HAPPY NEW YEAR!

anuary 13, 2025—6:30 p.m.

SPEAKER: Desi Mayner

Executive Coach and Founder, Mayner Leadership Motivation, Goals, and Business Planning for 2025

Streamline your operations with elite leadership and a united high performing team Leadership coaching, consulting & workshops for service business leaders and teams.

Mr. Mayner helps transform local businesses and entrepreneurs into successful machines. He teaches leadership, accountability, strategic planning, and goal setting. Whether you ’re part of an organizaperson team, Desi can help you improve your business and personal skills.

Monday, February 10, 2025~6:30 p.m. Monday, March 10, 2025~6:30 p.m.

Monday, April 14, 2025~6:30 p.m.

Monday, May 12, 2025~6:30 p.m.

Monday, June 9, 2025~6:30 p.m.

As we move forward, our website will be improved and expanded in an effort to meet the needs of our members. The tenant court list is updated each month to provide the most current information to our members. Remember to tell your friends, buyers and sellers to check out our website too. You have the ability to print out rental forms. Members can advertise their rental property on our website. We also have a Facebook page. Check us Out!

We look forward to seeing each of you at our meetings. Please take advantage of the networking opportunities before and after the meetings.

Your membership in our Association gives you the chance to meet and learn from experienced investors whether you are starting out or are a longtime Landlord. We also have special Meetup meetings, the ability to obtain credit reports and past court evictions on prospective tenants, just to name a few services.

In a higher interest rate environment, when property prices remain elevated, it can feel challenging to find deals that make financial sense. However, some of the best opportunities often come when we stop looking at properties for what they are now and start envisioning what they could be. Creativity and adaptability can transform deals that might seem marginal into profitable investments.

Here are a few examples to illustrate this mindset:

• Turning Resorts into Condos: Owning and renting out cabins at a small resort may not make financial sense in today’s market. However, purchasing the resort and converting the cabins into condos for individual ownership could create a more lucrative and sustainable opportunity.

• Maximizing Land Value: A single 10-acre parcel of vacant land might not attract buyers at a premium price, but splitting it into four 2.5-acre parcels can unlock higher value per acre and appeal to a broader range of buyers.

• Repurposing Small Motels: Many small motels have found new life by transitioning from short-term rentals to long-term efficiency apartments. This change often provides steady cash flow and caters to a growing demand for affordable, long-term housing solutions.

The key takeaway is to approach properties with a vision. Think about how you can add value, reimagine their use, or adapt them to meet current market needs. As we move through this higher-rate environment, this mindset will not only help you spot opportunities others might overlook but also position you to continue growing your portfolio.

Keep looking forward and thinking creatively!

Remember, for each new member you sign up with your name listed on their application, you will receive a $25 credit towards your renewal dues.

Arrive at the General membership meeting at 6:30 pm and bring your business cards.

• Monthly Meetings with expert guest speakers on a variety of topics

• Monthly newsletter containing valuable, up-to-date information

• Rental and Court forms

• Credit reports available on prospective tenants & access to OnlineRentApp.com

• List of Past Evictions

• The GLA website offers valuable Information & Rental Marketing.

• Discount on Sherwin Williams

• Networking with other investors, face to face

• Friendly office staff with answers and advice

• Notary public at GLA Office during business hours at no charge

To become a member of GLA mail your name, address, phone number and check payable to GLA G4428 Fenton Rd, Flint, MI 48507 OR on the web at glaoffice@geneseelandlords.org

Membership Application on Page 6

$147 NEW MEMBER FEE

$110 Renewing Member

You can't afford not to join!

The information that is requested is for the Landlord’s exclusive use, and the Landlord certifies that inquiries will be made ONLY for permissible purpose, namely in connection with a business transaction initiated by the consumer. Specifically for rental of home account to determine whether the consumer continues to meet the terms of the account such as rental of property. Landlords may not obtain reports on themselves, associates, family members, or any other person, exception the exercise of official duties. The law prohibits the Landlord from providing a copy of the report to the applicant.

Applications completed in black ink only. Please be sure member name is on application and is signed.

Check to make sure the name, SSN, current address, city and zip code are readable. Make sure application is signed by the tenant giving you permission to run the credit report. The office cannot complete the credit report unless it is signed by the applicant. And again, make sure the Landlord name is on the application and signed.

# of bedrooms

Monthly income of applicant

Security Deposit to be paid

Monthly rent to be paid

Lease term

If renting now, monthly rent

Credit reports can only be ordered by members whose account status is current.

Nationwide criminal search can also be obtain on your prospective tenants.

Do we have your email address?

We will notify members of important happenings and dates through email; be sure to keep current on information by providing the Genesee Landlord Office at (810) 767-3080 or email us at glaoffice@geneseelandlords.org

Please type or print and enclose this application with your check. One year membership fee is $147.

Name Address

City Zip

Phone

Fax

Spouse’s name

How did you hear about us?

Were you referred by a GLA member? If yes, who?

Please make check payable to : G4428 Fenton Road, Flint, MI 48507

VISA MASTERCARD Other

Number

Exp. Date Sec. Code

SIGNATURE x

Your membership in GLA affords you the possibility of becoming a more professional landlord, investor, or manager. Your continued support and participation in GLA provides the opportunity for a stronger association.

One faithful member was feeling rather blue, met with a neighbor, and then there were two. Two earnest members each enrolled one more, doubling their numbers; then there were four. Four determined members just couldn’t wait till each won another, and then there were eight! Eight excited members signed up sixteen more; in another six verses, there will be a thousand twenty-four!

- Author Unknown

TransUnion requires certain information from our members in order for us to provide credit reports or to obtain reports from your office directly through TransUnion. We are required to verify the security of stored documents by our members. This means that each member will have an on-site verification of their place of business (or their home office if they manage their rentals from home).

Our members should be aware that to continue obtaining credit reports from the Association, you will be required to complete this process. There will be no invasion of your privacy by this inspection. The inspection is performed by a person on behalf of GLA.

The verification requires each member have:

• Locked file cabinet or drawer where reports are stored;

• Secure office (a lock on the room where the reports are stored);

• Alarm system (optional)

• Paper shredder

• Picture of entire office (inside and out), picture of office sign (address must show on office, house and/or mailbox) to verify current location

• Driver’s license

• Password protected computer

**Once completed email information and pictures to Linda at geneseelandlord@comcast.net

The sole purpose of the physical verification and photographs is to protect our members and the Association from a claim that the credit reports and other information concerning potential tenants was not kept secure.

Failure to comply will require you to purchase credit reports through the old system at a cost of $17 per report. If you do comply the cost of the credit report will be $12.

We are still receiving incomplete and unreadable rental applications. The addresses and social security numbers are difficult to read. We must have the current address including city and zip code to run credit reports. Also all blanks on the application must be completed. PLEASE double check the information on the application for accuracy before you fax it to our office. MAKE SURE ALL THE INFORMATION IS READABLE. If the information is un-readable or important information is missing, we cannot process the rental application. This will certainly enable our staff to process the application quickly and accurately. Your cooperation will be appreciated.

FOR RENT SIGN

HEAVY DUTY WIRE STAND

INVESTOR PACKAGE

$10

$5

$25

PREMIUM INVESTOR PACKAGE $50

LEAD PAINT BOOKLET (EACH) $.75

LEAD PAINT BOOKLET (50) $25

7 DAY NOTICE, 30 DAY NOTICE, COMPLAINT AND SUMMONS FORMS (EACH)

7 DAY NOTICE, 30 DAY NOTICE, COMPLAINT AND SUMMONS FORMS (100)

$.50

$30

GLA MEMBERSHIP $147

For your convenience, we take orders over the phone and at our meetings for pick up or delivery (with shipping cost) of the items you need most and use everyday in your business.

It is imperative that owners request hard copies of credit reports. Credit reports can change daily, and there will never be another report exactly the same as the one the owner ran to determine acceptance of a tenant. Without a copy of the report, the owner cannot prove the financial reasons for acceptance or rejection if challenged in court.

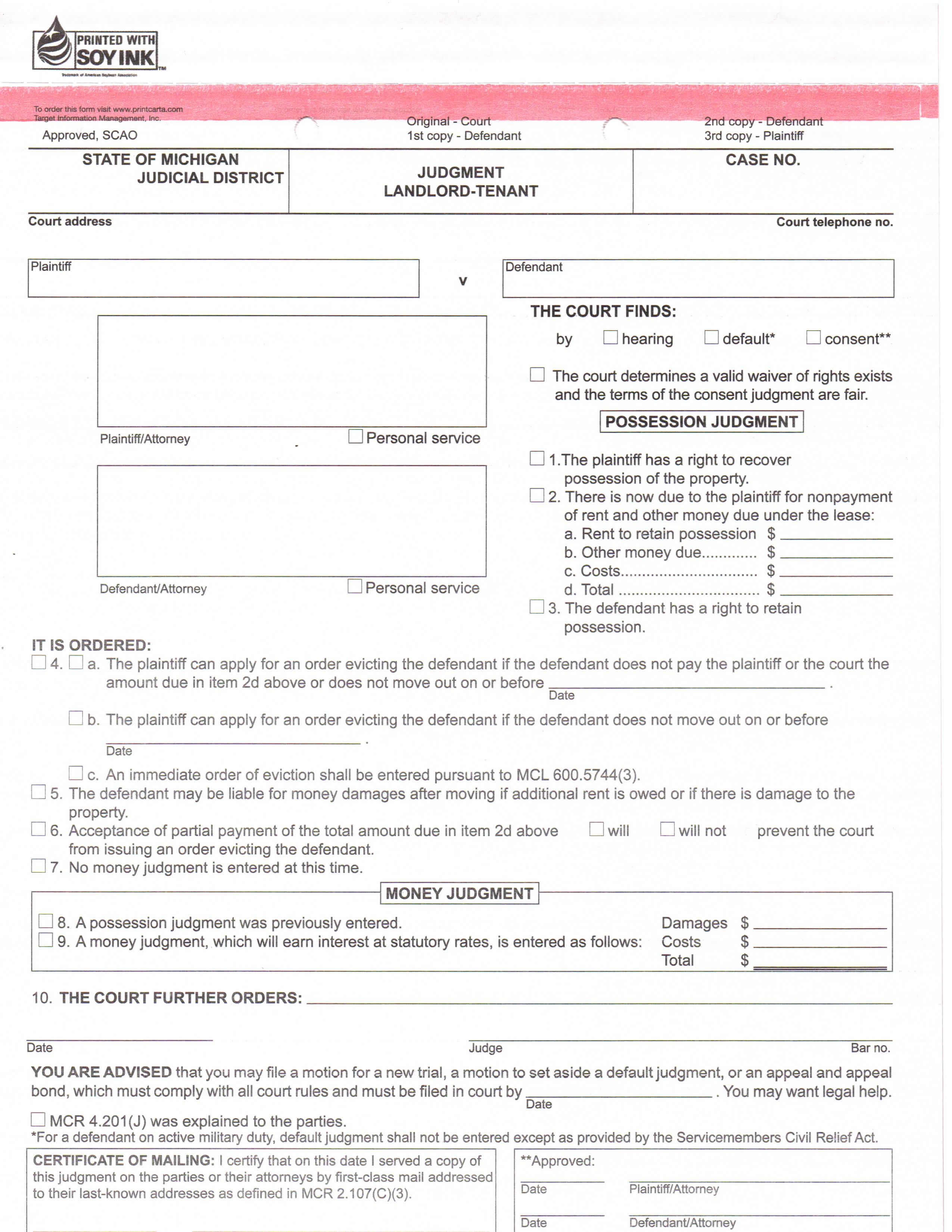

How can a landlord garnish wage when the tenant keeps switching jobs, moves, or is otherwise unable to be reached? Many landlords are left in this situation, where they won their case but have no way to collect. Going to a collection’s agency is an option in some cases, but most of the time it leaves landlords with little left over to collect.

Instead, landlords can benefit from learning how to execute a garnishment on their former tenants’ tax refunds. This process is not as commonly known, but it is a great way to ensure that you have a better shot at getting the funds you are owed.

Before you do anything else, you want to be sure that your state allows tax refund garnishments. In most cases, private creditors (in this case, that’s you, the landlord) cannot garnish federal tax refunds. Some states, however, allow state tax refunds to be garnished by private creditors who are owed money. To find out if you can garnish your tenant’s tax refund, check with the local court where you filed your judgment. They will have the most up-to-date information on what is and what is not allowed.

If your state does allow tax refund garnishment, you need to find out when the upcoming filing dates are going to be.

