I M PA CT REPOR T 2024

On behalf of FirstLight and our volunteer Board of Directors, we are proud to share the 2024 Annual Impact Report. This year has marked a period of exceptional growth, meaningful community impact, and unwavering dedication to our mission: “Improve Lives. Achieve Dreams.” As we look back on our progress, we are deeply grateful for the trust and support you continue to give us. You inspire us to innovate boldly while remaining grounded in our role as a community-focused financial partner. In 2024, we made significant strides to enhance your banking experience and deepen our engagement with the communities we proudly serve.

We proudly remodeled our Kenworthy and Lee Trevino Engagement Centers, introducing community rooms open to the public— free of charge. These spaces are designed to warmly welcome our community members, providing a place to gather, collaborate, and pursue their dreams. Whether it’s hosting local organizations or supporting personal milestones, these community rooms reflect our belief that when we invest in people, we all succeed.

We also opened our brand new Darrington and Mills locations— offering a modern banking experience that blends innovative self-service technology with the personalized, friendly support you’ve come to expect from FirstLight. Our new and remodeled centers provide greater flexibility and accessibility, allowing you to engage with us in ways that fit your life while continuing to deliver the caring, community-first service you deserve.

We take pride in supporting the next generation, and this year we awarded $50,000 in scholarships to local students. Through these scholarships, we are helping to empower bright minds and future leaders, reinforcing our commitment to improving lives beyond banking.

At FirstLight, our vision extends far beyond financial transactions—we aim to be a catalyst for positive impact. As a member-owned institution, every decision we make is rooted in your best interests and the well-being of the communities we proudly serve across El Paso, Fort Bliss, Doña Ana County, and Horizon City.

We invite you to explore this report and celebrate the milestones we’ve achieved together. Your feedback and engagement inspire us to keep innovating, supporting, and delivering on our promise to improve lives and achieve dreams—today and for generations to come. Thank you for being part of the FirstLight family—we are honored to serve you!

Juan Gonzalez, Chief Information Officer

Jim Huff, Chief Retail Officer

John Caladim, Chief Financial Officer

Margie Salazar, President & CEO

Judy DeHaro, Chief Lending Officer

It is our pleasure to present the 2024 Annual Report and Member Impact Statement. Our mission, “Improve Lives. Achieve Dreams,” guides us in everything we do, and we are honored to serve you.

We take extraordinary pride in announcing that Forbes recognized FirstLight as one of America’s Best-In-State Credit Unions in 2024 for fulfilling the unique needs and expectations of our serving communities. Accolades like this are tremendous motivators as we look to be more than a financial institution, ensuring our services and actions can have a positive impact and influence in Doña Ana and El Paso counties, and Fort Bliss.

Leveling the playing field through financial education and awareness continues to be a key focus for FirstLight, empowering our community with the knowledge and skills to make informed decisions. From our certified credit union financial counselors to our Community Foundation, we are committed to elevating individual and community financial wellness. And as a Community Development Financial Institution (CDFI), Minority Deposit Institution (MDI), and low-income designated financial cooperative with the Juntos Avanzamos designation, we strive to inspire socio-economic change by deploying non-traditional products and services to assist our underserved communities.

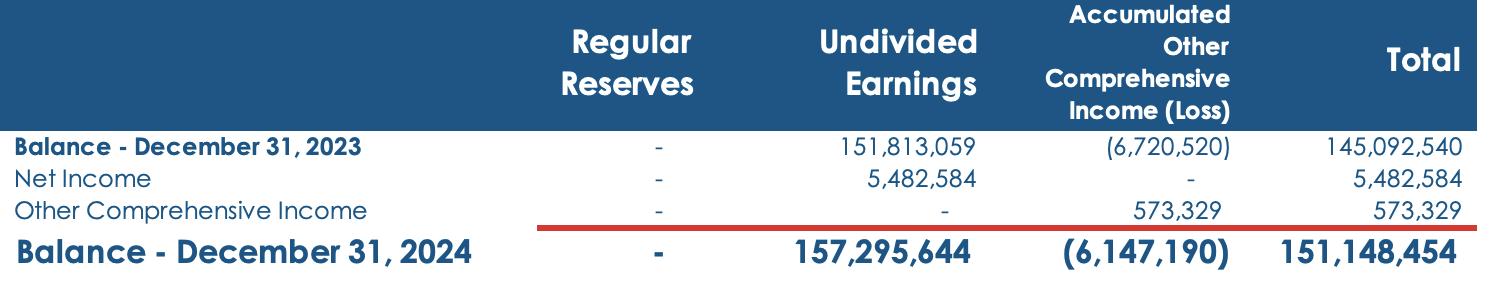

Through diligent and prudent decision making over the years, FirstLight maintains the financial strength and strong capital position that far exceeds the “well-capitalized” distinction of our regulators, the NCUA. We will be here when you need us today and in the future, continuing to deliver innovative solutions to meet your evolving needs.

Lifestyle Community Banking

Accessibility and convenience are at the forefront of our efforts. We reimagined our banking model, creating dynamic engagement centers leveraging the latest technology for our on-the-go members while maintaining our commitment for personalized service through universal agents. It was purposeful to include community engagement rooms for members and non-members alike to use for meetings and special gatherings. We were honored to host groups like the El Paso Veterans and Riders Association (EPVRA), Sun City Welding Academy, Young Women Leadership Academy, Mija, Yes You Can, El Paso Hispanic Chamber of Commerce, and In Her Element Foundation to name a few. Looking ahead, we will remain committed to adapting our banking solutions to align seamlessly with the changing lifestyles of our membership.

FirstLight fostered impactful relationships with Western Technical College, Southwest University, Texas Tech Health Science Center—EP, Sun City Welding Academy, EP Fighting Hunger Food Bank, Casa de Peregrinos, and YMCA. Through these community collaborations, we are able to have an impact on financial wellness offerings, scholarships, and food insecurity. Cultivating new relationships remains a cornerstone of our mission, ensuring that financial empowerment knows no bounds.

Our team facilitated sixty financial wellness offerings reaching over 10,150 community members, as well as two hundred community engagement and business development activities reaching 28,134 El Pasoans and Las Crucians. A few ways our impact was felt include:

We assisted local food banks through our FirstLight Giving Program. To mitigate food insecurity, the FirstLight Giving Program donates $1.00 from every funded loan to local food banks. Since January 2021, FirstLight has granted 58,613 loans equating to 586,130 meals to our serving communities.

Through our Annual FirstLight Community Foundation Golf Classic, we have raised $450,000 in the past four years to support student scholarships awarding over $150,000 to local high school students. Looking ahead, we will be introducing programs aimed at improving home accessibility.

Anticipating What is to Come

In 2025, FirstLight opened two new locations in the far east El Paso (Darrington) and in Las Cruces (Idaho) to serve our growing communities. Looking to the future, we are working on strengthening our security systems, investing in platforms to protect your information. And we will be rolling out new membership and onboarding platforms to improve your member experience, as well as a new website to launch in 2026.

Joshua Orozco Chairperson

On behalf of our volunteer Board of Directors, management, and staff, we thank you for your membership. We are committed to serve you as a trusted financial partner who is invested in helping you achieve your dreams.

Margie Salazar President & CEO

The Supervisory Committee oversees the protection of members’ funds and ensures policies and procedures safeguard member assets, including the accuracy of financial records in accordance with laws and regulations. The committee consists of member representatives who focus on the integrity of FirstLight Federal Credit Union’s financial reporting, compliance with federal regulations, and protection of members’ assets. The appointed committee accomplishes these objectives by collaborating with FirstLight’s Internal Audit Team to ensure policies are followed to monitor and mitigate operational risk and enhance the financial integrity of the credit union and assets of its valued members.

The Supervisory Committee is comprised of five volunteer members appointed by the Board of Directors who carry out their work in accordance with the credit union’s bylaws and the internal audit charter. Working in an independent manner, the committee follows an audit plan that emphasizes testing of internal controls and assuring compliance with applicable laws, rules, and accounting practices. And as a member-owned cooperative, the Supervisory Committee oversees member inquiries or concerns raised by members and prepares reports, as appropriate.

All audits, reviews, and examinations conducted during the period conclude that your credit union remains financially sound, is well-managed, and operating in compliance with federal laws, regulations, and policies. It is the opinion of your Supervisory Committee that the credit union’s policies and procedures, as well as management’s practices, are sound. Such opinion is based upon the Supervisory Committee internal audits, independent external audit, and the NCUA examination report.

