especially proud to announce during the business session of the Society’s 51st Biennial Convention in Huron, Ohio, in October 2003: “We did it. Our assets have surpassed $1 billion.” The benchmark was reached in September 2003, just weeks before the convention. At the end of 2004, the fi gure had grown to nearly $1.2 billion. Life insurance in force is another category of impressive growth. After having $180 million of face amount in force at the end of 1979, the Society surpassed the half-billion dollar mark in 1987, the billion dollar mark in 1995, and at the end of 2004 reached $1.75 billion.

Yet again, however, challenges would soon confront the nation and the Society. Housing prices across America began falling in 2006 after reaching a “bubble” of high prices. The following year, a crisis of growing mortgage delinquencies and foreclosures began, especially among what were known as subprime mortgages.

The Society had long observed conservative business practices, avoiding investments in common stocks and similar volatile investments. This practice protected the investment portfolio from the instability of the stock market. Likewise, the Society purchased only investment grade “A” bonds or better as rated by the two major rating bureaus, Moody’s and Standard and Poor’s. This policy had served the Society well when less than investment grade bonds, so-called “junk bonds,” came on the market in the 1980s. Some insurance companies purchased large numbers of junk bonds only to see their market value drop.

Yet the Society did hold high-rated bonds from well-respected investment fi rms that also were deeply invested in subprime mortgage derivatives. These were bundles of loans that had been repackaged and sold by banks, and it turned out that many bundles had enough bad loans embedded to cause the package to default. As warning signs of the Great Recession of 2008 appeared, Society investment income declined from 2006 to 2007, and assets and reserves fell in 2007 for the second year in a row. At the 53rd Biennial Convention, Terry Garner was elected to the Board of Directors.

The Board of Directors celebrates attaining $1 billion in assets with a cake cutting ceremony. Pictured from left are Frank Dick, David E. Sutton, Mark A. Wills, Richard J. Bennett, Michael J. Wade, Bill B. Warner and Suann D. Hammersmith.

Following this period, the Society selected a new leader from within its ranks. Senior Vice President Ellsworth L. “Ells” Stout became the Society’s eighth president and CEO on April 21, 2008. Stout already had more than 20 years’ service with the Society. He joined in mid-1987 as Director of Agency Development, and became a Vice President in 2000. He came to Gleaner with 21 years’ experience in insurance sales, including 17 with the John Hancock Insurance Co. His experience outside the Society began as an agent and continued as an agency manager, company sales manager, and fi eld assistant to his regional vice president.

As a native of Lenawee County, Michigan, and a graduate of Adrian High School and Michigan State University, Stout fi t in well with Gleaner from the beginning at its new Home Offi ce. He was serving in the position of Vice President of Corporate Relations when chosen to lead the Society, and he sought to calm members’ and agents’ worries as the recession deepened. “As Gleaner has maintained an excellent image and a solid record of growth, my appointment should not be seen as a change in the way Gleaner does business,” Stout wrote to members in the Spring 2008 Forum, highlighting a renewed emphasis on service. “While some believe sweeping changes may be necessary, I believe we should look to our past to be successful in our future.”

Further investment losses occurred in 2008 as total assets fell $45 million to $1.1 billion. Senior Vice President Jeff rey Patterson stated in the spring of 2009 it was “primarily due to bond investments in Lehman Brothers and Washington Mutual.” Although both were respected fi rms, Patterson noted “the credit and mortgage-related disaster in the fi nancial markets threw many well respected and highly rated brokerages, banks, and other fi nancial institutions into chaos, bankruptcy, or failure.”

With more than 500 members and guests in attendance, the Oak Ridge Boys performed at the Society’s 50th Biennial Convention. Pictured are band members Duane Allen, left, and William Lee Golden.

A key measure of how well an insurance company is operated is provided by independent rating agencies. The best known of these is the A.M. Best Company Inc. of Oldwick, New Jersey. Its reports, known as “The Best Ratings,” have been issued since 1899. The ratings are assigned after an extensive analysis that includes underwriting, expenses, reserves, investments, and capital suffi ciency. A.M. Best, which had rated the Society “A” (Excellent), the second-highest rating, for 14 consecutive years as of spring 2007, lowered the rating to “A-” (Excellent) in 2008. Society premium and net income began to rebound in 2009, adding more than $40 million in assets despite continued fallout among bond investment groups including CIT Group and Ambac Financial, in which the Society had small stakes. The Society still managed to increase its surplus by $542,000 to $81.1 million. The Society had weathered the recession thanks to its diversifi ed portfolio, strong surplus position, conservative investment policies, and zero debt.

During this time, the Society saw continued growth in some areas. In 2009, the Society awarded 126 scholarships, a new record. Flag Day remained a large event at the Home Offi ce in Michigan where President Stout was himself a retired offi cer who had served with the Michigan National Guard from 1964-72. Under Stout, Gleaner assets reached $1.4 billion by the end of 2011.

In 2010, the Society was saddened by the passing of Shirley Dick, the wife of former President Frank Dick and the Society’s beloved former First Lady. Shirley was well known for her philanthropic and volunteer work, but perhaps best remembered for compiling the 224-page Gleaner cookbook, “Home Grown Recipes,” in 1980. Shirley dedicated it to Nellie Goodknecht, a well-known Gleaner offi cial for decades from Kankakee, Illinois, who passed away in 1980 at age 92. The cookbook, originally named “Cooks’ Collaboration,” was created using recipes that members had contributed at picnic registration tables throughout the summers of 1979 and 1980. “Shirley’s caring spirit of helping others showed us how one person’s life can touch many people through the relationships they build,” Stout wrote in the Summer 2010 issue of Forum.

Stout marked 25 years with Gleaner Life in 2012, a tenure punctuated by growth in agents, surplus, new premiums, and other developments that helped the Society continue to grow following the turmoil of the Great Recession. His retirement came on June 8, 2012. “It has truly been an honor and a privilege to serve the Society,” Stout stated in a farewell printed in Forum. “I will always cherish my time with Gleaner, its members and sales representatives.”

Ellsworth L. Stout

President and CEO April 21, 2008, to June 8, 2012

101

102