Valerijus

Valerijus

Over the course of 4 issues, we’ve explored the dynamic world of fintech, bringing you the latest innovations, insights, trends and the challenges, from specialists in the sector. One of the most critical elements to driving business growth is having the right people and the right team in place. At fintechview, we introduce high-caliber executives from organizations in Fintech, PayTech, Banking, Crypto, InsurTech, RegTech, Real Estate, Security and more, as they share their lived experience and views, along with key learnings and pitfalls.

Historically, the financial sector has been a male-dominated one, and FinTech is not an exception to this. Fortunately, there are strong female executives making a significant difference in the sphere of FinTech by bringing their expertise and passion into their work, motivating women to break down obstacles and reach the top management positions.

Having our 4th issue launched in March, it is the perfect opportunity to

present some powerful women who excel in their sector, on a more personal note, their views on career, motherhood and challenges they face in the professional world.

Year one is done and we promise to maintain our niche and bring you insightful content. Enjoy, an issue full of inspiration!

Drosoula Hadjisavva Editor-in-Chief

Read us online www.fintechview360.com

Follow us

Editor-in-Chief: Drosoula Hadjisavva

Graphic Designer: Demetra Ioannou

Photography: Petros Demetriou

At XValley, we’ve built a complete and mature brokerage ecosystem that empowers forex and crypto brokers to hit the ground running.

At XValley, you offer a full brokerage solution. Could you share information on the services you offer? Absolutely! At XValley, we’ve built a complete and mature brokerage ecosystem that empowers forex and crypto brokers to hit the ground running.

Our core offering includes a powerful, bespoke trading platform, a fully integrated CRM & client area, a comprehensive risk management system, and a robust liquidity bridge.

But that’s just the beginning! We also provide a host of modules that are built to seamlessly plug into the XValley ecosystem.

ncluded in our suite of modules are the Prop Trading, MAM/PAMM, Copy Trading & Social Trading, Portfolio Management, Cashier / Payment Orchestrator, and Live Chat modules. And that’s just scratching the surface! In short, we provide everything a brokerage needs to scale and succeed, all under one roof.

What’s XValley unique selling point and how do you differentiate from the competition?

What really sets XValley apart is how streamlined and mature our ecosystem is. Since launching in 2015, we’ve seen the FX & Crypto spaces evolve drastically, and we’ve grown alongside them, tailoring our ecosystem to align with all the regulatory changes.

One of the biggest differentiators?

Our ecosystem isn’t a patchwork of third-party tools duct-taped together. We built the framework first, and that solid foundation is what allows the entire XValley ecosystem to flourish. Every module we add slots

in perfectly because it’s designed to work within our own framework. Think of it like an iPhone and its App Store. The iPhone’s hardware and software are built to work seamlessly, and the apps integrate effortlessly. That’s how our framework and modules work together. There’s flawless integration without the headaches.

This approach not only streamlines the entire system but also allows us to keep costs low, making XValley an attractive and realistic proposition for both startup and established Forex & Crypto brokerages. Plus, by eliminating the need for multiple providers, we reduce the usual headaches brokers face when juggling seven or more service providers.

But it’s not just about cutting costs. Our clients love that they only need to deal with one company, us. We simplify operations and offer tailored solutions because we know that no two brokers are alike. Need a custom module? No problem. We thrive on building unique tools to meet specific needs.

At XValley, we’re not just a tech provider, we’re a partner. We walk alongside our clients, helping them grow, optimise, and scale without sacrificing performance or breaking the bank.

What are the features and challenges a broker should consider to ensure he has the right CRM solution?

If you ask any CEO, COO, or C-level exec at a brokerage, I believe the majority of them will say the same thing, “a CRM isn’t just a tool; it’s the beating heart of our brokerage.” And they’re right to say so!

The right CRM should go far beyond basic client management. It needs to offer advanced lead tracking, a dedicated sales & partners portal, seamless KYC integrations, straightforward payment processing, real-time analytical risk monitoring, and automated workflows that streamline daily operations. It should also give a full 360-degree view of client activities, making it easier for brokers to personalise their services and increase retention.

One of the biggest challenges brokers face is scalability. As their trader &partner base grows, so do operational complexities. The right CRM must not only manage the current workload but also be flexible enough to grow with the brokerage.

At XValley, we’ve designed our CRM to be fully modular, so brokers can start simple and scale as they grow. Whether it’s integrating new payment providers, adding custom reports, or expanding sales pipelines, our CRM evolves with the brokerage.

Another major challenge is maintaining compliance. There’s been a glacial shift in regulatory requirements, and they’re changing constantly. A CRM needs to not just help brokers stay ahead without slowing them down, but empower them to do so. XValley’s CRM integrates KYC and AML tools directly into the workflow, automating compliance checks and reducing manual errors.

Finally, ease of use is often overlooked. A powerful CRM is useless if teams can’t navigate it easily. That’s why we focused on a clean, intuitive interface that makes complex tasks simple, so brokers can focus on growing their business rather than wrestling with clunky software.

We see brokers following a multi-branding solution in the last years . How complicated is this from your point of view and can XValley support this?

Multi-branding can get messy fast if your systems aren’t built for it. Juggling multiple brands with different setups often leads to inefficiencies, duplicated efforts, and rising costs. But when it comes to XValley, we make multi-branding simple.

And we don’t just make multi-branding a breeze.

Our ecosystem is designed from the ground up to support multiple brands, entities, and white labels under a single umbrella. Brokers nowadays don’t just use one regulatory band such as CySEC. All of our clients use multiple regulators, ranging from CySEC, FCA, through to FSC, FSA, FSCA, and a host of others.

With the XValley ecosystem, brokers can easily manage everything from one centralised CRM, making it effortless to scale and diversify their offerings. Setting up a new brand, entity, or white label is straight-

forward and really easy, too. We’ve created it this way so that there’s no need for complicated integrations or starting from scratch.

Within the XValley CRM, you can configure multiple entities, each with its own distinct settings, trading conditions, KYC rules, and payment providers, all while maintaining shared access to the broader ecosystem.

Managing multiple brands becomes seamless with shared liquidity pools, unified risk management, and centralised reporting. You can monitor performance across all brands from one dashboard while still main-

taining granular control over each brand’s specific operations.

Plus, with our flexible white-label solution, brokers can easily onboard partners or launch region-specific brands without additional tech headaches. Everything is built to scale, so whether you’re running two brands or twenty, the process stays smooth and efficient.

With XValley, multi-branding isn’t a challenge, it’s an opportunity to scale smarter.

Need a custom module? No problem. We thrive on building unique tools to meet specific needs. At XValley, we’re not just a tech provider, we’re a partner.”

“If you ask any CEO, COO, or C-level exec at a brokerage, I believe the majority of them will say the same thing, “a CRM isn’t just a tool; it’s the beating heart of our brokerage.” And they’re right to say so!”

How has the trader’s profile changed throughout the years and how has this impacted the needs of a brokerage firm? Traders today are savvier and more demanding than ever. They know what they want, and they also know how to investigate a broker before making their first deposit. From what we’re seeing at XValley, and through conversations with our clients, traders now expect instant execution, zero downtime, and access to a variety of trading tools.

Social trading and copy trading have exploded, as has the need for transparency and personalised experiences. This shift has forced brokerages to up their game, meaning they need to offer more tailored solutions and engaging platforms. That’s why we’ve baked social trading, prop trading, and advanced analytics into the XValley ecosystem, so brokers can meet these evolving demands head-on.

I’ve mentioned prop trading because it’s become a major driver for many of our clients who have diversified by launching prop firm brands. Our prop trading module is designed specifically to make setting up and managing a prop firm as seamless as possible. It allows brokers to create fully customisable funding programs, set specific trading challenges, and define rules and risk parameters without any complex integrations or third-party tools. What really makes our prop trading module stand out is its flexibility. Brokers can set tailored profit targets, drawdown limits, and scaling plans, all while managing everything directly within the XValley ecosystem. Plus, it integrates perfectly with our risk management system, ensuring that both the broker and the funded trader are fully protected.

We’ve seen many of our clients successfully branch out into prop trading using our module, often launching entire new brands around it. It’s opened new revenue streams for them and has allowed them to attract a different type of trader, those who are skilled but might not have the capital to trade at scale. Prop trading has become a massive opportunity for brokers, and at XValley, we’ve made sure they have the right tools to capitalise on it.

What are the fintech B2B trends in 2025, businesses should not ignore? AI and automation are going to dominate 2025, and we dedicated the theme of CFS (Cyprus Fintech Summit) in December 2024 to the role of AI within fintech. The event was a real success and we’re looking forward to CFS 2025 later on this year.

From smarter risk management algorithms to predictive analytics that help brokers make data-driven decisions, AI is becoming essential. Embedded finance is also growing, and we’re seeing the need to integrate more payment solutions directly into platforms. And let’s not forget about personalisation. Brokers will need to offer tailored trading experiences based on user behaviour. At XValley, we’re already ahead of the curve, integrating AI-driven tools and keeping our clients on the cutting edge. We’ll be making a few really cool announcements soon.

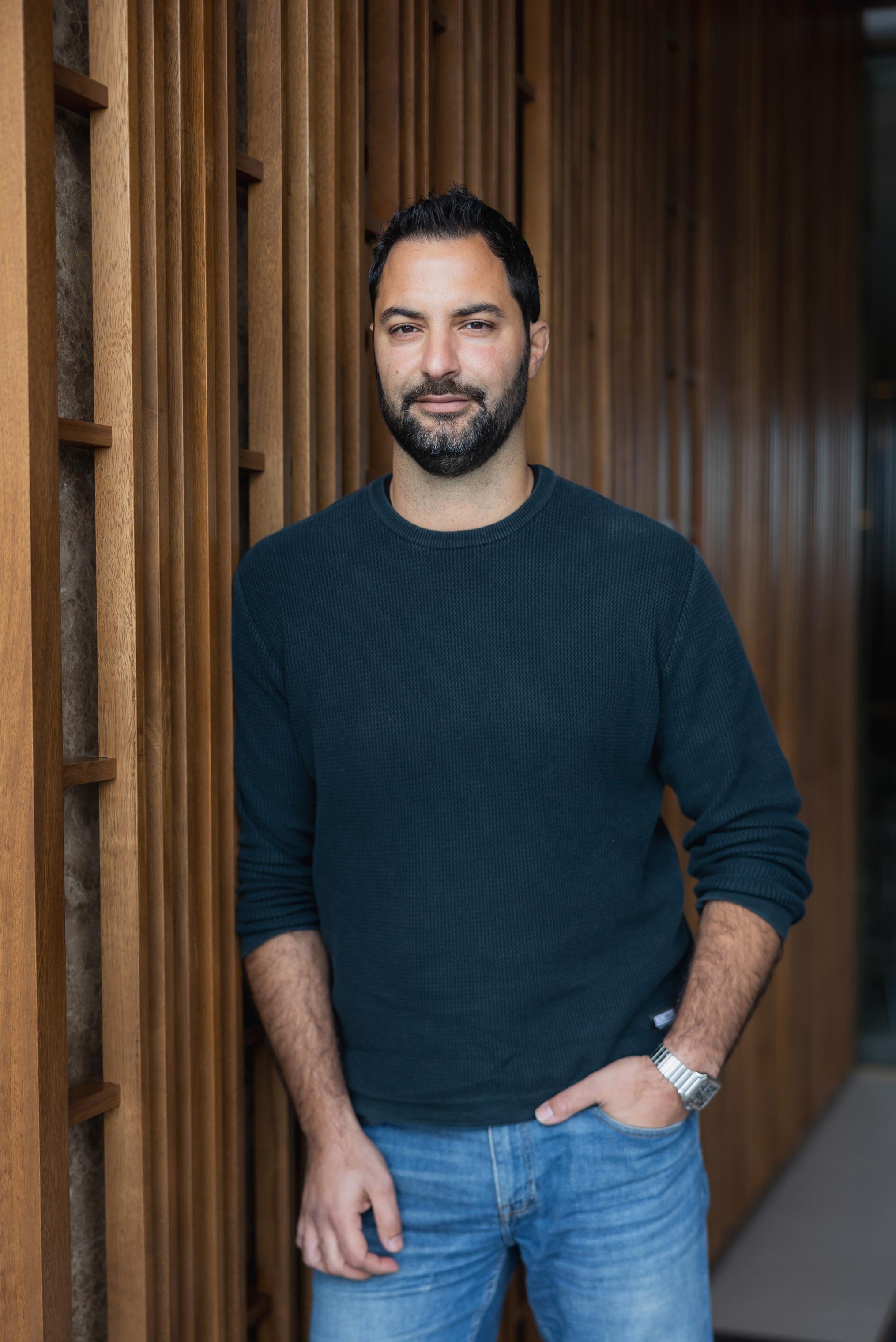

How many years are you in this industry Andreas? Tell us more about your entrepreneurship spirit and your success story

I’ve been in the fintech space for over 15 years, with deep roots in both forex and crypto. My journey started as a fintech developer, but my entrepreneurial spirit pushed me to create something bigger - something that would address the real

gaps in the brokerage world. And that’s how XValley was born. I saw CRM providers, trading platform providers, and a host of additional plugin providers. What I never saw was an ecosystem that encompassed it all.

From day one, my focus has been on building solutions that actually solve problems, not just adding more noise to an already crowded and overly saturated market. I wanted to create an ecosystem that brokers could rely on, something seamless, scalable, and cost-effective.

It hasn’t always been easy, but I’ve learned that persistence and adaptability are key in this ever-changing industry. I’ve surrounded myself with a truly talented team that shares my vision, and together we’ve grown XValley into one of the most trusted brokerage ecosystems on the market today.

For me, success isn’t just about growth or numbers, it’s about knowing that we’re helping brokers around the world launch and scale with fewer headaches and more opportunities. That’s what drives me every day. It’s what drives everyone at XValley, and our clients can see and feel our passion and drive.

What’s coming up next for XValley?

Even though XValley has been empowering brokerages for a decade, we’re just getting started!

XValley Ecosystem 2.0 is already in the works, and it’s going to be a real game-changer. We’re introducing enhanced AI integrations that will take automation and risk management to the next level. Imagine predictive analytics that not only flag risks in real time but also suggest tailored strategies for brokers to mitigate them. That’s where we’re heading.

We’re also beefing up our analytics tools, giving brokers deeper insights into trader behaviour, market trends, and performance metrics. The goal is to provide brokers with actionable data that helps them make smarter decisions, faster.

Flexibility has always been a core part of what makes XValley unique, and with Ecosystem 2.0, we’re pushing that even further. We’re enhancing modularity so brokers can customise every aspect of the ecosystem from trading platform features to CRM workflows without needing a team of developers.

On top of that, we’re expanding into new markets and will be announcing the opening of new offices in at least 2 new locations this year. We’re also particularly focusing on regions where fintech is booming but brokerage solutions are still lagging.

2025 will see us put a big emphasis on strengthening our partner network. We want to build deeper collaborations with liquidity providers, fintech innovators, and marketing experts to create even more value for our clients.

Ultimately, our goal is simple: to keep evolving and giving brokers the tools they need to scale, innovate, and dominate their space. We’re not into being a reactive company but rather a proactive one. And we’re not just building solutions; we’re shaping how brokerages grow, compete, and succeed in an ever-changing market. That’s why I believe XValley is the game-changing brokerage solutions provider

Andreas is the founder of XValley Technologies Ltd, a firm with vast tailor-made services, focused on developing and trading software for diverse global clientele within the financial industry.

Upon completing his education of BSc in Computer Science and MSc in Finance in London, he held roles in fintech and forex companies, such as FxPro, PrimeXM and FBME Bank with projects in MT4, MT5, and cTrader. He founded his own company, XValley Technologies in 2015.

Alexis Leonidou is the CEO of both Fintech Crafts and Webedem and has over 12 years of experience in the brokerage and fintech industry, Alexis has a deep understanding of brokerage operations, from ground-level execution to executive management. In 2018, he also launched his own consulting firm, through which he has contributed to the growth and success of several renowned names in the industry.

He holds CySEC’s Legal Framework certification, a Regulatory Guide 146 - Tier 1 certification from ASIC Australia, and an Associate Qualification from the Chartered Institute for Securities & Investment, where he is also a member.

In this exclusive interview with Alexis Leonidou, CEO at Fintech Crafts, we explore Fintech Crafts unyielding commitment to excellence, and their mission to craft solutions that redefine what’s possible in the world of i nvestment and trading, and reshaping the industry by placing technology at the forefront of financial innovation.

ment through webinars, education, and live trading.

• An IB Module that allows influencers, affiliates, content creators, and IBs to interact with their internal audience and share content directly to external social media platforms to increase conversions.

• Direct messaging for trader-to-trader and broker-client communication.

• A proprietary mobile app available on iOS and Play Store.

What’s FinTech Crafts’ unique selling point, and how do you differentiate from the competition?

Most brokerage technology providers focus on backend systems and trading platforms. At FinTech Crafts, we focus on enhancing the trader experience and providing brokers with new ways to increase revenue.

• Monetization for Brokers/Prop firms: Unlike traditional platforms that simply improve engagement, HubPro gives brokers the option to create a new revenue stream. Brokers can charge traders a subscription fee for premium features such as advanced analytics, social trading, and exclusive content.

At FinTechCrafts, you offer a full brokerage solution. Could you share information on the services you offer? At FinTech Crafts, we provide brokers and prop firms with an opportunity to expand their business and unlock new revenue streams without disrupting their existing infrastructure. Our flagship product, HubPro, is a fully white-labeled, premium, social-centric ecosystem that brokers can seamlessly integrate into their client portal.

Instead of requiring a full system overhaul, HubPro is positioned as a “Pro Experience” that brokers/prop firms can offer either as a value-added service or as a subscription-based upgrade to their traders.

HubPro is designed to integrate within a broker’s existing client environment, providing a rich, community-driven trading experience where traders can interact, follow key market players, access institutional-grade data, live stream, and benefit from premium research, signals, and educational content.

What sets HubPro apart is its flexibility—brokers can offer this as a free enhancement to boost engagement and retention, or they can introduce a premium subscription model for advanced features, creating new monetization opportunities. This means brokers can choose how they position HubPro—whether as a value-added tool, a revenue-generating service, or both.

Within this Pro Experience, traders gain access to:

• A social trading community to exchange ideas and interact with other traders, analysts, and influencers.

• Institutional-grade market data (70,000+ assets).

• Live signals, technical analysis, and research to improve trading decisions.

• A built-in marketplace for monetizing trading strategies, signals, and educational content.

• A loyalty and experience points system to enhance engagement and redeem points in the Loyalty Store.

• An interactive live streaming service to boost engage-

• Deep Yet Flexible Integration: While competitors often require brokers to overhaul their entire system, HubPro integrates into a broker’s existing client area. The integration process is structured and well-supported, ensuring that brokers can seamlessly incorporate HubPro while maintaining their current infrastructure.

• Social Trading 2.0: Unlike traditional copy trading, HubPro provides a complete trading social network, an AI-driven content system, and a gamified user experience that keeps traders engaged and loyal to the broker.

• AI-Powered Insights and Compliance: Our AI technology moderates discussions, personalizes content, and ensures compliance, reducing risk for brokers while increasing community-driven engagement.

What are the features and challenges a broker should consider to ensure they have the right partner by their side?

Brokers need to think beyond just offering a trading platform—they need to create an ecosystem that keeps traders engaged and actively trading.

The biggest challenges brokers face today include:

1. Trader Retention and Engagement: Many brokers struggle to keep traders active. HubPro solves this by providing a dynamic, community-driven experience that encourages traders to engage, interact, and return consistently.

2. Scalability and Monetization: Brokers need solutions that grow with their business. HubPro offers multiple revenue opportunities, whether through increased trading activity, higher deposit sizes, or an optional premium-tier subscription model for exclusive content and features.

3. A Structured Yet Flexible Integration Process: While integrating advanced solutions always requires planning, HubPro is designed to fit within existing broker infrastructure, with dedicated technical support to ensure a smooth and efficient onboarding process.

Choosing the right technology partner is about more than just software—it is about finding a solution that truly aligns with a broker’s growth strategy.

We see brokers following a multi-branding solution in recent years. How complicated is this from your point of view, and can FinTechCrafts support this?

Multi-branding is becoming more common, especially as brokers expand into different regions and target specific trader segments. However, managing multiple brands across different platforms can become complex.

With HubPro, brokers can operate multiple brands under one infrastructure, offering a tailored Pro Experience for each brand. Since HubPro is fully white-labeled, brokers can customize branding, pricing, and features for each of their brands without needing separate integrations.

This approach allows brokers to optimize engagement and monetization across different brands while keeping operational complexity under control.

How has the trader’s profile changed throughout the years, and how has this impacted the needs of a brokerage firm? Today’s traders expect more than just a trading platform—they want a social, interactive, and educational experience with easy access to information.

• Traders Are Younger and Digital-First: A large portion of new traders are Gen Z and Millennials, who prefer app-based engagement, gamification, and social-driven trading experiences.

• The Rise of Subscription-Based Models: Most platforms have normalized paying for premium trading features, and users are now more eager to upgrade their experience for greater access to insights. Brokers can capitalize on this trend by offering HubPro as a premium add-on service, rather than relying solely on spreads, commissions, and standalone KPIs.

• Community-Driven Trading is the Future: Modern traders seek guidance, signals, and social validation. Brokers that offer interactive trading communities and premium insights will see increased trader retention and engagement.

• Traders Are Eager to Become Content Creators and Influencers: With the rise of social platforms and audience monetization, brokers can now provide tools for clients to become their own affiliates or influencers—creating new marketing funnels that drive conversion and dominate KPIs.

Which geo markets do you cover?

HubPro is designed to be a global solution and supports brokers in multiple regions. As long as a broker’s regulatory framework allows for specific geographical expansion, our AI-powered translation tool helps traders from different languages and backgrounds engage seamlessly within the same ecosystem, creating a strong, unified trading community and increasing loyalty to the broker’s brand.

What’s coming up next for FinTech Crafts?

We have many exciting features on our roadmap for HubPro. While some innovations, such as tertiary communities, open environments, competitions, and challenges, are in the pipeline, our immediate priorities are focused on:

• Developing a seamless and optimized integration process.

• Expanding language support to ensure a truly global experience

• Enhanced AI-Driven Market Insights – More powerful content curation based on trader behavior and real-time market movements.

• Many more.

We are continuously working to enhance our product, simplify adoption for brokers, and drive more value for traders while staying ahead of industry trends.

With HubPro, brokers can operate multiple brands under one infrastructure, offering a tailored Pro Experience for each brand…. without needing separate integrations.”

Share with us how your entrepreneurship/ career journey started?

Back in 2014 I came across the idea of creating a unique HR consulting firm that offered a more personalized and tailored approach to every aspect of human resources. I wanted to build a company that went beyond traditional HR services, focusing on customizing solutions to meet the specific needs of each client. This vision led me to establish a firm that prioritizes close relationships, individual attention, and a deep understanding of the challenges and opportunities organizations face. From that moment, I was determined to redefine the way HR consulting was perceived and create impactful and sustainable solutions for businesses.

Could you share information on the services you offer at Perha Group? What’s Perha’s Group’s unique selling point and how do you differentiate from the competition?

At PERHA Group we offer a comprehensive, one-stop solution for companies with headquarters in Cyprus, providing end-to-end business support. So I would say our unique selling point lies in providing complete, end-to-end business support with dedication and reliability. We cover a wide range of areas, including Workplace Compliance and HR services, like employment law, equal pay, health and safety, and diversity, equity, and inclusion (DEI). We manage the entire Employee Lifecycle Support, from recruitment and relocation (with concierge services) to onboarding and wellbeing initiatives. Wex also support Business Infrastructure needs such as payroll, banking, insurance, and claims handling, along with Branding and Engagement strategies, including corporate branding, communication, workplace culture, and lifestyle support.

What are the features a business should take in consideration to ensure you have the right tech partner and receive an efficient and quality service?

When selecting the right tech partner, a business must first prioritize expertise and proven experience within their industry. A tech partner who truly understands the unique challenges and needs of your business can deliver solutions that are both efficient and impactful. Equally important is alignment in corporate culture and values. With so many Gen Z professionals now shaping the tech industry, it’s essential to partner with a company that not only understands the generational dynamics but also shares a similar approach to innovation, collaboration, and workplace culture.

The 8th of March is women’s day. What does this stand for you? For me, International Women’s Day represents strength, empowerment, and women’s leadership. It marks the significant progress we’ve made over the years in establishing ourselves within the business world and securing our place in corporate spaces. Women bring unique skills and perspectives to the table, making them invaluable assets to organizations. Personally, I’ve been inspired by countless women in various roles, whose journeys have been nothing short of remarkable. Oprah Winfrey, for example, is a figure to inspire and motivate, since what she achieved until now is exceptional.

What are the needs of today’s woman? How do you see the business-motherhood balance?

Today’s women, like men, face unique challenges in balancing their personal and professional lives, especially when navigating demanding careers. While our needs may differ, it’s essential not to solely focus on women when designing HR policies or procedures aimed at improving work-life balance. The reality of balancing business and motherhood is often more complex than the idealized versions we hear about in books or podcasts. Striving for an “ideal” balance can sometimes be a myth. The key is to prioritize what matters most at the specific time and don’t be afraid to admit that sometimes we need to work a little harder and we need to take this extra vacation day just to cover things up. It’s about being adaptable and focusing on the bigger picture.

“With so many Gen Z professionals now shaping the tech industry, it’s essential to partner with a company that not only understands the generational dynamics but also shares a similar approach to innovation, collaboration, and workplace culture.”

You are very active in CSR. How this boosts you as an individual and how CSR can be beneficial for an organisation.

Giving back to society and people in need was something that my mother taught me in a very young age. I remember sharing some of my birthday presents in case I already had similar ones with kids that were not so fortunate. So growing up I decided that this was something that I wanted to do and grow over the years and I had the opportunity in the companies that I work to offer a lot back to people in need. Now in regards to organisations I believe that they should have CSR into their corporate culture. CSR not only aligns with global sustainability goals but also enhances a company’s reputation, especially as European Union directives on sustainability and ethical practices continue to evolve. Companies that actively engage in CSR initiatives are seen as more socially responsible, which can build stronger relationships with employees, customers, and stakeholders. Moreover, CSR contributes to long-term success by driving employee engagement. It’s a win-win situation that benefits both the organization and society as a whole.

What’s your one piece of advice for young women looking to have a career in fintech?

My one key piece of advice for young women pursuing a career in fintech is to embrace continuous learning and stay adaptable. The fintech industry is rapidly evolving, with new technologies, trends, and regulatory landscapes emerging regularly. To succeed, it’s crucial to remain curious and invest in developing both technical and soft skills. Don’t be afraid of challenges, and be proactive in seeking mentorship and networking opportunities with both peers and industry leaders. Building a strong professional network and seeking out diverse perspectives will empower you to navigate the complexities of the field. Most importantly, believe in your capabilities and remain confident in your potential to make a significant impact in this industry and most importantly be “unstoppable” and never give up on your dreams and aspirations.

What’s coming up next for Perha Group?

At PERHA in Cyprus, our primary focus is helping clients optimize their HR positioning and create environments where both individuals and organizations can thrive.

In 2023, we expanded into Dubai, marking a significant milestone in our growth. This expansion reflects our ambition to support HR projects across the Middle East, where the demand for innovative HR solutions and a strong corporate culture is rapidly growing. Our goal is to become a trusted partner in the region, helping businesses create sustainable and effective HR practices that attract top talent and foster a high-performance culture across diverse markets.

Marianna Hadjiandoniou holds a Master’s degree in Human Resource Management from the University of Surrey, UK, and is an esteemed member of the CIPD. With over two decades of extensive experience, Marianna has successfully formulated and implemented HR strategies for various local and international companies. Marianna is and an active BPW Cyprus Federation of Business and Professional Women member and an accredited trainer by Cyprus’s Human Resource Development Authority. From 2020 to 2023, she served as the Secretary of the CSR Cyprus Board.

She is also a board member of the Limassol Red Cross branch and supports the association “One Dream One Wish,” contributing to significant community welfare projects. Her outstanding leadership in HR was recognized in 2023 at the international ‘The Leadership Awards’, in London. She also received the title ‘Woman of the Year’ at the prestigious international awards, Rewards 2024.

Founder & CEO PS Novus Business Consulting

Share with us how your entrepreneurship journey started?

My entrepreneurship journey, establishing PS Novus Business Consulting Ltd was the result of a long career journey in the professional services industry and an empirical observation of the market which in my opinion lacked solutions to businesses requiring to have financial advice and management adjusted to their individual needs (external CFO services). What the market was offering was generic solutions not necessarily meeting the specific needs of businesses or even if such solutions were available there was a need of deciphering the information in a way which has a practical application to that specific business.

As a CFO in the legal industry I gained vast experience in operational and debt restructurings and spearheaded initiatives with respect to the creation of both single and multi family office services and also led the set-up of single family offices for families with substantial wealth.

What’s PS Novus unique selling point and how do you differentiate from the competition?

Our company is able to establish financial strategy focusing on the detailed short- and long-term strategy, short- and long-Term Forecasting understanding of the current and future capabilities of the company, as well as in-depth analysis of the competitive landscape within the industry, assist with the preparation of budgeting of typically 3 to 5 years forecast to guide the year’s financial decisions while keeping the organization on track to reach its goals, assistance in raising Capital based on our network of financiers, assistance in structuring capital including determining how much financing you need and what mix of debt and equity financing is best for the company’s goals. Our long experience in the area or restructuring have given us the competitive advantage to be in the position to renegotiate vendor contracts, restructuring client contracts, ensuring pricing is aligned with company & industry trends, analyzing commission structures, supply chain management, attributing costs to revenues.

In every recession there are a lot of opportunities however the investors need to be very careful in their moves. This is where financial advisory services are extremely useful as they can assist to eliminate risk and ensure that the investors are not derailed from their course. Investment appraisals are very important since the assessment of an investment project decreases the chances of failure and influences the company’s cost situation and performance while affecting decisions about investing in certain projects. In combination with the above we offer Consulting support provision on behalf of companies seeking to raise capital/ Consulting support provision on behalf of investors seeking investment opportunities/Presentation of the company and its business plan to prospective investors.

Alexandra is the CEO of PS Novus Business Consulting Ltd, a company giving bespoke consulting services. She has extensive experience in the finance and banking sector through her 9 year working experience as CFO of the biggest law Firm in Cyprus as well as a key member of the restructuring and insolvency team of the firm. Her experience extends in the development of the Single and Multi Family Office, and through her 15 years of working experience, both in a Big Four firm and in the legal industry, she has gained experience in tax and financial reporting, particularly in companies operating in the construction industry, investment firms and other regulated entities, involved in IPOs in London. She is member of STEP, ICAEW and ICPAC and holds an Advanced Diploma in International Taxation from Chartered Institute of Taxation.

Furthermore, she is a Member of the Board of Directors in Ancoria Bank Limited and Chairwoman of Audit committee and holds the position of an Independent Non-Executive Director in the Board of Directors of ‘GMM Global Money Managers AIFM Ltd. She is a Board member in Cyprus -South East Asia Business Association of CCCI and in Women association of WICCI Cyprus. Alexandra was as been named as one of the 50 most influential businesswomen in Cyprus, by Mondaq and in 2022 she was given the outstanding leadership award for her contribution in the field of Finance and insurance by Money Conference.

What’s the biggest challenge the financial sector is facing today, in your opinion?

The financial services industry has been undergoing a fundamental shift for many years now. As more people rely on digital to handle tasks and expect businesses to meet their new digital needs, financial services have been pivoting. Over the last few years, the focus on digital transformation has accelerated. Finding ways to exceed customer expectations and stay competitive ranked among the key concerns of businesses over the past year.

For the first time in decades the labor market has shifted in ways that have employees holding the upper hand, meaning many high-skilled, high-demand roles are open and difficult to fill. This challenge can be tackled with a twofold approach: emphasizing ESG initiatives and rethinking the industry’s usually very traditional work setups. This means embracing remote work as well as investing in eLearning and coaching capabilities. Data breaches continue to be a concern in the financial services industry. Financial services are a prime target for cybercrime due to the sensitive nature of their data. With the increase of transactions and communications online, security and risk mitigation have been key areas of focus. Finally, Financial services are already one of the most heavily regulated industries. As the industry shifts to new technologies, so do the regulations. Regulators are moving to increased supervision and enforcement.

8th of March is women’s day. What does this stand for you? 8th of March, International women’s day reminds me that every woman determines her own dynamics, whether we are talking about a mother who fights for her children, or a woman who consciously chooses and pursues a specific career path, or a woman who is fighting in a male-dominated society for what we should have taken for granted, such as the right to education, the right to drive the right to freedom. So I admire all the women who struggle to make the choices that make them happy.

What are the needs of today’s woman? How do you see the business-motherhood balance?

Being a mother does not and should not exclude the possibility of her having a successful career. Work life balance can be difficult however it’s not impossible. We assume work/family is a seesaw, and if work is up family is down. Yet, we forget that work/family can, and often is, mutually beneficial. Becoming a parent can help people become more self-aware, more empathetic, and develop new skills and relationships that help them thrive at work and become more successful leaders. Having a rich, meaningful career can help you be a better parent, as it provides perspective, meaning, and greater economic stability. My personal opinion is to become a role model for your children through your achievement and your actions and enrich them with values that matters. After all at all times you lead by example whether in your professional life or your personal life.

What’s your one piece of advice for young women looking to have a career in fintech?

Believe in yourself, make sure that your voice is heard, be authentic, work with integrity and create your own opportunities are some of my key pillars that would advise . Know and understand your own strengths but most importantly understand your weaknesses, and be confident enough to build a team around you that are better than you are at their specific focus areas. Learn from others who have gone before you, find those mentors you can trust fully, both men and women, and set time aside to support, guide and build up others earlier in their career. Passion and kindness is inspiring and infectious.

Share with us how this entrepreneurship journey started and the need and challenges you identified My journey in fintech began when I joined APS a few years ago, at a time when the company was on a mission to revolutionize online payments. I was drawn to their vision of creating fast, secure, and cost-effective payment solutions for businesses worldwide.

I quickly saw the challenges companies faced—high fees, slow transactions, and limited payment options— which made it harder for them to scale and operate efficiently. There was a clear need for a seamless payment system that could support global transactions while ensuring compliance with regulations.

By tackling these challenges, we have built solutions that help businesses increase conversions, reduce costs, and manage funds more efficiently. It has been an exciting journey of problem-solving, innovation, and continuous adaptation to the fast-changing industry.

Could you share information on the services you offer at APS.money?

APS simplifies modern transactions with a full suite of payment solutions:

• Online Payments – Process deposits and payments via MetaTrader 5

Embedded Payments while reducing third-party costs. Accept major cards (Visa, Mastercard, JCB, UnionPay) in 150+ countries and access alternative payment methods for emerging markets. Binance Pay integration enables instant, low-cost digital asset transactions for 250M+ users.

• On-Chain Payments – Settle transactions quickly and securely with Stellar Blockchain and multi-chain support for 60+ blockchains, including Solana, BSC, and Ethereum.

• Corporate Payments – Manage global operations with a multi-currency digital wallet for fiat and digital assets. Web3 Merchant Solutions optimize blockchain transactions, while OTC services offer fast, same-day conversions and settlements.

What’s APS.money unique selling point and how do you differentiate from the competition?

APS stands out for its all-in-one payment service, which covers online, on-chain, and corporate payments, as well as OTC and digital wallet solutions. Our complete payment ecosystem combines the reliability of traditional finance with digital and blockchain technology. This means our clients have access to multiple payment services suitable for businesses operating locally and internationally, allowing them to move funds seamlessly around the globe.

We offer affordable pricing and dedicated customer support, ensuring you pay only for what you need. Our platform integrates with systems like MetaTrader 5 and supports blockchain transactions using Stellar and Binance Pay. With a presence in over 150 to 200 countries, we help break geographical barriers while providing quick and efficient integration with your existing systems to minimize downtime and avoid third-party complexities.

What are the features a merchandise/fintech firm should consider to ensure the right partner and efficient service?

Businesses should seek a reliable payment service provider that supports global acceptance and multi-currency transactions. It’s important to choose a partner whose integration capabilities work well with multiple platforms and can adapt to unique businesses. A payment service should also offer flexible, transparent pricing with custom models that grow with a business’s needs.

We cannot overemphasize security and compliance. Look for a service that uses strong encryption, adheres to global regulations, and consistently monitors transactions. Finally, dedicated support is essential. Businesses should seek a partner that offers personalized customer service to address any challenges quickly.

Businesses can assess APS to see whether we fit these criteria.

What’s coming up in 2025 for the payments sector?

Digital and blockchain expansion: In 2025, expect payment providers to build on established blockchain frameworks by further integrating decentralized finance protocols. Networks like Stellar, Ethereum, and Binance will help lower costs and speed up global transactions.

Market penetration in emerging regions: As APAC, MENA, and other regions grow, payment solutions to fit local consumer habits and regulatory requirements will continue

“With a presence in over 150 to 200 countries, we help break geographical barriers while providing quick and efficient integration with your existing systems to minimize downtime and avoid third-party complexities.

building. Providers are adapting existing infrastructures to include more local payment methods and currencies, helping businesses reach new markets effectively. We’ll witness more real-time, global settlement solutions: Payment systems will continue enhancing real-time processing to provide instant borderless transactions. This focus on faster settlements and multi-currency support will give international businesses greater control over cash flow.

8th of March is women’s day. What does this stand for you?

To me, International Women’s Day is all about celebrating the amazing women in our lives and the progress we’ve made together. It’s a day to recognize the strength, creativity, and hard work of women who continue to inspire and pave the way for others.

Being in fintech, which has its challenges as a field often dominated by men, I’ve seen how important it is to support and empower each other. Whether it’s cheering on colleagues or lifting up the next generation of women leaders, this day reminds me of the power of unity and shared goals.

It’s a chance to pause and appreciate the women around me—who, in so many ways, make a difference in my life and work. And it’s a reminder that we should always be pushing for more equality, in business and in every aspect of life.”

Is it challenging to get into a male-dominated sector like finance?

Yes, it can be challenging to break into a male-dominated industry like finance, but it’s also rewarding. There are definitely barriers—like dealing with stereotypes, gaining credibility, or navigating a space that has mostly been shaped by men. But I see those challenges as opportunities to grow and stand out.

From my experience, persistence, building relationships, and having a clear purpose are key. Over time, the industry has become more inclusive, and diverse perspectives are being valued more. It’s all about being confident and recognizing that women bring something valuable to the table.

It’s not always easy, but the more women who succeed, the easier it gets for those who come after.

What’s your one piece of advice for young women looking to enter the world of finance?

Stay adaptable and open to change. The finance industry is constantly evolving with new technologies, regulations, and market trends. Being flexible and willing to learn, adapt, and innovate will keep you ahead of the curve. Embrace change as an opportunity rather than a challenge, and you’ll continue to grow in your career. remember that growth comes from stepping out of your comfort zone. The more you learn and adapt, the more confident and capable you’ll become in this field

Stay curious and never stop learning. Don’t be afraid to ask questions, explore new areas, and seek out knowledge—whether through formal education, networking, or self-study.

What’s coming up next for APS.money?

We have some exciting developments ahead! First, we’re expanding our global payment solutions—integrating more alternative payment methods (APMs) and enhancing our fiat-to-crypto on/off ramps to make transactions faster and more seamless.

One of our biggest moves is the launch of our APS Web3 Product. It’s designed to help businesses accept crypto payments effortlessly, supporting 60+ blockchains and offering instant settlements, smart contract automation, and smooth fiat-crypto conversions. Our goal is to bridge traditional finance and Web3, making payments faster, more secure, and truly global. Exciting times ahead.

Elena is an experienced professional with expertise in fintech, payments, and business development. She has extensive experience in optimizing financial infrastructures, enhancing operational efficiency, and driving strategic partnerships. Passionate about innovation, compliance, and financial accessibility, Elena is committed to helping businesses streamline transactions and improve user experiences. As a strong advocate for diversity and inclusion, she empowers the next generation to break barriers and thrive in dynamic industries.

Share with us how this entrepreneurship journey started and the need and challenges you identified

My entrepreneurship journey began after a decade of working in the financial services industry. Having gained a deep understanding of the intricacies of the industry as well as the struggles of many companies to navigate business complexities, the idea of transitioning from an in-house role to starting my own consultancy took root. More specifically, and the area I am most drawn to, influencing my decision, is payments.

Payments is an area which is constantly evolving, and businesses struggle to navigate through this side of operations, often lacking either the expertise or the resources to optimize and streamline their payment strategies and processes.

What are the services you offer at Loufinco?

Loufinco specializes in providing practical and tailored solutions that help businesses overcome challenges and make informed decisions within a constantly evolving business environment.

Loufinco offers a wide range of services including payment services consulting, regulatory compliance consulting and licensing services. Loufinco also offers fully furnished offices for lease in Seychelles. We are particularly excited about our recently shared video on Linkedin showing these offices, giving anyone interested a virtual tour.

What’s Loufinco’s unique selling point and how do you differentiate from the competition?

Loufinco combines a truly collaborative approach with deep first-hand industry expertise and an unwavering commitment to honesty, open communication and transparency.

We believe in providing our clients with realistic assessments and practical solutions. We build genuine partnerships with both our clients but also with our network of strategic partners. We have cultivaed strong relationships with key players across various industries, allowing us to tap into a wealth of resources and expertise to deliver comprehensive and tailored solutions. Therefore, I would differentiate Loufinco based on its honest counsel, network strength and focus on building long-lasting relationships based on trust and mutual success.

What are the features a broker should consider ensuring he has the right partner and receive an efficient service?

Several key considerations should be assessed. To name a few, brokers should ensure that the relevant partner understands their company’s overall strategy and long-term vision to ensure alignment. Also, clear and consistent communication is essential. Any right partner should be readily accessible, should provide regular updates and proactively address any potential issues or concerns.

We see brokers following a multi-branding solution in the last few years. How complicated is this from your point of view and can Loufinco assist with this?

Correct, brokers are increasingly opting for multi-branding strategies for a number of advantages. However, multi-branding does

“Loufinco can assist with bringing expertise and objectivity, assisting with strategic planning, operational set up and regulatory guidance.

introduce quite a lot of complexities such as increasing operational overheads, regulatory compliance and payment complexities.

Loufinco can assist with bringing expertise and objectivity, assisting with strategic planning, operational set up and regulatory guidance.

What’s coming up in 2025 for the financial services regulatory framework? In 2025 it is expected to see stricter regulatory frameworks, with global financial regulators tightening their rules. From MiCAR, to DORA, to the revised Payment Services Directive as well as the new Payment Services Regulation pending to be debated, regulated entities must adapt to various changes and challenges on the regulatory horizon, requiring them to reassess their strategies and operations to survive and thrive.

8th of March is International women’s day. What does this day mean for you? International Women’s Day is a powerful reminder of the progress women have made, and a celebration of strength and resilience.

Is it challenging to get into a male-dominated sector like finance?

Indeed, the financial services has been historically a male-dominated industry. Is it challenging? At times, yes. But is it impossible? Absolutely not. While progress has been made, challenges certainly remain. However, I would not want to paint an entirely negative picture.

In my career journey I was fortunate to receive incredible support from both men and women which I am grateful for.

The key is for women to focus on their strength and expertise, to have confidence in their potential and abilities and to build strong connections with colleagues.

What’s your one piece of advice for young women looking to enter the world offinance?

I would advise them to be unapologetically themselves. The financial world needs unique perspectives and innovative ideas. To embrace their strengths, to never give up and always believe in themselves and their potential.

What’s coming up next for Loufinco?

Loufinco is staying ahead of the curve, anticipating the needs of our clients and providing them with strategic solutions to thrive. Stay tuned with our Linkedin page to keep up with our news.

Loukia embarked on her career journey after completing her LLB (Hons) and LLM from the University of Leicester in 2010.

She joined the leading law firm of Messers Andreas Neocleous & Co LLC in Limassol and was admitted to the Cyprus Bar Association in 2011.

In 2012 Loukia joined the IronFX Group as a legal advisor. Loukia was promoted and served in the position as Head and Chief Legal and Compliance Officer for 10 years during which she spearhead the group’s global expansion and headed the group’s legal and compliance team.

How has this entrepreneurship/career journey been for you?

While studying at university, I had a vision that I converted into a goal: be able to provide assistance to people, especially when it came to solving complex security issues. In addition to my studies, I kept my motivation alive through progress in the business world and compiled many issues which needed solutions. Afterwards, I took upon myself to do my postgraduate studies in HR, to better prepare myself for solving complex communication, conflict resolution, strategic business thinking, internal and external change management issues. Post my postgraduate studies, I focused on behavioural economics, the psychology of money as well as on safety and VIP security.

I keep educating myself on understanding emotional intelligence within the working environment as this enables me to develop strong teams within the company and create long lasting relationships with clients. Achieving to fulfil huge contracts, gaining respect, and building unique relationships with clients leads me to imagine that we can all have a shared world that is safer and more interconnected.I remain futurist, I seek innovations, but most importantly I stand for community. The greatest innovations in big companies came from many people working together to achieve the greatest.

Could you share information on the services you offer at Securite One

At Securite, we have specialized security services designed to satisfy all the needs related to security matters. These include:

• Security for persons, businesses, events, Patrol Services,

• Central Monitoring Station 24/7

• Technology solutions (CCTV cameras, alarm systems, doors systems)

Our team of specialists has the information and experience to handle wide-ranging security problems and physical dangers. As professionals, we do not merely seek to answer client calls. Instead, we concentrate on preventative measures, helping on how to avert likely risks and addressing their safety concerns.

What’s Securite One unique selling point and how do you differentiate from the competition

Our biggest differentiator is our holistic approach.

• Personalized Service: We carry out in-depth analyses to comprehend the unique security requirements of every customer, enabling them to create and execute solutions that are efficient and successful in any situation.

• Advanced Technology: Securite One makes use of the newest security technology to guarantee that customers receive excellent solutions that provide increased dependability and protection.

• Expertise and Experience: From the first consultation to continuing maintenance and after-sales support, Securite One offers professional advice and assistance thanks to a group of knowledgeable employees.

• Customer-Oriented Approach: They put the needs of its customers first by providing after-sales assistance, customizable solutions that adjust to security-related requirements, and support.

What are the features a business should consider to ensure he has the right partner and receives an efficient service?

-Personalized Solutions. Given that every company has different security requirements depending on its size, location, and sector, a competent partner should provide customized security solutions that take these needs and requirements into account.

• Customer service and response times: Quick reaction times are essential in the case of a security breach. To ensure client pleasure, your partner should be accessible around-the-clock and provide prompt solutions.

• Reputation and dependability. A partner needs to be trustworthy and well-known for offering dependable, superior service.

• Integration Capabilities: The ideal security partner should have security systems that can easily adjust to changes and improvements in technology and interact with current company systems, including cameras, alarms, and access controls.

• Transparency and Communication: Strong customer relationships are fostered by open and transparent communication. Since security is a

continuous requirement, a partner should be dedicated to creating a long-term relationship by offering frequent updates, thorough reports, and openness about their procedures.

What’s coming up in 2025 for the security sector?

In 2025, the security industry will be characterized by the blend of modern technology, adaptive regulations, and increased attention to integrated systems. Securite One understands that threat protection and innovation go hand in hand, and for this reason, we are enthusiastic about expanding our technological capabilities, especially through the development of AI-enabled security systems that will enhance our services. AI technology is constantly evolving and we remain vigilant, testing each new technology before implementing it, knowing exactly its scope of application. However, offering seamless and efficient security solutions for our customers is one of the main focuses of the company. We work to improve the customer experience, and in doing so, we remain innovative and agile in an ever-changing fast-paced industry.

8th of March is women’s day. What does this stand for you? 8th march is a day to recognize and celebrate the achievements of women worldwide, across various fields. It’s also a day to raise awareness about the ongoing challenges and inequalities women face and to advocate for women’s rights. For me, it’s a reminder of the strength, resilience, and contributions of women throughout history and across cultures. It’s an opportunity to reflect on the progress made and the work still needed to create a world where women have equal opportunities, safety, and representation in all aspects of life.

Is it challenging to get into a male-dominated sector like this?

The Security Sector is a CHALLENGE. You need to have multidimensional knowledge to be able to answer. It’s a complicated realm where you have to have culture and understanding. You don’t just execute procedure or tasks, there is also a serious daily challenge regarding the responsibility you have towards the important clientele of the company, to serve their requirements, to be correct with their expectations, to support the team and to achieve all these in a sustainable financial agreement, in an era with a limited technical workforce.

For a female professional who is willing to manage all of the above, look for openings to initiate change, lead the way by example, and leave a path of acceptance for those to follow, being accepted by the male-dominated environment in Security, it is a simple game on the daily chessboard . Although it can be challenging, there’s also tremendous power in being part of the change.

The more women that step into these sectors, the more diverse and dynamic the workforce becomes. Women in leadership positions also have a chance to shape the workplace culture for future generations.

How important is safety for women in the workspace? Safety is absolutely paramount. Ensuring that women feel safe in the workplace goes beyond just physical safety—it encompasses emotional, psychological, and professional safety as well. A workplace that prioritizes safety and respect for all employees, regardless of gender, is one where people can thrive, increase their productivity and do their best work.

What’s your one piece of advice for young women looking to enter the world of technology?

My advice would be to be confident and trust their abilities. Grab every chance to get hands on experience by engage in projects, internships and allow themselves to apply their skills in real world situations. Also to join on-

line communities and connect with other women in this sector. The tech field is constantly evolving, so adaptability and curiosity are your best tools. Find mentors who will support and challenge you and never be afraid to take up space and voice your ideas. Confidence combined with competence is a powerful combination.

What’s coming up next for securite one?

Enhancing technology, expanding services, improving customer support even more, new product launches, updates on security protocols. Moreover, we make constant internal upgrades in our procedures through our own application, we organise trainings to learn and familiarize ourselves with new technology features, in order to provide better customer experience and prompt service. Furthermore we focus on AI solutions and system integrations. Innovation is key, and we’re always exploring how to stay ahead of the curve in a fast-evolving industry.

Raphaelia Longou is a dynamic and inspiring figure known for her multifaceted talents and contributions to various fields, with over 12 years of experience in the security field.

Raphaelia is the Head of Security Department at Securite One, while her Bachelor studies in Nursing, MSc in HR and various certifications in VIP Security, have empowered her to be involved in numerous projects as well as empowering others and fostering a sense of community.

“

Our strong point is that we offer a fully customized approach designed to meet the dynamic needs of forex and fintech firms, acting as a trusted partner dedicated to our clients’ success.

Share with us how this entrepreneurship journey started and the need and challenges you identified.

My journey with Reconbees began with a clear vision: to bridge the gap in financial reconciliation services, particularly in industries like forex and fintech, where accuracy and regulatory compliance are critical. Having worked closely with financial teams, I recognized that many firms struggled with inefficient.

Many forex firms face significant challenges in finding experienced and trustworthy reconciliation managers to oversee their reconciliation processes. The shortage of qualified experts in this field makes it even more difficult to hire individuals who can be relied upon to manage these critical processes with precision and integrity. Additionally, the training required to develop such expertise is complex and time-consuming, which only adds to the difficulty of.

Reconbees was founded to tackle these challenges by providing customized reconciliation services that improve financial integrity and operational control, leveraging over a decade of experience.

Could you share information on the services you offer at Reconbees?

At Reconbees, we specialize in financial reconciliation services tailored for forex brokers, fintech firms, and financial institutions. Our core offerings include:

Tailored Implementation of the per-transaction reconciliation using a software or other tools regarding the client’s needs and volume.

Our team run the daily per-transaction reconciliation to ensure that client funds are accurately matched with payment provider records, in case when our client has not an inhouse team.

Trainings to inhouse reconciliation teams on technical aspects or any general knowledge needed to individuals to handle the process. Help firms establish best practices by developing their reconciliation policies and procedures.

Customized reconciliation frameworks, integrating with multiple payment providers and trading platforms.

Regulatory reporting assistance, ensuring compliance with financial authorities.

We provide automation and system integration consulting, enhancing reconciliation efficiency through technology. Our goal is to provide an end-to-end reconciliation solution that minimizes risks andimproves financial accuracy.

What’s Reconbees’ unique selling point, and how do you differentiate from the competition?

Our strong point is that we offer a fully customized approach designed to meet the dynamic needs of forex and fintech firms, acting as a trusted partner dedicated to our clients’ success. What sets Reconbees apart is our ability to tailor solutions to the specific challenges of each client, leveraging over a decade of experience. This personalized approach, combined with our unwavering commitment to financial integrity and operational control, makes us a reliable partner in a field where expertise and trust are paramount.

What are the features brokers should consider to ensure they choose the right partner and efficient service?

Brokers should look for the following when selecting a reconciliation partner:

Accuracy & Reliability: The service should guarantee precise matching of transactions and immediate detection of discrepancies.

Accuracy & Reliability: The service should guarantee precise matching of transactions and immediate detection of discrepancies.

Automation & Scalability: A strong reconciliation process should seamlessly scale with the company’s growth.

Regulatory Compliance: The provider must ensure alignment with industry regulations to avoid legal issues.

Integration Capabilities: The ability to connect with multiple payment providers, trading platforms, and accounting systems is crucial.

Proactive Support: A dedicated team that offers ongoing monitoring and assistance ensures that reconciliation remains smooth and error-free.

But the most crucial factor brokers should consider is building a strong, transparent relationship with their reconciliation provider! Trust ensures that the provider will manage sensitive financial data with integrity, maintain accuracy in the reconciliation process, and uphold confidentiality.

What’s coming up in 2025 for financial reconciliation services?

2025 will see greater automation and AI-driven reconciliation tools, reducing manual efforts and improving real-time accuracy. Regulatory scrutiny is also expected to increase, making compliance-driven reconciliation more critical than ever. Additionally, with the rise of decentralized finance (DeFi) and alternative payment methods, reconciliation services will need to adapt to new transaction models. At Reconbees, we are actively enhancing our solutions to stay ahead of these trends.

The 8th of March is Women’s Day. What does this stand for you?

For me, Women’s Day is a celebration of resilience, leadership, and the progress women have made in various industries. It’s also a reminder that while we have made great strides, there’s still work to be done in achieving true gender equality, especially in finance and fintech.

Is it challenging to get into a male-dominated sector like finance?

Finance is often seen as a male-dominated field, but women have consistently proven that they possess the skills, analytical thinking, and resilience necessary to excel. Beyond accuracy, success in finance also requires critical thinking, problem-solving, and the ability to manage complex situations— qualities that women have demonstrated time and time again in various aspects of life. Women are not only capable of succeeding in finance; they are leading the way in many areas of the industry. Yes, it’s challenging, but it’s absolutely feasible!

What’s your one piece of advice for young women looking to enter the world of finance?

Believe in your abilities and don’t be afraid to take risks. Surround yourself with mentors and a strong support system. The finance industry values expertise, and with the right mindset, there are no limits to what you can achieve!

Efi Panagiotou, is the founder and Managing director of Reconbees. She is a highly accomplished professional with a Bachelor’s and Master’s degree in Applied Mathematics. In addition to her academic foundation, she holds diplomas in Accounting, Programming, and Data Analysis, giving her a unique blend of expertise that combines financial acumen with cutting-edge technological skills. Her strong analytical abilities, honed over more than a decade of experience in the forex industry, allow her to approach reconciliation challenges with precision and innovation.

“ Remember that setbacks are a part of the journey—it’s how you learn and grow from them that makes all the difference.”

Share with us how your career journey started?

My career in the Forex industry began at IronFX in 2012, where I took my first managerial role as a Marketing Supervisor. After that, I transitioned to Orbex as a Marketing Manager, where I managed the daily operations of the marketing department, developing comprehensive marketing plans, and leading a team in executing various marketing projects. In 2016, I joined Tickmill Group as the Chief Marketing Officer, a role I held for over four years. My focus was on driving revenue through marketing initiatives and establishing the brand on a Global level, something I achieved with the help of incredible individuals within the marketing department. I then moved to M4Markets in 2020 as the Group Chief Marketing Officer, before taking on the role of Chief Marketing Officer in 2023 for a few financial services firms under Doo Group, where I continue to drive our marketing strategies and growth.

Could you share information on the services DOO Group is offering and the region it operates? Doo Group, founded in 2014 and headquartered in Singapore, is a global financial services organization with a core focus on FinTech. The group operates across a diverse range of sectors, including brokerage, wealth management, property,

payment & exchange, FinTech, financial education, health care, consulting, cloud and digital marketing, continuously providing the highest standards in each business line. We are committed to delivering comprehensive financial services and innovative solutions to clients across the globe.

In the financial services space, Doo Group offers online trading on a wide range of CFD products, including stocks, Forex, precious metals, commodities, stock indices, futures, and cryptocurrencies. We also provide advanced copy trading services and access to top-tier trading platforms, such as MT4, MT5, and our proprietary platform. Our expanding partnership program features some of the industry’s most attractive IB commissions and rewards.

What’s DOO Group’s unique selling point and how do you differentiate from the competition?

Doo Group stands out in the global financial ecosystem due to its extensive portfolio of over 20 regulatory licenses, granted by some of the world’s most influential financial authorities. This regulatory strength, combined with our unique interconnected business model, allows us to continuously innovate and evolve, positioning us at the forefront of the industry.

Our diversification strategy enables us to respond more effectively to market demands, improve product quality, streamline processes, and enhance production speeds, keeping us competitive and resilient in a fast-changing market landscape.

A key differentiator is our exclusive partnership with Manchester United as their Official Online Financial Trading Platform Partner. This collaboration underscores our commitment to excellence, teamwork, and resilience, values that we share with the club and that are central to our continued success.

How have investor needs evolved through the years?

Can you share your insights?

Investors today are more tech-savvy and demand greater access to data and insights to make informed decisions. The growing trend is towards digital tools, and investors expect fast, responsive platforms that offer real-time market analysis. Additionally, there’s been a shift towards greater transparency, lower costs, and more educational resources. People are looking for both empowerment and personalized experiences and this is an area we heavily invest in.

8th of March is Women’s Day. What does this stand for you?

For me, International Women’s Day is a time to reflect on the importance of women in leadership roles and to recognize the impact they have in driving entrepreneurial and business excellence. Women bring unique perspectives, resilience, and collaboration to the table. Achieving success in any industry is about continuous growth, breaking barriers, and supporting each other. Women’s contributions are vital to business innovation and leadership, and we should celebrate these achievements every day.

How do you see the business-motherhood balance?

Balancing business and motherhood is all about setting priorities and maintaining a strong focus on goals. It’s not always easy, but it’s about managing time effectively and sticking to a plan. Flexibility is key, and I think finding the right balance between work and family is something that evolves over time. It’s important to give yourself grace and know that there will be times when one area needs more attention than the other.

What’s your one piece of advice for young women looking to have a career?

My advice would be to stay true to yourself and follow your passion, but also be willing to learn, adapt, and take risks. Don’t be afraid to ask for help or seek mentors along the way, as their insights and experiences can be invaluable. And, importantly, remember that setbacks are a part of the journey—it’s how you learn and grow from them that makes all the difference.

What’s coming up next for DOO Group?

At Doo Group, we’re gearing up for some exciting advancements to enhance our global footprint. We’re preparing for a brand transformation and introducing new products and services that will provide even greater value to our clients. Additionally, we are focusing on expanding our reach by acquiring new licenses and diversifying into new business lines across various sectors. We are never complacent. We continuously monitor market trends and the broader environment, actively listen to our clients’ feedback, and innovate to develop solutions that truly meet their evolving needs.

Marilena holds a degree in Marketing and Advertising and a Master’s degree in Public Relations & Communication from La Salle University in Philadelphia. With over 12 years of hands-on experience, she has successfully planned and executed marketing campaigns that drive revenue and enhance brand visibility for renowned global companies. Since 2012, Marilena has specialized in the financial sector, holding key marketing positions at leading financial firms such as Tickmill and M4Markets. As the Chief Marketing Officer for various Doo Group brands in the financial services industry, she is responsible for developing, implementing, and overseeing the strategic marketing initiatives that support business growth and brand development.

How did your entrepreneurship journey start?

Wellness and self-care have always been true passions of mine, and when I became self-employed, I realized that I needed it more than ever. Through a lot of experimentation (and burnout), I have found self-care to be a real game changer for my physical and mental health, and my overall happiness.

As entrepreneurs, and women in general, we often feel like we need to be everything for everyone at all times, and this is completely exhausting. Setting boundaries in your business isn’t always easy, but it’s key to taking care of yourself. This is how my journey started, my passion for wellness and providing a service that will support and boost women’s morale.

“

Our aim is to establish longevity and have fast connection, easy payments and a proper CRM.

Could you share information on the services you offer at Aether and how fintech and payment solution technology is important?

Aether Beauty Center covers a range of wellness treatments to support each woman’s needs. Being a small-to-medium sized SME merchant, technology and especially payment solutions (PSPs) is critical in our industry to maintain a professional relationship with our clients.

Our aim is to establish longevity and have fast connection, easy payments and a proper CRM.

How did your entrepreneurship journey start?