As we move forward, our website will be improved and expanded in an effort to meet the needs of our members. The tenant court list is updated each month to provide the most current information to our members. Remember to tell your friends, buyers and sellers to check out our website too. You have the ability to print out rental forms. Members can advertise their rental property on our website. We also have a Facebook page. Check us Out!

We look forward to seeing each of you at our meetings. Please take advantage of the networking opportunities before and after the meetings.

Your membership in our Association gives you the chance to meet and learn from experienced investors whether you are starting out or are a longtime Landlord. We also have special Meetup meetings, the ability to obtain credit reports and past court evictions on prospective tenants, just to name a few services.

Investing in rental homes can be a “get rich slow” strategy, but it still offers a relatively quick path to financial freedom. I understand that every investor has access to different levels of funds and is at a different stage in their journey.

Like with the stock market, the earlier you start investing, the better your long-term prospects. Unless you come from wealth or have a high-paying job that leaves you with significant disposable income, you will need to find ways to borrow money to invest in rental property.

Banks are an option for borrowing, but they can be difficult to work with, especially if you’re not yet established. Early in my career, I funded many of my big deals with borrowed money. There are several ways to borrow money, but one method I’ve used— and that many of our members have found successful—is the “joint venture.”

A joint venture typically involves two key documents:

1. Joint Venture Agreement: A simple, onepage document that outlines how profits will be split. Commonly, this means a 50-50 split, where the investor contributes most or all of the capital.

2. Simple Mortgage: A mortgage recorded against the property to secure the investor’s interest.

This straightforward approach has added significant cash flow to the portfolios of many of our members in a short period.

If you’re looking to grow your wealth, start researching the different ways people leverage other people’s money to generate profits for themselves.

Remember, for each new member you sign up with your name listed on their application, you will receive a $25 credit towards your renewal dues.

Arrive at the General membership meeting at 6:30 pm and bring your business cards.

• Monthly Meetings with expert guest speakers on a variety of topics

• Monthly newsletter containing valuable, up-to-date information

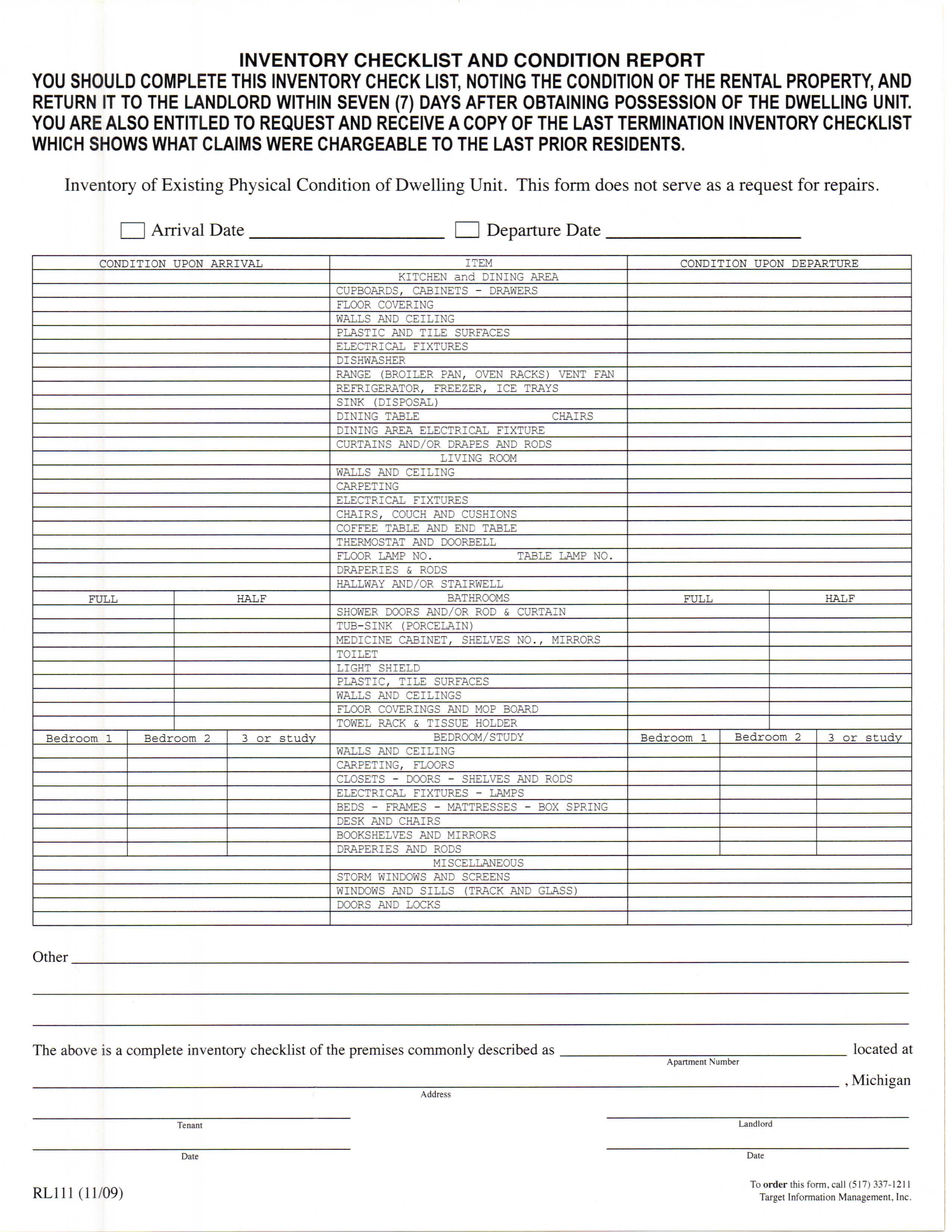

• Rental and Court forms

• Credit reports available on prospective tenants & access to OnlineRentApp.com

• List of Past Evictions

• The GLA website offers valuable Information & Rental Marketing.

• Discount on Sherwin Williams

• Networking with other investors, face to face

• Friendly office staff with answers and advice

• Notary public at GLA Office during business hours at no charge

To become a member of GLA mail your name, address, phone number and check payable to GLA G4428 Fenton Rd, Flint, MI 48507 OR on the web at glaoffice@geneseelandlords.org

Membership Application on Page 6

$147

$110

You can't afford not to join!

The information that is requested is for the Landlord’s exclusive use, and the Landlord certifies that inquiries will be made ONLY for permissible purpose, namely in connection with a business transaction initiated by the consumer. Specifically for rental of home account to determine whether the consumer continues to meet the terms of the account such as rental of property. Landlords may not obtain reports on themselves, associates, family members, or any other person, exception the exercise of official duties. The law prohibits the Landlord from providing a copy of the report to the applicant.

Applications completed in black ink only. Please be sure member name is on application and is signed.

Check to make sure the name, SSN, current address, city and zip code are readable. Make sure application is signed by the tenant giving you permission to run the credit report. The office cannot complete the credit report unless it is signed by the applicant. And again, make sure the Landlord name is on the application and signed.

# of bedrooms

Monthly income of applicant

Security Deposit to be paid

Monthly rent to be paid

Lease term

If renting now, monthly rent

Credit reports can only be ordered by members whose account status is current.

Nationwide criminal search can also be obtain on your prospective tenants.

Do we have your email address?

We will notify members of important happenings and dates through email; be sure to keep current on information by providing the Genesee Landlord Office at (810) 767-3080 or email us at glaoffice@geneseelandlords.org

Please type or print and enclose this application with your check. One year membership fee is $147.

Name Address

City Zip

Phone

Fax

Spouse’s name

How did you hear about us?

Were you referred by a GLA member? If yes, who?

Please make check payable to : G4428 Fenton Road, Flint, MI 48507

VISA MASTERCARD Other

Number

Exp. Date Sec. Code

SIGNATURE x

Your membership in GLA affords you the possibility of becoming a more professional landlord, investor, or manager. Your continued support and participation in GLA provides the opportunity for a stronger association.

One faithful member was feeling rather blue, met with a neighbor, and then there were two. Two earnest members each enrolled one more, doubling their numbers; then there were four. Four determined members just couldn’t wait till each won another, and then there were eight! Eight excited members signed up sixteen more; in another six verses, there will be a thousand twenty-four!

- Author Unknown

TransUnion requires certain information from our members in order for us to provide credit reports or to obtain reports from your office directly through TransUnion. We are required to verify the security of stored documents by our members. This means that each member will have an on-site verification of their place of business (or their home office if they manage their rentals from home).

