6 minute read

How To Change Leverage on Avatrade

by ForexMakets

How To Change Leverage on Avatrade

Changing leverage is one of the most powerful tools traders have when it comes to risk management and strategy optimization. Whether you're a seasoned trader or just starting your journey, understanding how to change leverage on AvaTrade can significantly impact your trading performance, capital efficiency, and overall success.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

What Is Leverage in Forex Trading?

Leverage is a financial tool that allows traders to open positions larger than their actual account balance. In Forex trading, leverage is expressed as a ratio, such as 1:100, 1:200, or even 1:500, depending on the broker.

For example, with a 1:100 leverage, you can control a $100,000 trade size with only $1,000 of your own capital.

Higher leverage means greater market exposure, but also greater risk.

The use of leverage enables traders to increase their potential profits—but also magnifies potential losses. This is why it's crucial to understand how to manage and change leverage on AvaTrade effectively.

How Does Leverage Work on AvaTrade?

AvaTrade is a globally recognized, regulated broker that offers competitive leverage across a wide range of instruments, including:

Forex pairs (major, minor, exotic)

Indices and commodities

Stocks and cryptocurrencies

Leverage levels on AvaTrade depend on:

Your account type (retail or professional)

The regulatory jurisdiction (e.g., EU, UK, Australia, South Africa, etc.)

The instrument traded

For example:

Retail traders under ESMA regulation may get leverage up to 1:30 for Forex majors

Traders under FSCA or ASIC regulation may access leverage up to 1:400 or 1:500

✅ AvaTrade provides flexible leverage, but it must be manually adjusted through the client portal or via customer support.

Why You May Want To Change Your Leverage on AvaTrade

There are several strategic reasons traders might want to change leverage on AvaTrade:

Risk Adjustment: Reduce exposure during high-volatility periods

Capital Preservation: Lower leverage for longer-term trades

Maximize Returns: Increase leverage for short-term, high-probability setups

Align with Strategy: Different strategies (scalping vs swing) need different leverage levels

Regulatory Compliance: Your account might need adjustment due to regulatory updates

Account Growth: As your capital increases, you may want to reduce risk per trade

Each trader's situation is unique, and understanding when and why to adjust leverage is critical for success.

Steps to Change Leverage on AvaTrade

Changing leverage on AvaTrade is simple but requires careful attention. Here is the step-by-step guide:

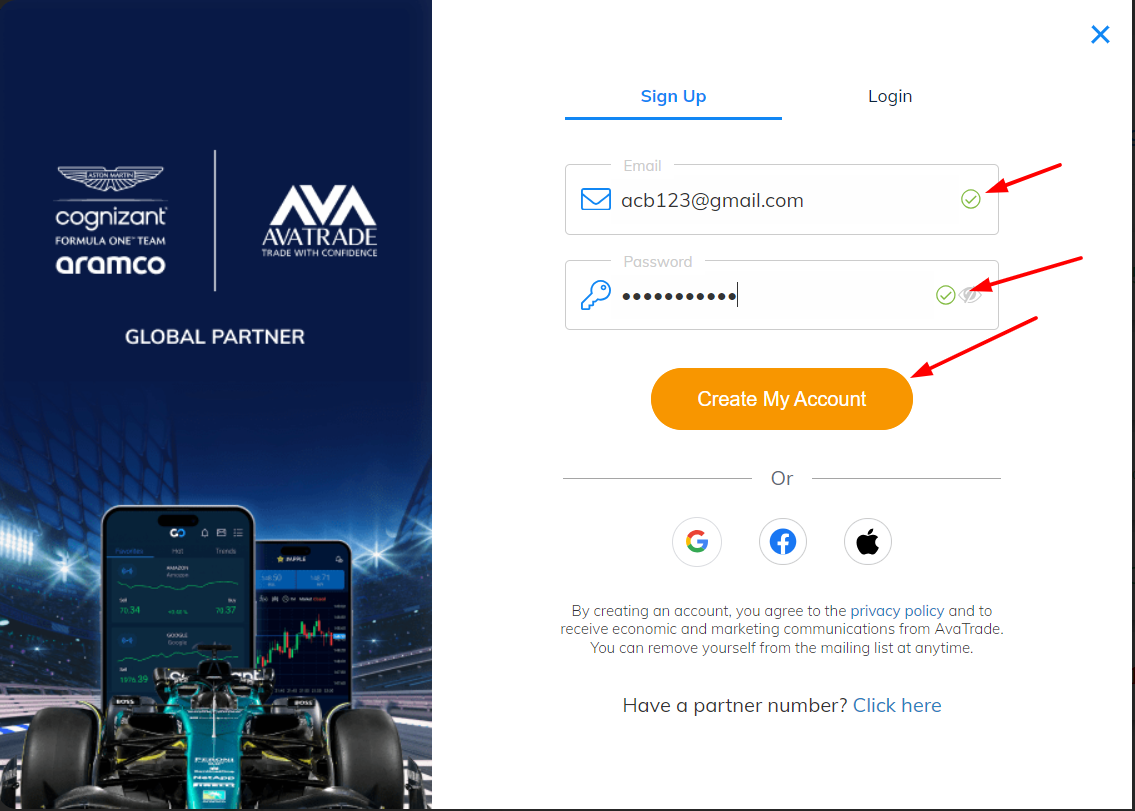

Log into Your AvaTrade Account

Use your registered credentials to access the client portal.

Navigate to the Account Settings

Look for "Account Details" or "Trading Preferences."

Choose the Relevant Trading Account

If you have multiple accounts, select the one you wish to modify.

Click on Leverage Settings

You will see available leverage options based on your region and account type.

Select Desired Leverage

Examples: 1:30, 1:100, 1:200, 1:400

Submit and Confirm Changes

Review your selection carefully before submitting.

Contact Customer Support (if required)

For some regulated regions, you may need to verify or request changes via support.

✅ Your leverage change will usually take effect within minutes during business hours.

Common Mistakes Traders Make When Changing Leverage ❌

While adjusting leverage is simple, here are some common mistakes to avoid:

Increasing leverage without adjusting stop-loss: Leads to large losses

Choosing maximum leverage recklessly: Especially with volatile assets like crypto

Ignoring margin requirements: Higher leverage decreases required margin, but increases liquidation risk

Failing to test changes on a demo account

Making changes based on emotions: Reacting to short-term market swings

Changing leverage should always be a calculated decision, not a reaction.

How To Choose The Right Leverage Setting ✅

Finding the right leverage is a balance between risk and reward. Here's how traders can approach it:

Beginner Traders: Start with lower leverage (1:30 - 1:50)

Experienced Traders: Can use 1:100 or higher based on strategy

Scalpers: Often prefer higher leverage (1:200+), but need strict discipline

Swing Traders: May use lower leverage (1:30 - 1:100) to hold positions longer

Day Traders: Typically use moderate leverage (1:50 - 1:200)

Use a risk calculator to test position sizes and potential drawdowns before modifying leverage.

✅ Always align leverage with your trading strategy and risk appetite.

Risk Management Tips When Adjusting Leverage

Proper risk management can make or break your trading career. When adjusting your leverage on AvaTrade, follow these tips:

Use stop-loss orders consistently

Risk no more than 1–2% of your capital per trade

Backtest your strategy using various leverage levels

Monitor margin level (%) to avoid margin calls

Avoid trading large lot sizes right after increasing leverage

Reassess leverage periodically based on market conditions

Real-World Scenarios: Leverage in Action

Let’s explore two practical examples of how leverage changes impact trading:

Scenario 1: Conservative Swing Trader

Account size: $5,000

Strategy: Hold trades for days/weeks

Leverage: 1:50

Risk per trade: 1%

Typical outcome: Lower stress, lower drawdowns, stable growth

Scenario 2: Aggressive Intraday Scalper

Account size: $5,000

Strategy: Trade 5–10 times per day

Leverage: 1:400

Risk per trade: 0.5%

Typical outcome: Higher potential returns, but risk of fast losses if undisciplined

Each trader must assess their comfort zone and objectives before applying leverage changes.

Marketing Call: Ready to Maximize Your Trading Power?

If you're ready to elevate your trading game, it's time to change your leverage on AvaTrade and unlock your full potential.

✅ AvaTrade offers world-class leverage flexibility, lightning-fast execution, and regulated safety.

Whether you're building a conservative portfolio or executing high-frequency strategies, AvaTrade empowers you with the right tools.

👉 Don’t wait—log into your AvaTrade account today and optimize your leverage for success.

Your trading journey deserves the best. Experience the power of choice, precision, and control—only with AvaTrade.

Frequently Asked Questions (FAQ)

1. Can I change leverage anytime on AvaTrade?Yes, but changes are subject to regulatory limits and may require support approval in certain regions.

2. Does changing leverage affect my open positions?No, existing positions typically remain unaffected. New leverage applies to future trades.

3. What is the maximum leverage AvaTrade offers?Up to 1:500 depending on your account type and jurisdiction.

4. Is high leverage better for small accounts?Not always. It increases exposure but also risk. Use with proper money management.

5. How often should I review my leverage?At least quarterly, or whenever your trading strategy changes.

6. Can I change leverage on the AvaTrade app?In most cases, leverage adjustments are made via the web portal. Contact support if unsure.

7. What happens if I exceed my margin after changing leverage?You may face a margin call or automatic position closure. Monitor margin levels closely.

8. Is leverage available on all AvaTrade assets?Most, but not all. Some instruments have fixed leverage or caps due to regulation.

9. Do demo accounts support leverage changes?Yes, you can test different leverage levels in demo mode to practice strategies safely.

10. Is AvaTrade a good broker for using leverage?Absolutely. AvaTrade combines competitive leverage with strong regulation and user-friendly platforms.

Master your leverage. Master your strategy. Master the markets—only with AvaTrade.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

💥 Read more: