With 2023 comes opportunities to start anew.

Along with the usual vows to eat better, exercise more, and cut down on clutter, we have some suggestions from folks right here in Kaufman County:

• Get your finances in order

• Read more books!

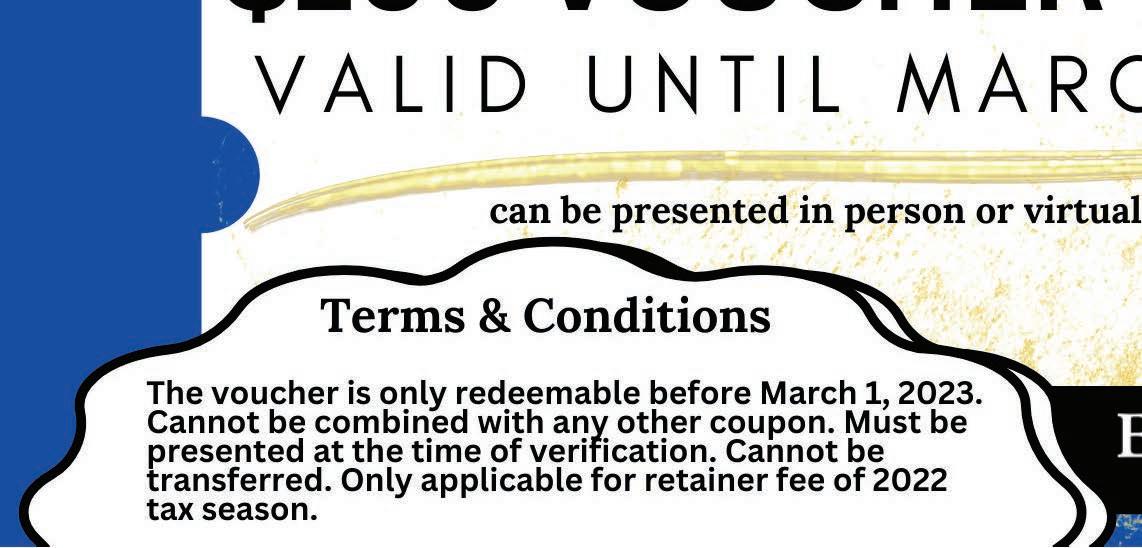

This is the year to make it happen! With some help from Empowered Finances, even an everyday taxpayer or small business owner can file returns on time and get a financial plan in place.

And with some assistance from volunteers with United Way of Kaufman County, books are available for anyone who wants to read them, for as long as needed. If you can’t finish a book in a couple of weeks, no problem! Misplaced book? It’s OK! The goal of free lending libraries is to keep books in the hands of readers.

We hope our readers join United Way volunteers and staff in this worthwhile endeavor.

Speaking of readers, thank you for the success of Connecting Kaufman as we begin our fifth year of publication! Like our weekly newspaper, the Kaufman Herald, and our weekly advertising publication, The Shopping Guide, we strive to bring our community together. We thank the advertisers and readers who make this mission possible.

Have a wonderful 2023, and we’ll keep meeting on the pages of this magazine!

Thanks for reading,

Amy Fowler Amy Fowler Publisher The Kaufman HeraldMarch

Contributing

Bailey

Contributing

Mollie

Bailey

It’s January, and that means cold weather, new beginnings, and… taxes. If your new year’s resolution is to get your taxes done early (or maybe on time, for once), Empowered Finances is here to help.

Based in Addison, Empowered Finances has recently opened a satellite office on the square in Kaufman. The firm has a 20-year history of assisting clients with personal and business taxes, military financial planning, and estate and financial planning. It began serving a handful of family and friends in 2002 and has been growing ever since. “We believe good things come from small beginnings,” says CEO Terrance Hatley.

While the world of finance may seem cold to some, Hatley has a different perspective. “My mission is to debunk the myth that an entity can’t become a successful business if it’s led by its heart with love,” he states. “Others may find this mission in contrast to being led by the mighty dollar.” This

point of view has made him successful, as evidenced by the company’s over 3,500 clients.

The multi-disciplinary financial team provides effective strategies to minimize tax burdens, manage tax returns, and help clients plan their financial future. The group consists of Executive Director Isabelle Hernandez, Training Director Nikki Pogue, Account Manager Supervisor Jason Pogue, Marketing Supervisor Paul Ouraga, Data Analyst Supervisor Bryan Harrington, E-Services Supervisor Yezennia Oyervides, and Client Specialist Supervisor Sharee Hannibal. They attend frequent tax seminars to keep their skills sharp and stay up to date on tax law changes.

Preparing your own tax return can be a daunting task, but Empowered Finances helps clients navigate the labyrinth of tax laws and regulations for both personal and business returns. Team members are skilled at finding deductions and providing

clients with a list of often-overlooked deductions. Each return is checked and re-checked to maximize refunds and minimize the chance of an IRS audit. They aid clients in planning for next year by showing them how to adjust payroll withholding to get more money in their paychecks each week. In addition, the firm offers electronic filing to get refunds into the bank accounts of clients as quickly as possible.

Once the current year’s tax return is complete, it is time to plan for next year. Empowered Finances assists clients with multiple tax saving strategies. They show clients how to defer income to keep money now and pay less tax later, as well as how to reduce tax on their income, estates, gifts, investments, and retirement distributions.

If you own your own business, accounting is a critical part of making it work. Empowered Finances handles the accounting so clients can concentrate on making and marketing their products and services. Client specialists keep track of operations and meet compliance obligations for clients. They also analyze business finances and provide reports so business owners can make the best financial decisions.

For more information about how Empowered Finances can help you, check out their website, https:// empoweredfinancesllc.com, call 214-432-7695, or email contactus@ empoweredfinancesllc.com. They are happy to guide you through your income tax journey.

To file the most accurate return, Empowered Finances suggests bringing the following information to your appointment.

PEOPLE LISTED ON TAX RETURN

• Correct birthdays and Social Security card copies of all persons listed on the return

• Childcare records (including the provider’s ID number)

• Approximate income of other adults in your home

• Form 8832, copies of your divorce decree, or other documents showing that your ex-spouse is releasing their right to claim a child to you

• Amount of alimony paid and ex-spouse’s social security number

EDUCATION PAYMENTS

• Bills from educational institutions

• Forms 1098-T and 1098-E, if you received them

• Scholarships and fellowships received

EMPLOYEE INFORMATION

• Forms W-2

SELF-EMPLOYMENT INFORMATION

• Forms 1099-MISC, Schedules K-1, income records to verify amounts not reported on 1099s

• Records of all expenses, check registers or credit cards statements, and receipts

• Business-use asset information (cost, date placed in service, etc.) for depreciation

• In-home office information, if applicable

VEHICLE INFORMATION

• Total miles driven for the year (or beginning/ending odometer readings)

• Total business miles driven for the year (other than commuting)

• Amount of parking and tolls paid

• Receipts or totals for gas, oil, car washes, licenses, personal property tax, lease, or interest expense, etc.

RENTAL INCOME

• Records of income and expense

• Rental asset information (cost, date placed in service, etc.) for depreciation

RETIREMENT INCOME

• Pension/IRA/Annuity income (1099-R)

• Social security /RRB income (1099-SSA, RRB-1099)

SAVINGS AND INVESTMENTS

• Interest, dividend income (1099-INT, 1099-OID, 1099-DIV)

• Income from sales of stock or other property (1099-B, 1099-S)

• Dates of acquisition and records of your cost or other basis in property you sold

OTHER INCOME

• Unemployment, state tax refund (1099-G)

• Gambling income (W-2G or records showing income, as well as expense records)

• Amount of alimony received and ex-spouse’s name

• Health care reimbursements (1099-SA or 1099-LTC)

• Jury duty records

• Hobby income and expenses

• Prizes and awards

• Other 1099

ITEMIZING DEDUCTIONS

• Forms 1098 or other mortgage statements

• Amount of state/local income tax paid (other than wage withholding), or amount of state and local sales tax paid

• Real estate and personal property tax records

• Amount of vehicle sales tax paid

• HUD statement showing closing date of home purchase

• Cash amounts donate to houses of worship, schools, or other charitable organization

• Amounts paid for healthcare insurance, doctors, dentists, vision, hospitals, etc.

• Amounts of miles driven for charitable or medical purposes

• Expenses related to your investments

• Amount paid for tax preparation

• Employment-related expenses (dues, publications, tools, uniform cost and cleaning, travel)

• Job-hunting expenses

IRA INFORMATION

• Amount contributed to any IRA

If you were affected by a federally declared disaster, see the Empowered Finances website for additional documents you may need to bring.

Deb Helm, Executive Director of the United Way of Kaufman County, has a passion for literacy, and it has led her to begin an ambitious project: placing tiny libraries all over Kaufman County. Her goal is for everyone to have access to free books. “I want to get books in the hands of people, because I love to read,” she shares.

Free Lending Libraries are small kiosks of familyfriendly books suitable for ages 0-99 and include selections from all genres. The books are free to take and keep, or patrons can opt to trade a book they have already enjoyed. They work entirely on the honor system, with no checkout or card required. The ones in Kaufman County are painted in the highly recognizable United Way colors of yellow and blue.

The project started as a fundraiser in 2018, prior to Helm’s tenure as executive director. When she took over the reins, Helm decided to place more importance on getting the libraries placed in public areas and less on using them as fundraisers. Now donors can purchase a Free Lending Library for the cost of materials and labor.

Early free lending libraries were smaller than current ones, and have not held up to Texas weather, so Helms recruited a cadre of volunteers to help build new ones. First, she asked a local veteran to redesign them using stronger wood, which he did. Due to an illness, however, he was unable to build them. Undeterred, Helm secured a grant from Home Depot in Terrell for materials to build seven boxes, and various craftsmen around the county have

helped build the bigger and better libraries using the new design. A phone call to Crandall ISD yielded student volunteers to help sort books and fill the libraries. Crandall High School National Honor Society President Katye Yanez even enlisted her family to help build and paint the libraries. The Art Department of Terrell ISD and the office staff of Magnolia Grove Apartments pitched in to help paint as well, and Ray Rodella of McCoy’s Building Supply donated concrete and labor to place them in the ground.

