To operate a high-impact, mature finance function, companies must develop a structure that incorporates sufficient business knowledge, the right tools, and people in place.

When Brian McGrath, Bill Webster, Harika Thoom, and myself started FutureView Systems, our goal was to help companies and finance functions reach a level of maturity quickly.

We have overcome the challenges many companies face such as completing an IPO, integrating acquisitions, organizational restructuring, and incorporated these methods into FutureView’s solutions.

FutureView Systems offers technology-driven solutions to help founders, CFOs, and finance teams gain control over operational and financial data and establish proven processes to best understand the drivers of the business and be strategic business partners.

FutureView Quarterly is a culmination of my experiences, insights, and our collective points of view regarding trends in the Finance industry along with our desire to create and share with other professionals. Enjoy!

John Baule CEO and Co-founder FutureView Systems

Have you posted a job requisite only to see that the vast majority of applicants don’t possess the advanced array of skills, knowledge and system expertise necessary to make an immediate impact?

Or when you finally come across an individual who checks all of the boxes, you simply can’t compete with the compensation expectations?

lf so, you are not alone, as 77% of CFOs say that hiring and retaining finance talent is a critical challenge and business driver, based on a recent PWC Survey.

To combat this challenge, more companies are turning to cosourcing within their finance function as a means to get the most value from a fractional resource.

Co-sourcing is a collaborative model that blends the strengths of your internal team with the expertise and resources of an external partner.

Unlike traditional outsourcing, where entire functions are handed over to a third party, co-sourcing involves a seamless integration of external capabilities with your existing operations.

Co-sourcing from fractional finance managed service firms allows your company to maintain control while benefiting from specialized knowledge and finance tools that you might otherwise not be able to attract, retain or afford.

Unlike consultants or other fractional service firms, we integrate with your team as an ongoing partner and resource with vested interests in helping your business scale and reach its objectives.

One of the primary advantages of co-sourcing is the access to a pool of specialized finance, accounting and business intelligence experience and skills.

At FutureView, we have a team of senior FP&A professionals as well as business intelligence and big data developers with nuanced experience working for a variety of industries and software tools.

Our proven expertise allows your internal team to benefit from specialized knowledge without the need to hire full-time additional staff. By leveraging our expertise, you can ensure that your financial operations are handled by professionals who are well-versed in process optimizations, best practices and are always utilized.

On average, our clients cite our resources as equivalent to a fulltime senior FP&A professional, with over a decade of industry experience at a fraction of the cost.

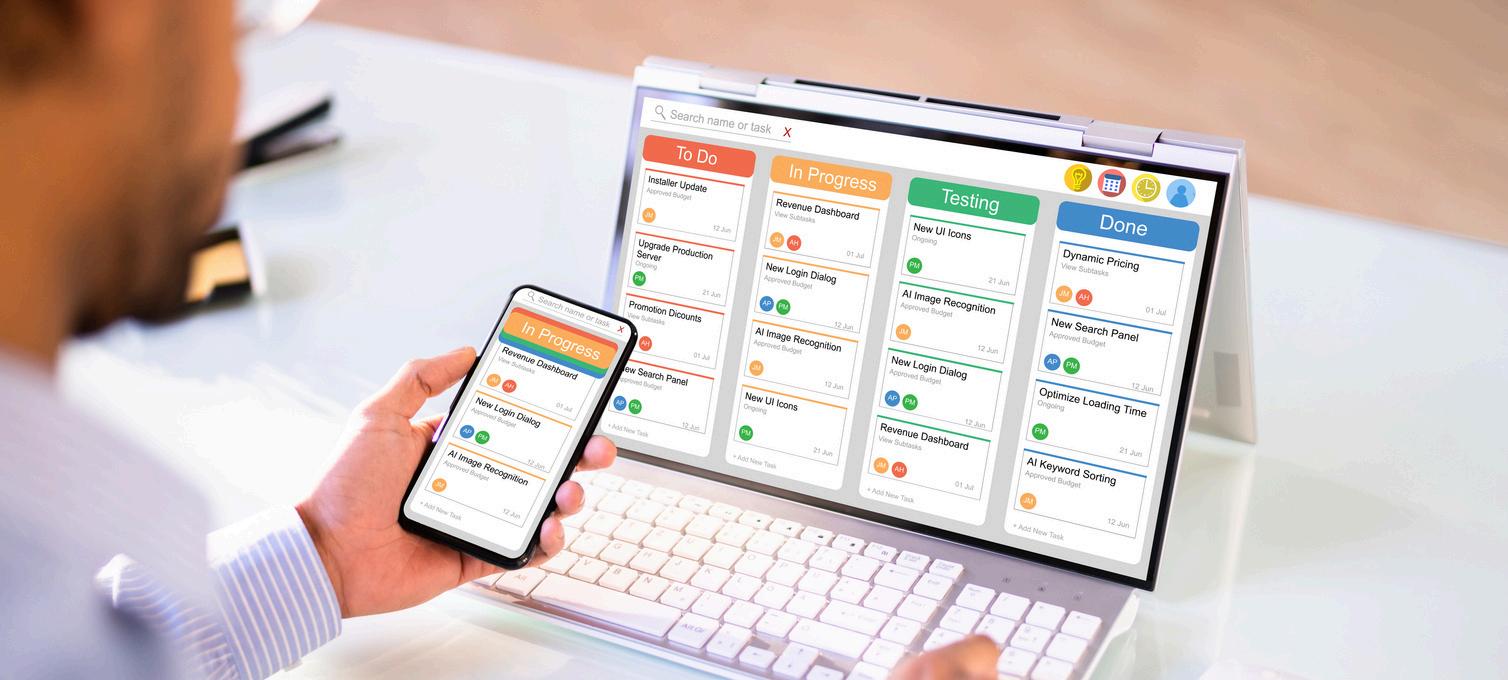

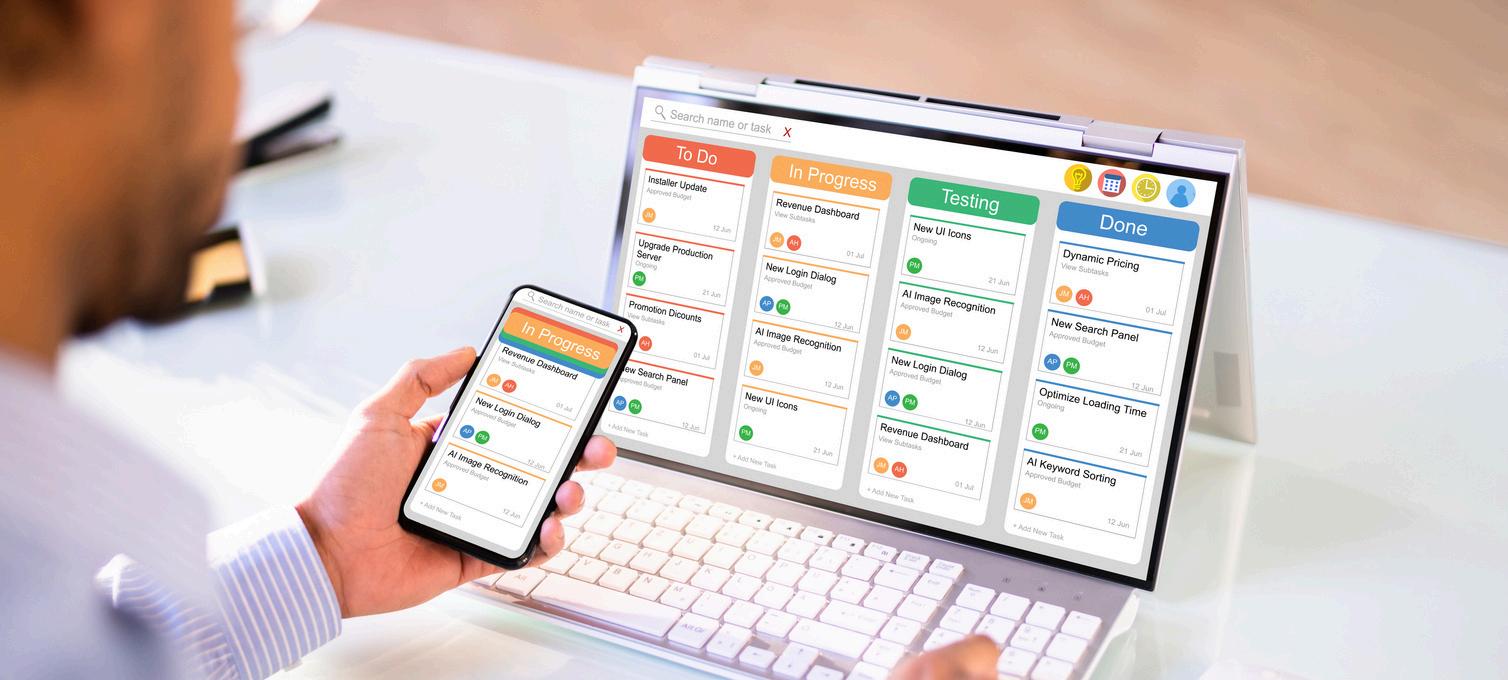

In today’s digital age, staying abreast of technological advancements is crucial for maintaining a competitive edge. Co-sourcing allows you to tap into our state-of-the-art financial technologies and tools, which can not only be costly to implement, but even more of a challenge to manage and customize.

We specialize in implementing and managing integrated, multidimensional FP&A and Corporate Performance Management (CPM) Software, connecting your operational and financial data into a single source of truth for informed reporting, analysis and planning.

No matter the industry, organizational size or location, business needs are constantly evolving, and the ability to adapt quickly is essential. Co-sourcing offers unparalleled scalability and flexibility, allowing you to scale services up or down based on your requirements.

Whether you need additional support during peak periods or specialized assistance for specific projects, we can adjust our involvement accordingly. This adaptability ensures that you have the optimal level of dedicated support to see experience value.

Given the vast knowledge from proven industry experts on our team, we are able to provide flexible engagement models that can be tailored to suit your specific needs. You can choose the level of support that best aligns with your business objectives, from supplementing your team entirely to sharing responsibilities for complex projects like your annual budget process.

This tailored approach ensures that you receive the optimal level of service, enhancing your operational efficiency and effectiveness.

One of the most compelling benefits of co-sourcing is the potential for significant cost savings. By co-sourcing, you can avoid the substantial costs associated with recruiting, training, and retaining a large in-house team.

You only pay for the level of service you need each month, giving you predictable and manageable expense insights. This cost-efficient model allows you to allocate resources more strategically, investing in areas that drive growth and innovation.

Our streamlined processes and experienced professionals can help identify opportunities and efficiencies within your finance and accounting operations.

By leveraging our expertise, you can optimize your workflows, reduce redundancies, and enhance overall productivity.

This operational efficiency translates into tangible financial benefits, contributing to your bottom line. You also gain tremendous continuity amongst your team and ours to mitigate risk and potential internal disruptions

Partnering with FutureView allows you to realize continuity and backup in case of unforeseen events affecting your internal team. This ensures that your financial operations remain stable and resilient, even in the face of challenges.

Co-sourcing non-core financial activities allows your internal team to focus on strategic initiatives that drive growth and innovation.

By freeing up resources from routine tasks, your team can dedicate more time and effort to activities that directly contribute to your business objectives.

This alignment ensures that your resources are utilized effectively, enhancing your competitive advantage.

Embracing co-sourcing can transform your financial operations, providing you with the expertise, efficiency, and flexibility needed to facilitate informed decision making and optimal strategic outcomes.

You have probably heard the saying cash is King, which is hard to refute. Without control over your cash flow and cash expenditures, even a profitable business can fall victim. In that sense, if cash is King, then context is Queen.

Context is critical to aiding decision makers in formulating and executing on strategies. Without context, the metrics alone provide little to no guidance, and rudimentary analysis leads to misguided outcomes.

Since your metrics are the center of your company performance, offering insights into its profitability, efficiency, and overall performance. However, metrics and reports only provide surface-level information.

This is where context becomes essential. The true value of FP&A lies not just in the number itself but in the context provided to stakeholders.

of CFOs listed FP&A as the one function they would like to improve the most.

— Deloitte CFO Survey

Benchmarking is a means to set a baseline comparison to your results. Every industry operates under unique conditions, which means the interpretation of metrics like profit margins, revenue growth, and operational efficiency will vary based on the sector.

A 12% profit margin might great for a manufacturing company, but low by SaaS vendor standards.

Comparing metrics against industry benchmarks provides essential context that allows analysts to measure a company's performance and adding meaning to the results.

Without this benchmark understanding, you risk providing information that can mislead decision makers.

Business performance is heavily influenced by broader economic trends. During a period of economic expansion, most businesses see revenue growth and stronger financial performance.

Conversely, in a recession, declining consumer spending and credit tightening can lead to reduced sales, higher costs, and lower profitability.

Ignoring these external economic factors can result in an inaccurate assessment of a company’s performance.

This can also be industry specific, where one industry is largely impacted by monetary policy and interest rates, while another is less burdened by increased cost of debt. Understanding the current phase of the economic cycle helps differentiate between companyspecific issues and industry-wide challenges.

In today’s globalized world, many companies operate in multiple geographic regions, each with its own economic, political, and regulatory environments. A financial analyst must consider regional variations when evaluating performance metrics.

For instance, a company’s strong performance in the U.S. market might be offset by struggles in foreign markets due to currency fluctuations, trade tariffs, or local competition.

Without geographical context, a company-wide decline in revenue might appear worse than it is. A closer look at the regional breakdown could reveal that growth in some areas is compensating for weakness in others.

Context allows analysts to paint a fuller picture and avoid jumping to inaccurate conclusions.

For many industries, certain times of the year are stronger performers than others. This is prevalent in retail and construction especially.

Holidays are a common example of seasonality, where a retailer or ecommerce business may see a spike in sales during a certain period. It would be contextually critical to compare the year-overyear change in revenue and units sold during these times.

But these traditionally impacted industries are not the only ones. Software advertising campaigns around specific calendar events or times of the year when the end user experiences the most issues can lead to more conversions and bookings.

While external factors like industry trends and economic cycles are inevitable, internal factors within a company also shape financial and operational performance.

Each company is unique, with its own strategic initiatives, stage of growth, and operational challenges. Analysts need to keep this in mind when reviewing metrics.

A company’s stage of growth whether it's a start-up, in growth mode, or a mature firm has a profound impact on how financial and operational metrics should be interpreted.

Early-stage companies typically have lower profit margins and higher reinvestment rates as they focus on growth over profitability.

Mature companies, on the other hand, are expected to deliver steady profits and operational efficiency.

Different business models and strategies require distinct financial approaches, making it essential to consider the specific strategy a company is pursuing.

For instance, a subscription-based SaaS company will have a different revenue recognition model compared to a retail business.

Operational metrics, like customer acquisition cost and churn rate, may be more critical for the SaaS company, while inventory turnover is more relevant for retail.

Company specific key performance indicators (KPIs) measure the efficiency of the business and overall resource utilization.

The types of metrics and KPIs you measure will vary by industry, and it’s imperative that you keep in mind what information is necessary for management to make informed decisions as your guide.

Failing to provide enough context around a metric or result can misguide decision makers to incorrectly course correct or double down on an initiative that does not stand to last. Some of the pitfalls of not providing enough context when analyzing financial and operational metrics include:

Without context, metrics can be misinterpreted, leading to the wrong conclusions and poor decision-making. A decline in profit might not necessarily mean the business is underperforming—it could be a result of strategic investments.

Comparing a company’s performance without considering its industry, market, or specific situation is like comparing apples to oranges. It’s essential to contextualize data to make valid comparisons.

Overemphasizing short-term results without understanding the broader context may lead to reactive decision-making, which could harm long-term performance.

If your company sees a surge in sales for a given quarter and does not have the proper context of why that surge occurred, it may incorrectly inform executives to over hire and an unsustainable increase in labor expenses.

Financial analysis should enrich conversations for operators to act on and metrics should never be viewed in isolation. Context is key to unlocking the full meaning of metrics, allowing budget owners and executive teams to make informed decisions that consider a range of rationale.

Clutch performances, the ones that define greatness, leave teammates and executives in awe and bring about references amongst fans and pundits to players as the greatest of all-time (GOAT). Even if you are not an avid American Football fan, you are likely familiar with Tom Brady.

Despite your team allegiance, fans can all recognize greatness, and Brady is synonymous with clutch performances, especially in the fourth quarter. Over his career, Brady tallied 58 game-winning drives, including seven Super Bowl victories - both NFL records.

The ability to stay vehemently focused on the objectives, even when the chips are stacked against you and time is running out, is a true mark of greatness and one that translates to the world of business, too. Like Brady, top-performers in finance, product development and sales find a way to get the job done and be the difference maker when it matters most.

This is known as the 4th Quarter Effect.

This isn’t a matter of procrastinating, where tasks or deliverables are put off, instead it’s a heightened focus to go above and beyond, backed by motivation and incentive.

When the 4th Quarter approaches, the pressure is at its peak, yet top performers find a way to get the job done and reach the targets. It’s less miraculous and more mindset - one that is established and managed by Finance.

The projections set by finance are necessary to hold teams accountable and when the target is in sight, the best of the best rise to the occasion.

Imagine your top sales performers at your Company. They find a way to hit or exceed quota, even when resources are sparse and others are missing their mark.

Even in the final months of the year, great salespeople overcome dwindling pipelines, prospects punting until next year, and the winter holiday frenzy to not only hit their quota but the Company’s objectives as well.

There’s a growing desire to replace annual budgets with rolling forecasts, and although our experienced team of finance executives disagree with this approach, at face value it’s understandable why one would consider it.

First, we encourage finance to forecast on a rolling monthly basis at a detailed level, but not as a means to avoid a budget.

But if you attempt to replace your annual budgeting process with a rolling forecast, you strip away the potential for added motivation to reach the targets set for the year.

Unfortunately for most, curating a company budget takes entirely too long and leaves battle scars on even the most advanced finance professionals.

Despite budgets being a fundamental of mature finance functions, dedicating an entire quarter or more to the process greatly diminishes your capacity for more impactful analysis and business partnering.

In an environment where remaining agile and keeping up with the growing competition is non-negotiable, you must find ways to increase efficiency and define scalable processes.

If there’s one thing that is concrete with budgets, it is that they force decisions to be made, which for many Companies isn’t as easy as it sounds.

If there aren’t achievable metrics to hit, and all stakeholders aren't aligned, budget owners are predisposed to punt on new initiatives and campaigns in an attempt to play it safe.

Focusing on your company’s budgeting process and following these best practices will make it feel more like a sprint, than an arduous marathon.

If there’s one thing that is concrete with budgets, it is that they force decisions to be made, which for many Companies isn’t as easy as it sounds.

If there aren’t achievable metrics in place, and all stakeholders aren't aligned, budget owners are predisposed to punt on new initiatives and campaigns in an attempt to play it safe.

When setting annual targets, stretch goals are common targets to set that would typically require everything to go as planned and work out favorably - which obviously is never the case.

Nonetheless, the act of setting these goals and working towards them as a team is a practice in getting the most out of everyone’s efforts, and going above and beyond.

Just remember when working with the executive team and board, the budget shouldn't be unreasonable in nature, regardless of the desires.

1. An annual budget clearly defines targets for everyone to focus on.

2. Keeps everyone in the Company aligned and motivated.

3. Allows budget owners and those managing P&Ls to examine their department and teams at both an aggregated and detailed level.

5. Evokes the 4th Quarter Effect –incentives going beyond and rising to the occasion before time runs out in the year.

To reach your objectives, a company-wide plan is necessary to align product, sales and marketing efforts, while investments are allocated optimally to grow the top line. As a business partner, it’s finance’s responsibility to forecast the possibilities and advise budget owners on potential outcomes.

This requires collaboration and an understanding of the needs and expectations of budget owners such that resources are allocated based on data-driven analysis and insights.

How the ideal partner defines and implements EPM Software

Before jumping in with both feet into a new enterprise performance management (EPM) software implementation it’s imperative to have a well-defined plan and expectations for success.

Start with what are the outputs and information necessary to facilitate informed decision making across the organization. From there, work with your implementation partner to determine the frameworks and prioritizations.

EPM software and its impact reaches beyond finance teams and executives. It includes your budget owner, their direct reports, the board and investors. As you implement this new system, consider their perspective and the use cases of both your finance team, as well as budget owners, who will be held accountable to the targets and variances in performance results.

Howyourdataiscollected, structuredandprocessedis essentialforasuccessful implementation.Otherwise,you riskagarbagein,garbageout situationthatcompounds issuesdowntheline.

Implementationpartnerslike FutureViewofferinputonhow tobeststructureandpiece togetheryourdisparatedatato unveilthemetricsandinsights neededtodrivestrategic decisionmaking.

The last thing you want in an implementation situation is to go live without any principles in place to ensure adoption. It would be like getting the keys to a new car, but you don’t know how to drive.

To ensure utilization, and that your new software doesn’t become shelfware, you want a partner who can train you and jump in to support you and your team in any capacity.

OurEPMPlatformisdesignedto automatereportingandfacilitate driver-based,detailedplanning andforecasting.Butwedon’t stopatimplementationand moveon.

Instead,weassignyoua dedicateddevelopmentresource toaddressanyadditional customizationsandaseniorlevelFP&Aprofessionalwithover adecadeofindustryexperience toprovidewhite-glove,fractional supportforyourfinanceteam.