MIDDLE EAST & AFRICA

STARTUP FEATURE:

BLOOMLINE CREATIONS

PACK MATERIAL:

GLASS IN PHARMA

TECH FOCUS:

HYBRID PRESSES

SUSTAINABILITY:

ROLE OF WASTE PICKERS

PEPSICO: SUSTAINABILITY PUSH IN AFRICA AND MEA

STARTUP FEATURE:

BLOOMLINE CREATIONS

PACK MATERIAL:

GLASS IN PHARMA

TECH FOCUS:

HYBRID PRESSES

SUSTAINABILITY:

ROLE OF WASTE PICKERS

PEPSICO: SUSTAINABILITY PUSH IN AFRICA AND MEA

Building Kenya's circular economy from the ground up

As 2025 draws to a close, it offers us a natural pause, a moment to look back at the year that has been. For many, it was a year of contrasts: challenges alongside opportunities, setbacks tempered by progress, and moments that tested our resilience. Some of us felt the weight of difficulties more keenly than the thrill of achievement, while others felt the promise of growth overshadowed the obstacles. Yet amidst all this, one thing remained constant: the human drive to make the year count, to leave it better than we found it.

This year, Kenya also bid farewell to a leader whose life embodied persistence and courage. For over eighty years, he fought for causes he believed in, often confronting obstacles, betrayals, and systems resistant to change. What stands out is not the struggles themselves, but the unwavering commitment to continue pushing forward—because in persistence lies the seed of transformation.

For those of us advocating for sustainability, 2025 has posed a personal and professional challenge: what have we done to make our environment and ecosystems more sustainable? Can we look back and affirm that we played a part in driving positive change? These questions are more than rhetorical; they are a call to action as we step into a new year.

In this spirit, we present Issue 10 of Sustainable Packaging Middle East & Africa, centered on sustainability. Inside, we delve into extended producer responsibility in Kenya, featuring PAKPRO, an organization that championed a structured waste value chain long before regulations caught up.

We also spotlight Bloomline Creations, a start-up transforming textile waste into custom backpacks, tote

bags, and more. Founder Wangari Kamanga reminds us that sustainability can also be entrepreneurial, proving that recycling can drive creativity, innovation, and economic opportunity.

The issue further highlights the critical, often underappreciated role of waste pickers in Kenya’s circular economy. Their daily efforts, coupled with emerging innovations in the sector, underscore the collaborative nature of sustainability; it is a journey that requires collective action and recognition.

Innovation at the global level also features prominently. From the rise of refillable packaging in the cosmetics sector to the growing adoption of hybrid printing presses, businesses are finding new ways to balance functionality, aesthetics, and environmental responsibility. We also trace PepsiCo’s sustainable journey and those of other industry leaders, providing insights into the strategies shaping circular economies across the region.

As we look toward 2026, let these stories inspire reflection and action. May they remind us that even small steps toward sustainability, whether at an individual, organizational, or industrial level, ripple outward to create meaningful change. The end of a year is never just a closing; it is also an invitation to rethink, innovate, and commit anew.

Merry Christmas and a Happy New Year 2026.

Alphonse Okoth Senior Editor, FW Africa.

The material of choice for pharma packaging, strength, safety and a surge of innovation The Surge of Refillable Packaging in the Cosmetics Industry The superior advantage transforming packaging print

A Lifeline for Africa and the MEA Region’s Mounting Waste Crisis

Pacprocess MEA

December 9 - 12, 2025

Egypt International Exhibition Centre, Cairo, Egypt www.pacprocess-mea.com

Interplast Pack East Africa 2026

January 29 – 31, 2026

Diamond Jubilee Hall, Dar-Es-Salaam, Tanzania www.mxmexhibitions.com/iplastpackTanzania

Africa Dairy Innovation Summit

February 25 – 27, 2026

Argyle Grand Hotel Nairobi Airport, Nairobi, Kenya www.africadairysummit.com

Propak East Africa

March 3 – 5, 2026

Sarit Expo Centre, Nairobi, Kenya www.propakeastafrica.com

Sino-Pack 2026

March 4 - 6, 2026

China Import & Export Fair Complex, Guangzhou, CN www.chinasinopack.com

Iterpack 2026

May 7 -13, 2026

Messe Düsseldorf convention center, Dusseldorf, DE www.interpack.com

Paper Eurasia Expo 2026

June 10 – 12, 2026

İFM - Istanbul Expo Center, Istanbul, Turkiye. www.papereurasia.com/en

Africa Food Manufacturing Kenya & EA

July 15,17, 2026

Sarit Expo Centre, Nairobi, Kenya www.afmass.com

AFRIPACK Expo Kenya & Eastern Africa

July 15,17, 2026

Sarit Expo Centre, Nairobi, Kenya www.afripackexpo.com

Africa Packaging Awards

July 16, 2026

Nairobi, Kenya. www./manawards.fwafrica.net/pack

SUSTAINABLE

MIDDLE EAST & AFRICA

Year 3 | Issue No.10 | Oct - Dec 2025

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Alphonse Okoth

EDITOR

Mary Wanjira

Fridah Chepkoech

BUSINESS DEVELOPMENT

DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT

ASSOCIATE

Johna Sambai

HEAD OF DESIGN

Clare Ngode

ASSOCIATE DESIGNER

Emmaculate Ouma

ACCOUNTS

Anita Kinyua

Published By: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

We publish some of the most influential magazines and websites in Africa & the Middle East regions. Please visit the websites below for more information about our publications.

Sustainable Packaging Middle East & Africa is published 4 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

www.foodbusinessmea.com

www.millingmea.com

www.horecamea.com

www.dairybusinessmea.com

www.feedbusinessmea.com

www.healthcaremea.com

www.sustainabilitymea.com

www.hpcmagmea.com

UAE – Global food and beverage packaging leader Lamipak unveiled an expanded lineup of sustainable and innovative solutions at Gulfood Manufacturing 2025, marking one of its most impactful exhibitions to date.

The company highlighted new solutions designed to advance sustainability, enhance functionality, and elevate consumer engagement, reinforcing Lamipak’s position as a leading end-to-end aseptic packaging provider across the Middle East, Africa, and the Indian subcontinent.

A standout launch was LamiSleeve, Lamipak’s latest addition to its aseptic beverage carton portfolio.

The product completes the company’s offering across both sleeve and roll-fed formats, enabling customers to source comprehensive packaging solutions from a single supplier.

Lamipak also introduced Opticap 27, a new beverage carton cap featuring a patented anti-slip groove and an audible lock for freshness assurance, alongside the Sensory Straw, designed to deliver a smoother, more enjoyable drinking experience.

Further advancing digital engagement, the company showcased One Pack One Code, a traceability platform assigning a unique QR code to every package.

The solution supports product authentication, supply chain transparency, and interactive consumer campaigns.

Sustainability remained a core focus under the company’s “Pick Carton, Save Nature” campaign. Eco-driven solutions such as LamiPure and LamiPristine were spotlighted for their ability to reduce carbon emissions by 25% and 28%, respectively, compared to standard aseptic cartons.

With manufacturing hubs in China and Indonesia, Lamipak supplies more than 420 customers across over 80 countries, primarily in the dairy and juice sectors, cementing its role as a global leader in sustainable and consumer-driven aseptic packaging solutions.

- Coca-Cola HBC AG has agreed to acquire a 75% controlling stake in Coca-Cola Beverages Africa (CCBA) from The Coca-Cola Company and Gutsche Family Investments (GFI) in a deal worth US$3.4 billion.

The transaction involves Coca-Cola divesting 41.52% of its 66.52% holding in CCBA, while Coca-Cola HBC will acquire GFI’s 33.48% stake.

Post-deal, Coca-Cola will retain a 25% share, with CocaCola HBC holding an option to purchase the remaining shares within six years.

The acquisition is expected to close by the end of 2026, subject to regulatory and antitrust approvals.

CCBA, Coca-Cola’s largest African bottler, operates in 14 countries, representing roughly 40% of the company’s continental volume.

Coca-Cola HBC, a leading global bottler active in 29 countries across Europe and Africa, including major markets like Nigeria and Egypt, will, after the deal, manage about twothirds of the Coca-Cola system’s African volume and reach over half of the continent’s population.

The sale aligns with Coca-Cola’s global refranchising strategy, aimed at reducing direct bottling operations.

Bottling investments, which accounted for 52% of CocaCola’s consolidated net revenue in 2015, fell to 13% in 2024 and are projected to drop further to around 5% after this transaction. Earlier in 2025, Coca-Cola sold a 40% stake in its Indian bottler, retaining 60%.

Henrique Braun, Coca-Cola COO, emphasized HBC’s capability to drive growth for CCBA, while GFI Chairman Philipp Hugo Gutsche expressed confidence in HBC as a long-term partner.

Coca-Cola HBC also plans a secondary listing on the Johannesburg Stock Exchange, reinforcing its commitment to Africa and signaling strategic expansion across the continent.

www.manawards.fwafrica.net/pack

UK – The Department for Environment, Food & Rural Affairs (Defra) has issued updated guidance for reprocessors and exporters handling packaging waste, setting clear registration, accreditation, and operational requirements under revised regulations.

The changes aim to strengthen transparency and control in the recycling process, with all data managed through the new Regulated Producer Database (RPD) starting in 2026.

Businesses seeking to generate Packaging Waste Recycling Notes (PRNs) or Packaging Waste Export Recycling Notes (PERNs) from January 1, 2026, must submit applications and pay fees by October 1, 2025.

Reprocessors are required to submit separate applications for each material type at every operational site, while exporters submit one application per material using a unique organizational identifier.

Late submissions will prevent issuance of notes, potentially affecting the supply chains of obligated producers.

Large packaging producers, with 2025 recycling targets based on 2024 data, must acquire PRNs or PERNs by January 31, 2026, with each material type requiring separate purchases through accredited UK reprocessors, exporters, or trading platforms.

Environment Minister Steve Reed highlighted that early compliance is essential to avoid penalties of up to US$50,000 for serious non-compliance.

The guidance reflects post-Brexit adaptation of EUinspired reforms and includes support resources such as online portals and fee calculators.

Industry engagement is rising, with note trading volumes up 15% since September and projected PRN market activity expected to reach US$1.2 billion in 2026. Defra will host webinars to support smaller operators.

Globally, similar measures are emerging, including the UAE’s requirement for site-specific accreditation for plastic reprocessors and certified export notes equivalent to PERNs.

USA – Sealed Air Corporation, the company behind Bubble Wrap, has agreed to be acquired by funds affiliated with private equity firm Clayton, Dubilier & Rice (CD&R) in an all-cash deal valued at US$10.3 billion.

Approved unanimously by Sealed Air’s board, the transaction is expected to close by mid-2026, after which the company will go private, be delisted from the New York Stock Exchange, and retain its Charlotte, North Carolina headquarters.

Shareholders will receive US$42.15 per share, reflecting a substantial premium. The deal includes a 30-day “go-shop” period for the board to consider superior offers.

Financing will be supported by CD&R investment funds, with debt commitments led by major banks, including BofA Securities, Goldman Sachs, and JPMorgan. Sealed Air, which reported US$5.4 billion in revenue in 2024 and employs over 16,000 people globally, has a diverse portfolio spanning food, medical, industrial, and e-commerce packaging.

While recent quarters showed mixed results, including a Q2 FY25 net sales dip to US$1.33 billion, the company is focused on retail-ready packaging and productivity improvements under its CTO2Grow program.

CD&R partner Rob Volpe highlighted confidence in Sealed Air’s growth prospects, emphasizing continued investment in workforce, assets, and product innovation.

The takeover reflects ongoing consolidation in the global packaging sector, where private equity targets manufacturers for stable cash flows and exposure to growth areas such as e-commerce and sustainable materials.

Similar industry moves include International Paper’s US$9.74 billion acquisition of DS Smith, illustrating a broader effort to create global leaders in sustainable packaging across North America and Europe.

INDIA – Ball Corporation is strengthening its presence in India with a US$60 million investment to expand its aluminium can manufacturing plant in Sri City, Andhra Pradesh.

This follows a US$55 million upgrade earlier in 2025 at its Taloja facility near Mumbai, highlighting Ball’s long-term commitment to India, one of Asia’s fastest-growing beverage markets.

Mandy Glew, President of Ball Beverage Packaging EMEA and Asia, said the investment reflects the company’s strategic focus on scaling operations in high-growth regions.

India’s beverage can market is projected to grow more than 10% annually over the next five years, driven by demand for sustainable, convenient, and fully recyclable packaging.

Beyond carbonated drinks and energy beverages, new categories such as dairy and ready-to-drink (RTD) products increasingly use aluminium for portability, safety, and extended shelf life.

Ball’s proprietary retort technology, which preserves taste and nutrition in dairy and RTD beverages, strengthens its

competitive edge.

Since entering India in 2016, Ball has expanded capacity at Taloja and Sri City, supplying a broad range of can sizes from 185 ml to 500 ml to both multinational and local beverage brands.

The Sri City expansion positions Ball to meet rising local and regional demand while supporting brands’ sustainability goals, enhancing speed, flexibility, and innovation in beverage packaging.

The move aligns with wider regional trends in aluminium packaging expansion across Asia and Africa.

Industry players including Canpack, Crown Holdings, NAFFCO Metal Packaging, and Gulf Cans Industries are scaling up production, reflecting growing global momentum toward circular, low-carbon packaging.

Aluminium cans, recycled at significantly higher rates than plastics, are increasingly favored by brands and consumers alike.

KENYA – Silafrica has achieved a major sustainability milestone by implementing 100% recyclable plastic packaging across its product range.

The achievement results from close collaboration between customers and internal teams to redesign packaging for circularity without compromising performance or aesthetics.

Speaking at the K2025 exhibition in Düsseldorf, the company highlighted the plastics industry’s evolving role in balancing innovation, functionality, and environmental responsibility, emphasizing that the challenge lies not in plastics themselves, but in designing, manufacturing, using, reusing, and recycling them responsibly.

Silafrica’s milestone underscores its 63-year legacy in advancing sustainable packaging solutions in Africa and calls for industry-wide adoption of circular design principles, supported by data-driven comparisons with alternatives like glass, aluminum, and paper.

In Nigeria, Nestlé has similarly progressed toward circularity, incorporating 50% recycled PET (rPET) into its water bottles, the first company in the country to do so.

As a founding member of the Food and Beverage Recycling Alliance (FBRA), Nestlé supports Extended Producer

Responsibility (EPR) initiatives, diverting over 61,000 metric tons of plastic from landfills through community recycling programs and partnerships with local recyclers.

Its Plastic Advantage Programme trains and equips miniaggregators, while the Employee Plastics Collection Scheme promotes internal waste reduction.

Other regional players are following suit: Coca-Cola Nigeria aims for 50% rPET packaging by 2030, Bio Foods Ltd in Kenya has introduced 100% recyclable milk bottles, and PepsiCo Egypt launched 100% rPET bottles for Aquafina.

Experts note these initiatives indicate accelerating progress toward circularity in Africa, driven by multi-stakeholder collaboration, stronger EPR enforcement, and scalable recycling innovations.

GHANA – Ghana is taking major steps to strengthen its nuclear safety framework as it prepares to introduce nuclear power into its energy mix by 2030.

The government is finalizing a national policy on radioactive waste and spent fuel management, which will soon be submitted to the Attorney-General’s Office for legal review.

The policy aims to align the country with international standards, protect public health and the environment, and provide clear guidance on the generation, classification, transport, storage, and disposal of radioactive materials.

Professor Francis Otoo, Acting Director General of the Nuclear Regulatory Authority (NRA), stressed the importance of a comprehensive regulatory system as nuclear development progresses.

Kwamena Essilfie Quaison, Director of Science and Technology at MEST, said the policy is built on five pillars, safety, security, sustainability, transparency, and compliance with IAEA standards, underscoring both regulatory and ethical responsibilities.

Ghana’s move mirrors similar frameworks in South Africa and Kenya as more African nations pursue safe nuclear expansion.

In parallel, the Environmental Protection Agency (EPA) has launched a nationwide e-waste take-back scheme allowing consumers to return old electronics at designated Melcom stores in Accra.

Supported by GIZ and MEST, the pilot program aims to curb hazardous informal recycling by channeling products such as phones, batteries, laptops, and home appliances to licensed recyclers.

Plans include establishing modern dismantling centers in Accra, Koforidua, and Tamale, alongside incentives, public awareness campaigns, and the GH Waste App for bulky items.

Together, these initiatives demonstrate Ghana’s commitment to responsible waste management, green job creation, and environmental protection while laying the groundwork for a safe and sustainable nuclear energy future.

JORDAN - Jordan’s Energy and Minerals Regulatory Commission (EMRC) has announced that the rollout of plastic composite household gas cylinders has entered its final phase, setting the stage for nationwide adoption.

The new 12.5 kg-capacity cylinders match traditional metal cylinders in size, ensuring full compatibility for consumers, while offering significant safety, environmental, and convenience benefits.

According to EMRC, final technical tests are ongoing alongside infrastructure preparations in collaboration with multiple government bodies.

No licenses for importation or filling have been granted yet, as the commission awaits full compliance with all technical and regulatory standards.

Once approvals are finalized, EMRC will formally announce market entry and availability to the public.

The composite cylinders are a major upgrade from the metal versions commonly used across Jordan. Weighing just 5.3 kg when empty, compared with 17 kg for metal cylinders, they are easier to handle and transport.

Their corrosion-resistant, recyclable construction also reduces environmental impact and lowers carbon emissions.

EMRC developed the cylinders after years of consultation with experts, industry stakeholders, and international bodies.

Safety was a central component of the development process. The cylinders adhere to Jordanian and ISO 11119 standards, with tests by the Royal Scientific Society confirming their strong resistance to heat, high pressure, and explosion.

Consumers will be able to choose freely between plastic and metal cylinders at no extra cost. EMRC describes the innovation as a “high-quality, eco-friendly alternative” that offers improved safety and convenience.

The commission urged investors and stakeholders to follow regulatory updates closely as Jordan modernizes its domestic gas distribution system through this advanced technology.

KENYA - Italian closure manufacturer Guala Closures has expanded its East African footprint through the acquisition of Metal Crowns Group, a major Kenyan producer of crown caps and plastic closures.

Established in 1978, Metal Crowns operates two regional facilities and supplies both global and local beverage brands, recording revenues of about €32 million (KES 4.79 billion) for the 12 months ending July 2025.

Executive Director Gurdipsingh Parmar will continue leading the company to ensure operational continuity and integration.

The acquisition positions Guala to benefit from the region’s rapidly growing beverage sector, supported by urbanization, population growth, and rising consumer spending.

Alongside the deal, Guala has partnered with IKILEADS Ltd to introduce new 200ml “Don Coco” PET bottles across six spirit variants, including gin, vodka, whisky, tequila, and ready-to-drink blends, with projected annual production of 25–30 million units.

At the center of this launch is PICCOLO, a premium, tamper-evident closure engineered specifically for PET spirit bottles.

The two-piece closure offers dual-color customization, strong tamper resistance, and compatibility with specialized PET preforms, enhancing brand security and consumer trust.

Production will take place at Guala’s Nigerian plant, supported by technical collaboration with facilities in India and Nigeria and guided by innovations from its Product Development & Innovation Center in Italy.

Industry analysts note that the developments coincide with Africa’s shift toward safer, tamper-proof spirits packaging.

With the continent’s alcoholic beverages market projected to grow more than 5% annually through 2030, driven partly by demand for small-format PET bottles, Guala’s acquisition and PICCOLO technology position the company to elevate safety, design, and technical standards across Africa’s beverage packaging sector.

NIGERIA – Nigeria has unveiled the National Waste Marketplace Programme (NWMP), a digital platform designed to revolutionize the country’s waste management sector by linking waste generators, collectors, recyclers, and end-users in a transparent and traceable ecosystem.

Launched in Abuja by Environment Minister Balarabe Lawal, the platform is expected to formalize the waste value chain, spur innovation, create jobs, and promote sustainable environmental practices.

Lawal noted that the NWMP will use technology to strengthen economic linkages across the recycling sector while improving compliance, material recovery, and responsible production and consumption.

The initiative is aligned with Nigeria’s National Policy on Solid Waste Management, the Extended Producer Responsibility (EPR) framework, the National Circular Economy Roadmap, and global commitments such as the Basel Convention, the Paris Agreement, and the UN Sustainable Development Goals.

Professor Innocent Barikor, Director-General of NESREA, described the NWMP as a major milestone in digital environmental governance, emphasizing its ability to

improve traceability and ensure that all actors in the recycling value chain operate within a regulated system.

The programme is also expected to build a secondary materials market and train thousands of youths and microenterprises in circular economy models, generating green jobs in line with the Renewed Hope Agenda.

Private-sector stakeholders have welcomed the platform, with Nkem Orakwe of Recycle Stack Limited projecting that it could empower up to 10 million Nigerians by 2035 through training, certification, and integration into the recycling ecosystem.

Complementing similar innovations in Kenya and South Africa, the NWMP positions Nigeria as a regional leader in tech-enabled waste management and circular economy development.

FRANCE - France has introduced a new decree extending Extended Producer Responsibility (EPR) obligations to professional packaging used in business and industrial settings, with implementation scheduled for early 2026.

Under the updated framework, companies placing such packaging on the market will be required to finance or manage its collection, reuse, and recycling through approved ecoorganizations that must meet stricter transparency and costefficiency criteria.

A key component of the decree is a shared traceability system designed to monitor packaging waste from collection to treatment and recovery.

This ensures accurate reporting on recycling performance and progress toward national targets. Producers will also face eco-modulated fees, financial incentives for recyclable, reusable packaging designs and penalties for materials that hinder recycling, reinforcing France’s “3R” priorities: reduce, reuse, and recycle.

The move supports France’s commitment to cut single-use plastic packaging by 20% by the end of 2025.

Waste management operators must provide more detailed reporting on sorting and treatment practices, while producers retain full responsibility for end-of-life management, even when outsourcing operations to third-party contractors.

The updates also maintain alignment with new EU rules on cross-border waste shipments and dovetail with the EU Packaging and Packaging Waste Regulation (PPWR), which will require the incorporation of 5.4 million metric tons of recycled PET, polyethylene, and polypropylene annually by 2030. This shift creates both obligations and opportunities for suppliers of recycled materials.

France’s expanded EPR rules signal a major step toward stronger accountability, improved recyclability, and greater circularity in professional packaging.

SIG

SWITZERLAND – Swiss packaging leader SIG has appointed Mikko Keto, current CEO of Danish engineering group FLSmidth, as its new Chief Executive Officer, with his tenure beginning in the first half of 2026.

Keto, who will be based at SIG’s headquarters, brings a strong track record in industrial transformation.

At FLSmidth, he oversaw a major restructuring program focused on cost optimisation, portfolio streamlining, and targeted divestments, efforts that helped double the company’s enterprise value.

His career also includes senior leadership roles at Metso, Nokia Networks, and KONE, along with a board position at Normet Group.

SIG Board Chairman Ola Rollén highlighted Keto’s ability to drive both business and cultural transformation, expressing confidence that he will help make the company “leaner, simpler, and more agile.”

Interim CEO and CFO Anne Erkens will continue to lead operations until the transition is completed.

Founded in 1853, SIG is a global leader in aseptic carton, bag-in-box, and spouted pouch packaging.

The company reported €3.3 billion (US$3.82 billion) in revenue in 2024 and produces approximately 57 billion packs annually across more than 100 countries, supported by a workforce of 9,600.

As part of its sustainability push, SIG recently supplied Seoul Dairy with the world’s first full-barrier, aluminum-free aseptic carton, the SIG Terra Alu-free + Full Barrier, for its organic white milk.

Although aluminum represents just 5% of a typical carton’s weight, it contributes roughly 25% of its carbon footprint.

