Georgia Department of Education

School Nutrition Division

School Food Authorities (SFAs)

Guide to Financial Management

Issued Date: October 18, 1994

Effective Date: July 1, 1994

Section Title: Other Information

Revision History:

• Revision No.: 2

• Date Revised: July 2025

Chapter Title: School Nutrition Program Accounting Procedures

1. Introduction

2. School Nutrition Program Accounting Procedures

2.1 Accounts Payable

2.2 Accounts Receivable

2.3 Bank Reconciliations

2.4 Change Funds

2.5 Contracted Meals

2.6 Daily Cafeteria Receipts

2.7 Food Inventories

2.8 Interest Earned

2.9 Investments

2.10 Opening a New School

2.11 Prepaid Meals

2.12 Returned Checks

2.13 Summer Salaries

2.14 Transfer of Funds

2.15 Internal Control Procedures

2.16 Entering Claims & Financials in School Nutrition Online

2.17 Reduced Pricing

2.18 Natural Disaster and USDA Commodities

2.19 Fresh Fruit and Vegetable Program

3. Frequently Asked Questions

4. Chart of Accounts

5. Standard Operating Procedures (SOPs)

6. Contact Information

This guide provides proper accounting and reporting for School Nutrition Program (SNP) funds, ensuring compliance with federal and state regulations. This guidance presents the required procedures, documentation standards, and timelines to support accurate financial reporting and effective program management. This resource aims to promote consistency and accountability across local school systems, minimize audit findings, and ensure the integrity of School Nutrition’s financial operations. This resource replaces the previous Recordkeeping Guide and has been updated to better reflect current practices and policy requirements.

Refer to this resource whenever processing financial transactions, preparing reports, or seeking guidance on accounting procedures related to the School Nutrition Program. This guidance was designed as a tool to assist with day-to-day operations.

Key Points:

• Local school systems, referred to as "local education agency" (LEA), are designated as the School Food Authority (SFA) in the context of the SNP.

• SNP funds are typically reported as a Special Revenue Fund using the modified accrual basis of accounting.

• Subsidiary ledgers must be maintained for each school and central office operation.

Expenditures are to be recorded in the accounting records when they are incurred. Incurred means that the goods and services have been received and will be paid for from current resources. Past due amounts that should be payable from current resources are included in this definition. Invoices should be recorded in the appropriate expenditure accounts when received, or at least weekly. In all instances, invoices must be recorded by the end of the month. The expenditure is offset by an accounts payable credit. In the illustrated journal entries that follow, special revenue fund 601 is used; SFAs should use the account code assigned to the SNP special revenue fund.

When the vendor check is written (either in the current month or in a later month), the accounts payable amount is cleared:

A detailed listing by vendor and amount of the accounts payable account must be maintained; the total of which must agree with the total of the accounts payable account in the general ledger.

Revenues which are earned but not received by the end of a month must be accrued. An accounts receivable entry is posted by the school, to record the revenue. The following entry will be required for the month's breakfast and lunch accrued revenue:

To Record Lunch and Breakfast Revenue for September

(All federal funds except breakfast) 601-9600-4510

Grants, Lunch (All federal funds except breakfast)

SNP Grants, Breakfast

(All federal breakfast funds)

601-9600-4510

601-9600-4511

In the succeeding accounting period, when the check is received for the accounts receivable amount, the following entry should clear the balance in the receivable account, unless there is other revenue not yet collected. For example:

To Record Receipt of September Lunch and Breakfast Revenue

State reimbursement is not normally accrued, since the funds are usually received during the month when due. However, if the State reimbursement for a particular month has not been received before the last day of the month, it should be accrued in the accounting records.

Monthly bank reconciliations are required and should be performed as soon as possible after receipt of the statement. The bank statement will contain transactions through the last day of the month and the balance should be reconciled to the cash balance in the general ledger and subsidiary ledgers as shown on the books as of the last day of the month. The format on the reverse side of most bank statements may be used or a form may be established by the SFA for reconciliation purposes.

If it is determined that corrections are required by the bank, the bank should be notified immediately. If it is determined that corrections are required in the SFA's accounting records, the corrections should be made immediately in the current month's accounting records.

A recommended format for bank reconciliations is shown below:

*These amounts must be in agreement. Entries should be made to post interest earned and bank charges to the cash account. In addition, any bank corrections needed should also be posted.

It is recommended that the signature or initials of the person reconciling the bank statement, along with the date of the reconciliation, be included in the reconcilement.

When a change fund is desired at a school cafeteria, a check is written to the person who will be responsible for the funds with the notation "change fund." For example:

The person to whom the check is issued is responsible for the use and safe-keeping of the change fund. The accounting entry to record the check is as follows:

The check is cashed, and the change fund is established. The change fund must be always kept in a secure locked storage place when not being used for making change. At the end of the fiscal year (June 30) it is necessary to return the cash to the bank account. The accounting entry to record the deposit is as follows:

When an SFA provides meals on a contracted basis (such as to Head Start), an invoice should be issued at month end for the total amount due for the meals. The invoice should be recorded in the accounting records before the books are closed at month end as follows:

Description

Accounts

Contracted

601-0000-0153

601-9600-1623

When the payment is received from the contracting agency and deposited, it should be recorded as follows:

Each day, the cafeteria receipts for student income, adult income and supplemental sales income should be verified and recorded by category. The funds should be deposited daily, and the deposit slips should be retained with the income records and daily cash report. The daily cash receipts should be verified by more than one person (for example, the manager and the cashier).

It is recommended that a weekly form be developed which lists the daily receipts by account. This form should be submitted to the central office each week, along with copies of deposit slips which verify deposit of the total collections each day. A weekly total by account should be shown and should balance to the sum of the daily totals. The weekly total should be recorded in the accounting records, using the dates in the description of the transaction as follows: To Record Deposit of SNP Revenue for the Week of

SFAs must have a charge policy; when a school has charged meals for students and/or adults, a record should be kept of the charged meals and collections should be made per SFAs charge policy.

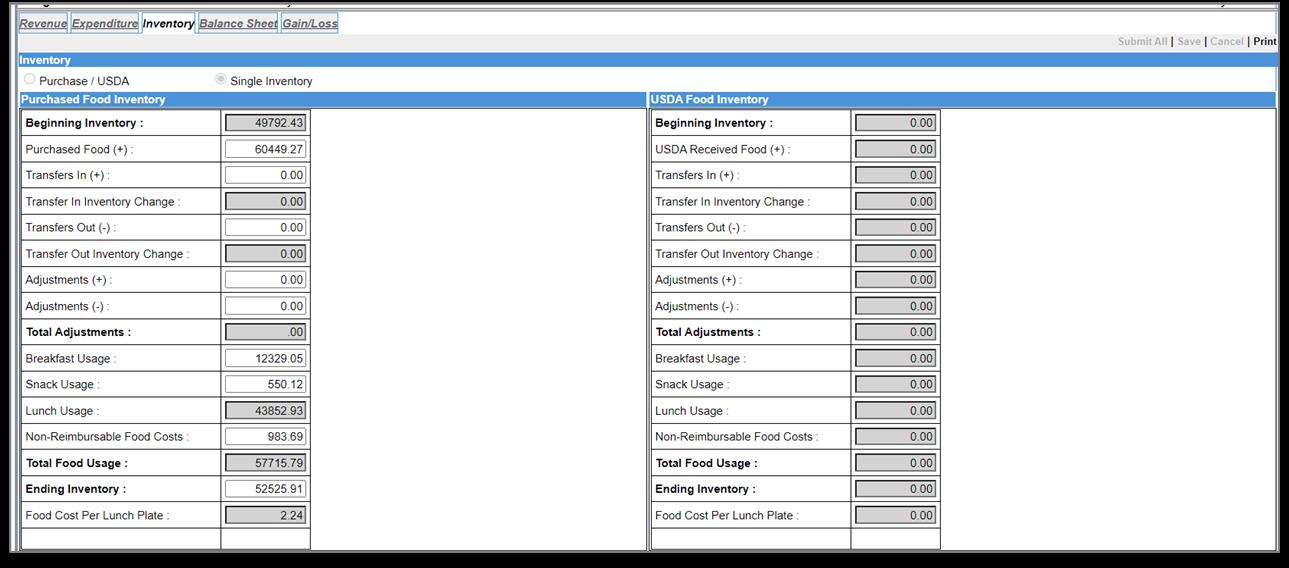

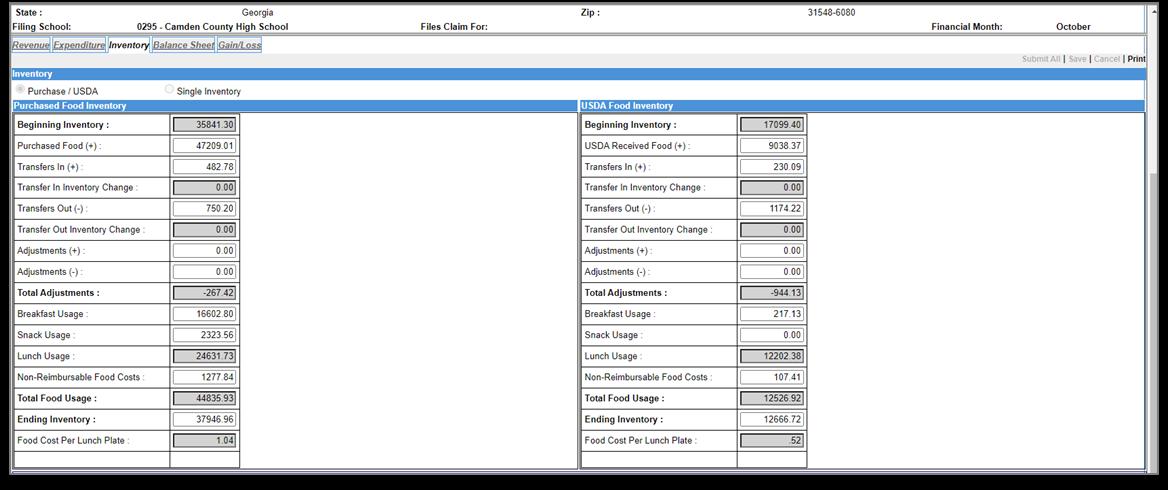

To comply with generally accepted accounting principles (GAAP), SFAs must record food inventories on the balance sheet of their financial statements. Revenues and expenditures related to the United States Department of Agriculture (USDA) donated commodities program should also be recorded in the financial statements.

Instructions to Complete Inventory Fields on School Nutrition Program Balance Sheet

To Record Value of Purchased Food Inventory at Month-End in a Single Inventory System:

To Record Value of USDA Commodities Inventory at Month-End in a System using Purchase/USDA Inventory System:

If single inventory is selected in the School Approval Module (SAM) in SNO, the USDA food inventory fields will be “grayed” out and not available for data entry. For Single Inventory, USDA information should be combined with purchased and entered in the purchased inventory fields.

At the end of each month, these accounts would be debited or credited to reflect the actual values of inventory on hand. During the FY, as purchased food and USDA commodities are received, the journal entries are:

To Record Purchased Food Received

Description Account No.

Purchased food

Accounts payable

601-9600-3100-630

601-0000-0421

To Record USDA Commodities Received (Only applicable if not using Single Inventory)

Description Account No.

Food Acquisitions - USDA

Revenue attributable to USDA commodities

601-9600-3100-6350

601-9600-4900

Note: The values of USDA direct delivery products are posted on the GaDOE SND website on the DE116 form by mid-June for the ensuing fiscal year

Then, based upon a physical inventory at the end of the fiscal year, the food inventories would be entered on the balance sheet of the financial statements by the following entry:

To Reserve Value of Food Inventory at 6/30/XX

To Reserve Value of USDA Commodities at 6/30/XX (Only applicable if not using Single Inventory)

Note: Physical inventories would be taken at the end of each month. These entries would be reversed at the beginning or end of the next FY:

Description Account No.

Fund balance-reserved for inventories 601-0000-0751

Value - Purchased Food Inventory 601-0000-0171

Fund balance-reserved for inventories 601-0000-0751

Interest earned on SNP investments or checking accounts must be credited as revenue in the SNP fund. The entry to record the revenue is:

To Record Interest Earned

Description

Cash in bank

Earnings on investments or deposits

601-0000-0101

601-9600-1500

When the interest amount is known but not received by the end of the month (such as with a maturing certificate of deposit), the amount should be accrued before closing the books for the month. An example of the entry to record the revenue accrual is:

To Record Interest Earned but Not Received Description

Refer to the topic "ACCOUNTS RECEIVABLE" for further information on accruals of revenue and subsequent receipt of the amount accrued.

It is recommended (but not required) that a separate checking account be maintained for SNP. When SNP funds are maintained in the general operating account with other funds, it is necessary to credit the SNP fund with the pro-rata share of interest for the SNP funds.

An SNP fund may have sufficient cash available for investments such as time deposits, savings certificates, etc. It is lawful to invest in securities of the state, United States, municipalities of the state or bank certificates of deposit (insured by F.D.I.C.). Investment in credit unions is not allowable. Note: Any investment in excess of $250,000.00 must be collateralized at 110% by the financial institution. The collateralized instruments should be pledged in the name of the SFA.

When an investment is purchased, the transaction is recorded as follows:

To Record Investment in a Certificate of Deposit Description

At the time an investment matures, the transaction should be recorded in the accounting records, regardless of whether it will be "rolled over," re-purchased or retained in the checking account. Assume that the above $20,000 certificate of deposit (CD) matures and the SFA receives a check or has its bank account automatically credited in the amount of $20,600, which includes $600 interest. The entry to record the automatic credit or the deposit in the SFA's bank account is as follows:

To Record Maturity of CD

If the money is not re-invested, no further entry is required. If a check is written for a new investment, an entry would be made to debit the investment account and credit the bank account; however, if the SFA allows the bank to "roll over" the investment and the accumulated interest, an entry to record the interest earned through the date of maturity would be needed as follows:

To Record Interest on Re-Investment of CD

Interest earned on any investment is always recorded in the Earnings on Investments or Deposits revenue account (1500). Federal regulations require that interest earned by SNP deposits or investments must be credited to the SNP fund and used only for the operation or improvement of the SNP program.

When a new school is opened, a new school number is assigned by the Facilities Division of GaDOE. This number can be obtained from the appropriate contact person in the superintendent's office of the LEA.

If purchased food or USDA food is transferred to the new school, it should be reported on the first transmission of Form DE106 Financial Inventory Tab for the new school as a plus (+) adjustment to purchased or USDA foods. The school transferring out the purchased food or USDA food would report a minus (-) adjustment to purchased or USDA food.

Any cash received from another school or central office will be reported as a part of the month's ending cash balance along with other Financial Data.

When students pay in advance for meals, the revenue should be recorded as student income, Student sales - breakfast and lunch programs. Example:

To Record Revenue for Prepaid Meals

Breakfast 601-9600-1612

Note: Systems may choose to combine and record breakfast and lunch sales in account 1611. It is necessary that a separate record be maintained by student, to track the prepayments and the meals applied against each student's account.

There are a number of vendors offering services for managing prepaid meal accounts.

When a check is returned by the bank for insufficient funds, it is necessary to record a transaction to reduce the bank balance. The SFA has the option to reduce the revenue account to which the original deposit was credited or to establish an accounts receivable.

Assume a $20.00 check for student meals is returned. If the SFA chooses to reduce revenue, the entry is as follows:

To Record Returned Check

Student salesbreakfast and lunch programs

When the money is received to replace the check, it will be credited to Student sales - Breakfast and lunch program revenue account, as usual.

If the SFA chooses to establish an accounts receivable, the entry is as follows:

To Set up Accounts Receivable for Returned Check Description

Accounts receivable

601-9600-1611

When the money is received to replace the check, it will be necessary to clear the accounts receivable balance, as follows:

To Record Replacement of Returned Check

NOTE: A detailed listing must be maintained for the accounts receivable account. The total of the detailed listing must agree with the total of the accounts receivable account in the general ledger.

Collection of returned checks may be contracted with a private vendor in return for service fees.

If SNP employees are paid over a twelve-month period for work performed only during the school year (or any period of time less than twelve months), it is necessary to accrue the portion of earned salaries which is "deferred," or set aside to be paid during the summer, as well as the corresponding employee benefits.

The steps for determining the amount of salaries and benefits to accrue are as follows:

1. Calculate the earned salaries, based upon the number of hours each employee worked during the current month.

2. Determine the gross salaries which will be paid on the monthly payroll.

3. The difference between earned salaries and the paid gross salaries is to be recorded as an expenditure in the current month, with an offsetting credit entry to salaries and benefits payable. Also, the related employee benefits are to be recorded as expenditures with an offsetting credit entry to the salaries and benefits payable.

The entries to record accruals for the month are shown in the following example:

To Record Deferred Salaries and Benefits for SNP Personnel

In the months of December and June, it is likely that the total amount earned for the month might be less than the gross salary paid for the month, because of the low number of hours worked. When this occurs, a negative amount may appear in the deferred (accrued) salary column. This amount will be entered as a debit to accounts payable rather than a debit to expenditures which will decrease the accounts payable account. The same principle applies to the matching cost of employee benefits which is relative to the negative salaries amount.

Labor costs, including salaries paid to employees who are not 12-month employees, must be reported as expenditures in the reporting period that the labor costs are incurred. Hourly rates are multiplied by the number of hours worked in the reporting period to which the matching benefits are added. The amount withheld for summer salaries must be set up as a liability in the accounts payable account. It is recommended that an "accounts payable/summer salaries" account be used in lieu of the regular accounts payable account, e.g., 0422. If any account number other than 0421 is used, it will be necessary to roll the account number into 0421 prior to transmitting the year-end financial report to GaDOE. This balance is to be reported each month, along with all other payables, as Total Liabilities on the Form DE106 Balance Sheet Tab.

By recording and reporting the total labor costs and other expenses incurred each month, the SFA enables GaDOE to allocate monthly expenditures to the meals served in the respective month to develop a more accurate plate cost. This information is also used in monitoring net worth and other aspects of financial management.

If it becomes necessary to transfer funds between schools within the SNP Fund, the transaction should be recorded in the accounting records as a "transfer out" for the contributing school and a "transfer in" for the receiving school.

Assume that the middle school is transferring money to the high school within the SNP fund. (No check is written.) The middle school is fund 603 and the high school is fund 604. The appropriate accounting entry is as follows:

Description

Operating transfers to other funds

Cash in bank

Cash in bank

Operating transfers from other funds

603-5000-9300

603-0000-0101

604-0000-0101

604-5000-5200

The Georgia Department of Education – School Nutrition Division (GaDOE SND) is committed to supporting School Food Authorities (SFAs) in maintaining strong accounting and administrative internal controls to promote financial integrity, regulatory compliance, and operational effectiveness. We provide guidance and oversight to ensure that SFAs implement policies and procedures that include proper authorization of transactions, separation of duties to minimize risk, accurate documentation and recordkeeping, controlled access to records and information, and routine independent performance reviews. These internal controls are critical to fostering transparency, preventing fraud, and ensuring responsible stewardship of resources dedicated to supporting Georgia’s students and school communities.

In School Nutrition, a voucher is a financial or procurement document that can be used to authorize payment for goods or services provided typically related to food, supplies, or equipment needed for meal program operations. Vouchers confirm receipt of ordered goods (e.g., food items, paper goods, kitchen equipment) or services (e.g., maintenance, food delivery), and ensure proper internal controls and financial tracking before payment is processed. Vouchers also serve as a record for audits, especially under federal Child Nutrition Programs (e.g., NSLP, SBP), where proper use of funds must be documented.

• Proper Authorization of Transactions and Activities

o Invoices are approved for payment before checks are written by someone other than the preparer.

o The signature of the superintendent, or some other official not directly associated with the cash records, is required on all checks.

• Adequate Segregation of Duties

o Duties of employees are structured so that recordkeeping, physical handling of cash and checks, and authorization of disbursements are separated.

o The bank statement is reconciled by someone other than the person who writes checks or records cash transactions.

o Check signing is assigned to someone other than the person who prepares the voucher for payment.

o Purchasing and approving purchases are separated from receiving and storing goods.

o Checks are prepared by someone other than the bookkeeper.

o Prepared checks are reviewed by someone other than the preparer before signing.

• Adequate Documentation and Records

o Vouchers are approved before payments.

o Bank reconciliations are reviewed by an administrative officer not connected with regular cash operations.

• Adequate Safeguards over Access and Use of Assets and Records

o All blank checks are stored under the control of someone other than the check preparer or bookkeeper.

o If a signature plate is used, control of the plate is maintained by someone independent of cash records.

o All signed checks are mailed by employees other than those with access to cash and cash records

• Independent Verifications on Performance

o Bank reconciliations are reviewed by an independent administrative officer.

o Prepared checks are reviewed by someone other than the preparer before signing

The procedures adopted by the SFA must be in writing or typed and made available to all personnel involved, as well as to state or independent auditors. Accounting practices should be monitored to ensure compliance with the established internal control procedures.

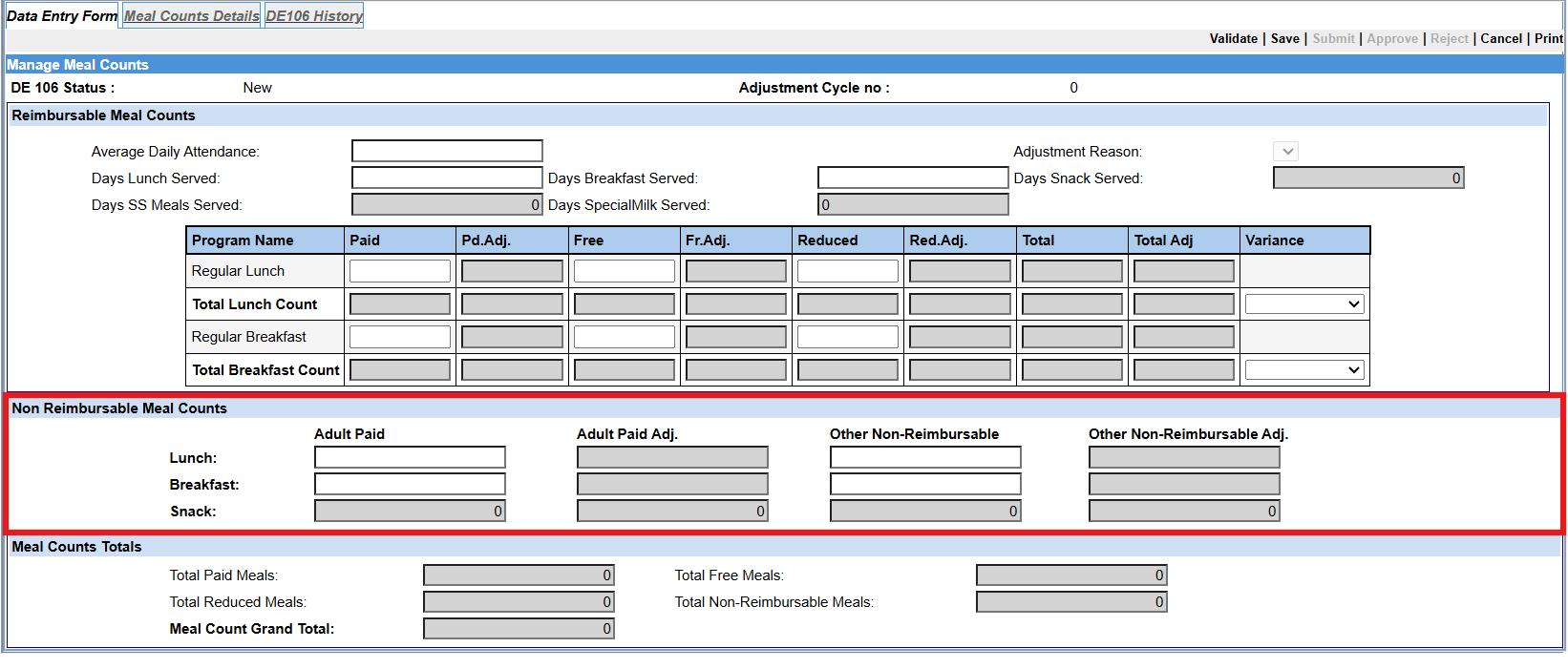

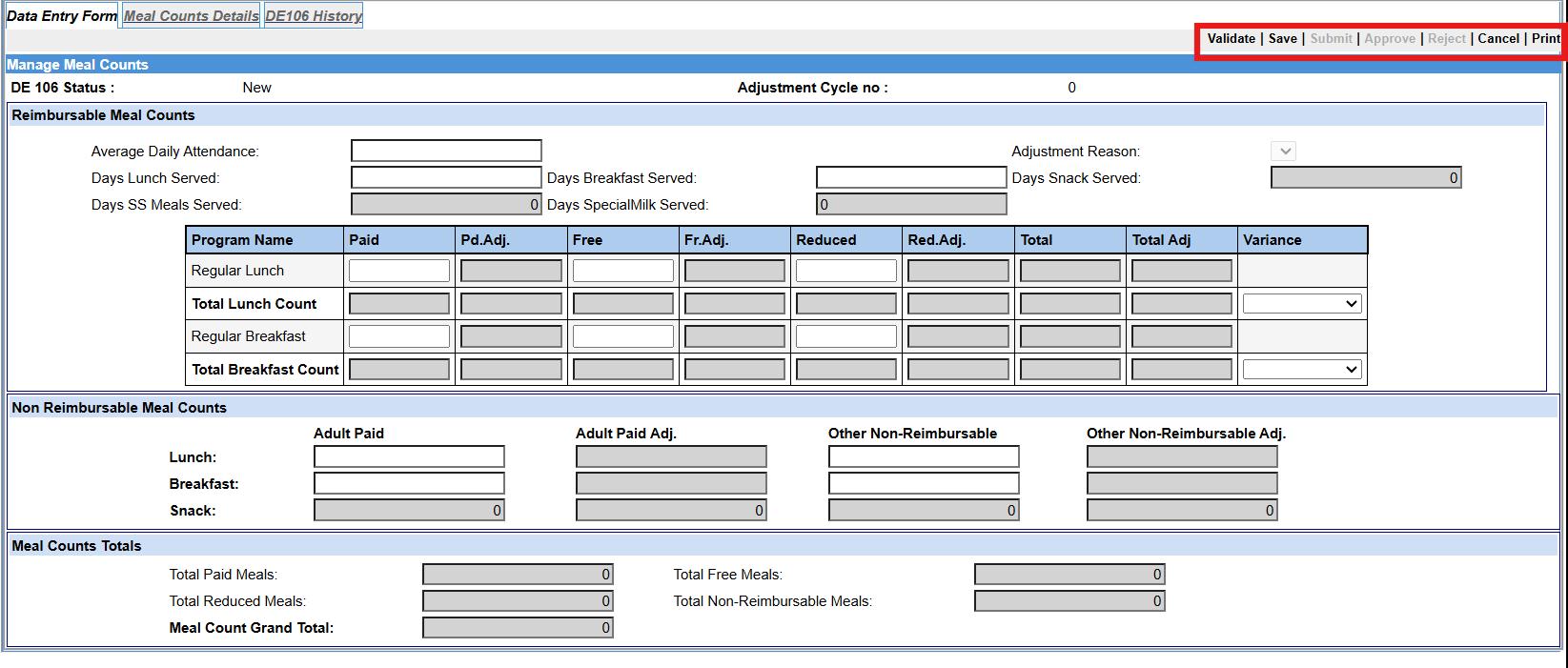

Entering Claims and Financial information in SNO provides essential guidance for submitting monthly school nutrition claims through Forms DE106 and DE107.

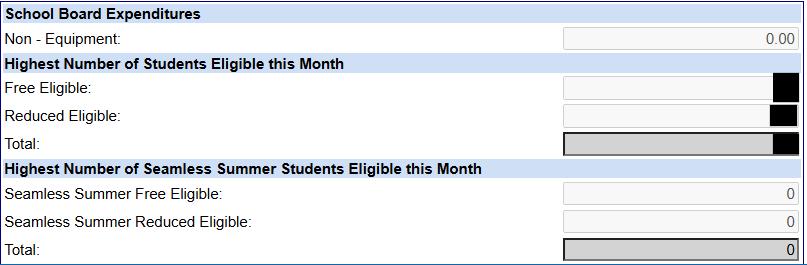

This section outlines step-by-step instructions detailing data entry procedures, including meal counts by category (paid, free, reduced), average daily attendance, days of service, and non-reimbursable meals. Additionally, instructions are provided for reporting school board expenditures and completing system-wide data on Form DE107.

The DE106 financial reporting process requires school nutrition programs to accurately record monthly revenue, expenditures, inventory, and balance sheet data using specific revenue sources and object codes from local, state, and federal funds.

It is essential to ensure all data, including food inventory adjustments and fund transfers, are entered correctly and retained for audit purposes. Accurate submission of both DE106 and DE107 is required to ensure claims are considered complete and eligible for reimbursement.

Claim Data for the current month should be transmitted to the School Nutrition Finance and Claims no later than the 20th calendar day of the month following the claim month

The reimbursement rates for all meals are entered into SNO by the GaDOE SND Finance Team SFAs are notified of the rate information at the beginning of each fiscal year.

Below is a listing of the key data required to file a Form DE106 Claim and the forms that can be used to compile this information.

• Avg. Daily Attendance - Enter the school's average daily attendance for the claim month.

• Number of Days Lunch Served - Enter the number of days lunches were served.

• Number of Days Breakfast Served - Enter the number of days breakfasts were served.

• Number of Days Snacks Served – Enter the number of days snacks were served.

• Number of Days SSO Served – Enter the number of days SSO meals were served.

Paid: Enter the number of paid reimbursable lunches served to students. (Column 2 of the Daily Record of Number of Lunches Served, Form DE118)

Free: Enter the number of free reimbursable lunches served to students. (Column 3 of Form DE118) A current, approved free meal application must be on file to document the eligibility of each student served unless the student has been directly certified.

Reduced: Enter the number of reduced price reimbursable lunches served to students. (Column 4 of Form DE118) A current, approved reduced-price meal application must be on file to document the eligibility of each student served.

If Seamless Summer Option (SSO) meals were served, enter number of Seamless Summer meals in the appropriate fields.

Paid: Enter the number of paid reimbursable breakfasts served to students.(Column 2 of the Daily Record of Number of Breakfasts Served - Form DE112).

Free: Enter the number of free reimbursable breakfasts served to students. (Column 3 of Form DE0112). A current, approved free price meal application must be on file to document the eligibility of each student served unless the student has been directly certified.

Reduced: Enter the number of reduced-price reimbursable breakfasts served to students. (Column 4 of Form DE112). A current, approved reduced price meal application must be on file to document the eligibility of each student served.

If Seamless Summer Nutrition Program (SSO) breakfasts were served, enter number of SSO breakfasts in the appropriate fields.

Paid: Enter the number of paid reimbursable snacks served to students. (Column 7 of the Daily Record of Number of Lunch Served – Form DE113).

Free: Enter the number of free reimbursable snacks served to students. (Column 8 of Form DE113). A current, approved free price meal application must be on file to document the eligibility of each student served unless the student has been directly certified or is participating in an At-Risk Snack Program.

Reduced: Enter the number of reduced-price reimbursable snacks served to students. (Column 9 of Form DE113). A current, approved reduced price meal application must be on file to document the eligibility of each student served unless the student is participating in an At-Risk Snack Program.

If Seamless Summer Option (SSO) Snacks were served, enter the number of SSO Snacks in the appropriate fields.

Enter Non-reimbursable Meal Counts.

Enter Non-reimbursable Meal Counts for Adult and Other Non-Reimbursable. This information can be found: Lunch Form DE118, Breakfast Form DE112, Snack Form DE113.

Lunch - Number of Schools

Enter the total number of schools participating in the National School Lunch Program. If two schools, an elementary and middle, for example, share the same cafeteria and are reported as only one school lunch program, they should be considered here as two schools, since each school participates in the program.

Enter the total number of schools participating in the School Breakfast Program. If two schools share the same cafeteria and are reported as only one school breakfast program, they should be considered as two schools, since they each participate in the program.

Information reported in this item is optional, with the exception of labor costs. However, failure to report all costs will distort the true cost of operating the program. Any charges paid for by the General Fund and charged to Function 3100 should be reported here. Examples of such expenditures include the following:

Salaries and Employee Benefits (Reporting is mandatory)

Enter the cost of salaries paid by the board for system level personnel with direct program responsibility for supervisory, clerical, or accounting services employed on a full or part-time basis, for the school nutrition program (SNP) only. This includes:

a) Salaries paid from the general fund for school personnel who perform SNP services on a full or part-time basis.

b) Employee benefits and fixed payroll charges for SNP personnel. This covers amounts paid from the general fund for items such as matching FICA, Medicare, insurance, sick leave, or annual leave. These costs should be documented by payroll records, monthly or quarterly reports, and SFA policy statements covering these items.

(Reporting is Optional)

a) Payment of utilities used by the SNP.

b) Payment of extermination and pest control.

c) Payment for SNP equipment maintenance.

d) Payment for outside contract for commodity storage and handling for the SNP.

e) Travel of SNP personnel.

f) Other costs benefiting the SNP.

NOTE! THE INFORMATION FOR NO. OF STUDENTS ELIGIBLE ON OCTOBER 31 AND ENROLLMENT ON OCTOBER 31 APPEARS ONLY ON THE OCTOBER SCREEN.

• Enter the highest number of students eligible for free and reduced-price meals on file during the month. This information is obtained by summarizing the information in Items A1 and A2 on the Daily Record of Number of Lunches Served (Form DE118).

• Number of Students Eligible on October 31

• Enter the total number of students eligible for free or reduced-price meals as of October 31.

• Enrollment on October 31

• Enter the total student enrollment as of October 31. If enrollment data is unavailable, you may report the SFA's most recent FTE count.

• After Form DE107 has been submitted, it must be printed and retained for audit/review purposes.

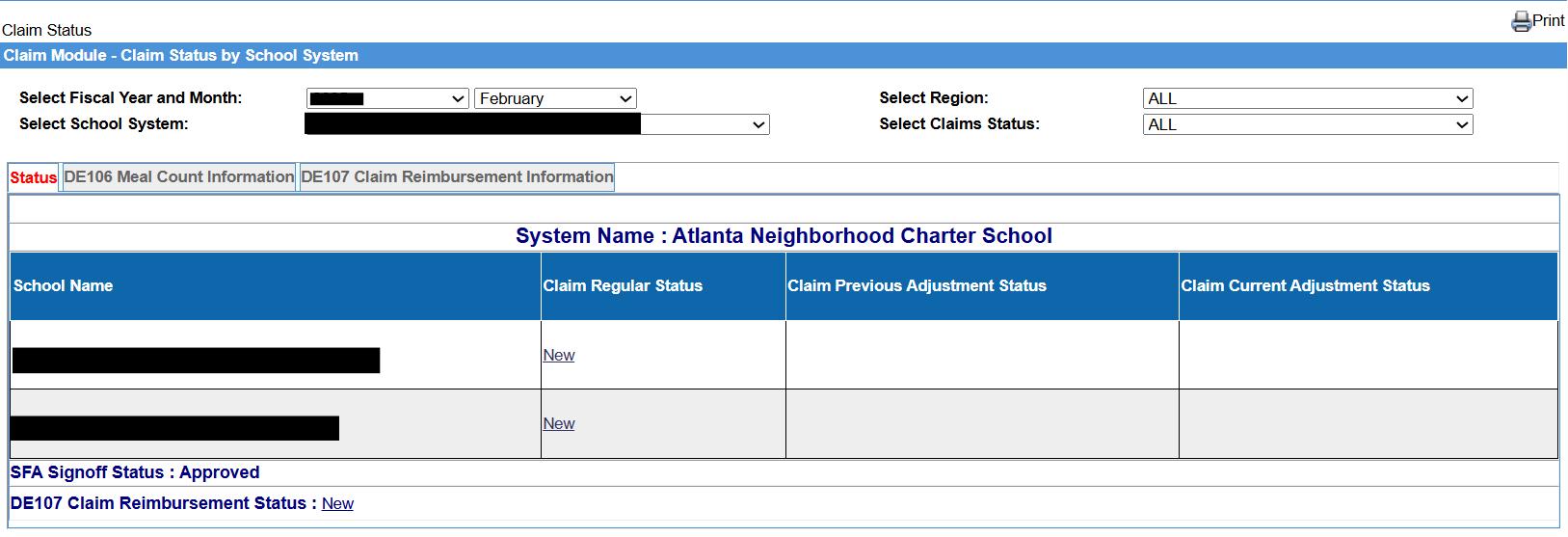

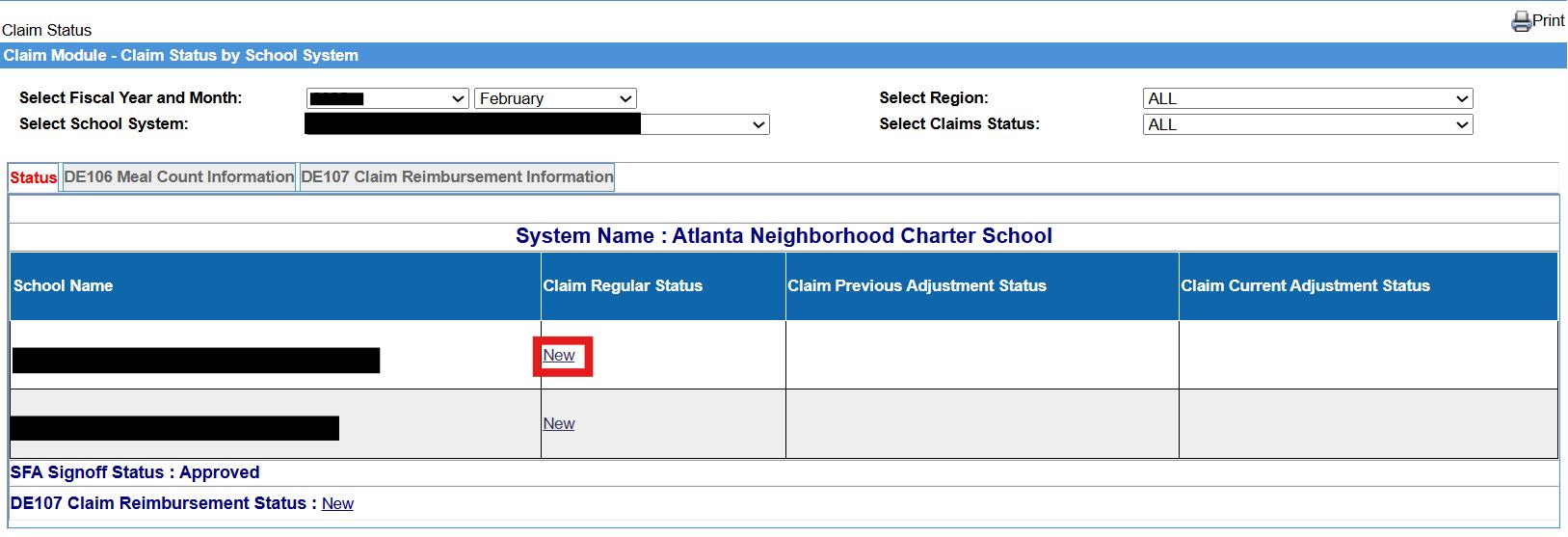

How To Complete DE106 Claim Reimbursement Form

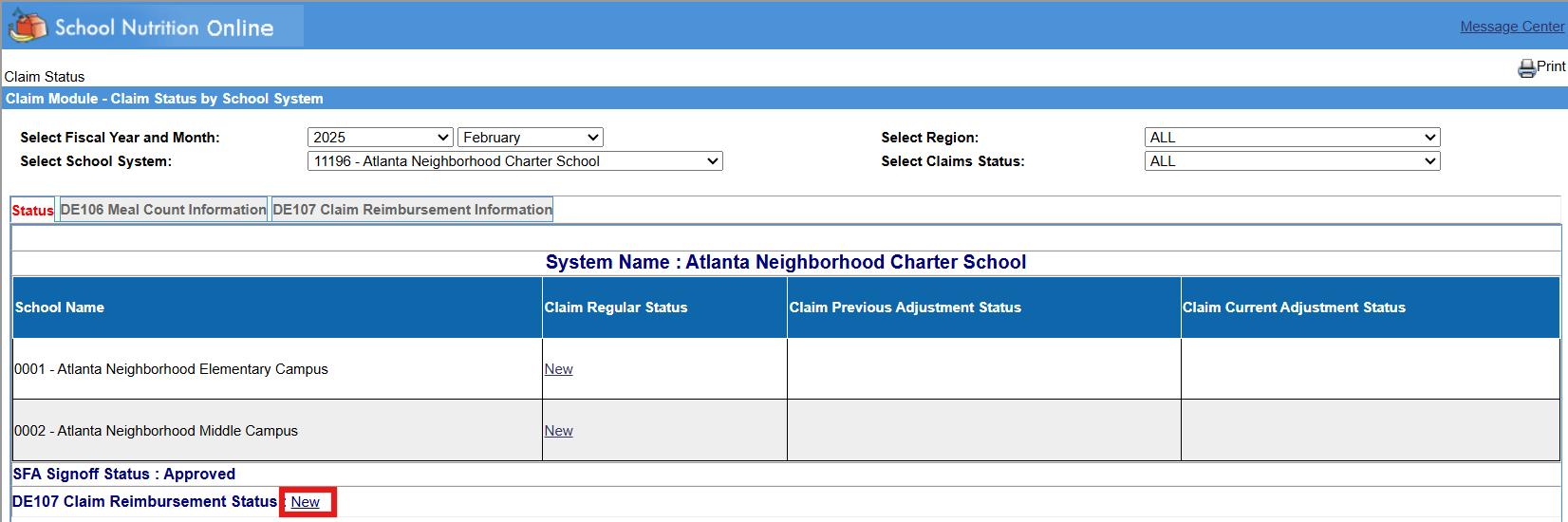

1. Navigate to Edit Claims

• Select School Nutrition.

• Select Claims.

• Select Edit Claims

• The Claims Status page appears.

• The Claims Status page displays each school that files a claim.

• The current claim status for each claiming school is shown under the Claim Regular Status heading.

• To change the month, click the drop-down arrow in the Month field and select the month for which data is being entered.

• The Select Region field is prefilled with the SFA’s Region.

• The School System field is prefilled with the SFA’s System.

• The Select Claims Field defaults to ALL.

• Click NEW under the Claims Regular Status column for the first school to be entered

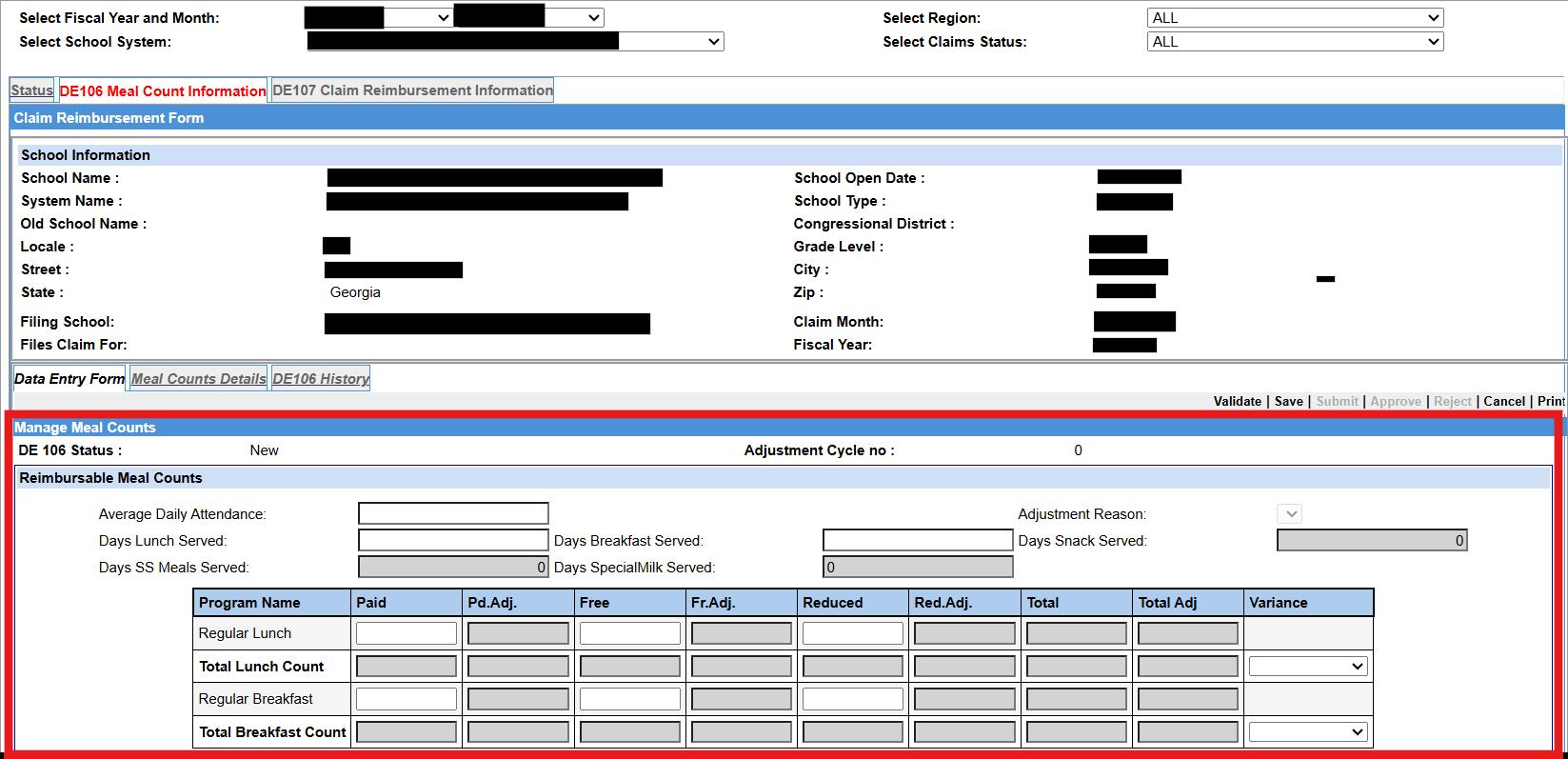

2. Enter Reimbursable Meal Served

• Enter the Average Daily Attendance.

• Enter the Days Lunch Served

• Enter the Days Breakfast Served

• Enter the number of Paid Regular Lunches, Free Regular Lunches, and Reduced Regular Lunches served.

• Enter the number of Paid Regular Breakfast, Free Regular Breakfast, Reduced Regular Breakfast meals served.

• Enter the number of Free At-Risk Snacks served.

• Enter the number of Free Regular Snacks served

3. Enter Non-Reimbursable Meal Served

• Enter the number of Adult Paid Lunches.

• Enter the number of Other Non-Reimbursable Lunches.

• Enter the number of Adult Paid Breakfasts.

• Enter the number of Other Non-Reimbursable meals

• Enter the number of Adult Paid Snacks

• Enter the number of Other Non-Reimbursable Snacks.

• Click the Save button.

• Click the OK button in the confirmation box.

• Click the Submit button.

• Click the OK button to confirm.

• Click the OK button in the confirmation dialog box.

5. Return to Status Page

• Click the Status tab.

• The Claim Regular Status changes form New to Approved

• Proceed to the next filing school to enter claims.

• Once the Claim Regular Status field for all active schools reads Approved, proceed to the DE107 Claim Reimbursement screen.

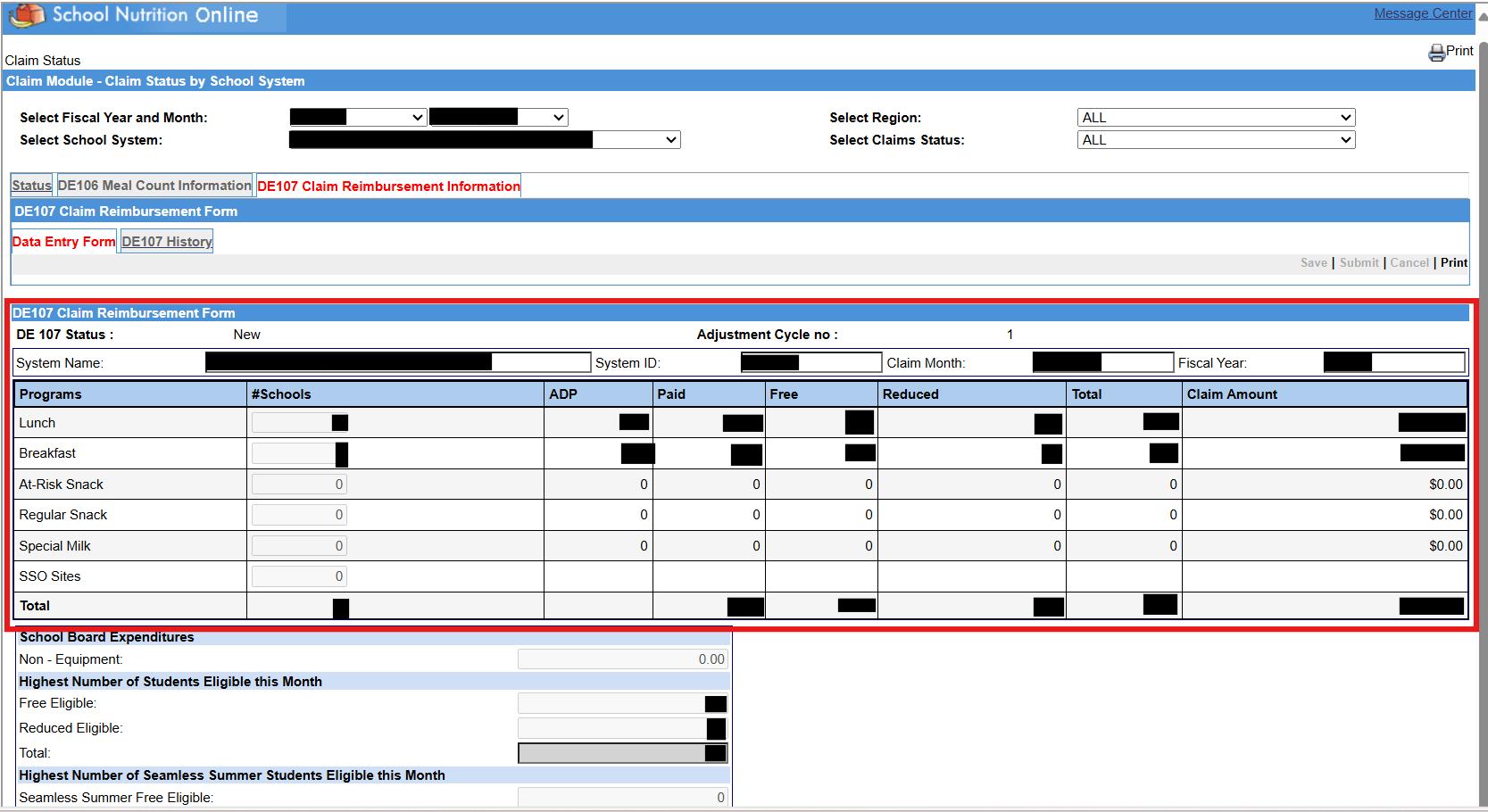

6. Navigate to

• Meal Claims for all active schools must be completed prior to completing the DE107 Claim Reimbursement form.

• Note: The Claim Regular Status for all active schools will read Approved

• Click the New link next to the DE107 Claim Reimbursement Status.

• Totals from the DE106 entries for all schools appear in the Programs area as System-wide totals.

• The calculated Claim Account is displayed.

• Enter the number of schools that participated in the Lunch program.

• Enter the number of schools that participated in the Breakfast program.

• Enter the number of schools that participated in the At-Risk Snack program

• Enter the amount for School Board Expenditures Non-Equipment.

• Enter the Highest Number of Students Eligible this Month for Free Meals.

• Enter the Highest Number of Students Eligible this Month for Reduced Meals.

Save and Submit the DE107 Claim Reimbursement Form

• Click the Save button.

• Clicking the Submit button on DE107 results in a warning stating that any further adjustments must be made using the adjustment process.

• If you are satisfied that the data submitted is accurate, click the OK button. Otherwise, click Cancel, make the appropriate corrections, then Save and Submit

• Click the OK button to close the confirmation dialog box.

• Step 1: Login to the portal and click on the edit claim.

• Step 2: Selected the correct claiming month.

• Step 3: Click on “new adjustment” next to the school.

• Step 4: Once it is open, use the “reason for adjustment” drop down box to state reasoning for making the necessary adjustment.

*After selecting the reasoning, User should be able to enter the corrected numbers.

• Step 5: Please be sure to use the difference of the original number and correct number.

For example, for users to make a change to paid lunch from 460 to 453, the user should enter -7.

Users will do this for every change.

If the change is an increase, the user should make the difference a positive number. For this example, to make a change to paid lunch from 453 to 460, the user should enter 7.

Once the user is done with all the corrections, save and submit and then resubmit the DE107.

When resubmitting DE107, please be sure to place zeros (0) in the boxes that do not have any changes. Once the user is done with all the corrections, save. Once the user has saved the changes, click the certification box, and click submit.

Please be sure to re-submit DE107.The claim is not complete until the user has successfully submitted the DE107. User should see the world “submitted” twice next to the DE107.

If you are making corrections to your DE107 and NOT your DE106, please follow steps 1-4 as stated above, then select your reasoning Save and Submit your DE106. (You do not need to enter zeros on the DE106)

Proceed to DE107 and make the necessary changes to DE107

To Increase the value, enter a positive difference

To Decrease the value, enter a negative difference.

Enter zeros in the boxes where no adjustment was made.

After making the necessary changes: save, click the certification box, and click submit.

All users should refer to the SNO Manual in conjunction with the following instructions. Data for the current month should be submitted no later than the 20th calendar day of the month following the claim month.

Instructions

Lunch Data:

• Cost of Purchased Foods - Enter the total cost of purchased foods used for breakfasts from column 10 of form DE112.

• Cost of USDA Foods - Enter the total cost of USDA foods used for breakfasts from column 9 of Form DE112.

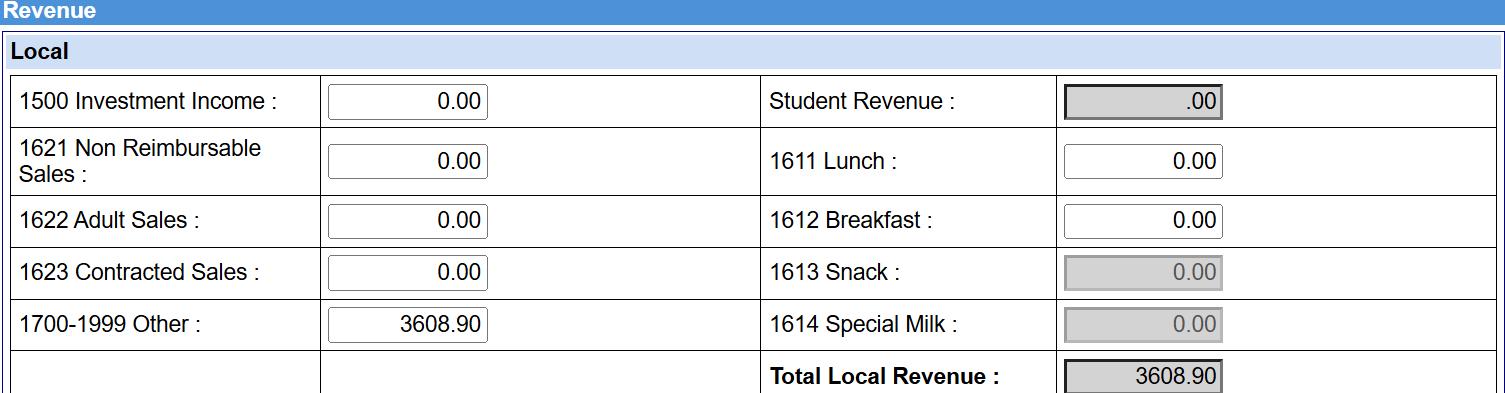

Local Revenue Sources

• The amounts entered in this section are the monthly totals obtained from your accounting records.

• 1500 Investment Income – Enter the amount of income from investments from Revenue Source 1500.

• 1621 Non-Reimbursable Sales - Enter the income for Non-Reimbursable Sales from Revenue Source 1621.

• 1622 Adult Sales - Enter the income for adult meals from revenue source 1622.

• 1623 Contracted Sales – Enter the income from Contracted Sales from revenue source 1623.

• 1700 – 1999 Other - Enter all other cash income (sale of assets, jury duty, fees, etc.) from revenue sources 1700 - 1999. Income received from students for a second meal is to be reported as other income.

NOTE: Lunch and breakfast revenue was separated into revenue sources 1611 and 1612; however, there is the option to combine and record both as revenue source 1611 for Form DE106 purposes.

• 1611 Lunch - Enter the amount of income for reimbursable student lunches from Revenue Source 1611.

• 1612 Breakfast - Enter the amount of income for reimbursable student breakfasts from Revenue Source 1612.

• 1613 Snack - Enter the amount of income for reimbursable student snack from Revenue Source 1613.

• 1614 Special Milk - This program is available only to schools which do not participate in either the school lunch or breakfast programs. Enter the income for Special Milk from Revenue Source 1614.

State Revenue Sources

• 3510 Salary Supplement- Enter the state funds income from Revenue Source 3510.

• 3995 Other State Agencies- Enter the Other State Agencies income from Revenue Source 3995.

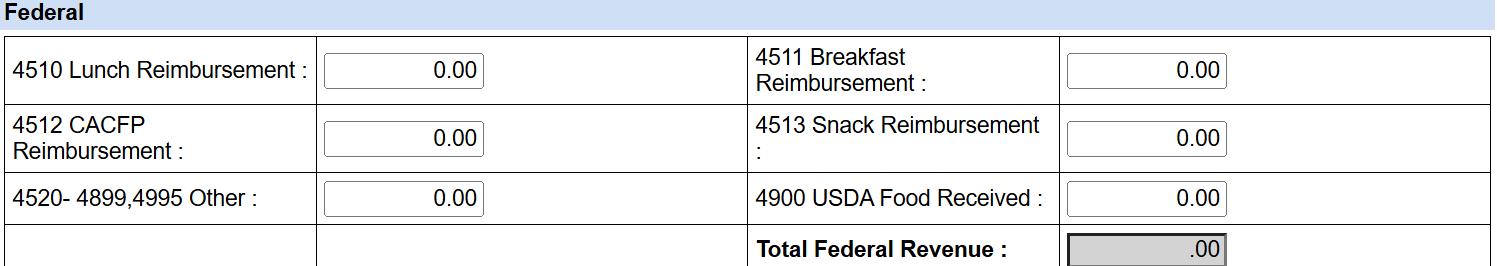

• 4510 Lunch Reimbursement) - Enter the federal reimbursement for lunches from Revenue Source 4510.

• 4512 CACFP Reimbursement - Enter the federal reimbursement from Revenue Source 4512.

• 4520 – 4899, 4995 Other - Enter the federal reimbursement from Revenue Sources 4520 –4899, 4995.

• 4511 Breakfast Reimbursement - Enter the federal reimbursement from Revenue Source 4511.

• 4513 Snack Reimbursement - Enter the federal reimbursement from Revenue Source 4513.

• 4900 USDA Food Received - Enter the federal revenue from Revenue Source 4900.

• 5200 – 5299 Transfer In - Enter transfers from other funds or other schools from function 5000 Revenue Source 5200 - 5299.

• 5300 - 5995 Other - Enter other funds from Revenue Source 5300 - 5995.

• 100-299 Labor - Enter the labor expense from objects 100-299.

• 630 Purchased Food - Enter the purchased food from object 630.

• 635 USDA Food Received - Enter the Food Received-USDA from object 635.

• 730 – 735 Equipment > $10,000 - Enter the equipment cost from objects 730 - 735.

• 300-879 Others (Except 630, 635, 730-735, & 880) - Enter expenditures from objects 300 through 879, with the exception of purchased food, USDA food received, equipment and indirect cost.

• 930 Transfer Out - Enter transfers to other funds or other schools from function 5000, object 930.

If single inventory is selected in the School Approval Module (SAM) in SNO, the USDA food inventory fields will be “grayed” out and not available for data entry. For Single Inventory, USDA information will be combined with purchased and entered in the purchased inventory fields.

• Beginning Inventory - this value is rolled over from the Ending Inventory field in the previous month.

• Purchased Food Received – enter the monthly amount from Purchased food (object 630) from the trial balance or general ledger. (Include 635 if on single inventory.)

• Transfers In (+): Enter the value of food transferred into the school.

• Transfers Out (-): Enter the value of food transferred out of the school.

• Inventory Adjustment (+) Enter positive adjustments when necessary.

• Inventory Adjustment (-) Enter negative adjustments when necessary.

• Breakfast Usage – Enter value of food used for breakfast for reporting month. If system utilizes Form DE112, the value will be found on that form.

• Snack Usage – Enter value of food used for Snack Program for reporting month. If system utilizes Form DE113, the value will be found on that form.

• Non-Reimbursable Food Cost - Enter the total of non-reimbursable food and milk used from column 4 of the production record for Non Reimbursable foods, Form DE120.

• Ending Inventory - Enter the total ending inventory of purchased foods from column 8 of the Monthly Inventory of Purchased Foods (Form DE115). (Include USDA as part of purchase foods ending inventory values by assigning them purchase values from the DE116 form and SFA contract awards if on single inventory.)

If SFA does not utilize Single Inventory, repeat the steps above for USDA Food inventory.

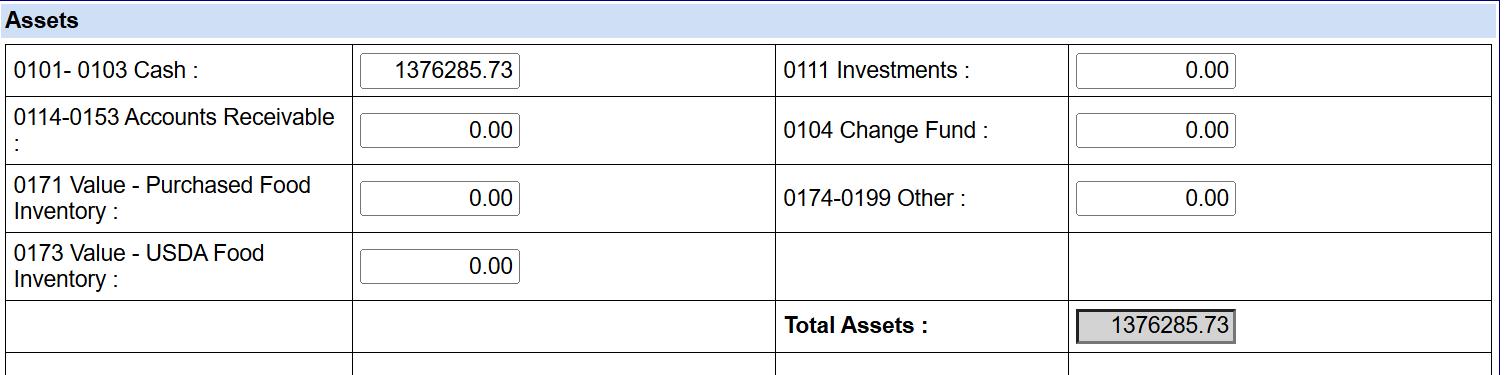

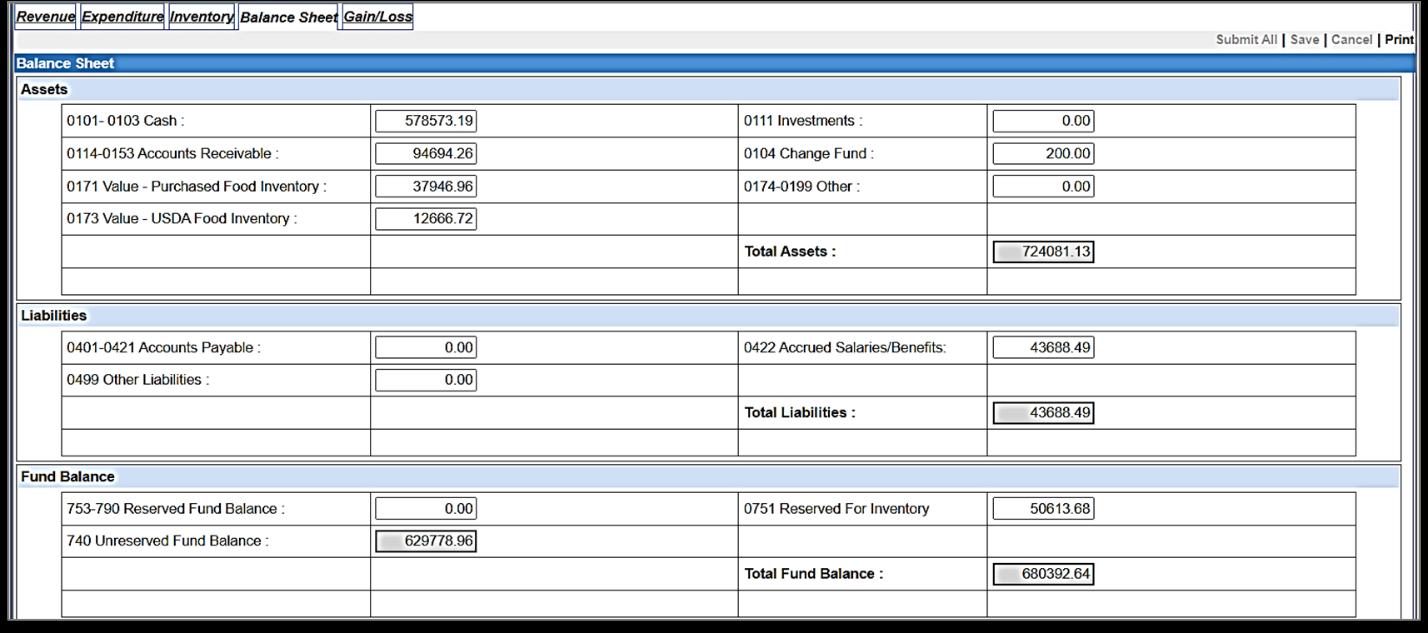

The amounts reported in this section are the year-to-date balances from the accounting records. A negative cash balance must be entered with a minus (-) sign.

• 0101-0103 Cash - Enter the account balance in Cash In Bank from accounts 0101 - 0103.

• 0114-0153 Accounts Receivable - Enter the combined account balances from account 0114 –0153.

• 0171 Value - Purchased Food Inventory - Enter the account balance from account 0171.

• 0173 Value -USDA Food Inventory - Enter the account balance from account 0173.

• 0111 Investments - Enter the account balance from account 0111.

• 0104 Change Fund - Enter the account balance from account 0104.

• 0174-0199 Other - Enter the account balance from accounts 0174 – 0199.

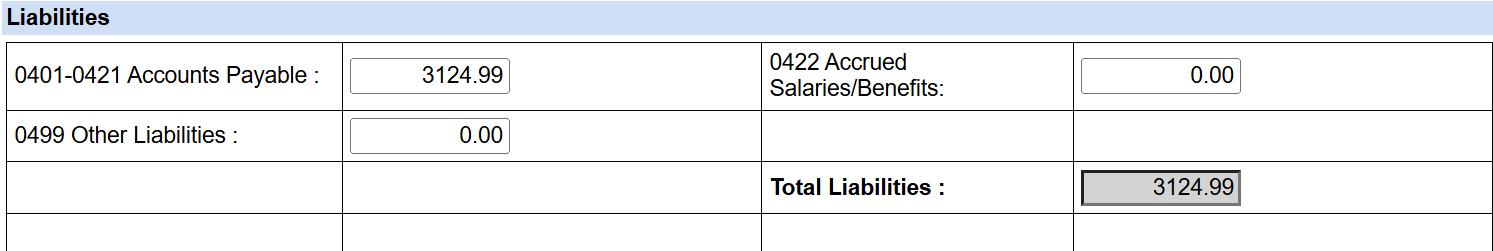

• 0401-0421 Accounts payable: Enter the total account balances from Accounts payable 0401 through 0421

• 0499 Other Liabilities: Enter the total account balance from account 0499.

• 0422 Accrued Salaries/Benefits: Enter the total account balance from account 0422.

• 0753- 0790 Reserved Fund Balance: Enter the total account balance from Accounts 0753 –0790.

• 0751 Reserved for Inventory: Enter the total account balance from Account 0751. Value should equal the total of Purchased Food Ending Inventory 0171 and USDA Ending Inventory 0173 for reporting month.

NOTE: After Form DE106 Financial data has been submitted, it must be printed and retained for audit/review purposes.

The State Reduced Meal Reimbursement funded by the State of Georgia allows SFAs to receive reimbursement for the service of reduced-price school meals at $0.30 for breakfast and $0.40 for lunch, covering costs not funded by Federal reimbursement that would otherwise be charged to students/households.

The Importance of State Reduced Meal Reimbursement:

• Funds allocated for SFAs in National School Breakfast and Lunch Programs

• Reimbursement provides $0.30 per breakfast and $0.40 per lunch

• Covers costs exceeding Federal reimbursement

All schools except those operating Provision 2 at both breakfast and lunch and/or the Community Eligibility Provision are eligible for reimbursement.

• SFA/school does not receive local payments from families for the cost of meals provided to students eligible for reduced-price meals. Meals are provided to all students at no cost.

• Allocation based on reduced-price meal service in school year

• # of reduced price lunches claimed X $0.40

• o Example: 579 lunches claimed X $0.40= $231.60

• # of reduced breakfast claimed X $0.30

• o Example 278 breakfast claimed X $0.30=$83.40

• 500 reduced breakfasts claimed. Of the 500 meals, 200 of the meals are being served at provision 2 schools. Therefore, the SFA will not receive reimbursement for those meals.

• 500 total breakfasts claimed – 200 breakfasts (from P2 schools) = 300 reduced meals

• 300 breakfast X $0.30 = $90.00

Please note that the “Payments Made & Due” report is the only report that will show the Reduced State Reimbursement total.

In the event of a natural disaster where food inventory is lost, the accounting procedures for the food loss are as follows:

1. Food Loss is Treated as Used:

a. Inventory loss, whether from purchased food or USDA commodities, is considered food "used" and should be reflected in the ending inventory figures. No separate accounting entries for the loss need to be made.

2. Documenting the Loss:

a. It's crucial to keep detailed records of both lost and donated food. These records may be required for insurance claims and audits to substantiate the loss. Please refer to the Emergency Preparedness for School Food Authority Guide for more detailed information about emergency management record keeping.

3. Impact on Average Plate Cost:

a. The loss of inventory will inflate the average plate cost, as it reduces the food available for consumption, but this is generally out of the control of the School Food Authority (SFA). As a result, the average plate cost will be higher than usual. SFAs impacted by significant inventory loss should follow FNS Instruction 782-5 for calculating adult meal prices for the upcoming school year.

b. Alternate Adult Meal Pricing:

i. SFAs should ensure that adult meal prices meet the required minimums:

1. For lunch, the price should cover at least the reimbursement received for a free lunch under the National School Lunch Act under Sections 4 and 11, plus the per-meal value of both entitlement and bonus donated foods.

2. For breakfast, the price must cover at least the reimbursement for free meals under Section 4 of the Child Nutrition Act, plus the value of any bonus commodities used.

c. FNS Instruction 782-5 Guidance:

i. FNS Instruction 782-5, Rev. 1, requires adult meal prices to reflect the total cost of the meal, including the value of any USDA commodities used in preparation.

This approach ensures that adult meal pricing accurately reflects the cost of meals while accounting for inventory losses and donated food during unforeseen events.

The USDA Fresh Fruit and Vegetable Program (FFVP): Getting Started with Bookkeeping FFVP Invoices

When do I record FFVP expenses? Record FFVP expenses monthly in the month that they are incurred. What account do I code the FFVP expenses to?

Code all FFVP expenses to the applicable Object Code. For example, FFVP produce would be coded to the Purchased Food Account, 630.

How should I record the journal entry for FFVP expenses?

Create a journal entry for all FFVP expenses using Fund Code 478 (similar to how you would use Fund Code 600 for all allowable School Nutrition expenses).

Do I initially pay FFVP invoices out of the School Nutrition Account? Yes.

What account do I pay FFVP invoices from?

How/When will we be reimbursed for FFVP claims?

Pay all FFVP expenses from Fund 478 (FFVP Account).

Reimbursement for FFVP claims will be made via wire transfer, approximately two weeks from the claim’s approval date. Where will the FFVP funds be deposited? FFVP reimbursement funds will be deposited into the district’s designated account.

Once deposited, do I need to transfer these funds to a different account?

How should I record FFVP revenue (reimbursement of funds)?

No, the reimbursement funds do not need to be transferred. Simply record the funds as FFVP revenue.

Please use the information provided in the Payment Advice and record FFVP revenue as follows:

• Fund Code = 478

• Program Code = 1972 (Operating) or 1973 (Administrative)**

• Revenue Code = 4520

To Record

To Record

To Record

1. What to look for when entering Financials for DE106

a. SNO has four tabs that SFA’s will utilize when entering financial reports for school nutrition. The tabs are:

i. Revenues

ii. Expenditures

iii. Inventory

iv. Balance Sheet Accounts

2. What is a Revenue

a. (Recording 10:37-10:57 https://url.gadoe.org/3am7)

b. Revenues (inflows)

i. Revenues are defined as money received in exchange for goods or services provided by the school nutrition program.

3. How to locate Revenue Data

a. (Recording 7:00-8:38)

State Resources (funds provided to the SFA’s from the state government)

Federal Sources (funds for reimbursable meal and UDSA Food Receives) (Recording 8:45-9:14 https://url.gadoe.org/3am7))

Recording (14:46-15:24 https://url.gadoe.org/3am7)

Other (funds received outside of School Nutrition)

4. What is an Expenditure?

a. (Recording 16:56-17:17 https://url.gadoe.org/3am7)

b. Expenditures (outflows)

i. Expenditures are allowable costs that can be identified specifically with the production and service of meals to school children such as payroll and related employee benefits, cost of materials and food, equipment, expenditure, and services expenditures.

5. What are some common School Nutrition Expenditures:

a. Labor (Salaries/Wages)

b. Employee Benefits (Fringe Benefits)

c. Purchased Professional and Technical Services

d. Purchased Property Services (Operating, Maintenance, and Energy)

e. Food (Purchased and USDA Foods)

f. Supplies (General and Food Production)

g. Capital Assets

h. Miscellaneous Expenditures

i. Indirect Costs

j. Fund Transfer-Out

6. Where to find Expenditures Data

a. (recording 18:14 –22:49 https://url.gadoe.org/3am7))

between schools (receiving school 5200)

7. What is Inventory

a. (Recording 3:39-3:54 https://url.gadoe.org/srnm )

b. Inventory is the value of food and supplies on hand, whether at the food preparation site or in a central warehouse or facility, that are being held for future use.

8. Where to Locate Inventory Data

a. (Recording 3:56-4:45 https://url.gadoe.org/srnm)

9. What is Single Inventory?

a. (Recording 5:20-5:44 and 6:29-10:08 https://url.gadoe.org/srnm

b. Single Inventory is when Purchased Food and USDA Food Inventory are combined The USDA column is “grayed” out.

10. What is Purchased Food and USDA Food Inventory?

a. (recording 5:44-5:52 and 10:29 -15:29 https://url.gadoe.org/srnm)

b. Purchased Food and USDA Food Inventory are recorded individually on the inventory tab in SNO if the SFA is not operating under a single inventory

11. Differences Between Each Inventory Entry Style

(Recording 10:29-15:55) https://url.gadoe.org/srnm

a. Single Inventory:

The process of combining the purchased and USDA commodity food existing inventories into one and reporting the value, along with future inventory additions, as only one inventory value as allowed by USDA.

a. The USDA processed product must be treated as both a purchased food product and as a USDA commodity product in the accounting records.

b. Balance Sheet Recording (15:55-16:09)

c. Balance Sheet Accounts Recording (17:38 -18:37)

Something that is owned by the school nutrition department that will produce or generate future cash flow.

Something that is owed by the school nutrition department

Net cash resources available to the school nutrition operation at any given time, less current liabilities.

13. Where to Locate Balance Sheet Data: a. Recording 16:10 -17:14 https://url.gadoe.org/srnm b. Assets

Sheet (Assets)

Assets: Accounts Receivable

(Recording 18:29 -19:35 https://url.gadoe.org/srnm

Revenues earned but not received by the end of a month must be accredited. An accounts receivable entry is posted as:

Accounts Receivable (0141) Debit

Revenue (4510, 4511, 4513) Credit

Once Cash has been received, post as:

Cash (0101) Debit

Accounts Receivable (0141) Credit

Where to Locate Balance Sheet Data: (Recording 17:16-17:37

Liabilities

The Georgia Department of Education School Nutrition Division, as the distributing agency, is responsible for maintaining any funds recovered through a claim that are not immediately used for the purchase of foods or for covering administrative expenses in a designated salvage account, in compliance with 7 CFR 250.15(f)(3). The Georgia Department of Education School Nutrition Division must also adhere to the requirements outlined in 7 CFR 250.15(f)(4) regarding the deposit and expenditure of funds from this account.

Additionally, the Georgia Department of Education School Nutrition Division must ensure that appropriate corrective actions are implemented to prevent future losses of USDA-donated foods or the misuse of associated funds. The Georgia Department of Education School Nutrition Division must also verify that recipient agencies or other relevant entities take necessary corrective measures to avoid similar losses in the future. The Food and Nutrition Service Regional Office (FNSRO) may recommend specific actions or procedures, either as needed or at Georgia’s request.

Please remember that the revenue received represents the value of USDA foods and should be accounted for in the inventory. SFAs should code the reimbursements as follows:

Fund Code: 600

Program Code: 9600

Revenue Code: 4900

How to Record Grants Funds for Commercial Warehouse Storage and Delivery Cost Reimbursement Grant

Recording of the Grant Funds:

Cash 0101 XX

Federal Revenue 4520 XX

To record reimbursement for commercial warehousing and storage.

Definition for Account 4520: 4520 OTHER FEDERAL GRANTS THROUGH GEORGIA DEPARTMENT OF EDUCATION

Federal grants received through GaDOE not classified elsewhere.

FAIN # = 245GA904N2533

CFDA# = 10.560

These funds will be allocated through the School Nutrition Online reporting system.

SFAs cannot begin the fiscal year with a negative fund balance. A transfer from the general fund must be made to bring the SFA fund balance to at least zero.

SFAs should establish the current value of all inventories according to their most current contract pricing and USDA pricing. USDA Foods Direct Delivery item pricing is updated in May of each year and posted on the GaDOE SND website as the DE116 Form.

The USDA Paid Lunch Equity (PLE) tool is a spreadsheet that helps SFAs determine if they need to raise their paid lunch prices to meet minimum requirements. It is an annual requirement for SFAs with a negative balance in their nonprofit school food service account, unless they are part of the Community Eligibility Provision (CEP). The PLE tool helps SFAs ensure they're charging enough for paid lunches to cover costs and maintain a healthy financial balance in their school food service account.

SFAs with a negative balance are required to use the PLE tool to calculate the necessary price increase for paid lunches. The tool compares the weighted average price of paid lunches to a target price determined by the USDA. The minimum unrounded price requirement is determined, which the SFA can round down to the nearest 5 cents. SFAs are not required to increase the price by more than 10 cents from the previous year, but they can increase it more. For instance, if the SFA's paid lunch price was $3.50 in the previous school year, it would only need to increase the price by $0.10 to remain in compliance. This means the new price for the upcoming school year would be $3.60, even if the PLE tool indicates a recommended price of $3.75.

If using non-federal funds to supplement the price, the tool allows for calculations to determine the amount needed.

1. Determine the previous year's unrounded price requirement.

2. Calculate the weighted average price of paid lunches.

3. Compare the weighted average price to the target price.

4. Adjust paid lunch prices if needed.

5. Report the results in the PLE tool.

Finally, the SFA must save the completed PLE tool and supporting documentation.

Non-program foods are any foods and beverages sold in schools, other than those provided as part of the reimbursable meals, that are purchased using funds from the School Nutrition account. This includes foods for a la carte purchases, adult meals, food sold for fundraisers, vending machines, and catered or vended meals. Examples of non-program foods include: a la carte items, adult meals sold to staff and visitors, and catered or vended meals. USDA requires that the revenue generated from non-program food sales be at least equal to the food costs of those items. This means that nonprogram foods must be priced to cover the food costs, not just labor or other costs.

Depreciation is the method of allocating the cost of fixed assets (like equipment) over their useful life. SFAs can claim depreciation for equipment as an allowable operating cost, provided it's used, needed, and properly allocated to NSLP. Equipment is generally defined as tangible, non-expendable personal property with a useful life of more than one year and a per-unit acquisition cost of $10,000 or more, but this can be lower under specific grant programs.

Depreciation should be calculated using a method that aligns with the pattern of consumption of the asset. A common method is straight-line depreciation, where the cost is allocated evenly over the asset's useful life. Other methods may be used if the SFA can demonstrate a different pattern of consumption.

Depreciation is not allowable for:

• Land

• Buildings donated by the federal government

• Assets purchased with restricted program funds

• Assets that have been paid for in full, even if payments were made over multiple fiscal years

• Assets that have outlived their depreciable life

• Assets that are paid for in full in the current fiscal year

All depreciation claimed for federal reimbursement must be properly documented, including equipment inventory records

Although these tips have been developed for use at the end of the year, many should be implemented on a monthly basis. Checking reports and correcting errors monthly makes the end of the year tasks much easier.

Void any outstanding vendor checks that are dated six months or older

• Run Open Payable Report and balance to the General Ledger.

• Run Open Purchase Order Report and balance to the General Ledger.

• Run Open Receivable Report and balance to the General Ledger.

Review Open Payable Report for any open claims. Cancel the claims if needed. You may need to cancel the claims that have been set up monthly and enter new claims for July and August. However, do not report any of these new claims on the DE106 Financial. These claims have already been reported in the previous months. If there is a difference in the amount accrued and the actual amount that is to be paid in July and August, then make sure to enter the necessary entries into your accounting software program and report the difference in SNO.

Review accrued salaries and benefits to be paid in July and August of 20XX, current year.

• Revenues and Expenditures are closed to equity

o Result is an increase in equity

o Result is a decrease in equity

• All Revenues and Expenditures are closing into 0740 (Retained Earnings-Unreserved)

• Enter all Revenue expected to be received for FYXX, current, as an Accounts Receivable before the books are closed on June 30.

• Enter all Expenses expected to be billed for FYXX, current, as an Accounts Payable before the books are closed on June 30.

• Transfer In/Transfer Out: Run appropriate reports to reconcile the Transfer In (5200) and the Transfer Out (5000-930) accounts.

• Review Trial Balances or General Ledger for posting errors. Make appropriate Journal Entries to correct any errors found.

The DE046 is a financial report generated from the school system's general ledger through accounting software such as Genesis or Munis. It reflects actual financial data entered by the finance department and represents the official record of expenditures and revenues. The DE046 is due to the GADOE SND by August 31st subsequent to the June 30th year end.

The DE106 is a financial report submitted through the SNO system. It captures all financial activity entered by the SNP staff monthly, including Revenue, Expenditure, Inventory, and Balance Sheet data.

To ensure financial accuracy and compliance, best business practice is to reconcile the DE046 and DE106 reports on a monthly basis. This process allows districts to identify and correct discrepancies early, ensuring alignment between the SNO data and the official financial records maintained in the district’s general ledger.

Year-end adjustment deadlines to reconcile the DE106 Report:

• July 1 – August 31: SFAs may make their own financial adjustments.

• September 1 – September 30: The State Agency is authorized to make final adjustments.

• After September 30: No adjustments can be made.

Reminders

• Ending inventory is posted monthly.

• USDA Received Food Values: USDA Foods Direct Delivery items must be receipted in WBSCM no later than two business days after receipt, and DoD items must be receipted in FFAVORs no later than two business days after receipt.

• Submit a June and July DE106 Financial report even if there is not any June or July activity.

• You will still have cash on hand as well as inventory that will need to be reported.

• Have SNP Manager redeposit change fund, created at the beginning of the school year, with a separate deposit and record necessary journal entry.

The Chart of accounts is a crucial component in accounting, serving as a structured framework for organizing and categorizing financial transactions. It provides a clear and consistent way to record, track, and report financial data, ensuring accuracy and transparency in financial statements. A wellorganized chart of accounts helps monitor income, expenses, assets, liabilities, and equity in a systematic manner, enabling efficient financial analysis, budgeting, and decision-making. Furthermore, it ensures compliance with accounting standards and regulatory requirements, making it an essential tool for both internal financial management and external auditing processes.

Balance Sheet Assets 0104 CHANGE FUND

Balance Sheet Assets 0114 INTEREST RECEIVABLE

Balance Sheet Assets 0121 Taxes Receivable

Cash provided to operations needing to make change. This account should be closed at year-end by returning all unused cash and reopening the account the next fiscal year.

The amount of interest receivable on investments.

The amount of taxes collected and anticipated to be collected within 60 days by the tax collecting agency, but not remitted to the LEA

Balance Sheet Assets 0131 Interfund Loans Receivable Amounts that are due, other than charges for goods and services rendered, from another fund in the LEA and that are due within one year.

Balance Sheet Assets 0132 Interfund Accounts Receivable Amounts due from another fund. The offsetting transaction is an entry to Interfund Accounts Payable (Account 0402) in the appropriate fund.

Balance Sheet Assets 0133 Advance To Other Funds Amounts that are owed, other than charges for goods and services rendered, to a particular fund by another fund in the LEA and that are not due within one year.

Balance Sheet Assets 0141 Intergovernmental Accounts Receivable - State Amounts due from another state governmental unit.

Balance Sheet Assets 0142 Intergovernmental Accounts Receivable - Federal Amounts due from another federal governmental unit.

Balance Sheet Assets 0143 Intergovernmental Accounts ReceivableLocal Amounts due from another local government, but not include local taxes.

Balance Sheet Assets 0153 Accounts Receivable Amounts due from individuals, firms or corporations for goods and services furnished by an LEA (but not including amounts due from other funds or from other governmental units.

Balance Sheet Assets 0171 Value - Purchased Food Inventory Value of purchased food on hand for use in the School Nutrition Program, and other supplies (e.g., custodial supplies, office supplies) on hand for LEA use.

Balance Sheet Assets 0173 INVENTORY - U.S. DEPARTMENT OF AGRICULTURE (USDA) COMMODITIES Value of donated USDA commodities on hand for use in the School Nutrition Program.

Balance Sheet Assets 0181 PREPAID EXPENDITURES/EXPENSES Payment in advance of the receipt of goods and service, such as rent and insurance. Generally, prepaid items cover more than one fiscal year and only the noncurrent portion is recorded as an asset.

Balance Sheet Assets 0185 DEFERRED CHARGES

Balance Sheet Assets

Balance Sheet Fund Equity and Other Credits

OTHER CURRENT ASSETS

FUND BALANCE - NONSPENDABLE FOR INVENTORIES

Balance Sheet Fund Equity and Other Credits 0753 FUND BALANCE - NONSPENDABLE FOR ENCUMBRANCES

Expenditures that are not chargeable to the fiscal period in which they were made but that are carried as an asset, pending amortization or other disposition (e.g., bond issuance costs). Deferred charges differ from prepaid items in that they usually extend over a longer period of time (more than five years) and are not regularly recurring costs of operation.

Other items of value owned but not provided for elsewhere.

The amount of funds not in a spendable form because they are invested inventories.

A reserve representing the separation of a portion of a fund balance to provide for unliquidated encumbrances.

Separate accounts may be maintained for current encumbrances and prior year encumbrances. This will be mapped for financial reporting purposes as Assigned fund balance for GASB 54 purposes

Expenditures by the LEA on behalf of employees. These amounts are not included in the gross salary, but are in excess of that amount. Such payments are fringe benefit payments and, while not paid directly to employees, are part of the cost of personal services. The employee benefit applicable to any salary should be charged directly to the function to which the salary was charged. Employer benefits should include (but are not limited to) group insurance, social security, retirement, workers compensation, unemployment compensation and annuity plans.

to pension plan participants, including pension benefits, death benefits and benefits due on termination of employment – For Use by Local LEA-Managed Retirement Plans ONLY. (Not TRS)

to

plan participants – For Use by Local LEA-Managed Retirement Plans ONLY. (Not TRS)

to be used to record pension expense activity for TRS, ERS, PSERS and any local retirement systems for GASB 68 reporting requirements, as well as the OPEB expense activity for SHBP or any other post-employment benefit for GASB 75 reporting requirements. District-wide activity only. (Fund 9xx only) This account is updated to reflect it is allowable for both the Pension Fund 902 and the OPEB Fund 904. (FY 2018)

Salaries of cafeteria managers, assistant managers, cafeteria workers or cashiers.

Object

Services which can be performed only by persons or firms with specialized skills and knowledge. While a product may or may not result from the transaction, the primary reason for the purchase is the service provided. Included are the services and travel of architects, engineers, auditors, dentists, medical doctors, lawyers, consultants, teachers, accountants, therapists (physical/occupational/ mobility/ speech), etc. LEAs may assign objects within the 300 Series for each type of service provided but must combine all services for reporting to GaDOE. Object

Payments made to lawyers and attorneys, including retainer fees for services to be rendered.

on a hourly or daily fee basis for which the employer makes no payroll deduction. All employees are required to be compensated through payroll.

Object Purchased Professional & Technical Services 362 Per Diem and FeesExpenses

Reimbursable costs such as travel, postage, telephone, etc. in connection with services rendered on a per diem basis.

Object Supplies 630 PURCHASED FOOD Food purchased for use in the School Nutrition Program.

Object Supplies 635 FOOD ACQUISITIONSUSDA The value of donated commodities received from the USDA.

Object Property 730 PURCHASE OF EQUIPMENT - OTHER THAN BUSES AND COMPUTERS

Expenditures for initial, additional, and replacement items of equipment such as machinery, furniture and fixtures, and vehicles. To be charged to equipment, an item must meet the following criteria:

a. The cost must be over the board's per unit capitalization policy threshold.

b. The life expectancy must be more than one year.

Program Regular Programs 1972 Fresh Fruit and VegetablesOperating This program is designed to set aside some time outside of breakfast/lunch to serve fruits and vegetables to students only. Fund 478. (Program code updated for fiscal year 2019.)

Program Regular Programs 1973 Fresh Fruit and VegetablesAdministrative This program is designed to set aside some time outside of breakfast/lunch to serve fruits and vegetables to students only administrative expenses. Fund 478. (Program code updated for fiscal year 2019.)

Program Regular Programs 1974 School Food Storage and Delivery School Food Authority (SFA) Commercial Warehouse Storage and Delivery Reimbursement

Program Regular Programs 1976 Farm to School Grant Program This program is designed to assist school districts in developing and/or expanding their farm to school programs. The Farm to School grants help connect students to the sources of their food through education, school gardens, and field trips. The school gardens are used as outdoor classrooms and are a means to provide direct instruction to the students.

Revenue Source Federal Sources 4510 CHILD NUTRITION PROGRAM SERVICE GRANTS (ALL FEDERAL FUNDS EXCEPT BREAKFAST PROGRAM) Federal Child Nutrition Program grants, including student lunch reimbursements. (State grant is recorded in 3510).

Revenue Source Federal Sources 4511 CHILD NUTRITION PROGRAM GRANTS (FEDERAL FUNDSBREAKFAST PROGRAM)

Revenue Source Federal Sources 4513 FEDERAL REIMBURSEMENT FOR AFTER-SCHOOL SNACKS

Federal Child Nutrition Program grants received from GDOE only. (State grant is recorded in 3510).

Revenue Source Local Sources 1500 Investment Income Interest or dividends earned on investments or deposits. Also included are gains/losses realized from changes in the fair value of investments.

GASBS Statement 31 requires that all investment income, including changes in fair value of investments,

Revenue Source Local Sources 1611 STUDENT SALESBREAKFAST AND LUNCH PROGRAMS

Revenue Source Local Sources 1612 Student Sales - Breakfast Programs

be reported as revenue in the operating statement.

The changes in fair value for the Georgia Extended Asset Pool would be recorded here.

Funds received from students daily, weekly, or monthly for paid and reduced-price meals.

Funds received from students daily, weekly, or monthly for paid and reduced-price breakfast meals.

Revenue Source Local Sources 1613 Student Sales - Snack Programs

Funds received from students daily, weekly, or monthly for paid and reduced Snacks.

Revenue Source Local Sources 1614 Student Sales - Special Milk Funds received from students daily, weekly, or monthly for paid and reduced-price Special Milk program.

Revenue Source Local Sources 1621 SUPPLEMENTAL SALESBREAKFAST AND LUNCH PROGRAMS

Revenue Source Local Sources 1622 ADULT SALESBREAKFAST AND LUNCH PROGRAMS

Funds received from students and adults for food sold a la carte.

Funds received from adults for meals.

Revenue Source Local Sources 1623 CONTRACTED SALESBREAKFAST AND LUNCH PROGRAMS Fund received for meals sold under contract to a separate entity.

Revenue Source Local Sources 1995 OTHER LOCAL REVENUES Revenue from local sources not otherwise classified.

Revenue Source State Sources 3510 SCHOOL NUTRITION SERVICE GRANTS (STATE FUNDS ONLY) SALARY SUPPLEMENT State School Nutrition Service Program grants. (Federal grants are recorded in 4510 and 4511)

Purpose:

Revenues received by the nonprofit school food service are to be used only for the operation or improvement of such food service, except that, such revenues shall not be used to purchase land or buildings, unless otherwise approved by FNS, or to construct buildings. Expenditures of nonprofit school food service revenues shall be in accordance with the financial management system established by the State agency under 7 CFR 210.14 (a).

Procedure:

1. The School Food Authority (SFA) will create a payment for food, supplies, services, etc., once invoice/statement is reconciled according to the agreement established between the SFA and the Vendor.

2. The SFA maintains all documentation for each payment.

3. The payment is reviewed and signed by the School Nutrition Director, and then the payment is mailed or electronically submitted to the Vendor.

4. Expenditures are to be recorded in the accounting records when they are incurred.

5. If the Vendor is a district site or department, the School Nutrition Director will sign the invoice and provide a budget code to charge. The signed invoice shall be mailed or emailed to the financial services department responsible for the payment of the invoice.

6. An interfund transfer is completed in the financial database to record monies expended for the transaction. This is to be done monthly for budget and fund maintenance.

Monitoring:

The SFA monitors the revenues and expenses in the financial database that is used by the district for all budgets, revenues, and expenditures tracking. The details for each accounts payable interfund transfer or journal entry are maintained by the SFA.

Interfund transfers are reviewed throughout the year and any errors identified are corrected in the financial database.

Financial records are kept on file for a minimum of five program years and are available for the administrative review process and audits conducted by internal and outside agencies.

Resources:

1. 7 CFR Sections 200.302, 210.2, 210.14, and 210.19

2. Local Policy

Purpose:

The school nutrition account is a restricted account so once monies are deposited into the school nutrition account, they are considered part of the non-profit food service and are governed, protected and restricted by federal law under 7 CFR Sections 210.2, 210.14, 210.19.

All receipts of the cafeteria or cafeterias (defined as school food services) derived from the sale of food shall be deposited in the school nutrition account and shall be expended only for the maintenance of the cafeteria or cafeterias.

Procedure:

1. The School Food Authority (SFA) will create an invoice for food and services provided through school nutrition operations to district departments, district sites, and other business entities.

2. The SFA maintains all documentation for each invoice.

3. Invoices are created after the sale of the food or service is complete.

4. The invoice is reviewed and signed by the School Nutrition Director, and then the invoice is mailed and/or emailed to the recipient.

5. If the recipient is a district site or department, the authorized official will sign the invoice and provide a budget code to charge. The signed invoice shall be mailed or emailed to fiscal services staff.

6. An interfund transfer is completed in the financial database to record monies received for the transaction. This is to be done monthly for budget and fund maintenance.

7. If the recipient is outside of the district, payment is accepted by cash or check within the timeframe indicated in the agreement between the SFA and vendor. It is recorded under accounts receivable in the financial database and a journal entry records the transaction in the district’s financial database.

Monitoring:

The SFA monitors the revenues and expenses in the financial database that is used by the district for all budgets, revenues, and expenditures tracking. The details for each account receivable, interfund transfer, or journal entry are maintained by the SFA

Corrective Action:

Interfund transfers are reviewed throughout the year and any errors identified are corrected in the financial database.

Validation and Record Keeping:

Financial records are kept on file for a minimum of five program years and are available for the administrative review process and audits conducted by internal and outside agencies.

Resources:

1. 7 CFR Sections 210.2, 210.14, and 210.19

2. Local Policy

Requirement:

The School Food Authority (SFA) will submit financial reports within the timelines set by the State Agency (SA).

Procedure:

1. The SFA will submit the following financial reports by the end of the month into School Nutrition Online, the State Agency school nutrition software.

a. Inventory

b. Other Financials- Revenues, Expenditures, Balance Sheet

2. The steps to report the financial reports are in the GaDOE School Nutrition Division’s Bookkeeper Manual.

3. Annual Financial Report (DE046) is due to SA by August 31st which includes all financial activity through June 30.

The SFA monitors the process by calendaring the due dates of each financial report and reviewing reports submitted by the SFA to the SA to ensure timeliness.

Corrective

Financial reporting is reviewed monthly. Errors identified or late submissions are corrected by the SFA.

The SFA will review financial reports monthly to ensure the Bookkeeper has submitted accurate reports by deadlines established by the SA.

Resources:

1. 7 CFR Sections 210.8, 210.9, 210.15

2. Local Policy

Requirement:

The School Food Authority’s (SFA) accounting and administrative internal control policies and procedures include proper authorization of transactions and activities, separation of duties, properly maintaining documentation and records, safeguards on access to records and their use, and independent evaluation on performance.

Procedure:

1. Proper authorization of transactions and activities

a. Approval workflow of transactions?

b. Fill in who is responsible for what in the transaction process and when

2. Separation of duties

a. Bookkeeper

b. Accountant

c. Director

d. Financial Services

3. Properly maintaining documentation and records

a. Files paper or electronic

b. Accounting Database

c. Reporting to GaDOE

4. Safeguards on access to records and their use.

a. Who has access to local School Nutrition Program records?

b. Bank Account Access

c. Are login credentials password protected?

5. Independent Evaluation on Performance

a. Independent Audit annually

Monitoring:

The SFA will monitor internal controls monthly to ensure the procedure is being followed.

Corrective Action: