5 minute read

Best Forex Pairs to Trend Trading 2025

from Exness Guide

Trend trading remains one of the most reliable and profitable strategies in the Forex market. Instead of chasing small scalps or reacting to news, trend traders focus on the overall direction of the market — entering trades with momentum and letting profits run.

But not all Forex pairs are created equal when it comes to trending behavior. Some pairs are choppy, others range-bound, and only a select few deliver clean, sustained trends that are ideal for this strategy.

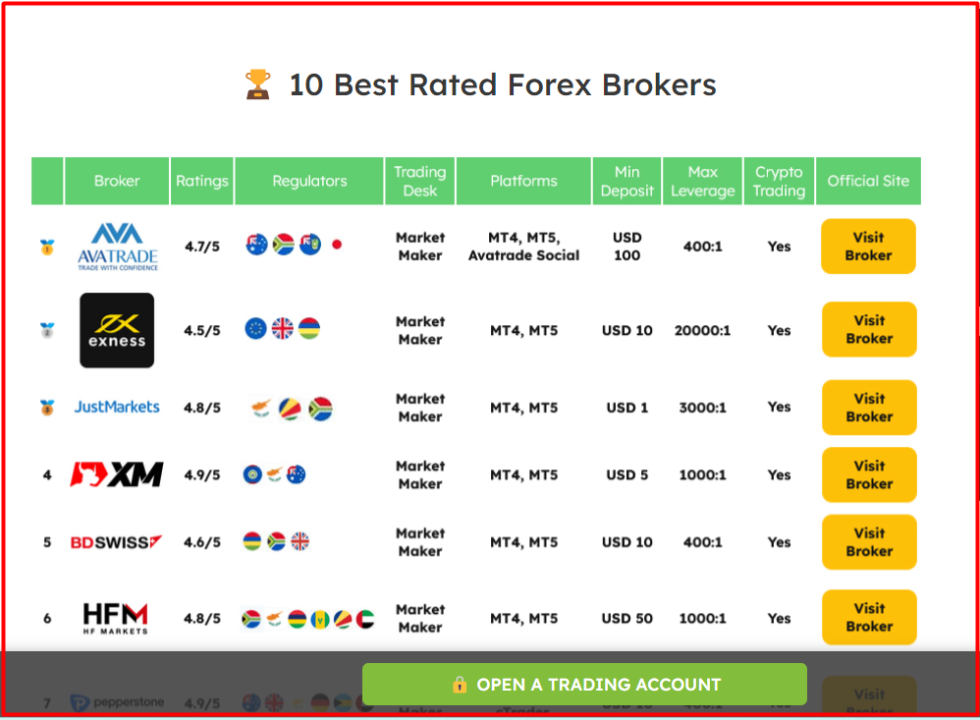

"Now that you know which currency pairs are most promising for trend trading in 2025, it’s essential to choose a reliable broker. The right broker provides a stable platform, competitive fees, and expert support. Here are some of the best Forex brokers in the world to consider.⬇️⬇️⬇️"

1️⃣ Exness: Open Account | Go to Website

2️⃣ JustMarkets: Open Account | Go to Website

3️⃣ XM: Open Account | Go to Website

5️⃣Avatrade: Open Account | Go to Website

In this guide, we’ll explore the best Forex pairs for trend trading in 2025, along with practical strategies and tools to help you stay on the right side of the market.

What Makes a Forex Pair Ideal for Trend Trading?

Before we dive into the list, here’s what defines a “trend-friendly” pair:

✅ High liquidity – easier entries and exits✅ Clear directional movement – fewer fakeouts✅ Responsive to fundamentals – follow global economic trends✅ Low spread – cost-effective for long-term holds✅ Stable price behavior – not overly influenced by random volatility

Top 7 Best Forex Pairs for Trend Trading in 2025

1. EUR/USD (Euro / US Dollar)

Why It’s Great:

Most liquid pair in the world

Strong reaction to macroeconomic trends (ECB vs Fed policy)

Ideal for long-term trend followers and swing traders

Trend Strategy Tip:Use 50 and 200 EMA crossovers for high-timeframe trend signals

2. GBP/USD (British Pound / US Dollar)

Why It’s Great:

High volatility = larger trend opportunities

Reacts strongly to UK and US political and economic data

Excellent for medium- and long-term trend trades

Trend Strategy Tip:Combine trendlines and RSI divergence for optimal entries

3. USD/JPY (US Dollar / Japanese Yen)

Why It’s Great:

Often trends for weeks due to US-Japan interest rate divergence

Influenced by BOJ policy, bond yields, and risk sentiment

Clean technical movement during US and Tokyo hours

Trend Strategy Tip:Use Ichimoku Cloud and daily support/resistance zones

See more: how to open exness account

4. AUD/USD (Australian Dollar / US Dollar)

Why It’s Great:

Closely tied to commodity prices and China’s economy

Trending behavior during global risk-on/risk-off shifts

Perfect for swing trading in Asian and US sessions

Trend Strategy Tip:MACD + 100 EMA for identifying sustained directional moves

5. USD/CHF (US Dollar / Swiss Franc)

Why It’s Great:

Often provides long-term trending structure with less noise

Sensitive to global risk appetite and monetary policy

Works well for position traders and H4/D1 chart followers

Trend Strategy Tip:Combine Bollinger Bands with trendline breaks for confirmation

6. NZD/JPY (New Zealand Dollar / Japanese Yen)

Why It’s Great:

Cross pair with trending momentum during Asia-Pacific sessions

Driven by carry trade interest and RBNZ/BOJ divergence

Often trends cleanly with fewer fakeouts

Trend Strategy Tip:Use trend channels and Fibonacci extensions for profit targets

7. EUR/JPY (Euro / Japanese Yen)

Why It’s Great:

Combines European trend strength with JPY stability

Reacts to monetary divergence and risk sentiment

Ideal for trend-following across multiple sessions

Trend Strategy Tip:Use multi-timeframe analysis (H1, H4, D1) for clean entries

How to open Exness real account on phone?

Best Indicators for Trend Trading

✅ EMA (Exponential Moving Average) – Track trend direction and strength

✅ MACD – Confirm momentum and identify entry points

✅ Trendlines – Visually define trend structure

✅ RSI – Spot divergence and avoid overbought traps

✅ Fibonacci Levels – Set realistic take profit zones

Proven Trend Trading Strategies for 2025

1. Moving Average Cross Strategy

Use 50 EMA and 200 EMA cross on H4 or D1

Enter on confirmed breakout candle

Exit on pullback or opposite crossover

2. Trendline Breakout Method

Draw trendline on swing highs/lows

Wait for strong break + retest

Confirm with RSI or MACD for entry

3. Multi-Timeframe Trend Entry

Identify main trend on D1

Fine-tune entry on H4 or H1 with candlestick confirmation

Use trailing stop or ATR-based SL

Mistakes to Avoid in Trend Trading

❌ Trading choppy pairs like EUR/GBP

❌ Entering late in the trend

❌ Ignoring fundamentals that can reverse a trend

❌ Overleveraging during slow trend periods

❌ Relying on one timeframe without confirmation

FAQs: Best Forex Pairs for Trend Trading

1. Which pair trends the most in 2025?GBP/USD and USD/JPY are showing strong, consistent trends driven by rate divergence.

2. Is trend trading profitable in Forex?Yes, when done with discipline, proper risk management, and confirmation tools.

3. What timeframes are best for trend trading?H4 and D1 offer the cleanest trend signals. H1 works for aggressive entries.

4. Can I trend trade with a small account?Yes. Use micro-lots and wider timeframes to avoid overexposure.

5. What are the risks of trend trading?Reversals during major news, consolidation periods, or false breakouts.

6. Should I use indicators for trend trading?Yes, but keep it simple — 2 to 3 tools are enough (e.g., EMA + RSI).

7. Is EUR/USD still good for trend trading?Yes, especially during Fed or ECB policy shifts.

8. Can I trend trade on mobile?Yes, using MT4/MT5 apps or web terminals, but it’s easier with charting tools on desktop.

9. How long should I hold trend trades?From a few hours to several days, depending on the trend strength and your strategy.

10. Do all Forex pairs trend the same way?No. Some are more range-bound. Stick to the pairs listed above for the best results.

Final Thoughts: Trend the Right Way in 2025

The Forex market continues to offer massive opportunities for traders who can spot and ride trends. By focusing on the right pairs — like EUR/USD, GBP/USD, USD/JPY, and AUD/USD — and using proven tools, you can build a system that grows with your skill.

In 2025, as global economies adjust interest rates and shift fundamentals, trend traders who stay informed and disciplined will find consistent, profitable setups across all major sessions.

See more: