AgriView

Whats new in the carbon and natural capital markets?

Technology takeover

Farmland market update

Rural update from Fisher German Spring 2023

Rural update from Fisher German Spring 2023

Whats new in the carbon and natural capital markets?

Technology takeover

Farmland market update

Rural update from Fisher German Spring 2023

Rural update from Fisher German Spring 2023

Commodity prices have come down from the highs of 2022, but there are still concerns over demand and creating an oversupplied market after a period of strong production. It is important that agricultural businesses remain adaptable and resilient as there is still a lot of uncertainty within the industry.

In this issue David Kinnersley considers the developing carbon and natural capital markets. He also discusses Fisher German’s collaboration with Trinity AgTech and how their software will assist with identifying natural capital and carbon potential for our clients.

We explore the importance of reviewing the performance of assets through land zoning mapping exercises. It is evident that there has never been more opportunity for landowners to utilise their assets to generate income outside of current agricultural activities.

The technology that we use at Fisher German is constantly evolving and supports us in giving quality advice to our clients.

We speak to key professionals in our minerals, planning and GIS service lines to establish how the technology that they use is assisting them in the advice that they are giving to our rural clients.

There has been more detailed information released on Environmental Land Management (ELM) and Biodiversity Net Gain (BNG) and how they will impact landowners. Our experts explain the standards and processes that will give landowners the information they need to make key decisions for their business.

Richard Gadd updates us on the farmland market where the competition for land remains strong. He gives examples of recently

sold properties and an overview of current land requirements in England.

We hope that you find this issue of AgriView of interest. If you would like to learn more about any of the matters featured, please do not hesitate to get in touch. We would be very pleased to help.

David Merton Rural Property Management01530 410806

The agricultural sector continues to be challenged by the weather, volatile input and commodity prices as well as adjusting to new trade deals and a different trading arrangement with Europe. The impact of the UK agricultural reforms with falling BPS payments in England under the “Agricultural Transition” plan, is undoubtedly making us all focus even harder on the performance of the farming businesses that we manage for clients and advise on to ensure a profitable future.

Good and efficient farming practice will always be central to farm profitability and the challenge is to ensure that the focus on this isn’t lost, while looking at the other opportunities that are emerging from both government and private markets. Both these markets have the potential to generate further income while helping businesses become more sustainable and resilient, financially and environmentally.

As far as government environmental schemes are concerned the further detail on “ELMS” is emerging with the Landscape Recovery Round 1 complete, the introduction of “CS and CS Plus” to replace the Mid Tier Scheme and, at the simplest and most flexible level, the Sustainable Farming Incentive (SFI), which will have new elements being introduced later in the year.

But government are also keen to open up opportunities for farmers and landowners to access private funding alongside their schemes, as set out in the recently published “Nature Markets Framework” and the “Green Finance Strategy”.

The voluntary carbon markets are taking longer to evolve with continuing debate over standards and verification of carbon sequestration and the tools to measure the carbon impact of business operations. The woodland carbon code standards and protocols are now well established, but a soil carbon code is taking longer to develop. Defra have also announced that they want a consistent approach to measuring emissions from farms and are looking at ways to support that.

Meanwhile, pioneering clients, the Blaston Estate, are forging ahead with completing the sale of Verified Emission Reduction units (VERs) based on measured CO2e sequestered across their arable cropping area during harvest 2022. A measurement methodology developed by Ecometrics with intensive soil analysis and multispectral satellite imagery measured the stock change in Soil Organic Carbon (SOC) in 12 months across the farmed area. This has generated income, which is more than the corresponding BPS income for the year.

However, understanding farm emissions and carbon stocks isn’t just about generating new income sources. It is a useful way to look at the efficiency of farm

Trinity AgTech is a member of the Trinity Natural Capital Group and offers a cutting-edge new generation digital platform providing full sustainability decision support to farmers. Supported by a 41-strong Scientific Board, the company has developed an ecosystem of products, which in combination aim to improve the measurement of agricultural economics and sustainability.

Sandy enables farmers and landowners to measure, manage and optimise all aspects of their natural capital assets. Sandy includes industry-leading modules for carbon, biodiversity and water protection, as well as many other functions, and includes a full suite of non-prescriptive optimisation and scenario planning modules.

From a rural perspective, we want to help our farmers and landowners identify business efficiencies and new income opportunities, especially with the reduction in government subsidies. Sandy will help these clients to identify the potential to improve their sustainability and unlock capital within their land, without the need to diversify outside of agriculture.

production and underlying profitability as well as increasingly being requested by supply chains. There is a wide range of software tools to assess farm emissions which are suitable for a range of situations.

At Fisher German we are pleased to announce that we are working with Trinity AgTech to use their end-to-end navigator software ‘Sandy’ to support our clients, both rural and commercial. This will assist with gaining a credible view of the natural capital and carbon potential and develop ways of improving them while maintaining the core focus of business resilience and profitability.

David Kinnersley Agribusiness

01905 459427

david.kinnersley@fishergerman.co.uk

When it comes to reviewing the performance of assets, it can be very difficult to take a step back from the day-to-day management and look at the bigger picture. Rural landowners have faced, and will continue to face, regulative, legislative and political change that has a direct impact on their enterprises and therefore income. With so much uncertainty, reviewing current assets should be seen as an opportunity to establish if the current land uses are providing optimum output.

A simple and straightforward way of approaching this is Land Zoning. This is a mapping exercise where a landowner’s portfolio is split into different land use classifications and then reviewed as to whether the current land use is the most suitable. At Fisher German we have found this process vital in identifying new opportunities for development (both residential and commercial), mineral extraction, sustainable energy and biodiversity net gain (BNG). This process is very straightforward and can reveal optimal alternative land use options, which is highly important when considering longer-term strategy.

Having the ability to visualise the segmented land zoning layers on a plan of the owned portfolio provides simple clarity. In addition to this, land zoning highlights areas that could be reconfigured in order

to unlock new opportunities. Individual assessment of land use, and whether the current location is the most suitable, is important when looking to release areas of land for more advantageous operations.

It is essential, when reviewing potential alternative land uses, to consider the impact on current rural business activities both logistically and financially. In addition to this, any change in enterprise will need to consider environmental social governance impact (ESG). Businesses must be mindful of how any adaptation or change in their current activities will impact their ESG credentials, for example carbon footprint and contribution to Net Zero. Therefore, thought needs to be given to environmental impacts, adding value to the community, and adhering to any relevant legislation.

Other considerations that will require expert advice prior to any change in land use would include planning permissions and tax implications. The respective experts should be consulted early in the process.

At Fisher German we provide an asset review service to highlight areas of opportunity in order to support estate or farm business strategy and ensure future resilience.

Ellie Savage Rural Property Management

01905 459473

ellie.savage@fishergerman.co.uk

Technology has an ever-increasing presence in our everyday lives, no matter the industry or profession. At Fisher German, using specific technology has allowed us to evaluate and review our clients’ assets in a lot more depth, allowing the exploration of different opportunities.

The Fisher German Minerals Department now utilise specialist 3D volumetric software, which can determine the smallest of changes in land surfaces. The digital terrain modelling software ‘LSS’ is a complete land survey, terrain modelling, volume, design and visualisation package, which provides landowners with a variety of landscape and visual solutions.

The software transforms topographic data obtained from traditional GPS land surveys (or, increasingly, point cloud data obtained from survey drones) to create digital terrain models of the landholdings. The software can measure and quantify every aspect of the terrain including heights and areas, but specifically volumes.

The capabilities are applicable to a wide variety of our clients. The minerals team traditionally use the software to create quarry designs and detect volumetric

differences within the construction aggregates sector; however, the software is also utilised in agricultural, commercial, residential and infrastructure projects. The application of 3D models can be applied to:

• Volume analysis

• Flood plain analysis

• Flooding extents

• Restoration and earthworks designs

• Pipeline sterilisation claims

• Landscape and visual assessments

• Viewpoint analysis

Typical outputs for landowners can be anything from simple figures and PDF plans to fully rendered 3D landscape and visual flythroughs of projects and designs.

This specialist software and further applications gives landowners reassurance that their assets are protected, and value is maximised.

Fisher German has developed a solution for monitoring planning applications around specific landholdings. The ‘Map and Track’ product automatically picks up all new planning applications in a defined area and alerts the Fisher German team who can advise clients accordingly.

Map and Track aims to alert owners, in advance, to applications that might pose a material impact on the land value, for example new housing or commercial developments on the borders of ownership or overlying mineral title. This solution works for both surface owners and mineral owners alike.

This automated alert and reporting process means we can move quickly and proactively to inform surface and mineral owners and developers alike about potential impact to clients’ property.

• Automated Map and Track solution removes the manual interaction to monitor surface and mineral title, allowing clients to both protect and maximise the value.

• Fisher German can alert developers to our client’s ownership, informing them of the potential for mineral sterilisation/trespass or material impact on adjoining land allowing owners to raise objection.

• Helps our clients to keep track of third-party developments which may affect their property.

• Negotiate on our client’s behalf to ensure they receive fair financial compensation for the mineral title before development work begins.

Geographic Information System (GIS) mapping is an essential tool for land zoning, layering data, and providing demographic information. GIS is a computer-based system used to capture, store, manipulate, analyse and present geographic data. GIS mapping has become increasingly popular in recent years, primarily because of its potential to help land and property owners in making informed decisions. There is an abundance of data available to a GIS analyst on land use and population for the UK, which can be leveraged to give insight into the characteristics of an area.

GIS mapping makes it possible to layer multiple data sets, providing planners with a more comprehensive understanding of the area they are analysing. For instance, a map of land use can be overlaid with a map of transportation infrastructure or ‘travel time’ to determine the accessibility of different zones. With any constraints such as green belt or environmentally sensitive areas, the system

identifies which parts of these zones are not suitable for alternative opportunity.

Demographic information can also be interrogated in this way. This involves analysing data on the population, such as age, income, education and ethnicity. This data is given a geometry by joining it to an existing area such as a county or postcode district. GIS mapping can be used to create maps of this data. These maps, tables and infographics can help clients understand the opportunities for a type of facility within a region or a suitable location to site such a facility.

Fisher German acted on behalf of a client who was undertaking an essential infrastructure project involving a network of pipelines. This project crossed a permitted sand and gravel quarry where the pipeline would sterilise a significant tonnage of sand and gravel.

Under the ‘Mining Code’ the quarry operator lodged a claim against our client, in excess of £1.2 million, for restricting access to the permitted minerals. As a result of this, the technology used to quantify and value the minerals in the river valley was critical in being able to act as an intermediary between our client and the quarry owner to work out an effective solution that reduced the compensation claim.

In this case, Fisher German’s internal bespoke department of specialised minerals experts were called upon to build the case with industry knowledge as well as the technological findings.

Fisher German’s first step was to review the implications to effectively decide whether the best option was to leave the pipeline in place or to relocate

it. An informed decision was taken to remove the pipeline from its current alignment and seek a new easement to reroute the pipework.

Equipped with years of industry experience and knowledge, Fisher German challenged the design assumptions of the quarry operator’s geotechnical engineer and worked together to reduce the overall sterilised mineral volume.

Fisher German introduced a 3D extraction design for the operator and provided alternative extraction techniques to remove the previously sterilised minerals from past working phases.

The outcome of using both specialist industry experts and 3D terrain modelling software reduced the claim by approximately £1 million.

Fisher German identified that a developer had received planning permission to build new homes on a site where the mineral rights were still owned by the client.

While the developers owned rights to the surface of the land, the mineral rights beneath were separately owned and belonged to the client. As a result of this, the developers were in danger of trespassing or sterilising access to the minerals once the homes were built.

The GIS mapping capabilities within Fisher German, combined with the team’s minerals expertise, meant that a value of the minerals beneath the ground could be established.

After consulting with the developers, Fisher German negotiated a settlement, meaning the mineral owner was compensated fairly for the minerals.

This proactive approach to identifying threats on mineral ownership has resulted in the development of automated tracking software. By mapping mineral ownership and then setting up an alert system based upon these areas, any approved planning permission on these titles will create an automatic notification to Fisher German.

This automated alert process means we can move quickly and proactively to inform mineral owners and surface developers alike about potential minerals trespass or sterilisation. The Fisher German Minerals Team can negotiate a fair price for our clients before any work is started on the site.

Last summer saw the initial rollout of the Sustainable Farming Incentive (SFI), the first component of Environmental Land Management (ELM), with the introduction of the Soils and Moorland Standards. In January 2023, DEFRA published much-anticipated details on the continuing rollout of ELM.

Six additional SFI standards with 19 new actions are to be made available for applications in the summer. The new standards include hedgerows, integrated pest management, nutrient management, arable/ horticultural land and grassland (improved and low input grassland).

As we saw with the introductory level of the soil health standard, the payments are intended to encourage sustainable food production rather than large-scale removal of productive land, and are payments for practices farmers are often already undertaking. We discussed some of the wider benefits of the arable soil health SFI in the last AgriView (www.fishergerman.co.uk/ publications/2133-agriview-winter-2022).

Those already participating in SFI can add the new standards and additional land on anniversaries within their existing scheme.

As SFI expands each year, DEFRA will be introducing more standards and actions incrementally, with the full set planned to be in place by the start of 2025.

To further encourage farmer uptake, an SFI Management Payment is now also available for all new and existing SFI agreements. This is £20 per hectare per annum, payable on the first

50 hectares and up to £1,000 per scheme. Further detail of the practical management of the proposed standards is still awaited, but the initial detail indicates that a number of options are similar to those available under Countryside Stewardship with equivalent payment rates. The advantages of SFI are the shorter agreement of the term (three years instead of five), more frequent payments and flexibility to add land and options annually.

Whilst the payment rates, if considered in isolation, may not seem initially attractive, the opportunity for ‘stacking’ SFI options on the same area of land could contribute towards offsetting reductions in Basic Payment Scheme with little change required, and we are urging farmers to consider whether SFI might work for their business.

An enhanced version of Countryside Stewardship will form the second tier of ELM, replacing the previously planned Local Nature Recovery (but delivering the same environmental ambition).

An additional 30 actions will be available by the end of 2024 in addition to the 250-plus already in place. The aim is to improve the existing actions where possible as the scheme evolves, by making them more ‘outcome focused’, less prescriptive and more flexible about how to achieve the intended outcomes. Further details and payment rates are expected to be published later this year.

Countryside Stewardship Plus will further reward land managers for working with their neighbours to support ‘climate and nature aims’ on a larger scale.

As SFI and CS evolve over the next two years, DEFRA aims to offer them in a single ‘integrated service’. At this stage it seems difficult to see how DEFRA will achieve the aim of simplifying the application process, but there is no doubt that the increased scope of the scheme is a step in the right direction for rewarding farmers for producing food and enhancing the environment.

SFI applications are open year-round. The mid-tier Countryside Stewardship application window opened on 21 March 2023 and closes on 18 August 2023 for agreements starting 1 January 2024.

Charlotte Gore Agribusiness01858 411218

charlotte.gore@fishergerman.co.uk

01234 827113

matthew.ayres@fishergerman.co.uk

Having identified areas on a farm or estate with lower agricultural productive capacity, and a desire to establish a ‘natural capital’ income source, the different opportunities available can seem overwhelming – Environmental Land Management (ELM), woodland creation, carbon trading, nutrient offsetting, biodiversity offsetting…

Natural capital is still a relatively new concept with limited transactional evidence, and the finer policy details are awaited. The temptation may be to wait until full details are scoped and the markets mature, but proactive landowners are advised to discuss options with an expert to ensure they are best positioned to take advantage of the new opportunities.

Public funding in the form of Countryside Stewardship (or SFI) will provide a basic income with regular payments for managing less productive land sustainably, but emerging

private funding such as Biodiversity Net Gain may present a more lucrative income to farms in the right area. The landowner would need to be willing to take a higher risk and pay a higher initial outgoing. It is also important to note that biodiversity offsetting is a minimum 30-year legal commitment and is binding on successors in the title.

Biodiversity Net Gain (BNG) is an approach to development that leaves biodiversity in a measurably better state than before the development took place. Losses can

be mitigated within a development site or delivered offsite through the creation or enhancement of habitats to replace those lost during development. Providing a 10% BNG is a legal requirement for most new developments from November 2023 (with some exceptions including small sites).

Land located near to areas of development is likely to be in higher demand, due to the spatial risk multiplier, which increases the value of habitat delivered close to the development.

The basic process for an interested landowner is:

1. Identify the land suitable for habitat creation or enhancement. Ideally this should be mindful of any Local Nature Recovery Strategy (local environmental priorities) which will improve the habitat rating.

2. A competent person (likely to be an ecologist) will assess the baseline habitat value of the area of land, and then the resultant potential habitat rating of the enhanced or created habitat.

3. Draw up a management plan to create or enhance the required habitat and maintain over the 30-year BNG period.

4. Identify a developer with a demand for biodiversity offsetting.

5. Enter into a Conservation Covenant or s106 agreement with the developer and the local authority or a ‘responsible body’.

6. Record the site on the BNG Site Register (DEFRA to release further details on this).

7. Undertake the habitat creation or enhancement.

8. Provide monitoring reports as required (likely to be at years 1, 2, 5, 10, 20 and 30).

Under the rules of additionality, a landowner cannot sell a biodiversity enhancement that has been delivered by an Agri-environment scheme. It is therefore advisable to weigh up opportunities for biodiversity offsetting on a farm, before entering into any stewardship scheme involving habitat creation. It is possible to ‘stack’ nutrient credits and biodiversity units created from the same piece of land. However, land used to create and sell carbon units can only be used to sell biodiversity units if the habitat is enhanced further.

Tom Beeley Agribusiness

Demand for farms and land remains strong across the country from a varied pool of buyers, with continuing demand from non-agricultural investors.

Taxation-led ‘rollover’ buyers continue to represent the majority of agricultural buyers, especially for commercial-sized land holdings. Developers and strategic land buyers continue to drive demand for medium- and long-term freehold strategic opportunities. We expect to see this demand continue with strong capital values being achieved nationally.

Charities, institutions and private buyers will continue to drive demand for bare land, often

2022 proved a strong year for agricultural land as an asset class, with values outperforming most other property asset classes for capital appreciation.

Location is often the most important factor in determining land values; however, scale and land quality are also significant. We expect average values to strengthen for all land types albeit at varying rates depending on the above factors.

The supply of arable land has been suppressed leading to pent-up demand across the country; we therefore expect a moderate increase in values nationally.

With growing demand from corporate

We expect to see a modest increase in supply in 2023 compared with 2022 across all land types. Subsidy payments will reduce further in 2023 and it is forecast that input and energy prices will remain well above average. These increasing pressures will likely lead to an increase in both smaller and larger holdings to the market.

poorer quality pastureland for tree planting, carbon sequestration and carbon offsetting requirements.

Continuing the trend of the last few years, lifestyle and amenity buyers make up a large proportion of the buying market for farmsteads and smaller holdings, as the postpandemic shift to flexible and home working continues.

and institutional buyers due to increasing carbon offsetting pressures, we foresee the strongest growth will come from lower-quality pasture and upland farmland with offsetting and carbon-led buyers often prepared to pay in excess of agricultural value.

Early transactional evidence would suggest that residential farms and amenity land parcels will maintain strong values across 2023 as demand continues for space and a tangible investment.

Prime pastureland values increased by about 10% in 2022. We expect to see slightly less aggressive growth in values through 2023.

Fisher German continue to act for a small number of retained purchasers across the country to acquire farms and estates. A small selection of these requirements are shown below. Please do not hesitate to contact us if you are considering a sale in 2023; all enquiries will be treated in the strictest confidence.

A strategically located and accessible arable farm with principal Georgian farmhouse and secondary accommodation. In all about 189 acres.

A 246-acre farm with a period farmhouse and large range of traditional and modern farm buildings, within a ring fence.

SOLD SOLD

A rarely available country estate with Grade II* listed manor house, extensive range of traditional & modern buildings, six dwellings, pasture, arable & woodland. In all about 523 acres.

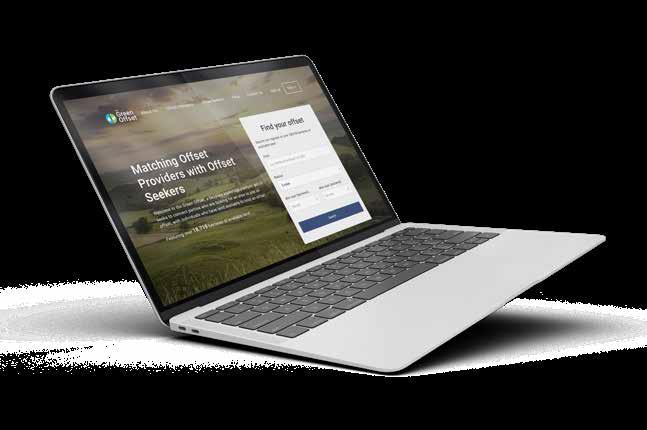

Richard Gadd Farm AgencyDeveloped by Fisher German, The Green Offset is a bespoke brokerage platform which seeks to connect parties who are looking for an area to site an offset, with individuals who have suitable land for siting natural capital schemes.

For Offset Providers we offer a simple way to market land for the potential provision of offset sites and other opportunities

For Offset Seekers we offer an easy and low-cost way to search for offset sites and other land requirements

Registering your land on The Green Offset platform is completely free with no commitment required.

For more information, or to register as an Offset Provider or Seeker, please visit our website or call us on: 0845 437 7359

www.thegreenoffset.co.uk