4 minute read

Avatrade Vs Oanda 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Oanda 2025: Compared - which is better broker?

In the dynamic world of forex and CFD trading, choosing the right broker is crucial for both novice and experienced traders. Two prominent names in the industry are AvaTrade and OANDA. This comprehensive comparison delves into their offerings, highlighting key differences and helping you make an informed decision.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

🔍 Broker Overview

AvaTrade

Founded: 2006

Headquarters: Dublin, Ireland

Regulations: Central Bank of Ireland, ASIC (Australia), FSA (Japan), FSCA (South Africa), ADGM (UAE), FFAJ (Japan), BVI FSC

Trading Platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTradeGO

Minimum Deposit: $250

Leverage: Up to 1:400

Spreads: Starting from 0.9 pips on major pairs

Commission: None

👉 See more: Avatrade Review

OANDA

Founded: 1996

Headquarters: New York, USA

Regulations: FCA (UK), ASIC (Australia), MAS (Singapore), CFTC (USA), MiFID (EU)

Trading Platforms: MetaTrader 4 (MT4), OANDA Trade

Minimum Deposit: $1

Leverage: Up to 1:100

Spreads: Starting from 0.6 pips on major pairs

Commission: Varies by account type

📊 Key Comparison

1. Regulatory Oversight

Both brokers are well-regulated, ensuring a secure trading environment. However, AvaTrade's extensive global regulatory presence, including jurisdictions like the UAE and South Africa, provides broader coverage compared to OANDA's focus on major markets.

2. Trading Platforms

AvaTrade: Offers multiple platforms, including MT4, MT5, and its proprietary AvaTradeGO, catering to various trading styles.

OANDA: Provides MT4 and its OANDA Trade platform, suitable for traders seeking a streamlined experience.

3. Minimum Deposit

AvaTrade: Requires a minimum deposit of $250, aligning with industry standards.

OANDA: Offers a low minimum deposit of $1, making it accessible for beginners.

4. Leverage

AvaTrade: Provides higher leverage up to 1:400, offering more flexibility for experienced traders.

OANDA: Offers leverage up to 1:100, adhering to stricter regulatory limits.

5. Spreads and Commissions

AvaTrade: Competitive spreads starting from 0.9 pips with no commission fees.

OANDA: Tighter spreads from 0.6 pips but may include commission fees depending on the account type.

✅ Why Choose AvaTrade Over OANDA?

Higher Leverage: AvaTrade's up to 1:400 leverage allows for more significant positions, beneficial for experienced traders.

Broader Regulation: With oversight in multiple jurisdictions, AvaTrade offers a more globally recognized regulatory framework.

Diverse Platforms: Access to MT4, MT5, and AvaTradeGO caters to various trading preferences.

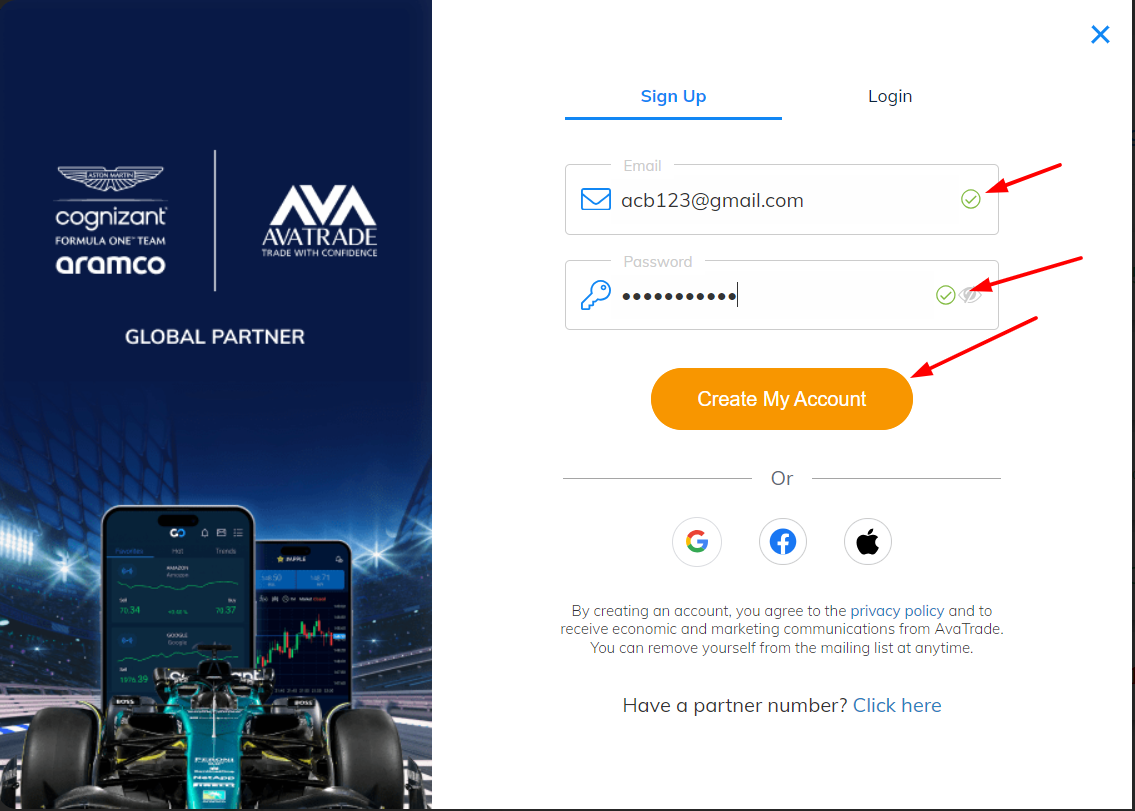

👉 Open your AvaTrade account today

❌ Considerations for OANDA

Lower Leverage: The 1:100 leverage limit may restrict trading strategies requiring higher leverage.

Commission Fees: Potential commission charges on certain account types could increase trading costs.

💬 Frequently Asked Questions

Which broker offers better leverage?

AvaTrade provides higher leverage up to 1:400, offering more flexibility for traders.

Is there a minimum deposit requirement?

AvaTrade requires a minimum deposit of $250, while OANDA has a minimum deposit of $1.

What trading platforms are available?

AvaTrade offers MT4, MT5, and AvaTradeGO, whereas OANDA provides MT4 and its proprietary OANDA Trade platform.

Are there commission fees?

AvaTrade charges no commission fees, while OANDA may charge commissions depending on the account type.

Which broker is more regulated?

AvaTrade has a broader regulatory presence across multiple jurisdictions.

Can I trade on mobile devices?

Both brokers offer mobile trading platforms for on-the-go trading.

Which broker is better for beginners?

OANDA's low minimum deposit and user-friendly platforms make it suitable for beginners.

Does AvaTrade offer educational resources?

Yes, AvaTrade provides extensive educational materials for

Can I use automated trading?

Both brokers support automated trading through platforms like MT4.

Which broker has better customer support?

Both brokers offer robust customer support, but AvaTrade's multilingual support may be advantageous for international traders.

🚀 Conclusion

Both AvaTrade and OANDA offer compelling features for traders. However, AvaTrade's higher leverage, broader regulatory coverage, and diverse platform options make it a more attractive choice for traders seeking flexibility and global reach. If you're ready to take your trading to the next level, consider opening an account with AvaTrade today.

💥 Read more: