Federation of Small Businesses: Annual Report and Financial Statements 2023-2024

Federation of Small Businesses: Annual Report and Financial Statements 2023-2024

Our vision is to be recognised as the most influential and trusted organisation representing the voice of all small businesses, in every region and nation of the UK

Our purpose is for support, for protection, for business . FSB is a non-profit, non-party-political grassroots business organisation that provides its members with a wide range of vital business services . These include advice, financial expertise, legal support and a powerful voice heard in government for over 50 years .

The UK’s 5.5 million small businesses and self-employed make up 99 per cent of all private sector businesses. They contribute a staggering amount to the UK’s economy as well as being a major source of employment; more than 16.6 million people are employed by smaller firms. Our local, national and international activism helps shape policy decisions that have a direct impact on the day-to-day running of smaller businesses. We work for their interests through research and engagement with our members and by effective campaigning—influencing those in power through policy analysis, public affairs, media and public relations activity.

We also support our members by providing them with vital business products and services, from legal advice to access to finance, and from debt recovery to training, ensuring that these remain relevant and competitive. Our members have opportunities to be an active part of the FSB community; by volunteering, by taking part in our Big Voice surveys, focus groups and roundtables and by joining hundreds of events we hold each year.

• To represent the diversity of the UK’s small business community

• To provide support, advice and practical solutions to our community of members

• To advocate on behalf of small businesses and the self-employed, providing a powerful voice heard by government and key decision makers

• To maintain a critical mass of customers to deliver scale and to operate efficiently, ensuring financial stability and safeguarding FSB for the future

Campaigning and giving its members a powerful voice to political decision-makers and others were at the heart of FSB in what became a General Election year. The importance, breadth and effectiveness of this was crucial in 2023/24, with a backdrop of small firms struggling with a range of costs, taxes and barriers; a small business population 500,000 smaller than before the COVID-19 pandemic; and political instability and uncertainty.

When the General Election was called, FSB’s plan for impactful engagement and communications was put into action immediately. Our Manifesto for Small Businesses and the Self-Employed set out a comprehensive blueprint of pro-small business policies for whichever party was to win power.

A snap poll of FSB members was carried out, rooting our messaging in up-to-theminute evidence. The survey results supported the successful messaging cut-through up to and including the top levels of politics and media—with the key message that the owners of the UK’s 5.5 million small businesses are motivated voters (96% had planned to vote); discerning voters (53% were open to persuasion while hearing the rival pitches);

and a significant part of the electorate, along with the estimated 16 million voters who are employed in small businesses.

FSB is a cross-party organisation, and that was reflected throughout the campaign, including at The Small Business Debate— an FSB UK hustings event in partnership with two other business organisations, featuring prominent politicians from Labour, Conservatives and Liberal Democrats. FSB was also a major partner in Bloomberg’s head-to-head live business debate between the then Business and Trade Secretary, Kemi Badenoch, and her Labour Shadow, Jonathan Reynolds.

FSB had engaged extensively with the main parties long before the election was actually called, which in turn led to good and extensive engagement with the new Labour government on a range of issues.

Under the previous government, FSB successfully campaigned ahead of the Autumn Statement 2023 and Spring Budget 2024. Wins included cuts in self-employed National Insurance Contributions, extended business rates reliefs for small firms in retail, hospitality and leisure in England, and a rise in the VAT threshold. At the despatch box, the then Chancellor, Jeremy Hunt, also committed to action on tackling late

and poor payment practices, which he acknowledged was as a direct result of FSB campaigning. Separately, Labour in opposition also committed to action on late payments following extensive engagement with FSB.

On international trade, FSB led an exports taskforce, leading to research and a five-point-plan of recommendations to increase UK exports, including growing the number of small businesses which trade internationally. This work was originally commissioned by Jonathan Reynolds while Labour was still in Opposition, and he welcomed it when it was published shortly after Labour took power.

Other campaigning, policy and media work this year included issues such as the impact of crime on small businesses; the challenges and opportunities of artificial intelligence; and access to finance— including a super-complaint to the Financial Conduct Authority about excessive demands from lenders for personal guarantees on small business loans.

The future of high streets was the basis of flagship FSB research, recommendations and campaigning in summer 2024.

FSB set out an extensive, optimistic, futurefocused plan to ensure that high streets can evolve, thrive and remain at the heart of communities and local economies long into the future. Our digital advocacy for this sought to engage not only politicians, but members and other small business owners. Subsequently, both FSB’s sales team and FSB Insurance Service took the opportunity to create offers for small retailers, illustrating the complementary nature of FSB’s advocacy and membership benefits.

Martin McTague OBE National Chair

Tina McKenzie MBE National Vice Chair (Policy and Advocacy Chair)

2024 was a momentous year, marking 50 years since FSB was established. Beginning as a collective of self-employed people who came together to rally against a proposed tax hike for the self-employed, FSB was founded in Lytham St. Annes, Lancashire, in 1974.

Fifty-years on, FSB is viewed as the most influential grassroots organisation representing small businesses and the self-employed in the UK. We remain headquartered in Blackpool, Lancashire, and are one of the area’s biggest employers. We now also have offices in Westminster, Cardiff, Glasgow and Belfast.

There is a unique passion that affects all of us who are part of FSB—the members, volunteers and staff. We do what we do to have a real impact on making the UK one of the best places in the world to start and grow a smaller business. All our staff are dedicated to helping small businesses, but I would like to pay tribute, in particular, to FSB’s UK external affairs team in Westminster and the counterpart teams in the nations. This external affairs work (policy, public affairs, media & communications and international) has been exemplary and remains the backbone of the business carrying on the work that our founder, Norman Small, began.

Our members are a significant section of the UK’s 5.5 million small business and self-employed community. This diverse cohort spans all industry sectors and people of all demographics, and includes sole-traders, microbusinesses (fewer than 10 employees), small businesses (10 to 49 employees) and medium size businesses (50 to 249 employees). Though diverse, what all our members have in common is entrepreneurial spirit, tenacity, creativity and resilience.

We venture to be the go-to organisation that has small businesses’ interests at heart, and our membership is reflective of the wider community. FSB is unique as a nationwide grassroots organisation focused wholly on small businesses, precisely because it looks after the interests of such a varied group of enterprises, people and businesses. Each of these with its own sector-specific and geographic-specific needs and unique priorities at any given time. This is what gives us the edge on credibility and influence—we truly represent the voice of small businesses.

These are ever-shifting sands. The small business sector is an eco-system; what impacts one sector affects others. For example, you can’t have a strong and innovative B2C sector without a robust supply chain; you can’t have a strong supply chain without good infrastructure and easy cross-border trade, and you can’t create a climate for tech innovation without a tax and regulatory environment which is pro-enterprise and pro-investment.

There are, however, fundamental issues that touch the entire eco-system across all sectors at whatever stage of business lifecycle. These include cashflow, funding and finance and legal issues.

Cashflow and access to finance were some of our key focuses when developing member products and services in the last year. We launched new partnerships with several financial service providers to upscale the range of exclusive options for members to make cost savings, returns on savings and to access financial support and payment options with Zempler Bank (formerly Cashplus Bank) and Allica Bank.

The business changed provider for some of our other white-labelled member services. FSB Payments is now provided in partnership with Tyl by NatWest and FSB Funding Platform is now in association with Capitalise.

Small businesses that can’t access finance are cut off from opportunities to grow; it’s that simple. During the year, £425,000 of funding was secured for members through their FSB Funding Platform. Giving access to a broad range of lenders, from challenger banks and fintechs, to peer-to-peer lenders and crowdfunders, the platform was developed as a ‘single-destination’ to open up lending in the quickest and easiest way possible for members.

Whilst FSB’s external affairs team achieved a landmark commitment from the Business and Trade Secretary to introduce new legislative measures to tackle late payments to small businesses from large corporates and the public sector, our FSB Debt Recovery service had recovered an impressive £3.7 million for our members.

FSB Legal remained one of the most used and valued member benefits. The year saw 95,000 calls to the legal advice line and 280,000 downloads of documents and templates from the online hub. We added specialist R&D tax claims support for members and we soft-launched new member healthcare and occupational health services which we’ll be rolling out over the next 12 months.

We continued to deliver excellent customer service, bucking the trend of other companies looking to cut costs where

Minister for Veterans’ Affairs Johnny Mercer, FSB Westminster offices, October 2023

possible, often at the expense of good customer experience. In fact, the latest benchmarking survey from the Institute of Customer Services (ICS) shows an overall fall in UK consumer satisfaction over the last two years. However, I’m delighted that through our quarterly satisfaction monitor where we ask our members about their overall satisfaction level with FSB’s customer service, we measured at 75 per cent (with the remaining overwhelmingly of no view either way). Our ICS assessment found the digital experience for users of the FSB Legal hub was 90 per cent satisfaction.

It is important to me that our members have touch points with us that include opportunities to talk to real people. Our members’ situations are sometimes unique and being a small business owner or self-employed can feel lonely at times. Our customer services team managed over 60,000 inbound calls, emails and chats in the last year. Members, of course, also have access to our network of field staff in each local area and can attend hundreds of local events.

We employed new technology to improve the customer experience journey, including AI tools. However, unlike other businesses, this is not replacing our personal service

approach—a USP for FSB—but, rather, enhancing our team’s capability to deliver excellence. During our assessment by the ICS, the Net Promoter Score (advocacy) shows FSB ranked above Ikea, Next, Boots and Apple for customer service satisfaction.

We increased our digital capability through a new finance system which will link into a new customer relationship management system in the near future. The introduction of this new technology also brought an opportunity to to employ new apprentices.

Throughout the year, we continued to monitor diversity across the organisation, with our committees now being more representative of our wider membership.

Almost half our workforce (86 employees) is based in our head office in Blackpool, contributing to social mobility in the town which has high levels of deprivation. Improving diversity and inclusivity will remain a focus for FSB, as we continually seek new ways to create an equitable environment.

Julie Lilley Chief Executive

2024 marked 50 years since FSB was established . Beginning as a collective of self-employed people who came together to rally against a proposed tax hike for the self-employed, FSB was founded in 1974 in Lytham St . Annes, Lancashire . Fifty years on, FSB is the UK’s biggest grassroots business membership organisation representing the voice of small businesses .

I’d like to extend a happy birthday wish to the Federation of Small Businesses which does a fantastic job of bringing the voice of small business right to the heart of Government.

Secretary of State for Business and Trade Jonathan Reynolds addresses Parliament, 2024

We’re really proud to be celebrating 50 years of FSB supporting small businesses and the self-employed . When FSB was first formed in 1974, it was a coming-together of thousands of small business owners who realised their voice was stronger if it was a collective one .

“And that’s still at the heart of FSB today—now the biggest organisation dedicated to representing and supporting small businesses and the self-employed . Alongside that, we’re here to help our members run and grow their businesses with a whole range of business support services and events .

“FSB’s 50th anniversary isn’t just about us as an organisation; it’s about our members and all small businesses up and down the country and the contribution they make to the economy and communities .

FSB’s 50th anniversary and the contribution the organisation makes was widely recognised. Business and Trade Secretary Jonathan Reynolds, along with other MPs and Lords, attended FSB’s 50th Anniversary Parliamentary Reception. In his key note speech, (pictured below left) the Secretary of State said: “I love FSB, I really do. Not because we always agree or because you tell me what I want to hear... But because of how genuine this organisation is, because of the authenticity that comes with this organisation, the good faith. Even when we do disagree, I trust what you tell me.”

Scotland’s public finance minister, Ivan McKee (pictured below right), also paid tribute in the Scottish Parliament, saying: “FSB has been and continues to be an absolutely outstanding champion of the small business community.”

2023 – SEPTEMBER 2024

• Government and Opposition commitment to new measures to tackle late payment to small businesses from large corporates and the public sector

• Extension of the one-year National Insurance relief for small businesses which employ an armed forces veteran

• A rise in the VAT threshold from £85,000 to £90,000

• Cuts in Class IV Self-Employed National Insurance Contributions, reducing the rate from nine per cent to six per cent

• Removal of the requirement for the self-employed to pay Class II National Insurance Contributions

• Protection of the Employment Allowance from potential cuts

• Small business multiplier frozen on business rates in England, cancelling the scheduled inflation-linked increase

• Legislation to make assaults on retail workers a stand-alone crime

• Expansion of the Energy Ombudsman, allowing SMEs with up to 50 employees to access redress

• Expansion of the training that is eligible for tax relief for the self-employed

• All apprenticeship training costs for young apprentices employed at small businesses now covered by Government

• UK Government commitments on reducing barriers to UK-EU trade

• The Recovery Loan Scheme (renamed the Growth Guarantee Scheme) extended by two years until 2026

• Government announcement of a £7.4 million upskilling fund pilot to help SMEs develop artificial intelligence (AI) skills

• Expansion of Made Smarter, a technology adoption programme for small manufacturers, to all of the UK

• A freeze on fuel duty rates for 2024-5, worth £3 1 billion

• Government commitment to consider the introduction of tax-free shopping for overseas visitors

FSB membership automatically makes available several commercial services to help members with the running of their businesses . Most of these are at no extra cost whilst some are at competitive additional rates . These services benefited many of our members in the last financial year . These services were:

FSB Business Banking

FSB Debt Recovery

FSB Funding Platform

FSB Insurance Service

FSB Healthcare

FSB Employment Protection

FSB Health and Safety Advice

FSB Legal Advice Line

FSB Making Tax Digital app FSB Payments

FSB Payroll and Pensions

FSB PR and Crisis Management

FSB Tax Investigation Protection FSB Training

FSB Commercial Legal Expense Insurance FSB Occupational Health

Key member service usage October 2023 – September 2024

95,000 calls to the legal advice line

283,000 downloads from the legal and business hub

£3.7 million (service total) recovered for members through FSB Debt Recovery

£425,000 funding secured for members through FSB Funding Platform

400 members signed to the new healthcare app

5,000 courses completed through FSB Training

60,000 customer service inbound calls, emails and chats

1,100 member events delivered

44,000 event registrations

FSB commercial legal expenses insurance, October 2023 – September 2024 usage by members

FSB customer satisfaction ratings for the financial year:

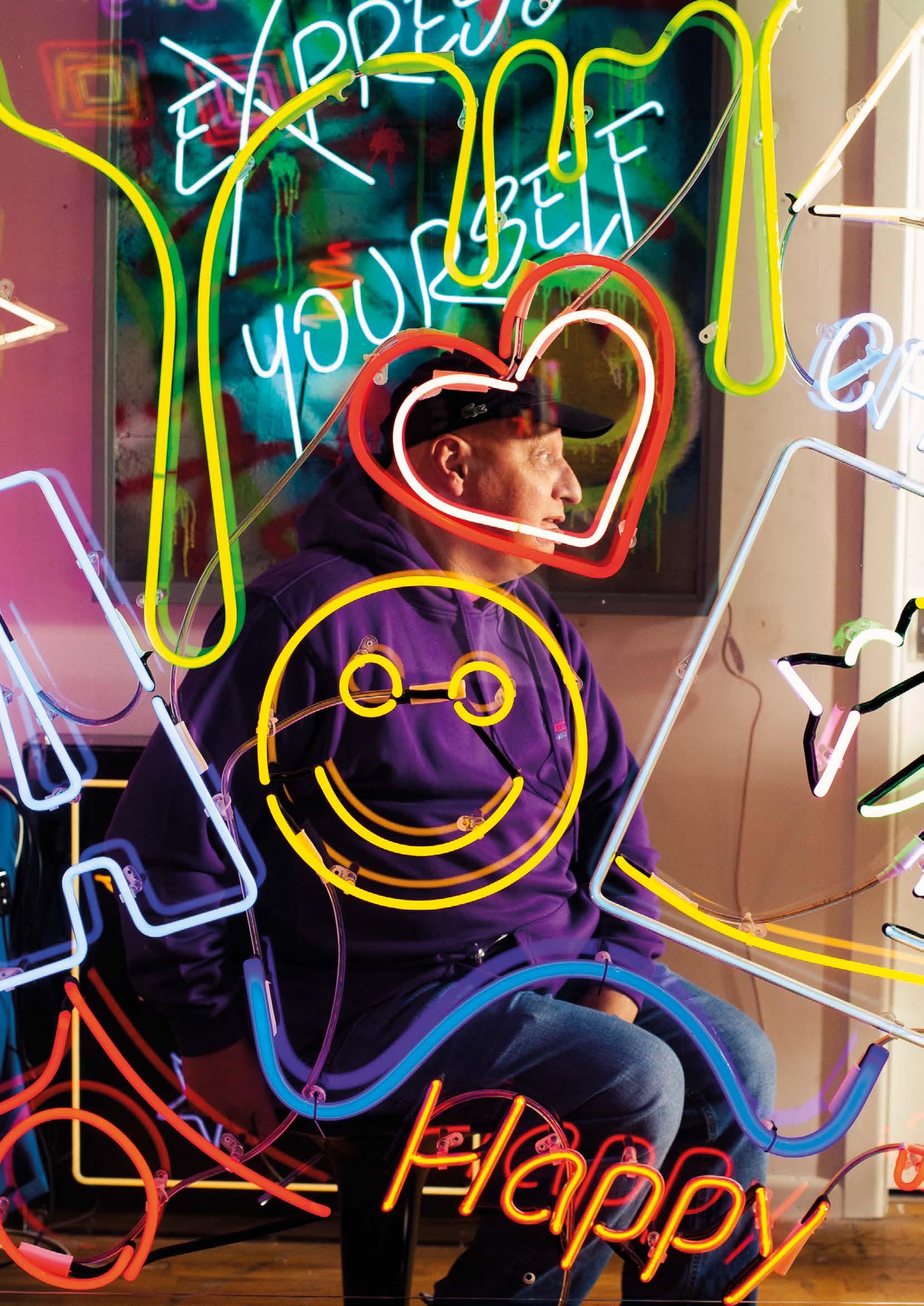

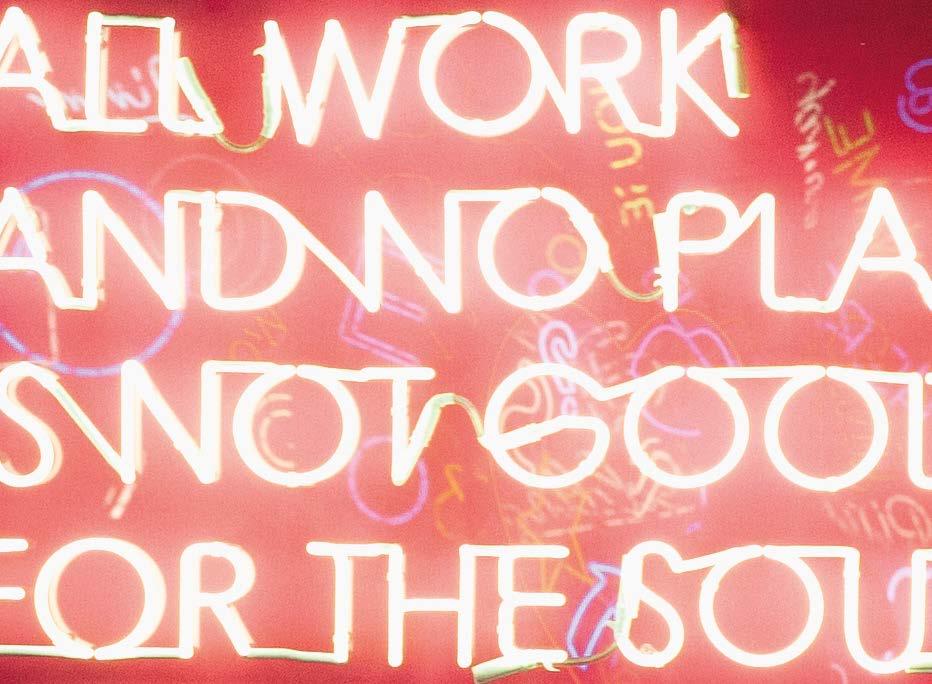

Wife and husband Catherine and Tony Spink co-founded Neon Creations Ltd. in 2005. Based in Bolton, Lancashire, the business specialises in the design and manufacture of custom-made neon signs, neon lights and neon art. The business is secreted inside the imposing former Swan Lane Mill, built 1901 –1914 due to the expansion of the Lancashire cotton industry in the early 20th century. The brick façade now houses a labyrinth of storage spaces and warehouses. Stepping beyond the non-descript door of Neon Creations you enter a gloriously vivid enclave. It is like stepping into a giant pinball machine.

The studio is where everything happens for the business—the glass bending and blowing, the creative design, the business management, the staff training, the sales meetings. Catherine and Tony also offer workshops, ever keen to educate people about the history and value of the neon industry, keeping it alive and understood. In 2024, they were invited by Bolton Museum to curate an exhibition of their work, engaging the community and dispelling misconceptions about neon signs (“expensive to run; hot to touch; easy to break; contain toxic gases; dangerous voltage”).

In 2019, neon glass bending was added to the Heritage Crafts Association Red List of Endangered Crafts in the UK. An influx of cheaper LED signs, falsely advertised as neon, and neon craftspeople retiring from the trade without being able to pass on their skills have both led to the threat.

Research by FSB and Public First (2022) found that the number one area in which the public said that small businesses were more important than large businesses was for keeping traditional craft and skills alive (78%). This was followed by pride in local communities (76%), providing unique services and products (72%) and growing the local economy (57%).

Catherine and Tony have been working to get a campaign off the ground to halt the false advertising of other products as neon. “We don’t have anything against LED signage,” explains Tony, “in fact we can even supply it, but it’s false to market a product as neon if it is not. It’s not fair to the consumer and it’s not fair for the industry.”

They have met with the Mayor of Bolton and local MPs to discuss the issue and get buyin. They’ve been working with their local FSB development manager for Greater Manchester, Robert Downes, too.

Tony’s industry background stems from his early apprenticeship with a signage company in south-east London in the 1980s. Tony’s focus is on production whilst Catherine manages the business. “There’s much we could do to expand,” explains Catherine, “I can see a market for running more corporate events. We could also grow our VIP buyers. But I’d need to put time into developing that. That’s one thing when you run your own business you’re short on. It’s a difficult decision—do we invest in another staff member who could take on some of the day-to-day business? How might that affect our bottom line?”

In 2012, the Spinks made the decision to take on an apprentice. They found Sam, who by 2025 is now an accomplished glass bender and a core member of the small production team. “Sam was 16 and fresh out of school when she responded to our ad in a local newspaper,” says Tony, “Her

mum spotted the advert and said to Sam, who at the time wasn’t sure what she wanted to do but was considering joining the forces, ‘why don’t you see what it’s all about?’. She came to see us; I showed her some basics and she really wanted to learn. She became hooked. She’s now been with us 12 years, but the first five of those were really training. She now works on projects and leads workshops and when I watch her do this, it fills me with pride!”

Around 50 per cent of the business’s market is hospitality: “We’ve felt how the cost-of-living rise over the last few years has affected the hospitality industry. It’s had a knock-on effect. The cost of our production materials hasn’t affected us too much directly, but with us being part of the hospitality supply chain, that has affected us.” says Catherine.

Happily, the business is not solely reliant on the hospitality sector and has also carved out a strong market share in the TV, film and entertainment industry. They also supply to the interior design industry. This non-reliance on any one market is a strong business model.

Tony, admittedly, “lives and breathes neon.” He spends any time he has creating his own neon art. Many of these pieces are inspired by and reflect his heyday in the 1980s rave scene. Recurring motifs are smiley face emojis, house music references and acid house notes. He constantly experiments with new applications of neon: creating works that use UV paint with UV neon tubing (black, if you’re asking) hovering over the artwork to light it up. He experiments with mixed media; an example is a huge wooden cross high on the studio wall with the neon words ‘Who’s next?’ flashing (sold to a private collector).

The business is a shining example of the diversity and innovativeness of FSB members, and it will be interesting to see ‘what’s next’ for Catherine and Tony.

Neon gas is discovered by British scientists Sir William Ramsay and Morris W. Travers by liquefying air to isolate its various parts; they name it neon, from the Greek for new

The first neon lamp is displayed in Paris by French engineer Georges Claude by applying an electrical discharge to a sealed tube of neon gas. Claude first files for a patent in France

The newly formed Claude Neon Company sells the first ever advertising neon sign to Parisien barber shop ‘Palais Coiffurre’. By the end of 1913, Claude Neon has installed 160 neon signs in Paris, including the first ever rooftop neon sign, advertising Cinzano

The first neon gas signs are introduced to the US, with the sale of a pair of neon signs to car giant Packard, for $24,000. One of these signs remains to this day

With the introduction of phosphorus coatings and coloured tubing opening up a new spectrum of colours, there is an explosion in the demand for neon signs

Neon in the form of advertising signage declines in popularity. However, there is an emergence of neon art

Neon Creations Ltd. is founded by Tony and Catherine Spink in Bolton

Neon glass bending is added to the Heritage Crafts Association Red List of Endangered Crafts in the UK

UK high streets stand on the cusp of a transformative era . In summer 2024, FSB published an innovative blueprint, setting forth a bold vision for the next generation high street— a vision where small businesses can be the driving force behind a thriving, dynamic, and inclusive future . Key recommendations were around five central themes:

1. 2. 3. 4. 5.

Destination

Fostering the distinctive diversity of each high street as destinations in their own right

Transformation

Focusing on revitalising high streets through transformation, such as vacant units into vibrant pop-up spaces, reforming the planning system and strategies to further integrate high street firms’ physical presence with the online world

Experience

Advancing accessibility, functionality, safety and cleanliness of high streets to create a fabulous consumer experience

Competitiveness

Delivering strategic support such as a balanced business rates system for fair competition among high street, out-of-town and online retailers and expansion of Small Business Rates Relief

Infrastructure

A focus on forward-thinking infrastructure that creates accessibility and convenience, including transport. By prioritising these factors, local authorities can encourage more people to visit and invest in their local high streets

The high street has always been about experience . That’s something we’ve lost a little bit with the internet coming in . The internet was a new experience but we’re now starting to realise it’s a bit boring . It’s not a nice way to shop . For small businesses, like mine, it’s about thinking, what is your USP that makes you stand out from the others? That’s one of the biggest challenges for any retailer on the high street .

FSB Member Phil Pinder, The Potions Cauldron, York

• Small business multiplier frozen on business rates, cancelling the scheduled inflation-linked increase in England

• A further year of business rates relief for small firms in retail, hospitality and leisure in 2025/26 in England

• A new draft Non-Domestic Ratings Bill published, laying out the legal framework needed to implement more multipliers to seek to balance the high street with out-of-town online delivery fulfilment centres in England

• New business rates review, announced in the Autumn Budget 2024, with the explicit aim of protecting the high street. It will look at several elements, including allowing multiple properties to be eligible within Small Business Rates Relief in England

• Extension of 40 per cent business rates relief for business premises in the retail, leisure, and hospitality sectors, and the capping of the business rates multiplier in Wales

• The Small Business Bonus Scheme and rates reliefs maintained in Scotland

• UK Government introduces legislation to make assault on retail workers a stand-alone crime

• FCA finalised its Access to Cash regime in September 2024, to protect cash infrastructure for consumers and businesses in communities across the country

Shimayne Smith’s business Head Shed is about more than just popping in for a quick trim. Her salon specialises in curly hair—and with this comes a raft of expertise and specialist knowledge. Shimayne and her team know everything that’s worth knowing about waves, curls and coils, often transforming a client completely.

“What I’m trying to create is a spa for hair,” Shimayne says. “It’s a very nurturing environment. We get a lot of people coming to us who have a lot of trauma related to their hair. They’ve had a bad experience or just haven’t known how to look after their hair and have always felt frizzy and unkempt. Essentially, they’ve not liked a major part of who they are; so much of a woman’s identity relates to our hair.”

Beyond offering expert services, tailored cuts and treatments, Shimayne wanted to create a space where people “feel empowered and confident in their natural hair,” providing education and support for clients on their curly journey.

“I decided to set up my own business because I saw a real gap in the market for a salon that truly understands and celebrates curly hair,” she adds, “Too many people with curls, waves, and coils struggle to find stylists who genuinely know how to care for their hair, and I wanted to change that.”

Head Shed launched in December 2019, slowly building up a client base before the national lockdown hit just months later. As hairdressers began to reopen their doors later in 2020, Shimayne had a purpose-built salon constructed in her smallholding back garden, which allowed her to keep clients feeling safer than they may have done visiting a busy shop.

As well as the garden studio, she now has a high street salon in Wimborne, a pretty Dorset market town, home to scores of other independent businesses. The salon itself is every inch a spa-like experience, with wood panelling, gold rimmed mirrors and houseplants adorning the walls. This is a place clients go to feel pampered and fall back in love with their hair.

While the salon’s look and feel is undoubtedly important, sustainability and ethical practices are at its core. As well as being incredibly passionate about curls, Shimayne is very conscious of the waste produced by the beauty

industry and feels a strong responsibility towards reusing and recycling.

The business uses organic, eco-friendly products that are not tested on animals— as well as products that can be reused such as silicone cutting collars and colour bowls made from wheat-based bio plastics. Shimayne also works with local company Green Salon Collective to recycle used foils, bottles and, fascinatingly, hair, which is used to do extraordinary things like create hair booms used to clean up oil spills and polluted rivers across the UK and Ireland.

According to the Green Salon Collective, 98 per cent of salon metals in the UK, including items like salon foil and colour tubes, end up in landfill instead of being recycled. Through recycling initiatives, over 175 tonnes of waste from UK hair salons, including waste hair and salon metals, have been prevented from going to landfill.

In the longer term, Shimayne is working towards gaining a B-Corp certification,

a verification that a business meets high standards of social and environmental performance, transparency and accountability. She says: “The hair and beauty industry has been such a fast-moving place to be. Being able to stop and think about how we’re impacting the environment with the products we’re using can only be a positive, particularly in an industry as big as this—we are taking heed and making better choices.”

The local community is close to Shimayne’s heart too, and she’s keen to give back as much as she can. As well as selling local artists’ work in the salon, she plans to roll out free haircuts for the homeless.

Of course, keeping to these values comes with its own set of challenges. Sourcing eco-friendly products adds extra cost, on top of the general increase in costs being felt by so many businesses. Last year, in fact, her biggest supplier increased their prices by 49 per cent without any warning. Being a luxury brand, Shimayne is reluctant to cut costs and so she’s inevitably, but reluctantly, having to consider increasing pricing for clients.

As demand for expert curly hair services increases, finding and training the right stylists who have the right skills has also been a challenge. Shimayne currently employs three members of staff, who are all paid above the national living wage, and an apprentice.

The legal advice service available to FSB members has been invaluable to Shimayne, guiding her through previous staffing issues. “Without FSB’s help,” she says, “It would have been a very different and trickier landscape to navigate.”

Navigating the ever-changing world of social media and marketing is another challenge faced by the business and Shimayne has recently taken on a social media manager to help manage the load. She says: “As a small business, staying visible and continuously attracting new clients requires constant creativity and adaptation. Making sure we reach the right audience while also managing day-to-day salon operations is a juggling act.”

Not one to rest on her laurels, Shimayne is planning big things with her business, taking a step back from clients to concentrate on her long-term plan of growing her brand across the UK. With clients already travelling from as far as Scotland to use her services, Shimayne hopes to gradually open more salons in different towns and cities.

“More and more curly salons are becoming available,” she says. “But like anything, not all curly specialists are created equal. For us, continuing to grow our client base, build connections and our reputation is a really big thing that we are excelling at. So, to be able to then offer our services in different parts of the country, I think, would really help the curly community as a whole.”

It’s clear Shimayne has a passion for helping her clients evolve and feel their best as well as a determination to help her beloved industry make an environmental difference. This strong foundation has given her the ambition to make waves across the UK.

In May 2024, a General Election was called for 4 July and FSB’s plan for impactful engagement and communications was put into action. Our Manifesto for Small Businesses and the Self-Employed, published in June, set out a comprehensive blueprint of pro-small business policies for whichever party was to win power in five pillars:

As FSB’s members prepared to cast their votes in the General Election, we co-hosted and partnered two live hustings, where election parties debated policies and answered questions from the audience about how they would support small firms and the self-employed.

The Small Business Debate (pictured right), questioned Small Business Minister Kevin Hollinrake for the Conservatives, Shadow Business and Trade Secretary Jonathan Reynolds for Labour, and for the Liberal Democrats, Spokesperson for Treasury and Business & Industrial Strategy Sarah Olney.

Bloomberg TV’s UK Election: Business Debate (pictured below) saw UK Business Secretary Kemi Badenoch and Shadow Business Secretary Jonathan Reynolds go head-to-head in a live debate, moderated by Bloomberg’s Anna Edwards, including questions from FSB.

Having engaged extensively with the main parties long before the election was called meant that FSB had immediate good engagement with the new Labour government on a range of issues.

2023-2024

Shadow Business and Trade

Small Business Minister Gareth Thomas tweets about meeting with FSB’s policy chair, Tina McKenzie, from the Labour Party Conference 2024

FSB National Chair Martin McTague with Business and Trade Secretary Jonathan Reynolds (centre and right) at the Labour Party Conference 2024

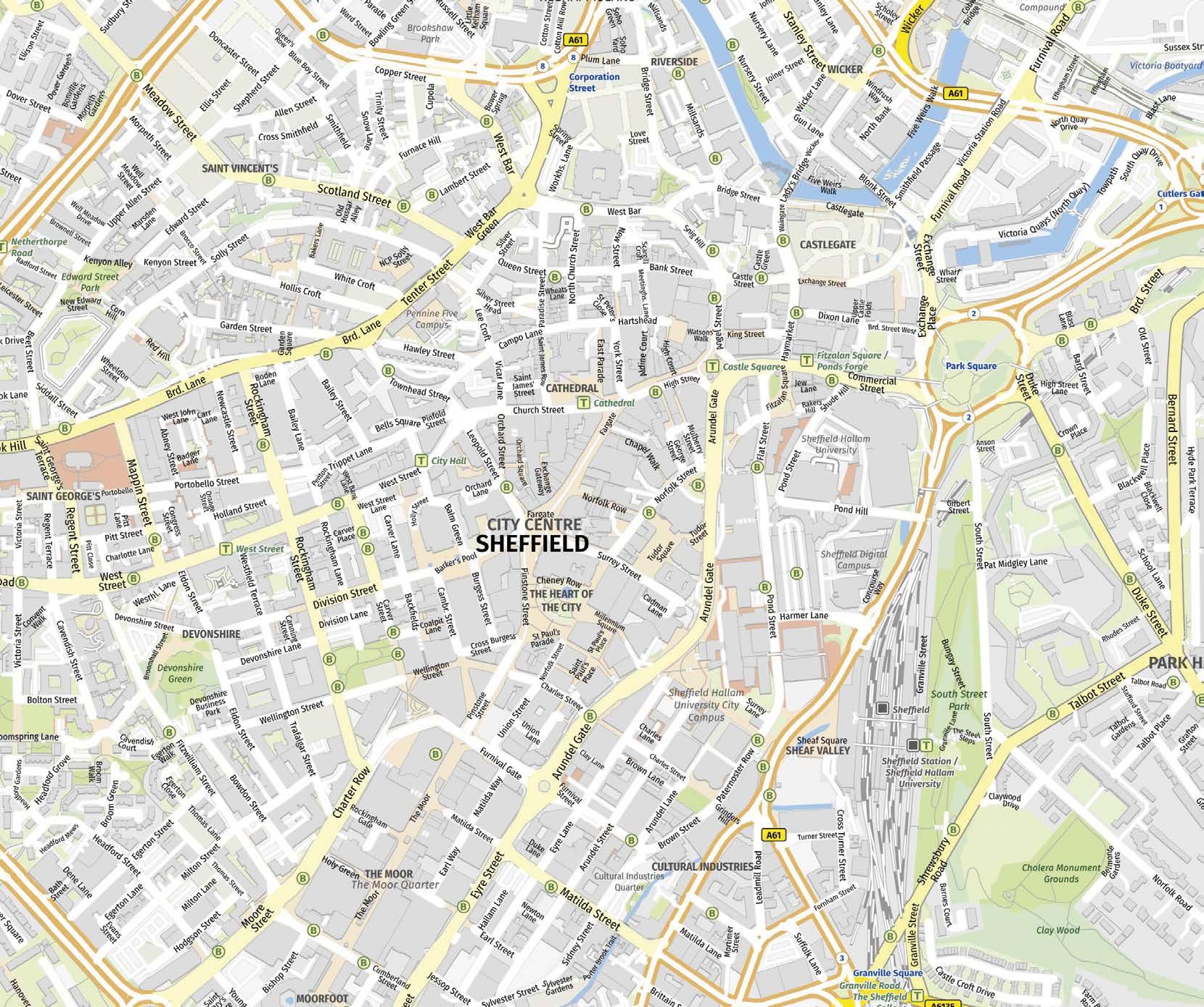

David Turton South Yorkshire Roofing Repairs Limited Sheffield

“At 16, I was kicked out of school,” says David Turton, founder and owner of South Yorkshire Roofing Repairs Ltd. in Sheffield. “I got a job with a guy called Max Bennett, a roofer. He’d been roofing 30 years, and I started doing a bit of work with him; learned the trade quickly.” Two years later, aged 19, David started his own roofing business.

At the time, there was no internet or mobile phones. “I was literally knocking on doors to get work. That’s how driven I am,” says David. “Delivering leaflets, knocking on doors. I started with nothing. I just built it up bit by bit. I’ve made mistakes, but I’ve always bounced back.” Now in his forties, David leads a thriving company with plans to scale it and then sell by age 60.

Sheffield sits between the rugged Pennines to the west and the South Yorkshire Coalfield to the east, at the meeting point of five rivers: the Don, Sheaf, Rivelin, Loxley and Porter. Its hilly terrain offers vivid vistas with rooftops of all styles. From traditional pitched slate roofs to modern architectural designs, the diversity of the city’s rooftops reflects its industrial heritage alongside its modern evolution.

In 2024, David’s business moved to sharp new premises a stone’s throw from Sheffield United’s (‘The Blades’) Bramall Lane Stadium. The workspace is filled with a maze of roofing materials: elegant, rugged slates, known for their beauty and durability, lounge beside modern concrete tiles in an array of colours—pink, terracotta, sand, steel grey—with interlocking lugs and grooves (for security and faster installation); clay tiles (first used by the Romans and still used for historic aesthetics despite a vulnerability to the elements); ridge and hip tiles; boxes of modern dry ridge systems; flashing; fascias and soffits.

While some of the tools (think power tools) and materials (think concrete and glass reinforced plastic) used in the roofing trade have advanced over the years, the fundamental skills remain grounded in traditional craftsmanship going back centuries.

David now manages a loyal crew of 15 subcontractors, each bringing experience and expertise to the job. “Managing personalities is the hardest part. Everyone has their strengths and weaknesses, but we’re all on the same page we want the best for the business, and for our customers,” he says.

Among the crew is none other than Max Bennett, now 80, still roofing and passing on his skills and knowledge to the younger roofers. Max is a wiry, intelligent, charismatic man who lives in a house with a thatched roof in the Peak District and keeps horses. Max says earnestly: “I’ll never give up the trade. If I did retire, I think I’d die.”

David’s wife, Victoria, is also part of the team: “Victoria gets stuck in; she’ll do the manual work, get up on the roofs. Now she’s helping me on the

admin and with deliveries. Delivery is key to keep jobs efficient and get materials to site so the lads aren’t driving around all over Sheffield wasting time. So, we’ve just bought a big pick-up lorry. Victoria’s out there doing deliveries with it.”

On any given day, the business has several jobs in operation simultaneously. Then there are roof inspections to do, with a state-of-the-art drone, and around 40 quotations to calculate each week which swallow up David’s time. David, who is diagnosed with attention deficit hyperactivity disorder (ADHD), has to be highly organised, recently investing in new customer relationship management (CRM) software. “The more the business grows, the more assistance I need through technology and having the right people around me.” Outsourcing what he can, he says: “I’ve always been the salesman. But I can’t be the salesman, the roofer, the telephone answering service I can’t do it. There’s no way you can expand the business and do all that on your own. I’ve done it and it’s made me poorly many, many times.”

Now, it’s about having a system: “This CRM system is a godsend. It does my quotes, my invoices, puts the jobs out for the lads, it’s got my website on it. Customers get notified when the work’s starting. I can be two weeks in front with jobs on the scheduler and so the lads don’t need to ask me where they’re going, what they’re doing; it’s there, on the system.” David is still transferring the last bits of his former ‘analogue’ system (a series of whiteboards filled with meticulous lists, tables, bullet points and Post-it® notes) to the new CRM.

Meeting customers remains the best part of the job. “When I inspect a roof with a drone and show customers clear evidence of what needs fixing, they love it. They trust that our quotes are based on facts, and building a relationship with customers is why they want to use us,” he says.

A focus is building up online reviews which are crucial to the business’s growth. “When you see customers’ reviews, that relationship shines through. Having a new roof shouldn’t be a scary ordeal for a customer but it’s daunting to most people. It’s our job to make it a positive, reassuring experience and give them a great end product.” David and the team take so much pride in their work that he gives customers a rare ten-year workmanship guarantee.

From knocking on doors as a teenager to running a thriving roofing business with a strong team

and cutting-edge technology, David Turton’s journey is a testament to hard work, resilience, and a relentless commitment to excellence. With ambitious plans, South Yorkshire Roofing Repairs is on its way to becoming a household name in Sheffield and beyond.

Late payments are a critical issue for our small business members, exacerbating an already precarious cash flow situation meaning small businesses cannot grow or, in some cases, survive. Analysis of FSB’s SBI since 2021 reveals that the majority of small businesses have routinely faced late payments each quarter.

Since 2020, the small business and self-employed community in the UK contracted by a net half a million. With smaller businesses generally having much lower cash reserves than their larger counterparts, the clear risk is that late payment was already a contributory factor to this 10 per cent shrink and would now cause this number to rise.

FSB successfully campaigned for the issue to become an urgent priority for the UK Government, and for those competing to become the next UK government. Previous government measures, while commendable and necessary, were not sufficient.

Proportion of small businesses reporting that they had experienced late payment

Source: FSB’s Small Business Index

This financial year, FSB made significant strides in addressing this issue. Notably, the new Labour Government and FSB held a joint announcement in September 2024, at FSB’s Westminster offices. The Small Business Minister and the Secretary of State for Business and Trade declared a new package of measures to tackle the scourge of late payment to small businesses from large businesses and the public sector. This included consulting on tough new legislation on holding larger firms accountable for their payment practices, and refreshed powers for the Small Business Commissioner.

We’re determined to back small businesses by unlocking their barriers to growth, and stamping out late payments is at the heart of this .

“We know how important it is for business owners to have the peace of mind and certainty around their cashflow to keep their businesses alive . Late payments cost businesses tens of thousands of pounds and is one of the biggest reasons businesses collapse . After years of delay, we’re bringing forward measures that small businesses have long been calling for to tackle late payments once and for all .

Prime Minister Keir Starmer, September 2024

As FSB’s external affairs (Westminster) team achieved this landmark commitment from the Business and Trade Secretary to introduce new legislative measures to tackle late payments to small businesses, the FSB Debt Recovery service, which is available to all members, had recovered an impressive £3.7 million for members since its launch.

Roni Savage Jomas Associates London

“It was by chance, really,” says FSB member Roni Savage, when asked what made her set up her own construction engineering business, Jomas Associates, 15 years ago. “I was fortunate to have people around me who believed in me. My ex-boss was a strong supporter of me starting out on my own; my mother was as well.

“I had two very young children at the time, and with the encouragement I was getting, I decided to take the leap of faith. That’s why I said it was by chance—it was a decision I made without fear of failure, to give me more time with my boys. It was a fun experience—I was working in a sector I thoroughly enjoyed, and now I was doing it for myself. I wasn’t thinking, ‘I’m building a business that I am going to grow and scale.’ My focus was on delivering a high-quality service to the construction industry and having some flexibility with my time.”

In doing so, Roni joined a category of entrepreneurs which was—and sadly remains—a rarity in the UK: women account for just 15 per cent of the construction workforce, with only a small proportion in the role of founder.

“There’s a common misconception that construction-related jobs are better suited for men than women,” says Roni, “Historically, girls have been encouraged to pursue certain paths in schools, while boys were guided towards different subjects. These stereotypes and this conditioning have made it difficult to naturally attract women to the construction industry. And so, having visible role models is crucial to challenge these stereotypes and overcome these ingrained beliefs.”

Alongside her successful and growing business, which has 30 employees, Roni has become a leading champion of promoting STEM (science, technology, engineering and mathematics) and construction as a career for women, which includes her speaking in schools to highlight it as an educational and vocational choice for girls as well as boys. She also founded and runs the Inspirational Business Women in STEM and Construction initiative, which showcases role models to young people and culminates in a prestigious reception in Parliament.

Yet in the early years of running her business, Roni didn’t imagine herself being such a visible champion. The turning point came in 2017, when she was selected to be part of the Goldman Sachs 10,000 Small Businesses UK programme, which provides practical education and business support to leaders of high-growth small businesses.

She received encouragement from her Goldman Sachs business growth mentor. “It was the wake-up call I desperately needed,” Roni recalls, “I realised that I’d been hiding in the shadows because I didn’t see any role models ahead of

me, who resembled me. It was important, I then realised, that I put myself forward as the role model for future generations. The impact has been incredible. I’ve had young people reaching out to say they’ve made important decisions after seeing me as a relatable role model.”

Having found the confidence and the zeal to be ‘out there,’ Roni decided that “you can’t just work and build a business, you’ve got to give back to the next generation. So, I started searching for people who were doing initiatives that aligned with what I was trying to do.”

It was at that point Roni came across FSB’s public relations campaign for International Women’s Day 2018—the year which marked the 100th anniversary of the suffragettes succeeding in their fight for women to get the vote. The campaign featured a hundred women FSB members as ‘digital role models’, sharing their advice and inspiration for other women entrepreneurs. “It aligned with what I was trying to do at the same time,” says Roni, “I could see FSB was supportive of the same visions and missions.” Roni became a member of FSB and quickly then became involved as a volunteer for

the organisation, championing women in enterprise and later as a champion for the construction industry too.

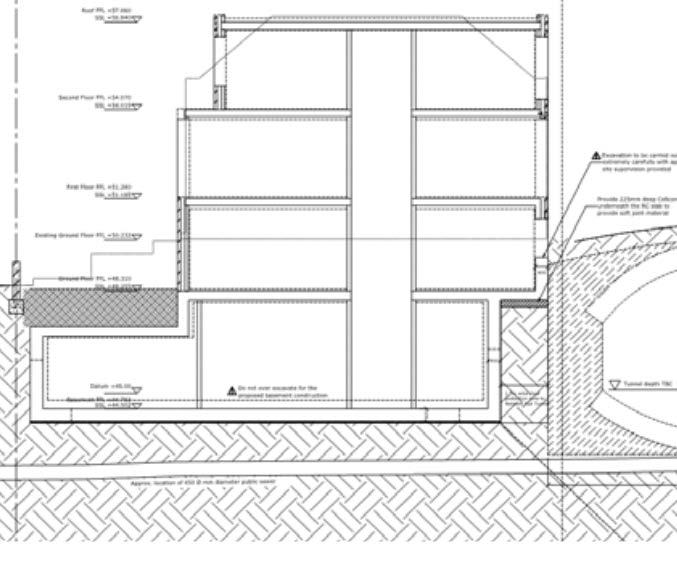

Roni’s business specialises in below-ground, geotechnical engineering, mainly for construction projects. “When you’re putting up a new building or infrastructure, you need to understand the ground that you’re building on, and both the engineering and environmental properties of that ground,” she explains, “Our work makes sure that anything that’s built on that ground can stand the test of time, identifying the depth and type of foundations that are needed for new buildings and infrastructure depending on ground conditions.”

Jomas Associates also works on the reclamation of brownfield sites where there can be contamination in the ground. As well as designing foundations, they assess and investigate land contamination, then design and implement remediation solutions that bring the site to good use. Many of the sites are developed for houses, schools, hospitals, roads and industry.

Among the flagship projects Roni is most proud of are a major extension of the M25 motorway, and a road-widening and adjacent housing project along the busy A406 road in north London. “I remind my children when we drive past that I was involved in making this project happen, alleviating traffic. It’s a rewarding feeling that the legacy of the projects I’m involved in will carry on for years to come.”

But construction projects aren’t the only legacy she’s building. Her championing of women in STEM has made a real difference to some lives: “A young woman reached out to me on LinkedIn to share that she had been contemplating her career path and had come across an engineering geology degree. Initially, she didn’t think it was for her due to stereotypes. But then she told me ‘I found a video and interview you did, and now I’ve applied to the same university you attended, to study the same degree you pursued.’

“I’ve still got a screenshot of the message,” says Roni proudly. “She’s graduated now, and it’s the most rewarding feeling to have such an impact on someone’s life, aside from watching my three sons grow and excel.”

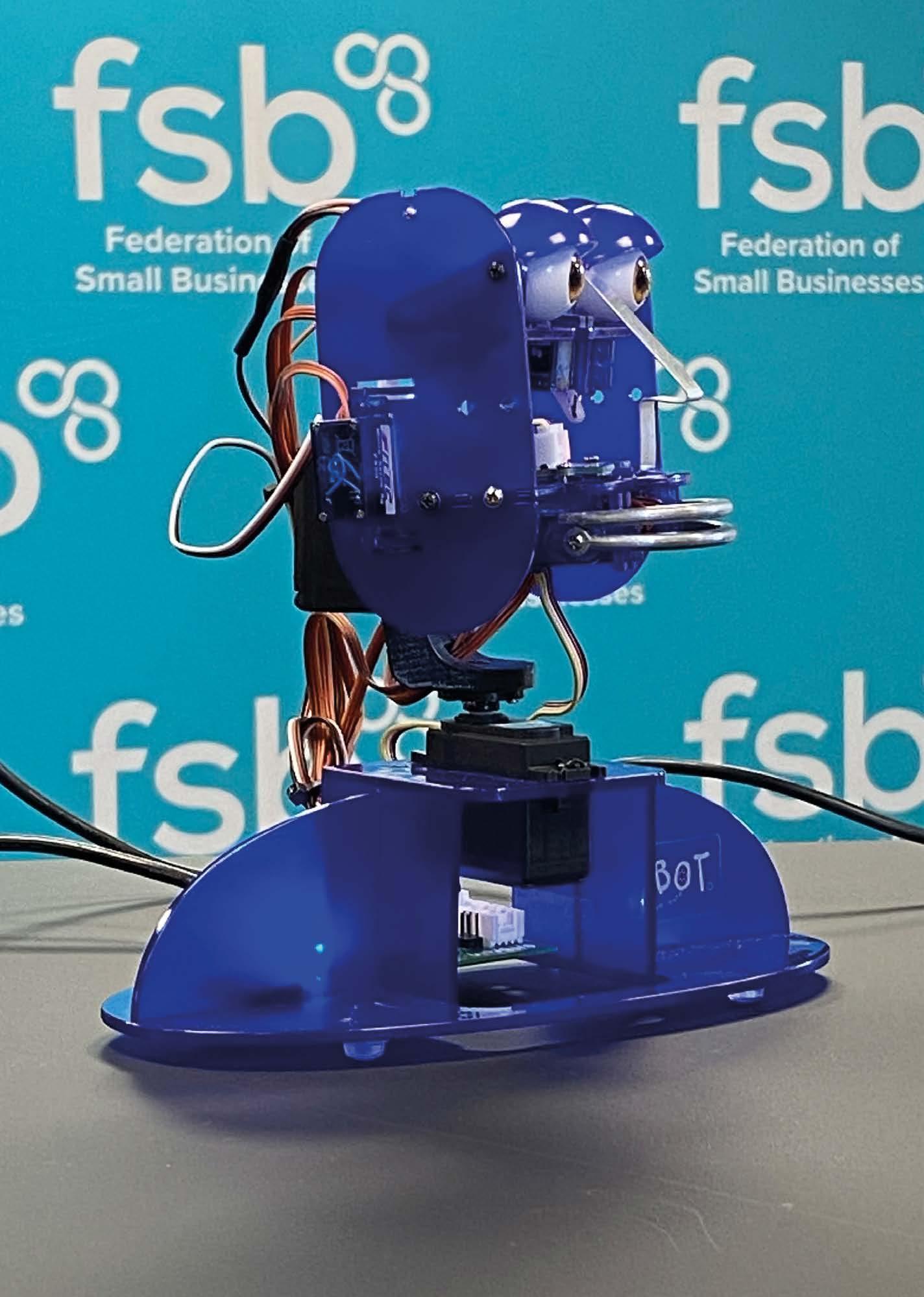

Ohbot launches FSB’s Redefining Intelligence report, examining the growth of artificial intelligence (AI) among small firms, March 2024 Created by FSB members, robotocist Mat Walker and ICT and education specialist Dan Warner, Ohbot is an advanced robot that brings AI concepts to life through expressive movement, voice interaction and real-time response

Group Strategic Report, Report of the Directors and Consolidated Financial Statements for the Year Ended 30 September 2024 for National Federation of Self Employed and Small Businesses Limited

For the Year Ended 30 September 2024

DIRECTORS: M G McTague

S J T Askew

A North M E McKenzie

S Jandu

J Lilley

I O’Donnell

C Platt

REGISTERED OFFICE: Sir Frank Whittle Way Blackpool Business Park Blackpool Lancashire FY4 2FE

REGISTERED NUMBER: 01263540

AUDITORS:

Haines Watts

Statutory Auditor

3rd Floor Pacific Chambers 11-13 Victoria Street Liverpool Merseyside L2 5QQ

For the Year Ended 30 September 2024

The directors present their strategic report of the company and the group for the year ended 30 September 2024.

The principal activity of the National Federation of Self Employed and Small Businesses Limited (‘the Federation’) continues to be that of the promotion and furtherance of the interests of persons who are self-employed, direct or control small businesses, and the provision of a national voice and platform for such persons.

The results for the group (‘FSB’) show a surplus for the financial year of £62k (2023: deficit £0.89m). This is after accounting for an unrealised gain of £0.46m resulting from an increase in the carrying value of investments (2023: unrealised gain of £0.18m) and an unrealised gain of £0.56m resulting from a revaluation of investment property (2023: nil). As a result, general reserves increased to £18.2m (2023: £18.1m).

Income from subscriptions and joining fees, which provided 93% of the group’s income (2023: 94%) amounted to £23.5m (2023: £24.3m). The group is undertaking a digital transformation programme, in order to deliver significant future benefits to the organisation and its members. Both capital expenditure and administrative expenses have been incurred relating to the digital transformation during the year. Overall administrative expenses have reduced from £25.3m in 2023 to £24.2m. The net cash outflow from operating activities was £1.4m (2023: cash outflow of £2.2m).

The consolidated financial statements include the results of its three subsidiary companies; FSB Publications Limited, the principal activity of which is publications, F.S.B. (Member Services) Limited, which arranges additional benefits on behalf of FSB members and FSB Recruitment Limited, which provides recruitment services for FSB.

FSB’s vision is to be the UK’s most influential and trusted organisation representing the voice of all small businesses, in every nation and region. Its purpose is for support, for protection, for business. The business’s corporate objectives are to represent the diversity of the UK’s small business community; to provide support, advice and practical solutions to our community of members; to advocate on behalf of small businesses and the self-employed, providing a powerful voice heard by Government and key decision makers; and to maintain a critical mass of customers to deliver scale and to operate efficiently, ensuring financial stability and safeguarding FSB for the future.

2024 was a momentous year, marking 50 years since FSB was established. Beginning as a collective of selfemployed people who came together to rally against

a proposed tax hike for the self-employed, FSB was founded in Lytham St. Annes, Lancashire, in 1974. Fiftyyears on, it is the UK’s biggest grass roots membership organisation for small businesses and the self-employed. Its head office remains in Blackpool, Lancashire, being one of the biggest employers in the town which has a high rate of deprivation. It also has offices in Westminster, Cardiff, Glasgow and Belfast as well as a network of field staff across the English regions. Its Board of Directors is made up of its small business and self-employed members who volunteer their time for the cause and who are supported by a professional staff team.

The UK’s 5.5 million small businesses and self-employed make up more than 99 per cent of all private sector businesses.

They contribute a staggering amount to the UK’s economy as well as being a major source of employment; more than 16.6 million people are employed by smaller firms. FSB’s local, national and international activism helps shape policy decisions that have a direct impact on the day-today running of smaller businesses.

FSB campaigns to influence those in power through policy analysis, public affairs, media and public relations activity. It also supports its members by providing them with vital business products and services, from legal advice to access to finance, and from debt recovery to training, ensuring that these remain relevant and competitive. Members have opportunities to be an active part of the FSB community by volunteering; by taking part in the FSB Big Voice survey programme, focus groups and roundtables and by joining local FSB networking and knowledge-sharing events held throughout the year.

Throughout the year, FSB produces and publishes policy reports, including the quarterly FSB Small Business Index (SBI) - which measures confidence among small firms and is widely quoted by the Bank of England, ICAEW and respected media outlets - and digital advocacy content that raises awareness of issues that affect small businesses and the self-employed along with policy recommendations. Reports are founded on robust research of its members’ opinions and experiences through FSB’s Big Voice survey programme, and frequently result in successfully influencing government policy.

Campaigning and giving its members a powerful voice to political decision-makers and others is at the heart of FSB. Its effectiveness relies on a credible reputation, cultivated through effective public affairs, public relations and policy research strategies. The importance, breadth and effectiveness of this was crucial in 2023/24 with small firms struggling with a range of costs, taxes and barriers; a small business population 500,000 smaller than prior to the COVID-19 pandemic and political instability and uncertainty.

Group Strategic Report

For the Year Ended 30 September 2024

In the last financial year, successful campaigning ahead of both the Autumn Statement 2023 and Spring Budget 2024 resulted in multiple important wins for members. These included cuts in self-employed National Insurance Contributions, extended business rates reliefs for small firms in retail, hospitality and leisure in England, and a rise in the VAT threshold. At the despatch box, the then Conservative Government Chancellor, Jeremy Hunt, also committed to action on tackling late and poor payment practices, acknowledging this was as a direct result of FSB campaigning. Separately, Labour in opposition also committed to action on late payments following extensive engagement with FSB, going on, when in Government, to announce a commitment to new measures to tackle late payments from large corporates and the public sector in September 2024 at FSB’s Westminster offices.

When a snap UK General Election was called in 2024, FSB’s plan for impactful engagement and communications was immediately put into action with its Manifesto for Small Businesses and the Self-Employed setting out a comprehensive blueprint of pro-small business policies for whichever party was to win power. FSB’s cross-party commitment was reflected throughout the campaign, including at a co-presented hustings event The Small Business Debate, featuring prominent politicians from Labour, Conservatives and Liberal Democrats.

FSB’s flagship The Future of the High Street report and campaign, summer 2024, successfully set out an extensive, optimistic, future-focused plan for high streets to evolve, thrive and remain at the heart of communities and local economies into the future, with the emphasis on small businesses. The campaign’s digital advocacy and public relations activity engaged with politicians - many of them brand new MPs, FSB members and other small business owners. The campaign was publicly endorsed on social media by both the Business and Trade Secretary and the Shadow Business and Trade Secretary. The strength of the campaign prompted both FSB’s sales team and FSB Insurance Service (a specialist insurance broker for members, part-owned by FSB) to develop and market new offers and products for small retailers off the back of it.

Other campaigning, policy and media work in the year achieved results on the impact of crime on small businesses; the challenges and opportunities of Artificial Intelligence; and access to finance. The latter included a super-complaint to the Financial Conduct Authority about excessive demands from lenders for personal guarantees on small business loans. At the request of then Shadow Business and Trade Secretary Jonathan Reynolds, FSB led an exports taskforce, delivering new research and a five-point-plan to increase the number of small businesses which trade internationally. Published shortly after Labour took power, the work was commended by Reynolds, now Secretary of State.

FSB members are provided with access to white-labelled business support services and advice, some of which are available at no additional cost and others at favourable rates. This portfolio of products for the support and protection of members’ businesses is constantly reviewed for relevance and effectiveness and is regularly enhanced with new services. It includes a suite of legal, employment and tax protection, backed by legal expense insurance; employment tribunal insurance; tax investigation insurance; 24/7 advice from qualified solicitors complemented by an online legal hub with downloadable legal documents and templates; dedicated insurance broking; business banking which is free for the duration of FSB membership; access to a funding platform offering a single application for funding with advice and support; a comprehensive bundle of CPD training programmes; payroll and pensions services; and payment services.

With economic factors continuing to negatively impact members’ costs and cashflows, access to new financial services and products were a key focus in developing member products and services in the last financial year. We launched new partnerships with several financial service providers to upscale the range of exclusive options for members to make cost savings, returns on savings, access financial support and payment options. These were with Zempler Bank (formerly Cashplus Bank), NatWest Group, Allica Bank and GoCardless.

A new FSB Healthcare service, in association with MySanté, was introduced, offering members, and their employees, access to counselling sessions, private GP services and an employee assistance programme, at a competitive rate. Specialist R&D tax claims support for members through the FSB Legal and Business Hub was also added.

The business changed providers for other white-labelled member services. FSB Payments switched to a new delivery partner in Tyl by NatWest and FSB Funding Platform to a new association with Capitalise. During the year, £425,000 of funding was secured for members through their FSB Funding Platform. The platform was developed as a ‘single destination’ to open up funding in the easiest way possible for members. Whilst FSB’s external affairs team achieved a landmark commitment to introduce new legislative measures to tackle late payments to small businesses from large corporates and the public sector, FSB Debt Recovery service had recovered £3.7 million for members by the end of the year.

Marketing campaigns concentrated on joining around ‘Black Friday’, and retention through an ‘FSB Day’ campaign. The latter focused on reminding members of the extensive benefits and products available to them. To enhance engagement and demonstrate the value of FSB membership, exclusive, limited-time deals, discounts, and prizes were offered to members. To motivate and reward

Group Strategic Report

For the Year Ended 30 September 2024

participation, FSB offered a grand prize of £5,000 to one lucky member who logged into the website dashboard between 13 September and 15 September. The website received more than 4,000 unique member logins, an increase from the average 110 logins per day, during the campaign.

Strong customer service remained a priority for FSB with its accreditation with the Institute of Customer Services remaining in place. FSB’s customer services team managed over 60,000 inbound calls, emails and chats in the year and a further 95,000 calls were managed by the FSB Legal advice line. The business’s quarterly satisfaction monitor found overall satisfaction level with FSB’s customer service at 75 per cent. The Institute of Customer Services assessment found the digital experience for users of the FSB Legal online hub was 90 per cent satisfaction.

The responsibility for risk management and the internal control environment resides with the Board of Directors. FSB has a senior management team, subsidiary companies and various committees reporting to the Board of Directors, that control and manage various activities, identifying on an on-going basis any potential risks faced by the organisation and proposing solutions to mitigate these.

The list below includes the principal risks that may impact the company achieving its strategic objectives. The list does not include all of the risks faced by the company, nor does it list the risks in order of priority.

The organisation’s strategy for growth is underpinned by excellence in representation and service, and ongoing development of relevant products and services to enhance the experience of members, improve retention levels and attract growing numbers of new members.

Lack of action to ensure FSB meets its responsibilities to protect the environment may present a risk to the organisation. FSB takes seriously all issues with regard to the environment and there is an active focus on reduction in energy consumption, improved waste management and reducing travel. Internally there has been a move to reduce the use of paper and aim for a paperless office environment, together with investment in virtual meeting technology to reduce overall travel requirements. FSB also offers a cycle to work scheme to its employees.

Communications with members, including membership renewal, are distributed digitally. FSB takes account of environmental factors such as carbon footprint when sourcing goods and services and seeks to maximise

recycling opportunities. We also look towards best practise in terms of refurbishment projects on our property and adopting energy saving options wherever possible. The Board has an ESG Committee to give prominence to Environmental, Social and Governance matters.

FSB is committed to, and values, diversity and inclusion in everything we do, recognising that it is fundamental to success. The strength of FSB rests on the diversity of our self-employed and small business owners who reflect the whole of the UK small business population, both as members and volunteers. With this, we want to ensure all small business owners and the self-employed, from whichever communities they belong, feel welcome and a part of FSB. We do not condone discrimination of any kind and we aspire to have a diverse and inclusive environment, where everyone is able to bring their whole self to any volunteering role they undertake.

The organisation has an Equality, Diversity and Inclusion (EDI) strategy to cover all aspects of operations.

As an equal opportunities employer, FSB is committed to the equal treatment of all current and prospective employees. We celebrate equality, diversity and inclusion and this is reflected in our diverse and inclusive workplace, where all employees can bring their whole self to work. We strongly encourage suitably qualified applicants from a range of backgrounds to apply and join FSB and are happy to make adjustments for candidates with disabilities. In the event of employees becoming disabled, every effort is made to retain them in order that the employment with the group may continue.

It is the policy of the group that training, career development and promotion opportunities should be available to all employees.

The success of the organisation relies on the availability of suitably skilled and motivated employees, benefitting from excellent training and support, working within a supportive environment and with appropriate HR strategies and policies in place. Failure to deliver these conditions may impact on the ability of the organisation to deliver the necessary support and solutions to its members.

FSB places significant focus on its people, ensuring that processes to recruit, develop and retain them are robust. It regularly reviews compensation and benefits packages and continually develops its working environment and practices in order to attract and retain staff, ensure appropriate succession planning and support productivity.

The organisation is committed to the wellbeing of its employees and has policies in place to support this

Group Strategic Report

For the Year Ended 30 September 2024

in practice, as well as a wellbeing hub on the intranet providing access to a range of support mechanisms. FSB has signed the Menopause Workplace Pledge and has introduced and trained mental health first-aiders.

The group has continued its practice of keeping employees informed of matters affecting them as employees and the financial and economic factors affecting the performance of the group. This is achieved through quarterly Joint Consultative Forum meetings, departmental meetings, question and answer sessions with the Chief Executive and Chair, and presentations to all employees.

The company operates in a competitive industry, and its ability to attract and retain members may be impacted by economic conditions, business confidence and the behaviour of competitors. The Board of Directors reviews performance and ensures that management is focused on key priorities to mitigate this risk, including enhancing the range of services offered to members, maintaining excellence in service and ensuring prices are competitive.

The organisation is non-party political, engaged in representing and promoting the interests of its members. Failure to meet the expectations of members may impact on the brand and reputation and member loyalty. The Board of Directors determine that procedures are in place to ensure that its non-party political position and service level expectations are not compromised.

The Group has £15.3m cash and £4.8m investment balances as at 30 September 2024 and changes in investment conditions may expose the company to risks of poor returns. The company invests its funds for a combination of liquidity and returns, ensuring that cash is deposited on varying terms and with various financial institutions, and that investments are made into mixed portfolios with long term rather than short term growth aims. The group undertakes regular financial planning, including cash flow forecasting to reflect a range of scenarios.

The directors consider the surplus or deficit on ordinary activities before taxation to be the main financial KPI for the business, and monitor a range of non-financial KPIs, the principal ones being as follows:

- Audience numbers

- Membership numbers

- New member numbers

- Member retention

M G McTague Director

Date: 5th February 2025

For the Year Ended 30 September 2024

The directors present their report with the financial statements of the company and the group for the year ended 30 September 2024.

The directors shown below have held office during the whole of the period from 1 October 2023 to the date of this report.

M G McTague

S J T Askew

A North

M E McKenzie

J Lilley

I O’Donnell

C Platt

S Jandu

Other changes in directors holding office are as follows:

M Ulyatt – resigned 09.04.24

L Milsted – resigned 09.04.24

N Sawford – resigned 06.03.24

The company has in place professional indemnity and management liability insurance which covers the directors during the year and up to the date of signing the financial statements.

The Board of Directors continues to progress a programme of modernisation to enable the group to continue to provide excellent representation and service to members from the whole UK smaller business community. This programme involves continuous improvement in all areas of the group’s operations, including enhancements to services offered and developments in technology and communication.

The directors are responsible for preparing the Group Strategic Report, the Report of the Directors and the financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have prepared the group and the company financial statements in accordance with United Kingdom generally accepted accounting practice (United Kingdom

Accounting Standards, comprising FRS 102 ‘The financial reporting standard applicable in the UK and Republic of Ireland’, and applicable law).

Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the group and company and of the surplus or deficit of the group for that period. In preparing these financial statements, the directors are required to:

- select suitable accounting policies and then apply them consistently;

- state whether applicable United Kingdom Accounting Standards, comprising FRS102 have been followed, subject to any material departures disclosed and explained in the financial statements;

- make judgements and accounting estimates that are reasonable and prudent; and

- prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company’s and the group’s transactions and disclose with reasonable accuracy at any time the financial position of the company and the group and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the company and the group and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

So far as the directors are aware, there is no relevant audit information (as defined by Section 418 of the Companies Act 2006) of which the group’s auditors are unaware, and each director has taken all the steps that he or she ought to have taken as a director in order to make himself or herself aware of any relevant audit information and to establish that the group’s auditors are aware of that information.

Following a tender exercise carried out in 2024, Grant Thornton UK LLP will be proposed for appointment as Auditor for the year ending 30 September 2025, at the forthcoming Annual General Meeting.

M G McTague

Director

Date: 5th February 2025

To the Members of National Federation of Self Employed and Small Businesses Limited

We have audited the financial statements of National Federation of Self Employed and Small Businesses Limited (the ‘parent company’) and its subsidiaries (the ‘group’) for the year ended 30 September 2024 which comprise the Consolidated Statement of Comprehensive Income, Consolidated Statement of Financial Position, Company Statement of Financial Position, Consolidated Statement of Changes in Equity, Company Statement of Changes in Equity, Consolidated Cash Flow Statement and Notes to the Consolidated Cash Flow Statement, Notes to the Financial Statements, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards, including Financial Reporting Standard 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’ (United Kingdom Generally Accepted Accounting Practice).

In our opinion the financial statements:

- give a true and fair view of the state of the group’s and of the parent company affairs as at 30 September 2024 and of the group’s surplus for the year then ended;

- have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice; and

- have been prepared in accordance with the requirements of the Companies Act 2006.

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditors’ responsibilities for the audit of the financial statements section of our report. We are independent of the group in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

- the directors’ use of the going concern basis of accounting in the preparation of the financial statements is not appropriate, or

- the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

The directors are responsible for the other information. The other information comprises the information in the Group Strategic Report and the Report of the Directors, but does not include the financial statements and our Report of the Auditors thereon.

Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Opinion on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

- the information given in the Group Strategic Report and the Report of the Directors for the financial year for which the financial statements are prepared is consistent with the financial statements; and

- the Group Strategic Report and the Report of the Directors have been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and the parent company and its environment obtained in the course of the audit, we have not identified material misstatements in the Group Strategic Report or the Report of the Directors.

To the Members of National Federation of Self Employed and Small Businesses Limited

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in our opinion:

- adequate accounting records have not been kept by the parent company, or returns adequate for our audit have not been received from branches not visited by us; or

- the parent company financial statements are not in agreement with the accounting records and returns; or