U.S. homeowners 62 and over are sitting on an impressive amount of home equity — THE OPPORTUNITY: HELP YOUR SENIOR CLIENTS IMPROVE RETIREMENT.

borrowers are using reverse mortgage loans as a retirement planning tool to maximize cash flow, reduce taxes and minimize risks.*

“Will my retirement funds last throughout retirement?” is a question that weighs on the minds of many people nearing or in retirement. There are many unknowns that come into play, such as:

Longevity — How long will they live? Thus, not knowing how long to make their wealth last.

Market cycles — How will the market perform during retirement?

Contingencies — What financial shocks will they face in retirement (e.g., medical care)?

As a financial professional, you want to give your clients the best chance at financial success. That’s why it’s important for you to explore all options and strategies available. One often overlooked or dismissed opportunity is the strategic use of home equity. The home is simply too large of an asset to ignore.

By incorporating home equity planning and reverse mortgages into your practice, you could help make the lives of your older-adult clients better, give them financial flexibility to navigate uncertainties in retirement, prolong the life of their assets under your management and much more. Reverse mortgages are a valuable planning tool in the right situation, and they should be explored and embraced by advisers.

What is a reverse mortgage?

A Home Equity Conversion Mortgage (HECM, commonly called a reverse mortgage) is a federally insured home loan that allows homeowners aged 62 and older to convert a percentage of their home equity into cash, fixed monthly advances or a growing line of credit. The borrower can defer repayment of the loan balance so long as they live in the home and pay the property-related taxes, insurance and upkeep expenses.

Most, but not all, reverse mortgages today are HECMs, the only reverse mortgage insured by the Federal Housing Administration (FHA). This brochure talks about HECMs only.

The youngest borrower’s age (or nonborrowing spouse’s age), the interest rate and the home value all factor into how much of the home’s equity the borrower can initially access with a HECM.

You can get an idea of how much your client may be able to borrow by using our reverse mortgage calculator at Fairwayreverse.com/Calculator.

on incorporating home equity and reverse mortgages into retirement planning.

As an advisor, you can serve your older-adult clients more fully by being well-informed about the reverse mortgage product and related findings in reports from retirement experts like Wade Pfau, Ph.D., CFA, and Barry Sacks, Ph.D., J.D.

Key Findings: Housing wealth should be considered in retirement planning. It may be prudent for your client to obtain a reverse mortgage line of credit at the earliest possible age, as it could lower the risks of them outliving their savings and help them leave a larger legacy to their heirs. Researchers measured this by performing thousands of “Monte Carlo” simulations to test portfolio sustainability when portfolio distributions are coordinated with a reverse mortgage.1

1. HECM Reverse Mortgages: Now or Last Resort? 2

Early establishment of a HECM line of credit in a low interest rate environment consistently provides higher 30-year survival rates than those for last-resort strategies.

3

Retirees’ residual net worth (portfolio plus home equity) after 30 years is nearly twice as likely to be greater when using an active strategy as opposed to the conventional strategy. The active strategy uses the growing line of credit (LOC) during stock market down years.

If your clients use home equity first, the probability of success for longevity doubles.

is poised to play a more critical role in meeting retirement security needs.

1. Lower savings rate with less retirement preparation

2. Fewer pensions and defined benefit plans

3. Longer life expectancy increases the risk of outliving savings

4. Over the next 20 years, approximately 10,000 Americans will turn 62 each day, with 3,000 of them still making a mortgage payment

• Borrower(s) must be 62 or older

• Must be homeowner and either own home outright or have significant equity

• Must live in home as primary residence

• Property must be a single-family home, 2- to 4-unit dwelling, townhouse, planned unit development, modular home or FHAapproved condo

• Minimal credit and property requirements

• Must receive reverse mortgage counseling from a HUD-approved counseling agency

• Not delinquent on any federal debt

• Borrower keeps the title to their home

• Tax-free cash from a percentage of their housing equity*

• Borrower can receive loan proceeds as a onetime lump sum payment at closing, as a line of credit to draw from as needed or as fixed monthly advances (term or tenure)

• Monthly mortgage payments are optional. However, borrower must live in the home as their primary residence and pay the propertyrelated taxes, insurance and upkeep expenses

• Loan balance does NOT require repayment until last living borrower permanently leaves the home or the loan terms are not met

• Borrower may sell the property, if they so choose

• Neither the borrower nor their estate will owe more than the value of the home at the time it’s sold (FHA-insured non-recourse feature)**

• Borrower can use a reverse mortgage to purchase a new home, with 45%-70% down from their own funds***

• Generally will not affect Social Security and Medicare*

• Growing line of credit (applies to the unused funds)

• If used in a coordinated strategy, may increase value of legacy*

1. Refinance standard mortgage to a reverse mortgage to eliminate the burden of monthly mortgage payments. Still required to pay property-related charges, like taxes, insurance and home maintenance costs.

2. Use the HECM line of credit’s growth feature as a way to establish a financial safety net. The unused funds in the line grow at the same compounding rate (interest rate plus 0.50%) as the loan balance. This means your client will have more funds to draw on in the future when needed, such as to pay for health care expenses.

3. Standby portfolio protection — use a reverse mortgage as a cash management tool in stock market down times. This can make investments last longer while net worth will not necessarily decrease.

4. Replaces need for cash reserve bucket – home loans are not taxable income. Can increase cash flow and peace of mind.

5. Can use loan proceeds to purchase long-term care insurance.

6. Use it as a management tool to receive deductions when needed or if client wants to withdraw less from IRAs and other taxable sources, lower taxes and preserve their portfolio, reducing the risk of outliving their savings.

7. Gifting to family – help family members in need or simply leave a larger legacy.

8. Donating to non-profits so they can enjoy gifting while they’re alive to see the results.

18 to 62 Years Old

Think about your clients’ finances as three “buckets.”

Bucket 1 is their ability to make money, commissions, wages, salaries, etc.

Bucket 2 is the money they entrust to you for their future — their nest egg.

Bucket 3 is the money they’re depositing into their house, which turns into home equity.

Once your clients retire, most come to you first and start drawing money out of Bucket 2 (and stop contributing to it). Meanwhile, Bucket 1 decreases into (potentially) only Social Security and pension income, increasing demand for you and Bucket 2 to continue to fund their lifestyle.

Even with these changes, it’s surprising that about 44% of homeowners 62 and older continue to put money into Bucket 3 when they don’t necessarily need to. They continue sending us money when they already have more than enough equity in their home — all in the face of new retirement risks. Retirees must sustain spending while managing an unknown length of life, unexpected spending shocks, inflation, market volatility and other risks.

With a HECM loan, they can take cash out of Bucket 3, just like they pull money out of Bucket 2. The money flow from the reverse mortgage is not taxable income. Plus, repayment of the loan balance can be deferred so long as the borrower lives in the house, maintains it and pays critical property charges, like taxes and insurance. When incorporated into a comprehensive retirement strategy, a HECM can potentially help your client:

• Improve cash flow

• Mitigate retirement risks and sequence-of-return risks**

• Preserve their nest egg** (coordinate the use of home equity and the nest egg to meet spending goals while still preserving as much legacy as possible)

The third bucket of home equity can help your clients confidently face their future and keep more productive assets under your management.

HECMs are insured by the Federal Housing Administration (FHA), meaning there is no required loan repayment until the borrowers fail to meet the loan terms or the last borrower moves out, sells the property or passes away. When a reverse mortgage loan becomes due, the borrower or their estate has up to 12 months to repay the loan.

No penalty for early payment (may vary in some states).

HECMs are non-recourse loans. When the loan becomes due and payable, if the balance on the loan exceeds the home sale value, HUD/ FHA covers the difference.

The borrower or their heirs keep any excess proceeds from the home sale (after payment of the reverse mortgage and costs of sale).

With Your Client’s Mortgage:

Do you have any clients with a 15-year mortgage? Have you noticed a decrease in contributions to their retirement plan because they’re in a rush to pay off their house before they turn 62? People with 15-year mortgages often decrease retirement contributions because they’re paying more towards the equity of their house. Oftentimes, these people will make extra home mortgage payments instead of investing in a retirement plan. You can have them refinance to a 30-year mortgage to increase contributions to investments sooner.

(Eliminate Payments – Increase Cash Flow)

Refinance their standard mortgage to make monthly mortgage payments optional (client is still required to pay taxes, insurance and maintenance). Cash flow increases, preventing having to pull assets under your management to make mortgage payments that are no longer necessary. Anyone 62+ still making a mortgage payment needs to take a serious look at refinancing their mortgage into a reverse mortgage loan. If they take out a line of credit, they can allow for a guaranteed increase in the credit line.

Historically, there have only been two ways to buy a new home: in all cash or with a mortgage that requires monthly principal and interest payments. Now your clients aged 62+ may be able to downsize, upsize or rightsize into their dream home using a HECM for Purchase (H4P) loan. An H4P enables the borrower to buy a new home by putting as little as 45%-70% of the purchase price down from their own funds — the remainder is funded by the H4P loan. The big advantages are that your clients get to keep more of their assets to use as they wish (compared to paying all cash), and unlike a traditional mortgage, they won’t have to make monthly mortgage payments so long as they reside in the home. Of course, they do have to pay the property-related taxes, insurance and upkeep expenses.

Client uses $220,000 as a down payment

Client uses $130,000 for an H4P loan

Client finds a NEW home for $350,000

For example, let’s say your clients, both 65, plan on selling their home for $250,000 and purchasing a retirement home closer to their children. They informed the Realtor that their budget was $250,000. However, they found an irresistible property that was $350,000 and decided to do a HECM for Purchase loan. Sell Your Client’s Home for $250,000 Pay off $0 mortgage = $250,000 Cash

$250,000 - $220,000 = $30,000

Cash Down Payment Remaining Funds

Client still has $30,000 cash available and NO monthly mortgage payment – Still responsible for taxes, insurance and maintenance. $250,000 Sell Home - = $0 Pay Off $250,000 Cash $220,000 Down Payment - = $130,000 HECM $350,000 New Home

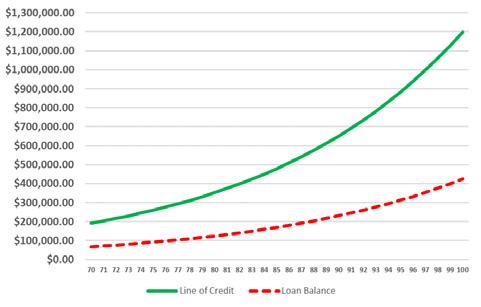

Here’s an example of how an unused line of credit grows over time versus a loan balance in which the borrower makes no voluntary prepayments.

Home Value

$600,000

An increasing number of advisors and consumers are now viewing the reverse mortgage in a financial planning sense — not only because it offers the borrower access to emergency funds, but also because of the long-term financial planning opportunities its growing line of credit presents.

Naturally, the loan balance on a reverse mortgage grows over time. The HECM line of credit loan balance grows at the selected Constant Maturity Treasury (CMT) rate, plus a fixed lender’s margin set in the contract and a fixed mortgage-insurance premium of 0.50%. This combination of three factors is called the effective rate. More broadly, the effective rate is applied to growth not just for the loan balance, but for the overall principal limit. In other words, the borrower will have greater borrowing capacity in the future, if needed. For this reason, it can be wise to establish the HECM line of credit sooner rather than later. The HECM line of credit cannot be capped, reduced, frozen or eliminated, so long as the borrower complies with the loan terms.

Expected Interest Rate 5.625%

Initial Principal Limit

$249,800 Age 70

Initial Loan Balance

$68,000 including payoffs and closing costs

Initial Line of Credit

$191,800

& NON-COORDINATED

Standard & Poor’s 25-Year Historical Numbers: Jan. 2000 - Dec. 2024

Reverse Mortgage Loan Lifeboat Sample Loan Rate: 6.875% Sample Credit Line Growth Rate: 6.875%

Coordinating retirement investments along with a HECM Line of Credit can potentially allow for your clients to maintain more wealth later into their retirement. Starting a standby line of credit earlier, rather than later, in retirement could allow for:

• Holding investments in down markets

• Turning home equity into a usable source of cash flow

• Increasing portfolio longevity without impacting wealth

• Decreasing the need for a large cash buffer

In the example, a coordinated approach involves opening a reverse mortgage line of credit at the start of retirement and tapping into it after years of market downturns instead of pulling from investments. In contrast, a non-coordinated approach relies on fixed withdrawals from investments each year, regardless of market conditions.

Reverse Mortgage Loan HECM Lifeboat

$19,173

12/31/13 $225,858 32.15% $19,173

12/31/14 $237,221 13.52% $19,173

12/31/15 $221,322 1.38% $19,173

12/31/16

(1) The numbers above, sample loan rate and the sample credit line growth rates are for illustration purposes and may or may not be indicative of what a reverse mortgage loan consumer may experience with his/her own loan. (2) The HECM draws shown above were reduced by 20% to reflect the fact that reverse loan proceeds are usually not taxable. (3) Investment Values (second column above) were calculated with entire withdrawal at the end of the year. HECM draws monthly. (4) Yearly gains and losses are consistent with S&P, and include potential tax benefits from using HECM line of credit or interest rate adjustments. (5) This is not tax or financial advice. Your client should consult a tax and/or financial advisor for his or her specific situation. Annual Returns S&P 500 Source: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ histretSP.html

• Medicaid only pays for shared rooms

• 95% of people have no LTC insurance

• Over 50% will need LTC insurance

Source: CaseScout.com 2024 Survey

In the face of fluctuating home prices and potential nursing home and long-term care expenses, it’s typically better to have equity in cash and in a controllable form instead of relying on uncontrollable factors.

Use small amounts of equity to protect all other assets, such as:

• Traditional Monthly LTC Premiums

• Lump Sum LTC/Life Insurance

• UL Life Insurance With Living Benefit Riders

Understanding the basics of LTC insurance and how it can relate to home equity is critical to your clients.

Ability to purchase needed insurance or investment products because of change in cash flow - insurance can multiply the wealth and guarantee the home equity.

• Paying for life insurance policies needed for planning or that are running out

• Replace home asset

• Estate planning – leave behind larger legacy

• Leverage of tax-free payments to heirs*

NATIONAL AVERAGE LTC COSTS

Home Health Care

$75,504

• Alzheimer’s Care

• Meal prep/diet monitoring

• Light housekeeping

• Errands or shopping

Assisted Living Facility

$64,200

• Private apartments

• On-site nursing

• Help with daily living

• Help with medication Nursing Home Facility

$116,800 Annually (Private)

• Full-time in-facility care

• Advanced LTC

• Help with daily living

• Help with medication

LTC continues to be the greatest threat to your clients’ income, assets and planned legacy to the next generation.

Statistically, less than 5% of your clients have LTC insurance.**

Unless they’re very wealthy, most clients cannot self-insure. So what’s the plan? 1. Clients

1. Use a growing line of credit to fund potential LTC costs at an early setup age of 62, so that the funds will be available to your clients in their 80s and 90s when they’re most likely to need LTC.

2. Use additional cash flow from a HECM to fund vacations and luxuries, so you can use other investments to purchase LTC insurance or life insurance with LTC living benefit riders.

3. HECM proceeds may be used to shield home equity and income when a spouse is still in the home while an institutionalized spouse needs to qualify for Medicaid.

1. A reverse mortgage loan has the potential to protect and shield equity as it places two mortgage liens on the home, even if money isn’t drawn and only a growing line of credit is put in place. Use it as an additional asset when a client shouldn’t draw from IRAs and other retirement funds because of tax purposes.

2. In extreme bankruptcy and foreclosure situations, a reverse mortgage might protect equity and allow borrowers to convert it to cash. Some bankruptcy attorneys use a reverse mortgage as part of pre-bankruptcy planning to reduce equity, avoiding the need for a home sale.

3. Potentially protect home equity from liens and/or lawsuits.

Typically, the average retiree makes their financial decisions without even thinking about home equity or a reverse mortgage loan. However, on this page are several common retirement strategies and questions which could change how those decisions are usually made.

Health insurance can be astronomically expensive, especially after someone retires and is no longer under their employer’s coverage. Even though your client may qualify for a pension or Social Security checks, they may end up paying $1,000 or $2,000 in monthly premiums, forcing them to go back to work or pull more money out of their nest egg and decreasing their long-term investment income. Those three years can cause shortfalls of $30,000$60,000. Home equity can be released with a reverse mortgage to cover some — or all — of those costs without dipping into the investment accounts and other parts of their nest egg. Many people want to work during this time period, but simply cannot find work in their field or are unable to physically continue working. They don’t have to take the risk of being uninsured or underinsured during this vulnerable time.

Oftentimes, it makes sense to do Roth Conversions from traditional IRAs or pay taxes in a lump sum on company stocks during retirement. When your client has a lower income or a special window for paying taxes on investment accounts, the question often comes up as to where the money will come from. No one disputes the fact that it makes sense to pay taxes at a 15% rate as compared to a 25% or 35% rate. If the tax bill must deplete the investment account and cause additional taxes, it typically doesn’t make sense unless there is another non-taxable bucket that the client can draw from. A reverse mortgage line of credit can often fill that need.

This became a very controversial subject in late summer 2017 when the CFPB came out with the directive that “reverse mortgages should not be used to delay Social Security filing.” 1 Almost immediately, several people from the financial planning community wrote articles for Investment News and Forbes Magazine that took an opposite viewpoint and disagreed with the math used in the CFPB examples.

As members of the reverse mortgage industry, it isn’t our place to advise on the best time to draw Social Security payments. We simply know that this is one of the single biggest sources of income for many retirees and many make the decision without consulting a trained advisor familiar with all the options. Unfortunately, about 50% of retirees draw at ages 62 and 63 and, because of projected longevity, should be waiting longer. 2

Jamie Hopkins and Mary Beth Franklin both wrote their opinions on Social Security and reverse mortgage use. The links are provided here for your reference when analyzing your client’s Social Security plans.

1Source: http://files.consumerfinance.gov/f/documents/201708_cfpb_costs-and-risks-of-using-reverse-mortgage-to-delay-collecting-ss.pdf. 2Source: https://www.fool.com/retirement/general/2016/04/19/ when-does-the-average-american-start-collecting-so.aspx. Additional Sources: https://www.forbes.com/sites/jamiehopkins/2017/08/28/cfpb-releases-misleading-report-on-social-security-deferralstrategies/#381e37f3a1b0 Jamie Hopkins. http://www.investmentnews.com/article/20170906/BLOG05/170909967/reverse-mortgages-under-fire-again. Mary Beth Franklin. Note: This is not tax, legal or financial advice. Client(s) should consult a tax, legal or financial expert for their specific situation.

• Make payments when your clients want to, not when they have to (payment of taxes, insurance and maintenance always required)

• Letting interest build up so deductions can be bunched together, unlike forward mortgages which require your clients to make payments even if there isn’t enough to deduct**

• Ability to increase itemized deductions as compared to standard deduction

• Use as potential deductions in years of high income or required minimum distributions

• Paying interest the same year as IRA withdrawals are taken out to offset retirementfunding income**

• Replace taxable income with reverse mortgage loan proceeds, which are usually non-taxable

• Decrease estate value to avoid estate tax in some states Required minimum distributions

• Estate tax planning: Pass on a potential tax deduction to heirs to offset the inherited taxable IRAs***

See how Fairway customers have used HECM reverse mortgages to improve their financial future and enjoy a more fulfilling retirement.

https://qr1.be/JT2Y

At Fairway Independent Mortgage Corporation, customer service is our way of life. #FairwayNation mortgage loan officers are dedicated to finding great rates and loan options for our customers while offering some of the fastest turn times in the industry. Our goal is to act as a trusted mortgage advisor, providing highly personalized service and helping you through every step of the loan process—from application to closing and beyond. It’s all designed to exceed expectations, provide satisfaction and earn trust. We are also highly committed to improving the way retirement is done in this country by helping older Americans use their home equity via HECMs or other home loan products so they can enjoy the retirement they desire and deserve.

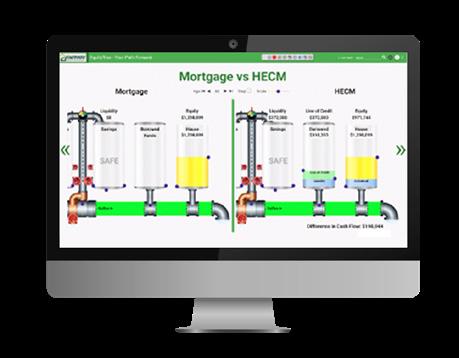

• EquityTrax is our proprietary tool

• Designed in partnership with Circle of Wealth© and MoneyTrax

• Provides you and your clients with an easy-tograsp, holistic view of your clients’ retirement outlook, specifically as it relates to home equity