6 minute read

Does Avatrade Have Leverage

by ForexMakets

Does Avatrade Have Leverage

Forex trading is all about maximizing opportunities. One of the most powerful tools traders use to amplify their trades is leverage. But when it comes to choosing a broker, knowing whether that broker offers suitable leverage options can make or break your trading strategy. So, does Avatrade have leverage? Absolutely — and in this detailed guide, we’ll break down everything you need to know about Avatrade leverage: how it works, its pros and cons, and how you can use it to your advantage.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

✅ This is the ultimate deep-dive for traders who want to master leverage with Avatrade and open their trading accounts with confidence.

1. What is Leverage in Forex Trading?

In simple terms, leverage allows traders to control larger positions with a smaller amount of capital. For example, a 1:100 leverage ratio means that for every $1 of your own money, you can control $100 in the market.

It’s like using a magnifying glass on your trades — small moves become amplified. This can lead to larger profits, but also increased risk. That’s why choosing a broker with flexible and transparent leverage options is essential.

2. Does Avatrade Have Leverage?

Yes, Avatrade does offer leverage. In fact, leverage is a core feature of their trading platform. Depending on your region, regulation, and the asset class you're trading, the available leverage may vary.

✅ Avatrade provides leverage to help traders make the most of market movements, while still adhering to global regulatory guidelines.

3. Avatrade Leverage by Account Type

Avatrade offers multiple account types, and leverage options are tailored based on the account and jurisdiction:

Retail Traders in Europe/UK: Leverage is capped due to ESMA regulations:

Forex pairs: up to 1:30

Indices and commodities: up to 1:20

Cryptocurrencies: up to 1:2

International Retail Traders:

Forex: up to 1:400

Commodities and indices: up to 1:100

Stocks: up to 1:20

Professional Clients:

Forex: up to 1:400 or more depending on region

❌ Note: If you're a retail trader under strict regulation, you cannot increase your leverage unless you qualify as a professional client.

4. Leverage on Different Instruments with Avatrade

Avatrade’s leverage settings differ based on the instrument class:

Major Forex Pairs: up to 1:400

Minor & Exotic Pairs: typically between 1:50 and 1:200

Indices: up to 1:100

Commodities: up to 1:200

Cryptocurrencies: up to 1:20

Stocks & ETFs: up to 1:20

✅ This variety allows traders to customize strategies across different markets.

5. Avatrade Leverage vs Other Brokers

When comparing Avatrade leverage to other top brokers, several strengths stand out:

Higher leverage for international clients

Transparent tiered leverage model

Regulatory compliance with local limits

Avatrade holds its own against other major brokers such as Pepperstone, XM, or FBS when it comes to offering competitive leverage, especially outside the EU/UK.

6. How to Use Leverage Wisely on Avatrade

To succeed with Avatrade leverage, it's essential to:

Start with small lot sizes and scale gradually.

Use stop-loss orders religiously.

Trade during high-liquidity sessions.

Avoid using maximum leverage on volatile assets like crypto.

Monitor margin requirements and account balance regularly.

Discipline is key when using leverage to avoid margin calls or stop-outs.

7. Pros and Cons of Avatrade Leverage

Pros:

✅ High leverage options for international clients

✅ Variety across asset classes

✅ Easy leverage adjustment via platform

✅ Strong education to support leveraged trading

Cons:

❌ Retail clients in Europe face tight limits

❌ High leverage increases risk of large losses

❌ Crypto leverage is capped at 1:2 for regulated clients

8. Risk Management with Avatrade Leverage

Using leverage without a plan is like driving without brakes. Here’s how to manage your risk effectively:

Use stop-loss and take-profit tools

Always calculate your risk-reward ratio

Use Avatrade's risk management tools like AvaProtect

Avoid overleveraging during major news events

✅ Avatrade’s risk tools make it easier to control downside exposure.

9. How to Change Your Leverage Setting on Avatrade

Adjusting leverage with Avatrade is straightforward:

Log in to your Avatrade account

Navigate to the account settings section

Select “Change Leverage”

Choose the preferred level based on available limits

Confirm the change

⚠️ Some changes might require support approval, especially in regulated regions.

👉 See more: How To Change Leverage on Avatrade

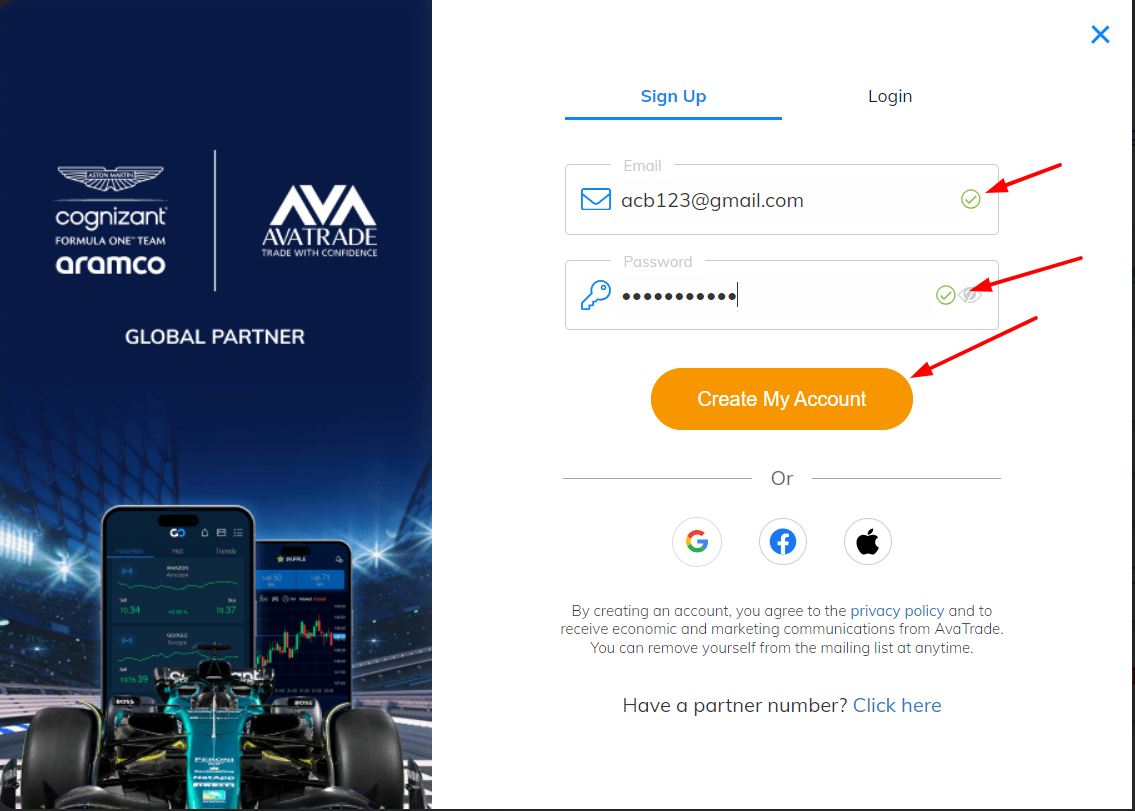

10. How to Open an Avatrade Account

Opening an account to access Avatrade leverage options is simple:

Click “Register” and fill in personal info

Verify identity documents (KYC process)

Fund your account using card, wire, or e-wallet

Start trading with your preferred leverage!

✅ It takes just minutes to set up and begin leveraging your trades.

11. Why Choose Avatrade for Leveraged Trading?

There are many reasons why traders worldwide trust Avatrade:

Regulated in multiple jurisdictions

User-friendly platforms (MetaTrader, AvaTradeGO)

Competitive spreads and leverage

Negative balance protection

Excellent educational content and tools

Avatrade leverage gives you the flexibility and power to amplify your trading — responsibly and efficiently.

12. Advanced Tips for Trading with Avatrade Leverage

Use multi-timeframe analysis to identify higher-probability setups

Leverage economic calendar insights before high-volatility events

Combine low-leverage scaling strategies for long-term trades

Trade with correlated assets to diversify risk

Use demo accounts to test strategies before applying high leverage

Professional-level strategies + smart leverage = consistent results.

13. Frequently Asked Questions (FAQs)

1. What is the maximum leverage Avatrade offers?Up to 1:400 for international clients on major forex pairs.

2. Is Avatrade leverage adjustable?Yes, traders can adjust leverage in the account settings.

3. Is leverage available on cryptocurrencies?Yes, but it’s limited to 1:2 for regulated clients.

4. How does leverage affect my margin?Higher leverage reduces margin required per trade but increases risk.

5. Can I change leverage after opening a trade?No, changes apply only to new trades.

6. Is there negative balance protection on Avatrade?Yes, especially for retail clients under regulation.

7. Does Avatrade offer educational tools for leverage?Yes, including webinars, videos, and articles.

8. What platform can I use for leveraged trading with Avatrade?MetaTrader 4/5, AvaTradeGO, and WebTrader.

9. Can I apply for professional status for higher leverage?Yes, but you must meet Avatrade’s eligibility criteria.

10. Is high leverage recommended for beginners?Not usually — beginners should start with lower leverage.

Ready to unlock the full power of your trades?

✅ Open your account with Avatrade today and experience the flexibility of professional-grade leverage, secure platforms, and world-class support.

Don’t just trade — trade smarter with Avatrade leverage!

💥 Read more: