7 minute read

Does Avatrade Have Futures

by ForexMakets

Does Avatrade Have Futures

Are you exploring Futures trading and wondering if AvaTrade is the right platform for you? You’re in the right place. In this comprehensive, in-depth, and easy-to-understand guide tailored for traders of all levels, we’ll break down everything you need to know about AvaTrade Futures, including what they offer, how they work, and how you can leverage them for strategic gains in the Forex market.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. What Are Futures Contracts?

Futures are standardized legal agreements to buy or sell a specific asset at a predetermined price at a specified time in the future. They are popular among traders for speculation, hedging, and portfolio diversification. These contracts are traded on regulated exchanges and cover a wide range of underlying assets such as commodities, indices, currencies, and more.

In the Forex and CFD trading world, futures provide a way to speculate on the future price movement of an asset without owning the underlying instrument. This is perfect for traders who want to engage in short-term trading strategies with leverage.

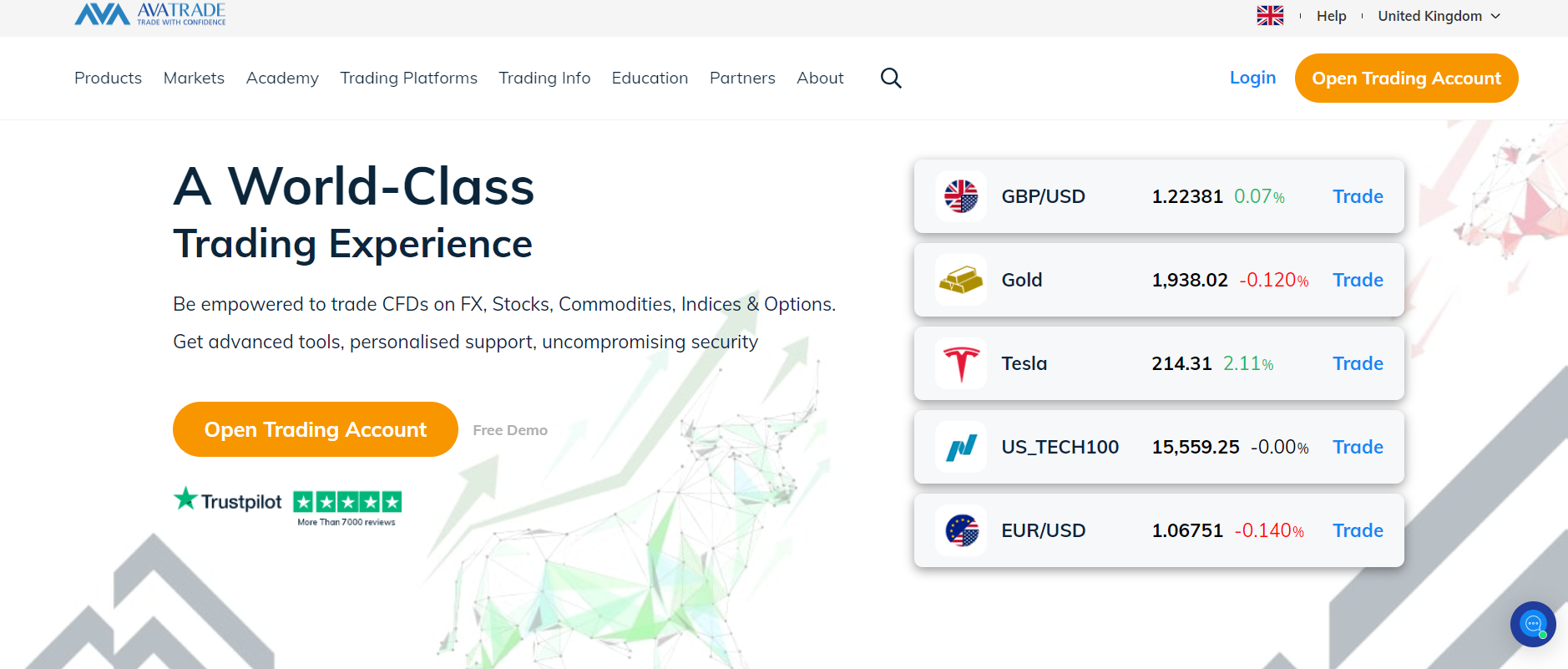

2. Overview of AvaTrade as a Broker

AvaTrade is a globally recognized online broker established in 2006. With over a million registered users and a presence in more than 150 countries, AvaTrade is known for its regulatory compliance, user-friendly platforms, and broad selection of trading instruments.

Key AvaTrade features include:

Regulated in multiple jurisdictions

Offers CFDs on Forex, Stocks, Indices, Commodities, and more

Advanced platforms like MetaTrader 4, MetaTrader 5, WebTrader

Educational resources for all levels of traders

AvaTrade’s mission is to make trading accessible, secure, and profitable for everyone. But the burning question remains…

3. Does AvaTrade Have Futures? – Direct Answer

Yes, AvaTrade offers Futures trading, but through CFD (Contract for Difference) instruments rather than traditional exchange-traded futures contracts.

This means you are trading on the price movement of Futures rather than buying the Futures contract itself.

✅ You can trade Futures on indices, commodities, and bonds via AvaTrade’s CFD model, which gives you access to leverage, short-selling opportunities, and 24/5 market access.

This makes Futures trading at AvaTrade:

More accessible

More flexible

Lower-cost due to no exchange fees

4. Types of Futures AvaTrade Offers

AvaTrade provides CFD access to the following Futures types:

Commodity Futures – Crude oil, natural gas, gold, silver, and agricultural products

Index Futures – S&P 500, Nasdaq, FTSE 100, DAX 30, and more

Bond Futures – U.S. Treasury Bonds, Euro Bunds

By trading these CFDs, traders can benefit from price volatility without holding physical commodities or owning a futures contract on an exchange.

5. How to Trade Futures with AvaTrade

To trade Futures with AvaTrade, follow these steps:

Open a trading account with AvaTrade

Verify your identity (KYC process)

Fund your account (bank transfer, credit/debit card, e-wallets)

Choose your platform (MT4, MT5, WebTrader)

Select a Futures instrument under the Commodities or Indices section

Analyze the market using AvaTrade’s tools

Place your CFD trade (long or short)

Manage your position using stop-loss, take-profit, and trailing stops

💥💥💥 If you do not have an Avatrade account, please: 👉 Open An Account or 👉 Go to broker

6. Key Benefits of Futures Trading at AvaTrade

Why should you consider AvaTrade for Futures trading?

✅ Here’s what sets them apart:

Leverage options to amplify profits

Tight spreads and no commissions

Negative balance protection for risk management

Fast execution speeds for real-time opportunities

Award-winning platforms with superior charting tools

Whether you're a scalper, swing trader, or long-term investor, AvaTrade gives you the tools and market access needed to capitalize on price movements.

7. AvaTrade vs. Other Brokers for Futures

When comparing AvaTrade to other brokers in the Futures space, here’s how it stands:

Offers CFDs on Futures instead of direct Futures – ✅ Easier to access

No exchange fees – ✅ Cost-efficient

Regulated globally – ✅ Higher trust

Strong educational platform – ✅ Great for beginners

Limited to certain Futures assets – ❌ Not for exotic Futures seekers

8. Trading Tools and Platforms for Futures on AvaTrade

AvaTrade supports several robust trading platforms ideal for Futures CFD trading:

MetaTrader 4 – Great for technical analysis

MetaTrader 5 – Supports more Futures instruments

AvaTradeGO – Mobile-friendly and intuitive

WebTrader – No download required

Additional tools:

Economic Calendar

Technical indicators and expert advisors

Risk management tools

9. Regulatory Framework and Safety of Funds

✅ AvaTrade is fully regulated in multiple jurisdictions:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

FSA (Japan)

BVIFSC (British Virgin Islands)

All client funds are held in segregated accounts, ensuring the safety of your trading capital. AvaTrade also offers negative balance protection, shielding you from losing more than your deposit.

10. How to Open a Futures Trading Account with AvaTrade

Follow these quick steps to get started:

Visit the AvaTrade homepage

Click “Register Now”

Enter your personal details and trading experience

Complete KYC document verification

Fund your account with as little as $100

Start trading Futures CFDs on your chosen platform

11. Marketing Benefits and Promotions AvaTrade Offers

AvaTrade loves rewarding new and loyal clients.

Here’s what you might get:

✅ Welcome bonuses (depending on region)

✅ Referral programs with cash rewards

✅ Trading contests and prizes

✅ Loyalty programs with rebates

All these make AvaTrade not just a trading platform but a rewarding ecosystem.

12. Tips for Trading Futures as a Beginner

If you’re just starting out:

Start with a demo account to test strategies

Use stop-loss and take-profit settings to manage risks

Focus on 1-2 markets initially

Follow global economic news

Never over-leverage – it’s a double-edged sword

13. Risks of Trading Futures at AvaTrade

❌ Like any leveraged trading, Futures trading is risky.

Risks include:

High market volatility

Slippage during major events

Emotional trading under pressure

Lack of understanding of margin/leverage

Always educate yourself and start small.

14. Common Mistakes Traders Make (And How to Avoid Them)

Avoid these common traps:

Over-trading

Ignoring risk management

Trading without a strategy

Following hype instead of analysis

Using full leverage without understanding the consequences

15. ✅ Who Should Choose AvaTrade for Futures?

Traders looking for easy access to Futures via CFDs

Beginners who need educational resources

Traders who want a regulated and safe broker

Mobile-first traders using AvaTradeGO

16. ❌ Who Might Not Find AvaTrade Suitable?

Traders wanting direct exchange Futures contracts

Those needing ultra-low spreads on all instruments

Users from restricted jurisdictions

17. Final Verdict: Should You Trade Futures on AvaTrade?

Absolutely – if you’re seeking flexibility, simplicity, and strong support.

While AvaTrade doesn’t offer traditional Futures contracts, it gives traders all the tools needed to speculate on Futures price movements with CFD advantages.

✅ A safe, regulated, and beginner-friendly broker.

Ready to try Futures trading with AvaTrade? Now is the perfect time to sign up and take advantage of their latest promotions.

👉 Open your AvaTrade account today

18. FAQs

1. Does AvaTrade have Futures trading?Yes, via CFDs on Futures assets like commodities, indices, and bonds.

2. Can I trade Futures on AvaTrade with leverage?Yes, AvaTrade offers leverage depending on your region and asset type.

3. Is AvaTrade regulated for Futures trading?Yes, it is regulated in multiple jurisdictions worldwide.

4. What’s the minimum deposit to start Futures trading on AvaTrade?Only $100 is required to open an account.

5. Is Futures trading risky on AvaTrade?Yes, like any leveraged trading, it involves risk. Use proper risk management.

6. Can I open a demo account for Futures trading?Absolutely. AvaTrade provides free demo accounts.

7. What platforms support Futures on AvaTrade?MT4, MT5, WebTrader, and AvaTradeGO all support Futures CFDs.

8. Are there any promotions for new Futures traders on AvaTrade?Yes, AvaTrade frequently runs promotions and bonuses.

9. Can I short-sell Futures on AvaTrade?Yes, both long and short positions are supported.

10. What assets can I trade as Futures on AvaTrade?Commodities (oil, gold), Indices (S&P, DAX), and Bonds.

💥 Read more:

Avatrade Signals Review 2025: Pros & Cons A Comprehensive Review

Avatrade Copy Trading Review 2025: Pros & Cons A Comprehensive Review