Removing the layer significantly cuts environmental impact, improves recyclability, and ensures compliance with Korea’s evolving environmental regulations.

VIETNAM – Japanese packaging giant Oji Holdings is investing US$104 million to build a new liquid packaging carton manufacturing facility in Dong Nai Province, Vietnam, with operations scheduled to start in March 2028.

The 57,000-square-meter plant, located in the Amata Long Thanh Industrial Park, will produce beverage and liquid cartons, including aseptic packaging suitable for long-term storage at room temperature.

The investment supports Oji’s strategy to strengthen local supply chains and meet rising demand for sustainable, recyclable packaging across Southeast Asia.

The project forms part of Oji’s Medium-Term Management Plan 2027, which prioritizes greener product lines and improved circularity in packaging materials.

The company also plans to address recycling challenges associated with multi-layer liquid cartons by strengthening collection systems and adopting advanced processing technologies.

Globally, Oji has expanded its market presence since acquiring Italian carton producer IPI in 2023. This move boosted sustainable carton sales by 15% year-on-year and supported urban waste management initiatives.

Pilot programs using automated sorting lines have reduced landfill waste by up to 30%, highlighting opportunities for better material recovery.

The new Vietnam plant is expected to create 200 jobs and source 40% of its raw materials locally, contributing to economic development and regional sustainability goals.

Oji’s expansion aligns with broader industry trends, including Tetra Pak’s recent upgrade of its Binh Duong plant, which increased annual production capacity from 12 billion to 30 billion packages.

With this investment, Oji strengthens its position in Southeast Asia’s growing sustainable packaging market, advancing circularity, local manufacturing, and environmentally responsible production.

GHANA - MTN Ghana has introduced its first biodegradable SIM cards, marking a significant advancement in its environmental sustainability agenda.

Launched during the 2025 Sustainability Week in Accra, the new SIMs are designed to reduce electronic waste and integrate more eco-friendly materials into the telecom supply chain.

Patrick Afari, General Manager for Supply Chain Management and General Services, explained that the SIM cards are made from forest-certified biodegradable materials engineered to break down safely in the environment.

Even the embedded metal components have been redesigned to degrade without releasing harmful substances.

He emphasized that the cards match the performance, reliability, and user experience of traditional SIMs, offering a lower-impact alternative without compromise.

Chief Corporate Services and Sustainability Officer, Adwoa Wiafe, described the initiative as a defining moment in MTN Ghana’s sustainability journey, reinforcing the company’s commitment to responsible leadership and environmental protection.

CEO Stephen Blewett added that the move aligns with MTN’s broader decarbonization efforts, including its Project

Zero shift to electric mobility.

Over the past year, MTN deployed two electric vehicles, ten e-bikes, and installed its first EV charging station at its head office.

The biodegradable SIM launch forms part of MTN Ghana’s wider ESG strategy, which includes cutting electronic waste, eliminating single-use plastics, promoting recycling, and embedding circular economy principles across operations.

The initiative also mirrors global trends, such as Bahrain’s Batelco, which recently introduced Eco-SIMs made entirely from recycled plastic.

As physical SIM cards remain widely used despite growing adoption of eSIMs, biodegradable and recycled alternatives are emerging as practical solutions for telecom operators striving to reduce environmental impact while advancing greener technologies.

INDIA – Toyo Ink India has announced plans to expand liquid ink production at its Gujarat plant by approximately 1.5 times, reflecting its commitment to meeting the country’s rapidly growing packaging market.

The expansion, expected to begin in 2028, will strengthen Toyo Ink’s domestic presence and position the facility as a regional export hub.

Shekhar Barua, head of Toyo Ink India’s liquid ink and plastic colorant units, noted that India’s expanding middle class, evolving dietary habits, and rising consumption of packaged goods are driving increased demand for highperformance inks.

“Scaling up capacity and enhancing our sustainable portfolio ensures we continue delivering innovative solutions that meet evolving customer needs,” he said.

Toyo Ink has steadily grown in India over the past decade, starting liquid ink imports in 2011 and launching local

manufacturing in Delhi in 2013.

Its Gujarat plant, operational since 2021, serves flexible packaging, labels, and food applications, and has been operating near full capacity due to surging demand.

The ink expansion complements a separate initiative at the Gujarat site to increase solvent-based adhesive production by 3.5 times, with a new plant scheduled to begin operations in April 2026.

This move supports sectors including automotive interiors, home appliances, and labels, building on Toyo Ink’s earlier imports and local manufacturing efforts.

Together, these dual investments underline Toyo Ink India’s strategy to strengthen supply reliability, expand market reach, and establish Gujarat as a key production hub, ensuring the company remains well-positioned to capitalize on India’s booming packaging and manufacturing sectors while advancing sustainable, scalable growth.

COLOMBIA – CANPACK Group has announced a US$140 million investment to build its second aluminium beverage can plant in Colombia, reinforcing its commitment to the country’s rapidly growing packaging sector.

The new greenfield facility will be located near Barranquilla in the Caribbean region and is supported by a long-term supply agreement with a strategic customer.

Production is scheduled to begin in the first quarter of 2027, with a state-of-the-art line capable of producing approximately 1 billion aluminium can bodies per year.

The project is expected to generate around 160 highly skilled direct jobs, contributing to regional economic development and positioning Colombia as a key beverage can manufacturing hub in Latin America.

CANPACK CEO Marius Croitoru highlighted the company’s ongoing expansion in Colombia, following its first plant in Tocancipá opened in 2019.

CANPACK Colombia, part of the group since 2018, is recognized for customer service, continuous innovation, and corporate social responsibility initiatives in local communities.

In a parallel announcement, CANPACK appointed Fabio Hees as Chief Commercial Officer, effective September 2, 2025.

Hees, previously Commercial Vice President at Ball Corporation, brings over 20 years of experience in the global beverage can industry.

Croitoru emphasized Hees’ expertise in driving commercial strategy and growth, while Hees expressed enthusiasm about joining CANPACK during this transformative phase.

The Barranquilla facility, combined with Hees’ commercial leadership, positions CANPACK to strengthen regional supply security, meet rising beverage can demand, and advance its sustainability and innovation objectives across the Americas.

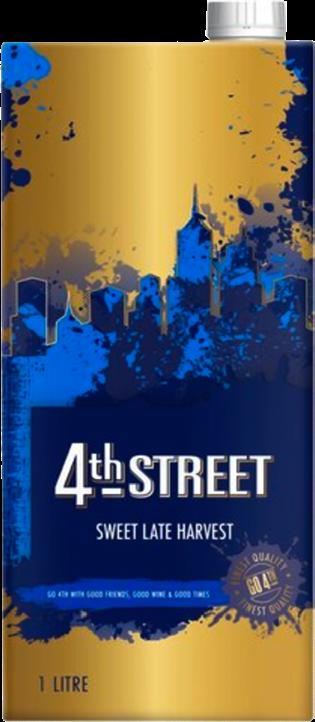

Heineken South Africa’s has introduced 4th Street Late Harvest Wine in a 1L Tetra Brik Aseptic carton, offering a lightweight, portable and ecofriendly format with FSC certification and recycling prompts.

The design reflects the brand’s urban, youthful energy, pairing bold graphics with clear messaging on responsible drinking, alcohol content and health warnings.

Prominent labelling highlights its sweet, easy-drinking style, South African origin and convenience, equivalent to eight glasses, making it ideal for chilled, casual enjoyment on any occasion.

Laiterie Soummam has repackaged its apricot yogurt in a compact 95g plastic pot designed for convenience and freshness.

The packaging typically features bright apricot imagery and clean branding to highlight its fruity flavour and natural appeal.

Clear labelling communicates key product details such as refrigeration requirements, Algerian origin, fresh local milk, and nutritional benefits like calcium for strong bones.

Beatson Clark has created a new 420ml multi-dose glass bottle for UNROOTED, designed to deliver seven 60ml functional shots in one convenient weekly supply.

The flint bottle aligns with the brand’s existing 60ml singleshot format, reinforcing its commitment to plastic-free, infinitely recyclable packaging.

Its durable, inert glass structure keeps the product fresh without preservatives, supporting UNROOTED’s sustainability ethos inspired by the longevity of the baobab tree.

Appartement 103 created a luxury, sculptural bottle for Oyster Gin, inspired by the organic curves of an oyster shell.

The embossed silhouette and subtly tinted glass elevate the maritime story, with the Adriatic Gin presented in clear green glass and a deep-green leather neck ring, while Wild Citrus features a frosted finish for added tactility.

Both variants use natural wooden closures and an embossed metal coin, with understated typography that lets the bottle’s iconic form stand out as the hero.

Calbee America has refreshed the Harvest Snaps packaging with a brighter, more informative design that highlights its real-veggie credentials.

A prominent “Made with Real Veggies” seal, along with clear protein and fibre callouts, reinforces the snacks’ pea- and lentil-based origins.

The core range now features the word “crispy” and an illustrative graphic showing legumes milled in-house.

Unilever has refreshed the global packaging of its Comfort laundry softener with JDO, introducing bold, nature-inspired colours, fresh floral imagery and a modernized wordmark to emphasize heightened freshness.

JDO shaped a cohesive design system to guide portfolio segmentation and key visuals, ensuring consistency while amplifying Comfort’s freshness message.

According to Unilever, the revamped packaging elevates the consumer experience and reinforces the brand’s leadership by blending strategic insight with creative execution for a more contemporary, premium look.

Building Kenya's circular economy from the ground up

When Kenya banned plastic carrier bags in 2017, it triggered a national conversation about waste and marked the beginning of a journey that would reshape how the country manages packaging. At the heart of this transformation is Joyce Gachugi Waweru, Chief Executive Officer of the Packaging Producer Responsibility Organization (PAKPRO). Her work, and that of the collective she leads, has been central to establishing Extended Producer Responsibility (EPR) in Kenya, a system now recognized as one of the continent’s most progressive waste-management frameworks.

But the story of EPR in Kenya is not only about policy; it is also about a woman who grew up dreaming of a life as a globe-trotting environmentalist working at the United Nations Environment Programme (UNEP), an ambition that, by chance and persistence, aligned with a mission to build the foundations of Kenya’s circular economy.

This year, Joyce was nationally celebrated for her leadership and was recently honored BY

among Kenya’s heroes for her contributions to sustainable waste management. For her, the accolade symbolized something bigger: “It validated the work that we have been championing for the last seven years, that we are creating an impact.”

PAKPRO’s story traces back to 2018, when the country was debating what to do about PET bottles, the next major pollutant after plastic carrier bags. “There was this conversation: should we ban the bottles?” Joyce recalls. For manufacturers who had heavily invested in PET production, the debate threatened their business model.

Relief came from a model already thriving in South Africa. Kenyan companies like Coca-Cola were members of PETCO South Africa, which had been effectively managing post-consumer plastic since 2004. The model showed that producers could fund collection and recycling while supporting waste pickers and aggregators. Through the Kenya Association of Manufacturers, a framework of cooperation was established with the Ministry of Environment, Climate Change & Forestry and NEMA. PETCO Kenya was launched with eight founding companies, “a coalition of the willing,” Joyce notes. They operated without a regulatory blueprint, experimenting, iterating, and gradually building a system that worked.

Between 2018 and 2022, PETCO collected close to one billion PET bottles, raised the value of collected PET bottles, and injected more than KES 150 million into the recycling value chain. Even UNEP's then country representative acknowledged visible progress. "Where we used to have an accumulation of PET bottles, it's not like that anymore. We are noticing that there's some traction; this thing might actually be working," Joyce notes with evident satisfaction. This success set off a policy shift. In 2022, the Sustainable Waste Management Act was gazetted, followed by EPR regulations in 2024, making EPR mandatory for all producers.

PETCO now had to evolve.

"We realized that we could no longer only handle one packaging material – PET bottles," she explains. "We had to rebrand so that we could handle all types of packaging materials, and that's why now we are PAKPRO, the Packaging Producer Responsibility Organization."

At its core, PAKPRO operates as an intermediary, collecting fees from producers and reinvesting them into the waste recovery value chain. But the organization's value proposition extends far beyond simple compliance. “Our value proposition is not only compliance,” Joyce says. “Most important is that we take care of your legal liability once consumers have used your packaging.”

PAKPRO provides members with comprehensive data: where their packaging ends up after use, how much has been recycled, how many people have been impacted by the money injected into the waste stream, and the carbon footprint of managing their waste. The organization also advises on packaging design, steering members toward materials that are more recyclable and cost-effective to recover.

"We have also helped our members to design their packaging so that they are using more recyclable, less expensive materials to reduce their environmental impact, because not all materials are equal," Joyce notes.

Perhaps most importantly, the PRO has brought transparency to a historically opaque market. By publishing prices and connecting waste pickers directly with contracted recyclers, the organization is dismantling the brokerdominated system that has long characterized the waste trade.

"We are breaking down layers that have made it opaque as a business," she explains. "We are trying to make it more transparent so that you have more people who are willing to play and participate in this business."

Waste pickers working through PAKPRO's network receive premium prices, better than they would get from non-contracted recyclers, because the organization subsidizes collection costs. This creates an incentive for more material

to enter the formal recycling stream.

What began with two aggregators has grown to more than 600 aggregators and 6,000 waste pickers, supported by a 16-member PAKPRO team. Joyce believes the potential is far greater. “We can have the potential to create over 100,000 green jobs for waste entrepreneurs,” she says.

Instead of building parallel structures, PAKPRO works through the regional offices of KAM, KEPSA, and the Kenya National Chamber of Commerce to reach producers. They conduct training, registration drives, and market activation events to strengthen local recycling ecosystems.

PAKPRO is also working with existing and new material recovery facilities (MRFs) in strategic clusters. “These MRFs need volume to be sustainable,” Joyce emphasizes. “You create clusters to ensure constant movement of vehicles and material.”

One of PAKPRO's most significant contributions has been quantifying Kenya's packaging waste for the first time. Before the organization's formation, no comprehensive data existed on how much packaging material entered the market or what happened to it afterward.

"We've been able to quantify waste and quantify it from the context of packaging. How much packaging material is going out? How much product, be it beverages, cosmetics, or cement, we can trace within our system, how many of these products are actually going out," Joyce explains. "Before that,

no one was collecting it. No one cared for it. It was not useful to anybody. Now we are acting as repositories for this data."

This information is transforming how Kenya understands and manages its packaging pollution challenge. "Data is really the currency," she insists. "This is how we are going to know how much volume of good plastics we have in Kenya? Bad plastics, do we have? Of glass? Of etc."

The organization is also reframing the conversation around packaging pollution itself. "We are now trying to tell you, the Packaging isn’t the problem, it is how we dispose of it and whether there is any value in it that will drive recovery," she explains. "It's not just me throwing my used bottle, no, because I can be throwing my used bottle, but if it doesn't have value, then it becomes a pollutant. If it has value, it will not even lie around in the streets for two minutes."

PAKPRO's expansion comes amid a complex regulatory environment. Two key regulations drive membership: the Extended Producer Responsibility regulations that require all producers to obtain EPR certificates. In contrast, the Plastics Clearance Certificate regulation requires any company using plastic to demonstrate Extended Producer Responsibility plans.

Non-compliance carries fines and jail terms. Yet awareness remains low, especially among SMEs and freight forwarders, who often serve as primary distributors of imported goods. “They don’t know they must be paying an organization like ours before putting products on the market,” Joyce warns.

“Awareness is now the most critical factor for EPR success.”

PAKPRO is also calling for collaborative awareness campaigns by industry and government to close this knowledge gap. "This is one of the most collaborative legislative pieces that have been done in Kenya, collaborative between the private sector, civil society, and the government," Joyce acknowledges. "That being said, however, there is a deficiency in terms of awareness creation."

Despite the organization’s success, significant challenges remain. PAKPRO recently overcame a major hurdle when conservatory orders that had halted EPR implementation were lifted, allowing the system to proceed. But other obstacles persist.

Government fees for legacy waste management create friction with producers already paying EPR fees. "County governments are arguing they need to raise money so that they can push it into the counties, so that they handle this legacy waste," Joyce explains. "Now, in doing that, it means they are charging these same manufacturers we are charging a fee, so already there's some friction there."

Infrastructure gaps present another major setback. Outside major urban centers, waste management systems remain severely underdeveloped. Joyce notes that in many areas, the prevailing culture is to throw waste away. Counties often focus on removing visible waste from public spaces rather than building systems for proper collection, sorting, and recycling. This not only undermines efforts to increase recovery rates but also leaves rural regions far behind in adopting circular economy principles.

Financing the circular economy is another challenge.

Banks, which play a central role in funding business operations, often struggle to understand waste management and recycling as viable, scalable sectors. As Joyce points out, “They are the heart of money. If they don’t understand, we are in trouble.” Without tailored financial products or risk assessments suited to the sector, recycling businesses and waste innovators face difficulties accessing the capital needed for equipment, expansion, or technology upgrades.

Policy reversals have also slowed momentum. In 2019, the government introduced tax exemptions for recycling equipment to stimulate investment in the sector. However, these incentives were reversed after the COVID-19 pandemic, creating uncertainty and placing additional financial strain on recyclers. Joyce expresses frustration at this stop-start approach, saying, “We are being asked to run before we have even found our feet.” For the circular economy to thrive, she argues, policy stability and long-term support are essential.

Despite domestic obstacles, PAKPRO envisions EPR expanding regionally but warns against fragmented policies. Different bans and regulations across Kenya, Uganda, and Tanzania create market distortions.

“We need a common protocol,” Joyce emphasizes. Harmonizing regulations across East Africa would not only streamline compliance for producers but also open the door to cross-border trade in recycled materials. She envisions a system where recyclers and manufacturers benefit equally.

“We could reach a point where Uganda has crushed PET or glass, and Kenya has the market for it. They sell to us, we sell to them, everyone wins. We promote what we’re doing, and vice versa. It unlocks an entirely new level of regional trade.”

As Kenya moves from voluntary to mandatory EPR, Joyce’s vision for PAKPRO centers on being bold and better. Bold means greater visibility, higher impact, more partnerships, and stronger value chain investments.

Better means improving metrics, more collection, more jobs, more money in the waste value chain, and more producers in compliance.

Her recognition as a national hero affirms the sector’s collective effort. “It validated the work we’ve been championing for seven years,” she reflects. “Circular economy is coming of age in Kenya.”

PAKPRO’s journey, from eight pioneering companies to a national mandatory system, shows that environmental responsibility and economic opportunity can coexist. As Joyce puts it: “Better to have something and work around making it work than have nothing at all.” SPMEA

BY ALPHONSE OKOTH

When Kenya banned singleuse plastic bags in 2017, few imagined that the move would spark a wave of innovation that would ripple across industries and ignite fresh thinking about waste. For Wangari Kamanga, it marked the beginning of a transformative journey that would later give birth to Bloomline Creations, a small but bold enterprise breathing new life into textile waste.

“I think that was the moment I started to understand sustainability and the circular economy,” she recalls. “At the time, I was working with a manufacturing association helping communicate what the ban meant for industries and consumers. Suddenly, the country was forced to ask, if we can’t use plastic, what’s the alternative?”

The experience opened Wangari’s eyes to Kenya’s growing waste challenge, particularly in plastics. But beyond bottles and packaging, she saw another problem quietly piling up in landfills, discarded textiles. Clothes, curtains, blankets, and sheets that no longer had use at home were ending up in dumpsites, where they

would take decades to break down.

“I realized that unlike organic waste, textiles don’t disintegrate. They just sit there,” she says. “That’s when I started to ask, what if we could reuse them? What if waste could become beautiful again?”

Wangari’s first experiment with textile upcycling began almost by accident. One day, she found herself staring at a pair of old jeans she couldn’t bring herself to throw away. The denim was frayed and torn, yet the material was still strong. She took it to a tailor she knew, Isaac, and sketched an idea, a simple tote bag.

“There was a lot of back and forth,” she laughs. “But finally, he made it. That was my first tote bag, and I still carry it around to remind myself how it all started.”

That small act of creation lit a spark. Soon, friends, family, and church members were donating their old clothes. At first, most brought jeans, assuming the project was only about denim. But Wangari saw potential in everything, blankets, bedsheets, curtains, even carpets.

EVERY BAG IS DESIGNED TO BE DIFFERENT. WHEN YOU BUY ONE, YOU’RE THE ONLY PERSON IN THE WORLD WITH THAT DESIGN

“I wanted to see how different materials could come together in one product,” she says. “Blankets became the padding, bedsheets turned into linings, and carpets gave structure. The idea was to make every part useful.”

The result was a series of colourful, one-of-a-kind bags, each piece telling a different story. Some were patched from multiple fabrics, others lined with old shirts or quilts. What could have ended up in a landfill was instead transformed into something functional and beautiful.

At the time, Wangari was already running a communications consultancy called Bloomline Communications. When the upcycling venture began to take shape, she decided to merge her two worlds, creativity and sustainability, into one name: Bloomline Creations.

“The idea of ‘Bloomline’ came from the concept of a rose - I have been in the background for so long in many things around my career - it is now time to bloom,” she explains. “It’s about creating hope and colour out of what people consider waste.”

From its inception, Bloomline Creations was more than a passion project. Wangari saw it as a business with the potential to create jobs, raise awareness about waste management, and contribute to Kenya’s circular economy. Her vision was clear: to build an enterprise that could stand on its own, not just a social cause dependent on donations or grants.

“There’s a business in waste,” she insists. “We just have to figure out the market. If we can create products people want to buy, we can make sustainability sustainable.”

Bloomline’s signature products are tote bags, backpacks, and clutch purses, all handmade, all unique. Each carries a story,

often deeply personal to the customer. Some clients bring in garments with sentimental value, a favourite T-shirt, a beloved pair of jeans, and ask Wangari to turn them into something lasting.

“One customer brought me her sister’s T-shirt,” Wangari recalls softly. “It was torn, but she couldn’t throw it away. So, we used it as the front of a bag. It became a keepsake, a way of holding onto memory.”

This personal connection gives Bloomline Creations an emotional weight that mass-produced goods can never match. Every bag is designed to be different. “No two are alike,” she says proudly. “When you buy one, you’re the only person in the world with that design.”

Her approach also challenges Kenya’s fast-fashion culture, where cheap second-hand clothes flood local markets but end up as waste within months. By transforming textile scraps into durable, high-quality products, Bloomline demonstrates that fashion can be circular, sustainable, and deeply human.

Yet, running an upcycling business in Kenya comes with its own set of hurdles. Collecting textile waste isn’t as simple as picking up bottles or cans. There’s no established take-back system in the country. And while many people have piles of old garments at home, few know what to do with them.

Most waste collectors won’t touch textiles,” Wangari

explains. “They’ll take PET, glass, or metal, but not clothes. That’s why I rely on people bringing them directly to me.”

Still, she sees progress. Across Kenya, conversations about waste segregation and sustainable living are gaining traction. Bloomline has begun informal partnerships with tailors who supply fabric offcuts, and Wangari is in talks with local waste collectors to set up a more organized collection process.

She also hopes to collaborate with secondhand clothing importers to repurpose unsellable garments before they end up in dumpsites. “The goal is to catch the waste at the source,” she says. “If we can intercept it before it’s thrown away, we can make a real impact.”

As Bloomline grows, Wangari faces the classic challenge of many green entrepreneurs: balancing environmental passion with financial sustainability. Producing handmade upcycled items takes time, skill, and resources, yet the local market often undervalues such products.

“The margins are small,” she admits. “That’s why I’m looking beyond individual buyers to the export and B2B market. If we can secure consistent orders, say from boutiques, hotels, or international partners, we can scale up, hire more tailors, and handle more waste.”

Her long-term goal is to make Bloomline a continental brand, a symbol of African creativity and circular innovation. “In five years, I want us to be the go-to name for textile upcycling in Africa,” she says with conviction. “A business case that shows recycling isn’t just good for the planet—it’s good for business too.”

Among Bloomline’s most touching initiatives is the Bag of Hope project. For every two bags sold, Wangari commits to making an extra one for donation to a child in need. Many schoolchildren in rural Kenya still carry books in plastic or paper bags. Bloomline’s handmade school bags provide a small but meaningful alternative.

“It’s not charity, it’s purpose,” she says. “I want it to be our corporate social responsibility, not a dependency model. If a child can walk to school with dignity carrying a bag made from

what others threw away, that’s powerful.”

Even as she dreams big, Wangari is candid about the obstacles ahead. Collecting enough clean textile waste remains difficult, as many people hesitate to part with old clothes due to sentimental attachment. Machinery is another constraint, thicker materials like carpets and blankets can break sewing needles, slowing production.

Then there’s the matter of awareness. “Many people still don’t understand what circular economy means,” she says. “They think recycling is just about bottles. But it’s also about rethinking how we use what we already have.”

To address this, she seesk to use her background in communications to educate customers and communities through storytelling. ‘ I am in the process of working with other story tellers to use ou social media to share transformation stories—before-and-after photos of fabrics reborn as new products. Each post becomes a small act of environmental education.

Kenya’s waste management landscape is evolving, with new laws like the Sustainable Waste Management Act and EPR regulations aiming to promote circular practices. Wangari hopes that future policies will extend to textiles, offering incentives for small upcyclers like her to set up local workshops.

“Waste management is now devolved,” she notes. “So, if counties could partner with enterprises like Bloomline to process textile waste locally, it would create jobs and reduce landfill pressure. Incentives like tax breaks or access to workspace would go a long way.”

Her advocacy extends beyond her own business. She dreams of building a network of African upcyclers, a community of changemakers transforming waste into opportunity. “We can’t do it alone,” she says. “There’s enough waste for everyone. The more of us doing this, the better for the planet.”

Today, Bloomline Creations is still a small operation. Wangari works closely with one main tailor, sometimes hiring others for big orders. Every bag that leaves her hands carries the imprint of collaboration, patience, and purpose. It’s a modest beginning, but one grounded in vision.

When asked what keeps her going, she pauses for a moment before replying: “Hope. The belief that we can change how people see waste. That something torn, forgotten, or discarded can become useful again.”

From a single pair of jeans to a growing movement, Wangari ‘Rosy’ Kamanga’s story is a testament to what happens when creativity meets conscience. In her hands, scraps of fabric become not just bags, but symbols of resilience, renewal, and the promise of a greener Kenya. SPMEA

BY MARY WANJIRA

Glass has long been the backbone of pharmaceutical primary packaging, especially for injectable drugs, biologics and other highvalue therapies. Yet its role in the industry is undergoing a transformation. Over the past years, the sector has shifted from viewing glass as a dependable legacy material to treating it as a dynamic platform for innovation, efficiency and safety.

This momentum comes from both sides of the value chain: pharmaceutical manufacturers and CDMOs continue to prioritize glass for its chemical inertness and robust barrier properties, while leading glass-makers are re-engineering the material to address concerns around breakage, supply security, delamination and sterile manufacturing efficiency.

As a result, glass packaging today sits at the intersection of engineering innovation, regulatory confidence and shifting global market demand. Understanding why this material remains dominant, even as polymer alternatives make incremental gains, requires a closer look at its intrinsic advantages, commercial performance and the rapid pace of innovation reshaping its future.

At a materials-science level, the fundamental strengths of glass remain difficult to replicate. Type I borosilicate and other neutral pharmaceutical-grade glasses continue to offer unparalleled chemical inertness, resisting interactions with delicate molecules, solvents and biologics. This matters greatly in an industry where even minimal leachables and extractables can destabilize formulations, accelerate degradation or raise regulatory red flags.

Glass’s impermeability to gases and vapours further enhances drug stability, while its ability to tolerate extreme sterilization methods, from high-heat autoclaving to radiation, gives manufacturers process flexibility that many polymers cannot safely support. These intrinsic characteristics translate directly into regulatory and clinical advantages.

Longer shelf lives, predictable stability profiles and reduced material-drug interactions give regulators clearer compatibility data and manufacturers greater confidence that their products will maintain quality across the supply chain.

For biologics, where even small environmental deviations can compromise therapeutic integrity, this security remains indispensable. It is no surprise that glass vials, ampoules and cartridges still dominate in segments where efficacy, sterility and molecular sensitivity are paramount.

This scientific and regulatory foundation aligns with strong commercial performance. Market research over the past three years has consistently pointed to a growing pharmaceutical glass packaging sector.

Grand View Research estimates the market at approximately US$19.8 billion in 2023, with expectations of a robust compound annual growth rate of around 9.8% through 2030. Other analysts place the 2024–2025 global valuation in the low-to-mid tens of billions and forecast midsingle- to high-single-digit growth well into the next decade.

What explains this trajectory is not only the expanding market for biologics, one of the fastest-growing categories in drug development, but also broader industry shifts. Vaccination programs have expanded globally; sterile injectable generics continue to proliferate; and drug makers are increasingly adopting prefilled and ready-to-use (RTU) systems that rely heavily on high-quality glass containment.

This mix of structural tailwinds positions glass not just as a mainstay but as a growth category, attracting investment from converters, material scientists and packaging giants seeking a competitive edge in a high-value market.

Much of the excitement in the glass arena comes from the surge of innovation addressing long-standing operational challenges. One of the most visible players in this space is Corning, which has developed a suite of strengthened and surface-engineered glass types, such as Valor® glass and the newer Velocity® and Viridian™ vial formats.

These products were designed to reduce breakage, friction and delamination, persistent issues on high-speed filling lines and during cold-chain handling. By reinforcing the glass structure and optimizing surfaces to lower particulate generation, Corning has positioned these innovations as solutions tailored for sensitive biologics and the demanding processing speeds of advanced manufacturing lines.

Pharmaceutical companies, facing pressure to increase throughput while meeting stringent regulatory controls, have responded positively to materials that enhance both safety and operational efficiency.

Other market leaders have taken a complementary approach by innovating at the process and container-preparation levels. SCHOTT, Gerresheimer and Stevanato Group, three giants in pharmaceutical packaging, jointly announced an “Alliance

for RTU” in late 2024, signalling a coordinated industry push toward pre-sterilised, ready-to-fill containers.

RTU formats are increasingly attractive to CDMOs and pharma manufacturers because they simplify sterile production workflows. Instead of sterilizing vials or syringes in-house and managing multiple contamination-prone handling steps, manufacturers receive containers that are prewashed, depyrogenated, sterilized and packaged for immediate use.

This streamlines operations, reduces capital costs, enhances product sterility and shortens time-to-filling, a key competitive metric in contract manufacturing. The alliance’s emergence reflects how deeply RTU adoption is shaping the strategic direction of the glass industry, especially as biologics continue to surge and contamination risk management becomes ever more critical.

Running parallel to these technological trends is a significant shift in supply-chain strategy. The pandemic exposed vulnerabilities in global pharmaceutical packaging supply chains, particularly around the availability of high-quality borosilicate tubing and the capacity to convert tubing into finished vials.

In response, glass manufacturers have intensified investments in regional capacity-building. Gerresheimer and Corning’s 2023 joint arrangements strengthened production closer to key pharma hubs, ensuring shorter lead times and reducing the risk of supply disruptions for biologics with tight

manufacturing windows.

Companies such as SGD Pharma and other converters have announced expansions in Asia, India and Europe, reflecting an industry-wide pivot toward localizing tubing production, enhancing resilience and allowing pharmaceutical clients to operate with greater predictability. These investments have become crucial as the number of injectable drug launches grows and regulatory expectations around supply-chain robustness tighten.

Sustainability is also emerging as a strategic pillar in discussions around the future of glass packaging. While healthcare waste streams are highly regulated and often not compatible with conventional recycling infrastructure, glass retains an inherent sustainability advantage: it can be endlessly recycled without loss of quality, unlike many plastics that degrade after multiple cycles.

Several pharmaceutical companies, when developing sustainability roadmaps, now consider the full lifecycle impacts of primary and secondary packaging. This includes not only the recyclability of glass containers but also the environmental footprint of transport, sterilization and line operations.

Innovations such as lightweighted glass formats, optimized packaging for higher transport density and energyefficient RTU processing are helping align glass with the industry’s broader climate commitments. Glass producers have responded with their own sustainability strategies, setting targets for reducing emissions in melting operations, increasing recycled content where permitted and improving overall energy efficiency.

Despite its strengths, glass is not without meaningful challenges. Fragility remains a concern, especially for products shipped long distances or requiring ultra-cold chain conditions. Breakage, while declining due to new surface treatments and strengthened formulations, still carries cost implications for manufacturers.

Weight is another factor, particularly where transport emissions and logistics costs are scrutinized. Unit cost comparisons often favour polymer alternatives, especially for high-volume, lower-margin products. Materials like cyclic olefin polymers (COP) have gained ground in specific niches such as prefilled syringes, where break resistance and design flexibility matter.

Yet polymers face their own limitations: susceptibility to interaction with active ingredients, permeability issues and a

more complex regulatory pathway for certain biologics. As a result, the industry’s direction is not shifting toward replacing glass with polymers, but toward combining glass’s unique strengths with engineering enhancements that mitigate its historical weaknesses.

Looking ahead, several trends are poised to shape the next chapter of pharmaceutical glass packaging. Consolidation among converters and glass-makers is likely to intensify as companies seek scale, integrated tubing-to-vial capabilities and vertically aligned production networks.

The uptick in mergers and acquisitions over the past two years hints at the competitive pressure to expand footprints and control more of the supply chain. RTU adoption

will accelerate, driven by the success of alliances, emerging standards and the rising demand for aseptic flexibility among CDMOs.

At the same time, regional capacity expansion will continue, particularly in Asia, India and the Middle East, where biologics manufacturing is growing quickly and governments are emphasizing local pharmaceutical production.

In the end, glass remains the material of choice for pharmaceutical primary packaging not because it is a legacy material, but because it continues to evolve. New coatings reduce delamination and friction; RTU formats minimize contamination risk; strengthened formulations replace fragility with resilience; and global investments in local capacity are making the supply chain more responsive than at any point in its history.

Market projections are strong, and industry actions –from Corning’s strengthened vial technologies to SCHOTT, Gerresheimer and Stevanato’s RTU alliance, show a sector attuned to the fast-changing demands of modern drug manufacturing.

For pharmaceutical companies, the strategic question is no longer whether to use glass or polymers, but how to maximize the advantages of a material that remains unmatched in chemical performance while addressing its limitations through smart design, process innovation and collaborative supplychain engineering.

BY MARY WANJIRA

For decades, the beauty industry has lived with an uncomfortable contradiction. The products meant to elevate confidence and self-expression have left behind enormous amounts of waste, tiny jars, ornate bottles, shiny compacts, and multilayered pumps that rarely see a second life. Globally, the industry produces more than 120 billion units of packaging every year, according to the British Beauty Council, and an estimated 95% of it ends up in landfills or oceans.

Yet within this mountain of waste, a quiet transformation has begun to take root. What started with eco-driven indie brands experimenting with reusable jars has grown into a sweeping industry shift. Luxury houses, mass-market leaders, and packaging manufacturers are all rethinking not just how beauty is presented, but what the future of beauty feels like in the hands of consumers.

Traditional cosmetics packaging remains one of the toughest categories for recycling because even a single foundation bottle can contain glass, mixed plastics, rubber, and metal, materials that are nearly impossible to separate cost-effectively.

While recycling sounds ideal, the reality is that most systems can’t handle this complexity. Refillables offer a cleaner, smarter alternative. Consumers buy a durable, beautifully designed container once, then top it up with lightweight refills that use up to 70% less material. Over multiple cycles, the environmental impact is significant, a compact reused five times replaces four disposable ones.

This shift also aligns with today’s beauty culture, where

longevity is increasingly seen as a form of luxury. Millennials and Gen Z are especially skeptical of throwaway habits and more conscious of the carbon footprint of daily routines. With searches for “refillable beauty” surging and 61% of consumers linking sustainability to caring for the planet, refillable packaging is becoming more than a solution, it’s a new way of valuing beauty itself.

While Europe and North America lead the refill movement, the Middle East and Africa (MEA) region is quickly gaining momentum, particularly in affluent urban centres such as Dubai, Riyadh, Nairobi, and Cape Town.

Mordor Intelligence estimates the MEA cosmetics packaging market at US$1.62 billion in 2025, projected to rise to US$2.02 billion by 2030 at a 4.49% CAGR. Within this growth, refillables are emerging fastest in luxury fragrance, premium skincare, and halal-certified categories, spurred by regulatory pressure such as Saudi Arabia’s push for oxobiodegradable packaging and the UAE’s focus on sustainable imports.

While adoption remains early-stage, the region’s massive beauty spend and growing sustainability consciousness signal strong potential for refillables to become mainstream across MEA in the coming decade.

The late 2010s marked a turning point as consumers became more educated about the waste footprint of beauty packaging.

Social media advocacy, documentaries on ocean plastic, and zero-waste influencers all played a role.

A NielsenIQ survey highlighted that 61% of global consumers now associate sustainability with planetary benefits, while searches for "refillable" beauty products increased by 64% in recent years.

In addition, the Shorr Packaging 2025 Consumer Report revealed that 30% of U.S. consumers specifically noted progress in beauty and cosmetics sustainability, with 54% actively choosing products based on eco-friendly packaging in the prior six months.

Luxury brands were among the first to merge sustainability with elegance, proving that green initiatives can heighten, not dilute, the premium experience.

La Mer’s refillable Treatment Lotion captures this ethos: customers invest in a weighty glass bottle meant to live on the vanity for years, while lightweight refill pouches dramatically reduce material use.

Guerlain takes the concept further with its Orchidée Impériale ritual, inviting customers to bring their jars back

to boutiques for expert in-store refilling. This eliminates unnecessary packaging and turns the refill moment into a loyalty-building brand experience.

While skincare has transitioned smoothly into refill systems, color cosmetics present tougher challenges due to shade diversity and hygiene demands. Yet innovation continues to accelerate. MAC’s long-running Back-to-MAC initiative helped normalize circular behaviour by rewarding customers for returning empty containers.

Newer entrants such as Kjaer Weis have redesigned the category entirely with durable metal compacts that allow users to replace pans with a simple click, the refill mechanism becoming part of the product’s tactile appeal.

Scalability remains the next frontier, and Japanese giant Shiseido illustrates how thoughtful engineering can unlock mass adoption. Its Elixir line uses sleek, mess-free pouches that cut plastic use by up to 85% and remove the inconvenience that often discourages consumers from refilling. By pairing design intelligence with user-friendly systems, the company demonstrates that refills can thrive across both premium and mainstream markets.

Meanwhile, L’Oréal Groupe has expanded its refillable portfolio seventeen-fold since 2019, supported by factory

WHILE

TRANSITIONED

retooling, pod-based formats, and a 2025 cross-brand #JoinTheRefillMovement campaign featuring Lancôme, Yves Saint Laurent, Kiehl’s, Mugler, Elvive and Kérastase.

Early life-cycle assessments show that these formats can cut packaging-related emissions by more than 60% per cycle. The Estée Lauder Companies are advancing a similar strategy through their “5 Rs” framework, achieving 71% alignment across 28 brands in 2024. Standout initiatives include Le Labo’s fragrance refill program and reusable components now integrated across nine luxury lines.

Packaging manufacturers have transformed refillable beauty packaging from a sustainability afterthought into a core innovation driver, blending advanced engineering, new materials, and user-centric design to achieve true circularity while preserving the premium feel that beauty consumers demand.

Aptar Beauty leads with its Future Airless refillable pump (fully recyclable PE mono-material) and the Rosette double-wall jar system, where the outer luxury glass or metal shell remains permanent and only a lightweight inner cup is replaced, reducing plastic by up to 87%. Their patented “QuickFill” lipstick mechanism (launched 2024) allows consumers to swap refills in one click without touching the bullet, now used by L’Oréal Luxe and Estée Lauder lines.