PUBLISHER

NORMAN ISAZA

EDITOR - IN - CHIEF

CARLOS JARA

CONTENT DIRECTOR

YESENIA MORENO

MANAGING EDITOR

ISABELLA MENDES

EVENT DIRECTOR

NICOLE ISAZA

CONTRIBUTING WRITERS

MELANIE ISAZA

ORLANDO DIAZ

NORMAN ISAZA

PHOTOGRAPHER

EDUARDO MENDEZ

PUBLISHER

NORMAN ISAZA

EDITOR - IN - CHIEF

CARLOS JARA

CONTENT DIRECTOR

YESENIA MORENO

MANAGING EDITOR

ISABELLA MENDES

EVENT DIRECTOR

NICOLE ISAZA

CONTRIBUTING WRITERS

MELANIE ISAZA

ORLANDO DIAZ

NORMAN ISAZA

PHOTOGRAPHER

EDUARDO MENDEZ

SEPTEMBER/ OCTOBER ISSUE 08

OUR CONTRIBUTORS

ORLANDO A. DIAZ

President of Metro Fund Inc in Miami, Florida, a leading private capital provider in South Florida

President of the Florida Association of Mortgage Professionals

ALEX SOTO

Senior Vice President, Head of Premier Banking Grove Bank & Trust

DR. CLAUDIA URIBE

Director @ Miami-Dade County Fair | Mental Health Therapist | Professor at University of Miami

LISSETTE REYES

Contributing Writer

DIGITAL CONTENT COORDINATORS

CAROLINA IGLESIAS

JORDAN KETTINGER

MICHAEL GIRON

This October, prioritize your health: get screened, encourage loved ones to do the same, and remember that early action truly saves lives

Early breast examinations are a vital step in winning the fight against breast cancer, saving countless lives through vigilance and proactive care October’s Breast Cancer Awareness Month is more than a ribbon; it’s an annual reminder that early detection remains the most powerful tool we have.

Breast cancer will affect about one in eight U.S. women; in 2025 alone, experts expect over 316,000 new invasive cases The key to survival is catching it early: if breast cancer is found at a localized stage, the five-year survival rate soars to 99%, compared to much lower rates for cancers discovered after they have spread. This fact underscores why early and routine screenings, both self-exams and mammograms, are essential for every woman, and increasingly, for younger women as well, given a notable rise in cases among those under 50.

Unfortunately, screening rates have dropped in recent years, with only about half of adults participating in routine checks. This means many cancers may go undetected until symptoms emerge, by which point treatment options are fewer and outcomes far less favorable. National guidelines recommend that women, especially those between 40 and 50 or at greater risk, schedule annual mammograms, while all adults should remain mindful of their personal risks and discuss tailored plans with their doctor.

Awareness is not enough Early breast exams empower people to make informed choices, catch subtle changes, and seek help sooner, making the difference between a manageable diagnosis and a devastating one. A single exam, performed early, can spark hope instead of fear, opening the door to successful, less invasive treatments and longer, healthier lives

Carlos Fernandez Guzman’s journey from a young banker hopeful to transform to CEO is a testament to grit, vision, and unwavering leadership. His legacy weaves together decades of private sector ingenuity, civic engagement, and a singular ability to restore struggling entities to their full potential.

Long before taking the reins as President and CEO of Pacific National Bank, FernandezGuzman had set his sights on a law degree, working nights at a local bank to finance his studies A pivotal lesson in financial leverage shifted his ambition squarely to finance, a field where his talents would leave an indelible mark. “Accounting was good, but finance is a good fit,” he reflected, and so began a career that would shape South Florida’s banking landscape

After early management roles at Southeast Bank and Consolidated Banks, FernandezGuzman honed a reputation as the “white knight” for troubled financial institutions His ability to orchestrate private sector turnarounds led to headlining roles in saving American Savings and revitalizing BankUnited, later facing and overcoming the scrutiny that marked the 2008 financial crisis Despite industry hesitancy, he persisted, seeking out roles few dared to accept

fic National Bank andez-Guzman embraced est challenge yet: reviving Bank, then considered industry insiders In record new management team, onal standards, and dures with a driving focus efficiency, and customer stewardship, PNB soared o become one of South profitable and innovative nto Coral Gables, Pinecrest, a vision unconstrained by

n ’ s approach is rooted in mination and the belief that s is sacred. “Efficiency is the me, and you must remain ving the efficiencies of the he notes, championing ovation while fostering a change and improvement

"

Do not follow where the path may lead. Go instead where there is no path and leave a trail."

Ralph Waldo Emerson

Yet, his greatest impact often transcends the world of finance As chairman of Chapman Partnership, Fernandez-Guzman champions initiatives to empower Miami’s homeless population, overseeing programs with a 60 percent lifetime success rate in moving individuals to self-sufficiency “It’s so rewarding to see people remake themselves, living in homes, having jobs, raising families,” he affirms

His civic devotion extends to chairing the Greater Miami Chamber of Commerce, advising at Florida International University, and lending his expertise to boards and charitable causes, all while mentoring the next generation of leaders through an ethos of service and passion

For more than 30 years, Fernandez-Guzman and his family have called Miami Lakes home He and his wife, Mari, high school sweethearts, raised three children here and are now proud grandparents to seven, valuing deep community roots over professional relocation His affection for his hometown is palpable; he compares Miami Lakes' transformation to watching a child grow, describing its community spirit and parks as “unparalleled to any other city”

Now with over four decades in finance, Carlos Fernandez-Guzman remains at the helm of Pacific National Bank, a partner to clients across South Florida, the Caribbean, and Latin America As technological innovation drives banking forward, he is poised to make PNB’s virtual presence as vital as its branches, always guided by one mission: maximizing value for customers and shareholders with unwavering excellence

His story is not just one of business acumen, but of leadership anchored in community, service, and the power to lift others alongside personal success, a legacy that will continue to shape the future for years to come.

Safeguard your business against today’s risks and tomorrow’s evolving challenges. We offer customized solutions for property, casualty, and specialty insurance

Identify and mitigate risks before they turn into liabilities. Our services include proactive risk assessments and expert strategic advice

Attract and retain top talent while controlling costs with our smart, comprehensive benefit packages.

Safeguard the life you’ve built with personalized services, including insurance for luxury homes, fine art, yachts, and more.

With decades of experience, our team delivers top-tier insurance and risk management solutions.

We prioritize your unique needs, offering personalized recommendations tailored to you

From personal and commercial property & liability to employee health & benefits, we provide adaptable options as your life and business evolves

As an independently owned firm, we are driven by our clients, not corporate agendas. We pride ourselves on being responsive, connected, and efficient insurance experts

What motivated you to pursue a leadership role, and did you always envision yourself as a CEO?

I don’t think there was ever a moment where I woke up and said, “I want to be a leader ” It really developed naturally over time Growing up, I was heavily involved in sports, and that experience taught me a lot about teamwork, discipline, and perseverance I often served as team captain, and that’s where I discovered my passion for guiding others through challenges and helping a group achieve something bigger than themselves

In my banking career, I’ve faced plenty of situations where I didn’t initially know all the answers, but I figured things out and kept moving forward That problem-solving mindset has been a big part of my growth. More importantly, I’ve learned that leadership isn’t about doing everything yourself it’s about building great teams So, while there wasn’t one single moment that defined it, leadership has always been something I’ve grown into and truly enjoyed

What gaps in the market did you see that made you decide Miami needed a new bank?

There were hardly any community banks left In 2008, Miami had 42 banks headquartered here; by 2023, only 17 remained, even though the population had nearly doubled. Many of those banks now focus on international markets, not the local community Clients kept saying they wanted another option a true community bank and that’s when it became clear the time was right

Do you remember a time or moment when you said, “You know what, I’m going to do this one day”?

Starting a bank is very different from leading one. Years ago, I had the opportunity to work with a remarkable group of professionals to help build Professional Bank I wasn’t part of the original de novo team Danny was there before me, along with a few others but when I joined, we were still very small In fact, we had more board members than employees and about $80 million in assets a year and a half in I served as controller, but I was also responsible for HR, operations, IT, finance, and accounting essentially everything behind the scenes It was a true hands-on experience that allowed me to see how impactful a small, community-focused institution can be You can make meaningful changes and actually see the results, both for clients and for your team That experience planted the seed I often told people, “One day, I’m going to start a bank ” And after the sale of Professional Bank, the timing finally felt right There are still many great organizations in our community, but with all the mergers and acquisitions, fewer locally owned banks remain. Many large institutions that have entered our market simply can’t provide that same personalized service once they reach a certain size

The opportunity came together like a trifecta clients looking for better solutions, talented bankers displaced by consolidation, and a thriving market in Miami, which has nearly doubled in size over the past 15 years. I realized that if I didn’t do it then, I might never get another chance

With the sale providing some liquidity, I spoke with peers including Danny, who joined me early in the process and we decided to take the leap The rest is history

What unique challenges have you faced as a woman, and how do you overcome them?

I’m often asked about being the first woman to start a bank here Honestly, I feel very blessed, I haven’t faced many challenges just for being a woman I’m grateful to leaders like Miriam Lopez and Adrian Arch, who broke barriers before me and made my path easier Personally, the biggest challenge has been balancing being a mom to my two young kids now 8 and 7 while building a bank When we started, they were just 6 and 5, and I had to sacrifice a lot of time with them to focus on the team and growth It’s still something I work on every day, and I wouldn’t say I’ve mastered it, but it’s been the most meaningful challenge of all

“I was 24 years old and put into a boardroom to present to directors You should not have been, but it taught me at very early age and when I didn’t believe in myself, there were people that did believe in me and at professional bank I would say probably the most important person to the date in mentorship, outside of banking and it's my grandfather and he played a huge part in just everything I do and how I lived every day “

Have you ever doubted yourself or wondered how you’d get past a major challenge?

Yes, one moment that really stands out was on my 40th birthday trip to Switzerland and France I thought I’d finally get a break, but my attorney called: we had six days to raise capital or withdraw our application I remember locking myself in the bathroom, asking, “What am I doing? Are we going to give up?” After a sleepless night, long walks, and conversations with our chairman, I spoke one-on-one with the regulators and explained that we were close to the finish line and needed an extension They granted six months, and we raised the capital within three weeks It was a dark moment, but having great attorneys, a supportive chairman, and regulators who genuinely wanted us to succeed made all the difference Since then, it’s been an uphill climb, and I’m grateful for the success we ’ ve achieved

“In my banking career, I’ve faced plenty of situations where I didn’t initially know all the answers, but I figured things out and kept moving forward ”

As artificial intelligence (AI) reshapes the financial sector, robust governance has become indispensable to ensuring long-term security, stability, and trust. In 2025, more than 85% of financial institutions are leveraging AI for everything from fraud detection and risk modeling to hyper-personalized services, driving both operational efficiency and competitive advantage. Yet this rapid adoption comes with heightened risks algorithmic bias, lack of transparency, cybersecurity threats, regulatory gaps, and broader systemic vulnerabilities now pose significant challenges alongside opportunities.

The need for governance is more urgent than ever, as reliance on AI outpaces traditional risk management and regulatory frameworks. Effective oversight must be embedded from the earliest stages of AI development not added as an afterthought. This requires comprehensive frameworks that address key areas: explainability (so decisions are understandable to users and regulators), regulatory compliance (including adherence to laws like the Fair Credit Reporting Act and GDPR), privacy protection for sensitive data, and continuous monitoring for evolving risks, especially as AI models learn and adapt over time.

A “sliding scale” of scrutiny is emerging, with highimpact applications like credit scoring, fraud detection, and algorithmic trading subject to the most rigorous controls and transparent auditing. Banks are encouraged to adopt AI model inventories, centralize governance across risk, compliance, and IT, enforce human-in-theloop protocols for critical decisions, and build clear accountability structures at all organizational levels. Moreover, regular audits, staff training, and vendor risk assessments are vital to reinforce these controls and keep pace with rapid change.

In this evolving landscape, strong governance is not a brake on progress it is the bedrock enabling responsible innovation, public confidence, and resilience in the face of emerging threats

Vice President, Head of Marketing & Communications at International Finance Bank

Vanessa Sanchez has been with International Finance Bank since 2015, starting as an Executive Assistant before transitioning to Preferred Banking, where she gained hands-on experience in client services and banking operations Her deep understanding of how departments interconnect became the foundation for her leadership in marketing Vanessa played a pivotal role in IFB’s rebranding initiative as part of the Young Leaders Workgroup, overseeing projects such as logo redesign, website development, and brand alignment across all platforms Recognizing her talent, IFB promoted her to establish and lead its Marketing & Communications department, which she has successfully managed for over seven years Vanessa also champions community engagement through financial literacy events and serves on committees including Hard Hats & High Heels and Casa Familia’s Marketing Committee. Her innovative approach continues to strengthen IFB’s brand and community presence

Executive Assistant to the CEO at Grove Bank & Trust

Jessie Martinez-Lastres is a first-generation Cuban-American and is currently the Executive Assistant to the CEO, Jose E Cueto, at Grove Bank and Trust, providing strategic support and managing executive operations

A graduate of St Thomas University with a B S in Finance, Jessie has held leadership roles across banking, finance, and administration, including Director of Administration at Advanced Systems Resources, Inc , Administration and HR Director at Blue Harbor Lending, and Executive Assistant to the President and CEO at International Finance Bank

Married for 35 years and a mother of three, she stepped away from the corporate world 20 years ago to focus on raising her family, guided by faith and prayer Jessie is known for her operational expertise, leadership, and commitment to excellence, bringing both professional skill and a heart for service to her work and community

As community banks in South Florida plan for 2026, talent strategy is no longer a back-office concern, it’s a competitive front. Between AI, tighter competition for tech skills, changing work preferences, and the region’s bilingual customer base, Miami-area community banks must be intentional about hiring, structure, and workforce development to preserve the relationship advantage that defines community banking. Below is a practical, bankleader–friendly rundown of what matters and what to do next.

What’s changing - the headlines you need

1 AI is moving from experiment to production. Banks are shifting generative AI and automation from pilots into revenue- and risk-focused use cases (customer service, fraud detection, underwriting support). That increases demand for AI-literate staff and changes the skills required across functions.

2 Technology talent is a bottleneck. Community banks repeatedly name attracting and retaining competent technology personnel among top implementation challenges — a gap that affects digital delivery, cybersecurity and fintech partnerships.

3 Work models are settled into hybrid, but with variation. Some large banks insist on in-office days; others intentionally preserve hybrid models as recruiting advantages. Community banks can use flexible models strategically to compete for talent.

4 Internal mobility and “skills marketplaces” are gaining traction. Leading financial institutions are experimenting with internal talent marketplaces and gig-like project staffing to redeploy skills quickly and retain people who want varied work. This is an approach community banks can adopt at smaller scale.

5 Local labor realities — bilingual skills matter. Miami’s market has a continued, measurable demand for bilingual banking staff (Spanish at minimum), shaping hiring, training and customer-facing role design.

Why this matters for community banks in Miami

Community banks’ primary advantage is relationships and local knowledge. But that advantage can be eroded if technology gaps slow service, if frontline staff don’t reflect customer language needs, or if banks lose loan- and deposit-generating producers to regional competitors or fintechs. The right staffing strategy turns those risks into strengths: better digital service, faster underwriting, stronger fraud controls, and culturally aligned relationship teams.

Practical priorities for 2026

(what to do, not just what to know)

1) Make “reskilling + hiring” a single budget line

AI and automation will change job content more than job counts in the near term. Invest in role-based reskilling programs e.g., upskill credit officers on analytics-assisted underwriting, and train contact center staff on AI-augmented customer triage so you capture efficiency gains without losing institutional knowledge. Use external partners or regional community college tech programs for modular upskilling.

2) Build a small internal talent marketplace

You don’t need a corporate-scale system. Start with a simple internal posting board and short-term project pools (compliance cleanup, digital onboarding UX sprint, datacleaning project). This increases retention, speeds projects, and surfaces employees with latent skills. Pilot with 6–12 month rotations before scaling.

3) Prioritize hiring for cyber, fraud and data skills

Community banks face growing cyber and fraud risk that requires specialized staff, threat analytics, fraud ops, data governance. If you can’t hire senior specialists, consider managed services or fractional hires while building internal capacity. Surveys show talent gaps in tech/cyber are a persistent implementation blocker.

4) Use flexible work intentionally to widen the talent pool

Offer hybrid or remote options for roles that don’t require daily branch presence (e.g., underwriting, analyst roles, contact center). This widens candidate pools and can be a differentiator versus regional banks that demand full-time office presence. However, maintain structured in-person touchpoints for relationship teams to preserve culture and local market insight.

5) Double down on bilingual hiring and culturally competent service

Make Spanish (or other local languages) a preferred credential for client-facing roles and include language capability in recruitment and performance plans. The Miami market continues to show high demand for bilingual banking professionals; aligning talent composition with customer demographics is low-hanging ROI.

6) Lean on contingent staffing and partnerships for episodic needs

Use staffing firms or contingent workers for seasonal spikes (mortgage surges, stimulus-related activity) or short-term projects (core conversion, branch consolidation), rather than inflating permanent headcount. This allows agility and cost control while you build permanent capabilities where needed.

7) Rework compensation to reflect skills and scarcity

For tech and data roles, benchmark against local and regional markets and consider hybrid pay bands, signing bonuses for critical skills, and career ladders tied to clear technical competencies. Noncash benefits, flexible schedules, education stipends, clear advancement can be differentiators in tight markets.

8) Strengthen campus and community pipelines

Partner with Miami-area colleges, trade schools, and Hispanic-serving institutions to create internships, apprenticeship programs and fast-track roles into banking. These pipelines deliver two outcomes: talent and stronger community ties (a core community bank asset).

Time-to-fill for tech/data/cyber roles (and trend it quarterly)

Percentage of hires who are bilingual in client-facing positions

Internal mobility rate (transfers/promotions) and post-move retention

Overtime/contingent spend as share of total labor (to identify over-reliance)

Training hours per FTE in digital/AI/cyber topics

Final note - culture and governance matter

Technology, hybrid work, and reskilling succeed only when embedded in governance: boards and senior leadership must treat talent strategy as strategic capital. Consider adding a talent/technology subcommittee or ensuring HR and CIO brief the board quarterly on workforce readiness tied to technology roadmaps. Industry surveys continue to show board-level attention to tech skills is increasing, community banks should follow suit.