The Free Lending Library Project is off to a great start, but volunteer support is needed to expand and maintain it. Helm would like to see

the libraries all over Kaufman County. “We want to get more books out there,” she emphasizes. If you would like to support literacy through this project, there are several ways to help. Schools, organizations, or individuals can sponsor a library financially, or they can maintain and replenish books monthly. Helm has a “humongous amount of books,” that volunteers can choose from to restock the libraries. Book donations also need to be sorted and shelved. There is also a need for building and painting the boxes.

To volunteer, contact Deb Helm at 214-8783930, or visit her office at 102 East Moore Ave, Suite 218 in Terrell. She is in the office Tuesdays, Wednesdays, and Thursdays from 9:00 am until 5:00 pm.

TERRELL

• Each city park (coming soon)

• American National Bank

•High Street Dental

• Edward Jones

KAUFMAN

• American National Bank

CRANDALL

• Webb Park

Dirt-track racing on the weekends, mothering two children, and cheering for Sunday football may sound like the familiar southern household. But fresh-baking thousands of cookies, icing them by hand, and applying special customization in that same household is the reality of Crandall’s Vickie Pierson, owner of Momma P’s Cookie Co.

Before baking up a cookie empire, a normal day for Pierson was filled with the constant activity of a high school senior. Her daughter, Jordyn Pierson, was set to graduate in spring of 2018 and Momma P’s days leading up were spent at drill team performances, travelling to theatre competitions, taking senior photos, and celebrating all the ‘lasts’ before college arrived.

With a suddenly free schedule and a quiet household, the resilient Momma P found angst in twiddling her thumbs at home. In her boredom, she craved something that would fill her open schedule. What she didn’t anticipate was discovering something that would also fill people’s bellies. Early in

2019, after seeing numerous posts online of different bakers making customized cookies from home, she garnered the ‘no challenge too big’ mentality and took off running.

A year later, a global pandemic shut doors to businesses worldwide. In a devastating time for most, Momma P stayed hard at work in her kitchen, adding a touch of sweetness back to a bitter time. Now, four years later, Pierson stays busy hand-crafting customized cookies for every type of festivity.

Pierson’s talents are of no question, as she continues to challenge herself in every creation. Leaving customization up to your customers can lead to some big asks, but four years into icing cookies, Momma P has acquired thousands of cookie cutters and mastered her made-from-scratch recipes. While you can never go wrong with her vanilla sugar cookies, her dark chocolate and seasonal pumpkin spice cookies add flavor to every event.

Even more impressive, the appeal starts well before your first bite. Pierson takes careful time packaging

each creation for a beautiful presentation. To start, each cookie is individually wrapped so cookie-lovers can take their time indulging in their delicious batch. Then, each cookie makes their way into a box filled with confetti, celebrating the arrival of your scrumptious treat.

While each cookie is made with love, Momma P’s favorite treats are ones she makes with creative liberty. She loves inventing new designs on typically ‘normal’ cutouts, pushing her creativity and innovation.

After years of perfecting her skills, Pierson is ready to tackle her next venture - sharing her knowledge with others. Pierson hopes to get the ball rolling by starting cookie classes in the future. She hopes she can spread her techniques and teach others in the same way she so effortlessly learned her skill. In the meantime, fellow creatives can practice by purchasing one of her DIY cookie-kits.

Momma P’s Cookie Co. can be reached at 214-202-5247 or email vpierson76@gmail.com.

Facebook: facebook.com/mommapscookieco

Instagram: mommapscookieco

By Melanie Brubaker Mazur

By Melanie Brubaker Mazur

Frieda’s Chicken is one of those standbys from my mother that my boys love, and it’s simple enough to put together at the end of the day, place it in the oven, and you have a tasty supper in an hour. It can also be made ahead, then baked when you get home, or cooked on low on a slow cooker until the chicken is tender. The mustard and flour combine to create a tangy, flavorful crust that can be topped with green onions, mushrooms, or both.

In the winter, this is good with some brown rice or noodles and a salad. In the summer, my family enjoys it with fresh corn on the cob, as well as tomatoes and cucumbers out of the garden.

Four to six chicken breasts or boneless chicken thighs

Mustard - either stoneground or classic yellow

Flour

Teriyaki sauce

Green onions (optional)

Mushrooms (optional)

Place the chicken pieces in an oiled casserole dish. Spread 1 to 2 teaspoons of mustard on top of each piece of chicken, followed by a tablespoon of flour.

If you like green onions or mushrooms, slice one or two green onions, and sprinkle some on each chicken piece. Repeat for the mushrooms, if desired.

Liberally shake 1 to 2 tablespoons of teriyaki sauce over each chicken piece, then pour a quarter-cup in the pan to make the sauce.

Cover and bake at 350 degrees for 45 minutes.

Serve each piece of chicken with a spoonful of the baked teriyaki sauce. The sauce is also excellent served over the rice or noodles.

Serves six, or four if you’re feeding teenagers.