About NAB

One of the leading banks of Australia

13 million customers

1600 service centres in entire Australia

Competition in Banking Industry

● Highly competitive Banking Industry

● Dominated by 4 key banks: National Australia Bank. Commonwealth Bank, ANZ Bank, and Westpac

● Future of banking industry is expected to have some drastic changes

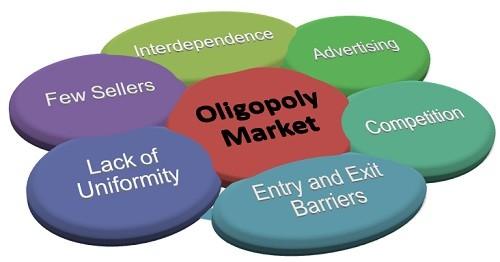

Market Structure

● NAB operates in Oligopolistic and a market structure in which a series of companies offer products.

● Number of sellers in such a market structure is not as large as it is necessary to assure perfect competition prices.

Factors influencing Demand in Banking Industry

● The interest rate on loads

● The value of number of monetary transactions that people are expected to conduct

● Changes in the gross domestic product of the country

● The extent to which people want to have other financial assets like saving, property as well as bonds

● The speculative motive of the people to hold money

● The rate of predicted inflation

● The speed of financial innovation

Factors influencing supply in Banking Industry

Elasticity

● There is high price elasticity of demand in the Australian banking sector especially for NAB.

● This is because of the high interest rates that NAB in the country charge on any funds borrowed.

Conclusion

● To conclude, four leading banks have taken the whole country into its grip thereby overshadowing the existence of any other bank there.

● This has proved to be a positive aspect because of the trustworthiness of these banks which has resulted in absolutely no fraudulent cases in the banking field of the country. In this sector,

References

Allen, D. E., & Powell, R. (2009). Structural credit modelling and its relationship to market value at risk: An Australian sectoral perspective. The VaR implementation handbook, 403-414. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.468.3151&rep=rep1&type=pdf#page=436

Chan, D., Schumacher, C., & Tripe, D. (2007). Bank Competition in New Zealand andAustralia. Finsia_MCFS.TheMelbourneCenter for Financial Studies. Retrieved from website: http://www. melbournecentre. com. Au. https://www.researchgate.net/profile/David_Tripe/publication/228380562_Bank_Competition_in_New_Zealand_and_Australia/links/02e 7e5241ee775696a000000.pdf

Cuesta, C., Ruesta, M., Tuesta, D., & Urbiola, P. (2015). The digital transformation of the banking industry. BBVAResearch(available at https://www. bbvaresearch. com/wp-content/uploads/2015/08/EN_Observatorio_Banca_Digital_vf3. pdf).. https://www.researchgate.net/profile/David_Tuesta/publication/291357544_The_digital_transformation_of_the_banking_industry/links/ 56a2cc6f08ae1b65112cbdb9/The-digital-transformation-of-the-banking-industry.pdf