Personal Commitment, Professional Excellence: Mariano Martinez Transforms South Florida Banking

Personal Commitment, Professional Excellence: Mariano Martinez Transforms South Florida Banking

SENIOR VICE PRESIDENT - PRIVATE CLIENT GROUP

For Mariano Martinez, banking is more than numbers and contracts it’s about people, trust, and a lasting sense of partnership. As Senior Vice President of the Private Client Group at U S Century Bank, Mariano’s approach is deeply personal, blending expert financial insight with an authentic dedication to his clients’ long-term success Over nearly twenty years in community banking, he has become an indispensable advisor to attorneys, professionals, and high-net-worth individuals across South Florida, celebrated for offering custom banking solutions grounded in a nuanced understanding of his clients’ unique needs

Mariano’s expertise is especially pronounced in sectors where financial complexity reigns: trust and estate management, specialty accounts, and real estate law Clients rely on him not just for products, but for his accessibility, keen interest in their business goals, and problem-solving acumen. As one of the architects of the Bank’s MD Advantage Program, he also champions the financial well-being of medical professionals, delivering bespoke lending and deposit solutions tailored to the realities of today’s healthcare environment.

But Mariano’s story stretches far beyond his professional achievements Deeply rooted in the South Florida community, he has shaped its growth as Chairman of ChamberSouth, dedicating over twelve years to the Board of Directors and spearheading initiatives to strengthen local business and professional networks He leads by example, fostering relationships and development opportunities that ripple across the region cultivating a culture of giving back and continuous improvement

Community service holds a special place in Mariano’s life. He’s a steadfast supporter of local nonprofits like Kristi House, the SebastianStrong Foundation, Carlito’s House, and Parent to Parent of Miami, uplifting families facing significant challenges His ethos of giving, mentorship, and positivity anchored in the “Givers Gain” principle from his networking days continues to set the standard for civic and business leadership in Miami-Dade

A proud graduate of FIU’s Colleg and Miami’s Christopher Columbu Mariano lives in Pinecrest with his children, including a Division 1 row University He balances work remaining ever-present in comm always open to new ways to serve a

ISSUE 8

“Negativity leads to failure; posit success,” Mariano often says. His relationship-building, client servi engagement has made him far more than a banker he’s a trusted advisor and pillar of South Florida’s professional family

by:AlexSoto

Contribuitiing Writer

In today’s fast-paced, data-driven world, it’s easy to lose sight of what actually fuels long-term success, which is people. Not just their performance, but their sense of belonging, purpose, and being seen.

To me is has become clear that authentic kindness and caring about your people is not just the “right thing to do”.

People don’t leave companies. They leave leaders who don’t care.

When someone feels that their manager or company REALLY values them everything changes. Productivity increases. Loyalty deepens. And most importantly, a healthy culture takes root that strengthens with time.

There’s a long-lasting misconception that kindness is weakness. Truth be told, it is quite the opposite, as authentic kindness requires courage, empathy, and consistency.

It means: Giving people your full attention. Supporting them through personal or professional challenges.

Celebrating their wins whether big or small. Providing honest feedback with respect. When people know you care — who you really are — they go the extra mile because they want to, not because they must.

SVP, Head of Premier Banking Grove Bank & Trust

Leaders set the tone. If a leader is guarded, transactional, or indifferent, that becomes the culture; no matter how many "values" are printed on the wall. But when a leader leads with heart, listens actively, and puts people first, it creates a real, deep effect.

Let’s be 100% honest here, people can sense false or fake behavior a mile away. They notice when kindness is being used as a tactic, not a truth. The only way to make people feel valued is to actually value them. That comes from within.

So, ask yourself:

Do I know what matters to the people I work with?

Do I show up consistently, not just when it's convenient?

Do I make time for real conversations?

If the answer is yes, you’re already on the right path. The companies that will thrive long-term are those that realize business is ultimately about people. And the leaders who will rise are those who lead with kindness, with courage, and with care.

It’s not about being perfect. It’s about being real.

Powering South Florida’s Homes and Businesses for 20 Years We’ve helped thousands of homes and businesses across South Florida stay powered through every storm and rebuilt communities in the process.

Mike Dion is a dedicated business owner focused on keeping South Florida the paradise we all love, even when storms hit. For nearly two decades, Dion Generator Solutions has helped families, businesses, and communities stay powered, protected, and prepared.

For many clients, generators are more than a convenience: they’re a matter of safety and quality of life, ensuring medical devices stay running, preserving valuable collections, or keeping essential systems online. Mike’s vision has always been to serve as the foundation on which the community runs. Beyond business, he’s a strong supporter of local causes from the Police Benevolent Association and PATCHES to seven different Chambers of Commerce throughout the region.

Mike had spent years in the electrical and mechanics industry when, one Halloween night after Hurricane Wilma, a cemetery lost power. At midnight, he and a colleague were called in to set up generators to keep the bodies preserved in the heat. That moment changed everything: he saw firsthand how vital reliable power is to life, dignity, and community. The next day, his former boss helped him launch his own generator business. Mike eventually bought the company himself, expanding to two locations in Pinecrest and Key Largo. He laughs about it now, calling it “the Halloween Generator Curse,” but it’s one he’s grateful for every day.

To expand throughout Florida and protect every community vulnerable to hurricanes while training our workforce to become skilled, certified professionals capable of serving with excellence and pride. Company Vision:

Generator Sales – Top brands for residential, commercial and industrial use, including Kohler and Generac which we are local authorized, trained and certified dealers for. Our Services

Installation – Turn-key electrical & gas setup with permits handled

Maintenance / PMA – Scheduled preventative maintenance plans, 3x per year to ensure the health and reliability of your generator

Repairs & Emergency Service – 24/7 response and troubleshooting

To expand throughout Florida and protect every community vulnerable to hurricanes while training our workforce to become skilled, certified professionals capable of serving with excellence and pride.

Rentals – Temporary power solutions for events and construction

Dion Generator Solutions is a fully licensed electrical and gas contractor and an authorized, trained and certified dealer for Generac and Kohler systems. From consultation to permitting, installation, and ongoing maintenance, the team provides a complete end-to-end service experience. Their certified technicians are trained to handle everything from residential setups to large-scale commercial installations, always meeting Florida’s strict safety and compliance standards. With many generators lasting 20 years or more, clients trust Dion as a business that will be there for every inspection, repair, and storm season ahead.

Founded in 2006, Dion Generator Solutions serves residential, commercial, and industrial clients across MiamiDade and the Upper Keys. The company’s core principle is simple: only promise what can be delivered, so we can always be there when it matters most. “We don’t serve areas we can’t reach in an emergency,” says Mike. “You wouldn’t order a pizza from another county, and you shouldn’t rely on a service provider that can’t get to you when you need them.” This mindset has guided their strategic growth and reputation for reliability. Their newest location in Key Largo expands their ability to serve the Florida Keys community more closely.

Beyond keeping the lights on, Dion Generator Solutions is deeply involved in the community. The company supports local initiatives like Adopt-a-Family and Hurricane Preparedness drives and regularly partners with first responders for safety and power education campaigns. They are active supporters of the Police Benevolent Association (PBA), PATCHES (Pediatric Alternative Therapy Care), and seven Chambers of Commerce throughout South Florida. In addition, the company prioritizes employee growth. Training technicians in a niche field that offers both stability and pride of craftsmanship.

“At the end of the day, living in paradise takes effort And power is the foundation of everything we do We believe in planning ahead, living well, and growing together as a community ”

When it comes to your financial aspirations, there are no boundaries at PNB. We believe in your potential and helping you reach new heights. Our comprehensive range of banking solutions, personalized service, and cutting-edge technology is built from the ground up to help you reach your financial goals. Whether you ’ re starting a new business, expanding your portfolio, or realizing your dreams, PNB is here to provide the support and guidance you need. Elevate your financial journey with a bank that understands your ambitions and is dedicated to building your success. Break boundaries, block by block, with PNB as your trusted partner.

Psychology plays a powerful, often underappreciated role in banking. It affects how individuals interact with money, make financial decisions, trust institutions, and even how banks design products and services.

Here are the key psychological aspects that matter in banking:

Banking is built on trust. Customers must believe their money is safe, that the bank is stable, and that their information is secure.

Brand reputation and transparent communication are crucial because people are emotionally cautious with money.

Even a rumor about instability can trigger a bank run — not because of facts, but fear.

Banks use insights from behavioral psychology to shape customer behavior:

Defaults: People stick with default options (e.g. automatic savings plans).

Framing: How a financial product is presented affects people’s choices.

Customers don’t always make rational financial decisions. Psychology influences:

Spending vs Saving behavior

Loan choices (e.g., falling for low monthly payments rather than considering total cost)

Impulse vs Delayed gratification

Banks use this understanding to design financial products, marketing strategies, and to draw attention.

Bankers (especially in retail or private banking) need emotional intelligence

Reading client emotions

Building rapport

Guiding them through anxiety-inducing decisions (e.g., debt, investing)

Trust is an essential component

6.DigitalExperienceandPsychology

Convenience

24/7 access to accounts, payments, transfers, and loans. No need to visit a branch.

Customer feels in control 24/7

Provides a sense of control and security

7.OrganizationalPsychology(InsideBanks)

Staff motivation, ethical behavior, and risk culture are psychological factors that shape a bank's internal health.

After the 2008 crisis, regulators began paying attention to "risk culture" the shared mindset about taking or avoiding risks

p

customers in ways that truly meet their needs—not just their numbers

By: Dr. Claudia Uribe

For decades community and regional banks have been the backbone of South Florida s economy They ve helped build condos finance small businesses, and support the region s growing international community

But today, those banks are facing a perfect storm of change: Falling interest rates which put pressure on profits

Artificial intelligence (AI) which is transforming how financial services work

And the rise of cryptocurrency, which is creating a whole new financial ecosystem

These shifts are forcing local banks to rethink how they make money use technology and compete in one of the most dynamic and fast-moving markets in the country

When the Federal Reserve lowers interest rates, it may sound like good news for borrowers i e cheaper loans and lower credit costs But for banks, especially smaller community banks rate cuts can hurt the bottom line

Here s why: many banks in South Florida focus on commercial real estate loans investment property loans, and adjustable-rate mortgages which are tied to floating interest rates When the Fed cuts rates the income banks earn on those loans drops almost immediately

But on the other side of the balance sheet deposit costs, what banks pay customers on CDs and savings accounts, don t fall as fast People don t want to give up the higher rates they’ve been earning, and if a bank cuts them too quickly depositors might simply move their money elsewhere

This delay between lower loan income and slower-to-drop funding costs is called margin compression And for banks that rely on commercial and investment property lending, which is common in South Florida that squeeze can be painful

The challenge is even tougher in this region because many depositors are retirees international investors, or high-networth individuals who are very rate sensitive If they can get a better yield elsewhere, even in a digital account or crypto platform, they won’t hesitate to move their money

To soften the blow of falling rates, many local banks are using strategies to protect their income and strengthen their balance sheets:

Hedging with swaps and loan floors: These tools help keep earnings steady even when rates fall

Shifting deposit strategies: Banks try to encourage customers to keep funds in lower-cost accounts like checking rather than high-rate CDs

Making use of stronger bond values: When rates fall bond portfolios often rise in value, giving banks a little extra financial cushion

These are risk-mitigation tools, not profit engines They help cushion the blow but they don t eliminate it While these traditional tools help, they re not always enough in today s environment That s why banks are also looking at how new technologies, especially AI which can help them operate smarter and more efficiently

THE AI ADVANTAGE: FASTER, SMARTER, LEANER

Artificial intelligence is reshaping the financial world Big banks already use AI for everything from approving loans faster to spotting fraud to automating customer service For community and regional banks in Miami-Dade, Broward and Palm Beach counties adopting AI isn t just nice to have anymore it s becoming essential to stay competitive

Some local banks are already moving in this direction

They re using AI chatbots to answer customer questions

24/7 automating loan applications to speed up approvals, and using smarter risk models to make better lending decisions

The benefits are clear:

Lower costs at a time when margins are shrinking

Faster service for borrowers in South Florida s fastmoving real estate market

More personalized service that can help keep customers loyal even when rates go down

But AI isn’t easy to implement It requires investment new technology and the right talent to manage it Meanwhile, fintech companies and larger national banks can adopt these tools more quickly, creating a gap that local banks need to close

South Florida and Miami in particular, have become a hotspot for cryptocurrency and blockchain innovation Bitcoin events the arrival of major crypto exchanges and political support for fintech have turned the region into a magnet for digital finance

For traditional banks, this creates two major challenges:

1 Deposit flight: More individuals and businesses are moving their money into digital assets and stablecoins That means less cash sitting in bank accounts especially when interest rates are low

2 New payment systems: Crypto and blockchain offer fast, low-cost cross-border transactions That directly competes with the traditional correspondent banking services many South Florida banks rely on to serve Latin American clients

Some local banks are starting to adapt by exploring crypto custody, partnerships or stablecoin integrations But others are hesitant partly because crypto remains loosely regulated, which creates compliance and risk challenges for highly regulated community banks that must operate under strict oversight

For community and regional banks, falling rates alone would be a big enough challenge But combined with the rise of AI and crypto it’s a turning point

To succeed, local banks will need to:

Manage rate risk more carefully to protect earnings

Adopt AI strategically to cut costs, speed up service, and deepen customer relationships

Stay connected to the digital finance world so they don’t lose relevance with international and tech-savvy clients

South Florida s financial sector has always been dynamic It s a place where real estate entrepreneurship, and global capital intersect The banks that embrace this new reality can turn disruption into opportunity The ones that don’t may find themselves losing ground to fintechs larger institutions or digital platforms that move faster

Falling interest rates, rapid AI adoption, and the rise of crypto are reshaping the local banking landscape For South Florida s community banks the challenge is clear: adapt quickly or risk getting left behind in a financial world that’s changing faster than ever before But if there’s one thing history has shown it s that South Florida banks have a knack for resilience they adapt innovate, and find ways to thrive no matter how turbulent the financial environment becomes

WRITTEN BY Orlando Diaz

Contributor to the Florida Banking Forum and President of Metro Fund Inc. in Miami, Florida, a leading private capital provider in South Florida. Mr. Diaz also serves as the President of the Florida Association of Mortgage Professionals.

I T ' S T I M E F O R . . . IT'S TIME FOR...

Building relationships one cafecito at a time

Building relationships one cafecito at a time

Sandy Fernandez is the woman who walks into a bank and reads a balance sheet, financial statements like tarot cards She’s a financial expert, intuitive coach, speaker, mother, No. 1 best-selling author, Sandy is an SVP at InterCredit bank and the founder of Karmic Currency™, the energy behind business and finance A transformational space where spiritual alignment and financial power come together But her story isn’t just about success; it’s about survival and starting over

Sandy has spent over 25 years in banking, rising from a teenage teller to Senior Vice President, overseeing portfolios in the hundreds of millions She knew how to close a loans, manage branches and lead a teams but it was the moments outside the office that defined her the most

Through divorce she raised her two sons with grace and grit and when her mother was diagnosed in 2022 with terminal stage 4 lung cancer, she became a full-time caregiver while still holding her business and her heart together

That’s when the entrepreneurship of Karmic Currency™ allowed her to heal others while healing herself A space where women could talk about credit scores, Money, and energy in the same breath Where you could look at your budget and your belief and understand that they’re connected Where money wasn’t a mystery it was a mirror

Sandy has now helped thousands of women untangle themselves from money shame, understand the analytics of money and how to rebuild their lives after heartbreak or loss, and finally feel safe: not just with their finances, but with their future Her Book and programs like the 7-Day Money Challenge and Chakras & Money Mini Course are infused with practical financial tools, spiritual wisdom, and yes a little bit of magic

Sandy often tells the story of the day her mom took her hand and said, “I’m so glad you’re able to be here with me ” If Sandy had stayed in corporate and not listened to her own intuition, she wouldn’t have had that moment That presence? That is a gift That’s why she teaches women that real wealth is freedom

Now, after eight powerful years as a full-time entrepreneur, Sandy has returned to the corporate world as SVP at Intercredit Bank, but this time, She brings with her the wisdom of both worlds: the suit and the sage, the numbers and the knowing

She’s currently writing her second book, “ A Zen Girl’s Guide to Money: 100 Ways to F** Up Your Relationship With Money and How to Fix It,” a raw, funny, and powerful journey into what really keeps women stuck and how to finally break free

Because Sandy knows: Money isn’t just about what you earn It’s about who you’re becoming while you’re earning it and the legacy you choose to leave behind to those you love.

Strengthen your team Strengthen your team

Every business needs blocks.

Pieces that fit. Placed with purpose. Timed with care.

To strengthen, scale, and grow.

At Popular Bank, we set lasting foundations for owners, managers, and builders of business.

To help shape futures, imagine innovations, and elevate communities.

Our blocks for your success.

Capital Continuity Connection

That’s the deal. Ready to make yours?

Our

son “Nelly” Lopez is a recognized force in Miami’s estate finance community, driven by a mmitment to service, innovative lending practices, local engagement. As the owner and broker of ding with Nelly, Lopez has cultivated a reputation trust and expertise, earning accolades such as ctor & Lender of the Year 2025 a testament to mpact among peers and clients alike

Through Lending with Nelly and his devoted service in the LBA, Nelson Lopez remains a pillar of trust, advocacy, and innovation in Miami’s professional landscape.

Lending with Nelly: A Personal Approach to Lending

nded in 2023 and based in downtown Miami, ding with Nelly has quickly grown into an vative mortgage platform renowned for its omer-centric focus and efficiency Nelson’s mpany offers a wide range of lending solutions, m traditional residential mortgages to struction, commercial, and even out-of-the-box -prime loans The firm serves both individual mebuyers and real estate investors, streamlining loan process with the latest digital tools to ure transparency and fast approvals, all while ntaining competitive rates and ethical practices principal broker, Nelson is driven by a vision to power consumers by providing holistic mortgage tions that are affordable, transparent, and sle-free,” according to company materials

Leadership and Community with the LBA

Lopez’s leadership extends beyond his company He serves as a director and Membership Chair for the Latin Builders Association (LBA), one of the most influential business organizations in South Florida’s construction and development sectors His involvement with the LBA is marked by a focus on professional growth, networking, and community engagement Lopez’s work furthers the LBA’s mission, particularly in providing mentorship, resources, and events for Miami’s vibrant and diverse construction industry

LOPEZ CONTINUES TO INSPIRE, LEAD, AND INNOVATE, SHAPING MIAMI’S FUTURE ONE LOAN AND ONE MEANINGFUL CONNECTION AT A TIME.

