Security company Fidelity ADT has warned homeowners to ensure their battery backups and security support systems are maintained during load shedding.

The group said that load shedding has knock-on effects on home security, and the increased frequency and duration of rolling blackouts in the country are causing damage to these systems.

Regular power cuts are impacting a range of technologies and communications systems, including alarm systems that start to malfunction without adequate battery backup, it said.

The group added that malfunctioning alarm systems increase false alarm activations, which, in turn, impact armed response’s ability to deal with real emergencies.

“Sufficient battery backups and charging capacity can extend the uptime of alarm systems during load shedding,” it said. The group noted, however, that it is not ideal for any battery to be faced with continuing bouts of power cuts –whether they are planned or unplanned.

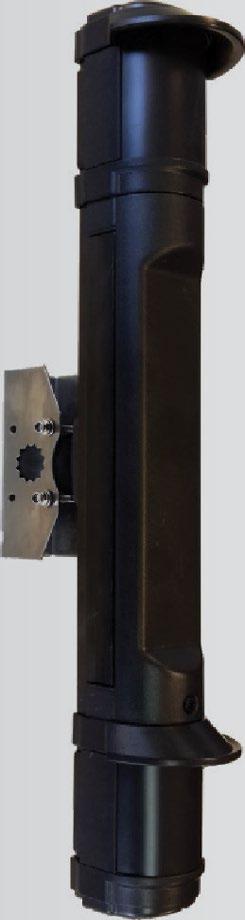

According to Fidelity’s head of communications, Charnel Hattingh, batteries already play a big part in the home security system, including for electric fences and gate motors. While wireless security systems have batteries in the detectors that are not affected by load shedding, the main control box still contains a backup battery that should not be neglected, she said.

“When you check your backup batteries, make sure you look at everything. Preventative maintenance action today can help ensure that your security system still operates the way it should tomorrow,” said the head of communications.

According to Hattingh, batteries have a limited lifespan as they charge and discharge repeatedly.

Batteries that have gone through too many of these cycles deteriorate and may not be able to charge sufficiently during load-shedding times – compromising security systems.

Stage 1 load shedding can give batteries enough time to recharge; however, the higher stages place more pressure on batteries.

Hattingh added that armed response companies might alert homeowners of the potentially low batteries via SMS. Homeowners should ensure that alarm systems are working optimally, said Hattingh.

“Your security system’s keypad can

Making home security a priority during South Africa’s near-permanent state of load shedding is vital, as the rolling blackouts provide the most opportune time for criminals in the country to act. Security experts and insurers recently warned that crime and claim data are pointing to elevated levels of crime in the country, attributing the spike to high levels of load shedding that have been in place since the start of the year.

Auto & General said that it has seen a 40% increase in the number of burglaries reported in the first two weeks of 2023 compared to the same period in 2022.

Speaking at a National Press Club briefing on load shedding security risks last week, security experts said blackouts were simply making South Africa’s already bad crime situation worse.

The warnings go hand-in-hand with alerts from major metros in the country, which have been placed on a high alert to tackle elevated levels of vandalism and theft of public infrastructure during load shedding.

provide you with information about any problems that need technical intervention. Search on the internet for a copy of the system’s user guide or ask your monitoring company to send you a copy.”

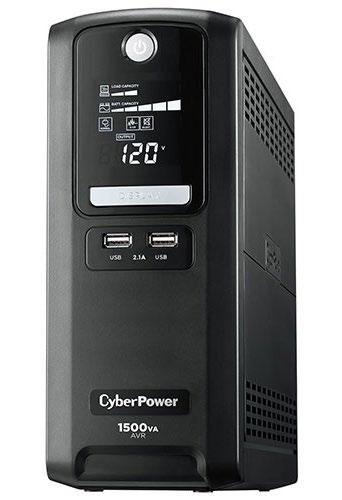

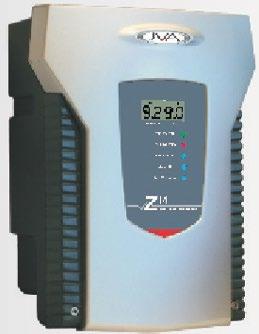

Hattingh said UPS backup systems are also useful to add to any home system, even if they are costly.

“They can play a part in keeping you and your property safe if they are connected properly and used in the way they were intended to be used.”

“The increases seem to be spiking as a result of load shedding. Load shedding is a very worrying factor that powers on to a number of other factors that weaken our public security situation and the ability of the state to effectively respond to that situation,” the security experts said.

Loadshedding is hitting South African consumers right in their pockets. Since the current round of loadshedding started, insurer King Price has seen a 100% increase in the number of claims for damage caused to appliances due to power surges –and with Eskom running out of money to buy diesel in the coming months, as announced in its State of the System Presentation, things are only going to get worse.

That’s the warning from King Price Insurance’s client experience partner, Wynand van Vuuren, who says the company has settled more than R21 million in claims in the past 14 months alone, for damages sustained through power surges and dips affecting residential buildings, home contents and portable possessions. This figure excludes lightning-related and large commercial claims.

“We’re getting a massive number of claims for ‘fried’ computer equipment, fridges, TVs and even distribution boards caused by power surges,” said Van Vuuren. “But there are several steps you can take to avoid having to replace your expensive appliances.”

The easiest, cheapest and most effective way of protecting your appliances is simply to unplug them when you’re not using them, or when the power goes off. That way, you’re 100% protected from power surges, says Van Vuuren.

UPS (uninterruptable power supply) systems can go a long way towards protecting your most valuable appliances. A UPS enables your appliances to shut down properly when the power goes off, and it’ll protect them from the power surges that often occur when the power comes back on.

The most effective surge protectors are connected directly to your distribution board by a qualified electrician. These protectors divert any excess power into a grounding wire. Another option is to use surge protector strips on all your plugs, which provide a certain level of protection against surges caused by the power coming back on after an outage, or by lightning strikes.

Alternative power supplies must comply with safety guidelines, and they must be installed by a registered electrician. Portable generators are relatively cheap and easy to operate but must be correctly linked to your power supply. Simply plugging a generator into a house plug is known as back-feeding and it’s not only dangerous, it may result in any damage not being covered by your insurer.

It’s important to check your home contents insurance to see if you’re covered for damage from power surges, says Van Vuuren. In general, consumers should be able to claim these damages directly from their municipality, but this isn’t always viable. If you’re insured for electrical damage due to power surges and dips, you can claim directly from your insurer, who will then claim from the municipality on your behalf.

If you’re looking to amp up the security of your house or apartment to guard against intruders, you’ve got tons of options. From home security systems and devices to more economical, DIY home security tools, there are many proactive measures you can take to protect your property.

To help with your home security checklist, we put together a straightforward guide of the top 10 easiest and most affordable steps you can take to secure your home and deter burglars

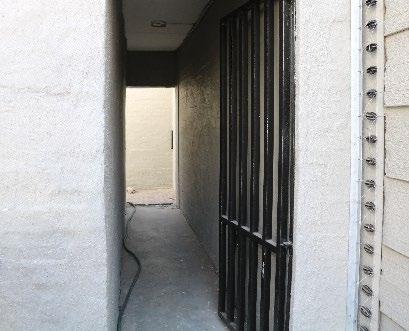

Locking your doors and windows is the first and easiest defense against home intruders, but how many of us are doing it consistently? Burglars are often looking for easy targets, and an unlocked door or window is just that. Even when you’re home, its good practice to keep them locked. And when you’re leaving the house, double-check doors and first-floor windows to make sure they’re all secured. Some devices can also help you keep track of your entryways. Door and window sensors can track whether a door or window has been left ajar, and smart locks can be scheduled to lock automatically at certain times.

Locking your doors and windows may not be enough if you don’t have high-quality locks. First, make sure all exterior doors have a deadbolt, making it more difficult for intruders to break in. While you’re at it, make sure your door frames and hinges are strong enough to endure an attempted break-in -- older doors or exposed hinges can pose an unnecessary risk. Finally, as mentioned above, you can upgrade to smart locks, which you can engage remotely.

Installing a home security system is one of the most effective ways to prevent intruders from entering and to alert you if there’s been a break-in. Data shows that a home without a security system is roughly three times more likely to be broken into. If an intruder spots a security camera or a sign indicating you have a security system, they’ll likely keep moving.

Home security cameras are a great option to add another layer of home protection. Security cameras can alert you if there’s movement in your yard or on your verandah, and door and window sensors will let you know if someone has entered or is attempting to enter your home. Depending on your security company, they may also alert law enforcement on your behalf.

Security systems also don’t have to break the bank. There are plenty of affordable security cameras and great DIY security systems, in addition to stand-alone devices, out there that you can install yourself on a budget.

Some burglars may scope out potential targets ahead of time, ensuring they hit houses where they can get their hands on valuables. As a result, it’s best to avoid keeping your expensive items where intruders can easily see them as they pass by. For example, avoid leaving expensive tools or bikes out in the open, close your garage door, and don’t leave expensive electronics, purses, jewelry, cash and other big-ticket items in front of open windows. You can also consider installing window treatments like curtains or blinds to keep out spying eyes.

Burglars don’t want to feel like they’re on display when breaking into a home, and outdoor lights can help to do just that. Since these crimes are often ones of opportunity, outdoor lights may encourage the intruder to keep moving. Rather than keeping your outdoor light on all the time, consider investing in motion-sensor lights that illuminate the yard when they detect movement. The light will catch an intruder off-guard and potentially scare them off.

And if you would like to take the extra step, there are plenty of outdoor security cameras on the market. From high-end devices to budgetfriendly options, boosting your video-surveillance system can keep your loved ones and your property as safe as possible.

People put a lot of effort into securing their homes but often forget entirely about their garages. Unfortunately, that can be an easy way to gain entrance into your home. First, be sure any regular doors and windows to your garage are locked. Next, consider keeping your garage door opener in the house rather than in your car where someone could steal it. Finally, you should also keep the interior door from your garage to your home locked. That way, if someone does gain entry into your garage, they still can’t get into your home.

As with door locks, buying an aftermarket smart garage door opener is an option. These devices allow you to check the status of your garage while you’re away, control it remotely and schedule it to shut at certain times.

unexpected location far from your doorway. A little extra caution and mindfulness can go a long way in keeping your home safe.

Most burglars don’t want to enter your home when you’re there. They’d rather find an empty home and be in and out as quickly as possible. Therefore, one of the best ways to prevent intruders is to make it look like someone is home at all times.

During the workday, this might include leaving an interior light or the TV on. When you’re gone for a longer period of time such as a vacation, make sure to have a neighbor or family member collect your mail, since mail piling up can be a giveaway that the homeowner is gone for a while.

Smart lights can create an even more convincing effect: many can be programmed to turn on and off periodically to simulate a person being home.

In a perfect world, intruders would never make it into your home, and so you’d never have to worry about your valuables being stolen. Unfortunately, even the best-laid plans can go astray. And on the offchance that an intruder does make it into your home, you want to make sure they can steal as little as possible.

First, consider buying a safe or lockbox where you can keep things like cash, jewelry, important documents and other items you wouldn’t want a thief to walk away with. As far as bigger items such as electronics, you can make them more difficult to steal by putting them in a concealed place when you aren’t using them. Thieves want to be in and out of your home as quickly as possible, so even the smallest deterrent can help.

It’s also important to remember home security extends to deliveries from courier companies or food service companies at your gate. Make sure that there is official paperwork before turning over your ID documents and signing for the delivery.

Do not fall for Please sign for the neighbor who is out story without a prior arrangement. There are con artists everywhere be aware

If you have a house key under your doormat or flowerpot on the porch, rethink its placement. Intruders know these popular hiding places for spare keys, and those are the first places they’ll look. Instead, consider giving the extra key to a trusted neighbor or friend. If you must have a spare key outside your home, look for safer alternatives such as a concealed combination lockbox -- or at least a discreet and

No one wants to become the victim of a home invasion. Implementing the tips on this checklist will help discourage and prevent burglars -- and keep your family and belongings safe. You can start small and pick just a couple of things on this list to focus on. Once you have those down, you can move on to other items on the checklist. Each small improvement you make will ensure your home and loved ones are safe and secure.

It’s Car Insurance Day from 1 February – and it’s time to throw a huge insurance party. Invite your friends. Switch on those desk-top disco lights. Pour a strong coffee. And get down to reviewing your car insurance to make sure you’re properly covered.

Sure, car insurance is one of the great grudge purchases of our time. But, in South Africa, it isn’t a nice-to-have: It’s vital to protect yourself from a range of risks. Car Insurance Day is a great opportunity to review your car insurance to make sure you’re properly covered and celebrate your proud possession.

Many times, when deciding what car insurance cover is best for you, you normally have a choice between ‘retail value’ and ‘market value’. But now you have a third option: Insuring your car for an agreed value.

But what does each option mean? Wynand van Vuuren, the client experience partner at King Price Insurance, breaks it down in the article.

When you insure your car, you normally have a choice between ‘retail value’ and ‘market value’. But now you have a third option: Insuring your car for an agreed value.

But what does each option mean?

We asked Wynand van Vuuren, the client experience partner at King Price Insurance, to break it down.

The retail value is what it would cost to replace your current car. In other words, this is what it would cost to buy your car from a dealer, considering its age, condition and mileage. The retail value is higher than the market value, which is what you’d be able to sell your car for at any given time.

Both retail and market values will depreciate over time, in line with the value of your car. This means that, if your car is written-off or stolen and not recovered, your insurance pay-out wouldn’t be enough for you to replace

the car with a brand-new model.

Insuring your car for an agreed value means exactly that: You’ll be covered for an amount that’s agreed between you and your insurer, for an agreed period. This means that if your car is written off or stolen, you’ll know exactly how much your pay-out will be.

“Agreed value insurance has traditionally been reserved for classic and rare vehicles that are hard to replace in the open market, but it’s starting to become an option for car owners who want the certainty of knowing how much they’ll be paid out if disaster strikes,” said Van Vuuren.

Obviously, insurance premiums for agreed value policies tend to be higher, because the agreed value would be higher than if your car was

Which is better? There’s no right or wrong answer, says Van Vuuren.

“When deciding what car insurance cover is best for you, you need to compare apples with apples – or in this case, comprehensive cover with comprehensive cover. But, when it comes to deciding between market value or agreed value, it all depends on your personal circumstances.

How do you value your car in relation to the market? How much can you afford for your monthly premium? Insuring your car for its market value means a lower premium, but also a lower pay-out. Agreed value means higher premiums, and 100% certainty when it comes to your settlement. The important thing is that you have options,” he said.

You’re the owner of a small business, and your employees are all set up to work from home. Firewall and enterprise-level anti-virus software in place. Regular data back-ups. You may even have cyber-insurance. And then Stage 6 loadshedding kicks in, and your people head for local coffee shops to get some work done – and all your preparation and precautions go flying out of the window.

That’s because they’re likely to log into an unsecured public Wi-Fi network, which brings with it a range of risks – including identity theft, theft of passwords, the installation of malware, snooping for confidential data and even ransomware attacks.

Problem is, both hybrid work and loadshedding are here to stay. So how do you keep your people safe on public Wi-Fi?

It’s Safer Internet Day on 7 February, and we asked King Price Insurance’s George Parrott, commercial partner at King Price, for their top tips for employers and employees alike.

If you can’t ensure your people have backup power systems and safe internet, it’s up to the business to ensure they have somewhere safe to work, like a flexible workspace, that allows them to access company and customer data safely.

“When it comes to security, your people are the weakest link. They use unsecured networks. They click on dodgy links. They use weak passwords. They let other people use their

devices. Your best defence is to create an active cybersecurity culture that gets everyone in the business following basic security habits,” said George.

To stay completely secure, the best thing is to not use public Wi-Fi connections. But if you need to connect to do some work, there are a couple of precautions you can take. Turn your VPN on, and your Bluetooth off. Check your antivirus is working. Use multi-factor authentication. Avoid filling in sensitive information while connected. It’s not ideal, but it’s safer, says George.

Combining a proactive security approach with a strong cyber insurance policy is essential for any business to guard against the potential cost of restoring productivity and reputation after an attack. Proactive security measures include implementing firewalls, appropriate security software, malware scanning and continuous employee training on the basics of security.

Ensure that software patch management on all laptops are enabled as this will fix vulnerabilities on your software and applications that are susceptible po cyber-attacks, helping your organisation reduce its security risk.

“And while cyber insurance policies can’t prevent your company from being attacked, it is an important way to protect businesses from the after-effects of a breach,” said George.

Igrew up on a farm. We had no electricity no municipal water. The house had a rain water container a huge thing it seemed like it went to the moon it was so large We also had a geyser we called it a donkey.

It was made out of a 45 gallon drum with a fire pit underneath it. The moon rocket would feed into the geyser. We would light the fire under the donkey and it would boil the water in the drum which would feed the bath and taps. We had a bathroom and an inside toilet after we had bathed all 5 of us the bath water would be re-cycled into the toilet or the vegetable garden and we never experienced Load shedding as there was no load to shed

When evening came my uncle would start the generator so we had lights and it was my job at 9 pm to pull the cable which switched off the generator

We had a paraffin fridge and a cold room we had a gas stove of sorts with a wood fired oven We kept chickens and sheep

We would go to the local school and come back play in the bush or ride our bikes without helmets. We also had 3 square meals a day.

So why am I telling you all of this?

Unless the government and Eskom get their act together we are going to go back to those days. I read an article from the reserve bank last night that said loadshedding was costing the country 900 million rand a day. No country in the world can sustain that kind of loss.

Big business can live through that but the small to medium business cannot. More and more restaurants, places of entertainment, small 5 or

10 man businesses are closing every day. Insurance companies are refusing to pay for loadshedding damaged goods-fridges; small appliances etc. and the Government seem powerless to stop the loadshedding or just maybe they don’t know how to.

Eskom is trapped in a never-ending cycle of sabotage, poor service delivery and the tail wagging the dog. There are way too many illegal connections and municipalities that do not pay their electricity bills.

For the poor suffering people that do pay their electricity bill they are faced with another price hike.

I for one am GatVol with the state of affairs. It’s time for the government to either fix the issue or hand it over to the private sector who will fix it.

Jason Keogh

Sivile Mabandla

Kerrie Tunder

Elias (JHB)

Samantha (JHB Internal Sales)

Wendy (Bloemfontein)

Eric (Retail Sales)

Gail (Sales Manager)

Georgia (Digital Sales)

Keith (EC Sales)

Billy Keogh (CPT Sales)

Che (KZN Sales)

Kerrie (Corporate Sales)

Daniel (Stores Controller)

Brian (Stores Assistant)

Nontobeko (Product Controller)

We do Graphic Design, Web Design, E-Commerce, Digita

Our mission is to provide our clients with affordable & co without declining in the quality or services provided

WHY CHOOSE US?

We are performance driven and quality assured We alwa what's best for you and your project and that's what we

R1399.99

T'S&C'S APPLY.