The Greatest Show on Earth

Industry expectations for FIFA World Cup 2026

Snapshot

most popular news stories on GamingIntelligence.com

Playtech shares plummet as Evolution names company in report scandal

The UAE Lottery confirms first AED 100 million jackpot winner

Banijay Group agrees transformative deal to acquire Tipico

Premier League club owner denies betting on matches involving his team

Star Entertainment shares soar on Bally’s takeover approval

Gambling industry reacts to UK’s record-breaking Budget

Paddy Power Betfair agrees £2 million settlement

Caesars facing $7.8 million fine over alleged AML failings in Las Vegas

Allwyn and OPAP to combine to create €16 billion lottery and gaming giant

Gambling Commission fines Unibet operator £10 million

Allwyn and OPAP set to create €16bn lottery and gaming giant

ALLWYN INTERNATIONAL AND OPAP have entered into a business combination to create a leading global lottery-led entertainment and gaming operator.

The transaction brings together two leading lottery and gaming operators, and creates the second largest listed gaming entertainment company globally, with market-leading positions across Europe, the United States and other international markets.

Allwyn currently owns a 51.78 per cent majority stake in OPAP, with the all-share transaction valuing the combined company at an equity value of €16 billion.

The agreement builds on the existing successful partnership between OPAP and Allwyn which goes back to 2013, when KKCG, the controlling shareholder of Allwyn, first invested in OPAP.

“For investors, this is a unique opportunity to be part of a dynamic company that is shaping the

future of entertainment,” said Allwyn founder and chair Karel Komarek. “The combined strength and scale of these multi-billion dollar businesses, massive customer base and Allwyn’s continued investment in technology and content, will accelerate innovation and fuel significant international growth. We’re on a mission to build the world’s leading global gaming entertainment company, and today’s transaction takes us one step closer to that goal.”

The combined business will maintain OPAP’s listing on the Athens Stock Exchange, with the company to be renamed Allwyn International. Allwyn also intends to pursue an additional listing on another leading international exchange such as London or in New York.

Independently of the transaction, OPAP has made a strategic decision to change its consumer brand from OPAP to Allwyn from Q1 2026.

M&A ROUND-UP IN Q4 2025

GIQ highlights the key M&A deals during the final quarter of 2025

Banijay Group is seeking to become a European betting and gaming powerhouse after agreeing to acquire a majority stake in Tipico Group for €3 billion. The agreement with CVC and Tipico’s founders will combine the Betclic and Tipico brands, including recently acquired Admiral Austria, with Banijay becoming the majority shareholder of the combined entity. As part of the deal, Banijay has divested its 53.9 per cent stake in bet-at-home.com, the Frankfurt-listed online gaming and sports betting business.

“Banijay Group’s story is one of sustained growth and expansion – uniting entrepreneurs, talent and expertise across industries to build champions,” said Banijay Group chairman Stéphane Courbit, who also serves as president of Lov Group Invest, the largest shareholder in Banijay. “The addition of Tipico marks another decisive step in that journey and reinforces our position as a driving force in the European sports

betting and gaming landscape. This is a strong move that reflects our ambition and long-term vision.”

Elsewhere in Europe, Hacksaw Gaming acquired a minority stake in UK-based games developer Kitsune Studios, which is already a studio partner of Hacksaw’s OpenRGS platform, while Gaming1 agreed to acquire the remaining 50 per cent stake in Betca BV, operator of the Circus.nl brand in the Netherlands.

After completing the acquisition of Bally’s International Interactive business, Intralot is increasing its focus on the lottery and iGaming sectors after selling its stake in Regency Casino Mont Parnes in Athens for €8 million.

Spain’s Cirsa expanded its slot route operations in Valencia with the acquisition of Catarroja-based Amusement Machines Grupo Comatel, and enlarged its land-based presence in Peru with the acquisition of four casinos, three

Allwyn CEO Robert Chvatal commented: “This transaction marks a further milestone in Allwyn’s successful journey. Since being founded 13 years ago, we have grown substantially in terms of business performance, scale and innovation. With this combination, we will be able to grow further, faster as we deploy group-wide know-how, a unified brand and sponsorship strategy, and in-house technology and content.”

DEAL OF THE QUARTER

while OPAP shareholders (excluding Allwyn) will hold the remaining 21.5 per cent, assuming an all-share combination. Following an amendment to the agreement in December, KKCG’s voting interest will be reduced from 85.0 per cent to 75.1 per cent.

Immediately following completion, Allwyn is expected to have an economic interest in the combined company of approximately 78.5 per cent,

“This transaction successful journey.”

of which are based in Lima.

Germany’s Merkur Group was another to strengthen its presence in Spain through the acquisition of eleven arcades in the Basque Country, alongside acquiring Northern Ireland’s largest gaming and amusement machine operator, Oasis Retail Services.

EveryMatrix boosted its front-end development capabilities with the acquisition of Portuguese software provider Goma Gaming, and Oddin.gg strengthened its esports data infrastructure with the acquisition of Denmarkbased GameScorekeeper.

Elsewhere, Aristocrat Leisure agreed a deal to acquire Tel Aviv-headquartered online live casino games provider Awager, Sportradar completed its acquisition of IMG Arena, and Fortuna Entertainment Group entered Montenegro after acquiring a majority stake in Lob, the second largest operator in the country.

In Asia, SJM Holdings entered into an agreement to acquire Casino L’Arc Macau for HK$1.75 billion, while DigiPlus Interactive Corp is preparing to move into the Philippine land-based

“This exciting combination creates a leading gaming company with strong Greek heritage, as well as a continued presence and listing in Greece,” said OPAP CEO Jan Karas. “I’m excited about the opportunity for OPAP to deepen our strong existing relationship with Allwyn, driving innovation and additional growth opportunities.”

Upon completion, Chvatal and Allwyn finance chief Kenneth Morton will continue to lead the management team of the combined company as CEO and CFO respectively. OPAP’s current management team, led by Karas as CEO and Pavel Mucha as CFO, will continue to lead OPAP’s operations in Greece and Cyprus.

Allwyn also owns a 36.75 per cent stake in Kaizen Gaming’s Betano, and is in the process of acquiring majority stakes in fantasy sports operator PrizePicks and iGaming operator Novibet.

gaming sector with the proposed acquisition of New Coast Hotel Manila’s parent company.

It was a busy quarter for Jumbo Interactive which entered the prize draw sector in both the United Kingdom and the United States. First, the company acquired UK-based Dream Car Giveaways for A$109.9 million, where customers can participate to win prizes such as cars, cash, property and lifestyle products. A few weeks later, Jumbo entered the US with the acquisition of the similarly named Dream Giveaway for A$57.8 million.

Also in the US, Kambi accelerated its entry into Nevada’s sports betting market with the acquisition of a player account management (PAM) platform from OMEGA Systems, Accel Entertainment acquired Nevada route operator Dynasty Games, and MGM Resorts agreed to sell the operations of MGM Northfield Park in Ohio to private equity funds managed by Clairvest Group for $546 million.

Entertainment revenue in Q3 2025

trading volumes at Kalshi

equity value of Allwyn and OPAP business combination

Banijay’s proposed offer for majority stake in Tipico

Offshore iGaming: it’s .COMplicated

With greater domestic regulation there is the expectation of a reduction in the offshore iGaming sector. The reality is more complicated.

GOVERNMENTS ACROSS THE world continue the process of regulating their domestic iGaming markets. Brazil’s iGaming sector went live in 2025, while Finland, the last EU member state with an online gambling monopoly, is making progress towards regulating parts of its market, as is New Zealand on the other side of the world. With greater domestic regulation there is the expectation of a reduction in the offshore ‘globally licensed’ iGaming sector. But the nature of the domestic rules being implemented means the situation is more complicated than that.

The blocking lists compiled by gambling regulators give a sense of the scale of the globally licensed sector. Cyprus’ National Betting Authority had almost 21,000 URLs on its blocking list at the end of 2024, up by a third on the number listed in 2021. The Swiss Federal Gaming Board’s list includes 2,600 URLs and the Australian Communications and Media Authority (ACMA) has blocked 1,285 URLs. Across the lists, many URLs are variations used by a single brand and several defunct brands and inactive URLs are included. Nevertheless, the lists do indicate how many opportunities there are for consumers to play with unregulated sites, deliberately or inadvertently, in their domestic market.

There are different approaches to regulating iGaming adopted by governments, but none have been able to prevent the appeal of offshore brands outside their locally-licensed model.

The Hong Kong Jockey Club (HKJC) has long argued that its high taxation and restricted betting options has allowed the illegal market to flourish in Hong Kong.

In 2024 the HKJC briefed a delegation of the United Nations Office on Drugs and Crime (UNODC) that illegal gambling turnover in Hong Kong was estimated to be more than HK$350 billion (€38 billion). By comparison, the HKJC’s own turnover was HK$305 billion in 2024.

Hong Kong’s Legislative Council passed the Betting Duty (Amendment) Bill 2025 in September to legalise betting on basketball in an effort to combat illegal gambling.

The illegal market in basketball betting in Hong Kong is estimated at between HK$70 billion and HK$90 billion.

Expanding the range of betting sports beyond horse racing and football is a welcome development for the HKJC. But its overall duty and profits tax still represents 66 per cent of revenue, so it will always be difficult to be as competitive on price as the illegal market.

Finland’s reason for ending its own gambling monopoly was the recognition that its ability to reduce the social harms associated with gambling has been weakening over the years.

This fact was highlighted in a report published by the Finnish Competition and Consumer Authority (FCCA) in June 2023, which estimated that gambling revenue earned outside the Finnish state monopoly amounted to approximately €520–590 million in 2021, which was 50 per cent of the total spent on online gambling in Finland. This is a level similar to Hong Kong’s estimates of illegal betting turnover – 53 per cent.

Finland’s licensing process will be conducted in several stages, with the first being application for operators’ licences in 2026 and a market launch in 2027.

Looking around Europe, however, there is no guarantee that ending the monopoly in Finland will automatically reduce or end the appeal of the offshore market to consumers.

France ended its gambling monopoly in 2010 but opted not to permit online casino games in its regulation. Online casino games, particularly slots, are the biggest category in many regulated markets, so it is no surprise that unlicensed online gambling is still a significant problem in France.

A 2023 PwC report for French gambling regulator ANJ estimated that unlicensed online gambling revenue in France ranged between €748 million and €1.54 billion, which would represent anywhere from a third to two-thirds of the regulated online sector.

Finland is at least allowing all the key online gambling products under its new regulations, but even fully competitive markets are struggling to achieve a channelisation rate (amount of online gambling revenue spent with licensed operators) of more than 75 per cent.

The Netherlands Gambling Authority (KSA) has conducted research into the size of the illegal market in the country and it drew some stark conclusions. Based on its estimates, the KSA believes that since the start of 2023 the channelisation rate has gradually declined from an average of 66 per cent in Q1 2023 to 57 per cent in Q3 2024.

On 1 October 2024 new deposit limits came into force with the aim of ‘protecting consumers from the risks of online gambling’. After the limits were introduced, the channelisation rate dropped even further to an average of 49 per cent in the final quarter of the year.

The KSA concluded that the size of the illegal online market in the last three months of 2024 represented 50 per cent of the Netherlands’ total online gambling revenue (legal and illegal) at approximately €305 million.

The Dutch government exacerbated the situation by increasing gambling tax to 34.2 per cent at the start of 2025.

For the first four months of 2025, the KSA estimated the channelisation rate for legal online gambling revenue to be 51 per cent.

Furthermore, the regulator said that overall gambling tax revenue in the Netherlands for 2025 will be 5 per cent (€40 million) less than 2024, despite the higher tax rate.

Michel Groothuizen, chairman of KSA, expressed his concern about the developments in the sector: “The measures we have taken to offer players more protection have made it more difficult for providers financially. This has led to a decrease in the gross revenue for the entire market. As a result, the revenue from gambling tax has also decreased.”

In Sweden, the government’s aim for its competitive online gambling market was for 90 per cent revenue channelisation.

Swedish horseracing licensee Ab Trav Och Galopp (ATG) monitors the rate of channelisation in the domestic Swedish market and its Q4 2024 report suggested that the channelisation rate was between 69 per cent and 82 per cent across all products. For online casino gaming,

“The measures we have taken to offer players more protection have made it more difficult for providers financially”

KSA

chairman Michel Groothuizen

ATG estimated the channelisation rate in Q4 could have been as low as 59 per cent.

Even though the rate was likely below target, the government still increased gambling tax from 18 per cent to 22 per cent in July 2024.

In October 2025, the Swedish state-owned operator Svenska Spel called for tighter spending limits and a ban on the direct marketing of gambling to people under the age of 25, as well as a general marketing ban on online games deemed to be high-risk.

Sweden’s online gaming industry trade association BOS warned of driving players to unlicensed sites with these restrictive regulations.

“If Svenska Spel’s proposal were to go through, even greater market share awaits unlicensed and illegal online casinos,” claimed BOS secretary general Gustaf Hoffstedt.

“It is a natural consequence if the legally licensed gaming companies are prevented from marketing themselves and their products. The proposal that Svenska Spel dresses up in the name of consumer protection would therefore, on the contrary, harm consumer protection,

as we know that a transition from licensed to unlicensed gaming entails an increased risk of problem gambling.”

European markets like Sweden, the Netherlands and the United Kingdom have taken many years to adopt regulatory measures that are hurting their online gambling markets. Brazil has started along the same path within just a few months of regulating its gambling sector.

Brazil’s locally licensed gambling market opened at the start of 2025 and the reduction of the country’s illegal gambling market was one of the drivers for regulation.

By June 2025 there was already a proposal for a 50 per cent increase in the rate of gambling tax, taking it from 12 per cent of revenue to 18 per cent.

The Brazilian Institute of Responsible Gaming (IBJR) reacted strongly to the tax proposal, stating, “the measure is unacceptable and makes it impossible for many companies that trusted and invested in the regulated market to operate, generates legal uncertainty and threatens public revenue.”

Fortunately for Brazil’s licensees, the tax increase was removed from the proposal (MP 1,303) before a vote was held in October 2025. A new measure to tax Brazil’s licensees retrospectively on their revenue back to 2014 was added to MP 1,303 at the last minute and this may have caused it to have been voted down in the Chamber of Deputies.

But the Brazilian government does seem intent on increasing gambling tax as part of its revenue-raising plans from “betting, billionaires and banks”.

A survey of 2,000 gamblers in Brazil conducted by Instituto Locomotiva between April and May 2025 concluded that between 41 per cent 51 per cent of the Brazilian betting market was still unregulated.

Regulatory change is not restricted to the onshore iGaming markets and there is also a shift taking place in the offshore gambling

jurisdictions. In recent years there has been a changing of the guard between old and new jurisdictions, as operators’ requirements alter.

Some of the long-established European jurisdictions are fighting for relevance with licensees. Alderney has seen its licensees fall from a peak of 57 in 2016 to 36 in 2024 and the Alderney Gambling Control Commission issued no new licences in 2024.

The Isle of Man Gambling Supervision Commission oversees 63 licensees but in the first nine months of 2025 28 licences were cancelled or surrendered and just five issued.

In August 2025, Annexio Limited, operator of the lottery betting brand LottoGo, said it was to surrender its Isle of Man gaming licence because of what the company described as “changing market realities”.

Annexio highlighted factors such as the rising costs of compliance and customer acquisition across multiple jurisdictions for its decision. The company will maintain its office in the Isle of Man but will operate under licences issued in the UK, Jersey and Northern Territory, Australia.

Jurisdictions like Tobique and Anjouan are finding favour with “globally licensed” operators and both oversee many more licensees than Alderney and the Isle of Man.

The Nevis Online Gaming Authority (NOGA), which was established in 2025, is also seeking to attract its share of offshore operators.

Global Gaming Solutions launched its new venture called iGaming Licensing in September 2025 to meet the needs of the changing market dynamics.

iGaming Licensing positions the rise of the newer jurisdictions as one of financial cost, saying it will focus on “helping emerging operators and software providers which are looking to acquire more affordable licences in jurisdictions such as Anjouan, Nevis and Tobique”.

Mark O’Neill, managing partner, said: “Not every operator and software provider needs a toptier gambling licence, the cost of which is often

Summary of unregulated gambling market size

“Not every operator and software provider needs a top-tier gambling licence, the cost of which is often prohibitive for smaller, emerging companies.”

Global Gaming Solutions managing partner Mark

O’Neill

prohibitive for smaller, emerging companies. However, it’s vital companies still ensure they are compliant and have a strong regulatory framework so they can protect their business and players and build a strong foundation for growth.”

Within the European Union, Estonia is making its own push to establish itself as an online gambling hub and is reducing its rate of gambling tax to 4 per cent over the next few years.

But one of Estonia’s key licensees is notably going against the offshore trend. Yolo Group announced in September 2025 that it would be leaving behind its Sportsbet.io and Bitcasino.io brands in favour of a single Yolo.com brand that will focus on Tier-1 regulated markets.

Yolo stated it would turn its attention to markets like Canada, Sweden and Finland and has also secured two B2B Vendor licences issued by the General Commercial Gaming Regulatory Authority (GCGRA) of the United Arab Emirates.

It is clear there are several competing forces currently acting upon the online gambling sector, which are causing changing market dynamics.

The trend for local licensing is giving more opportunities for both gamblers and operators in regulated markets.

But the accompanying drive for higher tax and restrictions on players’ behaviour in the name of responsibility is an area offshore operators can exploit.

Tax rises are not necessarily ‘seen’ by a player but their impact is reflected in prices, bonuses and even minimum bet size - all of which can be a source of competitive advantage for offshore brands.

At the end of 2025, seven leading European gambling regulators, including the UK, Italy and Spain, announced an agreement to work more closely to tackle illegal online gambling. The agreement focuses on preventing the promotion of illegal gambling. But the success of the likes of Anjouan and Tobique in attracting licensees in recent years combined with governments’ own detrimental policies shows the battle will be far from straightforward. n

Finland enters the modern era

Hippos

ATG chief compliance

officer Antti Koivula

gives GIQ an overview of what’s in store for Finland’s re-regulated gambling market

TUESDAY 16 DECEMBER marked a historic moment for Finland. On that day, Parliament voted 158-9 with 32 absentees to approve the long-anticipated Gambling Reform Bill, formally ending the country’s decades-long reliance on a monopoly model. The new legislation introduces a partial licensing regime that will reshape how gambling is regulated, offered, and supervised in Finland.

Under the new framework, betting, online casino, online bingo and online slot games will move to a multi-licensing system, while other allowed gambling verticals will remain within the exclusive rights of the state-controlled operator. The policy ambition is familiar from other Nordic and European reforms: open parts of the market to competition to improve channelisation and consumer choice, while tightening harm-prevention and enforcement to protect players and the public interest.

Timeline and scope of the new system

The B2C licensing window will open on 1 March 2026, with licensed operators permitted to enter the Finnish market from 1 July 2027. In parallel, Finland will introduce a B2B licensing regime. Applications for B2B licences will open on 1 July 2027, and from 1 July 2028 B2C licensees will only be allowed to use B2B suppliers that hold a Finnish licence.

Legislative background and international benchmarks

The reform builds heavily on the old Lotteries Act, which served as the starting point for drafting the new legislation. Many concepts, obligations and enforcement mechanisms have been carried over directly or modified only slightly, rather than rewritten from scratch. The legislator also benchmarked foreign

systems, with Sweden’s gambling framework serving as the primary reference point. Elements from the Danish, Dutch and a few of other European systems were also considered.

Licensing, fees and taxation

On both the competitive B2C side and the B2B side, the number of licences is not capped, and licences are granted for five years at a time. The B2C licensing fee is € 29k (note: at the time of writing, this had not yet been formally confirmed).

Licensed B2C operators will be subject to a 22% gambling tax on GGR, in addition to an annual supervision fee calculated on GGR. The supervision fee ranges from €4k for operators with under €100k in annual GGR up to €434k for operators with at least €50M in GGR. B2B providers are subject to annual supervision fee of €1500.

Marketing rules and restrictions

Marketing is permitted only through explicitly listed channels, including the operator’s own websites and social media accounts, TV and radio, sports events and other public events, printed media and digital publications equivalent to printed media, search engines, outdoor advertising, direct marketing with explicit customer consent, and sponsorships.

Even within these permitted channels, significant restrictions apply. The use of affiliates and influencers is prohibited, and digital marketing is generally heavily limited. In practice, this is a framework where operators must work harder to earn attention through brand trust and product quality, rather than the typical aggressive acquisition mechanics.

Bonuses and player incentives

Bonuses will be allowed only in a limited and tightly controlled form. Moderate bonuses may be offered to existing customers, but the amount a player has gambled may not influence bonus eligibility or value. In practice, this eliminates welcome bonuses and VIP. Bonus wagering requirements must fall between 1x and 5x.

Player identification and financial safeguards

All players must register and authenticate using strong electronic identification. Gambling with cryptocurrencies is prohibited, as is gambling on credit.

Players will be required to set self-imposed deposit limits. Mandatory loss limits are not included in the initial implementation, although the legislative materials suggest that mandatory loss limits could be introduced later through secondary regulation.

Responsible gambling and duty of care

Finland will introduce a centralised gambling blocking system, closely modelled on Sweden’s Spelpaus. In addition, operators must offer operator-specific blocks as well as game-type or game-specific blocks.

The duty of care obligations require licence holders to use automated processing of specified player data to assess the risk of gamblingrelated harm and to intervene where necessary. Importantly, the system also includes a socalled “panic button”, allowing players to suspend all gambling immediately until the end of the following day. Additionally, the framework mandates gambling time reminders, clear onscreen responsible gambling notices, and clear information on available self-exclusion tools and public gambling harm support services.

“Finland’s reform offers a rare opportunity to build a sustainable gambling market from the outset, and the ambition if to combine modern player protection tools with transparency and a genuinely player-first mindset.”

Hippos ATG chief compliance officer Antti Koivula

Enforcement and supervision

The regulator is equipped with an enforcement toolbox that includes cease-and-desist orders, administrative fines, content and website removal orders, public “name and shame” listings, referrals to criminal proceedings, and ultimately licence revocation. These tools provide a solid framework for supervising licensed operators that are identifiable, cooperative and operating within the regulatory perimeter. Their ability to address unlicensed offshore operators is, however, more questionable. The possible introduction of payment service provider and internet service provider blocking mechanisms was expressly left for future assessment.

Decree-level regulation and remaining uncertainty

Several key elements of the system were intentionally left to be defined through government or ministerial decrees following the bill’s approval. While this allows flexibility and faster regulatory responses, it also introduces uncertainty, as decree-level rules

can be amended relatively quickly.

Notably, matters such as mandatory loss limits, permitted game characteristics (for example autoplay or bonus buy features), temporal and time-based restrictions, maximum stakes, and round speeds will be determined at decree level rather than directly in the Act. For operators this makes Finland a market where compliance readiness must include not only the statute, but also active monitoring of secondary regulation and its practical interpretation.

What this means for horse betting and Hippos ATG

Hippos ATG is one of the operators preparing for Finland’s new licensing regime. The company has been established to operate in the re-regulated Finnish gambling market with a strong focus on horse racing and is a 50–50 joint venture between the central organisation of Finnish equestrian sports and horse breeding, Suomen Hippos ry, and Sweden’s most prominent gambling operator, ATG. This structure combines deep roots in Finnish horse racing with more than five decades of experience from regulated gambling markets.

The premise is straightforward: in a licensed and competitive environment, horse racing can remain viable only if it competes as a modern gambling product. Horse betting does not exist in isolation, but competes directly with sports betting and online casino, both of which invest heavily in innovation and user experience. To retain its position, horse racing must meet comparable consumer expectations while preserving its close connection to the sport itself through continuous product development and a clear prioritisation of horse racing as a core offering.

The ownership structure reinforces this alignment. Hippos ATG is owned by the sport, and profits flow back to sport. Suomen Hippos receives 60% of all profits, regardless of whether customers choose horse betting, sports betting or casino products. This creates a direct and transparent link between commercial success and the future of Finnish horse racing that no other operator in Finland can match.

Responsible gambling is embedded into this model. Finland’s reform offers a rare opportunity to build a sustainable gambling market from the outset, and the ambition is to combine modern player protection tools with transparency and a genuinely player-first mindset. Operationally, Hippos ATG is building a Finnish organisation for Finnish consumers, operating from Finland with a local team that understands the culture, language and regulatory environment.n

TOGETHER IN PERFECT DISHARMONY

As leading operators try to mitigate higher remote gambling taxes in the UK, GIQ takes a look at what options are available to them

THE UK GOVERNMENT’S policy development in the area of gambling is disjointed and reactionary at best. But to consult on the benefits of tax harmonisation and somehow have more gambling taxes at the end of the process is truly remarkable. That is where the United Kingdom’s remote gambling sector finds itself after November’s Budget.

In May 2025 HM Treasury launched a consultation on the introduction of a single tax for remote gambling, claiming a single duty would provide tax certainty and increase simplification for remote gambling operators.

The proposal in the consultation was for the introduction of a single Remote Betting and Gaming Duty (RBGD) and the government put forward several reasons for the idea:

● ensure the taxation of remote gambling is appropriate to the industry

● create a tax which reflects the commonalities of remote gambling

● simplify the system and reduce administrative burdens

None of these purported benefits will apply to the taxation of remote gambling from April 2027.