The Supervisory Committee members are all volunteers and serve without compensation. Committee members include:

Sylvia Duarte – Chairperson

Marcia Heller – Vice Chairperson

Gilbert Andujo – Member

Gary Bruner – Member

Michael Gomez – Member

I would like to express my appreciation to the committee members who volunteer their time, as well as their broad skills and knowledge to support the credit union. Moreover, my gratitude to the internal audit department, board of directors, management, and staff, for their continued cooperation and assistance.

Sylvia Duarte

Chairperson/Secretary

Raised for golf tournament

50+ Registered golfers 164 Sponsors 42

Volunteers in golf tournament

We extend our heartfelt thanks to our incredible sponsors, dedicated volunteers, and enthusiastic participants for making the 4th Annual FirstLight Community Foundation Golf Classic a success! Your support helps us continue our mission to uplift our community through home accessibility, financial education and scholarships.

To learn more about FirstLight Community Foundation, visit www.firstlightcommunityfoundation.org

DATE:

Saturday, May 18, 2024 TIME: 10 am

Mr. Barceleau welcomed members of FirstLight Federal Credit Union and noted that the meeting was being broadcasted at all four community engagement centers and introduced a short video of 2023 achievements. He thanked members for their support following the video and encouraged them to follow FirstLight Federal Credit Union on social media platforms.

Mr. Barceleau reviewed some housekeeping items like referencing the annual report, and shared that there would be a Q&A session towards the end of the meeting.

Ms. Judy Deharo, Chief of Lending, presented the invocation and the Pledge of Allegiance.

The meeting was called to order by Mr. Jaime Barceleau, Chairman of the Board of Directors at 10:16 a.m.

The meeting was conducted in adherence with Robert’s Rules of Order. Ms. Adriana Muñiz was appointed as recording secretary.

Mr. Barceleau introduced the current members of the Board of Directors, Supervisory Committee and Advisory Board and thanked the volunteers for their service to FirstLight Federal Credit Union. He introduced the new FirstLight Federal Credit Union President/CEO, Margie Salazar.

Mr. Barceleau stated on behalf of Mr. Joshua Orozco, Treasurer of the Board of Directors, that a quorum was present. He shared that 18 members were present at the North Desert Branch. He asked that any motions be made by the North Desert branch as it has been designated the official meeting site.

The minutes of the 68th Annual Meeting were presented.

A motion to approve and accept the minutes of May 13, 2023, as written, was made by Arturo Pastrana and seconded by Jesus Saavedra. Motion carried. None opposed.

Mr. Barceleau noted the official reports presented in the 2023 annual report, including the chairman and president’s report, the supervisory committee’s report, and the financial statements.

A motion was made by Maria Elva Delgado and seconded by Arturo Pastrana to accept all reports as written. Motion carried. None opposed.

Mr. Barceleau then introduced Ms. Salazar, CEO/President of FirstLight Federal Credit Union to provide an update of Credit Union operations to the members.

Ms. Salazar thanked the Board and Supervisory Committee and Advisory Board volunteers for their service to the Credit Union and introduced the Executive Officers and Senior Management Team of the Credit Union.

Ms. Salazar went on to share some highlights from 2023 like the various engagement activities FirstLight participated in and how they reached over 50k community members. She also shared that $35k was awarded in student scholarships along with funding over 178k meals to local food banks by funding 17,180 loans through the FirstLight Giving Program.

Ms. Salazar addressed the transition of the branches into engagement centers. She explained the “why” behind the change was to create a better member experience.

FirstLight wanted to balance the diverse membership and service the on-the go member with simple transactions

through technology but also have the universal experience representatives to assist members personally with more complex transactions.

Ms. Salazar also announced the recent expansion of FirstLight Federal Credit Union at the Cortez building downtown and also the new branch that will be opening in Horizon City later this year.

Ms. Salazar ended by saying that FirstLight Federal Credit Union wants to continue to be a trusted financial partner that helps members improve their lives and achieve their dreams and thanked members for being part of the FirstLight Family.

Mr. Barceleau recognized the two employees of the year. The Internal Employee of the Year, Jennifer Calderon, Help Desk Technician II in our Information Technology Department and External Employee of the Year, Leann Kishton, a Member Experience Manager with the Virtual Delivery Department. He congratulated both employees for demonstrating our core values and commitment to membership. Mr. Huff then highlighted Mr. Barceleau for his service to FirstLight Federal Credit Union. He recognized Mr. Barceleau as Chairman of the Board of Directors for 5 years and as a volunteer for 18 years.

Mr. Joshua Orozco, Treasurer of the Board, then said a few words on behalf of the board. He thanked Mr. Barceleau not only for his years of service but also for the leadership and mentorship he has provided to the board members.

Ms. Salazar thanked the membership for submitting questions and turned it over to the executive team to answer questions. Mr. Huff, Chief Retail Officer, answered several questions, the first regarding the difficulty with banking and low amounts of ATMs in Las Cruces. He shared that as they continue expansion, FirstLight continues to look for opportunities in expanding the ATM network and noted that Las Cruces has 16 free ATMs through the Coop network that members can use. He shared that there were several questions regarding the new engagement centers and the new environment with the ITMs. He reiterated Margie’s stance on elevating the member experience by creating convenience and access for members. He also spoke on rates and explained that as a not-for-profit financial institution, our earnings go back into operations and FirstLight has been able to stay fairly competitive with national and local banks.

Mr. Gonzalez, Chief Information Officer, answered the next few questions. A member was concerned if the credit union had a plan if there was an earthquake. He shared that we do have two internet dependent circuits that back each other up in an emergency. He added that we also back up all our servers in case headquarters go down we can go back up on a secondary site. Another member asked why members cannot use their debit cards in casinos. Mr. Gonzalez explained that our primary responsibility is to protect the information and funds of our members, so there are certain guidelines we have in place for this. However, ATMs are available where members can use cash as an option at a casino. There was another member that asked if FirstLight would open a branch in South Central El Paso. Mr. Gonzalez explained that we are looking for sites in that area and reminded members of our newest location on East Mills, in downtown El Paso. Mr. Gonzalez also addressed a question about banking notifications taking over 24 hrs. to receive. He answered that the notification should not take that long but he will look into the issue and work on it.

Mr. Tim Vilter, Chief Financial Officer, answered a few questions. The first question asked where interest rates are going. He stated that the market has indicated that rates should be coming down but that point in time has shifted further out to fourth quarter 2024 or early 2025. He also addressed a question regarding the annual report and the net interest expense, he noted that the rounding of the numbers make it look like a miscalculation. Mr. Vilter turned it back over to Mr. Huff for some additional questions.

Mr. Huff answered a question regarding the coin machines in the entrances of the engagement centers and noted the amount of noise the machines made in the lobbies of the previous lobby layout. This was a concern because the newer lobbies would be smaller so they would create even more noise. Mr. Huff also answered why there are only two teller machines at the North Desert branch. He explained that transaction studies were completed to figure out how many machines were needed at each location.

The last question he answered was why shared branching was discontinued. He explained to the membership that studies were also done to determine this decision. He stated that only a small percentage of members were using this service and in comparison, to the cost of the service it was more efficient to discontinue the service.

Ms. Salazar thanked the membership for their questions and highlighted how important member feedback is to FirstLight.

Mr. Jaime Medina, chair of the Nominating Committee, announced that three candidates were nominated to the three open board positions. As a result, no election was held, and the candidates were appointed to the board of directors by acclamation. He welcomed Ms. Renee Jimenez, Ms. Barbara Walker and Mr. Rick Bernal to the Board of Directors for 2024.

Mr. Barceleau announced the conclusion of the 69th Annual Meeting of the FirstLight Federal Credit Union. A motion to accept adjournment of the meeting was made by Arturo Pastrana and seconded by Gerald Seigels. Motion carried. None opposed.

There being no further business, the meeting adjourned at 10:53 a.m.

Darrington 15002 Darrington St. Horizon, TX 79928

East Fort Bliss

20727 Constitution Ave. El Paso, TX 79918

Kenworthy 9993 Kenworthy St. El Paso, TX 79924

Lee Trevino

1555 N. Lee Trevino Dr. El Paso, TX 79936

Mills

207 E. Mills Ave. El Paso, TX 79901

North Desert

5050 N. Desert Blvd. El Paso, TX 79912

Pike

1635 Pike Rd. El Paso, TX 79906

Zaragoza

2200 N Zaragoza Road El Paso, TX 79938

Del Rey 3105 Del Rey Blvd. Las Cruces, NM 88012

Idaho

522 East Idaho Las Cruces, NM 88001

Lohman 3791 E. Lohman Ave. Las Cruces, NM 88011

Speak to a friendly live video representative today!

Monday - Friday: 8:00 am - 8:00 pm (MST) Saturday: 9:00 am - 3:00 pm (MST)