HILLSBORO

Higginbotham Public Sector (833) 825-6445 www.mybenefitshub.com/hillsboroisd hillsboroisd@hps.higginbotham.com

EECU (817) 882-0800 www.eecu.org

Lincoln Financial Group Group #73951 (800) 423-2765 www.lfg.com

American Public Life Group #19432 (800) 256-8606 www.ampublic.com

TRS Medical - BCBSTX (866) 355-5999 www.bcbstx.com/trsactivecare

Lincoln Financial Group (800) 423-2765 www.lfg.com

Superior Vision Group #323900 (800) 507-3800 www.superiorvision.com

Lincoln Financial Group (800) 423-2765 www.lfg.com

BASIC AND VOLUNTARY LIFE INDIVIDUAL LIFE

Lincoln Financial Group Group #76017 (800) 423-2765 www.lfg.com

MASA

Group #MKHILS (800) 423-3226 www.masamts.com

National Benefit Services (855) 399-3035 www.nbsbenefits.com

Higginbotham (877) 278-5419 www.higginbotham.com

5Star Life Insurance Company Group #2269 (866) 863-9753 http://5starlifeinsurance.com

Higginbotham (866) 419-3519

https://flexservices.higginbotham.net Flexclaims@higginbotham.com

National Benefit Services (855) 399-3035 www.nbsbenefits.com

Clever RX Group ID: 1085 (800) 873-1195

http://www.cleverrx.com/hillsboroisd

Express Scripts (844) 238-8084 https://express-scripts.com/trsactivecare

MDLIVE (888) 365-1663 www.mdlive.com/fbs

AUL a OneAmerica Company Group #615889 (800) 537-6442 https://www.oneamerica.com

Unum Group #474622 (800) 635-5597 www.unum.com

THEFT MONITORING

Identity Guard (855) 443-7748 www.identityguard.com

LegalShield (800) 654-7757 www.legalshield.com

National Benefit Services (855) 399-3035 www.nbsbenefits.com

1

2

3

www.mybenefitshub.com/hillsboroisd

4

CLICK LOGIN

5

Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

For supplemental benefit questions, you can contact your Benefits department or you can call Higginbotham Public Sector at (833) 825-6445 for assistance.

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/ hillsboroisd. Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

For benefit summaries and claim forms, go to the Hillsboro ISD benefit website: www.mybenefitshub.com/hillsboroisd. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can login to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card.

If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefit Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Supplemental Benefits: Eligible employees must work 20 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2025 benefits become effective on September 1, 2025, you must be actively-at-work on September 1, 2025 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

To age 26

To Age 26 Telehealth To Age 26

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector, LLC from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your Benefit Office to request a continuation of coverage.

Description

(IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employee’s names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

(IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax- free.

Employer Eligibility A qualified high deductible health plan. All employers

Contribution Source Employee and/or employer

Account Owner Individual

Underlying Insurance

Requirement High deductible health plan

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

Year-to-year rollover of account balance?

Does the account earn interest?

Portable?

$1,650 single (2025)

$3,300 family (2025)

$4,300 single (2025)

$8,550 family (2025)

55+ catch up +$1,000

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

Employee and/or employer

Employer

None

N/A

$3,300 (2025)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Yes, will roll over to use for subsequent year’s health coverage.

Yes

Yes, portable year-to-year and between jobs.

No. Access to some funds may be extended if your employer’s plan contains a 2 1/2-month grace period or $660 rollover provision.

No

No

website: www.mybenefitshub.com/hillsboroisd

• PREMIUM: The monthly amount you pay for health care coverage.

• DEDUCTIBLE: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• COPAY: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• COINSURANCE: The portion you’re required to pay for services after you meet your deductible. It’s often a specifed percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• OUT-OF-POCKET MAXIMUM: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

100% FREE to use

Unlock discounts on thousands of medications

Save up to 80% off prescription drugs – often beats the average copay

Accepted at most pharmacies nationwide

For full plan details, please visit: partner.cleverrx.com/hillsboroisd

With Clever RX, you never have to overpay for prescriptions. When you use the Clever RX card or app, you get up to 80% off prescription drugs, discounts on thousands of medications and usage at most pharmacies nationwide.

STEP 1

Download the free Clever RX app and enter these numbers during the onboarding process:

• Group ID 1085

• Member ID 3956

STEP 2

Use your ZIP code to find a local pharmacy with the best price for your medication - up to 80% off!

STEP 3

Click the voucher with the lowest price, closest location, and/or at your preferred pharmacy and show the voucher to the pharmacist.

Call Clever RX Customer Service at (800) 873-1195

A Health Savings Account (HSA) is a personal savings account where the money can only be used for eligible medical expenses. Unlike a flexible spending account (FSA), the money rolls over year to year however only those funds that have been deposited in your account can be used. Contributions to a Health Savings Account can only be used if you are also enrolled in a High Deductible Health Care Plan (HDHP).

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

A Health Savings Account (HSA) is a tax-exempt tool to supplement your retirement savings and to cover current and future health costs.

An HSA is a type of personal savings account that is always yours even if you change health plans or jobs. The money in your HSA (including interest and investment earnings) grows tax-free and spends tax-free if used to pay for current or future qualified medical expenses. There is no “use it or lose it” rule — you do not lose your money if you do not spend it in the calendar year — and there are no vesting requirements or forfeiture provisions. The account automatically rolls over year after year.

Use it Now

• Make annual HSA contributions.

• Pay for eligible medical costs.

• Keep HSA funds in cash. Let it Grow

• Make annual HSA contributions.

• Pay for medical costs with other funds.

• Invest HSA funds.

If you are age 55 or older, you may make a yearly catch-up contribution of up to $1,000 to your HSA. If you turn 55 at any time during the plan year, you are eligible to make the catch-up contribution for the entire plan year.

• Have your in-network doctor file your claims and use your HSA debit card to pay any balance due.

• You must keep ALL your records and receipts for HSA reimbursements in case of an IRS audit.

• Only HSA accounts opened through our plan administrator are eligible for automatic payroll deduction.

You are eligible to open and contribute to an HSA if you are:

• Enrolled in an HSA-eligible HDHP

• Not covered by another plan that is not a qualified HDHP, such as your spouse’s health plan

• Not enrolled in a Health Care Flexible Spending Account

• Not eligible to be claimed as a dependent on someone else’s tax return

• Not enrolled in Medicare, Medicaid, or TRICARE

• Not receiving Veterans Administration benefits

• $4,300 Individual

• $8,550 Family

HSA contributions are tax-deductible and grow taxdeferred. Withdrawals for qualifying medical expenses are tax-free.

• Register for an account at www.eecu.org

• Call (817) 882-0800

This is an affordable supplemental plan that pays you should you be inpatient hospital confined. This plan complements your health insurance by helping you pay for costs left unpaid by your health insurance.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

The Hospital Indemnity plan helps you with the high cost of medical care by paying you a cash benefit when you have an inpatient hospital stay. Unlike traditional insurance which pays a benefit to the hospital or doctor, this plan pays you directly. It is up to you how you want to use the cash benefit. These costs may include meals, travel, childcare or eldercare, deductibles, coinsurance, medication, or time away from work. See the plan document for full details.

Telehealth provides 24/7/365 access to board-certified doctors via telephone or video consultations that can diagnose, recommend treatment and prescribe medication. Telehealth makes care more convenient and accessible for non-emergency care when your primary care physician is not available.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Alongside your medical coverage is access to quality telehealth services through MDLIVE. Connect anytime day or night with a board-certified doctor via your mobile device or computer. While MDLIVE does not replace your primary care physician, it is a convenient and cost-effective option when you need care and:

• Have a non-emergency issue and are considering a convenience care clinic, urgent care clinic or emergency room for treatment

• Are on a business trip, vacation or away from home

• Are unable to see your primary care physician

At a cost that is the same or less than a visit to your physician, use telehealth services for minor conditions such as:

• Sore throat

• Headache

• Stomachache

• Cold

• Flu

• Allergies

• Fever

• Urinary tract infections

Do not use telemedicine for serious or life-threatening emergencies.

