The home of business finance in New Zealand.

The home of business finance in New Zealand.

Finance New Zealand provides a structured, knowledgeable and tailored finance service. Since 2015, we have helped thousands of New Zealand businesses with finance solutions, resulting in over $4 billion in transactions.

Founded in 2015, we’re New Zealand’s largest business finance adviser. Our friendly and approachable team are experts in the finance industry. With hundreds of years of collective experience, we understand the full life cycle of business and the challenges that owners and managers can face. Our expertise means we determine and facilitate the best finance solution for your unique business needs.

Whether you’re buying your first piece of equipment, growing your asset base or aligning your lending structure to your business needs, we can help.

We work on your behalf to facilitate a proven finance solution from a selection of over 40 lenders including New Zealand banks, specialist asset finance, working capital and property lenders.

Our finance solutions can minimise the total cost of finance by structuring debt over the economic/working life of each asset, accessing competitive interest rates, aligning repayments to cash flow and using a combination of revolving credit and fixed or floating term loans that provide cash flow flexibility.

Our dedicated hassle-free service means we work on your behalf as ‘your one point of contact for all your finance needs’. Our personalised professional approach truly sets us apart.

We work as your dedicated finance partner

Our team of 41 has over 800 years collective experience in the finance industry. Our expertise ensures you receive the most efficient finance solution.

Finance New Zealand is a limited liability company led by managing director Simon Webster with directors Simon Bell and Shane McDermott. The head group structure of Finance New Zealand holds eight share parcels held by the managing director and seven business finance advisers.

Our business finance advisers work exclusively for the head group as contractors.

The Finance New Zealand head group manages our relationship with our funding partners, manages our regulatory compliance, and provides administration and sales support to the wider group via the managing director, sales and business associates and part-time compliance oversight. Support includes assistance with marketing, CRM management, credit applications, loan documentation, settlements and general administration.

Our head office is located in Auckland, and our finance advisers manage their own offices in their respective regions.

Finance New Zealand Limited and all contractors are FSP (Financial Service Provider) registered. Finance New Zealand Limited is a licenced Financial Advice Provider and our advisers are engaged to give advice on behalf of Finance New Zealand Ltd.

We are a member of a disputes resolution scheme as provided by the Insurance and Financial Services Ombudsman.

We save you time by working on your behalf to facilitate the best finance solution from one of, or a combination of, our 40 funding partners. No matter your business size or the industry you work in, our team can help.

Establised in 2015, we’re NZ’s largest business finance adviser

Our team offers a personalised service across New Zealand.Getting to know you, your business and your goals in depth is what sets us apart.

We have a 97.7% client satisfaction rating, with 88% attributed to our excellent service.

Net Promoter Score® (NPS®) measures customer experiencevia AskNicely.

Our support team ensures you receive a high level of service and communication when it comes to settlement time, drawdowns and general requests.

Through our close relationships with funding partners and understanding their finance criteria, we are able to provide you with a flexible, competitive and efficient solution. By combining the most suitable structures, facilities, and payment terms, we can minimise your total cost of finance to help you reach your goals faster.

Our hassle-free service gives you easy and fast access to flexible and efficient business finance for new or used business assets, business growth, stock or access to working capital.

We save you time by working as your one point of contact for all your asset finance needs. We work on your behalf to facilitate the best finance solution from one or more of our over 40 funding partners, including New Zealand banks and specialist asset finance funders.

Our friendly and approachable team members are experts in the finance industry. With hundreds of years of collective experience, we understand the full life cycle of business and the challenges that owners and managers can face. Our expertise means we can determine and facilitate the best finance solution for your unique business needs that will nudge you towards your goals faster.

We make it easy for our clients to execute their finance requests. By working with only one person when buying new business equipment, a property or a new motor vehicle, our clients save valuable time. Because we can work with many different funders, our clients may have their funding spread across multiple lenders and/or decide to change funders over time; however, they can continue dealing with us and the one person that knows their business well.

Our clients’ business finance placements can be adaptable to funders’ changing appetites for risk, portfolio growth, pricing expectations, new products, and the changing service proposition across the range of funding partners with which we work.

Whatever the nature of business, our team has extensive experience in structuring lending facilities that add value:

• Business term loans

• Refinances and restructures

• Funding for business growth

• Seasonal assistance

• Overdrafts

• Succession planning

• Release of security

We make it easier and faster to access flexible and efficient finance for your business assets:

• Term loans

• Revolving credit facilities

• Equity access

• Seasonal loans

• Succession planning

• New project finance

• Floor plans

We assist with a range of property finance requirements:

• Development finance

• Construction finance

• Subdivision finance

• Farm and rural finance

• Equity release

• Residenital mortgages

Our lease solutions preserve your capital, minimise disposal risk at the end of term and provide you certainty of cost over the life of an asset:

• Fully maintained lease

• Non-maintained lease

• Finance lease

• IT equipment leasing

• Healthcare leasing

Finance New Zealand can help businesess to fund trading activities:

• Importation of stock

• One-off machinery importation

• Stock funding

• Provision of letters of credit or other forms of trade finance

• Foreign exchange

• Investment property finance Working Capital

Borrow funds against your future cashflow, debtors or stock to meet your day-to-day running costs:

• Invoice finance

• Equity access

• Overdrafts

• Stock loans

• Business term loans

• Line of credit

Finance New Zealand sources and manages funding for new and used motor vehicles:

• Competitive rates

• Fast turn around

• Single motor vehicle or fleet

• Flexible payment structures

• Pre-approvals

We source specialist funders who will pay your insurance premiums upfront. This will spread your payments during the year and may help your cash flow when compared to making payments in one lump sum:

• Insurance funding

Finance New Zealand has established relationships with more than 40 funding partners based both in New Zealand and overseas. These relationships allow us to provide a solution for almost all business finance requirements.

Our established funding relationships allow us to provide a solution for almost all business finance requirements as well as consumer property and motor vehicle funding.

As financial markets change constantly, so do our funders’ products, prices and risk appetites. Our close client relationships, coupled with our in-depth knowledge of the finance market, allow us to guide and assist our clients through the funding process. This may include working with multiple funders and products to get the best solution for a client.

We are strongly committed to long-term mutually beneficial relationships with our funding partners. We are determined to provide quality referrals that meet the joint objectives of the client, the funder and Finance New Zealand.

A core strength of our team is our ability to hunt new, and to build enduring, client relationships. Our funding partners benefit from the client transactions we bring in that are complementary to those sourced through their direct sales networks. Our funding partners

only incur costs for successful transactions that meet all parties’ quality, risk and pricing criteria. These costs are not additional to the funding partner or the client, but rather replace costs otherwise incurred by the funding partner related to the origination and management of client relationships by their own employees.

We aim to provide clear, concise and accurate funding submissions that enable our funding partners to provide a positive solution for the client.

While in most cases Finance New Zealand will act as the primary contact point for an ongoing client relationship, we work proactively to keep our funding partners informed and to assist with any issues that may arise during the course of a loan or lease.

Finance New Zealand’s network of funding partnerships allows us to provide a tailored solution that is the best fit for our clients.

More than one path to finance — we’ll will find the best one for you.

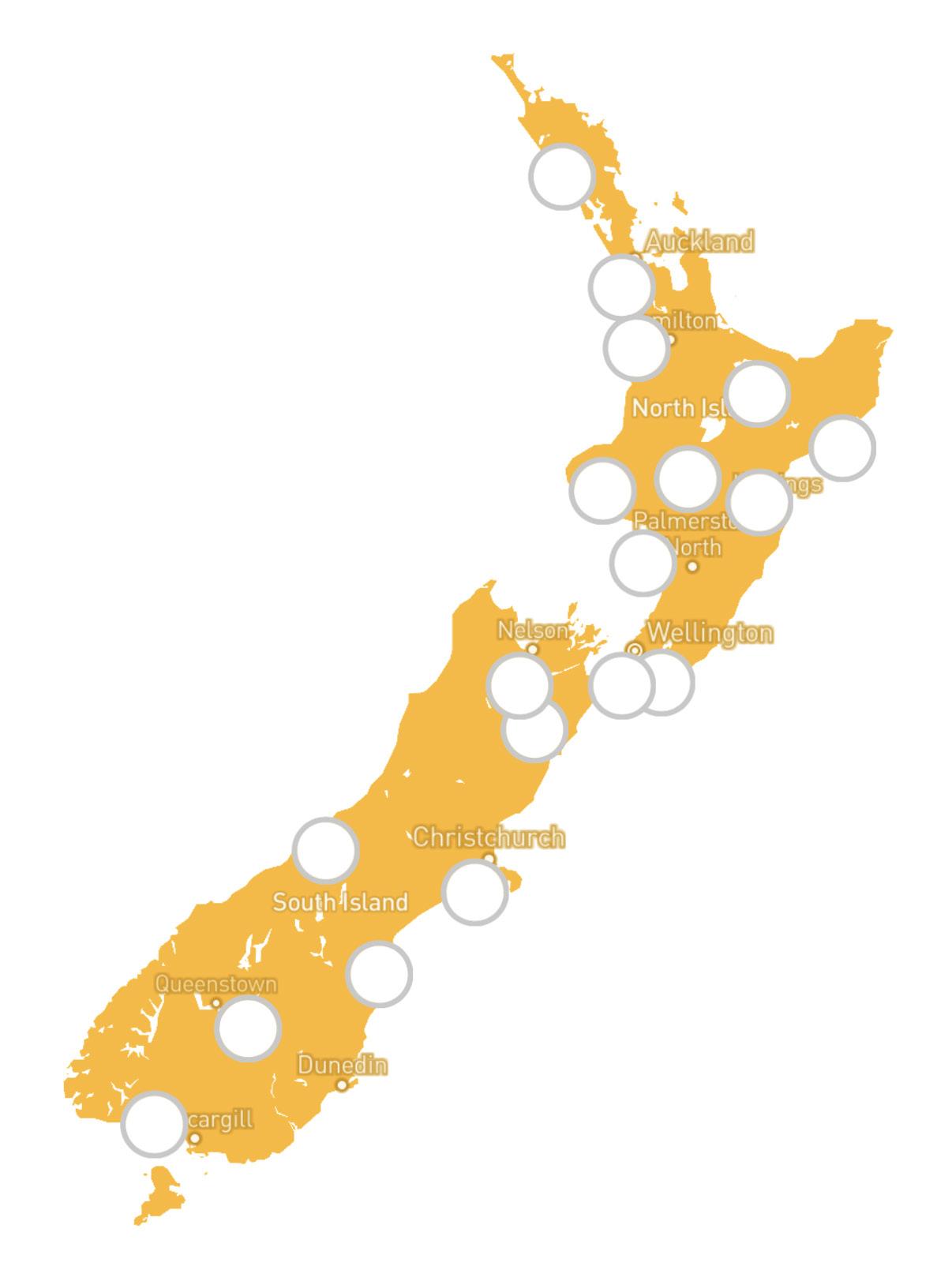

Finance New Zealand has business finance advisers available to meet on-site throughout the country.

We particularly value on-site meetings as they allow us to see your operations first hand and fully understand the opportunities to be had.

Our nationwide coverage allows us to understand business and economic conditions throughout the country. Whether our clients work in our urban centres or provincial New Zealand, we are in touch with the specific regional economic conditions and business drivers.

A snapshot of businesses we can help

We’re New Zealand owned and operated. No matter where you’re located, your business size or your industry, our team is available to help. Since 2015, we have helped thousands of New Zealand businesses with finance solutions, resulting in over $4.15 billion in transactions.

team provides a personal and dedicated service across a wide range of industries, including:

Our aim is to grow the company while retaining our core focus on maintaining solid funding partner and client relationships without compromising our high level of personal service that assists clients to focus on driving their businesses forward.

A total of $4.15 billion has been settled by Finance New Zealand since its establishment in November 2015. Looking forward, the plan is to develop and deepen our presence within New Zealand, while providing excellent ongoing support to a growing client base.

Our service offering will appeal to a wide range of self-starting professionals who are client focused first and foremost. They will enjoy assisting a wide range of businesses with tailored solutions for their industries and trading environments.

An advantage of our service offering is being able to use our various funding partners to provide our clients with a complete funding solution. This ensures our clients enjoy one point of contact that knows their business well, and can deliver across their business needs.

Acting as a head group, Finance New Zealand provides support to minimise the time each business finance adviser needs to spend on compliance, regulatory structure, business administration and other non-client related business activity.

In addition to providing sales support, product training, assistance

in deal structuring, deal submission and approvals, and CRM systems, the head group pools the costs of individual items like insurance.

By bringing scale and having built a professional business, we are able to access funding partners, products and funding rates not widely available to smaller or independent finance advisers.

Our marketing strategy incorporates communications which are delivered to the Finance New Zealand contact database via an HTML email newsletter, social media and through our website www.financenz.co.nz/news. We also have other communications available such as radio, print, direct mail and digital campaigns.

Our head group structure is funded by the retention of a percentage of commissions payable for settled transactions and a small monthly charge to cover operating expenses.

Overall, by becoming part of the Finance New Zealand team, suitably qualified and motivated individuals can build their own highly successful business within a supportive and effective support structure.

Our friendly and approachable team are experts in the finance industry.

Read how Finance New Zealand made a difference for these clients.

“I couldn’t press more to reach out to Finance New Zealand and ask them if you fit because it is the best decision you can possibly make”

We met Sarah and Finance New Zealand at a real crunch point in our business life. We were expanding really quickly and our bank wasn’t comfortable with that. Our accountant at the time introduced us to Finance New Zealand and Sarah, and it’s one of the best introductions we’ve ever had.

Your bank can’t commit the same time, the same passion, the same involvement as Sarah and Finance New Zealand do. She’s part of our round table for every decision our business makes.

On top of that, what we thought was great terms or great pricing — to say we were fairly naive with that — because terms through Finance New Zealand.

Mark Cook - Palmer & Cook

We use Ask Nicely to independently track our Net Promoter Score (NPS), giving us real-time feedback from the businesses we support. With one of the highest satisfaction scores in our industry, we’re proud to be trusted by clients nationwide — and their experiences speak for themselves.

Having modern machinery makes a huge difference — it reduces downtime and boosts productivity.

This was my first time working with a finance broker, and after dealing with banks in the past, it was a relief to have someone who truly understood my industry and what I was trying to achieve. They also identified a few areas where my existing finance could be improved.

It was a great experience, and I’d definitely recommend giving Finance New Zealand a call to see how one of their professional brokers can help.

Shane Berkett - Berkett Aggregates

“Sarah has always provided exceptional service & results as well as supportive information. I highly recommend her professionalism.”

Robert Cameron, RMCFT Ltd

“I have been dealing with Nilesh for over 6 years now. He always delivers, nothing is a problem and always gets me a good deal. I will continue to use Nilesh with what ever financing needs that I require.”

Michael Giles, MD Giles Limited

Rob is always quick to respond to our needs. The process is efficient, and settlements are achieved even when we’ve pushed tight timeframes.”

Guy Broadbelt, Guyza Contracting Limited

Stu makes our finance arrangements on Vehicles easy. He sends clear emails and doesn’t waste our time

Stackit Storage Solutions Limited

“We can plan for the future and have more assurance around our financial position.”

Michael ViningMicheal Vining Contracting Limited

“Simon goes above and byond to help... we have used his services a few times now, and it’s always the same - profesional, fast and reliable!”

Mel Price, Price Contracting

View more: www.financenz.co.nz/testimonials

To find out more about Finance New Zealand Limited and how we can help your business, contact us today on 09 222 0320 or visit www.financenz.co.nz

L11, BDO Tower, 19-21 Como Street, Takapuna, Auckland 0622

PO Box 65164, Mairangi Bay, Auckland 0754

T 09 222 0320 E info@financenz.co.nz

Finance New Zealand Limited is a licenced Financial Advice Provider. FSP number: 468730

Disputes Resolution Scheme – Insurance & Financial Services Ombudsman: 2001681

The information provided is of a general nature and does not constitute financial or other professional advice. While every care has been taken to supply accurate information, Finance New Zealand Limited does not accept any responsibility or liability for any loss or damage which may result directly or indirectly from any information or omission contained in this document. Visit our website for more information, a complete portfolio and important disclosure information relating to Finance New Zealand Limited.

97.8%

Net Promoter Score® (NPS®) measures customer experience. We work hard to ensure our clients receive the highest level of service. We’re proud of our NPS® for the previous 6 months, which reflects the high level of service provided to our clients. Read some of our client reviews at https://www.financenz.co.nz/client-reviews