MONEY matters

FINANCIAL PLANNING FOR THE FUTURE - A Special Supplement of -

Estate Planning, Wills, Probate, and Business Planning Real Estate Financing Options Norman T. Reynolds Law Firm, P.C. Firm, Retirement Planning Q&A What to Know About Life Insurance

Protecting your Assets, Income, & Legacy What can you find on www.fergusonfinancial.com? Why are retirees choosing annuities over CDs Set Appointment Online Business Succession Strategies Retirement Income Solutions • Lawsuits • Stock Market Losses • Income or estate taxes • Disgruntled family/beneficiaries • Blended family structure Protect Your Estate From: • Gifting Strategies • Legacy Planning Non-Profit Organizations: Gregg Ferguson President Dale Dockery Agent/Director Kara Love Office Manager 979.206.2100 info@fergusonfinancial.com 1417 West Hwy 71, La Grange, TX

PUBLISHER

Regina B. Keilers

EDITOR

Jeff Wick

DIGITAL EDITOR

Andy Behlen

ADVERTISING

Becky Weise

Tammy Browning

PRODUCTION

John CastanedaNewspaper

Lindsey Fojtik - Special Sections

OFFICE STAFF

LouAnn Adcox

ACCOUNTING

Theresia Karstedt

Nonnie Barton

CIRCULATION

George Kana

Jesse Montez

Nicol Krenek

Leigh Ann Bedient

Bobby Bedient

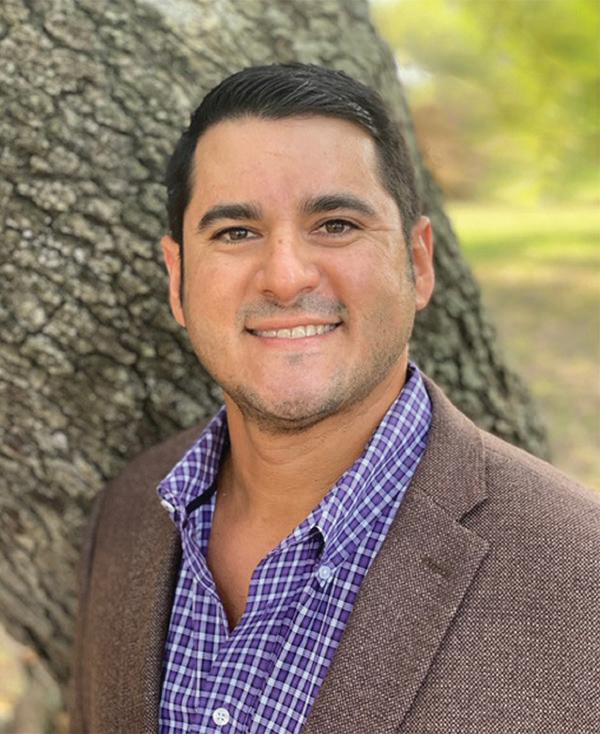

It’s Never Too Early and Never Too Late.................................... 4 Round Top State Bank .................................................................. 10 What to Know about Life Insurance ..........................................12 Steps to Take Before Applying for a Mortgage ......................14 Financial Focus ................................................................................16 Fayette Savings Bank ....................................................................18 A Q&A About Retirement Planning.......................................... 20 Land Bank Your Way to Wealth ..................................................22 Open the Door of Opportunity ...................................................24 Common Investment Terms to Know .......................................26 Diversifying Risk .............................................................................28 127 S. Washington St. | P.O. Box 400 La Grange, Texas 78945 Ph: 979.968.3155 | Fx: 979.968.6767 Email: editor@fayettecountyrecord.com www.FayetteCountyRecord.com The Fayette County Record is published every Tuesday and Friday, except the publication immediately following Christmas by Fayette County Record, Inc. serving Fayette County since 1922. The Fayette County Record is locally owned and operated by the Barton family since 1976. (USPS 188-440) MONEY MATTERS ADVERTISER INDEX Adamcik Insurance............................13 Community Financial Partners.............................................32 Edward Jones Chuck Mazac.............17 Fayette Community Foundation........................................25 Fayette Savings Bank........................19 Fayetteville Bank...............................31 Ferguson Financial..............................2 Hatfield Dental..................................15 National Bank and Trust...................27 Norman T. Reynolds Law Firm, P.C.............................................9 Round Top State Bank.......................11 Sandra Kana.......................................31 SBA Investments..............................23 Sleep Solutions of Central Texas.....31 The Fayette County Record...........30 FINANCIAL PLANNING FOR THE FUTURE ESTATE PLANNING CONSIDERATIONS - A Special Supplement ofMONEY matters Estate Planning, Wills, Probate, and Business Planning Real Estate Financing Options Norman T. Reynolds Law Firm, P.C. Retirement Planning Q&A What to Know About Life Insurance About the Cover Norman Reynolds with Norman T. Reynolds Law Firm, P.C. Photo by Lindsey Fojtik

Money Matters | 3

IT’S NEVER TOO EARLY AND NEVER TOO LATE!

Norman T. Reynolds Law Firm, P.C.

Most of us are probably familiar with the Boy Scouts’ motto, “Be Prepared.” That phrase is the essence of estate planning. We should all be prepared for the future and how we want our property to be distributed. We want to be thoughtful and precise about naming our executor and how we wish important matters to be handled. Some estates are relatively simple to settle, but some are complicated and careful consideration of all details can save a great deal of money and a great deal of time. And it is important to protect the diversity of interests we find in all families. It is never too early and never too late to put in place a clear plan for the distribution of the assets we have accumulated during our lifetime.

4 | Money Matters

Norman Reynolds has prepared numerous wills and trusts for his clients. His services have included the drafting of simple or complex wills and trusts as required by the needs of the client.

When necessary, Norman Reynolds has provided probate services for clients to implement the passage of a deceased client’s estate. His services include the preparation of all necessary documents to probate an estate, and appearances in the probate court as may be required.

There are several topics which should be considered in the preparation of any estate plan. Provided below is a discussion of some of the important reasons why you should have a properly drafted will. Please keep in mind that the federal estate tax exemption, currently, $12,920,000 per person, is set to expire at the end of 2025, and will be reduced to $5 million (inflation indexed) after 2025, if the current exemption level is allowed to expire. The federal annual gift tax exclusion amount is currently $17,000.

There is no guarantee that the Congress will wait until 2025, to change the current exemption or exclusion levels. So, be on the lookout.

Unless you wish for your property to pass at your death according to the Texas intestate succession law, you must execute a valid written will. Pursuant to the Texas Estates Code, a person dying without a will (i.e., “intestate”), your property would most likely pass in ways that you would not desire. The law of intestacy is quite complex and is beyond the scope of this article. You should contact Norman Reynolds or some other attorney for clarification, before you decide to rely on it.

Probate has gotten a bad reputation as being expensive and causing delays. As a result, many people try to avoid it at all cost. In many states, that reputation has been well earned. But in Texas, probate of a properly drafted will is typically nothing to be feared. This is because Texas has one of the most simplified probate processes in the nation.

Probate is the legal process of proving the validity of a will and the passage of the decedent’s property as desired upon his death. Probate is also commonly understood to refer to the legal process in which the estate of a decedent is administered. During the probate process, the executor (if there is a will) or administrator (if there is no will) of an estate collects a decedent’s assets, liquidates his liabilities, pays necessary taxes, and distributes property to the heirs, pursuant to the terms of a will, or if there is no will, pursuant to the laws of descent and distribution.

Probate is usually equated with court supervision, which is expensive and time-consuming. However, in Texas, if a testator instructs in his will that there should be no action in the probate court in the settlement of the his estate other than the probating and recording the will and the return of an inventory, appraisement, and the list of claims of his estate, then there will be an independent administration free from court supervision and control. Independent administrations usually involve only one court hearing and the filing of an inventory. They account for more than 80 percent of Texas probates.

ESTATE PLANNING AND

PROBATE

Money Matters | 5

Any will executed in Texas, should provide for independent administration free of court supervision. This means that after an independent executor is approved and an inventory of estate assets (or an affidavit in lieu of an inventory) has been filed, the executor can take care of the administration of the estate without further court involvement or supervision.

The independent executor can settle with creditors, set aside the homestead and other exempt property, manage the property of the estate, sell assets for payment of debts or taxes, and distribute the remaining estate to those entitled to it. Thus, independent administration avoids the costs and delays associated with a court-supervised estate administration in which the administrator must seek court approval before doing any of these acts.

The powers of an independent administrator are broad and include all the powers of a personal representative of a courtsupervised administration. These powers may be usurped by the probate court only where the Texas Estates Code specifically and explicitly provides for some action in the court.

After a person dies and leaves behind property to be administered, one of the first steps is for a personal representative to apply to the probate court for letters testamentary, if the decedent had a will, or letters of administration, if there is no will.

Letters testamentary give the personal representative the legal authority to administer the decedent’s probate estate. The letters provide proof of appointment and qualification of the personal representative of an estate and the date of qualification. Most banks and financial institutions require a copy of the letters before giving the personal representative information or access to the decedent’s accounts.

In the appointment of an independent executor in a will, the appointment should specify that there shall be no requirement for the posting of a bond by the independent executor. The failure to do so could prove to be very expensive and result in the failure of the independent administration.

In every will, where there is the likelihood that the property of an estate will pass to a testator’s child under 18 years of age (i.e., a minor) provision should be made for the appointment of a guardian of the person of each of the testator’s minor children.

Traditionally, estate planners have recommended a number of techniques to avoid, defer, or minimize the estate tax. However, as the estate and gift tax exemption amount continues to increase and the bar for “wealth” moves north, a greater number of couples may fall into the “moderately wealthy” category. Moderately wealthy refers to those couples that are currently below the exemption amount ($25,840.000 per couple) but have potential for wealth increases in the future.

6 | Money Matters

A complete estate plan should also include a general power of attorney and a medical directive, commonly referred to as a living will, and if desired, a an out of hospital Do Not Resuscitate form (“DNR”). These documents are important to enable someone to act in a time of need, when the person granting the power is unable to do so, or the individual does not want to be resuscitated. Please know that a DNR must be executed by your physician and a copy must be retained in the physician’s office to be effective.

TRUSTS

In addition to wealth planning, one of the real advantages of a trust is to hold mineral interests and other properties in other states. If you own property at your death in a state other than Texas, it will most likely be necessary to file a probate proceeding in the state where the property is located. This can be an expensive and wasteful exercise. If the properties were held in a trust, an ancillary probate in the foreign state would not be necessary, and the trust assets would continue to be held and administered as if death had not occurred.

A common estate planning technique for the moderately wealthy couple has been the use of the Bypass Trust and/or the QTIP Trust, upon the death of the first spouse to die. If a couple is concerned that they may exceed the exemption amount (currently,

$12,920,000 per spouse), a QTIP Trust and a Bypass Trust may both be utilized by leaving a bequest to a Bypass Trust of the maximum amount possible without incurring estate tax with any remaining property above this amount passing to the QTIP Trust. A couple who is never expected to exceed the exemption amount may still benefit from utilizing the QTIP Trust or the Bypass Trust instead of leaving the estate outright to the surviving spouse.

ORGANIZATION OF BUSINESS

An important segment of Norman Reynolds’ law practice relates to the organization of businesses, including corporations, limited liability companies, partnerships, joint ventures, and limited partnerships, preparation and filing of necessary organization documents and buy-sell agreements. Included in these services would be the formulation, when required, of mixed capital structures, including preferred stock and debenture issues, voting trust arrangements and security agreements. Additionally, Norman Reynolds advises on acquisitions and dispositions of businesses, including stock purchase or asset purchase agreements, leveraged buy-outs, mergers and liquidations. An integral part of these services is the necessary tax planning to achieve the best possible tax consequences for the client.

Money Matters | 7

REAL ESTATE TRANSACTIONS

Norman Reynolds has been involved in numerous real estate transactions for clients, ranging from the purchase or sale of raw land, shopping centers, and office buildings. His services have included the drafting of all necessary documents as may be required by the needs of the client, including preparation of leases, operating agreements, and services related to capitalizing, and financing of real estate.

LITIGATION, MEDIATION AND ARBITRATION

Norman Reynolds’ services also include commercial litigation, probate litigation, construction claims, and associated mediation and arbitration. He focuses on what matters most to his clients –achieving the clients’ objectives in a quick, decisive and efficient manner. With accurate case evaluation, efficient staffing, targeted discovery and motion practices, and appropriate technological support, Norman Reynolds conducts litigation in ways that make business sense for his clients. His goal in every case is to provide the highest quality of service at a fee structure that serves his clients’ needs, while always focusing on the clients’ objectives.

With years of experience Norman Reynolds stands ready to be of assistance to the residents of the greater Fayette County area and respond to various legal questions and needs.

Norman T. Reynolds is an AV rated attorney who has been in the practice of law, initially in Houston, Texas, and for the last five years in Round Top, Texas, following his graduation from Rice University and The University of Texas School of Law and his return from active duty with the United States Army. The Norman T. Reynolds Law Firm, P.C. headed by Mr. Reynolds is a multidisciplinary law firm which advises individuals and businesses on estate planning, real estate, litigation, general corporate and commercial matters and the legal aspects of strategic decisions relating to both the form and structure of entities and transactions and then assists in their implementation.

8 | Money Matters

© Norman T. Reynolds 2023, all rights reserved

5-STAR ROUND TOP STATE BANK… Strength, Stability, and Success

10 | Money Matters

Established in 1912, Round Top State Bank has been a dedicated banking partner for this county for 111 years. Being rated 5-Stars, the highest rating by Bauer Financial for the past 19 years, exemplifies this dedication and has earned them the prestigious title of an “Exceptional Performance Bank”. Round Top State Bank is a community bank that has the strength to support its community as it consistently excels in areas of capital strength, profitability, and asset quality. Round Top State Bank promotes local growth by investing back into the same neighborhoods that their deposits come from. By fostering these relationships, Round Top State Bank achieves two goals; they are highly capitalized, and they are accountable to their customers.

Strength and stability are only part of Round Top State Bank’s success. The bank’s success is also attributed to its commitment to superior customer service. This commitment is supported by the longevity of Round Top State Bank’s employees. The vast majority of the bank’s employees live in the communities that the bank serves and supports. In addition, many of RTSB’s employees have tenure that exceeds 20 years of service. This amount of experience and knowledge provides customers with quality service from people that they know and trust. Round Top State Bank’s staff places their focus on local people and local businesses because that’s who they are. Fast, courteous service is what you can expect from local people that genuinely care about helping you. They know the value of providing excellent customer service with the knowledge needed to help you with all your banking needs.

Round Top State Bank also has the advanced technology to keep up with this fast-paced world we live in. You can access your bank accounts through their Online Banking or Mobile Banking App on your smartphone or tablet. You can pay bills online using their Bill Pay Service or you can deposit checks directly into your account using Mobile Deposit with the camera on your smartphone or tablet. Visit their website at www.roundtopstatebank.com to try it out. They also offer Tele-Banking in which you can call 1-877-4377872 to access your balance, transfer funds, check items that have cleared your account and get current CD and savings rates 24 hours a day, 7 days a week. If technology is not for you and you prefer to speak to one of their friendly bankers, you can call (979)-966-0556 during banking hours, Monday through Friday 8 a.m. – 5 p.m. and Saturday 8 a.m. – 12 p.m.

Along with the various deposit account options, Round Top State Bank has a wide array of loan products with competitive rates and low closing costs to meet your lending needs. They finance loans to purchase your first car, purchase business equipment, build your dream home or buy some land for agricultural purposes. Choosing the right lender is just as important as choosing the right property. Whatever your need may be, you will be pleased with their fast response time and courteous service. After all, they value their customers and treat them like family. If you are looking for a bank that is not only friendly, but very sound, stable and successful, go see the welcoming folks at Round Top State Bank. Round Top State Bank…Local People, Local Decisions, Local Bank!

Money Matters | 11

WHAT TO KNOW about life insurance

Millions of adults go to great lengths to protect their assets. Those measures run the gamut from simple everyday efforts like utilizing twofactor authentication when accessing financial accounts via online or mobile banking apps to more complicated undertakings like estate planning. Life insurance is a component of estate planning that is vital to anyone looking to protect their assets in the event of their death.

12 | Money Matters

EXPLAINING LIFE INSURANCE

Life insurance is both similar to and different from other types of insurance. Like homeowners and auto insurance policies, life insurance provides financial protection in difficult circumstances. A life insurance policy is a contract between an insurance provider and a policy holder that guarantees a payout to beneficiaries designated by the insured individual in the wake of that individual’s death.

PERSONAL HISTORY

Insurance providers differ, but individuals interested in life insurance can expect to be asked about their medical histories and lifestyle habits when discussing policies. Prospective policy holders will often be asked to sign waivers that allow providers to access their medical records. This is necessary so companies can get an idea of the health of the person applying for life insurance, which will determine the cost of a policy. That information, as well as family history, is important because it can serve as an indicator of future health risks. Some variables, including lifestyle habits like smoking, won’t necessarily appear on an individual’s medical history. In an effort to address that, insurance providers typically ask prospective policy holders to answer a variety of questions about their lifestyle, including whether or not they smoke and how much alcohol they consume. It’s vital that individuals answer these questions honestly, as companies can deny payouts to beneficiaries if they determine policy holders misled them during the application process.

COVERAGE

Coverage needs vary depending on the individual. Life insurance is intended to provide for loved ones in the aftermath of a policy holder’s death. How much money will those individuals need to

pay their bills? Young adults who are just starting their families may want more coverage than aging adults who have already paid off their homes and saved a considerable amount for retirement. The National Association of Insurance Commissioners recommends that individuals ask themselves how much of the family income they provide and if anyone else, such as an aging parent, depends on them for financial support. Answering these questions can help individuals determine how much coverage they need.

TYPES OF COVERAGE

Insurance providers offer various types of life insurance policies. Term life policies are among the most popular because they tend to be affordable while offering substantial coverage. There are different types of term life policies, but policies tend to run for anywhere from 10 to 30 years and expire around the time individuals reach retirement age. That’s because many people save enough for retirement and don’t have the sizable expenses, such as a mortgage, to account for at this point in their lives. That means loved ones won’t necessarily need to be provided for in the wake of a policy holder’s death.

Permanent life insurance policies last until the policy holder’s death so long as he or she continues to pay the premiums on time. Financial advisors can help individuals understand the ins and outs of the various types of permanent life insurance policies, which differ from term life policies because they can serve as investment vehicles and sources of loans in certain instances.

Life insurance is a vital component of asset protection that can offer peace of mind to policy holders who want to ensure their loved ones are provided for in the wake of their death.

Plan your

dream. Whatever you’re saving for next, it’s easier to get there with the right plan. I can help you look at your financial goals and find smart ways to save. Call me today. Like a good neighbor, State Farm is there. ® Phillip Adamcik, Agent 420 W Travis Street Suite 102 La Grange, TX 78945 979-968-3600 phillip.adamcik.f26r@statefarm.com Mon-Fri 9:00AM - 5:00PM After Hours by Appointment Se habla Español

next

Money Matters | 13

STEPS TO TAKE BEFORE applying for a mortgage

A home is the single biggest purchase most people will ever make. That’s perhaps become even more true in recent years, when the cost of homes has increased dramatically.

The sticker price of a home may come as a shock to first-time buyers, but few homeowners purchase their homes in cash. Mortgages are a vital component of home ownership for the vast majority of buyers. Mortgages are loans obtained through the conveyance of property as security. When homeowners pay off their mortgages, the title of the property officially transfers to them from their lenders.

Though most homeowners utilize mortgages to buy their homes, that does not mean the process is the same for everyone. A host of factors affect mortgage terms, and there’s much prospective homeowners can do to secure the best agreement possible.

RECOGNIZE WHY A LOW INTEREST RATE IS IMPORTANT.

Mortgage interest rates have drawn considerable attention in recent years, as rising inflation has led to rates that have reached their highest point in more than a decade. Even a seemingly small difference in interest rates can save or cost homeowners thousands of dollars, if not tens of thousands, over the course of a loan. For example, the financial experts at Bankrate.com note that the difference between a 5.5 percent interest rate and a 6 percent interest rate on a $200,000 mortgage is roughly $64 per month. That might not seem like a lot, but over the course of a 30-mortgage the borrower who gets the 6 percent loan will pay in excess of $23,000 more in interest than the borrower who secures the 5.5 percent loan. Recognition of the benefits of

securing the lowest interest rate possible can motivate prospective buyers to do everything in their power to get a low rate.

WORK ON YOUR CREDIT SCORE.

So how can borrowers get the best possible rate? One way to go about it is to improve credit scores. Average mortgage interest rates vary significantly by credit score, with higher scores earning borrowers significantly lower rates. According to data from FICO, as of mid-February 2023 borrowers with a FICO score of 760+ earned an average interest rate of 6.06 percent, while those with scores between 620-639 secured an average rate of 7.65 percent. By bolstering their credit scores before applying for a mortgage, prospective homeowners can improve their standing in the eyes of mortgage lenders, which can potentially save them tens of thousands of dollars over the life of the loan.

IDENTIFY HOW MUCH YOU WANT TO SPEND.

Prospective home buyers may be approved to borrow much more money than they think they will qualify for. That’s because lenders do not consider factors like utilities, insurance, day care, or other expenses everyone has. That means it’s up to borrowers to determine how much those expenses will be, and how much they should be spending on a home. Though it might be tempting to borrow up to the amount lenders approve you for, in general it’s best to stay below that amount so you can capably meet all of your additional obligations.

Mortgages enable millions of people to buy homes each year. Some simple steps before applying for a mortgage can help prospective homeowners secure the best terms.

14 | Money Matters

220 W. GUADALUPE ST. L A GRANGE, TX BEST DENTAL OFFICE BEST DENTIST BEST DENTAL HYGIENIST WWW.HATFIELDDENTALCLINICPC.COM Se Habla Español E @hatfielddentalclinicpc Money Matters | 15

FINANCIAL FOCUS Should investors ‘ go it alone’?

by Edward Jones

by Edward Jones

If you’re going to enjoy a comfortable retirement, you should know, among other things, how much money you’ll need. And you may have a much better chance of knowing this if you get some professional help.

16 | Money Matters

Consider these findings from a 2021 study by Dalbar, a financial services market research firm:

• Investors who worked with a financial advisor were three times more likely to estimate what they would have saved at retirement than “do-it-yourself’ investors.

• More than two-thirds of investors with a financial advisor were satisfied with the amount they would have saved at retirement, compared to about 27% of the do-it yourselfers.

How do financial professionals help their clients in these ways?

First, consider the issue of determining how much money will be needed for retirement. It’s not always easy for individuals to estimate this amount. But financial professionals can help clients like you arrive at this figure by exploring your hopes and goals. How long do you plan to work? What kind of lifestyle do you anticipate enjoying in retirement? Where would you like to live? How much would you like to travel? Are you open to pursuing earned income opportunities, such as consulting or working part time?

Next comes the other key question: How much money will be available for retirement? This big question leads to many others: How much do you need to save and invest each year until you retire? About what sort of investment return will you need to reach your retirement income goals? What level of risk are you willing to take to achieve that return? What is the role of other income sources such as Social Security or any pensions you might have?

Having a financial professional help you gain a clear idea of your retirement income picture can certainly be reassuring. But there may be other reasons why “going it alone” as an investor might not be desirable.

For example, when the financial markets are down, as was the case for much of 2022, some investors make decisions based on shortterm volatility, such as selling investments to “cut their losses,” even if these same investments still have solid business fundamentals and good prospects for growth. But if you work with a financial professional, you might decide to stick with these investments, especially if they’re still appropriate for your long-term strategy. Other times, of course, the advice may be different -but it will always be advice based on your goals, needs and time horizon.

Furthermore, if you’re investing on your own, you may always be measuring your results against the major market indexes, such as the S&P 500 or the Dow Jones Industrial Average. But in reality, your portfolio should contain a wide range of investments, some of which aren’t contained in these indexes, so you might not be assessing your performance appropriately. A financial professional can help you develop your own, more meaningful benchmarks that can show the progress you’re actually making toward your goals.

In some areas of life, going it alone can be exciting -but when it comes to investing for your future, you may benefit from some company on the journey.

3.5” x 2” MKT-5894N-A > edwardjones.com Chuck Mazac Financial Advisor 322 N Jefferson St La Grange, TX 78945 979-968-6373 3.5” x 2” MKT-5894N-A > edwardjones.com Chuck Mazac Financial Advisor 322 N Jefferson St La Grange, TX 78945 979-968-6373 Lisa Adamcik Sr Branch Administrator Bailey Grzyb Registered Branch Associate Chuck Mazac Financial Advisor

Money Matters | 17

Fayette Savings Bank

When your #1 priority as a bank is Customer Service, it’s very assuring when you win an award, voted on by the people of Fayette County for “Best Customer Service” – especially for THREE Years in a Row!

Fayette Savings Bank (FSB), in La Grange, Flatonia, Schulenburg and Weimar is proud and thankful to have won this award in the Fayette County Record’s “Best of Fayette” Readers’ Choice contest.

18 | Money Matters

Throw in the “Best Bank” award for the second year in a row, and FSB is obviously doing banking right in the public’s eye!

“In an age where banking and lending is becoming increasingly automated and less personal, we still place exceptional, personalized service as our top goal,” says Wade Mozisek, FSB President. “We have and will continue to constantly add and implement modern day banking technological products and services as well, to make it easier for our customers to bank from wherever they are.”

At Fayette Savings Bank, over 90% of current FSB employees graduated from a Fayette or neighboring county high school.

“This translates to a genuine caring for the people of our communities, and the communities themselves,” said David Zapalac, CEO – a 42-year FSB veteran. “Many were born here, raised here, went to school here. What better way to know the culture, be able to feel the pulse of the community, identify its needs, wants, desires.”

“Having great products and competitive rates is only a portion of the battle,” Mozisek said. “Hiring the right people is what has made FSB successful. We have a phenomenal collection of seasoned veterans, but have also been blessed with the addition of some young, talented individuals from our local areas – many who went away to college but decided to come back home and build a career here, raise their families here.”

“Banking can be a stressful task nowadays, especially with all the fraud, spam and schemes out there,” says Darlene Brothers, VP Deposit Services. “While we wish it wouldn’t happen, many times, we have assisted customers who fell victim to fraud. We sit down with the customer who is obviously distraught, and help mitigate the fraud, stop further damage, investigate the fraud, try to get restitution, etc. This is not the favorable side of banking, but it is rewarding when we can help the customer get through the unfortunate experience.”

Fayette Savings Bank further shows their commitment to community service by facilitating matching funds accounts for non-profits when tragedy strikes – i.e., Knights of Columbus Hall and Second Chance Emporium when flooded, and Queen of the Holy Rosary Church in Hostyn when it was destroyed by fire.

FSB also has a School Debit Card program. Customers pick their card and earn money for their school with every transaction in a donation from FSB. Participating schools are La Grange, Flatonia, Schulenburg, Weimar – public and Catholic schools.

“We want to be the bank our customers are proud to be a part of –we want our customers to be proud of our success and feel they are the reason for that success…because they are” Zapalac concluded.

All in all – Community Banking at its Best!

Fayette County Record Best of Fayette, Readers’ Choice Awards

La Grange Schulenburg Flatonia Weimar 2021, 2022

SERVICE 2020,

©The Fayette County Record

www.fayettesavingsbank.com

BEST BANK BEST CUSTOMER

2021, 2022

Money Matters | 19

A Q&A ABOUTRetirement Planning

Individuals need not look very far to be reminded of the importance of planning for retirement. Television ad campaigns touting the need to plan for retirement have been front and center for many years. Banks also heavily promote their retirement planning services to account holders. The emphasis financial firms and banks place on retirement planning underscores just how important it is for individuals from all walks of life to prioritize securing their financial futures.

Ad campaigns can make saving for retirement seem simple, but plenty of people may have questions about how to save for the days when they are no longer working.

WHY AND WHEN SHOULD I BEGIN INVESTING TO BUILD MY RETIREMENT SAVINGS?

It’s never too early to start saving for retirement. Young professionals may not be anywhere close to retirement, but that doesn’t mean they can afford to put off saving for the day when they call it a career. Much of that has to do with inflation. The rate of inflation varies, but it’s fair to assume that your cost of living will rise dramatically between your twenty-third birthday and your seventieth birthday. If you choose to simply save as opposed to investing that money, your money will not grow at a rate necessary to overcome inflation. Though there’s no guarantees with investing, traditional retirement investment vehicles have a proven track record of outpacing inflation. For example, Standard & Poor’s 500® (S&P 500) reports that individual retirement accounts (IRAs) grew by an average of 10.8 percent between 1971 and 2020. Over that same period, the U.S. Bureau of Labor Statistics indicates that the dollar had an average rate of inflation of 3.99 percent.

HOW CAN I SAVE FOR RETIREMENT?

Various investment vehicles can help people save for retirement. Many people utilize employer-sponsored 401(k) retirement plans. These allow individuals to

deposit money via pre-tax contributions deducted from their paycheck. For young people, enrolling in these plans as soon as they’re eligible can be a great way to begin building their retirement savings, and since many people contribute between 6 and 10 percent of their pre-tax earnings, their take-home pay will not be significantly different once they enroll. IRAs, pension plans, certain life insurance policies, and regular contributions to personal savings accounts are some additional aways to save for retirement.

HOW MUCH WILL I NEED TO SAVE FOR RETIREMENT?

No two people are the same, so there’s no simple answer to this question. Estimates about how much people will need in retirement range from 60 to 80 percent of their yearly income the year they stopped working full-time. A financial advisor can be a useful ally as people try to calculate how much they will need to save for retirement. However, the simplest answer to this common question is that there’s no such thing as saving too much money for retirement so long as saving does not adversely affect other areas of your life.

WHAT IF I NEED MONEY BEFORE RETIREMENT?

No law prohibits people from withdrawing funds from designated retirement accounts before they retire. However, there may be significant financial penalties and tax consequences if you do so. For example, the Internal Revenue Service allows penalty-free withdrawals from a 401(k) after an account holder turns 591⁄2. Withdrawals made before then could be subject to federal and state income tax and a 10 percent penalty of withdrawn funds. Individuals are urged to speak with a financial advisor about withdrawal guidelines and penalties prior to opening a retirement account.

Saving for retirement is vital and it’s never too early to begin investing in your financial future.

20 | Money Matters

Money Matters | 21

Land Bank Your Way to Wealth

Ninety percent of all millionaires become so through owning real estate. - Andrew Carnegie In the ever-changing world of investments, one asset class has stood the test of time and continues to shine bright: land. While stocks, bonds, and, more recently, cryptocurrencies may captivate investors’ attention, the age-old practice of investing in land remains an enticing option for those seeking stable returns and long-term wealth accumulation. In this article, we delve into the reasons why investing in land is a great strategy, and why they are choosing Fayette County as an exceptional area for such investments.

When it comes to real estate, the adage “they’re not making any more land” rings true. Unlike other investments that can be

by Brandon Schielack

manufactured or digitally created, land is a finite resource, making it inherently valuable. Investing in land offers numerous advantages, including a potential hedge against inflation, stable long-term appreciation, and diversification of investment portfolios. Franklin Roosevelt’s mantra: “Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”

One area that has caught the attention of seasoned investors is our area, Fayette County. Renowned for its scenic beauty, rich history, and strategic location, Fayette County provides a fertile ground for land investment. Its strategic location between Austin and Houston

22 | Money Matters

offers a perfect blend of rural charm and urban connectivity, making it a prime destination for both investors and residents.

Local investors and real estate professionals have long recognized the potential of Fayette and surrounding counties as an investment haven. One of the new developments Bubela Real Estate is representing is Borden Creek Ranch, just east of Fayette County. As one home builder who recently toured the ranch said, “You must see it to believe it. Truly a special place to call yours. It really is the hill country in Houston’s back yard.”

In addition to the region’s market resilience, Fayette County boasts a wealth of natural resources and diverse landscapes, making it an attractive proposition for various land uses. From sprawling ranches and farmland to picturesque properties and vineyards, the county offers a plethora of investment opportunities to cater to a wide range of investor preferences. Not to mention, it’s home to Round Top and The Antique Show two times a year which is now turning into a year-round retail destination.

Kayli Seitter, another local real estate professional, and listing agent for NearLake Views, a new development with two acre lots near Fayette Lake says, “Folk’s love to come to Northern Fayette County because its easy access from Highway 290 and they see the amount of investment the area is attracting. When people see an area being invested in, they know their money is well spent. It doesn’t hurt that Round Top is often referred to as the Aspen of Texas.”

The county’s favorable tax environment is another factor that draws investors to our region. Texas is known for its business-friendly policies and does not impose state income tax, which provides a significant advantage for investors.

As with any investment, it is essential to conduct thorough research and due diligence. Consulting with local experts and real estate professionals who possess in-depth knowledge of Fayette County’s land market can be invaluable in making informed investment decisions. They can provide guidance on property values, zoning regulations, and future development plans, enabling investors to make calculated choices and maximize their returns.

In conclusion, investing in land remains an attractive proposition for investors seeking stability, diversification, and long-term wealth accumulation. Fayette County, with its thriving economy, breathtaking landscapes, and favorable investment climate, stands out as a prime destination for land investment. The county’s unique blend of natural beauty, vibrant community, and strategic location between two major cities positions it an exceptional area for investors seeking to unlock the full potential of their capital. As Chip Bubela says ”It’s the San Fran Gold rush all over again, but this time it’s the Texas Land Rush.”

Written by Brandon Schielack - a real estate professional helping Fayette County area residents buy, sell, invest in and develop real estate.

Money Matters | 23

OPEN THE DOOR

OPPORTUNITY FOR GENERATIONS TO COME: The Power of Planned Giving

OF

24 | Money Matters

Planned giving is a philanthropic strategy that allows individuals to leave a lasting legacy by designating a portion of their assets or estate to charitable organizations. When directed towards a Community Foundation, this form of giving has even more power to make a profound and transformative impact that resonates for generations to come.

Community foundations like the Fayette Community Foundation (FCF) are uniquely positioned with experienced staff who possess deep knowledge of the local area’s needs and develop effective strategies to address them. They have expertise in identifying effective nonprofits, charitable programs, and public initiativesensuring that your charitable dollars are strategically invested in areas where they will make the greatest difference. By contributing to the Fayette Community Foundation through planned giving, donors help create a reliable source of funding for community projects, scholarships, grants, and other initiatives that foster longlasting positive change.

To ensure our local communities are stronger, safer, and vibrant for generations to come, Fayette Community Foundation is excited to launch The Key Society in 2023.

The Key Society is a giving circle made up of generous donors who have committed to leaving a portion of their estate, no matter the size, to the Fayette Community Foundation. These planned gifts ensure FCF continues to be the “KEY” that opens the door of opportunity, providing meaningful benefits to our community- now and in the future.

No estate gift is too small to leave a lasting impact. Individuals can become a Key Society member by simply naming Fayette Community Foundation as a beneficiary in their will, trust, or insurance policy. This form of philanthropy allows donors to shape the future of their community and be remembered for their generosity, compassion, and commitment to making a difference. Including Fayette Community Foundation in your estate plan has the potential to transform our local communities for generations, leaving a positive and indelible mark on society.

If you love our community and want to ensure it continues to thrive, or if you’ve already included Fayette Community Foundation in your estate plans, the Key Society is for you. Contact your Financial Advisor or email FCF Executive Director, Susannah Mikulin, at susannah@faycofoundation.com to learn how to become an official Key Society Member.

Money Matters | 25

Common investment terms to know

The importance of investing is undeniable. That value was especially apparent throughout 2022, when inflation took center stage. As the cost of living rises, investors can more capably handle that spike because they’ve been growing their money through various investment vehicles all along. With so much to gain from successful investing, novices may benefit from a rundown of common investment terms.

26 | Money Matters

• 401(k): A popular way to save for retirement, a 401(k) is an employer-sponsored retirement plan. Individuals with a 401(k) make pre-tax contributions during each pay period and some employers match these contributions up to a certain percentage. Money in a 401(k) can be withdrawn at any time, but there is a penalty on withdrawals made prior to the account holder reaching 591⁄2 years of age.

• Bear market: A bear market is a market in which stock prices sharply decline over a prolonged period of time. Bear markets may be inspired by an array of factors, including rising unemployment.

• Bonds: Bonds are a low-risk investment that attract novices who are not yet certain of their risk tolerance. Bonds are loans to governments and even corporations that pay interest to the individuals who invest in them.

• Bull market: The opposite of a bear market, a bull market refers to a market in which stock prices are rising.

• Diversification: Diversification is a savvy investment strategy in which investors spread out their investments so their portfolio is as diverse as possible. When diversifying, investors may invest in stocks, bonds, IRAs, a 401(k), and other vehicles.

• Dividend: A dividend is a payment made to a shareholder in a company.

• Individual retirement account (IRA): An IRA is a retirement account individuals open on their own. There are various types of

IRAs, and contributions to these accounts are post-tax.

• Market index: The Dow Jones Industrial Average (DJIA) is perhaps the most recognizable market index, though it’s not the only one. A market index such as the DJIA tracks the financial market by analyzing data from various companies.

• Mutual funds: Mutual funds are a popular way to invest. According to the investment experts at J.P. Morgan Asset Management, with a mutual fund, money is raised by an investment company and is then invested in a portfolio that includes stocks, bonds, options, commodities, or money market securities.

• Share: The online financial resource Mint notes that a share is a unit of ownership in a company or in an asset. Shareholders are eligible for benefits, including payouts, when a company makes money.

• Stock: Stocks are long-term investments that represent an ownership stake in a company. Most investors invest in common stocks, which are not subject to the same conditions as preferred stocks. Preferred stocks tend to be less volatile than common stocks, though that security also makes them less profitable when the stock performs well.

Knowledge of these basic investment terms can serve as a good foundation for novices who want to begin investing. As investors become more comfortable, they can expand their knowledge even further.

979.968.3136 | @NBTLaGrange | @nbtlagrange1888 You're more than a customer. At NBT, you're part of the Family. B U S I N E S S A N D P E R S O N A L B A N K I N G | L E N D I N G S O L U T I O N S | W E A L T H M A N A G E M E N T

Money Matters | 27

Diversifying Risk

As you approach retirement, it’s important to consider the risks associated with your portfolio. While it’s tempting to take on more risk in order to maximize returns, it’s important to remember that the higher the risk, the greater the potential for losses.

28 | Money Matters

by Bo Thibodeaux | Financial Advisor Community Financial Partners

When it comes to managing risk in your portfolio, diversification is key. By spreading your investments across different asset classes, you can reduce the risk of any one investment performing poorly. For example, if you invest in stocks, you can diversify by investing in different sectors, such as technology, healthcare, and energy. You can also diversify by investing in different countries, such as the United States, Europe, and Asia.

Another way to manage risk is to invest in lowcost index funds. Index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500. By investing in index funds, you can reduce the risk of any one stock performing poorly, as the fund is diversified across the entire index.

It’s also important to consider the time horizon of your investments. If you’re investing for the long-term, you can take on more risk, as you have more time to recover from any losses. However, if you’re investing for the short-term, you should take on less risk, as you don’t have as much time to recover from any losses.

Finally, it’s important to remember that risk is relative. What may be considered a high-risk investment for one person may be considered a low-risk investment for another. It’s important to consider your own risk tolerance and financial goals when deciding how to allocate your investments.

As you approach retirement, it’s important to consider the risks associated with your portfolio. By diversifying your investments, investing in low-cost index funds, and considering your own risk tolerance and financial goals, you can manage the risk in your portfolio and maximize your potential returns.

Securities and insurance products are offered through Cetera Investment Services LLC, member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered.

Investments are: *Not FDIC/NCUSIF insured *May lose value

*Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency. 500 West Travis, La Grange, TX 78956 979-206-2200

• A diversified portfolio does not assure a profit or protect against loss in a declining market

• It is not possible to invest directly in an index.

Money Matters | 29

30 | Money Matters YOUR LOCAL NEWSPAPER, TWICE EVERY WEEK 127 S. Washington St. La Grange, Texas 78945 979.968.3155 WWW.FAYETTECOUNTYRECORD.COM Reserve your spot in the 2024 Financial Planner today! FEATURING YOUR FAVORITE Financial Planners • Insurance Agents Lawyers • Accountants • and More! SECURE THE FUTURE WITH OUR ULTIMATE FINANCIAL PLANNER

fax 979.968.3084 |skana@verizon.net 615 W. Travis, Ste. 103 • P.O. Box 957 • La Grange, Tx 78945 ©The Fayette County Record 979.968.5527 Sandra E. Kana CERTIFIED PUBLIC ACCOUNTANT Complete Accounting Services Income Tax Preparation Financial Planning Client Representation Services Voted Best Accounting Firm in Fayette county! Personal Banking • Business Banking • Lending Solutions www.fayettevillebank.com Serving The Community For Over 100 Years Schulenburg 979.743.4576 Personal Banking, made more personal. ©The Fayette County Record Fayetteville 979.378.4261 La Grange 979.968.3200 Money Matters | 31

by Edward Jones

by Edward Jones