A UK online gambling brand with a sportsbook and casino currently pays General Betting Duty (GBD) at 15 per cent of revenue and Remote Gaming Duty (RGD) at 21 per cent.

By April 2027, that brand will pay GBD on horseracing at 15 per cent, GBD on sports betting at 25 per cent and RGD on online gaming at 40 per cent.

UK gambling duty summary

In 2024 RGD collected £1.12 billion in revenue for HM Treasury, which was a new annual record and the second year in a row in which more than £1 billion was earned. RGD was the single largest contributor to UK gambling tax in both 2023 and 2024 at around 30 per cent.

RGD was raised by six percentage points to 21 per cent in April 2019, and measuring the direct impact of this increase is complicated by the pandemic period over the following couple of years.

But revenue from online slots and gaming has generally continued to grow year-on-year and hit £5 billion in FY 2025. A near doubling in RGD from 21 per cent to 40 per cent, however, is a different scale of increase.

From 2027/28, when all the new gambling tax measures from the Budget are implemented, the Treasury estimates it will add £1.1 billion in extra gambling tax per year.

This estimate assumes that 89 per cent of the duty rise is passed on to customers in higher margins and that gambling demand is likely to fall as a result of those higher margins. The assumptions were based on analysis of the 2019 RGD increase and rate changes in both Denmark and Sweden.

The most recent data on the influence of tax

changes to gambling behaviour and revenue comes from the Netherlands, where the Dutch government increased gambling tax to 34.2 per cent at the start of 2025.

The Dutch regulator KSA said that it expects overall gambling tax revenue for 2025 to be 5 per cent (€40 million) less than 2024, despite the higher tax rate.

It is also worth noting that the unregulated online gambling market in the Netherlands is almost equal to the size of its licensed online market.

Several of the leading operators in the UK have understandably said that they will try to mitigate the higher taxes.

So, what options might be open to them?

Increase the win margin

Increasing the margins is the most obvious course of action open to operators and is a key assumption in the government’s estimates.

The sector-wide gross win margin on online slots has been steadily increasing since FY 2021 from 3.87 per cent to 4.95 per cent.

When the annual turnover on online slots exceeds £80 billion, even a rise of a tenth of one per cent is meaningful to improve gross revenue.

ICE SPECIAL 2026

It is easier to hide a margin increase in online slots, but customers will notice that their usual deposit does not last as long as it previously did.

Most individual gamblers will bet their deposit to extinction, so unless they increase their deposit size, the operator is simply earning the same amount of revenue from them more quickly than before it raised the margin – which does nothing to mitigate the RGD it pays.

The risk to raising the margin is that customer demand reduces and some customers stop playing altogether.

Increase the minimum bet size

Increasing the minimum bet size has been used by sportsbooks in jurisdictions where tax rates have been raised.

As with increasing the margin, the measure can mean some gamblers just use up their deposit more quickly, rather than earning the operator any more revenue.

It can also dissuade casual gamblers from betting, which might reduce revenue but does remove a cohort of low-spending customers who are no longer profitable to administer in the face of higher taxes.

The implementation of maximum stakes at £2/£5 for online slots in the UK makes a minimum bet less relevant as a means of mitigation for this product.

Product development – testing the boundaries

The substantial difference between GBD and RGD means there is a definite incentive to test the boundary between fixed-odds betting games and casino games.

This has been seen in South Africa where online betting is permitted but online gaming is not. Sportsbooks have been offering “betting” on online gaming by arguing that their products were not casino games, but rather fixed-odds bets on the outcome of a “scheduled, remote contingency” – such as the spin of a roulette wheel located in another jurisdiction.

A similar argument was used by bookmakers in the UK over 25 years ago to install fixedodds betting terminals in betting shops.

But any significant success in pushing the boundaries will likely be short-lived because government and the regulator will simply close the loophole.

Subscription service

A subscription service with a monthly fee to get better odds, unique promotions or early access to new games can offer a new source of revenue.

The risk for an operator is that there is very

little differentiation between UK brands in the odds and games they offer.

If customers can go to a rival brand to get the same odds or games for free, then the subscription service fails.

Reduce marketing and promotions

Cutting costs is another option for operators and marketing is a key expense for the sector.

Operators that can spend their budget most effectively and target the right customers to get the quickest return on that spending will be in a stronger position for a high-tax environment.

But it is easier said than done, as the oft quoted saying demonstrates: “Half the money I spend on advertising is wasted; the trouble is I don’t know which half.”

Cut jobs and increase automation

The trend for automation in various business processes from game development to customer service and trading will be intensified with the higher taxes.

Reductions in the number of employees could mean that the sector contributes less to employment taxes, offsetting the government’s gain from any higher gambling duty paid.

A final measure announced in the Budget

was that the UK Gambling Commission (UKGC) will receive £26 million in funding over the next three years to tackle illegal gambling.

In November 2025 UKGC published the final chapter of its research into illegal gambling in which it concluded, “having examined different methodologies, we are not yet in a position to make a robust and reliable estimate of the size of this [illegal] market”.

Super Group CEO Neal Menashe responded to the tax increase by saying that it needed to be matched by action on unlicensed brands:

“Super Group supports the reasonable taxation of online gaming in the UK. We rely on the government to ensure that today’s very substantial increase should be paired with robust and strict enforcement against non-paying offshore operators. This is essential to protect the regulated sector’s investment in jobs, technology, and responsible gaming in the UK.”

UK remote gambling brands face a combination of high tax and regulatory measures, such as affordability checks, that play into the hands of unlicensed operators.

The options to mitigate the tax also come with the risk of deterring customers from playing.

Estimates from other jurisdictions with high-tax, restrictive online gambling markets are that the unlicensed sector accounts for anywhere between 18 per cent and 50 per cent of total online gambling.

“UK remote gambling brands face a combination of high tax and regulatory measures, such as affordability checks, that play into the hands of unlicensed operators.”

If UKGC fails to protect its licensees from a growing illegal market, it would be no surprise to see legal action taken by an operator in the future.

The government’s forecast for an extra £1 billion in annual gambling tax is by no means a certainty.n

Be Informed

From breaking news to CEO interviews, legal and regulatory information, financial analysis, product developments, and in-depth company profiles. Gaming Intelligence provides a one-stop source of news and intelligence on markets and competitors.

Sign up today at GamingIntelligence.com and join the thousands of industry professionals who rely on Gaming Intelligence to deliver critical business information.

What do the world’s most successful gaming companies have in common?

They have empowered their organisations from the top down with the information they need to succeed in a rapidly evolving market.

SPONSORED BY

We received an unprecedented number of outstanding nominees for this year’s Hot 50. Congratulations to all of those who are celebrated on the following pages, and thank you to the thousands more that make this industry what it is.

Keiron Downs

Head of Content Operations

Evoke

With over 11 years in the iGaming industry, Keiron has developed deep expertise through his work at Evoke, where he has managed key gaming products for William Hill, 888, and Mr Green. Initially focused on Evoke’s UK portfolio, Keiron has since supported the group’s wider international expansion, developing tailored strategies and curated game roadmaps that align with the unique behaviours, expectations, and commercial priorities of each brand and region.

Over the years, he has become known for his ability to balance customer-focused product thinking with strong commercial awareness, ensuring each market receives a thoughtful, data-driven approach that supports sustainable growth.

Dezso Pazmany

Director of Product Operations

Bally’s Corp

With nearly a decade of experience in the iGaming industry, Dezso has developed deep expertise across multiple verticals, successfully leading teams in marketing, commercial, and product functions. He began his career at Kindred, progressed to key roles at Entain, and now serves as a Director at Bally’s.

Throughout his career, Dezso has established strong relationships with leading suppliers— partnerships that have been instrumental in elevating and expanding Bally’s product portfolio into a truly market-leading proposition. His commitment to personalisation and a data-driven strategy has helped position Bally’s as the UK market leader in new-game performance.

Dezso’s strategic vision, innovative mindset, and disciplined execution continue to drive significant growth. These qualities make him exceptionally well-placed to support Bally’s ambitions for new-market expansion and sustained commercial success.

Rob Passerino Senior Manager, Casino Operations BetMGM

Rob has been instrumental in cementing BetMGM’s position as a leading online casino operator in North America. Overseeing a period of rapid growth and innovation, Rob’s main responsibilities include managing the overall content strategy, owning all commercial relationships and negotiations with vendors, and running day-to-day operations across BetMGM Casino. Having been promoted three times in just five years, Rob has played a pivotal role in shaping Bet-

MGM’s success.

During this time, he has helped expand operations into Michigan, Pennsylvania, and Ontario, overseen the launch of Wheel of Fortune Casino, and delivered an industry-first omni-channel exclusive with Rakin’ Bacon, uniting MGM properties and BetMGM online. Rob also secured a landmark partnership with The Wizard of Oz and continues to drive bespoke IP development with major entertainment and sports brands including The Price is Right, the NHL and more. His strategic focus on bringing top new studios to the U.S. market first, including Octoplay, and helping coordinate Push Gaming’s debut in the U.S. following MGM’s acquisition, has further strengthened BetMGM’s leadership position. With his strategic vision, creative leadership, and unwavering focus on execution, Rob continues to set new standards for innovation, partnership, and omni-channel excellence in iGaming.

Greg Kett Director of Casino ComeOn Group

Greg is the Director of Casino at ComeOn Group — a role that builds on his senior leadership experience across some of the biggest names in iGaming, including Betway, Betfair, and Bet365, as well as a stint at The National Lottery (Camelot). With a foundation in product, commercial, and marketing roles, he has developed a deep understanding of how to strategically scale casino operations across multiple brands with a strong focus on regulated markets.

He has led the development and execution of a long-term casino vision, leveraging in-house platforms to drive data-driven personalisation, optimise retention strategies, and deliver a first-class player experience across all casino verticals.

Innovation has been a constant thread throughout his career. In previous roles, he contributed to product roadmaps and crossfunctional initiatives, shaping commercially successful, player-centric offerings. He combines this hands-on experience with a focus on longterm growth — building partnerships, defining go-to-market strategies, and leading transformation initiatives that put the player first, all while ensuring scalability, compliance, and strong business impact.

Keiron Downs

Dezso Pazmany

Greg Kett

Rob Passerino

Sam Leggott

Director of Gaming Operations LeoVegas Group

Sam is a seasoned iGaming executive and currently Director of Gaming Operations at LeoVegas Group, where he leads operational strategy and delivery across the gaming division. With more than a decade of industry experience, he focuses on driving performance, efficiency, and product excellence.

Since joining LeoVegas in 2020, Sam has progressed through several senior roles, including Head of Gaming Performance, underscoring his strategic impact and ability to scale operational capability.

His career began at William Hill in 2008, followed by senior positions at Betclic, Kindred Group, BGO Group, Paddy Power Betfair, and Playzido, giving him deep expertise across commercial, operational, and strategic disciplines.

Sam’s promotion to director forms part of Leo Vegas’ wider organisational realignment and reflects his reputation as a forward-thinking leader with a strong track record in shaping high-performing gaming operations.

Tugomil Cerovˇcki

Director of Casino SuperSport – Entain

Few leaders in European iGaming embody longevity, loyalty, and adaptability quite like Tugomil. Celebrating 25 years with the same company, his journey mirrors the very growth of the Croatian market itself. He joined when SuperSport had only one location and personally opened the second. From that moment onward, he has been part of every major chapter in the company’s evolution.

Starting his career in a hands-on operational role, he steadily rose through leadership positions, including Head of IT, Head of Security, CTO, CIO, and ultimately, when Croatian legislation allowed casinos, he built one from

scratch and became Director of Casino. This progression is more than a résume; it represents a rare combination of institutional knowledge, market understanding, and the ability to lead through continuous change.

Under his direction, the company’s casino has grown into a central and eastern Europe industry benchmark. The platform is widely recognised as one of the strongest, most usercentric and best-performing casinos in the region, praised for its design, product quality and commercial impact. His leadership has been instrumental in transforming it from an internal project into a market-defining revenue engine.

Colleagues and partners across the industry describe him as the “go-to person” for understanding how the Croatian online casino landscape truly works. From regulation and product strategy to provider relations and long-term commercial planning. What sets him apart is his ability to balance operational discipline with a sharp strategic eye, ensuring that the casino offering remains both competitive today

Matt Taylor

Content Director

Flutter Entertainment UK&I

As Content Director for Flutter UKI, Matt has reshaped how three major brands, Sky Betting & Gaming, Paddy Power and Betfair, work together, unifying their content teams into a single, strategically aligned function.

His team now has end to end ownership of the full content lifecycle with dedicated teams focused on Delivery, Growth, Performance & Innovation.

Central to this transformation is Matt’s commitment to building deep, data-driven

and ready for tomorrow.

With 25 years of service, countless launches, regulatory shifts, and market transitions behind him, Tugo continues to drive forward with the same calm determination and clarity that have defined his entire career. His influence on the Croatian iGaming sector is undeniable, and his role in shaping its future is far from over.

Alberto Telias Chief Marketing Officer Codere Online

Alberto is celebrated for his outstanding leadership in elevating the brand across Spain and Latin America. With nearly two decades of digital marketing experience, including stints at William Hill and The Stars Group, he has driven remarkable growth through innovative sponsorships, omnichannel strategies and culturally resonant campaigns. His work played a key role in Codere rising to 7 th in the prestigious “Brand Finance Spain 100” ranking, the only gaming brand featured.

Alberto has also spearheaded highimpact partnerships, including an expanded sponsorship with Mexican football club CF Monterrey, and helped launch Codere’s GOAT campaign, celebrating everyday bettors as the “Greatest Of All Time”.

His data-driven, football-centric marketing has strengthened Codere’s presence across regulated markets, cementing him as an award-worthy leader shaping the future of gaming in Spanishspeaking regions.

partnerships with both internal and external studios to secure the best content possible for Flutter’s players.

With 17 years in the industry and wideranging experience across product, operations, marketing and analytics, Matt’s strategic leadership style allows him to connect teams, align strategy and unlock value.

His influence will be pivotal to Flutter’s growth and content innovation in the year ahead.

Sam Leggott

Tugomil Cerovˇcki

Pierluigi Rinaldi Head of Casino & Business Development FDJ UNITED

Pierluigi is a key strategic leader at FDJ UNITED, driving the direction and commercial performance of the Casino vertical across multiple regulated markets. As Head of Casino & Business Development, he is central to shaping product strategy, elevating supplier partnerships, and ensuring the business delivers against ambitious growth targets. Pierluigi combines strong product expertise

with clear strategic vision, guiding teams to make confident, data-driven decisions that strengthen FDJ UNITED’s market position. His leadership ensures the casino offering evolves with customer needs while staying aligned with long-term business goals. A decisive and influential leader, Pierluigi brings direction, discipline, and measurable impact to every initiative he drives.

Luca Galli Vice President of Business

Jack Bailey

Commercial Director Octoplay

Jack has been a driving force in the iGaming industry for the past four and a half years, beginning his career at Playzido where he led the commercial charge during a period of exceptional growth. Under his leadership, Playzido – now Light & Wonder’s Spark platform – achieved its earnout targets, launched more than ten new studios into all regulated U.S. states, and expanded from just ten operator brands in a single jurisdiction to over 250 operator brands across more than twenty global markets.

Jack’s strategic approach and deep understanding of both product and partnership have been instrumental in elevating Playzido into one of the industry’s most competitive B2B platforms. His ability to blend commercial acumen with creativity has helped forge strong operator relationships and deliver consistent revenue growth.

“Jack’s strategic approach and deep understanding have been instrumental in elevating Playzido into one of the industry’s most competitive B2B platforms”

Luca Galli

Jack Bailey

Matt Taylor

Justin Cosnett Chief Product Officer

Continent 8 Technologies

Justin’s work not only drives Continent 8’s success but also elevates infrastructure standards across the global gaming ecosystem. With more than 25 years in technology and service delivery, including 12 years in betting and gaming sector, he has delivered transformative advances, including the integration of MIRACL’s password-less multi-factor authentication (MFA) into Continent 8’s cybersecurity suite, setting new standards for secure, frictionless authentication.

A respected industry voice, Justin has become a major presence on the international conference circuit, sharing expertise on AI, cybersecurity, cloud and next-generation gaming tech. He is highly respected by Continent 8’s vast customer base, spearheading workshops for customers across the globe, and features regularly on Continent 8’s Ask The Expert podcast. His ability to bridge technical innovation with commercial strategy, while actively shaping industry discourse, make him a worthy Hot 50 winner.

Oren Cohen Shwartz Chief Executive Officer Delasport

Oren is a leader whose vision and expertise continue to elevate the global iGaming technology landscape. With more than 15 years in C-level roles, he brings deep industry knowledge to Delasport, championing innovation and the transformative power of personalization in gaming.

In 2025, under Oren’s strategic leadership, Delasport delivered exceptional double-digit sportsbook growth across major EMEA markets including the UK, Sweden, Denmark and the Netherlands. He has strengthened Delasport’s reputation for reliability and innovation, advancing its GLI-certified full-stack sportsbook and expanding the product suite with standout solutions such as SuperPot.

His impact drives measurable value for partners while shaping the future of personalized, scalable iGaming solutions worldwide. This is Oren’s second Hot 50 award after winning his first nomination back in 2020 while managing director of Skywind Group.

Jonathan Gauci Founder and Chief Executive Officer Elantil

Jonathan is an innovator whose 22 years’ experience in iGaming has reshaped platform engineering and product strategy. He founded Elantil to solve one of the industry’s biggest challenges - the inflexibility of legacy systems. His API-first, modular architecture empowers operators with true control rather than locking them into a “one-size- fits-all” solution.

Elantil has already integrated more than 50

Tom Light

Chief Executive Officer

FIRST - Best in Sports

Tom has been a defining force in sports betting for over 20 years and helped shape the modern sports betting ecosystem through innovations such as SBTech’s Pulse Betting product. After being part of SBTech’s $3.3 billion merger with DraftKings, he founded FIRST – Best in Sports in 2023.

In under two years, he has transformed FIRST into one of Brazil’s leading sportsbook suppliers, powering more than 38 operators, as well as a global B2B powerhouse, serving more than 35 operators worldwide. Tom’s product vision has produced game-changing technolo gies such as SnapBet, SportOS and GMFY, building a team of more than 500 employees and generating over €100 million in B2B rev enue. His impact continues to define the future of sports betting.

partners, setting an internal benchmark where one integration took less than two hours, and launched four customers in just 12 months. He leads from the front with a values-driven approach - focusing on freedom, agility and control - core to Elantil’s operational ethos. His work is shaping the future of iGaming platforms, setting a new benchmark for operator autonomy, scalable architecture and industry transformation.

Justin Cosnett

Tom Light

Oren Cohen Schwartz

Jonathan Gauci

Dr Alexandra Krone Managing Director GAMOMAT

Alexandra’s strategic vision and people-first philosophy has transformed GAMOMAT into one of the iGaming sector’s most respected employers. She joined the supplier as chief people officer in 2017 and stepped into the MD role in 2021, where she has restructured GAMOMAT for long-term success.

This included establishing a new C-level board, building in-house software development and marketing teams that previously didn’t exist, and redefining the company’s identity through five core values that guide its culture and decision-making.

Alexandra’s blend of strategic strength and human-centred leadership has introduced value-based recruitment and developed People & Culture programmes such as GAMOcademy and GAMOlog. Her commitment to transparency, fairness and empowerment has elevated both GAMOMAT’s workplace culture and its standing within the global iGaming industry.

Ebbe Groes

Co-founder and Chief Executive Officer

EveryMatrix

Ebbe is an exceptional industry leader whose vision has transformed the company into the world’s fastest-growing iGaming technology supplier. He has been the driving force behind EveryMatrix since co-founding the company in 2008.

Under his leadership, EveryMatrix has achieved record results, including €181 million in net revenue and €101 million in EBITDA, and tripled the Group’s headcount in the past five years to 1,500 employees across 16 offices. He has also spearheaded the all-cash acquisitions of FSB Technology, Fantasma Games and Goma Gaming, strengthening the company’s global portfolio.

Beyond commercial success, Ebbe’s commitment to social impact is also praiseworthy, with the opening of a second fully funded NGO to provide new careers to veterans of the war in Ukraine. ‘Academy for Heroes’ was inspired by the company’s 300+ employees that are based in Lviv in Ukraine, some of whom are fighting in the war. Ebbe’s leadership drives both industry excellence and meaningful societal change.

Thomas Metzger Chief Executive Officer Lotto.com

Since founding Lotto.com in 2020, Thomas’s bold vision is redefining how Americans access the lottery. In 2025, he guided Lotto.com to a landmark year, reach ing nearly 4 million cus tomers and celebrating more than $100 million in winnings, including historic wins across Arkansas, Massachusetts, New York, Colorado, Maine, New Jersey and Oregon. Lotto.com expanded access with the launch of a full suite of lottery draw games in Maine and strengthened partnerships in 11 states.

His initiatives have also paved the way for the future of the courier industry as a whole. Through efforts in Arizona, Colorado, Maine, New Jersey, New York and Oregon, courier regulation has been established, creating not only a safer ecosystem for lottery players, but also establishing a standard by which all couriers will continue to abide by.

Lotto.com now employs more than 200 staff and has delivered nearly $200 million back to state programs - modernising an entire industry in the process.

Simon’s vision has helped to redefine CRM and player engagement in iGaming. Within ten years, he has built Fast Track into one of the industry’s leading automation and engagement platforms, celebrated for its deep integration, scalability and multi-brand strength.

While the industry rushed to add AI features to existing systems, Simon pioneered Fast Track AI, iGaming’s first natural language CRM platform, capable of analysing real-time data at massive scale and taking direct action with unprecedented usability.

His leadership has scaled the company to 160 employees across three countries, while maintaining Great Place to Work certification. Simon hasn’t just adapted to the rise of AI, he has reshaped the future of CRM

Simon Lidzén

Thomas Metzger

Dr Alexandra Krone

Ebbe Groes

Don Jaques

Senior Vice President – Americas OpenBet

Don is recognized for his transformative impact on the global gambling industry, driving strategic market entry and technology adoption for OpenBet across the Americas. He has delivered significant commercial expansion for the supplier into Brazil’s newly regulated market via landmark deals with GSS and Band - two of Brazil’s largest media conglomerates - to power the end-to-end operations of TQJ and BandBet.

He has also advanced the industry’s commitment to integrity by championing the

widespread adoption of OpenBet’s AI-powered responsible gaming solution, Neccton, and strategically deployed the company’s new geolocation tool, OpenBet Locator, with major partners such as Fanatics during the product’s first live year. After nearly 20 years’ service in the gambling sector, which includes stints at Ongame, Amaya, NYX and SG Digital, Don finally gets the recognition he deserves as a worthy Hot 50 winner.

Merv Huber

Founder and Chief Executive Officer

Merv Digital Solutions

Merv has over 20 years’ experience in the gambling sector, including seven years’ service at Scientific Games, which earned him his first Hot 50 award in 2022 for his leadership of CRM programs across 12 US lotteries.

In 2025, he took a gamble on himself and

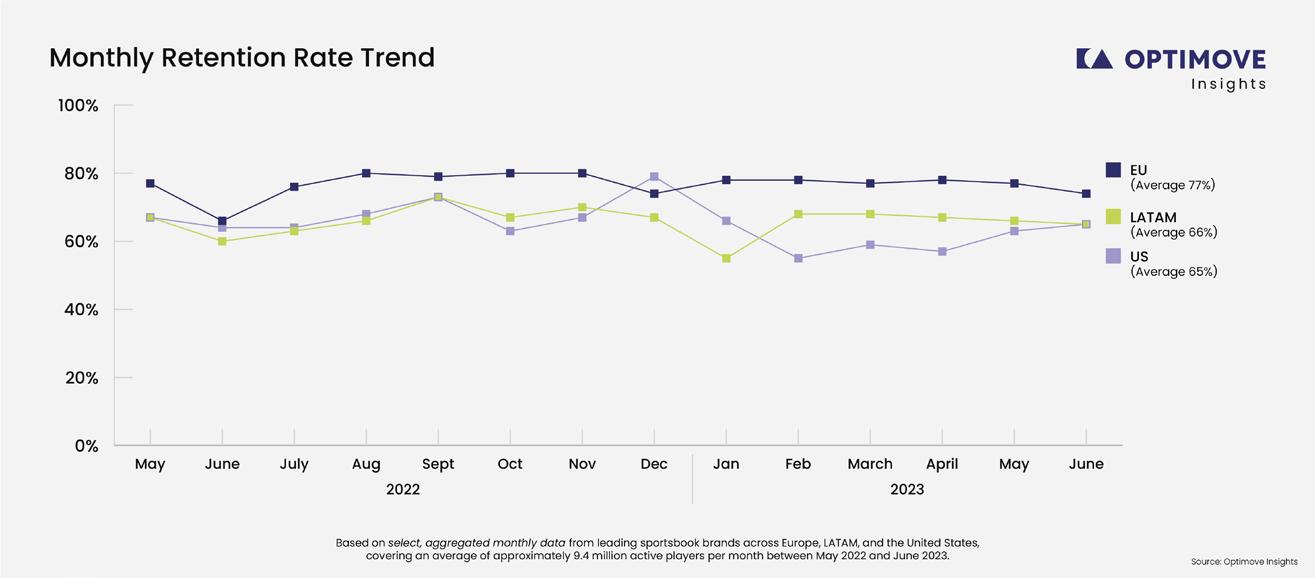

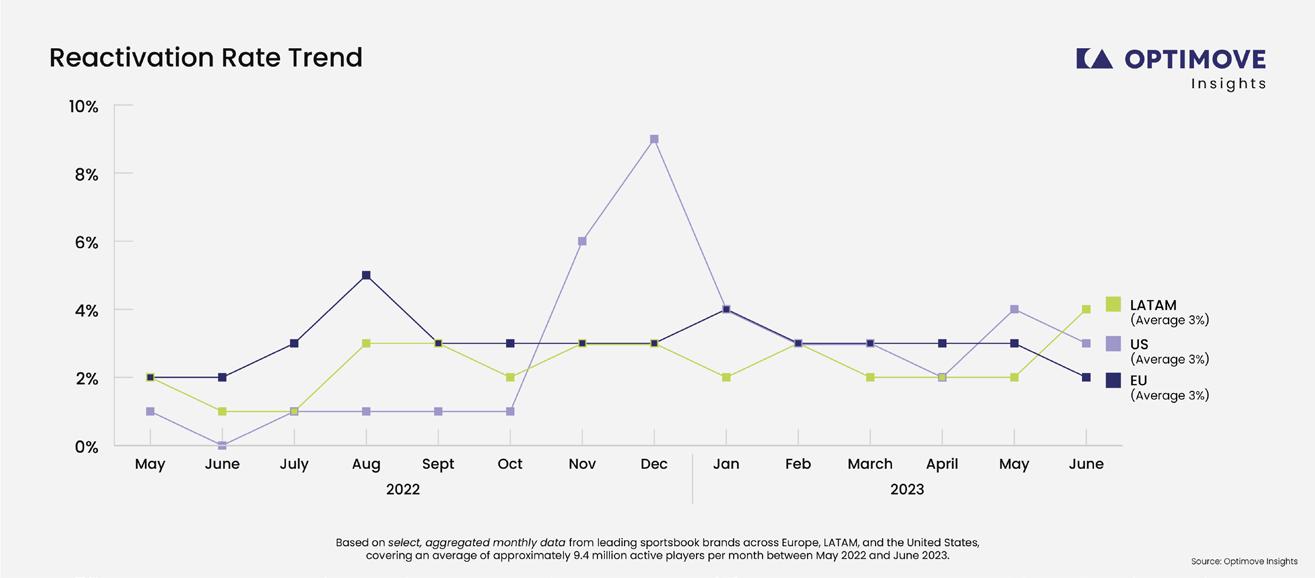

Pini Yakuel

Co-founder & CEO

Optimove

Pini is honoured for his pioneering vision and decade-long commitment to AI in the gambling industry, culminating in last year’s creation of Positionless Marketing. Since founding the company in 2012, he has been instrumental in embedding advanced AI directly into the Optimove platform, setting the stage for modern, data-driven marketing. This foundational work delivered the revolutionary Positionless Marketing method, which breaks down traditional silos and grants marketers the unprecedented ability to streamline workflows from insight to creation to optimization, independently.

This transformative approach has yielded significant, measurable impactimproving campaign efficiency by 88 per cent for global iGaming operators. What started as a two-person startup, Optimove is now a global marketing tech company trusted by hundreds of leading consumer brands. Pini’s ability to transform complex technology into accessible and empowering tools make him one of the most influential leaders in the gaming industry today.

Janine Copperstone

Senior Marketing Manager

PearFiction Studios

Janine is one of the industry’s most dynamic and influential marketing pioneers, fundamentally shifting how studios approach marketing, brand and player-facing storytelling. Upon joining PearFiction, she built the entire studio marketing function from scratch, creating a new, high-impact model that has since been emulated by numerous studios across the Games Global network.

Despite being a team of one, she delivers the output of an entire department, leading strategy, brand and execution for various key launches. 2025 was the year that PearFiction really made its mark on the industry, and Janine was behind every beat of the drum. She developed the marketing strategies for Squealin’ Riches 2 and Treasures of Kilauea 2, resulting in both games breaking internal performance records. Her disruptive approach and ability to transform PearFiction into a distinct, recognized brand make her a true Hot 50 leader who is actively shaping the future of slot studio marketing.

Don Jaques

Janine Copperstone

Merv Huber

Pini Yakuel

founded two specialised start-up studios to transform lottery and iGaming marketing and game content creation - Merv Marketing Studio and Merv Game Studio.

His marketing studio has already delivered CRM programs for five major clients, including the UAE Lottery and Connecticut Lottery. Simultaneously, his new game studio is building a portfolio of more than 12 eInstant games, featuring entirely new mechanics, which are slated for release in Q1 2026.

Merv’s dual-studio vision is reshaping digital transformation across the lottery and iGam-

Magnus Olsson

Chief Commercial Officer Play’n GO

Now in his eighth year with the company, Magnus has helped to reinforce Play’n GO’s position as a leading supplier in regulated markets by proving that commercial success aligns with long-term sustainability. Under his commercial stewardship, Play’n GO has delivered some of its most significant milestones to date.

He pioneered its entry into the land-based gaming sector through a landmark partnership with Genting, opening a completely new revenue stream for its content. He also oversaw the record-breaking launch of Reactoonz 100, which went live with more online casinos on day one than any other title in 2025, setting a new standard for game rollout success. Central to his impact has been Play’n GO’s continuing global expansion, including its rapid rise across North America, its successful debut in Brazil, and cementing its South African presence

Shimon is the operational backbone who continues to make Playtech tick. He was a Hot 50 honouree in just the second year of the awards back in 2013 when serving as vice president of operations.

“Now in his eighth year with the company, Magnus has helped to reinforce Play’n GO’s position as a leading supplier in regulated markets by proving that commercial success aligns with long-term sustainability”

Now in his 15th year with Playtech, including COO since 2015, he has overseen the supplier’s expansion into new markets such as the US and Latin America, alongside several European jurisdictions.

He has played a critical role in Playtech’s US success since first expanding into the market in 2020, securing landmark partnerships with the likes of DraftKings and Parx Casino. He was also instrumental in landing the innovative ‘Live from Vegas’ deal with MGM Resorts. Shimon’s influence is felt across every key vertical, balancing operational excellence with strategic vision for scalability and compliance. Crucially, he has championed ESG and diversity initiatives, embedding responsible gambling and inclusion into Playtech’s culture.

His ability to balance commercial success with ethi cal leadership makes him one of the most influential figures in the industry today.

Eyal Naor SkillOnNet Chief Operating Officer

Eyal has been the brains behind SkillonNet’s recent technological innovations, including the launch of GAIA Roulette, a ground-breaking new roulette experience powered by AI. He has led transformative initiatives including the integration of advanced AI-driven personalization tools and the development of seamless player-experience features.

His commitment to technological excellence, regulatory expansion, and player-centric product development has strengthened SkillOnNet’s position as a leading B2B platform provider and a successful B2C operator. Eyal’s strategic leadership, ability to execute at scale, and continuous pursuit of innovation make him a deserved Hot 50 winner.

Shimon Akad

Eyal Naor

Magnus Olsson

Dom Le Garsmeur

Product Radars

Co-Founder & Head of Tech and Product

Dom has redefined iGaming market intelligence, elevating Product Radars from a nascent concept to an essential industry benchmark that is shaping how the industry views performance and competition. He has engineered a sophisticated data pipeline that processes thousands of daily lobby positions, converting raw data into high-impact commercial insights.

His leadership culminated in the launch of Slot Intel, a first-of-its-kind tool integrating position-weighted scoring and studio consolidation to provide an objective view of highly competitive iGaming markets such as Brazil and the US. By introducing intelligent automation and a user-centric design, Dom has empowered studios and operators to make data-driven decisions with unprecedented speed.

His technical precision and visionary product strategy have established a new standard for clarity, making Product Radars a definitive force in the sector.

platforms, expanding across Brazil, Chile and Peru. Through this journey, he discovered a much larger challenge: the lack of fast, reliable, and compliant payment infrastructure for the LatAm iGaming industry. In response, he founded ProntoPaga, a payment service provider that now processes over US$220 million monthly, covering 93 per cent of the LatAm population. His influence extends beyond operations into high-level advocacy; Sebastián has been instrumental in shaping modern regulatory frameworks, testifying before the Chilean Senate to champion transparent, responsible gaming standards. Currently spearheading Yol1, a pioneering neobank, he is bridging the gap between traditional banking and fintech. Sebastián’s career is defined by this unique ability to scale complex businesses while driving socio-economic inclusion across the continent.

Sebastián Salazar

ProntoPaga Chief Executive Officer

Sebastián’s path to this Hot 50 award reflects the evolution of Latin America’s digital economy, which began when he founded EstelarBet during the Covid pandemic. What started out as a small initiative soon became one of the region’s fastest-growing iGaming

Michele Fischer SIS Content Services Vice President

Michele has been a trans formative presence in the US racing and betting landscape for more than twenty-five years, helping to modernise racing, expand international wagering and introduce new betting formats that have shaped the future of the industry.

She played a key role in establishing SIS Content Services in 2021 and guiding the com pany’s growth stateside, expanding its esports product into 16 states. Having advocated for fixed-odds wagering long before the repeal of PASPA, she oversaw the launch of fixed-odds horse racing in Colorado with bet365 in 2024an initiative widely recognised as a landmark

moment for the American market. She also played a major role in bringing international racing content from Australia, Bahrain, South Australia, Chile and Sweden into the US market, and helped create the first simulcast wagering link between Australia and North America, strengthening cross-market collaboration.

Michele has shaped the industry’s past and continues to play an influential role in its future.

Ivan Kodaj

Synot Games Chief Executive Officer

Over the past nine years, Ivan has taken Synot Games on a transformational journey, scaling it from a local start-up into a global supplier that is live in 45 regulated jurisdictions. Now with a workforce of over 300 professionals across four international offices, the studio’s portfolio has swelled to more than 220 titles, supported by the development of in-house proprietary jackpot systems and engagement tools. Under his guidance, Synot has evolved into a place where ideas turn into world-class products, and where teamwork drives lasting success. His ability to deliver consistent com mercial growth while maintaining technical excellence has solidified Synot’s reputation as a top-tier iGaming supplier.

Johan Törnqvist

Co-founder and Chief Executive Officer

Play’n GO

More than two decades after co-founding the company, Johan’s unconventional foresight

Dom Le Garsmeur

Michele Fischer

Johan Törnqvist

Sebastián Salazar

Noémi Németh Director of B2B Services and Customer Success Playtech

A key figure behind the success of Playtech Managed Services (PTMS), Noémi leads a global team that is redefining what customer success means in the gaming industry. She pioneered the creation and commercial development of PTMS’s Advisory Services, transforming operational expertise into a scalable commercial offering that secures long-term partnerships, including a landmark agreement with Gaming1.

Arguably, her biggest triumph has been the launch of Playtech Academy, a comprehensive online learning platform that democratized access to operational expertise across PTMS’ client portfolio. She spearheaded development of the platform, which contains video content, self-paced courses, searchable knowledge bases, and multilingual support. The platform has had a transformative effect on Playtech’s responsible gambling efforts, with customer protection specialists

tory loopholes of sweepstakes casinos in the US. Furthermore, Play’n GO’s landmark F1 sponsorship with the MoneyGram Haas F1 Team demonstrates an innovative strategy for expanding the gaming audience globally and introducing the brand to new demographics, creating a blueprint for the industry’s future growth and reach.

Dr Eyal Loz

RubyPlay Chief Product Officer

2025 has been a defining year for RubyPlay, and Eyal has orchestrated a period of unprecedented global expansion for the supplier, including a breakthrough launch in the US and rapid expansion across Latin America, particularly in Brazil and Argentina.

Under Eyal’s guidance, RubyPlay’s “Game Craft Unleashed” philosophy has come to define its approach to slot development - blending artistry, psychology and data-driven insight to craft games that captivate players worldwide. He helped transform RubyPlay into a multi-studio powerhouse with the launch of Koala Games in July 2025, a fully independent studio built within the RubyPlay network, and has established himself as an industry thought leader through his iGaming Checkup podcast, delving into the philosophical, psychological and technological dimensions of the online

mational move supported by two high-level C-suite hires that significantly expanded the company’s offering.

A marketing veteran of over 20 years, Ben’s industry authority was further solidified when he delivered the keynote speech at the International Federation of Horseracing Authorities (IFHA) 59th International Conference in Paris. His ability to fuse creative excellence with commercial scale has cemented Square in the Air as one of the UK’s leading PR firms.

Michael Boylan

Chief Operating Officer

Pragmatic Solutions

Michael is a highly accomplished technology and operations executive who has been instrumental in the adoption of Pragmatic Solutions’ “client-first” ethos across all of the company initiatives. Bringing two decades of B2C experience from the likes of Entain and DAZN Bet, he brought an insider’s perspective to the platform technology landscape, playing a crucial role in setting the foundation for scalable and sustainable innovation, and implementing clear, data-driven strategies that deliver tangible value.

By bridging the gap between creative storytelling and commercial performance, Eyal has redefined how innovation, localisation and player psychology intersect in the modern iGaming industry.

Ben Cleminson

Chief Executive Officer

Since his promotion to CEO in July 2024, Ben has steered Square in the Air to its most successful period to date, delivering record annual revenues in 2025. Last year he also masterminded the formation of the agency’s fully integrated creative division, a transfor -

Michael’s ability to fuse large-scale B2C operational discipline with B2B technology delivery has directly elevated the standards of service and operational efficiency for platform suppliers across the gambling industry. Great technology is developed and managed by smart, talented and passionate people, and Pragmatic Solutions is fortunate to have some of the best.

Noémi Németh

Dr Eyal Loz

Michael Boylan

Ben Cleminson

Matt King Chief Executive Officer

Fanatics Betting & Gaming

Fanatics Betting & Gaming launched its first retail sportsbook in January 2023. The company followed in the footsteps of other sportsrelated brands such as FOX, Sports Illustrated, and ESPN in believing they could rival the traditional gambling brands.

Under the leadership of former FanDuel CFO turned CEO Matt King, Fanatics has succeeded where other have failed. It is active with its online sportsbook in 24 US jurisdictions and has retail betting in 25. It is also live with online casino in Michigan, New Jersey, Pennsylvania and West Virginia.

But Fanatics is not just there to make up the numbers, it has overtaken the likes of BetMGM and Caesars Sportsbook in several key states and is rapidly catching them up in the rest. With a CEO like Matt who knows how to expand a business without losing sight of the finances that make it viable, Fanatics is shaping up to become the most likely challenger to the dominant betting operators in the United States.

Eduardo Aching

Vice President, iGaming & International Gaming Operations

Konami Gaming

Konami Gaming has long been a force in the land-based casino sector and has provided games to online casino operators for over a dec-

ade in partnership with various game aggregators. This year will see the company officially launch Konami Online Interactive as a new business division.

Under the leadership of Eduardo, Konami Online Interactive will give operators access to Konami’s broad portfolio of slot games via the company’s proprietary remote gaming server, taking the fight to the likes of Light & Wonder and IGT’s PlayDigital business.

With more than 23 years of experience with the likes of Aristocrat, Bally Technologies and Konami, Eduardo will leverage all of his experience to rapidly establish Konami Online Interactive a true force in iGaming. He will also be instrumental in developing opportunities in the upcoming casino markets of the United Arab Emirates, where Konami recently secured license approval.

Sara

Slane Head of Corporate Development Kalshi

Sara’s Hot 50 recognition is long overdue. She has held key roles in the gaming industry for almost 20 years, most notably as senior vice president of public affairs at the American Gaming Association (AGA) between 2014 and 2019. During her time at the AGA and later as founder of Slane Advisory, Sara helped to create the US sports betting industry that we see today.

Serving at Kalshi since April 2025, Sara’s latest challenge is to ensure that Kalshi’s prediction markets offering can continue to include sports event contracts. She has always been a strong advocate of regulated gaming and recently helped to create the Coalition for Pre diction Markets to defend against state efforts to outlaw sports event contracts.

Having successfully lobbied for the repeal of PASPA and helped to deliver some of the first market access deals between sports teams and betting, no one is better placed to take on this latest fight to shape the sports betting landscape in the United States.

Jim Allen Chief Executive Officer Seminole Gaming

Jim is one of the most influ ential leaders in the global gaming and hospitality industry. As chief exec utive of Seminole Gaming for the past 25 years, Jim has transformed the gaming and hospi tality arm of the Seminole Tribe of Florida, anchored by the 2007 acquisition of Hard Rock International. In 2020 he expanded the Hard Rock brand into online betting and gaming with the creation of Hard Rock Digital, which

Matt King

Sara Slane

Eduardo Aching