2024 State of Business

Survey & Report

Prepared by:

City of Fountain Economic Development Department Winter 2025 Edition

Executive Summary

As a customary process, the City’s Economic Development (ED) department hosts business visits/outreach engagement every couple of years to identify trends and areas in need of assistance for business. As part of COVID-19 pandemic economic recovery, the 2024 Business Survey represents the first coordinated touchpoint with the Fountain business community since 2019 and highlights the major themes which are present within business operations. The inaugural State of Business city report provides a summary snapshot of the findings and recommendations as to the activities, operations, and expressed challenges and needs of profile businesses in Fountain.

A primary theme is the difficulty of business entry in Fountain difficulties include lack of vacant space, aged building stock utility-served land sites, undeveloped land with costly offsite infrastructure improvements, limited access to capital/finance, complexities of dual-permitting through the City Planning and Pikes Peak Regional Building Department, and lengthy City land development or regulatory review processes.

A second major theme is the struggle for a quality workforce. This includes attracting quality labor to fill needed positions or retaining employees in current positions. This dilemma is caused by a combination of factors, including but not limited to the decline in workforce ready population, diminishing education and industry profiles, demand for more comprehensive job benefits, wage disparity in select positions, and/or general shift in worker mental health/work-life balance.

A third major theme is the lack of ready infrastructure (transportation and/or connectivity). This includes but is not limited to inadequate roadway / access conditions, limited broadband internet (particularly west of I25), insufficient wayfinding and business-oriented signage, and limited last-mile connections of freight by rail or air in supply chains. The lack of such connectivity for business shall include inhibiting business expansion

Methodology

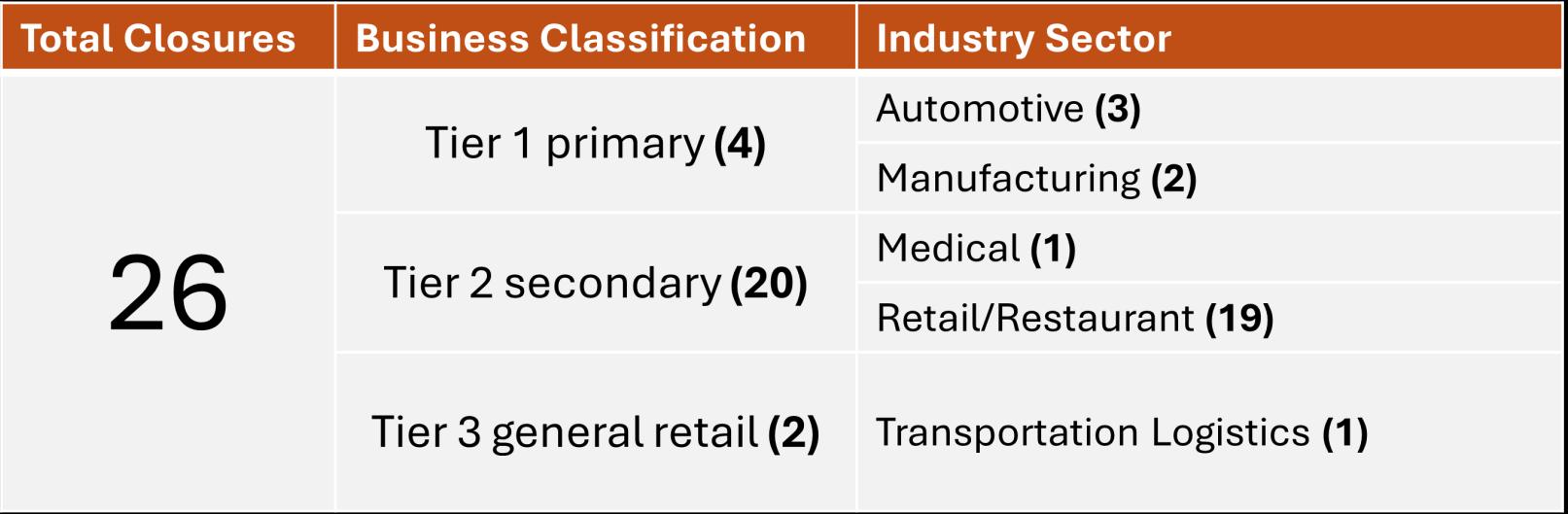

Economic Development conducted its annual business visit consultations between January 2024 and June 2024. A total of approximately 50 businesses were identified and outreached with in order to complete the 2024 business survey. Communication methods for contact included email, phone call, and impromptu drop-ins. In total, 31 business surveys were conducted; 13 businesses expressed a comfort level with operations (no priority needs identified), and approximately 6 businesses were unresponsive to outreach. The audience for the surveys were businesses classified as Tier 1 (primary employers) and Tier 2 (secondary employers). Primary employers are those defined as producing goods and/or services that are consumed both internal and external to the local economy. They are typically attributed with high-quality wages, larger capital investment, and significant sales revenue projections. Secondary employers are those defined as producing goods and services to serve the local community. They are typically comprised of Main Street, local small business, and quality of life providers.

Tier 3 is categorized as general retail and box brand retail businesses and Tier 4 is representative of independent contractors, entrepreneurial or home-based business. As Economic Development supports all business, it maintains a tailored focus towards Tier 1 and Tier 2 business; which consist of approximately 730 jobs and their operational impacts could be far –reaching on the local economy.

Data was initially collected during the interview and subsequently tabulated into a Microsoft Excel database. Field information consisted of the following:

Business characteristics (e.g. sector, years in business, legal structure, products & services, space occupancy/owner vs lease, employee count)

Business operations (e.g. expansion or downsizing, upgrades/capital expenditures, workforce hiring/ training, market draw (labor or customer base), marketing and relationships, infrastructure and utility needs)

City Business Profile

Business challenges (e.g. permitting, labor shortages, supply chains,

Six Business Districts

Bandley Dr

Gateway / Charter Oak (includes PPIR)

Mesa Ridge

N. US HWY 85/87

Olde Town

South Academy Highlands

170 Brick-and-Mortar Small Businesses

Tier 1 (Primary employers) = 22

Tier 2 (Secondary employers) = 42

Tier 3 (General retail) = 106

150+ independent contractors, entrepreneurial, or home-based

*Top Industry Employment Concentra-

* Includes Automotive Sales, Supplier, and Entertainment

Business Attrition

It is customary for a City’s business profile to change which may transpire due to a variety of influential factors. For a comparison perspective of the City of Fountain’s business industry profile in 2019 vs. 2024 using data from occupation / business license records, see the tables below:

The business vacancy is reflective of a quick tenant backfill as space becomes available in our City and/or new commercial development within the six business districts comes online for new occupancy.

As of June 2024, there is < 4% commercial vacancy in the office and retail real estate markets (per CoStar, aggregate by UCCS College of Business)

The Olde Town district has incorporated an Overlay District to address shared parking allowances, mixed-use occupancy, and adaptive land reuse policy to support business entry in the historic downtown of the City.

Emerging Industries

Survey Findings

& Logistics / Manufacturing Office / Professional Services

Retail / Restaurant

Hospitality / Lodging

Automotive / Supplier / Entertainment

Business Characteristics

New Businesses (0-3 years)

Adolescent Businesses (4-10 years)

Maturing Businesses (11-20 years)

Legacy Businesses (20+ years)

The largest industry sector composition is transportation & logistics / manufacturing at 29% (Tier 1). The smallest was hospitality / lodging at 9%. Note: this sector has shown a 30% growth rate since 2014 (now an emerging industry)

Just under half of businesses surveyed have been in business more than 20 years (i.e. legacy business), compared to one quarter having been in business less than 3 years (i.e. entrepreneurial)

Approximately 8 businesses employ more than 50 employees (Tier 1) with less than one third of all businesses surveyed have fewer than 4 employees.

The majority (55%) of businesses surveyed own their space (includes land and structure) while 40% lease their space.

Over one third of businesses surveyed operate out of a space under 3,000 sq. ft., while nearly one in eight businesses operate out of space greater than 50,000 sq. ft. and/or require high bay ceilings (i.e. Tier 1 and 3).

Recommendation: There are special needs on the full spectrum of a business’ life-cycle and property land use regentrification. Due to larger affiliates’ acquisition of small business, City should maintain strong relationships for industry and job preservation.

Business Operations

Survey Question: “Do you have any plans to expand / downsize / relocate your business? If so, what is your timeline?”

When asked about future business growth plans (both employee size and physical location), responses varied considerably. Nearly 30% of respondents stated they anticipate expanding in 10 years or beyond, while 20% stated that they desire to expand within the next 05 years. Among those who may expand, several stated that they own multiple locations from which they would use to grow out their operations. A handful expressed buy-out acquisition by larger corporate affiliates and over 20% own or have considered purchasing real estate adjacent to their existing business location for future expansion of business operations.

A smaller cohort of businesses expressed that they either have no intentions to expand or expect to downsize, 15% and 7%, respectively. Those few who suggested they might downsize (all legacy businesses) stated that they could benefit from business planning services or are looking to retire within the next few years.

Recommendation: Legacy businesses should be paid close attention to with respect to generation acquisitions with new job creation and/ or complete closure of operations with job losses. Due to the decades of legacy business operations and possible transitionof land use, there is an opportunity to explore Brownfields site-readiness funding for adaptive reuse or redevelopment potential of new business entry.

Survey Question: “Are you seeking any upgrades or anticipating future capital expenditures to your existing building or property? “

Responses to this question were generally lumped into three categories: business performed upgrades / incurred capital expenditures within the past 5 years (since COVID-19), business is seeking new upgrades / capital expenditures in the near future, or business is not seeking upgrades / capital expenditures at this time.

Approximately half of the businesses stated that they recently performed some type of facility upgrade or incurred a capital expense, including but not limited to MEP system, HVAC system, flooring, security system, appliance upgrades, or general interior finishes.

Under 30% suggested they are seeking new upgrades to their facility or have planned for a capital expense to include new building additions, decking or flooring, MEP systems, HVAC systems, appliances, hardware, or other retrofits. The remaining 20% indicated they are not seeking any facility upgrades or property-based capital expenditures at this time; primarily due to inflation.

Survey Question: “How far/where are your employees and customers traveling from?”

Businesses were asked to describe both the catchment area of their customer base and the workforce labor shed (i.e. how far their customers and/or employees travel to get to their place of business). Around half of the surveyed businesses responded to this question. The customer base for these businesses is vast, with many traveling from Denver metro, northern Colorado, and bordering states of Wyoming, Nebraska, Kansas, New Mexico, and some as far as Texas. The workforce labor shed (excluding Fountain proper and the greater Fountain Valley) was denoted by a majority of businesses as having to travel from either Pueblo or Colorado Springs, with a noticeable percentage deriving from rural eastern plains and outlying municipalities of Peyton, Calhan, Canon City, Penrose, and Castle Rock.

The two maps below illustrate the customer base catchment area (map 1) and the workforce labor shed (map 2).

Recommendation: There is a leakage opportunity to capture reciprocal business traffic and discretionary income generated by a wide labor shed/customer draw area (e.g. hotel stays, food and beverage sales, specialty retail). City should consider implementing select findings of the wayfinding signage program, as well as encourage co-op marketing programs and marketing collateral among businesses.

Map 1

Survey Question: “Do you have any workforce needs? What training and/or certifications do you offer to or require of your employees?”

When asked about workforce needs, the responses were wide-ranging. Roughly 20% addressed the question based on workforce productivity and morale, expressing frustration with the lack of strong work ethic and ability to retain employee numbers. The data supports the conclusion that a higher concentration of issues with workforce retention exist within in the retail / restaurant and hospitality / lodging sectors. However, there was no correlation found between employee size and workforce retention.

Alternatively, around 33% of businesses surveyed responded to the question based on the need to recruit new employees, either those actively seeking (open positions) or passively seeking (needed skill sets). Amongst the positions / skills being sought includes:

Retail sales reps

Customer service reps

Servers / line cooks

Service technicians / mechanics

Equipment operators

Veterinarian / dog groomers

Notably, these position vacancies are not exclusive to Fountain businesses. According to recent data (April 2024) from the Pikes Peak Workforce Center (aggregate by UCCS College of Business), four of the above-noted positions (retail sales reps, customer service reps, servers/line cooks, and service technician/mechanics) are in the list of top 10 Pikes Peak Region Job Postings. See table 1 below illustrating lower-end positions and table 2 for comparison with higher-end positions.

Recommendation: The Pikes Peak Workforce Center (PPWFC) is a universal free workforce service in El Paso County offered to both employers and individuals seeking work. There is an opportunity to cater to the specific needs of industry through the coordination of a “Fountain” Job Fair in 2025.

Table 2

Table 1

The other responses to the question related to training and certifications. Around 85% responded that they offer or require some form of training or certification on-the-job. Below is a list of training methods, programs, and licensures/certifications offered or required by profile businesses.

Recommendation: All training curriculum is an eligible tax rebate item under the Pikes Peak Enterprise Zone designation per the City of Fountain with El Paso County and the State of Colorado. The City should maintain regular communications with eligible businesses to assure compliance with program pre-certification requirements and annual renewal procedures.

Survey Question: “What infrastructure, transportation, and/or utilities are critical to your business’ operations? How do you perceive the availability and/or quality of these assets?

Businesses were asked to share the impact that various types of infrastructure have on their operations. Overall, the majority of businesses identified highway access (i.e. proximity to I-25 exits) and favorable utility rates (electrical and water) as positive factors.

In addition, the City has taken proactive steps under its Strategic Plan to address business and/or public safety conditions. Below is a current list of identified infrastructure, transportation, and utility concerns captured by business:

Underperforming or restricted roadways and poor parking lot conditions

Aging, under-sized, or limited capacity water, electric, or gas service lines for redevelopment

Lack of wayfinding direction signage and/or business-oriented signage for customers

Lack of access or interruptions to high-speed commercial broadband internet

Limited options for first or last-mile connections of freight by rail or air in supply chains

A means of irrigation in right-of-way for district landscaping or property beautification

Recommendation: Several forms of infrastructure (i.e. commercial signage, irrigation, parking lots), may be addressed through an amendment to the City’s Town + Aesthetics Design Guideline Incentive pilot program as alternative types of eligibility for weighted criteria metrics of determination. A proposed 2025 amendment could address concerns of mutual interest between City and business.

Business Challenges

Survey Question: “What are some current obstacles or impediments to your business’ success?”

The question on business obstacles or impediments was intended to be open ended, prompted by several examples including potential labor shortages, supply chain issues, and/or cash flow deficits. The resulting responses again were wide-ranging, but thematically can be categorized into the following subject areas, see pie chart below.

Infrastructure Concerns

(note: businesses responded to multiple subject areas, thus total % shown is based off 31 business surveys, rather than the sum of responses)

Underperforming or restricted roadways and parking lot conditions (potholes, etc.)

Both physical hazard to employees and deterrent to customer base

Lack of wayfinding direction and business-oriented signage (HWY marquee signs)

Impacts customer volumes and subsequent cash flows revenues

Contributes to poor public awareness of existing businesses in the City

Inaccessibility to and/or lack of critical utility infrastructure (water, broadband)

Slows down/limits operational capacities

A handful of Tier 1 businesses responded positively to potential use of freight rail for supply chain and product service delivery; Further positive reception to Information on transportation improvements/master plans at the local municipality or

Limited options for first/last-mile freight service delivery by rail or air in supply chains

Land Development Concerns

Cautious to proceed in the City/PPRBD development review process

Experience with lengthy timelines and high $$ expenditures

Regulatory / setbacks / encumbrance limitations (e.g. flood zones, utility easements)

Delays in business licenses application, review, approval processes

Impacts supply vendors relationships or insurance renewals to business operations

Recommendation: Under City Council’s Strategic Plan objectives, in-house departments should work collectively to address business procedures and recommend improvements to the submittal/ review processes to address inefficiencies and adjust responsiveness in the shifting dynamics of business.

Public Safety Concerns

Roadway construction impediments (sightline and drive access impairments)

Improve business communications due to lack of adequate notice of disruptions (CDOT, PPACG, or CoF)

Trash and debris/smells/weeds (property caretaking concerns)

Creates discord, broken rapport between businesses

Isolated homeless population issues (camping on business property, especially near Fountain Creek) and how to properly address

Workforce Concerns

Struggle to recruit and/or retain employees

Tier 1 primary employers – technical / mechanical / trade industry positions

Tier 2 secondary employers – retail sales, customer service, auto technicians, and food accommodations positions

Low productivity / morale / work ethic / mental health (will quit during training or no-show ghosting)

Dissatisfied with limited job benefits

Financial Concerns

Lack of cash flows and business planning

Early start-up or unable to sustain (primary entrepreneurial and early-stage Tier 2 businesses)

Vague customer forecasting or marketing the business

Lack of access to capital or financial relationships

Non-certified SBA lender or commercial financial portfolio banking affiliate located within the City or Greater Valley

Unfamiliar with statewide programs (C-PACE and/or Colorado Start-Up Loan Fund)

Costly facility and/or equipment upgrades

Aged building stock (>50YRS which requires reoccurring costly upgrades for energy/climate efficiency, environmental hazards, or adaptive reuse modifications )

Assistance with costly offsite infrastructure burdens (e.g. CDOT drive access, stormwater detention, transportation impact fees)

Several businesses noted positive public safety improvements since 2019 (particularly those along Bandley Drive and Charter Oak Ranch Road), with faster response times by PD/ City Neighborhood Services and a reduction in property theft/vandalism.

Four surveyed businesses expressed appreciation and participated in the City’s Business Impact Assistance Program (BIAP) grant awarded funding during the COVID-pandemic era. ($154,883.97 funds in total)

Expansion/Retention Concerns

Very limited land/space available

Lack of entry spec space product at < 4% vacancy

Lack of utility served land sites

Undeveloped land with offsite infrastructure improvements

Supply chain shortfalls

Lack of complementary industry partners (suppliers/distributors of materials primarily Tier 1 businesses); difficulties recruiting due to multitude of factors

Land Development complexities (see Land Development items)

Marketing / Exposure Concerns

Lack of marketing support (primarily for entrepreneurial Tier 2 businesses)

Disconnected to larger marketing assistance organizations (e.g. SBDC, Visit CO)

Low visibility and/or acknowledgment of presence (see Infrastructure/Wayfinding items)

2024 is the first year of external agencies momentum to engage with businessincludes El Paso County EcoDev & Housing, Pikes Peak SBDC, and Fountain EDC Business Lecture Series Speakers

2024 saw the enactment of Olde Town District proclamation for continued business awareness and strong cross marketing collaboration between local business districts

Note: Strong referrals exist between the Gateway and Olde Town business districts to build upon with all 6.

Prospects/ Site Readiness

In addition to the customary business retention and expansion (BRE) activities, the Economic Development department works with its regional partner, the Colorado Springs Chamber and EDC (CSCEDC), on primary employer (Tier 1) business attraction. Per the lead agency in the region, ED staff shall receive requests for information (RFI) on prospect businesses from the CSCEDC to review business criteria with an opportunity to submit available/eligible land sites.

The following information summarizes the 2024 RFI pool i.e. industry sectors, investments, and requirements/ criteria and the City’s response to match site readiness, a submission review, and factors keen to decision making.

Business Attraction Overview

City ED staff received 12 RFIs in 2024. The business prospects were composed of entirely industrial sector businesses. The potential cumulative fiscal and economic investments which may have been realized by the City range between $3.2 to 3.35 billion in capital for facility and/or infrastructure improvements, and roughly 3,600 new jobs providing mid high salary attainment.

Typically, a RFI contains a very wide range of land/building and utility requirements and specifics as to the end-user

Land/building factors examined included parcel acreage, occupancy type, site location, proximity to transportation, land zoning, building size, minimum height/clearance, and

Utility requirements included water, electricity, wastewater, gas, and telecommunications . As a cityowned Water and Electric utility it is keen to maintain favorable commercial rates and high redundancy standards of service for business attraction. See table 1 for

Per a Water Adequacy Policy adopted by the City in November 2024, site readiness/land availabilities are constricted at this time.

Table 1 Example of Prospect Requirements

Areas of Recommendation

During an October 2024 Economic Development Commission general meeting, a join work session was held with City Council and the Public to identify areas of need and procedural policies that the City could lend resources of support on behalf of business development.

Listed below are the Top 4 Recommendations as a guide to city lead resources for business alignment measures in 2025 and beyond:

• Identify “Business Point-of-Entry” struggles to delineate a Clear Process and/or Business Compliance coaching materials. To include audience members consisting of landlords, rental tenants, and new build developers.

• Cultivate a “Shop Local” community which may be devised from a City Awareness Business District Campaign, phased-in Wayfinding Signage Plan implementation, and/or a Business-2-Business Referral Program. (tied ranking)

• Seek “Creative Resources” to identify a means of funding assistance to address parking lot conditions, lack of directional signage, and/or enhance properties’ curb appeal/ beautification. A conceptual approach to build upon the Olde Town district pilot incentive program for citywide replication conditions. (tied ranking)

• Attract a “Workforce Readiness” pipeline for business recruitment and job creation. Support and coordinate an inaugural Fountain Job Fair (with additional partnership resources) to build awareness of local jobs, match apprenticeship opportunities, and attract talent for business operations.

Additional Resources

Challenges:

Business Perception Survey (May 2024)

The State of Colorado completed its Business Perception Survey under the Governor’s Office of Recovery in response to the COVID pandemic. There are similarities among the local and state business conditions, the highlights are listed below:

Business Costs: Lease space & facilities, utilities, and other costs associated with operating your business

Workforce: Difficulties in finding skilled talent, education gaps, innovation, and a lack of affordability/ availability of homes to rent or purchase

Cost of Living: high costs of goods, taxes, and inflation are cited as significant issues for business

Government-Related Costs: Businesses express frustrating with overregulation, permit fees, and government intervention

Positives:

Quality of Life and Local Atmosphere

Reputation of Business and Economic Climate among industry leaders

Economic Support/ Incentives for tax relief or working capital for growth and development

Business climate and economic outlook overall a mix of optimism about a community’s potential

Comprehensive Economic Development Strategy (August 2024)

Effective 2023, the Pikes Peak Council of Government (PPACG) completed a tri-county Comprehensive Economic Development Strategy (CEDS) to which the City of Fountain was an active participant to aide in business retention and expansion and quality of life amenities for workforce attraction. The inaugural regional strategy identifies areas of shared visions, recommendations of policy actions, climate resiliency measures, and goals/metrics for sustainable growth within communities.

The Vision Statement evokes the Pikes Peak region to be a welcoming, dynamic, creative, and inclusive community fostering economic vitality, offering and abundance of healthy recreational opportunities, nurturing an elevated quality of life, providing affordable and attainable housing solutions, and education systems that excel to further economic opportunity for all.

Please visit the CEDS published online at: Comprehensive Economic Development Strategy for the Pikes Peak region – Pikes Peak Area Council of Governments (ppacg.org)

2024 Colorado Challenge Accelerator Program (June

Downtown Colorado Inc completed the Fountain Findings Report as a byproduct of the City’s participation in the Colorado Challenge Accelerator Program.

The Program was geared towards identifying catalyst sites, assessing the City’s capacity index, and driving awareness of project feasibility variables.

The Report is the culmination of 6+ months of analysis, stakeholder input, and expert insight which serves as a template guide for future commercial redevelopment and/or an accelerator to underperforming opportunity sites in Fountain.

A list of recommended actions was prepared based on short term (0-6 months), midterm (1-3 years), and long-term (3-5 years) feasibility.

Several of these recommendations may have an impact on enhancing business activities or may address aspects identified within the 2024 State of Business Report.