MIDDLE EAST & AFRICA

EVENT REVIEW

Buhler Networking Days 2025

TECHNOLOGY FOCUS Dust & Explosion Control

BAKING TECH

Sustainable Packaging in Baking

EVENT REVIEW

Buhler Networking Days 2025

TECHNOLOGY FOCUS Dust & Explosion Control

BAKING TECH

Sustainable Packaging in Baking

MIDDLE EAST & AFRICA

Year 3 | Issue No.15 | July - Aug 2025

FOUNDER & PUBLISHER

Francis Juma

SENIOR EDITOR

Martha Kuria

EDITOR

Wangari Kamau

Stephen Kibe

EXTERNAL CONTRIBUTORS

Martin Mucha

Kipng'etich Yegon

BUSINESS DEVELOPMENT

DIRECTOR

Virginia Nyoro

BUSINESS DEVELOPMENT

ASSOCIATE

Johna Sambai

HEAD OF DESIGN

Clare Ngode

ASSOCIATE DESIGNER

Emmaculate Ouma

ACCOUNTS

Anita Kinyua

Published By: FW Africa

P.O. Box 1874-00621, Nairobi Kenya

Tel: +254725 343932

Email: info@fwafrica.net

Company Website: www.fwafrica.net

We publish some of the most influential magazines and websites in Africa & the Middle East regions. Please visit the websites below for more information about our publications.

Milling Middle East & Africa is published 6 times a year by FW Africa. Reproduction of the whole or any part of the contents without written permission from the editor is prohibited. All information is published in good faith. While care is taken to prevent inaccuracies, the publishers accept no liability for any errors or omissions or for the consequences of any action taken on the basis of information published.

www.foodbusinessmea.com

www.millingmea.com

www.horecamea.com

www.dairybusinessmea.com

www.feedbusinessmea.com

www.healthcaremea.com

www.sustainabilitymea.com

www.hpcmagmea.com

With over 50 years of experience, Pakmaya stands by your side from diagnosis to solution. We offer practical and expert approaches tailored to your needs.

In this issue, we shine a spotlight on industry leaders driving solutions that are shaping the future of Africa’s food and agriculture sector. These giants are not only addressing current challenges but are also laying the foundations for a sustainable and prosperous tomorrow.

Stern Ingredients East Africa exemplifies innovation through its MC Mühlenchemie Technology Center in Kenya. Their “Understanding Flour” strategy is redefining baking across the region. “We’re particularly proud of our cake mix solutions,” says Nolte, pointing to their flexibility, which has become a game-changer for local markets. In addition, their fortification solutions for maize and wheat flour are enhancing nutritional outcomes, proving that innovation and impact can go hand in hand.

Meanwhile, Bühler, a global leader in milling equipment, continues to set the benchmark for sustainability. At their Fourth Networking Days, the message was clear: sustainability is no longer optional; it is essential for long-term business success. By integrating eco-conscious practices into cuttingedge technologies, Bühler is shaping a future where efficiency and environmental responsibility are inseparable.

This issue also sheds light on why dust control and explosion prevention remain paramount in the milling industry. Fine organic dust generated during grinding, handling, and storage is highly combustible. When suspended in the air, even the smallest spark—from static electricity, machinery, or friction, can trigger a devastating explosion. Beyond the immediate risk to workers’ safety, such events can damage equipment, halt production, and cause lasting reputational harm.

On the commodity front, Tanzania’s “Grain Drive” is positioning the country as a potential breadbasket of the region. Through strategic commitments and partnerships with private investors, the government is expanding grain production, particularly maize, rice, and wheat, which are staples in East Africa. These efforts are designed not only to meet domestic demand but also to strengthen Tanzania’s role as a reliable supplier to food-deficient neighboring countries.

Consumer preferences are also reshaping the grains industry. Whole and specialty grains are gaining ground globally, driven by growing health awareness and the demand for fiber-rich, nutritious foods. Their strong association with reducing chronic diseases, including obesity, cardiovascular conditions, diabetes, and certain cancers, continues to fuel this momentum. For millers and processors, however, working with whole and specialty grains presents unique challenges. These require specialized equipment and techniques, making their processing a call for innovation for the industry. In this issue, we share expert insights into how the industry is adapting to these demands.

Finally, we bring you a comprehensive roundup of the latest developments in the baking, milling, grains, and cereals sectors as well as the most relevant news shaping our industry.

Enjoy your read!

Martha Kuria, Senior Editor, FW Africa.

Grain & Milling Expo (GME)

October 8–9, 2025

Casablanca, Morocco

https://expo.grainmillingexpo.ma/en/

Grain Industry Expo

October 10–12, 2025

Bikaner, Rajasthan, India

https://www.grainindustryexpo.com/bikaner/

11th MAGROTEX 2025

October 23, 2025 - October 26, 2025

Mardin, Turkey

https://shorturl.at/ZtjoF

AgroFood Summit 2025

November 5-7, 2025

Mersin, Türkiye

https://agrofoodsummit.com/

VIV MEA

November 25-27, 2025

Abu Dhabi, UAE

https://www.vivmea.nl/

IAOM MEA Conference & Expo

December 1-4, 2025

Jeddah, Saudi Arabia

https://iaom-mea.com/Jeddah-2025/

Africa Dairy Innovations Summit

February 25-27, 2026

Nairobi, Kenya

http://www.africadairysummit.com/

Africa Food Manufacturing Nigeria & Western Africa

April 14-16, 2026

Lagos, Nigeria

http://www.afmass.com/

Africa Food Manufacturing Kenya & EA

July 15-17, 2026

Nairobi, Kenya http://www.afmass.com/

IDMA Istanbul 2026

June 25- 27, 2026

Turkiye

https://www.idma.com.tr/

SAUDI ARABIA - Saudi Arabia’s First Milling Company (First Mills), a producer of flour, bran, animal feed, and wheat derivatives, has completed the acquisition of Al-Manar Feed Company Ltd., a leading feed manufacturer in the Kingdom.

The deal, valued at SAR 77 million (US$20.52 million), was announced on August 12 and involves the purchase of 100% of Al-Manar’s shares. First Mills said the acquisition will be financed through Sharia-compliant bank facilities, available cash, and other financing options. Its financial impact will appear in the company’s third-quarter 2025 consolidated statements. Al-Manar, headquartered in Makkah, is known for producing high-quality animal feed for ruminants, poultry, and horses. Its integration into First Mills’ operations follows earlier board approval, conditional on successful operational testing to confirm quality, quantity, and efficiency standards.

Vice Chairman Abdullah Ahmed Al-Shehri described the acquisition as a milestone in First Mills’ strategy to grow its footprint in the feed sector. “We continue to pursue highvalue opportunities for sustainable growth in support of the objectives of Saudi Vision 2030 and to enhance the contribution of local production to achieving food security, while serving our customers across all regions of the kingdom,” he said.

The deal adds 420 tonnes per day of feed output to First Mills’ operations, lifting total daily production to 1,320 tonnes. The company noted the added capacity will help meet rising demand, broaden its geographic reach, and diversify revenue sources.

Chief Executive Officer Abdullah Abdulaziz Ababtain added that the move would strengthen competitiveness. “The acquisition will enable us to deliver a more comprehensive range of products and services, better meet the needs of the local market and reinforce the company’s long-term competitive position,” he said.

MOROCCO – Morocco is expected to import 7.5 million tonnes of wheat in the 2025/26 marketing year, according to the latest global supply and demand outlook from the U.S. Department of Agriculture’s Foreign Agricultural Service (USDA). This forecast, highlighted in an August report and cited by UkrAgroConsult, signals the country’s deepening reliance on external markets to meet over half of its wheat demand, driven by persistent droughts and escalating global grain prices.

Global wheat production is estimated at 789.8 million tons, down 2.1 million tons from July, while consumption remains

steady at 801.6 million tons, creating a supply-demand gap that is pushing prices higher. For Morocco, where wheat accounts for over half of cereal consumption and bread is a dietary staple, this global shortfall is particularly concerning.

The USDA projects global wheat reserves at 256.2 million tons for the 2025/26 season, the lowest since 2016/17, due to poor harvests in key producing regions like Europe, Russia, and Ukraine. The USDA FAS reported that the 2024/25 marketing year saw total wheat and barley production drop to 3.12 million metric tons, a 43% decline from the previous year. For 2025/26, production is expected to recover slightly but remain below the 10-year average, with forecasts of 1.7 million metric tons for common wheat, 1.1 million metric tons for durum wheat, and 0.7 million metric tons for barley.

According to a report by Interfax, Morocco imported more than 1.1 million metric tons of wheat from Russia by the end of June 2025, marking a 2.3-fold increase compared to the previous agricultural season. This sharp rise in wheat imports signals a notable expansion in Morocco’s grain import capacity and reflects broader shifts in global grain flows, especially as countries reassess their supply strategies amid mounting geopolitical and climate pressures.

