Farm sales hopping as prices reset

Neal Wallace MARKETS Real Estate

THE absence of competition from forestry companies has reset prices for sheep and beef farms, with some easing by as much as $5000/ha.

Property Brokers rural manager Conrad Wilkshire said government policy restricting whole-farm forestry planting to certain land classes and uncertainty over the future of the Emissions Trading Scheme (ETS) have taken the edge off prices and demand for land previously targeted by forestry investors.

On a like-for-like basis, Wilkshire said, this absence of competition has seen prices ease by a third.

“What is clear is new, wholefarm conversions to forestry are off the table for this year.”

Bayleys Gisborne director Simon Bousfield agreed. He estimates average values in some regions have eased by around $5000/ha.

Bankers and real estate agents said lower interest rates and renewed confidence from higher product prices have underpinned a rebound in farm sale activity in the past six months.

With forestry companies not as active, that heightened activity is being driven by existing landowners and also first-farm buyers.

“On one property we sold, we had three first-farm buyers making offers. That’s a great sign of what’s coming in the pastoral sector,” Bousfield said.

A Beef +Lamb NZ-commissioned report by Orme & Associates reveals forestry companies have since January 1 2017 bought 300,000 hectares of sheep and beef farmland, which BLNZ estimates has displaced more than 2 million stock units.

The maths of buying the neighbours’ is working out better than it has for a long time.

Aidan Gent ASB

Foreign buyers requiring Overseas Investment Office approval were the largest purchasers over that period at 122,875ha.

The report calculates 38,921ha of farmland had been sold for forestry since September last year.

From 2020 to 2024 74,469ha was bought for carbon farming, planted in exotic species to absorb carbon and earn carbon credits that are traded on the ETS but will never to be harvested.

Federated Farmers meat and wool chair Toby Williams said the ETS has distorted property prices

Continued page 6

Waiting game for lamb finishing farm

Long-time Mid Canterbury farmer Simon Bonifant has faced one of his toughest years on the lamb finishing operation he runs with his son and brother. But with the prospect of a $10 lamb schedule come spring, he is holding on with the expectation of better times ahead.

NEWS 5

Abuse, dangerous roads forcing some truckies to quit the industry.

NEWS 6

Photo: Annette Scott

Rural Women stalwart takes the cake

Retired Elstow dairy farmer Lesley Berry is considered a legend when it comes to knitting together communities and making time to help others.

DAIRY 23-28

Ashburton dairy farm transforms into large-scale apple orchard.

NEWS 9

Internship for women providing launchpad for future ag leaders.

PEOPLE 16

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME

Delivered by Reach Media Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

News in brief Fieldays boost Wool

More than 110,000 visitors went through the gates at Fieldays this year. New Zealand National Fieldays Society CEO Richard Lindroos said early indications suggest that exhibitors had a good event delivering momentum for the primary and fibre industries. He said the society is committed to growing Fieldays and will review this year’s event as planning begins for the 2026 event, which will run from June 10 to 13.

Superior strong wool took a hit in both the latest North and South Island wool auction sales.

PGG Wrightson said the Napier wool auction delivered mixed results, with the rising NZ dollar against the United States dollar dampening export demand and putting pressure on prices. In the South the Christchurch auction swung to more of a buyers’ market for most styles of crossbred wool, compared to recent sales.

takes a hit Solar support

An initiative to make the installation of solar energy on farms easier has been announced. The Energy Efficiency and Conservation Authority has allocated funding to support farmers cross the regulatory hurdles to install solar and battery storage systems either on buildings or as solar farms. Energy Minister Simon Watts said ASB and Farmlands have both launched programmes to encourage farmers to install solar systems, but inconsistent consenting regulations between local authorities have proven an impediment.

Banding together

Three national road transport associations have banded together to strengthen the sector’s role in the livestock value chain. National Road Carriers, NZ Trucking and Transporting New Zealand have established the National Livestock Transport and Safety Council, a new body for the livestock transport sector.

Lamb market lifts on $10.20 spring promise

Neal Wallace MARKETS Beef and lamb

AFFCO’s $10.20/kg winter lamb contract could reflect a new level in global markets for the immediate future at least, say industry leaders.

AFFCO is offering contracts at a minimum guaranteed price of $9.70/kg, peaking at $10.20/kg on September 21, prices AgriHQ senior analyst Mel Croad said are mostly grounded in market reality.

Croad said such is the strength of current markets, AgriHQ’s latest Livestock Outlook report is forecasting September and October North Island prices to average above $10/kg.

“But that is on the proviso that this export demand can at least be maintained and procurement pressure doesn’t take its place,” she said.

“From that point prices will seasonally ease as the new season gets underway.”

Croad warns the key to

managing farmer expectations is to not pressure export markets unnecessarily.

AFFCO chief executive Nigel Stevens said markets in the European Union, United Kingdom and United States are all strong, but the winter contracts are designed to secure supply and processing volumes for planning plant capacity and staffing requirements.

Stevens said if the spot market exceeds the contracted price, suppliers will receive the higher price, meaning all the risk rests with AFFCO.

“In a broader sense, given a continued decline in lamb numbers, we want to offer farmers certainty for their planning purposes, and the highest price possible to encourage ongoing lamb production and supply.”

New Zealand’s lamb shortage has created procurement tension, but Croad said cool stores are empty and tight supplies in the traditional UK and EU markets are driving demand and increasing prices.

“We are seeing some of the highest prices in our export markets for lamb ever for this time of the season,” she said.

Stats NZ is about to release May export values for lamb, which Croad believes could be at record levels, potentially pushing above $13.50/kg.

That is on the proviso that this export demand can at least be maintained and procurement pressure doesn’t take its place.

Mel Croad AgriHQ

In May last year they were $10.40/kg, well below the five-year average for that month of $11/kg.

Nationally the number of lambs processed for the season up to May 17 was 8.7% behind last year, 12.917 million compared with 14.146 million.

Croad said the South Island kill was 14% behind last year, 7.93

Waiting game for lamb finishing farm

Annette Scott MARKETS Beef and lamb

IT HAS been the toughest year farming in 40 years for Mid Canterbury farmer Simon Bonifant, who is holding out for better times with the expectation of a $10 lamb schedule come spring.

Bonifant, his son Harry and brother Roger farm a 550 hectare mixed cropping and lambing finishing operation.

The trio are re-enthused about farming sheep given the buoyancy in the sector.

“Last year the outlook wasn’t good. We chose to stay in but then nobody wanted them [lambs]. Now this year the question is being

asked why farmers are not letting them go.

“Well, it’s been a tough year since January, the toughest I’ve ever experienced in my time farming since the ’80s. Sheep didn’t go well last season, harvest was drawn out in a battle with the weather, so we were late getting winter crops in the ground.

“The reality now, given the big improvement coming off a low base with the lamb schedule, is to hang on as long as we can to maximise absolute potential from the lambs this year.”

This season the farm is carrying 9000 finishing lambs across different stages.

“Lambs are part of the whole farm system. We start buying in from March, carry them over

winter, shear in August, use them in spring to manage the ryegrass and clover crops until closing, getting them off through October.”

It’s been an expensive market to buy in this season, but Bonifant has done the maths; buying in at around $120 to $140 a lamb, finishing to an average 22-27 kilograms market weight.

“The schedule is around $9.30 now, so it’s on track to be $10 and that’s what we’re aiming for.

“The breeders have been rewarded this year and we certainly don’t begrudge them, they need that, and maybe this year the finishers will also be rewarded, we need it too.”

Bonifant has moved on from loyalty to any one company.

“Every year is different and we

Genomics has sped up genetic progress worldwide. With gNZI© and smart selection, Samen NZ delivers top sires to maximise your herd’s potential.

Don’t miss out, grab a Samen

million compared to 6.82 million.

This reflects the impact of a cold, wet spring in Southland and Otago and high store prices in MarchApril, which have encouraged winter finishers to retain them longer to reach higher weights.

Croad said heavier carcases have offset the lower kill, with the export volume processed in March, April and May higher than the five-year average for that period.

“Export markets could easily take more if we had it.”

Murray Behrent, Alliance Group’s manager of livestock and shareholder services, said the South Island lamb kill is more than 13% behind last year, which represents a shortfall of about 1.1 million lambs.

He is anticipating livestock flows to ramp from late July-early August through to October.

“We know that a large number of lambs from Southland have been sold as store lambs and moved to the Canterbury region.”

He expects global markets to remain firm for the remainder of the season.

Jarrod Stewart, the chief supply officer for Silver Fern Farms, said kill volumes have dropped off earlier than normal, which has created procurement pressure.

“Our markets are operating at near-record levels. However, some customers report uncertainty around potential further positivity, or whether a reset is on the horizon.”

Stewart said current pricing could have implications on processors’ margins and on servicing customers with consistent volumes at a price consumers can afford.

“In a competitive global environment, shelf space is hard won, and relatively easy to lose.”

Stevens said traditional markets are performing strongly, but the Middle East and China are flat after recent price increases.

Soft economic conditions in China and strong domestic lamb production are factors, as is increased availability, with 10 additional Australian processing plants recently licensed to export meat to that market.

have to make decisions for our own business. It just got too hard because all the companies wanted was gold-plated lambs.

“We play the markets now. Mostly lambs can go in a paddock lot sold, processed and paid for. It’s working well for us.”

FATTENING PROFITS: Simon Bonifant says the aim is to hang onto lambs as long as he can to maximise potential from the rising lamb schedule this year.

Photo: Annette Scott

Livestock truckies face a raft of irksome issues

SHONA Robertson says her truckies face so many challenges that some have quit the industry.

Robertson and husband Bruce are owner operators of Road Transport Logistics from Tapanui, and she is chair of the National Livestock Transport and Safety Council.

The 2025 National Road Freight Survey showed rural and livestock transporters, and drivers across other industries, often cop abuse from the public over issues they don’t have control over.

Congestion is a daily frustration, but dangerous driving is the worst, Robertson said.

“Cameras in our trucks show the public passing on double yellows or blind corners, not understanding the weight and stopping

Continued from page 1

so far in favour of carbon farming that even dairy cannot financially compete.

Citing Ministry for Primary Industries carbon sequestration tables, he calculated that 16 years after planting, a 410ha carbon plantation of pinus radiata earning $60/tonne of carbon dioxide equivalent will generate $24,600/ ha.

“Dairy can’t compete with that. It’s a massive return on investment.”

Wilkshire said the environmental damage caused by forest slash following Cyclone Gabrielle has driven change to plantation compliance and management and created uncertainty for forestry companies.

Bousfield said pastoral land will still be converted to forestry as

distance of trucks,” she said.

Drivers quit the industry because of the carnage on the roads, she said.

There’s also increasing disruption from animal rights groups protesting animal slaughter.

“Our guys and girls just want to do their job and earn a living.”

Head of policy and advocacy at Transporting New Zealand Billy Clemens told Farmers Weekly that voluntary terms of trade are needed between rural livestock transporters, processors and farmers.

Three national road transport associations recently united to form the National Livestock Transport and Safety Council, a new livestock transport sector body that aims to strengthen the sector’s role in the livestock value chain.

Transporting New Zealand is scheduling de-escalation training at an upcoming conference after

government changes are bedded in.

He anticipates increased demand for LUC Class 7 and 8

rural operators said drivers are put in tough situations.

Livestock transporters have a lot to worry about, having pressure from the Ministry for Primary Industries, processors and farmers, he said.

Jim Crouchley, membership adviser for the rural/livestock sector at Transporting New Zealand, said the transport industry is highly regulated, and depends on farms, processors and saleyards for business, but these entities come with a raft of issues.

There’s no means to deal with issues from a legal and regulatory perspective, and it often falls back on drivers and owners of transport businesses

Crouchley said drivers who, for example, deliver a sick or injured animal, often see that animal for only a few seconds before having to make a call on whether it is fit to load, but they can be fined for transporting it.

land, where planting is allowed to continue, but “more genuine farmer competition” for Classes 1-6 land, which will be unavailable

Likewise, some processors seemingly reach a cap on their consent for effluent storage and do not provide facilities for drivers to empty effluent tanks.

Drivers are then in trouble for spilling effluent on roads.

“We don’t have robust chainof-responsibility legislation,” Crouchley said.

The dairy industry culls cows once a year, but farmers don’t adequately prepare cows for transport.

for whole-farm planting.

ASB rural manager Aidan Gent said recent property transactions were the busiest in at least a decade.

CHANGE: Conrad Wilkshire says the environmental damage caused by forest slash following Cyclone Gabrielle has driven change to plantation compliance and management and created uncertainty for forestry companies.

Rabobank’s manager of country banking, Bruce Weir, said activity has been picking since Christmas after a quiet couple of years.

He said prices for quality, productive properties have lifted between 5% and 10% in Taranaki, Mid Canterbury and Waikato.

“Properties with a strong production history and low input are particularly sought after.”

Gent said demand has taken off this year.

“The market was sticky pre-Christmas but since then confidence has lifted on the back of improved prices and farm working expenses and interest rates which are lower.”

A price deferential has emerged

“They should feed them dry feed, boost them with magnesium, make sure they travel well.”

Often cows go straight from the milking shed to a truck, arriving at a plant sick. The transport company and the drivers are then in trouble.

Regulation should govern this, he said.

Clemens said stock effluent is an easy fix, with government and local councils needing to create better effluent facilities on roads.

for properties with high quality infrastructure, resource consent compliance and location over those with poorer quality.

“For all sectors, the maths of buying the neighbours’ is working out better than it has for a long time.”

Wilkshire said Property Brokers has sold 39% more properties in the past 12 months than it did in the comparable period a year earlier, with most of that increase occurring in recent months.

He expects it to be a busy year for land sales.

Bayleys Waikato manager Mark Dawe said there is a growing pool of older dairy farm owners seeking to retire.

“Many of them will be looking at the dairy sector optimism and thinking this next year or two is their best opportunity to move,” he said.

LEGAL: Jim Crouchley, membership adviser for the rural/livestock sector at Transporting New Zealand, says the transport industry depends on farming, processing and saleyards for business, but these entities came with a raft of issues.

Gerhard Uys NEWS Transport

Native forests are mighty CO2 sponges

Richard Rennie NEWS Environment

NEW research suggests New Zealand’s native forests are soaking up far more carbon dioxide than previously believed – a finding that is likely to affect climate policy, carbon accounting and land-use decisions.

NIWA atmospheric scientist Dr Beata Bukosa and her team analysed a decade’s worth of atmospheric data from 2011 to 2020 using advanced modelling and NIWA’s supercomputer.

The findings revealed New Zealand’s land ecosystems absorb around 171 million tonnes of CO2 annually, well above earlier estimates of 24-118 million tonnes.

“This research shows our mature

native forests, particularly in the South Island, are far from carbon neutral,” Bukosa said.

“They’re playing a bigger role as carbon sinks than we thought.”

The team, including scientists

Middle East looks to stock up on butter

Hugh Stringleman MARKETS Dairy

GLOBAL Dairy Trade prices

eased a further 1% overall in the second auction of June and the second for the 2026 New Zealand dairy season.

Whole Milk Powder prices were down 2.1%, skim milk powder and anhydrous milk fat both down 1.3%, mozzarella down 1.9% and lactose down 3.6%.

The two commodities to rise in price were butter, up 1.4%, and cheddar, up 5.1%.

WMP has now eased 6.6% since its recent high point in early May but remains above US$4000/tonne to underpin the farmgate $10/kg milksolids forecasts for the new season.

“The demand outlook seemed to be weakening over the past few weeks as buyers wait for new season product,”

NZX dairy analyst Lewis Hoggard said.

“However, we believe there was a degree of stockpiling pressure due to elevated geopolitical risk in the Middle East, which helped ease the fall in commodity prices.”

Hoggard said the heightened tensions in the Middle East had sharpened the appetite for butter, with buyers from that region taking one-third of the latest GDT offering compared with nil purchasing in early June.

GDT butter prices for the different contract periods remain at or near their record highs of $8000/tonne.

from GNS Science, Manaaki Whenua and international collaborators, used a method known as inverse modelling. It combines atmospheric CO2 readings with air transport models

to pinpoint carbon sources and sinks. These results were compared with New Zealand’s official greenhouse gas inventory and other “bottom-up” estimates, based on land use and ecosystem behaviour.

Significant differences were observed in the South Island, especially in mature native forest areas and some grazed lands.

Seasonal patterns also showed less CO2 released during autumn and winter than previously assumed.

The findings follow a 2017 pilot study in Fiordland that hinted at greater carbon uptake by native forests, but at the time it was unclear if this was temporary or localised.

NIWA principal scientist Dr Sara Mikaloff-Fletcher said this work opens new possibilities for land management as a climate solution.

This week’s poll question: Have your say at farmersweekly.co.nz/poll Do you support the introduction of biodiversity credits that recognise on-farm environmental improvements?

“Improved understanding of our native forests could help reduce reliance on offshore offsets, and provide biodiversity benefits too.”

While not yet part of official carbon reporting, the study could eventually influence how New Zealand meets its Paris Agreement commitments and manages its natural carbon sinks.

Sheep sector running into ‘market reality’

Annette Scott MARKETS Sheep and beef

THE New Zealand sheep and beef industry has provided an excellent financial platform for NZ and its people for a “long, long time”, but the time for change is here, specialist agribusiness accountant Pita Alexander says.

Addressing the potential collapse of the sheep industry in his Pita’s Perspective newsletter, Alexander recalled some 54 meatworks of various sizes closing over the past 55 years as sheep numbers dropped 50 million, to stand at around 23 million presently.

“I have suggested at several recent meetings that unless the sale value of lamb is near $200 per head at the farm gate, and strong wool increases to $6 a kilogram, then sheep numbers will keep dropping.”

This is similar to where the NZ sheep industry was in the 1980s. Presently there are about 16.8

million lambs to spread across the total lamb processor sector, compared with 39 million in 1984.

“One cannot expect the NZ banking system to keep funding any industry that is not facing market reality, which deep down is what is happening in this case.

“It is hard to see government wanting to find capital to inject into the exercise.

“Any potential stakeholder would want to see an annual return of 15% every year.

“A 5% return would not even be vaguely sufficient. The problem needs heavy money.”

Alexander suggested the present farmer controlled “freezing works structure” is past its use by date.

“The key issue is that there may be 15,000 sheep and beef farmers in NZ but each of them has such a small stake in their freezing works that if they lost it all it would not be the end of the world.

“More importantly, if they get a better price for any stock they have to sell, they will take it.

“Loyalty on these issues is spelt with a very small l.”

In financial terms NZ sheep and beef farming over the past 10 years has not, in any real sense of the word, been an income game in the main; it has been a “sound balance sheet game”.

Reducing the industry’s existing debt is not a solution unless at the same time there is a very strong plan to improve profitability.

“At the moment there is nothing on the table to answer this issue.”

It’s inevitable more meat processing works will have to close, just who and where is the question.

“Don’t lose sight of the answer here, that is yes, more works will close.

“Industry ‘collapse’ is the wrong word; it is a further restructuring with increasing focus on why the private ownership structure seems to be more appropriate than the co-op structure when the livestock numbers and throughput is much lower.”

Are you involved with a project that’s making a positive impact in your local rural community? Whether your local sports club needs a lick of paint, or your community hall needs a makeover, we’d love to hear from you!

Your project could receive a day of labour and $5,000 cash from the teams at Rabobank and The Country radio show to help bring your community initiative to life. We’re committed to helping rural communities thrive, and your project could be the next to benefit.

Entries can be submitted at rabobank.co.nz/good-deeds Entries close 30 June 2025 T&C’s apply.

2024 Rabobank Good Deeds Winner Te Mata Tennis Club

OLD SOAKS: NZ’s native forests have shown themselves to be bigger carbon sponges than first estimated, based on latest NIWA research.

Dairy farm moving into apples at scale

Annette Scott NEWS Horticulture

ACOASTAL dairy farm in the Ashburton district is transitioning into an orchard, setting a new benchmark for large scale horticulture in New Zealand.

It will also mark the first commercial scale operation of the new apple variety Joli in Canterbury.

The Torea orchard development is fully owned by the NZ Super Fund (NZSF) and managed by rural investment management company FarmRight, which has managed NZSF’s horticulture and dairy assets since 2010.

FarmRight owns the orchard and will manage all growing and harvesting activities.

FarmRight’s general manager or the NZSF rural portfolio, Ed Tapp, said the company has considerable experience in managing apple orchards and the teams involved in the activities on the properties.

The 460 hectare seaside farm, formerly running up to 1200 dairy cows, currently has 250ha undergoing staged conversion to a large-scale apple orchard while the remaining land will continue as a dairy operation.

The initial phase involves

planting 125ha of Rockit apples and 25ha of Joli.

Launched in 2023, Joli is T&G’s newest global premium apple. T&G partnered with FarmRight to license their growing in Canterbury.

The first 150ha of trees will start going in the ground at the end of June, with planting of the remaining 100ha of Joli scheduled for early 2026.

Canterbury came up strong for these apple varieties, but you are not going to see apples all over Canterbury.

Gavin Tayles FarmRight

By October 2026, 900,000 trees, in a mix of Joli and Rockit, will be in the ground set to produce 116 million apples, 72,500 bins of fruit a year.

Initially the apples will go to Nelson for grading and packing but future plans include the development of a packhouse at the Ashburton site.

Accommodation facilities will be built near the site for picking and pruning workers brought into the region.

Orchard manager Matt Bentley

said about 60 staff are currently working on the structural work with further staff recruitment underway.

“We need another 70-85, a total 150 once we start planting in a couple of weeks and over the picking period up to 450 people will be employed; during thinning and pruning we’ll need about 150.”

Tapp said FarmRight will be looking to create synergies with other local seasonal workforces to help extend periods of work for people.

FarmRight chief operating office Gavin Tayles said extensive research identified the latitude of Mid Canterbury as a suitable location for growing apples using modern, trellised growing systems that will incorporate canopies for frost and hail protection.

“With its climatic conditions, temperature, reliable irrigation, soil types and land suitable for development at scale, Canterbury came up strong for these apple varieties.

“But you are not going to see apples all over Canterbury.”

An added benefit to the development is the reduced environmental impact with modelled reductions in annual carbon emission of 81%, nitrogen loss reductions of 82% and irrigation water use reductions of 40%.

T&G chief operating officer apples Shane Kingston said the agreement to expand the growing of Joli into Canterbury reflects both companies’ shared growth strategies.

“At T&G we have built an exceptional global apples business, underpinned by the world’s best varieties and an end-to-end worldclass system, focused on meeting growing consumer demand for our premium global apple brands.”

For consumers, Joli is a vibrant

large red apple, bursting with juiciness and sweetness.

“This is a flavour profile that consumers across Asia are actively seeking out, and we have customers and consumers eagerly awaiting the first commercial Joli fruit in 2027.”

Both the Joli and Rockit apples at Torea Orchard are licensed and destined for the export market, Rockit predominately to Asia and US markets while Joli’s first key market will be Asia.

WIRING: Sarlo Kalren and Torea Orchard manager Matt Bentley work on the infrastructure wiring.

Photo: Annette Scott

Record bull prices spread through south

Hugh Stringleman MARKETS Livestock

SOUTHERN breeders have continued the very strong average prices and good clearances for two-yearold beef bulls with a selling season of personal highlights.

Matariki Herefords, Clarence Valley, made a breed record price of $80,000 for Matariki Qualifier Q361 and an extraordinary average price of $14,921 for the full clearance of 63 bulls bred by the Murray family.

The record price was paid by the Humphreys of Wilencote Polled Herefords and the Reeves family of Mokairau Herefords near Gisborne.

Matariki also made $40,000 for Lot 52, Quick Shot Q124, paid by Maungahina Herefords, Masterton. Clarence neighbours Woodbank Angus sold 65 from 70, averaged $11,532 and had two high prices of $30,000, paid by Grampians Angus and Oranga Angus.

Taimate Angus, Grassmere, sold all 96 bulls offered for an average pf $13,541 and the top price of $62,000 was paid by Riverlee Angus, Kimbolton, for Taimate U60.

Umbrella Range Angus, on Argyle Station at Waikaia, Southland, made $50,000 for Lot 13, bought by the McFadzean Cattle Company, in Wairarapa.

Johnie McFadzean said he went south to find an easy-calving sire and paid $33,000 for Lot 2.

When Lot 13 also presented with a stacked medium frame and good data, he had to compete strongly with other buyers up to the $50,000 hammer-fall.

In North Canterbury, Hemingford Charolais had a full clearance of 64 bulls and a top of $50,000 paid for Lot 1 by Te Pukerakau Herefords and Charolais, Eketahuna.

The Hemingford average was $12,125 and stud transfers went to Longhill at $23,000, Kia Toa at $20,000, Tawa Ridge at $19,000 and Windy Ridge at $15,000.

Meadowslea Angus, Fairlie, sold 68 out of 76, averaging $8742. The top price of $30,000 for Lot 1 was paid by Delmont Angus, Clinton, and Stern Angus, Pleasant Point, paid $18,500 for Lot 16.

Herefords, Awakino, for $11,000.

CROWDED:

Competition was keen for 70 Angus bulls at Grampians Angus stud, North Canterbury.

Grampians Angus, Culverden, sold 68 of 70 and had a top price of $28,000 paid for Lot 11. The average price was $12,911.

Sudeley Angus, Irwell, sold 63 from 66 and averaged $11,067 with top prices of $21,000 paid by Kenhardt Angus, Nuhaka, and $20,000 by Pine Park Angus, Marton.

Beechwood Herefords and Richon Herefords, Amberley, sold all 28 bulls, averaging $10,000 with a top price of $30,000 paid by Lochaburn Herefords, Luggate.

Other stud transfers were to Polled Monymusk Herefords, Te Anau, for $28,000 and to Bexley

Kakahu Angus, Geraldine, sold 54 from 59 with an average of $11,180 and two top prices of $30,000 paid by Tinui Station and $17,000 paid by Mt Peel Station.

Red Oak Angus, Weka Pass, sold 31 from 33, averaged $8800 and had a top of $15,000.

Kaiwara Angus, Culverden, sold 26 of 29, averaged $8200 and had a top price of $12,500.

Koanui Polled Herefords, Havelock North, sold all 50 bulls, averaging $11,730, with a top of $18,000 and a transfer at $17,500 to Sarona Herefords.

Elgin Angus, Elsthorpe, sold 28 out of 29 and averaged $13,566 with a top price of $23,000 paid by a commercial farmer.

RESOUNDING:

Hemingford Charolais, Culverden, finished the winter sales of two-year-old bulls for that breed with $50,000 top and $12,125 average.

Brackenfield Angus, Awatere Valley, sold 19 from 20 bulls, averaging $9315 with a top of $15,000, paid by Alice and Ben Norton.

Wilencote Hereford Stud, Gisborne sold 28 from 28, averaged $12,821 and had a highest price of $16,000.

Leefield Station, Waihopai Valley, sold 16 from 17 and averaged $8700, with a top of $12,000 paid for Lot 1, Leefield 2339.

Blacknight Angus, Blenheim, had a full clearance of 16 and averaged $9218, with a top price of $15,000 paid twice by commercial farmers. Snake Gully Limousins, Waiotira, sold 18 from 19, averaged $7150 and had a top price of $11,700 paid by Waikura Station.

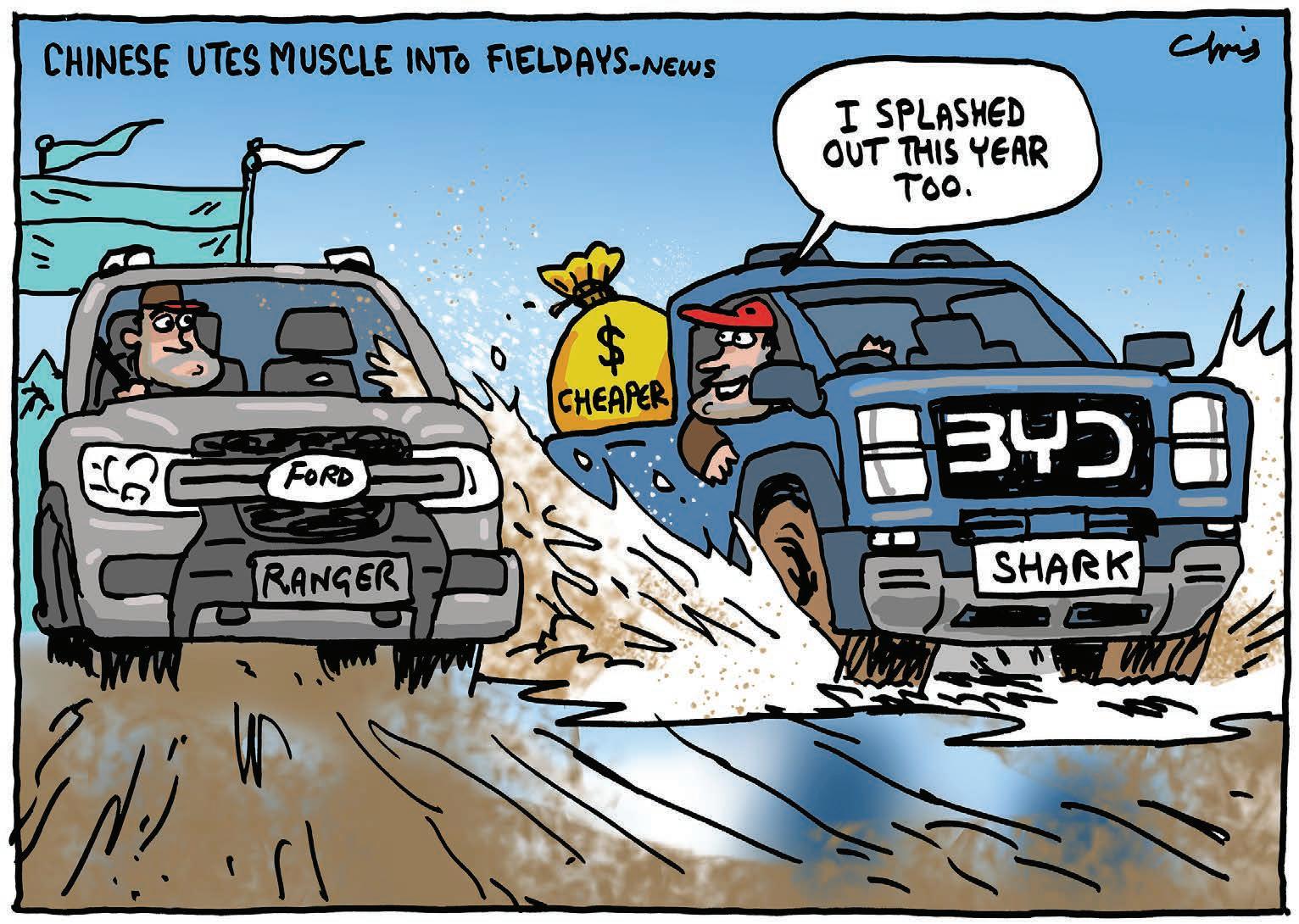

Chinese utes rev up interest at Fieldays

Richard Rennie TECHNOLOGY Transport

THE ute market, long dominated by established brands Toyota and Ford, is facing a shake-up as Chinese manufacturers muscle in on the market.

Fieldays highlighted what an alphabet soup of brand names the market has become, with GWM, BYD, JAC and LDV all in the market mix.

Vehicle sales data indicates they are still in the single digits for market share, with GWM registering 300 sales in 2023, and LDV 700 for its combined vehicle types.

But predictions are GWM will more than double those numbers this year, while BYD’s Shark ute had sold 350 in just the first quarter this year.

Batch milking dairy bot crosses Tasman

Rennie TECHNOLOGY Dairy

GERMAN dairy tech company

GEA has launched a robotic milker that balances increased automation with the typical Kiwi pastoral dairying system.

Appearing for the first time at Fieldays, the DairyRobot R9500 milking system is already well established in Australia, with almost 70 farms running GEA units.

Craig Lowry, head of GEA’s farm tech division in NZ, said the system takes a different approach to the type of roboticised milking most NZ farmers would be familiar with.

That system will typically have cows moving to their own milking clock, voluntarily entering and exiting the robotic milking shed at leisure, moving via a laned system back to paddocks.

“But if you look at how NZ has farmed for many years, we looked at how do we utilise that system while introducing robotic milking into it, with minimal disruption or changes to the infrastructure?”

Voluntary robotic systems can result in limitations to cow grazing patterns, often dictated by the cowshed’s location.

The GEA machine works on a “batch milking” method, with

From a small base, the sector has stirred up competition and interest in the popular sector in a country where Ford Ranger accounted for 28% of the ute market in 2024, followed by Toyota HiLux at 18%.

We are finding we are getting interest from lots of young dairy farmers in these.

Claire Dalton LDV

Claire Dalton, LDV’s national sales manager, told Farmers Weekly at Mystery Creek that the offer of a seven-year warranty, roadside assistance and WoF provision all helped, while the government’s 20% depreciation allowance announced in the Budget was a bonus.

“That really represents a decent sort of deposit on a new vehicle.”

She said the seven-year warranty was helping ease any misgivings new buyers may have about Chinese brands, some which were marred by quality issues in earlier models.

“We are finding we are getting interest from lots of young dairy farmers in these.”

LDV used Mystery Creek to launch its Terron 9, a 2.5 litre turbo diesel ute with 3.5 tonne towing capacity. During Fieldays, Dalton said, a fleet deal had been signed, and several of the vehicles sold to farmers.

A GWM spokesperson at Mystery Creek said the ANCAP 5-star safety rating its models have acquired is also providing prospective buyers with peace of mind.

Earlier Chinese models had reported dubious safety ratings.

“People are spoilt for choice now, and you simply cannot come to the market with bad products.”

Mystery Creek was also the

cows bought in as they have always been, and milked by a fully automated robot stall processing about 60 cows per milking.

There are options to bring in groups of cows through the day, or use multiple machines to bring the entire herd in as they have always been. A typical average 420-cow herd would require eight units.

For a farm converting to the system, this would represent an outlay of about $1.8 million.

Lowry was confident the company would have at least one installation complete within the farming year.

The main driver for farmer interest in the machine at Mystery Creek was labour constraints.

“The constraint around labour will always be a driver. Even if farmers have good labour, they are looking to future proof their farm,” Lowry said.

“And we have an aging farmer base. Farmers are asking ‘What am I going to do with the farm,

launch for the BYD Shark plugin electric hybrid ute, essentially more electric than petrol powered with two electric motors and a small 1.5 litre turbocharged petrol engine for auxiliary power and battery recharge.