Registration is Easy Register with MDLIVE so you are ready to use this valuable service when and where you need it.

• Online – www.mdlive.com/fbs

• Phone – (888) 365-1663

• Mobile – download the MDLIVE mobile app to your smartphone or mobile device

• Select – “MDLIVE as a benefit” and “FBS” as your Employer/Organization when registering your account

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease. For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Visit LincolnFinancial.com/FindADentist

• Location

• Dentist name or office name

• Distance you are willing to travel

• Specialty, language and more

Your search will automatically provide up to 100 dentists that most closely match your criteria. If your search does not locate the dentist you prefer, you can nominate one—just click the Nominate a Dentist link and complete the online form.

Calendar (Annual) Deductible

Deductibles are combined for basic and major Contracting Dentist’s services.

Deductibles are combined for basic and major Non-Contracting Dentist’s services.

Annual Maximum

Individual: $50; Family: $150 Waived for: Preventive

Individual: $50; Family: $150 Waived for: Preventive

MaxRewards® lets you and your covered family members roll a portion of unused dental benefits from one year into the next. So you have extra benefit dollars available when you need them most.

Lifetime Orthodontic Max

Orthodontic Coverage is available for dependent children and adults.

Waiting Period There are no benefit waiting periods for any service types. Preventive Services

Routine oral exams, Bitewing X-rays, Full-mouth or panoramic X-rays, Other dental X-rays (including periapical films), Routine cleanings, Fluoride treatments, Space maintainers for children, Sealants, Problem focused exams, Palliative treatment (including emergency relief of dental pain)

Basic Services

Consultations, Injections of antibiotics and other therapeutic medications, Prefabricated stainless steel and resin crowns, Surgical extractions Oral surgery, Biopsy and examination of oral tissue (including brush biopsy), General anesthesia and I.V. sedation, Prosthetic repair and recementation services Endodontics (including root canal treatment), Periodontal maintenance procedures, Non-surgical periodontal therapy Periodontal surgery, Bridges, Full and partial dentures, Denture reline and rebase services Crowns, inlays, onlays and related services Implants & implant related services

To find a contracting dentist near you, visit www.LincolnFinancial.com/FindADentis

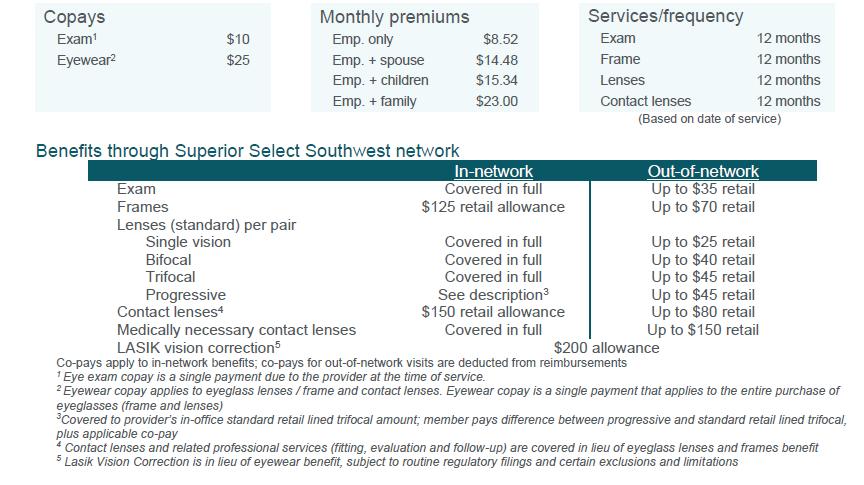

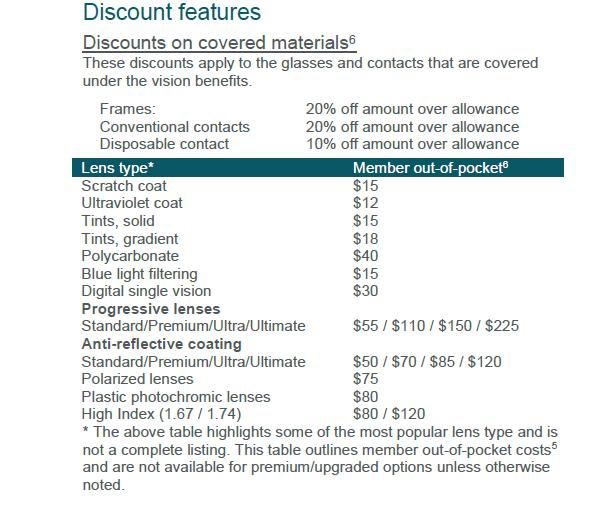

Vision insurance helps cover the cost of care for maintaining healthy vision. Similar to an annual checkup at your family doctor, routine eyecare is necessary to ensure that your eyes are healthy and to check for any signs of eye conditions or diseases . Most plans cover your routine eye exam with a copay and provide an allowance for Frames or Contact Lenses.

For full plan details, please visit your benefit website: www.mybenefitshub.com/ hillsboroisd

Superior Vision Customer Service 1-800-507-3800

• In-network benefits available through network eye care professionals.

• Find an in-network eye care professional at superiorvision.com. Call your eye doctor to verify network participation.

• Obtain a vision exam with either an MD or OD.

• Flexibility to use different eye care professionals for exam and for eyewear.

• Access your benefits through our mobile app – Display member ID card – view your member ID card in full screen or save to wallet .

Our network is built to support you.

• We manage one of the largest eye care professional networks in the country .

• The network includes 50 of the top 50 national retailers . Examples include:

• In-network online retail Providers :

Members may also receive additional discounts, including 20% off lens upgrades and 30% off additional pairs of glasses.*

*Discounts are provided by participating locations. Verify if their eye care professional participates in the discount featur e before receiving service. www.mybenefitshub.com/hillsboroisd

A LASIK discount is available to all covered members. Our Discounted LASIK services are administered by QualSight. Visit lasik.sv.qualsight.com to learn more.

Members save up to 40% on brand name hearing aids and have access to a nationwide network of licensed hearing professionals through Your Hearing Network.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Elimination Period: This is a period of consecutive days of disability before benefits may become payable under the contract. Maximum Benefit Duration: This is the length of time that you may be paid benefits if continuously disabled as outlined in the contract.

Pre-Existing Condition Period: Certain disabilities are not covered if the cause of the disability is traceable to a condition existing prior to your effective date of coverage.

You may select a benefit of 40%, 50% or 60% of your monthly pre -disability earnings, up to a maximum monthly benefit of $7,500.

Contact OneAmerica at (855) 517-6365. Find claim packets online at www.employeebenefits.aul.com You can email questions to disability.claims@oneamerica.com.

Cancer insurance offers you and your family supplemental insurance protection in the event you or a covered family member is diagnosed with cancer. It pays a benefit directly to you to help with expenses associated with cancer treatment.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Treatment for cancer is often lengthy and expensive. While your health insurance helps pay the medical expenses for cancer treatment, it does not cover the cost of non-medical expenses, such as out-of-town treatments, special diets, daily living, and household upkeep. In addition to these non-medical expenses, you are responsible for paying your health plan deductibles and/or coinsurance. Cancer insurance helps pay for these direct and indirect treatment costs so you can focus on your health.

Do you have kids playing sports, are you a weekend warrior, or maybe accident prone? Accident plans are designed to help pay for medical costs associated with accidents and benefits are paid directly to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Accident insurance provides affordable protection against a sudden, unforeseen accident. This benefit helps offset the direct and indirect expenses resulting from an accident such as copayments, deductible, ambulance, physical therapy, childcare, rent, and other costs not covered by traditional health plans. See the plan document for full details.

– up to 365 days

Dislocations, ruptured discs, eye injuries, fractures, lacerations, concussions, and more

Critical illness insurance can be used towards medical or other expenses. It provides a lump sum benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke. The money can also be used for non-medical costs related to the illness, including transportation, child care, etc.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Critical Illness insurance provides financial protection by paying a lump sum benefit if you are diagnosed with a covered critical illness. To file a claim call Unum at (800) 858-6843 or find claim form at www.mybenefitshub.com/hillsboroisd

Who is eligible for this coverage? All employees in active employment in the United States working at least 20 hours per week and their eligible spouses and children (up to age 26 regardless of student or marital status).

What are the Critical Illness coverage amounts?

The following coverage amounts are available. For you: Select one of the following $10,000, $15,000 or $20,000

For your Spouse and Children: 50% of employee coverage amount

Can I be denied coverage? Coverage is guarantee issue.

When is coverage effective?

What critical illness conditions are covered?

Please see your Plan Administrator for your effective date of coverage. Insurance coverage will be delayed if you are not in active employment because of an injury, sickness, temporary layoff, or leave of absence on the date that insurance would otherwise become effective.

your

Covered Condition Benefit

Reoccurring Condition Benefit

Pre-existing Conditions

The covered condition benefit is payable once per covered condition per insured. Unum will pay a covered condition benefit for a different covered condition if: - the new covered condition is medically unrelated to the first covered condition; or - the dates of diagnosis are separated by more than 180 days.

We will pay the reoccurring condition benefit for the diagnosis of the same covered condition if the covered condition benefit was previously paid and the new date of diagnosis is more than 180 days after the prior date of diagnosis. The benefit amount for any reoccurring condition benefit is 100% of the percentage of coverage amount for that condition. The following Covered Conditions are eligible for a reoccurring condition benefit:

• Benign Brain Tumor

• Coma

• Coronary Artery Disease (Major)

• Coronary Artery Disease (Minor)

• End Stage Renal (Kidney) Failure

• Heart Attack (Myocardial Infarction)

• Invasive Cancer (includes all Breast Cancer)

• Major Organ Failure Requiring Transplant

• Non-Invasive Cancer

• Stroke

We will not pay benefits for a claim when the covered loss occurs in the first 12 months following an insured’s coverage effective date and the covered loss is caused by, contributed to by, or occurs as a result of any of the following:

• a pre-existing condition; or

• complications arising from treatment or surgery for, or medications taken for, a pre-existing condition.

An insured has a pre-existing condition if, within the 3 months just prior to their coverage effective date, they have an injury or sickness, whether diagnosed or not, for which:

• medical treatment, consultation, care or services, or diagnostic measures were received or recommended to be received during that period;

• drugs or medications were taken, or prescribed to be taken during that period; or

• symptoms existed.

The pre-existing condition provision applies to any Insured’s initial coverage and any increases in coverage. Coverage effective date refers to the date any initial coverage or increases in coverage become effective.

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

• Initial Open Enrollment: When you are first offered this coverage, you can choose a coverage amount up to $200,000 without providing evidence of insurability.

• Annual Limited Enrollment: If you are a continuing employee, you can increase your coverage amount up to $40,000 without providing evidence of insurability . If you submitted evidence of insurability in the past and were declined for medical reasons, you may be required to submit evidence of insurability.

• If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense.

Life Insurance Coverage Amount

• You can choose a coverage amount up to 7 times your annual salary ($500,000 maximum) with evidence of insurability. See the Evidence of Insurability page for details.

• Your coverage amount will reduce by 50% when you reach age 70.

Guaranteed Life Insurance Coverage Amount

• Initial Open Enrollment: When you are first offered this coverage, you can choose a coverage amount up to 100% of your coverage amount ($50,000 maximum) for your spouse without providing evidence of insurability.

• Annual Limited Enrollment: If you are a continuing employee, you can increase the coverage amount for your spouse up to $20,000 without providing evidence of

If you submitted evidence of

in the past and were declined for medical reasons, you may be required to submit evidence of insurability.

• If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense.

• You can choose a coverage amount up to 100% of your coverage amount ($500,000 maximum) for your spouse with evidence of insurability.

• Coverage amounts are reduced by 50% when you reach age 70.

Individual insurance is a policy that covers a single person and is intended to meet the financial needs of the beneficiary, in the event of the insured’s death. This coverage is portable and can continue after you leave employment or retire.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Help protect your family with the Family Protection Plan Group Level Term Life Insurance to age 121. You can get coverage for your spouse even if you don’t elect coverage on yourself. And you can cover your financially dependent children and grandchildren (14 days to 26 years old). The coverage lasts until age 121 for all insured,* so no matter what the future brings, your family is protected.

Why buy life insurance when you’re young?

Buying life insurance when you’re younger allows you to take advantage of lower premium rates while you’re generally healthy, which allows you to purchase more insurance coverage for the future. This is especially important if you have dependents who rely on your income, or you have debt that would need to be paid off.

Coverage continues with no loss of benefits or increase in cost if you terminate employment after the first premium is paid. We simply bill you directly.

Why is portability important?

Life moves fast so having a portable life insurance allows you to keep your coverage if you leave your school district. Keeping the coverage helps you ensure your family is protected even into your retirement years.

Coverage pays 30% (25% in CT and MI) of the coverage amount in a lump sum upon the occurrence of a terminal condition that will result in a limited life span of less than 12 months (24 months in IL).

Protection you can count on

Within one business day of notification, payment of 50% of coverage or $10,000 whichever is less is mailed to the beneficiary, unless the death is within the two-year contestability period and/or under investigation. This coverage has no war or terrorism exclusions.

Easy payment through payroll deduction.

Optional benefit that accelerates a portion of the death benefit on a monthly basis, up to 75% of your benefit, and is payable directly to you on a tax favored basis* for the following:

• Permanent inability to perform at least two of the six Activities of Daily Living (ADLs) without substantial assistance; or

• Permanent severe cognitive impairment, such as dementia, Alzheimer’s disease and other forms of senility, requiring substantial supervision.

does

Many individuals who can’t take care of themselves require special accommodations to perform ADLs and would need to make modifications to continue to live at home with physical limitation. The proceeds from the Quality of Life benefit can be used for any purpose, including costs for infacility care, home healthcare professionals, home modifications, and more.

The Family Protection Plan offers a lump-sum cash benefit if you die before age 121. The initial death benefit is guaranteed to be level for at least the first ten policy years. Afterward, the company intends to provide a nonguaranteed death benefit enhancement which will maintain the initial death benefit level until age 121. The company has the right to discontinue this enhancement. The death benefit enhancement cannot be discontinued on a particular insured due to a change in age, health, or employment status.

Identity theft protection monitors and alerts you to identity threats. Resolution services are included should your identity ever be compromised while you are covered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

We’re always on alert … so you don’t have to be. For nearly 25 years, Identity Guard’s industry-leading products and services have made it easier for customers to manage their identity and faster for them to recover from cybertheft. By coupling superior technology with operational excellence, Identity Guard delivers solutions that help employees save time and reduce stress … so they can focus on the things that matter.

Why Identity Guard?

• Best-in-class cyber protection that’s never offline … even when you are

• Breach-free track record of excellence spanning more than two decades

• Intuitive technology – powered by IBM® Watson™ – that thinks for you

• Proactive, user-friendly solution requiring minimal ongoing maintenance from users

• Around-the-clock, U.S.-based customer support and remediation

Identity Guard is different.

Exclusive partnership with IBM® Watson™ artificial intelligence. Identity Guard is the only solution in the market that combines the power of IBM® Watson™ AI with best-in-class cyber wellness solutions to deliver comprehensive coverage and impactful, tailored cybersecurity insights that meet each employee’s unique needs. By harnessing IBM® Watson™ capabilities, Identity Guard offers:

• Unparalleled family and cyberbullying protection that enables easier social media monitoring and more accurate alerts that help to ensure that your kids are safe online.

• Enhanced risk management tools that provide tailored, personalized insights, best practices, and suggestions to help employees mitigate their personal risks and improve their cybersecurity.

• Personalized threat alerts based on curated content tailored to each user’s cyberthreat profile, ensuring that employees only receive high-value communication applicable to their lives.

Fastest speed and largest breadth of alerts.

The only cyber wellness solution that’s fully integrated with all three credit bureaus, Identity Guard has the fastest alert speeds and largest breadth of coverage in the industry 1. By delivering more alerts than competitors and alerting customers to suspicious activity within minutes – instead of hours, like competing solutions – Identity Guard empowers employees to stop identity theft before it spirals out of control, and more easily recover from the fallout.

Identity Guard delivers nearly 15% more alerts (on average) than industry competitors2

• Identity Guard: 4 minutes

• LifeLock: >9 hours

• InfoArmor: >18 hours

• CSID: > 29 hours

Comprehensive safe browsing tools.

Identity Guard is one of the only identity theft solution to include a comprehensive safe browsing suite, including malware monitoring, anti-phishing tools, and HTTPS/flash/ad blockers. These solutions help protect both personal and corporate computers against malware attacks, and hacks that may lead to catastrophic data breaches. This added layer of protection can save your organization headaches, money and – in extreme cases – years of clean-up.

Medical Transport covers emergency transportation to and from appropriate medical facilities by covering the out-of-pocket costs that are not covered by insurance. It can include emergency transportation via ground ambulance, air ambulance and helicopter, depending on the plan.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

A MASA MTS Membership provides the ultimate peace of mind at an affordable rate for emergency ground and air transportation service within the United States and Canada, regardless of whether the provider is in or out of a given group healthcare benefits network. After the group health plan pays its portion, MASA MTS works with providers to deliver our members’ $0 in out-of-pocket costs for emergency transport.

Emergent Air Transportation – In the event of a serious medical emergency, Members have access to emergency air transportation into a medical facility or between medical facilities.

Emergent Ground Transportation – In the event of a serious medical emergency, Members have access to emergency ground transportation into a medical facility or between medical facilities.

Non-Emergency Inter-Facility Transportation – In the event that a member is in stable condition in a medical facility but requires a heightened level of care that is not available at their current medical facility, Members have access to nonemergency air or ground transportation between medical facilities.

Repatriation/Recuperation – Suppose you or a family member is hospitalized more than 100-miles from your home. In that case, you have benefit coverage for air or ground medical transportation into a medical facility closer to your home for recuperation.

Should you need assistance with a claim contact MASA at (800) 643-9023. You can find full benefit details at www.mybenefitshub.com/hillsboroisd

A Flexible Spending Account allows you to pay for eligible healthcare expenses with a pre-loaded debit card. You choose the amount to set aside from your paycheck every plan year, based on your employer’s annual plan limit. This money is use it or lose it within the plan year.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

A Flexible Spending Account (FSA) allows you to set aside pretax dollars from each paycheck to pay for certain IRS-approved health and dependent care expenses.

The Health Care FSA covers qualified medical, dental, and vision expenses for you or your eligible dependents. Eligible expenses include:

• Dental and vision expenses

• Medical deductibles and coinsurance

• Prescription copays

• Hearing aids and batteries

You may not contribute to a Health Care FSA if you enrolled in a High Deductible Health Plan (HDHP) and contribute to a Health Savings Account (HSA).

You can access the funds in your Health Care two different ways:

• Use your FSA debit card to pay for qualified expenses, doctor visits, and prescription copays.

• Pay out-of-pocket and submit your receipts for reimbursement:

• Fax – 866-419-3516

• Email – flexclaims@higginbotham.net

• Online – https://flexservices.higginbotham.net

• Phone – (866) 419-3519

The Dependent Care FSA helps pay for expenses associated with caring for elder or child dependents so you or your spouse can work or attend school full-time. You can use the account to pay for daycare or babysitter expenses for your children under age 13 and qualifying older dependents, such as dependent parents. Reimbursement from your Dependent Care FSA is limited to the total amount deposited in your account at that time. To be eligible, you (and your spouse, if married) must be gainfully employed, looking for work, a full-time student, or incapable of self-care.

• Overnight camps are not eligible for reimbursement (only day camps can be considered).

• f your child turns 13 midyear, you may only request reimbursement for the part of the year when the child is under age 13.

• You may request reimbursement for care of a spouse or dependent of any age who spends at least eight hours a day in your home and is mentally or physically incapable of selfcare.

