SMALL BUSINESS INDEX

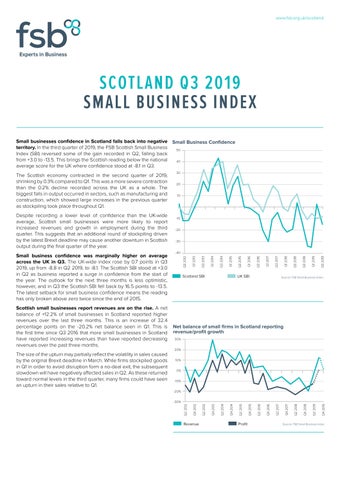

Small businesses confidence in Scotland falls back into negative territory. In the third quarter of 2019, the FSB Scottish Small Business Index (SBI) reversed some of the gain recorded in Q2, falling back from +3.0 to -13.5. This brings the Scottish reading below the national average score for the UK where confidence stood at -8.1 in Q3.

The Scottish economy contracted in the second quarter of 2019, shrinking by 0.3% compared to Q1. This was a more severe contraction than the 0.2% decline recorded across the UK as a whole. The biggest falls in output occurred in sectors, such as manufacturing and construction, which showed large increases in the previous quarter as stockpiling took place throughout Q1.

Despite recording a lower level of confidence than the UK-wide average, Scottish small businesses were more likely to report increased revenues and growth in employment during the third quarter. This suggests that an additional round of stockpiling driven by the latest Brexit deadline may cause another downturn in Scottish output during the final quarter of the year.

Small business confidence was marginally higher on average across the UK in Q3. The UK-wide index rose by 0.7 points in Q3 2019, up from -8.8 in Q2 2019, to -8.1. The Scottish SBI stood at +3.0 in Q2 as business reported a surge in confidence from the start of the year. The outlook for the next three months is less optimistic, however, and in Q3 the Scottish SBI fell back by 16.5 points to -13.5. The latest setback for small business confidence means the reading has only broken above zero twice since the end of 2015.

Scottish small businesses report revenues are on the rise. A net balance of +12.2% of small businesses in Scotland reported higher revenues over the last three months. This is an increase of 32.4 percentage points on the -20.2% net balance seen in Q1. This is the first time since Q3 2016 that more small businesses in Scotland have reported increasing revenues than have reported decreasing revenues over the past three months.

The size of the upturn may partially reflect the volatility in sales caused by the original Brexit deadline in March. While firms stockpiled goods in Q1 in order to avoid disruption form a no-deal exit, the subsequent slowdown will have negatively affected sales in Q2. As these returned toward normal levels in the third quarter, many firms could have seen an upturn in their sales relative to Q1.

Small Business Confidence

Net balance of small firms in Scotland reporting revenue/profit growth

Small business employment returns to growth in Q3. The small business employment net balance was +5.2% in Q3 2019. The 14.1 percentage point increase in the employment reading marks the first time that more small businesses in Scotland expanded their headcount than reduced it since Q2 2017. Looking ahead, a net balance of +2.9% of Scottish small businesses foresee employment levels expanding over the next 12 months.

The latest official data for the Scottish labour market indicate that in the three months to July the total number of unemployed people had fallen by 3% compared to the same period a year earlier. Over the course of 2019, however, the unemployment rate has risen from a low of 3.3% to 4.0% in the most recent data and the employment rate has fallen. Despite a slowdown in total employment, small businesses in Scotland are now indicating a greater willingness to take on additional staff after a long period of decline.

Staff costs were the most prominent cause of cost pressure for Scottish businesses. In Q3 2019, the net balance of small businesses in Scotland that saw costs rise over the quarter stood at 73.3%, 5.0 percentage points higher than in Q2. This was above the UK average of 59.8%. Compared to the previous quarter, concerns over the cost of utilities and inputs fell away to leave the cost of labour as the most commonly cited issue. Nevertheless, the proportion of small businesses that highlighted employment costs as a pressure also declined to 43.4% in Q3, down from 48.0% in Q2.

The fastest rising source of cost pressure was related to the exchange rate. While only 12.3% of businesses had experienced cost increases related to the value of the pound in Q2, this had risen by 9.8 percentage points to 22.1% in the latest quarter as the value of the pound fell by over 6% between the start of Q2 and August.

The share of small businesses in Scotland operating below capacity fell in the third quarter. In Q3 2019, the difference between the proportion of Scottish small businesses operating below or above capacity was 43.7% -a decrease of 18.4 percentage points on the 62.1% recorded in Q1 2019. With the UK net balance standing at 47.3%, Scottish small businesses were less likely than the national average to be operating with spare capacity in Q3. This trend looks set to continue as the difference between those small business in Scotland anticipating spare capacity and those operating above capacity in the next three months falling to just 34.4%.

Tel: 0141 221 0775

scotland.policy@fsb.org.uk

www.fsb.org.uk/scotland