Community Commitment

True to his community-first values, Lopez is also known for large-scale charitable work, organizing what’s considered the largest toy drive for the Boys & Girls Clubs of Miami-Dade This annual effort brings joy to children in underserved neighborhoods and underscores his belief in giving back a theme reflected in his daily business practices and public presence

Lopez’s insights into Miami’s real estate and lending market are sought-after, as reflected in exclusive interviews and local media features, such as a recent spotlight by ChamberSouth. His philosophy, steeped in resilience and a genuine drive to see others succeed, positions Lending with Nelly not just as a business, but as a Miami institution where community impact matches business growth

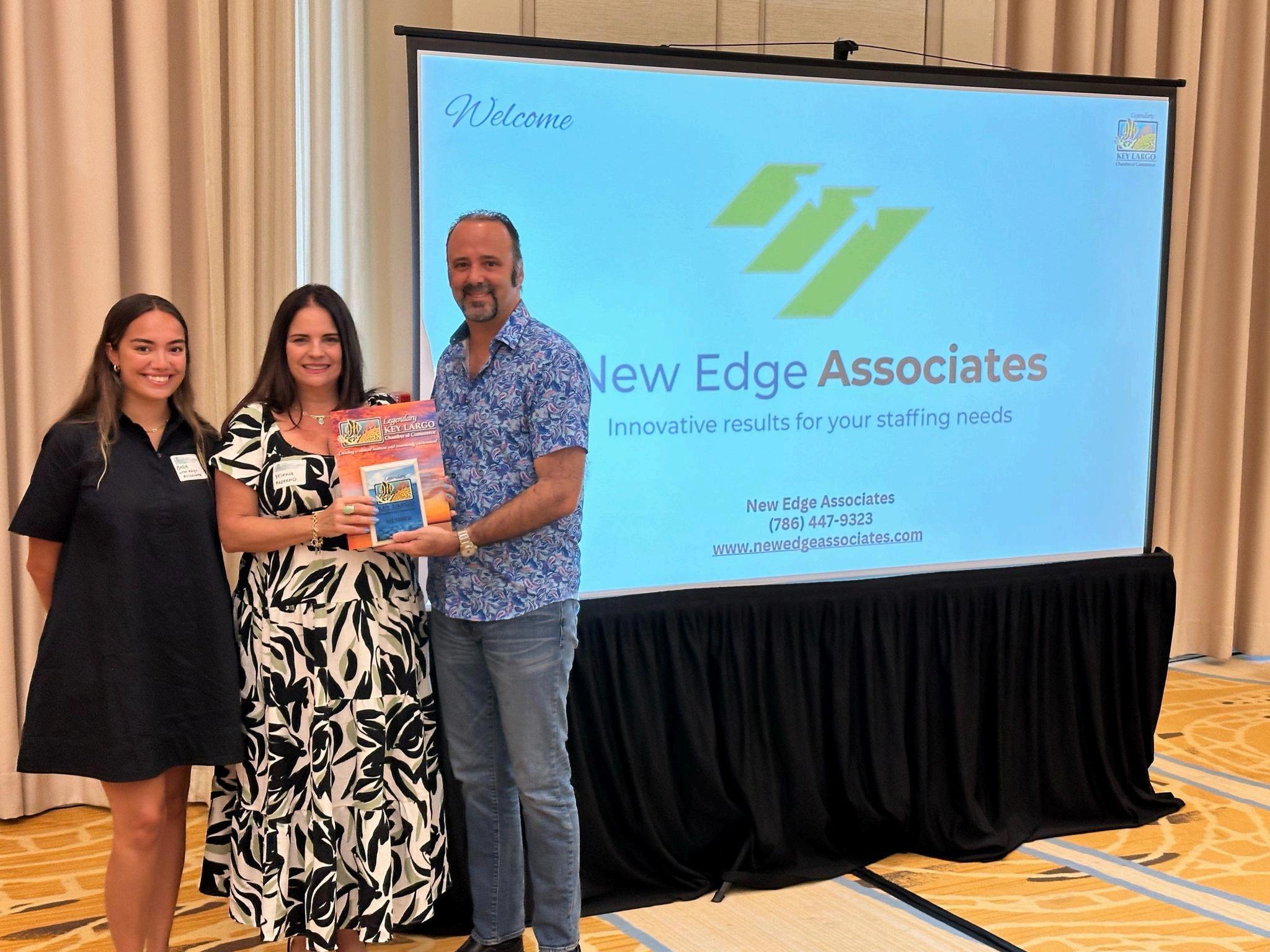

The New Edge Associates team had the honor of attending the Autism Speaks Gala at the elegant Loews Hotel in Miami, a truly inspiring evening that brought together leaders, advocates, and supporters united by compassion and purpose. From the grand ballroom ambiance to the heartfelt conversations that filled the room, the evening was a celebration of hope, inclusion, and the power of community.

This year’s chairs, Jackie and Carlos E. Fernandez, Corporate Banking Executive at City National Bank, led with grace and passion, curating an unforgettable experience that beautifully reflected the mission behind Autism Speaks. Their dedication to the cause and to every family touched by autism was evident in every thoughtful detail. One of the most touching highlights was meeting some of the children who created beautiful teddy bears, each one a symbol of creativity, love, and the joy that this organization nurtures every day.

As an organization, Autism Speaks continues to make an extraordinary impact on families and individuals across the spectrum. Founded in 2005, Autism Speaks has grown into a global movement driven by a clear vision: a world where all people with autism can reach their full potential. Through a strong foundation of advocacy, research, innovation, and community engagement, Autism Speaks is creating pathways to a more inclusive and accessible future for all.

“When community, compas together, remarkable change is the po er to mak “When community, compassion, and purpose come together, remarkable change is possible and every voice has the power to make a difference.”

Their work spans from early diagnosis and interventions to supporting adults through employment, housing, and health initiatives. The organization’s Next 10 Vision sets an ambitious path forward focused on transforming the landscape of autism care, advancing equity, and ensuring that every person with autism, regardless of background, has access to the tools and opportunities they need to thrive.

At the heart of Autism Speaks lies a profound commitment to diversity, equity, access, and inclusion (DEAI). Their mission extends beyond advocacy it’s about celebrating every individual’s unique potential and ensuring representation across all abilities, ages, and communities. By building partnerships, investing in innovation, and amplifying voices within the autism community, Autism Speaks continues to make meaningful progress toward a more compassionate and connected world.

For the New Edge Associates team, the Gala was more than an evening event. It was a reminder of the power of unity and purpose. Seeing so many people come together to uplift families and advance awareness reinforced the belief that when business, community, and compassion intersect, remarkable things can happen.

It was heartwarming to witness a community so deeply dedicated to making a difference — one that celebrates inclusion, promotes understanding, and embraces every story with empathy and hope.

At New Edge Associates, we are proud to support initiatives like this that reflect the values we hold close: leadership, connection, and community impact. Together, we stand alongside Autism Speaks and countless others working to ensure that every person with autism is empowered to reach their full potential.

If you really want to understand Florida’s economy, don’t start with a market report; stand inside a branch lobby on a Friday afternoon. That’s where the real economic data lives, between the quiet conversations and the worried glances across the counter.

Today, those conversations sound different. Customers are cautious, selective, and tired. Many are earning more but feeling poorer. Their emotional confidence has dropped, even if their balances haven’t.

That’s where you’ll meet people like Jenny, a 48-year-old small business owner from Coral Gables who’s been running her catering company for nearly a decade. She’s survived the pandemic, navigated higher food costs, and kept her five employees on payroll. On paper, Jenny’s doing fine. But when she walked into her branch last week, she wasn’t there to open an account or ask about a loan. She just needed to talk.

“Everything costs more,” she said. “I’m working harder and saving less. I’m not sure what to do next.”

And that right there, the sigh between the sentences, is the real state of the economy.

After more than two decades in retail and business banking, I’ve learned that before any economic trend makes the headlines, it shows up in how customers behave. The conversations we hear at the teller line often predict the next quarter’s data.

That’s what I call the emotional economy, the space between what people have and how they feel about it. When uncertainty lingers, logic takes a back seat to emotion. Customers start making financial choices based on reassurance, not return.

Frontline bankers see it first: clients pulling small amounts of cash just in case, depositors moving funds into short-term CDs for control, not yield, and borrowers stalling on loan decisions until things settle. These aren’t random behaviors; they’re symptoms of fatigue. People are tired of making money decisions in an uncertain world.

Jenny’s story tells one side of the coin. On the other side are Mr. and Mrs. Garcia, a retired couple who’ve been with the bank for over 30 years. They recently came in to renew a CD worth $250,000. Their home is paid off. Their retirement is stable. Their concern isn’t debt; it’s protection. They just want to know their money is safe and earning something meaningful.

Jenny, meanwhile, carries about $250,000 in business and personal debt. Her wealth is tied up in accounts receivable, equipment loans, and credit cards. She’s not sitting on liquidity; she’s fueling her own growth with leverage.

And yet, both customers are anxious. The Garcias worry about losing what they’ve built. Jenny worries about ever getting ahead.

This is what I call the inverted wealth cycle. The older generation holds cash. The working generation holds credit. And both feel uneasy. It’s a quiet reversal that’s reshaping community banking in Florida. The people who once represented the safe money now fear erosion, while those driving business activity are carrying more financial weight than ever before.

Across our branches, the same questions echo from different voices: Should I just pay everything off? Is my money safer in a CD? Should I wait before taking out another loan? They’re not technical questions; they’re emotional ones. Customers are seeking reassurance that someone understands their uncertainty.

The best bankers know how to respond: not with a sales pitch, but with clarity. A simple, confident explanation of how the bank protects deposits, manages risk, and supports the local community can calm fears far more effectively than any marketing campaign. In moments like this, clarity becomes currency.

What happens in the lobby should shape what happens in the boardroom. The institutions that thrive through economic uncertainty are the ones that treat human insight as a strategic asset.

Here’s how leaders can bridge strategy and sentiment:

1. Align messaging with mindset. Customers crave stability. Replace rate-driven marketing with claritydriven communication. Focus on words like security, partnership, and trust. When customers feel grounded, they engage more deeply.

2. Revisit lending conversations. When someone hesitates to borrow, it’s not always a no, it’s often a not yet. Equip bankers to guide clients through scenario planning. Jenny doesn’t need a product; she needs perspective.

3. Empower the frontline. The people closest to customers hold the most valuable insights. Build channels that let those insights flow upward quickly. A five-minute morning huddle can reveal more about your market than a quarterly report.

4. Humanize digital banking. Even in an online world, human connection builds trust. Follow-up calls, personal emails, or short videos from branch managers can bridge the digital gap. Technology should deliver convenience, but empathy creates loyalty.

We tend to define wealth by numbers, but the definition is changing. The Garcias may have more in savings, but Jenny’s the one driving the local economy, spending, hiring, and investing. Both play essential roles in the ecosystem of banking, yet each needs something different from us. The Garcias want protection. Jenny needs confidence.

Our job as bankers is to serve both, to help the cautious feel secure and the ambitious feel supported. That’s how we strengthen relationships, no matter where rates or markets go. Because at the end of the day, the true measure of a bank’s success isn’t how much money flows in, it’s how much trust stays there.

The lobby is more than a waiting area; it’s a reflection of the economy itself. Every conversation, hesitation, and sigh tells us something valuable.

If we want to prepare for what’s ahead, we need to start by listening again, to Jenny, to the Garcias, to the rhythm of our own branches. Because the future of Florida banking won’t be defined by who has the best rates or the largest balance sheet. It will be defined by who listens best, who understands their customers most deeply, and who leads with both data and heart.

Sometimes, the most important market research isn’t in the reports or the dashboards. It’s happening right there, in the lobby.

By: Sandy Fernandez-Fortun