• The dependent care provider cannot be your child under age 19 or anyone claimed as a dependent on your income taxes.

$5,000 if filing jointly or head of household and

if married filing separately.

— use it or lose it

Legal plans provide benefits that cover the most common legal needs you may encounter - like creating a standard will, living will, healthcare power of attorney or buying a home.

For full plan details, please visit your benefit website: www.mybenefitshub.com/hillsboroisd

Protecting the legal rights of millions of North Americans, LegalShield is the largest legal plan provider. With 45 years of experience in customer centric legal plans, we hold our lawyers and employees to high service standards. We've replaced the traditional provider network approach, with a modernized service network that places the participant's needs first and provides a high-tech, high-touch service experience.

• Advice: Toll-free phone consultations with your Provider Law Firm for any personal legal matter, even on preexisting conditions

• Letters and Phone Calls on Your Behalf: Available at the discretion of your

• Provider Lawyer: Contract and Document Review Contract/document review up to 15 pages each

• 24/7 Emergency Assistance: After-hours legal consultation for covered legal emergencies. Specific coverage depends on plan, such as: if you’re arrested or detained, if you’re seriously injured, if you’re served with a warrant, or if the state tries to take your child (ren).

• Uncontested Name Change Assistance*: Uncontested name change prepared by Provider Law Firm

• Uncontested Adoption Representation*: Representation by your Provider Law Firm for uncontested adoption proceedings

• Uncontested Separation/Divorce Representation*: Representation by your Provider Law Firm for uncontested legal separation, uncontested civil annulment and uncontested divorce proceedings

• Assistance if you or your spouse are named defendant or respondent in a covered civil action filed in court

• Trial Defense Services: Assistance if you or your spouse are named defendant in a covered civil action filed in court

• Standard Will Preparation: Will preparation and annual reviews and updates for covered members

* Other documents available: Living Will, Health Care Power of Attorney and Financial Power of Attorney

• Residential Loan Document Assistance: Mortgage documents (as required of the borrower by the lending institution) prepared by your Provider Law Firm for the purchase of your primary residence

• Non-criminal moving traffic violation assistance

• Motor vehicle-related criminal charge assistance for manslaughter, involuntary manslaughter, negligent homicide or vehicular homicide

• Up to 2.5 hours of help with driver’s license reinstatement and property damage collection assistance of $5,000 or less per claim

• Available only if member has a valid driver’s license and is driving a noncommercial motor vehicle

IRS

IRS Audit Legal Services

• One hour of consultation, advice or assistance when you are notified of an audit by the IRS

• An additional 2.5 hours if a settlement is not achieved within 30 days

• If your case goes to trial, you’ll receive 46.5 hours of your Provider Law Firm’s services

• Coverage for this service begins with the tax return due April 15 of the year you enroll

Additional Benefits

25% Preferred Member Discount: You may continue to use your Provider Law Firm for legal situations that extend beyond plan coverage. The additional services are 25% off the law firm's standard hourly rates. Your Provider Law Firm will let you know when the 25% discount applies, and go over these fees

Your Plan Cover:

Family Plan:

• The member

• The member’s spouse/ domestic partner

• Never-married dependent children under age 26 living at home

• Dependent children under age 18 for whom the member is legal guardian

• Never married, dependent, children who are full-time college students up to age 26

• Physically or mentally disabled children living at home

*These services are available 90 consecutive days from the effective date of your membership. For detailed information about the legal services provided by the LegalShield contract, go to http://www.legalshield.com/ info/legalplan. Business issues are not included; however, plans providing those services are available.

Specific exclusions apply. See plan contract for complete terms, coverage, amounts, conditions and exclusions.

Access LegalShield on the go!

The LegalShield app puts your law firm in the palm of your hand. Tap to call your law firm directly, access free legal forms, and send info directly to your law firm with features like Prepare Your Will and Snap (for speeding tickets). The LegalShield app makes it easy to access legal guidance you can trust.

Download the free app from the App Store or Google Play. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Android is a trademark of Google Inc.

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the Hillsboro ISD Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the Hillsboro ISD Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.