6 minute read

How to Use Leverage on Avatrade

by ForexMakets

How to Use Leverage on Avatrade

Using leverage is one of the most powerful tools available to traders in the forex and CFD markets. With the right strategy, leverage can amplify profits and unlock access to larger positions with smaller capital. AvaTrade, a globally recognized forex broker, provides flexible leverage options that cater to both beginner and professional traders. In this comprehensive guide, we’ll dive deep into understanding leverage on AvaTrade, how it works, its benefits, potential risks, and how to use it wisely for optimal trading results.

📌 Choosing a Forex broker is crucial. Don’t miss our honest and updated Review Forex Broker to help you decide wisely.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. What is Leverage in Forex Trading?

Leverage allows traders to control a larger position in the market with a relatively small amount of capital. It is expressed as a ratio, such as 1:10, 1:50, or 1:400. This means that for every $1 of your own money, you can trade with $10, $50, or $400, respectively.

Example: If you use 1:100 leverage and invest $100, you can open a position worth $10,000.

Leverage magnifies both potential profits and potential losses. Therefore, it's essential to understand how it works before applying it in live markets.

2. Overview of Leverage on AvaTrade

AvaTrade offers competitive leverage options that align with regulatory guidelines and client profiles. For most retail clients:

Forex pairs: up to 1:30

Commodities: up to 1:20

Indices: up to 1:20

Cryptocurrencies: up to 1:2

However, professional traders can access leverage up to 1:400 depending on the instrument.

AvaTrade complies with major regulations including ESMA, ASIC, FSCA, and more, which define maximum leverage limits.

3. How Leverage Works on AvaTrade: Detailed Breakdown

On AvaTrade’s platform, leverage is integrated into the trading interface. Once you deposit funds and select a product, the platform automatically adjusts your margin requirement based on your chosen leverage.

For example:

If trading EUR/USD with a 1:30 leverage, only 3.33% of the trade’s value is required as margin.

AvaTrade’s margin calculator can help you determine exact values before executing trades.

✅ Efficient margin usage allows you to spread capital across multiple trades.

4. ✅ Key Benefits of Using Leverage on AvaTrade

Amplify potential profits with minimal capital

Access to more markets and larger positions

Efficient capital allocation across multiple strategies

Advanced risk management tools like stop-loss and take-profit

AvaTrade provides negative balance protection, ensuring your losses don’t exceed your deposit

✅ These benefits make AvaTrade highly attractive for traders looking to maximize opportunities.

5. ❌ Risks of Using Leverage Incorrectly

While leverage is powerful, misuse can be financially damaging.

Magnified losses: Just as profits can grow, so can losses

Margin calls: AvaTrade will close positions if equity falls below margin requirements

Market volatility: Sudden moves can liquidate leveraged positions quickly

❌ Lack of risk management can lead to rapid capital loss.

Always test your strategy using AvaTrade’s demo account before going live.

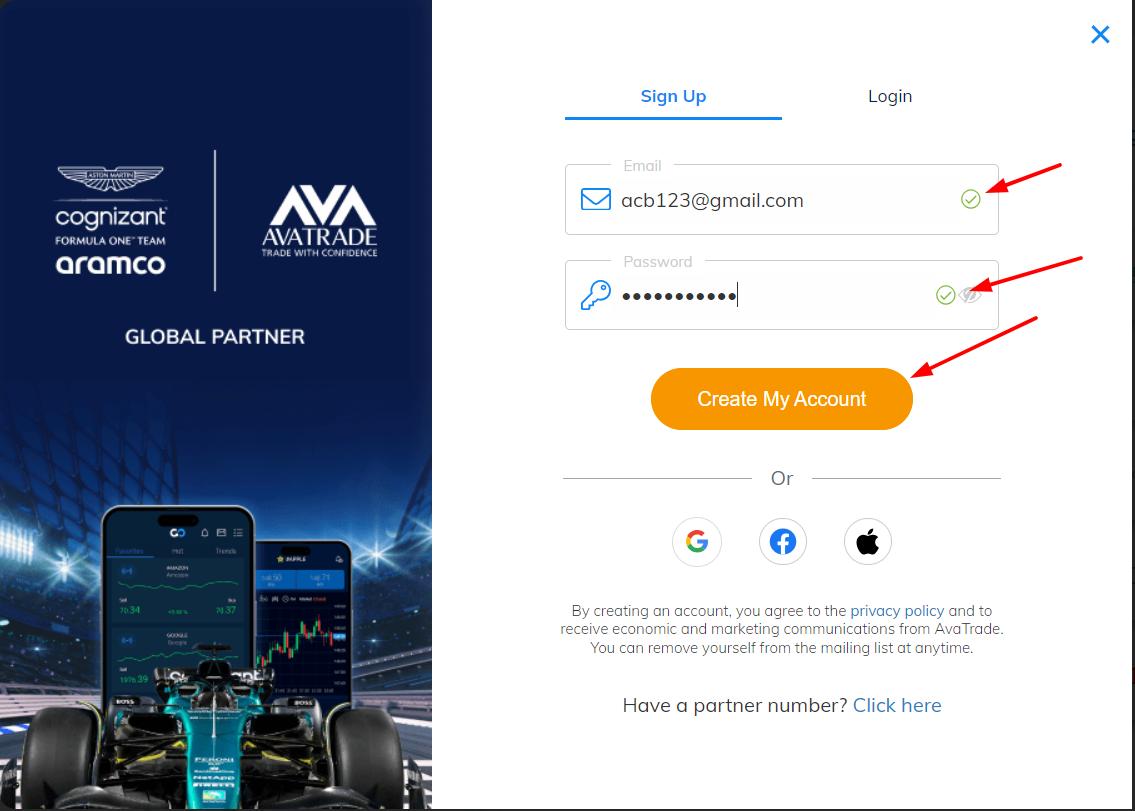

6. How to Open an Account with AvaTrade to Use Leverage

Opening an account on AvaTrade is straightforward:

Visit AvaTrade’s official platform

Click Register and complete the sign-up form

Submit KYC documents (ID and proof of address)

Choose account type (Retail or Professional)

Fund your account

Select leverage settings within the platform

✅ Once approved, you're ready to begin leveraged trading.

7. How AvaTrade’s Leverage Differs from Other Brokers

Unlike many brokers, AvaTrade emphasizes risk-controlled leverage to ensure client safety.

Transparent leverage options

Negative balance protection

Competitive leverage for professionals

Regulated across multiple jurisdictions

Compared to offshore brokers, AvaTrade’s leverage might seem conservative, but it prioritizes trader protection and regulatory compliance.

8. How to Choose the Right Leverage Ratio

Your ideal leverage ratio depends on:

Trading experience

Risk appetite

Market volatility

Capital size

Beginners should consider using lower leverage such as 1:10 or 1:20 to minimize risk. Seasoned traders may use higher leverage, backed by a solid risk management plan.

✅ AvaTrade allows flexibility, letting users adjust leverage settings per trade.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

9. Leverage Limits for Retail vs. Professional Traders

Retail Traders:

Capped at 1:30 for forex, per ESMA rules

Lower leverage on other assets

Professional Traders:

Can access up to 1:400 leverage

Must meet AvaTrade’s eligibility criteria:

Portfolio over €500,000

Financial sector experience

Sufficient trading activity

If you qualify, request a professional account upgrade.

10. Strategies for Managing Risk When Using Leverage

To trade safely with leverage, consider:

Using stop-loss on every trade

Never risking more than 1-2% of account per trade

Regularly analyzing market trends

Avoiding overtrading

Testing in demo mode before committing real funds

❌ High leverage without discipline = high risk ✅ Risk management separates winners from losers

11. Marketing Advantages of AvaTrade Leverage for Traders

Traders flock to AvaTrade because:

User-friendly platforms: MetaTrader 4/5, WebTrader, AvaOptions

Flexible leverage tailored to trader profiles

Low spreads and zero commission

Strong educational resources and live webinars

24/5 multilingual support

✅ AvaTrade positions itself as a trustworthy and efficient gateway to global markets. Opening an account is the first step to maximizing leverage potential.

12. Frequently Asked Questions (FAQs)

Q1: What is the maximum leverage on AvaTrade?AvaTrade offers up to 1:30 for retail clients and up to 1:400 for professional traders.

Q2: Can I change my leverage setting on AvaTrade?Yes, you can adjust leverage per trade or by switching account type.

Q3: Is leveraged trading risky?Yes, if not managed properly. Use stop-losses and sound strategy.

Q4: Do I need a lot of capital to use leverage?No. Leverage allows you to open large positions with small capital.

Q5: How does AvaTrade protect against negative balances?AvaTrade has a negative balance protection policy.

Q6: What platform can I use to trade with leverage on AvaTrade?AvaTrade supports MT4, MT5, WebTrader, and AvaOptions.

Q7: Can beginners use leverage safely on AvaTrade?Yes, but it’s recommended to start with lower leverage and a demo account.

Q8: What is margin in leveraged trading?Margin is the minimum capital required to open a leveraged position.

Q9: What happens if I get a margin call?AvaTrade will close your trades to prevent further loss.

Q10: How fast can I start using leverage after account approval?Immediately after funding your account and verifying KYC.

Start your journey today. Unlock the power of leverage on AvaTrade and take your trading to the next level.

✅ Sign up, fund your account, choose your leverage – and trade smarter with AvaTrade.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

💥 Read more:

Avatrade Vs Saxo 2025: Compared - which is better broker?

Avatrade Vs Deriv 2025: Compared - which is better broker?