Executive Summary

This report presents the findings of a UK-wide business survey led by FSB Northern Ireland, aimed at assessing the real-world impact of the Windsor Framework on businesses of all sizes, with a particular focus on the operation of the UK Internal Market. This survey, conducted across all four nations, received strong engagement from SMEs and micro businesses, many of which are either already navigating new trade rules or preparing for upcoming implementation deadlines. The findings reveal a system under pressure, marked by confusion and disruption, underscored by a pressing need for clearer government support and communication, alongside measures to reduce remaining frictions.

Key findings

• Widespread trade friction: Over half of respondents (58%) who trade between Great Britain and Northern Ireland have experienced moderate or significant difficulties operating across the UK Internal Market. Of those who move goods or provide services between Northern Ireland and GB, 34% have halted trade with the other region entirely rather than contend with the Windsor Framework’s demanding requirements. This pattern is most pronounced for GB firms cutting off Northern Ireland customers, a trend that could accelerate if compliance costs remain high.

• Low strategic confidence: Ongoing regulatory changes have undermined business planning. The survey showed that, of those affected by the Windsor Framework, 56% are “not confident” or only “slightly confident” in shaping their business strategy for the next 12 months. Only a minority (4%) felt completely confident. Uncertainty around upcoming rule changes (such as new “Not for EU” labelling from July 2025) is weighing heavily on small businesses.

• Dual Market Access underutilised: Northern Ireland’s promised dual access to both the UK and EU markets, potentially a major competitive advantage, is not yet being realised for most. Only 14% of NI - based businesses who responded to the survey said they understand and are benefiting from dual market access; the rest either lack

sufficient understanding to benefit from it or have not been able to leverage it. Moreover, 51% of respondents believe this opportunity is not being adequately explained or promoted by government authorities, indicating a major communication gap.

• Government support gaps: The quality and accessibility of official support services (for example, HMRC guidance and the Trader Support Service) received poor ratings across the board. When asked about the quality of support, 78% of respondents rated the support quality as “poor” or “very poor”, and a similarly high proportion found access to support difficult. Businesses frequently cited confusing or inconsistent guidance. As one NI manufacturer put it, navigating new customs paperwork via the Trader Support Service often feels like a “guessing game”, and “some suppliers with a 30-year trading history have just stopped supplying to us. It’s a real challenge bringing materials and components from GB”.

• Operational disruptions and costs: One in three businesses (33%) have already faced significant disruptions (such as supply delays, stock shortfalls, or lost sales) attributable to the Windsor Framework’s changes, with a similarly large segment (29%) anticipating future disruptions. Many NI - based firms report rising transport and compliance costs, extra administrative workload, and having to rearrange supply chains. In some cases, dual regulatory regimes mean companies effectively operate two systems, increasing overheads. For example, new parcel and agrifood rules are set to add further costs, and certain industries (such as plant nurseries and veterinary suppliers) remain unable to serve NI without additional bureaucracy.

• Regional and sectoral variations: Impacts are not uniform. NI headquartered businesses are far more likely to report negative effects. 78% of NI respondents had experienced some negative impact so far, versus 56% for GB respondents, which is unsurprising given that NI firms are directly subject to EU rules and extra processes under the Windsor Framework. Sectors reliant on goods trade, manufacturing, construction, retail/wholesale, and agriculture report the greatest difficulties (and

most of the instances of ceased trade). Meanwhile, service-based businesses often see little direct effect other than minor cost pass-through. Notably, a small cohort of manufacturers and food exporters do report advantages in NI’s ability to trade into the EU market without tariffs or checks, validating the concept of dual market access. However, this group is dwarfed by those struggling or adjusting to new barriers.

Recommendations

FSB NI is calling for urgent, targeted action to address these findings. Policy measures should focus on reducing red tape, improving communication and support, and enabling businesses to capitalise on NI’s unique status

1. Reduce barriers and bureaucracy: Work with the EU to remove unnecessary regulatory friction and simplify requirements.

2. Simplify forms and processes: Streamline customs, registration, and compliance paperwork for SMEs, using plain language and automation.

3. Enhance the Trader Support Service (TSS): Improve the usability and clarity of the TSS to better meet the needs of small businesses, ensuring guidance is timely, accessible and easy to navigate.

4. Centralise SME guidance: Establish a ‘single window’ for Windsor Framework related queries across: Customs, VAT, Agri food, and regulatory areas.

5. Improve communication and outreach: The newly launched Business Growth Service1 presents an opportunity to review Government communications2 and launch a targeted campaign to explain the Windsor Framework clearly and consistently to SMEs.

6. Expand tailored SME support across the UK: Deliver enhanced, practical, on the ground support across the UK through; roadshows, 1:1 advice, and simplified step-

1 https://www.gov.uk/government/news/government-growth-service-to-save-small-business-time-and-money

2 https://www.fsb.org.uk/resources/policy-reports/ready-to-dispatch-MCUFJTZB443JC3LO4EXNMF524THQ

by-step guides. This should be coordinated by the UK Government, working in conjunction with the devolved governments.

7. Promote dual market access: Equip SMEs to understand and then exploit NI’s unique access to UK and EU markets, through real world examples and training.

8. Position Northern Ireland as a gateway for trade: Market Northern Ireland as a strategic launchpad for UK businesses exporting to the EU and as a destination for overseas businesses to set up operations to access the two markets.

9. Secure supplementary agreements with the EU: In heralding the 19 May Agreement between the UK and the EU, the Government recognised the need to make moving goods between GB and NI easier; to reduce the need for paperwork and checks; and to make sure that barriers within the UK Internal Market are dismantled.3 To achieve this, conclusion and implementation of the agreement must be progressed as a matter of urgency. Beyond that, we urge the Government to negotiate further UK-EU arrangements to continue to reduce compliance burdens and futureproof SME trading conditions, in areas such as a veterinary agreement to reduce food and agricultural trade frictions (benefitting NI greatly and UK food exporters broadly) and an arrangement on mutual recognition of professional qualifications in order to sustain trade.

10.Improve monitoring and interpretation of regulatory divergence: Strengthen crossgovernment coordination to monitor, explain and respond to evolving UK- EU regulatory divergence, helping businesses anticipate changes and adapt in real time.

11.Provide a single, centralised source for UK-EU trade rules: Ensure businesses have access to up-to-date, clear and centralised guidance on applicable UK and EU trade rules, including real-time updates and practical decision tools.

12.Improve data and transparency: Regularly publish data relating to the Windsor Framework’s performance, usage of schemes and trade flows, to build trust and

3 https://www.gov.uk/government/publications/ukeu-summit-key-documentation/uk-eu-summit-explainer-html

track progress.

The Windsor Framework is already reshaping internal UK trade, but its benefits are intangible to many. Without urgent, targeted intervention, the risks of market contraction, compliance failure, and SME disengagement will increase This report provides a clear evidence base for the government to move to support small firms, restore confidence in the UK Internal Market and unlock the strategic potential of dual market access.

Introduction

Following the UK's departure from the European Union, the original Northern Ireland Protocol part of the 2019 Withdrawal Agreement was introduced. However, this created barriers to trade between Great Britain and Northern Ireland, leading to significant disruption for businesses. In response, the UK and EU negotiated the Windsor Framework, announced in February 2023, to reduce friction while preserving the Protocol’s core objectives. Northern Ireland retains a unique position: it remains part of the UK’s customs territory, but continues to follow many EU rules for goods, giving it privileged access to both the UK Internal Market and the EU Single Market. However, whilst framed as a compromise to support the smooth flow of goods, the Windsor Framework introduces a number of complex regulatory provisions, including changes to customs processes, parcel movements, labelling rules, and access to dual markets.

Despite frequent commentary and anecdotal evidence, there remains a lack of reliable, data-driven insight into how the Windsor Framework is affecting businesses on the ground. To address this gap, FSB NI launched a dedicated business survey to capture the lived experience, levels of understanding, and operational responses of firms navigating these new arrangements.

While political debates have often dominated headlines on this topic, it is essential that the practical impacts on employers, entrepreneurs and traders inform the ongoing policy response. Small and medium-sized enterprises (SMEs) form the backbone of the NI economy and are integral to GB-NI trade. If the Windsor Framework is creating inhibitors to their growth or, conversely, new opportunities, then policymakers need to know. This research provides an evidence base to guide decisions in London, Belfast and Brussels. It drills into how confident SMEs feel, what challenges or opportunities they see, what actions they are taking, and what support they need. The goal is to ensure that the Windsor Framework’s operation “recedes as an inhibitor to small businesses”4 and instead

4 Written evidence submitted by FSB NI, relating to the operation of The Windsor Framework

becomes a workable platform for prosperity.

The evidence gathered is intended to support policymakers in evaluating the Windsor Framework’s implementation, identifying unintended consequences and ensuring that the needs of smaller businesses are not overlooked.

Business Sentiment

FSB NI has identified five distinct cohorts of business, offering a useful analytical framework for understanding varied experiences;

• Businesses benefitting from the new arrangements: These firms may be taking advantage of dual market access or regulatory opportunities.

• Businesses largely unaffected: Typically, those not trading goods or operating in sectors shielded from regulatory change.

• Businesses unaware of the changes: Typically, very small businesses which get their supplies from a NI-based wholesaler who is navigating the trading challenges on their behalf

• Businesses protected by grace periods: These firms may not yet have encountered disruption, but risk sudden impact when temporary arrangements come to an end.

• Businesses negatively impacted: Already experiencing increased friction, delays, administrative burdens or lost opportunities due to Windsor Framework-related challenges.

All businesses in Northern Ireland sit within at least one of these cohorts, and many move between them over time as the Windsor Framework evolves and is implemented in full. This highlights that the impact of the Windsor Framework is not uniform across businesses, rather its impact is shaped by factors such as; sector, size, supply chain structure and level of regulatory awareness.

When asked how the Windsor Framework has affected their business so far, 61% of businesses report a negative impact. This includes; 26% describing the impact as ‘very negative’ and 35% indicating a ‘somewhat negative experience’. This is a strong indication that the Windsor Framework is, in its current form, imposing significant burdens or friction on small firms. It has been stated that customs and port clearance procedures remain complex and often lack consistent interpretation, leading to significant challenges for businesses. In contrast, only 2% of respondents reported any positive impact, with no

respondents citing a ‘very positive’ impact - a critical signal for policymakers. A further 28% reported no significant impact while 10% said they did not know. This is a concerning signal.

A high ‘no significant impact’ response (28%) suggests the effects are concentrated in specific sectors or trade routes, not yet widespread across the full economy. However, as grace periods end and further phases of implementation come into force, many of these businesses may soon transition into the negatively affected group. This highlights the importance of timely and targeted intervention to improve clarity and mitigate disruption.

Figure 3: Overall, how has the Windsor Framework affected your business so far?

Source:

FSB NI, N=266

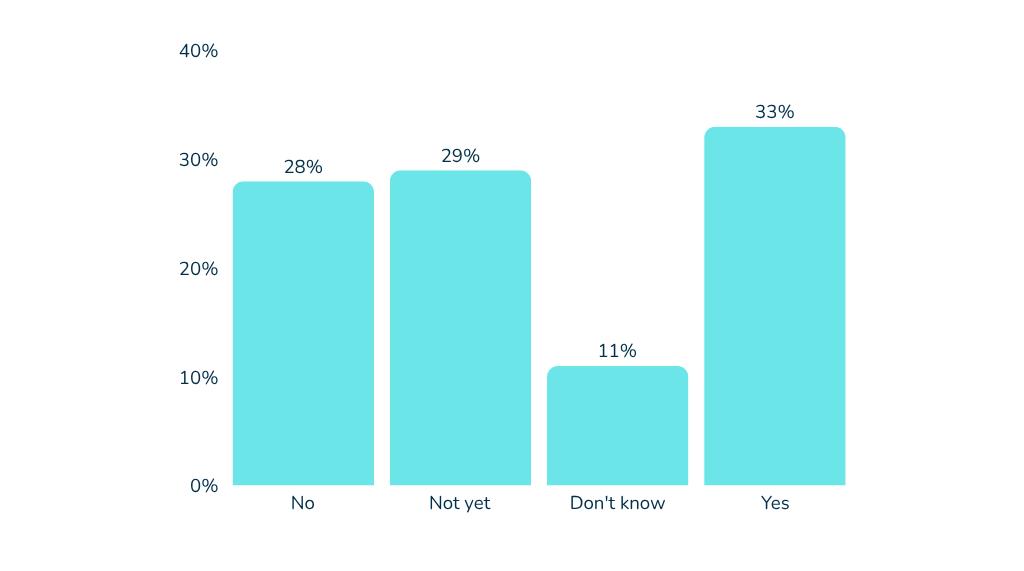

Operational Disruption

Of those who responded, 33% indicated that they have already experienced operational disruptions as a result of the Windsor Framework, with 29% responding ‘not yet’. These disruptions encompass a range of business-critical issues, including delays in production, stock shortages, and lost sales opportunities.

This evidence indicates that the Windsor Framework is not merely a regulatory change, it is materially interfering with business continuity. For many small firms, it is introducing

uncertainty and inefficiencies across supply chains, particularly for those with limited capacity to absorb additional costs or delays.

As the chart below shows, 33% of businesses have already experienced disruption; 29% anticipate future disruption, 28% do not expect to be affected and 11% remain unsure.

Figure 4: Have you experienced any significant operational disruptions due to the Windsor Framework?

Source: FSB NI, N=264

This distribution highlights an atmosphere of ongoing uncertainty, with a significant share of the business community concerned about future phases of implementation and regulatory divergence. 28% of firms are confident that the Windsor Framework will not affect their operations, underscoring the need for more proactive support and clearer guidance to mitigate emerging risks.

“To comply is far too expensive, time consuming and onerous a task for small / micro businesses. The chance of getting things wrong, being non-compliant and risking fines etc. are very high. On balance it's no longer worth trading with NI which is awful and cuts out a lot of business and makes no sense as it's easier currently to trade with USA and Australia.” Quote from a micro business operating in the wholesale and retail sector, headquartered in Scotland.

“We have suspended sales to Ireland and Northern Ireland as both areas have created huge challenge for us at this time.” Quote from a micro business operating in the manufacturing sector, headquartered in Wales.

Trade Disruption within the Internal Market

The Windsor Framework is frequently portrayed as impacting only businesses in Northern Ireland. However, while firms in Northern Ireland do experience its effects, businesses in other parts of the United Kingdom are also subjected to its associated bureaucratic responsibilities, including perceived and actual burdens from elements such as; GPSR6 , B2B parcel requirements7, ‘Not for EU labelling8’ and more. The Windsor Framework has already had a material impact on trade within the UK internal market. Of those respondents who move goods or sell services between GB and NI, a third (34%) have already ceased supplying customers or partners in either Great Britain or Northern Ireland due to new barriers This highlights a significant level of market fragmentation, directly contradicting the intention of maintaining seamless trade within the UK Internal Market.

The survey results show that a substantial proportion of businesses (42%) are experiencing some form of operational friction due to the Windsor Framework 9 This reinforces the sense that the Windsor Framework, while perhaps structurally sound, may not yet be functioning smoothly at ground level for many firms. It is pertinent to note that at the time when this survey was conducted, requirements on B2B parcel movements and Phase 3 labelling had not yet come into effect. Many businesses that have not yet felt any impacts of the Windsor Framework may have been apprehensive about its approaching requirements

An estimated 38% of all businesses reported no impact, suggesting the Windsor

6 General Product Safety Regulation (GPSR) refers to updated EU legislation aimed at strengthening consumer safety rules for nonfood products which came into effect on 13th December 2024 and applies to Northern Ireland under the Windsor Framework - EU GPSR (Regulation (EU) 2023/988).

7 B2B parcel movements refers to the movement of parcels between businesses (business-to-business) from Great Britain to Northern Ireland. These movements are subject to specific rules, (which came into effect on the 1st of May 2025) such as customs declarations, safety and security paperwork, and compliance with EU product standards.

8 ‘Not for EU’ labelling is a requirement introduced under the Windsor Framework for certain goods moving from Great Britain to Northern Ireland to help ensure that products intended solely for the UK market do not enter the EU Single Market. This regulation has come into effect via a phased approach, with Phase 3 scheduled for 1st July 2025.

9 Defined as those who reported significant barriers, moderate challenges or minor frictions.

Framework has not disrupted all sectors equally, likely those who trade within one jurisdiction or are not goods focused. Just under 20% report significant barriers and another 15% moderate challenges, pointing to a clear segment of businesses facing real operational strain. The fact that nearly 20% don’t know indicates confusion or lack of clarity, a potential warning sign of poor communication or limited engagement by smaller firms.

Figure 5: To what extent has the Windsor Framework affected your ability to operate across the UK Internal Market?

Source:FSBNI,N=677

“IhaveasmallbusinesslocatedinWalesandhavealwayssentitemstoNI.Icannolonger dothisastheamountofworkneededforboththeWindsorFrameworkandtheGPSRis justtoomuchforatinybusinesstocopewith,butthisdoesmeanthatIloseabout10-15% ofmyturnover,andmycustomerswillalsolosecustomersastheywon’tbeabletogetmy products,whichareonlyavailablefromme. ”Quote from a micro business, operating in the wholesale and retail sector, headquartered in Wales.

“There is a lack of understanding. The level of business we have in Northern Ireland no longer justifies time spent trying to understand the complexities of supplying, so we have simply stopped selling there ” Quote from a small business, operating in the manufacturing sector, headquartered in Scotland.

Experience of the Windsor Framework

As part of the survey, respondents were invited to share any additional thoughts on the Windsor Framework, including its impacts or opportunities. This optional question received 177 comments (23% of respondents) revealing a striking level of engagement from the business community and a strong desire to be heard on the real-world consequences of the policy.

Crucially, virtually none of the comments expressed a positive experience. Instead, the free text responses described serious operational and emotional strain including;

• Increased costs from having to upgrade systems or hire additional staff to manage compliance.

• Extended delays and administrative confusion around procedures such as the ‘at risk/ not at risk’ classification at ports.

• Cessation of trade with Northern Ireland, often by micro and small businesses, due to the perceived burden and risk.

• Frustration and disengagement from businesses who feel unsupported, ignored, or trapped between two markets.

A few anonymised quotes from respondents powerfully illustrate these concerns.

"It’s a huge change without any information on understanding exactly what we have to do which is why we have suspended sales to NI." Quote from a micro-sized business operating in the wholesale sector, headquartered in Wales.

“Divergence of standards over time meaning we will have to comply with two sets of standards rather than just one. It would be much simpler and cheaper to align all standards with the EU or allow UK retailers the option of complying only with EU standards.” Quote from a small business operating in the wholesale and retail sector, headquartered in England.

“The paperwork needs to stop. An additional member of staff would need to be employed

to deal with all of this nonsense. Very frustrating. The entire system has been designed by people with no common sense or business knowledge.” Quote from a small sized business operating in the wholesale and retail sector, headquartered in Northern Ireland.

“Trader Support Service is an over-complicated joke of a system. Trying to complete movement declarations is a ‘guessing game.’ Some suppliers with a 30-year trading history have just stopped supplying to us. It’s a real challenge bringing materials and components from GB.” Quote from a small sized business operating in the manufacturing sector, headquartered in Northern Ireland.

“Easier for us to stop trading with Northern Ireland than to comply with these complex requirements. Only small trades in any case, no longer viable.” Quote from a small sized business operating in the professional services sector, headquartered in England.

“Uncertainty is causing suppliers to be nervous and it’s affecting our trade to the wider EU, as they are confusing us as an NI business with mainland Great Britain. There is a general lack of understanding of the unique opportunities and position for Northern Ireland.” Quote from a small sized business operating in the manufacturing sector, headquartered in Northern Ireland.

"The paperwork needs to stop. An additional member of staff would need to be employed to deal with all of this." Quote from micro sized business operating in the manufacturing sector, headquartered in Northern Ireland.

These comments highlight how bureaucracy, regulatory uncertainty and fear of penalties are affecting even routine operations. Importantly, they also express a sense of disillusionment with the policy and its implementation, with some businesses seeing the UK Internal Market as now harder to navigate than international trade. “In order to comply it is far too expensive, time consuming and onerous a task for very small / micro businesses. Chance of getting things wrong, being non-compliant and risking fines very high. On balance it's no longer worth trading with NI which is awful and cuts out a lot of business and makes no sense as it's easier currently to trade with USA, Australia etc.”.

This qualitative feedback confirms and reinforces the quantitative findings throughout the

survey. It provides a vital narrative layer that gives voice to the frustration, confusion, and real operational barriers faced by SMEs across the UK. More than anything it underscores the urgent need for: simplified procedures and guidance; tailored support for micro and small businesses; and rebuilt trust through engagement and responsiveness. Without these measures, the Windsor Framework risks further alienating the businesses it was intended to support.

Sectoral and Regional Comparisons

The survey’s broad respondent base allows an analysis of how impacts differ across regions and industry sectors. Understanding these distinctions is important; the Windsor Framework does not affect all businesses equally. Below, we outline some key comparative insights.

Northern Ireland vs Great Britain

The contrast in the survey responses between Northern Ireland based firms and those in Great Britain (England, Scotland, Wales) is particularly pronounced.

Northern Ireland businesses report greater negative impacts in both frequency and intensity. Around 78% of NI respondents said the Windsor Framework has had a negative effect on their business so far (with 37% saying “very negative”), whereas among GB respondents a smaller proportion, just over half (56%) reported negative impacts, with a substantial minority in GB (around one-third) saying it had no significant impact on them.

This isn’t surprising, as NI firms are living and breathing the new rules daily, while many GB firms only encounter them if they trade with NI. It means NI’s local economy is bearing the brunt of adjustment costs.

As noted, GB companies are more likely to have halted shipments to NI than vice versa. In our sample, 39% of GB respondents involved in NI trade answered “Yes” to having stopped supplying NI customers, compared to about 16% of NI respondents who stopped selling to GB. The GB figure aligns with FSB NI’s warning that a “substantial proportion” of suppliers might opt out of the NI market due to costs and burdens. This asymmetry (GB

firms opting out) is a major concern for NI supply chains.

Over half of NI businesses (52%) in the survey experienced significant disruptions (e.g. delayed shipments, products unavailable) since the Windsor Framework’s introduction, compared to 27% of GB businesses reporting such disruptions. NI firms are also more likely to anticipate future disruptions if/when grace periods expire (66% anticipate significant or moderate challenges), compared to 52% of GB businesses. For example, NI retailers talked about struggling to find replacement suppliers for goods that suddenly couldn’t be shipped from GB firms; whilst GB firms mentioning NI orders being problematic have focused elsewhere, thereby avoiding disruptions at their end by simply not buying from NI firms.

NI respondents generally have a more detailed understanding of the Windsor Framework’s details (54% scored their understanding at 3 or above out of 5) and thus were more determined in their criticism of it. Whereas 75% of GB respondents had very low or low levels of understanding of the Windsor Framework with some (22%) not sure if certain rules applied to them or not, suggesting parts of GB’s small business community remain somewhat disengaged from NI trade issues. Nevertheless, those GB businesses that do engage with NI tended to share NI firms’ frustrations and were equally critical of bureaucracy.

Sector level insights

Different industries experience the Windsor Framework’s provisions in different ways. From the survey, a few sectoral patterns stand out.

• Manufacturing: Manufacturers were among the hardest hit according to the survey, with many reporting burdensome paperwork, delays and cost inflation linked to goods moving between GB and NI. Compliance obligations included customs declarations, ‘at risk’ assessments and Rules of Origin documentation. Some businesses stated that these requirements had slowed or fractured supply chains.

• Wholesale and Retail: This sector arguably has felt the most direct impact. NI wholesalers/retailers depend on large volumes of goods coming from GB

distribution. They reported issues such as shipment delays, additional courier fees, required registration of GB suppliers in schemes, and even product lines being discontinued for NI. One NI retailer said: “English companies have stopped supplying us due to the hassle or lack of understanding”, illustrating some of the breakdown in supply chains. GB wholesalers that serve NI have had to invest in compliance or withdraw; the data shows many smaller GB wholesalers chose the latter due to low margins.

• Sectors dealing in physical goods, particularly cross-border supply chains, face the greatest disruption under the Windsor Framework, whereas sectors focused on local services see minimal direct effects. Among goods sectors, those in NI have a dual perspective, extra burdens on one side, potential new markets on the other, whereas goods sectors in GB view it mostly as a new trade barrier to a small part of their market. This means policy fixes might need to be tailored; for example, targeted support for retail/wholesale and manufacturing SMEs to adapt supply chains, and targeted promotion of export opportunities for NI producers in sectors that could benefit.

The regional and sectoral analysis reinforces the overarching narrative; small businesses in Northern Ireland, and those trading with it, need specific attention. Their challenges are acute, but can be addressed with the right interventions that appreciate the detailed realities of each sector.

Dual Market Access

The concept of ‘dual market access', allowing businesses in Northern Ireland to sell goods freely into both the UK Internal Market and the EU Single Market has been widely hailed as a unique economic advantage of the Windsor Framework. In theory, this arrangement should provide firms with a competitive edge, offering seamless access to over half a billion consumers without the trade barriers faced by counterparts in GB or, indeed, those in the EU, in accessing the GB market.

However, the evidence from this survey suggest that this theoretical benefit is not being

realised in practice by the vast majority of businesses, indicating a clear shortfall in the UK Government or Northern Ireland Executive’s efforts to explain, harness and promote this opportunity.

It should be noted that this question was asked of Northern Ireland businesses only. When asked whether they had been able to understand and take advantage of dual market access, only 24% of respondents answered yes. In contrast, a substantial 64% said no and a further 12% said they didn’t know, highlighting widespread confusion or disengagement from what could be a major strategic opportunity for the Northern Ireland economy.

The data points to a significant disconnect between political messaging and business level understanding. Rather than being an engine of growth or a competitive differentiator, dual market access currently appears to be a missed or misunderstood opportunity for SMEs.

Figure 7: Have you been able to understand and take advantage of your dual market access to both the UK and the EU markets from Northern Ireland?

Source: FSB NI, N=5810

The chart below further reinforces this gap. When asked whether the concept of dual market access is being adequately explained and promoted by the UK Government and the Northern Ireland Executive, only 7% of Northern Ireland businesses agreed. An overwhelming 88% said no, with 5% being unsure. These figures point to a critical failure

10 This question was asked of NI businesses only

in communication and engagement by both central and devolved government. Despite initiatives by local agencies, responses to the survey suggest that businesses are not only unaware of how to benefit from dual market access, they are also not receiving sufficient guidance, case studies or real-world examples to illustrate its relevance or practical application

This perception problem has consequences. If businesses do not understand how to access both markets, they are less likely to structure supply chains, production models or product standards to exploit the opportunity. This undermines a key pillar of the Windsor Framework’s policy rationale and limits its economic potential. Many business owners feel that, if properly leveraged, dual market access could position Northern Ireland as a hub of economic excellence. To maximise the economic potential of dual market access, there is an urgent need for clearer guidance, practical assistance, and a strategic communications plan from the UK Government that ensures businesses can fully capitalise on this unique position. A number of NI businesses voiced frustration that dual market access feels “more theoretical than real”.

Figure 8: Do you think dual market access is being adequately explained and promoted by the UK Government and the Northern Ireland Executive?

Source: FSB NI, N=5811

11 This question was asked of NI businesses only

“N.Ishouldbedoingsomuchmorewiththeuniqueopportunitywehavewithdualmarkets. Idon'tunderstandwhythisisn'tapriorityatStormonttomassivelyimproveourlocal economy.”Quote from a medium sized business operating in the wholesale and retail sector, headquartered in Northern Ireland.

“ForthoseNIcompanieswhotradeprimarilywithintheUK,statementssuch"NI'sunique position"&"NIhasthebestofbothworlds"areviewedasoverplayedmarketingterms.”

Quote from a medium-sized business operating in the manufacturing sector, headquartered in Scotland.

In summary, dual market access remains an underutilised asset. The survey suggests two main causes: lack of awareness/understanding, and practical impediments that diminish the value of dual market access. Until businesses both know about and can readily exploit NI’s access to the EU market, the economic upside of the Windsor Framework will not be fully realised. The findings make it clear that the Government must dramatically improve outreach and guidance on this front, an issue to which we return in our recommendations.

Government Support and Accessibility

Businesses were asked to reflect on the quality and accessibility of government support relating to the Windsor Framework, including services provided by the bodies such as: HMRC, the Department for Environment, Food and Rural Affairs, the Department of Agriculture, Environment and Rural Affairs, and the Trader Support Service The feedback was clear and consistent - current support is falling short of expectations. Both the quality of guidance and the ease of access to help were rated poorly by respondents

This revealed a deep dissatisfaction with current support systems. On a scale of 1 to 5, where 1 was “very poor” and 5 “excellent,” responses overwhelmingly clustered at the low end. In fact, 78% of those who rated the support gave it either a 1 or 2 (poor) rating. Barely a handful (only 2% of respondents) deemed the guidance “excellent.” The median rating was 1 out of 5, a failing grade by any measure. This indicates that businesses feel they are

not getting the clear, consistent information they need

Figure 9: How would you rate the current level and quality of government support for understanding or complying with the Windsor Framework?

Source: FSB NI, N= 193

Similarly, when asked how easy it is to access government support, the scores were poor. The majority of respondents, 80% who gave an opinion, selected “very difficult” (1 out of 5) or “difficult” (2 out of 5) From the survey data, only 2% found accessing support to be “very easy”.

Figure 10: How would you rate the current ease of access to government support for understanding or complying with the Windsor Framework?

Source: FSB NI, N= 189

Together, these findings highlight a major gap in the implementation infrastructure surrounding the Windsor Framework. While businesses are generally adaptable, a lack of clarity over which bodies are responsible for specific aspects of the Windsor Framework can create uncertainty and hinder effective engagement. It has also been reported by members and through the qualitative responses in the survey, that when trying to engage with government support, those structures are confusing, involving complex redirects and a lack of sufficient direct contact, for example an inbox, phone line or secretariat. While new regulations and systems are being rolled out, many businesses, particularly SMEs, are being left without the practical support needed to comply or adapt with confidence

This compounds the earlier findings on poor understanding (average score of 1) and lack of strategic confidence (41% not confident in planning). In order to maintain full, faithful and timely implementation of the Windsor Framework, businesses must be a key part of the process, with information and guidance readily available in a streamlined fashion to all trading within the UK Internal Market.

Trader Support Service (TSS): This free government-backed service was set up to help with NI-GB trade processes. However, it drew particularly sharp criticism in the survey comments. A manufacturing business from Northern Ireland described the TSS as “an over-complicated joke of a system”. They explained that trying to complete the required digital declarations feels like a “guessing game”, even for someone reasonably experienced, saying “some suppliers with a 30-year trading history have just stopped supplying to us. It's a real challenge bringing materials and components from GB”.

Another respondent noted they received conflicting advice from the TSS and HMRC. Such feedback suggests that the system is not effectively serving the smallest traders, even though it was ostensibly designed for them.

“There is sadly an increased cost in dealing with Northern Ireland, which as it is part of the UK, is frankly disappointing for all parties. Costs are rising for Businesses and there is no clear understanding from the current Government.” Quote from a micro business operating

in the manufacturing sector, headquartered in England.

In summary, the prevailing view is that government support has been insufficiently clear and accessible for SMEs navigating the Windsor Framework. The data reveals a deep frustration: businesses feel they have been left to shoulder the burden of compliance alone. This not only breeds resentment but also increases the risk of non-compliance (out of confusion) and trade reduction (as some give up on difficult markets). The findings strongly point to the need for enhanced support measures, whether that’s simplifying the TSS process, providing one-stop helpdesks, issuing plain-language guides, or even financial support for professional advice. Companies want to comply and thrive under the new rules, but they need government to meet them halfway with quality guidance.

Business Response

In the face of challenges posed by the Windsor Framework, small businesses have not stood idle. Many have actively taken, or are considering, strategic action to mitigate its operational impacts and protect profit margins. The survey findings reveal a wide range of responses, from cautious withdrawal to proactive adaptation. These actions provide a window into how businesses are navigating new trade barriers and shifting supply chains, with some responses carrying wider implications for the health of the UK Internal Market.

Key actions reported include

• Ceasing trade: The most common response is for firms to stop trading with Northern Ireland 32% of GB businesses reported that they had already ceased trading with Northern Ireland due to new compliance burdens or operational friction. This reflects a partial fragmentation of the UK Internal Market, directly undermining the Windsor Framework’s key objectives.

• No strategic change (wait-and-see): The second most frequent response was inaction, 18% of businesses reported that they had made no strategic changes in response to the Windsor Framework. Most of these businesses described themselves as being in wait-and-see mode, often citing uncertainty about rules,

resource constraints or hopes that issues might be resolved politically. Others noted that they were not yet directly affected. This group includes businesses that may shift cohorts quickly once grace periods expire or market dynamics change.

• Seeking guidance and support: The survey results suggest that the majority of businesses have not proactively sought external help. For instance, 6% of respondents said they had contacted a government body for guidance (such as calling the Trader Support Service or HMRC), and a similar number had reached out to business organizations or trade bodies for advice (6%). This underscores the earlier finding that many need clarifications on rules and are turning to any available source. Only 4% reported using paid customs broker services or consultants, likely due to the cost, which many small businesses cannot afford, though some medium firms have gone down that route for assurance.

• Enrolling in schemes: Some have taken advantage of government schemes aimed at easing Windsor Framework requirements. An estimated 5% of respondents stated that they had joined the likes of the UK Internal Market Scheme (UKIMS), a scheme allowing trusted traders to move goods not at risk of leaving NI without tariffs, essentially a cornerstone of the green lane system. The limited uptake suggests either low awareness or ineligibility

• Reorganising and diversifying: Several businesses are adapting by restructuring their operations or supply chains. 10 respondents said they had diversified suppliers, often shifting from GB to NI based options, or sourcing from the EU directly with 11 businesses noting that they had reorganised operations to work around friction points.

• Deferring investment or growth plans: While not an explicit option in the multiplechoice list, many wrote in comments that they have effectively put expansion on hold. This includes pausing plans to enter new markets, delaying capital expenditures, or holding off on hiring. Uncertainty surrounding the Windsor Framework appears to be having a dampening effect on businesses’ investment and

growth plans. For example, one business owner wrote: “As a company based in NI, I have had to stop supplying ROI web orders as have had to specify product coming to shop from GB is 'green lane' otherwise the whole process is too complicated for the volume of sales to ROI so easier to just not supply to ROI. I was planning to grow this export area of my business but now I have had to stop it altogether.”12 Such decisions mean lost opportunities and slower economic growth.

Figure 11: If the Windsor Framework impacts your business operations or profit margins, have you taken or considered any of the following actions?

Source: FSB NI, N=251

“As an SME we do not have excess resources and now have to incur training costs and divert resources to complete customs documentation. Most of our GB to NI supplies are at risk and this is a huge administrative burden. Quote from a small business, operating in the manufacturing sector, headquartered in Northern Ireland.

“Northern Ireland is being economically cut off from the UK and is in limbo with Europe ” Quote from a micro business, operating in the manufacturing sector, headquartered in Wales.

12 Quote from a Northern Ireland based business operating in the wholesale and retail sector.

Collectively, these findings suggest that the small business community is resourceful, yet under strain. Firms are making difficult choices, some are investing in workarounds, others are pulling back from previously viable markets. The emergence of ‘ceasing trade with NI’ as the top action sends a clear policy signal that red tape, if left unaddressed, can actively distort and diminish trade within the UK.

While some businesses are adapting through reorganisation or supplier changes, these strategies often reduce efficiency, extend supply chains and come at a higher cost. The presence of adaptative behaviour is encouraging; however, it should not be assumed that these actions are sustainable in the long term without further government support. The policy implication is clear - to keep trade flowing and protect the competitiveness of small businesses, compliance processes must be simplified and support improved. Every firm that ceases to exist in the NI-GB market, due to the Windsor Framework, represents a preventable loss to the economy.

The Year Ahead

The Windsor Framework has created significant uncertainty for business planning, particularly among smaller firms with limited capacity to absorb new compliance demands. When asked how confident they felt in setting strategy for the next twelve months, 41% of respondents say they are not confident. The absence of clear, operational standards and a comprehensive understanding of requirements contributes to inefficiencies, especially across the small business sector. In the context of increased business costs, and the threat of deeply damaging employment law changes, additional costs arising from bureaucracy must be reduced to a minimum. This sentiment reflects a broader climate of uncertainty, particularly for firms dependent on trade within the UK Internal Market or currently protected by grace periods.

A further 27% expressed limited confidence, with 12% reporting as slightly confident and 15% somewhat confident. Only 18% said they were fairly confident or completely confident in their ability to plan ahead. Importantly, 14% of businesses answered, ‘don’t know’, which could indicate an information gap

These figures clearly indicate the need for: enhanced support mechanisms; clearer regulatory timelines; and dedicated outreach to improve both understanding and strategic certainty among affected businesses.

Figure 12: How confident are you in planning your business strategy over the next 12 months given the ongoing changes around the Windsor Framework?

Source:FSBNIN=263

Qualitative comments underline the reasons behind this hesitancy. Business owners commonly cite uncertainty around requirements, future rules and lack of clarity about how the Windsor Framework will operate once fully implemented. Several NI based firms note that without a stable regulatory environment, they are deferring investment decisions and growth plans. Even GB businesses (for whom NI trade might be a smaller share) mention that they are reluctant to devise NI market strategies until they’re sure the trading conditions will stabilise. Overall, the Windsor Framework’s evolving nature has introduced a strategic planning paralysis for many small companies. Until businesses have confidence that the “rules of the game” will remain consistent, or that they at least fully understand them, their willingness to take risks and expand is limited.

“It has significantly impacted my business. We have forked out the money to improve our systems and update our equipment and software ready for regulations, but years on, it’s

still not clear that at the ports, authorities know what an ‘at risk’ or ‘not at risk’ good is.

We’ve had perfectly good stock held up for long periods of time, keeping staff working longer, keeping materials held up longer.” Quote from a small business operating in the manufacturing sector, headquartered in England.

Many NI respondents explicitly tied their lack of confidence to political uncertainty (the unresolved governance of the arrangements, and the previous absence of a functioning NI Executive) on top of the Windsor Framework’s technical aspects. In contrast, some respondents from elsewhere in the UK, whose exposure to the Windsor Framework might be indirect, felt more optimistic, often because they could choose to “wait and see” or easily pivot away from NI trade if needed. This creates an uneven landscape where NI’s domestic entrepreneurs are carrying the greatest burden of uncertainty.

In summary, these findings paint a picture of hesitant, risk adverse strategy-setting among small businesses. Confidence in short-term planning is low, inhibiting everything from hiring to capital investments. If business confidence is to improve, government must act to reduce regulatory burdens and signal stability.

Recommendations

The survey results point to clear areas where government action is needed. Below, we set out targeted, actionable recommendations directed at the UK Government, the Northern Ireland Executive, and their relevant agencies. Implementing these measures will help reduce friction, restore business confidence, and unlock the Windsor Framework’s intended economic benefits. The overarching theme is the need for a shift from firefighting problems to proactively enabling trade and opportunity.

A significant cohort of businesses, particularly SMEs, are either already experiencing disruption or unsure of their future position, suggesting a strong need for: clearer communication, targeted support, monitoring of sectoral impacts as grace periods expire, and a wider political ambition to reach better agreements that will ultimately address the root causes of the challenges being experienced.

Actions to reduce friction and restore confidence

1. Pursue a relentless drive to reduce barriers: As FSB NI13 urged in recent parliamentary evidence, Westminster should make it an explicit policy goal to simplify and strip back any unnecessary bureaucracy in the Windsor Framework’s operation. This means working intensively with the EU to lighten the burden of compliance (e.g. seeking flexibility or equivalences on remaining SPS checks, parcel documentation, etc.) and unilaterally streamlining UK processes. Continuous improvement of the green lane system should be prioritised so that it becomes truly seamless for traders

2. Simplify forms and processes: A mapping process should be undertaken of all agencies which have regulatory or compliance influence or control with respect to the Windsor Framework. Thereafter, these agencies should review all compliance processes in which SMEs must engage (from customs declaration forms to registration processes such as the UK Internal Market Scheme) and extensively

13 https://committees.parliament.uk/work/9002/strengthening-northern-irelands-voice-in-the-context-of-the-windsorframework/publications/

simplify them. Use plain language, remove redundant data fields, and introduce smart automation where feasible. For example, if a micro-business is sending parcels, an app or simple web form could be adopted to replace the standard full customs form for low-risk goods. Embrace a risk-based approach that genuinely streamlines requirements for the smallest and lowest-risk shipments.

3. Enhance the Trader Support Service (TSS): Improve the usability and clarity of the TSS to better meet the needs of small businesses, ensuring guidance is timely, accessible and easy to navigate. This means making the interface more user-friendly for small traders, providing rapid one-to-one assistance (a helpline that answers promptly, with experts on NI trade) and fixing the “guessing game” elements by offering clearer step-by-step guidance for common shipment types.

Improving support, guidance and SME accessibility

4. Centralise guidance for SMEs: Government must streamline the Windsor Framework’s implementation through accessible and consolidated advice. A single, regularly updated online hub supported by webinars, helplines and sector specific briefings is essential. Currently, one query or complaint from a business can be passed around multiple agencies. Our recommendation is to implement a “single window” approach for Windsor Framework compliance queries – whether a question is about VAT, agri-food rules, or customs, the business should have one point of entry to the agencies that will then sort it out internally. This requires strong coordination between HMRC, DEFRA (for GB) / DAERA (in NI), and others. Regular joint briefings and unified guidance documents will ensure consistency. Essentially, present a “single front” to the user.

5. Improve communication and outreach: The newly launched Business Growth Service14 presents an opportunity to review Government communications15 and launch a targeted campaign to explain the Windsor Framework clearly, consistently

14 https://www.gov.uk/government/news/government-growth-service-to-save-small-business-time-and-money

15 https://www.fsb.org.uk/resources/policy-reports/ready-to-dispatch-MCUFJTZB443JC3LO4EXNMF524THQ

and repeatedly to SMEs. This involves launching an extensive information campaign clarifying what dual market access means, how NI businesses can benefit, and reassuring GB businesses that “Northern Ireland remains an open and easily accessed part of the UK Internal Market”. Practical, plain-English guides and decision tools should be developed for SMEs – e.g. a simple online checker: “Do these new rules apply to my business?” or “What rules apply to the process I am trying to undertake for my business?” All guidance should be consolidated on a onestop portal, regularly updated, and actively pushed out via business organisations, social media, and direct mailings.

6. Expand tailored SME support across the UK: Micro and small firms require support in formats they can access and trust, including one-to-one assistance, local engagement events and clear step-by-step compliance guides. Windsor Framework advice could be offered to any business that needs help mapping out solutions. For example, helping a small retailer figure out new supply options, or an agrifood firm to navigate export certification. This should be coordinated by the UK Government, working in conjunction with the devolved governments and should ensure that every business in the UK knows where to turn for help No one should be unaware of available support due to lack of publicity.

Maximise opportunity and economic potential

7. Promote dual market access: Using real-world case studies and clearer messaging. The NI Executive should take ownership of maximising the dual market advantage for local firms. This means setting up a dedicated taskforce (with industry representation) to identify sectors with high EU export potential and to coordinate support for them. Organise regular trade delegations to go EU Member States demonstrating what is available in Northern Ireland, to ensure that the full benefits of dual market access are understood and capitalised upon

8. Position Northern Ireland as a gateway for trade: Using its unique status as a ‘nursery slope’ for GB businesses preparing to export to the EU, as well as for rest of

the world businesses seeking a location to access both the UK and EU markets, Government should leverage NI’s unique status in its overarching UK trade strategy. Rather than seeing NI merely as a problem area, the UK Government should actively promote NI’s dual market access as a strategic opportunity, championing it in global trade promotion activities. The Prime Minister and Secretaries of State should articulate a vision of NI as a hub (one we’ve analogised as a potential “Singapore of the Western Hemisphere” if properly enabled). Placing Northern Ireland centrally in the UK’s global trade ambitions should go a considerable way towards counterbalancing the negative effects that other restrictions arising from its unique status have brought.

9. Secure supplementary agreements with the EU: The UK-EU reset agreement of May 2025 was a positive first step in this trajectory, holding the potential to reduce bureaucracy, and reverse the trend of GB firms withdrawing from the Northern Ireland market. However, key issues persist, such as GPSR, parcel movement requirements, the continuing absence of an agreement on veterinary medicines, and the continued rollout of ‘Not for EU’ labelling, despite agreed plans that should obviate the need for it under the new deal. Diplomatically, the UK Government should seek to build on the Windsor Framework with further agreements that eliminate pain points. High on the list should be conclusion of a comprehensive SPS/veterinary agreement to reduce food and agricultural trade frictions (benefitting NI greatly and UK food exporters broadly) and an arrangement on mutual recognition of professional qualifications in order to increase the services trade. As the changes are not yet legally binding, the UK Government should instill a sense of urgency to deliver the final agreement without delay, because every additional alignment or understanding reached with the EU will lighten the load on NI businesses and encourage GB-NI trade.

Long term structural reform and monitoring

10.Improve monitoring and interpretation of regulatory divergence: Strengthen cross-

government coordination to monitor, explain and respond to evolving UK-EU regulatory divergence, helping businesses anticipate changes and adapt in real time. Currently, the process is undertaken piecemeal by various departments and it provides little or no foresight of changes to allow businesses to prepare and adapt. SMEs are especially vulnerable to divergence, often lacking the resources to interpret and adapt to change in real time, and this disjointed approach not only burdens businesses with uncertainty, but it also risks the UK Government missing key opportunities to shape divergence to its advantage.

11.Provide a single, centralised source for UK-EU trade rules: Ensure businesses have access to up-to-date, clear and centralised guidance on applicable UK and EU trade rules, including real-time updates and practical decision tools. No single existing body currently has the capacity to monitor, understand and address the fast-paced, technical nature of divergence under the Windsor Framework. Such a service have sufficient capacity to provide effective horizon scanning and real-time guidance accompanied by a clear route to escalate unresolved or unclear issues.

12.Improve data and transparency: Government agencies should publish regular updates on trade flows and compliance issues under the Windsor Framework Sharing statistics on, for example, the number of consignments using the green lane, average processing times, number of firms registered in schemes, can help identify holdups and build confidence that things are under control or highlight where problems are building. It will also allow performance tracking of the system, highlighting where further changes are necessary. Such transparency can reassure businesses (e.g., if they see 99% of parcels are going through smoothly, they may be less anxious about engaging in NI trade).