Most states only allow you to file within a certain window. In Michigan for example, the filing dates are from November 1st to December 31st.

Make sure that you are familiar with what the process will be like by continuing to read through RentPrep’s ultimate guide to tax refund garnishments. In general, you should be prepared for the filing well before it’s time to file.

When it comes to filing for wage or tax refund garnishment, you always want to file as soon as you are able.

For tax refund garnishment, the funds are going to be distributed on a first-come, first-served basis among eligible creditors. Every state will have a hierarchy of who gets paid first. For example, most states will pay out overdue child support or taxes before allowing private creditors to collect. The sooner you file your request, the more likely you are to receive some type of payout.

Keep yourself up-to-date with the tenant’s information as you approach the filing window. To file, you will need your judgment as well as the following:

• Tenant’s full name

• Tenant’s Social Security number

• Tenant’s last known address If possible, look over the forms you will needto fill out in advance so you are sure you have all the information needed on record.

Once the filing window opens, complete the Non-periodic Garnishment form, like this one for Michigan. Pay the court fees, which typically fall between $15 and $20 depending on the jurisdiction. Some jurisdictions may allow you to do this online; others will require the form to be filed in person. Once you pay, the court will stamp your documents so they are ready to submit.

The stamped and completed form should bemailed to the appropriate state tax refund department. It is best to send this out by certified mail to ensure its safe and

secure arrival.

It’s also important that you let the tenant know you have filed to garnish their refund. Do this by sending the defendant (tenant) a copy of the completed form using their last known address, which may or may not be correct.

Since filing for a tax refund garnishment is not a service-required filing, you do not need proof they received it. You only need proof that you sent it out.

Wait for tax season! If your application is received early enough and approved, you will receive communication about your payout after the tenant has filed their taxes.

Using collection agencies and attorneys for a wage garnishment is always an option, but a tax refund garnishment is by far the most effective method I’ve seen. I’ve personally spoken with more than a dozen landlords in the past few months

who have had success with this method and would adamantly recommend tax refund garnishments to every landlord. Here at RentPrep, we work closely with landlords to learn about what struggles they are facing and how to work through them. This knowledge helps us to continuously improve RentPrep, working to create services that are truly beneficial to those who need them most. Surprisingly, the recommendations for pursuing tax refund garnishments starkly contrast with landlord opinions on wage garnishment. When you try to garnish wages for rent money, you are often left in a more complex situation. Let’s review how that process works so that you can decide which type of garnishment will best suit your situation.

Similar to the process for garnishing a tax refund, landlords who want to garnish wages for unpaid rent will need to do a bit of leg work, and that work will involve the local court system. Whether you have an eviction judgment or are simply owed rent, you need to have a money judgment to be able to garnish wages. If you do not yet have one, most states will require you to go to court for this judgment to prove what you are owed. Once you have this judgment, it can be used to garnish wages. Most of the time, landlords can garnish up to 25% of a tenant’s income until the unpaid rent is paid in full. The specific amount is decided by federal,

state, and local laws. Now that you know how to garnish wages for unpaid rent as well as how tax refund garnishment works, you can make the best decision on what will work to collect any rent you are owed.

Landlord tip: In my experience, having owned a licensed collection agency, I would not recommend spending any money on wage garnishments, as they are so rarely successful. Because those people in this situation are often struggling financially and have many obligations, there are manyways for former tenants to stop wage garnishment, including changing jobs, filing an order to stop the garnishment, or simply running from their debt. Often, the time and monetary investment required from landlords to garnish wages doesn’t see a good return. If you’re stuck on the idea, find an attorney or collection agency that will work on a contingency basis. There’s no sense in spending good money to chase money you’ll never get.

Avoiding the need to chase down unpaid rent at all is a better scenario, but how can you make that happen?

Improving your tenant screening process can reduce the risk of ending up in a garnishment situation. High-quality tenant screening services assist in ensuring that you are able to choose the best possible fit for your properties.

Managing a rental property can create numerous legal issues. One of the most important aspects of supervising a rental unit is the prevention of problems before they occur. Knowledge of the basic duties a landlord owes to tenants is one of the first steps in warding off legal issues. The following landlord tips provide an overview of the common legal issues faced by landlords.

A landlord may not reject a prospective tenant for reasons that are discriminatory. The Federal Fair Housing Acts prohibits a landlord from denying an applicant because of race or color, national origin, familial status, disability, or sex. A landlord may base a decision on the following factors: credit history, employment history, and income. If a landlord decides to reject an applicant because of information in a credit report, the Fair Credit Reporting Act

requires the landlord to provide the applicant with the name and address of the credit reporting agency. A landlord should keep written documentation of the reason a prospective tenant was rejected and the screening process used should be applied consistently with each applicant.

One of the most important landlord tips is to enter into a written rental agreement with the tenant. Typical residential lease agreements specify important rental terms that will guide the landlord/tenant relationship. The most important provisions include the following: the names of the tenants, the length of the tenancy, the amount of the security deposit, the party responsible for specific repairs, whether pets may live in the rental unit, and the amount of rent. A lease agreement should specify when rent is due, what form of payment is acceptable, whether a grace period applies, and whether late fees and returned check fees apply.

A landlord should inspect a rental property for dangerous conditions. When a tenant sustains injuries on the property, the landowner may bear legal responsibility. The law allows a person injured on a property to recover compensation when the landlord

behaved recklessly or with intent, was unreasonably careless, violated health and safety regulations, failed to make certain repairs, or the premises was inhabitable.

Stay up-to-date with how the law affects your life

A landlord should also be aware of criminal activity on and around the rental property. In many states, a landlord is responsible for providing the surrounding neighborhood with protection against illegal activity engaged in by tenants. At the same time, the landlord must protect tenants from each other and from criminals that enter the property. A landlord should make note of reports of criminal activity on the premises and should provide security features like deadbolts, security lighting, and locks on windows.

Every state has different guidelines on when it is permissible for a landlord to enter a rental unit, but most laws are based on the tenant’s right of privacy.

Therefore, a landlord may only enter a rental unit for a few specific purposes. Most states will permit a landlord to enter a unit to make repairs, inspect the property, show the property to prospective tenants, or in the case of an emergency. In all instances, except during an emergency, a landlord must provide a verbal or written notice of the intent to enter the premises 24 hours before the entry. An emergency, such as a gas or water leak, overrides the requirement of notice.

It is a landlord’s duty to repair and maintain a rental property in a way that is fit for occupancy. The law refers to this as an “implied warranty of habitability.” Most states require rental units to provide tenants with heating, plumbing, electricity, and gas. The failure to provide these basic features is a violation of the law. When a tenant makes a request for repairs to a necessary fixture in the unit and the landlord fails to make the repair, the tenant has a several options. Most states will allow a tenant to withhold rent, make the repair and deduct the cost from the rent, move out, inform state or local building inspectors, or pay the rent and sue the landlord for the difference of the rent and the real rental value of the property. If an injury occurs because of the failure to make a repair, the tenant may sue the landlord for compensation.

Have you ever gone to your rental property only to have a stranger you don’t recognize answer the door and ask you who you are as if you don’t belong there? Well, it’s happened to me and lots of other landlords. Its kind of goes like this:

The landlord rings doorbell: Ding Dong.

Unauthorized Tenant in smelly dirty T-shirt with a beer in his hand opens door: Yeah, what do you want?

Landlord: I just dropped by to talk to Mrs. Jones (tenant).

Unauthorized tenant: She’s not here. Who are you?

Landlord: I’m the landlord. Who are you?

Unauthorized tenant: I live here. Call back later. She’ll be home later. How do you feel knowing you have someone in your rental property that you didn’t even agree to let live there?

It is not as uncommon as one might think, and it is not as uncommon as one might think, and it may not always be noticeable, but you must be on the lookout for unauthorized occupants. Many leases provide a clause to prohibit the tenant from allowing unauthorized residents, the way mine does:

Occupancy by guests staying over 7 days will be a violation of this provision. In the event any other people occupy and live in this rental, in any capacity, without Owner’s written consent, it will constitute a breach of this lease and it is agreed that the rent will be increased $500.00 per person per month, and the Owner at his sole option may terminate this lease.

The lease isn’t always enough to deter it from happening, but it can help give you the means to solve the problem. With the clause protecting you in the lease, you have the legal right to enforce the lease.

You can enforce the lease in 3 ways: 1) You can allow the unauthorized occupant to become an authorized resident if he is cooperative. You can do this by:

• Giving him a rental application so you can screen him like any other tenant.

• If you approve him, have him sign the lease that the original tenants signed, making them all 100% responsible for the agreement.

2) Lease Violation Notice. You can notify the tenant(s) of their lease violation, giving them the required notice period to cure their default. I make sure I remind the tenants of the penalty fee for-unauthorized occupants that they agreed to in the lease agreement. That alone gives you some bargaining power. I also include a Termination Notice containing the lease paragraph violation, just to show the tenants that I’m not afraid to lose them.

3) In the event your lease does not provide for an unauthorized tenant situation, you may want to update your lease to include a Lease UpdateChange of Terms Notice form to modify your lease agreement.

It is important to be able to take a tough written stance in these situations. The tenant has to believe you will stop at nothing to rectify the problem by legal eviction or to make them conform to the rules. Never tell the tenant or hint to the tenant that you are afraid or don’t want to go to court. If they suspect you are afraid, they will take the upper hand and use it to their advantage.

Pretend you love to go to court. That you love to watch your attorney in action. I do love to watch my attorney in action. I love to call the tenant’s bluff and take the upper hand. I love to evict a bad tenant FAST! It doesn’t happen often, but there are times when we must take fast decisive action.

By the way, always be sure to have a clause in your lease that covers your attorney’s fee and court costs at the tenant’s expense.

In many cases, tenants who bring I authorized tenants are the type of people who don’t always go by the rules. That is why you should always be prepared to begin an eviction at any time.

I always say, “The best way to avoid tenant problems it to avoid problem tenants.”

Presented by Bobbie Kirby, Gla Executive director

of Flint

Many thanks to Deb Cherry and her crew, after many years of sitting abandoned on Flint’s west side, demolition of the old building that once housed Ballenger Manor Apartments began Friday, December 6, 2024. Increased blight removal has been underway across the city of Flint for the last several years. The removal of the vacant Ballenger Manor Apartments has been on the table for a long time, and now the crumbling structure on Ballenger Highway is no more.

A line of Flint residents asked City Council members to set aside issues that have left them mired in political gridlock on Monday, Dec. 17, and at least for that day, they got their wish. Council members passed multiple resolutions during a series of meetings on Monday, setting aside efforts to elect a new council president or fill an open 3rd Ward council seat, two time-consuming issues they’ve been unable to agree on.

City of Grand Blanc

The City of Grand Blanc is taking a major step forward in transforming a former golf course into an outdoor recreation space, thanks to a $1.5 million grant from the Michigan Natural Resources Trust Fund.

Grand Blanc City Manager Wendy Jean-Buhrer said this funding is a significant boost for the city’s plans to turn part of the Jewel of Grand Blanc golf course into a 147-acre public park, offering a range of outdoor activities for residents.

“We are adding 147 acres of park land

to our park system,” she said. “This new green space will provide a muchneeded recreational area, especially for residents of the city’s east side, where there is currently limited access to parks or outdoor areas.”

The redevelopment project is part of an ongoing effort to revitalize the area. Since 2021, a foreclosed business on the city’s east side has been earmarked for potential redevelopment. Local community members are hopeful that the area will soon transform into an active, green space.

In addition to the green space development, the city is also moving forward with plans for residential development on the north side of the golf course. A project that will add approximately 142 homes is scheduled to break ground in the spring.

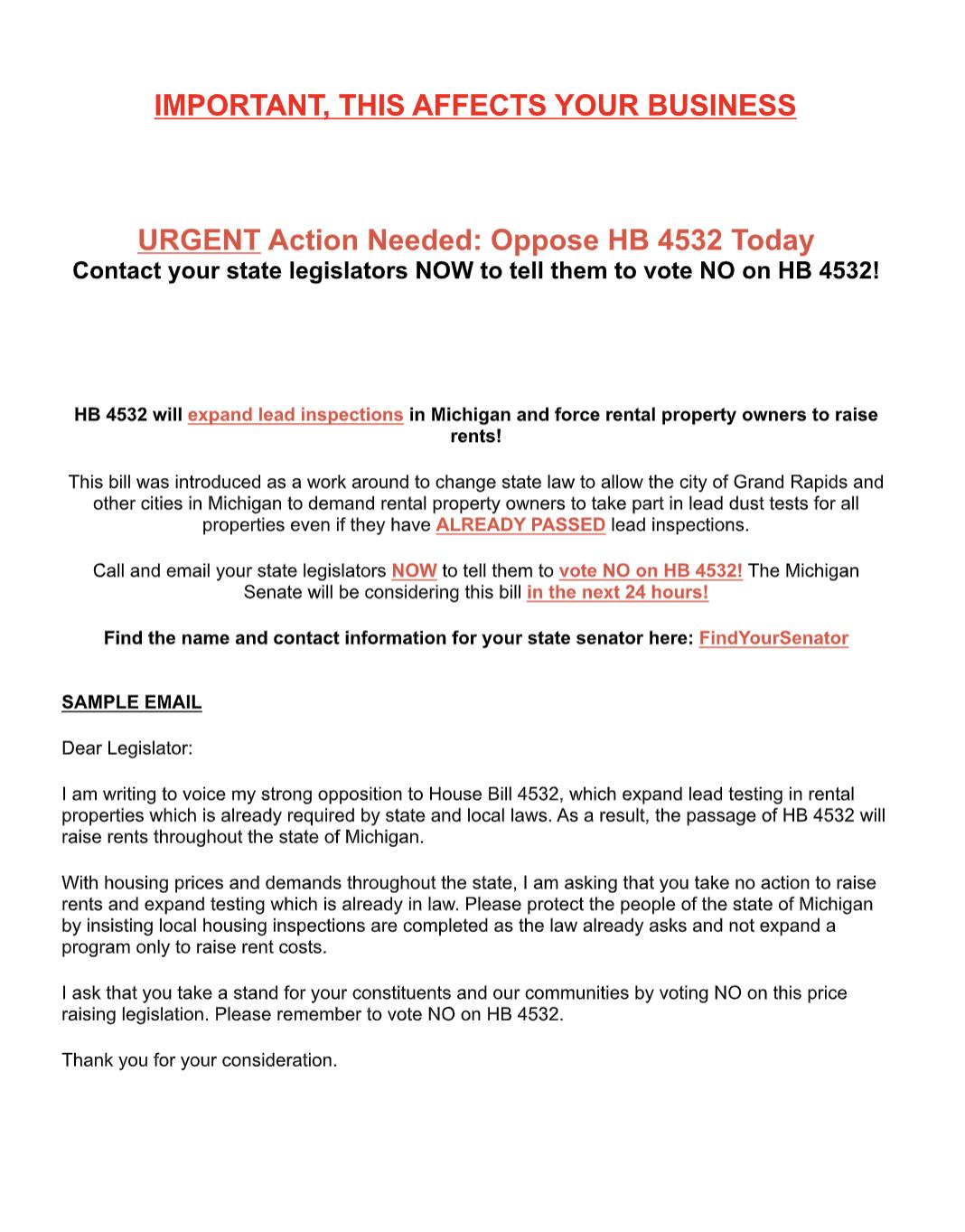

A package of housing bills that would bar landlords from discriminating against tenants based on their source of income, like Section 8 housing vouchers, social security or veterans’ benefits, is heading to the governor’s desk.

The Michigan Senate passed House Bills 4062 and 4063 with a 20-16 vote along party lines during a lame duck session last week.

Under the legislation, renters would be able to sue if they believe landlords are discriminating based on source of income.

UPDATE: GOVERNOR SIGNED LAW THAT LANDLORDS HAVE TO CONSIDER ALL SOURCES OF INCOME INCLUDING SECTION 8.

Advertising not only offsets the cost of newsletter printing and member outreach, it also provides services to our association from sources who are excited to work with us at reason- able and reliable rates. Our newsletter reaches an extensive network of real estate investors. Please refer to our local businesses when possible and let them know you saw their ad. If you are interested in placing an ad or know someone who is, the rates are as follows:

What do you like most about the GLA?

What changes would you like to see?

Meeting topic suggestions

Member benefits you’d be interested in

Vendors you’d like to see at meetings

Comments

The following is optional:

Name

Phone Email

Would you like to be on committe? Yes / No

Reduce disputes with tenants by videotaping or taking pictures with your cell phone or camera of the unit’s condition before move-in and after move-out. If you do this when the unit is vacant, the tenant cannot claim his or her privacy was invaded. When move-out is completed, repeat the process again and have evidence of any damage that occurred during the occupancy of the affected tenant.