Our members should be aware that to continue obtaining credit reports from the Association, you will be required to complete this process. There will be no invasion of your privacy by this inspection. The inspection is performed by a person on behalf of GLA.

The verification requires each member have:

• Locked file cabinet or drawer where reports are stored;

• Secure office (a lock on the room where the reports are stored);

• Alarm system (optional)

• Paper shredder

• Picture of entire office (inside and out), picture of office sign (address must show on office, house and/or mailbox) to verify current location

• Driver’s license

• Password protected computer

**Once completed email information and pictures to Linda at geneseelandlord@comcast.net

The sole purpose of the physical verification and photographs is to protect our members and the Association from a claim that the credit reports and other information concerning potential tenants was not kept secure.

Failure to comply will require you to purchase credit reports through the old system at a cost of $17 per report. If you do comply the cost of the credit report will be $12.

We are still receiving incomplete and unreadable rental applications. The addresses and social security numbers are difficult to read. We must have the current address including city and zip code to run credit reports. Also all blanks on the application must be completed. PLEASE double check the information on the application for accuracy before you fax it to our office. MAKE SURE ALL THE INFORMATION IS READABLE. If the information is un-readable or important information is missing, we cannot process the rental application. This will certainly enable our staff to process the application quickly and accurately. Your cooperation will be appreciated.

FOR RENT SIGN

HEAVY DUTY WIRE STAND

INVESTOR PACKAGE

$10

$5

$25

PREMIUM INVESTOR PACKAGE $50

LEAD PAINT BOOKLET (EACH) $.75

LEAD PAINT BOOKLET (50) $25

7 DAY NOTICE, 30 DAY NOTICE, COMPLAINT AND SUMMONS FORMS (EACH)

7 DAY NOTICE, 30 DAY NOTICE, COMPLAINT AND SUMMONS FORMS (100)

$.50

$30

GLA MEMBERSHIP $147

For your convenience, we take orders over the phone and at our meetings for pick up or delivery (with shipping cost) of the items you need most and use everyday in your business.

It is imperative that owners request hard copies of credit reports. Credit reports can change daily, and there will never be another report exactly the same as the one the owner ran to determine acceptance of a tenant. Without a copy of the report, the owner cannot prove the financial reasons for acceptance or rejection if challenged in court.

Springtime is here, which means spring cleaning is in order. For landlords, this means sprucing up your rental property and tending to any repairs that you put on hold during the long winter months. Here are a dozen tips to get you well on your way to a tidy attractive property your tenants will be proud to call home.

Your doormats are likely looking a little worse for wear come springtime. Give them a good vacuum and replace as needed. If you get frequent rain, dry mats out in the sun and then freshen them up by spreading some baking soda as a natural deodorizer.

Before you turn on those ceiling fans in common areas and have them swirl around months of dust, wipe them down. The same goes for light fixtures and vents.

If you’ve got carpet in the hallways, Now is a good time to give each floor a deep cleaning. While you’re at it, wipe down walls and trim, and consider repainting or touching up spots as needed for a clean look.

Whether you have window units or central air, now is the time to ensure they’re all in working order well before hot weather rolls in and HVAC appointments are hard to come by. Remember, comfortable tenants are happy tenants, so

take advantage of the temperate season to take care of your rentals heating and cooling systems.

Now that the snow is (hopefully) gone, it’s time to inspect decks and patios for loose boards, chipped pavers, and other damage. Replace or repair any loose rails or steps and pressure-wash patios. If decks need to be retreated, take advantage of the cool dry weather to do it.

Green spaces on your property need hydration to keep them looking healthy and lush all season. Don’t rely on those April showers alone -- make sure your sprinkler system is ready to go for spring so your grass and foliage don’t get parched.

Examine the buildings foundation base for cracks or other deterioration. A good rule of thumb is that if you can fit a nickel into a crack in your foundation, it’s time to call a professional to check it out.

Let the sunshine on a clean exterior, not one that’s been battered by winters dirt and grime. Aim that hose on sidewalks, decks, and patios, too, for a fresh start to the outdoor season. You can rent a power washer to DIY it, but if you’re worried about causing more harm than good to the building’s exterior, call in a pro.

Snow and rain during winter also tends to pile up the debris in your gutters and downspouts, particularly leaves that might have gotten trapped there from the fall. Don’t forget to fix any that have become detached so they can drain excess rainwater away. Wash windows and screens Ice, snow, rain, and other remnants of winter weather have clouded over windows and screens. Hire a service to clean the windows for a building, but if you’ve got smaller homes in your portfolio and are feeling energetic, a bucket of soapy water and a squeegee are all it takes.

Don’t wait for a leak to happen before you inspect your roof for damage. Spring is a good time to fix or replace shingles or flashing. If it’s looking like a bigger project, book an appointment soon so that you can get it done before the cold weather returns; spring and summer are typically the busiest times for roofers.

When it’s time to turn the clocks ahead in the spring, it’s also time to swap out batteries in those smoke and carbon

monoxide detectors. Be sure to test that they are working properly, too -- be sure to post a notice in your building that you’ll be testing the alarms on a certain date so that tenants know not to evacuate. Do the same thing again when the clocks turn back in the fall and you’ll have peace of mind that your smoke and CO2 alert system is at the ready.

A landlord’s to-do list is never done, but spring weather has a way of making those tasks a bit more pleasant. Prioritize your tasks accordingly and take advantage of the longer days, and you’ll get them done in no time.

Here are 5 essential marketing strategies for rental property owners on how to boost occupancy rates.

Owning and managing rental properties can be a lucrative venture, but to maximize your profits, you need to keep those occupancy rates high.

An empty rental property means lost income and increased expenses. To ensure a steady stream of tenants, effective marketing strategies are essential. In this blog post, we’ll explore five essential marketing strategies that rental property owners can implement to boost their occupancy rates.

In today’s digital age, the first place potential tenants look for rental properties is online. Therefore, it’s crucial to establish a strong online presence. Start by creating a professional and user-friendly website for your rental properties. Include highquality photos, detailed descriptions, and virtual tours if possible. Make sure your website is mobile-responsive, as many people use their smartphones to search for properties.

Additionally, list your properties on popular real estate and rental websites. Utilize social media platforms to showcase your properties and engage with potential tenants. Regularly post updates, share tenant testimonials, and respond promptly

to inquiries. An appealing online presence not only helps you attract tenants but also builds trust and credibility.

What sets your rental properties apart from the competition? Whether it’s a prime location, modern amenities, or exceptional views, identifying and highlighting your unique selling points can make a significant difference. Use compelling language and visuals to showcase what makes your properties special.

For example, if your rental property is in a vibrant neighborhood with access to public transportation and trendy restaurants, emphasize these benefits in your marketing materials. If you offer amenities like a fitness center, swimming pool, or pet-friendly features, make sure to mention them prominently.

Blanket advertising might attract some interest, but targeted advertising is more effective at reaching your ideal tenants. Identify your target audience based on factors such as demographics, interests, and lifestyle. Once you have a clear picture of your ideal tenant, tailor your marketing efforts to reach them specifically.

Utilize online advertising platforms like Google Ads and Facebook Ads to create highly targetedcampaigns. For instance, if you’re targeting young professionals, you might focus on platforms like LinkedIn or Instagram. By narrowing your audience, you increase the likelihood of attracting individuals who are genuinely interested in your rental properties.

To entice potential tenants, consider offering incentives or flexible leasing options. This could include discounted rent for the first month, waived security deposits, or even including utilities in the rent. These incentives can make your properties more appealing compared to

others in the market.

Additionally, offering flexible leasing options such as month-to-month leases or shorter lease terms can attract tenants who may not want to commit to a longer rental agreement. Providing choices and accommodating different needs can give you an edge in a competitive market.

Your current and past tenants can be valuable advocates for your rental properties. Engage with them and encourage them to leave positive reviews on platforms like Google, Yelp, and social media. Positive testimonials from satisfied tenants can significantly influence the decisions of potential renters.

Consider implementing a referral program where tenants can receive rewards for referring friends and family who ultimately become tenants. This not only helps with tenant retention but also brings in new leads through word-of-mouth marketing.

