WHATTYPE OF FORECASTING PROCESSSHOULD YOUUSE?

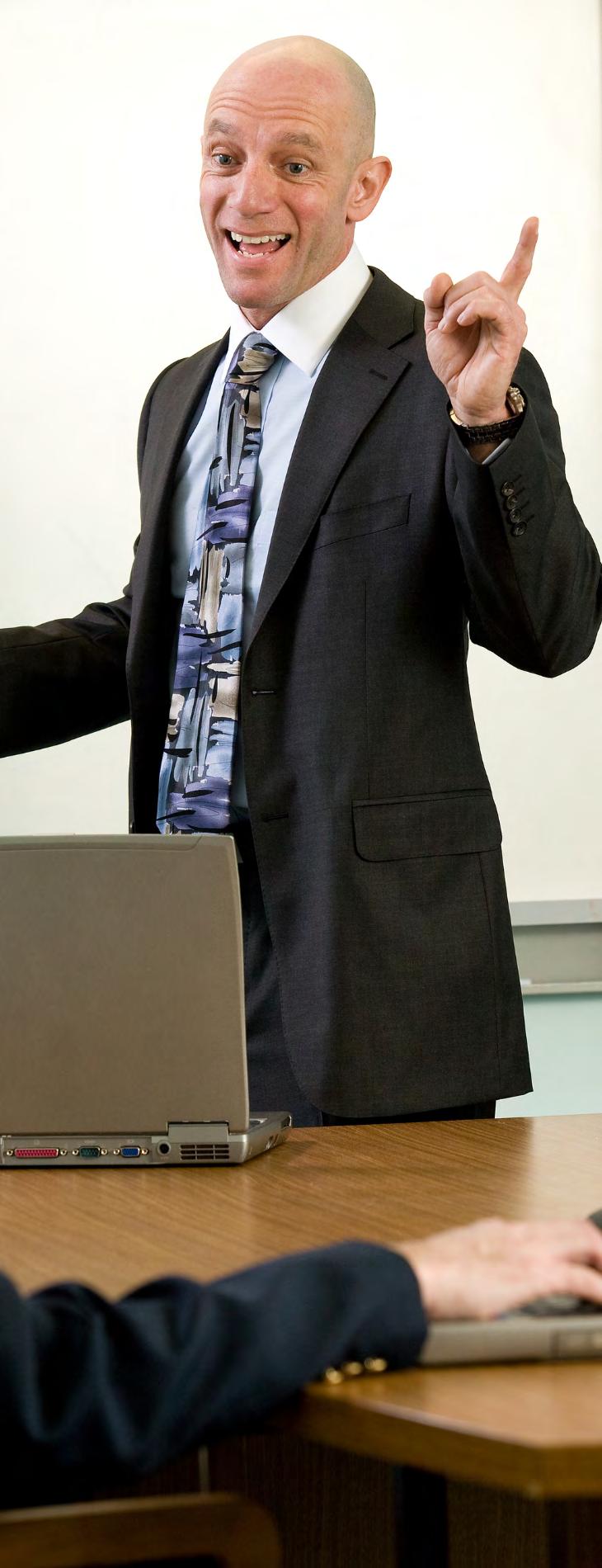

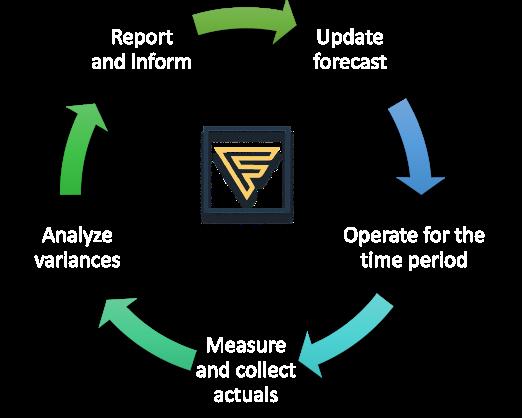

Mypreferredmethodof forecastingiswhatwerefer toasAccountability-based Forecasting (ABF). Withthis forecastingmethod, the primefocusoftheforecastis enablingbudgetownersto trackprogressagainstthe annualtargettheycommitted tointhebudget.

