‘Market set to spin in favour of strong wool’

strong wool price fell 41% between 1990/91 and 2018/19 to an average annual price of $3.52/kg clean.

THERE is growing confidence that profitability could be returning to the strong wool sector.

Prices are inching towards $4/ kg, helped by demand exceeding supply as sheep numbers continue to fall. New uses for the fibre are imminent and there is evidence consumers are switching from fossil fuel products to those made from natural fibre.

Industry leaders warn not to expect a sudden recovery in prices, but they are more confident than they have been in decades that better times are ahead.

They acknowledge producers have heard such promises before, but say the market feels different this time.

Associate Agriculture Minister and NZ First Member of Parliament Mark Patterson said he has never been more confident of a recovery in the strong wool sector, and, while admitting to going out on a limb, predicts $10/kg will one day be achieved.

His optimism is based on the multiple research and development projects underway and evidence consumers are turning off fossil fuel fibres.

Sector leaders acknowledge returns are still well below what growers need.

In inflation-adjusted terms, the

It subsequently fell to $3/kg or below for the next three years until starting to lift in 2023-24.

In the 1990s, wool carpets comprised up to 95% of soft floor coverings.

By 2021 that had fallen to between 10% and 15%, depending on the market.

Latest data shows it has increased to 18-19% with Wools of NZ reporting a 25% increase in sales of its floor coverings in 2023-24.

The challenge facing the industry is that since the demise of the Wool Board 22 years ago, consumers have not been told of the merits of strong wool.

Despite that, a new generation of consumers are seeking natural, environmentally friendly products and are discovering wool.

Prospects are being boosted by new uses and products such as carpet tiles and insulation, while a policy to use wool in government buildings is pending.

Growing interest from global architecture companies and expansion of India’s textile industry also hold promise.

Patterson, who has responsibility for wool, is especially enthused about the particles, pigments and powders developed by Wool Research of

Pelletised fertiliser delivers nutrients precisely while reducing waste. From Vineyards to the High Country, the little guys can be tailored to your farm’s needs. cplimesolutions.net.nz

Oats

the future sprouting down south

A group of oat growers in Southland and Otago have made significant strides in oat breeding and development, increasing yields and improving nutrition in oats.

Growing consumer demand and new uses hopefully mean a brighter future for the strong wool sector. Angela Stevens is pictured competing in the woolhandling section at this year’s Golden Shears final.

Photo: Pete Nikolaison/Golden Shears

Neal Wallace and Annette Scott

Get in touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Focus

1-9

10-15

16-17

18-20

Farmers . 21-24

25-28

29-31

32-35

COMPREHENSIVE: Rob Hewett has been appointed chair of Bremworth, after a group of disgruntled shareholders pushed for a change to the company’s board.

P8

The Global Dairy Trade price index remained steady and unmoving after the latest auction.

Mozzarella was the biggest improver on the night, at plus 5.1%, and anhydrous milk fats the biggest loser, at minus 1.8%. Butter prices continued their record run, up a further 1.1% to US$7667/tonne, now 4% higher than the previous peak in June last year.

News in brief GDT steady Salmonella survey

The Ministry for Primary Industries has launched a salmonella survey as an outbreak from last year continues in Southland and Otago.

Surveillance principal adviser at the MPI Jonathan Watts said Southland and South Otago have been experiencing a significant outbreak of salmonella in cattle since spring last year. The survey is to help understand the risk factors that led to the outbreak and mitigate future outbreaks.

Cherri liquidation

One of New Zealand’s largest cherry growers, Cherri Global, has gone into liquidation.

Cherri Global, with orchards in Hawke’s Bay and Central Otago, and subsidiary companies Cherri Holdings and Cherri Machinery, was placed in liquidation on March 8. According to the first PwC report, more than 30 unsecured creditors are owned about $42 million.

Discharge fines

Gore man Bryson Clark has been fined $130,000 after pleading guilty to discharging leachate in February 2024 from farm tailings, leachate from sileage, and dairy effluent onto land in circumstances where it could enter water.

Environment Southland compliance manager Donna Ferguson said the impact of the event was among the most serious the council had investigated and led to the death of thousands of eels.

New Zealand (WRONZ), which can be used in personal care, cosmetics, printing, painting and coating.

Wool Source, a WRONZ subsidiary, is building a pilot plant to advance development of the patented products.

Improved prices are one pillar of rebuilding the wool sector, which also requires a leadership structure that Patterson said must be led by farmers.

Tim Bathgate, an associate with Otago-based chartered accountants Shand Thomson, said a wool income target of covering shearing costs, which in 2023 were $2.55/kg not including shed and production costs, would be a start.

He said clients’ focus in recent years has, unsurprisingly, been on lamb production, but should prices improve farmers could start looking favourably at wool again.

Bathgate noted shearing costs have been impacted by contractors being bound to changes in the minimum wage and competition from Australian employers.

The wool sector of the future will not resemble that which operated before the Wool Board was dismantled, and that means a likely move away from farmers relying on the auction system.

Wool Impact chief executive Andy Caughey said the future of NZ strong wool is in globally recognised brands backed by the NZ strong wool production story.

Fleeces will need be separated and sold according to tailored specifications and markets to meet various end-use requirements, which will attract different prices.

“We can tell the crossbred story with integrity. We need a pathway for growers to give reassurance to manufacturers,” he said.

“We need to treat it as a portfolio of wool types.

“For us to restore our reputation as wool’s leading producer and to earn premium prices, we have to bring a renewed focus on genetics, selection for wool, harvesting, grading and presentation because it’s about NZ’s reputation and our farmer’s reputation.”

Campaign for Wool manager Kara Biggs said the organisation’s educational, promotional and advocacy work is starting to bear fruit.

“I believe sustainable price increases are closer now than ever before.”

She gives five reasons for her optimism: increased wool activity and innovation, growing positive consumer sentiment towards wool, more diverse wool supply systems, growers using data to verify their production systems and industry collaboration.

That collaboration was evident in convincing Kainga Ora (Housing NZ) to reopen its tender system to consider wool floor coverings.

“Four years ago things were very different to now and it’s very positive,” she said.

Exporters marshal US tariff arguments

ONigel Stirling MARKETS Trade

NE of the country’s largest meat exporters believes its investment in further processing in the United States should be grounds for it to be exempted from tariffs on lamb.

US President Donald Trump is due to announce reciprocal tariff rates on imports from more than 200 countries on April 2.

Farm lobbies in the US are also calling for tariffs as high as 25% on Australian and New Zealand lamb to stem surging imports they say are wiping out US sheep producers.

One exporter spoken to by Farmers Weekly believes any specific tariffs on NZ and Australian lamb would be on top of next month’s reciprocal tariffs, which researchers at Yale University recently estimated could be as high as 16% for goods imported from New Zealand.

DIVIDENDS: Campaign for Wool manager

Kara Biggs says the organisation’s educational, promotional and advocacy work is starting to bear fruit.

Photo: Supplied

“The reciprocal tariff is a global thing. Everyone is going to be hit by it in different ways and that is cool and there is going to be a limit to how you can fight against it but to me it is what they do on top of that,” the exporter said.

A director of another of the country’s largest meat exporters, who also did not want to be named, said the company believes its investment in the Lamb Company should be taken into consideration by the Trump administration when setting tariffs.

The Lamb Company, which buys 60% of NZ’s lamb exports to the US, and is owned by Alliance Group, ANZCO, Silver Fern Farms and Perth-based WAMMCO, owns three processing plants in North America.

Between 2015 and 2020 it spent $30 million on a new plant near Philadelphia and improving its two other plants, including one in Los Angeles. It employs around 250 people. It also accounts for a much smaller share of NZ beef exports to the US.

“Yes the grass is grown in NZ and primal cuts arrive there from NZ, but the cutting and packaging occurs in the US,” the meat company director said.

“That is Trump’s rallying cry, that ‘tariff’ is a beautiful word and tariffs will create jobs and if you want to avoid tariffs do your manufacturing in the US.”

The director did not know if all of the Lamb Company’s shareholders were agreed on such an approach but said the board of the exporter they belonged to agreed it was a logical argument to put back on the Americans.

ANZCO’s general manager of sales and marketing, Rick Walker, said he is not aware of an

INVESTMENT: The Lamb Company, which

is

of

agreed position among the Lamb Company’s shareholders but believes it is a valid argument to make.

“It is a valid one and if we face the situation where the lamb industry is targeted then yes, obviously, we will be doing everything we can to argue through the NZ government to try and mitigate the damage.”

On beef Walker believed NZ exporters have the upper hand.

Such is the US beef shortage, NZ exporters could demand importers either absorb a large portion of any tariff or pass it on to consumers. Asked if higher prices could turn off US consumers, Walker was optimistic.

“There has been talk for a long time that beef prices are at record highs and consumers just can’t pay this much and yet beef consumption continues to grow and retail prices continue to rise.

“It shows the massive resilience of the US beef market.”

buys 60%

NZ’s lamb exports to the US, and

owned by Alliance Group, ANZCO, Silver Fern Farms and Perth-based WAMMCO, owns three processing plants in North America.

Photo: Pexels

NZ would be ‘mad’ to quit Paris pact

Neal Wallace POLITICS Climate change

ALLS for New Zealand

Cto leave the Paris Agreement on climate change have been labelled “completely mad” by trade expert Stephen Jacobi.

“I’ve heard those calls and they are completely mad,” said Jacobi, the executive director of the New Zealand International Business Forum.

Jacobi said doing so would mean the loss of market access, and the economic and reputational cost would be significant.

Meat Industry Association chief executive Sirma Karapeeva said about 80% of NZ’s exports are destined for markets that either already have or are proposing mandatory climate-related disclosures.

“For example, both the European Union and United Kingdom free trade agreements contain specific provisions that enforce commitments made under the Paris Agreement.”

These are enforceable obligations and withdrawing from

the agreement would pose legal, commercial and reputational risks for exporters and the sector.

Jacobi and Karapeeva were commenting on calls for NZ to follow the lead of the United States and leave the Paris Agreement.

The 2015 agreement commits the 196 signatories to reduce emissions and work together to mitigate the impacts of climate change.

Last week Beef + Lamb NZ chair

Kate Acland said in an opinion piece published in Farmers Weekly that to leave Paris would result in reputational damage and threaten trade agreements, many with highpaying markets.

ACT leader David Seymour previously floated the idea that NZ should exit, but last week changed his tune, saying the risk to market access and to our international reputation would exceed any benefits.

“Yes we should [stay] because the trade retaliation from not being in would be greater than the cost of being in it,” he said.

Dave Courtney, Silver Fern Farms’ chief customer officer, said as protectionism increases, it’s

important NZ shows leadership and upholds rather than walks away from international arrangements.

“Many of our larger highvalue customers are required to demonstrate action towards emissions reduction within their full supply chain, which includes SFF and our suppliers.”

He said farmers measuring and reducing their emissions footprint would leverage new commercial opportunities and value.

Dairy Companies Association of NZ executive director Kimberly Crewther said the organisation does not support withdrawing but wants the government to ensure the agreement is implemented to support its core purpose of limiting global temperature increases while maintaining food production.

“The NZ negotiators who worked on the agreement got good outcomes in establishing a framework that recognised the critical role of nutrition and enabled flexibility for countries to set targets appropriate to their national circumstances.”

Crewther said global food systems could be adversely impacted

CHANGE: ACT leader David Seymour previously floated the idea that NZ should exit the Paris Agreement, but last week changed his tune, saying the risk to market access and to our international reputation would exceed any benefits.

We will not risk losing access to markets.

Simon Watts Climate Change Minister

if emission reduction targets are met by limiting emissions-efficient production.

“We are pleased that the government has committed to avoiding policies that only achieve emissions reductions through production cuts, and risk emissions leakage.”

Should NZ fail to meet its emission reduction commitments,

Crewther wants the government to engage with other signatories to ensure the agreement is consistent with the core purpose of the agreement, which includes food production.

Climate Change Minister Simon Watts said NZ is committed to the agreement, which is in the interests of the country and exporters.

“This remains unchanged, and we will not risk losing access to markets. That’s not good for our rural communities or our economy.”

He said a review on new 2050 methane targets will be confirmed later this year.

New Zealand’s Envy apples protected by court in China

Richard Rennie NEWS Horticulture

CHINESE orchardists who unlawfully cultivated the New Zealand-sourced Envy apple variety have been given a sharp message from that country’s Supreme People’s Court. The court upheld an earlier ruling that a defendant had breached T&G’s proprietary rights by unlawfully cultivating the Scilate apple variety, marketed

as the Envy brand. The defendant had grown, harvested and sold the apples.

T&G was awarded RMB 3.3 million, about $NZ800,000, and the defendant was also ordered to cut out the illegally grown apple trees.

T&G CEO Gareth Edgecombe welcomed the court’s decision on what he said was a vital aspect of the company’s business model that needed to be protected.

“Our whole business model is based on plant protection, and this

is for our own business and for our partner orchardists as well.”

He said the ruling came under China’s newly strengthened Seed Law, which protects plant variety rights and aims to stop illegal production and infringement.

“It has laid a solid foundation for our future enforcement actions,” he said.

China is a problematic market for illegally grown fruit. Zespri has also taken action against illegally branded fruit being sold there, and more than 8000 hectares of

illegally acquired SunGold fruit is providing an additional headache for Zespri executives to manage.

Edgecombe said T&G’s strategy is to know what is planted, and where, while also undertaking constant surveillance on plant material and brand protection.

Envy represents a significant success story for the company since first being launched in 2008 and is now grown in 13 locations across both hemispheres.

“If you have a brand programme

like Envy that has value in it, that is where you will see this sort of action,” Edgecombe said.

Determining the legality of fruit can sometimes extend to DNA analysis, and this had been the case with the latest instance.

Edgecombe said having a local growing Chinese partner on the ground there who was managing significant volumes of legitimate Envy was an important demonstration to Chinese authorities of the company’s intent.

Fonterra result ‘shows strategy working’

Gerald Piddock NEWS Fonterra

FONTERRA’S strong interim result for the 2025 financial year shows that its strategy is working, chief executive Miles Hurrell says.

It is a reflection of the hard work across the co-op from its farmerowners through to those selling the product in the market, he said.

“What we set out to deliver a year ago is happening. We have seen the confidence come through in those conversations with potential investors.”

Fonterra is divesting its consumer business and is currently perusing both an IPO and trade sale of this business and will select one, which its shareholders will vote on.

The co-operative reported a half-year profit after tax of $729 million for the 2025 financial year, earnings of 44 cents per share, and will pay an interim dividend of 22 cents per share.

It also lifted its earnings range to 55-75 cents per share. Fonterra CFO Andrew Murray said this was

a result of resilience across its three business channels.

They were able to quickly respond to the higher milk price and this led to higher levels of resilience in their consumer and food service businesses, he said.

“It’s across all three of the channels.”

Its consumer business had an improved second quarter with a strong volume of sales coming out of southeast Asia, Murray said.

It also updated its milk price, narrowing its range from $9.50$10.50/kg MS to $9.70-$10.30. Its midpoint remained unchanged at $10/kg MS.

Hurrell said global conditions remain favourable with strong demand from key importing regions. The co-operative is also well prepared to weather any potential geopolitical issues it faces.

“In term of where our focus goes, it’s about the things we can control.”

Hurrell said the result also shows the co-op is starting to get value from how its farmers farm in NZ.

While some farmers and some in government might be questioning

First-half profit boasts 8% bump

Hugh Stringleman NEWS Fonterra

FONTERRA has reported a strong interim profit after tax of $729 million, up 8% on the previous corresponding period in FY24.

Operating profit in the first half of FY25 was up 16% to $1.1 billion and 44c earnings per share were up 10%.

The co-op will pay a fully imputed interim dividend of 22c a share and unit, and remains on track to deliver full-year earnings in the range 55c to 75c.

Fonterra has narrowed the farmgate milk price range to $9.70-$10.30, keeping the forecast mid-point steady at $10/kg.

Chief executive Miles Hurrell said Fonterra was focused on driving value, which includes delivering strong financial performance while achieving the highest sustainable farmgate milk price.

“We are seeing good demand for our quality products, and our teams have worked hard to optimise our product portfolio to capture value from the market conditions, leaving us well contracted for the season.

“We have also optimised the advance rate schedule to get cash to farmers sooner, underpinned by our balance sheet strength.

“Favourable pasture growth across most of New Zealand earlier in the season delivered forecast

whether NZ should opt out of the Paris Agreement on climate change, he said, customer feedback is showing the importance of farmers reducing their emissions.

milk collections up 2.7% to 1510 million kg in the full season, but many parts of the country are currently experiencing very dry conditions,” he said.

The average milk collection per farm is forecast to be 184,000kg compared with 175,000kg last season. Fonterra said its milk collection market share is steady on 78% from 8200 farms, down 200 because of consolidations and sales to other land uses and competitors.

The ingredients channel delivered 63% of the operating profit, at $696m, followed by foodservice at $230m and consumer division $173m.

Fonterra claimed that the foodservice profit was healthy when compared with the record high of $342m in FY24 when input costs were much lower.

Consumer sales volumes were up 8.5% and gross margin increased despite the higher milk price and operating profit was largely flat on the previous corresponding period.

“As we look to the balance of the year ahead, we are focused on maintaining this momentum in performance, while progressing delivery of our strategy, including the dual-track consumer divestment process, which is on track as planned,” Hurrell said. Net debt has increased by $1.3bn to $5.5bn because of the higher advance rate and the higher

In term of where our focus goes, it’s about the things we can control.

who are prepared to pay the value that they do because of what they demand in how we farm or do we go to a market and customer that doesn’t?”

He was also optimistic about the possibility of New Zealand’s free trade negotiations with India resulting in access to that market.

“We have a lot to offer, not just in products but also in services as well to support the growing Indian economy.”

“While you may see governments slow down their ambition, it’s not being slowed down from a customer perspective and that’s what is more important to us.”

This will be explained when the board and management meet with farmers in the coming weeks at roadshows, he said.

“Clearly Fonterra has a choice. Do we play with those customers

‘Earn while you learn’ idea for students

Samantha Tennent TECHNOLOGY Training

MANY students leave school early because unpaid work experience simply isn’t an option – they need a paycheque, not just experience. But what if that barrier was removed?

Finding a way to compensate students for hands-on learning could be the key to keeping them in school and vocational training longer.

“A young person in New Zealand can leave school at 16, or even 15 with a principal and parent signature,” said Josh Williams from Skills Consulting Group at the Food and Fibre Centre of Vocational Excellence (FFCoVE) insights forum in Wellington last week.

“So if you can leave school at 15 and get a job where you will be paid, shouldn’t you also be able to partially leave school and have that secondary employment, secondary school and work experience?”

Williams presented data highlighting only 31% of Year 1113 students pursue degree-level study, and only 6% participate in trades academies, with 18% in food and fibre.

He demonstrated that trades academies (or secondary-tertiary programmes, STP) significantly improve retention, with 45%

Looking ahead, while acknowledging that pundits have predicted another buoyant milk price for the 2025-2026 year, he was more cautious, pointing out they are in a volatile geopolitical environment.

“My message back to farmershareholders is that be mindful that we are dealing in an international market.”

SHOWCASED: Virtual reality and artificial intelligence are being explored for their potential in training and assessment, which was showcased during the Food and Fibre Centre of Vocational Excellence insights forum in Wellington.

Shouldn’t you be able to partially leave school and have secondary employment?

Josh Williams Skills Consulting Group

staying over three years.

“The chances of leaving within a year (of joining the sector) are 40% for someone who hasn’t completed an STP, compared to 45% remaining for at least three years if they had. If churn and retaining people is what we’re worried about, then this shows that trades academies work.”

Secondary school pathways were one of the presentations at the CoVE forum in Wellington, where around 75 attendees heard about the work from the past four years.

The Food and Fibre CoVE was set up in 2021 as part of the 2020 Reform of Vocational Education.

Its goal is to improve vocational training for New Zealand’s food and fibre sector by identifying opportunities for growth through research, insights and lifelong workplace learning.

Associate Minister of Agriculture Andrew Hoggard opened the two-day forum by sharing progress from the government and his personal experiences with on-the-job learning. He believes pastoral care is a significant factor in ensuring learners’ success.

“Measuring productivity needs to be in terms of higher wages for people and higher profits for businesses,” was a key message in economist Shamubeel Eaqub’s keynote speech. He emphasised the need to work smarter, not harder, as we continue to face workforce challenges into the future.

The CoVE has been involved in 80 projects since its inception and is exploring its future direction post-2025 when the original funding ceases.

DELIVERY: From left, Fonterra chief financial officer Andrew Murray, chief executive Miles Hurrell and chair Peter McBride address the media on the co-operative’s interim result for the 2025 financial year.

Miles Hurrell Fonterra

We’ll soon be retiring the copper network. If your phone and internet use copper technology, now’s a good time to look at your options.

chorus.co.nz/copper-retirement

Native options highlight challenges

Richard Rennie NEWS Environment

THE tough and expensive business of re-establishing native trees in New Zealand means there is no “one size fits all” approach, with four optimal options available to landowners, depending upon their situation.

Stanislav Garbuz, leader of the native afforestation research programme at the Ministry for Primary Industries’ Te Uru Rakāu, presented those options to delegates at the International Union of Forest Research Organisations conference, hosted by Scion in Rotorua.

His work reviewed the scalable, evidence-based restoration methods available for native forests across a variety of terrain and locations.

“Restoring native forests is complex, faces high establishment costs, slow regeneration in degraded landscapes, issues with seeding survival, erosion and uncertainty in what final success will look like,” he said.

Typically, establishing a native forest runs many times over the cost per hectare of planting exotic pine, with estimates varying from $5600 a hectare to $30,000/ha. And ongoing pest and weed management costs to get trees to a self-care stage can run many times more again.

The four methods Garbuz and his team examined were direct establishment, natural reversion, the Timata method and transitional techniques.

Direct establishment represents the highest cost, highest certainty method that has proven best on degraded land with no seed sources available and offers immediate erosion control.

“It is especially effective if the landscape has been recently affected.”

He cited a Northland project working with local iwi on 300ha that has proven a good case study.

Natural reversion and regeneration leverages off existing seed sources with minimal intervention, making it a “lowerslower” option in terms of costs and time involved.

He highlighted a Bank’s Peninsula project that draws on part of the property already containing native forest area that acts as a seed source to enable future reversion, alongside planting done with landowners.

“It requires long-term community commitment and education, along with good land management approaches.”

The Timata method of restoration has recently enjoyed greater publicity, thanks to work done by high-profile farmer and conservationist John Burke.

It has been demonstrated as a lower cost, intensive means of establishing native forest by using

Wine exporter loads up ahead of tariffs

Nigel Stirling MARKETS Wine

WINE exporters are stockpiling their product in warehouses in the United States to beat possible tariffs next month.

US President Donald Trump is due to announce reciprocal tariffs on the more than 200 countries the US trades with on April 2. A recent study by Yale University researchers estimated reciprocal tariffs on imports from NZ could be as high as 16%.

What other markets should we focus our efforts on?

David Babich Babich Wines

The US is NZ’s largest wine market, buying $800 million of NZ wine last year.

West Auckland-based Babich Wines is one of more than 100 NZ wine producers that export to the US.

Chief executive David Babich said shipping deadlines mean orders received after the middle of February would not have made it to the US in time to beat the April 2 announcement date. He said uncertainty over

commercial forestry techniques applied to native plantings. It is estimated to lower per hectare costs of establishment by as much as $20,000 a hectare.

Kānuka and mānuka are used as early colonisers, spaced further apart than conventional native reforestation methods dictate. The method has been demonstrated around Lake Tutira in Hawke’s Bay and has gained greater interest from regional councils in the upper North Island.

Garbuz said the approach combines science and community goals in a method that is flexible to different sites’ challenges. However, it also requires detailed planning, collaboration and a good level of community engagement to

be a complete success.

“Even with careful planning there are a number of obstacles, particularly with browsers.”

There is also significant outlay required for plant guards, fertilisers and herbicide treatments early on.

Additional interventions may include fencing and weed control and have a role to play on sites with high grazing pressure, poor soils or heavy weed competition and where passive restoration alone may not be enough.

Garbuz also pointed to knowledge gaps in New Zealand about native restoration that includes levels of carbon sequestration in natives during establishment and cost:benefit

data for landowners, and what constitutes a cost-effective nursery production model.

Trump’s intended tariff targets and customers’ desire to keep inventories to a minimum had meant there had been no large increase in direct orders to meet that deadline.

“The main response has been business as usual. We have put an extra loading of stock into our own US-based warehouse, however.”

Babich said the company keeps warehouse space in the US to “supply customers not large enough to order direct from NZ”.

“We hold about three months’ stock but have moved this up to five months in case we get increased demand due to the imposition of tariffs.”

NZ Winegrowers chief executive Philip Gregan said strong US demand during the covid pandemic had been followed by a period of weak sales.

“Some of the apparent increase in consumption around covid from 2022 onwards was driven by supply chain uncertainty and building up stocks so that retailers could guarantee that they had product available to sell.

“Now it is clear that the supply chain in the US was carrying excess stock and they are now rapidly de-stocking.”

Babich expected “mixed” results from negotiations with importers over who would carry the cost of any tariff.

“Some will absorb what they can while others will leave it to the importer to pay the tariff.

“We have had some recent benefit for exporters from the depreciating NZ dollar, so that does support a mixed approach where the supplier contributes to some of the tariff cost.”

Asked what strategies he could deploy should NZ wine be hit with tariffs, Babich said he was considering two things.

“Can our wine stand being at a higher price point if tariffs are applied and, second, what other markets should we focus our efforts on to mitigate a reduction in demand due to higher shelf prices in the US.”

This week’s poll question: Have your say at farmersweekly.co.nz/poll Is the government doing enough to stop wholefarm conversions to forestry?

Genetics insights at the click of a mouse

Annette Scott TECHNOLOGY Sheep and beef

A FREE, online programme aimed at increasing the use of highquality genetics in New Zealand’s beef industry has been unveiled by Beef + Lamb NZ.

Launched at the BLNZ Genetics beef breeder forum in Christchurch, nProve Beef aims to put genetics insights into the hands of commercial farmers.

BLNZ Genetics systems manager David Campbell told farmers the nProve programme is an important component of Informing NZ Beef (INZB) delivering intuitive, easy-to use genetics tools for farmers.

“Using a series of buttons and slider scales, the tool finds stud breeders who rank highly in the traits specifically important to you.”

The seven-year INZB programme, a partnership between BLNZ and the Ministry for Primary Industries, co-funded through the Sustainable Food and Fibre Futures fund, aims to boost sector profits by $460 million.

A key milestone is the introduction of three new, NZdesigned beef cattle indexes, the Maternal (NZ$Maternal), Terminal (NZ$Terminal) and Beef-on-Dairy (BOD) (NZ$BeefxDairy) tailored to

NZ’s unique farming systems.

BOD is becoming a part of the toolkit in breeding beef cows with dairy bulls as industry practice gains momentum bringing resilience and sustainability to dairy and beef supply chains while allowing dairy cows to produce replacement heifers for the milking herd and beef cross calves that are worth more because they produce more kilograms of beef.

BLNZ’s general manager for farming excellence, Dan Brier, said the nProve tool has been built in collaboration with commercial farmers for use by commercial farmers.

“Farmers can customise what they are looking for in their bull team.”

In his presentation, BLNZ Genetics specialist livestock Jason Archer said the new indexes will help farmers “get their head around a good bull without 58 pieces of information”.

“This will tell you what you want a bull to do in the choice of three purposes, creating a consistent approach for commercial beef producers to identify genetics for their farming businesses.”

As part of the nProve rollout, BLNZ will run Better Beef Breeding workshops across the country. They will include sessions to help farmers get the most out of nProve Beef and the new indexes.

RETURN OF THE NATIVE: No one method offers the silver bullet solution to re-establishing native forests, with community resources, location and seed sources all requiring consideration, says Stanislav Garbuz.

EXPORT: West Auckland-based

Babich Wines is one of more than 100 NZ wine producers that export to the US.

DCANZ upbeat on India dairy prospects

Richard Rennie and Neal Wallace NEWS Trade

DAIRY processors are welcoming the use of the word “comprehensive” in describing the New Zealand-India trade negotiations which began last week.

Prior to Prime Minister Christopher Luxon’s arrival in New Delhi, intensive efforts by Minister for Trade and Investment Todd McClay with his Indian counterpart had set the terms of engagement to be known as the “Comprehensive Free Trade Agreement” between the two countries.

Luxon described it as a breakthrough, coming after McClay has visited India five times and had eight meetings with his counterpart.

NZ’s recent efforts also included a visit from Foreign Affairs Minister Winston Peters and Luxon’s meeting last year with India’s Prime Minister Narendra Modi.

Kimberly Crewther, CEO for Dairy Companies Association of NZ (DCANZ), said it was good to see the commitment from both sides to a comprehensive agreement, the first bilateral negotiations since 2016.

Those negotiations foundered on agreement over NZ dairy’s access to the world’s largest dairy production market, which has been

a sticking point since.

Crewther acknowledged dairy’s significance to both countries.

“But it is good to see that the negotiating table is the place to discuss this.”

In the absence of a free trade agreement with India, Fonterra has adopted a softly-softly approach to the market. India is expected

We have a broad range of ingredients that we can supply including specialised protein ingredients across a broad range of products.

Kimberly Crewther DCANZ CEO

to face a domestic production shortfall in seven to 10 years.

“And at that point we would like to be at the front of the queue,” said Crewther.

She pointed to continuing economic growth, an emerging middle class and shifts in diets as people consume a broader range of dairy-based products.

Estimates are the middle class of 350 million will double by 2030.

At present tariffs of 30-60% remain in place for most dairy products. Fonterra exited its local joint venture Dreamery product range in early 2022, with no plans for similar projects in the immediate future.

Crewther said flexibility in any agreement was possible and “very

much for the negotiating table” where they may get down to specific products.

“It is not often you have an agreement that is a blanket one for everything.”

Meanwhile, the red meat sector has also welcomed the formal launch of FTA negotiations with India.

Nathan Guy, the independent chair of the Meat Industry Association (MIA), is part of Luxon’s business delegation, alongside representatives from three red meat companies.

“Like many developing countries around the world, India has experienced significant economic growth over recent decades and has a growing middle class with a focus on health and wellness, who are seeking high quality and nutritious animal protein options.”

Guy said India offers real opportunities for NZ, which has a reputation as a trusted, reliable and responsible trading partner

“As well as sheepmeat products, the wide range of by-products known as the fifth quarter provide significant opportunities for NZ, with offal exports boosted through the rise of the petfood industry and the strengthening demand for serum exports.

“India plays a key role in the pharmaceutical industry, manufacturing and exporting products such as vaccines to other countries.

“NZ’s fifth-quarter products are sought after because of our disease-free status,” he said.

Spore counts point to high facial eczema risk

Staff reporter NEWS Animal welfare

FACIAL eczema is again proving to be an issue on farms across the North Island and parts of the South Island as counts of diseasecausing spore have steadily increased over the past month.

Sheep and cattle develop FE after eating pasture that contains a fungus that, when entering the animal’s rumen, releases a toxic spore that attacks the bile duct and liver.

Speaking at a recent Beef+Lamb NZ seminar in Huntly, rural veterinarian Ginny Dodunski urged farmers to talk to their local vet and get a risk assessment done on their farm.

Eczema is a lot like worms –where the worst of the spores are in the base of the pasture, she said.

Awanui Veterinary’s weekly data based on spore count collections from across the country shows numbers have come off their seasonal peak from a week ago as the count enters week 12 out of its 22-week coverage starting in January.

In Northland, counts have stayed above the 30,000 spore threshold –

FUNGUS: Sheep and cattle get facial eczema after eating pasture containing a fungus that, when entering the animal’s rumen, releases a toxic spore that attacks its bile duct and liver.

the level that tells farmers that it is time to take preventative action.

In Whakatane, counts have spiked above 700,000 over the past three weeks and in central and southern Waikato, counts have been recorded at 195,000 and 270,000 in the past few weeks. Counts are also above the threshold in Taranaki, peaking at 293,000 at New Plymouth and 155,000 in Ruapehu.

In Hawke’s Bay, counts jumped to 130,000 before dropping to

Swift changes at the top of Bremworth

Hugh Stringleman NEWS Food and fibre

LISTED wool carpet company

Bremworth has appointed four new independent directors with immediate effect, from a group of disgruntled shareholders reportedly representing more than one-third of the company’s owners.

The new chair will be Silver Fern Farms and Farmlands chair Rob Hewett, who was appointed along with Julie Bohnenn, Murray Dyer and Trevor Burt.

Paul Izzard, Katherine Turner and Dianne Williams are stepping down from the board and former chair George Adams and John Rae are staying on as board members.

What it calls constructive engagement since March 1 resulted in the board changes and a withdrawal of the need for a special meeting, the company announced.

The revolutionary group emerged last month with demands for a special meeting of shareholders, the complete removal of the board and the appointment of the four new directors.

50,000-55,000 over the past two weeks.

In the lower North Island, counts have steadily lifted over the past three weeks with counts recorded at 315,000 for Horowhenua, 380,000 in Manawatū, 135,000 in Tararua and 110,000 in Wairarapa. Spore counts have also jumped in the South Island, climbing to 110,000 in Westland-West Coast before dropping to 60,000 in the latest week. Spore readings were also high in Tasman, averaging 50,000 in the past few weeks.

The then board said it attempted to engage with the group of requesting shareholders to avoid the disruption of a special meeting at a critical junction when a strategic review is in progress.

Bremworth had said earlier that offers had been received from outside parties and the strategic review would consider the best long-term ownership structure.

The changes on the board are effective immediately, though all new directors will have to stand for election at the next

annual meeting, not scheduled until November.

Hewett said the refreshed board would conduct a comprehensive review of Bremworth’s operations, ensuring disciplined financial management and a renewed commitment to the company’s core business and growth opportunities.

“Bremworth is at a crucial crossroads. We will need to call on the experience of all directors as we take Bremworth into its new era, which demands a fresh approach to drive growth and earnings.

“The new directors are committed to bringing our collective agri, operating and governance experience and skills to stabilising the business, protecting shareholder value, and unlocking the potential of Bremworth,” Hewett said.

Bremworth has 71 million issued shares and is presently trading around 60c, giving a market capitalisation of $42 million.

The largest shareholders are associated with former directors of Bremworth, Grant Biel and the late Tony Timpson.

COMPREHENSIVE: Rob Hewett has been appointed chair of Bremworth, in addition to Silver Fern Farms, Farmlands Cooperative and Woolworks.

SCALE: India’s 70 million dairy farmers account for a significant political force, capable of influencing that country’s moves on freeing up trade in dairy products.

Subscriber question: If I pay a voluntary subscription, will my neighbours still get it free?

Answer: Yes. By starting a voluntary subscription you help keep vital farming news accessible to all. Together, we can inform, challenge, and support the conversations that shape our industry.

Activate a voluntary subscription today because together we’re stronger.

Thank you to the 351 who have already activated voluntary subscriptions. Our goal is 8000, so please encourage your friends and neighbours to follow your lead.

Thank you for supporting the stories we produce for the website every day, the newspaper every week and the podcast every Friday.

Keep firing questions and feedback our way.

BECOME A VOLUNTARY SUBSCRIBER

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterboxholder already receiving Farmers Weekly every week, free, and for those who read us online.

Choose from the following three options:

Scan the QR code or go to www.farmersweekly.co.nz/donate

3.

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice Call us on 0800 85 25 80

Note: A GST receipt will be provided for all contributions.

Dean Williamson – Publisher dean.williamson@agrihq.co.nz 027 323 9407

The Future of Wool

‘I’m more confident than I’ve ever been’

Neal Wallace MARKETS Food and fibre

MARK Patterson believes $10/kg for crossbred wool is achievable and farmers will soon be breeding wool attributes back into their flocks.

The associate agriculture minister and South Otago sheep and beef farmer said his optimism stems from the nearly 10 New Zealand companies working on new uses and products for crossbred wool.

What he considers the moonshot are pigments, particles and powders being developed by Wool Research of NZ (WRONZ).

“That is one farmers should really be watching.”

He is calling 2025 the year for wool, believing wool-based developments will once again make the fibre an economic contributor for sheep farmers.

“Absolutely we can. I’m more confident than I’ve ever been.”

It is unlikely all wool initiatives being pursued will be viable,

Patterson said, but if two or three come off it will create significant new demand.

His confidence is boosted by consumers looking for natural alternatives to synthetic fibre and the enthusiasm of United States architectural services company

Gensler investigating the use of wool floor covering, acoustic panels and insulation in new buildings.

Hang in there. This is more

than just hope and if we get it right, it’s a major opportunity.

Mark Patterson Associate Minister of Agriculture

With 2023 revenue of $NZ3.23 billion, Gensler partners with clients in over 100 countries, including 10 of Fortune magazine’s most profitable companies and nine of the world’s largest pharmaceutical, technology and entertainment companies.

Gensler has a goal of a zerocarbon impact portfolio by 2030.

“They’ve been out here and visited farms and they are very excited about using wool,” Patterson said.

He is also closely watching India, which currently takes 16% of our wool but has plans to triple the size of its textile industry.

Meanwhile, the government is expected to soon announce details of its policy on wool in government buildings, which is part of the NZ First-National coalition agreement.

Patterson said improved prices are only one part of the equation needed for a permanent recovery for wool.

Any improvement in prices needs to reach farmers but he does not believe the traditional auction system will achieve that.

Instead, farmers need direct links with users and processors to shorten the supply chain and to receive feedback on fibre quality.

“The auction system hasn’t delivered for us.

“Farmers need to have a conversation with the industry about how to take wool to market more direct.”

It also requires sector leadership and that means bringing together entities such as Wool Impact, Campaign for Wool, WRONZ and Beef + Lamb NZ to create a leadership structure.

“It has be driven by farmers as they own a large portion of the supply chain.”

He said there is much happening behind closed doors to address these challenges and the government is willing to do its part.

His message to farmers is simple: “Hang in there. This is more than just hope and if we get it right, it’s a major opportunity.”

Time to cash in and turn research into reality

Annette Scott NEWS Food and fibre

ESTABLISHING a model structure geared with new uses to position high value and high volume is key to ensuring the future for New Zealand strong wool, says Wool Research of New Zealand chair Andrew Morrison.

Morrison is confident there is an enduring future for strong wool but he said new uses and new initiatives are needed to pull the sector out of the doldrums.

“There is a future for strong wool, but not if we keep doing what we have always done as we will only get what we have always got,” the new industry leader said. Finding new high-value, high-

volume uses for NZ strong wool is a fundamental priority for WRONZ.

“We have 21 wool industry members operating in the traditional use space. They asked for us to look at new uses and we will play our part in the new use spaces.

“We can support and encourage existing uses because there is still

demand but we need to expand to incorporate new uses; even the old users have got to look at new initiatives,” Morrison said.

But he said the purpose must be an enduring model structure geared to position the product for high value and high volume.

Morrison said WRONZ is committed to its co-funded Ministry for Primary Industries

Sustainable Food and Fibre Futures (SFFF) fund New Uses for Strong Wool research programme.

The now-complete seven-year research programme has delivered several new deconstructed products that have established a variety of new types of consumer products that can be made while

Continued page 12

ALTERNATIVES: Mark Patterson says his confidence in wool is boosted by consumers looking for natural alternatives to synthetic fibre.

The sorry tale of how wool unravelled

Neal Wallace NEWS Food and fibre

THE intent was quite straightforward but the reality vastly different when farmers overwhelmingly voted to disestablish the Wool Board in 2003.

In response to lingering concerns about the sector’s financial performance and the performance of the board, in 2000 consultants McKinsey and Co had undertaken a study and recommended the dissolution of the board and the establishment of new industry good commercial entities including a move into biotechnology using wool derivatives.

An overwhelming 96.9% of growers who voted at a subsequent referendum in September 2003 were in favour of winding up the Wool Board.

The participation rate was equivalent to just 35.5% of wool growers.

It brought the shutters down on an entity established in 1944, although there were earlier iterations dating back to 1936, which had responsibility for marketing, promotion, market development, wool and sheep research and technology transfer.

Following the referendum, the board’s assets and functions were transferred to a transitional body, the New Zealand Wool Board Disestablishment Company Ltd (DisCo).

It prepared the Wool Board’s final report and financial statements, collected a 2% transitional levy on wool for a limited range of industry good purposes and oversaw the distribution of board assets.

Farmers with more than 250 sheep were allocated redeemable preference and ordinary shares in Wool Equities Ltd (WEL), for crossbred growers, or Merino Grower Investments Ltd, for Merino growers.

SheepCo, a non-profit organisation, was formed to fund research and development with funding from the commodity wool levy.

Of the $40 million in board cash and assets available to be distributed, WEL received nearly $14m in cash and $10.8m in assets to invest in business that would improve grower returns.

A 2016 Farmers Weekly investigation revealed that the WEL investment portfolio included products such as keratin and companies like Romney Rugs and Just Shorn, a 74% stake in Bruce Woollen Mill and 100% of Town & Country Textiles NZ.

WEL also made an unsuccessful bid in 2011 for the wool marketer Wool Services International.

But WEL failed to live up to the expectations promoted by McKinsey.

Farmers Weekly reported in 2016 that in 2012 it had equity of just $2.4m, assets of just over $3m, liabilities of $712,000 and cash of $1.8m.

Its 2014 unaudited accounts showed equity of just $287,000, assets of $1.85m, liabilities of $1.56m and cash of $38,000.

From 2006 to 2016 WEL had racked up cumulative losses of $24.6m.

Later, Primary Wool Cooperative became a cornerstone shareholder, but the relationship soon unravelled with the co-

operative declining to put forward director nominations due to the state of its accounts.

In 2009 farmers voted to stop paying a levy for wool research and the following year AgResearch closed its wool and textiles research division with the loss of 36 scientists and technicians.

This was despite a governmentappointed task force at the time identifying research and development as essential to creating new products, uses and markets for New Zealand wool, which it considered key to the industry’s recovery.

Equally there were farmers questioning the merits of paying a research levy citing the lack of progress in developing new products and uses from the fibre.

• In the 1990s, wool carpets made up to 95% of soft floor coverings.

• In 2021 wool’s share of that market had fallen to between 10% and 15%.

• NZ sells 148,000 tonnes of carpet a year – mostly synthetic.

• In 1990 NZ produced close to 250,000 tonnes of strong wool. In 2024 NZ produced about 100,000 tonnes of strong wool.

• Of that, 85,000 tonnes is exported.

Wool’s

Wool Source geared to ‘ink’ a deal

Annette Scott TECHNOLOGY Food and fibre

THE research is over, the pilot plant has done its job and Wool Source, a subsidiary of Wool Research of New Zealand, is geared for business, driving new demand and pricing for growers.

A business case has been confirmed by Corporate Value Associates (CVA) with Wool Source particles, pigments and powders all assessed as having large addressable markets with defined, unique product benefits and strong commercial proposition.

The CVA work approved several pathways forward with recommendation the best option was to establish a commercial entity that would be responsible for the development of a production facility and all commercial trading.

WRONZ subsequently set up Wool Source Manufacturing with

DICTATING: Wool Source chief executive Tom Hooper says it is now the market dictating as manufacturing aligns to large markets that can pay increased prices for wool.

Continued from page 10

maintaining the fundamental properties of wool.

Under the recently incorporated subsidiary, Wool Source Manufacturing, intended to be the vehicle used for commercial transactions, WRONZ has an ultimate plan to build and operate a 1 million kilogramme facility, the stepping stone to investigate commercial products and volume opportunities that will be the cornerstone of a $20 million commercial scale processing plant.

“When we reach the market validation point, WRONZ will have committed $11.6m, 60% of the cost, with conversations underway to fund the remaining 40%.

“Yes, we can take the criticism, let’s hurry up, but research programmes have yielded phenomenal results, now validation needs to be done properly to benefit the research and deliver both volume and value.

“We have looked at the market

a board and committee overseeing the commercial development activity.

Wool Source chief executive Tom Hooper said the pre-research is over, the pilot plant has been working for three years and the focus in now on the three Ps –powder, particles and pigments.

The commercial development programme is conditional on two fundamental points being achieved for the three products.

Both market validation and product readiness for commercial supply are required to be proven to commit to the next phase, the building of the production facility.

“We are now into applied research, product development and commercialisation.

“While research is ongoing it’s now the market telling us what they want as we align to large markets that can pay increased prices for wool.

“What drives a lot of our products across all three Ps are bio-based materials to replace synthetics.”

Two key markets have been identified for powder: hydrolysed keratin for use in shampoo, and the building material industry because of wool’s natural fire retardancy.

European environmental regulations are driving packaging companies towards alternatives to synthetics in coating and laminate formulations, which led to an opportunity for Wool Source powder.

The key market for powder is with industrial coatings for flexibility and anti-marring.

“This is a woollen product to replace the outer layer of coatings in packaging such as cosmetic and perfume boxes.”

Innovations with pigments are hitting the ink market to provide colourant for the increasingly popular bioplastics segment, especially for screen printing.

size of the places we are playing in and these are significant.

“We haven’t pursued any research that is only low value or low volume.

“The challenge now is we have created this wonderful research and we need to establish the structure to create and capture value and volume.

“We are working hard on that model and we are giving industry the opportunity to invest,” Morrison said.

Wool Source has produced sample production materials of particles, powders and pigments and is working on scale-up options and costs for a commercial plant to be established at Lincoln.

“The detailed business case is set now to build the deconstruction facility to meet the needs of particles, powders and pigments.”

The pilot plant has enabled testing of the scalability of production processes, identifying more cost-efficient high-volume options that will aid competitive cost models once commercial production begins.

adoptions processes are all achieved.

We are now into applied research, product development and commercialisation.

Tom Hooper Wool Source

“It is unique, and we are the only people that we are aware of who can do a full colour pallet of biobased inks.

“That [ink] market is the most complex and hardest to crack, but also the biggest.”

Key markets are Europe and North America, where legislation requires the swapping of materials.

North America is driven by brands with trials underway with several of the biggest brands in the world.

“Next is to build the production facility but we have to prove that demand, price point, and product

We have created this wonderful research and we need to establish the structure to create and capture value and volume.

Andrew Morrison WRONZ

“When we get the market validation points required, we will push go.”

WRONZ believes this will bring the best opportunity to move the dial on the wool price, using upwards of 20 million kilograms of wool annually.

This wool will be bought directly from the farm gate.

“Farmers want us to save the industry and believe me I’m a farmer too; holy shit it is hard, I’m losing as much sleep as they are.

“This is about solutions as a farming collective.

“We are running as fast as we can but the magnitude of the opportunities the programme

“Demand is proven around the world, done and happy.

“Price is okay; proof will be when people start paying but we’ve talked price and its not been too much of a problem.”

Product adoption process is the most complex and hardest.

“We are talking to really big firms stepping through that process.

“We are not in control; we are relying on our partners to want to do it. That’s the bit we’ve got to get over the line and depending on the use depends on how complex that process is.

“We have to nail all of the above before we build a factory.

“Everyone wants us to go fast but no one wants a failure.

“We are really aware of the state of the sector and the need for speed.

“We are going as fast as we can but doing it all right to ensure we

build a good business.”

Hooper said there is no defined timeframe.

“We are running lots of trials with lots of clients all around the world. We need to get clients through that product adoption process, that’s the current key focus.”

The first mid-size factory is envisaged to start with 1 million kg (1000 tonnes) of wool with the optimal target 20 million kg (20,000t).

The first commercial volumes of particles were shipped to Japan last December.

“We are buying in small quantities from farmers now and that will grow significantly as we can step upwards to the [20,000t] target.”

Hooper said the progression of the new-use products into the commercial market represents the final step of the journey to see new uses for strong wool driving new demand and pricing for growers.

has delivered needs its deserved time and we won’t build until the markets are secured.”

Morrison acknowledged red meat is currently doing the heavy lifting for sheep farmers.

“But when WRONZ delivers that will have a massive impact on farm profitability.”

In its 2024 annual report

WRONZ, together with the NZ Wool Industry Charitable Trust it controls, reported an overall deficit

SOLUTIONS: WRONZ chair

Andrew Morrison says saving the strong wool industry is about new-use solutions as a farming collective.

for the year of $1.5m, compared with the previous year’s deficit of $968,000.

The investment portfolio as of June 30 last year totalled almost $33m, which is $1.6m lower than the same time in 2023.

Total assets as June 30, 2024 were $37m with the key components of this being the investment portfolio and pilot plant. The 2023 total assets were $39m.

PIGMENTS: Innovations with pigments are hitting the ink market to provide colourant for the increasingly popular bioplastics segment, especially for screen printing.

Photo: Supplied

SHEEP SHEARING WOUND PROTOCOL

In the unlikely event of a wound occurring during shearing, follow this guide

IS THIS A MINOR WOUND? IS THIS A MODERATE WOUND?

• Minor facial/ear nicks

• Minor graze of skin

• Superficial cuts under <5cm in length

• Minor bleeding

• Pizzle, udder, scrotum or vulva cuts

• Cuts that extend deeper into tissue or muscle or are over >5cm in length

• Contaminated wounds

THIS A MAJOR WOUND?

• Excessive bleeding

• Tendons are cut

• Stomach or intestines visible

• Deep cut

Vet clinic contact details

Authorised pain relief

Wound spray products

Action & Treatment

Clean wound and apply antiseptic

Consider pain relief

Action & Treatment

Place in hospital pen and alert farm staff

First Aid Apply wound spray

Apply pain relief

Veterinary advice

Action & Treatment

Notify farmer immediately

Veterinary advice while stopping the bleeding

Apply pain relief

Euthanase if required

We’re here for the good of the country.

‘Zero investment results in zero results’

Neal Wallace MARKETS Food and fibre

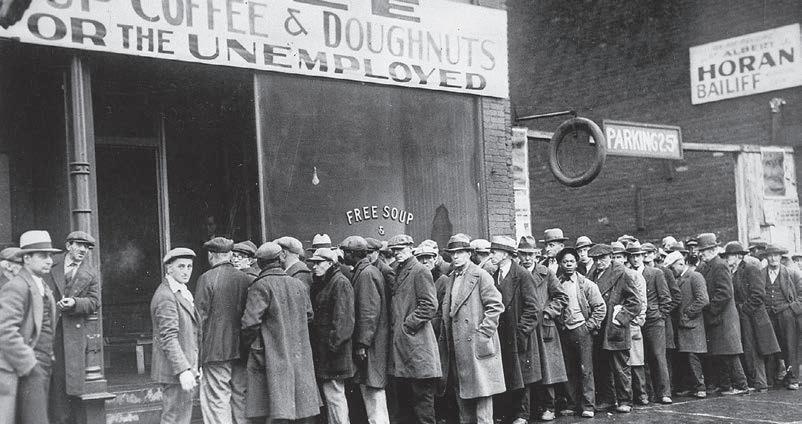

THE strong wool sector is reaping what it has not sown, having for 22 years failed to invest in promoting the fibre and educating consumers about its merits.

“Zero investment results in zero results,” said Wools of NZ chief executive John McWhirter. Consumers are positively responding to the limited amount of investment companies are now making, with sales of wool carpets growing, new products such as wool tiles released and carpet manufacturers investing in processing equipment.

“The future is bright. This is a

sustainable fibre and it will make money for farmers, the industry and NZ,” said McWhirter.

“There is absolutely a future for wool.”

Wools of NZ sees part of that future in shortening the supply chain. It recently launched the Natural Fibre Exchange (NFX), a global auction system modelled on the Global Dairy Trade (GDT).

As with the GDT, McWhirter said, a larger pool of buyers and the way the NFX auction operates will create better price transparency than the current auction system. He believes this will lead to better prices and greater demand.

“Now we have 6000 farmers selling their wool to hundreds of international buyers so it changes

farmers cut costs by changing shearing patterns, says John McWhirter

the dynamics of the auction system in favour of farmers.”

He does not expect a sudden jump in prices in the NFX early auctions.

“Initially I believe prices will be as well as they are currently but I have no doubt we will deliver better pricing in the medium to long term.”

Demand is growing for wool 50 to 100mm in length and suitable for carpet manufacturing, but volume is limited as farmers cut costs by changing shearing patterns.

To attract volume, Wools of NZ is offering $5/kg contracts.

McWhirter said since farmers voted to disestablish the Wool Board in 2003 there has been next to nothing invested in promoting the merits of wool, a role farmers at the time expected businesses to fill.

“For the last 20 years no one out there has been telling consumers why they should buy wool.”

McWhirter said petrochemical carpet producers immediately filled the void, promoting their products as cheaper, less inclined to fade and having the ability to wash out stains.

The data is not precise, but McWhirter said in the 1990s, wool carpets constituted up to 95% of soft floor coverings in some markets.

By 2021 that had fallen to between 10% and 15% depending on the market.

Latest data shows global sales of wool floor coverings had increased to about 18-19% and he said there is growing demand in China, India,

CONSUMERS: For the past 20 years, says Wools of NZ CEO John McWhirter, ‘no one out there has been telling consumers why they should buy wool’.

“The more wool we trade, the faster we’ll go.”

I have no doubt we will deliver better pricing in the medium to long term.

the United Kingdom, Europe and significant potential in the United States.

“All the pointers are that wool demand will grow and we won’t have enough.”

To use those opportunities, McWhirter said, companies like Wools of NZ need farmer support, to provide the raw material and economic influence.

McWhirter said to grow returns, farmers will need to make some management changes, such as shifting shearing patterns to supply wool of the required length, but as it makes up less than 2% of world fibre, wool needs to be promoted as the Rolls-Royce of fibre, something people aspire to have.

Consumers in many countries replace the floor coverings in one room at a time, unlike in NZ, where they tend to replace the whole house.

If they can be convinced to use wool in one room at a time, McWhirter said, he would consider that a victory.

‘There is still a future for strong wool’

Annette Scott NEWS Food and fibre

MARK Copland has been farming sheep all his life and while he says wool is “bloody slow”, he has confidence the strong wool sector has a future, “when industry gets things right”.

Copland, who is president of the New Zealand Sheepbreeders Association, heads a fourth-generation mixed sheep, beef and arable operation in Mid Canterbury, where the family’s original McCombie Border Leicester Stud, started in 1932 by Mark’s grandfather and known as Westmere Farming since 1953, is still surviving.

“My father used to get through on wool and meat was the bonus. Now wool is only talked about for what it is not making.

“It has lost sync with inflation and wool can’t physically cover the cost of the way we are producing it.

“There is a future for strong wool, though the $50 million

question being what the future is.

“Wool has lot of positives.

“It’s about awareness, developing new uses and getting markets for it.”

The Copland farming operation – including a commercial breeding flock of Romney and Border Romneys – will have fewer breeding ewes going forward, but will have more finishing lambs.

The sheep industry is so small it’s almost a niche industry these days.

Mark Copland

Mid Canterbury

“If we can get them [lambs] is another question. There are a lot of curveballs in between and that includes reduced numbers in the stud in line with reduced ram sales.

“We still have the commercial ewes; we are still buying in Romney replacements and I reiterate, there is still a future for strong wool.

“Historically not much has changed. Just the goal posts have moved, and it’s hard work.

“We are struggling with the sheep but on the back of our other farming activities we are doing okay.

“Our son Hugh is chasing more crop, but the commercial crossbred ewes are still paying for the shearing and I never begrudge the shearers’ money.”

Copland, a respected judge in the industry, said all breeds, especially maternal breeds, are feeling the pinch with declining numbers.

“Meat breeds are still flying the flag but at the end of the day we need something to produce the meat lambs.”

Copland is upbeat about the future of sheep farming.

“Wool has got its value; it just needs to be found back and it will do.

“There’s enough out there working on it, it’s just not happening in a hurry.

“The sheep industry is so small it’s almost a niche industry these days. I’m happy to stay a part of it.”

HIGHLIGHT: Taking out the supreme champion wool award with their Border Leicester

a

LIMITED: Demand is growing for wool 50 to 100mm in length and suitable for carpet manufacturing, but volume is limited as

John McWhirter Wools of NZ

stud ram fleece at the NZ Agricultural Show has been

career highlight for Mark and Robyn Copland, who remain upbeat about the future of strong wool.

Photo: Annette Scott

From the Editor

Business as usual not an option for wool

Neal Wallace Senior reporter

ASTORY relayed by Wool Impact chief executive Andy Caughey about a recent meeting with two people from the United States wearing Allbirds shoes may provide a template for a recovery of the strong wool sector.

Allbirds shoes are made from Merino wool and the company was co-founded by former New Zealand footballer Tim Brown.

Caughey says his two guests were surprised to learn their chosen footwear was made from wool, as that was not the reason for their purchase.

They bought them purely because of the reputation and status of the Allbirds brand.

Caughey says that encounter illustrates the power of brands and he believes the viability of the strong wool sector can be rebuilt through developing brands based on the fibre’s merits and attributes.

Strong wool’s dismal performance in the 22 years since the demise of the Wool Board reinforces the reality that business as usual is not an option.

The supply chain of the future will, by necessity, be vastly different.

For all its failings, the Wool Board successfully educated consumers on the merits of wool, but since its closure, a generation of consumers has been left in ignorance of those attributes.

As we discovered in our special report published this week, the days of farmers consigning their total clip to the auction system appear over.

Sector and industry groups have spent years trying to restore viability. They see the future of strong wool in branded products and growers having close links to industry and users.

Growers will have to be strategic, work closely with their buyers and treat their clip as a portfolio of wool types tailored to the requirements of various users.

It is understandable if sheep farmers dismiss this renewed confidence as yet another promise, but things feel different this time.

There is a suite of new and repurposed products in development or close to release. Demand for wool exceeds supply, and consumers are questioning the environmental impact of plastic alternatives.

Sector leaders say they have never been more confident, optimism that comes after

Farmers Weekly is published by GlobalHQ, PO Box 529, Feilding 4740. New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

EDITOR Bryan Gibson 06 323 1519

bryan.gibson@globalhq.co.nz

EDITORIAL

Carmelita Mentor-Fredericks editorial@globalhq.co.nz

Neal Wallace 03 474 9240 neal.wallace@globalhq.co.nz

Colin Williscroft 027 298 6127 colin.williscroft@globalhq.co.nz

Annette Scott 021 908 400 annette.scott@globalhq.co.nz

Hugh Stringleman 09 432 8594 hugh.stringleman@globalhq.co.nz

Is the government doing enough to stop wholefarm conversions to forestry?

Gerald Piddock 027 486 8346 gerald.piddock@globalhq.co.nz

Richard Rennie 07 552 6176 richard.rennie@globalhq.co.nz

Nigel Stirling 021 136 5570 nigel.g.stirling@gmail.com

PUBLISHER

Dean Williamson 027 323 9407 dean.williamson@globalhq.co.nz

ADVERTISING

Andy Whitson 027 626 2269

New Media & Business Development Lead andy.whitson@globalhq.co.nz

several years’ work turning around the sector’s fortunes.

That work has been done on the cheap, the costs met by taxpayers partnering with agricultural companies and growers while individual businesses have funded marketing out of cashflow.

Assuming a recovery is imminent, attention needs to turn to how to manage the strong wool sector. What are its core roles and how will it be funded?

We need to avoid the mistakes of the past, specifically the assumption made in 2003 that manufacturers and retailers would pick up the Wool Board’s role of generic strong wool promotion.

They didn’t last time, so why would they do it this time?

Naturally farmers will want to see substantial and permanent improvements in prices before agreeing to pay a levy on wool.

Twenty years of low wool returns have contributed to inconsistent profitability for crossbred sheep farmers.

Improving wool prices will smooth out those fluctuating fortunes, but – given the extent to which many farmers now treat wool as a byproduct – if we do not spark a recovery this time, there may not be another chance.

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Debbie Brown 06 323 0765

Noticeboard/Word Only/Primary Pathways classifieds@globalhq.co.nz

Letters of the week

Build trust with shareholders

Peter McDonald Dipton

THE excellent letters recently around cooperatives and their benefits by Hamish Gow, James Lockhart and Mike O’Connor have prompted me to write to essentially give a farmer or alternate view on cooperatives, namely Alliance Group.

I feel the “freeloader” term is an unhelpful one to describe farmers who wisely use sheepmeat procurement behaviours for their own benefit.

One must go back to why this “freeloading” is occurring.

The sheepmeat processors provided the conditions for third-party trading. With it came a loss of trust between the shareholder and the co-operative.

The fear of losing space or priority was the stick that kept all the farmers supplying.

Even before the dust settled as a car roared up our gravel road and the Alliance drafter put a foot on the ground, the same question would be asked: “What’s your space like for the week?”

That tight space kept us glued to the co-operative.

Alliance, because of a species mix heavily weighted towards sheepmeat, carried the majority of the overcapacity risk. Somehow it believed it was a whole-of-industry problem.