2024-2025

Ed Constable - President (810) 938-3339

edconstable1@yahoo.net

Aaron Dionne - Vice President (248) 705-1399

rangerbronco@charter.net

Bryan Udell - Treasurer (810) 287-4486 cbu@homeventures.com

Bobbie Kirby - Exec. Director 810-919-5130 ledesta1@att.net

Ryan Scully - Secretary (810) 577-3146 scullyrealestateteam@gmail.com

Bernard Drew

Craig Fiederlein (810) 232-1112

cfiederlein@cflegal.net

Michael Kennedy (810) 210-7347

Kennedyhousing1@gmail.com

Terry Hanson (810) 767-2500 terrylhanson@yahoo.com

Political Action Chairman

Henry Tannenbaum (810) 238-2600 hrt@USOL.com

Ohunwa Carthan 810-259-2724 caribo1387@att.org

Office Secretary

Amanda Lynch (810) 767-3080

Melanie Fiederlein (810) 288-9334 melfiederlein@gmail.com (810) 422-3655 mrbdrew@gmail.com

Contributor Linda MacKay

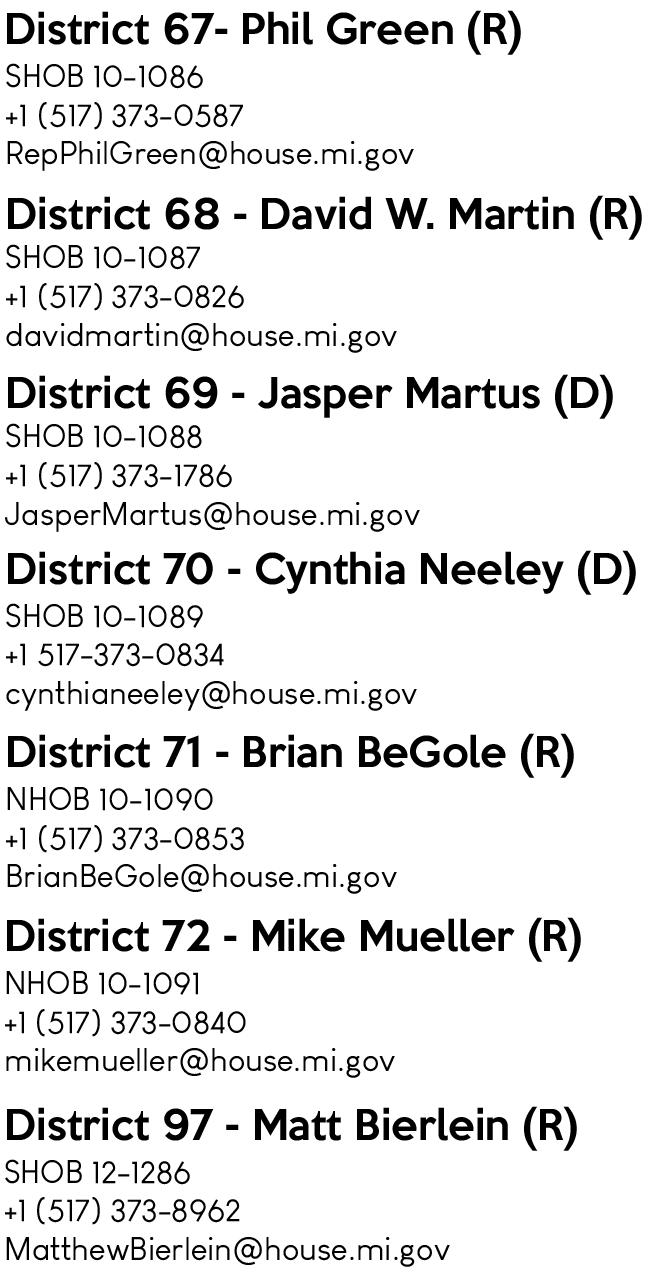

Ruth A. Johnson (R) Senate District 24

Contact: Senator Johnson Phone: 517-373-1636

Kevin Daley (R) Senate District 26

Contact: Senator Daley Phone: 517-373-1777

John Cherry (D) Senate District 27

Contact: Senator Cherry Phone: 517-373-0142

Graphic Designer