In implementing these recommendations, it’s important that policymakers maintain a sense of urgency. The survey responses make clear that delays in action have real costs: lost trade, lost trust, and lost opportunities. By moving swiftly to enact these proposals, the UK Government and Northern Ireland Executive can demonstrate to the small business

community that they are listening and acting

The Windsor Framework is a complex solution to a complex problem. It will never be entirely effortless for businesses but, with political will and administrative focus, it can be made significantly better. The ultimate aim should be a situation where small businesses in Belfast, Manchester, Glasgow or Cardiff can genuinely trade seamlessly with each other as part of the UK Internal Market, as easily as before, and where Northern Ireland’s dual market access is a reason to invest and grow, not to retreat. Achieving this will require continued collaboration between governments and the business community but the prize of success is great; whilst failure cannot be an option.

Conclusion

This report has provided a comprehensive overview of how the Windsor Framework is actually impacting small businesses, grounded in direct survey evidence from those living with its effects. The findings are clear: whilst the Windsor Framework has succeeded in avoiding some worst-case trade disruptions, it has introduced new frictions and uncertainties that weigh heavily on SMEs. For many businesses in Northern Ireland, the promised economic advantages of dual market access remain frustratingly out of reach, overshadowed by practical difficulties in moving goods across the Irish Sea. For businesses in Great Britain, the added complexity and costs have, in too many cases, led them to scale back engagement with the NI market. These outcomes serve neither the spirit nor the intention of the Windsor Framework.

However, the message is not one of inevitable decline; it is a call to action. The survey respondents, through their feedback and comments, have pointed out solutions and opportunities as well as problems. They ask for clearer guidance, simpler processes, and meaningful support. They want to see Government champion Northern Ireland’s unique position, not just manage it as a problem. There is a genuine appetite among the business community to make the best of the Windsor Framework by seeing the playing field levelled and the rules of the game made fair and transparent.

FSB, for its part, will continue to advocate for the interests of small businesses as the

Windsor Framework evolves. We will work constructively with the UK Government, the NI Executive, and international partners to share these findings and push for the supportive measures outlined. The Windsor Framework is not a one-time event, but an ongoing process, one that must remain responsive to the needs of those it affects.

By taking the necessary steps, policymakers can alleviate the current pains and pave the way for the Windsor Framework’s promise to be fully realised, a future where Northern Ireland truly enjoys the “best of both worlds” and where doing business across all parts of the UK is as seamless as it should be.

Without immediate action, the Windsor Framework risks becoming a policy defined by missed opportunities, lost trade and disproportionate impacts on the smallest firms. A proactive response, led by the Government, and delivered in partnership with industry, is essential to unlocking its full potential and preserving trust in the UK Internal Market

Methodology

This survey was conducted online from the 1st – 22nd April 2025. The survey was promoted through FSB’s networks and social media, targeting small business owners across the UK, with a particular focus on those engaged in trade between NI and GB. It was an online questionnaire comprised of a mix of multiple-choice and open-ended questions, allowing respondents both to quantify impacts and to provide commentary in their own words.

Key topics covered include; business engagement in NI-GB trade (to filter relevant respondents), the level of understanding of Windsor Framework provisions, the extent of impact on operations and the UK Internal Market, expectations of future impact as remaining phases roll out, actions taken by firms to mitigate the Windsor Framework’s effects and confidence levels in forward planning

An open-ended question invited respondents to share their biggest concerns or opportunities related to the Framework. Throughout the survey, ‘skip logic’ was used to direct respondents to relevant sections (for example, those not trading between GB and NI

could bypass certain detailed questions).

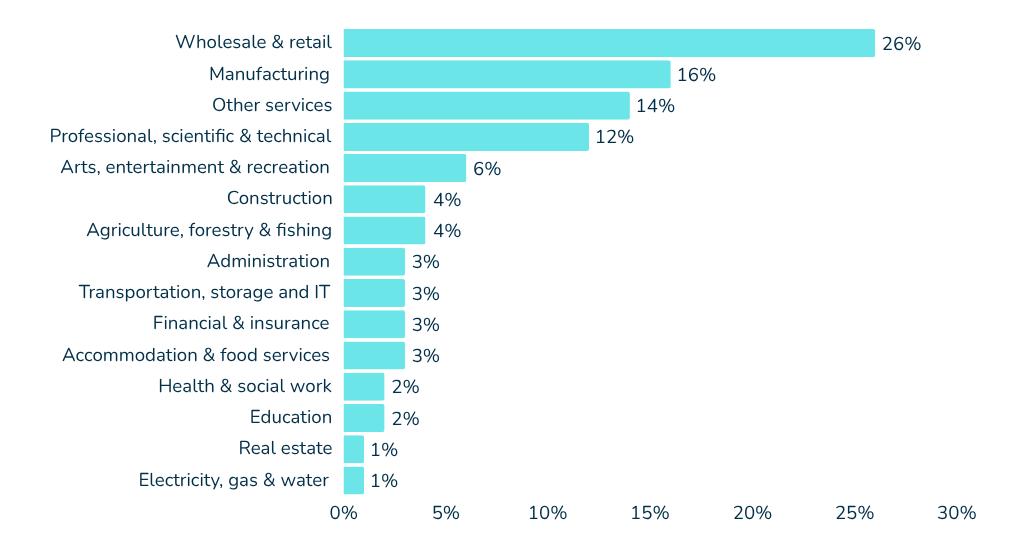

A total of 778 responses were received, spanning all regions of the UK. The majority of responses came from businesses headquartered in England (73%), followed by Northern Ireland (13%), Scotland (11%) and Wales (3%) and a few outside the UK. The sectoral mix was broad: the most represented industries were Wholesale/Retail (25%) and Manufacturing (16%), followed by professional services, construction, agriculture, arts/entertainment, and others. Businesses of all sizes participated, from sole traders to firms with over 250 employees, though the majority (around 96%) were small businesses with under 50 employees. This diverse sample provides a robust cross-section of enterprises likely to be affected (or unaffected) by the Windsor Framework.

Responses were analysed both quantitatively (with summary statistics and crosstabulations between NI-based and GB-based businesses, and by sector where noteworthy) and qualitatively (with thematic coding of comments). Given the survey’s mix of UK-wide and NI-specific respondents, comparisons were drawn between Northern Ireland vs Great Britain respondent groups to identify regional divergences. All data was self-reported by businesses and, while not a fully random sample, it closely aligns with FSB’s membership profile and known affected sectors. Selected anonymous quotes from respondents are included in this report to illustrate common sentiments, grouped by sector and location. These provide qualitative depth and human context to quantitative findings. The data has not been weighted We understand that businesses are more likely to respond to the survey if they have been affected by the Windsor Framework which could potentially mean that some of the percentages will be overstated compared to the total business population.