Employee Benefits Guide

Our Employees are our Most Valuable Asset

That’s why at ProNet Group we are committed to a comprehensive employee benefits program that helps our employees stay healthy, feel secure, and maintain a work/life balance.

This booklet is designed to provide you with information to make enrollment decisions that best meet your needs. The booklet highlights key features of the benefits program and will answer many of your immediate questions. Please review this booklet carefully. If you have questions, please contact Human Resources .

The information in this Benefits Guide is designed to provide an overview of the benefits offered through ProNet Group. Official plan documents, policies and certificates of insurance contain the details, conditions, maximum benefit levels and restrictions on benefits. These official documents govern your benefits program. If there is any discrepancy between the Benefits Guide and the official documents, the official documents prevail. These documents are available upon request through the Human Resources Department. Information provided in this brochure is not a guarantee of benefits. ProNet Group reserves the right to modify, change, revise, amend or terminate these benefits plans at any time.

Benefits Offered

Medical

Employees are offered the choice between a Traditional PPO plan and an HSA eligible plan through UHC . Employees that enroll in the HSA Medical plan are provided an HSA banking account with funding. ProNet Group pays 100 % of the employee premium and 50 % of dependent premium.

Dental

Employees are offered a Guardian PPO plan. ProNet Group pays 100 % of the employee premium. Employees pay 100 % of any dependent premium.

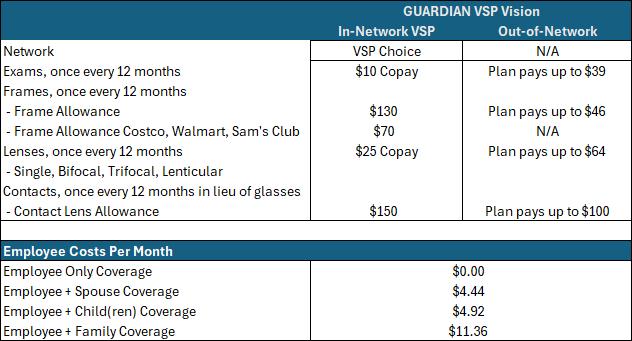

Vision

Employees are offered a Guardian / VSP PPO plan. ProNet Group pays 100 % of the employee premium. Employees pay 100 % of any dependent premium.

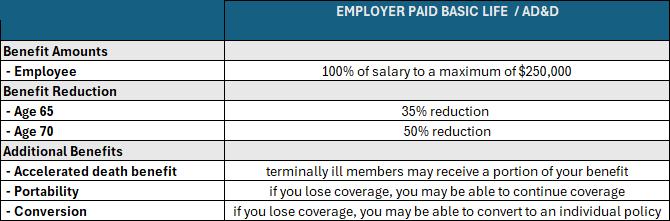

Life / AD&D

Employees are provided a Basic Life / AD&D policy of 1 times salary through Guardian. Employees may purchase additional Supplemental Life /AD&D through Guardian.

Disability

Employees are provided Long-Term Disability through Guardian. Employees may purchase Short-Term Disability coverage through Guardian.

Employee Assistance Program

All employees and their dependents are provided access to the Guardian Employee Assistance program with 24/7 counseling.

Eligibility, Enrollment, & Mid-Year Changes

Who is Eligible and when?

If you are a Full-Time employee (working 30 or more hours per week), then you are eligible to enroll in the benefits described in this guide. If you are hired as a Part-Time, Variable, or Seasonal employee, you are not eligible for benefits and will be placed in an initial measurement period to determine your eligibility after a period of 11 months.

Eligible Dependents

Eligible dependents include your spouse, domestic partner or a dependent child (up to age 26). The term child includes any of the following: A natural child, stepchild Legally adopted child,a child placed for adoption

A child for whom legal guardianship has been awarded to the subscriber or subscriber’s spouse

A grandchild of the subscriber who is a dependent of the subscriber for federal income tax purposes at the time the application for coverage of the grandchild is made

A dependent child of any age who is medically certified as disabled

New Hire

For new hires, coverage begins on the first day coinciding with or following 30 days of your Date of Full-Time hire.

Enrollment must be submitted within 31 days of your date of FullTime hire.

A note on Domestic Partners: There are tax consequences for enrolled domestic partners due to IRS regulations. The payroll deduction amounts associated with the coverage of your domestic partner and their dependents will be made on an after-tax basis. Likewise, the amounts that ProNet Group pays towards their coverage will be considered taxable income and reported as such on your W - 2.

Eligibility, Enrollment, & Mid-Year Changes

Open Enrollment Period

During the Annual Enrollment Period, eligible employees can enroll themselves and their dependents or make changes to their enrollments outside of a qualifying life event.

Coverage or any changes to coverage begins on January 1st.

The premium to pay for certain elected coverages is deducted before taxes in accordance with Section 125 of the IRS Code. As a result, the elections are binding and cannot be modified until the next enrollment period, unless there is a qualifying event resulting in a change of status.

Eligibility for Change in Status (Qualifying Life Event)

To be eligible to make a change in your benefit elections, one or more of the following qualifying events must have occurred:

Birth

Loss of coverage under another group plan

Court or administrative order

Gaining eligibility under another group plan

Legal adoption

Marriage or Divorce

Establishment or dissolution of a Domestic Partnership

Medical and Prescription Benefits

United Healthcare (UHC)

Provider Network: Choice Plus (All plans)

Our UHC plans are PPO plans where you may see the provider of your choice. However, the benefits are significantly richer when you see an in-network provider. Covered Out- ofNetwork claims will be subject to a higher deductible and will be reimbursed at 70% of the in-network negotiated rate. For out-of-network benefits, please refer to the Summary of Benefits and Coverage.

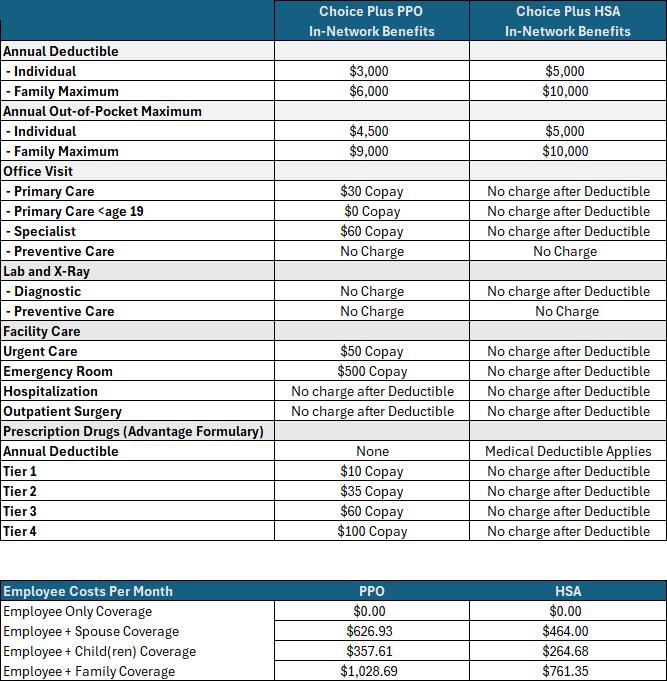

UHC Plans: PPO & HSA

Health Savings Accounts

Optum Financial

For employees enrolled in the HSA eligible medical plan

A Health Savings Account is a tax favored banking account that allows you to set aside funds for medical expenses on a pre-tax basis. It is used in conjunction with an HSAcompatible health plan.

The IRS has specific rules regarding HSA Bank account eligibility. In addition to being enrolled on an HSA eligible medical plan you must also not be covered by other nonHSA health insurance. This includes Medicare.

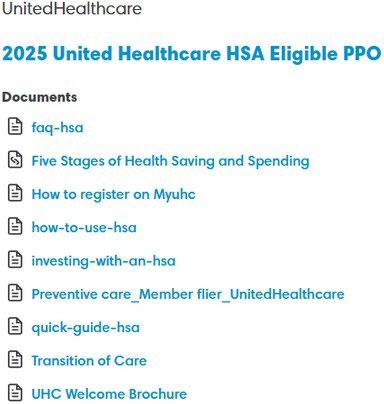

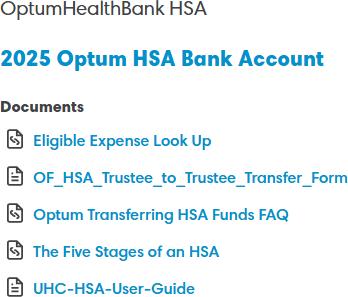

Optum Financial will be the HSA Bank Account for 2025. Those enrolled in the HSA eligible medical plan will have an account established for them. Please be on the look out for materials and information from Optum Financial. A debit card will be sent to you via USPS.

The Patriot Act requires the bank to validate your identity, and it is sometimes necessary to collect additional forms of identification. If you receive an email from optumfinancial.com, please be sure to respond in a timely manner.

If you have a current HSA account with another bank, please reach out to Human Resources to receive the transfer of assets form to request your funds be transferred. You will need to wait until your account number has been assigned.

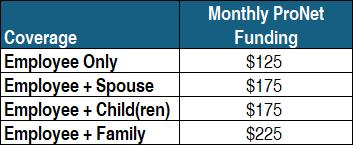

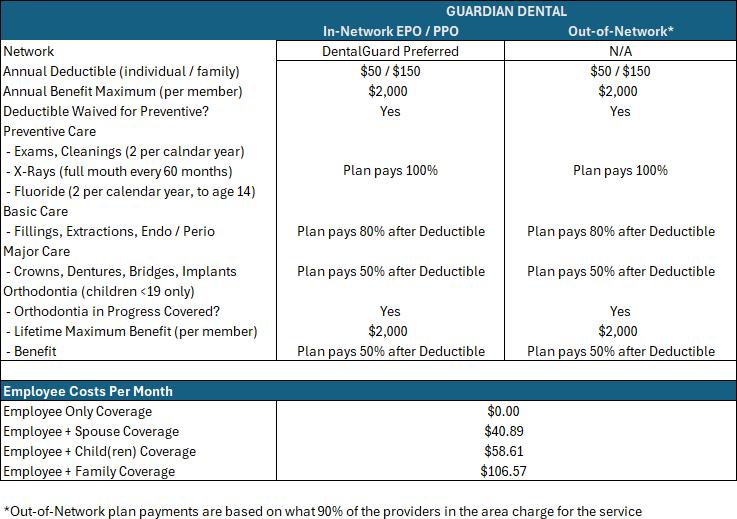

Health Savings Account Funding

With our HSA eligible medical plan, all non-preventive care is subject to the annual deductible. While your covered in-network preventive care is provided at no cost, all other services, including prescriptions, will be paid by you until your annual deductible of $5,000 is met. Families have a $10,000 deductible.

ProNet Group makes a monthly contribution into your HSA account to help with these expenses.

Funds in your HSA account are vested immediately and do not expire. While you may only contribute to an HSA bank account while enrolled in an HSA eligible medical plan, you may continue to use the deposited funds for eligible expenses even if you enroll in a non-HSA eligible medical plan at a later date.

You may also elect to contribute to your HSA account through pre-tax payroll deductions. The IRS establishes annual limits for funding (which include the ProNet employer contributions).

Employees that are 55 or older may add an extra $1,000 to the above.

Your contributions are tax free going in, tax free coming out, and grow tax free if you invest.

The IRS releases Publication 502 annually which establishes which expenses are eligible to be reimbursed from your HSA account. Optum Financial will not request documentation from you for reimbursement but you will want to keep your receipts in case you are audited. https://www.irs.gov/pub/irs-pdf/p502.pdf

United Healthcare Rewards Program

For those enrolled in our United Healthcare Medical Plans

Preventive Care Benefits

https://www.uhc.com/health-and-wellness/preventive-care

ANNUAL PHYSICALS & PREVENTIVE CARE

Preventive Care Physicals are covered under this group health plan at 100 % . Due to the Health Care Reform, when the primary purpose of your visit is for preventive care you will not have a charge for annual physicals, routine gynecological visits, and well-child exams if you see a participating provider. That means no copayment, no coinsurance and you do not have to meet your deductible first when using an in-network provider. Visit cdc.gov/prevention for recommended guidelines.

Important: Services will not be considered preventive if they are part of a visit to diagnose, monitor or treat an already existing symptom, illness or injury; or, if you utilize an out-of- network provider and/or facility for part of the visit or tests. If you discuss existing symptoms or issues during your preventive visit, the physician might file the claim as diagnostic services resulting in you having outof-pocket costs.

To help you make sure that your preventive visit is covered 100%, we have provided the following tips when scheduling your next preventive care visit and/or while you are at the physician’s office.

PREVENTIVE CARE TIPS

When you schedule your appointment, explain you are coming in for your annual preventive care physical and that it should be covered 100% by your insurance. Remember, not all screenings and tests are considered medically necessary, and some have age limits before they are recommended for preventive care and covered 100%.

While at your visit, if you mention to your physician that you are experiencing specific symptoms or issues the purpose of your visit could change from preventive to diagnosing a symptom and/or illness. You may need to schedule a separate appointment for symptoms you are already experiencing to ensure the testing is coded as preventive care and covered 100%. DO NOT ignore current symptoms or issues and schedule that appointment as soon as possible. Confirm your physician is in-network with your health plan.

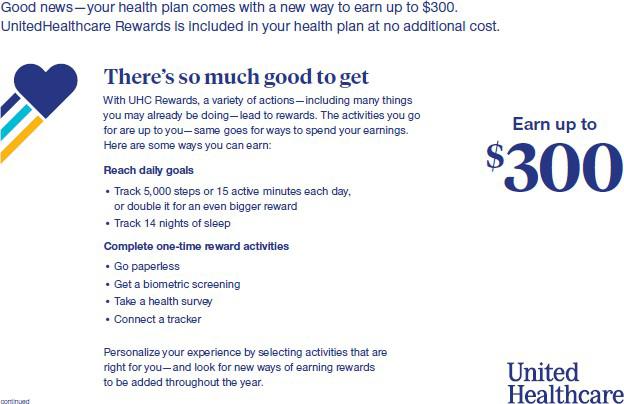

Dental

Guardian

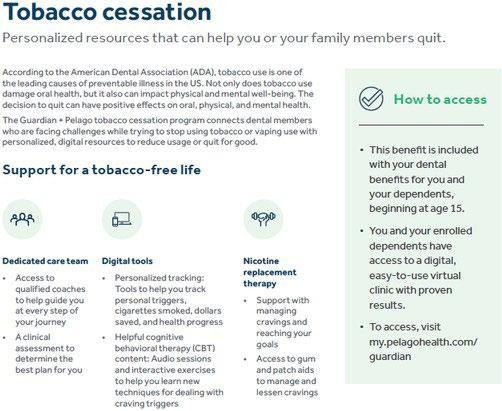

employees enrolled in the Guardian dental plans have free access to the pelago tobacco cessation program.

Vision Guardian (Provider Network VSP)

DID YOU KNOW?

Did you know your eyes can tell an eye care provider a lot about you? In addition to eye disease, a routine eye exam can help detect signs of serious health conditions like diabetes and high cholesterol. This is important, since you won’t always notice the symptoms yourself and since some of these diseases cause early and irreversible damage. Your vision plan provides professional vision care and high quality lenses and frames through a broad network of optical specialists. You will receive richer benefits if you utilize a network provider. If you utilize a non- network provider, you will be responsible to pay all charges at the time of service and file an itemized claim with your vision carrier.

Group Term Life & AD&D

The company provides every benefits eligible employee with a Term Life Insurance policy. The Accidental, Death and Dismemberment (AD&D) plan, pays a benefit in the event of death as a result of an accident. The policy also offers an accelerated death benefit, waiver of premium for disability, and conversion options in the event your employment ends. Coverage is automatic and requires no election by the employee.

DESIGNATING A BENEFICIARY

You must name the person(s) or entity to receive benefits in the event of your death.The beneficiary designation applies to your Group Term Life and AD&D Insurance, as well as your supplemental life, LTD, and HSA Bank account. As you make your open enrollment selections, please take a moment to review your beneficiaries update where necessary.

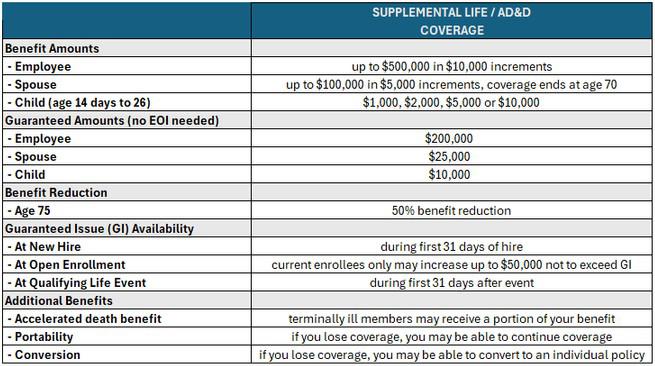

Supplemental Life & AD&D

Guardian

Voluntary, Optional or Supplemental Term Life Insurance coverage is a100% employeepaid benefit that helps employees and their dependents gain extra protection to fit their personal insurance needs. The employee must enroll in the supplemental life for the spouse and/or dependents to be enrolled.

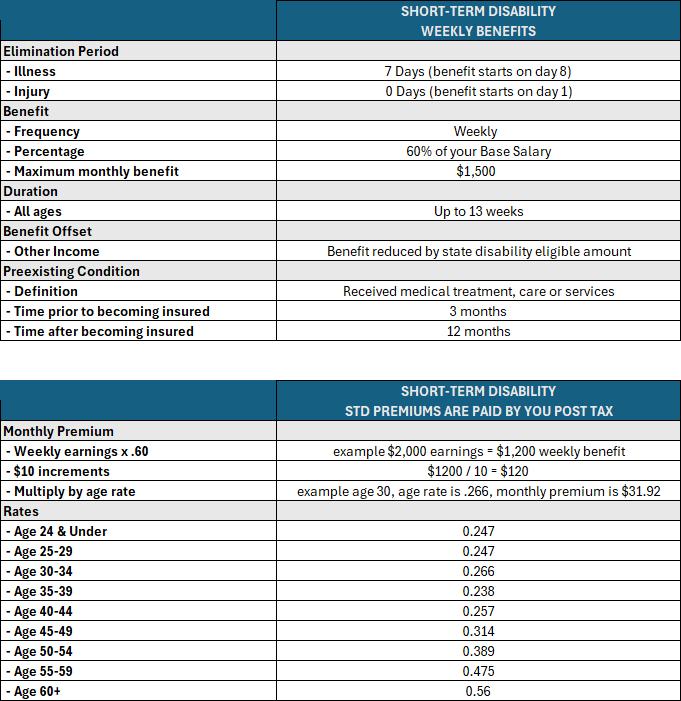

Voluntary Short-Term Disability

Guardian

Short-Term Disability (STD) insurance can help replace a portion of your income during the initial weeks of a disability to help you pay your bills and help maintain your current lifestyle. It helps by protecting you, and your income if a sickness or accidental injury kept you from working.

DO YOU NEED DISABILITY INSURANCE?

The short answer is “yes.” If your family relies on your income, you need disability insurance. According to the Affordable Insurance Protection website, over the course of your career, you are three and a half times more likely to be injured and need disability coverage than you are to die during your working days and need life insurance. You never know when you might suffer a temporary or permanent disability. Evidence of Insurability (EOI) or Proof of Good Health is the documentation of good health condition in order to be approved if you did not apply for coverage within the 30-day eligibility period from date of hire, or this initial offer.

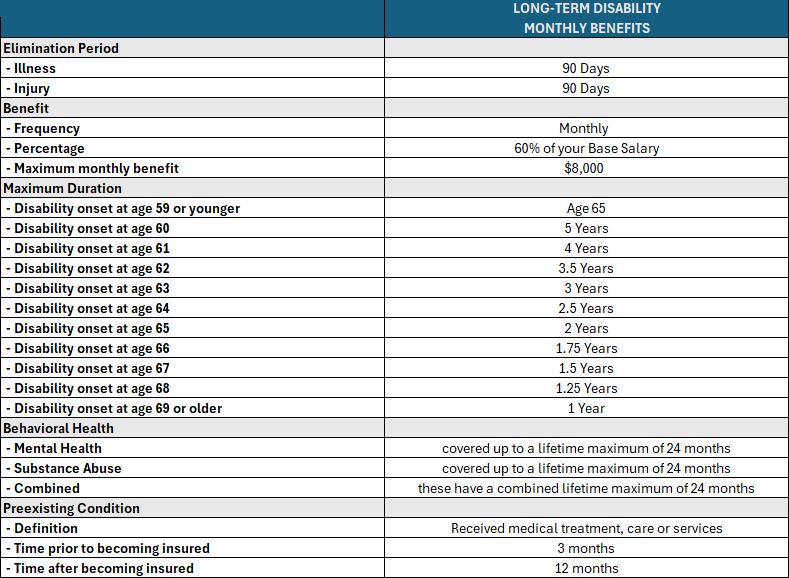

Long-Term Disability

Long-Term Disability (LTD) insurance helps replace a portion of your monthly income for an extended period of time. It is designed to assist you pay your bills and help maintain your current lifestyle. It helps by protecting you, and your income if a sickness or accidental injury kept you from working. These plans are being made available to you through ProNet Group at no additional cost.

Employee Assistance Program

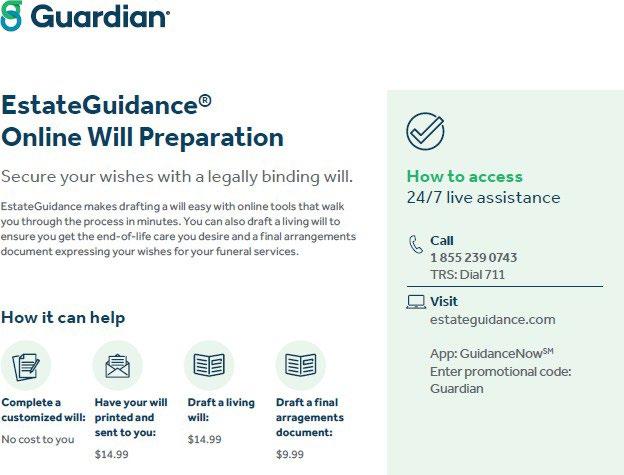

Additional Benefits

Additional Benefits