SCOTLAND Q2 2017 SMALL BUSINESS INDEX

Small business confidence improves in Scotland, but firms remain relatively pessimistic. The Small Business Index stands at -3.8 points in Scotland for Q2 2017, up from -9.6 points in the previous quarter. It is now over two years since confidence was in positive territory.

The latest small business confidence figures are likely to reflect an ongoing challenging economic environment in Scotland, which has underperformed compared to the rest of the UK. In part, this reflects the persistence of low oil prices. But it should be noted that Scotland’s economic weaknesses extend beyond the oil and gas sector. Scottish Government figures for Q4 2016 show economic output declining in the production and construction sectors and zero growth in the services sector, compared with Q3 2016. Scottish GDP saw zero growth in the year to Q4 2016, which compares with 1.9% growth across the UK.

Across the UK, small business confidence has dipped, but remains in positive territory. This quarter, the UK Small Business Index stands at +15.0 points, down from the +20.0 points seen in Q1 2017. However, small business confidence remains higher than a year ago. The dip in confidence may reflect data showing the UK economy losing momentum in the first half of 2017. The first estimate of UK economic growth in Q1 2017, released by the Office for National Statistics, showed GDP expanding by 0.2% compared with the previous quarter. This was sharply down from the 0.7% growth seen in Q4 2016 and the weakest quarter since Q1 2016. Critically, the slowdown in growth was driven by the services sector, which accounts for over three quarters of the economy. Services sector growth slowed from 0.8% in Q4 2016 to 0.3% in Q1 2017. There were falls in economic output in several important consumer-focused industries, such as retail sales and accommodation.

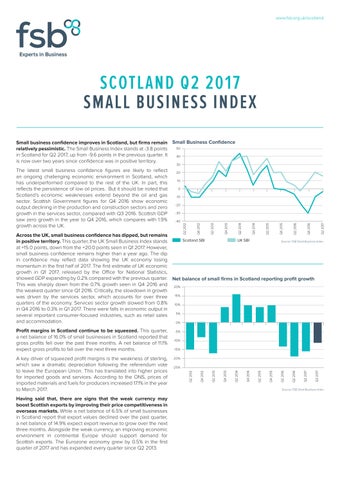

Profit margins in Scotland continue to be squeezed. This quarter, a net balance of 16.0% of small businesses in Scotland reported that gross profits fell over the past three months. A net balance of 11.1% expect gross profits to fall over the next three months.

A key driver of squeezed profit margins is the weakness of sterling, which saw a dramatic depreciation following the referendum vote to leave the European Union. This has translated into higher prices for imported goods and services. According to the ONS, prices of imported materials and fuels for producers increased 17.1% in the year to March 2017.

Having said that, there are signs that the weak currency may boost Scottish exports by improving their price competitiveness in overseas markets. While a net balance of 6.5% of small businesses in Scotland report that export values declined over the past quarter, a net balance of 14.9% expect export revenue to grow over the next three months. Alongside the weak currency, an improving economic environment in continental Europe should support demand for Scottish exports. The Eurozone economy grew by 0.5% in the first quarter of 2017 and has expanded every quarter since Q2 2013.

Despite subdued confidence levels, smaller businesses continue to create jobs. A net balance of 1.3% of small businesses in Scotland added to their payrolls during the second quarter of 2017, up from 0.3% in the first quarter of the year. In contrast, a net balance of small businesses reported declining headcount in three of the four quarters in 2016.

Overall despite the challenging economic environment in Scotland, the labour market remains relatively strong. In the three months to April 2017 the unemployment rate stood at 4%, lower than the 4.6% seen across the UK as a whole. While low unemployment is welcome, job creation without profit growth points to declining productivity in the Scottish workforce. This is likely to translate into weak pay growth for employees.

Increased fuel costs and the state of foreign economies have become more of a concern for small business owners. Reflecting higher import prices, the proportion of Scottish small businesses reporting fuel costs to be a barrier to growth has risen from 3.9% in Q2 2016 to 13.9% this quarter. Those reporting foreign economies as a barrier to growth also increased this quarter by twelve points to 19.8%.

Scotland’s economy remains sensitive to global commodity price developments, given the importance of North Sea oil. Global oil prices remain subdued at present, with Brent crude struggling to remain consistently above the $50 per barrel mark. Between 2010 and 2014 Brent crude prices were on average over $100 per barrel.

Investment intentions are more subdued than elsewhere in the UK. This quarter, a net balance of 5.7% of small businesses in Scotland expect capital investment to rise over the next three months, compared with the previous three months. This is notably lower than the 13.2% in the previous quarter and marks the third consecutive quarter where intentions have weakened. Scottish investment intentions now lag the UK as a whole by over 12% and this is in line with lower confidence levels among smaller businesses in Scotland.

The Small Business Index shows a challenging economic environment in Scotland. Although small business confidence has continued to improve in Scotland this quarter, businesses are still on average much less optimistic about the future outlook than they are across the UK as a whole. The latest economic data released by the Scottish Government also show Scotland’s economy underperforming against the UK as a whole.

All in all, this research suggests that the remainder of 2017 is set to be a challenging year for the economy and its smaller businesses. Higher inflation and weak earnings growth mean that household finances will be squeezed, limiting the ability of UK consumers to drive significant economic growth. One bright side of the economy is exports, where the weak pound could boost demand for Scottish goods and services over the coming months.