In conclusion, you can boost occupancy rates for your rental properties with a well -rounded marketing strategy that leverages both online and offline tactics. By creating a strong online presence, highlighting unique selling points, targeting your advertising efforts, offering incentives, and engaging with tenants, you can effectively attract and retain tenants, ensuring a steady income flow from your rental properties.

A good way to impress tenants and perhaps get a nice rent increase is to upgrade the baseboards for your rental property to give it a nicer look.

Baseboards for your rental property are a great way to update a room or put a finishing touch on a remodeled unit.

Base molding – the small trim that goes along the lowest and highest parts of interior wall of a room –can elevate the space of a unit and offer a stylish transition from wall to floor.

To find the best molding trim, select a baseboard that coordinates with your property’s style while staying within your budget.

1. Old-fashioned: Old-fashioned baseboards are often made out of pine or firwood. This style can add a dramatic Victorian or colonial style to your building, but the project can end up being very pricey. For example, a colonial-style trim shows a vintage and elegant style, often found in colonial-inspired living and dining rooms. This style brings

a unique character to a room. If your property is old-fashioned, try incorporating a similar style for the molding, or contrast the building style with a modern baseboard trim. schemes and features of a kitchen.

2. Modern: A modern molding is suitable for relaxed spaces, perfect for contemporary multifamily buildings. Subtle molding such as thin-base moldings are a great way to streamline the interior of a property, giving a modern, minimalistic look to any interior. Flat baseboard trims are optimal for an apartment. Extra-tall baseboards give a higher-end finish quality to any property.

Fiberboard: MDF is comprised of wood fibers, resin and other products. MDF is easy to shape into

various designs due to its material. MDF is also easy to paint or stain, and costs less compared to the majority of other materials. MDF baseboards are flexible and are one of the most popular types in the market. This material is a great option for property managers who want to repaint their baseboards during a rental turn.

2. Wood: Oak is the most popular wood-trim type, especially since it’s able to match any wood in your house. Wood can be vulnerable to warping, so double-check your trim before purchasing. Wood offers a high-end look to any property and you can find a wide range of price options, depending on what kind you buy.

Hardwood also fits in easily with existing molding, making installation cheap and easy. You can have a classic neutral look with a paintedwood baseboard or rustic look by leaving it unpainted.

3. Plastic: Plastic baseboards can easily be styled and colored, but not as easily as wood. Plastic baseboards are less expensive than vinyl or wood. On the other hand, the material is not very flexible, so it can easily be damaged.

4. Vinyl: Vinyl-trim molding is a great option for a ceiling that meets the stairs for an upper floor. The flexible material is great for a unit that has a vintage or classic style throughout the property. Vinyl baseboards also suit bathrooms well, since they can put up with dampness. Vinyl is durable, easy to install and replace, and is less expensive than hardwood. The negatives: vinyl baseboard tends to attract mildew, and the material can’t be painted.

The key to good Tenant Screening is effectively collecting and analyzing the necessary information about Applicants. Of course, the first step is a good Tenant Screening Service that ensures you get all of the information you need, including a credit report, criminal history report, eviction report, and Tenant Score. Using a Tenant Screening Checklist is an easy way to make sure you collect all the data you need. But the second step – analyzing the information and paying attention to any red flags – is also an important part of Tenant Screening. With that in mind, here are 4 things you should pay attention to in Tenant Screening Reports.

When screening Applicants, an important question for Landlords is: will the Applicant consistently pay rent on time? One of the best ways to answer this question is by looking at an Applicant’s past behavior. While screening questions and questionnaires for prior Landlords should ask about timely rent payments, you need more information about past payment behaviors. A credit report and either a credit score or, better yet, an ezTenantScore are the best ways to determine the likelihood that an Applicant will consistently pay rent on time. Here’s why this information is so important:

1. A thorough credit report shows patterns of making payments and managing debt. Most go back 7-10 years and provide evidence of whether an Applicant is on time with

payments.

2. A credit score uses information from the credit report to evaluate an individual’s likelihood of repaying a loan.

3. An ezTenantScore is similar to a credit score, but it’s more narrowly tailored to specifically evaluate the risk of an Applicant not paying rent on time.

Besides just asking Applicants and prior Landlords about timely rent payments, Landlords should evaluate credit reports and an ezTenantScore to look for any evidence that the Applicant has been late with payments or presents a heightened risk of not paying rent on time.

If an Applicant has a history of evictions, this is something you want to know about. Although some states prohibit using eviction history as a reason to reject an Applicant, many Landlords use an eviction history as an important factor in their Tenant Screening. While you can ask Applicants and their prior Landlords about any evictions, the best practice is getting an eviction history report. This will show any evictions in at least the past 7 years, including

times when an eviction was filed but the Applicant never ended up in court. A history of evictions is a major red flag. While some Landlords won’t rent to Applicants with a history of evictions, there are some circumstances where you might decide, based on additional context, to rent to the Applicant. Either way, it’s important to gather all of this information to make an informed decision.

When screening Applicants, you’re looking for a reliable Tenant that will stay through the entire Lease period, pay rent on time, and take care of your property. You want to look for Applicants with evidence of stability and avoid Applicants with evidence of instability. Some issues that could indicate instability include regularly changing jobs, moving frequently, having unexplained gaps in employment, or having poorly managed finances.

To help identify evidence of instability, it’s important to review an Applicant’s credit report, verify an Applicant’s employment and income, talk with two prior Landlords, and review employment and housing history. Sometimes evidence of instability isn’t as glaring of a red flag as other issues, but it’s something that Landlords should pay attention to and consider in

their screening process.

Finally, when reviewing an Application and Tenant Screening report, it’s important to pay attention to any missing or inaccurate information. While it might just be an oversight by the Applicant, it could also be evidence of a bigger issue. Whenever information is missing or inaccurate, it’s important to follow up with the Applicant and your screening provider to make sure you run all necessary reports with accurate information. And, if you determine that an Applicant intentionally withheld information, that would be a major red flag and grounds for rejecting the Application.

When evaluating Applicants, it’s important to know of any past criminal convictions an Applicant has had. While these might not be grounds for rejecting an Applicant – and in fact, in some circumstances and locations it’s illegal to do so – it’s still information that you want to have.

The reality is that there are some criminal history reports that might indicate that an Applicant poses a safety risk to other Tenants, neighbors, or the property. This is information that you need to have! To make sure that your process is consistent and fair, it’s a good idea to have objective guidelines that you use when evaluating all Applicants’ criminal history reports.

When creating these guidelines, remember to only consider convictions, not arrests, and to make sure that your guidelines comply with all state and local laws.

Presented by Bobbie Kirby, Gla Executive director

As of reported early March 2025: The Trump administration, with the help of the newly created Department of Government Efficiency (DOGE), is slashing its way through Federal spending. One of the line items that is now on the chopping block is the Section 8 housing vouchers that are given to about 9 million renters every year. Cuts to the program, or even delays in getting vouchers out, would create hardships for the qualifying low-income renters and could also hurt landlords who have leased to them.

Some fear landlords may be discouraged from accepting vouchers.

Section 8 housing vouchers are paid for by the Department of Housing and Urban Development (HUD). HUD was created in the 1970s and expanded in the 90s with the mission to “create strong, sustainable, inclusive communities and quality affordable homes for all.” The main vehicle they have is through Section 8 vouchers that can be paid directly to landlords. Last year HUD spent $32.4 billion on Section 8 rental assistance, almost half of their entire budget.

Now that budget, as well as the staff employed to spend it, are being looked at as ways to trim Federal spending. A leaked document shows a proposal to cut 4,000 HUD positions, around half of the agency’s staff. Even if the Section 8 program remains that much of a reduction in staff would make it hard for HUD to send the payments to the local housing authorities that then

pay them directly to landlords.

Landlords who do rent to Section 8 tenants will find themselves in a bad position. Most leases state that if renters continue to pay their portion of the rent they cannot be evicted. Even if a landlord decides to sell a property the Section 8 leases will be transferred with it and right now, with the uncertain state of the program, buyers will likely be looking for a significant discount for these kinds of properties.

The concern is that, even if the program continues, the threat of disruption in Section 8 payments will likely scare landlords away from renting to Section 8 tenants. “This program only works well when landlords are involved,” Georgi Banna, general counsel for the National Association of Housing and Redevelopment Officials “Without Landlords, this program can’t exist.”