Farmers spoken to about the Shark appreciated the presence of a petrol engine to deal with range anxiety, and the machine’s high

level of power (320kW) and torque (650Nm).

Plug-in electric hybrids have also been given a boost with the launch of the GWM Cannon that comes as either a 2.5 litre turbo diesel or a 2.0 litre turbo petrol hybrid.

“With an entry level pricing of $43,440, you are looking at a very sharp sub $50k ute,” said sales specialist Tim Elliott.

Confidence still at near-record highs

Staff reporter NEWS Agriculture

BATCH BOT: DairyRobot R9500 is already well established in Australia, with almost 70 farms running GEA units.

The constraint around labour will always be a driver.

Craig Lowry GEA Farm Technologies

I might be over the milking aspect, what can I do to continue farming without having to milk?’”

The machines have a preset process that kicks off with teat simulation and moves on to milking, measurement and sampling, teat spraying and finally rinsing the cups before the next cow steps up.

Victoria and Tasmania have had “significant” uptake of the robotic tech, said Lowry.

The government’s 20% depreciation figure up front as announced in the Budget is likely to be a strong motivator for farmers, Lowry predicted.

“It is the closest thing to a subsidy we have seen in NZ for some time.”

FARMER confidence in the agricultural economy remains at a near-record high, according to the latest Rabobank Rural Confidence Survey.

Farmer confidence in the broader agri-economy was unchanged at a net reading of +44% following consecutive lifts in the previous three quarters.

Alongside last quarter, this is the second-highest net reading recorded across the past decade, with only Quarter 2 in 2017 higher at +52%.

Completed in early June, the survey found 48% of farmers were now expecting the performance of the broader agri economy to improve in the year ahead, slightly down from 52% in the previous quarter, while the number expecting conditions to worsen had also fallen to 4% (from 8%).

The remaining 44% of farmers expected conditions to stay the same (36% previously).

Rabobank chief executive officer Todd Charteris said sentiment is high among producers across all of New Zealand’s major agri sectors.

“This broad-based positivity is largely being driven by strong commodity prices for our key agri exports,” he said.

Since the previous survey, Fonterra has announced a record opening forecast, and prices for beef and sheepmeat have also surged.

Horticulture products and export revenues have also lifted, and the latest Situation and Outlook for Primary Industries report, released at Fieldays, forecast horticulture export revenues to increase by

19% in the year to June 30.

“With all this positive pricing news coming in over recent months, it wasn’t a surprise to see close to two-thirds of farmers and growers in our Quarter 2 survey citing rising commodity prices as a key reason for their upbeat view on the outlook for the agri-economy.”

Improved marketing and overseas markets/economies were cited as key reasons for optimism. Among the 4% of farmers expecting conditions in the agri economy to deteriorate, “falling commodity prices” (66%) and “rising input prices” (46%) were the major factors cited.

Farmers’ expectations for their own farm business operations lifted from +37% to +40%. Dairy farmers and sheep and beef farmers’ confidence in their own businesses remained strong and was relatively unchanged from March, while horticulturalists were now much more upbeat.

“In our March survey, we actually saw horticulturalists dip into negative territory on this measure, but confidence has come roaring back this quarter and growers are now up to a net reading of +21%,” Charteris said.

“This upwards shift comes off the back of recent strong export revenues and elevated prices for a host of key horticultural products including kiwifruit, apples, pears and vegetables.”

Investment intentions are now at their highest level since 2018.

“Close to a third of farmers are now looking to increase investment, with only one in 20 looking to invest less, and this lifted the net reading on this measure to +25% from +16% previously,” Charteris said.

Richard

NEW UTE SMELL: Sharp pricing for entry-level Chinese utes is prompting more farmers to consider a new vehicle over a secondhand one, says Claire Dalton, national sales manager for LDV brand.

Ballance eyes imports as fert market shifts

Richard Rennie NEWS Fertiliser

THE over-capitalisation in phosphate plants has made Ballance’s Mount Maunganui shutdown inevitable and will bring a shift in fertiliser market dynamics, says CEO Kelvin Wickham.

Speaking to Farmers Weekly at Fieldays, Wickham said four super plants in New Zealand are simply too many, particularly when all are running at only 50% of capacity.

It costs us three times as much to move a tonne of product from the South Island to the North Island as it does to bring it in from China.

Kelvin Wickham Ballance

Ballance could double production out of its Awarua Southland plant, but the constraints are the complexities and costs within NZ’s logistics and supply chain network.

“For example, it costs us three

times as much to move a tonne of product from the South Island to the North Island as it does to bring it in from China.”

He confirmed Ballance will be bringing imported product into

NZ to support local supply but also expects NZ will start to see some different fertiliser types as companies respond to rising transport costs by importing more high analysis products – those with a higher percentage of essential plant nutrients.

“In places like Ireland and the UK you see them doing a lot of bespoke compound nitrogenbased fertilisers.

“Our view is we need to start embracing them here too, versus pushing something because we happen to be making it. We have to be more versatile and agile in our offerings for farmers.”

Wickham pointed out 85% of NZ’s fertilisers are already imported, including 60% of its nitrogen-based products.

Recent commentary on how secure NZ’s gas supply is has also been front and centre for Ballance executives, given it is the country’s second largest industrial gas user after Methanex.

“Of course, we are concerned on where gas will come from as

the long-term supply starts to come down, and we all need gas to transfer to a greener energy economy too. It is a stress point.

“We thought we had 10 years supply, but that is not so certain now. The government is trying to incentivise exploration options.”

His views on where future fert sources will be found was shared by the latest entrant to the NZ market, Australia-based Marnco.

Marnco’s NZ commercial manager, Jamie Thompson, agreed the costs of logistics and shipping will compel more high analysis fertilisers. However, he pointed to the supply risk that comes with this, with China recently tightening up on all phosphatebased products.

“And that seems to have continued beyond the usual spring period for them. There is good product available out of Europe, but this is quite a long way to bring it from.”

Wickham said sheep and beef operators are now firmly back in the fert market and he anticipates a lift in demand for nitrogen and phosphate products, while potash and sulphur are likely to remain steady.

Meantime dairy farmers are relatively cashed up, and about to kick off a new season with a $7.40/

kg milk solids advance, meaning they are in a reasonable cash position right from the start of the season.

“The challenge for us will be to ensure we can estimate demand as best as possible heading into spring.”

Students drive agriculture uptake at girls’ school

TWO senior students at Napier Girls’ High School are cultivating a future for agriculture at their school as they prepare for a second crack at the 2025 New Zealand Junior Young Farmer of the Year Grand Final next month.

Still buzzing from their thirdplace finish at last year’s Grand Final, Liana Redpath and Kaela Brans entered the FMG Junior Young Farmer East Coast competition in March, a regional qualifier to secure a spot at this year’s nationals.

But their ambitions go beyond trophies. They weren’t just competing, they were shaping the future of agriculture.

The two 17-year-olds who grew up on sheep and beef farms have reinvigorated Napier Girls’ High School’s Young Farmers Club, transforming it from a quiet, oncea-year gathering into a thriving hub.

Redpath and Brans are making sure young women passionate about farming and agribusiness have opportunities to connect, compete, and learn about NZ’s agricultural export industry.

“We put our feelers out and got the ball rolling, now it’s a club with real momentum,” Redpath said.

The club’s resurgence began in Year 11 when Brans drafted a proposal to school leadership, gauging school interest in

reinvigorating the club and on receiving the school’s support she called for club membership registrations.

NGHS’s Hewett House hostel is now host to 50 club members, most from rural backgrounds.

The annual regional FMG Junior Young Farmer of the Year competition, an event grown out of the historic flagship Young Farmer of the Year contest, has helped drive interest.

“Our third place at the grand finals last year really put us on the map. It encouraged more girls to give it a go,” Brans said.

At this year’s regionals in Masterton, NGHS had six teams enter the 25-team competition.

Alongside Brans and Redpath in

We put our feelers out and got the ball rolling, now it’s a club with real momentum.

Liana Redpath Napier Girl’s High School

first place, fellow club members Emma Brady and Georgie Wilson placed sixth, while Brady also won contestant of the day.

NGHS acting principal Megan Mannering said the school is “especially proud” of both students.

“Particularly for their contribution to our kura, their leadership, and especially their

outstanding success in the Junior Young Farmer of the Year competition.”

NGHS currently offers a primary industry course focused on practical, hands-on experience.

The young co-leaders and their growing club hosted quiz nights, guest speakers, organised a raffle to cover club apparel, and supported students for a Lincoln University presentation.

Meanwhile, both Redpath and Brans, with support from the school, plan to pursue a NZ scholarship for agricultural and horticultural science this year. Beyond high school, both are looking to study veterinary science at Massey University.

With the national Grand Final fast approaching, their focus is on the Grand Final where they’ll once again put their skills to the test across a range of presentations, exams and practical and theoretical challenges during two days of competition in Invercargill, July 3-5.

“You can’t help but be a little nervous, but it’s an incredible opportunity, and we’re grateful to experience it again.”

The girls are also thinking about the future having established a Young Farmers committee to ensure the school club continues when they move on.

“Our main goal is making sure it has solid foundations.”

Annette Scott PEOPLE Skills

AMBITIOUS: While winners in their field, Liana Redpath and Kaela Brans’ ambitions go beyond trophies. Photos: Supplied

PASSION: Liana Redpath and Kaela Brans are making sure young women passionate about farming and agribusiness have opportunities to connect, compete, and learn about NZ’s agricultural export industry.

OVERSEAS: Ballance CEO Kelvin Wickham says sourcing fertiliser offshore in more concentrated forms is one way to deal with high transport costs.

PERFECT PARTNER PASTURE’S

Scholar finds GE rules need broader touch

Richard Rennie TECHNOLOGY Genetics

WITH a background in veterinary science, sharemilking experience, and a leadership role in MyFarm’s apples division, Nuffield scholar Rachel Baker is well equipped for a broad view on genetic technology’s impact on New Zealand’s food production.

How this country manages the technology, monitors its risks, and capitalises on its gains was the subject of her 2024 Nuffield scholarship work.

As the Gene Technology Bill passes through Parliament, Baker has raised several timely questions on how the tech will sit within NZ’s coveted “clean green” image as a trusted food producer.

Scientists have lambasted NZ’s GE regulations for the tight, expensive constraints that put this country increasingly at odds with trading partners’ more progressive approach.

However, Baker said being a slow

starter in setting GE rules may not be such a disadvantage.

She found that a global saturation of broad acre GE crops has seen planted land area plateau, with soybeans and corn dominating particularly throughout the United States, Brazil and Canada.

We must be upfront and all trade partners be clear on defining what ‘minor’ changes means.

Rachel

Baker Nuffield scholar

“There is also, however, a global shift underway from those early productivity-focused gains GE delivered in those broad acre crops, to use CRISPR technology to address the challenges of food security, sustainability and viability.”

She agrees the tech has run the risk of overpromising and underdelivering since those early gains.

“There is a need to manage

expectations. There is an emerging conservatism as we enter a new phase after this saturation, ensuring new crops will deliver beyond productivity, and be safe.”

She also found NZ risks being solely focused on safety and economic outcomes with its regulation, without allowing for environmental, social and governance implications of the tech and the potential impacts on trade and markets.

“This more holistic approach would require case-by-case assessments of the technology. My concern is we are losing many scientists and social scientists whose skills would help in this area.

“Their expertise is needed not only to bring transparency to the process but also answer questions and help build trust among the sector’s growers and farmers, the public and our trade partners.

“This includes whether we deregulate for those minor GE changes that are indistinguishable from conventional breeding changes.

“And if we do, that we have

a registration process for transparency.

“We must be upfront and all trade partners be clear on defining what ‘minor’ changes means.”

NZ’s approach is going to need to start with more sector engagement within different farming/orchard types.

Taking all growers and society along together is vital, and signals from NZ’s organic sector are that it is already being left out of final regulations and conditions.

“We need to acknowledge the concerns, not only of organic farmers over cross-contamination, but also of conventional farmers

SHIFT: Nuffield scholar Rachel Baker says there is a global shift underway from early productivityfocused gains to using GE to address the challenges of food security, sustainability and viability.

who may not want to use GE technology. We need to know what successful co-existence would look like.”

Consumer acceptance is likely to be greater when there is an understanding about what the personal and societal benefit of the tech may be.

“We are very much at the beginning of the journey and need to avoid making GE a binary argument. We need to find middle ground with general acceptance within and across sectors and the public. This is a time for leadership to ensure we have those conversations.”

Comvita warns of loss and impairments

Hugh Stringleman NEWS Apiculture

COMVITA has advised an expected net loss before tax between $20 million and $24m in the 2025 financial year, ahead of the annual results publication date in late August.

It will be the second year of net losses of this magnitude and the listed mānuka honey producer and exporter has warned of significant non-cash impairments in the forthcoming results.

Revenue in the year ended June 30

is expected to be slightly down on the year before and gross margins will be down because of aggressive proving and channel loading by competitors in the core product, mānuka honey.

“Price discounting to sell surplus higher cost inventory is expected to continue through the next two quarters,” the company said.

On the positive side, targeted cost savings of $15m-$20m annually have been running ahead of target and the head count is down 70 fulltime equivalents.

Operating expenses are expected to be lower than in FY24 but there have been significant restructuring costs

and the main benefits will come in FY26.

Net debt has fallen from $82m at December 31 to about $63m on June 30.

The directors say further action is required to reduce debt further and the company is working with its investment bankers and legal advisers.

“As part of year-end processes, the company is assessing the level of a non-cash impairment of assets and provision against inventories, which are expected to be material.”

Comvita’s share price is sitting at 55c, down 50% over the past year.

DOWN: Comvita’s share price is sitting at 55c, down 50% over the past year.

MARKETS: Otis Oat Milk founder Tim Ryan says new markets represent a significant portion of their production.

New oat milk markets good news for rural NZ

Gerhard Uys NEWS Arable

THE opening up of new markets by oat milk companies Boring Oat Milk and Otis Oat Milk has benefits for entire farm communities, say industry experts.

Boring Oat Milk recently announced that its Original and Barista oat milk varieties will hit shelves in 953 Woolworths supermarkets in Australia, with Otis Oat Milk founder Tim Ryan saying they are specifically eyeing specialty food services in Japan and Taiwan for their locally grown and made oat milk.

Ryan said the new markets represent “a significant portion of our business”.

“A high tide lifts all boats. The more we can drive oat beverages to a thirsty world, the better we set our growers up for success in future years.”

The general manager of business operations at the Foundation for Arable Research, Ivan Lawrie, said any signs of expansion in markets for New Zealand-grown grains and its derived products is extremely positive.

Lawrie said this expansion highlights the high quality of locally grown grains and local products that can compete on the world stage.

“It is important that the expectations for growth are clearly communicated to the growers,” he said.

Southland oat grower Graeme Gardyne said the industry will have enough supply to meet an increase in demand.

Gardyne said Harraways is currently upgrading its mill, which will allow it to process more oats in future.

Managing director at Plant Research Adrian Russell, who works with Southland and Otago oat growers on a breeding programme, said Southland is New Zealand’s main oat growing region.

He said increased demand trickles down to more than just growers, but to contractors, cartage companies, chemical companies, seed developers, storage facilities and distribution networks.

Harraways chief executive officer Henry Hawkins said Harraways is well placed to meet the future needs of any expansion Boring may undertake.

Ultraviolet seed process shines a light on NZ

Neal Wallace TECHNOLOGY Arable

ANEW Zealanddeveloped seed treatment process could be about to break into the massive corn and rice growing sectors.

Corn is an initial target for Palmerston North-based BioLumic, which uses ultraviolet light backed by data science to alter the behaviour of seeds, such as increasing yield and energy levels, without altering their DNA.

Treated ryegrass seed will soon follow.

BioLumic founder and chief science officer Jason Wargent said 40 million hectares of commercial corn is grown in the United States each year from about 400,000ha of parent or foundation seed production, making it a lucrative market.

Ultraviolet-treated parent corn seed will be planted next year.

The technology alters a seed’s genetic expression 90% faster than traditional methods to improve yield, stress resilience, weed and pest tolerance and nutritional composition.

Wargent said other opportunities being looked at include rice, soybean, and following investment from Fonterra’s Ki Tua Fund earlier this year, ryegrass.

Laboratory trials on UV-treated ryegrass reveal lipid levels can be increased, which has been proven to reduce methane emissions and improve plant energy levels, root growth and pest and disease tolerance.

Wargent said this will potentially boost pasture productivity and energy density, with laboratory trials showing a 30% improvement in dry matter yield.

“Even if we get a 5% gain in productivity in the field, it will

TRIAL CROP: BioLumic’s head of research and development, Leyla Bustamante, checks a trial crop of ryegrass. The seed has been treated with ultraviolet light to enhance desirable traits.

translate into a huge increase in milk solid production.”

Lipid levels have been increased 6% in the laboratory, which could translate into a 12% decrease in methane emissions, data Wargent said needs to be ratified in field trials.

As with all seeds undergoing the process, ryegrass seeds are diagnosed in the laboratory to determine the UV light pulses needed to alter desired traits followed by hothouse trials, which can take up to 18 months.

This is followed by field trials which, for ryegrass, should start next year, with market release potentially in 2027-28.

Wargent said once parental seed has been treated with UV light, those traits are imbedded in commercial seed.

A recently oversubscribed capital raising round, which included investment from Fonterra’s Ki Tua Fund, is assisting BioLumic’s commercial launch of a seed category known as xTraits.

The capital raising attracted interest from investors as diverse as Azolla Ventures, a climatefocused agtech investor, and iSelect Fund, a US-based food, agriculture, and healthcare innovation fund.

US-based seed supplier Gro Alliance has been licensed by BioLumic to use the UV activation system to produce xTrait seed for its pure-bred or corn inbreds, and corn hybrid varieties.

Wargent said field trials have shown light-activated hybrid corn achieved over 20% yield gains and 8% gains in activated inbred parent lines.

These hybrid varieties will be commercially released for the 2026 US planting season.

The foundation UV technology has been around for more than 20 years but Wargent said it actually dates back to when plants first started growing on Earth.

The modern-day scientific adaption of the technology was refined at Massey University when Wargent joined in 2010 and researchers determined the precise UV treatment needed to unlock seed traits.

Initially the process was not viable due to the cost of technology and the unreliability of lights and associated equipment.

“We can only do it now because technology has progressed and has got us to this point,” Wargent said.

He said all crops could be treated including fruit and vegetables.

Fairlight a springboard for women in ag

Rebecca Greaves PEOPLE Training

THE Fairlight Foundation’s unique internship programme for women is providing a launchpad for future leaders in agriculture, and has the potential to be replicated by other industries in the food and fibre sector, an independent report has found. The report, carried out by Dr Lesley Petersen and funded by the Food and Fibre Centre of Vocational Excellence, evaluated the impact, relevance and sustainability of the Fairlight Foundation internship programme.

Now in its fifth year, and run at Fairlight Station in Southland, the programme accepts three female interns annually for its year-long course. It provides a winning blend of hands-on practical experience, leadership development and robust mentorship. Mentorship was identified as a cornerstone of the programme’s success.

The foundation works to address the underrepresentation of women in management roles in agriculture.

The report says the programme’s emphasis on leadership development and promoting female representation is a defining strength, and called it a “highly impactful” initiative.

It also found the programme has broader potential as a replicable model for other industries, advancing gender equality and professional development across the food and fibre sector.

Graduates of the programme and employers of graduates were interviewed as part of the evaluation. Graduates cited it as being instrumental in preparing them for leadership roles, highlighting confidence building, the core value of “wellness” and mentorship as other strengths.

“The programme is highly regarded by employers for producing skilled and capable graduates ... able to handle responsibility and fit in well with farm teams,” the report says.

Fairlight Foundation executive director Laura Koot said the report was amazing, but the foundation would not be resting on its laurels.

“I feel we are on track. We’re excited to have independent feedback on our programme, but all it does is cement our purpose. It is encouraging that someone outside the organisation can see value in what we’re doing.”

Koot said the foundation regularly conducts its own interviews with interns and graduates and is constantly reviewing and fine-tuning its offering to ensure it meets the changing demands of the industry.

“We’re here for 100 years. It’s not set and forget, it has to be fit for purpose, every year ... we’re giving them the tools they need to navigate the industry as they want to, to advance their career in any area of the sector.”

The report does identify some areas for improvement, such as more practical skills and education around financial management, some of which the foundation has already addressed.

This year it introduced a financial literacy programme in conjunction with ANZ bank, which takes interns from basic budgeting right through to building equity in a farming business, Koot said. She was quick to pay credit to Doug and Mari Harpur (majority owners of Fairlight Station), who provide the endowment that allows the programme to run,

and to the work done by Fairlight Station managers and shareholders Simon and Lou Wright, particularly the high-quality pastoral care provided under their watch.

“One of the biggest reasons the programme is a success is because it’s being run on Fairlight Station. It’s the incredibly supportive family environment, it’s a safe place to learn, combined with Simon’s skills and experience – his farming skills are of the highest quality. You could not run this programme on just any station,” she said.

“I want all farmers to look at the environment they’re providing, particularly if they’re taking on young people.”

More broadly, the foundation is now moving into the wider community and schooling space, running its first one-day workshops for secondary school girls last month, with the support of Land Based Training and its tutors. It also has plans to run twoday Pasture Camps.

Koot sees the benefits as twofold – there’s an industry good element, and the creation of a pipeline for future internship applicants.

GE Bill a fork in road: organic sector

Rennie TECHNOLOGY Genetics

ORGANIC Aotearoa New Zealand

CEO Tiffany Tompkins cautions that NZ’s agri sector is at a fork in the road as it contemplates its genetic technology options. Her organisation is continuing to push back on government plans to deregulate and open the gene technology sector, pushing aside legislation that is more than 20 years old, and regarded as some of the most restrictive in the world today.

But Tompkins is cautioning against swinging to a deregulated extreme where she says NZ risks losing not only any value a “GMO free” claim may hold, but also eroding value in organics, the fastest growing sector within the primary industry.

The release of OANZ’s four yearly industry report earlier this month highlighted how the sector had broken through the $1 billion-

a-year value point, experiencing industry-leading year-on-year growth of 12% in a global market expected to be worth US$650 billion by 2033.

Tompkins said she is concerned at the speed with which the government wants to push legislation through. It is aiming the Gene Technology Bill will be an Act by year’s end, and first applications through by late January 2026.

She said OANZ’s concerns remain as they were when they submitted on the Bill. These include how deregulated the sector was likely to become, and the lack of research and understanding on the technology’s “unintended consequences”.

She cites the case of gene-edited poll cattle exhibiting antibiotic resistance, discovered by the United States’ Food and Drug Administration.

“Globally there is a huge push right now for more countries to accept more GE type crops, due to

pressure to reduce sprays and crop treatments.”

But, like Canterbury University’s Professor Jack Heinemann, she questions whether NZ is likely to see true value from a technology that has so far delivered only broadacre results to commodity type crops, namely corn, soybeans and cotton.

“So far the results have been relatively underwhelming. The hype has been there but it has not really delivered.”

In a Spinoff article last year Heinemann pointed to a failure in the tech to deliver on drought-, heat-, flood- or salt-tolerant crops to date.

Meantime Tompkins maintains the downside losses from seed contamination into NZ’s organic food production are far greater than what gene tech can deliver.

“At present we only have 0.6% of our farmland area in organics, earning over $1 billion a year.

“Globally we need 11-14% of land area to keep up with demand.

Imagine if NZ moved from 0.6% to even just 3% of farmland area. We are not playing in the commodity game here, we have a massive and growing market.”

The International Federation of Organic Agriculture Movements (IFOAM), to which OANZ belongs, is steadfast in its non-acceptance of gene editing technology and its integration into organic farming systems.

It cites the concerns echoed by OANZ, including unintended consequences, consumer trust issues should organics adopt the technology, and unforeseen environmental risks.

A review paper released by exGrasslanz CEO John Caradus in 2023 said GE crops had improved yield, quality and environmental outcomes to farmers while delivering benefits to consumers, and said they were unlikely to have an impact upon overseas markets.

“We are not anti-science. Biotech is a great industry but the risks associated with it are being

ignored. You need to regulate GE crops and everything has to be contained.

“The economic consequences of GE needs to be considered, and no economic evaluation has been done on the impact to organics.”

MOVING ON: Fairlight Foundation’s 2024 interns celebrate at their graduation with former graduates. From left are Holli Robinson, Aggie Burgess, Ella Clarke, Monique Mellow, Mikayla Beaumont, Lily Priest, Emma Foss, Ella Eades, Yvonne van Baarle and Samantha McKelvey. Photo: Patrick Fallon

Richard

PUSHING: Organics Aotearoa NZ CEO Tiffany Tompkins says no analysis has been made about the impact of GE tech on organics, NZ’s fastest growing food producing sector.

VALUE: Fairlight Foundation executive director, Laura Koot, says it is encouraging that ‘someone outside the organisation can see value in what we’re doing’.

INTERNS: Fairlight Foundation 2025 interns with Fairlight stock manager Sam Wright. From left, Tegan Butler, Sam Wright, Nerida Bateup and Maddi Hubers. Photo: Clare Toia-Bailey

Innovators honoured with Fieldays awards

Gerald Piddock TECHNOLOGY Awards

RUMINANT Biotech and Miti were big winners at the Fieldays Innovation Awards, receiving the Prototype Award and Early-Stage Award, respectively.

Rounding out the winners were CropX, whose Evato 1 product won the Growth & Scale Award, and St Paul’s Collegiate School, who won the Young Innovator Award with KiwiPrune.

There were five short-listed finalists in each awards category, who had their entries judged by a panel of 18 sector experts on June 11. This year’s awards had 63 overall entries.

Auckland-based Ruminant Biotech has created a slow-release bolus called Emitless, which delivers over 75% methane reduction in cattle for 100 days from a single treatment.

George Reeves said they were elated to win and also surprised given the calibre of the other finalists.

“It’s pretty humbling to win it when you’re amongst so many other good innovations.”

Oamaru’s Alps2Ocean Foods Tapui, the company behind Miti, has created a protein snack produced from surplus dairy calves. Company founder Daniel Carson said he was blown away at the win.

“It’s an incredible honour, especially knowing how many bold, innovative technology ventures are out here trying to make a difference.

“We didn’t come to Fieldays for awards, we came to share an idea, to invite feedback, and to kōrero with the people who this matters most to: farmers, food lovers, and the next generation of innovators.”

It was one small step on a much bigger journey, he said.

“We’re here to reshape the red meat value chain, for the good of people, animals and the land.”

CropX, from Wellington, won the Growth & Scale Award. The judges were impressed by the development and introduction of the Evato1 evapotranspiration sensor, a transformative addition to the CropX platform.

CropX sales and business development manager Julian Ramirez-Luna said he built the sensor, called Evato 1, in his garage.

“It’s a very simple, smart Kiwi innovation.”

It measures and monitors water evapotranspiration for irrigated crops and pastures, conveying the information to farmers and growers in an online dashboard, CropX.

The system also measures and displays soil moisture and rainfall, allowing farmers to make responsible decisions around when to irrigate.

The KiwiPrune team from Hamilton’s St Paul’s Collegiate School won the Fieldays Young Innovator Award for entrants 19 years old and under.

KiwiPrune was designed and developed as part of coursework for the AgriBusiness in Schools programme, to simplify the labourintensive task of removing the plastic clips used to secure the kiwifruit vine.

The device is designed to remove clips from kiwifruit vines on orchards, improving productivity, reducing strain, and enhancing sustainability.

“Usually people have to take the clips off with their hands. There’s thousands of them and it’s a bit of a pain,” co-creator Madeleine Anderson said.

KiwiPrune removes the clips without damaging the vine or the wire. It also has a serrated side to cut through ties, she said.

Co-creator Courtney Malloy grew up on orchards, having firsthand experience of manually removing the clips while working the vines during the school holidays.

“We came up with the idea to make it easier for all growers and workers.”

Both said it had been hugely popular with visitors to their Fieldays site, resulting in a list of people who want to order the tool.

Are you a member of a community group or club?

Your community group or club could be an incorporated society

Recent law changes mean that every incorporated society must reregister before 5 April 2026 to keep its status and assets.

Learn more about the law changes by scanning the QR code, or go to: is-register.companiesoffice.govt nz/ law-changes

PROTOTYPE: Ruminant Biotech won the Prototype Award at the Fieldays Innovation Awards for its slow-releasing bolus. The Ruminant Biotech team were, from left, head of intellectual assets and strategic partnerships George Reeves, senior business development manager Ian South and head of research studies Kirsty Bardoul.

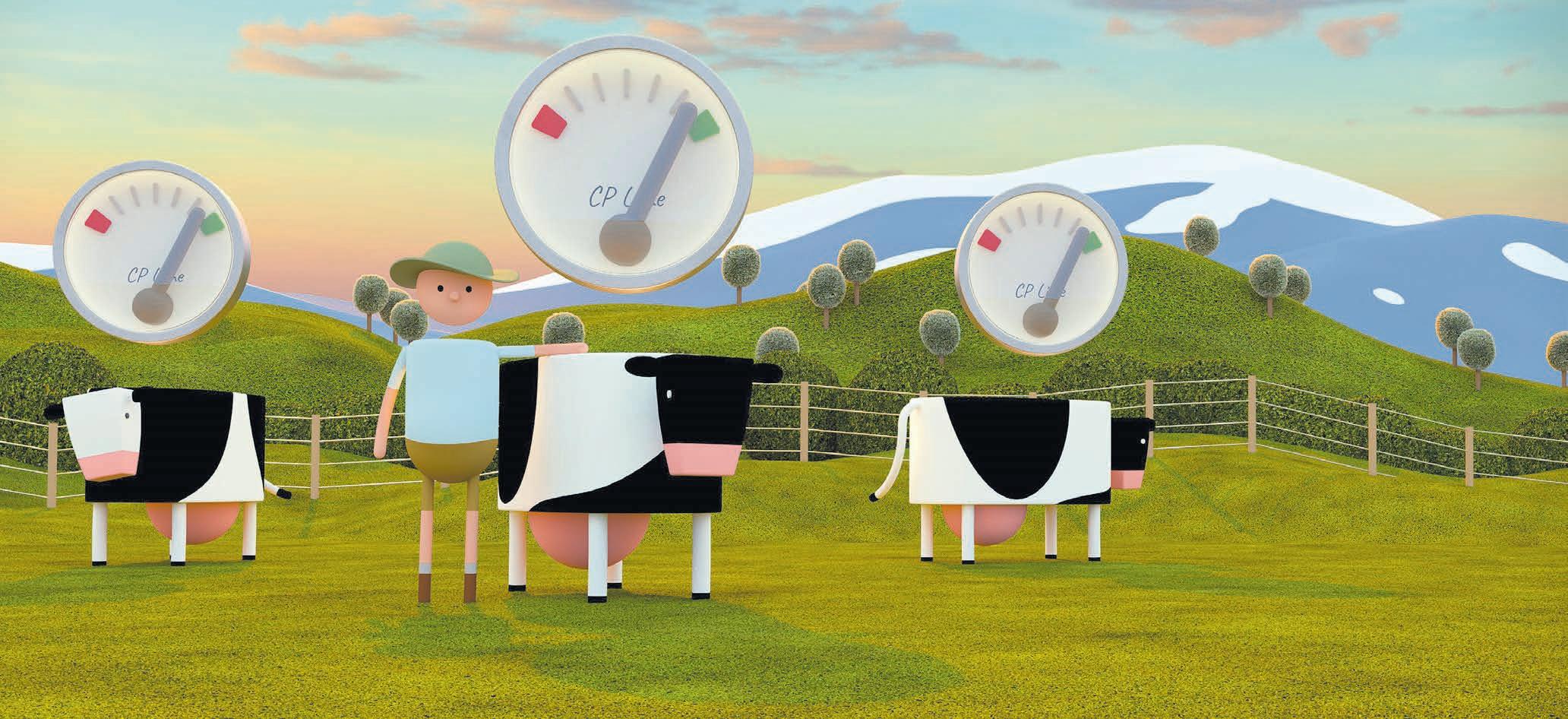

Science takes a scythe to fert waste

SOUTHLAND dairy farmer

David Dodunski pulls no punches when it comes to environmental stewardship.

To him, it’s not optional – it’s essential.

“We need to encourage fellow dairy farmers to use technology and modern science to reduce the wastage and contamination of artificial contaminants into our waterways,” Dodunski says.

Dodunski is the founder of the Fortuna Group. Fortuna has 23 dairy farms, producing 7.6 million kgMS from 16,500 cows at peak milk.

The group also has 2800 effective hectares of support land, making it largely self-contained and in full control of youngstock development.

It did not start this big but began four decades ago, when Dodunski started sharemilking with just 31 cows.

Very early on Dodunski became convinced that we need to do better.

His epiphany came to him when he was driving along a rural road and his windscreen was pelted with fertiliser granules, even though the bulk spreader was some distance away from him.

He realised how much fertiliser must be entering waterways –and decided to do something about it.

He began setting up buffer zones near waterways.

Without digital tools, he’d mark exclusion zones by hand on paper maps, fax them to drivers, and trust that they would use them correctly.

Fast-forward to today, and digital tools are at the heart of Fortuna’s nutrient management –

particularly Ballance’s SpreadWise platform.

SpreadWise gives the Fortuna team the info they need. With an advanced digital mapping tool, nutrient application on farms are optimised.

By identifying areas within paddocks naturally enriched by stock movements, such as gates, troughs and other hotspots, nutrients can be applied precisely where they’re needed, saving up to 10% on nutrient costs.

This means reduced nutrient use, improved efficiency, less waste and a lower environmental impact.

SpreadWise maps key farm features and uses Artificial Intelligence to create exclusion zones where nutrients aren’t needed.

These enhanced maps are integrated into every MyBallance spread journey request.

The tech helps the Fortuna team practically implement their

philosophy of only applying what’s really needed.

On-farm examples illustrate this best.

Trial work done at Fortuna Group showed that (potassium) K levels at the back third of paddocks were half the levels in the front twothirds, with levels in the gateways and troughs especially elevated.

We call an effluent pond a nutrient storage vessel. We know what the nutrients are in the effluent, we treat it just like artificial fertiliser.

David Dodunski Fortuna Group

MyBallance comes in handy in such a situation and Dodunski said they now do variable rate applications in paddocks, applying

double the amount of K on the back third of a paddock, compared to the front two-thirds.