Profile - First Heritage

Co-operative Credit Union Limited

THE CREDIT UNION MOVEMENT LOGO

The “hands, family and globe” symbol, represents credit unions worldwide. This trademark represents credit unions in any language. The theme is universal and conveys the image of all credit unions.

THE GLOBE - This represents the international network of credit unions.

THE FOUR SILHOUETTES - This represents the family of mankind working for the mutual benefit of all.

THE HANDS -This represents the self-help nature of credit unions.

8

9

10

11

12

13

MINUTES OF THE 10TH ANNUAL GENERAL MEETING OF FIRST HERITAGE CO-OPERATIVE CREDIT UNION LIMITED HELD HYBRID ON THURSDAY, MAY 19, 2022 AT

THE JAMAICA PEGASUS HOTEL

81 KNUTSFORD BOULEVARD, KINGSTON 5

1. ASCERTAINMENT OF QUORUM AND CALL TO ORDER

The Chairman, Mr. O’Neil W. Grant, welcomed all and noted that the meeting was being held via hybrid format, With 51 persons physically present and 64 persons on the virtual platform, the Chairman called the meeting to order at 3:00 p.m. having ascertained a quorum.

He then invited the Board Secretary to read the notice convening the meeting.

2. NATIONAL ANTHEM AND INVOCATION

The Chairman asked all to stand for the playing of the National Anthem. He then invited Miss Michelle Tracey, Assistant General Manager - Marketing, Communications & Member Experience to lead the meeting in prayer.

3. OPENING REMARKS, APOLOGIES AND TRIBUTES

The Chairman conveyed that the Annual General Meeting was being held on the cusp of the 10th year of the existence of First Heritage Co-operative Credit Union Limited which was borne out of the amalgamation of Churches, GSB and St. Thomas Co-operative Credit Unions.

He noted that the Credit Union lost a number of its members to COVID-19 and asked all to stand and observe a minute’s silence for the members who made their transition.

14

The Chairman then invited the Board Secretary, Mrs. Tamara Francis Riley-Dunn, to welcome the specially invited guests.

Mrs. Francis Riley-Dunn extended a warm welcome to the following persons:

Mr. Errol Gallimore

Sheryll Brown

Karen Little

Nichole Bruce

Robin Levy

Vera Lindo

Department of Co-operatives and Friendly Societies

Department of Co-operatives and Friendly Societies

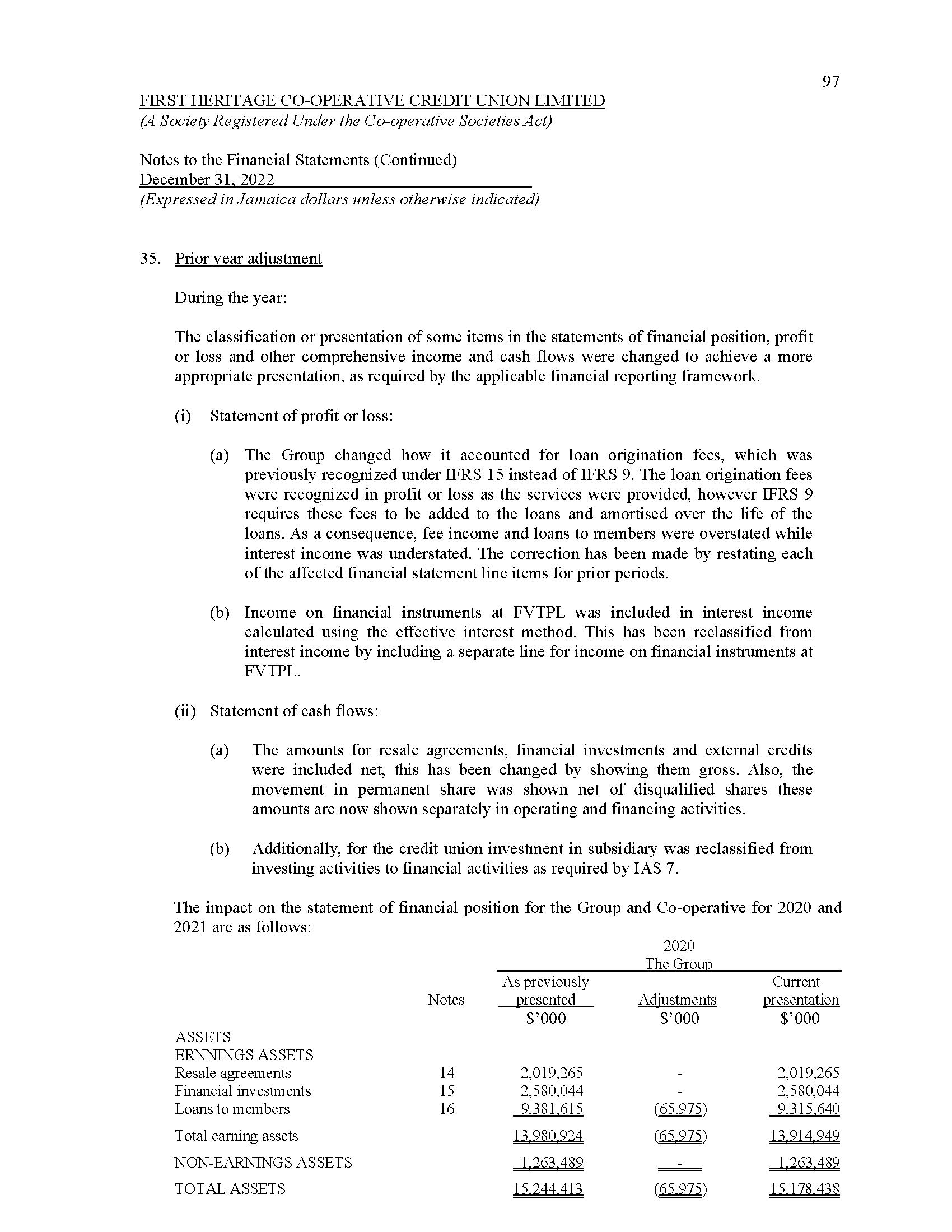

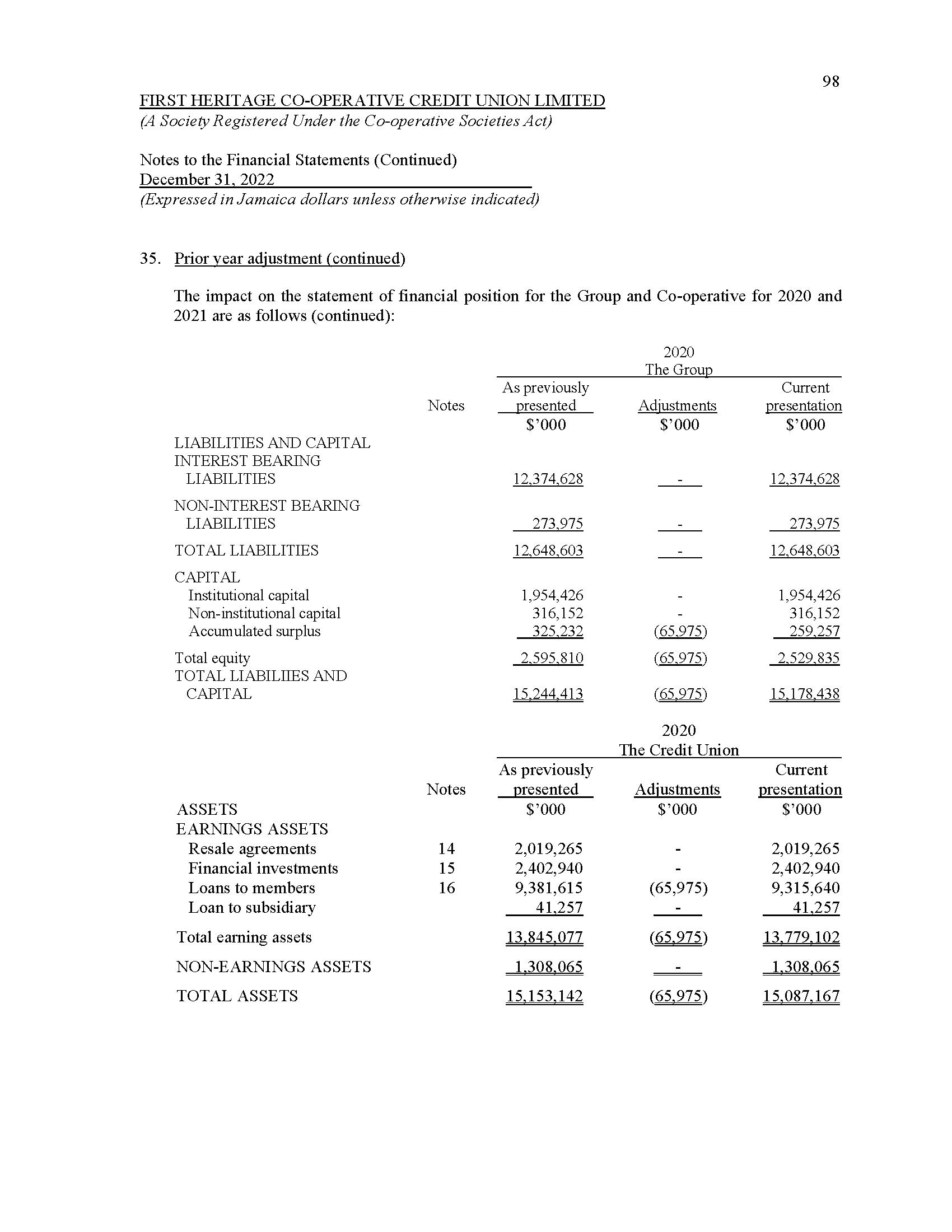

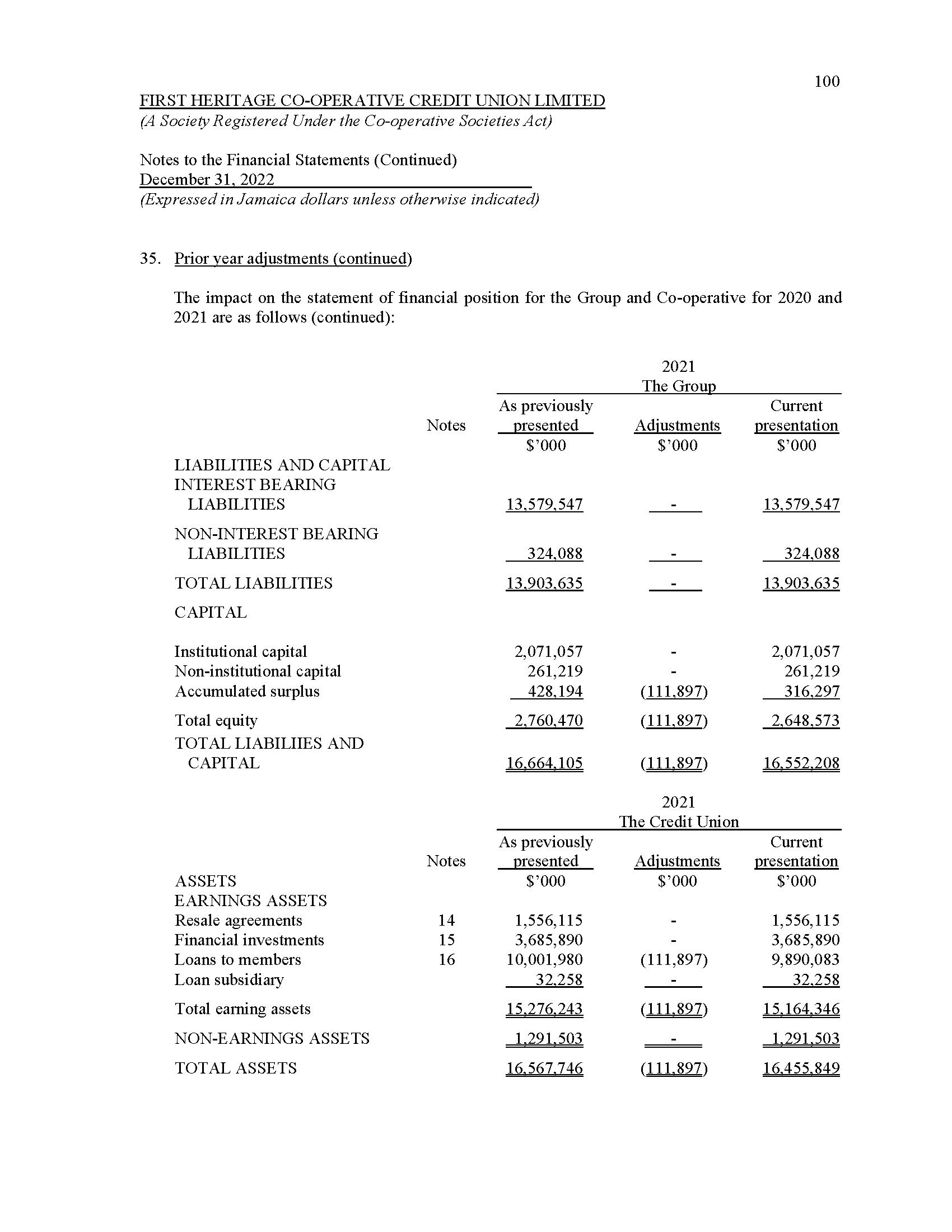

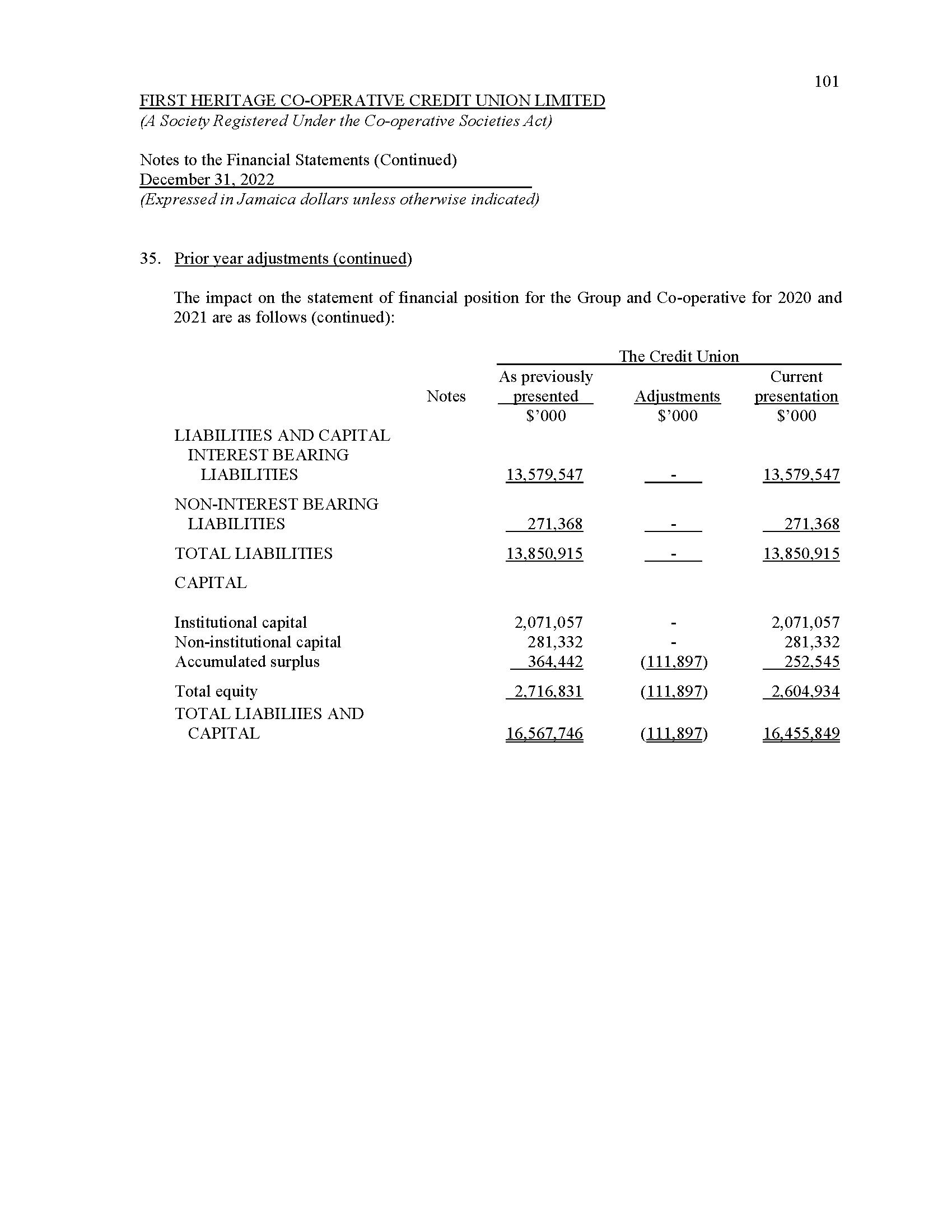

Department of Co-operatives and Friendly Societies

CUNA Caribbean Insurance Jamaica Limited

Jamaica Co-operative Credit Union League Limited

Jamaica Co-operative Credit Union League Limited

Claudette Christie Jamaica Co-operative Credit Union League Limited

Rochelle Stephenson KPMG

Apologies for absence were received from the following persons:

Ms. Judith Wright

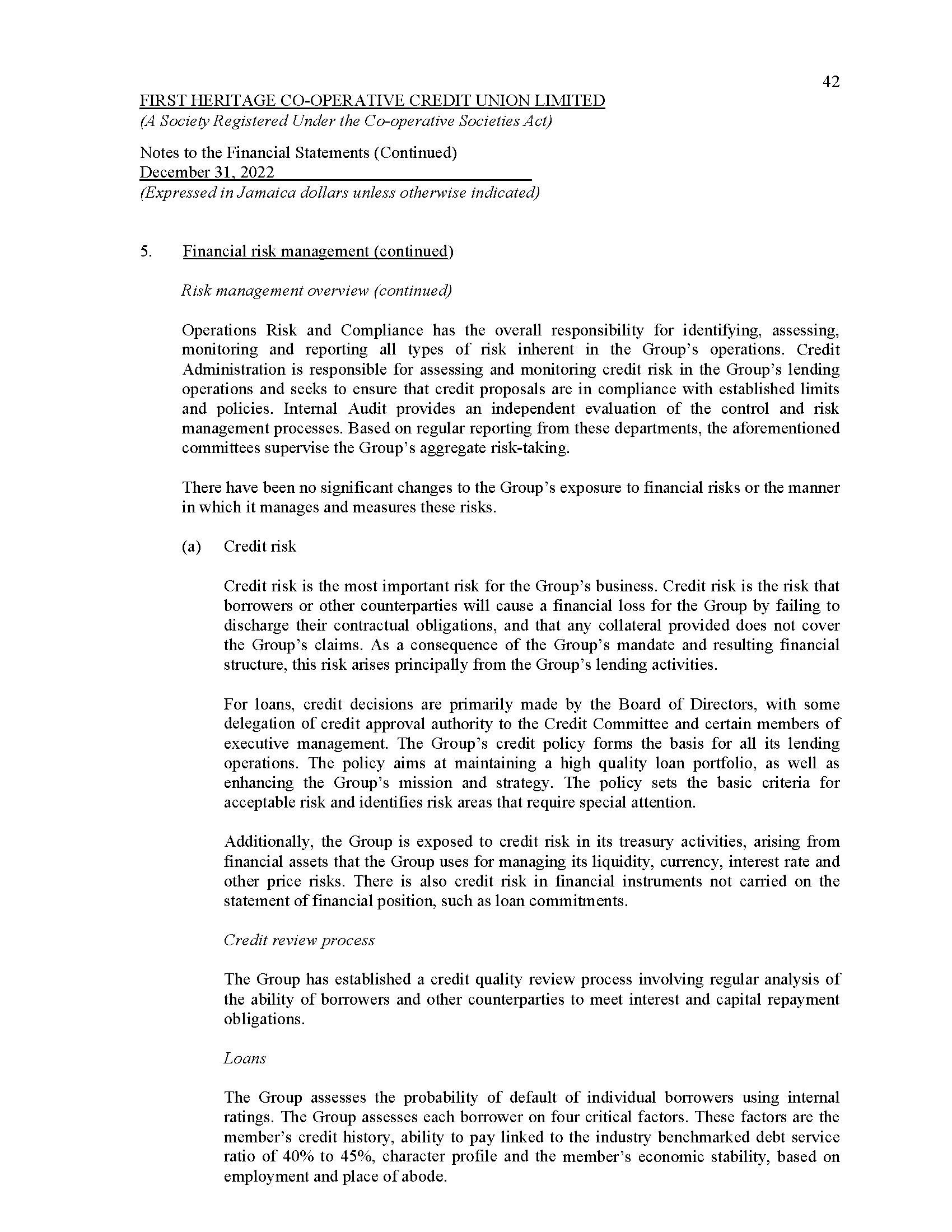

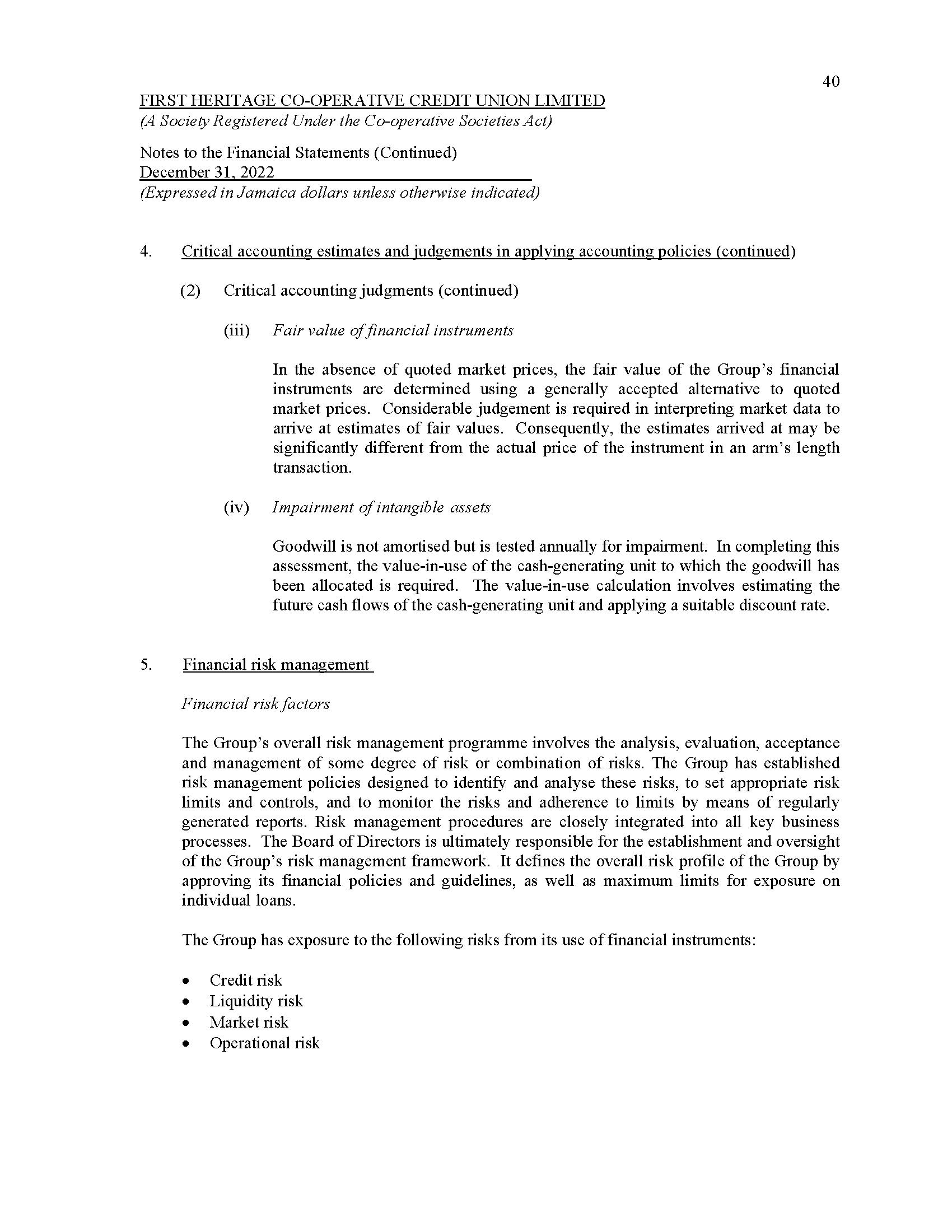

Ms. Georgia Morrison

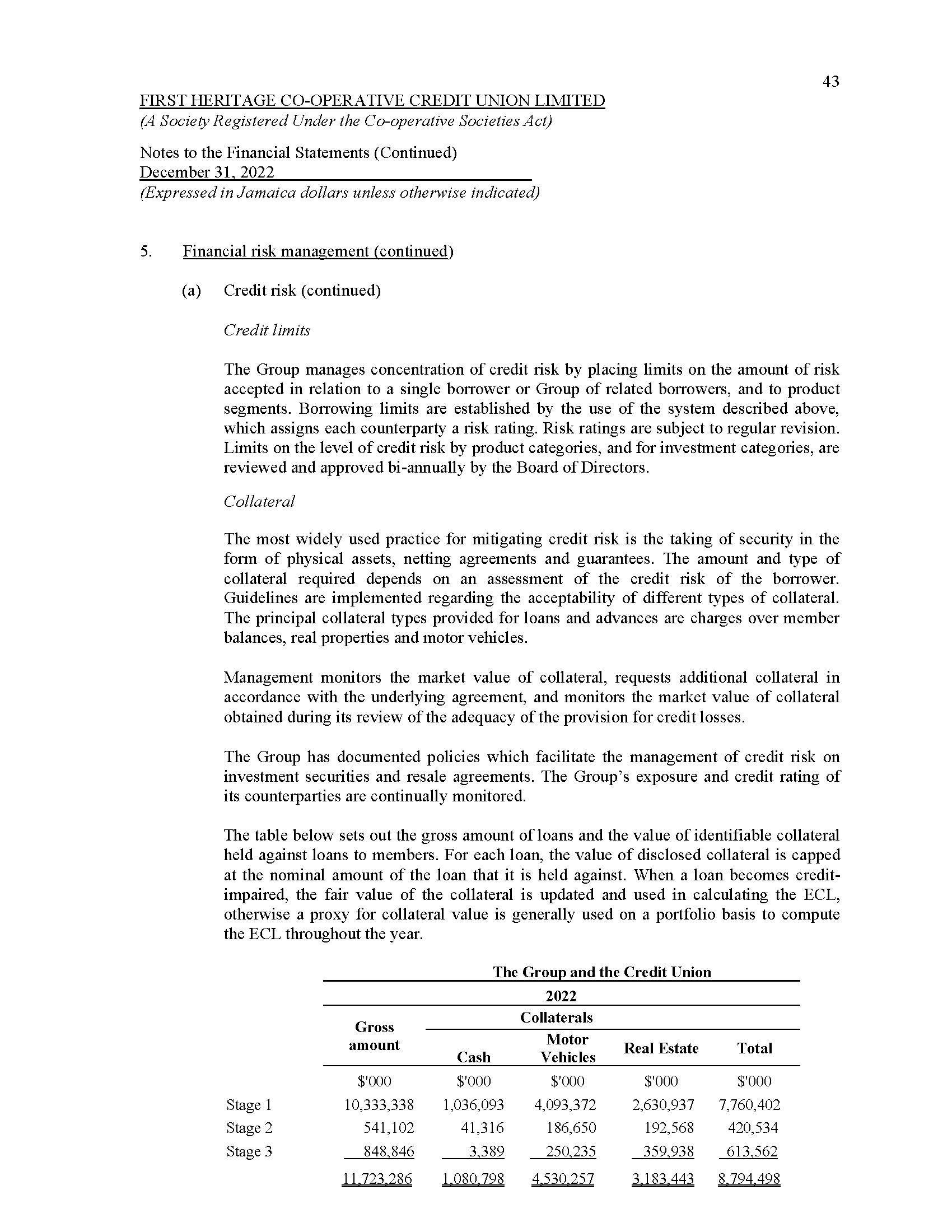

Mr. Dewayne Mullings

Mrs. Tracey-Ann Robinson Huie

Mr. Adrian Lyons

Ms. Denise Donna Mitchell

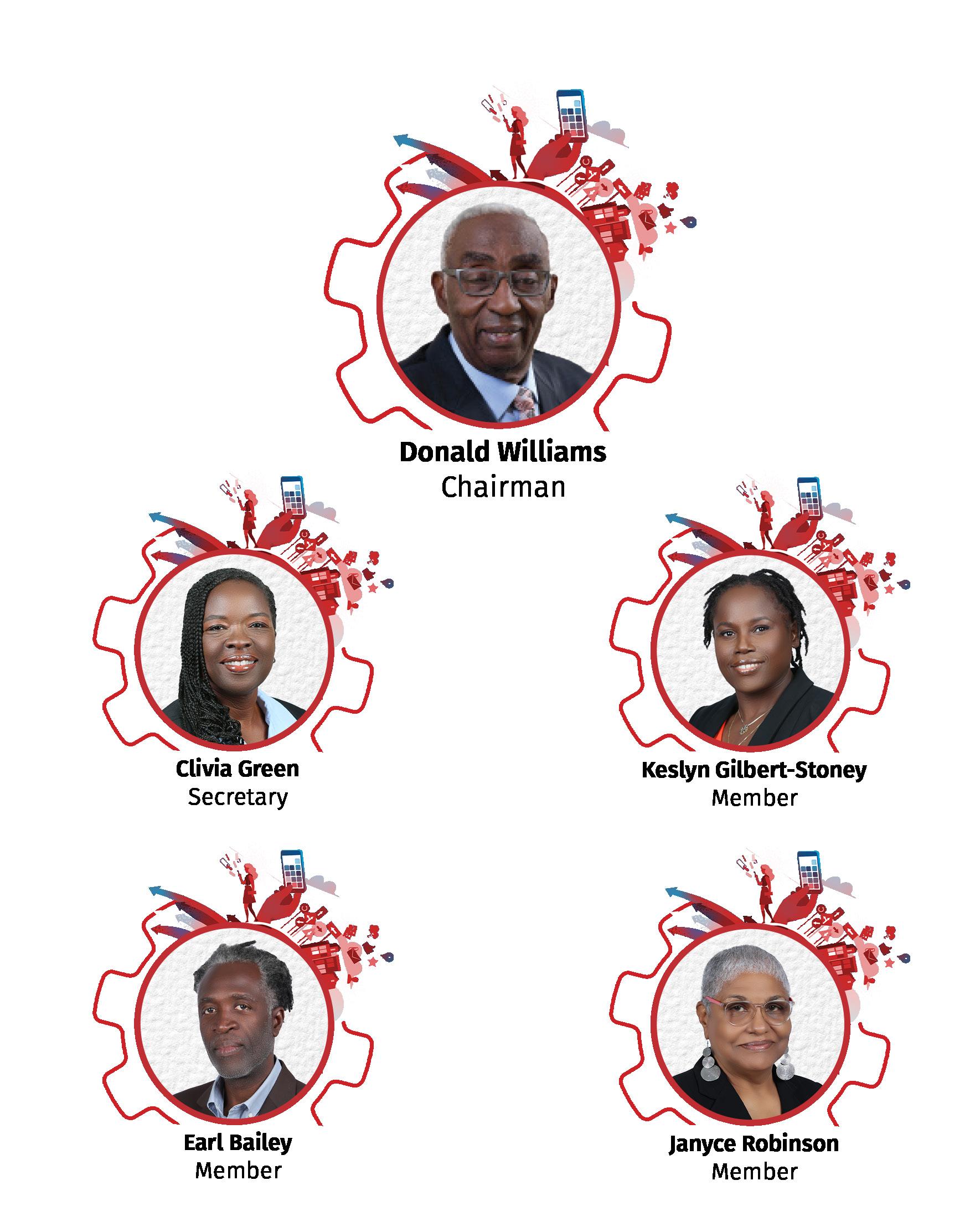

The Chairman then introduced the following Directors, Volunteers and the Chief Executive Officer: Directors

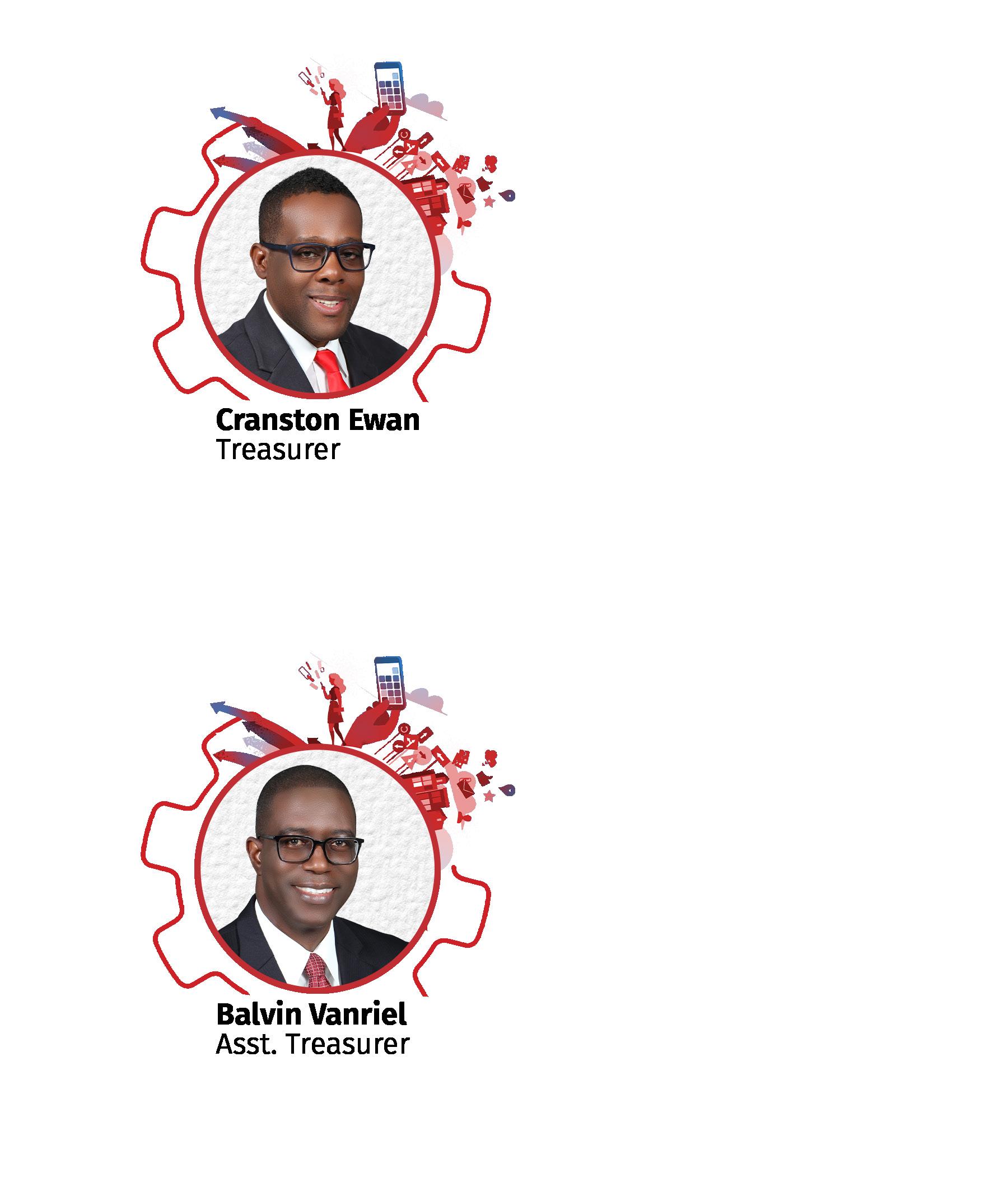

Mr. Cranston Ewan Treasurer

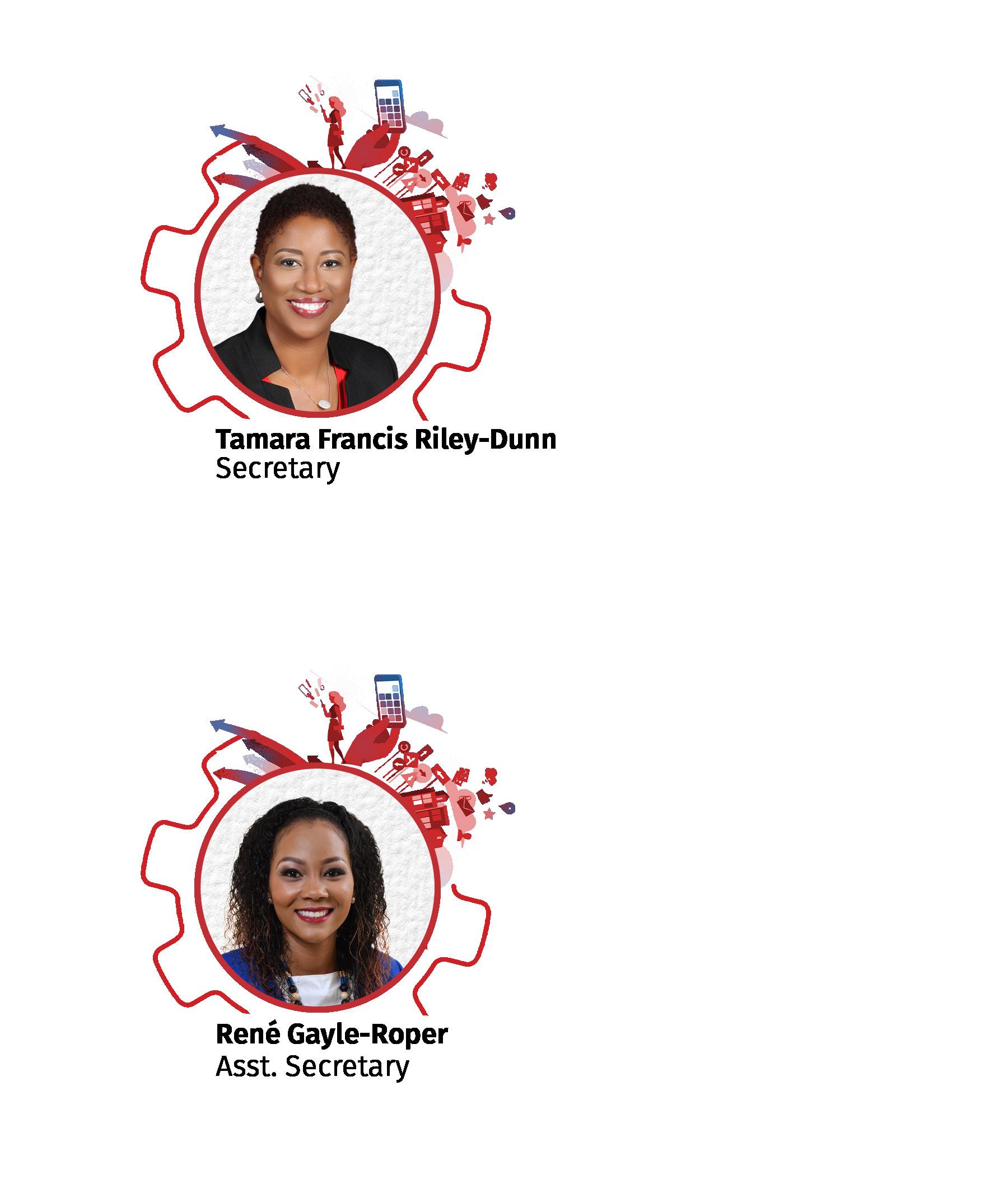

Mrs. Tamara Francis Riley-Dunn

Board Secretary

SSP Michael James Assistant Treasurer

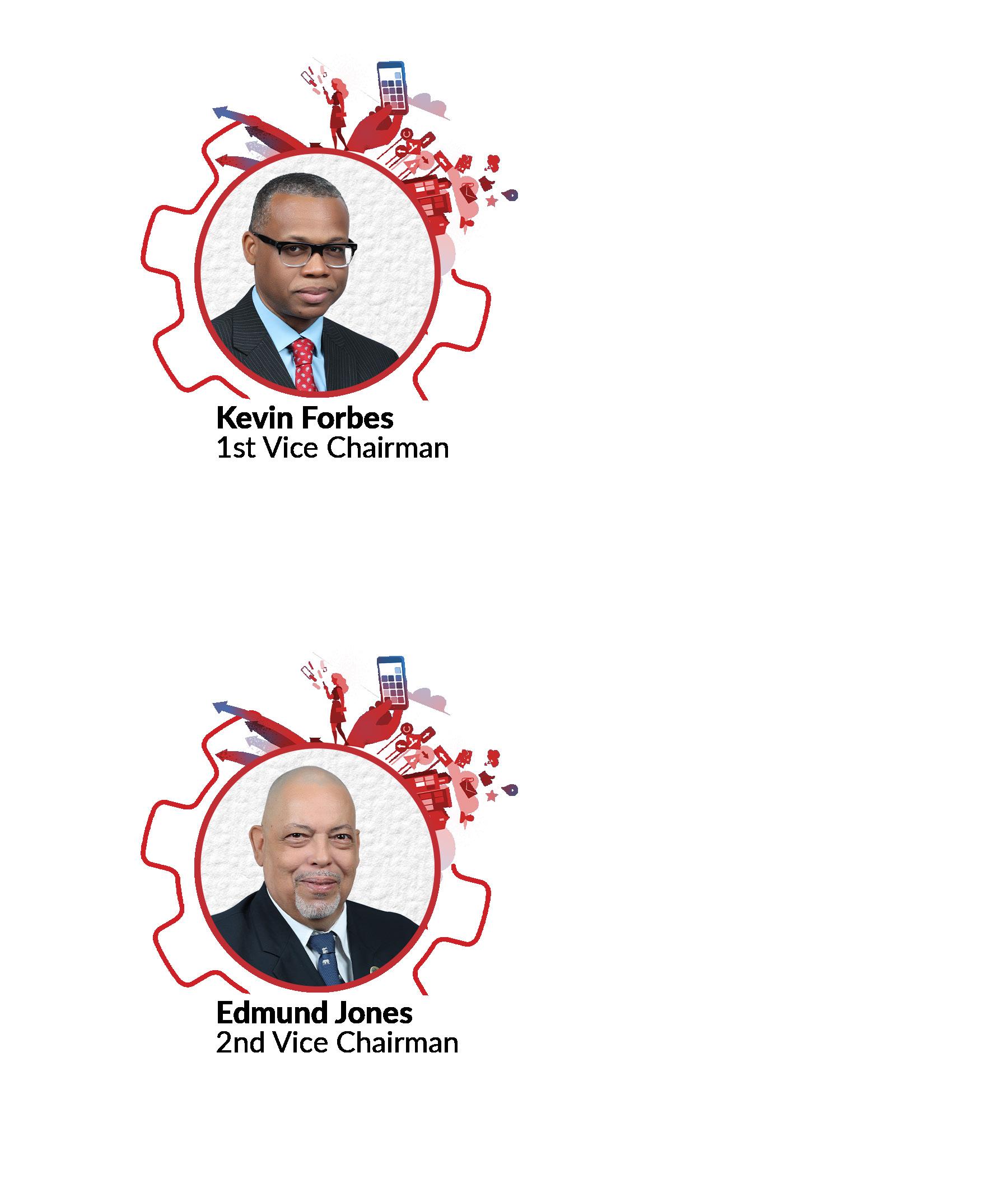

Mr. Edmund James

Mr. Balvin Vanriel

15

Mr. Kevin Forbes

Mr. Noel Francis

He noted that Mrs. Leodis Douglas was online.

Credit Committee

Mrs. Althea Daley

Mr. Donald Williams

Mr. Richard Ranger

Supervisory Committee

Ms. Shauna-Kaye Gordon

Executive Leadership

Ms. Roxann Linton Chief Executive Officer

And himself as Chairman of the Board of Directors.

4. READING & CORRECTION OF THE MINUTES OF THE 9TH AGM

The Minutes were taken as read on a motion moved by Director, SSP Michael James and seconded by Member, Mr. Richard Ranger.

The Board Secretary went through the Minutes commencing at page 16 through to page 34.

There being no corrections, the Minutes were unanimously confirmed on a motion moved by Member, Ms. Charmaine Allen and seconded by Member, Ms. Clivia Green.

5. MATTERS ARISING FROM THE MINUTES OF THE 9TH AGM

The Board Secretary drew the meeting’s attention to the item referred to by Member, A. N. Harris Esq.

16

under ‘Any Other Business’ where he reiterated the need for adequate parking spaces to be provided to the attendees and asked that the meeting be kept at venues where parking was available. She pointed out that they were now at the Jamaica Pegasus Hotel where adequate parking was available.

In relation to Member, Mr. Calvin Thompson’s point about not enough entertainment being provided, she assured the meeting that this would be provided throughout the meeting.

In relation to the third to last bullet point on page 4, Member, A. N. Harris Esq. queried what percentage readiness the Credit Union was at for BOJ regulation. The Chairman stated that though the Credit Union was ready it would be difficult to ascribe a percentage, but that they would continue to look at the processes and systems in preparation for the proposed regulation by the Bank of Jamaica.

Member, Mr. Michael Burke stated that the Credit Union Movement had not been militant enough with the Bank of Jamaica to let them know that the Movement did not want that level of regulation, and suggested that a committee of militant people be formed to ensure that the co-operative spirit in Jamaica was not destroyed. He noted that if such a committee was formed he would volunteer to be a part of it. He added that the people who were being corrupt were the ones to be regulated, but the Co-operative Movement should be left to regulate itself. The Committee, he stated, should not come from the Credit Union League but FHC members who would stand up and demand their rights.

The Chairman indicated that the Credit Union was part of a League that has a very strong lobbying component that had been having serious interface with the Bank of Jamaica over many decades; the most recent being a conversation with Minister Aubyn Hill where they went through some of the impediments and challenges likely to be faced.

6. BOARD OF DIRECTORS’ REPORT

The report was taken as read on a motion moved by Member, Althea Daley and seconded by Member, Charmaine Allen.

The Chairman stated that navigating the COVID-19 pandemic showed that the Credit Union once

17

again embodied the fabric of resilience.

FHC had its fair share of challenges given the general economic climate that prevailed worldwide, however, the hardworking Management Team, the Board of Directors, the right mindset, and the strategies employed ensured the Credit Union’s success during 2021.

The Chairman expressed his appreciation for the unwavering loyalty of our valued members during the trying times of the pandemic, and noted that the members continued to remain at the centre of all decisions and strategies employed by the Board and Management Team.

The Member Assistance Programme which was introduced during the pandemic, remained in effect to support members whose finances were negatively impacted by the economic disruption.

Focus was placed on the health, safety and wellbeing of members and team members during the period of the pandemic.

The Board of Directors, the Committees and FHC’s Executives continued their quest to drive the 2040 Vision, geared towards digital transformation, through the execution of the 2021/2023 Strategy Map. The Management Team was now examining how they conduct business with the aid of digital solutions which would give greater access to the various products and services.

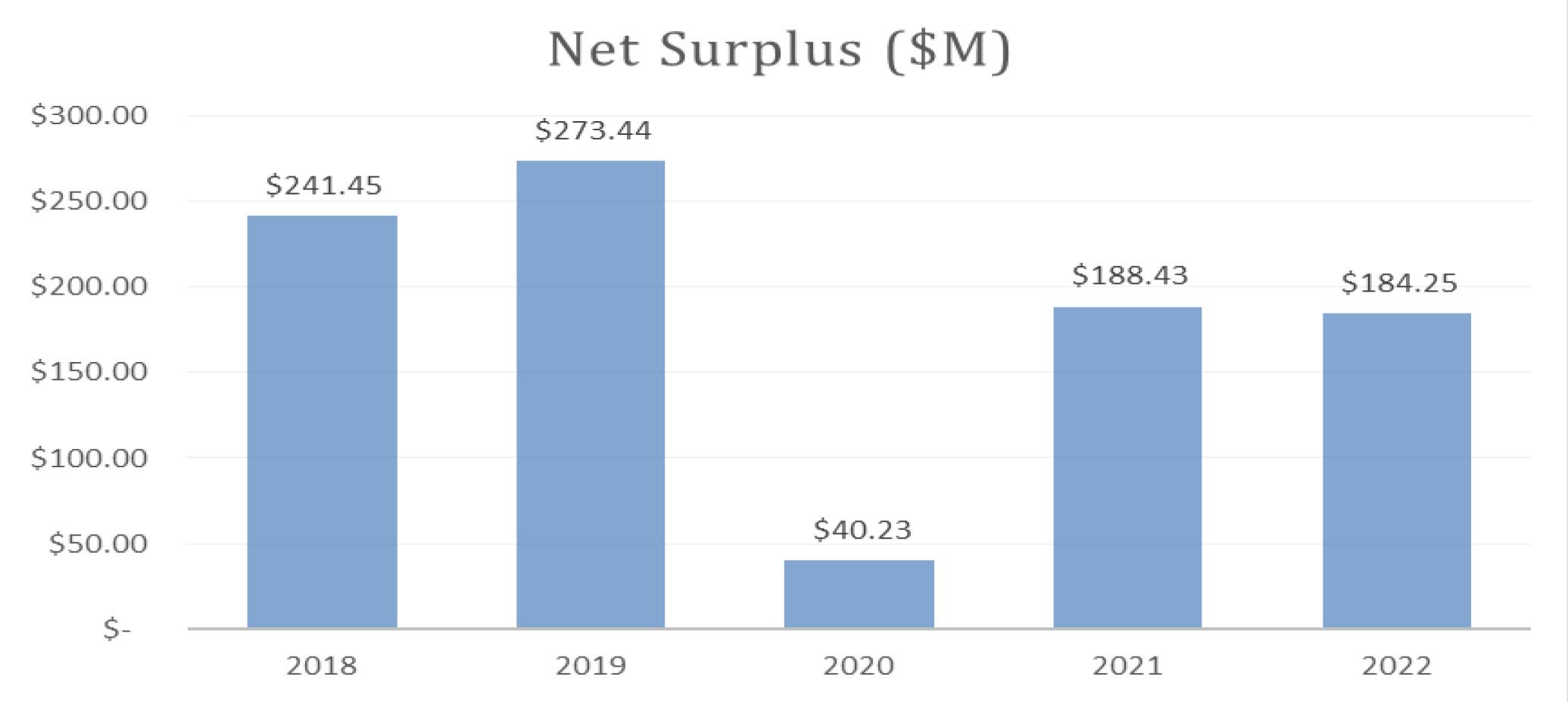

The Credit Union performed creditably, closing the financial year 2021 with a positive performance. At the end of the financial year, the Credit Union generated a net surplus of $235.35 Million compared to $106.2 Million in 2020.

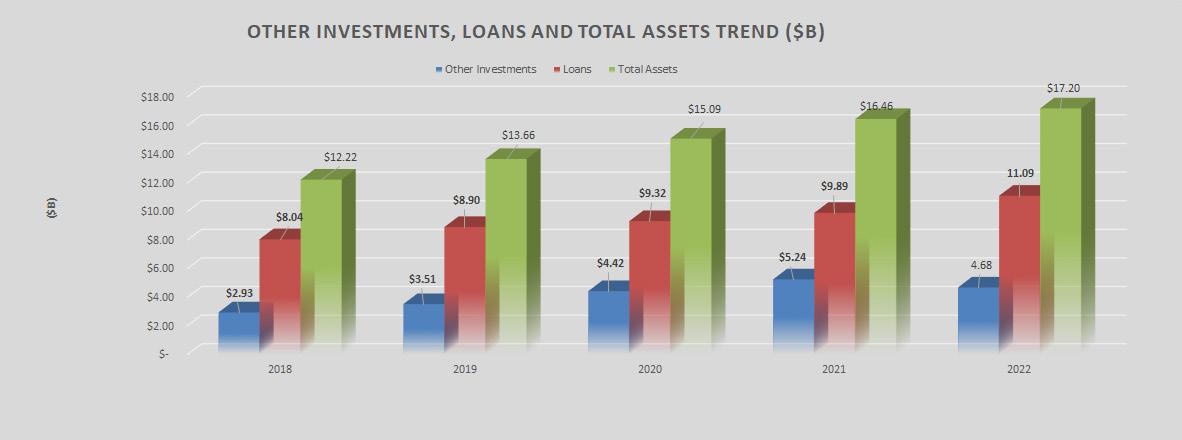

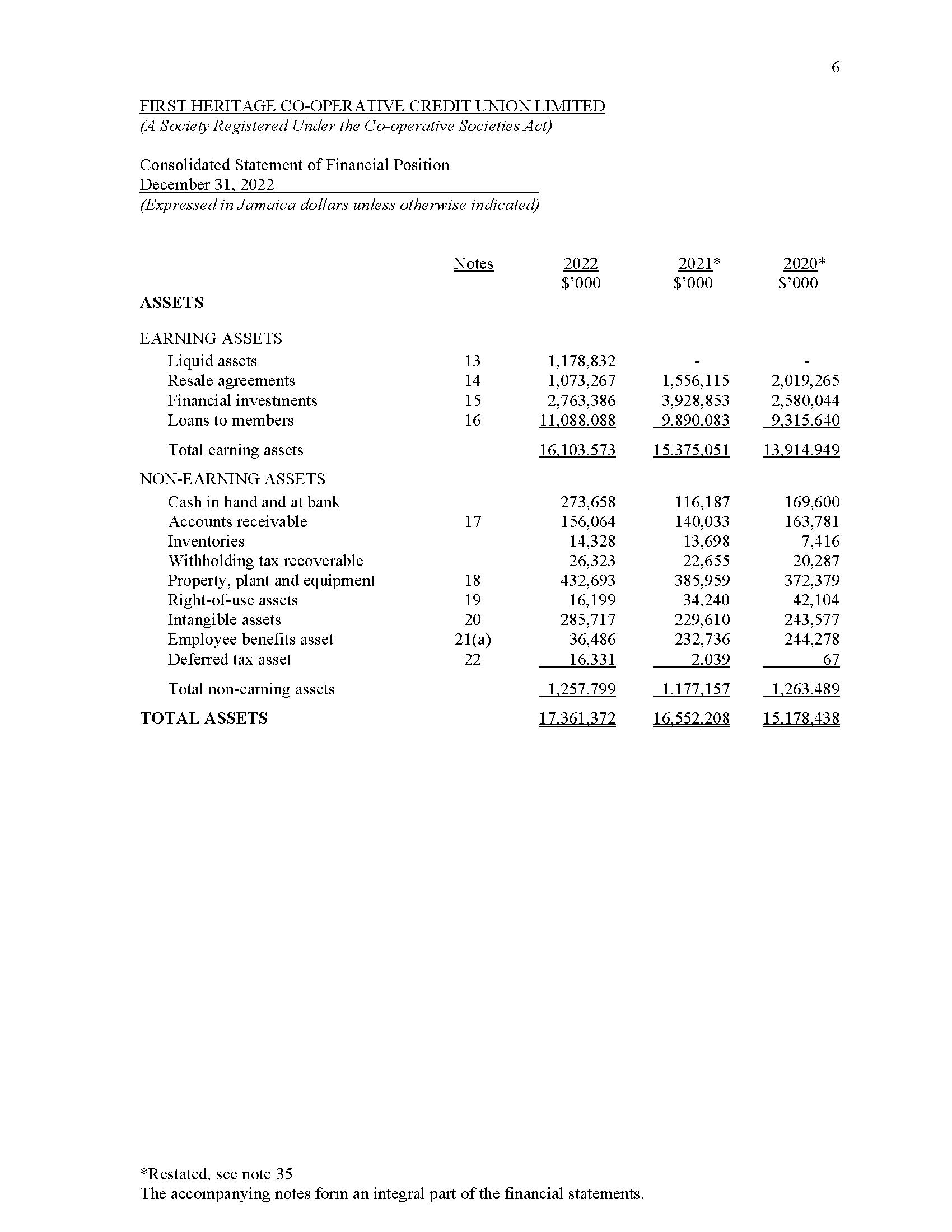

The asset base increased from $15.15 Billion in 2020 to $16.57 Billion in 2021.

In July of 2021, FHC Investments Limited (FHCIL) received its Member Dealer Licence enabling members to buy and sell stocks on the Jamaica Stock Exchange, thus, facilitating wealth creation amongst the membership.

18

The pandemic continued to have an effect on the members’ borrowing patterns, resulting in the leadership team carrying out tactical approaches to drive the growth of the deposits, loans and asset portfolios.

A robust risk and compliance approach was maintained throughout the year.

Despite the volatility of the financial markets stemming from rising inflation, high energy prices and supply chain disruption, FHCIL reported a net profit of $3.6 Million for the financial year ending December 2021 compared to a net loss of $5.2 Million the previous year.

The Credit Union and its subsidiary remained committed to its corporate social responsibility guided by 3 pillars, Youth, Education and Sports (Y.E.S.). A total of $1.75 Million was awarded to 37 recipients in the form of scholarships, bursaries and grants. The FHC Entrepreneurship Awards had been deferred to 2022 where grants amounting to a total of $1.5 Million would be disbursed to the awardees.

It was noted that the FHC Foundation and the FHC Credit Union together, donated one hundred tablets to the National Education Trust valued at $1.5 Million in 2020. Forty of these devices were allocated to children with special needs and the remaining sixty devices were donated to primary and secondary level students.

The Chairman, on behalf of the Board of Directors, expressed sincere gratitude and thanks to all members for their loyalty, dedication and continuous support over the year, and to the team members for their unrelenting focus, strident efforts and commitment to ensuring the Credit Union’s success.

He expressed the hope that with the uptake of the COVID-19 vaccine, the Government would incrementally ease the current restrictions, and businesses, including the Credit Union, would begin to return to a degree of normalcy.

The Board of Directors, he stated, was confident that the Management of the Credit Union would continue to focus on the strategic vision ensuring that the Credit Union remained solid.

19

Comments & Questions

Member, Mr. Michael Burke stated that he was happy to hear about the Stock Brokerage Licence as people would not be empowered until they own something which would cause the stress levels in the society to go down.

He indicated that for the last 10 years he had been a delegate from COK to the Jamaica Fishermen’s Co-operative, and suggested that First Heritage Credit Union takes steps to become a member of that co-operative so they could help them to get into the hotel industry which in turn would employ more people.

The Chairman stated that some of the initiatives that Member, Mr. Burke spoke of were being considered by the Jamaica Co-operative Credit Union League. He noted that the inclusion of other co-operatives under the umbrella of National Union of Co-operative Societies Limited (NUCS) was under active consideration, seeing that the League was now being transformed under the new legislation to become a special authorized Credit Union. In the interim, he noted that co-operatives could become members of FHC and engage the Micro & Small Business Unit so they could access micro-business loans for working capital support.

Member, Ms. Charmaine Allen endorsed Member, Mr. Michael Burke’s position and stated that the Credit Union should not take the suggestion that Member, Mr. Burke made lightly, in relation to the Fishermen’s Co-op and should seize the opportunity to assist them. She also added that the Credit Union needed to target the youth to begin saving at an early age. The Chairman assured her that her thoughts were aligned to that of the Credit Union, where the unbanked, underbanked and young people would now be able to get a foothold into the Credit Union. They would have an opportunity to be cultured and taught what it means to be a co-operator and incrementally become a full-fledged member. The Chairman noted that members would be asked to vote on a resolution to that effect later in the meeting.

Member, Mr. Wayne Jones commended the Leadership and team members of the Credit Union for its success over the past ten years. He noted that a significant number of younger persons were

20

exhibiting renewed interest in stocks and bonds, and that it was refreshing to hear that FHCIL was now branching out in that area. He recommended, that the Credit Union seek to deepen and broaden its participation in the market, paying close attention to the Millennial and Gen Z cohort and reviewing how the message was being packaged to attract them. The Chairman assured him that in looking at the member at the centre strategy, a strong component was the youth and that it was now expanded to look at the underbanked.

There being no further questions, the Board of Directors’ Report was unanimously adopted on a motion moved by Member, Mr. Wayne Jones and seconded by Member, Mr. Michael Burke.

7. MANAGEMENT REPORT

The Management report was taken as read on a motion moved by Director, Kevin Forbes, and seconded by Member, Althea Daley.

Ms. Linton expressed pleasure to once again meet with members face to face and acknowledged the strong representation online. She extended a warm welcome to all.

She acknowledged the presence of the FHC Board of Directors, invited guests from the Jamaica Co-operative Credit Union League and its member companies, the Department of Co-operatives and Friendly Societies, CUNA Caribbean Insurance Jamaica Limited, the Auditors from KPMG, the Executive Team, and other team members.

She stated that, despite the challenges that the Credit Union faced over the past two years, they were now powered up as they continued to raise the B.A.R., an acronym that was coined to challenge herself and team members to:

B - Be Aware - of changes that are happening in the members’ lives

A - Attitude - being flexible and embracing openness to change

R - Reimagine - continuously developing the capacity to understand how the Credit Union changes, and how it envisions a new way of operating; how the members interact with the Credit Union, and how the Credit Union plans for that transition going forward.

21

She noted that the AGM theme “POWER UP: Reimagining Possibilities” was a follow on from the Blast Off 2022 theme geared at energizing team members to raise the B.A.R.

She then highlighted the following:

That the team members were at the core of raising the B.A.R. so as to underpin their Member at the Centre mantra, and that she was proud of the ways in which over 250 team members, navigated through significant disruption and uncertainty, and responded to the members and communities while supporting each other.

That during the year a winning spirit was cultivated, despite the continuation of the COVID-19 pandemic, through the execution of a number of strategies.

A new event for 2021 was the introduction of a Kindness Week, where the week of November 8 to 12 was dedicated as FHC Kindness Week. Daily activities were undertaken to inspire acts of kindness among team members and persons with whom the Credit Union interacted. The week culminated with the handover of a cash donation to the Jamaica Legion Poppy Appeal towards food and medical care for military veterans.

Team members received the appropriate training and development to enhance their performance and broaden their scope of knowledge in critical areas of operation.

Training was also provided to team members, as it related to the new and imminent Data Protection Act that the Credit Union would be required to comply with.

A structured Leadership Development Programme was launched in recognition of the need to improve the strength of the branch leadership. This resulted in a new Branch Management Leadership Development Training Programme being launched in July. The curriculum focused on both technical and non-technical aspects of branch leadership.

22

The Credit Union was deeply shaken and saddened by the passing of two team members, Mrs. Dawn Edwards and Mr. Michael Williams; condolences were extended to their families.

The management team and team members continued to focus on our Member at the Centre ethos in a bid to continue to deliver an exceptional member experience where focus was placed on members’ needs and identifying their challenges and hurdles, so as to build trust and confidence.

The Credit Union connected digitally through various social media platforms to retain constant contact with members, regarding our various product and service offerings. In addition, members were communicated with through emails and text messages. The CEO invited members who have changed their email addresses to advise the Credit Union of the change, so that their records could be updated.

During the pandemic the Credit Union also communicated with its members through the monthly ‘Feeling the Joy’ webinars where it offered hope, joy and encouragement to the members along with useful financial information.

The Credit Union continued to maintain contact with civil servants through the staging of the Civil Servants of the Year Awards 2021. The CEO congratulated the winners, Ms. Andrene Davidson of the Jamaica Information Service, Mr. Ronald Frue of the Administrator General’s Department and Mr. Clayton McCalla of the Ministry of Health and Wellness.

Despite the movement restrictions, the Credit Union was able to host a Member Appreciation Day. These activities included a webinar under the theme ‘Helping Entrepreneurs Advance’, hosted by the FHC in collaboration with the Development Bank of Jamaica and other entities.

Members were reminded and encouraged to use the alternate channels to do business such as online banking via iTransact, to utilize their AccessPlus Debit Cards and very soon to be introduced AccessPlus Debit Mastercard. Members were also informed of other alternate banking mechanisms through Bill Express and electronic bank transfers.

23

In December 2021 the Credit Union hosted a ground breaking ceremony for the new St. Thomas branch, scheduled to be completed in the latter part of 2022. This is in preparation for the expected economic growth and development in that parish; and to provide existing members with a more comfortable and appealing experience.

Members were asked to enquire and learn more about the Family Indemnity Plan and the Family Critical Illness Insurance Plan; products offered by CUNA Caribbean Insurance for final expenses for themselves or their loved ones.

The Member Assistance Programme introduced during the pandemic continued, where members are accommodated through moratoria, reduced fees and other waivers.

Members continued to be provided with opportunities for restructuring and consolidation of their loans in order to strengthen their financial positions. Members having financial difficulties were urged to seek dialogue with the Credit Union so a solution could be arranged.

It was noted that the Credit Union was in the implementation stage of establishing governance structures to support the business continuity of its operations. Those plans are soon to be retested.

The Credit Union’s financial discipline, risk management culture, as well as a robust capital position, provided a solid foundation for growth during the year. FHC’s overall performance in 2021 demonstrated a positive progression reflecting solid results, which gave rise to a net surplus of $234.35 Million and disbursements totalling $4.17 Billion for the period.

In closing the CEO expressed gratitude to the members, team members, Board of Directors and Volunteers who worked tirelessly to ensure that the year was a success.

She expressed confidence that, equipped with a clear vision, strength and adaptability, the Credit Union would continue to leave an indelible mark on those it serves.

24

The floor was then opened for questions.

Member, Mr. Michael Burke commended the CEO on a comprehensive report. He recommended that going forward the CEO should make it known that FHC interfaces with the membership personally and not predominantly through digital mechanisms as occurs at a number of other financial institutions.

Member, Ms. Hanna Dixon commended the CEO for a good report, but noted that emphasis was being placed on the younger generation; and though she was not resisting digitalization, some members like herself who had been with the Credit Union for over forty years, do not know how to use these systems. She suggested that in each branch an officer be placed on the floor to deal with the older members. The CEO assured her that they were committed to not leaving any member behind and would be working with the different member cohorts to educate them as service delivery channels change and further assured her that the eleven locations are staffed to support members of differing ages.

Member, Ms. Loreen McDonald complained about the Portmore Branch which she stated needed upgrading and more tellers so as to reduce the wait time. The CEO undertook to look into the situation and make the necessary improvements as needed.

Member, Ms. Loreen McDonald then queried why the receipt from the ATM did not state the outstanding balance on the account as normally obtains. The CEO informed the meeting that due to the prevalence of fraudulent and criminal activity, the transaction receipt no longer stated the balance in the account and that members wishing to get their balances could talk to a Member Service Representative.

Member, A.N. Harris Esq. stated that he did not have online access to retrieve his Annual Report booklet and review it ahead of the Annual General Meeting. He queried whether the printed copies could be had at least two days before the meeting. The CEO stated that is was the team’s modus operandi to make the Annual Reports available in advance, but they were not able to maintain the standard due to some minor challenges that they encountered and apologized for the inconvenience.

25

There being no further questions the Management Report was unanimously approved on a motion moved by Director, Balvin Vanriel and seconded by Member, A. N. Harris Esq.

8. AUDITORS’ REPORT

The Chairman invited the representative from KPMG to present an abridged version of the Auditors’ Report.

The Auditor, Ms. Rochelle Stephenson, stated that in their opinion the accompanying financial statements gave a true and fair view of the financial position of the Credit Union and the Group as at December 31, 2021, and of the Group’s and Credit Union’s financial performance and cash flows for the year then ended, in accordance with International Financial Reporting Standards (IFRS) and the Co-operative Societies Act.

The Chairman thanked Ms. Stephenson for taking the meeting through the Auditors’ opinion.

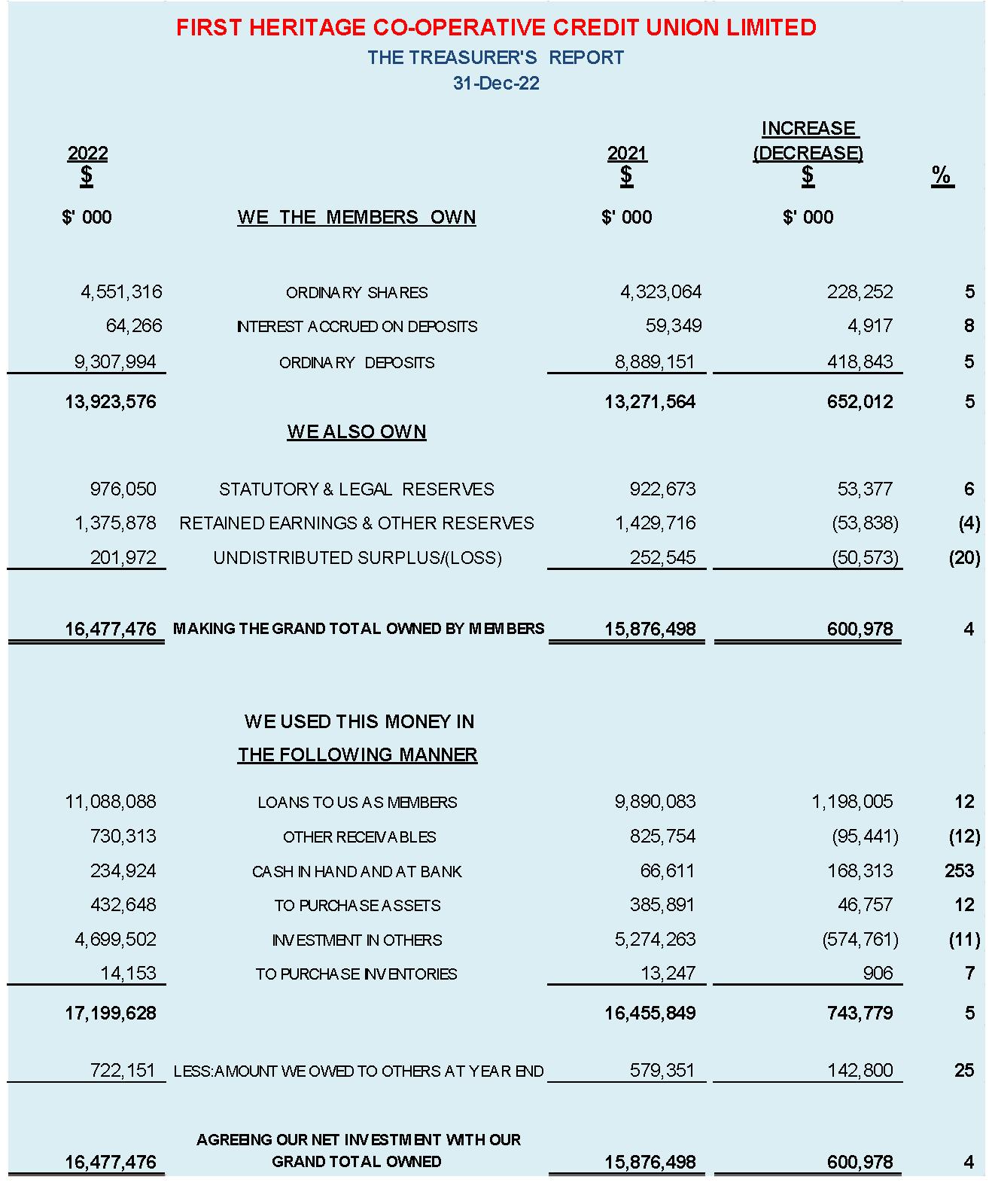

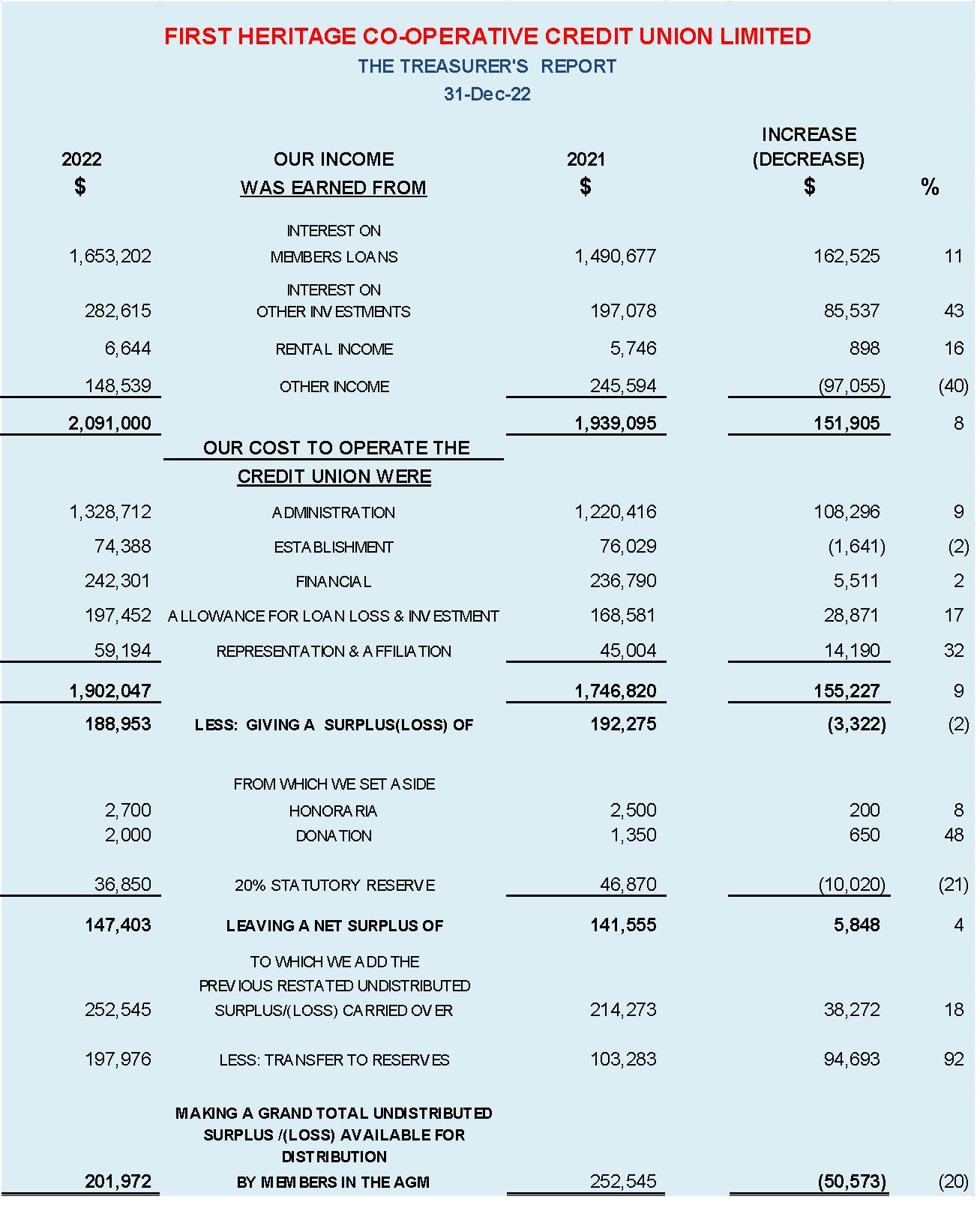

9. TREASURER’S REPORT

The Chairman invited the Treasurer Mr. Cranston Ewan to present the report for 2021.

The Treasurer’s Report was taken as read on a motion moved by Mrs. Carian Freckleton Cousins, Legal Counsel and Corporate Secretary and seconded by Director, SSP Michael James.

He highlighted the following:

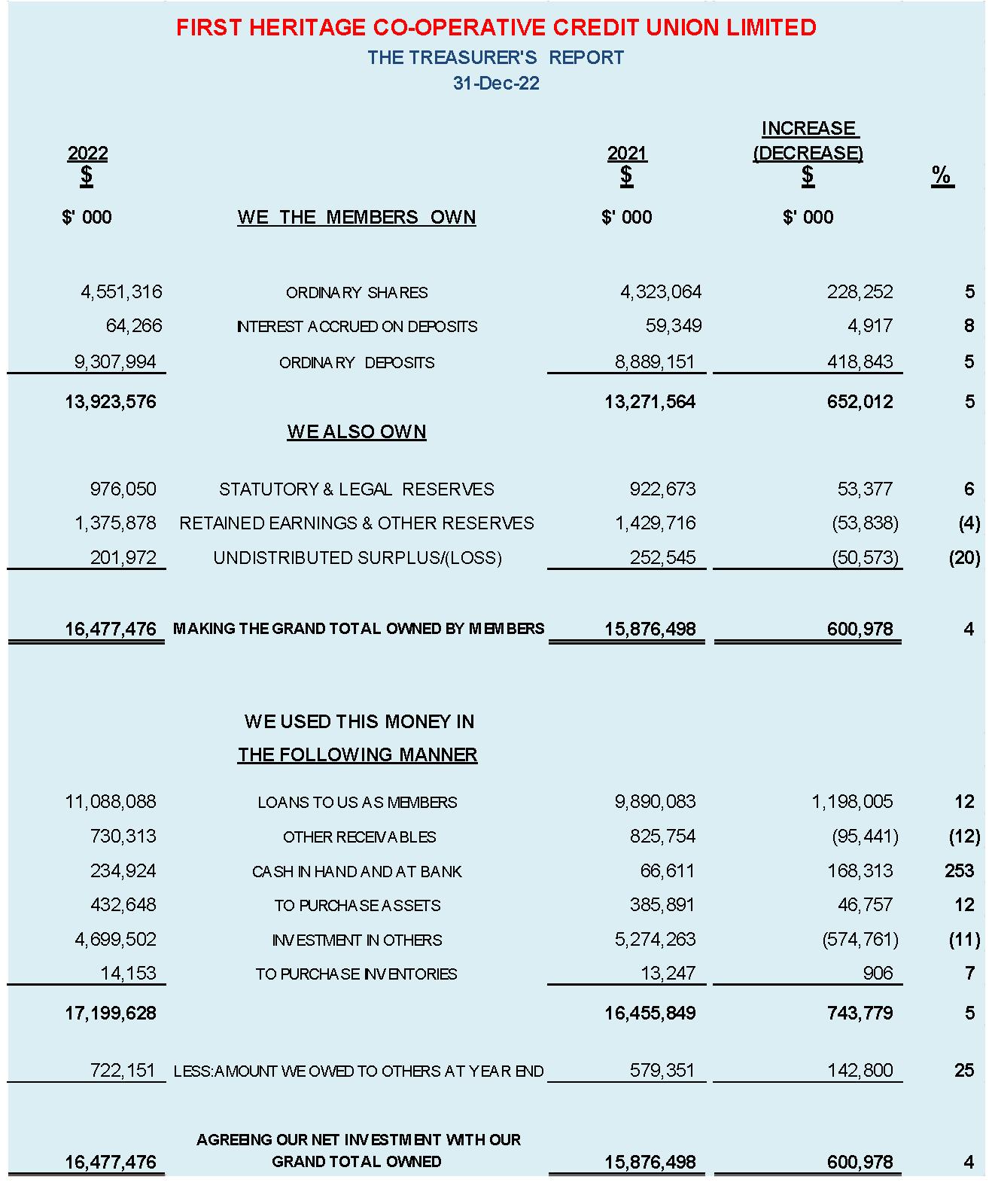

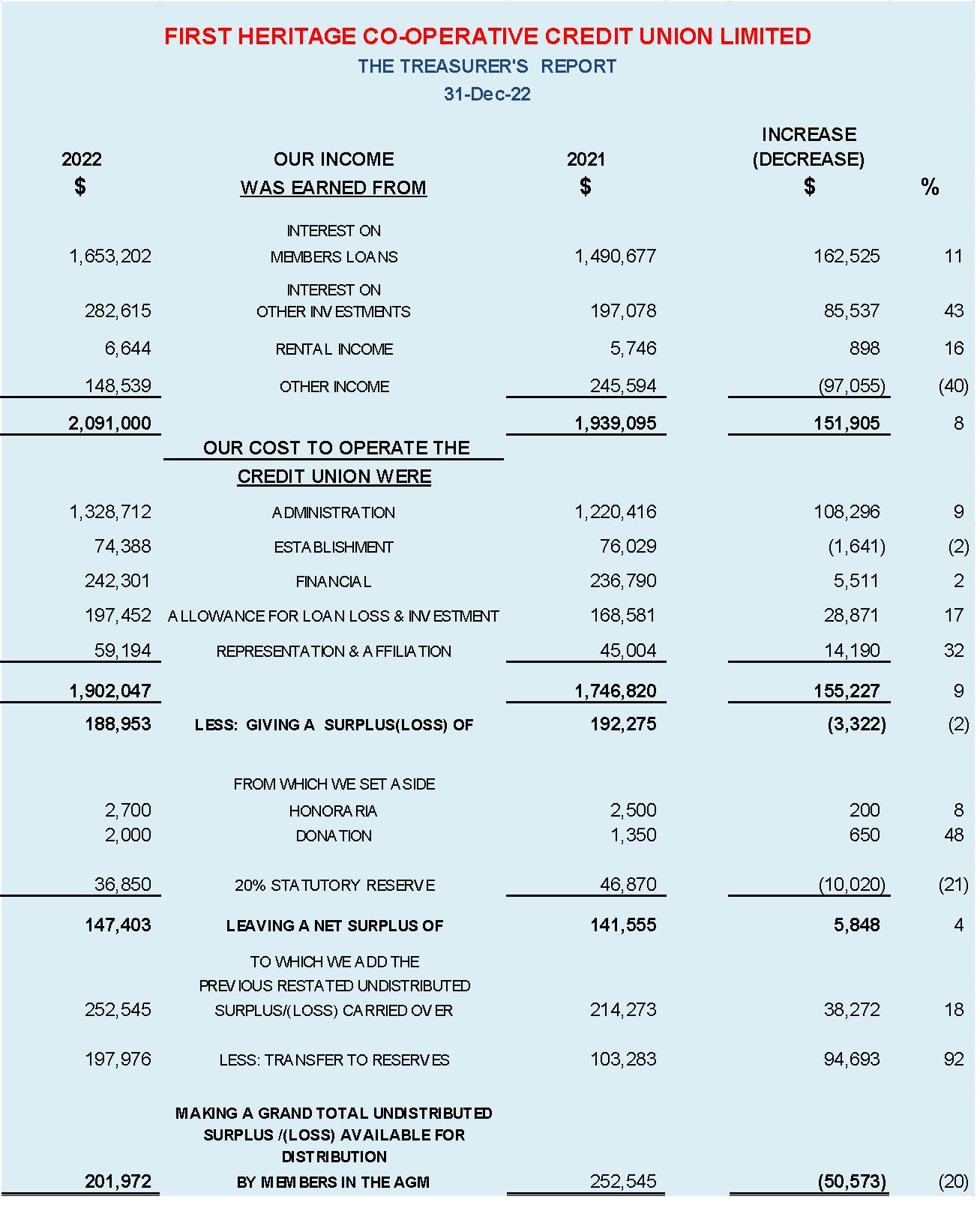

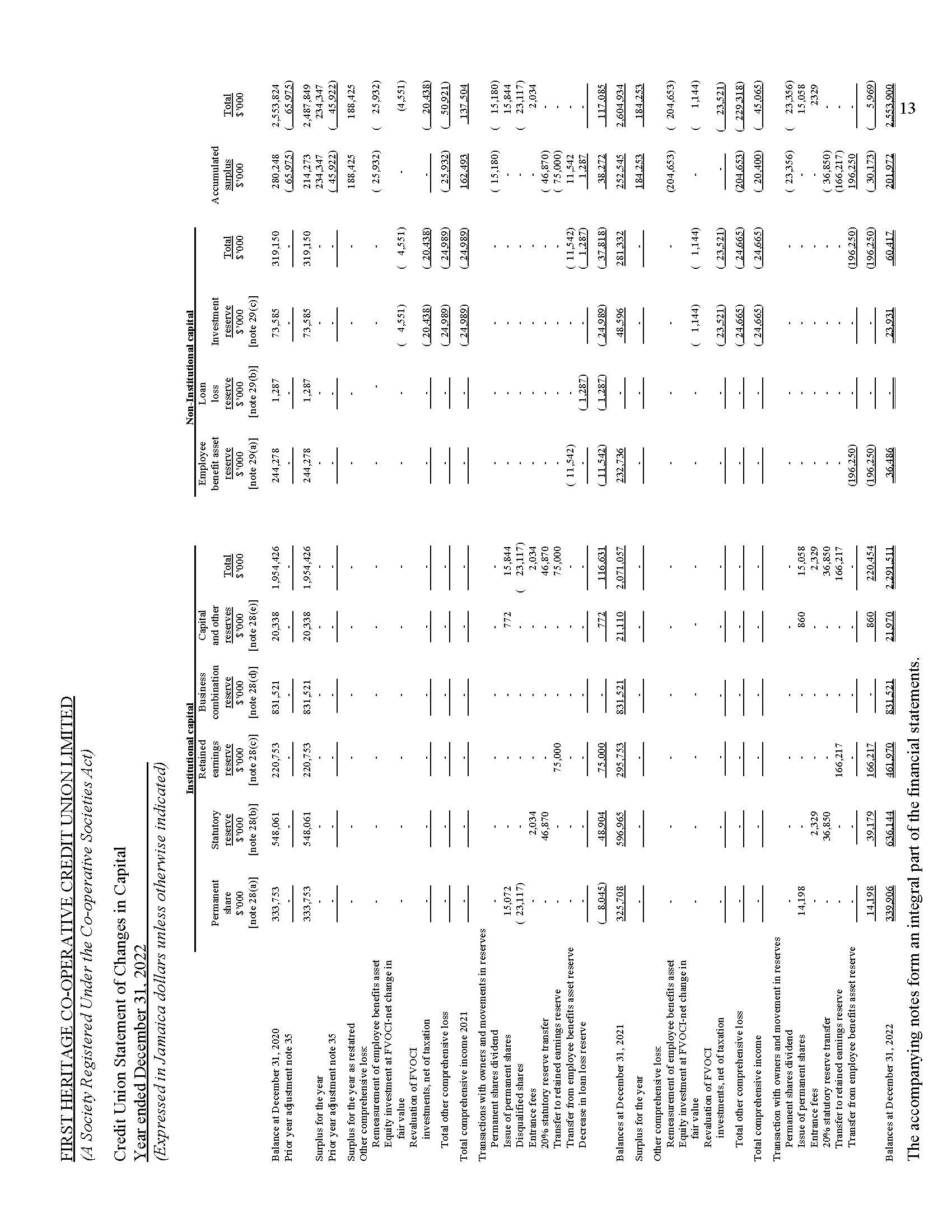

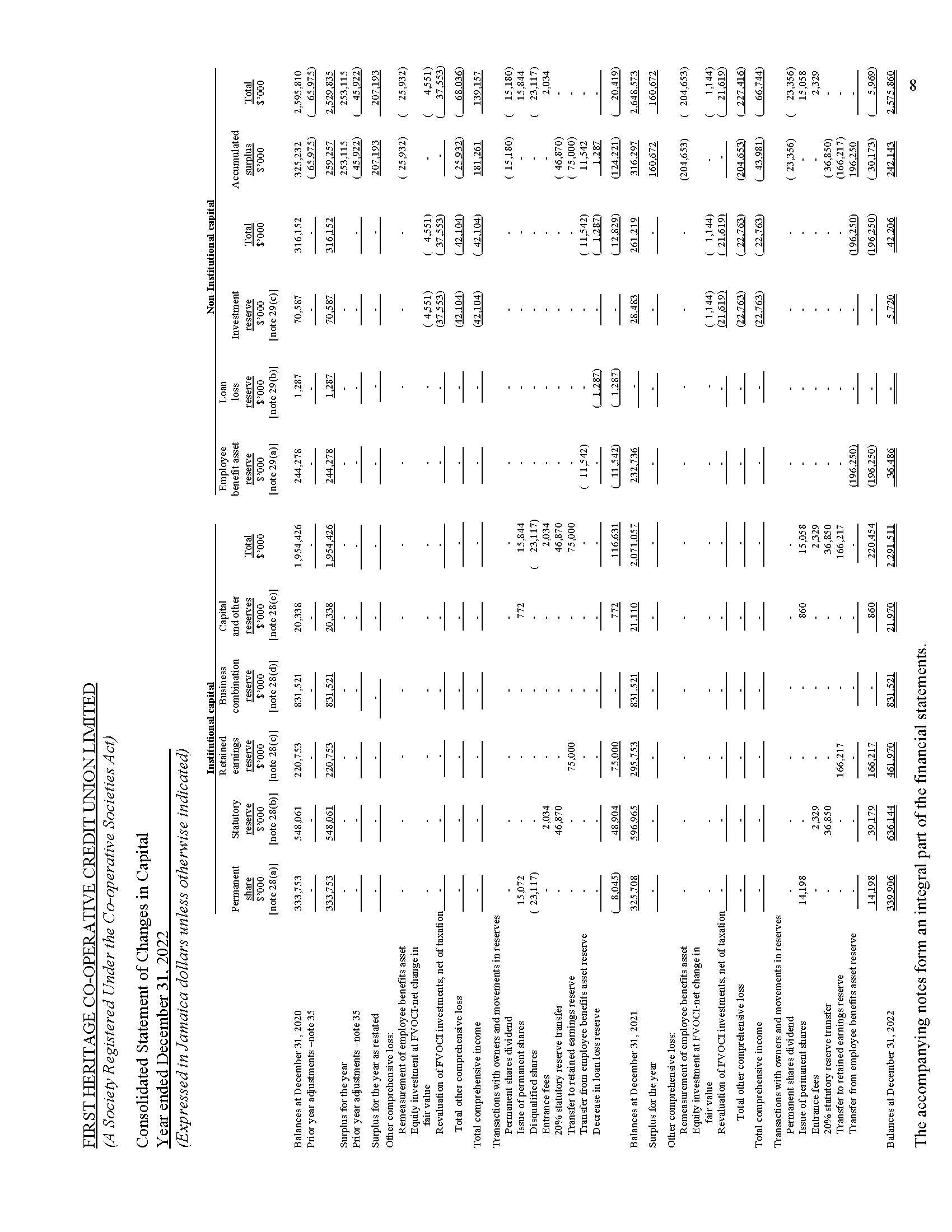

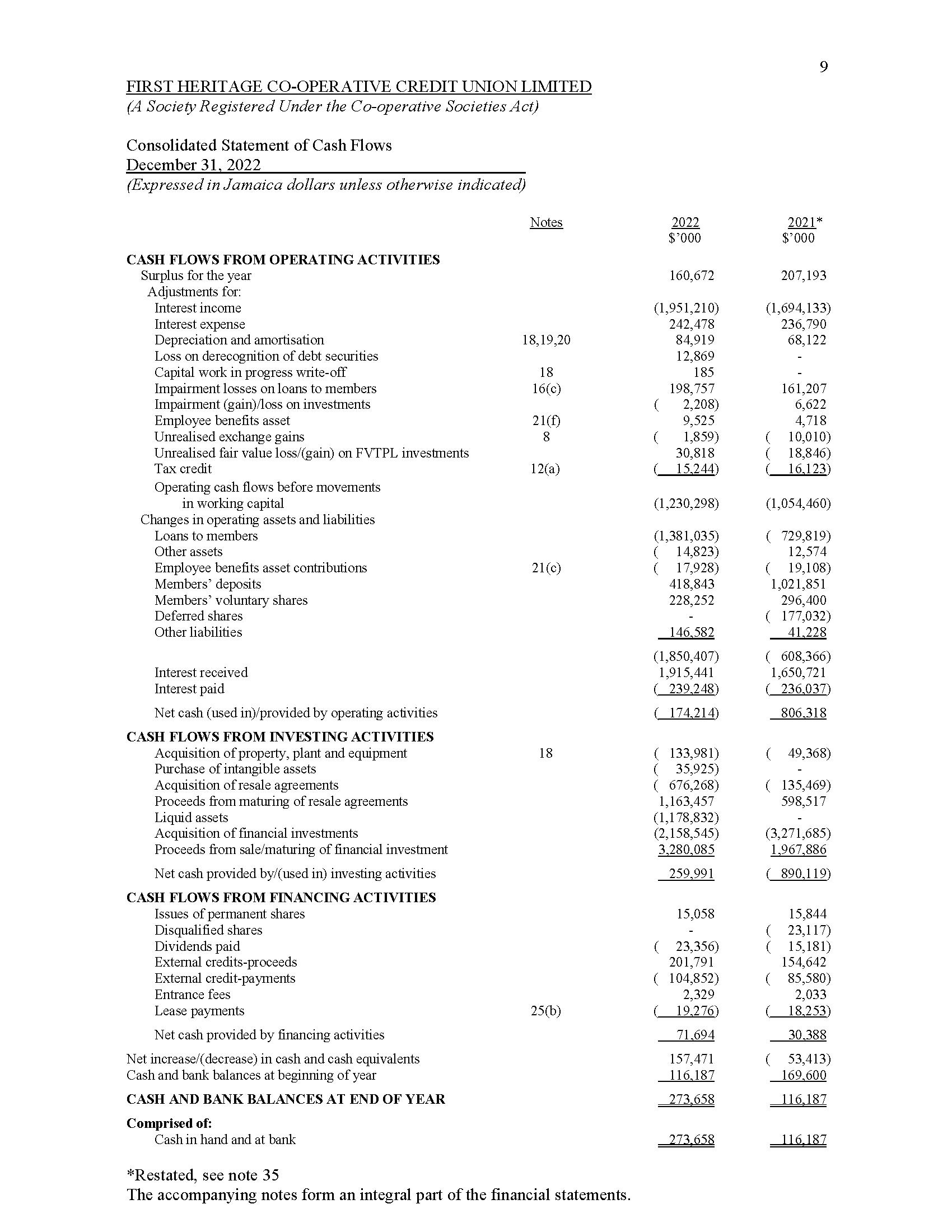

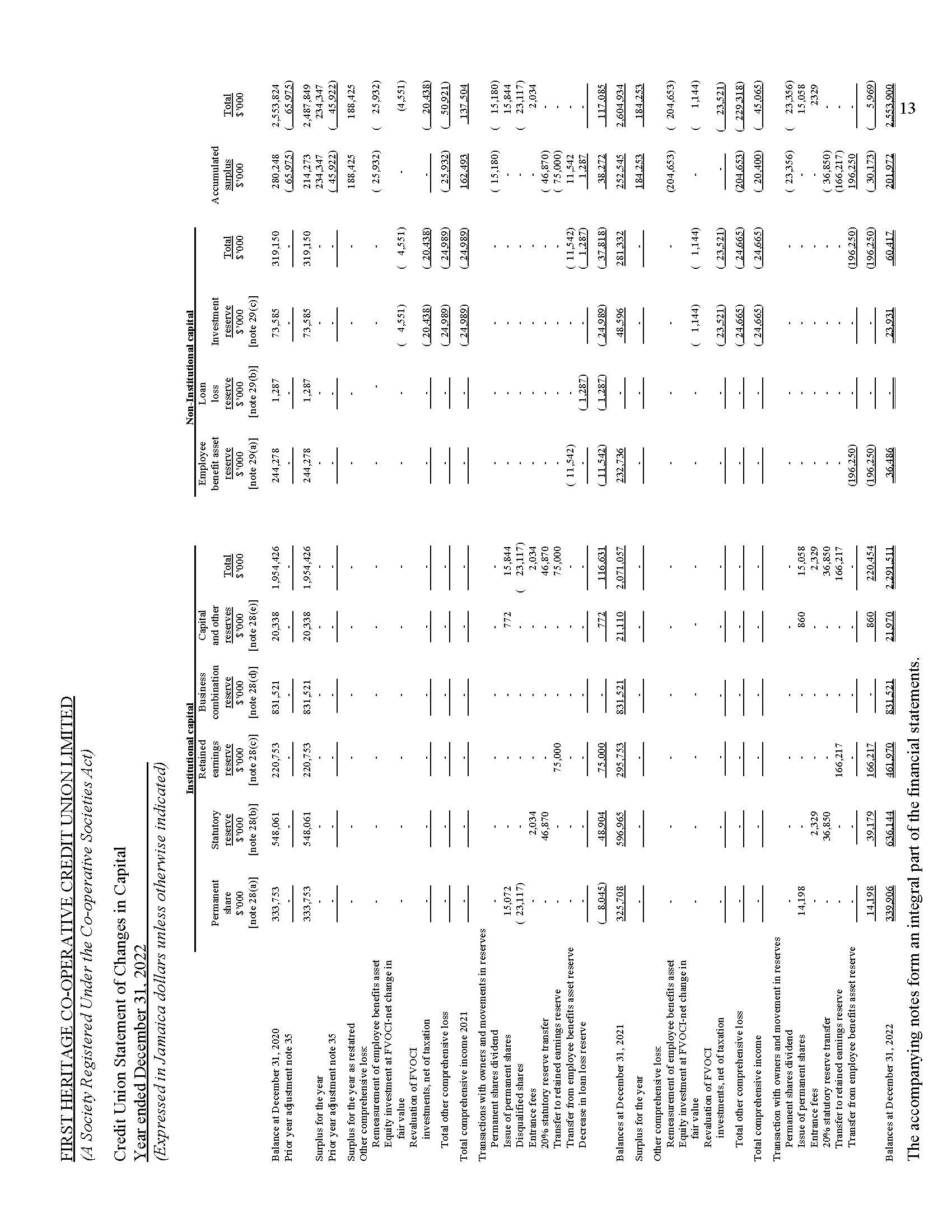

For 2021 a surplus of $234.35 Million was realized compared to $106.20 Million the previous year and for FHC Investments a profit of $3.63 Million was realized after taxes as compared to the prior year’s loss of $5.23 Million. The year’s performance resulted in an accumulated surplus of $364.44 Million accruing to the Credit Union. Loan disbursements totalled $4.17 Billion, while increased savings contributed favourably to liquidity during the year. The Past Due rate moved from 8.79% to 7.97%.

26

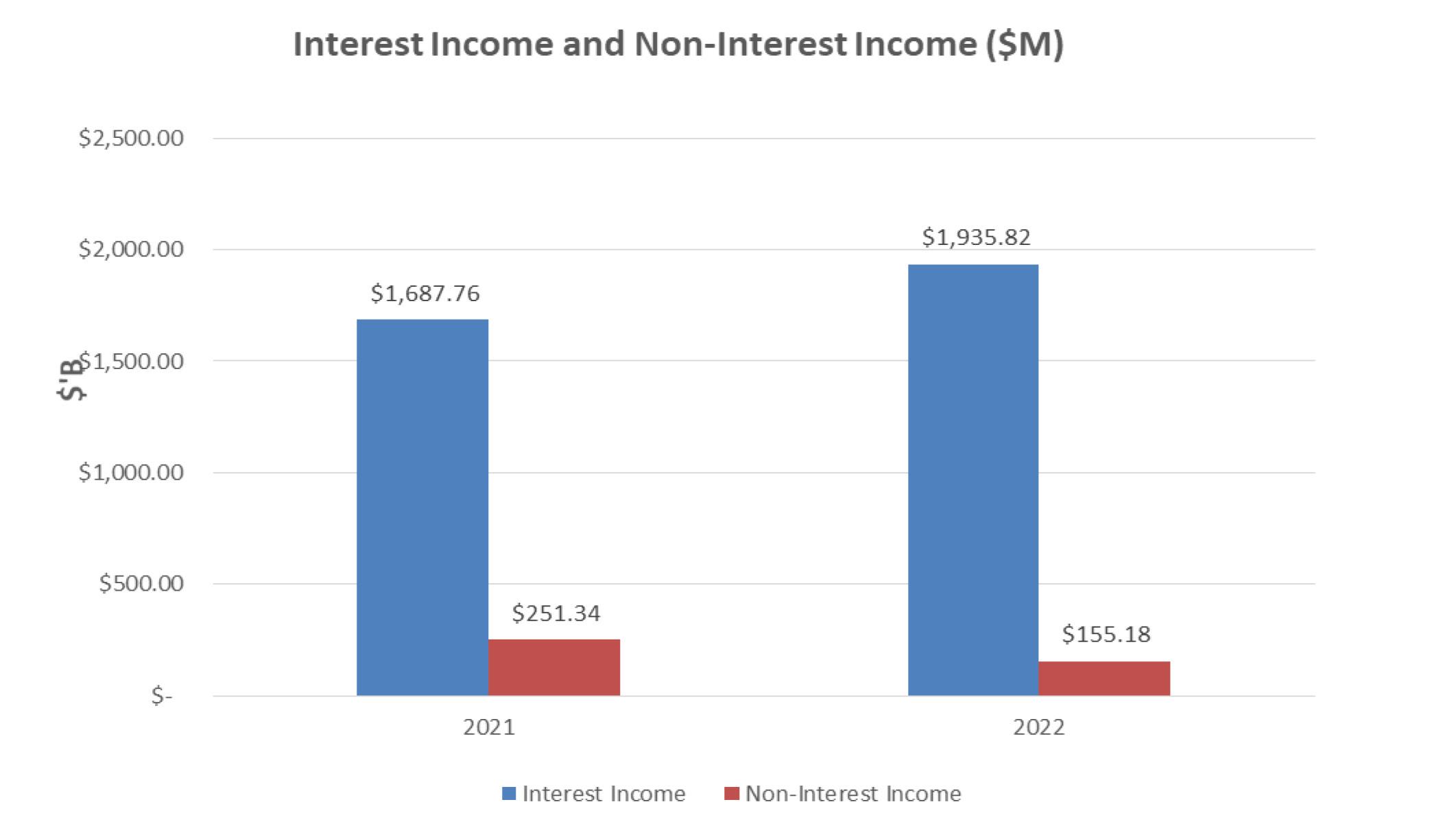

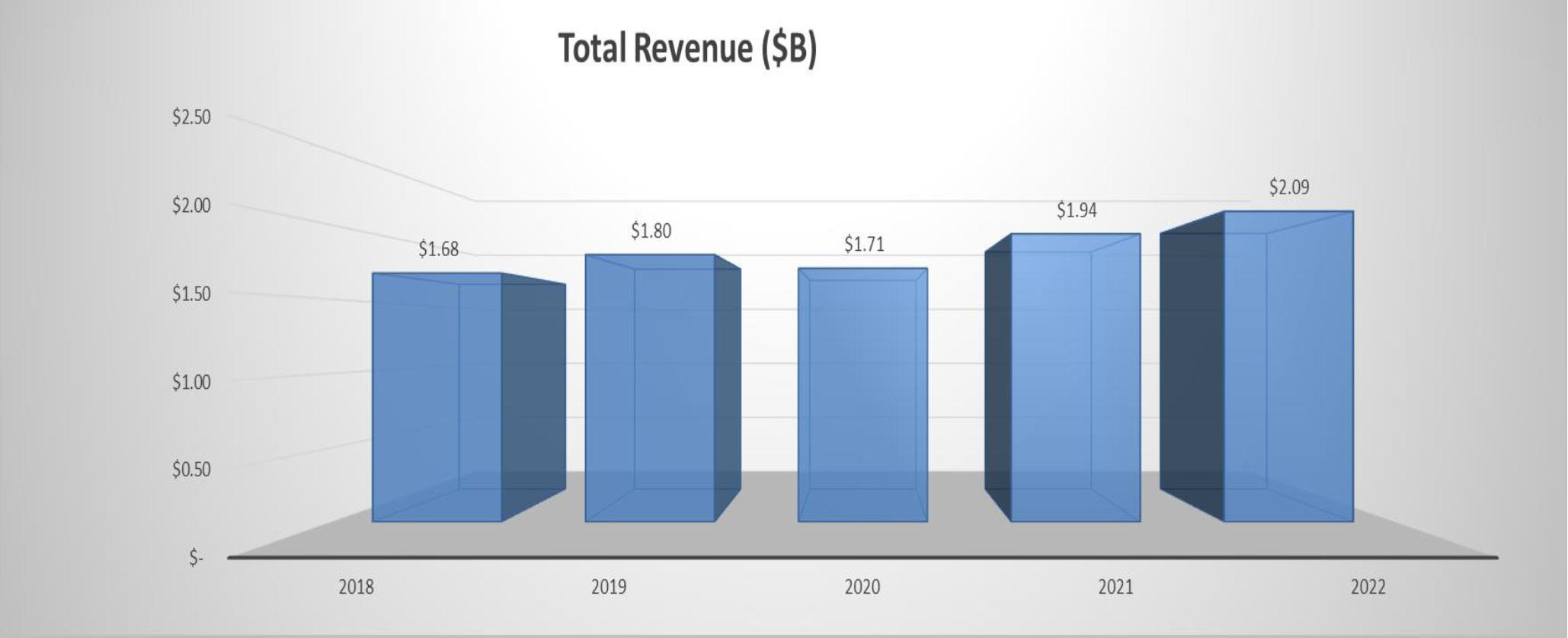

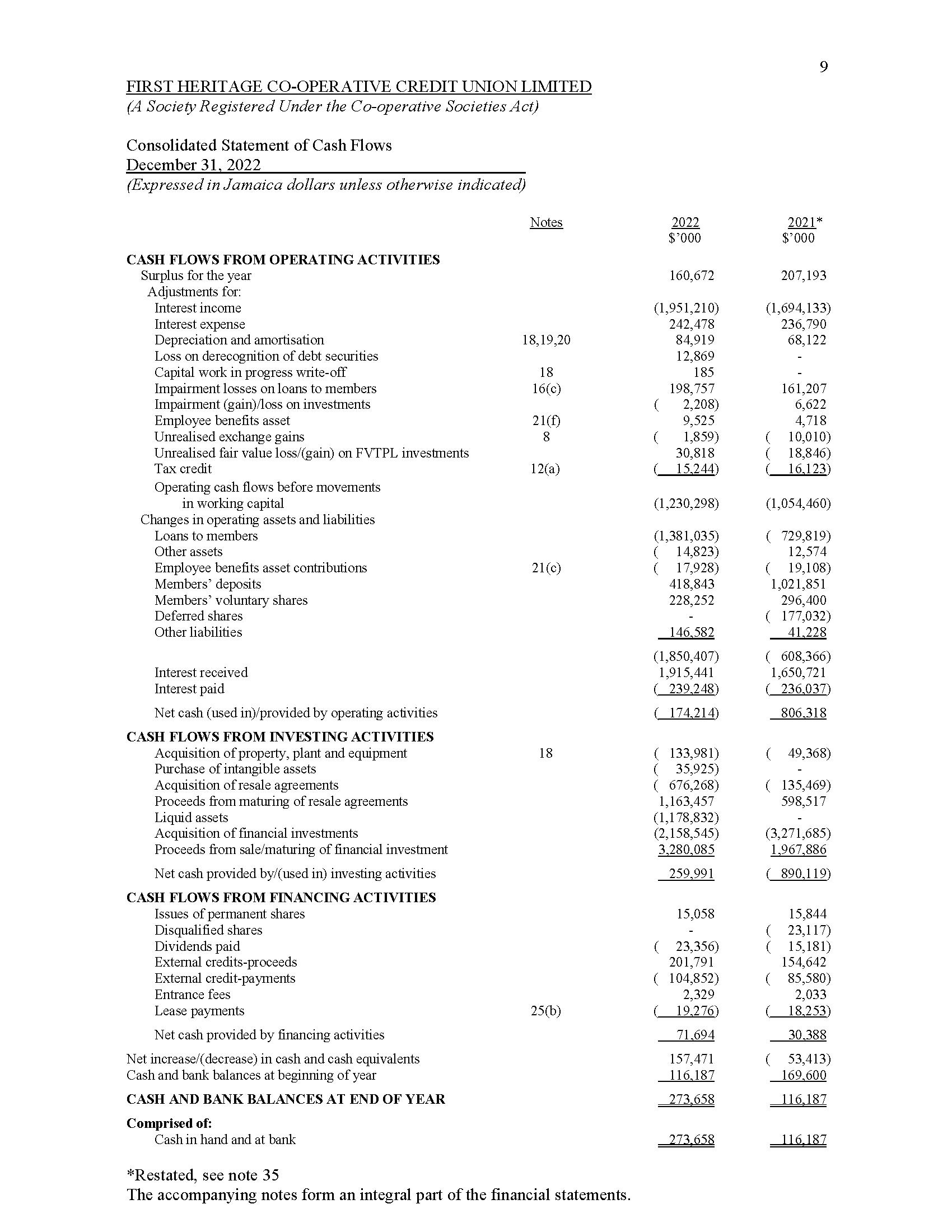

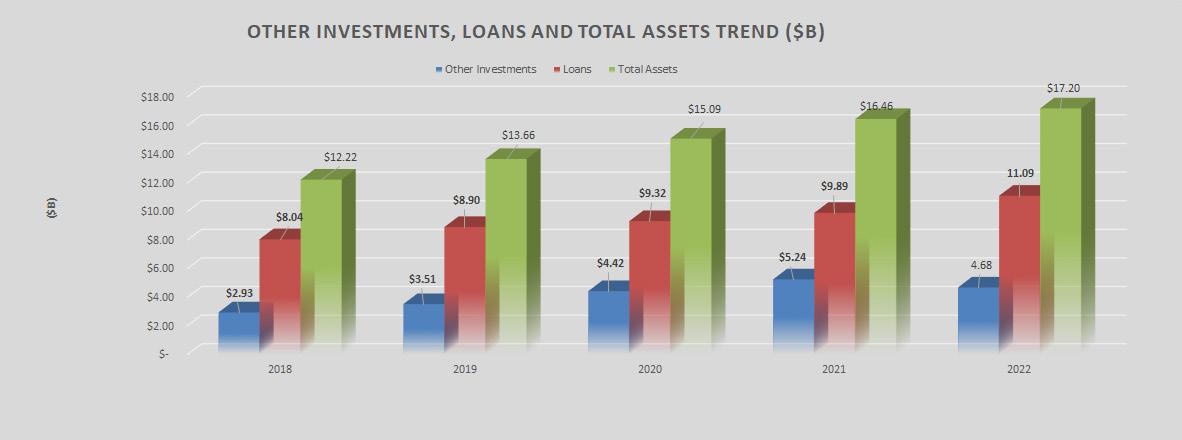

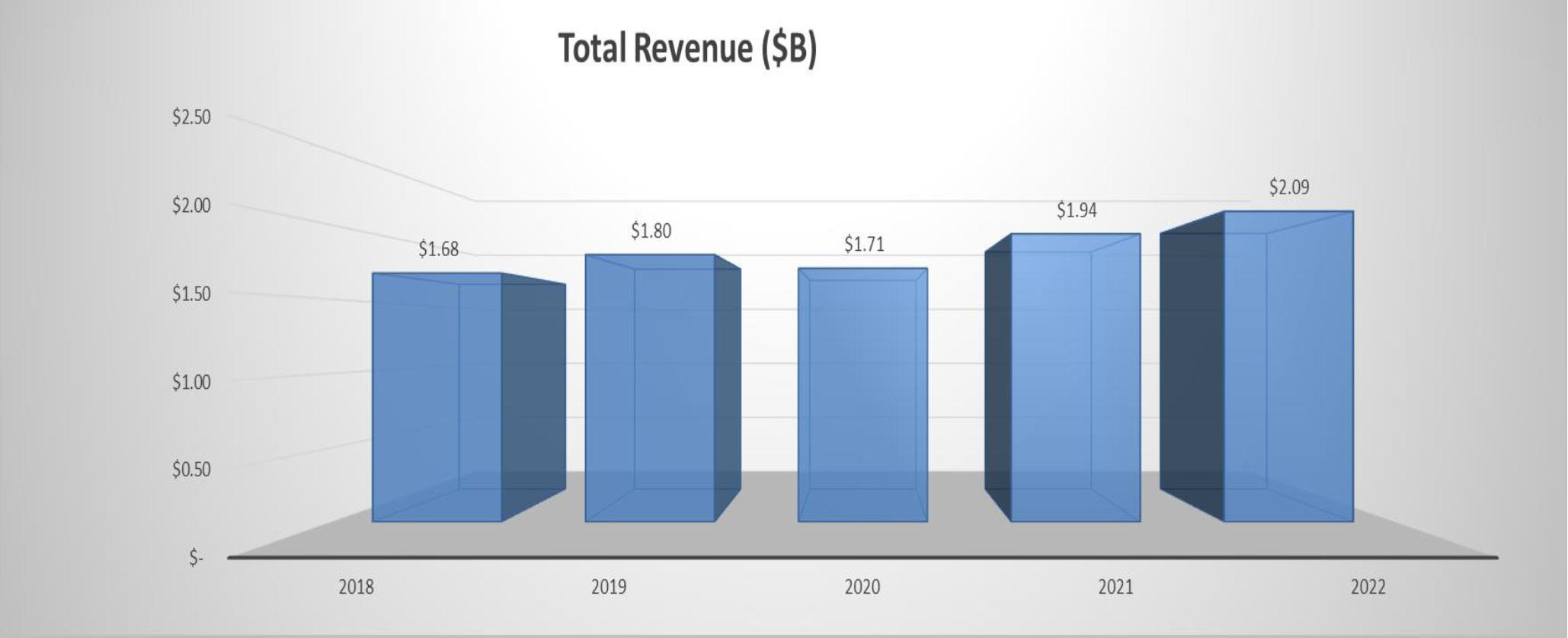

The Treasurer drew the members’ attention to the revenue chart which showed a consistent increase in revenue for the Credit Union since 2017 of $1.39 Billion to $1.99 Billion in 2021.

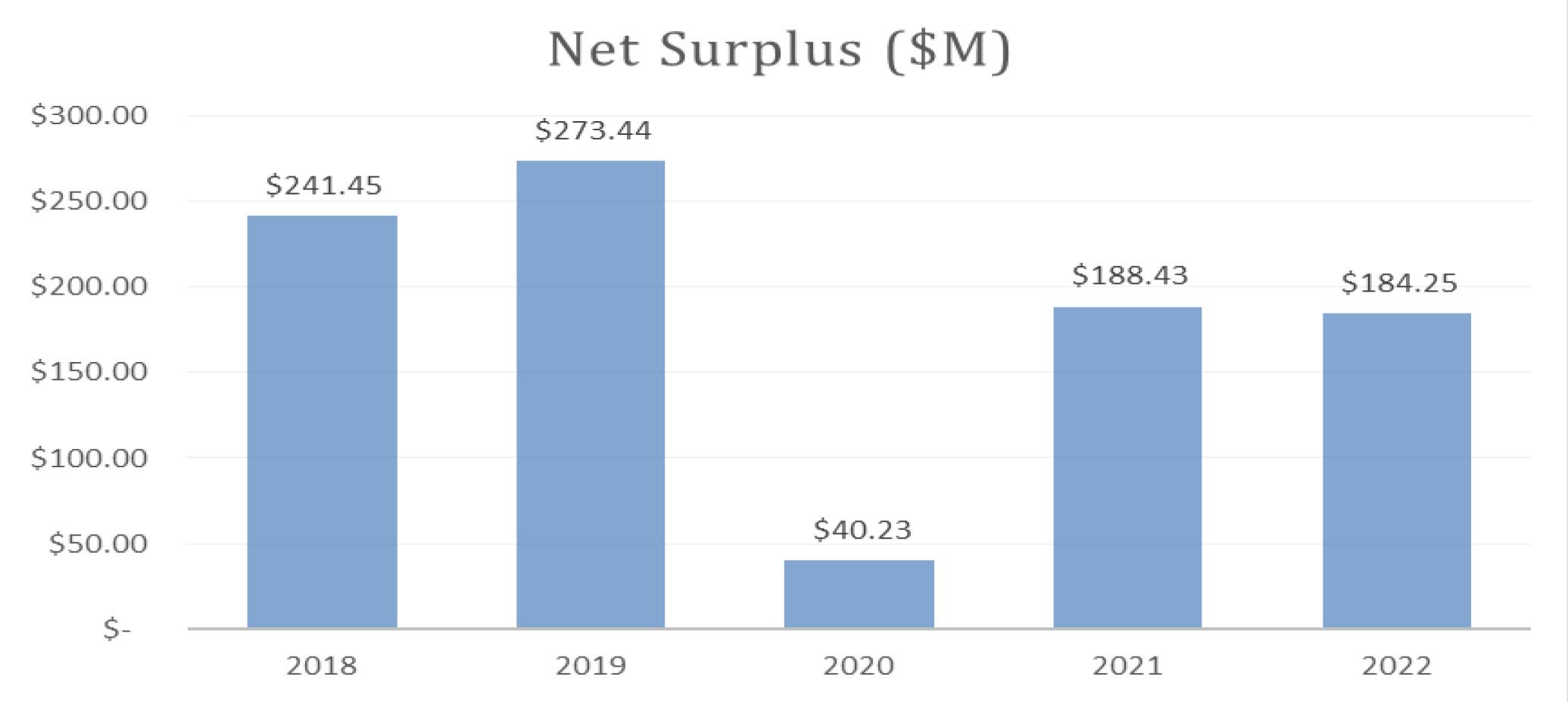

Net surplus he noted, showed a consistent improvement with the exception of 2020 during the heights of the COVID-19 pandemic. He reiterated that for 2021 a surplus of $234.35 Million was recorded compared to $106.20 Million the previous year.

Total assets as at December 31, 2021 stood at $16.57 Billion which represented an increase of 9.34% over the previous year of $15.15 Billion.

Total assets of the Group totalled $16.6 Billion compared to $15.24 Billion over the previous year representing a 9.31% increase. The Group’s net loan increased by 6.61% or $620.37 Million over the prior year from $9.38 Billion to $10 Billion.

Liquid assets and investments grew by $885 Million moving from $4.6 Billion to $5.48 Billion.

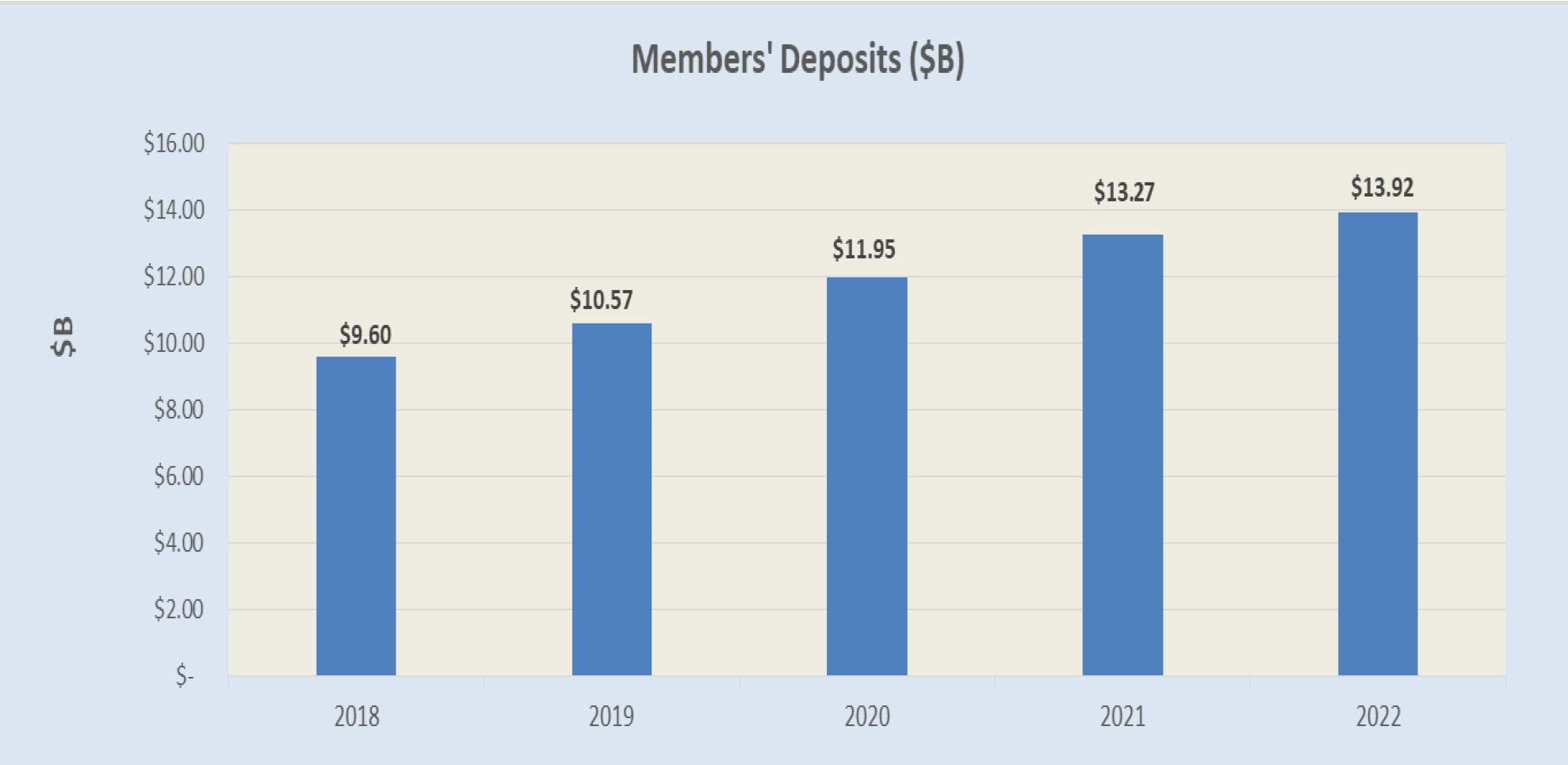

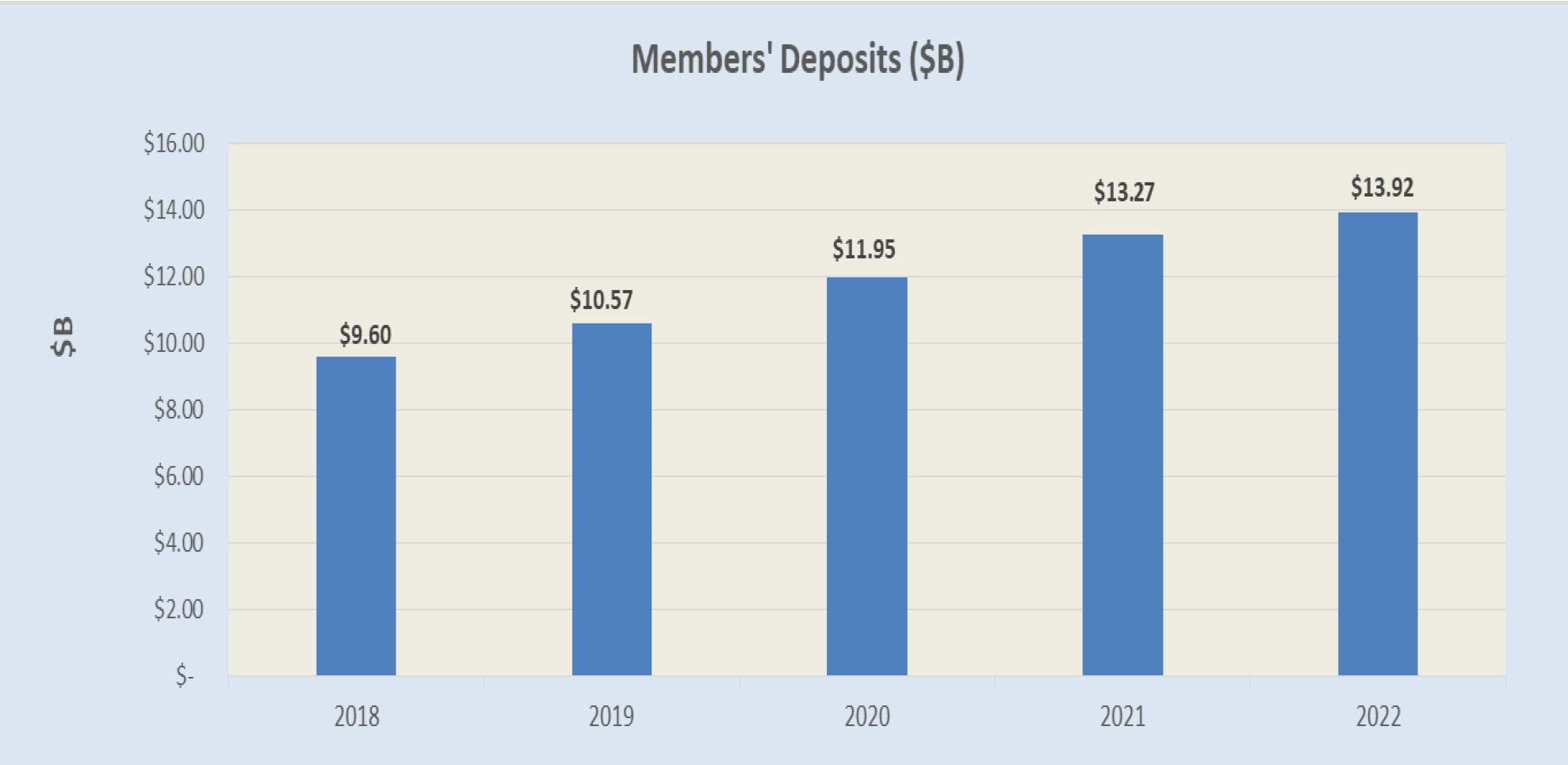

Members’ deposits and voluntary shares increased by $1.32 Billion or 11.06% up from $11.95 Billion to $13.27 Billion in 2021.

He gave a brief overview of the economy showing that estimates from the Statistical Institute of Jamaica indicated that the Jamaican economy grew 4.6% in real GDP year over year for 2021. The Jamaican dollar depreciated against the United States dollar by 8.72%. The unemployment rate as at October 2021 stood at 7.10% compared to 10.7% as at October 2020.

With respect to the regulatory environment, preparations continued in anticipation of supervision by the Bank of Jamaica; the Jamaica Co-operative Credit Union League continued to monitor the Credit Union’s performance against international credit union industry and financial benchmark standards.

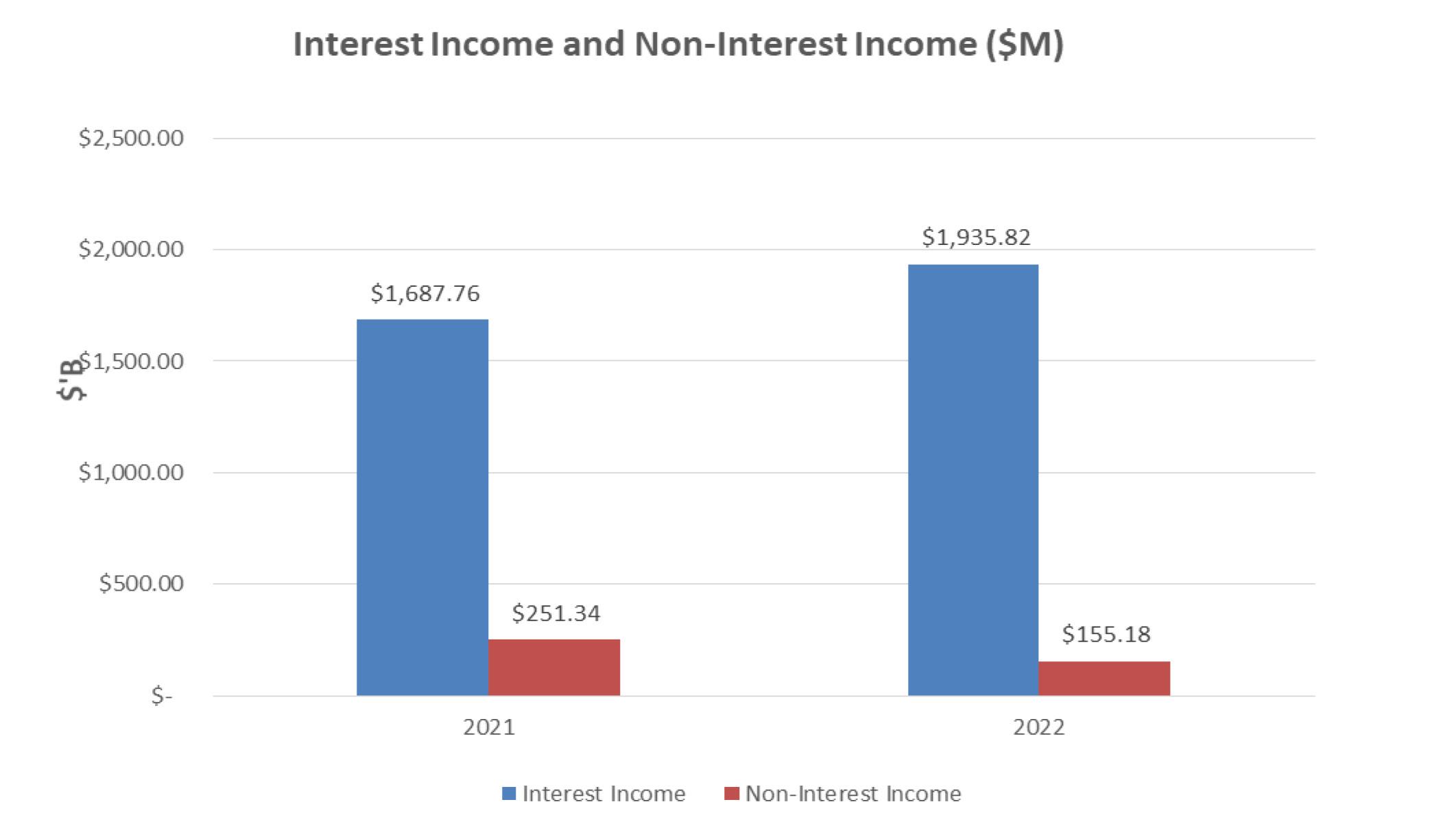

The Treasurer reported that the institutional capital to total assets ratio stood at 9.86% as at December 31, 2021 which compared favourably to the minimum PEARLS standard of 8% and 6% for the BOJ. Interest income of $1.65 Billion increased by $104.94 Million or 6.79% from $1.55 Billion in 2020.

27

Non-interest income of $334.19 Million increased by $106.78 Million or 46.9% compared to $227.4 Million the previous year.

Past Due loans as a percentage of the gross loan portfolio for the period, was 7.79% and provision for loan losses for the year net of recoveries, was $161.21 Billion in 2021 relative to $173.98 Billion in 2020. Accumulated surplus available for distribution increased to $364.44 Million from $280.25 Million which was an improvement of $84.2 Million over 2020.

In conclusion, Treasurer Ewan stated that the Credit Union’s performance for 2021 was highly commendable, and that the capital and liquidity positions remained adequate and above the benchmark. He noted that the improvements seen were a direct result of the commitment to the execution of the strategies that were presented at the Strategic Meeting.

He extended thanks to the Board of Directors, Volunteers, Management and Team Members led by CEO Ms. Roxann Linton and the Finance and Treasury Unit headed by Mr. Emil Williams and his team. He extended gratitude to the Auditors, KPMG and the loyal members of the Credit Union.

The floor was then opened for questions. Member, A.N. Harris Esq. noted that the Treasurer’s Report should have been presented before the Auditor’s Report in keeping with the agenda.

There being no further questions, the Treasurer’s and Auditor’s Report were approved on a motion moved by Member, Ms. Charmaine Allen and seconded by Member, Ms. Debbie-Ann Edwards.

10. DISTRIBUTION OF SURPLUS

The Treasurer tabled the Distribution of Surplus as presented in the Annual Report, which was circulated previously to all members outlining the distribution of $364.442 Million surplus for 2022 as follows:

28

Dividend on Permanent Shares (7.50%) $24.428 Million

Special Donation to the FHC Foundation $1 Million

Retained Earnings Reserve

Retained Earnings (closed accounts and others)

Accumulated Surplus

Million

Million

This was unanimously approved on a motion moved by Member, Ms. Charmaine Allen and seconded by Member, Mrs. Juven Montague-Anderson.

11. MAXIMUM LIABILITY

In keeping with the rules of the Credit Union, it was proposed by the Treasurer that the Maximum Liability be fixed at 20 times that of the Credit Union’s share capital.

This was unanimously approved on a motion moved by Volunteer, Ms. Shauna-Kaye Gordon and seconded by Director, Mrs. Leodis Douglas.

12. SUPERVISORY COMMITTEE REPORT

The report which was presented by Ms. Shauna-Kaye Gordon was taken as read on a motion moved by Member, Ms. Jillian Gayle and seconded by Member, Ms. Stephanie Radway.

Ms. Gordon shared that the theme “Power Up, Reimagining Possibilities”, meant that this was the year for wealth creation, and asked that all members whether in their youth, soft sixties or seventies stay connected to their Credit Union.

The Supervisory Committee, she stated, assists the Board of Directors in the discharge of its responsibilities, by providing oversight on aspects of the internal control system through the internal audit functions.

29

Honoraria $2.7 Million Donations $1 Million

$19.836 Million

$21.381

Retained Earnings Reserve $125 Million

$169.97

She introduced the members of the Supervisory Committee who were present, namely: Ms. Jacqueline Roberts, Ms. Tanisha Thompson and introduced herself, Ms. Shauna-Kaye Gordon, as Committee Chairperson.

She then highlighted the following:

There were seven audits outlined on the 2021 audit plan; the target completion rate was 70%, while the actual completion rate was 57%. She attributed the low completion rate to the redeployment of resources to a major special investigation, as well as the reduction in staff complement from 5 to 4 persons.

The four audits completed were:

1. Compliance with the liquidity and capital management policies;

2. Compliance with the loan origination, underwriting and disbursements service level agreements;

3. Review of the purchasing process for IT expenditure; and

4. Loan security management

The two audits that were incomplete or in progress at the end of 2021 were:

1. The follow up review of the Management Team’s corrective action on a major special investigation case

2. The review of the anti-money laundering and counter financing of terrorism framework

She noted that the Business Continuity Plan review was deferred.

She projected on screen a graph depicting a summary of the completed audits, showing that, of the 14 audits carried forward from 2020, 11 were completed and 3 were in progress with a completion rate of 70%. There were 31 new cases, of which 20 were completed and 11 in progress with a completion rate of 65%.

30

In relation to the bank reconciliation review, the Committee noted that the bank reconciliations were reviewed in a timely manner, and reconciled items were appropriately addressed.

Ms. Gordon also indicated that there were no team members, Volunteers or connected party loans that were outstanding for more than 30 days.

In concluding she extended thanks to the Nominating Committee for nominating the members of the Supervisory Committee, the members of the Credit Union for their trust and confidence in the Supervisory Committee, the Management Team and team members, the Internal Audit Department and the Board of Directors for their continued support.

There being no questions the Supervisory Committee Report was adopted on a motion moved by Member, Ms. Stephanie Radway and seconded by Member, Ms. Charmaine Allen.

13. CREDIT COMMITTEE REPORT

The Report, which was presented by Mrs. Althea Daley was taken as read on a motion moved by Member, Ms. Hanna Dixon and seconded by Member, Ms. Charmaine Allen.

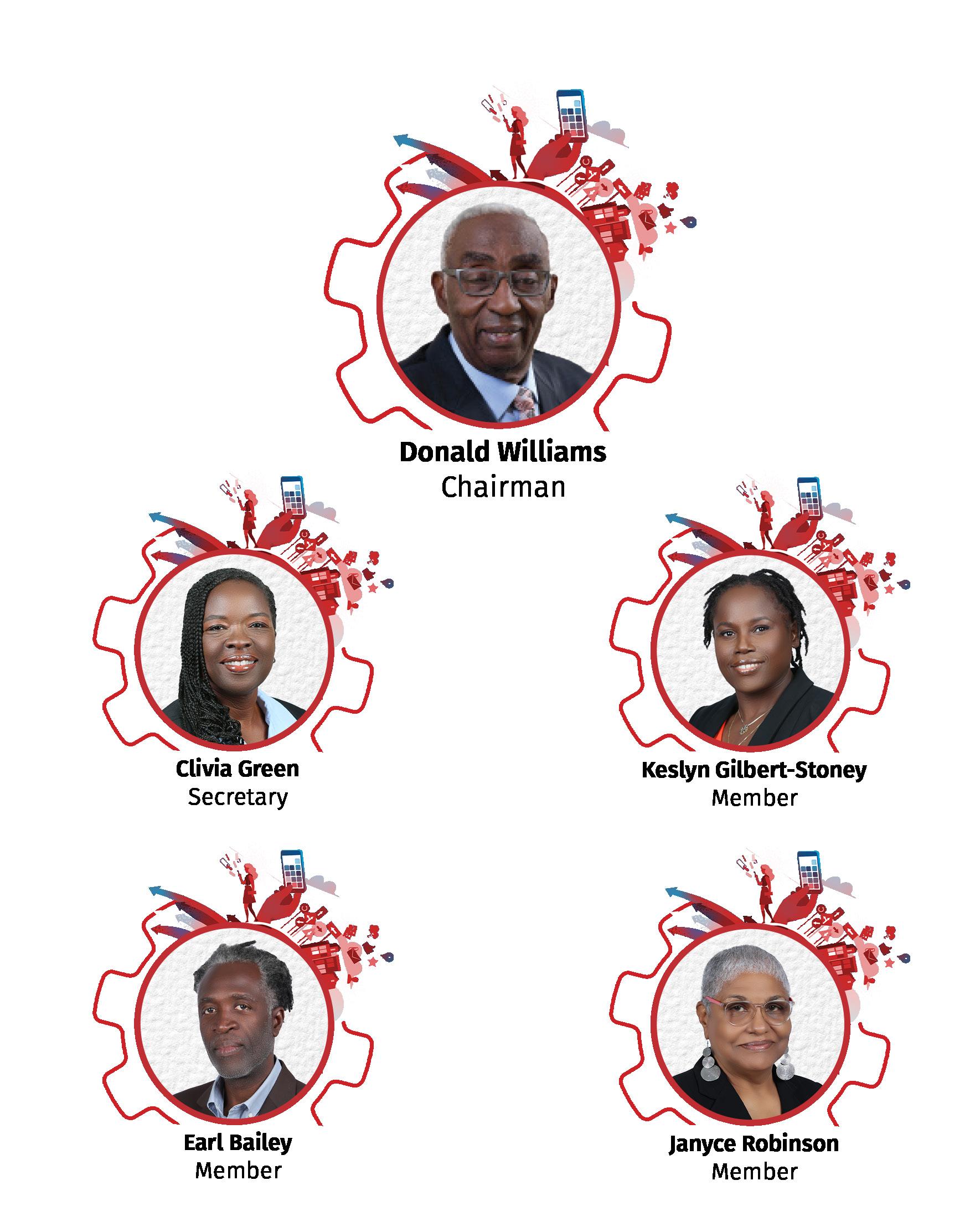

She introduced the following members of the Committee and asked them to stand and be recognized, Mr. Richard Ranger, Mr. Donald Williams, Ms. Clivia Green, Mr. Stennett McLean and herself, Althea Daley, Chairperson of the Committee.

She highlighted the following:

For the financial year 2021, the Credit Union experienced growth in the loan portfolio, albeit the fierce competition from other financial institutions, and the impact of the COVID-19 pandemic. Disbursements totalled $4.27 Billion in 2021 compared to a total of $4.21 Billion in 2020. The loan portfolio grew by 6.76%, moving from $9.77 Billion in 2020 to $10.4 Billion in 2021.

31

Ms. Daley also highlighted that, the Past Due rate decreased from 8.79% as at December 2020, to 7.97% as at December 2021. For the Micro and Small Business Loan Portfolio, she reported that the unit saw a decrease in total disbursements from $394.16 Million in 2020 to $256.82 Million in 2021, a decrease of $137.34 Million or 34.84%. The Past Due rate for that portfolio increased to 30.27% in 2021 when compared to 17.56% in 2020.

The Committee extended thanks to the members for their assistance in reducing the overall Past Due rate, and encouraged them to pay their loans in a timely manner; she encouraged those experiencing difficulties to come in and speak with a team member.

In conclusion, Ms. Daley thanked the Board of Directors, the FHC team members, the Supervisory Committee and the valued members for their support. She noted that three members of the Committee would be retiring at this meeting, and on their behalf, she thanked the members of FHC’s Management Team and staff for the professional and caring manner with which they had been treated over the period.

There being no questions, the Credit Committee Report was accepted on a motion moved Member, Mr. Wayne Jones and seconded by Member, Ms. Eunice Campbell.

14. RESOLUTION - Starter Membership Tier

The resolution having been circulated was taken as read, on a motion moved by Member, A.N. Harris Esq. and seconded by Member, Mrs. René Gayle-Roper; the Board Secretary then took the meeting through the exercise of passing the resolution.

Mrs. Tamara Francis Riley-Dunn noted that the special Resolution being put forward was aligned with the discussions on the floor, as it sought to create a tier of membership that would facilitate an easier transition to financial access for young adult students, and the most vulnerable in the society. She advised, that the starter membership tier would target students aged 18 to 24 years and persons who were unemployed or low-income earners. The aim was for there to be a 3 year period whereby, these persons would be within the fold of the Credit Union and would be able to save. At the end of this 3 year period they would be transitioned to full membership.

32

The resolution sought to:

• Add sub-rule (iv) after Article III, Rule 5 (a) (iii) - This would amend the rules which currently provide for persons to qualify for membership with an entrance fee of $700 or any amount that may be prescribed by the Board of Directors from time to time, and subscribing to Permanent Shares with a nominal value of $2,500 or such amount that may be determined from time to time. This would now be amended to reflect a non-refundable entrance fee of $250 instead of $700, a nominal value of $500 instead of $2,500 in Permanent Shares, along with payment of $250 for Ordinary Shares to quality for “Starter Membership”.

Amend Article III, Rule 5(b) (iii) - Which speaks to the relaxation of the requirement for a national identification with photograph; given that this has been a challenge faced by some persons.

• Amend Article IV, Rule 6 - To allow an account number to be assigned to these “Starter Members”. This would also allow the “Starter Member” to resign his or her membership, by withdrawing their ordinary shares and disposing of Permanent Shares, by selling them to another member in keeping with Rule 14.

• Amend Article IV, Rule 9 - Which presently outlines that a person ceases to be a member on death or on ceasing to hold at least $2,500 in Permanent Shares; provided the Credit Union shall issue a 3 month notice. The rule would now be amended to include cessation of membership for “Starter Members” who hold less than ‘$500’ in Permanent Shares.

The floor was then opened for questions.

Volunteer, Mrs. Althea Daley enquired whether the $500 was going to be universal or if it was just for the starter members.

The CEO stated that this was solely for the purpose of onboarding “Starter Members” who were financially challenged and could not afford the standard $2,500, hence the 3 year period for them to amass the $2,500, enabling them to convert to the standard membership.

33

Volunteer, Mrs. Althea Daley stated that she did not understand the amendment speaking to a tiered membership which was further explained by the CEO and the Secretary.

Queried by Member, A.N. Harris Esq. as to how much the “Starter Member” would be paying initially, Mrs. Francis Riley-Dunn, stated that the person would be paying a $250 entrance fee, $500 for Permanent Shares and $250 for Ordinary Shares in order to qualify for membership; she then directed him to the second paragraph on Page 4, which gave a breakdown.

Member, Ms. Janyce Robinson asked for an explanation for amending Article lll Rule 5(b)(iii) speaking to providing a valid national ID with photograph, versus providing a non-governmental ID with photograph.

Mrs. Francis Riley-Dunn stated that from research conducted, it was found that a lot of persons do not have a national ID and cited an example where when the Government was giving out grants at the initial stage of COVID-19, and persons could not collect the grant as they did not have a Government issued ID. She noted that Government IDs are issued on the premise that one presents a proof of address. Acceptance of non-governmental IDs would therefore make it easier for persons who were not documented in that manner to enter into membership. The CEO added that these rules would enable the Credit Union to operationalize its due diligence processes.

Volunteer, Ms. Shauna-Kaye Gordon asked whether the photograph ID would need to be certified. Ms. Linton responded that standard operating procedures would be maintained, where copies made of IDs when opening accounts are required to be certified.

Mrs. Francis Riley-Dunn then invited the Registrar, Mr. Errol Gallimore to lead the voting exercise.

Mr. Gallimore stated that it was a pleasure to be in attendance. He then noted that there were 103 persons online and 88 persons physically present, making it 198 persons in all. It would therefore require 143 persons voting in favour of the resolution for it to be passed.

34

He informed the meeting that these rule amendments were rigorously vetted by his office and numerous discussions were had, which convinced him that the resolution was a practical step and would attract new members. He advised the meeting that this was a historic occasion, as no other Credit Union had yet put this in place and he expressed the hope that this would be carried by the news media. Mr. Gallimore stated, that this would be sending the message loud and clear to the Credit Union Movement that the time has come to create avenues for young people and the less advantaged to join the Credit Union Movement as “Starter Members” and thereafter transition to full membership.

He took the meeting through the voting process and at the end of the tallying of votes, 60 persons online and 87 persons present voted in favour of the resolution, making a total of 147 for, none against and 43 abstentions.

Mr. Gallimore declared the resolution as passed.

The Chairman thanked Mr. Gallimore for taking the meeting through this exercise.

(At this juncture the meeting was entertained by a musical interlude)

15. NOMINATING COMMITTEE REPORT

The Secretary presented the Nomination Report which was taken as read on a motion moved by Director, Mr. Edmund Jones and seconded by Director, Mr. Noel Francis.

Mrs. Francis Riley-Dunn highlighted that the custom was to have a 9 member Board but for 2021 it was recommended that this number be increased to 13 members because as of 2023, 5 longstanding Board Members would be retiring. By so doing this would ensure that the Credit Union’s business benefits from the experience of these 5 persons who would be demitting office, by creating a one year period for new entrants to experience the transfer of knowledge and in light of that, four persons had been recommended to join the Board in addition to its current complement of nine. She then introduced the four persons to include Mr. Wayne Jones, Mrs. Camille Ricketts-Moore, Mrs. René

35

Gayle-Roper and Mr. Richard Ranger whose profiles, she noted, were provided on pages 179 and 180. She indicated that this would require 50% of the members in attendance voting in favour of this recommendation, in order have it passed.

Instructions were given as to the voting procedure. She pointed out that 79 persons were in the virtual space while 87 were present in the room. At the end of the voting process, with 39 members online and 84 members in the physical space voting in favour of the recommendation; 2 against and 3 abstaining she declared the recommendation passed. Mr. Wayne Jones, Mrs. René Gayle Roper and Mrs. Camille Ricketts-Moore would serve for a period of two years while Mr. Richard Ranger would serve for one year.

Supervisory Committee:

Mrs. Francis Riley-Dunn stated that 3 sitting members would be retiring and the Committee had nominated Ms. Shauna-Kaye Gordon, Ms. Tanisha Thompson, Ms. Jacqueline Roberts, and Mrs. Carol Dallas-Robinson.

Credit Committee:

Retiring were Mrs. Althea Daley, Mr. Stennett McLean and Mr. Donald Williams and nominated were Mr. Donald Williams who would serve two years, Ms. Keslyn Gilbert would serve the remaining one year left on Mr. Richard Ranger’s term, Mr. Earl Bailey and Ms. Janyce Robinson would serve two years. The meeting was directed to their profiles on pages 180 – 184.

The Registrar, Mr. Gallimore, was asked to conduct the elections.

16. ELECTION

Mr. Gallimore congratulated First Heritage Credit Union for the strides it had made over the past year resulting in Total Assets moving from $15 Billion to $16 Billion and the surplus made, and congratulated the leadership, consisting of both the Board and Management Team, for their efforts.

36

He noted that the motion to increase the Board complement for one year had his blessing and support. He challenged the Board to make this the last year where they take nominations from the floor, a position that his Department had been advocating for the past five years. He pointed out that approximately 18 credit unions had made the necessary rule amendments to date and that the time had come for them to have a pool of persons with the type of skill sets needed, from which to elect persons to serve on the Board and various committees. He assured the meeting that nobody would be disenfranchised in terms of their right to nominate who they want and to be able to vote, and that it was just a matter of the process being dealt with in a structured way.

Board of Directors:

Mr. Gallimore laid out the ground rules that the election would follow both for those present and those online.

Nominated were Mr. Cranston Ewan, Mr. Balvin Vanriel, Mr. Noel Francis and Mrs. Leodis Douglas. He asked if there were any other nominations from the floor three times and hearing none, he asked that a motion be moved for all the persons recommended by the Nominating Committee to be accepted.

The motion was moved by Member, Ms. Jacqueline Roberts and seconded by Member, Ms. Lillian Lewis McDonald.

Supervisory Committee:

Nominated were Ms. Shauna-Kaye Gordon, Ms. Tanisha Thompson, Ms. Jacqueline Roberts, and Mrs. Carol Dallas-Robinson for a term of one year. Mr. Gallimore then asked three times for any other nominations and hearing none, he asked for a motion to be moved to accept these persons.

The motion was moved by Member, Ms. Althea Daley and seconded by Director, Mr. Edmund Jones.

37

Credit Committee:

Nominated were Mr. Donald Williams to serve two years, Ms. Keslyn Gilbert, one year, Mr. Earl Bailey, one year and Ms. Janyce Robinson, two years. Mr. Gallimore then asked three times for any other nominations from the floor and hearing none, he asked for a motion to be moved to accept these persons.

The motion was moved by Member, A. N. Harris, Esq. and seconded by Member, Ms. Paulette Lewis.

Delegates to the League and Various Other Agencies:

He noted that based on the rules of the Credit Union, the Board would choose the delegates and alternate delegates to the League and other external agencies.

The Chairman thanked Mr. Gallimore for ably carrying out the election exercise.

17. ANY OTHER BUISNESS

Member, A. N. Harris, Esq. expressed pleasure with the venue inside and outside as it had adequate parking however, he noted that there were no refreshments provided and the water that was provided was cold water, and he did not get any room temperature water when he asked for it. He expressed the hope that he would be getting a vegetarian meal at the end and reiterated the need for provisions to be made for vegetarians at these events. He congratulated the Chairman on the conduct of the meeting which he described as superb.

Miss Michelle Tracey was then invited to take the meeting through the give-away exercise. The Chairman then invited the Board Secretary to give the vote of thanks.

38

18. VOTE OF THANKS

The Secretary thanked the Chairman for his efficient conduct of the meeting, Miss Tracey, whose prayer set the inspirational tone of the meeting, the team at FHC that was in charge of coordinating the AGM. She thanked the Jamaica Pegasus Hotel team for making the physical space comfortable, Krystal Clear Productions for making the first and true hybrid meeting seamless, and the loyal members who participated and voted on the historic resolution for the underbanked and underserved communities.

The Chairman in closing pronounced the blessings of the Lord on all and wished for those travelling, a safe journey.

19. TERMINATION:

The Chairman terminated the meeting at 6:40 p.m.

Tamara Francis Riley-Dunn Secretary, Board of Directors

39

Corporate Governance Statement

Internal Controls: We have instituted effective internal control mechanisms to safeguard the accuracy and integrity of our financial reporting, as well as the effectiveness and efficiency of our operations. We conduct regular internal audits and risk assessments to identify and address any control weaknesses and ensure compliance with policies and procedures.

Compliant Posture: We are committed to compliance with all applicable laws, regulations, and industry standards. We maintain strong relationships with regulatory authorities and proactively address any compliance or regulatory matters that may arise. We also have a comprehensive compliance program in place to ensure adherence to anti-money laundering (AML) regulations and other relevant laws.

Continuous Improvement: We are committed to continuous improvement and regularly review and update our corporate governance practices to ensure that they remain effective and aligned with our credit union’s strategic objectives, member needs, and regulatory requirements. We welcome feedback from our members, employees, and stakeholders and use it as an opportunity to learn, adapt, and improve our governance practices.

Member-Centric Approach: Our Credit Union exists to serve our members, and their best interests are at the forefront of our decision-making processes. We believe that member engagement is critical to understanding their needs, expectations, and concerns, and we strive to align our strategies and operations accordingly.

In conclusion, at FHC, we are dedicated to maintaining the highest standards of corporate governance to ensure the safe and sound growth of our Credit Union and to protect the interests of our members.

41

Mrs. Leodis Douglas is currently the Principal Lecturer, Head of Department (HOD) at the G. C. Foster College of Physical Education and Sport. Prior to that, she was the Director of Human Resources for 12 years at the institution.

Mrs. Douglas holds, amongst her many qualifications, a Masters Degree in Business Administration from Florida International University (FIU), a Bachelor of Science in Human Resource Management, graduating Summa Cum Laude and a Diploma in Education with Honors. She is also certified in Executive Management, Six Sigma Project Lean Processes and is Six Sigma Black Belt Certified.

Mrs. Douglas currently serves as the Chairman of the Board of Directors of First Heritage Co-operative Credit Union and is also the Chairman of the FHC Foundation.

42

Mr. Forbes is currently employed to Look Beyond Limited as a Financial Controller. He previously served as Financial Manager at Cable & Wireless Limited, Financial Controller at Allied Insurance Brokers Limited, and has worked in various management capacities within the Grace Kennedy Company Limited as well as Ernst & Young Caribbean.

He holds a Masters of Business Administration in Finance from the Manchester Business School, United Kingdom, is a Fellow of the Association of Chartered Certified Accountants as well as a member of the Institute of Chartered Accountants of Jamaica.

He is the 1st Vice Chairman of the Board of Directors.

Mr. Jones is a retired Civil Servant with his last post being Technical Support Manager at the Ministry of Finance and the Public Service. He currently does contractual work in both the Public and Private Sectors managing projects, teaching and consulting.

His volunteer service includes Directorships at Quality Networks Co-operative and the Jamaica Paralympic Association. He is also a Council Member of the Aquatics Sports Association of Jamaica.

He is the 2nd Vice Chairman on the Board of Directors and is the Chairman of the Merger and IT Steering Committees.

Mr. Ewan is currently the CEO of 138 Student Living Jamaica Limited. He is a certified accountant, a Fellow of the Association of Chartered Certified Accountants (ACCA) and holds a Master’s Degree with a concentration in Finance from the Manchester Business School (UK). Mr. Ewan has vast experience in several industries, spanning Accounting, Shipping, Education, Energy Efficiency, and the Distributive Trade. His expertise includes accounting, finance, management consulting, human resource management, facilities management and leadership.

He is presently the Treasurer on the Board of Directors, Director of FHC Investments Limited and the Chairman of the Finance and Operations Committee.

Mr. Vanriel is currently a Partner with the auditing firm BDO Chartered Accountants. He is a qualified Accountant, a Fellow with the Institute of Chartered Accountants of Jamaica and a member of The Association of Chartered Certified Accountants (ACCA).

Mr. Vanriel is also a Registered Public Accountant. He serves as an Associate Minister in his denomination.

He is the Assistant Treasurer on the Board of Directors and the Chairman of FHC Investments Limited. He is also a Past Chair of FHC Credit Union.

Mrs. Francis Riley-Dunn is a legal practitioner in Jamaica, having been called to the Bar in 2000. She specializes in commercial law (with an emphasis on debt collection), conveyancing and family law.

She is an honours graduate of the University of the West Indies and also of the Norman Manley Law School, where she received her Certificate of Legal Education.

She is the Secretary on the Board of Directors.

Mrs. Gayle-Roper is a Legal Consultant with a decade of experience as an Attorney-at-Law, working on high impact projects and cross border transactions. She previously held the position of AGM of Legal Affairs of First Heritage Cooperative Credit Union Ltd and possesses a wealth of knowledge in corporate and commercial law.

She is the recipient of many academic accolades and is the holder of a Bachelors of Law Degree (1st Class Honours), a Certificate of Legal Education (with Merit) and a Master’s of Science in International and Comparative Dispute Resolution (with Merit). She is the Assistant Board Secretary.

Mr. James is a Retired Senior Superintendent of Police, a former Executive Member of the Police Officers’ Association and Divisional Commander of St. Thomas. He currently serves as Chairman of the Paul Bogle High School Board of Management.

He has received numerous awards including the Medal of Honour for Meritorious Service, the Jamaica Constabulary Force Distinguished Service Award for the Development of Police Youth Clubs in Jamaica, as well as being named the LASCO Police Officer of the Year 2000. He is a Past President of the Kiwanis Club of St. Thomas. He is a Director of FHC Credit Union.

Mr. Francis, a Commissioned Land Surveyor and a Class 1 Hydrographer, is an Associate of the Royal Institution of Chartered Surveyors. His work experience includes the management of the Survey Department as Deputy Director of Surveys, serving as a consultant in Dredging Engineering, Consultant to the Commonwealth Secretariat and the United Nations and serving as a Lecturer at the University of Technology.

Educated at the University of the West Indies, University College London, University of Toronto, Texas A&M University and Nova Southeastern University. Mr. Francis’ qualifications include a Bachelor’s of Sciences Degree (BSc.) and a Master of Arts in Business Administration (MBA).

Mr. Francis currently serves on the Board of the Jamaica Copyright Agency as Treasurer and sits on the Past Due Committee of FHC as well as the Board of Directors. Mr. Francis has been honored by the Jamaican Government with an Order of Distinction.

Mr. Grant is the immediate Past President of the Jamaica Civil Service Association and has served as President since 2011. He has held several positions in various Ministries, and currently sits on the Board of the National Housing Trust.

He is a trained Accountant and Financial Analyst and currently holds an Executive MBA from the Mona School of Business.

He is a Director of FHC Credit Union and also sits on the Board of the Jamaica Cooperative Credit Union League Limited and the Consumer Affairs and Fair Trading Commission.

Mr. Jones currently holds the post of Deputy Financial Secretary in the Ministry of Finance and Public Service and is in charge of Strategic Human Resource Management. Mr. Jones is an accomplished Human Resource Practitioner with over thirty-five years’ of experience in the field of Industrial Relations and Employment Management. He is a graduate of the University of the West Indies, City & Guild Institute of London, and a certified Change Management Specialist.

Mr. Jones is a former President of the Jamaica Civil Service Association (JCSA) and General Secretary of the Jamaica Confederation of Trade Unions (JCTU). At the regional and international levels, he held the presidency of the Caribbean Public Services Association and sat on the Executive Board of Public Services International as representative of the InterAmericas Region. He is also the recipient of an Oder of Distinction by the Jamaican Government and is a Director of FHC Credit Union.

Mr. Ranger is a Chartered Accountant, a member of the Association of Chartered Certified Accountants (ACCA) in the United Kingdom and a member of the Institute of Chartered Accountants of Jamaica (ICAJ). He has over fifteen years’ of experience in external and internal auditing, accounting and business operations. Mr. Ranger has worked with PricewaterhouseCoopers, Boldeck Jamaica Limited and the Neal and Massy Group, specializing in audit and assurance, accounting and income tax services.

He is presently the Principal of Ranger and Associates and previously served as a volunteer in the capacity of a member of the Credit Committee. He is a Director of FHC Credit Union.

Mrs. Ricketts-Moore possesses over 18 years’ experience in the field of Accounting, Internal Auditing and General Business Operations, acquired mainly from the manufacturing, distribution and retail industries. She previously worked with the Grace Kennedy Company Limited for 11 years and is currently the Managing Director of Sangster’s Book Stores Limited.

Mrs. Ricketts-Moore is a Chartered Accountant and holds a MBA from the Manchester School of Business. She is also a Certified Information System Auditor (CISA) and a Certified Internal Auditor (CIA).

She previously served as a Volunteer in the capacity of Chairperson on the Supervisory Committee at First Heritage Co-operative Credit Union Limited and is a Director of FHC Credit Union.

48

The positive outcomes of the financial year 2022 underscored First Heritage Co-operative Credit Union Limited’s (FHC) resilience. As a united team, we showcased how a well-defined strategy and shared vision can yield exceptional results. Despite ongoing economic challenges due to the COVID-19 pandemic, the easing of restrictions locally and internationally led to increased social and commercial activities, driving higher demand for financial services. This, combined with the strategic prowess of the Board of Directors and Management, dedicated focus of our Team Members, and Volunteers, backed by the support of our loyal members resulted in another successful financial year.

The Credit Union concluded the year with a surplus and robust loan disbursements, reflecting our steadfast commitment to assisting members in achieving their goals through the people-helping-people philosophy. Throughout the year, FHC Credit Union prioritized enriching the member experience through tangible improvements. We successfully upgraded our core banking system and inaugurated a new branch office in St. Thomas, aligning with our Member-At-The-Centre ethos. This principle isn’t just a statement but a consistent practice, as our leadership team actively engages with members and clients to understand and fulfill their needs.

The Board remains inspired by the leadership team and team members’ unwavering dedication to providing top-notch service to members and clients. This commitment is expected to fuel further innovations, contributing to the ongoing success of our Credit Union.

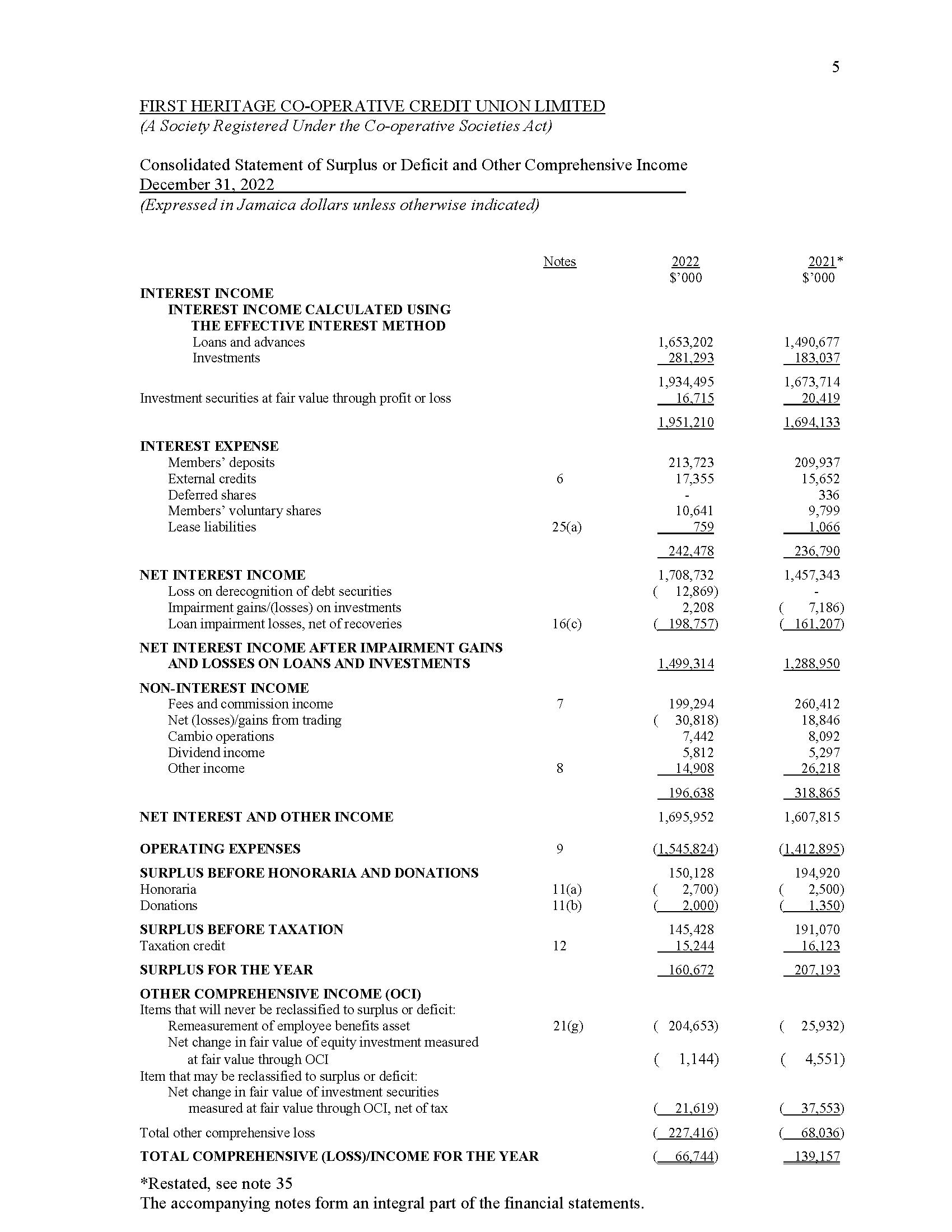

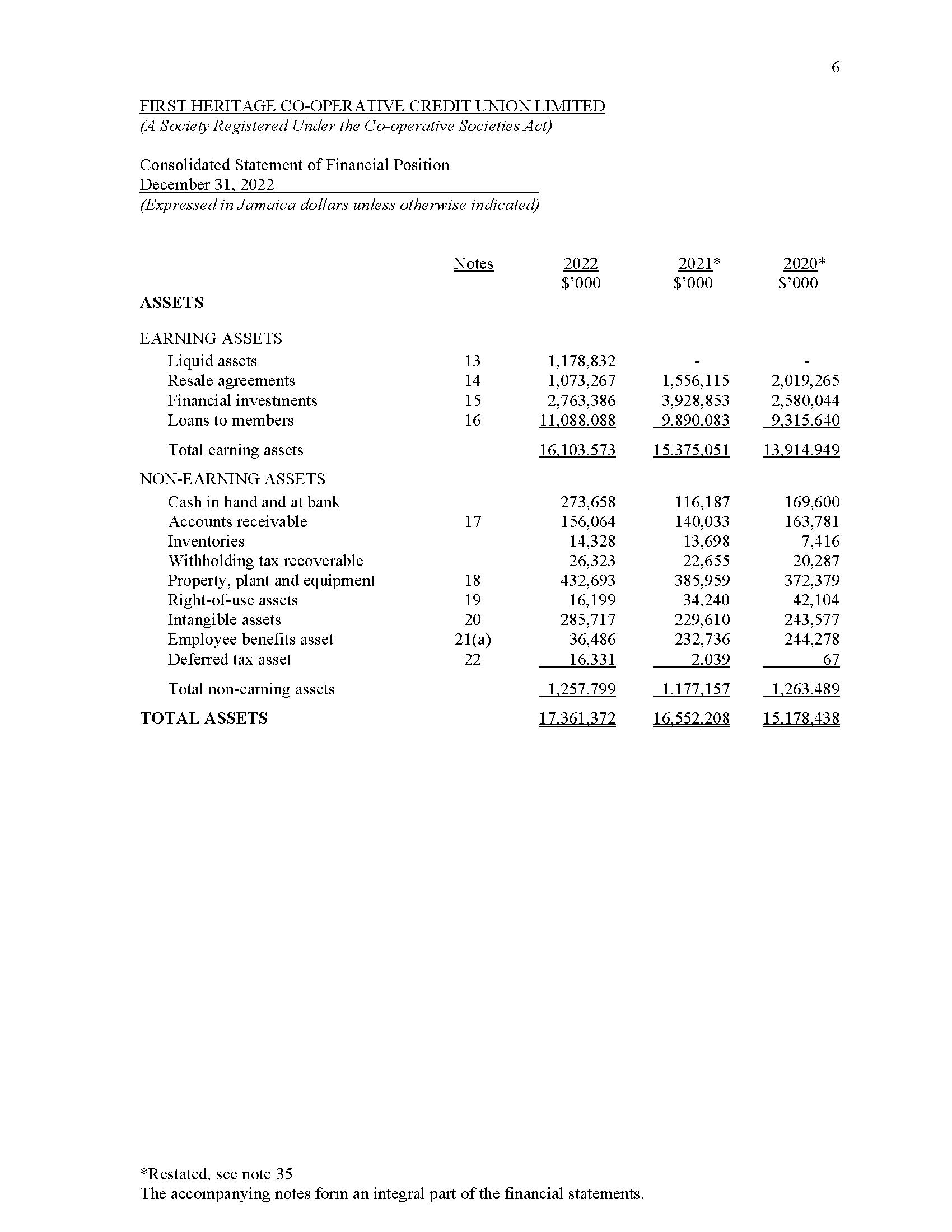

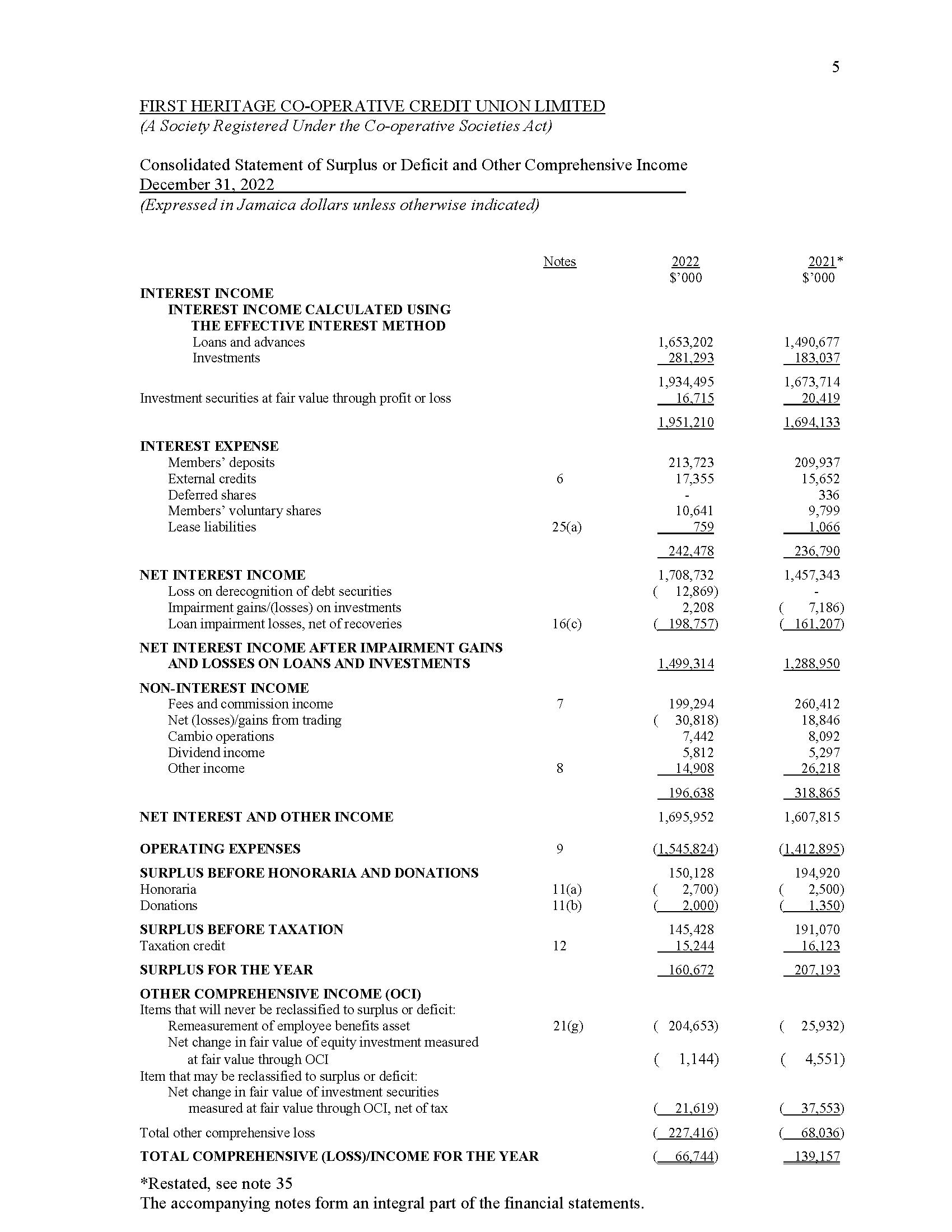

FINANCIAL PERFORMANCE

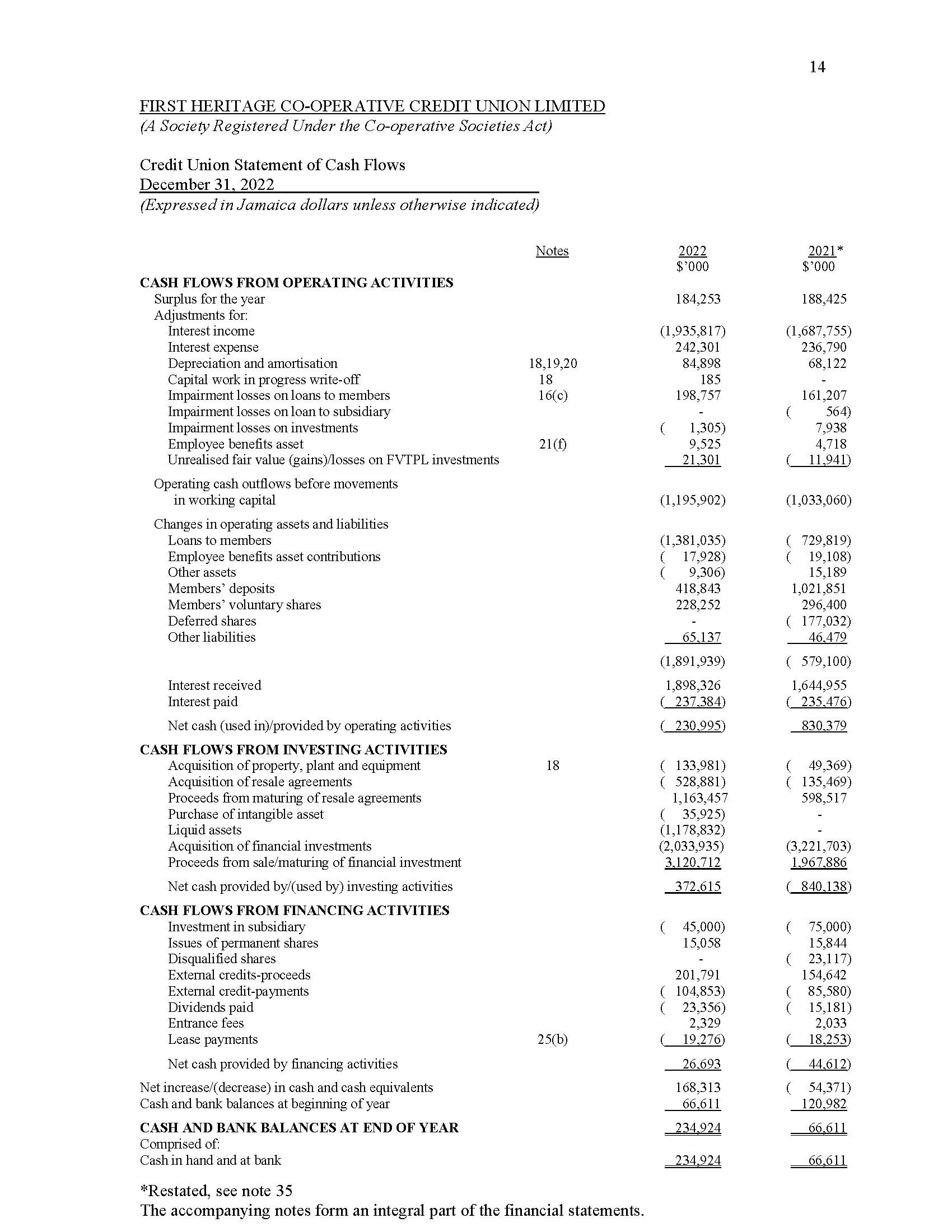

The financial year 2022 concluded with positive results. FHC Credit Union achieved a Net Surplus of $184.25 Million as against $188.43 Million for 2021. Additionally, the Company’s asset base grew to $17.19 Billion, up from $16.45 Billion in 2021. The easing of the COVID-19’s impact on the economy led to increased demand for our services, particularly in the context of our loan products. Simultaneously, our leadership team concentrated on engaging the market with our deposit product offerings. A robust risk and compliance framework continues to be in place, to maintain and build member confidence. We are also continuing our preparations for readiness for the Bank of Jamaica’s (BOJ) imminent supervision of Credit Unions as well as aligning our organization for the implementation of the Data Protection Act.

49

STRATEGIC VISION

The Board of Directors, Committees and leadership team remained committed to realizing our 2040 Vision, through the execution of our 2021-2023 Strategy Map. We recognize that integrating technological solutions is crucial to enhancing our service delivery and attracting and retaining our young members, hence, our Member-At-The Centre approach remains central to our daily operations and initiatives.

OUR SUBSIDIARY FHC Investments Limited (FHCIL)

In 2022, Central Banks across the world started increasing interest rates to combat higher inflation. This environment of rising interest rates and inflation resulted in the prices of most global asset classes recording declines in the first nine months while major stock market indices entered a “bear market”. Annual (point to point) inflation by December 2022 stood at 9.4% and local interest rates rose significantly, with the Bank of Jamaica (BOJ) raising its benchmark rate to 7.0% to counter inflation. The exchange rate for the Jamaican dollar (J$) to the United States dollar (US$) as at December 31, 2022 was J$152.05 to US$1.

As inflation rose, yields on global corporate and sovereign debt followed, adversely impacting the value of these assets in the investment portfolios and reducing potential for trading gains. Furthermore, as global recessionary fears led to a substantial contraction in demand for investment products, fee-based income categorized under Other Income declined. This is in contrast to the prior year when investor sentiment was moderately high and interest rates were low. Resultantly, FHCIL reported a Net Loss of $23.5 Million for the year ended December 31, 2022 compared to a net profit of $3.6 Million reported for the same period in 2021. The decline in profitability was mainly attributable to a 21.58% decrease in Net Interest and Other Income, when compared with the prior year.

Despite these challenging macro-economic conditions and rising inflation, FHCIL achieved remarkable growth in Net Interest Income of 138.5% for the financial year under review, reaching J$15.22 Million. Other Income however decreased by 34% when compared with the prior year, due to the fair value losses on assets, particularly local stocks.

50

Funds Under Management declined by 22% year over year (YoY) from $4.43 Billion to $3.44 Billion. The general weakness in market conditions and lower asset prices tempered the growth in the assets under management, both in the fixed income and equity markets, when compared to the similar period last year. No significant deterioration in the credit quality of the company’s assets occurred during the financial year.

With strategic positioning to better serve its clients as a core focus, FHCIL saw advancement in its service offerings, having secured its Member Dealer License from the Jamaica Stock Exchange and outfitted the company with a new and modern website which will enhance Client capabilities.

The FHC Retirement Scheme experienced growth with 92 new members enrolled when compared with 83 in the prior year. Members’ contribution totaled $155.22 Million which was a 20% increase over the prior year, while net assets available for benefits decreased by 1% to end the year at $1.46 Billion.

Despite the current volatile economic and market conditions, FHCIL remains optimistic for the next financial year aiming to diversify its revenue streams and improve performance through expanded products and services.

FHC FOUNDATION

Following its establishment in 2013, the FHC Foundation has upheld its mission to promote the development of Jamaican youth through our three pillars Youth, Education and Sport. As avenues for advancement within our society evolve, the Foundation has sought to further streamline its core focus, which during the 2022 financial year was aligned to Sports Education as a core thematic area.

With this in mind, the FHC Foundation has mobilized this new focus through initiatives that will see the Foundation focusing on Sports Education amongst the youth population.

51

Over the period under review, we donated a total of $1.03 Million to 16 recipients as a part of our annual Scholarships, Bursaries and Grants, namely our Primary Exit Profile (PEP), Oswald Thorbourne and Renald Mason Scholarships.

Our Entrepreneur Awards grants valuing $1.5 Million were successfully awarded to the 2021 recipients, with the Programme being enriched to include, for the first time, an Incubator Programme which saw the awardees participating in a two day intensive coaching session with a certified Business Coach courtesy of the Credit Union.

The Foundation intends to support a student pursuing Sports Education at the tertiary level through a tuition scholarship for the 2023/2024 academic year at a value of approximately $500,000.

We congratulate all our beneficiaries, members and YOUTH Savers, and encourage them to continue to work hard.

52

RECOGNITION

The FHC Credit Union team continues to consistently uphold a high standard of performance, placing member satisfaction at the forefront. Despite persistent economic challenges, the team has adeptly addressed our members’ needs through innovative products and skill-building strategies. The Board of Directors extends gratitude to all our Directors especially, those who will retire following our 2023 Annual General Meeting. Additionally, we thank the Volunteers, our Affiliates, the Leadership team, team members of both FHC Credit Union and FHC Investments, as well as our loyal members and clients for their continued dedication and unwavering support. Your commitment has greatly contributed to our Credit Union’s ongoing success and we are indeed appreciative and sincerely thankful.

OUTLOOK

The economic resurgence and relaxation of restrictions during the year 2022 have paved the way for a successful 2023. Our business operations have thrived, and increased capacity bodes well for further success throughout the year at new levels, along with the incremental increase in capacity, which we anticipate will result in greater successes throughout 2023.

Our Member-At-The-Centre focus remains central and squarely in sight, evidenced through our diverse suite of offerings. We will maintain a close relationship with our members to facilitate the continuous enrichment of our services. We are dedicated to promoting and expanding financial inclusivity for our youth, the underbanked, and underserved and will progressively expand efforts in this direction.

The Board of Directors remains confident in the Leadership team’s commitment to realizing our strategic vision and perpetuating our legacy of a solid past and a secure future.

Leodis Douglas Chairman, Board of Directors

Leodis Douglas Chairman, Board of Directors

53

…………………………………………………..

Board Of Directors’ Report

54

Names Position Scheduled Attended Excused Leodis Douglas Chairman 10 10Kevin Forbes 1st Vice 10 10Chairman Edmund Jones 2nd Vice 10 9 1 Chairman Cranston Ewan Treasurer 10 10Balvin Vanriel Asst. Treasurer 10 9 1 Tamara Francis Riley-Dunn Secretary 10 8 2 René Gayle-Roper* Assistant 6 5 1 Secretary SSP Michael James Director 10 8 2 Noel Francis Director 10 9 1 Richard Ranger* Director 6 6Camelle Ricketts-Moore* Director 6 6Wayne Jones* Director 6 2 4

Attendance at Board of Directors meetings

*Elected May 2022

57

We entered financial year 2022, with a keen focus on raising the B.A.R. that is, by actively being aware of our members’ dynamic needs, lifestyle and desire to be and feel fulfilled; maintaining an attitude for success by being flexible and embracing openness to change as this is indeed, the only constant; and reimagining our Credit Union, by actively developing our capacity to consider what this institution looks like years from today, and laying the ground work to ensure a successful trajectory towards that future. We have successfully ‘POWERED UP and Raised the B.A.R.’, as evidenced by a year of notable accomplishments, namely:

• The upgrading of our core banking system to Smart Universa, which has enabled us to realize greater efficiencies in serving our members.

• Being the first individual credit union to acquire a Stockbrokerage Licence through our subsidiary FHC Investments; which has seen FHC broadening our service offerings and developing the capacity to support the more sophisticated financial needs our members.

• The historic passing of a resolution to effect a Starter Membership Tier, which will see the unbanked and young adult population aged 18 to 24 years old joining the Credit Union Membership with an opportunity to gradually progress to full membership

• On December 31, 2022, we relocated to our newly minted St. Thomas Branch, offering our members a significantly more spacious and comfortable environment within which to conduct their business and;

While we have acknowledged and celebrated these successes on various occasions, including during our 10th Anniversary celebrations which we commemorated in August 2022, we remain committed to striving for further excellence and are not limited by past achievements, but rather, have resolved to forge on to New Horizons to…Dream. Dare. Deliver.

FINANCIAL PERFORMANCE

The collective performance of the Credit Union for financial year 2022 spurs confidence. FHC retained a positive position as Jamaica, and countries globally, began to recover following the COVID-19 pandemic. By remaining focused on our strategic pursuits and carefully navigating the complex business environment, FHC continued to chart the path for a successful future. Our efforts generated a Net Surplus of $184.25

59

Million for the financial year; while providing financial support to our members through loan facilities with disbursements totaling $5.21Billion for the period.

OUR STRATEGIC PRIORITIES

During the 2022 financial year, our Credit Union gained further traction in the execution of its strategic initiatives. While we worked to continue to grow the success of our business and advance the services of FHC to better serve our members, we periodically evaluated our strategic priorities to ensure that these align with our 2040 Vision. It is our objective, to ensure that our strategies allow us to anticipate and respond to our business environment, and in turn enable us to satisfy our vision of creating avenues for financial freedom and development for our members. Being cognizant of this, we have maintained at the forefront of our minds, our core principle, ‘Member at the Centre’, with a view to taking a membercentric approach to all we do.

OUR VALUED MEMBERS Deepening Member Relationships

We are pleased to report that the financial year ended December 2022, was punctuated with significant positive milestones in our history. It was a period in which as a team we experienced much success, achieved amazing performance, we broke previous records, and surpassed aspirational targets. This was made possible by the exceptional resilience of our Sales Team strongly supported by our different teams across the organization.

The strategies designed and implemented, brought greater value to our members, thus ensuring that their needs and expectations were surpassed. The increased commitment of the team, with a clear understanding of the overall company objectives, goals, purpose, high morale and motivation, was the driving force of our success.

The general economic recovery of the private and public sectors continued during 2022 however, the progress for some sectors remained slow.

Despite the highs and lows of the varied experiences within the economy, the financial services landscape remained very competitive. Our loans and deposit portfolios experienced solid growth and our other

60

offerings remained attractive as we continued to provide real value to our membership. Our innovative and dynamic approach in our planning as the base of our culture and our sales and service framework and processes have also supported our success.

Promotional activities, collaborations and strategic partnerships with major business entities as well as forging and maintaining our relationship with public sector entities were the hallmarks of our activities. This has been driven by amplified collaboration between our Retail and Marketing Department which has served to strengthen our business development efforts to effectively penetrate previously underserved segments of our membership and target market. We capitalized on and practised our relationship building strategies which have effectively stimulated growth in key areas. The team was engaged in over 60 new business development opportunities which resulted in the development of a robust pipeline for the period under review and onwards.

Much of our interactions with our members for 2022 have remained online. We were successful in making contact with our prospects remotely utilizing virtual modalities as we continued to establish new relationships whilst maintaining the existing ones utilizing a targeted approach.

Our efforts continued as we collaborate internally and with external stakeholders to improve on and provide exceptional service to our members.

Member Engagement Activities

Retaining a strong connection with our members remained a key point of focus throughout the year. This helped to assure our membership that despite the challenges faced as a nation, as we sought to recover from the impact of the pandemic, we would continue to support them in their endeavours and provide solutions to meet their various financial needs. A blended engagement approach was utilized with face to face interactions increasing in light of the relaxation of the COVID-19 restrictions by the Government of Jamaica. Online interface however remained an active and useful engagement tool through webinars and presentation sessions.

Our staple activities undertaken throughout the period which supported our sustained relationship with our Members included:

61

Civil Service Week

Civil Servants of the Year Awards

As proud title sponsor of the 2022 FHC Civil Servants of The Year Awards, we had the pleasure of interacting with all shortlisted nominees and selected the following winners from the three categories:

NAME CATEGORY DEPARTMENT

Mr. Lennox Wallace Management Ministry of Health and Wellness

Mr. Oliver Morris Middle Management Ministry of Justice

Ms. Simone Turton Technical Support Ministry of Health and Wellness

Credit Union Week

A number of member appreciation activities were held across all branches throughout Credit Union Week, and culminated with our Evening At The Movies event on International Credit Union Day on October 20, 2022, where our valued members were treated to a film and refreshments courtesy of FHC.

FHC Christmas Show

Our Christmas Show was held virtually on Friday, December 16, 2022 with a blend of FHC Team Member talent, professional entertainers and friends of FHC. The show was a success and saw team members caroling along with the performers online as well as engaging with us via the chat.

Products, Services and Promotions

Our commitment to ensuring that our members were assured and supported continued. Despite our organization’s on-going navigation of the pandemic with a thrust towards recovery to pre-COVID service levels, our connection with our members remained robust.

We hosted our POWER UP! Women Winning Financial Goals in 2022 Webinar at the beginning of the year, and closed the year by welcoming our new Brand Ambassador for FHC Investments, Dr. Sara Lawrence Lewis. The partnership was launched with our webinar entitled FHC Investments Fireside

62

Chat which was well received both across our client and member base along with the general public. Both webinars sought to share key insights about how persons could amplify their capacity to propel their financial journey through prudent savings habits, establishment of a healthy investment portfolio and critically, retirement planning at an early age so as to ensure a high quality of life upon demitting the workforce.

Encouraging the use of our alternate banking channels remained a core focus of the Credit Union; our members’ safety remains of paramount importance, and equipping them with the knowledge and tools to facilitate the same has been a part of our ongoing thrust. Our alternate banking channels include our iTransact internet banking platform, AccessPlus Debit Mastercard, Bill Express Payment Services, as well as Electronic Bank Transfers. Through these channels, our members have twenty-four hour access to conduct business and process their transactions safely and conveniently.

Supporting our members with fit for purpose products and services has always been a part of our strategic focus as a Credit Union, particularly as our members’ needs evolve and become more sophisticated. In keeping with this, a number of promotional offerings were proffered throughout the year to suit every member and his/her needs; these included:

1. ‘Sweetest Summer’ Loan Sale – Our Summer loan sale provided our Members with an opportunity to reach their financial goals with greater ease by taking advantage of reduced fees, and preferred rates that were made available to them.

2. ‘Holly Jolly Chris’Max’ Loan Sale – The Credit Union continued to promote our loan products by making them more readily accessible and attractive to members and enable our membership to bring their dreams to life with FHC as their financial partner.

3. FIP/FCIP Referral & Rewards Promotion - Following a brief cessation in 2021 as a result of the impact of the pandemic, we piqued our members’ interest in the Family Indemnity Plan and the Family Critical Illness Insurance Plan, subsequent to their reactivation, with the FIP/FCIP Referral & Rewards Promotion, wherein 20 members were awarded gift certificates as our special way of rewarding them for accepting the offer and building member loyalty.

4. AccessPlus Debit Mastercard Launch - The Credit Union movement, led by the Jamaica Co-operative Credit Union League, has commenced the transition from our AccessPlus Debit Card to the AccessPlus Debit Mastercard. This forms part of our strategic focus to foster financial enablement and safety

63

through digital interventions. Our members were invited to change their existing AccessPlus Debit Card to the new AccessPlus Debit Mastercard which is safer, more convenient and allows for accessibility to and use of funds not just locally, but globally as well as online.

5. FHCIL Brand Ambassador Agreement – FHC Investments onboarded Dr. Sara Lawrence Lewis as its first Brand Ambassador. Through this partnership, her creative delivery of the brand’s key benefits and sharing about her firsthand experience engaging with the company, is expected to yield greater visibility for the brand and drive demand for our services.

6. Investment Summer Promotion – Our members and prospective clients were encouraged to commence their investment journey by participating in our special summer and Christmas offer which enabled new account holders to benefit from a 50% discount on both the amount required to open their account as well as the brokerage fees.

7. The Member Assistance COVID - 19 Relief Programme – Numerous offerings were extended to our members to help to buffer the many challenges that were being experienced. These included waivers, moratoria and other options.

OUR PEOPLE AND CULTURE

Our Perseverance