Fearless Fanatics

Fanatics Sportsbook aims to break dominance of DraftKings & FanDuel

Taxing Times

Strong growth makes gambling a ripe target for tax increases

Fanatics Sportsbook aims to break dominance of DraftKings & FanDuel

Strong growth makes gambling a ripe target for tax increases

most popular news stories on GamingIntelligence.com

Illinois sports wagers top $7.6 billion in first half of 2025

Arizona sports handle approaches $4.5 billion for H1 2025

Stake.us and iGaming suppliers hit with civil suit in California

Ohio Governor calls for ban on prop bets

Ohio Lottery sales fall to $4.38 billion in FY 2025

New Jersey Lottery sales decline 8% in FY 2025

Virginians wagered $3.67 billion on sports in H1 2025

Louisiana casinos report $1.1 billion in H1 2025 revenue

Arkansas sports wagers top $300 million in H1 2025

Intralot vows to challenge loss of Maryland Lottery contract

Stay up to date with all of the latest industry news from around the world with Gaming Intelligence

INTRALOT ENTERED INTO a transformational deal to acquire Bally’s International Interactive business in a cash and shares transaction that values the business at € 2.7 billion (approx. $3.17bn).

Set to complete during the final quarter of 2025, Bally’s will receive €1.53 billion in cash and €1.14 billion of newly-issued shares in Intralot at an implied value of €1.30 per share. This will make Bally’s the majority shareholder in Intralot, while Intralot founder Sokratis Kokkalis will maintain a significant stake. Bally’s and its affiliates currently own a 33.34 per cent stake in Intralot.

The acquisition establishes a global lottery and online gaming juggernaut, which will be one of the largest companies by market capitalization on the Athens Stock Exchange, where it will continue to be listed.

The international interactive business comprises Bally’s UK and Spanish interactive businesses, a UK land-based casino acquired in Q4 2024 (Aspers in Newcastle), and royalties for certain intellectual properties. In 2024, the business recorded an 11.7 per cent increase in net gaming revenue to €685.6 million (approx. $806.1 mn), generating net income for the year

of €177.7 million. Its online casino and bingo brands include Jackpotjoy, Rainbow Riches, Botemania, Bally Casino, Virgin Games and Monopoly Casino.

Through this transaction, Intralot is taking a very different course of action from its two biggest lottery rivals – Scientific Games and International Game Technology (IGT). The former spun off its land-based and iGaming businesses (including SciPlay) to form Light & Wonder, while the latter recently spun off its lottery business to form Brightstar Lottery.

“This transaction marks a transformative moment for Bally’s as we unite our outstanding gaming and data technology with Intralot’s exceptional expertise in lottery,” said Bally’s CEO Robeson Reeves. “Together, we are creating a unique proposition that will pave the way for a new era of innovation and growth across the entire gaming spectrum.”

Reeves will assume the role of Intralot CEO upon completion, taking over from Nikolaos Nikolakopoulos, who will switch to president and CEO of Intralot’s Lotteries division. Intralot’s current group deputy CEO, Chrysostomos Sfatos, will serve as Intralot CFO.

BOYD GAMING SOLD its 5 per cent equity interest in FanDuel to Flutter Entertainment for $1.76 billion, valuing the FanDuel business at $31 billion, while Apollo Global Management completed the $6.3 billion acquisitions of IGT’s gaming and digital business and Everi Holdings. The combined enterprise now operates under the IGT name and under three business units – Gaming, Digital and FinTech.

Also on the supplier side, Novomatic is seeking full ownership of Ainsworth Game Technology through an unconditional cash takeover offer of A$1.00 per Ainsworth share, representing the same value as a scheme of arrangement announced in April. Novomatic is

currently the largest shareholder in Ainsworth with a 52.9 per cent stake and intends to delist the company if it can achieve a shareholding of over 75 per cent.

In the US casino sector, Churchill Downs Inc completed the acquisition of a 90 per cent stake in Casino Salem in New Hampshire for $180 million, while Elite Casino Resorts agreed to acquire Great River Entertainment, operator of the Catfish Bend Casino and FunCity Resort in Iowa.

Century Casinos initiated a strategic review process to enhance shareholder value, including a potential sale of the company, and Quick Custom Intelligence (QCI) enhanced its casino

management platform with the acquisition of casino analytics platform VizExplorer.

Having taken over full ownership of New York-based casino operator Empire Resorts earlier in the year, Genting Malaysia agreed to sell Empire’s non-gaming assets to Sullivan County Resort Facilities Local Development Corp. for $525 million, comprising two hotels, a golf course, an entertainment centre and multiple restaurants.

In the iLottery sector, venture capital fund Bullpen Capital has made an undisclosed investment in EQL Games to accelerate innovation and continue its global expansion, while Random State secured a strategic investment from

FDJ UNITED Ventures and ZEAL Network.

In other news, the National Football League (NFL) agreed a deal with the Walt Disney Company to acquire a 10 per cent equity stake in ESPN, in exchange for ESPN acquiring the NFL Network and certain other media assets owned and controlled by the NFL, including NFL’s linear RedZone Channel and NFL Fantasy.

Finally, Polymarket is plotting its re-entry into the US after acquiring CFTC-licensed derivatives exchange QCEX for $112 million.

Founded in 2020, the predictions market provider exited the US market after being fined $1.4 million by the CFTC for regulatory violations.

billion

billion

billion

billion

billion

States are in a race to the top when it comes to sports betting tax. Each round of budgets for the new fiscal year brings with it a competition to see which state can set the highest rate.

escalation race. The Prairie State began its regulated sports betting market with a perfectly reasonable tax rate of 15 per cent. For 2023, that rate earned total state betting tax of $150 million.

In May 2024 Illinois’ lawmakers voted to introduce a tiered tax structure for online sports betting, with licensed operators facing a maximum rate of 40 per cent of Adjusted Gross Revenue (AGR), effective from 1 July 2024.

The lowest tier increased from 15 per cent of AGR to 20 per cent, while the maximum 40 per cent tax rate applied to AGR in excess of $200 million. DraftKings and FanDuel were the only two licensees falling into this top band.

For the calendar year 2024, which had six months of the new rate, Illinois’ betting tax was $264 million, with an effective tax rate of 22 per cent.

Things got even worse for Illinois’ betting licensees with the state’s FY 2026 budget. From July 2025, an Illinois licensee will pay an addi tional $0.25 per bet on its first 20 million bets and $0.50 per bet after that.

As with the top rate of betting tax, FanDuel and DraftKings will also be hardest hit by this privilege tax and would have paid $74 million and $67 million respectively in 2024, if it had applied.

The two brands’ effective tax rate would have been 40 per cent in 2024 and will rise to over 50 per cent with a full year of all the new taxes, which puts Illinois on a level with New York and Rhode Island.

In New York, Resorts World Bet followed WynnBet in leaving the Empire State’s mobile sports betting sector. Before leaving the mar ket, neither brand earned enough betting revenue to cover the cost of the licence fee, even before they paid 51 per cent of their revenue in tax.

One response to high tax is to increase the margin and DraftKings has been trying to encourage parlay

state’s iGaming sectorand from Pennsylvania. CEO Neal Menashe cited “recent regulatory developments” as part of the reason for the closure of the company’s US iGaming operations.

Super Group’s Spin Palace and Jackpot City brands were certainly smaller players in New Jersey’s iGaming sector but still contributed

Policymakers’ logic that if a nearby state has a higher tax rate then their state must increase tax too simply perpetuates the tax escalation race. The endpoint is many states’ tax coalescing around the 40 to 50 per cent

There is a proposal in North Carolina’s Senate, for example, to double the sports betting tax rate from 18 per cent to 36 per cent.

Maryland has already increased its online sports betting tax by 5 percentage points to 20 per cent from June 2025. State governor Wes Moore had wanted a rate of 30 per cent.

House Bill 639 in Louisiana set a new rate of 32.5 per cent for online sports betting tax before being reduced to 21.5 per cent. The higher rate still increases Louisiana’s tax rate by

These three states all show that the initial ambitions were for rates of 30 per cent or more.

When Illinois introduced its banded tax rates in 2024, DraftKings stated ‘we have seen a shift to tax rates over 20 per cent in certain competitive markets, including a recent significant tax increase in Illinois. We now must consider the prospect that some states may choose to tax the industry at a rate that is in excess of what we can absorb while still generating a reasonable profit margin and remaining competitive against the pervasive illegal market that pays no taxes at all’.

In a few years’ time sportsbooks will be looking wistfully in the rear-view mirror at rates of 20 per cent, as betting taxes hurtle past 30 per cent.

DraftKings highlighted the risk of the illegal market but the other measures like subscription services, less generous odds and privilege fees also alter customer behaviour and spending. Unfortunately, the concept of long-term sustainability is not a focus for states that need money now.

The states earned $1 billion in sports and pari-mutuel betting tax for the first time in Q1 2025. Betting is a lucrative source of revenue for them and they will take the view that there is plenty more to be squeezed out before the tax race is run.

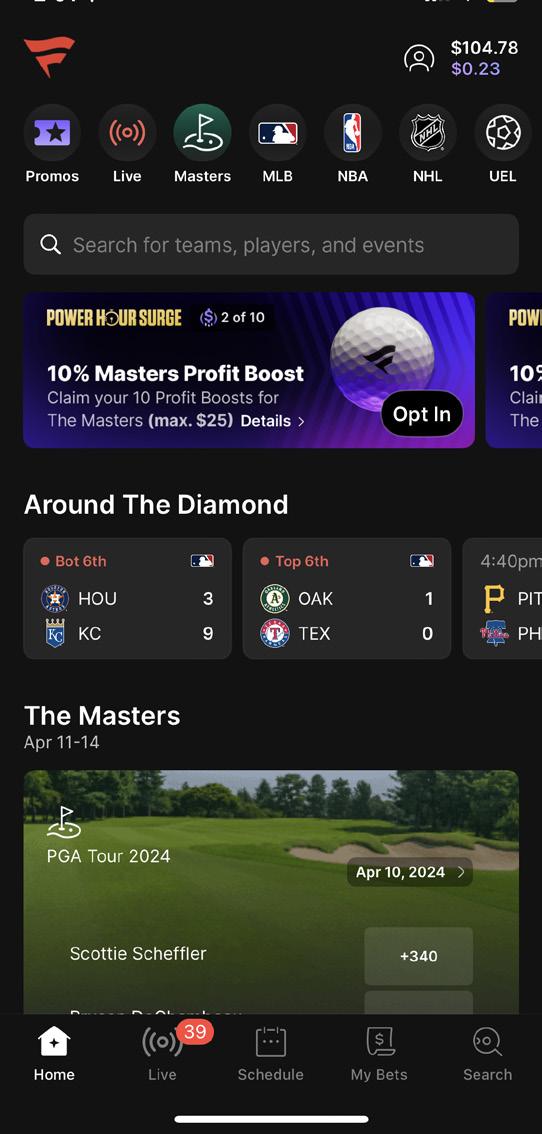

Fanatics is the not the first sports-related brand to target riches in online betting and gaming, but it may arguably be the most successful. Gaming Intelligence examines the early success of Fanatics Betting and Gaming and speaks to gaming president Conor Grant to learn what comes next

FANATICS HAS TRADITIONALLY been associated with official sports team apparel and, more recently, trading cards and collectables. Could this association with sport translate into success in betting and ultimately gaming? FOX Sports and ESPN thought they could.

Fanatics joined the fray in August 2021 when the company secured $325 million in funding to branch out from its well-established verticals. This eventually led to the creation of Fanatics Betting and Gaming, with the overall Fanatics CEO, Michael Rubin, bringing in former FanDuel chief executive Matt King to lead the venture.

Fanatics Betting and Gaming launched its first retail sportsbook in January 2023 in Maryland, with its first mobile launches coming in May of the same year in Ohio and Tennessee. The operator had a tough task on its hands as it looked to disrupt the established order dominated by runaway leaders FanDuel and DraftKings, and more established names such as BetMGM and Caesars.

It is now live with its online sportsbook in 23 US jurisdictions, with retail sportsbooks in eight.

New York is the largest online sports bet ting market in the United States and Illinois is the second largest.

In May 2025, the latest month for which Illi nois data was available at the time of publica tion, Fanatics held a comfortable third place in the market. It has held that position since September 2024, with Illinois representing its strongest market.

Its 12.5 per cent market share in Illi nois in May was more than double that of fourth placed BetRivers on 5.9 per cent. FanDuel held 30.6 per cent of Illinois’s sportsbook market and DraftKings was the market leader with 32.9 per cent share.

Fanatics is also performing strongly in New York, its second-best performing market, where it held third place in July behind market leader DraftKings and

FanDuel. It was the fastest growing sportsbook in New York with handle growth of 81 per cent, putting it comfortably ahead of nearest rival BetMGM, as well as Caesars and ESPN Bet.

Fanatic has held third place in New York since overtaking BetMGM in February.

You would think that as a late market entrant, solidifying third place in the largest markets in the US behind FanDuel and DraftKings would signal ‘mission accomplished’. Not so for Fanatics.

“Anyone who has met Michael Rubin knows how driven he is,” says Conor Grant, president of Gaming at Fanatics Betting & Gaming. “If someone in the company said we’re content being third, I think he’d have a few strong words. The objective is to scale the business, break into that top tier, and eventually become number one. We know it’s a huge hill, but the vision is clear.”

To match such a vision, you need effec tive leaders, and Rubin has found just that in

Grant has been in the online betting and gaming industry almost as long as there has been an industry, starting at bookmaker Paddy Power in 1998 and going on to hold sen ior leadership positions across sportsbook and casino at a number of leading brands. He was honoured in the Gaming Intelligence Hot 50 of when serving as chief executive officer of Flutter Entertainment’s UK & Ireland

Grant joined Fanatics one year after the com pany’s boldest move in the sector– the May 2023 acquisition of PointsBet’s US assets for $225 million. The deal delivered a trifecta of value: state market access, proven technology infrastructure, and a live customer base.

Although Grant was not there for the acquisition and integra tion, he sees how important it has been to the growth of

Fanatics Betting & Gaming over the past year.

“I think it’s fair to say it’s been incredibly successful,” he says. “We know how many acquisitions end up in terms of head count loss from the acquired business, but that simply wasn’t the case here. Many of the people who were important to the day-to-day running of the PointsBet business are here now.

“We also managed to migrate a lot of customers and keep them active on our platform, so I think it’s fair to say we wouldn’t be where we are today without that acquisition.”

Central to the Fanatics ecosystem is FanCash, a loyalty currency that goes beyond traditional bonus models with a cross-platform currency connecting sportsbook, casino, e-commerce, and even live stadium experiences.

Players earn points through gaming activ

“The objective is to scale the business, breaking into that top tier, and eventually become number one. We know it’s a huge hill, but the vision is clear.” President of gaming Conor Grant

for example, FanCash is integrated with the Colts’ in-stadium currency, allowing fans to use their rewards for purchases.

“What we are finding already with FanCash is that consumers are engaged with it, and how much they already use it,” says Grant.“This is just the beginning. We’ve built maybe 30 per cent of what FanCash is capable of. The next iterations will drive even more personalisation, access, and real-world value.”

FanCash leverages one of Fanatics’ strongest competitive advantages, its customer database of more than 100 million users from its core commerce business. Combined with advanced CRM capabilities, that reach gives Fanatics a head start in user acquisition that most market entrants can’t buy.

“We have seen great success in pulling sportsbook customers from our main commerce database, which is a database of over 100 million people, and we have been able to mine that and successfully bring customers through, which helped us out massively in the early stages,” Grant explains.

“What we have also noticed in terms of casino is that American sports bettors love to play casino. We have seen our sports bettors feeding into our casino segment more so than, say, the collectables part of the business.

“What do sports betting, casino and collectables all have in common? It’s all about entertainment,” says Grant. “So we will always see crossover from all of the segments into each other, which I think is something unique to Fanatics.”

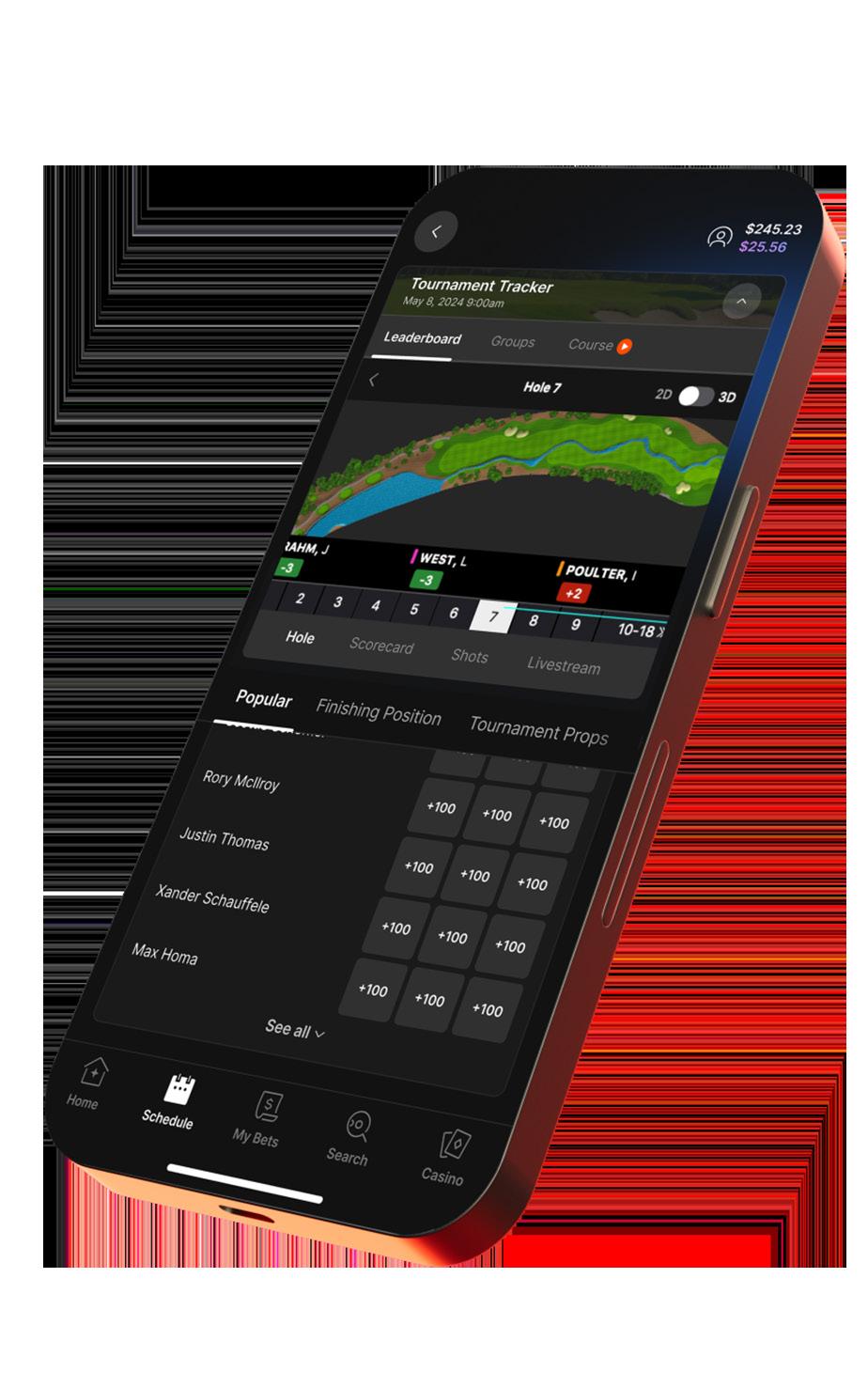

While Fanatics Betting & Gaming has had it biggest early success in sports betting, the company’s plans for online casino are no less ambitious. The company has approached online casino with a deliberate strategy: stay quiet, build solid foundations, and emerge with a product capable of competing with the best.

“We were late to market, no question,” admits Grant. “But that was a conscious decision. We didn’t want to go live until we were confident we could deliver a premium experience that met the expectations of the US casino customer. And we knew that would take time.

“From when I arrived at the company to where we are now in the casino part of the business, it’s night and day. We recently launched our standalone casino app, our integrated sportsbook and casino app, and we also have casino live on desktop as well.

“We have now got 92 per cent coverage in the market in terms of content, which, when all put together, puts us at a really competitive place,” he says. “We’ve gone from six people on the casino side last year to a fully staffed, specialist team. Our mission is clear: make Fanatics the number one destination for slots in the US.”

An ongoing question is when will more US states legalise iGaming. There are currently only seven states in which online casino is legal, with Fanatics live in four of them: Michigan, New Jersey, Pennsylvania, and West Virginia. The other legal iGaming states are Connecticut, Delaware, and Rhode Island.

Whatever come next, Grant believes that the business has built the foundations needed

Fanatics launched its standalone casino app in May 2025

to target leadership in any new market.

“We will evaluate each state on an individual basis. Compared to where we were 12 to 18 months ago, we have a completely different approach to how we enter new states.

“Back then we were still assembling the team, building the product and moving across the assets from the PointsBet acquisition,” he explains. “In terms of our maturity cycle, we have gone from zero to one, and now we are looking at going from one to two.

“When new states do open up, we are now better prepared. We already have market access partners who will aid us in entering new markets, and we have drastically improved our product.

“We understand how competitive the space is, and we aren’t complacent; we know we have to be very good to beat them when we enter new markets. I think that if and when states open up, we will be at the door waiting with a great product and team.”

So, what does the future hold for Fanatics? Grant believes that this year’s work will lead to even greater success in 2026.

“At Christmas time, I like to sit down and reflect on what has gone on in the previous year, and I believe all the hard work we are doing this year will mean that we will go hard in 2026 and go after our major competitors.

“We are doing things today, and there is a lot more to come, which I think will help us reach our targets of where we want the business to go.”

With its sportsbook market share growing, its casino product on the rise, and FanCash poised to penetrate its ecosystem even deeper, Fanatics is prepared to challenge the established order.

Fanatics has already done what ESPN could not. Who would bet against them taking the fight to DraftKings and FanDuel? n

The bidding process for three new commercial casino licences in New York is opening the doors to the state’s first integrated resorts, which

up to be one of the most fiercely contested bidding processes ever seen in the United States casino gaming market, with lucrative opportunities available to the winners and potential transformational developments

The New York Gaming Facility Location Board is tasked with overseeing the siting and evaluation process for the downstate casino licences, and will have the difficult job

The competition is fierce. There are eight applicants gunning for just three licences, with the proposals involving billionaires, property developers, rival casino operators… and even Jay-Z.

Some of the biggest casino operators in the world are pitted against each other - Caesars, Bally’s, Genting, Mohegan, MGM Resorts, Hard Rock, Rush Street Gaming and Saratoga – five of whom will be left disappointed… and out of

The proposed projects cover potential venues in Manhattan, the Bronx, Queens, Brooklyn and Yonkers. They represent billions of dollars in private investment, thousands of jobs, and numerous amenities that can transform a community.

The eight applicants have paid a $1 million application fee, and each project must obtain all local entitlements, including zoning approval, and then be approved by a specific

Community Advisory Committee (CAC), which consists of appointees of the elected officials representing the physical location of the proposal.

Throughout the summer, Committees have been holding public hearings to gauge support and opposition to their respective projects. Only those that meet both statutory requirementszoning and CAC approval – will be considered by the Board.

“This is a tabula rasa – there are no frontrunners or favorites,” said New York State Gaming Commission chair Brian O’Dwyer after the applicants were made public in June.

Those approved by their CAC will then submit supplemental application material, including a proposed tax rate, to the Board for evaluation and consideration, with a final decision expected to be made by 1 December.

The revenue from new gaming facilities will benefit New York’s public schools, mass transit, local governments, and problem gambling treatment services.

Two of the applicants for the three licences are already operating as video lottery terminal

(VLT) gaming properties - Resorts World New York City and Empire City Casino.

These two venues are the best performing commercial gaming venues in New York State and earned revenue of $691 million and $607 million respectively in FY2024.

The weakness of these two bids could be that they are perceived to offer limited new revenue growth, already being successful VLT venues.

A completely new venue, for example Caesars Palace Time Square, might offer better new revenue potential, attracting tourists to a Midtown Manhattan destination, while other bids provide transformational opportunities for communities in the Bronx, Queens and Coney Island. Three of the bids propose venues in Manhattan, so it seems likely that at least one of these bidders will miss out.

There are currently 13 commercial gaming venues in the Empire State, comprising four fully-fledged commercial casinos and nine video lottery terminal (VLT) gaming venues – comprising seven VLT racinos and two land-based VLT properties.

The New York gaming market is heavily focussed on slots, with table games only accounting for 6 per cent of annual revenue.

In FY2024, total revenue from commercial gaming was $3.11 billion, of which VLT venues contributed $2.44 billion. The casinos slots accounted for a further $483 million, alongside $179 million from table games, $11 million from poker tables and $5.1 million from sports wagering. There were 17,214 VLTs and 5,210 slots installed across the venues, alongside 288 gaming tables and 55 poker tables.

The four existing commercial casinos earned annual revenue of $678 million, down slightly from $681 million in 2023, with the average revenue per casino amounting to $170 million. This compared to an average of $243 million per VLT venue. The average daily win per slot machine in the casinos was $254, while the average daily win per VLT was $389.

There are another 21 tribal casinos in New York State run by three federally-recognised tribal nations - Seneca Nation of Indians, Oneida Indian Nation of New York, and St Regis Mohawk Tribe – but no figures are available for these venues.

As the bidding process for New York’s three downstate casino licenses heats up, GINA takes a look at the eight applicants

Developed by Silverstein Properties, Rush Street Gaming and Greenwood Gaming & Entertainment

Who’s involved?

Silverstein led the historic redevelopment of the World Trade Center campus after 9/11; Rush Street and Greenwood operate regional casinos in Chicago, Philadelphia and Pittsburgh, as well as in Schenectady, New York – the most successful of New York’s upstate casinos. Proposed Site: Hudson Yards, Manhattan

About the site:

Formerly a car dealership but now sitting vacant, the site is 92,000 square feet of unde -

veloped land at 41st Street and 11th Avenue, approximately one block north of the Javits Center. It is close to Times Square, Penn Station, the Port Authority Bus Terminal, the ferries to New Jersey, and the Lincoln Tunnel. The Avenir site is fully owned and is shovel-ready upon approval.

What’s on offer?

The $7 billion development includes 200,000 sq. ft of gaming floors, a 1,000-room Hyatt hotel, over a dozen restaurants and bars, and a food hall with favorite local West Side eateries. Additional amenities include a large ground-floor public art gallery for local artists and community-use; conference and meeting space; a spa and outdoor skyline pool; and a 150-seat entertainment venue.

Manhattan is the world’s preeminent tourist and entertainment center, with a recent state-commissioned study projecting that a destination casino there would create the most taxable gaming revenue for the city, state, and Metropolitan Transpor-

As this edition of GINA went to press, two of the bidders fell out of the race after failing to gain community support. Caesars Palace Time Square is no longer in the running after facing very vocal opposition from other entertainment venues in the area, including Broadway theatres and restaurants. Rush Street Gaming’s plans for The Avenir at Hudson Yards also hit a wall after failing to gain community support, leaving just one venue still in contention in Manhattan.

tation Authority (MTA) – 14 per cent more revenue than a casino in Queens. The report also claims that a Manhattan casino would generate 40 per cent more tourists than a casino in Queens. Manhattan also has the highest visitation from out-of- state residents, and is the best location to attract tourists, VIPs, and business travelers as patrons.

The Avenir’s priority is the well-being of its neighbors, including the 2,300 families that live in Silver Towers and River Place, the buildings Silverstein developed and own directly across the street from The Avenir site, to ensure benefits for the Hell’s Kitchen, Clinton and Hudson Yards communities.

Millions of dollars will be directed in new funding towards high-priority community needs, with The Avenir forming partnerships with The Hudson Guild, WIN, Covenant House and Rethink Food among others. It will invest equity capital in partnership with Metro Loft Developers to create office-to-residential conversions delivering more than 2,000 new Manhattan apartments, including at least 500 units of permanent affordable housing.

More than $2.5 billion generated in taxable gaming revenue in the first stabilized year of operations.

The Avenir will initially create 4,000 union construction jobs, and once fully operational will have more than 5,000 team members, with 4,037 of those new jobs projected to be full-time and 1,040 part-time.

Developed by Bally’s Corporation

Who’s involved?

Led by chairman Soo Kim, a Queens native, Bally’s owns and operates 19 casinos across 11 states and holds online sports betting licenses in 13 jurisdictions in North America. Proposed Site: Ferry Point, The Bronx

The vision for Bally’s Bronx is a $4 billion integrated resort spanning 16 acres of parking lots and practice green area of Bally’s Golf Links at Ferry Point, by developing a former landfill. It is surrounded by a 222-acre golf course and a cemetery, bracketed by two major bridges that each carry more than 40 million cars annually, while accessible in less than 20 minutes by public ferry from Manhattan’s Upper East Side.

What’s on offer?

Spanning more than 3 million sq. ft, Bally’s Bronx will include a 500,000 sq. ft gaming space, featuring 3,500 gaming machines, 250 table games including a poker room. The development includes a 500-room hotel, an array of dining and entertainment venues, a 2,000 capacity event centre, meeting spaces, and parking for 4,660 vehicles.

According to every governmental statistic and benchmark, the Bronx is the borough that suffers from a lack of economic opportunity, with the integrated resort directly creating thousands of good-paying unions jobs as well as hundreds of millions of dollars in community benefits. Bally’s is aiming to transform an underutilized corner of the Bronx into a vibrant and lasting economic engine, a hub for tourism, and a destination landmark.

Bally’s comes to the project with significant financial wherewithal, including an approximately $2.5 billion investment commitment from Gaming and Leisure Properties.

Bally’s has pledged $625 million for an array of community benefits, including direct financial support for local schools, housing, mental health, public safety, transportation upgrades, parkland enhancements and community organizations. It has also created an equity ownership initiative with up to 9 per cent of the equity in the Bally’s Bronx project, offering local residents an opportunity to directly benefit from the project’s success.

Bally’s is also investing heavily in the area’s infrastructure by allocating $100 million for parkland improvements, including new walking paths, playgrounds, and the revitalization of Ferry Point Park, as well as at least $75 million for transportation upgrades. Public

safety will be strengthened through a $10 million upfront investment in new NYPD substations and ongoing support for increased police presence in the direct catchment area of the project.

Over $1 billion in gross gaming revenue (GGR), $1.5 billion in total revenues, and more than $200 million in direct gaming taxes annually.

During construction, 15,000 union jobs will be created, and once operational, the gaming facility will employ nearly 4,000 permanent staff, making it the second-largest private employer in the Bronx.

Bally’s is a gaming and hospitality company. This is what we do. We are not a company from another sector seeking to become involved in gaming as a second or third source of revenue. Bally’s Bronx is more than a development - it is a once-in-a-generation transformational opportunity for the Bronx. If Bally’s is awarded the opportunity to build Bally’s Bronx, we will make the Bronx, New York City and the state of New York a very proud partner..

Developed by SL Green, Caesars Entertainment, Roc Nation and Live Nation

Who’s involved?

The project is led by SL Green, Manhattan’s largest office landlord; Caesars Entertainment, which operates 50 properties across the US and a successful sportsbook in New York; Roc Nation, the entertainment powerhouse founded in New York by Jay-Z; and Live Nation, the live events company with a longstanding presence in Times Square through existing venues. Proposed Site: Times Square, 1515 Broadway, Manhattan

Caesars Palace is a project built by New Yorkers with deep roots in the city. The second of three casino proposals in Manhattan, Caesars Palace would bring a new attraction to Times Square by transforming an existing office building at 1515 Broadway. It is the most accessible site via public transportation of any

proposal, with the development including a comprehensive congestion mitigation plan, which will substantially reduce congestion and maximize visitation by mass transit.

The $5.4 billion proposal features a 150,000 sq ft casino with over 3,000 slots, 190 table games, 13 private gaming salons, a World Series of Poker room, and the Caesars Sportsbook at The 40/40 Club. Other amenities include a 992-room hotel, with restaurants featuring local and international culinary innovation, a wellness retreat, and nightclubs and entertainment curated by Roc Nation.

The Times Square proposal was arguably the most beneficial for New York, given its ability to tap into out-of-state money from the throngs of tourists in the area. An estimated 50-60 million tourists visit Times Square each year, something that may be hard to replicate in Brooklyn or Queens.

Times Square comprises only 0.1 per cent of NYC’s land area, yet it supports 10 per cent of the City’s jobs and generates 15 per cent of its economic output. This project protects and enhances Times Square by providing a sustained source of private investment and new entertainment that will appeal to existing tourists to Times Square and attract new

visitors from around the world.

The project has committed $250 million of support to initiatives and groups that include childcare for Broadway workers, a civil rights museum and mental health services. This includes $127 million of direct investment for improvements to Times Square and Hell’s Kitchen, delivering substantial benefits to safety and security, publicly accessible restrooms, sanitation, mental health services, and improvements to the Times Square area more broadly.

More than $23.2 billion in GGR and $7 billion in direct tax and fee revenue in the first 10 years of operation, and forecast to drive over $26.7 billion of new revenue to neighboring businesses.

Over 3,800 workers from New York will be directly employed, while construction of the project will provide approximately 3,011 jobs in the state.

Developed by Thor Equities, The Chickasaw Nation, Saratoga Casino Hotel, and Legends Hospitality Group

Who’s involved?

Anchored by Thor Equities founder Joe Sitt, a South Brooklyn native, the project involves Global Gaming Solutions, the commercial operating arm of tribal casino operator The Chickasaw Nation; Saratoga Casino Development, operator of the most successful racino in Upstate New York; and Legends, a live events company trusted by iconic brands such as the New York Yankees.

Proposed Site: Coney Island, Brooklyn

About the site:

Coney Island has been known as a destination for recreation for more than a century, which reached a peak during the first half of the 20th century but has declined in popularity in recent years. The Coney Island Resort and Casino project will reignite the iconic neighborhood, making it an economic engine of South Brooklyn.

What’s on offer?

The Coney’s $3.4 billion proposal will be a 1.4

million square foot entertainment complex, including a casino with three main floors of gaming, including over 230 table games and over 4,500 slots. Other key features include a 500-room hotel, a 25,000 sq. ft entertainment venue, a 116,000 sq. ft convention centre, over 20 restaurants, as well as 92,000 sq. ft of retail and recreation space.

Once the horseracing capital of the country, today the unemployment rate is 17.2 per cent, over twice the Brooklyn rate of 7.2 per cent, while 28.7 per cent of families in the area live below the poverty line, 36.2 per cent are food insecure, and just 44.2 per cent of residents aged 16 and older are employed - the lowest employment rate in New York City. This is an area that has been promised reformation and transformation year after year, with little to show for it.

The Coney has committed to local hiring, local business development and support, and community mitigation, reflected most directly in a $200 million Coney Island Trust, dedicated to public improvements, economic mobilization and community engagement, ensuring residents benefit deeply and directly from the transformative project.

This is more than redevelopment; it’s a reawakening, an opportunity unlike any other to positively impact historically marginalized communities swiftly and tangibly. No project embodies the essence of realizing dormant economic opportunity and potential as completely as The Coney. Coney Island’s redemption story is here, ready to reclaim its role as New York’s timeless icon of entertainment and innovation. G2E

In addition, a $15 million annual fund for the first five years of the casino will be dedicated directly to community mitigation efforts, enhancing local police, fire, and EMS services, combined with a firm commitment and clear plans to support and enhance the existing local business and entertainment landscape.

Annual GGR of $1.45 billion in its first year of operation, rising to more than $2 billion by year 10.

The project would bring 4,000 union construction jobs and 4,500 permanent jobs, and over 2,500 jobs from indirect and induced effects.

Developed by Soloviev Group, Mohegan Tribe and Banyan Group

Who’s involved?

Soloviev Group has a stellar track record of large-scale developments on Manhattan’s East Side and across the US; Mohegan operates casinos in Connecticut, Pennsylvania and Canada; and Banyan Group is a leading operator of urban resort destinations around the world. Proposed Site: 686 1st Avenue, Manhattan

About the site:

The $11.1 billion investment will turn the largest undeveloped property in Midtown, formerly a brownfield site, into a 3.9 million sq. ft global development destination and community center point in Midtown East - the focal point for several of NYC’s most recent development initiatives. At the heart of Freedom Plaza is a 4.77-acre publicly-accessible waterfront park, offering a green oasis roughly the size of Manhattan’s Bryant Park. The entire shovel-ready

If Freedom Plaza is going to represent the city of New York, the workforce needs to represent New Yorkers, too. Throughout both the construction and operation of Freedom Plaza, diversity will be a priority. This is reflected in our plans to recruit with the principles of equity and inclusion in mind, through our partnerships with minority- and veteran-owned businesses, and our celebration of the historical and present-day diversity of the Murray Hill community. G2E

riverfront site is owned by Soloviev Group.

What’s on offer?

Freedom Plaza will offer distinct experiences and two unique-to-New York gaming entertainment leisure complexes, totalling 580,000 square feet. Amenities include two flagship hotels (1,251 rooms), the largest wellness centre in Manhattan, over 30 food and beverage options, a conference and entertainment space, and the nearly 5-acre park, pathways, and esplanade that covers 70 per cent of the site.

Additional assets include a City Market Hall with neighbourhood-serving restaurants; a day care facility and other community services; an open-air amphitheatre; a community centre; urgent care medical facility; a museum with architecture seamlessly integrated into the park and waterfront; public art exhibits; and recreation trails.

As with The Avenir and Caesars Palace bids, Freedom Plaza points out that Manhattan is the global epicenter of tourism, culture and

entertainment, with its proposal connecting the historic neighbourhood with its longobscured waterfront, becoming the only triborough waterfront in NYC.

The project addresses NYC’s housing crisis by introducing over 1,000 new apartments, including 513 units of affordable housing - the largest affordable housing component of any of the proposed projects.

Mohegan and Soloviev are also committing to the greater of two per cent of all gaming profits, and $5 million annually, to an evergreen fund for off-site programs and neighborhood improvements.

Annual net revenue to exceed $2.2 billion in year one of operation and $4.2 billion in year 10.

The project is estimated to support 25,875 fulltime and part-time jobs during construction, and 13,403 jobs once operational.

Developed by MGM Resorts International

Who’s involved?

MGM Resorts owns 31 destinations around the world, and holds casino licenses in 9 domestic and international jurisdictions.

Proposed Site: Empire City Casino, 810 Yonkers Avenue, Yonkers

About the site:

Empire City Casino at Yonkers Raceway has anchored the entertainment and tourism culture in downstate New York for more than a century, and is the largest private employer and taxpayer in the City of Yonkers.

MGM plans to reinvest $2.3 billion to transform the Empire City Casino at Yonkers Raceway site into a commercial casino and entertainment destination, while continuing to operate its historic horseracing track and parimutuel operations.

Plans include a full renovation and expansion of Empire City’s existing gaming areas, including high-limit gaming spaces and a new 10,100 sq. ft BetMGM Sportsbook. Other amenities include a 5,100 person capacity entertainment venue, a 9,300 sq. ft meeting space, five new restaurant venues, including a multiconcept Food Hall, and new beverage concepts featuring a center bar, a high limit lounge and two additional walk-up bars.

Since opening in October 2006, Empire City Casino has generated more than $5 billion for New York State education, including $1.6 billion since MGM Resorts assumed ownership in 2019. If awarded a license, 80 per cent of the venue’s tax revenue will go to the state education fund. The remaining 20 per cent will be split between the City of Yonkers - New York’s third-largest city - and the surrounding counties, with 10 per cent directed to the City of Yonkers, 5 per cent to Westchester County and 5 per cent divided between Rockland and Putnam counties.

MGM will also be obligated to continue funding substantial horse racing purses amounting to more than $70 million by year 4 of operations – something that does not apply to non-video lottery terminal (VLT) facility appli-

For generations, Empire City Casino and Yonkers Raceway have been at the center of entertainment and tourism in downstate New York. Its rich history – including two historic wins nearly a century ago by the legendary Seabiscuit – is woven into the fabric of the City’s economy, culture, and lore. MGM Yonkers will build upon this legacy, and we hope to one day soon welcome you to witness and enjoy all the incredible amenities and experiences that this gaming license has the potential to unlock.

cants. All of this results in an effective rate of tax that is higher than what might otherwise be collected from other candidates.

The project includes significant investments to support public infrastructure in the City of Yonkers, including improvements to roads, water lines and traffic technology. Energy efficient methods to conserve water and harness solar energy are also an integral part of the proposal.

Additional commitments include $2 million in annual funding for the costs of two additional sector police officers whose primary focus will be Empire City and the immediate surrounding area, and partially funding the replacement of a section of an existing water line in Central Park Avenue or fully funding its cleaning and relining.

Between $1.03 billion and $1.39 billion in annual GGR, which is an increase of between 92 per cent and 129 per cent over current VLT operations.

Job creation:

More employment opportunities will be created for all members of the community, with an estimated total headcount rising from 2,287 to 3,057. This includes an increase in incremental full-time headcount from 1,412 to 2,104, and a rise in incremental part-time headcount from 222 to 300.

Developed by Steve Cohen, Hard Rock International, McKissack & McKissack, and Siebert Williams Shank & Co.

Who’s involved?

New York-born Steve Cohen has been the owner of the New York Mets baseball team since 2020; Hard Rock is one of the most recognized hospitality brands in the world and has completed over $15 billion of casino development since 2000; McKissack & McKissack is the nation’s oldest minority and woman-owned professional design and construction firm; and Siebert Williams Shank & Co. is a minority and women-owned investment bank

Proposed Site: 126th Street, Willets Point, Queens

About the site:

Hard Rock Metropolitan Park is a shovel-ready proposal that will transform 50 acres of underused asphalt next to Citi Field into an entertainment district, anchored by 25 acres of new public park space and athletic fields.

What’s on offer?

Taking up just 10 per cent of the project’s size, the integrated resort will feature 286,208 sq. ft of gaming space, including 5,000 slots, 375 live dealer tables, 30 poker tables and an 18,381 sq. ft sportsbook. Other amenities include a 5,650 capacity live entertainment venue, 18 food and beverage venues, a convention center, retail areas, and a 1,000 room hotel.

The project will deliver approximately $1 billion in benefits for Queens via public and transit improvements, together with a $163 million impact fund and $50 million for local health, youth, and senior service initiatives. Local investments are centred around 25 acres of new park space, including expansive bike paths, athletic fields, and linking Flushing Meadows Corona Park to Flushing Bay and Citi Field via the integrated resort.

Metropolitan Park will become the city’s first true stadium district, centred between baseball at Citi Field, tennis at the USTA Billie Jean King National Tennis Centre, and professional soccer coming soon to Willets Point. The

Hard Rock Metropolitan Park is a visionary response to the state’s call for transformative development. We believe this project offers the highest investment, the greatest economic return, a shovel-ready timeline, and the deepest community support. It is powered by world-class partners and shaped by the voices of the Queens community. It raises the bar on job creation, diversity, tourism, and environmental stewardship. This is the moment to choose a project that does not just promise prosperity - it ensures it. Let’s build something extraordinary: Hard Rock Metropolitan Park.

site also sits adjacent to LaGuardia Airport, which welcomes over 22 million travellers annually, positioning the project as a global gateway to Queens.

The project has pledged to transform an underutilized asphalt parking lot in Corona into 450 units of all-affordable housing to help address the housing crisis facing the borough, while $1 billion has been pledged in direct support for Queens-based community organizations and programs. It will also bring safer neighborhood connectivity to an area long isolated from the surrounding community, and will deliver $1.75 billion in infrastructure updates that will transform the Mets-Willets Point 7 Train station into a welcoming entrance to Flushing Meadows-Corona Park.

Projected to generate $33.5 billion in new tax revenue over the proposed 30-year license period, with over $850 million in tax revenues generated from $3.9 billion in revenue by year three.

Metropolitan Park will create 17,100 direct construction jobs, and 6,081 direct permanent jobs, including 2,077 part-time jobs.

Developed by Genting Group

Who’s involved?

The Genting team behind RWNYC previously financed the development of Foxwoods Resort Casino in 1992 and the Seneca Niagara Resort & Casino in 2002, and brings 15 years of relevant experience in the state, having successfully constructed and operated casinos in Aqueduct, Catskills and Newburgh.

Proposed Site: Aqueduct Racetrack, Queens

About the site:

Since opening in 2011, RWNYC is the nation’s highest-grossing VLT casino property and New York State’s largest taxpayer, having contributed more than $4.5 billion to the state’s public education fund. The expansive 73-acre property is large enough for an integrated resort, having been constructed with additional space earmarked for future gaming expansion, and is a short distance from Jamaica Station and JFK Airport. RWNYC can begin construction immediately upon approval, as all required land use entitlements, SEQRA compliance, and

building permits have been secured.

What’s on offer?

The $5.5 billion, 5.6 million sq. ft integrated resort will eventually allow for 6,000 slot machines, 800 gaming tables, 2,000 hotel rooms, a 7,000-seat arena, over 7,000 parking spaces, over 30 food and beverage outlets, and over a dozen acres of community greenspace.

Why Aqueduct Raceway?

Aqueduct Raceway has historically accommodated over 70,000 visitors in an 8-hour window for racing and other events, and has the ability to comfortably handle increased casino patronage. With the completion of the 8-lane Van Wyck Expressway, RWNYC will be easily accessible within 35 to 45 minutes from all of New York City, as well as Nassau County, particularly during the peak casino hours between 8pm to 3am.

RWNYC plans to reconfigure its existing VLT facility and complete the fit-out of the third floor to establish a Permanent Casino by July 2026, featuring 4,000 slot machines and 250 table games. By January 2027, RWNYC will add 150 tables within the additional space built during the construction of the Hyatt, and by Janu-

The solid foundation that the experienced RWNYC team has built for over a decade, will immediately maximize incremental revenue and state and local tax contributions at a challenging time. Our unwavering commitment to the community has earned us unanimous support for our vision. Our proven track record provides the certainty NYS deserves for such an important decision. RWNYC is poised to become not only the premier integrated resort in the US, but also one of the most successful in the world, delivering the highest and best value for the state.

ary 2029, RWNYC will complete new construction to bring the final casino configuration to 6,000 slot machines and 800 tables.

RWNYC will continue to build on its fifteenyear partnership with the Queens Community Board 10, which will be bolstered by investments into the surrounding infrastructure, such as roadways and parks, as well as a new Innovation Campus with access to health and wellness, STEAM programming, and sports and media.

Accessibility will increase for the entire New York City transit system through more than $1 billion in RWNYC fees and revenue in the first five years of licensure, which will be specifically earmarked for the MTA – beginning as soon as 2026.

GGR is projected to more than double from the current $1 billion annually to $2.2 billion by 2027, and increase further when the Permanent Casino is fully expanded in January 2029.

The project will create 5,000 union construction jobs and 5,000 direct permanent jobs, while generating another 14,000 jobs across industries throughout the state.

Sports betting has gained most of the attention in the US since the repeal of PASPA, but it is arguably iGaming that has been the greater success for the seven states that have regulated online gaming

IN 2020 REGULATED US iGaming was a sector worth just $1.55 billion in revenue. By 2024, iGaming revenue had risen five-fold to $7.88 billion.

The pace of revenue growth has also been impressive. Monthly iGaming revenue hit $500 million for the first time in March 2023; $600 million was reached in February 2024; $700 million came in October of the same year and $800 million was passed in March 2025.

Total first half iGaming revenue in 2025 is not far short of $5 billion and the annual total is on target to surpass $9 billion.

Despite only seven US states offering iGaming, versus 30 for online sports betting, in 2024 iGaming revenue was equivalent to 60 per cent of sports betting revenue.

Across five of the iGaming states, their annual split of combined iGaming and online sports betting revenue was 75:25.

The lowest share of iGaming revenue in the five states was 69 per cent in New Jersey, compared with the highest share of 84 per cent in Michigan.

One advantage of iGaming is that its revenue is not subject to the same variation as sports

betting, which can be hit by a poor set of sports results.

The graph shows iGaming and sports betting revenue indexed to 100 in January 2022 and demonstrates the smooth growth for iGaming.

Sports betting’s index hits higher levels because new markets opened during the period, which added to overall revenue, but betting’s greater volatility is clear.

States also benefit from the more stable monthly iGaming revenue because it provides a more consistent source of tax.

Despite the benefits, there has been little progress in new states regulating iGaming. Rhode Island was the last state to regulate the activity and it opened its market in March 2024.

Maine is one state that has been trying to pass iGaming legislation in 2025 but the bill was not signed by Gov. Janet Mills in July.

If Maine followed the pattern of other iGaming states, it could have annual revenue of $140 million, once established.

The Pine Tree State’s iGaming legislation proposed a tax rate of 18 per cent, which would earn the state $25 million on that estimated revenue.

New York State Senator Joseph Addabbo Jr. has put forward several iGaming bills over the last few years but none has made much progress.

As in Maine, Senator Addabbo acknowledges that it requires a governor who is supportive of iGaming for there to be any chance of success.

States’ need for tax revenue might change their minds about the desirability of iGaming.

There is, of course, well-established opposition to iGaming in the US, specifically in the form of the National Association Against iGaming (NAAiG).

NAAiG states that it “champions community-driven, sustainable gaming. Our members support in-person gaming for its economic and social benefits while opposing iGaming’s risks, including isolation and addiction.”

Given NAAiG’s aim, it is not surprising that many of its members are land-based gaming groups in the US, such as Cordish Companies, Accel Entertainment, JACK Entertainment and Illinois Gaming Machine Operators Association.

In February 2025, NAAiG published a report it had commissioned from The Innovation Group into “the impacts of iGaming on land-based gaming, state economies, and public health in states

contemplating iGaming in 2025”.

The report’s conclusion was, “The data is clear: iGaming harms casino gaming.”

It went on to argue that iGaming steals revenue from existing gaming operations. NAAiG’s analysis of iGaming states showed that bricksand-mortar casino revenue underperformed by 16.5 per cent following iGaming’s introduction.

The report did have to acknowledge that critics of the methodology used “will claim that some states did not actually reduce their land-based gaming revenue upon authorizing iGaming”.

This accurate observation was explained away in the report by claiming that “iGaming states very clearly lag their non-iGaming counterparts (by double digits) in terms of growth over the last five years. So this is a “but-for” analysis, i.e., land-based gaming revenues would have been substantially higher in iGaming states but for the implementation of iGaming.”

NAAiG’s analysis was conducted on a revenue comparison between the two years of 2019 and 2024 and yet the report has very little discussion of the pandemic as a potential cause of long-term, sustained disruption in land-based gaming revenue growth.

Business models across many sectors were altered forever by the pandemic: remote working, fast-tracked adoption of e-commerce and hybrid online-offline retail (e.g. food delivery services), digital entertainment platforms etc. There is no reason to think that casinos were exempt from that behavioural change.

For three months between April and June 2020 New Jersey’s land-based casinos recorded no revenue at all because they were closed.

Total gaming tax paid in these three months was $41 million, of which iGaming contributed 92 per cent. New Jersey’s casino groups, their employees and the state coffers might have been thankful that they had an online offering to bring some revenue in during the shutdown.

NAAiG’s report simply acknowledges New Jersey “saw a substantial increase in iGaming revenue … during the pandemic as a result of increased player acquisition”.

Analysis of New Jersey’s gaming revenue over the longer term also weakens NAAiG’s assertion that the regulation of iGaming is a suppressor of land-based growth.

New Jersey’s land-based gaming revenue hit a high of $5.22 billion in 2006, seven years before regulated iGaming was launched in the state. From 2006 to 2013, land-based revenue was in free-fall and dropped by 45 per cent from its peak. None of that decline was due to regulated iGaming – it hadn’t been launched.

In 2019, six years after the launch of iGam-

ing, New Jersey’s casinos actually posted their best annual revenue rise since 2004 of 7 per cent, before the pandemic ruined the recovery.

Between 2000 and 2012, the average annual growth rate (AAGR) of New Jersey’s land-based gaming revenue was a decline of (2.6) per cent. For the period after iGaming’s launch in 2013 to 2024, that improved to growth of 2.7 per cent.

New Jersey’s gaming revenue was ‘exgrowth’ long before the state regulated iGaming.

Pennsylvania and Michigan present a similar picture – they were both exhibiting limited annual growth well before iGaming was regulated.

Pennsylvania’s land-based AAGR was 3.6 per cent (2010-2018) and 7.0 per cent post iGaming (2018-2024).

For commercial gaming in Michigan, the AAGR figures were 0.6 per cent (2010-2019) and 0.5 per cent (2021-2024).

One significant ‘hidden’ element of iGaming that might actually harm or suppress landbased revenue is offshore online casinos.

Over the last 25 years, billions of dollars have been spent by US customers with online casinos based in the Caribbean and Central America.

These websites might certainly have taken money out of the domestic US gaming market

but NAAiG’s report fails to consider offshore gaming as a factor.

Offshore casinos are, of course, an argument in favour of iGaming regulation because it enables state-licensed operators to capture a share of the revenue that was disappearing offshore and for states to earn tax from iGaming where previously they were earning none.

Michigan collected $451 million in state iGaming tax in 2024 yet is still having to issue cease-and-desist letters to unlicensed online casinos targeting its citizens in 2025.

NAAiG would do well to consider how much revenue and tax is being lost in gaming states without any regulated iGaming activity.

In the states that have regulated iGaming, land-based casino licensees have been the main beneficiaries of the new licences – either directly operating iGaming, or in a revenue share partnership with another brand, or by selling ‘skins’ that they have been allocated to other brands.

iGaming has been a success for the states that have adopted it but it should never be able to rival the entertainment that a visit to a casino can offer.

Casinos should have confidence in their landbased offering and see iGaming as an opportunity to add to their entertainment and customer engagement rather than as a threat to diminish it.n

The ‘Mob model’ that has served Las Vegas so well for so long is dead. An offer of cheap rooms, drinks and entertainment in exchange for gaming floor losses has been replaced by one in which the customer pays top dollar for everything.

IN 2025, THE average daily room rate across Las Vegas is $181 but a visitor wanting to stay on the Strip can expect to pay more than twice that. At most leading hotels there will also be an additional daily resort fee of $50, which covers services like internet access and use of the fitness centre. If a guest requires car parking at the resort, the daily charge is between $20 and $40. In some hotels guests might even be charged $50 for placing their own items in the mini-bar.

Prices for food and drink have also been rising in Las Vegas, from fast food to fine dining. At Caesars Palace, a pepperoni pizza from DiFara Pizza cost $52.99 in 2023 and a single slice was $9.99.

In 2025 the Buddy V’s Pizzeria which replaced DiFara charges $11.99 for a slice and $59.99 for a whole pie. The cost of a slice of pizza at Caesars Palace has risen by 20 per cent in two years.

The casinos in Las Vegas were able to get away with price hikes and charges in the immediate aftermath of the pandemic. People were looking to enjoy themselves following a period of restricted travel and they had money to spend because of almost two years of curtailed entertainment options. Now, however, tourists are beginning to stay away.

Visitor numbers to Las Vegas have been dropping in 2025. For July, there were 3.09 million visitors, a total which was 12 per cent down on July 2024. In the first seven months of 2025 visitor numbers are down by 8 per cent to 22.64 million.

Las Vegas’ hotel occupancy for July was 76.1 per cent, 7.6 percentage points lower than the same month of 2024. June’s occupancy rate was also below 80 per cent at 78.7 per cent.

The decline in visitors to Las Vegas is at odds with Nevada’s gambling revenue, which is at record levels.

Annual gaming revenue in Nevada was at its highest in 2024 at $15.61 billion, beating the previous record set in 2023. Nevada’s gaming revenue in H1 2025 was the state’s best first half performance at $7.79 billion.

But gaming’s share of Nevada’s overall revenue has been declining. It fell below 50 per cent in 2005 and, despite a spike of 58 per cent in 2021, is now around 43 per cent of revenue.

Rooms have been accounting for an increasing share of Nevada’s revenue and hit 24 per cent for the first time in 2023 and were at almost 25 per cent in 2024.

On the Las Vegas Strip, rooms accounted for 30 per cent of revenue last year, a new high, and not far behind gaming on 35 per cent.

As well as rising total accommodation costs, casual gamblers are also being squeezed by the casinos on the gaming floor.

Minimum bet levels are being raised and at the remaining lower staking tables the payout is often worse. Some gaming floors offer roulette wheels with triple zeros, increasing the house edge, and there are blackjack tables paying 6 to 5 rather than 3 to 2 for a natural 21.

Slot machines earn the bulk of the casinos’ gaming revenue and the hold percentage they achieve has been steadily increasing. Revenue from Nevada’s 127,176 slot machines was 67 per cent of gaming revenue in 2024 at $10.52 billion.

The statewide hold percentage from slots was 7.21 per cent in the year, the highest level in the last 20 years. 2024’s hold percentage was up by 4 per cent on 2019 and by 26 per cent on 2004’s hold rate.

On last year’s data, every 0.1 percentage point increase in slot hold is worth $145 million in revenue across the sector, and a higher margin is easier to hide from players on machines than at the gaming tables.

The casino operators are subject to inflationary pressures just like any sector. But Las Vegas is perhaps hit harder because it has previously been perceived, rightly or wrongly, to be a place of subsidised or ‘comped’ entertainment.

Several casino groups have also sold their real estate in recent years on ‘sale and lease back’ deals to free up cash. As a result, VICI Properties is possibly the biggest landlord on the

BRIGHTSTAR LOTTERY (FORMERLY

IGT) will fight it out with Allwyn-owned OPAP in a newly launched lottery concession tender in Greece, which attracted interest from just two prospective operators.

The tender aims to award a minimum tenyear concession for the exclusive right to produce, manage, operate and promote the Greek State Lotteries, which is currently run by Hellenic Lotteries, a division of OPAP.

The concession right covers the Instant State Lottery, the State Housing Lottery, the Popular Lottery, the Special Social National Lottery, the National Lottery, and the Extraordinary or Special Lottery drawn by the European Association of State Lotteries (AELLE).

Aristocrat Interactive bags Mass iLottery contract

Aristocrat Interactive secured a multi-year contract from the Massachusetts State Lottery Commission (MSLC) to deliver a new iLottery platform from next July 2026.

The supplier will provide the lottery with a full-service online lottery platform, game content including eInstants and draw games, player account management systems, and an aggregation platform for third-party game content.

“We are extremely proud to be selected as the partner for MSLC, after a highly competitive process,” said Aristocrat Interactive CEO Moti Malul. “We’re excited to be partnering with the MSLC, who are widely recognised as a global leader in lotteries. We look forward to helping the MSLC deliver on its objective to expand player engagement through innovative and responsible online play, and further enhance their ability to contribute to and support local communities.’

Intralot vows to challenge Maryland Lottery contract loss

INTRALOT IS EVALUATING its legal options after being dropped as the preferred bidder for a new central lottery monitoring and control system in Maryland.

The Maryland Lottery and Gaming Control Commission selected Intralot as its preferred bidder - over rival bids from Brightstar and Scientific Games - recommending that the company be awarded the new ten-year lottery contract which is due to commence in May 2027.

This decision was overturned in early August, with Intralot confirming that its bid had ultimately been rejected based on the alleged failure to meet the minimum required percentage of Minority Business Enterprise (MBE) participation.

“This decision comes as a great surprise, especially considering that Intralot, Inc. had allocated a significantly higher percentage of the project to local subcontractors than the minimum required,” said Intralot. “Moreover, the company had provided the Commission with very detailed clarifications, and the Commission was fully aware of the identity and role of these subcontractors.”

Games Global expands into iLottery…

ONLINE SLOT DEVELOPER Games Global is entering the iLottery market with the launch of its first eInstant games, which will be made available to World Lottery Association (WLA) members through EQL Games.

“Games Global is very pleased to announce our decision to invest the extensive capabilities and gaming DNA of our company into the world of Lottery,” said Games Global CEO Walter Bugno. “Our dedicated iLottery studio is already working on a suite of games designed specifically for iLottery and attuned to the needs and requirements of these customers.”

EQL is already integrated with lotteries in the United Arab Emirates, Peru and Michigan, Virginia, and Washington DC lotteries in the US. It plans to expand into Europe in the next year.

Pollard Banknote adds Godzilla to licensed portfolio

POLLARD BANKNOTE SIGNED a deal with Toho International to develop new lottery games based on Japanese fictional monster and cultural icon Godzilla.

Marking the ‘King of the Monsters’ first ever appearance in the lottery category, Pollard is developing a range of Godzilla-themed games across printed scratch cards, pull-tab and Fast Play tickets, as well as digital eInstant games. Alongside the rights to Godzilla, the agreement also includes a number of characters featured in the Godzilla series of films, including Mothra, King Ghidorah, Rodan, Jet Jaguar, Hedorah, Biollante and Mechagodzilla.

“Lottery players are drawn to brands that evoke a sense of nostalgia and excitement, and Godzilla delivers on both fronts,” said Pollard Banknote vice president of sales and marketing, Brad Thompson. “Its global fanbase, timeless appeal, and bold visual identity make it an ideal choice for creating standout games that drive both engagement and sales. We’re excited to help our clients bring this renowned franchise to life in compelling new ways.”

SAN FRANCISCO-BASED VENTURE capital fund Bullpen Capital has invested in EQL Games, with the funds to be used to accelerate innovation and further the supplier’s reach across lotteries worldwide. Bullpen previously invested in FanDuel in 2012 and Jackpocket in 2016.

“Lottery is one of the most widely played games in the world, yet it’s been historically underserved when it comes to innovation,” said Bullpen Capital general partner Paul Martino. “EQL Games is bringing modern infrastructure and content to a massive, regulated market – and doing so with a deep understanding of what government partners and players want. We believe they’re positioned to be the backbone of digital lottery.”

Can the 2026 World Cup succeed where its club counterpart failed?

Muted betting handle and empty seats at the 2025 Club World Cup in the United States raised eyebrows but the World Cup is a different beast entirely. With primetime US kickoffs, a maturing betting market, and surging soccer fandom across North America, 2026 could redefine soccer’s role in sports betting in the United States.

WHEN FIFA EXPANDED the Club World Cup and staged it in the United States this summer, some in the betting industry wondered whether it might serve as a useful barometer for next year’s World Cup. The theory was straightforward: if American bettors failed to engage with a global soccer event hosted on home soil, what might that say about the prospects for next year’s World Cup.

The early signs were not encouraging. Stadiums looked half empty, a million tickets reportedly went unsold during the group stage and betting handle in the US was muted. For those hoping that the Club World Cup would announce soccer’s arrival as a mainstream betting product in America, it was a sobering reality check.

But industry insiders are unanimous: to conflate the Club World Cup’s struggles with the outlook for FIFA’s flagship event would be a mistake. “We expect very little correlation between the Club World Cup US betting handle and the significant numbers we will likely see at the 2026 FIFA World Cup,” says Ryan Bailey, Red Knot industry expert and host of The Total Soccer Show on The Athletic.

Tom Waterhouse, founder of Waterhouse VC, adds: “The Club World Cup is a new tournament which might take some time to gain traction. The 2026 World Cup is an entirely different prop-

osition being the world’s most-watched sporting event. Hosting with prime-time kickoffs for US audiences will see engagement like no other.”

The expanded Club World Cup was supposed to showcase soccer’s global appeal to US audiences. Instead, it struggled to make a mark. Tickets went unsold, broadcasts were hard to find, and betting numbers were underwhelming.

The tournament did have similar betting patterns to what we would expect from a major tournament. Data provided to Gaming Intelligence by sports betting technology provider Betby showed that pre-match activity accounted for around 70 per cent of bets, but live markets consistently outperformed in terms of turnover, with just 28 per cent of bets on the final generating almost 40 per cent of staking volume.

“The 2026 World Cup is an entirely different proposition, being the world’s most watched sporting event”

Tom Waterhouse, founder of Waterhouse VC

The picture was even clearer across the group stage, where in-play accounted for over half of turnover, despite a smaller share of bets. Market preferences followed familiar patterns, with 1x2 outcomes driving more than a third of all action and totals the next most popular, while BetBuilders captured close to 10 per cent of volume but just 3–5 per cent of turnover, evidence of rising interest without mass adoption.

There are also other important lessons that operators can learn from the Club World Cup for next year’s World Cup.

Pricing challenges stood out the most. With little historical data to go on, traders found fixtures like Manchester City versus Al Hilal uniquely difficult to model. Customers, too, lacked a frame of reference. That uncertainty made both trading and betting riskier than in the highly liquid markets of international football.

Visibility was another issue. Broadcast rights were held by an unfamiliar broadcaster in the US, with no free-to-air exposure and little promotional push. As a result, the tournament barely registered with casual fans. As Mark Phillip, CEO at AreYouWatchingThis and MetaBet put it, “A lot of people here didn’t even know the Club World Cup was going on.”

Finally, the tournament highlighted soccer’s

crowded calendar. With Champions League, domestic leagues, the CONCACAF Gold Cup and the emerging Leagues Cup between MLS and Liga MX, American fans were not starved of soccer content. The Club World Cup simply didn’t provide a must-watch hook.

Contrast that with the World Cup: concentrated, prestigious, and involving national teams rather than clubs. As Phillip remarks, “If the World Cup were held on the moon, people would still watch.”

The best place to start when analysing the World Cup is to look into its most prominent host nation, the USA. When the country last hosted the World Cup in 1994, betting was illegal outside Nevada and soccer fandom was embryonic. Yet the tournament set attendance records that stand to this day and laid the foundation for Major League Soccer (MLS).

Fast forward three decades and the landscape is transformed. Sports betting is legal 40 US jurisdictions. Soccer has broken through to the mainstream, powered by a growing Hispanic fanbase, the rise of MLS, and global superstars

like Lionel Messi arriving on American soil.

“Legal sports betting has matured nationwide,” says Waterhouse. “Soccer’s popularity continues its upward trajectory driven by accessibility, a passionate and growing Hispanic fanbase, and expanding media coverage. With a US team capable of reaching the Round of 16, operators should expect engagement levels that eclipse anything soccer betting has delivered.”

The significance of US primetime kick-offs also cannot be overstated. Unlike the last tournament in Qatar, where matches took place early in the morning, every US game in 2026 will be on primetime television. That is the fuel sportsbooks need for watch-and-bet momentum.

If the US is being seen as an opportunity for a new wave of sports bettors, Mexico can be seen as the established field. Soccer is considered the national sports of the country and sports betting is already well-established in the country.

Codere Online chief marketing officer Alberto Telias believes that the Club World Cup showed how hungry the nation is when it comes to sports betting.

“Whenever Monterrey and Pachuca played at the Club World Cup, there was a massive amount of betting activity on our platform, which showed the interest the Mexican consumer had for the tournament. Even when those teams were knocked out, we saw consistent levels of activity in the latter stages of the tournament.”

Telias explains that the Mexican market in general is in a very different place to where it was during the last World Cup. “Four years ago, there were only two or three serious operators. Now that number has more than tripled. That means more content, more advertising, more exposure. Mexicans are dying to have another World Cup in their country.”

“Four years ago, there were only two or three serious operators. Now that number has more than tripled”

Alberto Telias, Codere Online chief marketing officer

If the Club World Cup offered one useful insight, it was how fragmented betting behaviour has become across markets. What works in Mexico doesn’t necessarily resonate in the US, and Canada may sit somewhere in between.

Telias says that bet builders are now the defining trend in Mexico. Customers love combining multiple markets into single wagers, often team result, first goal scorer, and a card market, and treating them as entertainment products in their own right.

“Live betting is also extremely strong,” adds Telias. “Mexicans can bet on a range of sports that is way bigger than anybody else. They watch NCAA, they watch baseball, they watch women’s football. And they do it live.”

By contrast, US bettors are still in the early stages of soccer adoption, and their habits are shaped by US sports, where the action is broken into constant stoppages and plays. That translates into a clear appetite for quick-hit props such as first players booked, a goal to be scored in the first 10 minutes etc. As Phillip explains: “The joy and the pain of your bet is why you bet. The ability to know the result in the next five or 10 minutes is what pulls people in. That’s why we expect first-to-X markets to explode during the 2026 World Cup.”

Phillip adds that this mirrors US betting habits in baseball (“no runs in the first inning”), basketball (“race to 10 points”), and NFL (“first

“The ability to know the result in the next five or 10 minutes is what pulls people in. That’s why we expect first-to-X markets to explode during the 2026 World Cup”

Mark Phillip, CEO of MetaBet

touchdown scorer”). For sportsbooks, the challenge will be to price these markets competitively while managing the higher volatility.

Canada is less developed but may behave as a hybrid between US and European markets. Canadian bettors are already exposed to hockey-style props, which lend themselves to micro-markets, but their soccer engagement has historically followed more traditional patterns.

With Canada hosting matches and the men’s team competing in the 2026 tournament, operators expect increased appetite for both match result bets and player props, goal scorer, assists, and cards, alongside growing interest in bet builders.

The consensus seems to be that all three host countries will lean heavily on bet builders, with Mexico maybe leaning more towards in-play betting and the US more towards micro-betting.

Two operational risks that stand out for next year’s World Cup are the weather and the differing time zones.