Disclaimer:

This pamphlet is not intended to take the place of legal advice. It is designed to provide you with basic information regarding wills, trusts, durable power of attorney, advance directives, probate and guardianship in Florida.

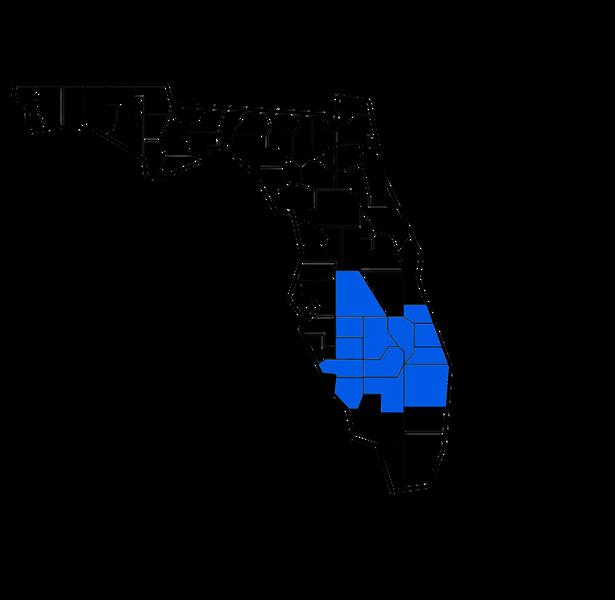

Florida Rural Legal Services, Inc. (FRLS) is a non-profit law firm that provides free civil legal aid to eligible individuals, families, and vulnerable communities across 13 Florida counties, as well as to farmworkers statewide.

FRLS office locations:

Belle Glade

Fort Myers

Fort Pierce

Immokalee

Lakeland Riviera Beach

Our offices serve the following counties: Lee, Polk, Palm Beach, St. Lucie, Martin, Okeechobee, Indian River, Highlands, Hardee, Hendry, Charlotte, Desoto, and Glades.

You can contact us on our Intake Hotline at 1-888-5823410. You can also apply online on our website at www.FRLS.org.

Everyone over the age of 18 or legally emancipated minors should have a written plan for if they are no longer able to make decisions for themselves or their dependents.

This written plan is called an "estate plan" and typical consists of documents like last wills and testaments, durable powers of attorney, designations of healthcare surrogates and living wills.

Sometimes, the term "advance directive" is also used to refer to an estate plan, but technically, only documents related to healthcare decision-making are advance directives.

Someone must have "capacity" to set up an estate plan, meaning they must understand: The nature and extent of the transaction, Their relationship to those who will benefit from the transaction, and The practical effect of the transaction.

If someone does not have an estate plan, then their family and friends must rely on the laws of Florida and its courts to make these decisions. The resulting court processes, like "guardianship" or "probate," are often lengthy and time-consuming.

Someone who is still living and does not have capacity to make decisions for themselves or their dependents may be subjected to a guardianship case.

In such a case, that person's family and friends ask the court to take away the individual’s rights to make these decisions and assign them to another person, who is called the "guardian.”

This is an extreme remedy, and a guardian is only appointed after the court has determined that there is no less restrictive alternative.

When someone dies without making an estate plan that distributes their belongings, their family and friends may ask the court to distribute the property according to the laws of Florida.

This type of court case is called a probate case, and the laws applied when there is no estate plan exclude everyone except surviving spouses and those related to the deceased by blood or adoption.

Not having an estate plan can have unintended consequences such as costing someone's family and friends more time and money, excluding loved ones or included estranged family members.

To avoid these costly court proceedings, everyone over the age of 18 or emancipated minors with capacity should have the following documents:

Last Will and Testament (and/or Trust)

Durable Power of Attorney

Declaration of Healthcare Surrogate

Living Will

If they have minor children, then they should also consider obtaining:

Declaration of Healthcare Surrogate for a Minor

Declaration of Preneed Guardian for a Minor

Bank Account in your name only.

Real Estate titled in your name only.

Bank Account held in trust for another. Bank Account held jointly with rights of survivorship.

Life insurance policy or individual retirement account policy payable to a specific beneficiary.

4

Who supervises the administration of your probate estate?

Your probate estate will be supervised by a Circuit Court Judge. The Circuit Judge will appoint a personal representative over your affairs and issue letters of administration. The letters of administration give the personal representative power or authority to act.

is a Personal Representative?

A personal representative is an individual appointed by the Court to be in charge of the administration of your estate. The personal representative may have authority to do any of the following things:

Identify, gather, and protect your assets

Publish notice to creditors in a local newspaper

Serve interested persons with a Notice of Administration regarding the estate

Pay valid claims, debts, or administrative expenses

Distribute statutory assets to the surviving spouse or family

Distribute assets to beneficiaries

Who can serve as a Personal Representative?

A bank or trust company under certain restrictions

An individual who is a resident of Florida

An individual who is a spouse, sibling, parent, child, or certain other close relative

Note: The Court will give preference to the person designated to serve as a personal representative under a valid will. If there is no will, the Court will give preference to the surviving spouse, or an individual selected by a majority of the heirs. Non-relatives who do not reside in Florida cannot be your personal representative.

A "will," or more formally a "last will and testament," is a legal document where someone says how they would like their things to be distributed after their death.

A will names a "personal representative," also known as the "executor" of the estate, who manages the estate and makes distribution with the approval and supervision of the court.

To be valid, a will must be signed in the presence of two witnesses and a notary.

If a person only has a will, then their estate may still need to go through probate, but the court will apply their distribution plan instead of Florida's default plan. However, someone cannot "disinherit," or leave nothing to, their surviving spouse or minor children.

Maker of the will must be at least 18 years old, Maker of the will must be of sound mind

Must be written

Must be signed and witnessed in a special manner as required under Florida law

Must be filed and proved in a probate court after your death in order to be effective

Any person who is of sound mind and who is either 18 or more years of age or an emancipated minor may make a will.

If you die without leaving a will, your property will be distributed according to a formula that has been created by the State with no allowances for relatives with specific needs, your non-familial relationships, or your desires. The court will appoint someone to handle your estate and the costs will probably be greater than if you leave a will.

If I have a Will, can I leave my property any way I want?

Almost. If you are married, you cannot exclude your spouse unless they agree in an ante or post nuptial agreement. If you leave nothing to your spouse, they can challenge the will and receive 30% of your estate. There are also restrictions on how you can leave homestead property.

My wife and I own everything jointly, so why should we have Wills?

Owning property jointly may simplify matters when the first owner dies - but what if you die together or within a short period of time? If this happens, joint ownership solves no title problems and the law will determine who gets your property.

What if I write a Will now while I am a widow and then I marry again next year?

When you remarry, consult your lawyer about possible changes. Your wishes may not be carried out without proper changes to your will.

I am now a Florida resident, but I have a Will I executed in another state. Do I have to have a new Will?

You should have the old will reviewed by a Florida lawyer to see if a new will is necessary. It may be void.

Can I write my own Will?

Yes. No particular form of words is necessary to the validity of a will if it is executed with the formalities required by Florida law. An attorney can make sure the will is properly signed and witnessed.

Where should I keep my Will?

A will should be kept in a conspicuous place so that it can be easily located if anything happens to you. A copy should also be given to a trusted friend or family member.

If I have a Will, is there anything else I should do to prepare for my death?

Yes. You should leave a list of your loved ones, your assets, your liabilities, etc. to help the survivors handle your affairs. The following is a list of the information we suggest you leave:

1.List of family names with addresses, home and work phone numbers.

2.List of names, addresses, home and work phone numbers of any beneficiaries under your will.

3.Name, address and phone number of your place of worship and the clergy member you want contacted.

4.Name, address and phone number of your lawyer.

5.Name, address and phone number of your employer.

6.If you have any funeral arrangements, leave a description of the arrangements along with names, addresses and phone numbers of the vendors involved.

7.Names and addresses of all your banks with a notation of what type of account and the account number. Give the location of any safety deposit box with a brief description of what is in the box.

8.Life insurance information including name and address of the insurance company and the policy number.

9. List of assets including where they are held. For example, if you have a Certificate of Deposit, list the amount of the Certificate, where it is and any appropriate account number.

10. List of bills due every month. For example, if you have a mortgage, put down how much you pay, when, and where you send the payment.

Do I have to include my life insurance policy in my Will?

No. Life insurance is a type of asset that does not affect the distribution of property in a will. Be sure that your choice of a beneficiary is up to date.

When should I change my Will?

It is recommended that you revise your will every time you experience a major life-changing event like the birth or adoption of a child, death of a spouse, marriage, or divorce.

A "trust" is an agreement created to manage a person's property - including but not limited to real property and financial accounts - during their lifetime and/or after their death.

Like a will, a trust must be signed in the presence of two witnesses and a notary.

There are many kinds of trusts, but generally, property that a grantor gives to the trust does not go through probate. Instead, that property is distributed according to the rules of the trust, which are set by the grantor.

Who sets up a Trust?

The person who sets up a trust is called the "grantor" or "settlor" of the trust. The person who manages the trust and its property is called the "trustee." The trust agreement is fundamentally an agreement between the grantor and the trustee.

A "durable power of attorney" is a legal document where someone nominates someone else to make legal and financial decisions for them if they cannot.

The person nominated is called the "power of attorney," the "attorney-in-fact," or simply, the "agent."

A durable power of attorney is ‘durable’ because if the person who made the power of attorney becomes incapacitated, the agent still has authority to act for them.

The durable power of attorney document must be signed in the presence of two witnesses and a notary.

A "declaration of healthcare surrogate" is a legal document where someone nominates someone else to make medical decisions for them and to receive their medical information if they are not able.

Sometimes, a declaration of healthcare surrogate is called a "medical power of attorney," but it is not preferred since it could easily be confused with a durable power of attorney.

The declaration of healthcare surrogate document must be signed in the presence of two witnesses.

A healthcare surrogate is an individual chosen by you to make all healthcare related decisions in the event of your incapacity. If you become incapacitated, your designated healthcare surrogate may consult and make decisions regarding your health. The healthcare surrogate will have authority to give informed consent to your physician and make decisions in your place.

How can I designate an individual to serve as my Healthcare Surrogate?

You must designate your healthcare surrogate through a written declaration. The written declaration must be signed by you in the presence of two witnesses.

Please note that at least one of the witnesses cannot be your spouse or relative. Most importantly, the individual

May I designate more than one person as my Healthcare Surrogate?

Yes. You may designate an individual to serve as an alternate surrogate. If the primary healthcare surrogate is unable or unwilling to perform his or her duties, the alternate surrogate may assume the responsibilities.

Does my designation of a Healthcare Surrogate expire at any time?

No. The designation of a healthcare surrogate will not expire.

However, you may revoke your designation at any time by executing a written document revoking your designation, destroying the original declaration, or by orally expressing your desire to revoke your designation of healthcare surrogate, if you decide to revoke your designation of healthcare surrogate, it is highly recommended that you let your physician or hospital know of your decision

A "living will" is a legal document where someone says what kind of treatment they want - if any - in an end-oflife situation.

For example, a living will may say that someone does not want to remain on life support if they are in an irreversible coma.

A living will can also nominate someone to make these decisions if something unplanned happens. This document must be signed in the presence of two

When you have executed a valid living will, it is recommended that you provide a copy of the living will to your physician and hospital to be placed in your medical records. You should also provide a copy of your living will to your spouse.

In order for a living will to be effective in Florida, it must be signed by you in the presence of two witnesses.

Please note that at least one of the witnesses cannot be your spouse or relative.

If you are physically unable to sign the document, one of the witnesses can sign for you in your presence as long as you are directing the individual to act on your behalf. Florida will recognize a living will that has been executed in another state, if the document was signed in compliance with the laws of that state or in compliance

Yes. You may revoke your living will at any time by executing a written document revoking your living will, destroying the original document, or by orally expressing your desire to revoke your living will.

If you decide to revoke your living will, it is highly recommended that you let your spouse, physician or hospital know of your decision.

A "declaration of healthcare surrogate for a minor" is a document where a parent or guardian can nominate someone else to make healthcare decisions for their minor child. Both parents must agree on the surrogate.

The declaration of healthcare surrogate for minor must be signed by the parents or guardian in the presence of two witnesses.

A "declaration of preneed guardian for a minor" is a document where the parents of a minor child nominate someone else to become guardian over their minor children if both parents die or become incapacitated.

The nominated guardian must still be approved by the court.

A declaration of preneed guardian does not need to be witnessed, but it does need to be signed and filed with the clerk of court where the minor resides.

Elder law focuses on addressing the unique legal needs of older adults and their families. FRLS's elder law services helps seniors plan for the future and secure their healthcare and financial well-being.

Our attorneys can help qualified elder clients within our service areas with any one of the following:

Advance Directives

Age Discrimination

Designations of Healthcare Surrogates

Durable Powers of Attorney

Guardianship

Housing Issues

Income Maintenance

Living Wills

Wills

AccesstoPublicEducationWhile Displaced

PowersofAttorney

Guardianship&SupportiveDecisionMaking

EmergencyCustodyModifications

ParentalOrderModifications(NewHome/ SchoolLocations)

DomesticViolenceIssues(IncludingACT EmergencyShelterreferrals)