CAMEROON - Cadyst Group, a leading agro-industrial and food processing player in Central Africa, has finalized the acquisition of the Grands Moulins du Cameroun (SGMC) and the Grands Moulins du Phare du Congo (SGMP), subsidiaries of the Somdia Group after a lengthy regulatory process. The transaction was officially concluded on August 6, 2025, with both companies’ boards of directors approving the change in shareholding and governance.

As part of the new leadership structure, Mr. Célestin Tawamba, President of Cadyst Group, was appointed Chairman of the Board of Directors of SGMC and SGMP. He will be supported by new directors, including Mrs. Elizabeth Gouater, Director and Chief Executive Officer of Cadyst Group. With this acquisition, Cadyst strengthens its leading position in Cameroon and extends its operations into the Republic of Congo, marking a significant step toward consolidating its status as a pan-African agro-industrial group.

Established by Mr. Tawamba with La Pasta, a small unit producing just 25 tons per day of pasta and flour, Cadyst has grown into a diversified conglomerate.

Its portfolio today includes flour production (Cadyst Grain), pasta and biscuits under the PANZANI brand, local distribution (Cadyst Retail), healthcare (Cadyst Health Care), and poultry farming (Cadyst Farming), which specializes in day-old chicks.

In his statement, Mr. Tawamba emphasized the human dimension of the deal. “It is with great joy and deep emotion that we welcome SGMC and SGMP to Cadyst. August 6, 2025 marks much more than an acquisition, it is the starting point of a new chapter, bringing new opportunities for our teams, our partners and our markets,” he said. According to him, beyond the assets and figures, it is women and men who join the adventure with their experience, their culture and their know-how.

Azam celebrates 50 years of excellence with special Golden Jubilee wheat flour pack

TANZANIA - Azam, the flagship brand of Bakhresa Group, has marked its Golden Jubilee, celebrating 50 years of quality, affordability, and innovation across Eastern and Southern Africa. The milestone was commemorated on August 8 at the Super Dome, where Tanzania’s leading conglomerate gathered in a colorful ceremony. Founded in 1975 by entrepreneur Said Salim Awadh Bakhresa, Azam began as a small restaurant before growing into one of Africa’s most recognized brands. Over the decades, it has become a symbol of trust and value for households across the region.

To honor the anniversary, Said Salim Bakhresa & Co. Ltd. unveiled a Special Golden Jubilee pack of Azam Ngano Bora Wheat Flour, a staple in Tanzanian homes. The refreshed packaging reflects both legacy and consumer loyalty. “This Golden Jubilee is not just a celebration of our history, but a reaffirmation of the values that define who we are,” said Ali Asgar Mukadam, CEO of Said Salim Bakhresa & Co. Ltd. He emphasized the company’s commitment to uncompromising quality, affordability, and community upliftment.

From its Tanzanian base, Azam has expanded into Uganda, Rwanda, Burundi, Malawi, Mozambique, South Africa, Zimbabwe, and Zanzibar, contributing to regional industrial growth, job creation, and economic development. Its diverse portfolio spans food and beverages—including wheat flour, biscuits, ice creams, juices, and soft drinks—transport services such as Azam Marine and Azam Transport, and digital broadcasting through Azam TV.

The group also invests in agriculture and manufacturing, operating Bagamoyo Sugar, Azam Edible Oil, Azam Poly Sacs, and expanding into household products like soaps and detergents. Its energy and hospitality ventures include United Petroleum and the eco-friendly Hotel Verde Zanzibar. Looking ahead, Azam is extending its carbonated soft drinks operations into Uganda, reinforcing its ambition to reach new markets while upholding its core promise of quality and affordability.

KAZAKHSTAN – Alapala has commissioned a new 300-tonnes-per-day wheat flour mill for Aruana LLP, one of Kazakhstan’s leading food producers, further strengthening the company’s role in the country’s milling sector.The project marks Aruana’s second major investment in milling capacity as it seeks to meet rising demand for flour both in Kazakhstan and in surrounding export markets. Kazakhstan remains one of the top wheat producers in the world, with the milling sector playing a crucial role in its economy and export earnings.

Founded in 2010, Aruana is recognized for its “Patsha” brand flour, produced from high-protein wheat grown in Kazakhstan, a country long regarded as Central Asia’s breadbasket. The company operates its own grain storage facilities, allowing for precise grain blending and strict quality control throughout the production process. By supplying bakeries, food manufacturers, and retail distributors at home and abroad, Aruana has positioned itself as a trusted supplier of premium flour.

The newly commissioned mill is fitted with state-of-theart cleaning, grinding, and sifting equipment, alongside fully automated process control systems designed to optimize energy use and reduce operational costs. This integration of technology ensures high milling efficiency and also guarantees consistent output and premium flour quality, helping the company to compete in regional markets where demand for quality wheat products continues to grow.

Commenting on the partnership, Görkem Alapala, chief executive officer of Alapala, said that Kazakhstan is a strategic market for Alapala, and they are proud to support Aruana’s growth with a tailor-made milling solution that delivers efficiency, quality and reliability. “Our collaboration with Aruana is a great example of how we can combine advanced milling technology with a client’s strong market vision,” he said.

INDIA – AGI Milltec, a leading manufacturer of grain processing solutions and a division of Ag Growth International (AGI), has announced the successful commissioning of the Hanuman Rice Mill in Karnataka. The newly completed facility is a fully integrated, state-of-the-art rice milling plant with a processing capacity of 6 tonnes per hour (TPH). The plant was officially inaugurated by Shrimad Samyamindra Thirtha Swamiji, head of the Kashi Math Samsthan. His presence lent a spiritual and cultural significance to the event, underlining the mill’s importance to the local community.

AGI Milltec is part of Canada-based Ag Growth International, which acquired the Bengaluru-headquartered company in 2019. Since then, the firm has extended its presence across Southeast Asia, Africa, and Latin America, focusing on grain handling, storage, and processing innovations tailored to local market needs. The company described the Karnataka project as a reflection of its ongoing commitment to empowering the rice milling sector with innovative, reliable, and performancedriven technologies. The new plant features a complete turnkey configuration, from pre-cleaning and de-stoning to whitening, polishing, grading, and packaging, designed to enhance product quality and operational efficiency.

“This milestone reflects our commitment to empowering the grain processing industry with advanced, reliable, and high-performance milling solutions. We are proud to be part of Hanuman Rice Mill’s growth journey and look forward to continued success together,” the company stated following the commissioning. The 6 TPH plant forms part of AGI Milltec’s broader strategy to provide end-to-end grain processing solutions across India and other major rice-producing regions. The company, which has delivered more than 15,000 installations in India, offers customized milling lines ranging from 2 TPH to 20 TPH capacities.

deal to acquire

USA – Bunge Global SA, a leading agribusiness and food ingredient company, has entered into a purchase agreement with Solae to acquire substantially all the assets related to the lecithin, soy protein concentrate, and crush businesses of International Flavors & Fragrances, Inc. (IFF).The deal, announced in early August 2025, allows IFF to sharpen its focus on higher-margin, innovation-driven segments like its isolated soy protein business. The transaction is expected to close by the end of 2025, pending regulatory approvals and customary closing conditions.

The acquisition includes IFF’s commodity-focused operations, which employ approximately 250 workers globally, which generated approximately US$240 million in revenue for IFF in 2024. While financial terms were not disclosed, the acquisition aligns with Bunge’s strategy to deepen its presence in the food, feed, and biofuel sectors. Speaking during a conference call with analysts following IFF’s August 6 earnings report, J. Erik Fyrwald, chief executive officer and director, described the soy crush, soy protein concentrate and lecithin products being divested as a “better fit with Bunge.”

For IFF, the divestiture reflects a broader portfolio

PARTNERSHIPS

optimisation strategy. CEO J. Erik Fyrwald described the assets as “commoditised” and better suited to Bunge’s operational model. “They were low single-digit EBITDA margins for us and were distracting from our very differentiated isolated soy protein business,” emphasised Fyrwald, adding that the sale will allow IFF to focus on innovation and application development in its core food ingredients segment. With a strong presence in the world’s top three soybean oilseedproducing countries, Brazil, the United States, and Argentina, Bunge is well-positioned to integrate and optimise the acquired operations.

ITALY – Italian milling technology specialist Ocrim has entered into a strategic partnership with Grespan Impianti, a longestablished designer and builder of turnkey feed production plants. The alliance aims to offer high-tech, flexible, and efficient solutions to the global feed and agri-food industry, the companies announced.

Founded in 1961 and headquartered in Castrette di Villorba, Italy, Grespan Impianti brings more than six decades of experience in developing systems tailored for the livestock, food, and agri-food sectors. Over the years, Grespan has evolved from serving Italy’s livestock industry to delivering

custom-engineered solutions for feed manufacturing, food premix production, and bulk material handling, including storage, dosing, and mixing systems used in food, paint, and construction industries.

“Together, the two companies offer integrated, high-tech, flexible solutions geared toward maximum efficiency. Our alliance is rooted in shared Italian manufacturing values, a commitment to innovation, and an ability to deliver on diverse customer needs,” the companies said in a joint statement. Ocrim, based in Cremona, Italy, is a global leader in the design and manufacture of milling equipment for wheat, maize, and other grains. It has completed high-profile flour and feed mill installations in more than 150 countries. On the other hand, Grespan has a notable international presence, having installed facilities in countries across North Africa and the Middle East, including Tunisia, Morocco, Algeria, and Saudi Arabia, as well as in Eastern Europe—Ukraine, Hungary, and Russia.

By combining their know-how, the partnership positions itself to meet growing global demand for advanced feed solutions, driven by the expanding livestock and poultry sectors and the need for food security through localized feed production.

ROMANIA – Cimbria, a global leader in grain and seed processing, has successfully installed its largest bucket elevator to date, the EH 64, at the UMEX SA Constanta Port Terminal in Romania. Standing an impressive 49 meters tall, this engineering marvel is designed to handle a staggering 1,500 tons of wheat per hour, setting a new standard for high-capacity vertical conveying in port terminals. The EH 64, with a belt speed of 3.60 m/sec, is engineered for efficiency, durability, and reliability in demanding industrial environments. It features a galvanized finish, pedestal bearings, and HARDOX wear plates, ensuring long-term performance under rigorous conditions.

As part of the same project, Cimbria also supplied a 1,500-ton-per-hour belt conveyor, creating an integrated solution that supports the growing logistical demands of Romania’s busiest port. The installation forms part of a comprehensive expansion at UMEX, which covers new terminals for both grain and fertilizer handling.

Cimbria first shipped the elevator top of the EH 64 to Romania in March 2024, working with VIGAN Engineering to ensure precise integration into UMEX’s ship-loader system. The nearly 10-ton elevator top was built with reinforced wear plates and corrosion-resistant finishes to endure the harsh conditions of continuous grain handling.

By September 2024, the EH 64 was fully operational, delivering the promised capacity of 1,500 tons per hour, confirming its status as Cimbria’s most advanced bucket elevator to date.

The UMEX terminal expansion also includes grain storage silos with a combined capacity of 100,000 tons and fully automated intake and loading systems. Backed by EU funding under Romania’s Transport Programme 2021-2027, the project is expected to raise the port’s annual handling capacity by close to one million tons.

ANNIVERSARY

SIMEZA celebrates 50 years of grain storage innovation, global

SPAIN – SIMEZA, the Spanish grain storage specialist is celebrating its 50th anniversary this year, marking a halfcentury of providing engineered steel silos to agricultural and industrial clients worldwide. Established in 1975 as Silos Metálicos de Zaragoza, the Zaragoza-based company has evolved into one of Europe’s leading manufacturers of modular silo systems, offering solutions with storage capacities ranging from 8 to 25,000 cubic meters.

The company now serves a wide range of clients across the agricultural, industrial, and farm sectors in Europe, the Middle East, Africa, and Latin America. “We have spent five decades focused on one thing, helping our customers store grain safely. Reliability, innovation and a renowned engineering expertise have been the keystones of our success. That’s what matters,” said Alberto Baena, chief executive officer of SIMEZA.

SIMEZA’s silo systems are designed with modularity in mind, allowing for efficient on-site assembly. The use of high-grade steel enables the structures to withstand extreme weather conditions, while integrated aeration systems help preserve grain quality by maintaining proper ventilation. These features have made the silos a preferred choice for clients looking for durability, ease of installation, and grain preservation performance.

The company operates under strict European Union quality and safety guidelines and holds the UNE-EN 10901:2011+A1:2012 certification, which governs the manufacturing of structural steel components. In addition, SIMEZA enforces rigorous standards for its suppliers, ensuring that every component used in its silos meets its quality benchmarks. Grain storage is becoming increasingly critical in global food supply chains. As climate variability, post-harvest losses, and rising demand for traceability put pressure on grain management systems, companies are investing in more reliable and efficient infrastructure.

BY STERN INGREDIENTS EAST AFRICA

The MC Mühlenchemie Technology Center in Kenya is a prime example of the “Understanding Flour” strategy in Africa

The MC Mühlenchemie Technology Center in Nairobi –operating as Stern Ingredients East Africa Ltd. (SIEA) – is the third of its kind on the African continent and a central element in the com-pany’s global strategy. Alongside locations in Nigeria and South Africa, this East African center – serving a region that extends as far as Angola – shows the commitment of the world market lead-er in flour treatment to be as close as possible to its customers – a sign of its special involvement in a region with enormous po-tential.

“Understanding Flour” is more than a motto – it is the foundation of MC Mühlenchemie’s philosophy. The company delivers customized solu-tions for the standardization, improvement, and enrichment of flour, a vital staple. True understanding requires deep knowledge of local con-ditions and challenges, something made possible by the presence of the Technology Center in Kenya. This close proximity to customers in the region enables finely tuned solutions that would be difficult to de-velop from afar.

The heart of the facility is a 400 square metre baking application tech-nology, development and consulting laboratory. It offers comprehensive possibilities for flour and grain analyses, and includes a trial bak-ery with the latest equipment, from spiral kneaders and sheeters to deck and convection ovens. Here, expert staff can simulate baking processes, test the effects of enzymes and other ingredients, and im-plement the results directly in local mills. This local research and de-velopment facility is part of MC Mühlenchemie’s global network of 12 Technology Centers and 7

production locations on 4 continents.

David Nolte, since August 2021 Head of Operations and R&D for Stern Ingredients East Africa, is a highly qualified miller with over two dec-ades of experience , giving him deep specialist knowledge which he brings to MC Mühlenchemie. “From the start, I focused on our African customers and developed a strong connection to the continent and its people,” Nolte notes. This connection is evidenced by the appreciation the company shows for the region.

The fact that in 2023 MC Müh-lenchemie held its centennial celebration for all of Africa in Nairobi underlines the special importance of this location and the strategic posi-tion of the East African market.

East Africa is a burgeoning region marked by impressive cultural di-versity. This melting pot of countless ethnic groups with their own traditions and languages has given rise to very specific product require-ments, especially in foods. This diversity is directly reflected in the ex-pectations placed on local solutions.

The team in Nairobi addresses this diversity

and can also serve the neighbouring countries of Tanzania, Uganda, Ethiopia and Rwanda from this central location in East Africa. It works on products like “Baker’s Flour” for sandwich bread, and – especially important for the local market –“Homebaking Flour” for regional specialities like chapati and mandazi. They meet not just technical standards, but also cul-tural preferences that would be next to impossible to understand without a local presence.

“We’re particularly proud of our cake mix solutions,” says Nolte. “They offer customers a flexibility that makes the difference in this region – a real milestone for us.” At the same time the team supports with fortification solutions for maize and wheat flour. These flours are enriched with important vitamins and nutrients like iron, zinc and folic acid, to combat malnourishment and “hidden hunger” – problems that remain acute in many parts of Africa.

This tremendous dynamic, with constantly changing challenges in daily life, demands flexibility and a deep understanding of local realities. But implementation is frequently “pole pole” – step by step, with delibera-tion. “In East Africa personal relationships and community are every-thing,” Nolte explains. “Social interaction

WE MEET NOT JUST TECHNICAL STANDARDS, BUT ALSO CULTURAL PREFERENCES THAT WOULD BE NEXT TO IMPOSSIBLE TO UNDERSTAND WITHOUT A LOCAL PRESENCE

beyond working hours is es-sential.” The Swahili saying “Haraka haraka haina baraka” (“Haste has no blessing”) encapsulates this approach, and underscores the need for the virtues of calm, patience and deliberation in East Africa, including in business life.

One of the most pressing issues for East African millers is "grist change" – fluctuating grain quality and a volatile global wheat market, strained further by geopolitical tensions. Rising costs, increasing infla-tion and higher fees are impacting manufacturers and customers alike, and leading to rising food prices – a development that has noticeable social effects, especially in developing countries. As a company that processes over 150 million tonnes of wheat each year, MC Müh-lenchemie has the necessary expertise to master these challenges.

Since the region is heavily agricultural, much of the raw materials like wheat and corn are locally sourced. With its analysis capacity in Nairo-bi, Mühlenchemie can develop solutions for individual needs and make them available to mills much faster. Personal communication between customer and consultant, from field to final product, is also much more direct.

the team also offers training, seminars and workshops. These services are critical for strengthening local know-how and building up sustained capacity and are further evi-dence of LOCAL APPLICATION TECHNOLOGY FACILITY HELPS TO DEVELOP TAILOR-MADE SOLUTIONS

In addition to analyses of grain and flour,

MC Mühlenchemie’s long-term commitment to the region.

development of our services in other parts of the world.”

The benefit of having an own local laboratory and application technolo-gy facility lies in the ability to develop tailor-made solutions in direct customer proximity. This enables fast reactions to inquiries and changes, as well as the development of locally adapted solutions de-signed especially for the challenges faced by African millers. “It is es-sential to build trust and long-term connections to local partners and decision-makers,” says Nolte of the challenges in working in Kenya. “Patience, sensitivity and the ability to deepen relationships are key in moving projects forward here.” In part thanks to this approach, today MC Mühlenchemie counts more than 2000 mills in over 150 countries among its customers.

The East African facility is part of a global ecosystem. Norman Loop, Regional Director for Europe, the Middle East, and Africa, explains: “With the Nairobi location, we are expanding our global network and adapting our services to local markets. In doing so, we can build on our global expertise. Meanwhile, the knowledge we gain on the African market contributes to the further

This dovetailing of global knowledge and local expertise is what makes MC Mühlenchemie strong. At the central “Future Makers” SternTechnology Center in Ahrensburg, Germany, over 100 scientists and applications technologists work on tailor-made solutions to the requirements of the worldwide milling industry. From there, knowledge is transferred to all regions and adapted to local conditions.

MC Mühlenchemie serves over 2000 mills in more than 150 countries. Today, the team of experts in the 12 Technology Centers around the world assists mills locally with individual solutions for optimum flour quality. The close collaboration among these worldwide centres makes it possible to share knowledge and best practices across regions, for the benefit of all customers.

“The combination of global R&D, regional understanding, and the ability to turn both into customer-specific solutions is what makes our ‘Under-standing Flour’ concept so effective,” says Khalif Steinbrich, Area Sales Manager East Africa. “The Nairobi center stands as a beacon for this approach and a strategic hub for the future of milling in one of Afri-ca’s most dynamic regions.”

Did you miss the Africa Food Manufacturing Expo - Kenya & Eastern Africa edition 2025, Africa's No.1 Food & Beverage Manufacturing and Milling Industry Trade Shows and Conferences? Here is a glimpse of what you missed, but dont worry, we have you covered in 2026!!

Held from July 2–4, 2025 at the Sarit Expo Centre in Nairobi, the event was more than just an exhibition, it was a story of how Africa is reimagining the way it feeds, serves, and manufactures for itself and the world.

For the first time, Africa Manufacturing Week and Africa Food & Hospitality Week came together, uniting industries that are often treated separately, food processing, hospitality, packaging, logistics, animal feed, and personal care. The result was a vibrant showcase of innovation and collaboration, with over 80 exhibitors presenting cuttingedge machinery, sustainable packaging solutions, plant-based ingredients, and

digital logistics platforms.

The 13-session conference program, powered by leading sponsors such as Kerry, Bühler, IFF, AGF, and Dohler, explored urgent themes including food security, circular economy strategies, protein alternatives, and digitization. Conversations underscored a shared mission: growth that is both profitable and sustainable.

Beyond the Expo hall, the Africa TasteMasters Culinary Festival captured hearts with flavors that told stories of culture and creativity.

From West, South and Eastern Africa, 2026 got you covered!! You can never miss

•AFMASS Zambia & Southern Africa Edition - March 25-27, 2026 | Lusaka, Zambia - 3rd edition

•AFMASS Nigeria & Western Africa Edition - June 2-4, 2026 | Lagos, Nigeria - 1st edition

•AFMASS Kenya & Eastern Africa Edition - July 15-17, 2026 | Sarit Expo Centre, Nairobi, Kenya - 11th edition

BY MARTHA KURIA

From July 2 to 4, 2025, the Sarit Expo Centre in Nairobi, Kenya, hosted the Africa Future Food Summit alongside the Africa Food Manufacturing Expo 2025, creating a dynamic platform for industry leaders, technology providers, and academic experts to converge. This three-day event catalyzed discussions on leveraging Africa's ancient crops such as millet, sorghum, teff, fonio, cassava, and sweet potatoes, to address the continent's evolving food security and market demands. Through shared expertise and innovative solutions, the summit illuminated a path to transform the grains, milling, and baking sectors.

The Africa Food Manufacturing Expo 2025 showcased stateof-the-art technologies designed to enhance efficiency and scalability in the milling, feed and food processing. Here is a highlight of milling equipment giants that graced the expo.

Bühler, a global leader in food processing equipment, presented its integrated solutions, bolstered by the Bühler Insights platform for real-time operational analytics, enabling data-driven decision-making. Italian firm OCRIM demonstrated its turnkey milling plants, optimized for wheat, corn, and other cereals, offering precision and reliability for large-scale operations.

Cimbria highlighted its engineered systems for grain, seed, and food handling and storage, ensuring quality preservation across the supply chain. Myande Group, with a portfolio of over 1,200 plants worldwide, showcased expertise in oils and fats processing, starch derivatives, fermentation, and smart factory technologies, blending innovation with operational

scale.

Grain storage and feed milling systems were represented by Turkish manufacturers Altınbilek, with over 200 turnkey facilities in more than 110 countries, and ÇSİ, which produces ISO 9001:2008-certified silos, handling equipment, and concrete floor systems. Depart, part of the Alapala Group, presented its range of spare parts, after-sales services, telescopic conveying systems, color sorters, rice machinery, and packaging solutions to support milling and pasta operations.

In the Fast-Moving Consumer Goods (FMCG) space, Capwell Industries Limited, a prominent sponsor of the event, stood out with its versatile portfolio, including flour, rice, pulses, confectionery, and beverages under trusted brands like Soko, Amaize, and Pearl, demonstrating their ability to meet varied consumer preferences. Bakex, a stalwart in wheat flour production, highlighted its role as a reliable supplier in Kenya’s market, showcasing its high-quality flour products to industry stakeholders. Spice World Ltd, operating under the “Butterfly” brand, presented its ISO 9001:2015-certified spices and food products, emphasizing rigorous quality standards and compliance to deliver consistent, flavorful offerings that

resonated with expo attendees.

In the bakery industry, Skypex Supplies Ltd played a pivotal role by exhibiting high-quality bakery ingredients and equipment tailored for industrial, artisanal, and hospitality applications. Their focus on precision, underscored the importance of consistent, high-quality baked goods. Broadway Bakery, recognized for its widely consumed bread varieties, and DPL Festive, which operates East Africa’s largest fully automated bakery facility, impressed attendees with their broad portfolio of products through live demonstrations and product displays.

Adding to the sector’s dynamism, Ndivisi showcased its soybean processing capabilities, presenting meals for human and animal nutrition alongside crude soya oil.

Africa’s ancient crops such as millet, sorghum, teff, and fonio, form the backbone of food security in semi-arid regions. The continent accounts for 60% of global millet production

and nearly 30 million tonnes of sorghum annually, led by Nigeria, Sudan, and Ethiopia. Rural consumption of sorghum often exceeds 50 kg per capita yearly, yet urban markets lean heavily on maize. These resilient crops thrive in challenging conditions, requiring minimal water and poor soils, but laborintensive processing limits their commercial potential. Current applications, such as milling into flour or brewing into beer, represent only a fraction of their possibilities, with untapped opportunities in value-added products, industrial applications, and exports. In a panel discussion featuring Austin Kearby, Managing Director of Anchor Foods, Francis Mbaki, Head of Service Sales for East Africa at Bühler, Peter Muni, a seasoned milling industry consultant, and Prof. Catherine Kunyanga, Associate Dean at the University of Nairobi’s Faculty of Agriculture, these crops, long overshadowed by maize and wheat, can be processed, marketed, and embraced by modern consumption patterns.

Francis Mbaki, Bühler’s Head of Service Sales for East Africa, reframed the discussion, urging a shift from "ancient grains" to "ancient crops" to include root staples like cassava and sweet potatoes. “A tuber is not a grain,” Mbaki noted. “Its higher moisture content and irregular sizes demand specialized equipment. Collaboration is key, we can’t solve these challenges in isolation.” This broader perspective underscores the need for tailored processing technologies to unlock the potential of diverse crops.

Austin Kearby, Managing Director of Anchor Foods and a small-scale sweet potato flour producer, shared insights into market challenges and opportunities. “Consumers often ask, What do I do with sweet potato flour?” he explained. By blending it with millet for nutrient-rich porridge, his team has created products that resonate with consumers for their sweetness, smoothness, and nutritional value. However, energy-intensive

drying processes remain a significant barrier, particularly for small-scale producers in East Africa.

Mbaki proposed innovative solutions, such as compact milling plants and “milling as a service” models, where farmers pay for processing without owning equipment. This approach, already successful in other regions, could democratize access to advanced technology for diverse crops like millet, sorghum, and cassava.

Peter Muni, a seasoned milling consultant, identified inconsistent supply as a critical obstacle. “Most millers aren’t familiar with millet or sorghum,” he said. “When they consider processing them, the first question is supply reliability.” In East Africa, these crops are rarely grown at commercial scale, leading to variability that complicates cleaning and grinding. Muni referenced past projects where equipment adaptation and collaboration with traditional users were essential to progress.

Regulatory compliance adds another layer of complexity. Muni advocated for early engagement with bodies like the Kenya Bureau of Standards, noting their openness to new product standards. Kearby highlighted the costbenefit dilemma for small and medium enterprises (SMEs): “Certification builds trust, especially for aflatoxin control, but the upfront investment can deter young entrepreneurs.” He acknowledged the value of standards in fostering consumer confidence, yet stressed the need for accessible pathways to compliance.

Prof. Catherine Kunyanga, Associate Dean at the University of Nairobi’s Faculty of Agriculture, addressed the disconnect

between academic innovation and market adoption. “We have countless innovations—ready-to-eat products like sorghum crackers, millet pasta, and amaranth cereals that appeal to modern consumers,” she said. Yet, these remain confined to university labs due to weak industry linkages. To address this, the university is developing one of Africa’s largest extrusion units for training and small-scale production, aiming to empower graduates as entrepreneurs.

“The gap is in connection,” Kunyanga emphasized. “Students have patented innovations; companies seek new products. We need stronger partnerships to bridge this divide.”

Collaboration emerged as the cornerstone of progress. Mbaki underscored its role in overcoming technical challenges, from optimizing enzyme performance to reducing energy costs in milling. “No single company has all the answers,” he said, highlighting partnerships with research institutions and technology providers. Muni stressed supply chain resilience, noting that joint training and knowledge-sharing platforms could streamline operations and mitigate risks like supply delays or contamination.

Kunyanga advocated for formalized partnerships, such as memoranda of understanding, to protect intellectual property and foster trust. “Clear terms create a safe environment for testing and scaling innovations,” she explained, emphasizing the need for legal and technical clarity to drive commercialization.

Bühler’s new Grain Application and Training Centre in Nigeria reflects the importance of regional customization. “Cassava and yam dominate in West Africa, while maize leads in East Africa,” Mbaki noted. “But diversification is gaining traction.” Bühler’s “Africa Grains Online” program aligns farmer capabilities with processor needs, fostering a cohesive supply chain.

Kunyanga captured the summit’s ethos: “These crops are our heritage, healthier, resilient, and ready to meet modern demands for safety, quality, and convenience.” Mbaki concluded with a call to action: “Challenges are opportunities. By working together, industry, academia, regulators, and farmers, we can unlock new markets and transform Africa’s food landscape.”

BY MARTHA KURIA

Over 1,200 leaders from the food, feed, and sustainable mobility sectors gathered at Bühler Group’s headquarters in Uzwil, Switzerland, for the fourth Networking Days, a triennial event focused on scaling innovative solutions to address the needs of a growing global population and a warming planet. Held on June 23–24, 2025, and themed “Multiplying Impact Together,” the summit emphasized collaborative leadership, circular business models, and bold innovation as critical drivers for transforming industries and achieving sustainability at scale.

The event welcomed participants from over 90 countries across six continents, including representatives from global food manufacturers, technology innovators, academia, and public institutions. Bühler’s leadership stressed that the era of experimentation has ended, urging the rapid scaling of proven solutions to sustainably feed and mobilize 10 billion people by 2050. “The true power of innovation lies in its multiplier effect. When breakthroughs connect across businesses and industries, they create waves of change,” said Bühler CEO Stefan Scheiber.

A key message throughout the event was that sustainability is no longer optional, it is integral to long-term business success.

Bühler CTO Ian Roberts highlighted the company’s progress on its 2019 pledge to develop technologies that reduce energy, waste, and

water use by 50% across 15 key value chains. With nearly CHF 500 million (US$624 million) invested in R&D since then, Bühler’s technologies have achieved up to 80% savings in processes such as aluminum processing and chocolate production.

Johan Rockström, Director of the Potsdam Institute and creator of the Planetary Boundaries framework, urged business leaders to view sustainability as a competitive advantage. “Sustainability enhances competitiveness, resilience, and access to new markets. Communicate that clearly and consistently,” he said.

Leaders from Mars, Cargill, Nestlé, and AAK shared practical examples of sustainable transitions. AAK CEO Johan Westman explained how transforming its palm oil supply chain to achieve 91% deforestation-free sources by 2024 delivered both environmental benefits and increased profitability. “Palm oil has the highest yield per hectare of any oil crop,” he noted, underscoring its vital role in future food systems.

Circular economy principles were a central theme. Michele Andriani of Andriani S.p.A. described how the company transformed production byproducts into new revenue streams, such as pet food and bioenergy, through partnerships with Bühler. Similarly, Illycaffè’s Andrea Illy outlined how coffee waste is repurposed for cosmetics and how regenerative farming is promoted among its growers. “Circularity isn’t just a sustainability concept, it’s a growth engine,” said Julia Binder, Professor at IMD, encouraging businesses to envision transformative innovations and map the steps to achieve them.

The second day expanded the discussion to trade flows, supply chain resilience, and food affordability. Rabobank’s Vito Martielli highlighted the growing grain trade driven by demand in Africa and China, while PTC’s Neil Barua emphasized digital tools like AI and predictive analytics to minimize disruptions. Panelists also addressed the challenge of delivering safe, affordable, and nutritious food amid rising global pressures. “Taste, nutrition, cost, and sustainability must all be achieved simultaneously, with taste remaining paramount,” said Cargill CTO Florian Schattenmann.

In Africa, companies like Naval Group and Partners in Food Solutions are establishing regional food production hubs and fostering cross-border expertise. “Let’s create an opportunity superhighway to transform Africa’s food systems, one factory at a time,” said Mandla Nkomo, CEO of Partners in Food Solutions.

The event concluded with an inspiring keynote from Francois Pienaar, former South African rugby captain, who spoke on integrity, courage, and leadership under pressure. Bühler’s Scheiber echoed this in his closing remarks: “Courageous leadership is essential to accelerate business transformation. Together, we can shape a better, more

sustainable future.”

Building on the momentum of the 2025 Networking Days, where global leaders united to scale sustainable solutions for food security and industry transformation, Bühler Group launched a state-of-the-art Milling Academy at its Uzwil headquarters. This 1,800-square-meter facility is designed to empower food and feed millers with advanced training, equipping them to tackle the evolving challenges highlighted during the summit, such as stricter food safety regulations, sustainability targets, climate impacts, labor shortages, and supply chain instability.

The Milling Academy directly supports Bühler’s commitment to multiplying impact through innovation and collaboration. CEO Stefan Scheiber emphasized that by providing hands-on training and access to cutting-edge technologies, the academy ensures millers can implement sustainable practices and optimize processes, aligning with the event’s focus on scaling solutions to feed 10 billion people by 2050. “With the opening of our state-of-the-art Milling Academy, we are empowering the next generation of milling

professionals to drive continuous improvement across the food and feed sectors,” said Stefan Birrer, Head of Business Area Milling Solutions at Bühler.

The facility integrates seamlessly with Bühler’s innovation ecosystem, offering access to the Grain Innovation Center, an arena within the machine park, three high-tech classrooms, two laboratories focused on analytics and electronics, and a fully automated school mill with a 24-tonne-per-day capacity. These resources provide an immersive learning experience, enabling participants to master both modern and legacy machinery while adopting the circular economy principles and digital tools championed at Networking Days.

Dario Grossmann, Head of the Milling Academy, emphasized its learner-centric approach. “Participants tell us the Milling Academy sets a new standard for quality, reflecting the collaborative and innovative spirit of our global network. We’re ready to meet the growing demand for training as our customers strive to achieve sustainability and resilience.”

Offering over 100 courses annually in seven languages and the capacity to train more than 750 professionals, the academy also houses the School of Feed Technology (SFT), expanding its impact across food and feed sectors. Courses are modular and flexible, supporting on-site learning in Uzwil or at customer facilities worldwide.

The Milling Academy complements Bühler’s global education network, which includes partnerships with Kansas State University in the U.S., the African Milling School in Nairobi, Kenya, and training mills in Wuxi and Changzhou, China. Participants can also engage with Bühler’s innovation infrastructure, including the Grain Processing Innovation Center in Nigeria, the Cocoa Competence Center in Côte d’Ivoire, and the International Rice Milling Academy in India.

Early trainees have praised the academy’s modern facilities, collaborative environment, and practical approach. “The infrastructure and concept are outstanding,” said Oliver Efrain Romero Lucero of CMI Alimentos, Guatemala. “The instructors are highly skilled, and the training materials are exceptionally well-prepared.” Jan Tuborg Pedersen from Denmark highlighted the integrated showroom and innovation center, describing the hands-on experience as “incredibly valuable.”

Reinforcing its commitment to advancing milling expertise in Africa, Bühler hosted its inaugural Food Extrusion Workshop from July 15–18, 2025, at the African Milling School in Nairobi. This first-of-its-kind workshop in Africa focused on enhancing skills in advanced extrusion processes critical to food production, including vacuum degassing, co-extrusion, remote-cut technology, and product coloring.

Participants explored the fundamentals of extrusion and how ingredients influence expansion, texture, color, and flavor through a blend of theory and hands-on learning. Sessions covered innovations like modified flours, breadcrumbs, reconstituted rice, and fortified blended foods such as super cereals. The Bühler twin-screw extruder facilitated practical training, allowing participants to evaluate samples and create products like breadcrumbs and dry textured protein flakes.

The workshop also featured live demonstrations at Proctor & Allan (EA) Ltd., showcasing modified flours, super cereals, breadcrumbs, breakfast cereals, and snacks. Participants delved into the science of puffing and drying, as well as the sensory aspects of cereals, snacks, and puffed products, gaining insights into how extrusion shapes consumer products and market trends. MMEA

BY STEPHEN KIBE

Grain milling and processing facilities are vital to the global food supply chain, yet they operate under constant threat from one of the most underestimated hazards in industrial environments: combustible dust. Fine particles generated during milling, conveying, and storage can accumulate in the air and on surfaces, creating a volatile atmosphere where a single spark may trigger a catastrophic explosion. To mitigate these risks, facilities must implement comprehensive dust control and explosion prevention systems tailored to the unique challenges of grain handling operations.

Grain dust, when suspended in air at the right concentration, is not just combustible; it's a potential catalyst for a deflagration or even a secondary explosion, often more destructive than the initial blast. Common ignition sources include overheated bearings, static electricity, friction from moving parts, and electrical faults. Equipment such as bucket elevators, hammer mills, and dust collectors are particularly vulnerable due to their enclosed design and high particle throughput.

The consequences of dust explosions are severe: loss of life, structural damage, regulatory penalties, and long-term reputational harm.

Therefore, proactive risk management is not just a regulatory requirement; it's a moral and operational imperative. Some of the examples of the case studies from Africa include the Quantum Foods Feed Mill Explosion that occurred in June 2024 in Malmesbury, South Africa, resulting in the death of one worker and serious injuries to two others. The incident triggered automated emergency protocols, including fire suppression systems, which helped contain the damage. The cause is still under investigation, but dust accumulation and ignition sources are suspected. In April 2022, the Spenza Maize Milling Factory Explosion in Kirinyaga County, Kenya, left a worker seriously injured. The incident led to disputes over compensation and raised concerns about safety protocols. Investigations pointed out possible dust ignition due to inadequate ventilation and dust accumulation.

A Kenyan study found that long-term exposure to grain dust in animal feed mills leads to reduced lung function in workers. This highlights serious health risks tied to inadequate dust control. Grain dust contains fine particles that, when inhaled over time, can impair respiratory health, causing conditions like chronic bronchitis or occupational asthma. The study emphasises the urgent need for protective measures such as proper ventilation systems and personal protective equipment (PPE) to safeguard workers in these environments.

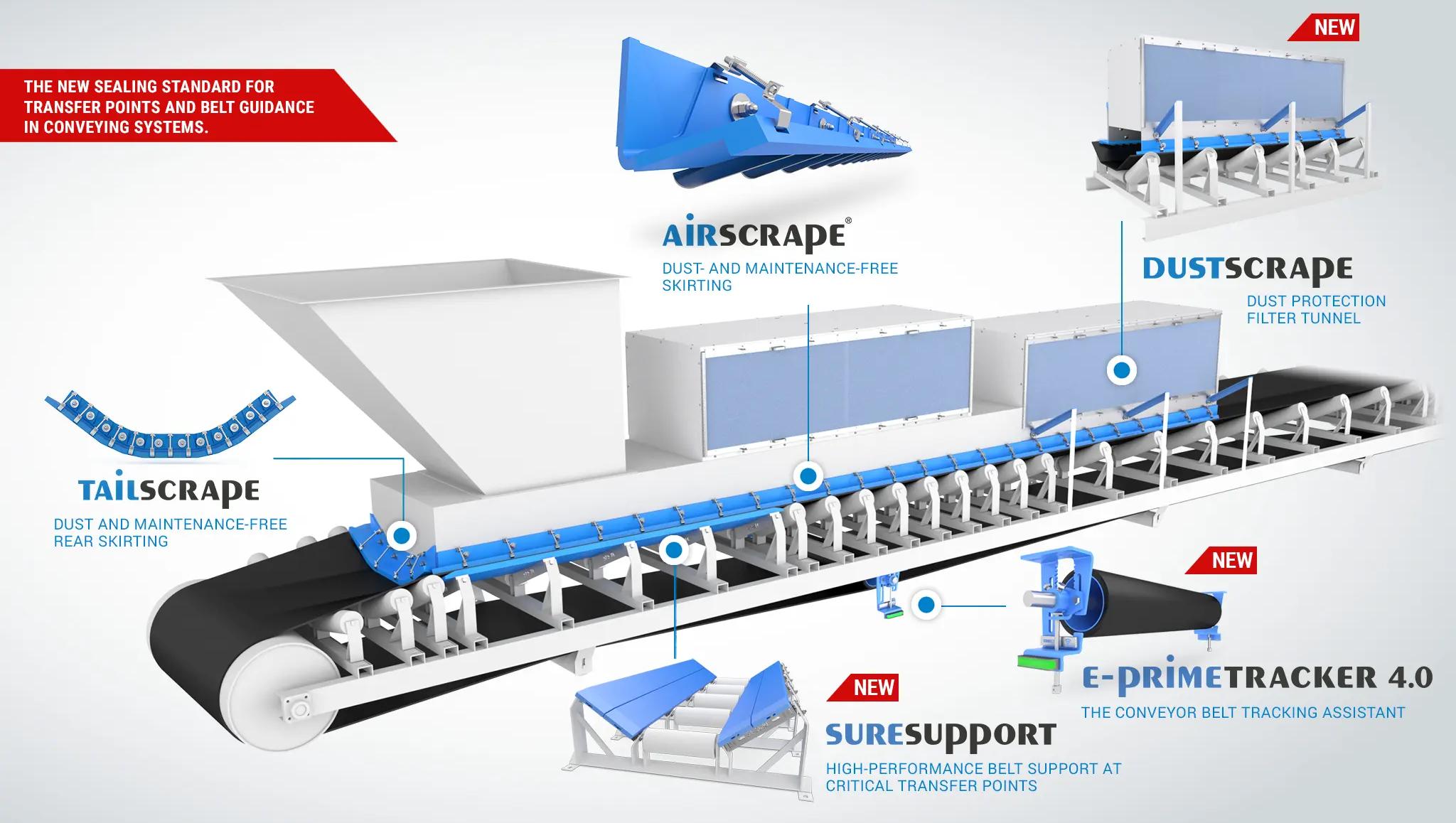

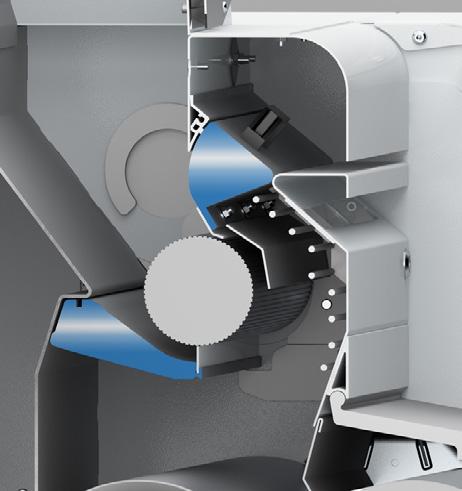

BLT WORLD, working closely with the international ScrapeTec team, is a key partner across Africa, helping businesses optimise their conveyor systems by controlling dust emissions and preventing material spillage. ScrapeTec Systems, distributed by BLT WORLD, are advanced German-engineered solutions designed to tackle dust and material spillage in bulk conveyor operations. These systems, like AirScrape and DustScrape, float just above the conveyor belt, avoiding direct contact and thereby reducing wear and damage. Instead of relying on traditional friction-based skirting, ScrapeTec uses a clever combination of airflow and angled steel blades to redirect particles inward and trap fine dust. This not only improves material flow but also drastically cuts down on airborne dust, minimising health risks and explosion hazards at transfer points.

Effective dust control in grain handling facilities relies on a combination of engineering solutions and operational practices designed to minimise airborne particles and reduce explosion risks. Transitioning from open conveyors to enclosed systems, such as screw conveyors or pneumatic transport, greatly limits dust emissions during material movement and reduces worker exposure. Industrial dust collectors, including baghouse filters, cartridge collectors, and cyclone separators, capture fine particles at critical source points. Advanced models like the Donaldson Torit PowerCore CP Series offer compact, highefficiency filtration tailored to the demands of grain processing environments. Local exhaust ventilation (LEV) systems further enhance control by extracting dust directly from machinery through strategically placed hoods and ducts, maintaining airflow velocity to prevent settling and clogging.

Complementing these mechanical systems is rigorous housekeeping protocols. Facilities implement routine cleaning using explosion-proof vacuums and anti-static tools to prevent dust accumulation on surfaces such as floors, beams, and equipment. Scheduled cleaning and visual inspections ensure ongoing compliance and safety. Additionally, dust suppression technologies, such as fogging systems or chemical agents, are deployed at high-risk areas like transfer points and unloading zones to bind particles and reduce airborne concentrations. Together, these measures form a comprehensive approach to dust management, safeguarding both personnel and infrastructure.

While dust control reduces the likelihood of ignition, explosion prevention systems are designed to detect, isolate, and suppress combustion events before they escalate. Grain handling facilities employ a range of advanced safety technologies to mitigate the risks of fire and explosion caused by combustible dust. Spark detection and extinguishing systems use infrared sensors to monitor ducts and chutes for sparks or hot particles continuously. When a threat is detected, extinguishing mechanisms, often water mist or chemical agents, activate within milliseconds to neutralise the hazard without disrupting operations. Complementing this are explosion venting systems, which feature engineered panels designed to rupture at specific pressure thresholds, safely releasing combustion gases. For indoor environments where

SOURCE: SCRAPTEC

external venting isn't feasible, flameless venting options provide a contained solution that prevents flame discharge while relieving pressure.

To further enhance protection, explosion suppression systems are installed on high-risk equipment such as silos, mills, and dust collectors. These systems detect rapid pressure increases and deploy suppressant chemicals to extinguish the flame front before it can spread. Isolation devices play a critical role in containing explosions within specific zones of the facility. Equipment such as isolation valves, abort gates, and rotary airlocks are strategically placed to seal off interconnected machinery during an event, preventing flame propagation and minimising damage. Together, these technologies form a layered defence strategy that prioritises both operational continuity and worker safety.

Emerging technologies are revolutionising dust control in grain handling and processing facilities, offering smarter, safer, and more efficient solutions. One major advancement is the use of automated dust monitoring systems, which rely on sensors to track airborne particle levels in real time. When dust concentrations exceed safe thresholds, these systems can trigger alarms or activate suppression mechanisms, allowing for immediate intervention and reducing the risk of ignition. Another innovation is the deployment of robotic cleaning units equipped with vacuum systems and brushes. These robots are particularly effective in confined or hazardous spaces such as silos and ducts, minimising the need for manual cleaning and significantly improving worker safety and operational efficiency.

Additionally, digital twins and simulation tools are being

used to create virtual models of grain handling environments. These models enable operators to simulate dust generation scenarios, identify problem areas, and optimise the placement of dust control equipment. Together, these technologies represent a proactive shift toward precision safety management in facilities where dust-related hazards are a constant concern.

In the United States, OSHA's Grain Handling Standard (29 CFR 1910.272) mandates dust control, ignition source management, and employee training. The National Fire Protection Association (NFPA) provides additional guidance through standards such as NFPA 61 (Agricultural and Food Processing Facilities), NFPA 68 (Explosion Venting), and NFPA 69 (Explosion Prevention Systems).

Facilities must conduct a Dust Hazard Analysis (DHA) to identify potential ignition sources, vulnerable equipment, and mitigation strategies. This analysis should be updated regularly and integrated into operational protocols. Training employees to understand the risks, recognise early warning signs, and follow safety procedures, including lockout/tagout, confined space entry, and personal protective equipment (PPE) usage. Grain milling and processing facilities operate in a highrisk environment where dust control and explosion prevention are non-negotiable. By investing in tailored systems, ranging from advanced filtration and spark detection to explosion suppression and venting, operators can protect their workforce, preserve infrastructure, and ensure regulatory compliance. Safety is not a one-time investment but an ongoing commitment to vigilance, innovation, and responsibility. MMEA

BY MARTHA KURIA

In Kenya’s evolving food industry, convenience is increasingly shaping consumer choices, yet cultural heritage remains central to dietary preferences.

James and Ben Enterprises, a Nairobibased startup, is bridging that gap with Ryan’s Instant Porridge, a product designed to combine traditional porridge with modern processing technologies for safety, nutrition, and ease of preparation. In an interview, Milling Middle East & Africa speaks with CEO and co-founder Kagwima Benson, who shares the journey from university-level product development to market launch, and the company’s ambitions to be “the king of the market.”

MMEA: Please introduce yourself and tell us about James and Ben Enterprises.

KAGWIMA: My name is Kagwima Benson, the CEO and co founder of James and Ben Enterprises. I hold a BSc in Food Science and Technology and have served in quality assurance, compliance, and food safety and quality management system development, including consulting for major companies in the Kenya. James and Ben Enterprises is a startup company based in Nairobi, Kenya, incubated at the Kenya Industrial Research and Development Institute (KIRDI). Here, my role is to provide an environment that creates potential for every employee that works with us so that we consistently meet customer satisfaction targets and achieve sustainable financial performance.

MMEA: What inspired you to start this venture in convenience foods?

KAGWIMA: The inspiration was to deliver “health and nutrition in a convenient and easy to prepare way that will save on time, while serving vulnerable groups such as weaning babies and busy urban and peri urban households. During our feasibility study, we recognized that imported convenience cereals like cornflakes and puffs are often unavailable or unaffordable, and many consumers don’t associate with it. Porridge, by contrast, resonates deeply with local traditions. With our flagship brand Ryan’s Instant Porridge, it was designed to deliver modern convenience without compromising nutrition or cultural familiarity.

Product development began in 2018 at university level. We subsequently incubated at KIRDI and secured certification to launch in August 2024. The company marks one year in market as of August 2025.

MMEA: Why the brand name ‘Ryan’s’?

KAGWIMA: Brand strategy was deliberate: a name that communicates the unique selling proposition and long term vision, to make Ryan’s synonymous with “ready to eat porridge. Ryan comes from a Greek origin, meaning that it’s kingly, signalling the intent to be the king of the market. Interestingly, some consumers purchase simply because a child or grandchild is named Ryan, proof the name connects with families.

MMEA: Please take us through the production process of Ryan’s Instant Porridge

Ryan’s Instant Porridge is made from a carefully curated blend of sorghum, soya, maize, and sweet potatoes. This combination was perfected through extensive trials to balance nutrition, functionality, and consumer appeal. Understanding ingredient chemistry was critical such as starch characteristics (amylose/ amylopectin ratios) affect hydration and lumping. The team chose raw materials they understand and the chemical composition behind, so the product disperses smoothly and delivers the intended mouthfeel while providing essential nutrition.

The production process is a blend of precision and innovation. Using conventional milling followed by extrusion cooking, we transform raw ingredients into an instant flour. “It’s like bringing your home kitchen to an industrial scale.” Ground ingredients are extruded at around 140 °C, where

shear and friction cook the product, drive off moisture, and provide a sterilizing effect. The cooked extrudate is then milled to specification. The result is a fine flour that reconstitutes in hot water within seconds, ready to serve.

MMEA: How do you ensure product safety and consistency?

KAGWIMA: Food safety starts with raw material reception. We source directly from farmers and aggregators, with supplier approval audits in place. Extrusion technology ensures microbial safety, while protective packaging, using resealable pouches maintains quality. We are KEBS certified, which validates our compliance with food safety and labeling requirements.

Processing follows KEBS standards, with strict operating procedures, sensory evaluations, and staff training. “A cooked product should not be grainy, should not have a rough texture, and it should have a mouth feel that is very soft.” Batches are also checked against packaging recipes for functional consistency. Staff and visitors must wear PPE; “there is no direct contact between the personnel and the product process.”

MMEA: How has the market responded so far?

KAGWIMA: The response has been very positive. Monthly output has grown from about 250 kg when we started to 1.5–2.0 tonnes We are already in more than 30 supermarket outlets within Nairobi, working to introduce our products in other major urban centers. We also offer home deliveries.

Demand sometimes outstrips supply, which has pushed us to improve our inventory management. Customers appreciate the convenience, safety of the product. We have ensured customers can effectively use the product by providing preparation guidance printed on the park and reinforced through social media demos and seasonal recipe cards during our campaigns. In addition, packaging is segmented by market. We have 250 g and 500 g pouches for household customers in resealable, water resistant pouches, and bulk packaging for institutional buyers. A cup per pack promotion reinforces “porridge on the move.”

Beyond retail, Ryan’s collaborates with NGOs such as Tabasamu Alliance, private institutions, and universities particularly Egerton University to run awareness and access programs. Tabasamu Alliance subsidizes porridge for children in daycare programs so “every kid

should have a cup of porridge whenever they want at any time.” Making bulk cooked porridge is impractical and unsafe to hold at day care level, because children arrive at intervals unlike schools where children follow a strict meal time. With instant porridge, a caregiver makes a fresh serving per child, cutting waste, reheating cycles and contamination risk while saving time and energy. The campaign aligns with the brand promise: nutrition, convenience, dignity.

MMEA: What challenges have you faced in sourcing raw materials and processing?

KAGWIMA: Two stand out: aflatoxin risk in maize and price volatility driven by seasonality. “By mid year, there is no maize again,” pushing prices up. The company cushions shocks through inventory management, buying in bulk when feasible, while keeping consumer purchasing power in view. For sweet potatoes, sun drying caused discoloration and long cycle times, so the team has partnered with a company that does good drying with a dryer. However, because extrusion can accept higher pre extrusion moisture (≈25–30%), we don’t have to dry the sweet potatoes to a lower moisture because the operation blends efficiently and targets a final flour moisture ≤13% for shelf stability. This is an advantage to us in cost reduction. Technology constrains is another challenge. Extrusion capacity and service support are scarce. “If your extruder fails, you find that you are the only player in the market. James and Ben mitigates risk through its KIRDI production contract, but sector wide, more accessible extrusion services would accelerate SME innovation.

MMEA: Who are your main competitors, and how do you differentiate?

KAGWIMA: We compete with both imported brands and local instant flour producers. Our edge lies in using natural, locally sourced ingredients and maintaining strong customer engagement. Unlike imported brands that may not understand local preferences, we listen to feedback and adapt our products

to community needs.

MMEA: Do you plan to diversify beyond porridge?

KAGWIMA: Yes. While Ryan’s Instant Porridge is our flagship product, we are already developing other instant flours, including millet-based varieties. A millet-based instant flour has already been certified, though the team is addressing processing challenges related to millet’s unique chemical composition. Our long-term goal is to become the go-to brand for convenient, nutritious meals in Kenya and beyond.

MMEA: How does your work support Kenya’s food and nutrition security initiatives?

KAGWIMA: We address food security through accessibility, affordability, stability, and utilization. By sourcing locally, we support farmers and reduce food loss. By sourcing locally and supporting contract farming, the company reduces postharvest losses and strengthens farmer livelihoods, contributing to a more resilient food system.

MMEA: What advice would you give to young entrepreneurs in the food industry?

KAGWIMA: Entrepreneurship can be lonely and challenging, but surrounding yourself with the right team makes all the difference. Build resilience, stay close to your customers, and never compromise on quality. Technology and innovation should be embraced as tools to solve challenges in nutrition and food security.

MMEA: Finally, what legacy do you hope to leave with this venture?

KAGWIMA: I want James and Ben Enterprises to be remembered as a champion of food security, using technology and innovation to deliver nutritious, culturally relevant, and convenient meals. Our vision is to set a standard for local enterprises proving that Kenya can produce safe, high-quality convenience foods that compete with global brands. MMEA

BY MARTHA KURIA

Tanzania, an East African country situated just south of the Equator, was formed as a sovereign state in 1964 through the union of the theretofore separate states of Tanganyika and Zanzibar. With a population exceeding 65 million as of 2025, the country relies heavily on agriculture as the backbone of its economy. The country boasts 44 million hectares of arable land, of which about 29.4 million hectares are suitable for irrigation, though only a fraction is currently utilized. The sector contributes nearly 30% to the country's Gross Domestic Product (GDP) and employs about three-quarters of the workforce. Among agricultural commodities, grains play a

pivotal role in ensuring food security, providing livelihoods, and driving economic activities. Major grains in Tanzania include maize (corn), rice, wheat, sorghum, and millet, which together form the staple diet for the majority of the population. Per capita grain intake is estimated at 150-200 kg/year. Maize alone accounts for over 80% of dietary calories, with a per capita consumption estimated at 100 kg/person.

Maize is the dominant grain in Tanzania, serving as a staple crop and accounting for a significant portion of the country’s export revenue. Key

production regions include the Southern Highlands and the Lake Zone, where soil and climate conditions are suitable. Yields typically average 1-2 tons per hectare (t/ha), which is well below potential levels due to limited access to improved seeds, irrigation, and mechanization.

For MY 2023/24, estimates from the United States Department of Agriculture (USDA) anticipated harvests at 6.1 MMT. However, recently, the Ministry of Agriculture revealed that the country harvested an impressive 11.7 million tonnes in the 2023/24 season, surpassing Nigeria to claim the title of Africa’s second-largest maize producer.

According to the April 2025 USDA report, maize production in Tanzania is forecast at 6.8 million metric tons (MMT) in 2025/26, a 3% decline (200,000 metric tons (MT)) from the prior year, and area harvested to decrease by 2.44 percent to four million hectares. Post attributes the decline primarily to below-average short rains (“Vuli”) in late 2024, input distribution delays, and pest pressure from

fall armyworm. The decline is also driven by farmers shifting to alternative crops due to low maize prices, which ranged from US$0.59 to US$1.41 per kilogram. Maize consumption was forecasted at 6.08 MMT in MY 2024/25, a decrease from 6.3 MMT the prior year, due to high prices and substitution with other staples.

Tanzania remains a net exporter of maize to neighboring countries, especially Kenya, Uganda, Rwanda, the Democratic Republic of the Congo, and Malawi, becoming a crucial part of the regional food supply chain. In 2023, Tanzania exported US$71.7M of Corn, making it the 36th largest exporter of Corn (out of 158) in the world. For 2025/26, the USDA projects corn exports to decrease by 10 per cent year-over-year, reaching approximately 900,000 metric tons. Post attributes the decline to the fact that traders are facing significant challenges in obtaining export permits through official channels, as the procedures have become increasingly stringent and bureaucratic.

Tanzania is the largest rice producer in East Africa, producing nearly twice the combined output of other East African countries like Kenya, Uganda, and the Democratic Republic of Congo. The crop is Tanzania’s second most important grain, and the government has identified it as a strategic crop. The strong output is driven by initiatives like the National Rice Development Strategy (NRDS), which aims for even greater output, targeting 8.8 million tonnes by 2030.

Primary production areas are Morogoro and Mbeya in the Southern Highlands, where water availability supports paddy cultivation. In 2015/16, rice was cultivated on 1.15 million hectares, producing about 2.94 million tonnes of paddy (rough rice) at an average yield of 2.54 tonnes per hectare. By 2019/20, yields had improved significantly to 3.30 tonnes per hectare, pushing rough production to 3.48 million tonnes even though the cultivated area slightly declined to 1.05 million hectares. Current yields range from 2-3 t/ha, reflecting progress but still below global benchmarks due to inconsistent access to quality inputs and infrastructure.

Production for 2025/26 is projected at 2.51 MMT (milled basis), slightly below the previous year due to delayed planting and disease pressure, particularly bacterial leaf blight. However, the country remains a net exporter of rice to neighboring countries, with the USDA projecting rice exports to decline significantly by 50 percent to 50,000 metric tons year-

MY 2015/16-MY2025/26

on-year, down from 100,000 metric tons in the previous marketing year 2024/25 on stringent bureaucratic export procedures implemented by the Government of Tanzania since 2023.

Wheat production in Tanzania is relatively minor compared to other grains, with the country heavily reliant on imports to meet demand. According to USDA data, the five-year average (2020/21–2024/25) for wheat production stands at 77,000 metric tons (MT), harvested from an average area of 61,000 hectares (ha), with an average yield of 1.27 MT/ha. The USDA forecasts a 10% year-onyear increase in 2025/26, reaching 80,000 MT, driven by government initiatives to boost output. Annual demand is around 1 million MT, with consumption projected to rise by 4% to 1.175 million MT in 2023/24, fueled by population growth, urbanization, and tourism. In 2023, Tanzania imported US$466 million worth of wheat, ranking as the 38th largest importer globally. Import volumes are estimated at 800,000–1 million MT annually, with a bill of about US$221 million. USDA projects a 15.4 percent increase in wheat imports for MY 2025/26, reaching 1.5 million MT to meet rising domestic demand.

TANZANIA IS A NET EXPORTER OF MAIZE BECOMING, A CRUCIAL PART OF THE REGIONAL FOOD

The Tanzanian government, however, has set ambitious plans to scale up production to 1 million tons by 2025 through the adoption of improved seeds and enhanced agricultural practices.

Sorghum is a drought-resistant grain well-suited to Tanzania's arid and semi-arid regions, providing a reliable food source in areas with unreliable rainfall. Over 70% of production is used domestically for human consumption (as flour for porridge or ugali) and animal feed, with the remainder for brewing and minor industrial uses.

Annual production hovers around 0.8-1 MMT,