The Most Promising Fintech Startups Pathfinder 2023

Table of Contents Foreword 3 Methodology 5 Fintech Market at a Glance 7 Top 10 Countries 9 The Most Promising Fintechs 100 Global List 11 The Most Promising Fintechs in Europe 21 The Most Promising Fintechs in North America 25 news@financialit.net

Foreword

Who will be who?

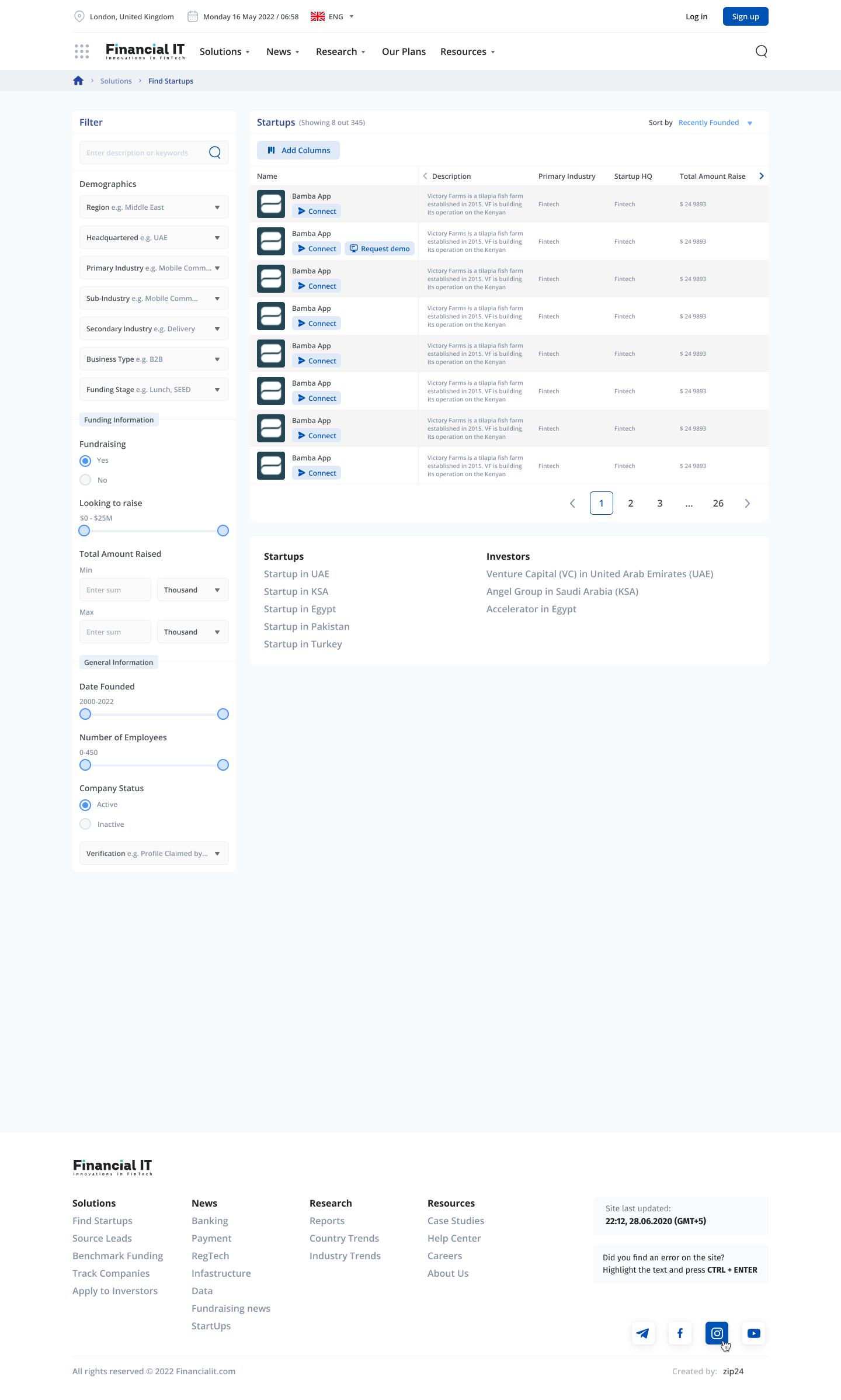

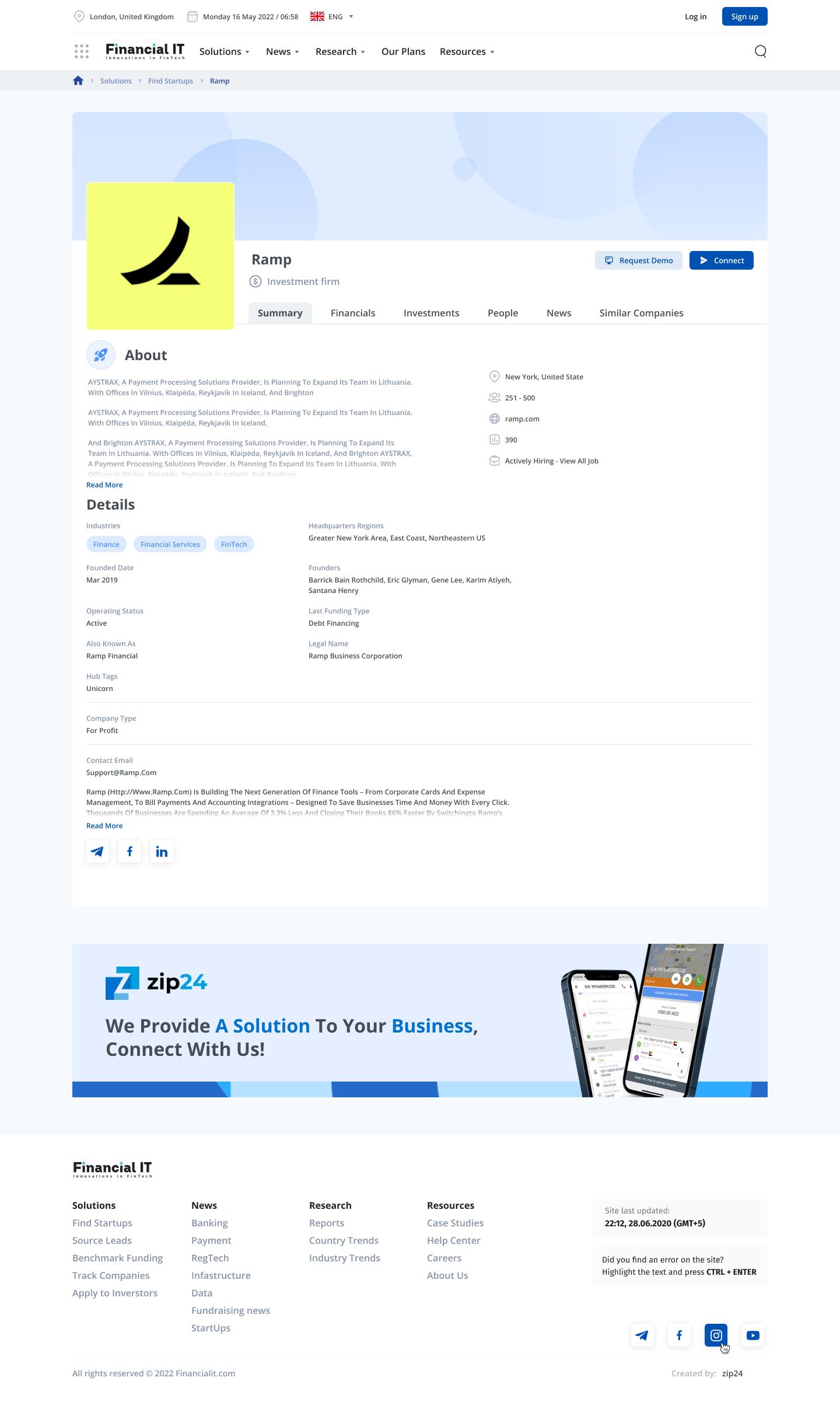

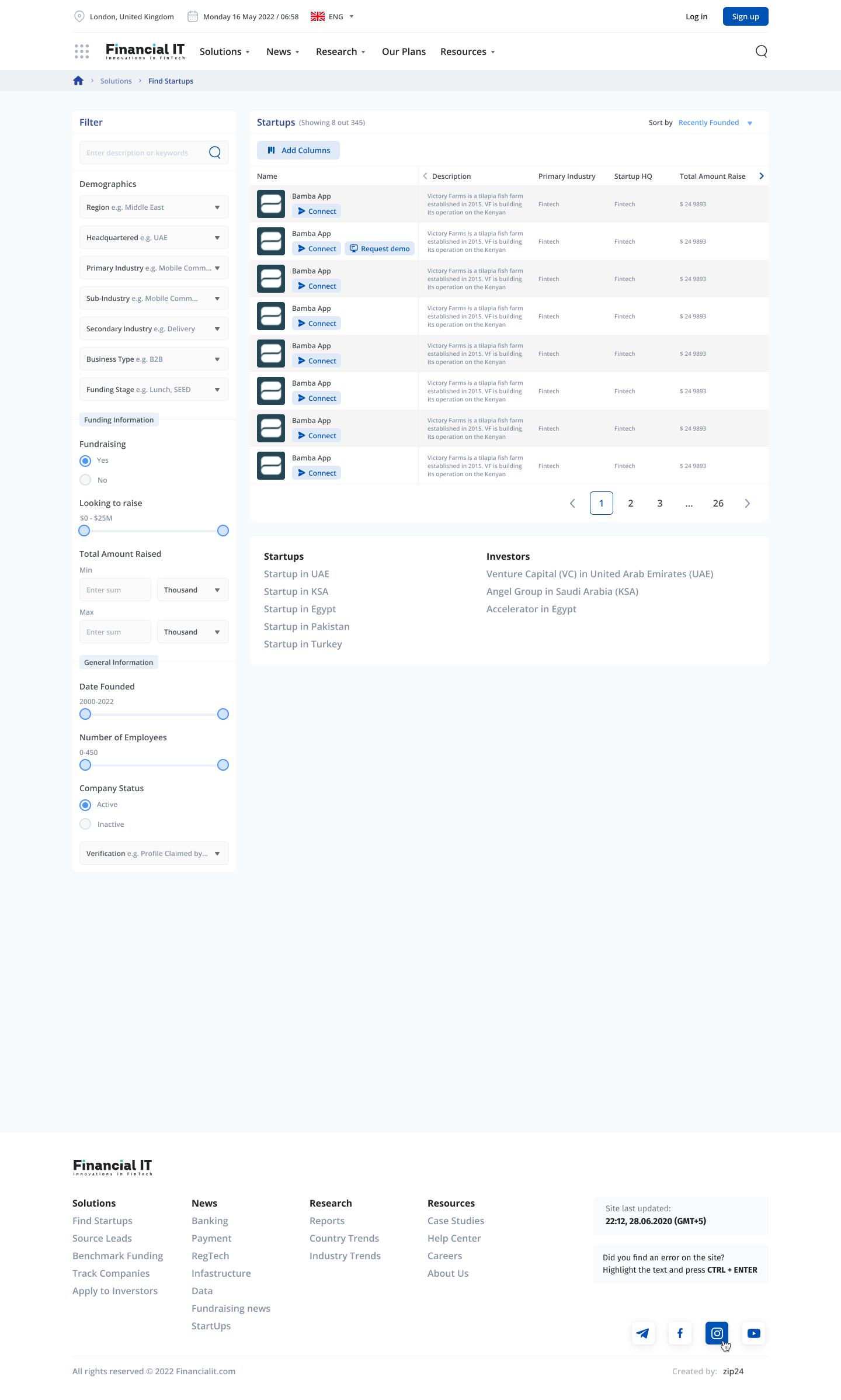

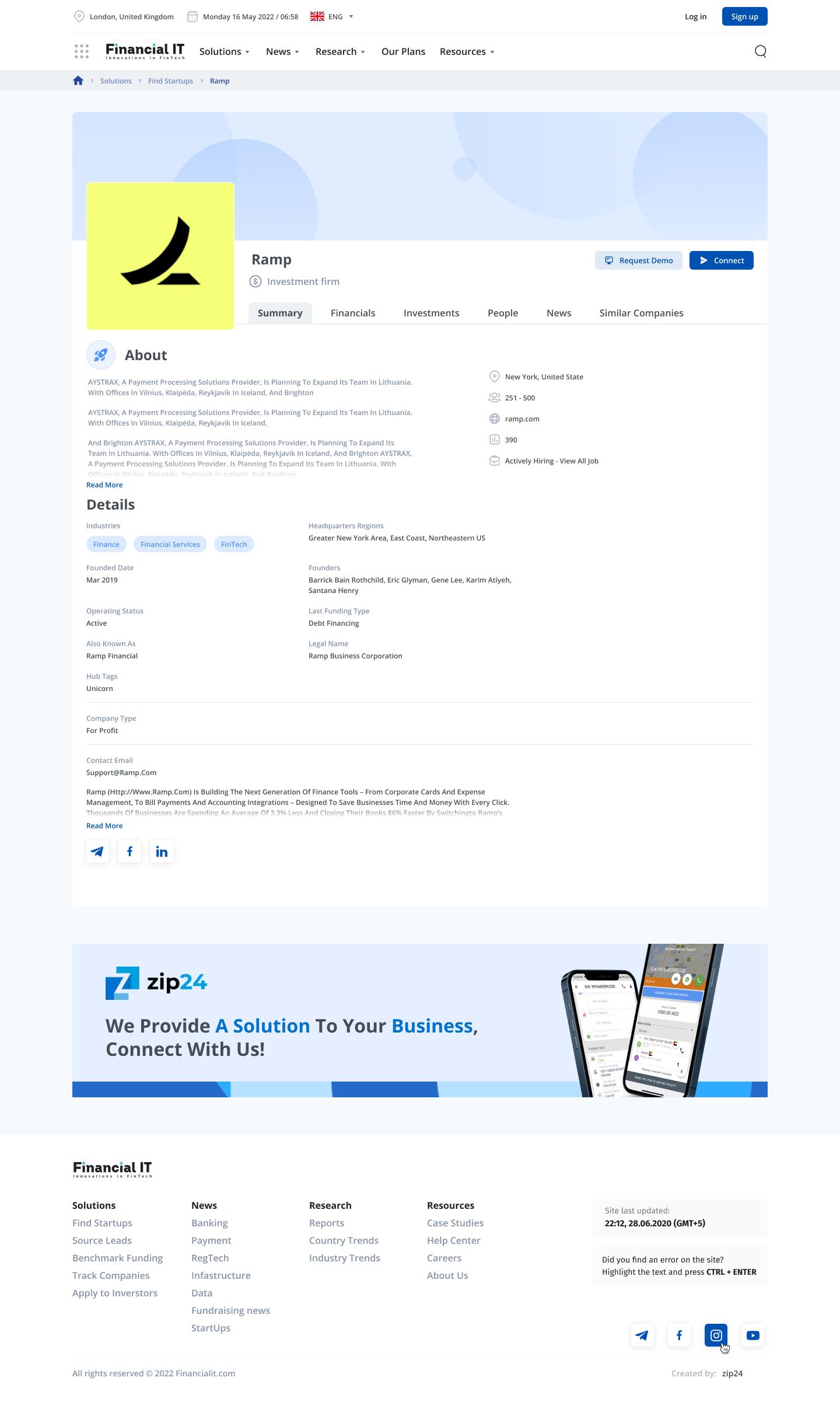

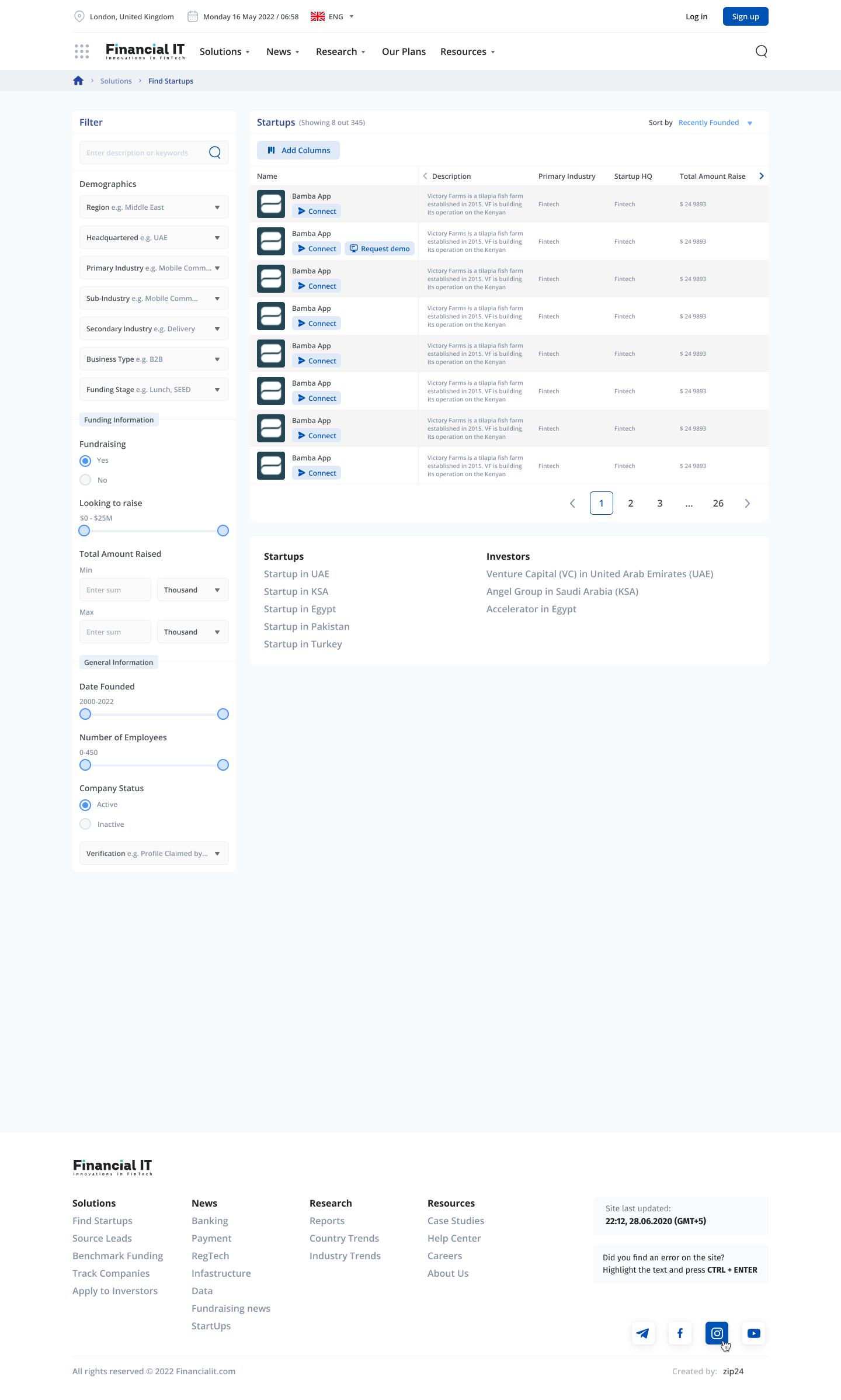

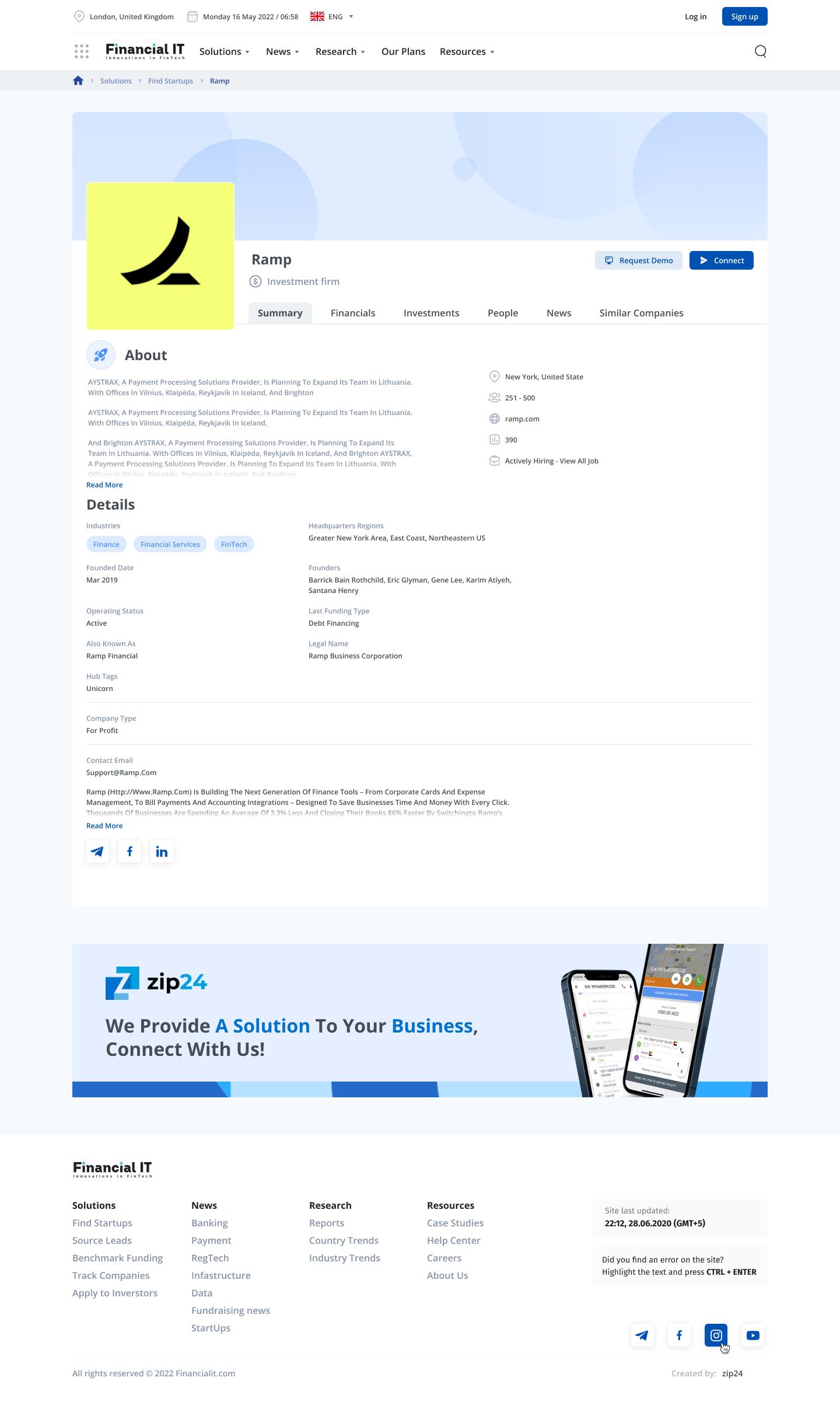

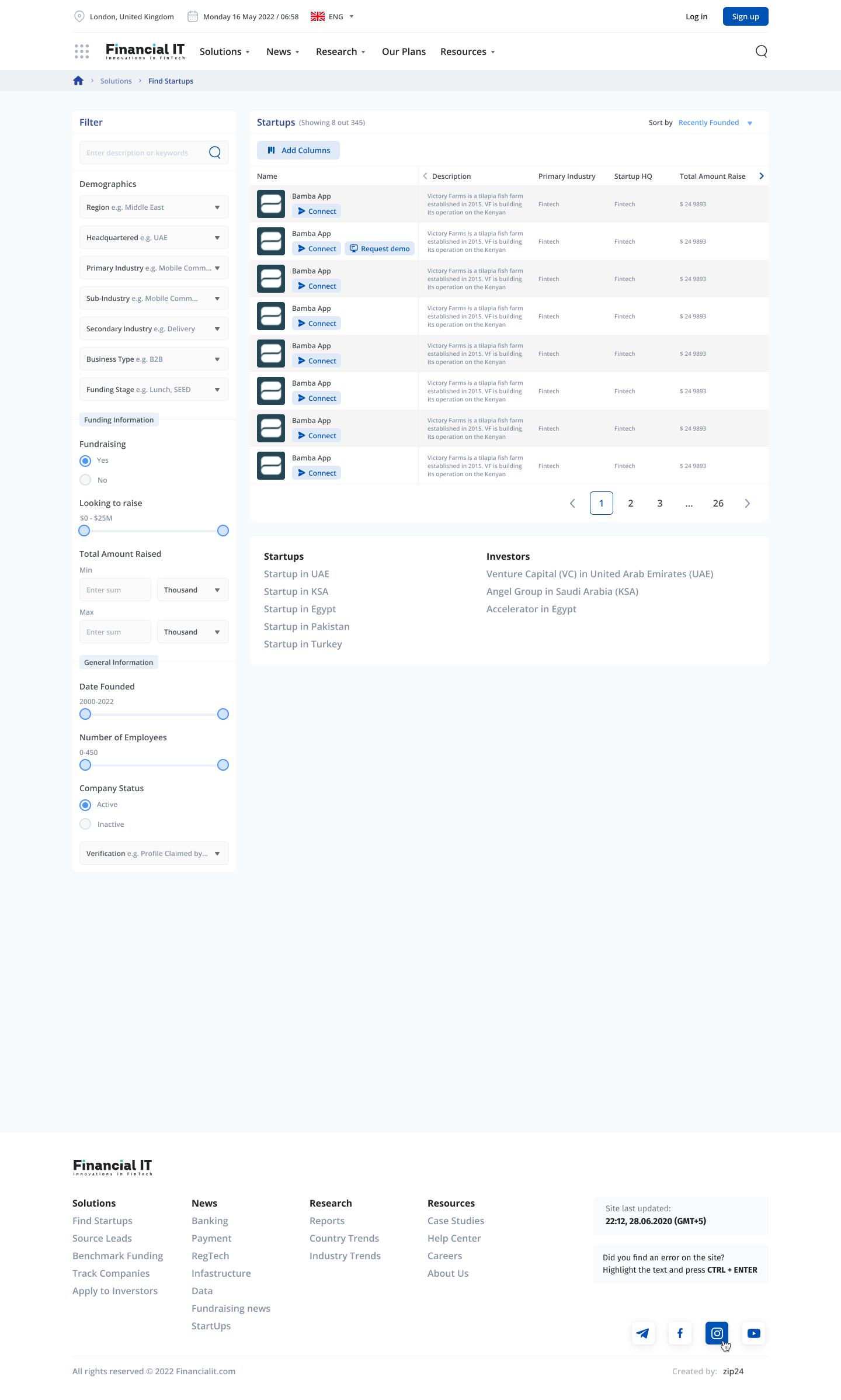

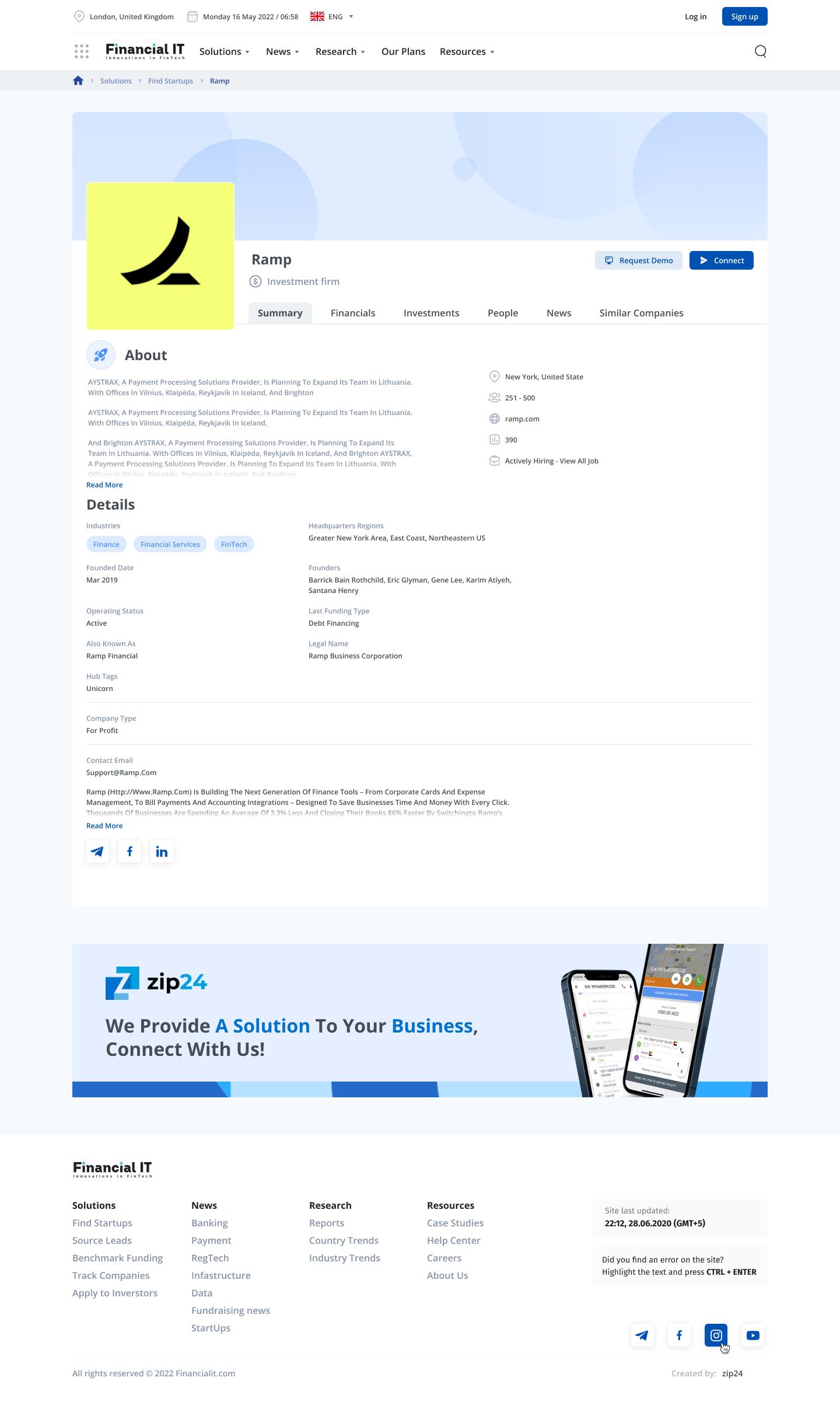

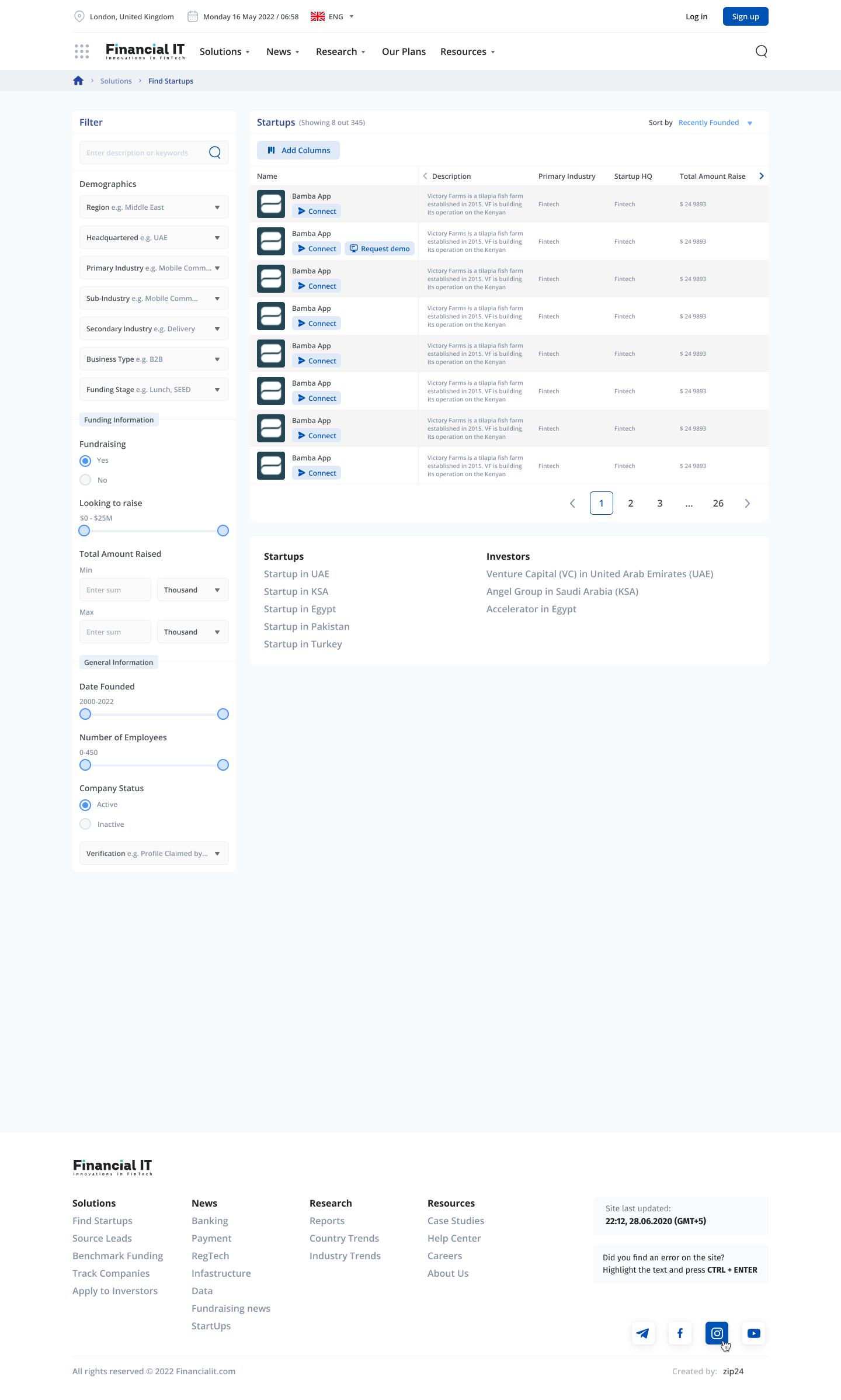

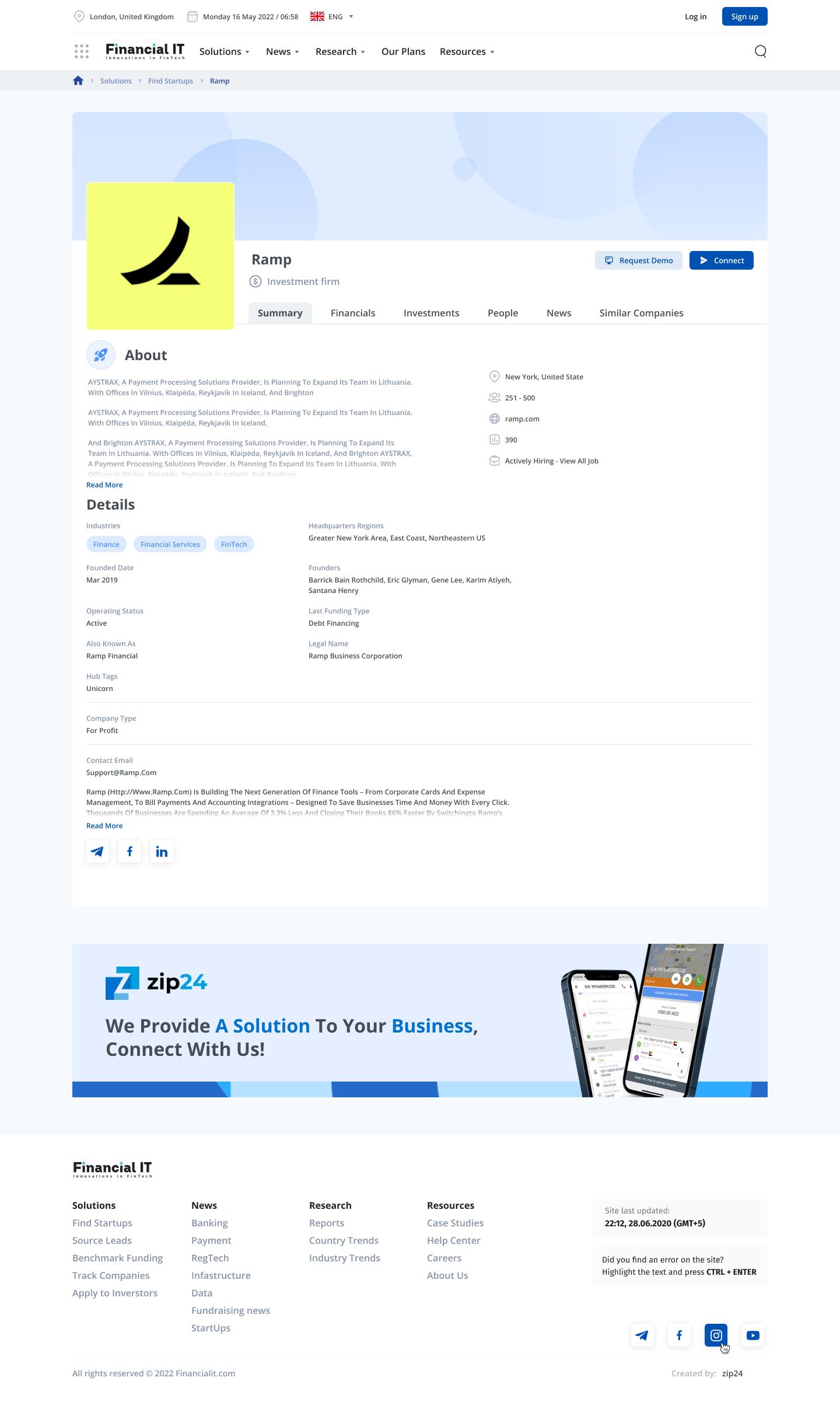

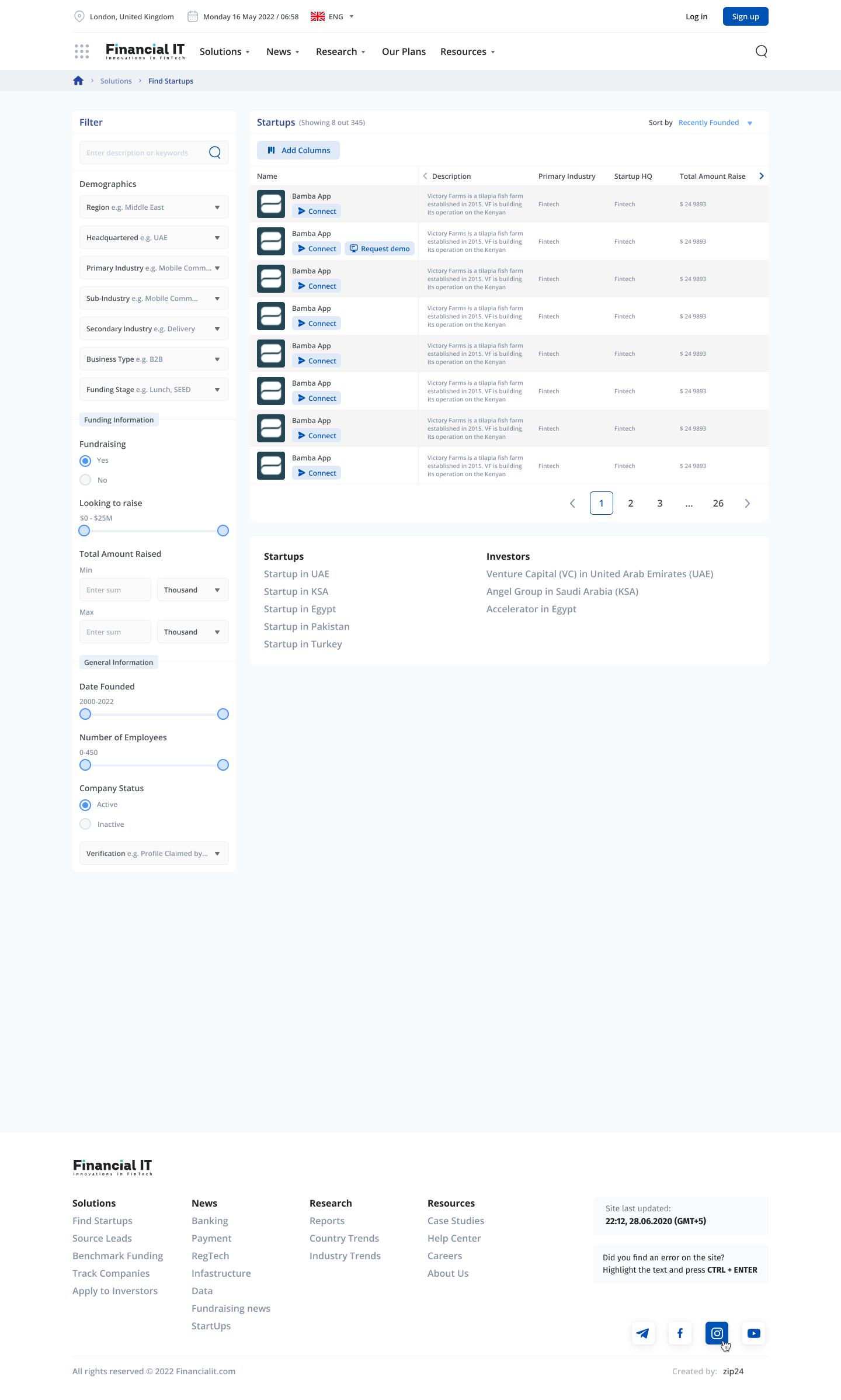

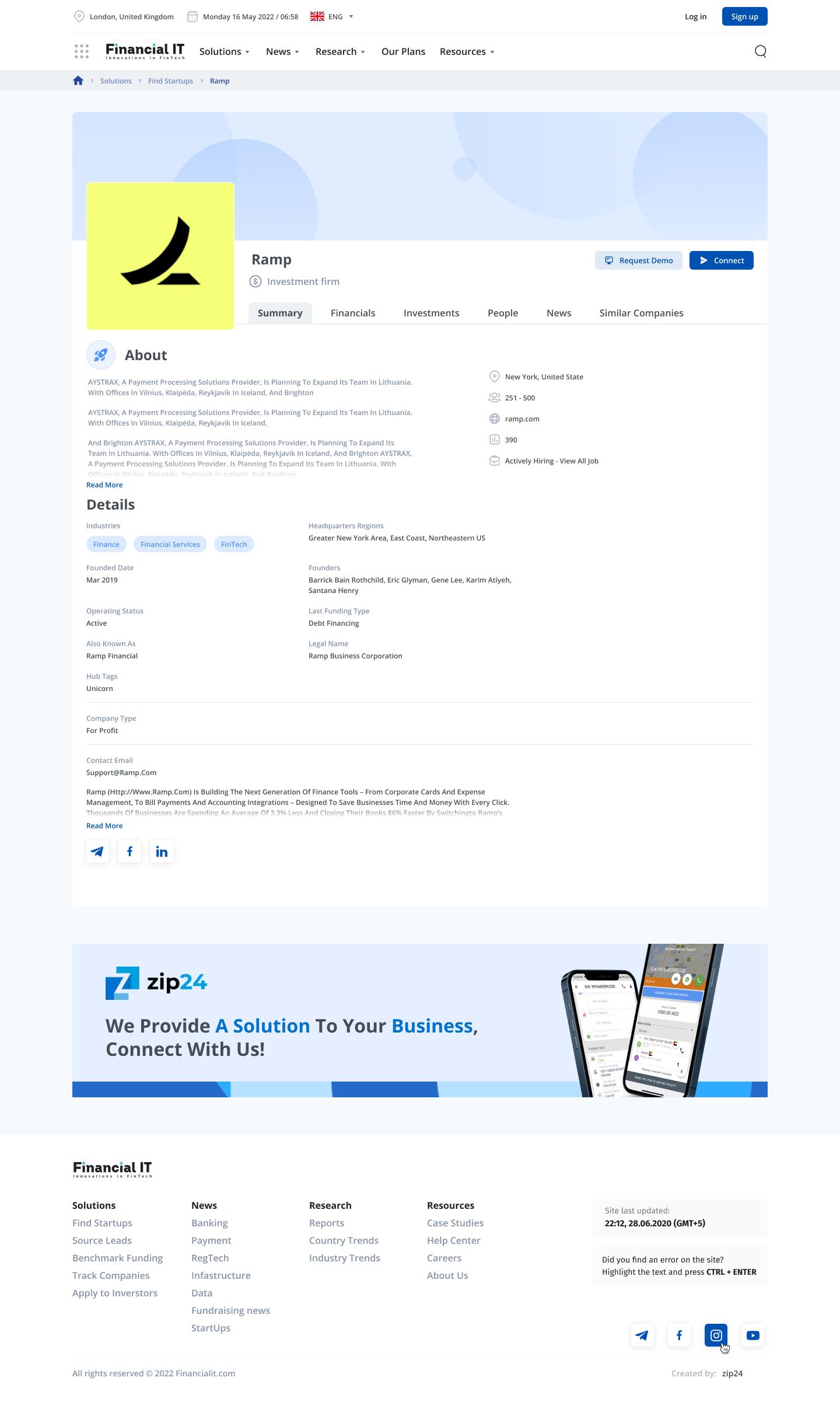

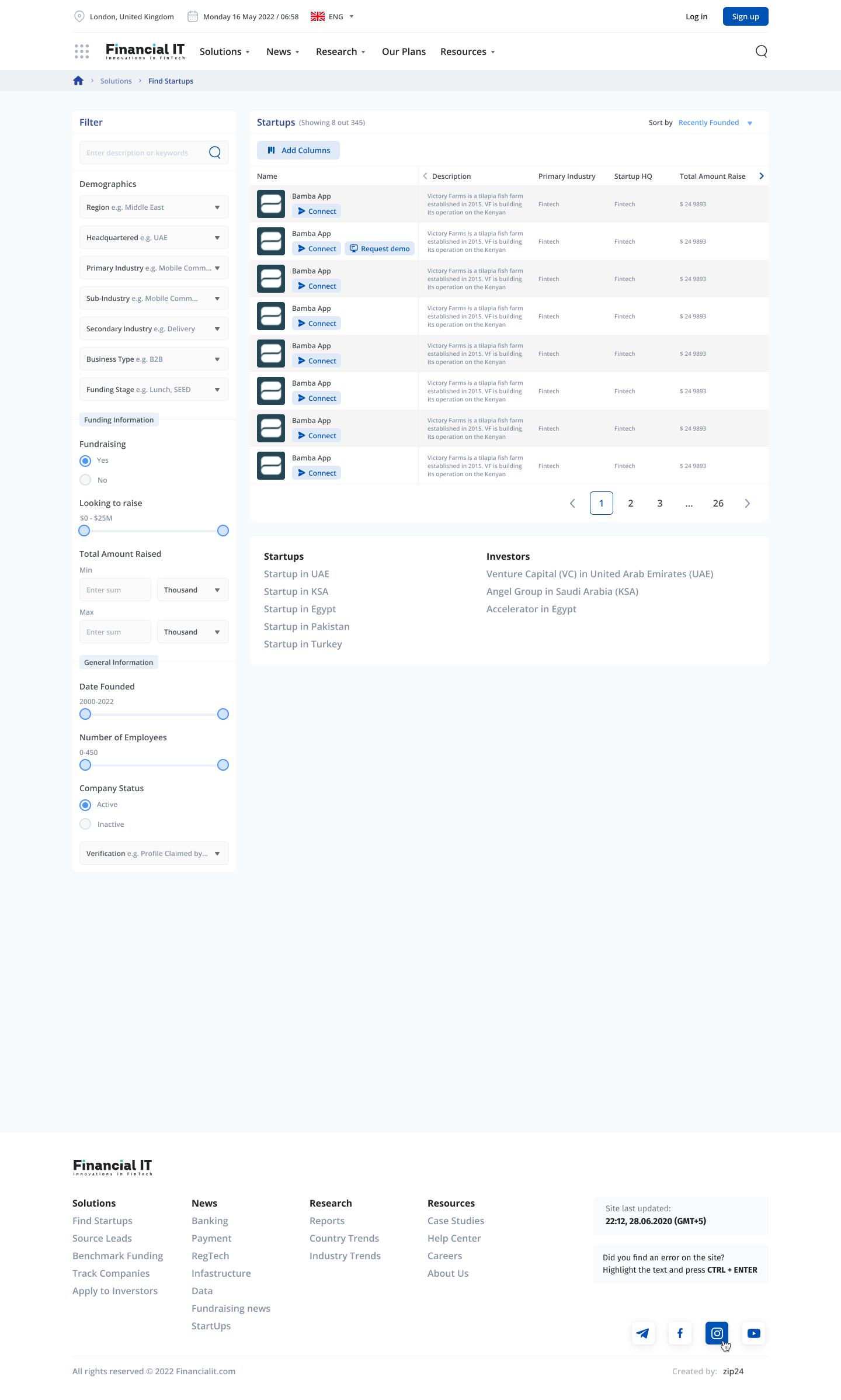

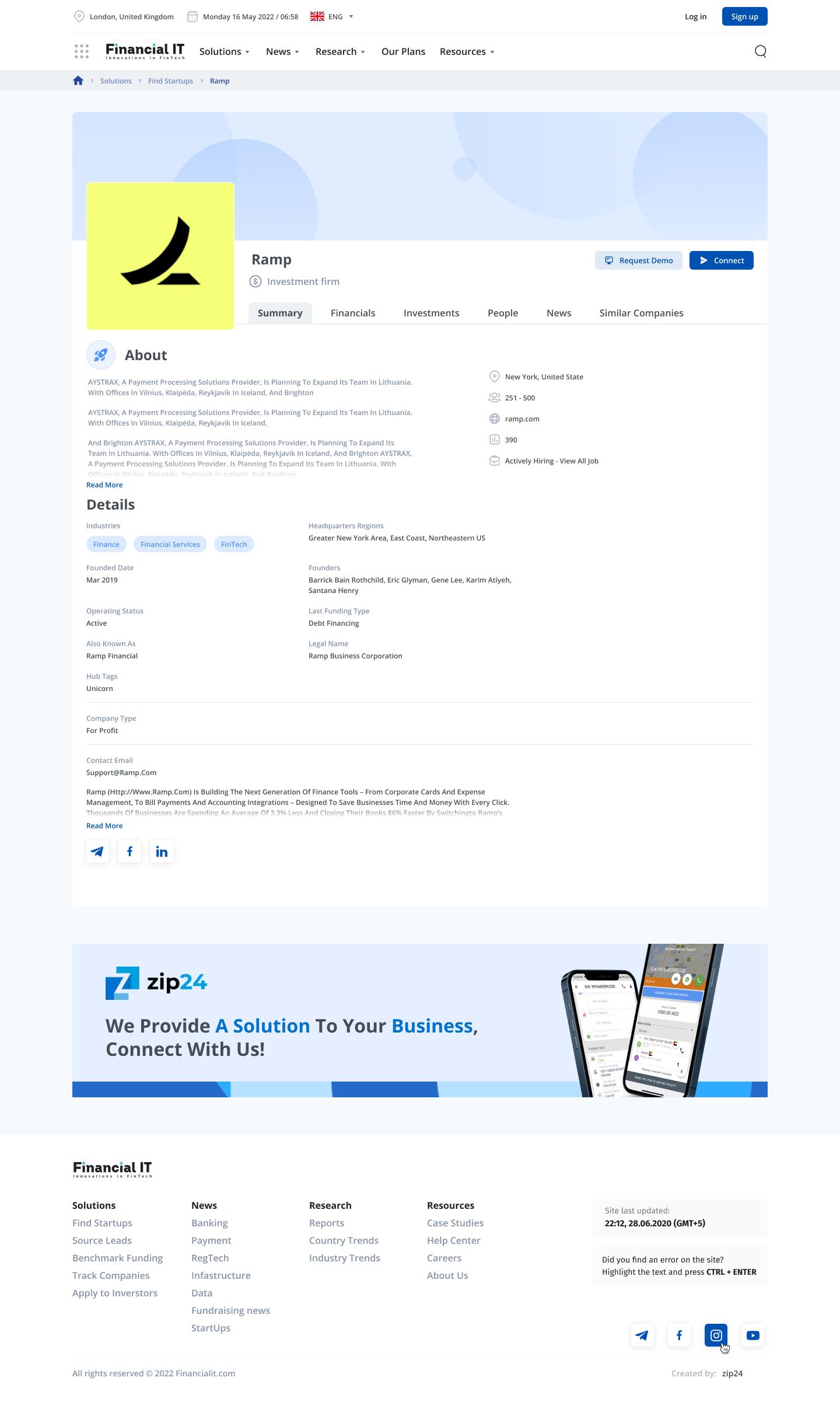

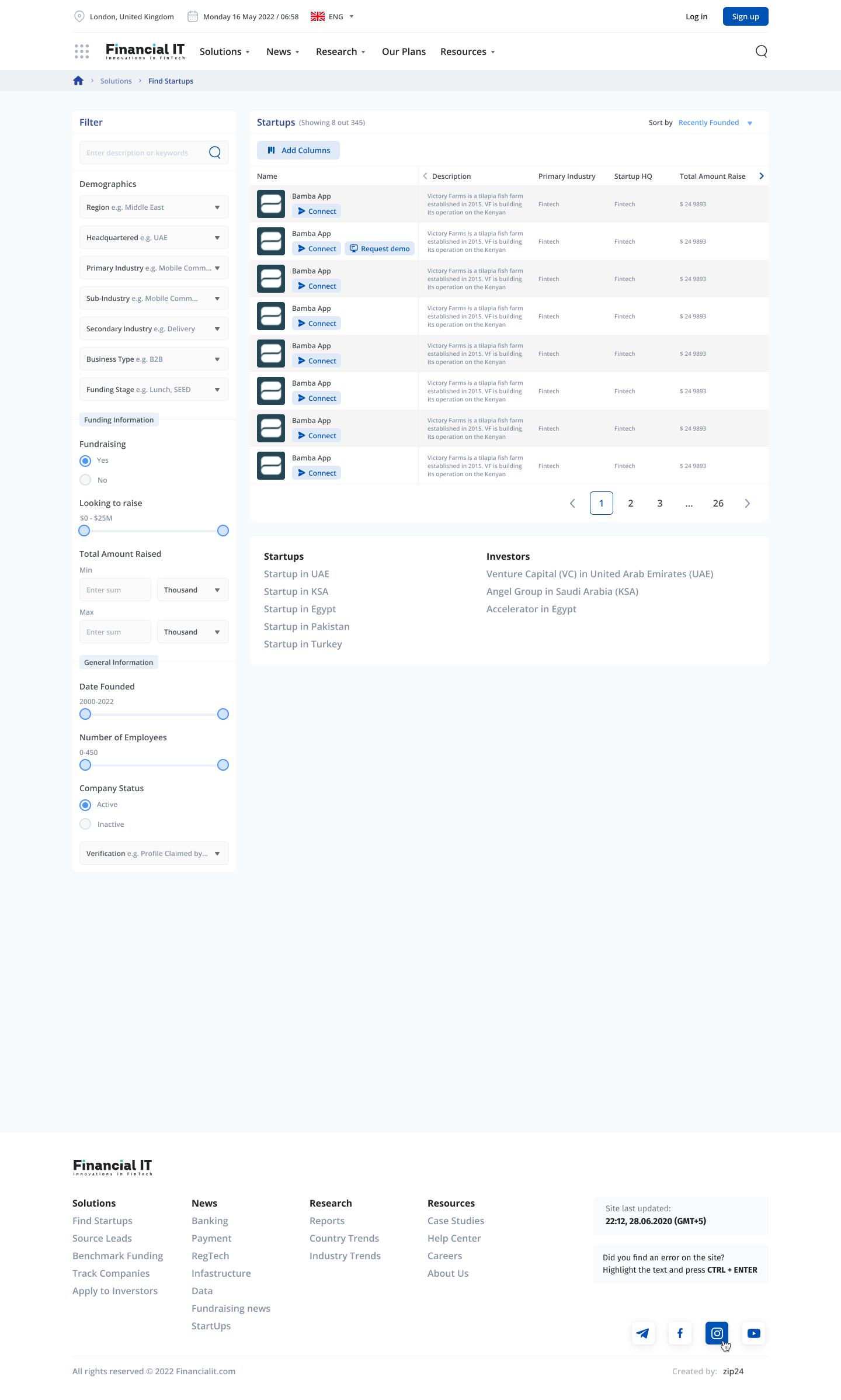

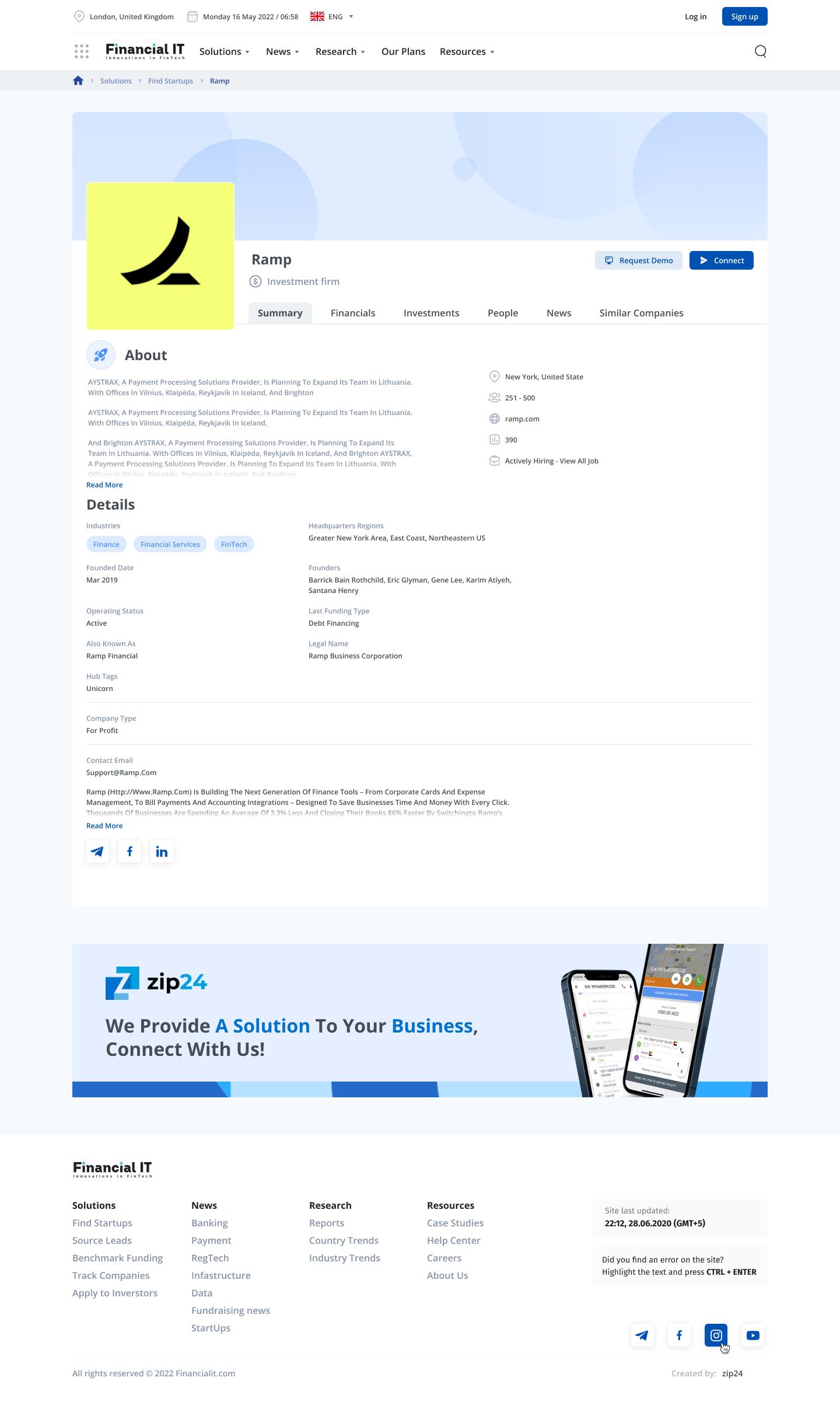

Welcome to the Fintech Pathfinder, an interactive database of fintech start up companies that has been compiled since mid-2021 by Financial IT’s research team.

Saving time and money

The database serves several functions.

Most obviously it seeks to make it cheap and easy for subscribers to find out key details about emerging fintech companies around the world. Specifically, the Fintech Pathfinder identifies for each company:

The timing and the amount of the latest funding round

Total funding received from Venture Capital (VC) funds and other ‘angel’ investors since its establishment

The number and identities of the lead investors

The total number of investors

Estimated overall valuation of the company

The contact details (e-mail, website and LinkedIn page)

The year in which it was founded

The city where it is based

The broad line of business in which the company is active

The company’s own description of itself

Its size in terms of number of employees

Its estimated annual revenue

The number and names of the founders

Its funding stage

The total number of funding rounds.

3 The Most Promising Fintech Startups Pathfinder 2023

Identifying where the action will be

As we explain in the description of the methodology, the Fintech Pathfinder only includes companies that meet certain criteria. Of these criteria the most important are that the company is unlisted and that it is no more than 10 years old.

Of particular importance are the funding rounds that have taken place in the last two years. How much has been raised in each of the various rounds that may have taken place? What has been the period between the various rounds? How large is the funding relative to the appraised overall valuation of the company?

Other things being equal, a company that has completed several funding rounds in rapid succession, and which has raised sums that are substantial relative to the assessed value, is one where the investors and the managers perceive that there are good opportunities for the company in the coming two years or so.

Conversely, a company that has not completed any funding rounds in the last two years may be one where opportunities are seen as being less exciting.

A company that is in the first group is, therefore, one that may evolve and grow rapidly over the coming two years. At very least, it is very probably a fintech to watch.

The mainstream and financial media do a good job of discussing fintech companies that have become substantial and (usually) listed businesses.

The rankings that can be produced from the Fintech Pathfinder show whereaccording to insiders - the action is most likely to take place in the future.

The Fintech Pathfinder is not really about the question, within the world of fintech, of Who is Who? It deals with the question of Who will be Who?

4 The Most Promising Fintech Startups Pathfinder 2023

Methodology

Highlighting the names that people don’t know…yet

Defining the universe

Fintech is - obviously - a portmanteau of Finance and Technology. It is frequently used to refer to new(ish) companies that use technology to perform the functions that would previously have been undertaken by an established bank, insurance company or other financial institution.

Typically, the idea is that the technology provides the new company with a competitive edge in terms of lower cost, greater flexibility, innovative distribution, attractive product or whatever. The new companies, usually with some reason, are often described as being ‘challengers’ or ‘disruptors’.

However, it is wrong to think of fintech companies as being naturally and automatically in competition with incumbent players. Frequently, the fintechs are developing or providing technology that can be used by the established companies.

Major consulting firms - and others - have done a good job of defining the size of the universe of fintech and identifying transactions that have taken place. For instance, KPMG’s latest Pulse of Fintech report, which was published in February 2023, suggests that total investment in fintech (including situations where companies are listed) over the course of last year amounted to $164.1bn. There were 6,006 deals, of which 5,136 involved investment by VC funds. VC investment in fintech in 2022 amounted to $80.5bn, or almost half of the total: much of the remainder was accounted for by merger and acquisition (M&A) activity.

5 The Most Promising Fintech Startups Pathfinder 2023

Following the money

Th basic assumption that is mad in th compilation of th databas is that th manag rs of and th inv stors in th fint ch compani s hav th b st und rstanding of th compani s prosp cts

If a funding round has b n compl t d in th last two y ars, that is a good sign

If a funding round in th last two y ars has b n follow d rapidly by anoth r funding round, that is an additional good sign

If th amounts rais d in th funding round(s) ar substantial r lativ to th ass ss d valu of th fint ch company, that is a particularly good sign. [NB th ov rall valuations of th fint ch compani s in th Fint ch Pathfind r sampl can g n rally b inf rr d from public comm nts mad at th tim of th funding round(s). In som instanc s, it has b n n c ssary for our r s arch rs to inf r th valuations using oth r m thods.]

Ev ry ranking that is produc d from th databas will cl arly id ntify what it shows. Most commonly, th rankings will id ntify thos compani s that hav compl t d at l ast on funding round in th last two y ars and wh r th amount(s) rais d ar substantial r lativ to th ass ss d valu of th company.

Th compani s in th Fint ch Pathfind r databas ar div rs in t rms of th ar as in which th y op rat . As of May 2023, th numb rs of compani s in th databas w r as follows:

Accounting -

Blockchain/ Cryptocurrency - 324 Payments - 650 Banking - 330 Insurance - 212 Finance - 145 Lending/ Credit - 308 Wealth Management - 150 RegTech - 350 6 Th Most Promising Fint ch Startups Pathfind r 2023

90

Global Fintech Market at Glance

The importance of fintech startups stems from their ability to disrupt traditional financial services and offer consumers more accessible, affordable, and convenient financial products and services.

The global fintech investment took a dip in 2022, decreasing from the previous year's record high of $238.9 billion invested across 7,321 deals to $164.1 billion invested across 6,006 deals in 2022. Despite this, some areas of the fintech sector showed resilience. The payments sector remained the strongest area of fintech investment globally, with $53.1 billion invested compared to $57.1 billion in 2021. Regtech was the only sector to experience growth, with investment in the space rising from $11.8 billion in 2021 to a record $18.6 billion in 2022. However, investment in crypto and blockchain experienced a decline, falling from $30 billion in 2021 to $23.1 billion in 2022, with a particularly sharp drop in the second half of the year following increased scrutiny in the space.

The decrease in global fintech investment was also evident in the drop in M&A deal value from $105.1 billion in 2021 to $73.9 billion in 2022, and global VC investment declining from $122.9 billion to $80.5 billion year-over-year. However, PE growth investment fell less sharply, decreasing from almost $11 billion in 2021 to $9.7 billion in

1https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2023/02/pulse-of-fintech-h2-22-web-file.pdf

2 https://kpmg.com/ie/en/home/insights/2023/03/fintech-investment-down-by-over-a-third-in-2022.html

7 The Most Promising Fintech Startups Pathfinder 2023

2022. Geographically, the Americas attracted $68.6 billion across 2,786 deals in 2022, with the US accounting for $61.6 billion across 2,222 deals, while the Asia-Pacific region attracted $50.5 billion across 1,227 deals, and EMEA attracted $44.9 billion across 1,977 deals.

Although the outlook for fintech investment in H1'2023 is subdued, there is optimism heading into the new year. The report suggests that investors will opt for safer investments, leading to rising M&As among established, larger organisations. Although corporate-participating VC investment globally fell from $62.8 billion in 2021 to $39.6 billion in 2022, the median deal size rose for angel and seed-stage deals (from $1.8 million in 2021 to $2.4 million in 2022) and early-stage VC deals (from $5.75 million to $6 million), while falling for laterstage VC deals (from $15 million to $13.9 million).

Despite the decline in investment, experts in the industry remain optimistic about the future of fintech. While the decrease in investment may indicate a slowing down of the sector, it is important to note that fintech is still a growing market with significant potential. Additionally, the pandemic has accelerated the adoption of digital payments and other fintech services, making the industry more relevant than ever. Therefore, many experts predict that fintech will continue to be a hub of innovation and investment in the years to come.

https://www.zawya.com/en/business/fintech/fintech-investment-in-emea-drops-sharply-to-449bln-in-2022-gqogn

https://assets.kpmg.com/content/dam/kpmg/sg/pdf/2022/09/pulse-of-fintech-h1-22-updated.pdf

8

Source: Statista

The Most Promising Fintech Startups Pathfinder 2023

Revenue of fintech industry worldwide from 2017 to 2027

Global Startup Pathfinder Map

Demographics

The financial technology (fintech) industry has brought about a revolution in the way we manage our finances and access financial services. Driven by technological advancements and increasing demand for innovative solutions, the fintech industry has been experiencing rapid growth globally in recent years. The current section demonstrates continents and countries that are leading the fintech innovation race, with a particular focus on the number of startups in each market. This section explores the distinct strengths and opportunities of each market, ranging from established fintech hubs such as the United States and the United Kingdom, to emerging markets like India and China, and what sets them apart from one another in the global fintech landscape.

Top Industries

The rise of fintech has led to the emergence of various sub-sectors, each with its own unique set of challenges and opportunities. This section will delve into the top 10 fintech segments that are shaping the global financial landscape.

Top 10 Industries

9

Payments-650 RegTech-350 Banking-330 Blockchain/Cryptocurrency-3 4 Lending/Credit-308 InsurTech- 1 WealthTech-150 Finance-145 Accounting-90 The Most Promising Fintech Startups Pathfinder 0 3

Global Startup Pathfinder Map

United States-850 157 United Kingdom-330 34 India-190 24 Singapore-105 7 Canada-90 11 Germany-96 10 France-66 12 China-60 18 Switzerland-55 3 Brazil-50 7 North America Latin America Europe Middle East Africa Asia Australasia 945 800 133 520 56 60 114 Top 10 Countries

100 Most Promising Startups

In addition to our 2023 Fintech Ranking lists, there have also been identified the year's breakthrough companies. These companies demonstrate how even small steps into the fintech market with minimal funding can lead to significant success. Rather than focusing solely on valuation, there was consideration of the difference between the first funding round and the most recent one, with a short period of time between them. Financial IT Pathfinder: Year's Highlights section acknowledges the efforts and contributions made by these companies

The Most Promising Fintech Startups Pathfinder 2023

The Most Promising Fintech

JPMorgan Partners (JPMP), Banking Competition Remedies, Tiger Global Management, American Express Ventures, PayPal Ventures, Capability and Innovation Fund, Index Ventures

12 Region Last Funding Amount № Total Funding Amount Estimated Valuation VCs/ Investors Colombia/Latin America $80M 1 $376.3M $700M

Payments GIC, Goldman Sachs, Greycroft, Union Square Ventures, Quona Capital, Andreessen Horowitz 2 $100M $118.9M $500M WealthTech France/Europe Greenoaks Capital, Partech, BlackFin Capital Partners United Kingdom/ Europe $105.87M 3 $345M $528—792M

Banking TCV, British Business Investments, Atalaya Capital, Warwick Capital LLP Singapore/ Asia $100M 4 $299.5M $400—600M

Banking Lightspeed Venture Partners, Sequoia Capital, Fasanara Capital, MassMutual Ventures Southeast Asia (MMV SEA), Y Combinator United States/ North America $75M 5 $257M $310—465M

Payments Elad Gil, General Catalyst,sanem fabri, Bloomberg Beta Israel/Middle East $350M 6 $436.5M $224 336M Payments Viola Credit

, Forerunner Ventures, Ribbit Capital United Arab Emirates/ Middle East $20M 7 $25.1M $80—120M Finance Valar Ventures United Kingdom/ Europe Undisclo sed 8 $102M $320—480M Banking TransUnion, TDR Capital, Goldman Sachs, HSBC, Banco Sabadell, Outward VC United States/ North America $40M 9 $50M $160 240M Payments Activant Capital, Accomplice, Greycroft, Pear VC United Kingdom / Europe $80M 10 $137.5M $500M RegTech Sofina, EQT Ventures, TriplePoint Capital, Balderton Capital, LocalGlobe United Kingdom / Europe $100M 11 $176.8M $400 600M Payments

Company Industries

Startups Pathfinder 2023

13 Brazil/Latin America $100M 12 $254.8M $464—696M Banking Greenoaks Capital, Ribbit Capital, Kaszek Mexico/Latin America $200M 13 $521.3M $168—252M Lending/ Credit FIRA, Credit Suisse, GS Growth, Point72 Ventures, Goldman Sachs, Kaszek, Elevar Equity United States/ North America $100M 14 $123.3M $400-600M InsurTech Anthemis Group, Brewer Lane Ventures, ManchesterStory Group United States/ North America 45M 15 $84.2M $180—270M RegTech Third Point Ventures, Felicis Ventures, Cloud Apps Capital Partners Israel/Middle East $50M 16 $103.5M $200-300M RegTech Qumra Capital, Zeev Ventures, Innovation Endeavors, Vertex Ventures, Vertex Ventures Israel Côte d'Ivoire/ Africa $14M 17 $15M $56—84M Banking Enza Capital, Oikocredit International, Partech, Y Combinator United States/ North America $10M 18 $27.7M $80M LegalTech/ Finance Coatue, Felicis, Andreessen Horowitz India/Asia $54.5M 19 $90M $232-348M Payments PayU, Fosun RZ Capital, PayU, Ruizheng Investment, Temasek Holdings India/Asia $38M 20 $42.9M $150-230M Payments Elevation Capital, Sequoia Capital India, Sequoia Capital India, Venture Highway, Y Combinator Singapore/Asia $5.3M 21 $179.4M $300-450M Banking Mitsubishi UFJ Financial Group, Lendable, B Capital Group, Insignia Ventures Partners, DST Global, Tiger Global Management, Y Combinator India/Asia $17M 22 $136.6M $545M Banking Alpha Wave Global, B Capital Group, Ribbit Capital, Sequoia Capital India/Asia $65M 23 $141M $260-390M Lending/ Credit Norwest Venture Partners, Faering Capital, Sequoia Capital India Chile/Latin America $39M 24 $54.9M $156—234M WealthT ech Sequoia Capital, Kaszek

Pathfinder 2023

The Most Promising Fintech Startups

The Most Promising Fintech Startups Pathfinder 2023

14 United States/ North America $60M 25 $75.2M $240—360M Banking Sequoia Capital Australia/ Australasia $15.46M 26 $30.9M $60—89M RegTech AirTree Ventures, Greycroft, Tidal Ventures United Arab Emirates/Middle East $20M 33 $22M $80-120M Payments Signal Peak Ventures, Emkan Capital, Mad'a Investment Company, MetLife Foundation Australia/ Australasia $35M 32 $57.3M $140—210M Accountin g/ payments AirTree Ventures, Left Lane Capital, EVP $40M $58.7M $160—240M Payments Brazil/Latin America 31 Kaszek, QED Investors, Canary India/Asia $22.6M 35 $111.7M $300M Investm ent Tiger Global Management, Arkam Ventures, Tribe Capital, WEH Ventures, Tribe Capital India/Asia Undiscl osed 36 $10M $40—60M Finance Accel Atoms, StrongHer Ventures China/Asia $80M 34 $314.4M $340-480M Account ing Sunshine Insurance Group, Gaocheng Capital, Xiaomi, IDG Capital, Tendence Capital, China Soft Capital RegTech United States/ North America $40M 27 $56M $160—240M State Street, Blumberg Capital, LionBird, Team8 United States/North America $7.8M 28 $10.8M $31—47M Payments Contour Venture Partners Australia/ Australasia $35M 29 $39.6M $26—39M Lending/ Credit Global Credit Investments United States/ North America $45M 30 $88M $180—270M Banking Pendulum Holdings, Truist Ventures Indonesia/Asia $30M 37 $155M $300M Lending/ Credit Credit Saison, Quona Capital, East Ventures, Skystar Capital Sweden/Europe $206M 38 $281.9M $400-600M Banking Mubadala Capital Ventures, TriplePoint Capital, EQT Ventures, Cherry Ventures, Felix Capital

The Most Promising Fintech

15 Mexico/Latin America $90M 44 $257.5M $500M Banking General Atlantic, Prosus Ventures, Quona Capital, Arc Labs, STARTegy Ventures India/Asia $100M 41 $186.5M $600M Payments Moore Strategic Ventures, Tribe Capital, B Capital Group, Surge Payments Egypt/Middle East $38M 42 $47.1M $76-114M Quona Capital, Lendable, Village Capital, Algebra Ventures India/Asia $80M 43 $142.5M $490M Payments/ BNPL Brunei Investment Agency, Northern Arc, Trifecta Capital Advisors, Navi Technologies, iLabs Capital, Sistema Asia Capital, Vertex Ventures, Fosun RZ Capital, Endiya Partners, VenturEast Lithuania/Europe $65M 40 $78.9M $260—390M Payments Accel, OTB Ventures, Speedinvest, Startup Wise Guys Payments Israel/Middle East $50M 39 $70M $200—300M Oak HC/FT, Zeev Ventures, F2 Capital United Kingdom/ Europe $32.7M 45 $71.5M $132—198M Payments Karlani Capital, Rudy Karsan Nigeria/ Africa $55M 46 $91.6M $500M Banking Target Global, Valar Ventures United States/ North America $50M 47 $98M $200—300M RegTech Fin Capital, J.P. Morgan Asset Management, Canapi Ventures, Third Prime United States/North America $55M 48 $74.5M $220—330M Accounting Accel, Addition, New Enterprise Associates United States/ North America $60M 49 $123M $240—360M Payments Alpha Wave Global, Tiger Global Management, TLV Partners India/Asia $110M 50 $166.1M $440—660M Lending/ Credit PremjiInvest

, Elevation Capital, Norwest Venture Partners, International Finance Corporation, Lok Capital

Startups Pathfinder 2023

FIS Impact Ventures, PayPal Ventures, Highland Europe, Capability and Innovation Fund, Blenheim Chalcot, Frog Capital, Blenheim

16 Egypt/Middle East $31M 52 $42.1M $124—186M WealthT ech Arzan Venture Capital, CommerzVentures,

Partners

Partech, Sawari Ventures, 500 Startups, Dubai Angel Investors Nigeria/ Africa $15M 53 $17.6M $60-90M Payments Tiger Global Management, Entrée Capital, Y Combinator Germany/ Europe $85.04M 54 $150.2M $550M Account ing Tiger Global Management, Valar Ventures, Cherry Ventures Australia/ Australasia $32.5M 55 $57.5M $130—195M Payments Acorn Capital, Artesian VC, Commencer Capital, Mastercard, Westpac Tanzania/ Africa $10M 56 $10.2M $40—60M Payments Accel, Amplo, Bessemer Venture Partners, Y Combinator, DFS Lab India/Asia $30M 57 $164.3M $400-600M Banking Multiples, Accel, Lightrock,

Ventures, Tencent, Prime Venture Partners, Social Capital United States/ North America $35M 58 $170.5M $720M Banking GGV Capital

, Stripes, Valar Ventures, Crosslink Capital, DCU FinTech Innovation Center, Techstars Israel/Middle East $18M 59 $25.4M $72—108M InsurTech MoreTech Ventures, Disruptive AI Venture Capital, Kamet, Moneta VC, Phoenix Insurance Company United Arab Emirates/Middle East $22.5M 60 $36.1M $90-135M Payments Mashreq Bank, Shorooq Partners, DisruptAD Nigeria/ Africa $100M 61 $140M $400-600M Payments TRANSSION United Kingdom/ Europe $108M 51 $181.2M $438—657M Payments General Atlantic,

Chalcot

Startups Pathfinder 2023

Middle East Venture

(MEVP),

Horizons

The Most Promising Fintech

Kohlberg Kravis Roberts, GGV Capital, Mandiri Capital Indonesia (MCI), MDI Ventures, Telkomsel Mitra Inovasi, Indigo by Telkom Indonesia

Beams FinTech Fund, Creation Investments Capital Management, LLC, Tiger Global Management, Stride Ventures, Sequoia Capital India, growX ventures

M13,

17 Indonesia/ Asia $55M 65 $113M $220-330M Investment Accel, Square Peg Capital, Openspace, Go-Ventures Argentina/ Latin America $15M 66 $60M $175M Payments Tiger Global Management, Sequoia Capital

, Index Ventures, Monashees United States/ North America $107M 67 $176M $428—642M Banking FIS, Akkadian Ventures, Mercato Partners, OK Group United Kingdom/ Europe $50M 68 $73.4M $425M Payments ICONIQ Growth, Accel, Balderton Capital, Seedcamp Indonesia/ Asia $48M 69 $71.6M $192—288M RegTech

United States/North America $75M 72 $194.9M $300-450M Banking

Community Investment Management,

Inspired Capital Partners Israel/ Middle East $25M 71 $57M $100-150M Banking Migdal Insurance and Financial Holdings, OurCrowd, Viola FinTech, Moneta VC India/Asia $48.6M 70 $150.6M $600M Finance

DFJ Growth, Dragoneer Investment Group,

United States/ North America $50M 64 $77M $500M Payments GGV Capital, Coatue Egypt/ Middle East $50M 62 $68.5M $200-300M Payments Clay Point Investors,

PayPal Ventures, Global Ventures, FMO, A15 France/ Europe $57M 63 $98.12M $220-330M Account ing Sequoia Capital, Global Founders Capital India/Asia $35M 73 $49M $140—210M Lending/ Credit Elevar Equity, Elevation Capital The Most Promising Fintech Startups Pathfinder 2023

Kora,

18 Arab Emirates/ Middle East $15M 74 $24.9M $60-90M WealthT ech Mubadala, Kuwait Investment Projects Company, Shorooq Partners Hungary/ Europe $94M 75 $107.8M $383—575M RegTech Institutional Venture Partners, Institutional Venture Partners, Creandum, PortfoLion Capital Partners United Kingdom/ Europe Undisclosed 76 $89.8M $160—240M Investm ent Valar Ventures, Singular Australia/ Australasia $25M 77 $36M $100-150M Banking 1835i Ventures, NAB Ventures United Kingdom/ Europe $180M 78 $263.2M $360—540M Banking Temasek Holdings, Battery Ventures, Dawn Capital, Silicon Valley Bank, Accel United States/ North America $63M 79 $80.8M $252—378M Banking FTV Capital, Headline, Base10 Partners Australia/ Australasia $35M 80 $52.1M $140-210M WealthT ech NAB Ventures, Grok Ventures, Alium Capital, H2 Ventures United States/ North America $50M 81 $84.7M $200-300M Payments Insight Partners, SignalFire India/Asia $70M 82 $345M $750M Banking Abstract Ventures, Tencent United States/ North America $300M 83 $491.3M $400-600M Banking Evolve Bank & Trust, TriplePoint Capital, General Catalyst, Bridge Bank, Coatue, Stripe, Crosslink Capital South Africa/ Africa $21M 84 $27M $85-125M Payments The Spruce House Partnership, Firstminute Capital, Raba United Arab Emirates/Middle East $58M 85 $394M $660M Payments/ BNPL Atalaya Capital, Sequoia Capital India, STV, Global Founders Capital, Partners for Growth, Arbor Ventures, Mubadala, Raed Ventures

Startups Pathfinder 2023

The Most Promising Fintech

The Most Promising Fintech Startups Pathfinder 2023

19 Saudi Arabia/ Middle East $150M 86 $365.6M $550M Payments/ BNPL Goldman Sachs

, Sanabil, Checkout.com, Impact46 Nigeria/ Africa $50M 87 $85.5M $200—300M Banking QED Investors, Novastar Ventures, Quantum Capital Partners United Kingdom/ Europe $22.8M 91 $28.9M $92—138M Banking/ Green Finance Valar Ventures, EQT Ventures

, Ecosia United States/ North America Undiscl osed 92 $143.4M $240-360M Payments Google for Startups, SOFTBANK Latin America Ventures, Partners for Growth, QED Investors, BECO Capital, Global Ventures Egypt/ Middle East $20M 88 $20.1M $80-120M WealthT ech BECO Capital, Prosus Ventures, Tiger Global Management, Global Ventures, Y Combinator Singapore/ Asia $30M 89 $160M $776M Payments Marshall Wace, Insight Partners, Helios Investment Partners, GGV Capital Singapore/ Asia $131M 90 $175M $524—786M Banking Mizuho Bank, iGlobe Partners, Point72 Ventures, Sequoia Capital India, Insignia Ventures Partners United States/ North America $50M 93 $94.9M $200-300M RegTech G Squared, American Express Ventures, Activant Capital, Sequoia Capital, Khosla Ventures United Kingdom/ Europe $80M 94 $118.9M $320-480M Payments Lakestar, Mouro Capital, Global Founders Capital Mexico/Latin America $30M 95 $41.3M $120-180M Payments IDC Ventures, Wayra, IGNIA, Dalus Capital, Cabiedes & Partners Mexico/Latin America $8.1M 96 $58.6M $32—49M Banking Magma Partners, Accial Capital, Trebol Capital Germany/ Europe $114M 97 $204.6M $853M Banking Greenoaks Capital, Ribbit Capital

20 Chile/Latin America $140M 99 $567M $444-666M Finance Goldman Sachs, Avenir Growth Capital, Kaszek, Community Investment Management, DST Global, Kaszek, Picus Capital, Kayyak Ventures, Manutara Ventures Mauritius/ Africa $5M 100 $43.3M $13-20M Payments Oikocredit International, Lion’s Head Global Partners, USAID East Africa Trade and Investment Hub United States/ North America $50M 98 $90M $200—300M Regtech Saudi Aramco Entrepreneurship Ventures, BECO Capital, Cue Ball

Promising Fintech Startups Pathfinder 2023

The Most

Top Europe 2023

Europe holds the position of the birthplace of fintech, primarily due to its global leadership in financial institutions and marketplaces. Fintech startups in Europe boast twice the value of any other tech sector.

The database comprises around 800 fintech companies in Europe itself, with 330 based in the UK, 96 in Germany, 66 in France, and 55 in Switzerland.

The UK

The UK fintech startup landscape has been thriving in recent years, with numerous startups and established companies alike leading the way in innovation and technological advancements in financial services. The UK fintech sector attracted a record-breaking US $5.3 billion in investment in 2020, despite the challenges posed by the COVID-19 pandemic. Despite a difficult global market, the UK has demonstrated its strength as a leading location for investment in FinTech, with $12.5 billion of FinTech venture capital investment received in 2022. And $8.9 billion of this amount was invested during the first half of 2022. However, the total investment for the full year reflects an 8% decline from 2021, when UK FinTech investments reached a record high of $13.5 billion.

One notable trend in the UK fintech startup landscape is the rise of challenger banks, such as Monzo, Starling, and Revolut. These companies have disrupted traditional banking models by offering mobile-first, user-friendly banking services with no fees or minimum balances. Another area of growth in the UK fintech startup landscape is in the insurance sector, with insurtech startups such as Zego and Honcho offering innovative solutions to traditional insurance challenges. The UK fintech startup landscape has also seen a rise in companies focused on sustainable finance, with startups such as Chip and Plum offering ethical investment options and carbon offsetting services.

https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2023/02/pulse-of-fintech-h2-22-web-file.pdf

21

The Most Promising Fintech Startups Pathfinder 2023

Overall, the UK fintech startup landscape is a dynamic and innovative ecosystem that continues to attract significant investment and produce groundbreaking solutions to traditional financial challenges. With the support of the UK government and a highly skilled workforce, it is likely that the UK fintech sector will continue to thrive in the years to come.

The Most Promising Fintech Startups Pathfinder 2023

, British Business Investments, Atalaya Capital, Warwick Capital LLP

JPMorgan Partners (JPMP), Banking Competition Remedies, Tiger Global Management, American Express Ventures, PayPal Ventures, Capability and Innovation Fund, Index Ventures United Kingdom / Europe

General Atlantic, FIS Impact Ventures, PayPal Ventures, Highland Europe, Capability and Innovation Fund, Blenheim Chalcot, Frog Capital, Blenheim Chalcot

Bristol, City of, United Kingdom

Amazon, SOFTBANK Latin America Ventures, Headline, Redpoint eventures United Kingdom / Europe

EQT Ventures, TriplePoint Capital, Balderton Capital, LocalGlobe United Kingdom / Europe

United Kingdom / Europe

f

Lakestar, Mouro Capital, Global Founders Capital

TransUnion, TDR Capital, Goldman Sachs, HSBC, Banco Sabadell, Outward VC

United Kingdom / Europe

United Kingdom / Europe

United Kingdom / Europe

Growth, Accel, Balderton Capital, Seedcamp

Dai-ichi Life, Target Global, Creandum, LocalGlobe

Temasek Holdings, Battery Ventures, Dawn Capital, Silicon Valley Bank, Accel

WestCap, Blumberg Capital, Maverick Ventures Israel, Target Global, Rhodium

23 Region Last Funding Amount № Total Funding Amount Estimated Valuation VCs/ Investors United Kingdom / Europe $196. 58M 8 $472.83M $290— 436M

Payments M&G

Founders

$50M 9 $73.4M $425M Payments ICONIQ

Investments, Global

Capital, Dawn Capital United Kingdom / Europe

$105.87M 1 $345M $528— 792M

Banking TCV

Kingdom

Europe $100M 2 $176.8M $400-600M Payments

United Kingdom / Europe

United

/

$108M 3 $181.2M $438—657M

Payments

$108M 4 $118M $432-648M Open Banking Accel,

$80M 5 $137.5M $500M RegTech

$80M 6 $118.9M $320-480M Payments

Bristol,

So

ina,

Undiscl osed 7 $102M $320—480M Banking

Undiscl osed 10 $206.6M $800M InsurTech

$64M 12 $82M $256-384M Lending/ Credit

11

$180M $263.2M $360—540M Open Banking

Company Industries

Fintech Startups Pathfinder 2023

The Most Promising

United Kingdom / Europe $32.7M 17 $71.5M $132—198M Payments Karlani Capital, Rudy Karsan United Kingdom / Europe Undiscl osed 18 $56.9M $166—249M Payments Notion Capital, Mosaic, Horizon 2020, Anthemis Group United Kingdom / Europe $40M 20 $54.4M $210M Payments Headline, Anthemis Group, Tiger Global Management United Kingdom / Europe Undiscl osed 19 $89.8M $160—240M Investment Valar Ventures, Singular United Kingdom / Europe $60M 14 $254.3M $240—360M WealthT ech BlackRock, Silicon Valley Bank, Smash Capital, Northzone, Balderton Capital, QED Investors United Kingdom / Europe Undiscl osed 16 $69.4M $204-306M Open Banking Future Fifty, Sapphire Ventures, Lakestar, HV Capital, LocalGlobe United Kingdom / Europe $22.8M 15 $28.9M $92—138M Banking Valar Ventures, EQT Ventures

, Ecosia United Kingdom / Europe $66M 13 $189M $375M RegTech Ten Eleven Ventures, Insight Partners

, Future Fifty, Summit Partners, Goldman Sachs 24 The Most Promising Fintech Startups Pathfinder 2023

Top North America

North America is a region with a thriving fintech industry and a significant amount of investment flows. In H1’21, Canadian fintechs attracted a record $4.8b investments, while USA-based fintech companies raised over $25b from VCs. In the first half of 2022, fintech investment in the Americas amounted to $39.4 billion, which is a decrease from the $59.7 billion seen in the second half of 2021. Despite the decrease in quarterly investment to $22.7 billion, the fintech market in the region remained robust, with 806 deals recorded in Q1'22, indicating a strong start to the year.

Based on observations, the United States is likely to dominate the fintech industry within the next five to six years. Until mid-2022, the expansion of the North American market was primarily attributable to construction projects. After the scandalous collapse of FTX, the majority of tokens lost value, prompting cryptos to close their doors. Nevertheless, open banking, paytech, lending/ credit, and regtech will continue to evolve. However, many of the startups in the database and some in the list below will see their valuations challenged during 2023, and the number of new entrants will lessen across the board, including this region.

The following 30 most promising fintech businesses (20 from the USA, 10 from Canada) in the North American region have been selected based on their innovation, growth potential, and financial performance.

6https://kpmg.com/xx/en/home/insights/2021/08/pulse-of-fintech-h1-2021-americas.html

https://kpmg.com/xx/en/home/insights/2022/08/pulse-of-fintech-h1-22-americas.html

25 The Most Promising Fintech Startups Pathfinder 2023

THE REST OF EUROPE

7 $138 .1M $246M Lending/ Credit Sweden / Europe FinTech Collective, Augmentum Fintech, EQT Ventures, Northzone, Accel, Global Founders Capital $31 .3M 8 $107.8M $383— 575M RegTech Hungary / Europe Institutional Venture Partners, Institutional Venture Partners, Creandum, PortfoLion Capital Partners $94M

№ Total Funding Amount Estimated Valuation Region VCs/ Investors Last Funding Amount 3 $281 .9M $400-600M Banking Sweden / Europe Mubadala Capital Ventures, TriplePoint Capital, EQT Ventures, Cherry Ventures, Felix Capital $206M 4 $78.9M $260— 390M Payments Lithuania / Europe Accel, OTB Ventures, Speedinvest, Startup Wise Guys $65M 5 $115 .9M $250-3 80M InsurTech Germany / Europe Swiss RE, Earlybird Venture Capital, Acton Capital, btov Partners, CommerzVentures, Global Founders Capital, Rocket Internet $ $63M 6 $75. 69M $198-2 97M Payments Finland / Europe Vitruvian Partners, Tencent, Maki.vc, Finnvera Venture Capital, LähiTapiola, Nordea $55 .2M 2 $85M $256-3 84M RegTech Germany / Europe Tiger Global Management, Accel, High-Tech Grunderfonds $64M 1 $204.6M $853M Open Banking Germany / Europe Greenoaks Capital, Ribbit Capital $114 M 26 9 $96.3M $$178— 267M Payments/ BNPL The Netherlands / Europe Force Over Mass Capital, Finch Capital $85 .3M 10 $107.8M $320-480M RegTech Switzerland / Europe Sequoia Capital, Left Lane Capital, SIX FinTech Ventures, Swisscom Ventures $80M Company Industries

Promising Fintech Startups Pathfinder 2023

The Most

USA $75M 4 $257M $310—465M Payments United States / North America Elad Gil, General Catalyst,sanem fabri, Bloomberg Beta $67M 7 $90.3M $268—402M

Banking United States / North America Battery Ventures, Peter Graham, Ferst Capital Partners - FCP $300M 1 $491.3M $400-600M Open Banking United States / North America Evolve Bank & Trust, TriplePoint Capital, General Catalyst, Bridge Bank, Coatue, Stripe, Crosslink Capital $60M 2 $244M $520M RegTech United States / North America GIC, Ribbit Capital, Thrive Capital $50M 3 $77M $500M Payments United States / North America GGV Capital, Coatue $75M 5 $194.9M $300-450M Open Banking United States / North America DFJ Growth, Dragoneer Investment Group, Community Investment Management, M13, Inspired Capital Partners $10M 6 $161M $40-60M Lending/ Credit United States / North America Singh Capital Partners, Forbright Bank, Active Capital $63M 8 $80.8M $252— 378M Banking United States / North America FTV Capital, Headline, Base10 Partners Undiscl osed 9 $143.4M $240-360M Payments United States / North America Google for Startups, SOFTBANK Latin America Ventures, Partners for Growth, QED Investors, BECO Capital, Global Ventures Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 27 $60M 10 $123M $240—360M Payments United States / North America Alpha Wave Global, Tiger Global Management, TLV Partners $60M 11 $75.2M $240—360M Banking United States / North America Sequoia Capital

Industries

Startups Pathfinder 2023

Company

The Most Promising Fintech

$60M 14 $84.7M $200-300M Payments United States / North America Insight Partners, SignalFire $60M 15 $90M $200—300M RegTech United States / North America Saudi Aramco Entrepreneurship Ventures, BECO Capital, Cue Ball $60M 16 $98M $200—300M RegTech United States / North America Fin Capital, J.P. Morgan Asset Management, Canapi Ventures, Third Prime $60M 17 $64M $180-270M Lending/ Credit United States / North America Insight Partners, Greylock $60M 18 $70.8M $164—246M Finance United States / North America Tribe Capital, Insight Partners, HubSpot Ventures, ATX Venture Partners $60M 19 $56M $160—240M RegTech United States / North America State Street, Blumberg Capital, LionBird, Team8 $40M 20 $50M $160-240M Payments United States / North America Activant Capital, Accomplice, Greycroft, Pear VC 28 $60M 12 $80M $220-330M Open Banking United States / North America Group 11, Target Global $60M 13 $94.9M $200-300M RegTech United States / North America G Squared, American Express Ventures, Activant Capital, Sequoia Capital, Khosla Ventures

Promising Fintech Startups Pathfinder 2023

The Most

Canada $17.8M 2 $28.4M $70—106M

WealthT ech Canada / North America Fidelity International Strategic Ventures Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 29 $118M 1 $278.9M $733M Payments Canada / North America Eldridge, TTV Capital, Drive Capital, Portage Ventures, Power Financial Corporation $57.3M 5 $109.4M $240-360M Account ing Canada / North America Contour Venture Partners, Inovia Capital, Bain Capital Ventures, Altos Ventures $70M 4 $90M $330M RegTech Canada / North America Dragoneer Investment Group, Vanedge Capital $78.9M 3 $93M $412-618M Open Banking Canada / North America National Bank of Canada, NAventures, Luge Capital, National Bank of Canada $30M 6 $39M $120-1 80M InsurTech Canada / North America Cota Capital, FUSE, Impression Ventures, Luge Capital $19.8M 7 $26.2M $80—120M

Payments Canada / North America Centana Growth Partners

, FINTOP Capital $413.7M 8 $530.4M $86M Payment s/BNPL Canada / North America National Bank of Canada, Credit Suisse, Globalive Capital

$13M 9 $22.1M $45-70M WealthTech Canada / North America CI Financial, Illuminate Financial, Purpose Unlimited $442.6K 10 $3.2M $4-5M Banking Canada / North America NEXT Canada, The Holt Xchange, Henon Capital, Sharia Portfolio Canada, DMZ Company Industries The

Promising Fintech Startups Pathfinder 2023

Most

The Most Promising Latin America 2023

Latin America is a rapidly growing region with a dynamic fintech industry that has been gaining traction in recent years. With the increasing adoption of digital technologies and the growing demand for financial services, the fintech market in Latin America is poised for significant growth. As a result, the region has become a hotbed for fintech innovation, with numerous startups and established companies offering a range of innovative products and services.However, the Latin American region witnessed a decline of 58% in FinTech investment in 2022, as it reached $5.4 billion, as compared to the previous year. Additionally, the number of deals recorded was 341, which was 15% less than that of 2021. Among the countries in Latin America, Brazil was the most active, with 134 deals announced, representing a 39% share of the total FinTech deals in the region.

PayTechs, Open Banking, Lending/Credit, and InsurTech are some of the most popular fintech solutions in Latin America. However, their valuations are expected to face challenges in 2023, and the number of new entrants in the region is expected to decline.

A list of 25 of the most promising fintech businesses in the Latin America region has been compiled. Some of the selected startups include Vexi, Ali Credito, Aplazo, and others.

https://fintech.global/2023/03/15/latin-american-fintech-investment-suffers-in-2022-declining-58/

30

The Most Promising Fintech Startups Pathfinder 2023

Brazil Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 31 $100M 1 $254.8M $464—696M Banking Brazil / Latin America / North America Eldridge, TTV Capital, Drive Capital, Portage Ventures, Power Financial Corporation $21M 2 $104.6M $224-3 36M WealthT ech Brazil / Latin America / North America Fidelity International Strategic Ventures $40M 3 $58.7M $160—240M

Payments Brazil / Latin America / North America National Bank of Canada, NAventures, Luge Capital, National Bank of Canada $31.4M 4 $39.6M $126—188M InsurTech Brazil / Latin America / North America Dragoneer Investment Group, Vanedge Capital $430M 5 $460M $1B Payments Brazil / Latin America / North America Contour Venture Partners, Inovia Capital, Bain Capital Ventures, Altos Ventures $27M 6 $98.9M $103— 154M Lending/ Credit Brazil / Latin America / North America Cota Capital, FUSE, Impression Ventures, Luge Capital $20M 8 $42.1M $80—120M

InsurT ech Brazil / Latin America / North America National Bank of Canada, Credit Suisse, Globalive Capital

$18.4M 9 $31.1M $60-90M Open Banking Brazil / Latin America CI Financial, Illuminate Financial, Purpose Unlimited $25M 7 $25.9M $101—152M

Lending/ Credit Brazil / Latin America / North America Centana Growth Partners

, FINTOP Capital $45M 10 $61.1M $180—270M Banking Brazil / Latin America NEXT Canada, The Holt Xchange, Henon Capital, Sharia Portfolio Canada, DMZ Company Industries

Startups Pathfinder 2023

The Most Promising Fintech

The rest of Latin America

Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 32 $80M 1 $376.3M $700M+ Payments Colombia / Latin America GIC, Goldman Sachs, Greycroft, Union Square Ventures, Quona Capital, Andreessen Horowitz $140M 2 $567M $444-666M Finance Chile / Latin America Goldman Sachs, Avenir Growth Capital, Kaszek, Community Investment Management, DST Global, Kaszek, Picus Capital, Kayyak Ventures, Manutara Ventures $90M 3 $348.5M $1B Payments Mexico / Latin America Accial Capital

, Goldman Sachs, Coatue, DST Global, General Catalyst $90M 4 $257.5M $500M Open Banking Mexico / Latin America General Atlantic, Prosus Ventures, Quona Capital, Arc Labs, STARTegy Ventures $57M 5 $70M $228 342M

Open Banking Mexico / Latin America Lightspeed Venture Partners, Accel, LATINIA $46M 6 $60.8M $184-276M Payments Colombia / Latin America Luxor Capital Group, First Check Ventures Undisclo sed 8 $56M $172-258M Open Banking Mexico / Latin America Citi Ventures, Visa, Founders Fund, Kaszek, MAYA Capital, Unpopular Ventures, STARTegy Ventures, VentureFriends $45M 7 $72.1M $180-270M Open Mexico / Latin America Valar Ventures, Mountain Nazca $200M 9 $521.3M $168 252M Lending/ Credit Mexico / Latin America FIRA, Credit Suisse, GS Growth, Point72 Ventures, Goldman Sachs, Kaszek, Elevar Equity $39M 10 $54.9M $156 234M WealthTech Chile / Latin America Sequoia Capital, Kaszek $15M 11 $40.1M $150-200M Finance Mexico / Latin America DILA Capital, Kayyak Ventures, Architect Capital, Mountain Nazca, QED Investors Company Industries

Startups Pathfinder 2023

The Most Promising Fintech

33 $15M 1 3 $60M $175M

Payments Argentina / Latin America Tiger Global Management, Sequoia Capital

, Index Ventures, Monashees Undiscl osed $42.3M $108-162M Payment s/BNPL Mexico / Latin America Oak HC/FT, Kaszek, Village Capital 14 $8.1M 15 $58.6M $32—49M

Open Banking Mexico / Latin America Magma Partners, Accial Capital, Trebol Capital $30M 12 $41.3M $120-180M Payments Mexico / Latin America Wayra, Dalus Capital, IGNIA, Cabiedes & Partners

Fintech Startups Pathfinder 2023

The Most Promising

The Most Promising Fintechs in Middle East

The fintech industry in the Middle East has been growing rapidly in recent years, driven by the increasing use of digital technologies and the growing demand for financial services. This region is evolving quickly and has the potential for significant growth in the fintech market.

In 2022, there was a decrease in both FinTech investment and deal activity in the Middle East. The region's FinTech investment dropped to $1.37 billion, which is 3.6% less than the previous year. Additionally, Middle Eastern FinTech companies raised 169 deals in 2022, a slight decline of 1.8% from the levels seen in 2021.

eastern fintech deal activity held positions in 2022 as global investment 0 The Most Promising Fintech Startups Pathfinder 2023

https://fintech.global/2023/02/27/middle

The Most Promisin Fintech Startups Pathfinder 2023

$20M 13 $20.1M $80-120M WealthTech E ypt / Middl BECO Capital, Prosus Ventures, Ti er Global Mana ement, Global Ventures, Y Combinator Last Funding Amount № Company Total Funding Amount Estimated Valuation Industries Region VCs/ Investors 35 $150M 1 $365.6M $550M Payment s/BNPL Saudi Arabia / Middle East Goldman Sachs

, Sanabil, Checkout.com, Impact46 $58M 2 $394M $660M Payment s/BNPL United Arab Emirates / Middle East Atalaya Capital, Sequoia Capital India, STV, Global Founders Capital, Partners for Growth, Arbor Ventures, Mubadala, Raed Ventures $350M 3 $436.5M $224-336M Payments Israel / Middle East Viola Credit

, Forerunner Ventures, Ribbit Capital $50M 4 $68.5M $200-300M Payments E ypt / Middle East Clay Point Investors, Kora, PayPal Ventures, Global Ventures, FMO, A15 $50M 5 $103.5M $200-300M Re Tech Israel / Middle East Qumra Capital, Zeev Ventures, Innovation Endeavors, Vertex Ventures, Vertex Ventures Israel $50M 6 $70M $200 300M

Payments Israel / Middle East Oak HC/FT, Zeev Ventures, F2 Capital $260M 7 $520M $1B Bankin E ypt / Middle East Chimera Investment, Commercial International Bank, Apis Partners, Development Partners International $33M 8 $36.5M $132-198M Re Tech Saudi Arabia / Middle East Sequoia Capital India, Outliers Venture Capital, Raed Ventures, Shorooq Partners $31M 9 $42.1M $124 186M

WealthTech E ypt / Middle East Arzan Venture Capital, CommerzVentures, Middle East Venture Partners (MEVP), Partech, Sawari Ventures, 500 Startups, Dubai An el Investors $25M 10 $57M $100-150M Bankin Israel / Middle East Mi dal Insurance and Financial Holdin s, OurCrowd, Viola FinTech, Moneta VC $22.5M 11 $36.1M $90-135M Payments United Arab Emirates / Middle East Mashreq Bank, Shorooq Partners, DisruptAD

36 $20M 12 $22M $80-120M Payments United Arab Emirates / Middle East Signal Peak Ventures, Emkan Capital, Mad'a Investment Company, MetLife Foundation $20M 14 $25.1M $80—120M Finance United Arab Emirates / Middle East Valar Ventures $20M 15 $25M $80—120M Payments Egypt / Middle East Global Founders Capital, Sequoia Capital $38M 16 $47.1M $76-114M Payments Egypt / Middle East Quona Capital, Lendable, Village Capital, Algebra Ventures $18M 17 $25.4M $72—108M InsurTech Israel / Middle East MoreTech Ventures, Disruptive AI Venture Capital, Kamet, Moneta VC, Phoenix Insurance Company $15M 18 $24.9M $60-90M WealthTech United Arab Emirates / Middle East Mubadala, Kuwait Investment Projects Company, Shorooq Partners $220M 19 $247M $80—120M

Payments Israel / Middle East Mitsubishi UFJ Financial Group, Viola Credit, NFX, Pitango VC, Glilot Capital Partners $3M 20 $4M $12— 18M

Banking United Arab Emirates / Middle East Y Combinator The Most Promising Fintech Startups Pathfinder 2023

The Most Promising Fintechs in Africa

Africa's fintech industry has been attracting a lot of attention from venture capitalists and investors, with news of local startups receiving capital constantly emerging since the beginning of the digital boom in the continent. This reflects a growing interest in building fintech infrastructure in Africa. In 2022, African fintech companies received approximately $900 million in funding from both local and foreign investors, with a quarter of that amount allocated to South

The following 20 fintech businesses have been selected as the most promising in Africa, including Kuda, Yoco, PalmPay, and more.

https://www.zawya.com/en/economy/africa/3-trends-that-will-shape-the-future-of-africas-fintech-startups-pzyfay

The Most Promising Fintech Startups Pathfinder 2023

Africa Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 38 $400M 1 $570M $2B Payments Nigeria / Africa SoftBank Vision Fund, IDG Capital, Sequoia Capital China, Source Code Capital $17M 2 $31.7M $68—102M

InsurTech South Africa / Africa International Finance Corporation, Naspers Foundry, Hollard Insurance, Yellowwood $150M 3 $217.6M $600—900M

Banking Algeria / Africa Bond, WndrCo, Unpopular Ventures, Y Combinator $100M 4 $140M $400-600M Payments Nigeria / Africa TRANSSION $55M 5 $91.6M $500M

Banking Nigeria / Africa Target Global, Valar Ventures $83M 6 $106M $330-400M Payments South Africa / Africa Dragoneer Investment Group, Partech, Quona Capital, Velocity Capital Fintech Ventures $30M 7 $230M $220—330M

Finance Nigeria / Africa Franklin Templeton

Speedinvest, Thelatest.ventures, NBK Capital Partners, IFC Venture Capital Group $21M 9 $27M $85-125M Payments South Africa / Africa The Spruce House Partnership, Firstminute Capital, Raba $50M 8 $85.5M $200—300M

Open Banking Nigeria / Africa QED Investors, Novastar Ventures, Quantum Capital Partners $15M 10 $17.6M $60-90M Payments Nigeria / Africa Tiger Global Management, Entrée Capital, Y Combinator $14M 11 $15M $56—84M Banking Côte d Ivoire / Africa Enza Capital, Oikocredit International, Partech, Y Combinator Company Industries

Fintech Startups Pathfinder 2023

Investments

, Emso Asset Management, Absa CIB, British International Investment, Left Lane Capital,

The Most Promising

39 $5M 1 3 $43.3M $13-20M Payments Mauritius / Africa Oikocredit International, Lion’s Head Global Partners, USAID East Africa Trade and Investment Hub $100M $217.2M $200-300M Payments South Africa / Africa MFS Africa is a digital payment company that offers mobile financial solutions for senders, money users, and service providers. 14 $120M 15 $175M $400M Open Banking South Africa / Africa Fidelity Management and Research Company, The MasterCard Foundation, LeapFrog Investments $10M 12 $10.2M $40—60M Payments Tanzania / Africa Accel, Amplo, Bessemer Venture Partners, Y Combinator, DFS Lab

Startups Pathfinder 2023

The Most Promising Fintech

The Most Promising Fintechs in Asia

Fintech investment in the Asia-Pacific region reached a record high in 2022, with total investment hitting $50.5 billion across 1,227 deals. This is a slight increase from the $50.2 billion invested across 1,604 deals in 2021. This rise in investment highlights the growing interest of investors in the region's fintech industry, indicating the potential for further growth and development in the sector.

The pandemic has forced people and businesses to move online, thereby creating an impetus for the fintech industry to grow. Analysts predict that the fintech industry in Asia-Pacific will expand rapidly over the next 5 to 10 years, presenting numerous opportunities for growth and investment. Open banking and other regulatory reforms have also paved the way for change in the financial services industry, with third-party providers now being able to access data from former bank customers. Countries like China and India have made significant strides in financial services, while Singapore leads the way in mobile payment solutions, with widespread acceptance across the island.

China

In recent years, rapid growth has been witnessed in the fintech market of China, propelled by increasing mobile usage, and government backing for entrepreneurship and innovation. China has established itself as a global leader in digital payments, with a significant proportion of transactions being conducted through mobile payments. The Chinese fintech sector is diverse, offering services such as mobile payments, online lending, wealth management, and insurance.

https://kpmg.com/au/en/home/insights/2023/02/pulse-of-fintech-h2-2022-apac.html

40

The Most Promising Fintech Startups Pathfinder 2023

To support the fintech industry's growth, the regulatory framework has been adjusted to promote innovation and protect consumers and financial stability. Although the market is highly competitive, with several firms competing for a share of the burgeoning market, Chinese fintech firms are increasingly seeking global expansion and collaborating with foreign businesses.

Despite concerns regarding data privacy and security and regulatory ambiguity, the Chinese fintech market is expected to continue its growth trajectory, supported by the country's vast consumer base, advanced technological capabilities, and regulatory environment.

Several venture capital firms invest heavily in China, focusing on startups and emerging businesses in various industries. Among the most active venture capital firms in China are Sequoia Capital China, IDG Capital, Qiming Venture Partners, GGV Capital, Matrix Partners China, and Hillhouse Capital Group.

41

The Most Promising Fintech Startups Pathfinder 2023

The Most Promisin Fintech

Zhon din , Guoxin Zhuoyue Venture Capital, Shan hai International Group (SIG), Yunqi Partners, InnoVen Capital, Youzu Interactive, China Creation Ventures (CCV), FREES FUND

E Fund Mana ement Co.,LTD., China SDIC Gaoxin, Xinhu Zhon bao Co Ltd, Fosun International, Insi ma Technolo y, Sunyard

Telstra Ventures, China Growth Capital | CGC,

Capital China

China $20M 13 $20.1M $80-120M WealthTech E ypt / Middl BECO Capital, Prosus Ventures, Ti er Global Mana ement, Global Ventures, Y Combinator Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 42 $100M 1 $244.2M $400-600M Account in China / Asia Apax Di ital, Vitruvian Partners, Hillhouse Capital Group, Archipela o Advisa Investment $80M 2 $314.4M $340-480M

Account in China / Asia Sunshine Insurance Group, Gaochen Capital, Xiaomi, IDG Capital, Tendence Capital, China Soft Capital $35M 3 $163.2M $140-210M Re Tech China / Asia

Undiscl osed 4 $6.2M $110 165M Ai/Finance China / Asia ByteDance, Global Founders Capital $22.9M 5 $38.1M $58 87M

InsurTech China / Asia Le end Capital $15.5M 6 $249.5M $46 69M

Re Tech China / Asia

Guochuan

Undiscl osed 7 $20M $40 60M

Bankin China / Asia Youshan

Undiscl osed 8 $36.5M $80-120M Payments China / Asia Matrix Partners, Sequoia Capital China, InnoVen Capital $150M 9 $238M $1B WealthTech China / Asia Gopher Asset

ement,

Capital,

dao

Capital, Xiaomi Company Industries

Capital,

Sequoia

Mana

Bojian

Hon

Capital, Mobai

Startups Pathfinder

2023

India

Indian fintech startups managed to raise $5.65 billion across 390 funding rounds in 2022. This marks a significant decline of 47% in funding amount and 29% in the number of funding rounds, as compared to the previous year. Despite this decrease, India still ranks as the third-highest funded country in the fintech sector, trailing only behind the US and the UK. The decline in funding can be attributed to the substantial drop in late-stage funding, which fell from $8.3 billion in 2021 to $3.7 billion in 2022, representing a decline of 56% . The table below demonstrates the most promising fintech startups in India.

https://financialit.net/news/fintech-startups/tracxn-releases-its-fintech-india-report-2022-total-funding-2022-falls-47

43

The Most Promising Fintech Startups Pathfinder 2023

Investment Agency, Northern Arc, Trifecta Capital Advisors, Navi Technologies, iLabs Capital, Sistema Asia Capital, Vertex Ventures, Fosun RZ Capital, Endiya

India Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 44 $70M 1 $345M $750M Open Banking India / Asia Abstract Ventures, Tencent $48.6M 2 $150.6M $600M Finance India / Asia Beams FinTech Fund, Creation Investments Capital Management, LLC, Tiger Global Management, Stride Ventures, Sequoia Capital India, growX ventures $100M 3 $186.5M $600M Payments India / Asia Moore Strategic Ventures, Tribe Capital, B Capital Group, Surge $30M 4 $164.3M $400-600M Banking India / Asia Multiples, Accel, Lightrock, Horizons Ventures, Tencent, Prime Venture Partners, Social Capital $80M 6 $142.5M $490M

Payments/ BNPL India / Asia Brunei

Partners,

$17M 5 $136.6M $545M Banking India / Asia Alpha Wave Global, B Capital Group, Ribbit Capital, Sequoia Capital $60M 7 $71M $400M Lending/ Credit India / Asia Bessemer Venture Partners, Susquehanna International Group (SIG) $65M 8 $141M $260-390M Lending/ Credit India / Asia Norwest Venture Partners, Faering Capital, Sequoia Capital India $54.5M 9 $90M $232-348M Payments India / Asia PayU, Fosun RZ Capital, PayU, Ruizheng Investment, Temasek Holdings $22.6M 10 $111.7M $300M Investment India / Asia Tiger Global Management, Arkam Ventures, Tribe Capital, WEH Ventures, Tribe Capital Company Industries The Most Promising Fintech Startups Pathfinder 2023

VenturEast

The Most Promising Fintech Startups

45 $16M 11 $188.8M $300M Lending/Credit India / Asia Lightbox, GGV Capital, Bertelsmann India Investments, GGV Capital, Accel, Sequoia Capital $40M 12 $62M $160-240M WealthTech India / Asia Faering Capital, HDFC Bank, DSP Group, Sequoia Capital India, Rainmatter Technology $110M 1 3 $166.1M $440—660M

Lending/ Credit India / Asia , Elevation Capital, Norwest Venture Partners, International Finance Corporation, Lok Capital $38M $42.9M $150-230M Payments India / Asia Elevation Capital, Sequoia Capital India, Sequoia Capital India, Venture Highway, Y Combinator 14 $35M 15 $49M $140—210M

Lending/ Credit India / Asia Elevar Equity, Elevation Capital $35M 16 $37.5M $140—210M Lending/ Credit India / Asia Westbridge Capital, India Quotient, Stellaris Venture Partners, Indian Angel Network $26M 17 $38.4M $104—156M

RegTech India / Asia Gaja Capital

, HPE Digital Catalyst Program,

Ventures, Mastercard, Contrarian Drishti Partners, Kalaari Capital, Stellaris Venture Partners $20M 18 $23M $80—120M

Payments India / Asia Ascent Capital, Axilor Ventures, Mayfield Fund $5M 19 $22.9M $60-90M RegTech India / Asia Michael & Susan Dell Foundation, Oikocredit International, Omidyar Network $20M 20 $25.3M $80—120M

Banking/ Finance India / Asia PayPal Ventures, HDFC Bank, Pravega Ventures

F10, Vertex Ventures, Arkam

Pathfinder 2023

THE REST OF ASIA

MDI Ventures, Triodos Investment Management, Lendable, Quona Capital, Triodos Bank Germany, Saison Capital, EV Growth, Quona Capital, Mandiri

Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 46 $131M 1 $175M $524—786M Banking India / Asia Mizuho Bank, iGlobe Partners, Point72 Ventures, Sequoia Capital India, Insignia Ventures Partners $100M 2 $299.5M $400—600M

Banking India / Asia Lightspeed Venture Partners, Sequoia Capital, Fasanara Capital, MassMutual Ventures Southeast Asia (MMV SEA), Y Combinator $85.4M 3 $121.4M $342—512M Payments India / Asia Tiger Global Management, Insight Partners $5.3M 4 $179.4M $300-450M Banking India / Asia Mitsubishi UFJ Financial Group,

Insignia Ventures Partners, DST Global, Tiger Global Management, Y Combinator $60M 5 $130M $240-360M Payments India / Asia Insight Partners, Helios Investment Partners, GGV Capital $55M 6 $113M $220-330M Investme nt/ Others India / Asia Accel, Square Peg Capital, Openspace, Go-Ventures $5.4M 7 $86.9M $325M

InsurTech India / Asia responsAbility, Eurazeo, Centauri Fund, Surge, Central Capital Ventura, SeedPlus $30M 8 155M $300M Lending/ Credit India / Asia Credit Saison, Quona Capital, East Ventures, Skystar Capital $48M 9 $71.6M $192—288M

RegTech India / Asia Kohlberg Kravis Roberts,

Mandiri Capital Indonesia (MCI), MDI Ventures, Telkomsel Mitra Inovasi, Indigo by Telkom Indonesia $43M 10 $180.1M $170-260M Lending/ Credit India / Asia

Company Industries The Most Promising Fintech Startups Pathfinder 2023

Lendable, B Capital Group,

GGV Capital,

Capital Indonesia (MCI)

The Most Promising Fintechs in Australasia

In 2022, the fintech sector in Australia received a total of US$30.2 billion in investments, with the largest portion of this amount (US$27.9 billion) coming from the Afterpay-Block deal. However, there was a decline in overall deal volume in the latter part of the year. Excluding the Afterpay-Block transaction, the fintech investment in Australia would have decreased from US$3.01 billion to US$2.2 billion in 202213.

The table presented below showcases some of the most promising fintech businesses in Australia and New Zealand, including Spriggy, Open, OCR Labs, and others.

https://kpmg.com/au/en/home/media/press-releases/2023/02/number-of-australian-fintech-deals-falls-from-2021

47

The Most Promising Fintech Startups Pathfinder 2023

Australia Last Funding Amount № Total Funding Amount Estimated Valuation Region VCs/ Investors 48 $35M 1 $52.1M $140-210M WealthT ech Australia / Australasia NAB Ventures, Grok Ventures, Alium Capital, H2 Ventures $31M 2 $54.7M $125-185M InsurTech Australia / Australasia Latitude, Movac, AirTree Ventures, Richard Enthoven $30M 3 $45M $120—180M

RegTech Australia / Australasia Equable Capital, OYAK $32 .5M 4 $57.5M $130—195M Payments Australia / Australasia Acorn Capital, Artesian VC, Commencer Capital, Mastercard, Westpac $25M 5 $36M $100-150M Open Banking Australia / Australasia 1835i Ventures, NAB Ventures $35M 8 $57.3M $140—210M Accounting/ payments Australia / Australasia AirTree Ventures, Left Lane Capital, EVP $20M 6 $22.9M $80-120M Payments Australia / Australasia 1835i Ventures, Australia and New Zealand Banking Group, H2 Ventures $15.46M 7 $30.9M $60—89M

RegTech Australia / Australasia AirTree Ventures, Greycroft, Tidal Ventures $35M 9 $39.6M $26—39M

Lending/ Credit Australia / Australasia Global Credit Investments $46.6M 10 $142.2M $189—283M Payments Australia / Australasia Silva Fortune, Versatile Group Company Industries The Most Promising Fintech Startups Pathfinder 2023