6 minute read

Avatrade Vs Saxo 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Saxo 2025: Compared - which is better broker?

In the competitive world of Forex and CFD trading, selecting the right broker can be the deciding factor between success and failure. With so many platforms available, it’s critical to make informed choices. In this comprehensive comparison of Avatrade vs Saxo, we dig deep into the features, fees, regulations, platforms, tools, and overall trading experiences offered by both brokers in 2025. Whether you're a seasoned trader or just getting started, this detailed guide will help you make the right decision.

Why Broker Choice Matters in Forex Trading

Your broker isn't just a middleman. It determines your trading costs, the reliability of your executions, and even your access to critical tools and instruments. Choosing poorly could mean:

❌ Higher trading fees eating into your profits

❌ Inadequate customer support during critical trading hours

❌ Limited access to global markets or instruments

Whereas the right broker, like Avatrade, can provide:

✅ Lower spreads and competitive commissions

✅ Access to advanced platforms like MetaTrader and AvaOptions

✅ Strong regulatory backing ensuring fund safety

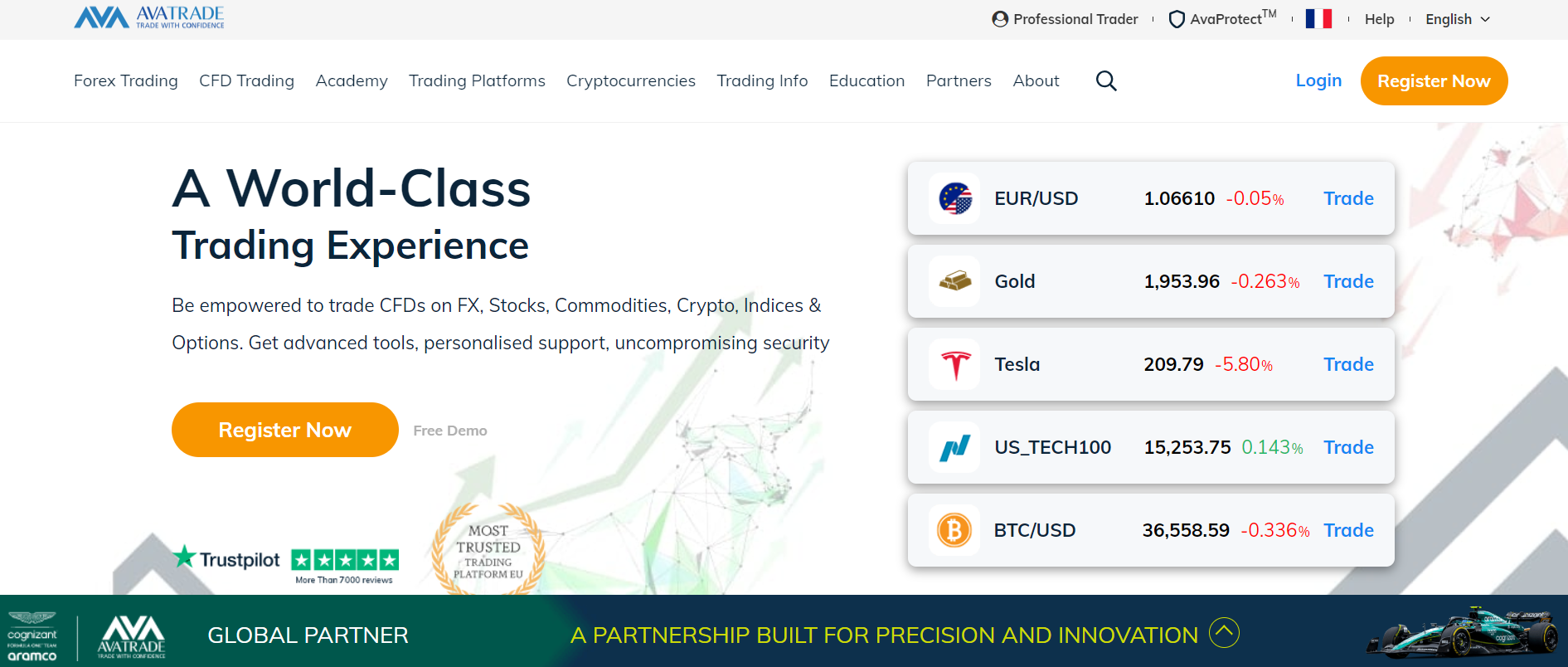

Avatrade Overview (2025)

Avatrade has been a consistent performer in the world of Forex and CFD trading. Founded in 2006, it has grown into a globally respected platform with robust regulation across multiple jurisdictions.

Key Strengths of Avatrade:

✅ Regulated in Ireland, Australia, UAE, Japan, South Africa, and more

✅ Offers MetaTrader 4, MetaTrader 5, WebTrader, and the intuitive AvaTradeGO app

✅ Spreads from as low as 0.9 pips on major pairs

✅ Excellent customer support available 24/5

✅ Advanced risk management tools including negative balance protection

✅ Social and copy trading integration

✅ Commission-free trading model

Instruments Offered by Avatrade:

Forex (55+ currency pairs)

Stocks (600+ shares from global markets)

Cryptocurrencies (including Bitcoin, Ethereum, Litecoin)

Indices, ETFs, Options, and Commodities

👉 See more: Avatrade Broker Review 2025

Saxo Bank Overview (2025)

Saxo Bank, based in Denmark, is renowned for its institutional-grade platform and vast asset coverage. However, its offering may not be suitable for everyone—especially retail traders with limited capital.

Key Characteristics of Saxo:

✅ Strong regulatory oversight, especially in Europe

✅ Advanced proprietary platform (SaxoTraderGO, SaxoTraderPRO)

✅ Wide market access across over 40,000 instruments

❌ High minimum deposit requirement (usually $2,000 or more)

❌ Complex interface not ideal for beginners

❌ Higher trading costs compared to commission-free models like Avatrade

Regulation & Security: Avatrade vs Saxo

Avatrade is regulated by:

Central Bank of Ireland

ASIC (Australia)

FSCA (South Africa)

FSA (Japan)

ADGM (Abu Dhabi)

Saxo Bank is regulated by:

Danish Financial Supervisory Authority

FCA (UK)

FINMA (Switzerland)

✅ Both brokers are heavily regulated, ensuring high security standards. However, Avatrade's wider global reach provides greater flexibility for international traders.

Trading Platforms

Avatrade:

MetaTrader 4 & 5

AvaOptions for options trading

WebTrader

AvaTradeGO mobile app

Social Trading via ZuluTrade & DupliTrade

Saxo:

SaxoTraderGO (web & mobile)

SaxoTraderPRO (desktop)

✅ While Saxo’s proprietary platforms are rich in features, they can be overwhelming for beginners. Avatrade's use of MT4/MT5 offers a familiar, customizable interface for all experience levels.

Fees & Commissions

Avatrade:

❌ No commissions on trades

✅ Spreads from 0.9 pips

✅ No deposit or withdrawal fees

Saxo:

❌ Commission-based structure

❌ Spreads vary and can be high for smaller accounts

❌ Inactivity fees apply

Conclusion: 👉 Avatrade is the clear winner here, especially for retail traders looking for low-cost trading without hidden charges.

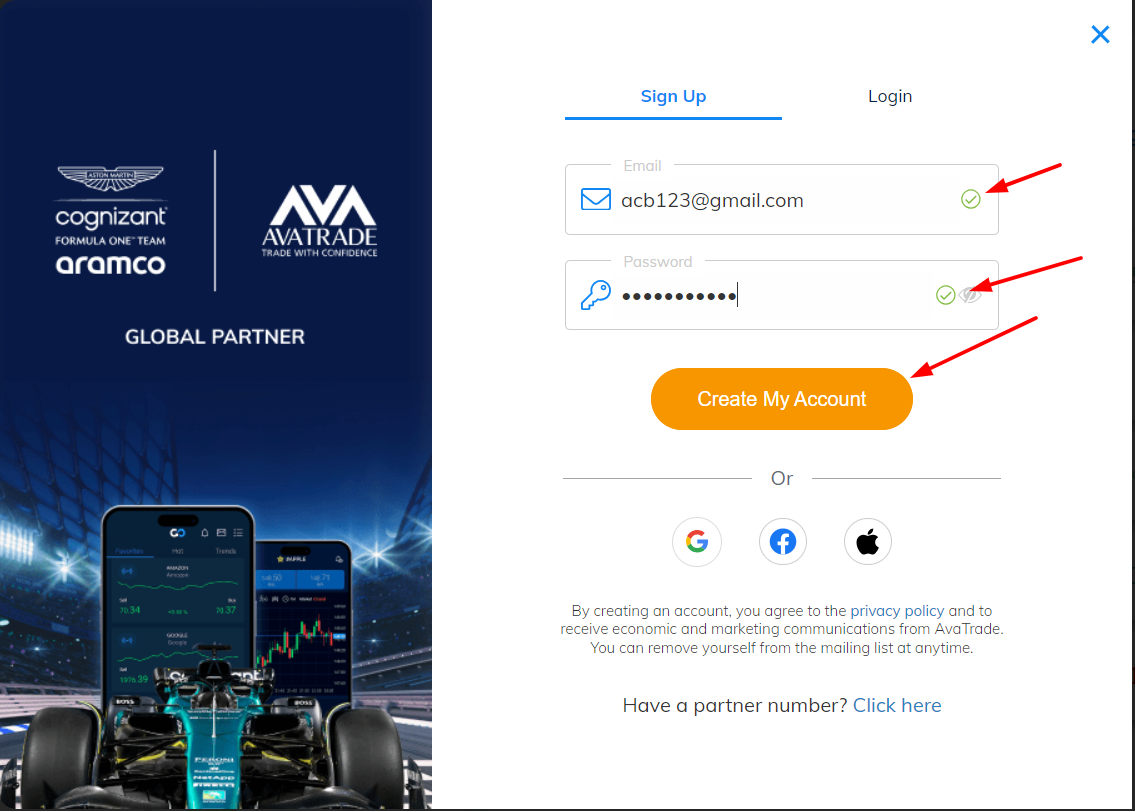

Account Types & Minimum Deposit

Avatrade:

✅ Standard account: $100 minimum

✅ Demo account available

✅ Islamic account option

Saxo:

❌ Minimum deposit: $2,000 for Classic Account

❌ No Islamic account for Muslim traders

Verdict: ✅ Avatrade caters to a broader audience with lower entry barriers.

Education & Tools

Avatrade:

✅ Comprehensive video tutorials and webinars

✅ Market analysis and economic calendar

✅ Trading Central integration

Saxo:

✅ Quality research and webinars

❌ Less beginner-friendly content

👉 Avatrade’s educational suite is more accessible and practical, especially for traders who are still learning the ropes.

Customer Support

Avatrade:

✅ 24/5 multilingual support

✅ Live chat, email, phone

Saxo:

❌ Limited live support for Classic accounts

✅ Priority support only for VIP accounts

✅ When it comes to responsiveness and availability, Avatrade outperforms Saxo for the average trader.

Mobile Trading

AvatradeGO offers a sleek, powerful, and user-friendly experience that includes:

One-touch execution

Market trends

Risk management features

Saxo’s mobile platform, while professional, lacks the simplicity that new traders need.

Social & Copy Trading

Avatrade:

✅ Integrated with ZuluTrade and DupliTrade

✅ Ideal for passive income strategies

Saxo:

❌ No built-in social or copy trading functionality

Avatrade clearly leads in this area, offering modern features that appeal to today’s retail traders.

Marketing Insight: Why Avatrade is the Better Choice in 2025

If you're looking to get serious in trading without getting stuck in a complex and costly system, Avatrade is your broker. Here's why thousands of traders are switching:

✅ Commission-free trading

✅ Easy-to-use platforms with global access

✅ Strong security with multi-jurisdiction regulation

✅ Low deposit threshold — get started with just $100!

Stop overpaying. Stop overcomplicating. Start trading smarter with Avatrade today. 👉 Join Avatrade Now

Join the wave of global traders choosing a platform that puts traders first.

❓ Frequently Asked Questions (FAQs)

1. Is Avatrade better than Saxo for beginners?✅ Yes, Avatrade is more beginner-friendly with simpler interfaces and better educational resources.

2. Which broker is cheaper to trade with?✅ Avatrade. It offers commission-free trading with tighter spreads.

3. Is Saxo Bank a safe broker?Yes, it's regulated by top-tier authorities. However, it’s more tailored to institutional traders.

4. Can I copy trade with Saxo?❌ No, Saxo does not offer built-in copy trading features. Avatrade does.

5. Which platform is more user-friendly?✅ Avatrade, thanks to MetaTrader and AvaTradeGO.

6. Does Avatrade support crypto trading?✅ Yes, it supports over 20 crypto assets.

7. What is the minimum deposit for Avatrade?Just $100.

8. Can Muslim traders open a Shariah-compliant account with Avatrade?✅ Yes, Islamic accounts are available.

9. Is Saxo Bank good for small traders?❌ Not ideal due to its high minimum deposit and fees.

10. Why should I open an account with Avatrade now?Because you can start trading globally with low fees, top-tier security, and cutting-edge tools — all starting at just $100. 👉 Join Avatrade Now

Final Word:

In the 2025 battle of Avatrade vs Saxo, the clear winner for most traders — especially retail and beginner-level traders — is Avatrade. With superior cost-efficiency, ease of use, robust tools, and global accessibility, Avatrade gives you everything you need to start and grow your trading journey.

Ready to trade smarter? Choose Avatrade — your future in Forex starts here.

💥 Read more: