3 minute read

Delaying Social Security Draw Dates

Three Ways

HECMs Help With Tax Planning*

1. Time Deductions

• Make payments when your clients want to, not when they have to (payment of taxes, insurance and maintenance always required). • Letting interest build up so deductions can be bunched together, unlike forward mortgages which require your clients to make payments even if there is not enough to deduct.** • Ability to increase itemized deductions as compared to standard deduction.

• Use as potential deductions in years of high income or required minimum distributions.

2. Tax-Free Withdrawals from Home Equity

• Paying interest the same year as IRA withdrawals are taken out to offset retirement funding income.** • Replace taxable income with reverse mortgage loan proceeds which are usually non-taxable.

3. Estate Planning – The Lost Deduction

• Decrease estate value to avoid estate tax in some states

• Required minimum distributions • Estate tax planning: Pass on a potential tax deduction to heirs to offset the inherited taxable IRAs.***

Why Work With A Fairway Reverse Mortgage Planner?

1. We make it easy for advisors like you to partner with us and better serve the fastgrowing population of Boomers. 2. We are dedicated to providing unparalleled customer service.

3. Fairway prides itself on a best fit, best product philosophy for your clients. We offer a variety of loan product, including ones that may provide a fuller, richer experience of the golden years for your clients. 4. We have specially trained Reverse Mortgage

Planners at our offices across the country, which give us the ability to meet with you and/ or your clients in person or virtually. 5. We offer free educational seminars and livestream webinars; books; collateral; and tools to help you and your clients to better understand the reverse mortgage product. 6. Our goal is to act as a trusted advisor, providing highly personalized service. It’s all designed to exceed expectations, guarantee satisfaction, and earn trust.

7. Potential referral partnership 8. The opportunity to work with more senior clients — and to improve more lives 9. We are happy to work together for possible

CFP CE credit, office Lunch N’ Learns, client face-to-face meetings with you, annual strategy sessions, and more.

Plus, we make communication easy among your clients, you, and your dedicated Fairway team about how home equity can be incorporated into retirement-planning strategies.

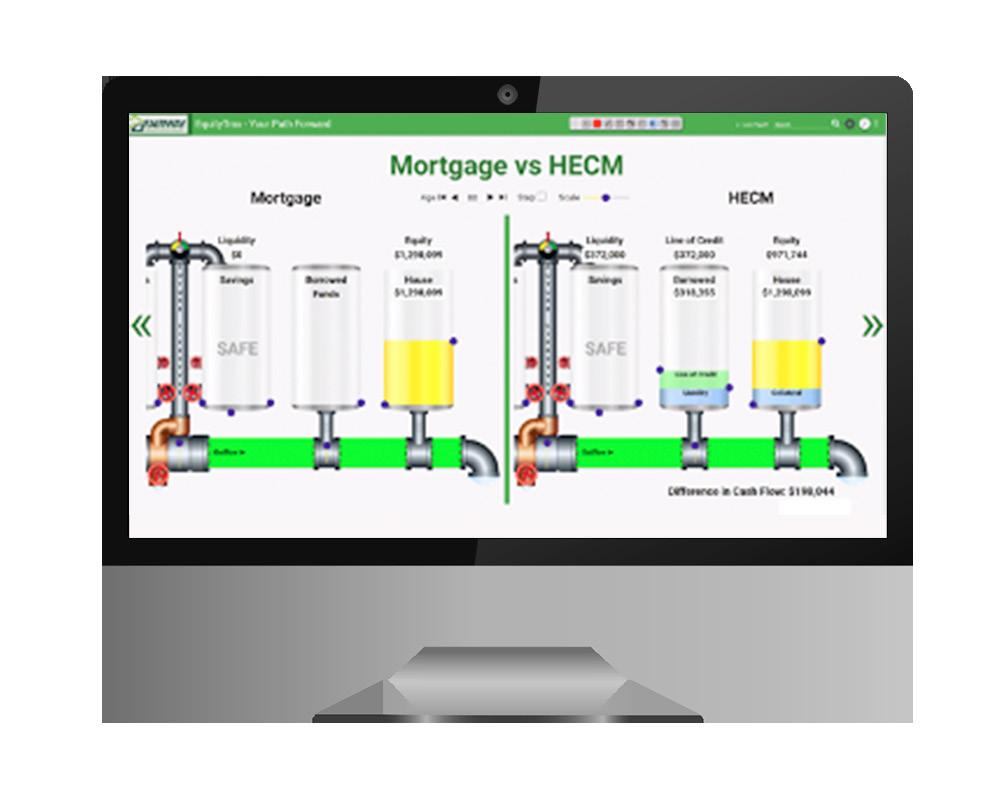

As part of our exclusive partnership with Circle of Wealth and MoneyTrax, Fairway has developed a proprietary tool designed with one audience in mind – you. This specialized tool is called EquityTrax and was created to provide you with an easy-to-grasp, holistic view of your clients’ retirement outlook, specifically as it relates to the use of home equity. A Fairway Reverse Mortgage Planner will walk you through our Five Step Process to integrate home equity into your client’s financial planning process and reach their retirement goals.

Fairway at a Glance

Since opening our doors in 1996, we have not only been dedicated to providing unparalleled customer service, but also to our continuous growth. Starting out with a staff of only 16 people, Fairway now employs more than 10,000 team members including over 2,800 producers and 700+ branches nationwide. Our team has helped thousands of Americans achieve their dream of homeownership throughout the years, funding more than $200 billion in loans since the company started and more than $72 billion in 2021 alone. Fairway has a culture of serving and collaborating with other professionals that’s unmatched in the industry. We are members of FPA, and we are a trusted partner of National Association of Insurance and Financial Advisors (NAIFA).