InourFutureViewplatform, weusea1+11, 2+10cadence toindicatethenumberof monthsofactualand forecastedmonths. So, after closingthebooksfor February, forexample, a companywouldcompletethe 2+1O forecast, aftertheMarch close, the 3+9, andsoonuntil theyearis complete.This approachprovidesaCompany withalaserfocusonthegoals thattheyestablishedinthe budget.

WHATABOUT ROLLING FORECASTS?

SeveralotherFP&Aplatform providersandso-called expertsadvocatefor"rolling forecasts"inlieuofan annualbudgetingprocess.

However, Idonotthinka rollingforecastisasubstitute forarobustannual budgetingprocess. Relyingsolelyonrolling forecasts, youlosetheforced decision-makingandthe processoftargetnegotiation thatisyieldedfromthe conclusiveannualbudget process. Intheory, youcould usearollingforecasttodrive decisionsanddiscusstargets forthenexttwelvemonths, butinreality, itisalittletoo easytopunttoughchoicesto thenextmonth. The perpetualnatureofthe rollingforecastworksagainst it - thereisneveraclear pointofconclusion. Budgets forcecompaniestomake toughchoices, theessenceof strategy.

Thesecondreasonthat I favoranintegratedbudgeting andaccountability-based forecastingprocessisless tangible. Ithink perpetual forecasting, tosome extent, deniestheseasonalnatureof thehumanpsychetowards achievement. Mostgreat endeavorsbeginwithan established goal followed by ajourneytoaccomplishment thatincludeswindfallsand setbacks.

Thebusinesscycleneedsto provideampletime for managementteamsto recognizeandadjusttothese fluctuations -asinglemonth or quarterisprobablynot sufficient. Marathonerscan adjusttoapoormile, but sprinterscannotmakea mistake.

Capital intensive businessesare better evaluated usingbroader measureslike return on assetsor economic profit. Thesemore complex measuresfactor in assetutilization. Return onassetsis theratio ofnet income to total assets. Return on assetscanbe bench marked against different size businesses and more capital efficient businesses have a higher returnon assets.

Economic Profitstarts with a measure like EBITDAand has anadditional cost for the working capital and assetsthe business deploys -these assetsare charged at the cost ofcapital, almost asifyou wererentingthem. Managinggrowth in Economic Profitcanbe very effectivefor capitalintensivecompanies and helpmanagement maketrade-offs between operatingand capitalefficiencies. We can cover thismore in afuture chat.

Q: As a CFO of a high-growth company, would you focus on EBITDA or another performance metric?

Foranycompanyit'scriticaltoidentifyaset ofmeasuresthatwillhelpguidemanagement andprovidefeedbackontheperformanceof thecompanywiththeultimateobjectiveof creatingavaluablebusiness.

EBITDA is more about simplicity. It is a great way to start building business acumen within a company. Ifyouare alreadythere, morecomprehensive measurescanbeintroduced.

Have a burning question for our team of CFOs and finance executives or care to add your perspective on a topic?

Reach out to us directly at info@futureviewsystems.com and we will answer your question immediately.

Your request might be featured in the next edition of FutureView Quarterly Q&A!

Foragrowthcompany, measuresshould reflectthesourcesofgrowth. Consider leadingindicatorsaroundsalesandgo-tomarketefficiencyandlaggingmetrics, suchas newlogosandlogoretention. Tietheseto revenuemetricssuchasbookings, upsell, and crosssell.

Investorsarenolongerinterestedingrowth atanycostandthatiswhere EBITDAcan comeintoplay. EBITDA will focus the team on the trade-off between growth and investment. Soinadditiontoyourcostto acquirecustomers (CAC), andreturnonsales andmarketingspend, EBITDAisagreat comprehensivemeasuretocapturehow muchcashthecompanyisgeneratingor burninginanyoneperiod.