The City of Flint’s Community Services Division has been awarded $472,000 from the Michigan State Housing Development Authority (MSHDA) through the MI Neighborhood Grant to support renters with accessibility needs. These funds will be used to make critical repairs and updates to rental homes, ensuring Flint residents with disabilities have safer and more accessible living spaces. Selections for the program will be made on a first-come , first-served basis , and eligibility will depend on both the renter and landlord meeting program requirements .

Renters who qualify must:

• Reside within the City of Flint have documented accessibility needs

• Fall within 120% of the Area Median Income (AMI) (Income limits apply)

• Have a written and signed lease with a guarantee that rent will not be increased for at least 12 months post-rehabilitation

• Ensure that the property is insured, has utilities turned on, and has no outstanding tax, mortgage, or code violations from the landlord

Eligible rental units may receive modifications such as:

• Handrails, grab bars, and barrierfree showers/tubs

• Lowered cabinets, ADA-compliant countertops, toilets, and vanities

• Ramps, widened doorways, and zero-step entries

• Indoor/outdoor stairlifts and modified rooms for first-floor accessibility

• Updated wiring to accommodate medical equipment.

The Genesee Landlords Association joins the city of Flint in mourning the passing of the Honorable Judge Archie Hayman, a dedicated public servant whose impact on our city and its legal system will never be forgotten. Judge Hayman was a good friend to the GLA and spoke at our meetings over the years along with acting as a mediator with the courts.

Mayor Sheldon Neeley expressed deep condolences, stating, “Judge Hayman was good friend, a man of integrity, wisdom and fairness in our community. His legacy will continue to inspire all including myself, and his loss will be felt deeply by all who knew him. Please keep his family lifted in prayer during this difficult time.”

As a proud Flint native, Judge Hayman was a graduate of Flint Northwestern High School, Mott Community College, the University of Michigan – Flint, and the Detroit College of Law. His commitment to education and lifelong learning served as a foundation for his distinguished career in the legal field. Throughout his esteemed career, he worked tirelessly to ensure that justice was accessible to all, leaving a lasting mark on the legal profession and the countless lives he touched.

Advertising not only offsets the cost of newsletter printing and member outreach, it also provides services to our association from sources who are excited to work with us at reason- able and reliable rates. Our newsletter reaches an extensive network of real estate investors. Please refer to our local businesses when possible and let them know you saw their ad. If you are interested in placing an ad or know someone who is, the rates are as follows:

What do you like most about the GLA?

What changes would you like to see?

Meeting topic suggestions

Member benefits you’d be interested in

Vendors you’d like to see at meetings

Comments

The following is optional:

Name

Phone Email

Would you like to be on committe? Yes / No

Reduce disputes with tenants by videotaping or taking pictures with your cell phone or camera of the unit’s condition before move-in and after move-out. If you do this when the unit is vacant, the tenant cannot claim his or her privacy was invaded. When move-out is completed, repeat the process again and have evidence of any damage that occurred during the occupancy of the affected tenant.

Ed Constable - President (810) 938-3339

edconstable1@yahoo.net

Aaron Dionne - Vice President (248) 705-1399

rangerbronco@charter.net

Bryan Udell - Treasurer (810) 287-4486 cbu@homeventures.com

Bobbie Kirby - Exec. Director 810-919-5130 ledesta1@att.net

Ryan Scully - Secretary (810) 577-3146 scullyrealestateteam@gmail.com

Bernard Drew

Craig Fiederlein (810) 232-1112

cfiederlein@cflegal.net

Michael Kennedy (810) 210-7347

Ruth A. Johnson (R) Senate District 24

Kennedyhousing1@gmail.com

Terry Hanson (810) 767-2500 terrylhanson@yahoo.com

Political Action Chairman

Henry Tannenbaum (810) 238-2600 hrt@USOL.com

Ohunwa Carthan 810-259-2724 caribo1387@att.org

Office Secretary

Amanda Lynch (810) 767-3080

Melanie Fiederlein (810) 288-9334 melfiederlein@gmail.com (810) 422-3655 mrbdrew@gmail.com

Contributor Linda MacKay

Graphic Designer

Contact: Senator Johnson Phone: 517-373-1636

Kevin Daley (R) Senate District 26

Contact: Senator Daley Phone: 517-373-1777

John Cherry (D) Senate District 27

Contact: Senator Cherry Phone: 517-373-0142